The IPO allowed the PE firm that had acquired Joann via an LBO in 2010 to dump the shares into the lap of the public in March 2021.

By Wolf Richter for WOLF STREET.

It all came together in one fabulous package, in the bankruptcy filing today by Joann Inc., an old-line fabric and crafts retailer with about 850 stores in the US.

It’s the stuff we’ve called Brick-and-Mortar Meltdown since 2017, during which hundreds of major retailers, from the biggest ones on down, filed for bankruptcy and most were liquidated. Plus, cherry on top of the cake, it’s the stuff we’ve seen since 2021 in our pantheon of Imploded Stocks.

Joann Inc. brings it all together:

- A PE firm (Leonard Green & Partners) that had acquired an established retailer in a $1.6 billion leveraged buyout (LBO) 13 years ago and left the retailer suffocating under the pile of debt that had funded its own buyout;

- The switch by Americans to ecommerce that then pressured revenues at its brick-and-mortar stores;

- An exit for the PE firm via an IPO at peak hype-and-hoopla in March 2021 that dumped those shares into the lap of the gullible public;

- Followed inevitably by the collapse of the shares that wiped out these shareholders;

- And today, three years after the IPO, the bankruptcy filing that begins the process of transferring ownership of the company from the current shareholders to others, with shareholders getting nothing.

Joann Inc. announced today, after weeks of rumors, that it filed for a “prepackaged” Chapter 11 bankruptcy, and that all outstanding shares will be canceled and that holders of the common stock will lose everything – they’ve already lost nearly everything – and that certain creditors, PE firms, and board members will get the restructured company.

People are still trading these worthless shares today at around 18 cents. Down the road, the end users of those shares, when they get tired of looking at that unsellable line item in their brokerage account, will have to ask their broker to remove those cancelled shares.

The company said today in an SEC filing that it had entered into a Transaction Support Agreement on March 15 with the holders of its senior secured term loan facility; and with the PE firms Green Equity Investors CF, L.P., Green Equity Investors Side CF, L.P., and LGP Associates CF, LLC; and with “certain current or former members of the Company’ board of directors”; and with “certain third-party financing parties that executed joinders thereto.”

It said its Chapter 11 bankruptcy filing today would provide “for a court-administered reorganization pursuant to a prepackaged joint plan of reorganization.”

The trigger for the bankruptcy filing was the company’s default on two loans totaling $1.06 billion, plus unpaid interest.

The transactions of the reorganization plan would result in:

- All issued and outstanding shares “being canceled and extinguished without consideration.”

- The company becoming a private company that will no longer report to the SEC.

- Its long-term debt being reduced by $505 million.

It said its stores would remain open during the reorganization, and that employees, vendors, landlords, and other trade creditors would get paid in full “in the ordinary course of business.”

Retention bonuses for executives. Three executives would be paid retention bonuses in about September 2024, which the board agreed to on March 15:

- $535,740 to Christopher DiTullio (Executive VP, Chief Customer Officer, member of the Interim Office of the CEO)

- $371,250 to Robert Will (Executive VP, Chief Merchandising Officer)

- $135,740 to Scott Sekella (Executive VP, CFO, and member of the Interim Office of the CEO.

The DIP loan. To fund the company during the bankruptcy proceedings, it has obtained a debtor-in-possession (DIP) loan of up to $142 million. The DIP facility will be secured by a super-priority lien on substantially all of the company’s assets.

All holders of its senior secured term loan “have been (or will be) offered the opportunity to participate and fund their pro rata share of the DIP Facility.” The DIP loans will accrue interest at SOFR (currently 5.3%) plus 9.5% per annum. So roughly 14.8%.

The DIP facility consists of $107 million in “new money term loans”; $25 million of outstanding trade payables exchanged into term loans; and up to $10 million via an uncommitted “accordion facility,” allowing the company to add term loans.

The brick-and-mortar meltdown. It has been tough for years being a brick-and-mortar retailer. Joann sells the type of merchandise – yarns, fabrics, crafts, art supplies, sewing machines, etc. – that anyone can find on the internet anywhere, not only on Joann’s own site, but at countless vendors, including cheap stuff directly from Asia listed on third-party platforms such as Amazon and now Temu. Online, the selection is endless, prices are easy to compare, and it arrives directly at the buyer’s home.

