To what extent are interest payments eating up the national income?

By Wolf Richter for WOLF STREET.

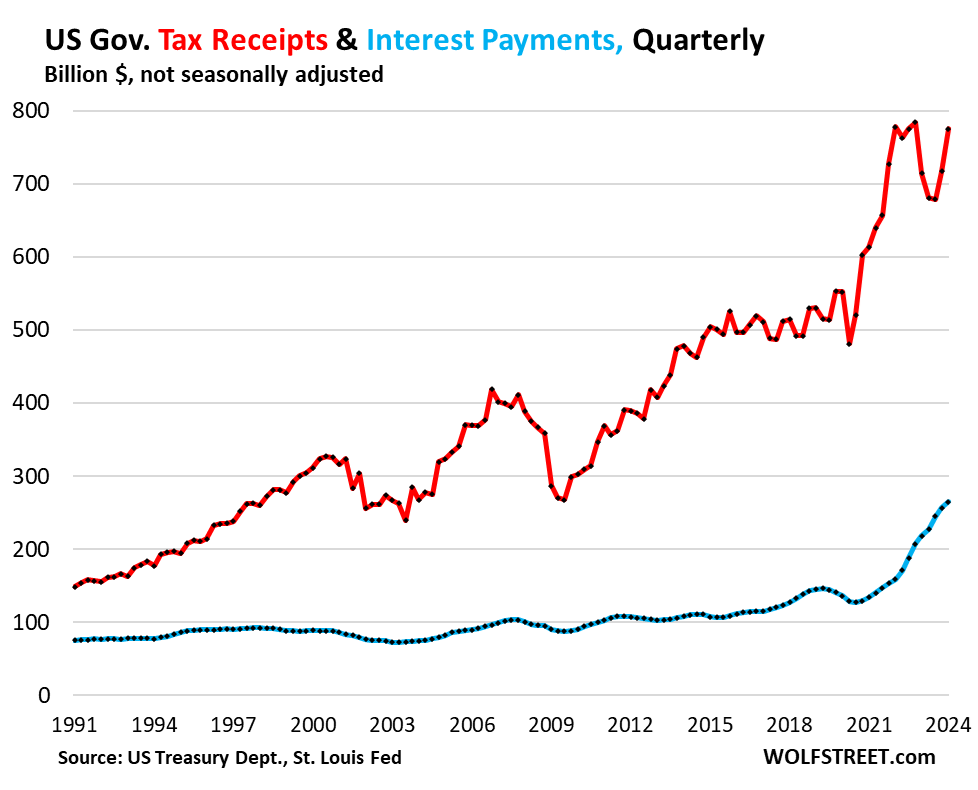

Tax receipts by the federal government in 2024 are shaping up to be pretty good. In 2023, Q1 and Q2 tax receipts were crappy because capital gains taxes had plunged because 2022 had been a terrible year for investors, and when it came time to pay capital gains taxes by April 15, 2023, there weren’t a lot of capital gains to pay taxes on.

This year, it’s different: By April 15, capital gains taxes were due on the profits realized in 2023. The year 2023 was one gigantic rally for stocks, bonds, and cryptos. So Q1 2024 tax receipts jumped by $60 billion (+8.4%) from a year ago, to $775 billion (red in the chart below).

We know from other data that tax receipts in Q2 have been solid so far, including that the national debt hasn’t budged in months from $34.6 trillion, despite the relentless surge in deficit spending, and that the balance in the government’s checking account, the TGA, spiked to over $950 billion in the days after April 15 as a result of tax payments coming in.

Interest payments by the government on its gigantic and ballooning pile of debt surged by $46 billion (+21%) year-over-year in Q1 to $264 billion (blue).

In the 20 years between 1995 and 2015, interest payments barely rose despite the debt that kept ballooning because interest rates kept falling as part of the 40-year bond bull market that ended in August 2020.

The measure of tax receipts here is what’s available to pay for regular government expenditures, including interest payments. The measure is total receipts minus contributions to Social Security and other social insurance, that are paid specifically by contributors into those programs and are not available to pay for general expenditures. This metric of tax receipts was released on May 30 by the Bureau of Economic Analysis as part of its Q1 GDP revision.

Interest payments surged because:

The debt that the government needs to pay interest on has surged at a mindboggling pace in recent years.

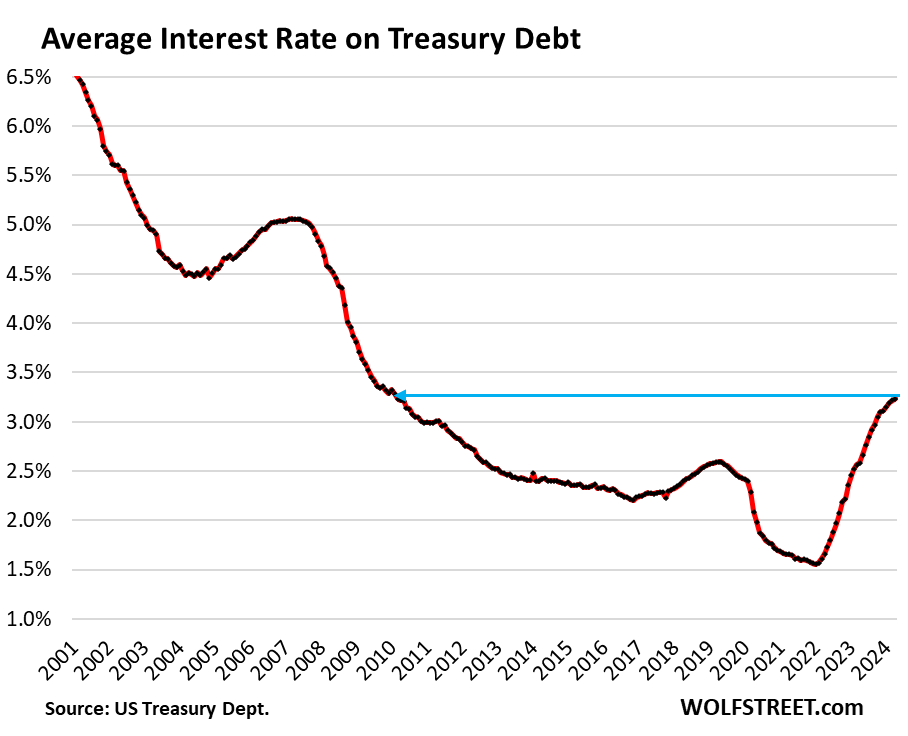

The higher interest rates are working themselves gradually into the national debt each time an old maturing Treasury note or bond is replaced with a new Treasury security, and each time the government issues new debt to fund the new deficit.

Short-term Treasury bills roll over all the time, and their interest rates have been at 5%-plus for over a year. Now, nearly 22% of the $26.9 trillion in marketable Treasury securities outstanding are T-bills that the government paid an average of 5.36% in interest on in April.

