Housing inflation refuses to cool for eighth month, and five of the remaining seven core services accelerated further. This is not good.

By Wolf Richter for WOLF STREET.

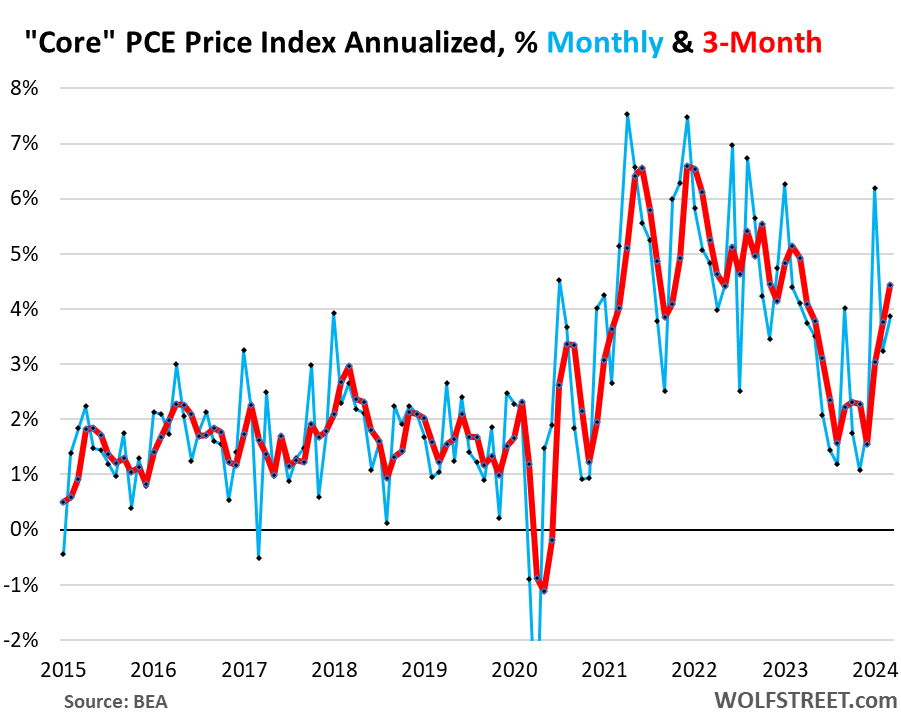

The core PCE price index, which excludes the volatile components of food and energy and is the inflation index the Fed is focused on, jumped by 3.9% annualized in March from February, nearly double the Fed’s target of 2%, according to the Bureau of Economic Analysis today (blue in the chart).

The three-month annualized core PCE price index, which irons out some of the month-to-month volatility and which Powell cites all the time, accelerated to 4.4%, the highest in a year (red), and moving decidedly away from the Fed’s 2% inflation target.

This was driven by the usual suspect, a sharp acceleration in core services to 5.5% (three-month annualized) that we’ll get to in a moment:

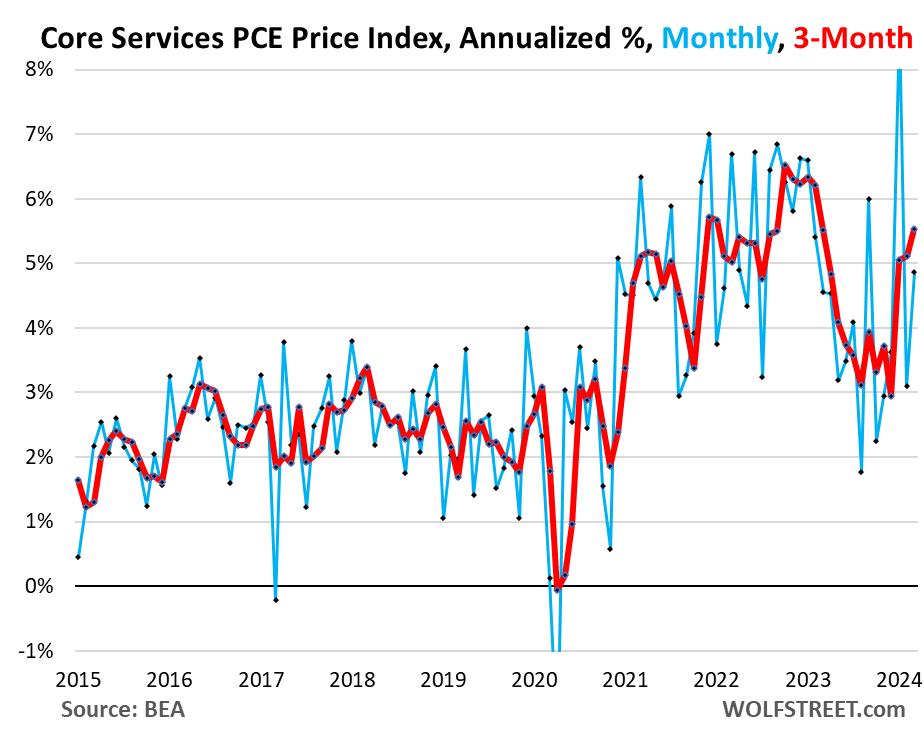

Core Services PCE price index, which excludes energy services, has been hot and is getting hotter. This is where inflation is entrenched, and where the majority of consumer spending takes place. And Fed speakers from Powell on down have pointed at this issue endlessly.

Core services inflation had calmed down somewhat by mid-2023, but then refused to calm down further, getting stuck in the 3.5% range annualized for five months. And in January, it began spiking in a very disconcerting manner.

The core services PCE price index jumped by 4.9% annualized In March, from February (blue). The three-month reading jumped by 5.5% annualized, the worst since February 2023.

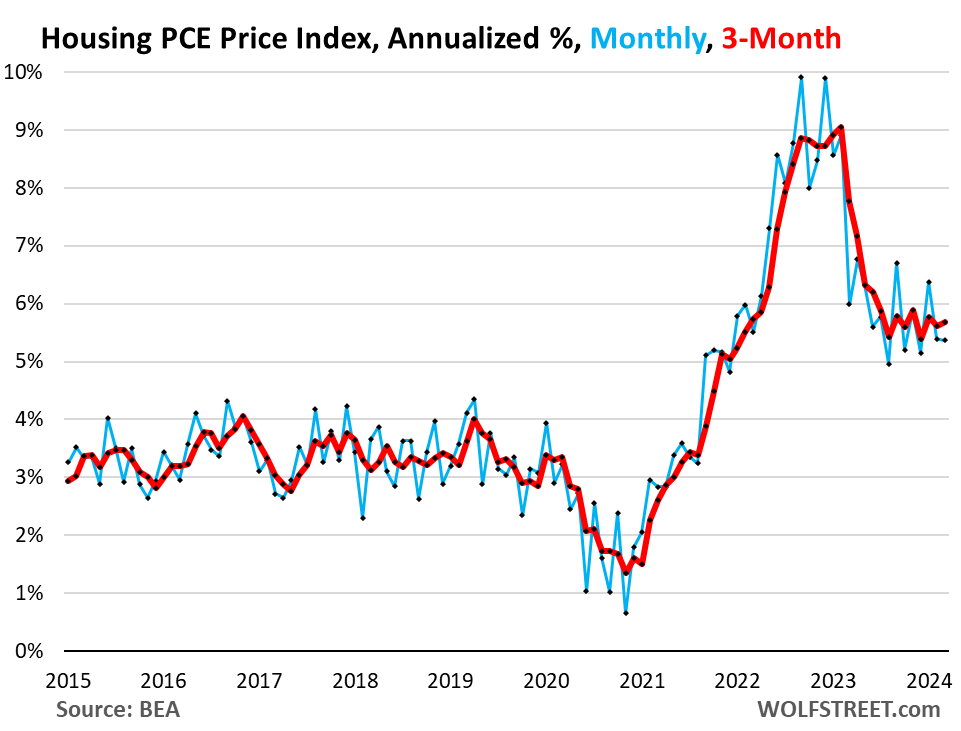

Housing PCE price index jumped by 5.4% annualized in March from February. The three-month reading jumped by 5.7% and has been in this range for eight months in a row.

The housing index is broad-based and includes factors for rent in tenant-occupied dwellings; imputed rent for owner-occupied housing, group housing, and rental value of farm dwellings.

Other core services are super-volatile month to month, so here are the PCE price indices on a six-month annualized basis. Five of the seven categories accelerated in March on a six-month basis; only two decelerated:

- Healthcare: +3.5% (acceleration)

- Transportation services: +5.4% (acceleration). Motor vehicle maintenance and repair, car rentals, parking fees, tolls, airline fares, etc.

- Financial services & insurance: +6.0% (acceleration).

- Non-energy utilities: +5.3% (acceleration).

- Other core services: +3.8% (acceleration). Broadband, cellphone, other communications; delivery; household maintenance and repair; moving and storage; education and training; legal, accounting, and tax services; dues; funeral and burial services; personal care and clothing services; social services such as homes for the elderly and rehab services, etc.

- Recreation services: +4.1% (deceleration). Cable, satellite TV & radio, streaming, concerts, sports, movies, gambling, vet services, package tours, maintenance and repair of recreational vehicles, etc.