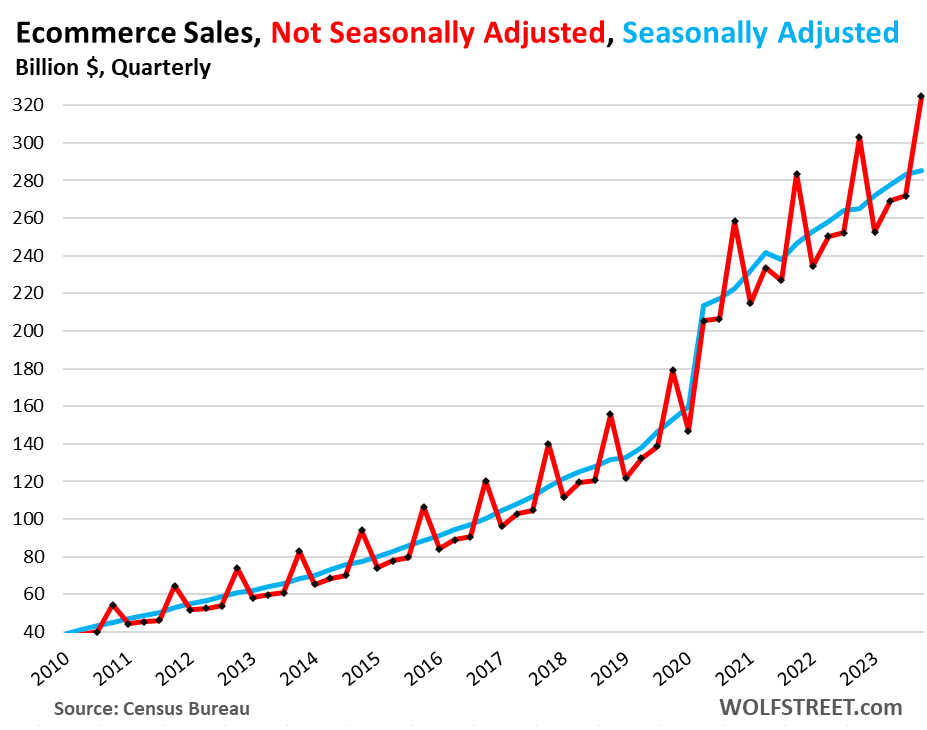

Ecommerce is a structural change in how Americans are shopping for this kind of stuff. Americans are still buying gasoline, food, and new vehicles at brick-and-mortar stores, which is over half of total retail sales, but the other stuff has been wandering off to ecommerce.

Walmart figured it out years ago and became the second largest ecommerce seller in the US, after Amazon, and the largest grocery seller. But most of the rest of its stuff at its brick-and-mortar stores is in slow-motion decline.

Ecommerce will continue to wipe out brick-and-mortar retail chains and retail properties, and thereby will continue to wreak havoc in commercial real estate as it has done for years.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The debt that was piled up in the process of buying out the company was a accounting trick that came back to haunt them.

Investors who are like Carl Icahn, and are “market activists,” provide a service to society in shaking up moribund corporations. But the vultures of private equity, focused on fleecing corporations of their assets and saddling them with debt, are exploiting lax laws and a permissive climate.

In the end, it might be good to bring back shame as a motivating (or de-motivating, as the case may be) factor stopping investors from looting helpless, defenseless companies.

PE firms have these plans in place all the time high debt hope things get to point for ipo why not during the free money era maybe one of their last free money eras i sure hope so. Having worked for a PE portfolio company I too have a bad taste for the group as a whole . But I don’t know that they do anything illegal. Just unscrupulous .

“The debt that was piled up in the process of buying out the company was a accounting trick that came back to haunt them.”

I think the increase of leveraged buyouts in recent years was a side effect of ultra-low interest rates. The cost of borrowing was very low, allowing large sums to be raised at minimum cost.

I suspect the deal itself results in large profits for the LBO organizers. If the company does well, it’s icing on the cake. If not, it served its purpose.

I totally agree with your comment. No way people and companies would have levered up without ridiculously low interest rates. And of course all this leverage just pushed prices up into the stratosphere, rewarding the first ones in line and penalizing those who came after.

“I suspect the deal itself results in large profits for the LBO organizers. If the company does well, it’s icing on the cake. If not, it served its purpose.”

Yes, either way it’s a win/win for them.

This wasn’t about low interest rates and free money. LBOs were happening years before the recent super-low rates. Easy money doesn’t help; neither did the “carry trade” on low loan rates in Japan, for example, low enough that it was easy to arbitrage, if you’re well-connected.

