The US became the largest LNG exporter in the world in 2023. It has long been the largest natural gas producer in the world.

By Wolf Richter for WOLF STREET.

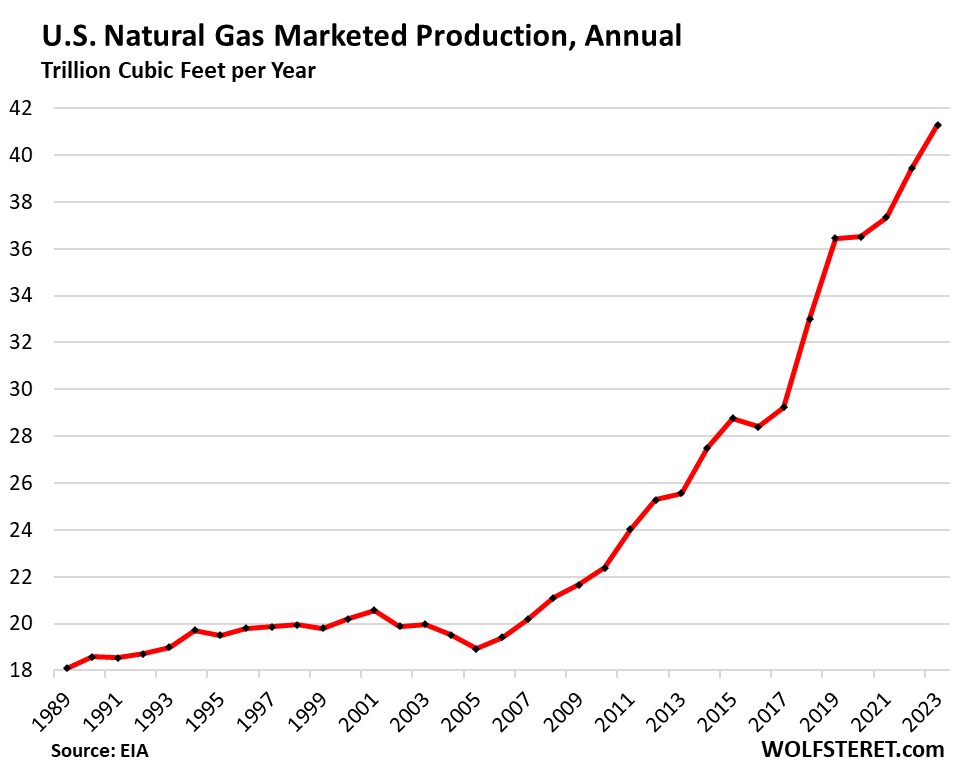

Annual natural gas marketed production in the US rose by 4.7% to a record 41.3 trillion cubic feet in 2023, according to EIA data. Natural gas production has surged by 113% since 2006, and by 41% since 2017, as a result of the massive US fracking boom that reshaped the energy landscape and pricing in the US and globally.

Some milestones:

- In 2009, the price of US natural gas collapsed amid overproduction from fracking, and no LNG export terminals in the lower 48 states.

- In 2011, the US became the largest natural gas producer in the world, with prices wobbling along collapsed levels.

- In 2016, natural gas became the dominant fuel for power generation in the US, beating coal.

- In 2016, the first LNG export terminal in the lower 48 states came on line, and large-scale LNG exports began.

- In 2023, the share of natural gas rose to another record of 42.7% of total power generated in the US.

- In 2023, the US became the largest exporter of liquefied natural gas (LNG) in the world for the first time, beating Qatar and Australia.