- Food services & accommodation: +3.1% (deceleration). Restaurants, hotels, motels, vacation rentals, cafeterias, cafes, delis, etc.

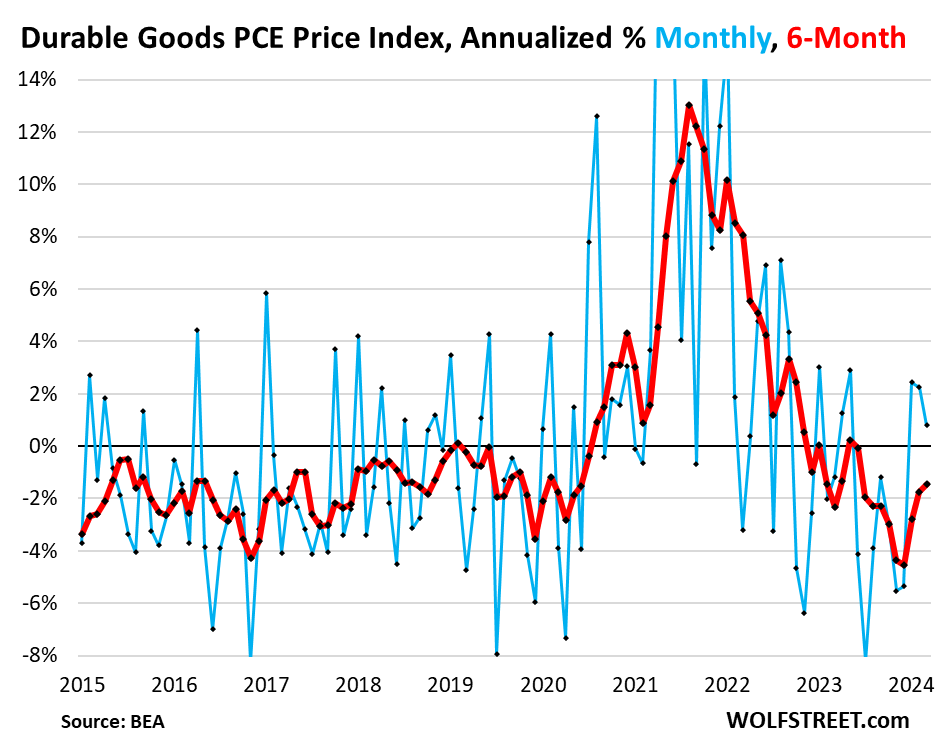

Durable goods PCE price index rose by 0.8% annualized in March from February, the third month in a row of positive readings, after the pandemic spike began to unwind with a series of negative readings (blue in the chart below). This raised the 6-month index to -1.4% (red).

Durable goods inflation is now normalizing, which reduces the counterbalance to hot inflation in services. The big negative inflation readings in 2023 of durable goods and energy had caused the very welcome cooling of inflation. But energy costs have been rising for months, and durable goods are rising again:

The overall PCE price index rose by 3.9% annualized in March from February, nearly double the Fed’s 2% target.

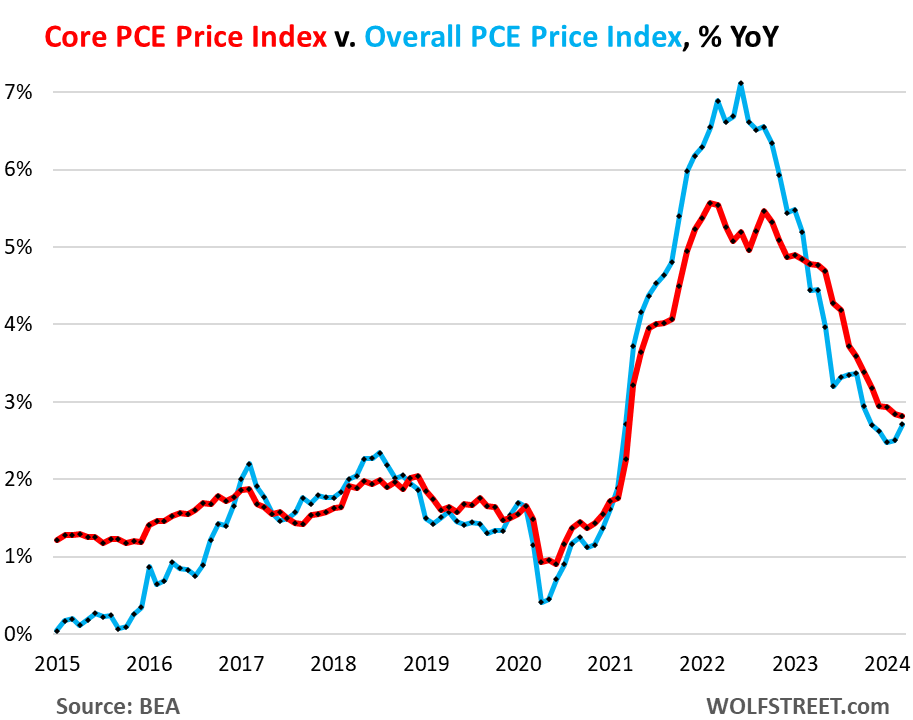

Year-over-year, it accelerated to 2.7%, second year-over-year acceleration in a row (blue in the chart below). The core PCE price index on a year-over-year basis rose by 2.8%, same as in February (red).

The majority portion of the year-over-year readings is composed of the “base effect” – the base of the calculation is the number a year ago – and what happened over the first six months of the 12-month time span. And those six months covered the sharp deceleration of inflation in mid-2023.

As seen in the month-to-month and three-month data above, the acceleration of inflation began happening in late 2023 and took off in leaps in 2024. It will take a while for these movements to dominate the year-over-year readings, which is why we look at monthly and three- or six-month readings because they give us a better feel of the current inflation trends. But with a lag, they will make their way into the year-over-year readings:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Yes! I will continue to go on record stating that this was simply the first wave of inflation. Furthermore, depending on whether or not CONgress can actually balance the budget (which it appears that cannot based on recent legislation), the next wave of inflation will be 30% larger…

Hedge accordingly.

HIGHER 👏 FOR 👏 LONGER

Question: How much longer does inflation have to push upward before this “wait and see” attitude shifts to “oh crap we missed again” for the Fed to resume hiking?

At this point, there’s a MOUNTAIN of data to suggest the Fed pulled back TOO SOON.

The main inflation indices are still BELOW the Fed’s policy rates. So that’s not such a terrible place to be. The problem arises when some of the inflation indices start rising above the policy rates. And then the Fed is going to chase after them. This could get rough. But no one can predict inflation.

re: “But no one can predict inflation.”

And James Grant told me no one can predict interest rates.

GW,

The problem is he Fed is also dealing with the crybabies who want their free money back.

Truly between a rock & a hardplace.

Staying put on rates is a compromise between the free money crybabies, and folks like fellow wolfstreet commenters who (rightfully) feel inflation is still too high.

Predicting rates is easy – just listen to the Fed LOL

July/August. Inflation was high in 2023’s first-half (and 2022’s) relative to their 2nd halves.

If this inflation is not seasonal and we continue to get +0.3% or higher monthly numbers by summer (a big if), the annual rates will start increasing and the Federal Reserve will be forced into a corner.

Until then, the Federal Reserve can get away with holding rates, as the +0.3/0.4 monthly gains are replacing +0.3/0.4s from early 2023, so the annual number is still +2.8%.

Almost 7 months after the fact, FRED FINALLY published the annualized interest expense for Q1 2024.

$1,059,235,000,000

So again, if the Fed doesn’t cut the FFR and interest rates stay high, possibly going even higher over the next 305 months, then this predicted expense becomes a reality for FY 2024.

Since Q3 2020, this number has more than doubled. And the CBO predicts that in 10 years it will be $1.6T, and we all know how conservative (aka wrong) the CBO consistently is.

Looking forward to Q2 2024 in about three months when it’s reported 2 quarters late.

This is idiotic braindead BS. I never ends, does, it, GuessWhat? Including the “Almost 7 months after the fact, FRED FINALLY published the annualized interest expense for Q1 2024” LOL, we’re just three weeks after Q1, not seven months.

This is what matters, and your gurus citing only the interest expense in a vacuum are idiots:

Inflation has attained the dreaded anchored status. The FFR is too low, given the grotesque obesity of the Fed balance sheet which provides liquidity to the asset markets.

Kudos to Wolf who thought the 10 year yield would increase, which it has.

The Central Banks are still funding the asset markets. The morality of that is debatable when a time like now arises.

Yeah, Wolf repeatedly said “head fake”.

I find it hilarious that the nuttersphere is now spreading the story that Zelensky is buying a new mansion every couple of months.

On one hand I am constantly amazed that people constantly fall for Russian propaganda, but on the other I recognize just how stupid the human mind can be.

Two issues – related to each other – work against an acceleration of inflation:

1. US Dollar strength relative to trading partner currencies

2. Recessionary trends in other countries.

How do these impact your expectations for inflation acceleration/deceleration, Wolf?