Unfortunately pensions, and the various retirement funds have little concern about a company being taken-out, loaded with debt, then, a few years later, launched as a new IPO. In the case of Joann’s, it seems like the residual value of the company is going to end up in the hands of the same PE firm that set this whole thing in motion.

I looked for a chart of LBO activity and found one: http://www.axios.com/2023/01/03/lbos-just-had-a-huge-year

Looks like an increasing trend and a spike in 2021.

I would guess if debt is cheaper, and debt is used for some desirable purpose, then it’s reasonable more debt would be used for that purpose.

Don’t forget the insider management (having the best financial info) who sold out the company (incumbent management usually gets an equity stake in LBOs) and the “free” ZIRP money (printed by the G, expropriating savers) that provided the indispensable rocket fuel for LBOs.

There are plenty of villains to go around.

Shame is for “losers”.

Ask anyone worth over, (or kiting) say $5-10M.

Check the price of gold in Argentine pesos, LOL

Empathy, fairness, is for losers here? 45 proved all are, in spades….why I threw in kiting.

I honestly didn’t quite get that response at all, but as you know Econ isn’t my strong suit.

I do know we are the worlds most powerful, dominant, and the biggest pigs……I’d hate to be in my equivalent wealth class in Argentina, GINI index much worse there. Born very lucky, both of us, compared to Argentina.

Private equity firms are cancer.

Yup I like it better when they honestly called themselves LBO firms the whole rebranding to Private Equity was a farce to make them sound like they are doing the market a favor.

You are looking at fast money (LBO, as JER says) hustlers compared to REAL Private Equity;

Cargill, Nestle, etc.

The owners of the world…..

Especially their stockholders. I have some rich asshole relatives invested in that type of PE. $1/4-2 M minimum buy in (?) and NOT as liquid as the stock market…..but stock values and profits good and steady most all the time, I imagine.

They are all Jesus freaks, too, one even has a church and a big website where you can donate to missionary work in Africa and elsewhere. They check up on it all quite often to make sure your donations are doing the Lord’s work…luxury trip plus salary. Good example of Calvin’s people with “the calling”. To be admired by all. But it’s not just Jesus freaks…..any filthy rich bastard has “the calling”….predestination and all that…..watch Joel Osteen for how it all works.

Also saw SPACS described as poor man’s LBO/Corp Raider “ETF” (?).

Still remember Soros comment at standard dog and pony “search for the guilty farce” after GFC.

“They will keep inventing this stuff faster than you can make laws to regulate it”….or something to that effect.

Yep, they pay themselves handsomly as they divest all the equity in the business. Ever watch “Shark Tank”, they offshore any production and ramp up the marketing, and if it sours they bail. Interesting to know how many ventures they have taken the money and run..

Keep wondering why Cuban is there. Guess a scripted reality show worked for Trump and he still wants to give Prez (or Congressman) a shot. Establishing a lot of busy-ness acumen and also reputation for helping the poor while there…must not be right time to go for it? Or maybe he just can’t get into one of our two political corporations.

Very true. And guess who is likely giving them the DIP financing to keep operating after pledging all their assets that have any value… another private equity group.

This is what they do – take sick companies private or buy them out if they’re already private, load them up with massive debt to make huge payouts to themselves and their investors. Huge as in 5x, 7x 10x their investments. Then they turn around and sell these zombie companies thru IPO’s to idiot retail investors.

The companies naturally go broke in a few years, retail investors lose their shirts, and a new private equity group comes in and does it all over again.

Welcome to Wall Street and Private Equity. This game pays for their expensive new houses down here in Florida, along with the yachts parked behind them and the jets they fly down in.

I just don’t understand why retail investors and pension fund managers keep buying this crap?

Friends with the PE guys or just plain dumb? Am I missing something?

All of them have a fiduciary duty to the shareholders. The real problem is that nobody goes to prison for fraud anymore.

Misemout,

But the question is why don’t retail buyers of the crippled IPOs wise up after a few rounds/decades of crapola LBOs?

In other words…who buys this sh*t and why?

Best guess, like with other gross malinvestments of the last 20 years, automatic investment programs – while providing useful baked-in diversification – have also baked-in witless uptake of any piece of crapola that somehow manages to be hauled across the finish line of an IPO.

Indexing is very useful, but I suspect that it is deep in its witlessness stage.

