In 2024, some banks will fail. In 2023, five banks failed. In 1989, over 500 banks failed. Since 1936, there were only 5 years without bank failures.

By Wolf Richter for WOLF STREET.

The rate-cut-mania-inspired plunge in longer-term yields at the end of Q4, now partially reverse, had a salubrious effect on the balance sheets of commercial banks, according to the FDIC’s quarterly bank data released on Thursday.

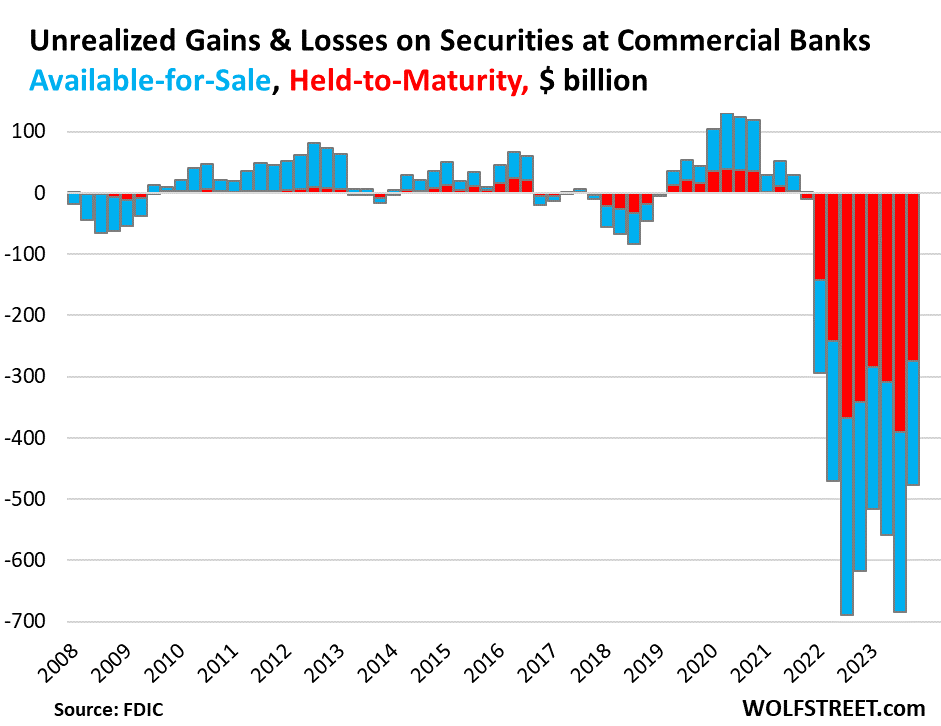

In Q4 2023, “unrealized losses” on securities fell by $206 billion (or by 30%) from the prior quarter, to a cumulative loss of $478 billion, or 8.8% of the $5.43 trillion in securities held by those banks. The securities are mostly Treasury securities and government-guaranteed MBS.

These unrealized losses were spread over the two accounting methods:

- HTM: Unrealized losses on the $2.50 trillion in held-to-maturity (HTM) securities fell by $116 billion from the prior quarter, to a cumulative loss of $274 billion (red in the chart below in total).

- AFS: Unrealized losses on the $2.93 trillion in available-for-sale (AFS) securities fell by $90 billion from the prior quarter to $204 billion (blue).

These paper losses started piling up in 2022 when the Fed began tightening its monetary policy, which pushed up bond yields. Long-term securities are particularly impacted by rising yields. Rising yields means prices fall.

So as yields rose in 2022, the market prices of those securities fell, and record-breaking unrealized losses piled up, given the massive amounts of longer-term securities that banks had put on their balance sheet during the near-0% pandemic era.

At that time, the Fed printed trillions of dollars, part of which ended up as deposits in the banking system, and the banks, unhappy with T-bill yields of near 0%, plowed this cash into longer-term securities to get a yield that was more than 0%.

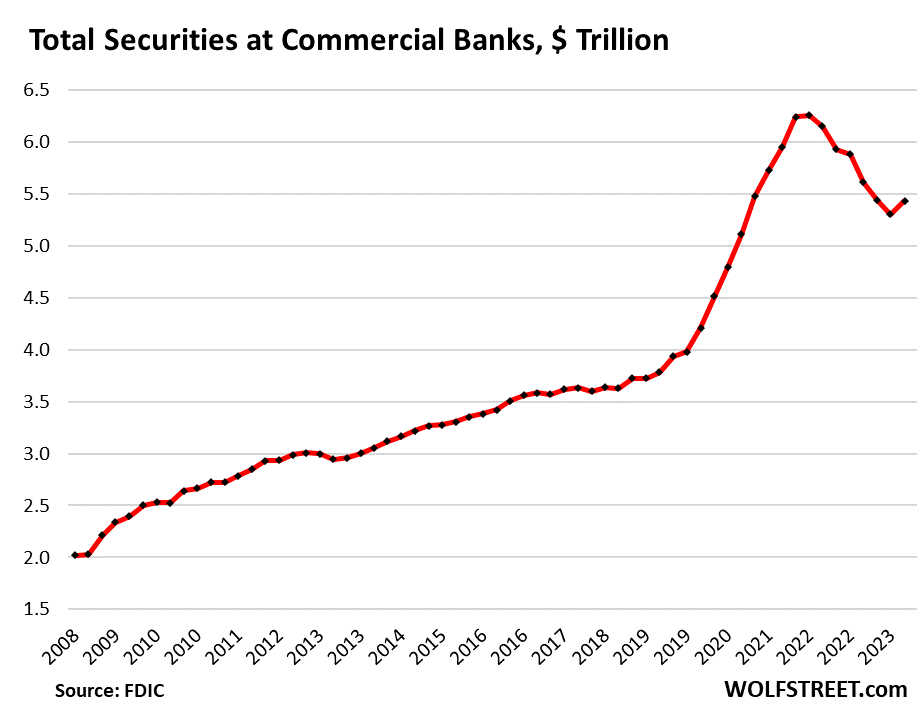

Total securities on bank balance sheets.

During the pandemic money-printing era, total securities held by banks soared by $2.5 trillion, or by 57%, to $6.2 trillion at the peak in Q1 2022.

By the end of 2023, the amount had dropped to $5.43 trillion, including the uptick in Q4. And the longer-term securities in this pile have lost a lot of market value. Several factors make up the decline, including:

- The portion of securities of the collapsed banks that the FDIC sold to non-banks are no longer part of it.

- Banks have written down AFS securities to market value.

- Some securities matured

- Banks may have sold some securities.

The $5.43 trillion in securities includes securities valued at market price and securities valued at purchase price.

Banks don’t have to mark these securities to market value, but can carry them at purchase price. The difference between market value and purchase price is the “unrealized gain or loss” that the bank must disclose in its quarterly financial filings.

In theory, “unrealized losses” on securities held by banks don’t matter because at maturity, whenever that may be, banks will be paid face value, and the unrealized loss diminishes as the security nears its maturity date, and goes to zero on the maturity date.