Like everyone else, just trying to piece it all together…

Thanks

Wow, thanks for the inflation insights Wolf. What to invest in now? Or is it best to just keep cash in high yield 5%+ money market?

I recently heard someone say in an interview:

“The Fed is closer to a rate HIKE than a cut”

If the Fed could just stop talking about cutting rates for a few months, I think that might tame the market’s irrational exuberance.

A next step could be for the Fed to start talking about rate hikes.

If that doesn’t work, then they could actually raise rates in a few years.

First things first.

Yeah it made zero sense for Fed officials esp Powell to say they expect to cut rates this year, if their goal was really to lower inflation this year. Of course that supports stock prices and makes homeowners want to hold rather than sell, fueling spending and reducing housing supply.

Powell’s comments make sense when viewed in an election year. Otherwise, not so much.

Does this mean we should be buying I-Bonds at the new rate? TIPS are way too complicated for me! Or is this a naive question?

Unrelated to this article, but I’d love a discussion on I-bond strategy.

I got mine about 18 months ago when the combined rate was something like 9.6%, but the base rate was almost nothing. Now my combined yield is lower than the yield on new issues because my base rate is lower than the current base rate.

I’ve been wondering if it would make more sense for me to redeem my I-bonds, take the 3 month interest penalty, and then just buy new issues in my TD account. I suspect the higher yields I’ll get over the next decade will more than make up for the early redemption penalty – but haven’t actually run the numbers.

I sold my 9.6 % I Bonds when the rates dropped below 3 and 6 month treasuries (waited the three months of low interest before selling). Now I just buy treasuries (~5.3 -5.4%) and repeat when they mature.

I had only just bought mine at that point – I was so excited to get that kind of yield on gov’t debt.

But these are my non-401k retirement funds, so I plan on holding them all the way thru their 30-year maturity. That’s why I’m thinking the higher base rate could be advantageous – but I’d also have to factor in the tax implications of selling them early.

I also have a small T-bill/CD ladder for my short-term funding needs.

I’m also getting a lower yield, but on a higher principal right now, since my accrued interest already compounded once.

Same here, at least with the “low risk” part of my portfolio. Still waiting for my miners to pop like all my energy stocks have…

Look, my dear friends, I think there is a basic misunderstanding as to what I-Bonds are for. They’re designed to form the very bottom layer of your nest egg, just above Social Security (old age insurance). They’re not designed to take advantage of the latest spike in yields or whatever. Some years their combined yield lags T-bill yields, other years they’re ahead.

But that’s not their point. Their point is that they offer tax-deferred interest income that is inflation protected by being pegged to CPI plus a base rate.

The interest income is added to the principal, and next year, you’ll earn interest on that prior year’s interest income. And you pay neither federal nor state income taxes on that interest income, and it grows untaxed and you keep earning interest on the untaxed interest income until you redeem the bond, which is when you get a 1099 and pay taxes on the accrued interest income.

For example:

If CPI inflation is high enough to where the combined rate is 5% for 15 years, your $10,000 I Bond bought today will have grown to $15,000 by 2039 (15 years from now). And you never paid taxes on that income.

If you hold it for 30 years under the same conditions, your $10,000 I Bond bought today will have grown to $43,000 by 2054 (30 years from now). And you never paid taxes on that income.

In year 30 is the first time you have to remember them because that’s when they stop paying interest and just sit there until you redeem them.

The idea is that every year while you’re working, you put $x,000 into I-bonds, and start redeeming them when you’re retired and want the extra cash.

I-bonds are designed to be buy-and-forget instruments. You don’t get a 1099 on them until you redeem them, so you don’t have to mess with them until you’re ready to redeem them.

But you should have stuff on top of your SS and I bonds in your nest egg. On top of I-bonds in your nest egg should be all the other stuff you have, your liquid cash, T-bills, T-notes and bonds, corporate bonds, stocks, RE, PMs, whatever you fancy, some with more risk, others with less risk.

Ideally, you save enough money every year to buy your I bonds plus all your other stuff that a diversified investor would want to have in their nest egg. It should not be a trade-off between I bonds or T-bills. They don’t have the same purpose.

ALSO, if you redeem I bonds before the 5-year mark, you lose some of the interest you earned. If you redeem them within the first year, I think you lose all the interest you earned. Check the rules.

They’re not designed to be short-term instruments. They’re not designed to make you a ton of money. They’re designed to protect a portion of your nest egg from inflation worry-free and tax-deferred.

The I bonds issued from Nov through April 30, are paying 5.27% total annual rate for the first six-month period. So a little lower than T-bills, but all interest is tax deferred. The variable rate portion will change every six month, and goes up when CPI goes up.

Further simplified….Anything that has a $10K/yr LIMIT on purchase is probably a good deal.

Just to clarify about the 10K I bond limit (Not investment advise)

You can buy I-bonds of more than 10K per year using Gift route.

In Nov 2022, I bought 120K for my family. I gave gift to wife, wife bought gift for me. We bought for our kids and gift for kids. On 1-Jan-2023, we transferred 10K gift and on 1-Jan-2024 remaining 10K to each other.

So there is much higher limit if you really want to buy higher amount for longer duration. (300K i.e. 30 years X 10K ).

its no wonder congress has no urgency to reign in spending or balance any budgets when there are plenty of people like you and other institutions willing to buy their paper to fund their debt addiction.

anybody who buys US gov’t debt: bills/notes/bonds facilitates the continued gross abuse of the national ‘credit card’.

the worst part is, that the basis for doing so is ostensibly ‘rational self interest’.. but when viewed from the larger perspective, its actually national financial/economic suicide.

every major economic power in history destroyed itself in similar fashion: rome being the most notable example. but more recently, every major european power whose money was, or was regarded as, an ‘international reserve standard’: the spanish, dutch, french, and british.. most recently.

Wolf thanks for smacking some sense into me. You’re right I should just keep sitting on my I-bonds.

Sometimes I forget not everything is an interest rate arb opportunity…

Too bad SRK can do shit like that….I actually thought they were something instituted for poorer people. Should have known better.

Congratulations for having the money and knowledge to get even wealthier so you and yours can trash this planet better and faster.

I bought $5k at the end of April 2022, and $5k six months later—redeemed them all at the beginning of January, added the proceeds to my T-Bill collection, and haven’t looked back. I’m a saver, but with a long enough horizon that I couldn’t justify keeping them.

Not really sure what to tell you, but I’d look at that option.

I took the 3 months penalty on I bills, and bought 4 wks bills.

At 9%+ with I bonds, all was well but at 3%+ all was not well

I bonds don’t make sense to me, seems they could easily be the worse place to put your money…. looking forward.

Guess if you buy, ‘put them away’, forget about them, and let them grow……still makes no sense.

Just read what wolf said about having an nest egg for later….

What type of company or business or billionaires would buy these, or are they primarily for squirrels…. bubba might be interested.

Howdy Home Toad. Bubba aka squirrel was interested in Ibonds when they were paying well over anything else. Was able to max out 40 000 in one year, 2 personal and 2 DBA accounts. Waited one year and sold out. 28 day T Bills are where my nuts are stored currently. As the Disco music gets louder, where will the nuts go??? We shall see……

We buy I-Bonds, but I appreciate them the most for our kids who would otherwise get very little through bank savings. Our oldest has his first real job this summer so besides I-Bonds, he will start putting money into a ROTH. He will only have about a year before the ROTH can be transferred directly to him.

3 possible explanations for the high inflation in Q1:

1) High inflation is seasonal & will naturally cool off in the second half. (Monthly inflation figures are already seasonally adjusted, but maybe those adjustments aren’t enough?) 2022 & 2023 also had much higher first-half inflation than second-half. Policy response: The Federal Reserve can just hold rates where they are (higher for longer.)

2) The Federal Reserve’s possibly-premature “dovish pivot” & nonstop chatter about rate cuts in Q4 2023 reignited animal spirits in the markets & economy. Many consumers are now sitting on thousands to millions in additional wealth as markets climbed 25%+ in 5 months, driving up consumption demand & prices. Policy response: The Federal Reserve can just hold rates where they are (higher for longer) & maybe talk less about easing.

3) Rates aren’t high enough to restrain inflation, and the Federal Reserve will need to tighten more to get it back to target.

Which one is it? I guess we’ll find out soon with Q2 inflation numbers.

Howdy Jackson. All of the above. Gonna be fun this time for some…

How about:

4) Interest rates are going to have a limited impact on demand while the federal government’s fiscal deficit is at 7% of GDP and the vast majority of homeowners are protected with their 2.5% – 3% 30 year mortgages.

4b) And the government is also massively spending into the real economy for (much needed) infrastructural development and repair/ replacement (unaffected by interest rates)

Personally I’d agree with all the above, with an emphasis on number 3.

The idea of rates having to be elevated to, or above the (peak?) rate of inflation seems to have some weight. We have just never seen a successful “inflation battle” in favor of the central planners…

Unless inflating away debt is the successful outcome, then we only have post WWII to examine. The economic landscape is fundamentally different than a literally bombed out global environment.

