And that’s very disconcerting.

By Wolf Richter for WOLF STREET.

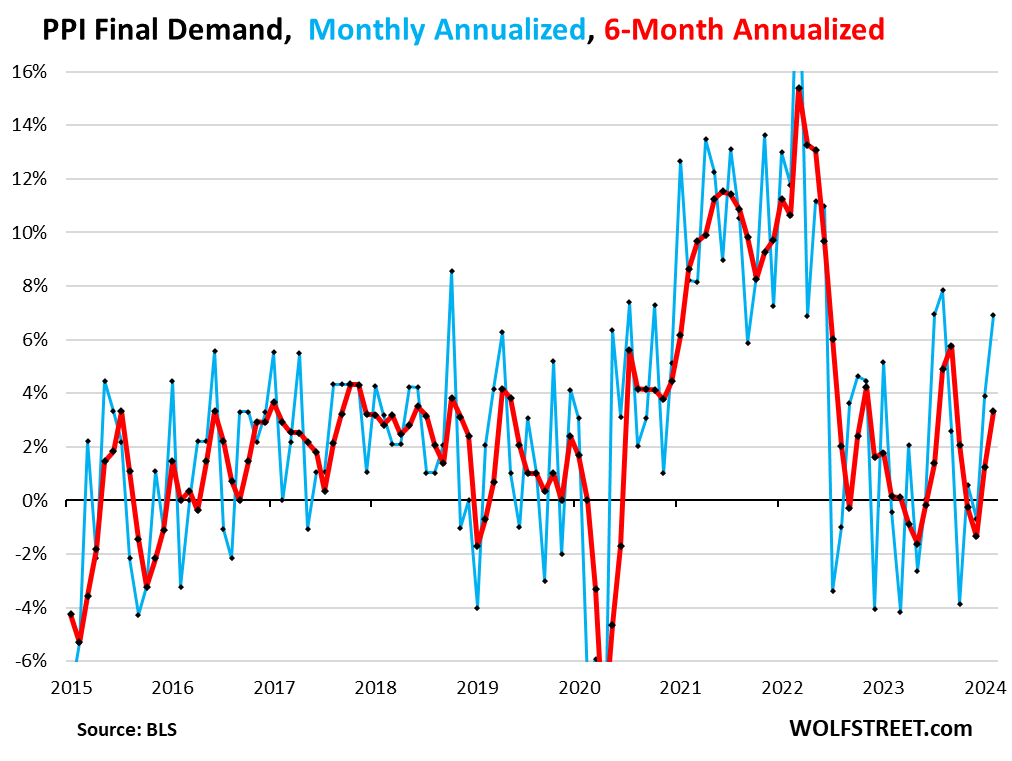

The Producer Price Index (PPI) for final demand jumped by 6.9% annualized in February from January, on top of the 3.9% jump in the prior month. The three-month rate jumped to 3.3% annualized, the highest since September.

Part of this was driven by a renewed surge in energy cost. But the other part was driven not only by surging costs in services – we knew that – but now also by surging costs in core goods, and that’s very disconcerting.

Services have been the driver of consumer price inflation for nearly two years, while falling energy costs and falling or slowly rising core goods costs in consumer price inflation measures served as a hefty counterweight to the hot inflation in services.

But what the PPI is beginning to outline is that core goods prices deeper in the pipeline are raising their ugly heads again – potentially leaving us with hot services inflation that is no longer counterbalanced by disinflation in core goods.

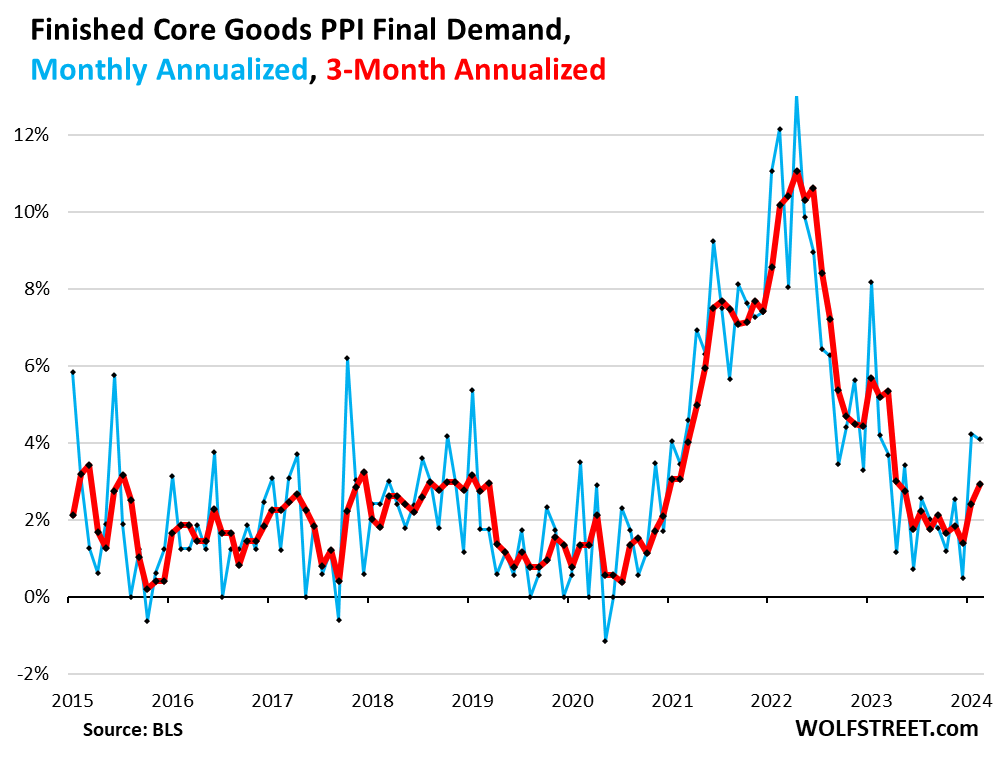

The finished core goods PPI final demand, which excludes energy costs, rose by 4.1% annualized on top of the 4.2% surge in the prior month (blue in the chart below). These are core goods that producers buy, and whose costs become part of their input costs.

The 3-month rate jumped to 2.9% annualized, the highest since April last year when it was on the way down (red). You can see the long hard plunge from mid-2022 through late 2023 of the 3-month rate. And that trend has now reversed:

The breakout of the 3-month rate of finished core goods PPI is very disconcerting. The whole disinflation momentum in consumer prices (CPI) in 2023 had been driven by drops in prices of durable goods (negative inflation or deflation) and by the plunge in energy prices, while services continued to be hot.

This PPI data on finished goods has now thrown some cold water for the second month in a row on the hopes that core goods deflation will continue.