CCCB-

Besides PE, don’t forget the foolhardy but fashionable high-risk bets being placed in the arena of private debt.

Take a look, for example, at non-marketable holdings (both equity and debt) in portfolios at the nations largest university endowments.

A possible parallel from a century ago:

“A severe depression like that of 1920-21 is outside the range of probability. We are not factoring protracted liquidation.”

— John Kenneth Galbraith, The Great Crash, [quoting a Harvard Economic Society official in reference to Harvard’s portfolio investments up until the post-1929 liquidations at huge losses.]

Private equity doesn’t even make any money for its investors. You are better off investing in small cap value for the same historical returns. PE does make its owners very rich, however.

The entire cabal running the US, from the corporations to the politicians and bureaucrats, is a giant cancer upon society. The US is finished as we ever knew it.

No worse than it was a hundred years ago. The collapse of the stock market was the result of massive financial chicanery and the government looking the other way.

The economic cancer is not just from private equity firms, albeit a takeover by avaricious persons putting profit ahead of everything is at the root of many companies’ problems, e.g., Boeing, which ruined its previously excellent reputation. As in China, customers in the USA are more and more likely to have less and less disposable income and must spend more on necessities as food, health insurance, and other consumer level prices go up, like rent.

Like the CCP, the tax evading US rich (who are desperately investing to try to replace their unhappy work force with embodied AI) wonder why ordinary Americans are less and less likely to buy expensive items or go shopping for things that are not necessities. See Oxfam: “According to a 2021 White House study, the wealthiest 400 billionaire families in the U.S. paid an average federal individual tax rate of just 8.2 percent. For comparison, the average American taxpayer in the same year paid 13 percent.” (That is the open, known billionaires as opposed to secret more than billionare families whose wealth is secret and hidden in foreign trusts, foreign, anonymous companies, etc.)

You can avoid most of these investment blow ups if you stick to companies paying long term dividends. But make sure the dividend is covered by earnings. Some play games like borrowing money to pay the dividend. Wall Street puts games like that in their heads.

Paying dividends is like Paying someone to be your friend. It artificially raises the stock price and encourages stock buy backs. Putting the money back into the company for real growth and development is probably better at keeping the boat floating wouldn’t you think?

Also love how the Clown committee gets paid and the so called “owners” get nothing.

In many cases there is a limit to how much you can usefully “put back into the company”, isn’t there? Take an old school company like Coca Cola for example. Not a lot of R&D going on there.

Why would you want to invest in a company if it doesn’t pay dividends?

No. People have studied this stuff endlessly. Dividends make no difference to no long term return that can’t be explained by other factors.

JoAnn today, Reddit tomorrow. I suspect corrupt pension managers bought the biggest bulk of the garbage. Investors with minimal due diligence won’t touch the stock with 10 feet pole.

Yet another business was killed by a private equity firm, just like Sears and Toys R Us. There should be regulations preventing this.

After Sears went into PE, I went into one of their supposedly revitalized stores. It was the worst retail location of any kind I have ever seen. It was obviously not survivable, bereft of staff (competent or not), and only had overpriced items not appropriate for our region. I walked out and never went back. Somebody was just mining that trademark into the ground.

That said, assuming PE is very greedy, I do not have excessive sympathy for the greedy retail investor bag-holders. In a free country we can’t protect people from themselves. A fool and his money are soon parted, no matter what we do.

I don’t think Sears ever went the PE route. IIRC, they spun off some of their real estate into a REIT around 2010 (Seritage) and then Eddie Lampert did a good job of killing the company himself without needing to go to Private Equity.

Sears stock was trading right up until a bankruptcy judge cancelled it.

However, there is a remnant of the old Sears called TransformCo. There are maybe 3 Sears stores left in the US, I think. They still have an e-commerce site branded as Sears.

Eddie Lampert and his ilk ARE the very apotheosis of private equity.

Sears was looted.

He was Kramer’s buddy and on his CEO “Hall of Fame” back when I was trying to learn Econ from CNBC….I got to see the S&P REAL bottom…LIVE!……666 and some change……thought there would be some Christian talk about that, but nothing. Guess all the big preachers were losing millions, too…..not feeling the Lord’s presence as much.

Learn more here.