So in April, the average interest rate that the Treasury department paid on all its marketable and nonmarketable securities – on the whole $34.6 trillion schmear – was 3.23%. That’s still low, and it will keep rising as the current yields are working themselves into the pile of debt. But it was the highest since early 2010:

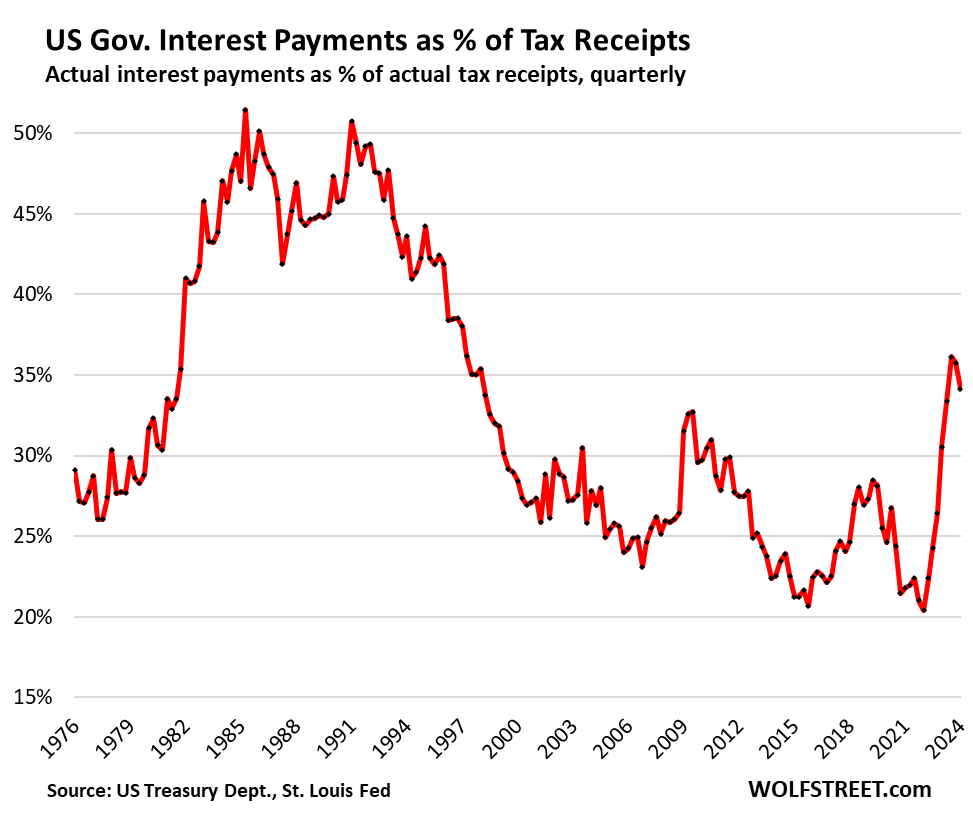

What matters: Interest payments versus tax receipts.

It’s not interest payments in a vacuum that matter, but interest payments in relation to tax receipts. Inflation and growing employment, both, inflate tax receipts. Inflation does so by inflating taxable wages, and growing employment does so by more workers earning taxable wages.

Higher interest rates themselves boost tax receipts because they generate taxable income, not only on the $26.4 trillion in marketable Treasury securities, but also in savings accounts and CDs, money market funds, corporate bonds, etc. American households and businesses hold many trillions of dollars of these interest-bearing assets. We’ve looked at the holdings of households: $3.6 trillion in money market funds, $1.1 trillion in CDs of less than $100,000, and $2.4 trillion in CDs over $100,000. In addition, households earn interest from their other bond holdings, from bond funds, etc. They all generate taxable income, when two years ago, during the 0%-era, they generated very little taxable income.

So the ratio of interest payments as a percent of tax receipts answers the question: To what extent are interest payments eating up the national income.

In Q1, interest payments as a percent of tax receipts dipped to 34.1%. It was 36.1% in Q3, the highest since 1997. In Q4 2023, the ratio had also dipped. In both quarters, tax receipts jumped in dollar terms more than interest payments.

In Q2, the ratio may dip further. And then in Q3 and Q4, the thing will turn around again and shoot higher.

In the 15 years between 1982 and 1997, the ratio was higher than today; and in the 10 years between 1983 and 1993, it ranged from 45% to 52%.

Back in the late 1980s and early 1990s, interest payments were eating up about 50% of the national tax revenues, and the US was careening toward a serious crisis. It wasn’t until then that Congress, which decides fiscal matters, had a come-to-Jesus moment and dealt with the ballooning deficit, further helped along by the budding Dotcom Bubble at the time, which generated huge capital gains, employment, and wage growth.

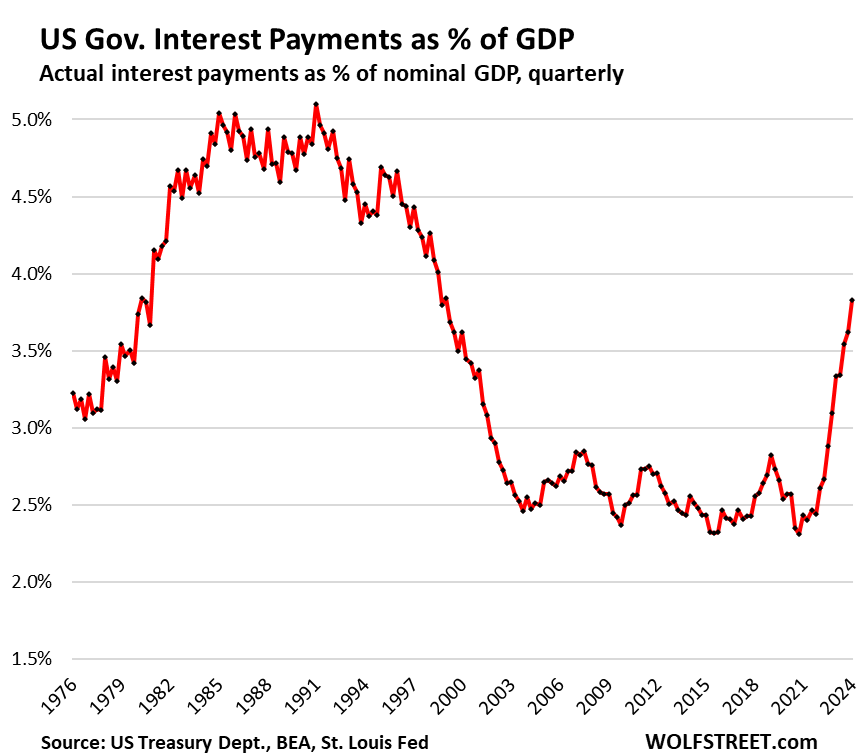

Interest payments as % of GDP.

Interest payments jumped to 3.8% of GDP in Q1, the worst since 1998 (the ratio is figured apples-to-apples: quarterly interest expense not adjusted for inflation, not seasonally adjusted, not annual rate; divided by quarterly GDP of $6.93 trillion in current dollars, not adjusted for inflation, not seasonally adjusted, not annual rate).

This is relentlessly heading in the wrong direction at a disconcerting pace:

Higher yields will solve demand problems.

The government has been selling massive amounts of new debt week after week. Someone has to buy this debt, and when not enough investors want to buy the debt at the current yield, yields rise until enough investors emerge that find that higher yield appealing.

We know what happened when the 10-year Treasury yield briefly hit 5% in October last year: it unleashed an epic buying frenzy amid huge demand that then pushed the yield back down.

So there will always be enough buyers because the yield will rise to attract them until every last one of the Treasury securities is sold. But the issue is that those higher yields will cause interest payments to spike further.

The classic long-term unwanted remedy and consequence to overindebted governments is inflation. Inflation has the effect of inflating tax receipts, and in devaluing the purchasing power of the old debt – it’s far easier to redeem old debt with devalued dollars. And there is good reason to think that continued inflation will also be a consequence and long-term remedy this time around.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“The classic long-term unwanted remedy and consequence to overindebted governments is inflation.” – so the US government actually wants higher inflation?

Re-read this: “unwanted remedy”

Would it be fair to say that it’s unwanted but necessary given than other options are politically damaging and/or hard to do?

Who gives a cat turd whether they say they want inflation or not. The fact is, the Fed created it via many years of ZIRP and $7T of money printing. We had 22% or so inflation since the pandemic, and the bottom 70% is paying the price for it. These are the renters and folks who rely on fixed income or wages for their income.

I see the angle of your question now. A little inflation is wanted, and always has been. The Fed’s 2% core PCE target is testimony of that. What’s not wanted is inflation in something like the 4%+ range (core PCE, which can be 5%+ core CPI) because that enrages Americans and it can damage the economy. But it’s that kind of unwanted inflation that can result from this fiscal mess. And it’s that kind of inflation that over the longer term also functions as bitter remedy for over-indebtedness. I still assume that Congress will get serious about it before it goes that far — they did last time.

Wolf, I’m glad you think so. As a child of the 80s, admittedly my view is shorter than many and perhaps this is recency bias, but the current dysfunction in Congress seems unprecedented. There seems to be a powerful and growing element on the fringes of each party who seem willing to let the country burn based on whether their guy sits in the Oval Office or not.