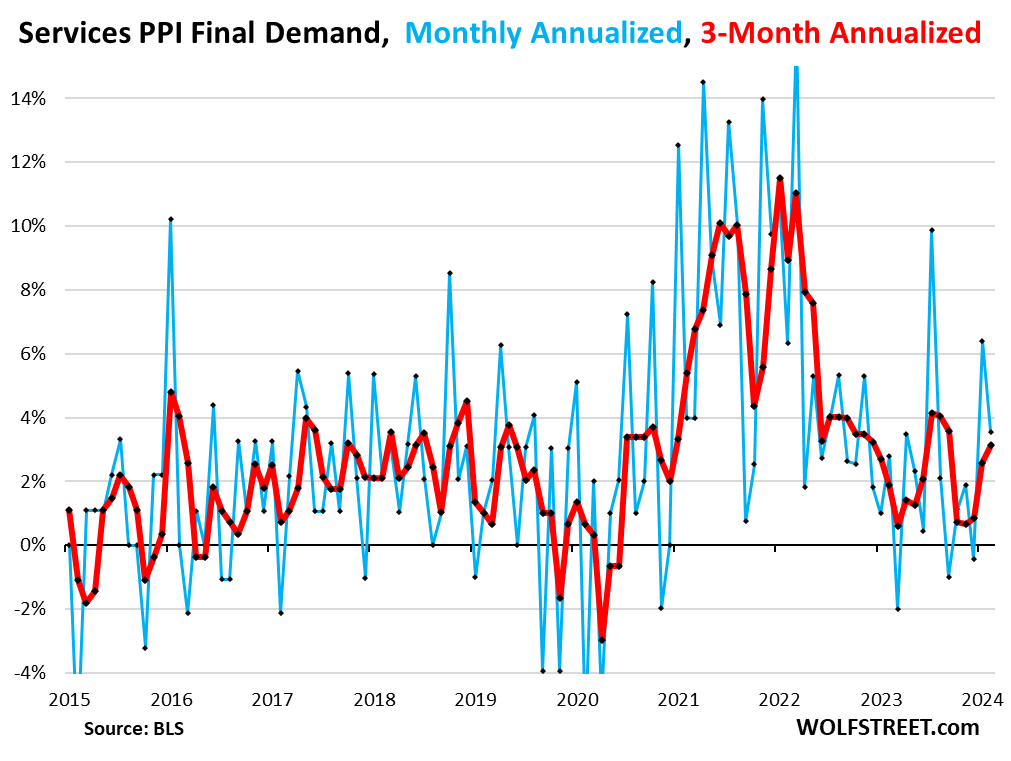

Services PPI final demand jumped by 3.6% annualized in February from January. The 3-month rate jumped by 3.1%, the highest since September.

These are services that producers use. They weigh 62% in the overall PPI. And producers will try to pass those price increases on to their customers.

All of this month-to-month inflation data is very volatile and noisy with big ups and downs, and trend changes take some time to be confirmed, and a couple of months aren’t enough. So we exercise some caution here. But it sets the warning lights blinking.

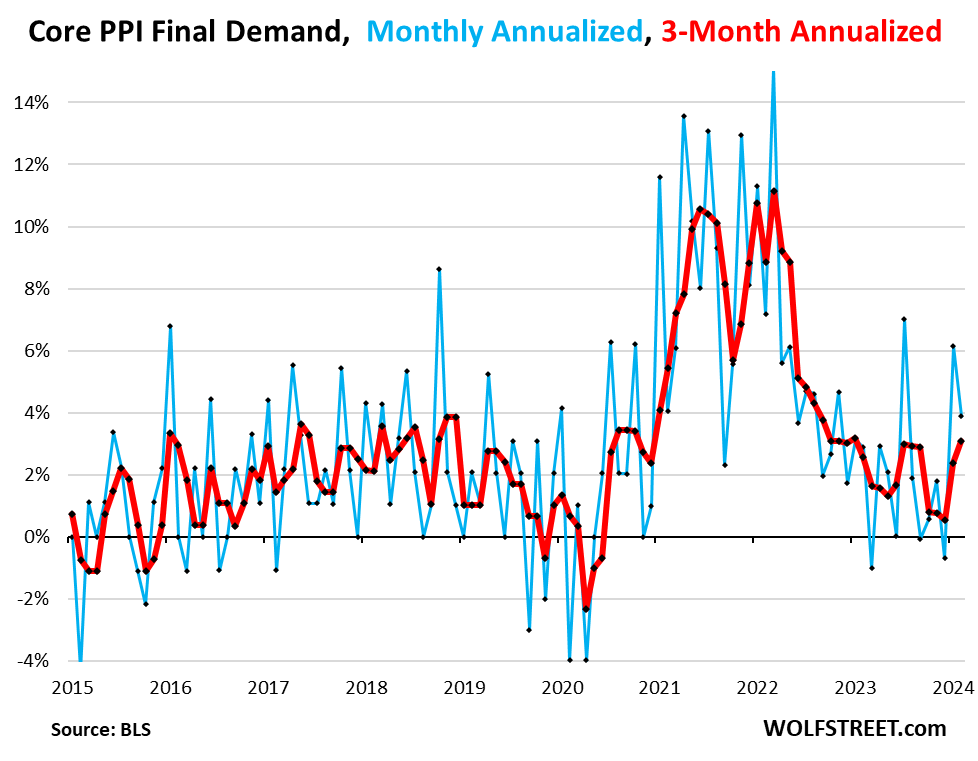

Core PPI final demand jumped by 3.9% annualized in February from January on top of the 6.1% spike in the prior month.

The three-month rate jumped to 3.1% annualized, the highest in 13 months, driven by the surge in services PPI and finished goods PPI.

What the PPI is telling us. The measure that tracks consumer-facing inflation, the Consumer Price Index, has for months seen hot and rising services inflation, but durable-goods inflation has been negative (deflation) since the peak of the spike in 2022, and these negative readings in durable goods, plus the plunging energy prices of yore provided a big counterweight to services inflation and a downward push for the overall CPI readings in 2023. But this counterweight and downward push is now in the early stages of fizzling – that’s what the PPI is telling us.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Would a hike to the Federal funds rate help? I think so, but…

We need a 100 basis point emergency hike. Like Bernanke once said – “The FED could stop inflation in 15 minutes.”

Can the US banking system really handle another 1% increase?

All those long bonds and sketchy CRE loans on their books….yikes.

Biden’s budget forecasts a $2.12T deficit this year. No one should be surprised if it ends up around $2.3T.

What all of this data is trying to tell us is that the labor market is not going to “roll over” pushing us into a recession with this kind of profuse government spending.

The geopolitical situation will also ensure all possible inflationary pressures come to bear.

2% core PCE inflation outside of a black swan event is an absolute pipe dream. The Fed should have taken the FFR up to at least 6% and even then, we still might have needed the final 50-basis points rise you call for, Depth Charge.

Bullard 14 months ago said 7% may be needed.

To get a big fat recession, rate cuts to 0%, and end-of-QT? Is that really what you want? Is 0% and end-of-QT on your wish list? Be careful what you wish for because you might get it, and then you’re even more furious and I’ll have to go to your home and manually peal you off the ceiling.

No, I want the big fat recession to clean out the excess, with rates staying at 5%+ and QT speeding up to $200 billion a month, at a minimum.

I want the nation’s housing stock and stonks to lose 80% of their value.

Einhal,

OK, that’s on your wish list, I understand now 🤣❤️

Where’s Andrew Mellon when you need him?

I feel that the younger generation has gotten screwed, so I want people with tons of assets that have had undeserved appreciation to take huge haircuts to even things out a bit.

Agreed with Wolf here on the caution note and too fast would backfire. I sympathize with you DC at the outrage over damage caused by the excesses of QE and ZIRP to causing this Everything Bubble we’re stuck in. (Not to mention all the billions of dollars in PPP fraud handouts still need to be clawed back). But the Fed is walking a tight-rope, and if monetary conditions tighten up too much too fast, then it would be a yoyo effect. JPow actually looking like Wolf’s famous satire picture of him, panicking and going too far in the opposite direction.

It stinks but the more cautious pace does make sense and keeping with higher for longer. What would be unacceptable right now, additional rate cuts pouring even more gas on the inflation fire. I was talking with an old friend who’d been a small landlord and got out of the business last year because he foresees a firestorm (literal) coming. With them and a lot of business owners in the cross-hairs if prices keep going up. He said even Americans with good salaries are being pushed to the limit now by all these price hikes, but especially in groceries and rent. Getting uglier now, with angry threats at landlords and stores targeted for looting. It’s bad for all involved but base culprit is ultra-loose monetary policy making basics too difficult to afford for Americans.

So the Federal Reserve had better steer way clear of any thoughts of 3% inflation as the new normal–it wouldn’t even help deal with the federal debt, would only make ongoing allocations even more costly and the national debt and deficits even worse. If anything Americans would prefer to have a bit of “makeup deflating” and prices going down, for a couple years–total inflation since 2020 would still be way beyond the 2% magic number. (A made-up number anyway with no actual basis, just the back of a napkin sketches by some Bank of New Zealand bankers who were trying to make something up for a meeting–we should try for much lower inflation so Americans can adjust). Some economists obsess about “deflation bad” but not all deflation is like the Depression, especially if it deflates bubbles from previous high inflationary cycles. f prices keep going up like this while wages don’t catch up–and most Americans for reasons can’t just up and take another job–it’s gonna lead to things literally burning before long.