Sadly, when you can’t afford to pay your debts you can always take them to war (and create a better competitive environment… for the “winners”).

4c) Many of us are now generating significant interest /income/ from our bond & credit investments – these yields being much higher than the rate owed on the mortgage.

4th option: a recession is right around the corner and demand craters killing inflation.

Please note, I am not predicting a recession. I have no idea. Just that before this era of easy money, a recession was always around the corner. It was just a matter of far out the corner was…..

A recession will eventually happen, it could be next month, next year, or 5 years from now, but it will come and kill inflation.

If I was a FED governor, I am worried about inflation, but I am also worried about recession that has mildly hit some of the rest of the world. I don’t want to be raising rates into a recession that no one sees until it is too late. That just makes the recession worse.

I would be leaning towards a rate increase, but it would be measured.

You left out the only explanation that matters. Massive increase in the money supply since 2019. Until this is reversed, there will be inflation.

M2 has been falling. I have heard that is the most important part of money supply.

To some, this heralds a “1930s style depression” to others it’s a required normalization.

To the Fed it’s not a data point they look at or consider?

“To some, this heralds a “1930s style depression” ….”

Yes, this is incontrovertible proof that there are a lot of ignorant idiots on YouTube and elsewhere.

The Fed is doing QT which reduces money supply, including M2. That’s the purpose of QT.

The Fed has removed $1.5 trillion in liquidity so far — so that’s money supply going down. It’s a small step toward “normalization,” as the others you cited would say:

https://wolfstreet.com/2024/04/04/fed-balance-sheet-qt-1-53-trillion-from-peak-to-7-44-trillion-lowest-since-february-2021-the-btfp-plunged-by-34-billion/

M2 is falling now but is up 30%+ from 2019. It will take several more years of QT to fix this, the inflation story is about a lot more than just the last 12 months.

Looks like the super-intelligent economists at the Fed failed badly by prematurely pausing the interest rate hikes.

I am waiting for them to scramble and reverse their stupid and short-sighted decision to please the banksters.

They screwed up when they continued QE after the stock market stabilized. A good 6 months before they started easing I was saying they should bring a hard end to it. Now, they backed off QT on the treasuries, and aren’t increasing on the MBS. They should be rolling off MBS as quickly as possible to pull money out of the economy. Biden should fire Powell. There is more than enough due cause here.

“Now, they backed off QT on the treasuries”

incorrect. They have not backed off at all. Still going full blast:

https://wolfstreet.com/2024/04/04/fed-balance-sheet-qt-1-53-trillion-from-peak-to-7-44-trillion-lowest-since-february-2021-the-btfp-plunged-by-34-billion/

They’re TALKING about backing off in the future, and will eventually release their official back-off plan.

Right, I was hearing about the potential for re-entering the market as soon as May, to the tune of $35-45 Billion. Of course it is speculation based on the official statements and murmurs from Fed officials in speeches.

Not eliminating QT, but a taper.

Where’s congressman Depth Charge calling for an additional 300-400bps hike?

I do think they should have followed through with the original proposal and hiked another 25bps, just on the basis of credibility. It’s just this ever present fear of a “Fed mistake” that seems to lead consistently to: A Fed mistake!

“They screwed up when they continued QE after the stock market stabilized.”

So the Fed should base its monetary policy on the stock market casino and its’gyrations? Did I read this correctly?

That’s exactly what the Fed was looking at. Preventing the stock market from crashing because of the pandemic.

No, they were looking at the economy and tried (successfully) to keep that from crashing. The stock market, though very volatile, is a reflection of that, not the other way around.

Wealth effect was adopted long ago by the genius Bernanke. I am unaware of any official abandonment of that policy. So, yes to gyrations most of which arrive at all time highs.

They screwed up colossally and unprecedentedly when they continued buying MBS after the housing market not only quickly stabilized but exploded and burned white hot for the next several years. I’m not sure they’re even capable of undoing the damage they did with that avoidable policy error.

Yep. The FED never should have continued buying MBS after 2009 – 2014 or so. I would argue they never should have bought any, but that is a different discussion.

The point is though, the FED screwed up by continuing to buy MBS, but that was a decade ago. They have stopped and are trying to move on from QE.

What is gained by continuing to rehash the FED mistake of continuing to buy MBS? It is like trying to drive by only looking at your rear view mirror.

When do we start looking through the front windshield?

Howdy Jim L. Don t forget while driving, if you really pay attention, the front windshield and rear view mirror scenery does not change, no matter how many miles you drive. Just repeats the same stupidity.

Amen. Total morons.

Continued QE until March 2022, dumping gasoline on raging inflation for more than a year.

Starting QT June 2022, at least a year later than it should have.

Limiting QT to non renewal of maturing instruments. No reason on earth they can’t sell before maturity.

Buying MBS during a time when home prices rose 30%.

Remember the Fed is supposed to remove the punch bowl as the party starts, instead they force fed the economy like a goose fed for foie gras. They have completely abandoned their credibility and it’s long past time to end the Fed.

The Fed has long time now had no credibility. Their policies pander to their rich owners and try to fit them into the appearance of a credible element. Frauds and liars. They have destroyed the lower and middle classes through wealth transfer(inflation), devaluing their fiat currency, now in its final collapse stage. They have raped Capitalism now, replacing it with engineered slavery, making your hard work worth-less. This is a Capital crime to the lower/middle classes which would have brought out pitchforks in times past. As long as they can print and give away, the fraud and enslavement continues….until the food disappears? we shall see.

You can’t expect much from Ph.Ds. that can’t distinguish between interbank demand deposits with correspondents and demand deposits from their nonbank customers.

The FED: “Thank you for your question. Net assets of retail money funds are a component of the M2 money stock, while net assets of institutional money funds are not.”

I’ve been following legal reserves since 1973. And total reserves of the last 7 out of 8 months have been up. That represents an injection of liquidity.

The FED: “If an investor transfers funds from a deposit account at their bank and places the funds into a retail money fund, the funds are accounted for in the retail money fund component of the M2 money stock rather than in the deposit components of M2.

If a money fund is holding funds with a bank in the form of a transaction account (e.g., demand deposit or other liquid deposit) or small-time deposit (time deposit held in amounts less than $100,000), then those funds would be counted in the money stock but those amounts are likely to be rather small. ”

The point is that the transaction is not a liability transfer. The accounting mis-classifies retail MMMFs deposits. Contrary to the FED’s technical staff, retail MMMFs are nonbanks.

In my 1958 Money and Banking text. “Purchases and sales between the Reserve banks and non-bank investors directly affect both bank reserves (outside money) and the money stock (inside money).”

Therefore, the draining of the O/N RRP facility increases the money stock.

They tried to foam the runway for Joe but set the plane on fire instead. We could see inflation prints in the 5-6 range late summer given how hot input costs are right now. All thanks to the scum at the Fed and treasury.

The protests at campuses now will morph into protests at grocery stores.

Joe’s plane was already on fire, but they turned off one of the still-operable engines.

My son is starting college next year. The college he’s attending has not provided final figures for dorms for the 2024-2025 year. When we applied for housing the application had the 2023-2024 pricing and said that while the new rates have not been determined, assume the prices will increase around 6.5%. That’s a large increase on an expensive item, but I guess it isn’t too far off current housing inflation readings. Yikes! Thanks for the report Wolf.

Housing inflation is a partial result of high interest rates. The incentive to build new homes and apartments isn’t that great right now.

The other problem are people with low interest mortgages and no mortgages that don’t have to worry about their spending. They’re really screwing it up for the rest of us. I have a bad feeling this is going to take several years to resolve.

More like a decade.

Cole,

“people with low interest mortgages and no mortgages that don’t have to worry about their spending. They’re really screwing it up for the rest of us. ”

So we people who have been saving, delayed consumption, and paid off our mortgages or re-financed when interest rates dropped are are screwing up everyone else. How is this so?

This is without a doubt the most brain dead comment I have every read on this site in the last 5 years.

I agree its not those people’s fault Swamp, but it does feel hard on those who were too young to have yet been in a position to get a house and mortgage pre interest rises.

House prices have only increased because the vast majority have low rates, locking out those largely younger generations. Its not only about savers vs spenders.

I don’t think that’s what he meant SC. I think he is speaking of what mortgage rate lockdown has done to the housing market in general.

eyeball Wolf’s past charts showing housing inflation. Present house is $420k and less than 5 years ago it was about $320k. So you gotta sell at some point, or take a bath, or screw that new job, stay here, or the economy falls off a cliff and presto, jingle mail. And 15 years ago they were $220k. House prices reflect inflation, they’re not worth a penny more in real terms.

Minutes

The pandemic screwed up a lot more than the mortgage rates. How about 1 million Americans who lost their lives through no fault of their own. I lost a couple of friends in the pandemic. People should be thankful that they are still on the planet and can come back for a second shot at the apple.

When we bought our first home we paid 10% interest rates on a home with 800 Sq feet of living space, with no help from anybody. There was one light bulb in the basement and every appliance had to be trashed. Today there are deals to be had if you look around. We do appraisals in low income neighborhoods. You can still get a nice livable home that’s even better than the shack we had to buy as our starter home. The comments I’ve read so far so far sound like a lot of sour grapes from a bunch of whining dogs who never managed their finances properly and want everyone else to bail them out.