But these disclosures of unrealized losses made uninsured depositors aware of what is going on, and they started yanking their money out of Silicon Valley Bank, Signature Bank, and First Republic – on the two fundamental principles of investing:

- He who panics first, panics best.

- After me the deluge.

But the banks couldn’t raise the cash needed to fund this outflow by selling those securities because their unrealized losses would have become realized losses, and the banks couldn’t get enough cash for them, and were insolvent.

Loans and securities with a remaining maturity of:

- 15+ years: 14.5% of total assets, roughly stable in 2023.

- 5-15 years: 14.2% of total assets, lowest since Q3 2020.

- 3-5 years: 8.4% of total assets, lowest since Q3 2022.

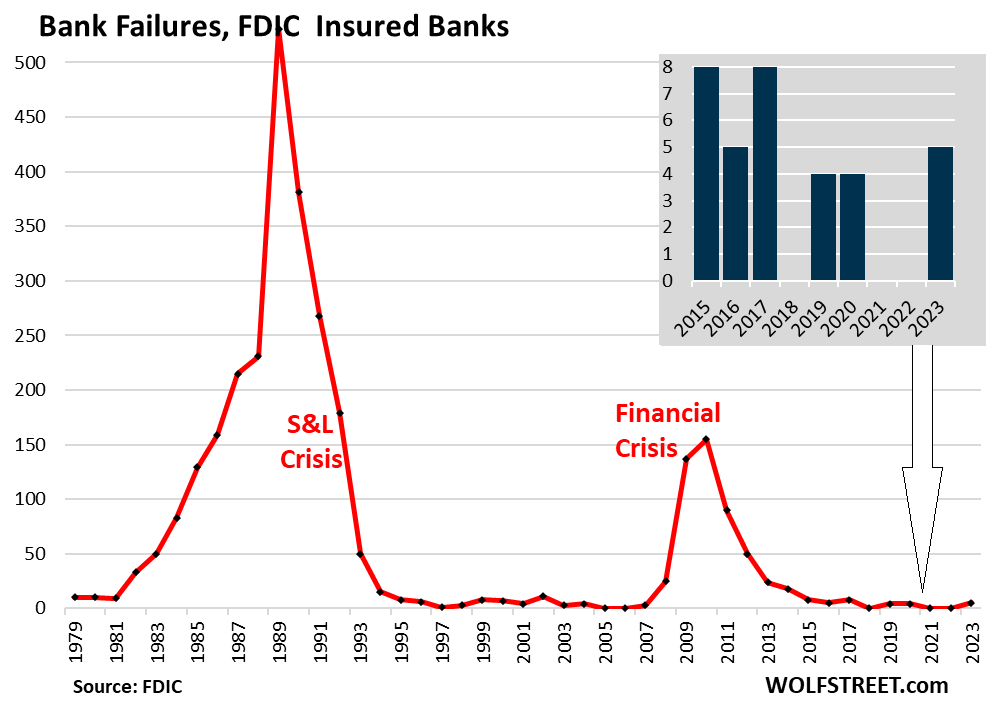

Bank failures.

In the FDIC’s data going back to 1936, there were only five years without failures of FDIC-insured banks. During the two free-money years of the pandemic – 2021 and 2022 – no bank failed. In 2018, no bank failed. In 2006 and 2005, no bank failed. And that was it.

In each of the remaining 88 years, some banks failed. In 1989, at the peak of the S&L Crisis and following the oil bust, 531 banks failed – and people actually went to jail over it. In 2010, during the Financial Crisis, 155 banks failed. But by then, the banks were far larger than in 1989. And in an insidious turn of events, no one went to jail; instead, bankers at the banks that got bailed out made record bonuses.

In 2023, six banks collapsed: Silicon Valley Bank, Signature Bank, First Republic, plus two very small banks in Iowa and in Kansas were taken over by the FDIC. And Silvergate Bank, with regulators breathing down its neck, agreed to self-liquidate, but since it had enough assets to cover its deposits without FDIC involvement, the FDIC doesn’t count it as a “failed bank.” So officially, there were five “failed banks” and one self-liquidation.

In 2024, some banks will fail. We pretty much know that; we just don’t know how many. If eight banks fail, that would be on par with 2015 and 2017.

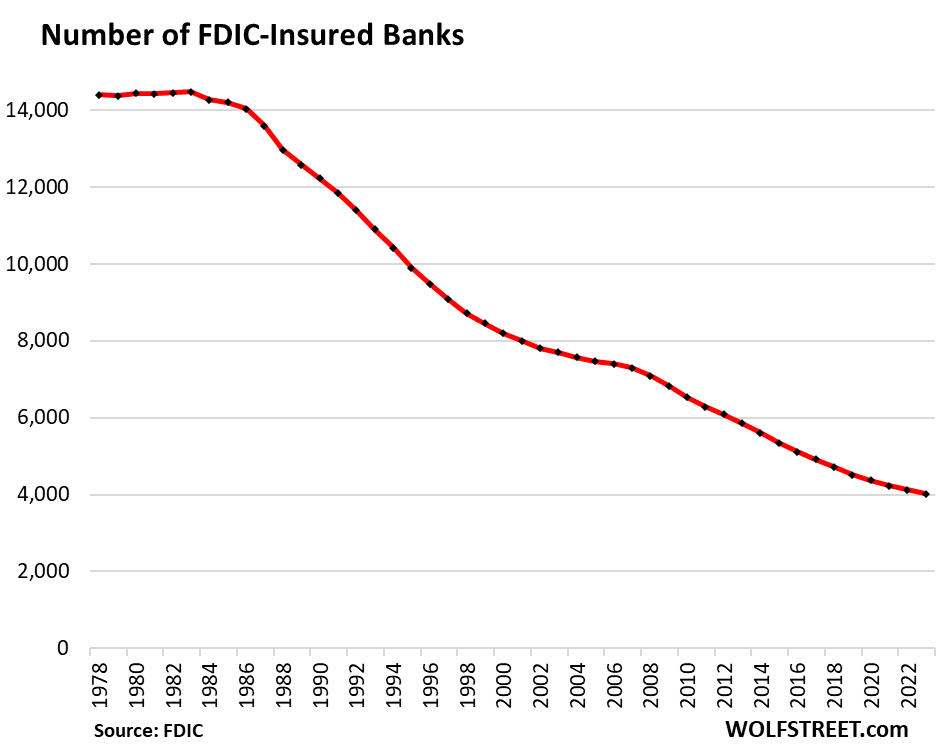

Commercial banks continue to vanish. In 2023, mergers took out 100 banks; bank failures and a self-liquidation took out 6 banks; but 6 new banks were started. At the end of 2023, the bank count was down to 4,026 commercial banks, from over 14,000 in the 1980s. As in 2023, the vast majority of banks disappeared because they got bought out by other banks, not because of bank failures.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The commercial real estate problem should take down a bank or two.