YES! That’s exactly what I want. A recession is the ONLY cure for high crazy high home prices. And that assumes we’re lucky and EWarren doesn’t get her wishes by trotting out rent & mortgage relief if it gets bad enough. Without a recession, home prices will not return to their mean. It’s that simple.

And, NO, the Fed would NOT have to cut rates to ZERO with a recession that pushes unemployment up towards 7%. Heck, the unemployment rate will move up to 5% with people re-entering the workforce and a modest rise of continuing unemployment claims above up to 2M which is hardly significant. That’s part of our problem. There’s this ENORMOUS over reaction on the part of the Fed & Congress. It happened in COVID and will happen again. The winners are always the uber affluent.

The FFR should never drop below 2%, unless there’s a really MAJOR issue. A good run of the mill 6-7% recession would in NO WAY necessitate anything close to ZIP.

And just to be clear about one more thing. I want the FED to get out of buying ANYTHING from the treasury longer dated that 7 years. The Fed had NO business mucking with 30YFRM by buying MBS. It was absolutely WRONG of them to do this, and they should not be buying 20- & 30-year bonds. That’s just crazy. This policy step is EXACTLY what created the housing price mess we’re grappling with along with the near ZIRP policy. For a short period of about 6 months during the pandemic, it made sense to go near ZIRP, but that’s the home point. The Fed waited more than a year longer than they should to start raising interest rates. The massive change in Fed policy post Sept 2008 is helping Congress justify & run $2T deficits.

At this point the least they could do is to say two cuts or less in next week’s March dot-plot projection. But so far they are not doing anything to try to correct the extremely loose financial conditions. If they still keep the projection at three cuts like last time, it is game over for main street.

The time for emergency hikes is over. However, JPow and the Gang could do almost as much good by dumping the “dot plot” nonsense and jawboning in unison (how about “no rate cuts until inflation is under 2% for 3 consecutuve months”?).

Now you WANT the government to lie to you? Things like the dot-plots and the release of the meeting minutes are there to increase transparency. People make up conspiracy theories even with all that and you want to make it easier?

Man I wish you were Fed chair…

Pretty sure you are correct. The Fed could stop inflation in 15 minutes. They would be seriously violating the employment mandate under which they operate under, and, most importantly, you and a host of others would not like the consequences of “ending inflation in 15 minutes”. I’ve seen that rodeo before.

Yes. I keep thinking that all this stuff SHOULD matter, and that they should actually be hiking rates instead of having the countdown to rate cuts, but it doesn’t seem like anything matters any more. We just keep bailing out banks and billionaires with more rate cuts, and slow down that QT while you’re at it. Screw the little people struggling with ongoing inflation. Go figure.

What about HOUSING ???

Should have raised rates sooner rather than later, and higher than they are now.

Inflation is always and everwhere a monetary phenomenon (Milton Freidman). Yes, sooner & higher rates would have helped however pumping newly created money into the system through record deficit spending is a more fundamental cause.

That one-liner is simplistic – which is why it’s cited so often. Inflation is caused among other things also by mass-psychology… by behavior, by the inflationary mindset: consumers willing to pay those prices, companies confident that their price increases will not lead to a loss in sales, etc., consumers and companies reacting to higher prices by front-loading purchases to beat price increases, etc. When that behavior takes off, inflation gets entrenched in the economy, and is very hard to eradicate.

I’d say inflation is pretty well entrenched. Anyone buying a home right now is bonkers unless it’s an absolute necessity and you have substantial equity to put down. Outside of a recession, it’s starting to look like the only thing that’s going to cause a meaningful drop in all homes prices is for sales to tank down to near zero. And that it’s likely to happen all by itself.

Wolf,

I think the size of our money supply is the biggest cause of inflation, certainly more than 50%.

That said, I think the Fed had to increase the money supply during the virus to stop what could have developed into a global depression.

Increasing the Fed balance sheet, the money supply, doing QE is a tool.

QT will get us to a less inflationary money supply and lower inflation eventually, with luck.

Let’s say it’s both monetary and also fiscal, fine. It’s still up to the fed to do all it can to eradicate inflation, which they have been slacking on, basically down to hopes and prayers that it truly is transitory and goes away on its own miraculously. With each passing report, that seems more and more like the magical thinking it always was.

They can’t just be passively “data-dependent,” they need to be way out in front managing this thing! The jacksonhole speech was at least a good start, as were the multiple 75bp hikes, but as soon as they started getting cocky, here we are again, 70’s redux. At least back then, it was a totally new phenomenon, now there’s just no excuse. I really don’t understand what the big deal is on going too high, they can just do an emergency 500bp cut at anytime, unannounced anyways. No one even believes they’ll stay “high” to begin with, so they have less and less efficacy, so in the end they may have to end up going higher than they would have had to otherwise because they were not resolute from the start.

Thing that gets me is that policy makers are going on and on about inflationary expectations – it doesn’t help having a survey in CPI aka OER .

Alexandros,

CPI for rent is also a survey of housing units, and whoever is in it fills out the survey. It’s the same housing units that get surveys for years ever six months, so that’s how they track actual rents that tenants are actually paying.

OER inflation is hot and has been the biggest contributor to the hot services inflation. That’s where property taxes and homeowner’s insurance get picked up. It works pretty well.

I agree and it appears that the Fed will have to raise rates again to lower inflation

With due respect, inflation in Venezuela and Argentina and Rwanda and Weimar Germany is or was entirely (or pretty close to entirely) a monetary phenomenon, and today’s worldwide inflation is similarly directly attributable to what moronic central banks did during and after the pandemic.

Inflation can also be driven by rapid increases in energy prices. A good example is the 1970’s when the oil embargo drove up oil prices in the US rapidly and the reamainer of the decade saw us mired in inflation ( stagflation). You can argue that Nixon taking us off the gold standard also set in to motion monetary policy inflation, but in my mind energy prices were the big Kahuna.

@Hubberts Curve

Your right about this, my family still tells us horror stories about the oil shocks in the 1970’s and the inflation that took off. One of them owned a small town gas station and it was really ugly when it hit. Not for any way defending Arthur Burns and his incompetence here, but as far as Fed chairs go he had a very rough challenge to deal with in bringing that kind of inflation down. Sticky and it shortly creeps into everything.

One interesting wild-card here on energy inflation front, is potential for prices to come down with how unexpected fast and comprehensively China has been installing those solar panels and turbines for wind generation, and getting really good yield from with other improved tech. That and with all the nuclear plants for basing-load, and they’re saying even with spiking economic growth China may well soon be dropping carbon emitting. (The shift out of housing as wealth source was planned, to move resources to power tech–smart and wish we’d done the same). And then as they export the cheap panels elsewhere in the world, it means demand for coal, oil and gas may soon start to drop faster than we all thought. This is that “new singularity” or next industrial revolution they’re talking about and also may help stabilize prices. Hard to be sure but interesting this happeing all a lot faster than anyone thought a decade ago.

“pumping newly created money into the system through record deficit spending is a more fundamental cause”

CNBC – The U.S. national debt is rising by $1 trillion (that’s ONE THOUSAND BILLION – W) about every 100 days – 1 Mar 2024

That which cannot continue indefinitely won’t. The longer it continues, the worse the eventual consequences will be.

Wolf taught me a great deal about inflation and the need to say no. Just yesterday I had a fluid leak on my 2009 Ram pickup (purchased new) 140k miles so thought about the truck curve published by wolf looking at the Ford F150. I need new tires and brake pads and dropped the vehicle off . They checked transmission (ok) and are looking for fluid leak most likely oil leak . Total cost in my opinion will be between 5-10k plus brakes and tires (2k) . I’m saying no to a new truck because of price

$5k to $10k to fix a fluid leak? I’d guess less than $3,000.