Swamp, et al. – makes me reconsider the long-term effects and results of the old ‘Murican Standard belief that parents ALWAYS ‘wanted a better life for their children’. What did that REALLY mean? Or was it only (among many) a comforting non-sequitor?

may we all find a better day.

Not sure dumb is the right word could be not exposed to Decision making and stress form cash flow options. I’ll give him a pass on dumb but having paid off a 3.5 mtg in 2017 was very happy and still am thought about a new mtg when rates below 3 but too expensive

Housing was going up in 2021 and 22 long before the Fed started hiking.

Interesting concept here that the burden of lowered spending needs to fall disproportionately to those who are not locked into a low interest rate on their home. It does make sense. I wonder what percentage of consumers have a fixed rate mortgage under 3.5 % or don’t live with a parent? Any historical context? I don’t know how interest rates evolved in the 70’s?

The gold price says that real interest rates are negative, and the govt’s inflation figures are understating the facts on the ground. Rate hike was needed a while ago, if rising prices are the problem.

Alternate interpretation: the gold price says that we’re in a bubble, and is simply overpriced along with most non-yielding assets.

At what point do we call Powell a failure?

four years of high inflation, an entire generation currently locked out of the housing market, and things continue to climb.

In 2021, people here said Powell would never end QE and he’d never hike rates, and if he tried a little bit, the economy would collapse. Now he has hiked to 5.5%, highest in decades, and produced the biggest QT ever by far. Inflation has come down a lot, from 9% to 3.5% (CPI). So that was a pretty good job. But he didn’t finish the job, and said many times that the job wasn’t finished, and now inflation is going back up. But no one knows for sure where this is going. Inflation is impossible to predict.

The last thing I would want to see, given the huge government deficits during a booming economy, is for the economy to crash, which would totally blow out the deficits. I know there are people here who’d love to see 10% interest rates, 10 million unemployed, economic chaos and mayhem… but let me tell you, that would restart QE and ZIRP all over again, and that’s the real enemy, though Wall Street would love nothing more than that.

Thank you for keeping reminding all this.

+1

QE is going to restart anyway within a few years, no matter how good or bad it is. We all know this, with certainty, since QE will be necessary to support the Treasury market, not optional.

That’s just BS.

How do you “know” this?

Are you hearing voices in your head again?

@JimL,

Because the Fed balance sheet can’t continue to fall forever. Also, the country will always need “emergency” spending to get past, well, “emergencies”. Funny how politicians always come up with new, “emergencies”.

JeffD, you need to get some basics straight. In the five years before 2008, the Fed’s balance sheet grew by 25%, and that wasn’t QE but the result of “currency in circulation” (a liability on the Fed’s balance sheet) growing, and assets HAVE to move in lockstep with liabilities because a balance sheet HAS to balance: assets = liabilities + capital. Since the Fed’s capital is fixed by Congress, every dollar-move in liabilities has to be matched by an equal dollar-move in assets. So as cash in circulation rises, assets must go up by an equal amount.

Currency in circulation is demand based: when you go to a bank/ATM to withdraw $100, you don’t expect to get a message that says: “Sorry, no cash for the next three years because the Fed stopped issuing currency to keep its balance sheet flat.”

There is global demand for US dollar-currency, and the Fed must send enough of these paper dollars into the banking system to meet that demand, and that’s what caused its balance sheet to rise before QE, and that’s what will cause the balance sheet to rise after QT. And that’s NOT QE. That’s normal central bank operations as the Fed has done it since its beginning 110 years ago.

@JimL,

If you go back through my posts since we began here, my posts have more often been prescient than wrong. I’m sure Wolf has them somewhere. If I were a baseball player, I’d have a batting average good enough for the major leagues.

I think you are right. The Fed has crossed the Rubicon with QE and will resort to it every time there is a recession in the future.

Folks will be disappointed. The Fed has already explained how it will move next time. QE did nothing for a recession and economic growth. Big interest rate cuts do a lot. Now it can cut from 5.5% to 2%, that’s a huge cut, and very stimulative. And then it can cut to 1%. The Fed has been explicit about that. The Fed loves being at 5.5% because it allows them to cut bigly when a recession hits; it gives them a tool that works. If we get another 2008-like financial crisis, it might use QE to save the banking system, and it might not. It might just use repos, the way it used to do before 2008. Repos come off the balance sheet as soon as the Fed steps away from the repo market. That’s the system that worked till 2008, when Bernanke decided to screw it up.

Howdy Lone Wolf ” but let me tell you, that would restart QE and ZIRP all over again, and that’s the real enemy, ” Amen and pray they never ZIRP again…

>I know there are people here who’d love to see 10% interest rates, 10 million unemployed, economic chaos and mayhem… but let me tell you, that would restart QE and ZIRP all over again, and that’s the real enemy, though Wall Street would love nothing more than that.

right … the 2008 redux has to happen WITHOUT the QE and ZIRP. Imagine if Bernanke were not a total tool and would have left markets to their own devices. Maybe we would have had a crappy 2009 instead of a crappy half 2009 … but by 2010-2011 everything would have normalized

Too big too fail = too big to exist … break them up, make it more regional, let crappy companies led by high risk decision makers who should have been jailed for taking on such high risk

the fed SHOULD end QE and should NOT return to ZIRP and should be OK with a 2000 ES and ‘normal’ housing prices, not 20% ROI yoy in crap zip codes

I absolutely hated QE and would have done thing differently, but your prediction that things would have stabilized on 2010 without QE is just pure speculation that doesn’t match what was happening on the ground.

In 2007-2008, the market for MBS securities ground to an absolute halt. Many companies literally could not value their balance sheets because there were no market prices to value their balance sheet with.

Many entities stayed away from MBS because it had the real potential to be dogshit, but other companies who would gladly buy it even if it was dogshit couldn’t buy MBSs even if they wanted to simply because they didn’t know what their own balance sheet looked like.

There was a real possibility of lots of companies going out of business simply from a lack of market information. Sure if it affected only financial firms that were gambling with their own money. Eff em. They gambled and deserved to lose.

The problem was that it also affected a lot of non-financial firms as well. Pensioners for sure, but even insurance companies. Imagine your house burning down or your car totaled and when you go to file a claim your find your insurance company is going bankrupt due to unknown reserves? You are now homeless without recourse.

Not only would have all of these companies lay off workers, but it would affect their innocent customers as well.

Then it would spiral downward where unemployed workers (and people who suffered massive financial loss due to no fault of their own) stopped buying stuff. Restaurants close, those workers get laid off, downward it goes.

The problem wasn’t just that there were some people who made some dumb bets that deserved to lose. It is that we (as a society) allowed those dumb bets to become embedded in everyday companies we allowed it to become systemic. Lots of people were going to get hurt through no fault of their own and it was going to spiral.

There was no way it was going to magically going to disappear by 2010. The is ignorant revisionism.

Interest rates are going up on the 10 year Treasury and hence mortgages no matter what the Fed does. The treasury auctions are starting to freeze up. Supply and demand are dictating the prices of these securities, not the Fed . Bond vigilantees are salivating. They are waiting in the wings for the whole market to collapse. They don’t a rat’s ass who they hurt or who loses their homes.

Two related issues work against an acceleration of inflation:

1. US Dollar strength relative to trading partner currencies

2. Recessionary trends in other countries.

How do these impact your expectations for inflation acceleration/deceleration, Wolf?

Like everyone else, just trying to piece it all together…

Thanks

Apologies… I inadvertently posted the above in wrong spot….I moved it to correct position after WB’s opening comment.

As Wolf would say, there will always be buyers for US treasurys, it just depends at what yield such sales happen.

“The treasury auctions are starting to freeze up.”

Not really… the last 10/20/30 year auctions had weaker demand, but the more recent 2 & 5 year auctions had strong demand and those tsys sold for a slight *premium* over par.

Overall, treasury demand remains strong in spite of DC’s spendthrift tentencies…

Warren Buffet said 50% of the population does not benefit from capitalism. The very group that inflation regressively impacts the hardest, and the group that is drawn from for manpower to protect the government. That 50% could care less what the deficit is, they want Food, Clothing, and Shelter right now.

If Buffet said this he is a complete idiot. There has been no more effective policy against poverty in the history of the earth than capitalism, or as it should more properly be known, private property rights and economic freedom. Show me a single country without effective private property rights and economic freedom with a middle class. They don’t exist.

Isn’t it possible that maybe, a ~6% FFR might be the medicine to induce a shallow recession & get inflation back to target for good, then the Federal Reserve can cut to ~4%, and problem solved?

Not every outcome has to be “10%+ interest rates” or a massive depression that requires restarting ZIRP & QE. Almost every recession between the Great Depression & mortgage meltdown was a garden-variety recession that didn’t require extraordinary policy actions to cure.

Wolf whatever it takes to reset this inflationary never ending cycle we are in. I am all for. Then again, I don’t have many years left, so party on sailors party on.