Or maybe Mnuchin and pals.will save em all.

CRE will play out over the next 3 years, from what I’ve read. One has to wonder if it’s another false flag being used by the hysteria crowd to push for rate cuts sooner than later. As the number of banks has dropped by 10K since the early 80’s, obviously the remaining banks have gotten bigger. However, the Fed will figure out a way to backstop this issue as it grows. At this point, I don’t see it becoming anything near the SNL crisis. If it contributes to a recession, this will probably happen in 2025.

A majority of CRE debt is held by investors, not banks, as we have seen over the past two years. And among the banks that hold CRE debt are lots of foreign banks, as we have seen.

So in terms of US banks, it’s just not such a big deal. For US banks, it means hits to incomes, they will just lose some money, and stock prices plunge, but the bank will wobble on just fine. The amounts are just not that big. Retail CRE has been shitty for many years, it has been and still is the worst category of any CRE, and it’s a big category, and it has not taken down a single bank – though investors took huge losses and some imploded. So the number of US bank failures due to CRE debt will be small, and it will not be any big banks because they’re so diversified and have such huge incomes that they’ll just add to their loan loss reserves and move on. The Fed knows that too.

Wolf, a question. If foreign banks take a big hit in CRE, is there any counterparty risk to US banks or another source of contagion that come back to bite?

US shareholders of Deutche Bank gripe that their shares tanked?

Wolf – would be interesting given the coverage of bank failures and unrealized losses held by banks to do a piece on how European banks are faring and/or differences with the US banks/system if that’s something you follow?

Promotions: In the 1980’s, if you bought a new toaster, you could get a free bank.

My grandparents already had one from WW2 celebration week. Back off you banker!

Lol

Best comment all day.

To heck with toasters and banks! Thanks to the Fed, anyone can “make yourself a bank” – with no real bank needed!

Everyone who refi’d into a sub-3% mortgage (and didn’t squander the funds they saved) can now earn 4-6% on all kinds of bonds or CDs.

What you are describing is the inverse of a bank, borrowing long to lend short. Business model of banks is typically the other way around.

@Wisdome Seeker: mortgage interest compounds monthly, CDs quote annual rates. Your plan is not the arbitrage that you think it is.

Less banks over time.

Banks increasingly protected by society, privatise profit, socialise debt, over time.

Regulatory hurdles to opening a bank larger and harder to meet over time.

End result one pseudo-private bank back-stopped entirely by society?

Is this what the FRB wants to become, using their own digital currency?

Fewer.

Doesn’t matter. Doesn’t improve the meaning in any way at all.

All it does is sound nicer to your conditioned mind; more in line with an arbitrary education level; changes too little to be worth correcting.

“End result one pseudo-private bank back-stopped entirely by society?”

1) Otherwise known as the US government….People would be surprised at the pretty high percentage of assets that banks hold in vehicles (cash, Treasuries, Agencies, etc.) that amount to little more than G securities.

The pitch is that this lends stability to the banks (and sure it does…the G can always print money/create inflation to paper over various f-ups) but *then why shouldn’t savers simply hold G promises/securities *directly* without the cut-out of the “banking system”?

At what percent of bank assets (30%, 40%, 50%…) do government securities holdings render the “private banking system” largely a front operation for G macroeconomic controls?

2) The incredible collapse in the number of banks since 1990 is not only a function of crap bank mgt (see pre 1990) but also a reflection of economic reality-denying G macro policies (see post 2000).

If the G destroys positive returns via 2 decades of money print ZIRP, how exactly would lenders *not* get whipsawed into extinction when reality reflecting interest rates are allowed to – finally – return? (20 years of 3% Treasuries get hugely slammed in mkt price terms when reality is allowed to raise rates to 7%).

Prohibiting downward “mark-to-market” (how often is *that* allowed for other industries?) is just a way to obscure what is really going on…and let the G avoid having to close even more banks due to impaired capital in reality.

But “the underwater G securities are money-good at maturity” – sure, except that inflation would have significantly eroded the actual value of those maturity pay offs. That’s the ugly truth that goes unspoken.

What’s “protected” is NOT the banks, but the depositors. The five banks that failed in 2023 were shut down and stockholders and bond holders lost their shirts, and their executives were fired. But depositors were made whole.

Insured depositors would have been made whole anyway. But uninsured depositors were bailed out too instead of getting a 10% or 15% haircut on their deposits, which would have been the case without bailout.

The penalty for mismanaging the bank was death of the bank and of investors in 2023, and there was no cost for the tax payers. The Fed which lent money to the FDIC got all its money back from the FDIC, and the FDIC is recuperating its losses by extra charges on the remaining bigger banks.

That was the difference between 2023 and 2008. In 2008, the biggest banks and their investors were bailed out and their executives got even richer, with huge involvement by the Fed. Only investors in the hundreds of smaller banks (including some fairly big ones for that time) that were actually allowed to fail got wiped out.

In 2023, only the uninsured depositors were bailed out.

Wolf, in your opinion, was bailing out uninsured depositors the right move?

No, and it was totally unnecessary. They should have allowed the system to work. Uninsured depositors would have gotten about a 15% haircut after the asset sales, and that’s it.

But bailing out uninsured depositors was far far better than what they did in 2008, which was bailing out investors and enriching the guilty bankers. In 2023, both of them got crushed.

Wolf: Respectfully, you did not mention that the FDIC, when a bank fails, always brings legal actions against decision making loan committees, board members and executives. Thus, it is not only investors getting wiped out, but it includes a large number of senior management & Board members who reduce the loss to the FDIC upon bank failure. The FDIC does not like to lose lawsuits so it will financially bludgeon the defendants into submission.

As to virtually unregulated derivatives (interconnected unsecured bets), these are the weapons of mass financial destruction and will ultimately result in world wide financial chaos when the dominoes fall. The undercapitalized giant banks all use derivatives and God help the financial system when this happens.

In terms of your 2nd paragraph: SVB failed because it did NOT use enough derivatives to hedge its interest rate exposure (it would still be alive if it had sold enough interest rate swaps). Anyone trading in stock options, trades in derivatives. The “notional value” of derivatives is meaningless. A $1,000 call option may have a notional value of $200,000 but the maximum loss is $1,000. This fearmongering about derivatives is all based on this “notional value” figure.

Their executives still kept the jobs as the “failed “ banks were acquired by other banks.

BS. in 2023, the failed banks were taken over by the FDIC and liquidated by selling the ASSETS (such as securities, loans, properties, etc.) to investors and other banks, the executives were fired, and SVB’s CEO also was forced out as a director of the FRB of San Francisco.

From what you’ve said it’s definitely a better outcome than 07.

But it’s still a case of society bailing out (FDIC payments ultimately originate in society) 10-15% of the money in those banks.

Moral hazard has been further encouraged right at a time when the FRB appears to be fighting that exact phenomenon.

I feel sticking to the established rules sets clear expectations.