To bad a mechanic “wolf” didn’t teach you how to try to find your own leak, can you fix it, can you do your own brakes. Now with your savings you report back to this site for direction.

Good luck BS ini

@BS ini: You might want to locate the source of the leak first so it gives you an idea of the size of the issue. If you notice the leak at the top of the engine block, it is very likely that the head gasket needs to be replaced. I fixed it myself after looking at YouTube videos and, to my recollection, after purchasing some tools and parts, it cost less than $200. Didn’t need to raise the car or do anything heavy duty. If the leak is underneath the car or if you cannot locate the source of the leak, then you have a bigger issue.

Brakes are another matter altogether. Good luck!

Time for Powell to give his speech “ The anguish of central banking”.

Burns is starting to look good. Unbelievable that we will go through the 70s again not because of ignorance but cowardice and luck of courage from our “public servants”.

You forgot corruption.

Wake up there are no public SERVNTS ,only boot licking billionaire puppets

Sounds like more interest on my money for some time. I will take what they give me even though I think it should be another .25 higher. If I get called on my one year this April going to six months or theee months. It is what it is.

At least gasoline isn’t spiking wildly in price. A lot of people drive SUVs and gas hikes would make a major hit on their wallets.

Spiking wildly being the key phrase there.

Gas futures have been up about 30% YTD

Down here in the big easy gas was close to 2 bucks a gallon but now closer to 3. One more dollar up and then it’ll be wild ha

Gas prices are headed higher into the summer, you can take that to the bank. It will probably get insane in California as I think there were new restrictions on refiners which they warned would result in shortages. If they didn’t get so much rain already I think they would be able to fill the reservoirs with their tears this summer!

Both oil and gas are breaking out, we are in stagflation and the idiots in charge want to pretend either it’s not the case or they can’t do anything about it. Gonna be a long hot summer of pain.

Copper is breaking out, also.

Gas is over $5/gallon at most Bay Area stations (except Costco) and when I passed the Chevron in Truckee this afternoon it was $6.39/gallon.

Just booked my annual summer flight to the PNW. Up 30%+ from last year, which was up probably 15-20% over the previous year.

I wish the extra cost went towards a better flight experience where I’m not treated like a farm animal, but that aint gonna happen.

Yep. The Brent hit $85 a barrel today and the WTI, broke $80.! You don’t need a crystal ball to realize that the price of gas will probably be over $3+ this summer. But hey, I too am sleeping alot better, since I got out of my bonds and stocks, and started taking advantage of the high interest rates, by investing in CD’S and Money market accounts!

Gas will be over $5 in Cali this summer.

On Gas Buddys. The average nationwide Gasoline price 10 years ago was $3.35 and has hovered between $2.5 and $3.5 over the past 10 years. Thus gas has really not been affected by inflation. Right now the average is $3.45. So a 10 cent is a 3% increase in price over 10 years.

According to the bls.gov inflation calculator. Gas at $3.35 in 2014 It should be $4.53 now.

No inflation for gasoline. ;) It can go up $1 and still be lower than the CPI over 10 years.

The Canadian Trans Mountain pipeline addition is apparently on schedule to start operation in the third quarter. This will shift some of the Canadian output to the West Coast and Asia with less overall export to the U.S.

Up over 60 cents in the past month.

You would think the fed having historical evidence from the 1970s showing what happens when you cut too soon would be enough for them to understand but apparently basic economic knowledge is lost om them.

They have NOT cut yet.

Haven’t cut yet but everyone can see their itchy trigger finger. It’ll be interesting to see the next dot plot.

The voting members have a wide range of opinions. There are definitely hawks that will try to hold the line. Some doves would be happy with 3% inflation no matter what official policy is. The dot plot is one dot per voter opinion. Based on the spread and the concentration of dots you can guesstimate where the direction might head. But a few really difficult voting members with strong data can lead the way, even with a moderate JP in the lead. There is lots of psychology in this game. Fear and greed. There needs to be more fear in the game at this point.

President Biden is going to want the price of gas to come down in time for the 2024 presidential election. Maybe he’ll unleash the Strategic Petroleum Reserve.

In Canada, the federal government used to own Petro-Canada. Around the time of every election the feds would order Petro-Canada to lower the price of its gas markedly, thus making the consumers happy and more likely to vote for Trudeau (yes, there was another Trudeau in power; the father of the current Justin).

I’m sure Biden would love to have that power now.

I think Biden may have already played that card for the midterms in 2022.

Plus more sour then sweet oil left in that thing and to my understanding it’s less useful and efficient

Should’ve been buying up that oil to refill all last year

What you are saying is Fuddle Duddle Mr. Dark, if you know what I mean :)

Ex-1970’s Canadian!

Meanwhile, the Saudis are planning a coordinated output reduction and strategically reducing or offlining “for maintenance” their huge refinery in Texas in time to make 2024 prices go up to hurt Biden’s re-election chances.

They’ve done this sort of thing before to attempt to meddle with Dems’ chances.

With Ukraine hitting refinery and production capability in Russia gas is going to go up. Likewise with the Red Sea and Gulf unrest. All those guys buying Russian and Iranian on the black mkt are going to be limited in what can move overland. If Ukraine can disrupt trains , especially through the “stans” oil will get very expensive.

It’s interesting to see the EU and US asking Ukraine not to hit the oil as they are going to impact inflation.

Jerome Powell had all this data before it comes out and he still says “we are not far from being able to cut rates” the other day. Its unbelievable how much they always err on the side of keeping inflation going and keeping financial conditions loose. Its gotten to the point beyond irritating and its now kind of scary how much these people lie to keep the facade going. Will they ever take the poor and working class into consideration when they play this game of a rate cut is coming just you wait and see.

If they were at all inclined to take the poor and working class into consideration, they would have behaved a lot differently between 2020 and 2022, and we wouldn’t be in this mess.

I know but its just so aggravating. I wonder if Powell will come up with a new word or phrase similar to transitory to explain the reacceleration of inflation.

“new word or phrase similar to transitory to explain the reacceleration of inflation.”

How about “recurrence” ? As in cancer coming back, and needing more treatment .

Re-transitory? Transitorier? The son of transitory?

He was talking to Congress. He knows what those gasbags want to hear.

Wolf,

How much inflation pain do you think the electorate needs to change political priorities?

Take however much would be necessary to spark a revolution and then subtract one basis point

Unfortunately, it could be a lot more inflation. Argentina finally elected someone who is committed to cutting debt and restoring free markets but even after supposedly 100% inflation in a year, there are still mass protests against and Senate rejection of the common sense, necessary efforts to return to normalcy. Part of it is maybe the defeated (for now) money printing debt mongers trying to gaslight and deceive the people against their own well being and of some people stubbornly averse to reducing their unsustainable living standards.

I’m in the UK and this is the weirdest economy I’ve ever known in the 20 years I’ve been working. I know people who have been made redundant and are struggling to find jobs. My partner’s work did two rounds of redundancies last year. Things are slowing up, but restaurants are still packed, flights, accomodation are still insane, bargains for second hand goods (e.g. musical instruments) seem to have dried up. You look one way and it’s clear there is a recession and the other and it’s boom time.

Rents where I am are still completely nuts, which massive numbers of offers for properties and prices holding up. House prices seems to have stopped rising but are holding peak prices despite interest rates being 3x higher than they were at those peaks. That alone makes no sense to me, but enough people seem to be able to pay up.

My gut feeling is that the economy has bifurcated; one group is being crushed into the ground and one group is still partying like it’s 2022. I’m not sure that the central bank will be able to really haul back inflation pressures. It would have to hike like crazy to have any effect on the wealthy group, which would have the side-effect of absolutely destroying the poor. I don’t think democracy could support that – we are already seeing a rise in crime and social breakdown. IMHO wealth inequality has reached breaking point and we’re about to see what happens when you go beyond that.

Come on Jon, it’s the U.K., you should know what feudalism looks like!