Howdy Lone Wolf. You mentioned Congress got serious and did something last time? My memory is failing me in my older age and can t remember what that might be?

Dear Debt Free Bubba:

Here are some Congressional actions of great importance to the US and its economy. These folks are HARD at work to spend your tax dollars wisely, they say we must trust them. Now, don’t you feel better? (Wink, wink)

“On September 20, 2022, the House Committee on Oversight and Reform ordered reported the following eight bills that would name different post offices:

H.R. 6630, a bill to designate the facility of the United States Postal Service located at 1400 N Kraemer Blvd. in Placentia, California, as the “PFC Jang Ho Kim Post Office Building,”

H.R. 6631, a bill to designate the facility of the United States Postal Service located at 4770 Eureka Ave in Yorba Linda, California, as the “Cottle Centanni Post Office Building,”

H.R. 7082, a bill to designate the facility of the United States Postal Service located at 2200 North George Mason Drive in Arlington, Virginia, as the “Jesus Antonio Collazos Post Office Building,”

H.R. 7832, a bill to designate the facility of the United States Postal Service located at 396 South California Avenue in West Covina, California, as the “Esteban E. Torres Post Office Building,”

H.R. 7988, a bill to designate the facility of the United States Postal Service located at 79125 Corporate Centre Drive in La Quinta, California, as the “Corporal Hunter Lopez Memorial Post Office Building,”

H.R. 8226, a bill to designate the facility of the United States Postal Service located at 236 Concord Exchange North in South Saint Paul, Minnesota, as the “Officer Leo Pavlak Post Office Building,”

H.R. 8370, a bill to designate the facility of the United States Postal Service located at 415 High Street in Freeport, Pennsylvania, as the “Corporal Joseph Rodney Chapman Post Office,” and

H.R. 8630, a bill to designate the facility of the United States Postal Service located at 400 North Main Street in Belen, New Mexico, as the “U.S. Senator Dennis Chávez Post Office.”

Cash flows for the Postal Service are recorded in the federal budget in the Postal Service Fund and are classified as off-budget direct spending. CBO estimates that naming those facilities would have no significant cost.

JS, they would never let the country burn based on whether their guy sits in the oval office. However, peaceful protests will be allowed.

I learned a lot about politicians in 2020. Any benefit of the doubt has been completely removed from the equation.

As you (Mr Wolf) wrote further down “they” (Federal Reserve) wants 2% inflation. This must be the ideal target percentage of “skimming” from the population. That 2% doesn’t operate alone, it is essentially a regressive tax and catches the lower income level people that the income tax misses.

Inflation applies equally to all incomes and assets. It eats away at everything. The richer you are, the more you lose in purchasing power of your assets. 2% goes mostly unnoticed, but with 6% inflation, the loss of purchasing power of your assets more than wipes out dividend yields, it wipes out the income from real estate, bonds, it wipes out most or all stock price increases. Some people have called inflation the fairest tax of all. No one can dodge it. You can only try to out-earn it.

“They” “it” “we” want inflation because deflation collapses economies. Since we NEED inflation, WE want it to be low and 2% became the unwritten rule after New Zealand economists convinced their central bank that inflation targeting was the best way to achieve long run price stability. Those economists settled on 2% and the world has ran with that ever since.

Do you know what has happened since WE decided inflation targeting was better than whatever nonsense they were doing in the seventies and Volker’s misguided, double plunge causing ratcheting in the 1980’s? Decades of mild inflation.

I disagree with Wolf’s assessment that inflation hurts all people equally. While those with hard assets lose purchasing power from the current income these assets generate they gain wealth by the increased value of the hard asset (especially if it’s levered). Low/middle income people with minimal hard assets continue to fall behind. Inflation is definitely regressive.

“…they gain wealth by the increased value of the hard asset (especially if it’s levered).”

Or they lose wealth by the decreasing selling price of the hard asset (especially if it’s levered). Happened many times. The idea that prices of hard assets don’t go down is just history-denying nonsense. Look at a long-term housing chart, or gold chart, huge price declines for many years, and leveraged investors got totally wiped out.

“That 2% doesn’t operate alone, it is essentially a regressive tax and catches the lower income level people that the income tax misses.”

and

“Some people have called inflation the fairest tax of all. No one can dodge it.”

Yes, these (although I don’t know about the use of the word, “fair”).

Basically, money printing by the G grants it,

1) The broadest possible sweep to appropriate (expropriate?) control over the entirety of the US Dollar domain (everyone in the *world* who uses/saves in USD),

2) it does so by diluting the value of all pre-existing USD (by hiking the ratio between USD and all existent real assets),

3) at the same time granting the US G unilateral spending power backed by (nothing/already withered tax power/military and police force/even more money printing).

It is a bad/dangerous/doomed way to run an economy and fiscal conservatives have been warning about it for decades and DC has been relentlessly striding towards it for just as long…or longer.

The gold bug crowd aren’t known for deep thoughts and this is one of their classic cross eyed myths. Common sense or a little very, very simple math shows you cannot inflate the debt away.

Higher inflation = higher interest rates = higher debt burden, but try going out into the desert and explaining that to a Peter Schiff looking for aliens late at night around his camp fire.

Jeremy,

You’re missing one huge element, and so you come to the wrong conclusion: The entire $34.6 trillion in debt gets deflated by inflation, but interest rates only go up for the newly issued debt, not for all of the $34.6 trillion, and they only go up for a few years. And then when interest rates go back down as inflation settles back down in a few years, the burden of that debt has been substantially reduced.

That’s what the US did after WWII. There was big inflation, including double-digit inflation, for a few years in the late 1940s, and it took care of a big part of the burden of the war debt. Everyone paid for it.

Except when you’re spending 6% of GDP in federal deficit the inflation isn’t going to calm down and the price of everything the federal government is buying is also inflating. The only way inflation calms down in a few years is if federal spending gets cut.

misemeout,

Correct. In a comment a little further down, I wrote in reply to:

Matthew Scott,

In terms of spending: All Congress has to do is let spending rise less fast than economic growth for long enough, and it will eventually balance the budget.

So, for example, if economic growth not adjusted for inflation is 4% long-term (about US 10-year average), tax receipts will rise by about 4% over the long term, but spending rises by only 1% not adjusted for inflation, and do this year-after-year, Congress will eventually reach a balanced budget.

PLEASE ‘inflation’ is govt THEFT by devaluing fiat $dollar

a little theft is better than large theft??? really

it’s only way they can keep huge debts – but NOW

it’s time for

GREAT reset – bankrupt private citizens and reset govt debt to $0

of course I’m for resetting govt debt, just as long as every politician/MIC/heir/1% who benefitted is mandated to go bankrupt with 100% assets taken

and 99% get their govt/public debt reset and keep their puny assets

Inflation does reduce our beloved bankers’ and US debts, little by little or it would not be happening despite the 2017 tax cuts, forgiven PPP loans, primarily to wealthy companies who must never suffer

losses, etc. To the banks, inflation is wunderbar, so it will continue because those who rule love it. Watch “The men who stole the world (and got away with it.)”

Forget the movie “The Big Short” or at least its ludicrous, imaginary, “noble” bankster character. Would the same baloney have happened if he had been a CRONY of the perpetrators?

For the cherry on top, after watching that, read the NYTimes: “On Wall Street, Bonuses, not profits were real!” Given recidicism, what’s next for the bankers? What was their next… ahem…act? (They better have paid their wonderbar “US AG,” who managed not to charge any of them somehow, generous bonuses too, for life!)

US Gov interest payments vs tax receipts doesn’t matter. Because tax receipts aren’t used to pay interest payments.

The Fed Gov simply rolls the debt over. Just take it further. When debt is about to mature, in advance of that the Fed Gov issues new debt to cover the debt that is maturing plus interest. And then pays that out. Net currency in = net currency out. And it’s going to and from the same parties. The parties that would prefer to hoard treasuries instead of currency. So the interest doesn’t matter.

This isn’t to suggest that interest rates don’t matter to the private sector – they certainly do. But at the end of the day, they don’t matter to the Fed Gov.