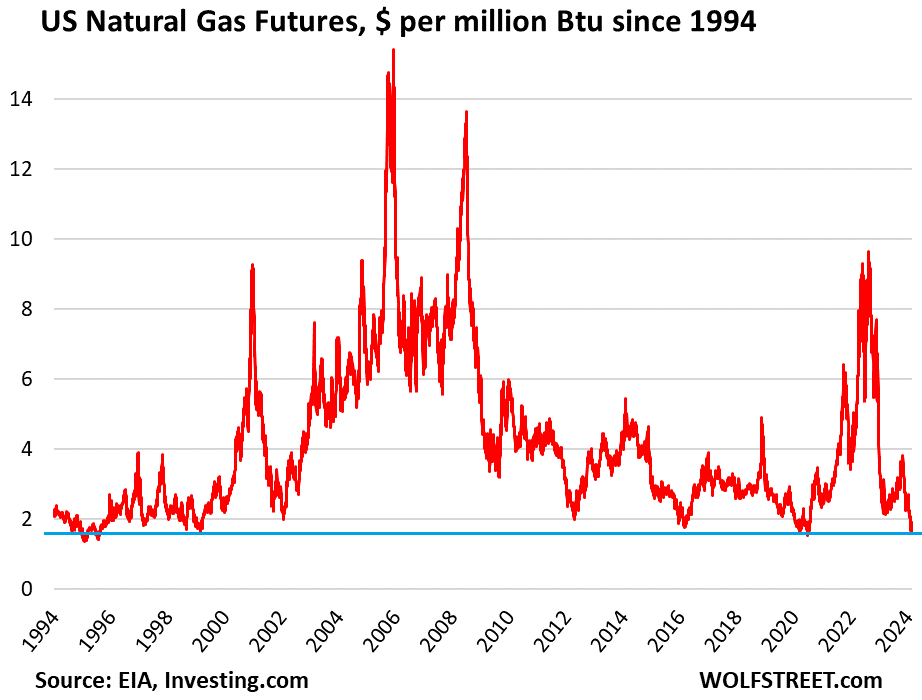

And the US natural gas price collapsed.

On February 20, the price of natural gas futures plunged as low as $1.53 per million Btu, coming just within a hair of the lows since the early 1990s. Before 2009, it had largely ranged between $4 and $13. On Friday, the collapsed price of natural gas futures traded at $1.89 per million Btu.

US natural gas exports.

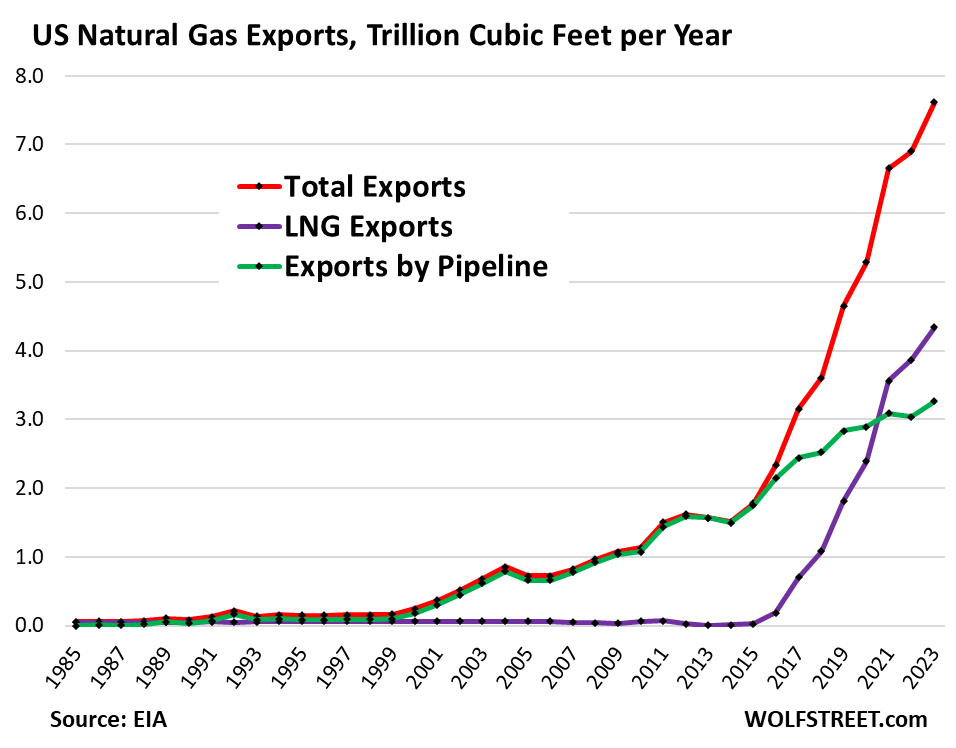

The US has exported natural gas via pipelines to Mexico since the late 1990s, and to a lesser extent to Canada (from which the US also imports natural gas). And the US has long had a small LNG export terminal in Alaska.