Jon W,

Well said. Wolf did an excellent discussion on QE etc. with another panelist and you are doing a good job of describing what you see first hand.

Do you have any insights into whether this is occurring throughout the rest of Europe and are you seeing actual political instability arising yet?

When I was in Greece it seemed like we might be getting to a point where we could actually get significant riots, snap elections with unpredictable consequences, etc. Also some political parties are talking about restructuring the Eurozone due to debt/currency problems etc., so wondering if you have thoughts on that plus timelines.

All we need are a few 1970s style coups in Latin America to drive up commodities prices and inflation would really go crazy.

Wait a year houses half price ,if not I owe tou a steak dinner

I accept your offer and plan to collect that steak dinner.

There will be too much inflation for asset prices to drop that much.

That’s gonna be a lot of steak dinners…..

Of course, “Sizzler” sells steaks…… :-/

This bifurcation is an indicator that should be watched.

If you’ll recall, when the lockdowns went into effect in March-April of 2020 (in the US), the economy barely hiccuped.

The GDP dipped about 11% in Q2, and then it recovered by Q3 and took off from there to the moon.

I think that revealed Pareto’s Law in action: the 20% of the workers who generate 80% of the economy’s productivity weren’t affected at all. Their lifestyle didn’t suffer. They got more free time working at home. Many became more productive overnight working from home. They stopped spending, but they didn’t stop working.

I think a similar story is playing out now: the 20% driving 80% of the economy’s productivity is not yet feeling the pain of the bottom 80%. And so they continue dining out at restaurants and other things.

The top 20% haven’t started to cut back yet, at least not much. Thats why services inflation continues to rise.

Until we observe a decline in the prices of the goods and services favored, purchased, and sold by the most productive segment of the economy, then there will be little slowdown in the economy.

But as history has shown, the fortunes of that top 20% can change almost overnight once the right conditions are finally triggered.

Inflation – pick one (or two, or three)

1) demand/pull

2) cost/push

3) inflation expectations

HowNow-

You’re on to something on you #3.

I remember the constant analysis in the 1970’s and 1980’s of “inflation expectations.” “Anchoring” of expectations was part of the lexicon of the day, along with “wage/price spiral” and “COLA” negotiations.

Expectations are certainly important and susceptible to becoming “embedded.”

I generally agree with your point, but I want to note a few things.

– The GDP only “recovered” in Q3 because of the massive and unnecessary stimulus that caused people to splurge on all sorts of things, mostly goods.

– The people who didn’t stop working didn’t stop spending either. They just spent on different things, like home remodeling, pelotons, TVs, RVs, boats, and the like.

– When you say “nation’s productivity and “the most productive segment of the economy,” that’s only productivity as measured in dollars, not actual production. Not unless one thinks that $1,000,000 of Instagram influencing is 10 times more “productive” than raising $100,000 worth of cattle.

Are government employees the 20% productive now?

This really rings true

There was an interesting statistic in the early 2010s from the government, it was that income inequality was lower than ever. What they didn’t say was that wealth inequality was higher than ever. And over time its only gotten worse. An entire economy designed to tax income and ignore wealth, while desirable land is in short supply. Then they decided to pump the pensions because that is where all the votes were. The UK is certainly a tale of two different countries, those who bought their houses and paid off their mortgages when things were good, and everyone else.

The cost of housing is so prohibitively high that very few can move up, especially with income taxes so high on the top end. The good times will only be spread when certain lucky individuals stand to inherit. The result is poor productivity, a crumbling economy and very public services, while the older property owning classes have never had it better. It is crazy indeed. Things have gotten so bad it looks like the Tories may finally lose power. Unfortunately other than put more money into public services, I’m not confident Labour will correct the situation much.

That’s what I’m seeing. Those with money

are spending with no hesitation, those

without, we’ll…

But since 65% of households are homeowners, and home prices have surged over the past many years, and employment is massive, topped off with big wage increases, and 401ks are flush, and people are earning 5%+ on their trillions of dollars in savings accounts, money market funds, and CDs, well, lots of people have plenty of money, and they’re spending some of it, and that’s what you’re seeing. The bottom 20% never have much money by definition; but they’re also not the big spenders.

And yet another 100 basis points cuts everybody off at the knees? C’mon, Wolf.

Each time I read those concise two sentences, I realize this is a summary of the simple fact the economy is booming based on all the important metrics. There are few signs this will change. The Fed made a horrible mistake to take the threat of future rate hikes off the “likely” plan in December. It made for a nice short term trade, but I exited early in fear. I see too many parallels to the late ’70s handling of inflation. Something more severe than stagflation is required.

Lyft and Uber leaving Minneapolis.

Higher for longer.

Was digging into median real household income data, looks to be increasing at about a 0.7% clip per year. Not as great as GDP or other figures would lead you to expect.

When i spent a lot of time in a factory in south Wales in the mid 80’s the problem was simple – the employees worked 9-5 with 1 hour for lunch and 2 30 minute breaks; they had 10 bank holidays + vacation + 10 sick days and productivity was about 80% (basically utilization was 50% and efficiency was about 100%) — the end result that the factory needed 2 workers to do the job of 1 worker — so a 500 person factory had a 1000 person payroll.

i don’t know if it is still the case in the UK – but i found it sad

All things reach their equilibrium over time. Housing, for example. Ran up prices like crazy, now prices are stagnating, even though interest rates are way up. So, what happens next? The answer is fairly clear, housing prices will not resume any real advance in prices until the historical trend line reaches the temporal market price (meaning the market price at that time). When does this happen? How does this happen? Why does this happen? All good questions. Who knows the answers? No one.

And yet Powell said again Wednesday that he believes the Federal Reserve will cut its key interest rate this year. So instead of an orderly decrease in equity securities prices, the bubble is reinforced. I honestly don’t understand what he’s doing.

What are they professionally trying to accomplish? Reducing total (“aggregate”) demand below total supply, thus reducing the rate of overall price increases. They wish to do this without causing a recession. Which is worse for incumbent politicians’ re-election prospects, inflation or recession? I think a consensus is building that, at this moment, before an election, it is recession. Hence the jawboning meant to ease financial conditions. But also maintaining QT and higher interest rates to address their stated policy goals.

The interesting thing about monetary policy is that the policy makers are also directly affected by policy. It’s not like an oil company executive blithely telling his subordinates to keep drilling despite warnings, while he sits safely far away in a mahogany-paneled office (Deepwater Horizon). No, the monetary policy maker is also on the rig.

Do Powell and his associates own interest rate-sensitive assets like stocks and real estate? Does he want a cushy sinecure on Wall Street a la Mr. Bernanke? What do the Senate and House finance committees desire? The president? Personal plus professional interests affect monetary policymakers and thus monetary policy, it seems to me.

It’s important to try and understand how exactly the system works. It’s also worthwhile to consider whether it should be structured the way it is.

Like knowing that a nuclear power plant has cold water intake and hot water exhaust, and the impact a reduction in water intake causes on the system temperature. Versus should the plant be there at all, or should it be of that design?

Anyhoo, why do they do what they do? Trying to please many masters it seems to me.

I agree that that is what they’re trying to do, but I disagree that a recession is worse than unabated inflation.

At least with a recession, you can campaign on being at the helm to fix it, and describing what you’ll do. Whereas, inflation, as a leader, you just look weak and incompetent.

It’s like taking charge after a boat starts to finally sink as opposed to watching while water slowly leaks in.

You raised good questions. and this point is intriguing but I doubt the Fed was saying one thing, doing another: “Hence the jawboning meant to ease financial conditions. But also maintaining QT and higher interest rates to address their stated policy goals.”

If the Fed now pivots and starts to prepare the market for a hold on rates or an increase, the market will convulse. Consider: these remarks are affecting mortgage commitments – buyers have probably been waiting to lock-in rates for a while longer thinking that rate cuts were in the works. I think we’ll see this delay in home buying this quarter. But… if the Fed starts talking increasing rates, that may jump-start rate lock-ins asap.