“Because tax receipts aren’t used to pay interest payments.”

LOL. Who put that bug into your ear? Tax receipts and proceeds from selling Treasury securities ALL go into the government’s checking account (the TGA), from which the government pays ALL expenses, including interest expense, and redemptions of maturing debt. Money is fungible.

CBO says FY expenditures so far for FY24 (up to and including April) are $3.821T. Interest on debt is roughly 13% of expenditures so $0.497T, leaving $3.324T for expenditures ignoring interest. In the same period, tax receipts were $2.965T, not enough to even cover expenditures ignoring interest. Bottom line tax receipts aren’t used to pay interest.

So you can divide debt issuance into two buckets: issuance to cover expenditures ignoring interest, to fill the gap after taxes. And issuance simply to roll the debt which includes issuance to cover interest. For the latter, currency in = currency out, from parties who like to hoard treasuries to parties who like to hoard treasuries. So the interest doesn’t matter.

Your first paragraph was OK until you got to “Bottom line tax receipts aren’t used to pay interest.” That conclusion has zero to do with what you said in the lines above, and it is only in your own imagination. Imagine whatever you want.

National income? No such critter. Taxes are not income

Vlad,

Yes. Unfortunately we may well end up like most people around the world.

Inflation is a fact of daily life for about 90% of the human population, and always has been.

Why? Because it is easier than balancing budgets. You just do, as Lula da Silva (Brazil’s president) says “patch any budget shortfall by printing”.

The question you need to be asking is why people put up with this.

People “put up with this” because the alternative is deflation, which is worse. See several 19th Century periods and the Great Depression for details — there’s a reason policymakers dread it.

Inflation also inflates tax receipts because it increases the inflation compensation component of interest income. At least conceptually, interest rates can be considered to have three components: (1) the value of having money sooner rather than later, (2) inflation compensation and (3) a risk premium. Inflation increases the inflation compensation component of interest, notwithstanding that the means by which it does so may be convoluted, which is then taxed as income in the hands of the recipient and generates more tax revenue. In effect the net interest paid by the government is not the gross interest rate, but the net interest after tax.

Yep, it’s some percentage of the tax rate but it’s likely around 20-25% discount on the rate paid. So the true cost to the government is likely around 80% of the current rate (3.25) so around 2.5-2.6%. I wonder if this is published somewhere?

Inflation destroys the middle class.

From where I’m sitting the middle class went right on getting destroyed during the entirety of “the Great Moderation” and the post-GFC (Great Financial Crisis) period — that’s the better part of 40 years of low inflation during which huge chunks of your middle class just disappeared.

This inflation certainly appears helpful to the government as it benefits in higher tax collections from the inflation problems it creates.

Now if only they could do away with those pesky higher interest rates they’re having to pay on debt to the moon, to keep debt buyers invested. (Historically these rates aren’t high.) we hear and read that there are winds of change in the world regarding currency, alliances, hegemony, those sorts of things. The US may have finally worked itself into a debt trap that may be painful to try and wiggle out of.

Truth, Truth, Truth

I agree that foremost it’s important to track debt payment versus income (or in this case, federal tax receipts). It’s no different as far as households such as securing a mortgage, and the bank calculating debt load as far as debt to income ratio.

But I’d also like to know for total annual federal spending, what percentage is debt service. I have not had much success with my preliminary searching for this statistic.

I’d like to compare that to spending for Veteran Affairs, the Pentagon, and Medicaid.

So what did Congress do last time to get this under control? What spending did they cut and what taxes did they raise?

Matthew Scott,

In terms of spending: All Congress has to do is let spending rise less fast than economic growth for long enough, and it will eventually balance the budget.

So, for example, if economic growth not adjusted for inflation is 4% long-term (about US 10-year average), tax receipts will rise by about 4% over the long term, but spending rises by only 1% not adjusted for inflation, and do this year-after-year, Congress will eventually reach a balanced budget.

In addition, in terms of revenues: Congress could do this, and combined with the above, it would very quickly lead to a balanced budget:

1. Impose a transaction tax of 0.1% on any and all nonfood transactions by any entity with at least one leg in the US, applied to all transactions from high-speed trading to corporate M&A, to repos, to stocks, to bonds, to home sales, to M&A. So that $100 billion corporate takeover generates a tax of $100 million. And the $5 trillion-plus in trading of securities, repos, etc., a day generates $5 billion in transaction taxes a day, or $1.3 trillion a year. Apply this transaction tax to futures, currency trading, credit default swaps, interest rate swaps… to all derivatives with at least one leg in the US. If you want to be serious about balancing the budget, you tax all these transactions one tiny bit (by 0.1%). This would have other benefits as well.

2. Make “charitable contributions” over $1,000 not tax-deductible, so that will tamp down on a lot of scams that the wealthy are playing with their “charitable trusts,” etc. If they want to donate to a good cause, let them do it out of the goodness of their hearts, and not to dodge billions of dollars in income taxes (Buffett).

3. Make all real-estate capital gains fully taxed at the capital gains tax rate, no matter what.

4. Make corporations pay a minimum 15% income tax on their highest earnings that they announce, such as “adjusted” earnings, etc. If they say that they made this much in profits, let them pay taxes on it.

5. Fully remove any deductibility of mortgage interest and property taxes by homeowners.

Totally agree with you!

Louie—Really! (Wolf’s item 3 real estate) Maybe you don’t own a home. For many, many folks there home is their major asset and over the 30 years they may have owned it, the only thing that’s really changed is the decrease in value of the money they’ve used to fund the mortgage. Now Wolf states All real estate capital gains should be fully taxed, so the government will have a larger windfall the higher inflation has driven real estate prices. Bad idea.

Item 5 from Wolf (deductions)

Many of us with lesser means never deducted property taxes or interest as the standard deduction was higher deduction, however, with what folks today are having to pay for those items, I can see that deduction to a point is necessary.

I could go on about corporate taxes & contributions that I never used but I’ll leave that to others as well as investment taxes.

My major point is that we don’t have a taxation problem, we have a Spending problem. Feeding the beast with more tax revenue will encourage politicians to attempt to buy votes with more wasteful spending and make the population more dependent on government programs.

I do not propose cutting social security as Wolf has pointed out in the past that is an enforced self funding Ponzi scheme that so far is working.

“… however, with what folks today are having to pay for those items, I can see that deduction to a point is necessary.”

No, it isn’t. Rents are not deductible either, and may households spend 50% of their income on rents! Why should homeowners with expensive homes get this special subsidy that renters don’t get?

And businesses can continue to deduct all legit expenses, including interest — and that includes landlords.

Don’t forget SALT. For those of us lucky enough to live in high tax states, we’re already not able to deduct home interest/property tax. This is effectively another transfer payment to red states (which already receive more federal benefits (“welfare”) than blue/purple states).

I’ve also come around to the idea of a wealth tax. It’s an oddity of how taxes map to jurisdictions that house values and real property are taxed at 1% every year, but massive wealth held at stocks, etc. are not. Since most Americans’ most valuable asset is their house, what we have is in effect a wealth tax on the middle class.

The government provides no services to stocks, but they do to homes. Fire protection, police (such that it is), roads, sewers, water, ambulances, parks, street lights, schools, etc..

A share of Tesla has none of those costs attributed to it.

Mar, That “Bernie” sticker on your bumper must be very faded by now.

Dividends are taxed. Profits from sales of stock are taxed. Stocks are bought with after-tax money. There is no profit unless stocks are sold and profit realized, otherwise they’re just paper with either a potential profit (or loss). Holding stocks can mean control of corporations, corporations pay tax on profits, and essentially are tax collectors themselves.

Just one dramatic example I remember is that Sheldon Adelson’s stock was worth $22B, a recession came and the stock was worth $2B. No stock was sold. Things got better, and the stock was then worth more than $22B. What do you do? Collect wealth tax on the $22B, then give him a refund on $20B? Tax and credit him each year as the value rises and falls?