Some tidbits on Joann 2021 IPO – ENJOY:

Forbes: Stitch Pitch: Fabric And Crafts Retailer JOANN Files For IPO

Feb 16, 2021 — The home crafting market is large—over $40 billion—and growing. JOANN is the category leader in sewing, with approximately one-third market …

Surprise, went below the expected price in 2021: Joann, Inc. (JOAN) raised $131.28 million in its initial public offering (IPO) on March 11, 2021, when it priced 10.94 million shares at $12 each. This was below the range of $15–$17, and the number of shares was the same as in the prospectus

Sounds like Trump valuation of his wealth: JOANN Inc. (JOAN) Statistics & Valuation Metrics – Stock Analysis

The enterprise value is $2.00 billion.

Again Forbes: Retail: Joann files for IPO as COVID pandemic lifts sales

Fortune — WHOSE FORTUNE!

fortune.com › joann-fabric-ipo-covid-sales-surge

Feb 16, 2021 — 31, Joann (previously known as Jo-Ann Stores) reported that its sales rose 24.3% to $1.921 billion, while the retailer returned to profit with …

sOMEONE CAN SAY, I told you:

Joann IPO: Will Investors Be Stuck Holding The Bag?

investing.com › analysis › joann-ipo-will-i…

Feb 23, 2021 — The company is heavily indebted, with over $921 million in long-term debt as of October 31, 2020. There is the threat of competition from …

I wonder if the PE firm issued some debt to pay themselves dividends before the IPO? Another good trick

“Joann sells the type of merchandise – yarns, fabrics, crafts, art supplies, sewing machines, etc. – that anyone can find on the internet anywhere, not only on Joann’s own site, but at countless vendors, including cheap stuff directly from Asia listed on third-party platforms such as Amazon and now Temu. Online, the selection is endless, prices are easy to compare, and it arrives directly at the buyer’s home.”

This is a BS narrative. JoAnn is just poorly run and overleveraged. I don’t see Hobby Lobby struggling.

“I don’t see Hobby Lobby struggling.”

Hobby Lobby is a private company and doesn’t disclose results. So you don’t “see” the results, and you don’t “see” what it’s struggling with.

Also it may not have a lot of long-term debt (it doesn’t have any publicly traded debt), and so it can afford to do pretty much whatever it wants. A company without debt can shut down, but doesn’t file for bankruptcy. All retailer bankruptcy filings entail debt that the cashflow from operations can no longer support. But if a big company doesn’t have debt, it has very long runway.

There are two parts to the Brick-and-Mortar Meltdown, as you can see in this article: debt and ecommerce.

Invariably, I have had people make these kinds of comments since 2017 about specific retailers, such as Bed Bath & Beyond, Toys R Us, etc., to show that the Brick-and-Mortar Meltdown is a “BS narrative,” and a few years later, the retailers collapsed, LOL. It never fails.

I can buy the same stuff in store for 20% less in Amazon and 90% less in Ali express. For some reason, I don’t need fancy case most of the type.

Not just physical stores are disappearing. Amazon will die if US government doesn’t quickly shutdown temu and alibaba.

So making Jeff Bezos even richer is the patriotic thing to do? To hell with him.

Agree. I don’t buy stocks and I shop local…..just not very damn much of anything.

Fabric is something we need brick and mortar stores to buy. Have you ever tried to buy fabric online? It’s one of the things you need to handle to before buying; feel the texture, the drape, etc. You can order a swatch online before purchasing, but then you have to spend $5 plus shipping before even starting your project. Ecommerce will never kill fabric stores.

Wolf,

Hobby Lobby may be private, but Michaels was public up until 2021. They reported a 10% operating margin in 2020. Joanns reported -23.85% the same year.

My wife is a crafter and I am frequently dragged to these stores. The difference between Joanns and Michaels is night and day.

I agree with the general sentiment of the brick & mortar meltdown…

…but I have to say I too notice a big difference between Michaels & Joanns in terms of merchandising quality (as someone with a crafter wife who also gets dragged to these stores).

“Ecommerce is a structural change in how Americans are shopping for this kind of stuff. ”

You may want to add the move to home based services to the mix of a change in buyers habits. Ms Swamps hairdresser is working right through Ramadon at her home salon. The mall hair salon where she also works will be losing customers to the home based salons and will go out of business along with the mall where the salon is located. Why pay $300 for a treatment at the mall salon that can be done at her home salon for $85. The brick and mortar meltdown will be receiving a fatal blow.

In Washington DC you see people getting haircuts right in full view on their front porches.