Tough predicament. I really, really do not believe that Powell or the Fed governors are interested in padding their own wallets or those of supposed “cronies”. You’ve got to be pretty damn cynical to believe that.

“I really, really do not believe that Powell or the Fed governors are interested in padding their own wallets or those of supposed “cronies”. You’ve got to be pretty damn cynical to believe that.”

id say you have to be pretty naive NOT to believe it..

uninformed as well.

the sheer amount of financial shenanigans transpiring in the upper echelons of society THAT ARE KNOWN AND REPORTED are massive. just imagine what the REAL amount is.

the USA is totally controlled by big money.. even big name recognition like Kennedy doesn’t account for much anymore. power rests with a financial/political oligarchy which masquerades as a democracy..

all that being said, the part of your comment i quoted is laughable. just look up “robert s kaplan trading” for one example of your squeaky clean fed boys being impartial and serving the public..

Or, does the Fed’s research indicate a recession is nigh, thus supporting the need for cuts later this year?

Fed is endless in patience with inflation above their target (almost 3 years now), but stock markets drop 50%, and watch trillions of instantaneous QT and emergency ZIRP. Dual mandate my a$$.

He is trying to control the markets with words rather than actions. Hoping to solve his perceived issues without actually doing anything on record.

As more international oil buyers move back to publicly listed supplies in the short term, it will be interesting to see what happens to the price

I think if they cut inflation rips higher.

They won’t cut, they’ll hold and wait and see. Inflation isn’t likely to fall quickly, but it’d be fairly surprising if rising inflation rips through the economy without cuts.

I am not against higher rates but longer they keep rates higher the small and midsize will fall further behind. We will be left with a monopoly or a duopoly in more sectors if this keeps up.

Nah, we used to have to borrow at double-digit rates on our working capital line of credit (secured by inventories and receivables), back in the 1980s and 1990s, and we did just fine. Higher rates motivated us strongly to minimize our debts, something business have forgotten how to do after 15 years or ZIRP.

You live in opposite land. High rates benefit retirees and savers in the middle class. Low rates benefit private equity and corporate raiders.

I think we need Wolf to attend the next Powell briefing to ask some very clear questions that they can’t wiggle out of.gord

Howdy gord. Quit encouraging things like that. The Lone Wolf would be assassinated. Or read he committed suicide.

You underestimate (probably again) the ability of bureaucrats to justify anything or everything…

Yes, the price of core goods may have stabilized…

…at a much higher price of course.

As I look at the above graphs, it seems to me that the current PPI on the right side of each graph looks a lot like the pre-pandemic PPI on the left. The current 3-month trend line is up, but will it stay that way? I appreciate Wolf’s insight about considering the PPI and hot services inflation combined, which paints a picture showing inflation has not been fully contained. If I were a voting member of the FOMC, I would like to see another 3-6 months of data, before making any decision to reduce short-term rates, or possibly increase rates. I would add that there’s only so much the FOMC can do to control inflation, given the lack of political will in the executive and legislative branches to stop pumping money into our economy. I wouldn’t be overly surprised if the FOMC refrains from adjusting rates until after the November elections.

You are 100% correct. So long as markets stay up (stocks, real estate, etc.) and unemployment stays low, they will hold course, especially as we get into election season.

Show us the cartoon, Wolf. You know the one I mean. He doesn’t deserve a break, or to keep his hair!

And here is Fed Chair Jerome Powell’s reaction when an underling sent him this report, as captured by cartoonist Marco Ricolli for WOLF STREET:

Well at least he has hair to pull.

Howdy Lone Wolf. Love this picture also. But, you knew in 2008 where things were going to lead. So, did a few others and some of US think this is the picture covering over the real one. Where he is sitting and laughing while drinking champagne with dollar bills bulging out of his pockets……

Thsnk you!

Not surprising PPI eventually catches up after wages catching up with the previous inflation. What we are looking forward to is several years of stagflation like the 70s. Maybe after US bond holders suffering the biggest losses the world have ever seen, will US dollar finally be given up as the reserve currency of the world. We will be back to gold standard again.

Plenty of evidence that we already are going back to a gold or commodity-backed monetary system. Treasuries are no longer “tier one” assets, and gold is. Ignore what the central planners are saying and watch what they are doing. Negotiations (war) are ongoing. Interesting times, so it’s good to find as much unbiased analysis of the available data as possible.

Same as it ever was.

“Treasuries are no longer “tier one” assets, and gold is.”

If you’re a foreign central bank or financial institution, you can get a dollar loan from the Fed using treasuries as collateral.

But you can’t use your gold as collateral for such a loan.

Treasuries are still internationally recognized as the cleanest collateral to lend against because the Fed is the safest dollar counterparty.

Wolf, you are one of the best analysts out there when it comes to inflation analysis and the Fed/liquidity/treasury stuff. You have been calling this inflation surge correctly for a long time. When so many other analysts and pundits out there have said it was “transitory”, and/or have been predicting yields to fall & QT to end since way back fall 2022 . Thanks again for what you do. Your articles have been superb. Thanks for being a truth teller.

True. And don’t forget to donate. I consider my meager donations the most valuable tuition I ever spent.

So I think it is very likely that rates will be “higher for longer” and in fact inflation itself might just be…..

Higherer for much longerer.

T-bills to 6.5 please!

Oh don’t worry…..the next old trick they haul out…….CPI calculation needs adjustment……that ought to be introduced quietly on a late Friday night…..magically a 6 percent rate will become 3.5.

After all…..that meatloaf could be made out of bread crumbs and taste just as good. Just use a cup of ketchup.

Powell and the Congress are really good at what they are doing……you just have to understand what they are doing.

The problem is the lies don’t work. People know what their own financial situations look like. We’ve got a doddering old man yammering on about shrinkflation in Snickers bars when housing, autos, insurance and everything else have shot the moon. People aren’t that stupid. They’re angry.

Howdy Depth Charge Millions of folks are fooled very easily too. ZIRP ed by Govern ment and think a 3% Mortgage benefited them.

MADNESS

My greatest fear is that the lies do work and have been working for quite some time.

Lies and misinformation about warning signs can give a false sense of security to people unaware, or ignorant, or in denial but the real problem doesn’t go away and will take its toll. Lies lead to downfall and destruction while holding fast to the truth gives freedom and peace. And the truth is that debasing money and running up debt have always been and will always be, very bad. Which is why the ignorant continue to spread lies and misinformation claiming it is good, or necessary, to prevent a “crisis” when it only increases the chance of a real unavoidable crisis.

Fed should have went another quarter point in November.

B B But Reverse Twist!!!!

Wolf, when the next possible down cycle takes hold. Not a correction but rather lets say a potential long term down cycle. Do you see the possibility for high yield debt deflation taking hold?

There is prices, then the 1st derivative of prices is inflation (+) or deflation (-). The second derivative is the rate of change of inflation (- = “disinflation” and + = reinflation). This second derivative is like looking at one’s feet while climbing the inflation hill (increase) and thoroughly examining the potholes on the way. The public is still facing massive inflation while Powell has us checking whether our shoelaces are untied on that inflation mountain of his.

Personally I am only hoping this fed starts going a quarter point every three months. and quits when claims start jumping. Could be next week for all I care.

BUT……more importantly the QT needs to be left alone until the congress runs an adjusted balanced budget. Adjusted by subtracting the inflationary effect on the debt from the annual deficit. i.e. 4% times 35 trillion equals approximately 1.4 trillion. The real annual deficit is some where around 600 billion. Alternatively it stops when it reaches the number Wolf has described many times as around 5 Trillion.

Reasonable…….loosen up the labor market and put the heat where it belongs……Congress. The swamp creatures need to stop eating us. Get longer term rates up.

BALANCED BUDGET!?!?!?!

bwaahahahahah…

the democrat budget proposal is to spend this country into oblivion.

the republicans are too weak and disunited to put forward an alternative.

the military will continue to get 850-900 BILLION a year.

no social programs or entitlements will be cut or revamped.

hell even powell himself stated that this country was on an ‘unsustainable path’.

so, unicorns and dragons have a better chance of both materializing in our dimension and reconciling themselves together in harmony than your fantastical ‘balanced (federal) budget’.