Besides being an accounting nightmare it would essentially be a zero-sum game, a periodic cash flow nightmare for the government, and if no credits were to be given to stock holders the inevitable destruction of the wealth of those who provide products and employment to the majority of workers.

The idea of a tax was to extract payment from income, not to confiscate wealth, the creation of which has never been a function or even an ability of governments that only destroy wealth.

Parasitic existence fails if the parasite destroys its host, and collective envy should not be the basis of taxation. It’s also worth noting that the top 5% of income earners pay 66% of all income tax (of which the top 1% pay 25%) and the bottom 50% (less than $47K income) pay 2%.

Governments provide lots of services to businesses, as well.

robert said “It’s also worth noting that the top 5% of income earners pay 66% of all income tax (of which the top 1% pay 25%) and the bottom 50% (less than $47K income) pay 2%.”

Of course context is important so it’s also worth noting the top 5% earned over 38% of all adjusted gross income (of which the top 1% earned 22% of AGI). The bottom 50% earned 10.2% of all income. My figures are from 2020.

It makes sense in a progressive tax system that when half of earners are dividing up only 10% of all income (and less than half the income of the top 1%), their income taxes, as a percentage of all income taxes, will be very low.

MarMar: “I’ve also come around to the idea of a wealth tax.”

Which article of the Constitution would you use to authorize this new tax law?

Grass:

“Which article of the Constitution would you use to authorize this new tax law?”

Do you really think that would stop them if they want to do something outside of the Constitution?

While a wealth tax is repugnant to me, this is not a constitutional issue. Congress has the right to “lay and collect taxes, duties, imposts and excises, to pay the debts and provide for the common defense and general welfare of the United States.” Also, the 16th amendment…

Love #4. Won’t move the needle like #1, but it’s fun policy.

Would need to exempt the Boomers from #5. Because, well, they’re special.

All joking aside, #1 does the job and nobody with less than, say $10-$20M would even notice it

These would be very good tax changes and probably result in a more fair system of taxation and better overall economic system. Unfortunately I think there are too many special interest groups with a lot of political clout that would oppose these measures. They didn’t even close the carried interest loophole that nearly everyone agrees is a good thing to get rid off.

Totally agree. It’s just a wish list, not anything I ever expect to happen.

There are many constitutional scholars that have argued that a wealth tax is in fact unconstitutional. They argue that unrecognized income is not income at all. If your house goes up in price, then what income have you received? The whole concept of a wealth tax is ludicrous. It would force people to sell their homes to pay taxes and business owners to liquidate their businesses to pay taxes. Not to mention the very good point made that asset prices are very fickle. They change daily. There is nothing in the least “fair” about a wealth tax. It is the very definition of unfair. Every time I hear this populist tripe about “taxing the rich” I can only roll my eyes. The rich have options. Many options. See my comments below.

You missed the most important item: no spending increases!

If you give politicians more revenue, each one thinks they can spend all that lovely extra money.

“congress could…”

wolf you have it the wrong way..

the REVENUE side of this ‘could’ hypothetical is subsidiary to the EXPENSE side: the profligate spending by congress itself, which it refuses to control.

sure, perhaps your suggestions of what congress ‘could’ do may balance things out.. UNTIL they decide to spend more, and more..

so you see? the cycle wont stop from a revenue standpoint. and thats because people (who hold power) will always be tempted to increasingly spend other people’s money.

besides that, balancing the budget isnt even remotely on the radar as a political imperative. so you might have given us a hypothetical set of suggestions that humanity could undertake if aliens landed in times square… it would be the same from a conceptual standpoint.

Totally agree. Spouting “historical examples” only makes one sound erudite. The reality is that there is NO current precedent for the situation we are in now. See my comments below about banana republics. The implication that all is fine and the govt will figure a way out of this is fairy tale thinking. “Oh, the U.S. is the most powerful country in the world.” But we are also the biggest debtor in the world. Japan and China are NOT rushing to buy our beloved Treasurys. The world has changed. Stop citing historical crap to claim that everything will be fine as usual. No, it won’t.

(Myopic) View,

Why don’t you go learn where the term “Banana Republic” really came from and quit using it in that now common error sense? Would make you an even more euridted commenter.

Then you can take on more some of the complex problems here…maybe…..

Hint: Defending the needs and situation of US Corporations in Central America by “adjusting” their governments……bananananana?…..

But the question Wolf is not what could they do this time, but what did they actually do last time? All good if you don’t know.

here in India Now we pay “Intraday” @ 0.015% on all cash securities/futures ,options ,commodities etc , overnight trading (sell it tomorrow or anytime after etc) )@0.1% for both legs (to buy & to sell) , Short term capital gain (up to 1 year holding) 20%, LTCG 10% beyond 1 year .I forget what I used to pay in USA stock &equity options trading via Td ameritrade till 2007. you are right that may fetch significant revenues to us govt and reduce the shenigans . you can add special tax at 210-20% tax on corporate stock buy back transaction value.

All of this sounds reasonable but number 3 would be a blow up. Could probably work around it by it only being in relation to non-primary residences. Then you’d get fairly large public support for it since most people don’t own multiple homes.

Every one of these suggestions would help fix huge unnatural price distotions in these markets.

“Fully remove any deductibility of mortgage interest”

But if interest I /earn/ is added to my income, why shouldn’t interest I /pay/ be subtracted from it?

If you’re not a business, you don’t get to deduct expenses that a business can deduct, such as interest, the salary of your housekeeper, the maintenance costs of your house, the repair costs of your car, the interest on your auto loan, etc. Businesses get to deduct all of these, you don’t. Why should interest on a home be different? Renters don’t get to deduct rent either.

“Why should interest on a home be different?”

I guess I didn’t realize its just mortgage interest that’s deductible – I assumed (yeah I know) that all loan interest was.

I agree that there shouldn’t be special favors just for homeowners.

A good read is “When Money Dies” by UK Author, Adam Fergusson begs

the QUESTION. Is the Nightmare of THE WEIMAR HYPER-INFLATION

UPON US? A REPEAT OF 1923?

A great read and in depth study.

Interesting book about a period 100 years ago, but comparing today’s US situation to the situation in Germany during the Weimar Republic is silly. Entirely different facts.

Yes, these bubbles of today are much worse.

Weimar’s debt was to foreign entities and was supposed to be paid in gold. It didn’t have enough, so it had to massively export its production in order to earn it. It couldn’t produce anywhere near enough that foreigners wanted to buy. So the government made a decision to print currency to buy gold. It worked for a very short period, but lead to hyperinflation.

But the other governments essentially wrote off Germany’s debt anyway because they wanted to protect their own industries from German producers flooding their markets. Moral of the story: don’t force the impossible on others and expect a good outcome.

Kent – outstanding observation. (Particularly admire the eloquence in your final sentence, though our species’ seeming preference for ‘last hits’ too-often obscures this…).

may we all find a better day.

Not in terms of hyperinflation.

We are literally no where close to Weinmar type inflation.

Laughable to suggest it. It shows an ignorance of history.

Ok, how about present day hyperinflation in Argentina?

Argentina is an example of real MMT, where the central bank is part of the Ministry of Finance. The US could go that route someday (though I doubt it will get that far), but Argentina has always gone that route.

There are actually many compelling similarities, both politically and financially. The complacent attitude that we will somehow figure a way out of this mess is fairy tale thinking.

Which mess? The bookeeping or planetary problems for large mammals?

Bet it’s the former……sadly……

Longer View indeed…….

I understand the point about yield solving demand problems, but is there a point where the Treasury market is temporarily saturated and some go unsold? I know that there are trillions in capital in the global economy, but most resources are committed at any point in time. Let’s say Japan is selling instead of buying, to prop up its currency, China is on a buyer’s strike in response to 100% tariffs, the EU is in recession, etc., how long can domestic buyers buy a trillion 2-3 times per year?

That sort of my concern too. Too high yields shifts money from actual investments to debt holders, suffocating the economy big time.