By arbitrarily acting or not acting gives scope for misinterpretation, which is exactly the wrong thing to have when you’re worrying about systemic risks isn’t it?

Circa April 2023, at least 33% of all bank assets where held in Federal securities of one form or another (cash, Treasuries, Agencies, etc.).

Total assets at commercial banks: $23.6 trillion

Securities: $5.4 trillion = 23% of total assets (but not all of them are Treasuries and federally backed securities; some are non-agency MBS, municipal bonds, and other securities).

Banks also have $3.4 trillion in “cash” on deposit at the Fed (“reserves” as the Fed calls this). So if you add this into the total = $8.8 trillion = 37%.

Unfortunately as in 2007 any bank failure will be covered by the taxpayer through printing as confidence can’t be allowed to collapse.

Interestingly, the US though does have an enormous number of banks. 4844 are in the Federal Deposit Insurance scheme. The UK only has 350 (roughly the same for France although Germany is at 4614).

Per person the US has over twice as many banks as the UK. You can’t open a new bank in the UK its effectively prohibited by regulatory barriers. Same as pubs/bars, if you wanted to open one the authorities would say there are already three in that area… The original thinking must have been that with a large number of US banks there is going to healthy competition to make loans (and grow the economy) and also that individually they are small enough to fail.

The reality seems to be that its like the Fed holding off a crowd with a handgun. They can shoot the first mover because you can’t speculate against a failing financial institution which is really what these bailouts are aka price manipulation again. Everything instead gets dropped on dollar value.

“Unfortunately as in 2007 any bank failure will be covered by the taxpayer through printing as confidence can’t be allowed to collapse.”

No, that’s nonsense. See my comment above. Well, OK here it is again:

The five banks that failed in 2023 were shut down and stockholders and bond holders lost their shirts, and their executives were fired. But depositors were made whole.

Insured depositors would have been made whole anyway. But uninsured depositors were bailed out too instead of getting a 10% or 15% haircut on their deposits, which would have been the case without bailout.

The penalty for mismanaging the bank was death of the bank and of investors in 2023, and there was no cost for the tax payers. The Fed which lent money to the FDIC got all its money back from the FDIC, and the FDIC is recuperating its losses by extra charges on the remaining bigger banks.

That was the difference between 2023 and 2008. In 2008, the biggest banks and their investors were bailed out and their executives got even richer, with huge involvement by the Fed. Only investors in the hundreds of smaller banks (including some fairly big ones for that time) that were actually allowed to fail got wiped out.

In 2023, only the uninsured depositors were bailed out.

The key sentence is..uninsured rich depositors were bailed out using tax payers money.

Those depositors were bailed out, but not with taxpayer money. The taxpayer didn’t pay a dime: sales of the assets of the collapsed banks paid for something like 85% of it, and the other 15% that the FDIC paid is now being charged back to the bigger banks via the special FDIC “assessments.”

“Uninsured depositors” …is that people with deposits over $250K?

Where do people with millions of cash dollars keep their assets if only the first $250K is protected?

Yes, that’s a risk. Big companies have many millions or even billions in the bank to meet regular payment needs, such as payroll. That cash is at risk.

“Where do people with millions of cash dollars keep their assets if only the first $250K is protected?”

Treasury bills?

Gabriel said “Where do people with millions of cash dollars keep their assets if only the first $250K is protected?”

It is $250k per account so spread your money over multiple accounts to obtain protection.

Don’t the higher FDIC needed from the other banks just get passed on to customers, I.e. taxpayers?

Well, by that logic, the higher milk prices get passed on to the taxpayer since nearly every adult is a taxpayer.

The real answer is: it gets passed on to the consumer. All this stuff ultimately gets passed on to the consumer. When wages increase, it gets passed on to the consumer eventually. Etc.

I guess Canada is even more concentrated than the US or UK. We have six big banks, and really only five of them matter.

As I recall, the bank failures in the late 1980’s were due to bad loans, which was the same reason that many banks failed or were given capital in 2008. In contrast, the recent high profile failures of SVB and FRC were not at all related to bad loans but were caused by investing in log term fixed rare AAA investments that have almost zero chance of default. As a result, these MTM interest rate losses due not signal credit risk but portend lower earnings because the rates/yields are very low relative to yields today. The bright spot in this situation is that the yields on all other shorter term and variable rate loans and investments are significantly higher than then which should boost the earnings of all the remaining banks with the underwater investments from 2021. Also, the CRE losses are mainly in the large city office sector and most of the 3500 small banks do not have much at risk. In summary, based on what we know today, only a few small banks are likely to fail as long as they are not hit with deposit runs by fearful depositors such as was occurring to NYCB prior to the capital injection by Mnuchin’s group. NYCB should avoid failure at this point. Mnuchin said he examined the loan books and does not expect loan losses they cannot handle. (I started in banking in 1972 and have seen it all first hand since then and own stock in several banks including NYCB).

While it’s true that banks that hold to maturity will receive the full value at maturity, the losses will come from the reduced purchasing value of the money they receive at maturity due to the inflation between now and then. The low interest rate these securities provide does little to offset that inflation. Over time I expect this loss of value will have a large effect on these banks, as these dollar amounts will be quite significant.

My question is why did the banks buy treasuries etc when interest rates were at 100 year lows. Anyone with half a brain stem knew not to buy a long term bond that was paying 1.5% and yet they tripped over themselves to buy these. Did they all have lunch at the same country club and after 3 martini lunch blew the banks capital that took 100 years to build up? So reckless and stupid.

I’m not defending banks but I do think this criticism over simplifies the situation. Regulators have rigid rules around what securities banks are allowed to own. When the rates on all of those go to zero, lending slows and the economy is awash in stimulus, banks take a ton of deposits in and it’s difficult for them to invest money at a positive spread without increasing duration risk, and it’s also difficult to hedge.

I’m not sure I agree. They could have refused to buy long dated treasuries at those prices and only bought treasuries bills. The Fed then would have been forced to fix the problem it created.

But no, the banks were confident rates would be low forever or that rates would go negative and they’d be able to sell at a capital gain.

It was a combination of stupidity and greed.

@Einhal: When the “professional management” of any corporation including banks thinks they can make great short-term profits and reward themselves with fat bonuses, they will certainly do so. They don’t have any skin in the game for what happens beyond a couple of years.

Make hay while the sun shines. Once you make off with a few million dollars, who cares what happens to the bank or corporation. I am totally against this but unfortunately that is how the system is set up and there seems to be no changes in the offing.

Ironic that Treasuries turned out to be high risk assets…

Everyone who invests in bonds has known of this risk from the first day that bonds were invented. It’s called “interest rate risk.” This is the risk that bonds lose market value when interest rates rise, but that loss diminishes as the bond gets closer to maturity, and at maturity, there is no loss.

For buy-at-auction and hold-to-maturity Treasury investors, there really is no risk, and people can sleep well, knowing that they’ll get their money back at maturity, and that they’ll collect coupon interest along the way. Maybe they got a bad deal because the interest income doesn’t cover inflation over this period; or maybe they got a good deal because their interest income is far above inflation.