And for gawds sake, please no adults please. Who cares if the national debt will be 100 trillion by 2037? I won’t be around to see it most likely, and if i am; i will be sucking my food from a straw, not knowing or caring.

QE begets more QE so it’s essential to go all the way back to the beginning of this vicious cycle. Presented with honesty about its side-effects and requirement to pay later, QE might have a purpose in response to an Act of God type event, such as a pandemic; but not in response to a stock, credit or housing market event.

The consequence of QE is, eventually, a slump commensurate with the size of the total print. Hard landing or more QE, answered with more QE; followed by a hard landing or more QE, until, eventually, QE stops working because it causes too much debasement and the slump wins. We are clearly not there yet.

” QE might have a purpose in response to an Act of God type event, such as a pandemic”

And maybe not even then. The Fed never should have done QE in 2020, for example. It was unnecessary.

Oh, but they couldn’t have known and they didn’t want to risk not doing enough, you say? Fine, they still could have done it in a limited–there was absolutely no reason to buy MBS–and data-driven way, if they absolutely insisted. But I still say they were horrifically wrong to reach for it as a tool immediately in 2020. And of course they were wrong even to consider it in 2008/9 etc.

The FED never should have paused the rate hikes. They should have hiked another 150 basis points, minimum. Worse, they started talking about rate cuts. Jerome Powell should not have a job. Instead, he’s rewarded for failing.

According to Judy Shelton, the interest rates increases to date have not had much affect on consumer spending. Most of the increases have been passed on to the consumer and most businesses haven’t suffered much. The increases thus far have just increased inflation. The Federal Spending is working against and negated the Feds policies. The only thing that will bring an end to this inflation is a hard landing in the form of a deep recession.

Oh, here’s DC.

Hi, I was wondering what your call was.

150bps: Are you feeling OK?

I ballparked 300-400 for you.

yep, in retrospect my calls for 7.0% ended up looking exaggerated for a long time, but I may be vindicated in the end.

The same way I stopped building homes two years ago when the fed started hiking rates and I’ve felt pretty dumb or paranoid since then. I’d still rather get out of a market early than fight the crowds at the only exit door when it’s too late.

7% ?

As soon as they saw 9% CPI they should have gone balls to the walls and shot up to 10%

7% long term rate at 2% inflation is the historical norm.

You say that because you are cheering for Team Catastrophe and Chaos.

In the real world, inflation has become worrisome, but it still isn’t out of control and there are reasons to be worried about tightening too much no matter how much you want to ignore them.

I would say that robbing the entire country of 30% of their purchasing power in 4 years is pretty close to the worst thing the Fed has done since the 70s.

The worst thing the Fed has done is years of QE and interest rate repression, which caused all kinds of problems, including the inflation we now have. QE and interest rate repression are the enemy.

Just change your name to JimGaslight already, because that’s all you do. Interesting that you were talking about “voices in your head” up the thread. Project much?

Somewhere in the hubris of this comment section, I’m impelled to ask you,

is the idea of the classic American novel dead?

Yes, the only time they should be ‘talking’ about rates, is in front of Congress.

So higher for longer until something breaks? Inflation isn’t going down with the stock market near all time highs and people having tons of home equity. To beat inflation you need consumers to pull back on spending.

At this point a mild recession would have better than this attempt at a soft landing.

Agreed. The Bailout Boys got greedy for their no landing (JPow’s implied “Mission Accomplished” speech in Dec, and ongoing salivating for rate cuts) that they may even cause the worst hard landing as a result. What a missed opportunity to have just finished the job when they had the chance.

There’s something wrong with the graph – “Core” PCE Price Index Annualized, % Monthly & 3-Month

The last 3 blue points are all above the last red point; how is this possible ?

It actually says “6-month.” So yes, that’s correct.

The reason I chose 6-month in this chart, rather than 3-month, is because the huge volatility overpowers the 3-month, which then is nearly as volatile as month-to-month, and you cannot tell what’s going on. To get a semi-smooth line, I had to use 6-month figures, and said so in the title of the chart.

So will the Fed need some shock and awe? Raise rates 50 basis points now. And again in three months. Show they’re serious. Or is Fed Chair Powell the 2nd coming of Burns and Miller? Inflation needs to be killed with fire while they can. Gonna hurt, but choices are all painful, either bad as hell right now for maybe a year, or so, or long and dragged out, e.g. worse. Sigh.

It all depends on your definition of bad.

Great for those on top: rising asset prices, increasing pricing power, future dollars less valuable: great time to lever up!

The FFR has little impact on the shadow banking system. The shadow system is enticing to the masses: “invest like private equity” and they loan, lever and speculate, taking profits and maybe even returning your investment capital (or a little more?).

Not gonna happen. We are going to have brutal inflation through the election. You think anyone in the elite class is going to do anything to alleviate the pain for the working class? Their full time occupation is denying the reality we see all around us, whether its the out of control cost of living, the rampant crime, the decay of our cities, etc. Media is working overtime to publish bs that would make Orwell blush.

The rate path is correct as is. The blew it by not “going big” on QT out of the gate. Doing so would have quelled tbe animal spirits that created this barbell economy. Now we have the uber rich stock and 3% mortgage holders distorting prices for everyone. Stocks never wohld have taken off like they did if there was strong QT when money was overflowing the world’s ability to do something with it. Now the cushion has almost dried up, so they’ve missed their opportunity. There is *at least* eighteen more months of this inflationary madness, and that’s assuming they do everything right from this point forward.

PS Other countries went big on their QT relative to the size of their economies, and they are in a better place for it than we are. I’ve been advocating “Big QT” from the very beginning.

John Beach-

Your comment: “Gonna hurt, but choices are all painful.”

Painful indeed! The wages of excessive money production is inflation, depression, or an alternating combination of both.

“Sooner or later everyone sits down to a banquet of consequences.”

— Robert Louis Stevenson

You think this fed will raise rates in an election year? I want some of what you are smoking.

Boy, December sure was a great time to start publicly signaling rate cuts, huh?

There sure were a lot of overconfident Fed folks flapping their gums about cuts just around the corner, and, perhaps even worse, continuing to do so after it became obvious that they were throwing gasoline on the fire.

I wonder if any of them feel any remorse over that “Mission Accomplished” type of talk?

Well, after all, the Fed continuing to do things they shouldn’t have done in the first place after it’s obvious they’re pouring gasoline on the fire is precisely how we got in this mess. So it’s not all that surprising to see them do that on a smaller scale.

I am always amazed at how people are unable to tell the difference between what the FED actually says and what the talking heads tell them the FED said.

You are letting the talking heads take advantage of you.

“You are letting the talking heads take advantage of you.”

What are you jibbering about? I know exactly what Powell and the other Fed heads said late last year. I paid attention to their words, not anybody’s summaries of their words. And their words very, very clearly were meant to signal that they were preparing to cut rates.

“Inflation is impossible to predict.”

Especially once it rears its head and starts to roll.

Restart QE and ZIRP again?

A nightmare. Especially for the less endowed (financially).

Worry no more Wolf Street peanut gallery!

From Yahoo:

“Trump to set interest rates himself under secret presidential plan

Donald Trump’s aides have drawn up secret plans to oust the chairman of the Federal Reserve and allow the president to set interest rates, according to reports.

Allies are said to have drawn up a range of proposals for the way monetary policy could be run in a second Trump administration, including rolling back the independence of the central bank, which has been critical to the functioning of the economy and financial system in recent decades.

Supporters of the Republican candidate have compiled a 10-page document with a new vision for the running of the central bank and monetary policy, according to the Wall Street Journal.

It includes the authority to eject Jerome Powell from his position as chairman of the rate-setting Federal Open Market Committee.

Mr Trump appointed Mr Powell to the position in his first term as president, having declined to give the incumbent, Janet Yellen, a second term at the Federal Reserve.

The document also suggests Mr Trump could be consulted on interest rate decisions by the Federal Reserve chair, who would then negotiate the final decision on borrowing costs with other policymakers on his behalf.

Less sweeping changes to the central bank could include exposing its regulations to more regular reviews by the White House, the WSJ reported….

Moves to limit the independence of the Fed would likely prove controversial. The independence of central banks has become a central pillar of the modern financial system.

Michael Pearce at Oxford Economics said: “Any serious attempt to undermine the Fed would have a high risk of having the opposite effect. There are many examples from history where political pressure for lower rates has had the opposite effect and pushed the Fed to lean towards tighter policy than otherwise.”

Even if interest rates did come down, financial markets would recognise the risk of higher inflation and charge the US government a higher borrowing cost to compensate. This would offset any anticipated boost to the economy.

The temptation for the president to lower interest rates under the proposed system could also prolong the inflation crisis in the US….”

“…according to reports…” gotta be true.

It’s Yahoo Finance – that’s all you need to know !

WSJ started started it with an exclusive, titled: “Trump Allies Draw Up Plans to Blunt Fed’s Independence”:

https://www.wsj.com/economy/central-banking/trump-allies-federal-reserve-independence-54423c2f

Yahoo just re-wrote the WSJ article

Gotta be true then.