Also there are cases in other countries that debt issuance had to be cancelled since not many buyers.

publius,

oh there is a ‘wall’, all right… somewhere.

no empire in history has been able to retain its central reserve currency role indefinitely. not rome, not great britain, or spain, or any of them. and the US is indeed an empire, much like rome was in its form and function.

the same events that led to rome’s ultimate fall are many of the same the US faces right now: massive unchecked immigration, currency debasement, unchecked gov’t spending, a vast military apparatus ‘policing’ a huge area with its associated costs.. the parallels are really something to behold. one could confidently say that the US is ‘new rome’ for all intensive purposes.

wolf’s ‘yield solves everything’ belief is incorrect, because yield can only rise to a certain extent IN ACTUAL PRACTICE. in theory, yes.. wolf would be right. but there will come a ‘point of no return’ with yields only going so high.. because if they reach that point, wolf’s often cited maxim on ‘things breaking’ will be the result.

its a vicious cycle now, that at best.. can only be ‘balanced’ for a time.. but the system itself is unstable, and so is people’s behavior. human nature dictates that people will act in their own best interests, but most do not see the larger picture. for example, while a person can make a ‘risk free’ 5+% on a t-bill, they are simply contributing to the gov’t spending problem by continuing to fund it. i think you would find that if you considered the overall ethics, doing so is solidly unethical.. just as funding a ‘get rich quick’ scheme for the return would be, or continuing to give dope to someone you are aware is a drug addict.

i knew a waitress who was a vegan. and no, the restaurant WASNT vegan. so they were happy to make money off the big $ steak dinner, but since they themself didnt eat beef.. it was ok somehow. the extent of some peoples hypocrisy really knows no bounds.

I don’t like providing funds to wasteful ignorance but what can a person who works full time so can’t research alternative investments put their money in to get an “ethical” safe return? Stocks are overvalued and I disagree with hoarding real estate and housing since it’s unaffordable for so many. 5% is just hoping to break even after inflation and taxes for someone saving to buy their first house. Now if you mean giving most to charity, that is very honorable conviction and sacrifice and whoever does so will be richly rewarded, according to the holy scripture.

Nobody said: “the extent of some peoples hypocrisy really knows no bounds.”

The boundaries of the hypocrisy are the same as those of our new “Rome.”

When it’s nearly impossible to move outside the bounds of the beast system that promises to eat us, what ate we to do?

I have had workplace qualms about environmental impacts; I have worked in construction.

The amount of waste is astounding! I’m in a luxury area.

The balance is: If I quit, they’ll have me replaced by tomorrow, doing the same wasteful job.

The work goes on, and I go hungry.

The hunger strike may have made a socio-political statement back in my 20s, now it makes for a destroyed household/ family.

On the Rome thing….you left out the most important factor in the downfall…….their chosen State Religion.

Man, did a lot of REAL creeps take over this thread!

Should have started much earlier, but it would be an overwhelming job.

The major banks that are members of the federal reserve are called the “primary dealers”. One of the responsibilities of being a member is being a market maker for the treasury market. Meaning that they will buy any treasuries outstanding. They can afford to do this because all deficit spending ends up in the banking system anyway.

You are speaking wisdom here, Kent — but the percentage of citizens who understand their own Federal government’s monetary operations (let alone the laws which circumscribe them) approximates to zero.

I wish you good luck in your efforts to educate them.

“is there a point where the Treasury market is temporarily saturated and some go unsold?”

Short answer: no.

Long answer: auctions always have bids at varying amounts above the when-issue rate. If there’s not enough demand at WI, then bids at sequentially higher rates get filled until the auction is sold out.

If anything, treasury demand will be maintained at the expense of other assets (stocks, RE will suffer).

1) This inflation historically is “normal”. The era of zero rates is over.

In 2020 all rates plunged. After about 2 years the US10Y reached its previous decade level. Most of them are in a trading range, or in a low slog up, for over a year.

2) Most bonds and notes still carry old rates. The culprit is the bills. The short term rate took off like a rocket in 2022 from zero to over 5%.

In 2025, after the Nov election, the Fed might cut rates. Investors in short term rates will get less than 5.5%. They might switch to 2Y/5Y sending their rates down. The yield curve will be normalized. The 10Y will be above the 2Y and the 30Y will be above all.

3) Gravity with Germany and Japan prevents higher rates.

4) Wages are rising. GDP is rising. Debt is rising. The cost of transfer money and other gov goodies is falling from $7T in 2020 to 3.5T. The US gov spends less on that and more on healthcare, infrastructure in several swing states, expanding “nativist” industries and the cost of debt. The US gov tariffs create inflation.

Re #2, there’s still a supply/demand issue. Treasury auctions are takers of market rates.

Citizens want government services, but not to pay taxes for them. In this system, inflation becomes the tax. I am in a fairly good spot with transfer payments receipts (form sources I also paid into over many years), but I accept that inflation is the price of that. It is also nice to be positioned well with inflation-resistant assets. These can be liquidated over time to mitigate these costs. I have low disposable income but a fair degree of comfort. That is, unless this system buckles. Maybe AI will provide that dotcom-type boost that the 90’s experienced (and Wolf referred to).

Re: AI, we may be able to grow our way out of some of this, but the massive amount of electricity generation that will be required to support this boom ($1T-$2T) plus the attempted electrification of over the road trucks plus charging infrastructure that already sits at $1T+ (without considering the govt incentives necessary to switch from diesel trucks (electric trucks are 2-3x more expensive)), it feels like we’ll continue to drive inflation upwards.

AI electricity usage can be and will be optimized over time. Bitcoin usage not, by definition.

‘optimized’ to the detriment of what? and who will decide?

DZ: technology ie Moore law.

Maybe even escaping the silicone.

Maybe even completely different approach to teaching AI. And maybe even way more breakthroughs.

Optimized meaning more efficient.

Biker,

No, they are going to ban mining, so they give all the extra juice to the data centers for AI. It is already happening in many of the low priced areas. Data centers are going to go the lowest and cheapest priced electricity in the nation. Do a search and you can see it. Question is how much will they take from the residential, commercial, ag, and industrial. They charge a higher rate per kwh than these other uses, so it is almost regulatory capture. So, there must be a careful balance and folks are watching carefully on both sides.

Electricity is not as elastic as you think it is.

AIP: just read my response, think a bit before responding NO. You are not saying no to my content.

Artificial general intelligence is the equivalent of an infinite number of monkeys on typewriters to produce a single great novel. It is in no way computationally efficient, and can require thousands to tens of thousands of times more computational effort that a carefully written algorithm to solve a specific problem.

There’s a lot of ‘maybes’ there, Biker. My plans involving the future minimize the use of ‘maybes’.

Yeah, you being a black and white type “thinker”, that makes sense.

Go wave a flag.

The benefits of AI are about 20 years out. Relative to AI, we are where computers were in the ’60’s or the Internet in the early ’90’s. The basic technology is there, but now enterprising folks have to figure out how to apply it profitably. That will come in fits and starts.

Phleep,

I would question the assumption that people want services but just don’t want to pay for them. The reality is so much of the spending occurs in areas most people dont want it spent or is spent inefficiently for a variety of reasons. Military spending and continuous imperialism is one area, and the other is for profit healthcare which may have equivalent outcomes for part of our society but about 10X the cost. There are solid reasons why the approval rating is so bad for our political system as it doesn’t work for the people. Unfortunate given the massive wealth of this country.

Central banks exist to help governments finance themselves by stealthily transferring wealth away from the average person’s savings.

It’s the hidden, but real, reason why central banks exist.

Modern central banks were created to backstop banks — very fragile creatures that are in the high-risk business of borrowing short and lending long and that used to blow up regularly and take depositors’ cash with them because those banks ran out of liquidity when customers wanted their money back (so everything stopped, wages didn’t get paid, transactions didn’t go through, lending stopped, rents and mortgage payments couldn’t be made, et.). Widespread banking collapses had a devastating impact on the economy. So the primary structural role of central banks is as “lender of last resort” to solvent banks when they’re out of cash during a run on the bank. Today they also have other huge roles that may or may not produce the effects you’re describing.

“banks high- risk business of borrowing short and lending long” Sounds like farming. Buy everything retail then sell everything wholesale. Never knew i was really a banker, thought i was just a dirt farmer. lol!