SeanShasta and Einhal-

Good points: bankers make dumb decisions, and personal short-term gain (to management) is often involved. Both points lead to a question of asymmetric motivations at both the management and shareholder levels.

Bank governance that reduces consequences for banking fraud or ineptness encourages bank malfeasance. Responsibility for malfeasance (whether illegal, unethical or simply ignorant) ultimately rests at the shareholder level. If shareholders were penalized BEYOND his/her original investment amount, they would be more vigilant in how they motivate management

Maybe it’s time to resurrect “Double Shareholder Liability:”

“From 1817 onwards, shareholders in most U.S. banks had so-called “double liability.” Double liability stipulates that, in case of bank failure, the banking supervisor levies a penalty on shareholders (up to the par or paid-in value of their shares) that is used to satisfy the bank’s depositors and other creditors.”

— Felipe Aldunate, Harvard Law School Forum on Corporate Governance, July, 6, 2021

Just throwing out the idea…

@John H: That addresses the penalty for shareholders who don’t even figure in these types of decisions. However, management who make these decisions and get unduly rewarded get away scot-free. They have all the upside, but no downside or accountability.

Again, there is no way to assign accountability to management who are rewarded hugely for short-term decisions. That is why a lot of companies have this short-term orientation and indulge in multi-million dollar bonuses based on short-term performance, share buybacks to prop up stock prices, etc.

I agree. Unlike stocks, bonds should have less volatility.

The dramatic Fed interest rate increase, along with the dramatic increase rate decrease during the pandemic caused the high volatility.

Nothing is market driven.

There are now dramatic winners and losers in the bond market. Everyone who borrowed long term or refi’d a house during the pandemic are winners for the moment.

If you loaned out long term or purchased long term bonds at low pandemic rates, you are a loser for the moment.

Since this is completely under the Fed control, the Fed could raise rates even more making the winners above even happier. Or the Fed could dramatically lower rates flipping the winners to losers above.

It is more of a gamble buying bonds than it used to be now with the inflation busting Fed.(except maybe in the 70’s and 80’s).

Everyone gets what they signed up for if they hold to maturity, so unlike volatile stocks, you know what you are getting into so whining about losing money in bonds doesn’t get much of my sympathy.

@ Sean and others, re: bankers having short term focus and no long term skin in the game.

You must not have ever worked for a bank or financial services firm. Most all of them have deferred compensation plans, where a chunk — often up to half — of their annual comp is held in some split between company stock and cash, for 3+ years. If the firm blows up they lose a minimum of a full year worth of comp, if not 1.5 years worth or more. This applies to the top brass all the way down to the mid levels.

These firms ALL have major incentives to maximize long term share price, not short term. If anything, they want low short term prices so the shares they have to buy every year are at a low basis.

But I get it, that doesn’t fit the popular narrative of evil, stupid bankers. I mean banksters. :-/

I think you’re oversimplifying it. A 2 year bond is still too long when it comes to liquidity for managing deposits. Loans are worse. When rates got to zero, the spread is so tight it’s even more unprofitable to hedge. 0 is hard to hedge, especially for smaller banks. The Fed is perfectly capable of creating a situation where banks can fail easily through rate policies alone.

@ Gattopardo: When the upside for management is high (multi-million dollar pay packages and bonuses) and the chances of the bank blowing up are so low – that is, it may happen once maybe in 20 years or so, management is likely to take more risks.

I am not talking about rank and file here. Since they do not figure in the decision-making, they are not relevant to the discussion though they may benefit or get hurt in the process.

No one can deny that our corporations including banks have a short-term quarter-to-quarter orientation to meet or beat Wall Street expectations and to pad their own compensations by whatever means possible including very opportune stock buybacks.

Seems like they could have moved out and minimized losses once the writing was on the wall. Although everyone thought this was all transitory and like like someone who had a ton of fiber and coffee believed “this too shall pass”.

Where else would banks invest their depositors covid cash?

No bank wanted to give out a 3% mortgage for 30 years. They would have needed at least 4.5% but the GSEs were loaning out money at 2.5%

to 3% so the GSEs took 98% of all home loans.

Most small banks and regional banks cannot buy stocks so that is a no go. They certainly did not want to loan anymore money to CRE after COVID.

I might not have my dates exactly correct but I am guessing banks tried to put the money in a safe place but the FED fooled them and raised rates much sooner than the banks and everyone was told. Powell in June, 2021 said they will not raise rates anytime soon. I guess in the FED mind soon is less than 9 months?

Then in August 2021 Powell said, rate hikes aren’t imminent as there is still “much ground to cover” before the economy hits full employment.

March 16, 2022: The Fed makes its first interest rate increase since 2018, raising rates by 0.25% to a level of 0.25–0.50%

ru82, I’m not an expert, but my understanding from Wolf’s articles is that they could have put depositors COVID cash into the reverse repos, or at the Fed as “reserves.” Alternatively, they could have bought short term treasuries. They weren’t forced to buy 30 year instruments at crap yields.

The cash arrived when rates were low. That’s the issue. Interest margins have to exceed fixed expenses or you lose money and go bankrupt. Large banks have enough other business to not rely on that margin as much, very low rates are a tough environment for a true bank, especially the smaller ones and regionals. I did a lot of work finance work in a professional services capacity for smaller banks earlier in my career. It’s not as profitable or exciting as it sounds — banking. They operate on fairly thin margins.

For some context, pre-FDIC, an estimated 4000 banks failed in 1933.

And when a bank failed pre-FDIC, customers’ deposits just vanished. So the mere fear of a bank failure would cause a bank run that would then guarantee that the bank collapsed.

That was one of the things that made the Great Depression so “Great” – many thrifty savers who would have made it through the bad times were instead rendered destitute when their bank failed and the cash they had so carefully squirreled away vanished into the ether.

Even as it is, people are irrationally afraid of bank failures, even if their deposits are fully insured.

The FDIC I think needs to do a better job educating the public just as to how it works. I’ve had multiple banks fail that I had deposits in. In those cases, I got an email that the bank was transitioning to a new owner, and by Monday morning, that I could log in to the new bank and see my accounts as though nothing happened.

If people realized just how seamless and zero risk it is, they might be less likely to cause the bank runs in the first place.

Yes I had the same experience during the S&L debacle in 1987. It was painless but I subsequently moved out of the S&L to a credit union. Been at the credit union over 37 years.

The GD was a fiasco. In 1933 the Federal Reserve Note had to be collateralized by at least 40 percent in gold bullion or coin, and the remaining collateral had to consist of eligible commercial paper, principally Trade and Banker’s Acceptances. The problem was the banks had practically no eligible collateral.

It was not until 1933 that we began to unshackle our paper money from the numerous and unnecessary restrictions pertaining to its issuance. With the numerous types of paper money in circulation at the time, this would seem to have been a non-problem.