I went to a home salon 30 years ago in my neighborhood. Her dog tried to hump my leg for half the session, and I had trouble shaking the little guy off. All she did was laugh. True Story. I’d still go to a home salon, but not one with a little dog present and I’m wearing soft corduroy pants.

There are quite a few home-based hair & nail salons in my neighborhood… there’s even a home-based karate studio down the street!

Wasn’t there also a theatre chain scam that was similar to this around the same time?

I remember shaking my head thinking “don’t do it people. Don’t buy these shares” Apparently people did.

The AMC theatre chain isn’t a scam. It’s a mental illness where thousands of gamblers convinced each other of a cataclysmic financial event that will make all owners of AMC stock (or gamestop, or bed bath beyond) infinitely rich in a new world order.

What happens when you only get your information from ZeroHedge and Reddit.

Urgh….once again this is feature of our system, not a bug…disgusting to say the least

Retention bonuses for executives. Three executives would be paid retention bonuses in about September 2024, which the board agreed to on March 15:

$535,740 to Christopher DiTullio (Executive VP, Chief Customer Officer, member of the Interim Office of the CEO)

$371,250 to Robert Will (Executive VP, Chief Merchandising Officer)

$135,740 to Scott Sekella (Executive VP, CFO, and member of the Interim Office of the CEO.

Let’s hope and pray Hobby Lobby makes a similar transition

@Redundant: Was the use of the word “pray” an intended pun? If yes, a very good one!

Amazing that kick starting ISIS for fake Bible relics just kind of faded into people’s memories.

So they relabel their business plan to feature AI and the stock takes off.

Nice to see your name and comments once again, AB.

To your point: as long as there’s froth in investible stuff (AI stocks, dot coms, beany babies, crypto currency, NFTs, Shirley Temple glassware, Dali lithographs), things will get hyperbolic valuations while the music is playing.

Why are we surprised?

If PE firms can sell an IPO story to galactic funds (Vanguard – over $8T, Fidelity – over $11T, Blackrock, B of A, State Street…) that have 8000+ stock holdings, why the surprise?

Artificial Insemination makes stuff “take off”…..(rather than waiting around for natural urges).

My wife sews so I have accompanied her to JoAnns a few times. The biggest thing it had going for it was that the actual fabric for sewing is not super practical to buy online ( the other stuff in the store is). You go in to the store and look over the bolts of cloth, looking and feeling them to decide on the one you want. Verbal descriptions or even photos do not do much justice to fabric in real life. Then you take it to the counter and have them cut off the amount that you need.

I think they several big problems. The crafty goods they sold with the best margins are being purchased online. People who seriously sew are in decline and the young ones that are picking up the craft are often located in arty urban areas and they go to cuts neighborhood stores with names like ” BOLT” to buy all natural fiber fabrics while JoAnn was mired in a kind 0f 1970’s sears catalog inventory.

A big ( and profitable) part of their business used to be patterns. You browsed these in a huge set of books, then once you found the one you liked you got the big fat envelope from the row of huge cabinets with the pattern in it.

The last time I was there ( 2 years ago) the pattern shopping process was still the same as when my mother dragged my along in the 1960’s. No switch to digital with videos of fashion shows, point and click on the look you wanted, and then customization to a client to then be printed out on a big printer. A huge opportunity missed I am sure.

“People who seriously sew are in decline”

Bingo, plus I’ve heard from sewing friends that it is much more expensive now to make your own clothes than to buy off the rack.

That depends, I suspect, on whether one wants a bespoke garment constructed from high quality fabric, or fast fashion sent over from Asia and ready to enter the waste stream after a few laundry cycles.

My wife sews/quilts and crochets.

Sewing/quilting takes up way too much space in the home. The only other sewer I know is her grandmother.

My wife, her friends, and our nieces are all in our 20s-30s. Almost none have a room they can dedicate to sewing. Instead, every single one of them crochets. You can crochet in your lap.

Joann’s sells yarn, but so does Michael’s. And Michael’s has a 1/4 of the fabric Joanns has and not nearly as much overhead.

Hubberts Curve,

My wife, too, is really into sewing. And she liked going to JoAnn to touch the fabrics in person. She rarely bought anything else. Some sewing needles or scissors that were on sale.

She used to get patterns there but she gets them, mostly, online.

Occasionally she’ll use the pattern software she installed on the PC but having helped her tape those together is a very large pain.

Excellent comment!