Wolf,

Is there an argument to be made that central banks have ended the risk of runaway deflation (which happened repeatedly when banks used to fail all the time) and instead have created the risk of slow and steady inflation (by constantly increasing monetary supply, bailing out people who really belong in handcuffs, and causing manic speculative psychology to take over because people now expect to be bailed out by printed money)?

The solution to one problem ends up creating another problem?

Some problems arrive slowly and some very quickly. As Keynes wrote, in the long run, we are all dead. The steepness of the ramp between here and there matters. (Walking is a controlled, regulated form of falling, etc.). Central banks are, I think, trying to avoid things (prices, employment) going fractal — i.e., to smooth them. One cannot project the counter-factual — the crash that didn’t happen — with confidence. I will go with “it could be worse,” meaning, far worse for many more people, as there are always fringes doing fantastically and horribly. But I can’t prove it. I didn’t get the full-package American Dream, and I never felt entitled to that — I made my trade-offs accordingly.

US Government Debt and Tax Receipts are out of balance. I guess that tax cuts don’t pay for themselves, after all.

Inflation may alleviate that problem to some degree but at the end of the day the US needs tax increases and/or government spending cuts.

We are in an unsustainable fiscal path. I used to be somewhat afraid of AI surpassing human intelligence but not anymore… Maybe AI advising or even running the government could be a solution to the never-ending stream of stupid and short-term-thinking demagogues we get in the US. ChatGPT can at least do basic math, something these “leaders” apparently cannot do.

Thanks Wolf for keeping us informed about this mess!

Nobody serious ever thought tax cuts pay for themselves, at least at the marginal rates we’ve have for the past several decades.

Inflation is and always has been the only the answer to the problem. Congress will do what is the most politically expedient thing. Here is my prediction:

Nothing changes until post election, this will shape the actual outcome so in many ways it’s the singularity that is difficult to see past. I don’t see anyone predicting a landslide type election where one party controls all levers of power so I will guess (predict) based on that outcome.

Tax increases will happen, mostly by the rolling off of the Trump individual rate decreases in 2025. Why? Both parties can blame the other for it happening no matter the outcome of the election.

Inflation will continue to unabated at around the current levels at least until the next recession- which will be in 2026 Why? It solves all the ills of the current day with minimal political cost. The fed is powerless to do much more than it has, without something breaking and inflation is imbedded without that happening. Fiscal policy is stuck until the tax rates change and bring receipts and outlays into a more sustainable balance (3% of gdp deficit).

Spending won’t be cut, because it enacts too large a political cost on whoever does it. Both parties see China as a looming military problem so defense spending will remain. Social security is solved by inflation and wage growth (now 160k as the wage base).

So there you have it. My bold and likely totally correct or not prediction.

Inflation and more inflation. Then higher tax rates for individuals. Then a recession in 2026

I kind of agree with you but how much will bringing back the SALT deduction affect tax liability. I thought that was why most of the wealthy people in California and New York and Michigan and New Jersey hated Trump. Here in California state taxes are big and real estate is inflated and the wealthy are all voting for Biden.

“It wasn’t until then that Congress, which decides fiscal matters”

Yeah, those were the good old days, when Congress actually decided fiscal matters.

We won the Cold War with those 80’s deficits and then cut military spending after the Berlin Wall fell. Also, top marginal rates coming down from 70+% helped fund early Silicon Valley.

In the 90’s Gingrich era Republicans and Clinton came to agreements to balance the budget. Trump era Republicans want to spend as much as Democrats.

I think the debt will keep going up and we’re going to be more like the family who maxxed their credit cards on fancy vacations and jet skis, not the family that took out loans for a house or to start a small business.

“WON” the Cold War? Reagan, ClintonS, and Gingrich all are worth MORE than my usual “rose to the top of an organization” DISGUST….plus a lot of $$$$$s.

And the cost of Vietnam War AND all the ENORMOUS amount of money HIDING caused most all that inflation….(plus the still always ongoing other “government shaping” and misc projects and corp profit defending actions here and there)

My uncle and his DC pals got rich, though……top MIC lobbyist for HUGE war equipment maker…planes, missiles, bombs, avionics, etc, etc, and even had big pieces of Apollo and the Space Shuttle. IKE maybe warned us verbally, but still did business with him, ie, Vietnam “stuff”.

Is it not important how the debt is used for?

Debt used to grow economic activities will also increase tax receipts in the long run. With new technologies e.g. KI, EV, and electrical heating, we need more power, which means an upgrade to the infrastructure (e.g. power grid), construction of new data centers, and energy plants.

All will stimulate growth and therefore higher tax receipts.

In my view not the level of governmental debt is important. Important is how the debt is used.

Critical is that more and more foreign states are moving (slowly?) away from the USD as the US is using it as a political weapon. Which may end in higher interest rates which are only sustainable when the economic growth is in the range of the long term interest.

You are correct on both fronts, but much heat and light will be generated about “how much” in order to obfuscate the much, much more important “on what.”

As Kurt Vonnegut would say, so it goes …

A good book on this very topic, written back in 1912 by one of the two founders of CornelL University, Andrew Dickson White, is, ” Fiat Money Inflation in France”. It shows how this same thing has played out many times in history. As they say, there is nothing new under the sun.

Under the sun that’s new, is my tomato plants, not to big yet, but in time big fat and juicy tomatoes…delicious.

At the store a tomato is very expensive so I’ve decided to grow my own. Soon I will have to report my tomato plants to the gov so they can tax my plants to help fight inflation, the gov drones will be flying low to catch the non complying gardeners.

Amazing what can be done with a little pack of seeds, water and care.

And—amazing what the government can do To you with more tax revenue to fund those tools to intrude into your life.

Last I heard about Mr. Tobin and his tax scheme, he was shipped off to south-east Asia, never to be heard from again. Luckily you do not work for some entity, government like Tobin or corporate, so your outcome of similar sort should not be expected.

Thanks for your tax lesson.

Please explain Tobin being shipped off to SE Asia, etc. Tobin died in 2002 in Connecticut after an active career in economics including a Nobel in economics in 1981.

His proposals on taxation of monetary transactions, tho never implemented, has produced a long list of proposals for taxation of economic activity and financial transactions, some of which would likely be far superior to the current tax system as administered by the IRS and other federal agencies and catastrophic for the financial markets as operated today.

It’s honestly not as bad as the doomsday, deficit spending is going to end America Sayers are making it out to be. Simply raising the corporate tax rate or closing the endless amount of ways corporations get their effective tax rates down to or close to zero would bring us back to levels of 2020. It would allow interest payments to be more easily covered, pay down the debt, all while not needing to take on new debt to cover infrastructure spending that is still not enough despite recent legislature. If increased government spending leads to increased economic activity, tax receipts would further increase as well.

This particular story that Wolf has shown us a few times is probably the most useful of all. You can see we do have some time until Congress is forced to act.

Wolf:

You seems to give too much credit to congress for the 1990’s reversals. I also lived through that period as a mature adult and the reason is much more complex than that.

Remember, before 1987 crash, the mantra used to be Triple deficits. Are we any better off in that metric now or before?

USSR broke up after the arms race (it was like the silly kids game of who blinks first and USSR did; it doesn’t mean that we were not hurt. We find it compelling to start new wars. Eisenhower himself addressed this issue) and that brought us a lot of good things (which we squandered away in Afghanistan, Iraq etc.). Even bigger influx of Indian immigrants started after USSR collapse (break up of socialism in many countries).

China became a bigger supplier for our low end good that kept the middle class inflation suppressed and still does to certain extent. I have been buying from Temu for a year and I can by pass our middle man, Amazon. On a different note I wonder if this the sequel or revenge to opium war that western countries imposed on China. Ruin western economies eventually by their superior, economical production methods.

Japan which was marching faster than us with all their discipline collapsed by their own bubble (remember the book, We can give away Maine to Japan?). IMHO, China might not suffer like that given a number of differences (population, unlike Japan, China had their own identity and pride etc.).