Here is the list: gold certificates, silver certificates, national bank notes, United States notes, Treasury notes of 1890, Federal Reserve Bank notes, and Federal Reserve notes.

With that array of paper money there should have been plenty to meet the liquidity demands placed on the banks by the public. But the volume of each type that could be issued was so circumscribed by restrictions that even the aggregate group could not begin to meet the panic demands of the public.

Yes, and we are right back to another money-good collateral crisis. This time with over 8 billion people on this rock. 1933 was a deflationary depression. However, thanks to the global coordination of central banks all over the developed world, my prediction is that this time around we get a inflationary depression, but this may take time to manifest. More immediate is the, almost 10 trillion in new issuance that the treasury will need to issue this year. Who will buy this? As Wolf says; “Yield solves all demand problems”

So, much higher, for much, much longer?

It’s not personal, it’s just MATH.

When it comes to the potential future rate of bank failures it is good to remember this quote by Lenin.

“There are decades where nothing happens; and there are weeks where decades happen.”

Love that quote and almost all his quotes! Most of mankind’s failures it seems are in imagination.

Most of man’s failures are the result of a few teaching us all to love having more and bigger”stuff” since “civilization began.

The biggest assholes seem to always get their way.

“And in an insidious turn of events, no one went to jail; instead, bankers at the banks that got bailed out made record bonuses.”

Makes me now realize I should have become a banker instead of an Engineer! I sure missed that boat (along with some others).

“Makes me now realize I should have become a banker instead of an Engineer! I sure missed that boat (along with some others).”

I had the same thought back in the early 1980s (while I was studying engineering). I took an accounting class. I realized I was more suited for engineering.

The 3-6-3 rule: borrow at 3 percent, lend at 6 percent, and be on the golf course by 3 no longer applies.

LOL! The banker I knew growing up did exactly this, but this was when Glass-Steagall still applied.

Traditional banking (money stewards, not robber barons) is long dead, and the outcome will be the same as it ever was…

hedge accordingly.

I think it’s because they don’t get high quality desks and chairs anymore.

Williams says the long term neutral rate is still low.

Summers it is much higher now.

I think the size of the money supply is the biggest driver of inflation and affects the long term neutral rate.

I guess taxes have to rise and consumption decease to stabilize our environment.

Are we seeing debt securities harder to sell? Especially government debt? Will governments have to offer higher interest rates perpetually? Does this confirm the Fed can not cut?

Does waiting for maturity affect liquidity? Does the expiring 7.5 Trillion, that needs to be replaced like all legal Ponzi schemes, have an effect on bids?

I think so.

“Are we seeing debt securities harder to sell? Especially government debt?”

No, that’s not how it works. If the yield is high enough, there’s always huge demand. And now the yield is very low, which means buyers are tearing them off the shelves, so to speak.

For example, a Treasury with a remaining life of 10 years sells at yield of just over 4%, which is ultra-low considering that short-term yields (bracketed by the Fed) are over 5%, and given the long-term inflation risk. There is still mindboggling demand for these securities.

I continue to be surprised at how much demand there is for duration. I really thought long bond rates would be higher by now – but clearly there’s still $$$ chasing them.

Wondering how much of that is investor hopium for rate cuts though…

With so much time left to maturity, it doesn’t matter all that much whether rate cuts begin June or next June. Many of us expect bonds to radically react to current events, which just doesn’t happen given the relative (relative!) unimportance of short term events to the overall P&L of a long bond.

Looking at the yield curve right now, the lowest yield is at the 5 year maturity. One could stipulate that that’s the timeframe in which the “bond market” thinks rate cuts are likely.

In other words, after the 5-year mark, bondholders start to want more compensation (interest) for increased duration – the natural state of things. The fact that bondholders of shorter maturities don’t want more compensation for duration means they are planning on getting paid another way – by capital gains from selling the bond after rates drop.

I’d be curious to see the yield curve animated over the last couple years.

I’d predict that the lowest yielding duration slowly moves closer to current time (leftwards on the yield curve chart), over time. I.e. as time goes on, the bond market slowly gives up on hopes of a rate cut, and eventually the lowest yielding duration is the 13 week bill – the natural state of things.

Wolf,

What do you think it will take to break through this?

It is amazing to me that long term rates haven’t gone up more, given the clear upside inflation risks.

Essentially negative term premium.

$56B of 3yr Treasuries went to auction today with strong foreign demand and a 2.6 bid to cover. WI Trade was at a 4.269% yield prior to auction and 4.256% at auction.

I too have looked at debt to GDP, the ongoing increase in cost of national debt and increasing deficit spending and thought: How the hell can this continue and why is there a bid, let alone a strong bid, for these securities? I think the answer is comes down to the dollar having an unfair advantage (Albeit uniforly appreciated to us all) of being the world reserve currency and ability to export our inflation. The dollar may be ugly but she is still the prettiest girl in school to ask to prom because the banks are mandated to hold so much of Tier 1 assets. Dollar milkshake theory caused me to rethink and question logic. The banks can’t just go and park money where they choose. Although they have choices, I feel that banks purchasing bonds, MBS etc. at high interest rate risk was not a matter of management incompetence or greed. I feel Basal, increased reserve requirements and forced acceptance of cash from the Fed put in place by regulators and the FRB required them to. I do believe a reckoning will come like none known in US history. I do think the derivatives market and counter party risk is insane and I think action in the repo market should draw a lot more attention than it is.

Howdy Folks. Another Obvious Reason they ZIRPed US. Not as many Sub Prime Mortgages hurting the Banksters this time. Make more of the squirrels share or else. Someday you will see how imprisoned you are in your own home?

///

So by increasing or holding the interest rates steady at a higher then usual value, the previously purchased bonds become less desirable, lowering their market value. So it is undesirable to sell them. But if they stay until maturity with the purchaser, they recieve the full purchase price back with the interest.

In a time of overabundance of liquidity, banks hold assets they cannot use or move without incurring losses. How profoundly ironic.

///

“And in an insidious turn of events, no one went to jail; instead, bankers at the banks that got bailed out made record bonuses.”

This is the cause of the current moral hazard which needs to be expunged – excised like a cancer that it is.

Howdy Depth Charge The cancer is needed to stay alive in this case.

Wait! You can’t possibly be suggesting the legal system favors the wealthy? Say it isn’t so!

In this post-pandemic world of resilience, which seems fueled by ambiguity and financial innovation — it’s unlikely that the supremacy of the Fed will decline.

The lingering and lagging pandemic stimulus has been at odds with QT, especially as the soft landing narrative resonates with every form of speculative excess.

It’s no surprise that banks, which should be in jeopardy are floating along with life preservers, pretending that the Fed lifeguard has their backs.

The initial shock of pandemic death, has coalesced into an acceptance that we live in a new world — if anything speculators have embraced a mindset where risk isn’t a factor.

With that backdrop, bank losses do seem unimportant and a lot of recession risk seems trivial — not unlike moving away from Newtonian physics into quantum mechanics.