I agree. Not only do the customers want to feel the fabric they also often need more to finish the job on the weekend, not delivered next week or even 2 day prime. One more consideration is the average age of the shopper, maybe 50 yrs old and not comfortable with the internet. There may be some life left in this chain. That said they will suffer the continued decline in the bricks and mortar model on all the other items easily found online. At some point the online price will be close to the same found on stores shelves. I see this happening now with may products. I wonder if online retailers will somehow figure out how to do a brake job or alignment via the internet?

Internet: The Weapon of Mass Disruption.

I agree. My mom used to sew and going to the fabric store was a ritual because you really cannot buy fabrics the way you can patterns online.

That said, this doesn’t really bother me too much. Some stores (and even industries) need to be run as private companies by committed activists rather than public ones my MBAs. I noticed that the three executives getting retention bonuses are all GUYS. Is that really what a company called “Joann’s Fabrics” needs in charge?

As a crafter, JoAnns had a great deal of fabric that was utilized for home decor to simple crafts. Really great prices with deals. It is near impossible to gather the feel of fabric (yarn, thread, cloth) from online. Serious sewers dropping large amounts of cash on fabric want to feel it first and verify the quality. I choose my textiles from quality brands I trust. If a new brand is introduced, I want to see where it is made and make sure the dye is the same. Seems like an opportunity for a niche Mom and Pop shop, because Walmart and Hobby Lobby carry very little in their stores and most of it is cheap bargains. With that said, most of my sewing friends went down to one project a year versus a week. Many of us entered back into the workforce due to inflation and don’t have time to make clothes and home fabrics. The down side, I know what I am buying (clothing and home goods) are less quality and cost more than my own brand. I just don’t have the time anymore. Are we sure we are not in a depression? This feels really depressing to my crafters heart! RIP DIY Stores!

Many are in a depression. Ask any of the unprecedented homeless you see. Inflation is just a word for wealth transfer. Wealth transfer is depressing for most. But we can live with the word inflation, so say the rich. Inflation will lead to only a few mega Corporations left, like Amazon..but as long as we say inflation and not wealth transfer, the rich shouldn’t face pitchforks. On the other hand, never say never..

We need a new metaphor for pitchforks. It’s colorful, but no one owns one.

Well said. The real-estate industry is next , Only Zillow and Redfin

There are several Mom and Pop fabric and sewing stores in my midwestern metro area. My wife and her grandma bought their machines there because they have significantly more product knowledge than Joanns.

Joanns needed an influencer.

Got to disagree – in my experience technical specificatons provide a close-to-perfect description of fabrics for those who have some previous experience. Measurements like Martindale index, fabric weight, material composition and various certificates already give you a pretty good idea of what to expect. Sure, when it comes to natural fibres the fineness and grain is more difficult to capture with a number – hence still all the rage about Egyptian cotton or Merino wool. Yet with a little research on internet forums it’s very difficult to purchase low-quality goods, especially since the younger generations are so addicted to being YouTube product reviewers.

IPO Banksters…

I hate the damn PE companies that are ruining our last places to shop. I know that I “can” buy Joann’s goods online but there is nothing like buying fabric in person. I need to get a feel for the “hand” of it. There is no way an online merchant’s description can tell me all the attributes I can assess in person. In addition, when you order online, you can’t return cut fabric so if it’s not what you were hoping for, tough luck. Joann is/was not a great fabric shop but it was the last one standing here (Hobby Lobby and Walmart are poor substitutes).

A relative bought fabric online and it brought bedbugs. I know, small sample size makes bad inference. Anyhow, cheers!

As Wolf points out repeatedly, these brick and mortar chains are due for either loss of market share or outright bankruptcy due to competition with e-commerce. Everyone in the comments today understandably feel rubbed the wrong way by PE companies. But they just sped up the bankruptcy for Joann’s; it was going to happen eventually.

Creative destructive forces of capitalism prevail. And I’ll echo another commenter regarding the IPO: “A fool and his money are easily parted.” Don’t hate the player, hate the game. If you hate the game, learn the rules or stop playing.

Very sad to see this happen again. So many others have disappeared through almost the same process and sequence of events.

Mervyns

GI Joes

🧩🧩🧩

There’s something to be said for engaging with certain goods before purchase. And certain articles of consumption need to be ascertained by more than just one of the five senses. Not sure whether that includes hot glue refills or bedazzling kits online, but fabric and thread — for sure. My guess is that brick-n-mortars become more of a boutique concern reserved for a certain type of buyer.