All these hedonic adjustments like you got bigger size TV or car with all electronics that allows us to reduce the official inflation number somewhere else, has run out of their usefulness. More and more poor people are getting pushed out (I am glad the EV might put a reset to big new auto price inflation). At the end of the day, average folks needs a reliable transportation with 4 wheels and what not and not some satellite connection etc.

We have all the opposite of what we saw in the 1990’s that helped us. End of globalization, currency wars, a new cold war etc.

Yes, in one reply, you gave what should be done. The question is, is there a will? Even that average person seems to support leaders who are interested in their own empire and not a proper solution.

And you said, 1923 German doesn’t apply here. Yeah, history never repeats but rhymes but again the visible minorities would get caught as usual.

When the banks ran out of cash congress let the Fed “short” people’s

bank account to pay the banks and the banks were saved.

As a youngin I had no idea how much we were paying towards interest as a nation in the 80’s. Wow. That interest as % of receipts now going back to the moon also very wow. much wow.

And as the article said that led to a lot of soul searching, the 1994 Republican Contract with America, and the first balanced budget in decades.

Hard to imagine any of that now – a balanced federal budget means an instant 5%+ drop in GDP and a spiralling depression.

A question about this current bout of inflation – in many of the indices there was a sizeable “step function” where price indices simultaneously shot up 30-40% very rapidly. Has that happened before?

Let us convert the national debt from dollars to moles (mol) in hopes of gaining new perspective from a different angle:

(34.6e12 dollars) (1 mol/6.02e23 dollars) = 5.7e-11 mol

This is a very small number, indeed.

This is what we get for making Avagadro’s number a defining SI constant?

Money will flow to where it is welcome. Raise taxes enough to pay for our welfare economy and the rich will find a new home. Just as they may find a new form of money.

Nonsense.

Exactly, Box.

Just WHERE will they “flow” to?

Those palm tree islands in Dubai, or my favorite, the World Map islands?….talk about an “in your face” to the rest of us concept…..arrogant fucks. But what do you expect out of a Medieval royalty type government?

I’ve been rolling cash over in a combination of 13 week bills and three year notes. The former at around 5.4, the latter at around 4.4. Their IS a small chance that inflation will settle back to 2% and stay there. But due to deficits and slowing QT (shadow QE?) it’s not all that likely. I think the Fed will allow inflation to ride along closer to 3% for a while, maybe with an unspoken explanation that this “makes up” for the subpar inflation in the 2010s. Whatever, there are always words to back-justify anything.

At steady 3% inflation ST bills should level out around 6% and the ten year over 5. Yield curve inversion used to mean a recession is coming – maybe that’s not true anymore or maybe this time it’s just building up like Krakatoa and when it blows after years and years there will be no hiding for anyone anywhere.

“Yield curve inversion used to mean a recession is coming”

Now it means that Fed Pivoteers and bond traders are still clinging to their fantasy of future rate cuts.

One of Wolf’s responses to a commenter included Wolf’s list of items that could be taxed or lose favored tax treatment that are now mostly exempt such as charitable contributions. I agree and would include taxing the accumulated wealth of tax-exempt entities like university and healthcare foundation endowments. An added benefit would be to limit the undue influence of the trustees of so much wealth. Of interest is the 11/2/1789 action of the French Constituent Assembly to confiscate all church property and redistribute it through bonds called assignants via auction.

1789 and 1917, IMO, are both prime examples of how not to expropriate the expropriators. Both yielded mass violence and ultimately, dictators at new historic levels. I would hope there is a more civil way.

MW: Roaring Kitty’s GameStop position worth over $386 million as of Monday morning as GameStop soars!!!

Central banks have a long ways to go before the inflationary excesses are drained from the system. Easy does it, so that it can go on for years.

MW: Oil has plunged back down to $74.22 per barrel and is headed much lower

The price of diesel is now right in line with unleaded. A year ago it was still 20% higher than premium and now it’s less. Doesn’t bode well, no?

DM: New York Stock Exchange chaos as Berkshire Hathaway and other stocks worth over $100B plummet by 99%

The New York Stock Exchange is urgently investigating a ‘technical issue’ that has caused dozens of billion dollar stocks to list a 99 percent loss.

Yes, “Technical Glitch” that all things of

“Value” now rely upon… the code.

The “net” was a dangerous new frontier in Y2k that threatened to blow up, everything! Calling for the stockpile of huge amounts of… toilet paper (what is wrong with Americans?).

Today we cannot survive without the screen and the notification to let us know: when we need toilet paper?

The financialization of everything creates economic growth by requiring legislation, legal protections and finally litigation surrounding the financial assets. All this “value” creation is revealed as artificial, when the lights go out.

Yes, the financial assets become the least important again with a warm fridge, full of rotten food and a tap with no water.

There is definitely no possibility that the NYSE can be hacked, just as we know bitcons are secure, private (or completely the opposite) and 100% legit.

9:37 AM 6/3/2024

Dow 38,288.11 -398.21 -1.03%

S&P 500 5,245.44 -32.07 -0.61%

Nasdaq 16,692.76 -42.26 -0.25%

VIX 14.09 1.17 9.06%

Gold 2,362.70 16.90 0.72%

Oil 74.29 -2.70 -3.51%

Rain day here. In the office doing paperwork.

Out in here in flyover, the brakes are finally getting applied

on construction.

finished green as it usually does. i think the fact that the rich own most stocks mean that there really isn’t any fear based selling. i don’t expect price discovery again in any assets.

Another factor in the government debt equation is that foreign countries are going to be considerably less eager to put money into US government controlled investments since the government has shown the world it will illegally steal that money any time it wants. If you refuse to do what the US wants, they may decide to steal any money you have loaned them.

Annual interest that must be paid on the US federal government debt is now MORE THAN $1 TRILLION and the amount of that federal debt is increasing by more than $3 TRILLION A YEAR.

We should give the IRS agents bazookas if that is what it takes to make the tax cheats pay.

I anticipate that in, oh maybe 50 years (?) Mosler will be proven correct that not only do the central banks have the relationship between interest rates and inflation wrong, but backwards.

I doubt the insects will have evolved enough in 50 years to be interested in “proving” shit…..maybe another few hundred million, though……

Wow, what an excellent article and fascinating comment thread. Many insightful comments. However, I think that the entire conversation is too focused on our domestic situation. The U.S. is currently a “rich developed nation with banana republic characteristics”. All of the solutions discussed here have been tried in many banana republics and have failed. As Wolf pointed out, the only true path out of this mess is to inflate away the debt by debasing the money supply via excess money printing and huge inflation. BUT, Wolf is very wrong to state that inflation affects all equally. This is only true IF the federal government can institute severe capital controls to prevent asset flight. The rich are not stupid. They are not a bunch of clueless kids who inherited their wealth. The vast majority are very savvy business people and sophisticated investors. In the current global financial regime, there are many escape hatches that the U.S. would have to close without turning completely into a dictatorship and just confiscating and nationalizing everything. Take a look at the many, many examples throughout history of other banana republics in the same boat, and what they tried to do. It is VERY ugly.

Read Lyn Alden’s book “Broken Money”. Her grasp of financial history and its implications for the current U.S. mess are incomparable. Parsing out half-baked tax policy solutions is simply an exercise in shuffling the deck chairs on the Titanic.

See also: Mozi (book)

Mohism is best known for the concept popularly translated as “universal love” (Chinese: 兼愛; pinyin: jiān ài; lit. ‘inclusive love/care’). According to Edward Craig, a more ACCURATE (my “shouting”) translation for 兼愛 is “impartial care” because Mozi was more concerned with ethics than morality, as the latter tends to be based on fear more than hope.[1]

Here, chew on this, might help your commenting….Last sentence, especially……I still think there is hope for you……with guidance…..

BTW, Craig was top grade athlete in his youth, connect that with democracy, ancient Greeks, and their love of actually DOING a sport…(when they could)..also important in your (anyone’s) training.

Hope that isn’t too much for ya all at once………but at least I didn’t recommend a book….that’s lame…..unless you are a kid.