The neanderthal Baby Boomers are paralyzed by pondering CRE loans and bank implosions, but obviously it’s pathetic to not realize the Fed and the powers that be, had this figured out four years ago.

What’s worse now, a few banks gasping for air, while Powell does mouth to mouth or, a handful of pointless buildings — that are in the way of progress, get demolished?

Between the omnipotent Fed and omnipresent AI, everything looks like our trip to the moon is unstoppable.

Bank losses are so ridiculous.

Two thoughts:

-The idea of m2m valuations are a twist of logic. Think about it: fundamentally, the difference between the market & par price represents (part of) the yet-to-be‐accrued interest. Consider a zero coupon bond, in which all of the interest comes from the difference between market & par.

Its like opening a new CD at a bank, and then immediately counting all the interest you will earn over the life of the CD as cash on your balance sheet. You can’t count future income as cash now – unless of course you call it ‘held to maturity’ or something.

Ironically, you could argue that held to maturity was legitamized by the btfp, since it loans against the par value of bonds.

—

Re the declining # of bank failures: is there a way to weight this based on the declining # of banks? For example, bank failures / total banks to get a % failure rate. Or maybe $$ value of deposits rescued by the FDIC / total on deposit at all banks?

Or does this not matter?

“Baltimore Lawyer Threw Own Client’s Case to Protect Bank-Robbing Banker from Scrutiny,” by investigative reporter Christian Stork. Also, google NRA Beckett Brown International to see major media articles documenting some of the crimes Wayne LaPierre and NRA ordered BBI commit against gun-control organizations. Beckett Brown International (BBI) is also cited in National Bestseller “Dark Money” by Jane Mayer, “Broker, Trader, Lawyer, Spy” Chapter 6 ‘The Chocolate War’ by CNBC’s Eamon Javers, and “We Know All About You: The Story of Surveillance in Britain and America,” by spy expert Rhodri Jeffreys-Jones.

Abolish the FDIC. Poorly run banks are supposed to fail and anyone with money in them should lose it. With no FDIC, people would become much more careful about where they put their money. They would read all the bank’s financial reports, just like reading a prospectus for a mutual fund.

Nobody bails you out if you made a poor stock or bond investment.

Nobody saves you if you bought a crappy house that was over-priced, or a crappy used car. FDIC is a classic economic inefficiency which props up banks which are supposed to fail, and ultimately makes the whole banking system more fragile.

Abolish auto insurance because in the ensuing chaos, people would become better drivers, and then they’d get hit anyway and no one would pay for their vehicle and medical care?

Abolish health insurance because the fear of dying in the gutter due to an untreated illness would cause people to be more careful with what they eat and how they live, and then they get cancer anyway?

How about insurance for capital losses up to $250,000? Or insurance for a bad house or car purchase? Or insurance for gambling debts? Or insurance for deposits placed in a bank about to fail (oops, already have that). All insured by an agency of the federal government.

Jeeeesus!

1. the deposit insurance premium is paid by the member banks to the FDIC into the FDIC insurance fund, and not by the taxpayer. Presumably, banks pass on the costs of the insurance premiums to their depositors by offing slightly lower interest rates.

2. comparing what is a standard part of modern life — bank accounts to pay of stuff — to gambling debts is the most absurd thing I’ve read all day.

Put options provide capital loss insurance.

That is insane. Bank financial statements are complex, and people with law degrees and MBAs can’t always figure them out. The average person doesn’t stand a chance.

Besides, key issues, like a small bank in Texas being involved in loan syndications for condos in south Florida, won’t be apparent, even in the financial statements. Plus, there’s EBITDA – Earnings Before I Tricked the Dumb Auditor (or rather Compromised auditor). To repeat, the average person doesn’t stand a chance, and society loses if they don’t have a safe, reliable place for their funds.

Most middle class people trying to save a few dollars are not sophisticated enough nor do they have the time to read a bank’s financial reports (even assuming they’re not outright fictious), and you know it.

You probably ought to familiarize yourself with the last 150 years of US banking history, William. The FDIC is not going away, and for good reason.

Hey Wolf, do you have any knowledge of how credit unions are doing these days?

Here in NC we have one called State Employees Credit Union. Historically only state employees could join or their family. But over the years they have relaxed the rules a lot and expanded into other states.

NC Secu had some controversy recently, a board vote from a retired CEO put 3 new board members on. And the current CEO was against the changes to the board. As the older retired CEO is exerting his will over the Bank’s direction. The new CEO is more open minded I kind of gather.

But anyway just wondering how Credit Unions in general are faring in today’s environment.

Check out Weiss Ratings. Here’s a link with your credit union’s rating:

https://weissratings.com/en/credit-union/377

Credit unions are banks that pay no income taxes.

Slight correction, Wolf: one CEO went to jail from the 2007/8 crisis, Lee Farkas, for his part in the collapse of Colonial Bank (due to tainted loans from his Taylor Bean and Whitaker). We were early whistleblowers on that case to FHFA, over at ml-implode. (FHFA sat on our tip for an extra year and the institution ultimately collapsed on its own. Never forget!!!)

Most of man’s failures are the result of a few teaching us all to love having more and bigger”stuff” since “civilization began.

The biggest assholes seem to always get their way.

In the eighties there were 14, 000 banks??

Jesus. How many McDonalds were there?

Don’t know if it was a bank or the S&L bank -like thing. but the Clintons ole buddy McDougal bought one in Arkansas for about a million. Shortly afterwards, it acquired a major new client in the real estate biz: McDougal.

We use the term ‘domino effect’ to describe one item falling which causes another to fall, etc. But actual dominoes are all the same size. It is possible to imagine a set of dominoes where each one was 10 % bigger than the former piece. So you can now construct a cascade of falling pieces where it begins with a small piece and ends with a big one.

Is the US banking system sound? Sure but nothing is perfect and perhaps it would be more sound if the speed of amalgamation was increased.

The US used to have the Glass-Steagall Act – a law that came out of the Depression – that purposefully prevented banks from getting big, for example, a bank could not do banking in different states, it could only be active in its state. And it could only to classic banking (take deposits and make loans), and not be a hedge fund or an investment bank. The idea was that it would allow these smaller banks to fail without blowing up the financial system. And it worked great for the 60 years so until Glass-Steagall was rescinded in the 1990s, and 10 years later we got the Financial Crisis where banks were investment banks and hedge funds and were so huge and so interconnected that they were deemed too big to fail. And the government and the Fed bailed them out in what has become one of the worst and most galling events ever.

During the 60 or so years that Glass-Steagall was around, there was no financial crisis in the US. It did its jobs, and banks were just banks, not hedge funds, and they failed and weren’t bailed out, and bankers want to jail for wrong-doing.

Glass-Steagall should be reinstated. Clinton administration repealed it. They also brought us NAFTA and promoted off-shoring of our manufacturing. What a disaster.

Congress voted to repeal it in 1999, both chambers had a Republican majority (the neocons), but Clinton signed the legislation that repealed it, instead of vetoing it.