It looks like the reckless bottomdwellers in D.C. are going to spend us right into our demise, and that’s probably the only thing that stops this rolling dumpster fire.

Sadly this is true. Neither party serious about the deficit, and one party really will destroy our finances within 10 years if given the opportunity.

If long term interest rates were where they belong you might be surprised how quick congress might wake up to what they have done.

They might try to spend even more to offset the slow down.

The amount necessary to offset a 30 year rate of 8 to 9% would be astounding. Politically impossible.

Howdy Nobody Spending by Govern ment is united . Divide, Conquer, blame the other side. Use every issue and tool over you. When it comes to spending, it is US against them. Both so called parties are really just one.

until the congress runs an adjusted balanced budget.

This would never happen.

Really nice interview about the monetary free lunch ending in May, and the concept of a deflationary recession causing radical Fed rate cuts later this year, followed by long yields spiking far higher.

I like the pragmatic chaotic dead cat /live cat ambiguity. Basically economy stalls and there’s confusion about a massive blowoff top in housing and equities, then as we go full nova with hotter cpi/poi and election chaos, QE is way too late and nobody trusts anything except scarce cash.

Ted Oakley – Oxbow Advisors – Interview Series 2024 – James Ferguson – March 11, 2024

Wolf,

What are your thoughts on long term demographics and inflationary impact? The conventional thinking is that aging and decreasing populations are deflationary, but in practice it causes governments to just print more money to (over)compensate (Exhibit A– Japan).

Most economic thought was put together from 1750 onwards, when the human population was growing at a rate of 2+% annually (whereas for most of human history it was around 0.1% annually).

This has skewed all the thinking into what “normal” demographics are, and has caused a lot of businesses to cater to demographic growth as a business strategy (think McDonald’s, where the employees and customers are both growing at 2% puts you in a good baseline position).

This also hits real estate, auto, utilities, etc. where the prime driver of profits is new customers to sell to.

How do you think about this and see it playing out?

Demographics move in decades. We cannot even forecast inflation for three months.

Since you have lived in Japan and know the culture, do you have any insights on this? It seems like economists are so scared of deflation, that they overcorrect and cause inflation.

Is Japan actually seeing any real negative effects from demographics or is this just propaganda in support of money printing?

Let me just clarify: I do not “know Japanese culture.” It remains as inscrutable to me as ever, despite being married to a Japanese woman, having Japanese in-laws that I adore, having some Japanese friends, and having spent some time in Japan.

The question is this: an economy for whom?

The population in Japan is very slowly declining, but the economy is growing slowly, and GDP growth per working person is the highest in the developed world (a number a saw a while ago).

Fertility rate in Japan is similar to those in many Western countries (just below replacement rate). But immigration is very low. You can’t just walk across the border in Japan.

Companies and politicians want constantly growing populations so that they have more customers, voters, and taxpayers.

But for individual and families, that’s not the case. They want their slice of the pie to increase. They’re better off if their slice of the pie is growing. They don’t really care if the overall pie is growing or not. They just want their slice to get larger.

In countries with big population growth (through immigration), the overall pie may be growing, but the slices may get smaller because more people are sharing it. This is the problem in Canada right now after the huge wave of immigration. It’s not a good situation for individuals and families.

So over the nearly 30 years I’ve been going to Japan periodically, I can see that life has gotten better for Japanese, living spaces are larger and nicer, trains are less packed during rush hour, food is delicious, and prices haven’t spiked out the wazoo over those 30 years as they have in the US. Salaries have also not gone up much, so that’s the other side of the coin, but overall it worked out pretty well.

But note the huge indebtedness of the government. That’s the actual price they paid – debt shifted from households to the government. And they’re going to have to deal with that. No free lunches.

Wolf – thank you! (…makes me again consider the viewpoint that the U.S. had to decide on what to do with itself post-WWII, having replaced the previous ‘Great Powers’, that decision essentially to become the largest ‘consumer society’ in world history (with it’s myriad branches). From this viewpoint, then, has the growing wealth-disparity been shifting the demand for consumption-engine fuel from general population spending and gov’t.-maintenance to that of government spending and gen. population-maintenance (a true ‘productivity’ question), seeking an admittedly-shaky equilibrium?).

may we all find a better day.

Bond Vigilante Wannabe, you might be interested in the Great Demographic Reversal by Goodhart and Pradhan. I’m still not completely convinced myself, but if you had taken to heart what they said, the course of inflation over the last 4 years was no surprise.

Read it. But that doesn’t explain for example, the rise in home prices.

Thanks for the recommendation I will add it to my reading list!

Is the climb in PPI inflation numbers an effect of the Ukraine War and the Red Sea conflict on logistic links?

Is this some sort of “cost push” inflation as production is curtailed globally? Is production being curtailed globally to cause this? How could we tell?

Services don’t have anything to do with either, and they’re surging.

Fair enough, so this is liquidity, money supply, and animal spirits.

Seems like something the Fed can fix with more QT, and “higher for longer”.

Yes, that’s the idea.

Could it be that 5 trillions in QE might take a few years to reverse?

As a tradesmen I find all this very confusing. I know that my costs of materials and labor along with insurance costs have surged. I also have very wealthy clients that advise me and interpret these numbers for me. Bottom line we’re screwed. The Fed has boxed themselves in a corner and there is no easy way out.Pain will come to the lower class.

I agree with your thinking. This period is how the universe reminds us that reality cannot be ignored. Hard work, thrift, and solid principles win long term.

Not sure I would describe feudalism as one of “hard work, thrift, and solid principles”, because that is where we are headed first.

Maybe, after power, monetary wealth, and control (which is what this is really all about) is wrestled back from these corrupt political puppets.

People have not gone to Washington to represent and serve their communities,as it should be. people have gone to Washington to increase their wealth, and power 10-fold. The data is very clear on this. Human nature is what it is. So yes, every 40-70 years or so, the laws of physics and Nature have to remind human hubris who is really in control.

People in the past, present, and future are born or can fall innocently under feudalism and the “wisdom literature” talks about how serfs and those in bondage guided by those principles make the best of their situation and can be more free than their masters, who can be captive to their own amorality.

I agree.

“Hard work, thrift and solid principles…” are what made America great! Now that we have replaced those values with easy money, debt and entitlement it’s really difficult to envision a positive future.

I also suspect that our standard of living is due at least in part to the long term strength in the dollar as a reserve currency. It’s also hard to imagine that reserve status continuing as we throw all of our traditional allies under the bus (i.e. NATO). If a certain someone becomes president it might be wise to load up on rubles or North Korean won.

Happy to throw NATO under the bus as it’s primary job is to uphold Western European and American systems under the guise of World peace and democracy for all. I’m rooting for BRICS and the balance it can create. Question is how will the US adapt/respond after 70 years of worldwide economic and military dominance. Currently the leaders are doubling down on the existing strategy which isn’t surprising.

The BRICS bs here in the comments has been going on for a decade, and in reality, the BRICS thing has gone nowhere.

Chris,

Obviously there are exceptions but typically those that succeed to realize the “American Dream” also benefit from the environment they grew up in, the color of their skin, generational wealth, among other factors. That isn’t to say, look at this person who made it, but that clearly is the statistical exception. Plus our society needs class hierarchy under it’s current construction although it would at least be nice to see a resurgence of unionization as long as everyone sees the common cause, rather than simply getting a slightly bigger slice of pie.

Chris,

The “Universe” has no “idea” in hell, nor does it “care”, for your little list of (likely religious morals)….OR YOUR belief in their “reality.

Grow up…….and speaking to the millions just like you…..make it FAST, PLEASE!

PS; Is “this period” the “Rapture”, or something similar?

Has anyone considered that this might just be the new normal? Say one cut, maybe two, then some inflation after the elections. Up 50 basis points, and the deficit gets smacked by higher taxes, and social security is also fixed by tax increases.