O’Keefe also reports there is a

Love affair between powell and the mean tweeter.

If that happens, God bless America!

“If that happens, God bless America!”

If that happens, God *save* America. If you thought 2019 through 2022 were an orgy of printing and rate repression, you really don’t want to see what happens when you don’t even have Jerome Powell et al acting as the adults in the room.

Pea Sea

agree with you!

just forgot to add “CS”

There’s actually an interesting relationship between core PCE price index — and Federal government current expenditures: Interest payments: to persons and business.

Uncle Sam hasn’t rewarded people with this much income since 1980.

Higher rates for longer, helps inflation to remain sticky.

Sure. Lots of people here hold T-bills, T-notes and bonds, and I bonds. Who else do you think is getting this interest, if not “persons and businesses?” Well, ok, governments and central banks around the world get this interest too. Yields are finally back to a normalish level, ABOVE inflation, and now there’s finally some value in holding this paper.

Note that your PCE Price index reference refers to the 12-month reading, which is still low, but the more recent inflation rates are much higher than the 12-month reading, but still below T-bill yields, but getting closer. So given the 3-month inflation readings, they’re not such a great deal anymore. Don’t be misled by the 12-month inflation readings, they lag far behind, as explained in this article.

The US M2 money supply is slowly trending downward. But the Canadian M2 money supply is trending upward. And there are talks of Canada cutting interest rates before the Federal Reserve.

Seems like a desperate attempt to keep the housing bubble going.

Seems the BOC is in the position of trying to get inflation under control while simultaneously avoiding a hard landing for the economy through monetary policy. The federal government is primarily interested in trying to regain popularity (getting re-elected) and seemingly pulling in a different direction than the BOC. With unfunded liabilities like public health care and OAS and further increases in program costs (including new programs – dental, pharma, housing), throw in productivity challenges and 8 straight months of gdp per capita decreases – tough to be optimistic for the near future. In the last bit I’ve been hearing a number of references to Hayek’s “the road to serfdom”; I think it’s a reflection of how some view our current government and economy.

Old Age Security? Well everyone who dealt with Service Canada knows that they pay people there who hire their friends who spend most of the day socializing and doing nothing, so applicants wait some time in long lines to get things done, because the majority of processing staff are watching YouTube or talking on their phones while at work, and it’s hard to discipline them.

The call centre and walk-ins have to process faster (can’t watch YouTube videos in the public view while at work).

Amusing, but do you have proof, or just randomized collective BS?

This forum is not a court of law. What I hear from members of the public can’t be posted here like SoundCloud or YouTube.

And I don’t have to provide you anything. There are way too many complaints about the overpaid public sector employees like teachers, police and public sector unionized bureaucrats that I’m wondering why you would be angered by my random anecdotal comment on an American financial blog. It’s very strange.

Gen Z,

Is this the pension plan in Canada which lost about $65 million in the FTX scandals, and then assured the taxpayer that the amount lost in the scheme was a drop in the bucket of total assets being held?

Oh, just another complaint about the overpaid public sector employees like teachers, police and public sector unionized bureaucrats. Just wondering why you would post a random anecdotal comment on an American financial blog. It’s very strange. 😏

It seems that a few Canadian federal government employees got shook that their wasteful and unproductive behaviour is being called out. I’m not entertaining off topic comments. It’s about the M2 money supply in Canada, and a good response was about the government spending.

Nice, that’s all I asked, for some good information. Thanks.

I appreciate all the comments from the doomsdayers wanting a crash as well as those that state a true increased interest rate driven crash would suck for lots of people. Both have an individual perspective that I can empathize with. Wolf and peanut gallery thanks for the insight as always. I have a fairly recession proof job so I don’t get emotional about either case… usually… but shoots I can relate to the desire to keep things sailing they way they on jPow’s plan… but on the days i want to own a house to put my kids in I sure get the “let’s crash the economy” with high rates and stop the erosion of my income. My job is not sensitive to inflation unfortunately given 65% of my income is tied to Medicare payments that get cut every year rather than adjust with inflation. Tough road to navigate for everyone it seems.

‘…a true increased interest rate driven crash would suck…’. LOL, increased interest rates are ‘normal’ to correct for inflation. A crash? People not properly positioned always bear the brunt of a correction. The current interest rate is low for 2% inflation. Plan wisely, greed kills.

Off topic but wondering if the new car market is behaving like the new house market. I.e. concessions, gradual price reductions, buy downs etc or is inventory of new cars still tight?

They seemed to behave similarly with a price spike and inventory drop during the pandemic with zirp helping to exacerbate demand and supply chain issues putting the brakes on supply.

Yes, there is some of that in new vehicles right now: lower prices, cheaper trim packages, incentives, rate buydowns, etc. But prices have not seriously come down from the spike; they’re very sticky. Used vehicle prices however have plunged like I’ve never seen before.

Thanks WR – Tesla did some price cutting but everyone else is holding out for the return of cheap money then I guess. I will take a look at used or keep driving the 06. Interesting how used cars plunged but used house prices have been sticky and vice versa.

Fred tracks average interest rates for used vehicles.

Double digit rate not seen for a few years. At least as far back as the chart let you go ( 2009 ).

I doubt its all cash buyers in the used market.

So it will take a harder hit.

Not on quality desirable cars including all BMW models.

A 1990 BMW Evolution 3-Series sold on BAT for $200,000 last week in black with red bumper accents, and another is up now which may well surpass that amount.

Not only are Wolf’s articles great, so are his replies to comments. Thanks for taking the time to correct erroneous comments, Wolf.

My better half saved me this week from going ahole mode.

My BIL thinks he is the sh1t in investing and everyone else is stupid (yeah, we all have one of these and probably half of the folks here is that BIL). Of course, he thinks I am one of the stupid ones and he basically said that to my face. We are frugal and modest in our life, so it appears that we are not doing well. I just wanted to say that I make at least 10x what you make in a year. I will show you my tax return. You know, a d1ck measuring contest. Of course, the boss whispers in my ear, “If you tell him that, he will be coming to us with his hand out when he goes bust.”

Ahh, I got a gem, I did. Good luck. :)

You have chosen… wisely.

Indiana Jones and the Last Crusade

Beware the renters and those only invested in 5% type fixed interest, in past inflationary periods people I knew like this were consumed by rising costs in a frighteningly short period of time. These were mostly central government and municipality charges, including energy etc., automatically increased at the supposed inflation rate. Up goes your landlord demand to suit and down goes your savings, thanks to the actual inflation being higher than your 5%. Discipline yourself, scrimp and save for enough years to buy a starter home and pay it off quickly. Buy bigger later if you want, making sure they are in the most desirable suburbs, this is the best investment you will make in your life and guarantee you capital when you retire.

Amen, and not just to renters. This also applies to all who are/were able to use the mortgage interest tax seduction (intended) as financial strategy. Add to that beware of much touted locales proclaiming ‘ no income tax here’, as they make up funding shortfalls for demanded or necessary services with sky high property taxes.

I have been astounded watching young folks just starting out using food delivery services, also often dine or party out, spend for all inclusive Mexican vacations, and drive nice vehicles. And let’s not even talk about loans for useless degrees….taken away from home. Learn to cook, maybe party on home made brews/wine or grow your own bud to go with your free bluetooth music and still enjoy a fun life with friends….while you scrimp and pay off your first starter home. Backyard barbecuing is fun. Running is free….no gym membership required. I have some terrific young renters who I offer a break on the rent cost, a substantial break. But they also have $100 K worth of vehicles in the driveway. Crazy.

Look out for states with the double barrel shot of high property & income taxes. Those who flee do keep us busy building.

$100k worth of vehicles is… two?

I keep seeing articles about the unprecedented wealth of the “younger generations” Z and millennials.

I am probably Xillenial… and not rich, but more than comfortable.

I just took my family to Hawai’i.

I don’t have the 3-4 bed house on a 1/4 acre like my folks did growing up and certainly fit the mold of buying experiences vs. stuff.

Charlie Munger astutely observed: EnVy is a joy killer!

Prices of nearly all housing in California start at $1,000,000.

Don’t.

This is the worst time to buy a home that too a starter home.

Absurdly high prices and high mortgage rates.

May be a decent time to buy luxury homes as these have seen steep correction

I know people are suffering from fomo but these price and rate levels are absolutely not sustainable and thus we have this frozen market.

Mortgage rates are not *high*. Mortgage rates are normalized. They are higher than the ZIRP era where many grew of age and thought that was the norm, yes. But they are not historically *high* by any measure.

Prices follow demand. High demand? High prices. I watched the market in FL when I was selling my sister’s house. I dropped the price steadily until I snagged a cash buyer. The house is approaching the age where the roof would become an insurance company hot potato (13 years) and the water supply lines were CPVC which I am not a fan of. Glad it’s gone. There are likely examples like that in other markets – but you’d need dry powder to take advantage of them.

Buying a house is a goal. If it is your goal, then other things must be sacrificed to achieve it. Contrary to the license plate frames of the 80’s, you can’t have it all (at least if you’re not independently wealthy).