A luxury eCommerce site, Matches Fashion, filed for administration in the UK a few days ago. Luxury retail is hurting too because good paying jobs are disappearing everywhere.

I have to laugh reading the comments crying about LBOs and how they ruined America. I have news for you. This country has always been about looting and pillaging on behalf of the oligarchy.

Precisely! Thank you for (sadly) reminding us. Prime contemporary example: groundwater withdrawals in the U.S. Midwest and West. Water users draw draw draw like the FED prints prints prints…

Please name a single empire, throughout history, that wasn’t based on looting, pillaging and thievery.

I used to sew. Make my own clothes. In the 1990’s there still were quality fabric stores. Good stuff. Then the buy outs came. Now fabric is cheap , low quality , ugh. Why go to the trouble of making anything with that. Plus the patterns. Terrible. It’s as though they on purpose make sure the end product does not fit. I only buy European patterns. Classic cuts and they turn out great. Joann’s fabrics are sooo over priced for the low quality. I am not surprised this happened

Plus the stores are filled with junkie crafty products. Most of the fabric is for “ quilters”. Low grade cotton / poly

A lot of old standard good quality products have gone to pot in this country due to cheap manufacturing and no quality materials (or quality control) in overseas manufacturing. Try buying some drill bits that can actually cut through mild steel these days.

Gotta make Frankenstein pattern; a mix of your favorite collar, pocket shape, button placket etc. built around a known-good pattern (ex-wife is a master tailor).

I’m sure there’s good stuff out there fabric-wise, but what used to be off-the-shelf awesome is now marketed as boutique or custom.

Honestly, all these complaints about PE firms and whatnot. Look, if you’ve lived in the US during my 50 years, and you haven’t come to the conclusion that sheisters are everywhere, then frankly, you’ve been high. It’s a free market, no one said people had to buy into the IPO. Anyone who did any due diligence knew better.

Look at Macys. How many more downsizings will they have before they give up? They controlled Federated, Consolidated and May Co, but lower sales today in nominal dollars. Less stores too.

Nieman Marcus filed bankruptcy. Super short cash on hand, access to credit. HBC (Saks) is trying to buy but the handlers are too greedy.

Honestly, I love to read about these things because it reminds me that while I’ve missed making money on some of this stuff, I wasn’t wrong about the fundamentals. Who needs malls and plazas? Really, not too many of us.

It’s a shell game, how good is your timing?

Buffalo – re: Macy’s, Wolf has reported here many times on their strong transition to online-their steady march of store closures to be expected…

may we all find a better day.

Sounds like more retailers should put ‘poison pill’ plans firmly in place to dissuade private equity trash from taking over.

But maybe company executive management wants the PE firms to show up when things start to go south to get in on the big payouts?

Is Fisker automotive on your list of imploded stocks? Word is they are preparing for bankruptcy filings. Stock is down more than 99% from the high.

Yes. Here is one from August, on EV startup stocks collapsing, including Fisker:

https://wolfstreet.com/2023/08/09/the-collapse-of-the-ev-spacs-another-one-goes-bankrupt-others-on-the-verge/

The “mallpocalypse” and the long, slow death of so much brick-and-mortar retail presages a similar fate for CRE insofar as it’s office space, since the pandemic accelerated the work-from-home revolution for which the technology already existed and had begun at least as far back as the mid 20-teens.

While I know nothing about h shopping for fabrics, Joann’s business seems like it could be much more efficient as an e-commerce operation:

They have a gazillion different skus for all the different color/size/etc. variations of a product, and most products are very small and light (inexpensive to ship).

It must be a headache keeping each store stocked with exactly the things customers in that area buy (and none of the things they don’t), but having everything in a central warehouse solves this.

I don’t even want to think about the headache that inventory management at these stores must be…

Just an old guy here, mostly ignorant of the workings of high finance, or “smart money”.

Is this a PE business model? Noticed similar patterns over a couple decades. Acquire wobbling, large retailers, borrow maximum out of what’s there to cash in handsomely, then peddle the terminally ill patient off to the public, then bankrupt the whole thing. Last is DIP lenders with super liens on whatever is left over, squeezing the last bits out of the bones before departing.

Not trying to be offensive, but maybe the “P” in PE stands for parasite. Perhaps that is unfair, and maybe these PE firms are just the natural “clean up” teams, a sort of Hospice for poorly run businesses.