Economic boredom. Markets do the usual overreacting, but ultimately meh. Ready for a new normal? Asset deflation will happen from a slow leak as reality reveals no buyers at nosebleed values.

In short, a return to roughly the year 1999.

Gas prices of $4? So what.

Our recession will be small, now Europe and Asia might have a bigger problem. The Ukraine war distorted international trade is much weaker than before 2022.

But boredom sucks for trading. It’s great for investing.

I went by my “Gas station from Hell” yesterday. Still posting $4.79 for regular. No change for the past year even though crude is over $80/barrel.

Strange. I’m paying $3.49 per gallon for premium at a Costco in NC. Of course the state average for regular in CA is $4.888 (CA has far and away the highest prices).

AAA National Gas prices has today’s national average for regular at $3.438 (3/15/24). That is up about 1% in the last week.

There have been some big gasoline draws lately. I would expect firmer prices through the spring

Big box chains subsidize gas prices with folks who go inside and buy groceries. Do you have any idea how huge the markups and profits on food are?

Gas around here in the greater Houston, TX area is just under $3.00/gal for 87 octane. Soon it will be over $3.00.

Just as I predicted years ago. Fed Funds rate increases did slow the economy, and brought down inflation, but inflation is still quite high. Stagflation. Asset prices will continue to grind higher, unless the Fed does a 1970s and jacks Fed Funds to the moon. That will never happen this year because of the Nov election. I don’t know if the Fed has courage to push Fed Funds too much higher. 3% is the new 2%. Could be 3.3% is the new 2%.

“Asset prices will continue to grind higher,”

Not sure what they “will” do, but here is what they DID, and so your “continue” is BS.

1. Commercial real estate asset prices have plunged, some have collapsed.

2. CRE debt prices have collapsed. The investors holding them are bond funds, life insurers, pension funds, REITs, private equity firms, etc. that are holding CMBS and CLOs, the mezzanine debt, and the mortgages. Banks, including foreign banks, are also taking big losses on those assets as they plunged in value – and so are their stockholders, LOL.

3. Home Prices have edged down from their All Time High in June 2022 (NAR), having failed to set a new all-time high in 2023 for the first time since the Housing Bust.

4. The Nasdaq Composite is down 1.5% from its all-time high in Nov 2021. It has “ground nowhere” in 28 months, while people with T-bills made over 10% over the same period without all the drama.

5. The S&P 500 is up by 6.7% from its prior ATH Jan 3, 2022. So it has risen 6.7% in 26 months, while people with T-bills made 10%, without all the drama. If you include dividends, they’re about even. If you include state income tax benefits of T-bills, T-bills are ahead.

You see, it’s only in your imagination that asset prices only go up.

I have been buying essentials like toilet paper in bulk and filling the garage and a storage container. Figuring it won’t be long before I can charge my neighbors crazy prices for essentials.

They’ll just buy a bidet, LOL.

Bidet is really probably the better way anyway. There was a joke going around in 2020 how peasants were hoarding toilet paper while the rich hoarded money. Only thing I ever hoarded was US Made vacuum tubes, old Levi’s (the ones still made in SF) and more recently halogen bulbs, because LED lighting sucks and blanches colors in oil paintings and fabric.

…the ‘/s’-switch, Glen, the ‘/s’-switch!…

may we all find a better day.

MW: Nearly everyone on Wall Street is abandoning their recession call, which is ‘dangerously reminiscent’ of 2007

MW: Dow sees losses accelerate as Nasdaq heads for first back-to-back weekly decline in 5 months

DM: The death knell for broker fees! Homeowners to see BIG drop in selling costs after Realtors agree to eliminate notorious commission scheme pay $418 million in damages in landmark legal settlement

Americans will likely see drastic drop in the cost of selling their houses after a landmark deal was reach on Friday which will end notoriously high commission.

SoCalBeachDude

Good. They should pay us their commissions. Most of them including every one I have ever used have turned out to be brain dead morons not worth a penny in commissions.

“The Pandemic Housing Boom increased the price of starter homes a whopping 45%.” Unless you include asset prices, you mis-judge inflation.

When home prices plunged in 2006-2012, CPI would have been in steep deflation for those years. But there was consumer price inflation as consumer goods got more expensive.

You have to separate consumer goods that are “consumed” and become worthless, and assets (homes, stocks, bonds, etc.) that are not consumed.

There is asset price inflation, and it went rampant through 2021, but it has since then fizzled. We measure asset price inflation separately. For example, my “Most Splendid Housing Bubbles” series tracks home price inflation, and I make a big deal out of it here. Stock indices track stock price inflation, etc.

Wolf,

Thank you for a very thoughtful and well written response on the immigration issue vis a vis US and Japanese policy.

It seems that the economic interests of 2 different groups in the US have diverged about as radically as in living memory– one group wants lots of immigration to secure cheap labor plus a market for their products and services, and the other group wants to prevent it to keep living standards high for themselves even if it means lower and slower overall economic growth.

There are pros and cons to each, but it appears that the benefits of immigration almost completely inure to the first group, but the costs to the second group.

A lot of the costs are borne by local governments and result in higher property taxes and special hospital and school assessments.

In most Western countries there are a lot of hidden costs in terms of language training, job placement training, housing, medical services, etc. for the immigration– but the local population doesn’t really see the rewards because the large corporations get the benefits of lower labor costs.

Having come from Latin America with its checkered history of democracy, I am perhaps overly convinced that US democracy will unravel under the weight of these changes.

What do you think?

Practically the only disinflation i’m seeing is on the prices of TV sets.

Whatabout laptops?

Yes, but it’s much easier to ignore the decline in lifestyle while watching sci-fi on my cheap 70” screen.

I can just eat the generic snack food and accelerate the process of getting cancer and my problems go away.

My slice of the pie is probably more than I deserve. There IS a demographic shift in process. Boomers leaving the workforce, and leaving inheritances. Our helpers from the south are loving the American payscale/ hablando Español esta bueno para los jeffes.

One who can manage people and fix things will remain in demand, as the unproductive class is prone to tantrums when the internet goes down and they’re unable to “influence.”

If the system falls apart: I am stuck in a remote refuge, with clean air and water.

1) More immigrant workers, especially educated to stabilize the job market

2) Less barriers to entry “service” sectors like healthcare, IT, etc.

3) looser zoning requirements to build cheaper housing

4) 0% federal loans to builders for building affordable (smaller with less amenities) houses/multifamily, aka 600sq feet 3bd 1bth

Have you been to Home Depot lately? Prices have me feeling more like I’m shopping at Tiffany’s with everything now being locked up behind cages.

One roll of blue painters tape, $7.49. ONE ROLL!

I’m one “coal mine canary” that is starting to feel a bit dizzy, let me go lay down for a bit.

Just bought some wasp spray at Lowe’s. Used to get a 2-pack for under $7, now it’s close to $5 for one.

Maybe there is one thing most people could agree on here. Congress should put restrictions on the ability of the Fed to use QE in the future.

As Wolf says, the Fed never should have done QE in the first place, and the Fed should only provide short-term market-rate loans to viable reasonably managed businesses via its emergency loan facilities. Also, the Fed should not be able to buy long-term assets such as MBS, BBB commercial bonds/ETFs, or anything other than short-term treasury bills. Purchases of LT assets creates significant unacceptable distortions, like we are seeing in the housing market now.

If such a policy were communicated tomorrow, I have a feeling the stock market would drop about 30% this year, inflation would cease, and RE would revert to a reasonable mean. Anybody looking for a safe return could find it in treasuries yielding 5% or more. The majority of people would be lot happier than they are today. Renters would get some badly needed relief, simply by reversing some of the windfall gains others have undeservedly realized.

I, for one, would settle for a 30% drop in my nest egg (which was artificially propped up by pandemic gains) in exchange for stable economic growth, stable inflation, and stable asset price growth for the long term. Today’s level of societal instability, if continued, is going to manifest itself in severe unknown problems at some point.