Mortgage rates are high in comparison with the home prices and monthly mortgage payment along with other home expenses is extremely high in comparison with income making it thr most unaffordable market for home buyers .

Renting is much much cheaper than buying at this time

That’s why you stay out of duration during periods of rising rates.

Laddering 3 month bills with a maturity every 2 weeks is a great way to “chase rates higher” and you’ll see the ladder’s avg yield till maturity go up as you reinvest in higher yielding bills.

NB; not investment advice.

The Fed will meet this Tuesday and Wednesday, April 30 and May 1st.

Will be very interesting to see how they respond to all this data.

It’ll be more wait-and-see — that’s my guess. There won’t be a dot plot, we’ll have to wait for the June meeting to get that piece of endless entertainment.

But they will come out with more of an actual plan for the slowdown of QT. They’ve already given us the rough outline: Treasury roll-off slows by about half, MBS roll-off remains unchanged. Maybe there will be some tweaking, with T-bills replacing longer-dated maturing securities.

Fed won’t do anything that would shock the market

Mark my words they’d put out dovish statements.

Jon,

No matter what the Fed and Powell will say, YOU will say that it was “dovish.” That’s my prediction based on what you said over the past two years.

WSJ: Regulators Seize Troubled Philly Bank REPUBLIC FIRST…

Finally. It’s a “small bank” — the 213th largest bank in the US, LOL — with $5.8 billion in assets and about $4 billion in deposits, that has been on the brink for years. Routine FDIC stuff. Investors will lose everything (the stockholders have already lost nearly everything), depositors will not notice the difference, except for a different bank name on their branch (now “Fulton Bank”).

There have been bank failures in nearly every year for many decades. That’s just normal.

This is what I said about “small banks” failing:

Small banks: 31% of their loans are CRE loans. These banks have between $1 billion to $10 billion in assets. There are about 700 of these banks. 31% of the loan book being CRE is huge exposure – with some banks being more exposed and others less exposed. CRE losses will likely pull the rug out from under some of those small banks over the next few years. And we’ll notice, but we’ll probably not write about it.

https://wolfstreet.com/2024/04/13/banks-exposure-to-cre-loans-by-bank-size/

It seems most commenters criticizing the fed thinks its only mandate is keeping inflation at 2%. It has a dual mandate, full employment and low inflation.

How about a round of applause to JP for all Americans who want a job being employed? But I suspect angry old man ranting is a hobby for a lot of people.

What is considered full employment? Unemployment at 2%, 3%, 4% or, 5%??? If that numbers two low you get significant wage inflation because companies can’t hire good talent as they grow so they need to outbid each other for it. If that numbers too high, it’s bad for the economy and general public. I think the long term average is around 5%, well above the current 3.8% so there’s some room for the fed to focus more on inflation before worrying about full employment.

Inflation also surged from q3 07 to q3 08.

Layoffs are surging, household survey employment measure is tanking majorly.

Claims and establishment non Farm payrolls are being distorted by the gig economy…

This bloodbath could be far worse than 08.

There’s still a chase for yield going on. 5% on savings is not enough to take down equity and RE prices, which are rising and driving CPI higher via a wealth effect.

5% interest is only 3.5% after tax, which is below the current rate of inflation and a realistic long-term inflation rate.

Taxes and inflation apply to stocks as well, they’re not tax free, any capital gains and dividends are taxed. And inflation is eating everything, including stocks. So with stocks you can lose 50%, and inflation eats into the remainder, and dividends are still taxed. So that’s the choice: high risk or low risk.

The Nasdaq composite is DOWN 2% from the peak in November 2021, despite the huge sucker rally in between. So that’s pretty shitty. You lost money on the Nasdaq portfolio since Nov 2021, you made some dividends, which were taxed, and all of it was eaten into by inflation, and you could have invested in T-bills and have been spared all this drama and come out way ahead. Risk is a HUGE factor in the return calculation, and some people just keep ignoring it?

Highest price of gold during Nov., 2021 was about $1870.

This month it’s averaging about $2325.

So, investing in gold would have put you “way ahead”, too.

Are people spending because their stocks are going up, or because they’re getting big raises at work? Maybe higher rates mean their interest income goes up?

Its not so simple. Personally I’ll make more $$ as rates go up.

Taxes really don’t apply this simplistically to interest income. First, taxes on interest earned in retirement accounts is deferred. The taxpayer can then time withdrawals to stay in lower brackets when they access these accounts. For example, a married couple using the standard deduction can have income just over $120,000 before they are out of the 12% Federal tax bracket.

Second, taxpayers can use instruments like I Bonds to defer taxes on the interest and cash the bond at a time it is advantageous from an income tax perspective.

Third, taxpayers can purchase discounted bonds with low coupons in the secondary market and choose to defer paying tax on the “interest” reflected in the discounted portion of the bond until it matures. This way taxpayers can to some degree time the recognition of interest income in a way that keeps them in lower tax brackets by having bonds mature in different years. There are lots of bonds with low coupons available now because interest rates were held so low for so long.

I’m just trying to point out there are several strategies for taxpayers to lower their personal tax rate on interest income far below the 30% used in your example. I think 15% (4.25% after tax) may be a better rule of thumb. If a taxpayer has so much income these strategies don’t really work to lower their marginal tax rate on interest income, then they’re probably doing fine financially.

DM: A Golden State bargain DOES exist – The nine California towns where you can still snap up a home for $150,000

California is well known for its red hot property market – with the average home in the state now valued at more than $1 million. Yet despite these eye-watering headline property prices, affordable real estate in the Golden State does still exist – if you know where you look. Indeed, there are nine towns where homes can be snatched up for just $150,000 or less. The only catch is that you may need to venture a fair way off the beaten track.

Yes, by all means leave where ever you are and move to CA….

Live in hell, so RE agents can make money….

I think he’s focusing more on the fact that the average price of a home in California is over $1 million.

Howdy Folks. What will the FED do? Seems to me, in the coming months, The Lone Wolfs charts comparing the FEDs History of plateaus and time lines may tell the tale??? If the FED first raises again and does not lower, what will the current plateau look like historically? Fun Stuff this time around…..

Meeting of Central Bankers Anonymous:

(Man walks into the room, sits down on a chair in a circle among others.)

“Hi, I’m Jay Powell, and I screwed the pooch.”

(facilitator) nice to meet you Mr. Powell. Welcome to the group, and please share more if you feel comfortable.

“Well, I should have realized that promising Wall St. rate cuts back in December would just stoke the animal spirits, and encourage greedy home sellers to hang tough and not cut asking prices. I need to retract that without completely losing face. I’ve recently started sniffing paint thinner to deal with it …”

‘The worst thing the Fed has done is years of QE and interest rate repression, which caused all kinds of problems, including the inflation we now have. QE and interest rate repression are the enemy.’

I wonder how long it will take to blow up the companies which have been coasting for years on cheap money without actually being profitable. The fact that Opendoor has the word Technologies in their name makes me laugh. They might as well have the ticker symbol OUIJA.

There’s a large employer in my area (Wolfspeed) which I believe has lost money for the last 10 years. Maybe they can coast on the CHiPs act for a while….

We also have Vinfast moving in which is going to turn into a massive fiasco…the story they spun is amazing, and the folks who helped them set up shop will be long gone after TSHTF.

US debt service interest will reach $1.8 trillion. Americans keep forking out cash for everything under the sun. Subsidies and giveaways keep adding up. Gen Y and Gen Z don’t get heavily involved at the American dream poker table, owning asset only brings more debt to maintain. Taxes, insurance, repair cost only keep increasing, cost own negates ROI.

This is what matters, and YouTube gurus citing only the interest payments in a vacuum are idiots:

https://wolfstreet.com/2024/03/31/curse-of-easy-money-us-government-interest-payments-on-the-ballooning-debt-v-tax-receipts-amid-higher-interest-rates-inflation/

The problem with this is that tax receipts can crash a lot faster than interest payments. It’s like if you have a great job and a big mortgage and an expensive wife and two to four nice cars (leased or financed). Lose the job, and you’re still on the hook for all the bills plus alimony.

Yes, that’s a problem. Cash receipts do fall in a big long recession, which is why the Fed does not want to trigger a big long recession.

Hey Wolf, you can possibly add Multivariate Core Trend Inflation (MCT) https://www.newyorkfed.org/research/policy/mct#–:faq into your analysis.

MCT model is heavily used by FED for future predictions.

That’s a new thing that some researchers at the New York Fed came up with in 2022. All its data is based on the PCE price index. It’s not used “heavily” by anyone. The Fed’s FOMC and the governors have never mentioned it.

Note the disclaimer: “Multivariate Core Trend Inflation estimates are not official estimates of the Federal Reserve Bank of New York, its President, the Federal Reserve System, or the Federal Open Market Committee.”

There are already a dozen or so inflation indices around by the regional Federal Reserve Banks that all twist and turn the basic core PCE price index and CPI numbers in different ways. So now there is another one. Kudos. They all use the same underlying data. They just twist it differently. I don’t cover any of them anymore. Instead, I go into the details of the actual PCE price index and CPI, so you can see for yourself.