Related: recent academic paper: 300 bank failures expected due to CRE distress: https://www.nber.org/papers/w31970 (apologies if already covered)

Well, the bank failures due to CRE better get started pronto because there haven’t been ANY yet, ZERO, and retail CRE has been in the shitter for years, and hotel CRE has been bad for years, and banks have survived that just fine. And office CRE has been in trouble for two years, and we still haven’t seen a single bank failure because most of the office CRE debt isn’t even held by banks, but by investors, and investors have been taking huge losses, as we discussed here endlessly. And of the banks that do hold office CRE debt, many are banks in other countries, which we also covered. So who cares.

The authors are just making another attempt to force the Fed by hook or crook to relent on its monetary policy. There is a lot of this fearmongering stuff out there.

I don’t cover manipulative garbage predictions like that.

I don’t think we have seen the end of interest rate rises. It we get a heat wave like last summer or this winter in the planting season we could get an epic crop failure in corn. Beef, pigs and chicken prices will skyrocket and force rates up not down. That will make those treasuries the banks are holding to be smashed even further. It will get nasty in the next ten years.

Good thing FEMA is flush with cash as hard to not see continuing expensive climate change events. Hopefully no serious crop issues as might make things more expensive in US but higher prices hurt poor nations most.

About your last graph – How are saving’s and loans handled? Prior to 1989 they were insured by the FSLIC which got rolled into the FDIC in 1989. So if they are included in the chart after 89 but not before I’d expect to see a bump in 89. If the chart just counts them as FDIC insured all the way back to 78 for consistency then that’s one possibility. Or if they aren’t being counted as ‘commercial banks’ at all then that’s another.

And I guess credit unions insured by the NCUA are being omitted entirely, correct?

They’re insured by the FDIC. It calls them “savings institutions.”

The FDIC has data on “commercial banks” and “savings institutions.” Everything here is just about commercial banks. Savings institutions are small in dollar terms.

I assume that the credit unions under NCUA are more like these FDIC “savings institutions” in terms of size in dollar terms and “classic banking” instead of investment banking or hedge funds. Is that right?

I guess it depends. Credit Unions have gone a buying spree, buying up community banks and converting them to branches of the credit union. Some credit unions have gotten pretty big.

Word of the day: Salubrious. – Healthy.

If feb cpi/ppi shows accelerating inflation this week, then Shocka should be able to continue to buy a salubrious amount of t-bills with a yield of around 5.4% for some time.

Yeah, and hopefully Shocka is in a 0% tax bracket, because if his/her tax rate is just 30%, you’re losing ground in real terms.

The unrealized losses present a temporary risk. They certainly do present a liquidity risk for banks, and if HTM, they won’t be a problem at maturity, or if most people keep making their payments. As time passes at more normal rates like we have now, the low rates will be replaced by more normal rate products, and banks will be swimming in cash.

All time highs in stocks, gold, sh.itcoins, 20$ burgers from 5 guys. It’s all glorious I’m told.

The FED never took the punch bowl away. We have a raging mania everything bubble. And they are going to let it ride all the way through the election. The US is finished as we ever knew it. The damage is way too extreme.

Certainly not because of the Federal Reserve. If you want to blame anyone then correctly blame the White House and Congress who are creating a punch bowl of reckless spending.

I think you are right. Many people now prefer Putin over their neighbors. Lots of societal damage done when government redistributes purchasing power from hard working savers to out of control spenders.

Given the level of large bank profits, we can infer the industry is highly innovative and constantly changing, requiring continuous business/capital investment and intensive labor from the brightest minds in the planet.

Sarc.

As long as foreigners keep buying US debt, every problem in the economy and US financial system can and will be papered over.

A crisis may come some day, but it will not likely occur in any way people predict. It will likely be some confluence of events.

Few people believe that a geopolitical upset will be the cause, but that is where I think it will happen. An accident created by people whose understanding of the world has been shaped by the Marvel Comic Book movies they were raised on.

The US is much less depending on foreign buyers. Their share share plunged dramatically:

Wolf, I see you deleted my comments which you disagree with. You can dish it out, but you can’t take it. Learn to man up. Some of your articles are okay, but you fail by only showing comments which kiss your ass.

Lies and BS comments either get deleted or shot down. If I don’t have time to shoot them down, I delete them. If I shoot them down, and you come back with more BS, I delete it. You cannot inundate the comments with BS.

Wolf Richter is an “Agenda Contributor” to the “World Economic Forum”

I am not joking or making things up. A simple google search will help to draw the mask from the eyes of the lemmings. Wolf is a weak form of controlled opposition at best, tempering the disdain of the thinking masses for the FED.

Bullshit. The WEF violated my copyright by publishing one of my articles in 2017, that they had gotten from Business Insider (which had my permission to republish, but I retained my copyright). I asked the WEF to take it down due to copyright violation, and they just ignored my demand.

Look at the thing you’re referring to, you moron.

Here is my original article that they stole:

https://wolfstreet.com/2017/08/31/most-expensive-u-s-cities-apartment-rents/

A gazillion websites have stolen my articles over the years in violation of my copyright, and they called me “contributor” or “associate” or whatever, and I should sue them all, but if they’re not in the US, I can’t sue them, and even if they are in the US, and even if I can find an entity that can be sued, it’s not worth it.

Adios.

Weird how you do not have the integrity to address what is happening to deposits….

When you remove part of mathematic equation, I guess you can make math lie….

When deposits decrease, bonds have to be sold at a loss. Banks go bankrupt….

“Weird how you do not have the integrity to address what is happening to deposits…. When deposits decrease, bonds have to be sold at a loss. Banks go bankrupt….”

LOL, you’re a funny bullshitter. I addressed that just fine in the article. You just didn’t read it. That’s not my fault tho.

Here is the section quoted verbatim from the article:

“In theory, “unrealized losses” on securities held by banks don’t matter because at maturity, whenever that may be, banks will be paid face value, and the unrealized loss diminishes as the security nears its maturity date, and goes to zero on the maturity date.

But these disclosures of unrealized losses made uninsured depositors aware of what is going on, and they started yanking their money out of Silicon Valley Bank, Signature Bank, and First Republic – on the two fundamental principles of investing:

1. He who panics first, panics best.

2. After me the deluge.

But the banks couldn’t raise the cash needed to fund this outflow by selling those securities because their unrealized losses would have become realized losses, and the banks couldn’t get enough cash for them, and were insolvent.

And further down again, quoted from the article:

“In 2023, six banks collapsed: Silicon Valley Bank, Signature Bank, First Republic, plus two very small banks in Iowa and in Kansas were taken over by the FDIC. And Silvergate Bank, with regulators breathing down its neck, agreed to self-liquidate, but since it had enough assets to cover its deposits without FDIC involvement, the FDIC doesn’t count it as a “failed bank.” So officially, there were five “failed banks” and one self-liquidation.”

Maybe I should post the entire article in the comments so that people read it?