But large-scale exports of LNG to the rest of the world was impossible until the first large-scale LNG export terminal on the Gulf Coast began operating in 2016. And as more export terminals were built, the LNG export boom took off, providing more demand for US production, but US production skyrocketed, inundating the US with supply – hence the renewed price collapse.

Total exports of natural gas via LNG to the rest of the world, and via pipelines to Mexico and Canada spiked by 10.2% in 2023 to a new record of 7.6 trillion cubic feet, or roughly 18% of US marketed production.

Exports via LNG spiked by 12.4% to a record 4.34 trillion cubic feet in 2023.

Exports via pipeline to Mexico and Canada jumped by 7.6% to 3.27 trillion cubic feet in 2023. The US imports no natural gas from Mexico. But it imports more natural gas from Canada than it exports to Canada.

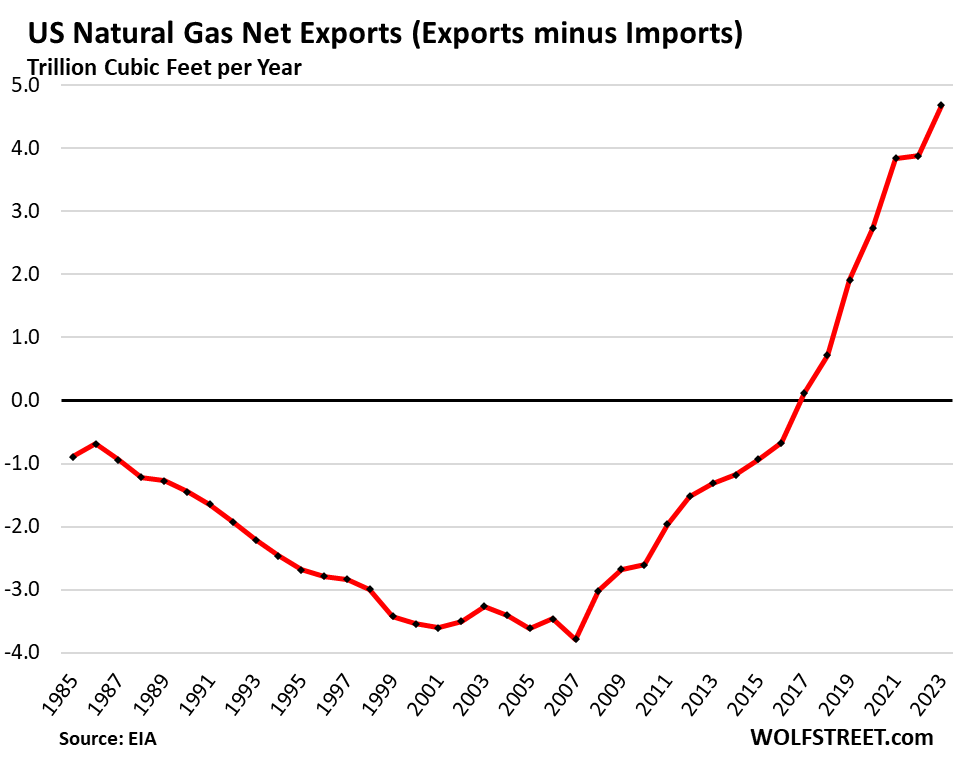

Net exports (exports minus imports) of natural gas soared to 4.7 trillion cubic feet. The US had long been a net importer of natural gas, with ever increasing imports. But fracking changed the equation. As production soared starting in 2007, imports began to fall, and net exports – a negative number at the time – became less negative.

In 2017, the US became a net exporter of natural gas, exporting more than importing, and net exports have continued to soar. The flat part in 2022 occurred because of the shutdown of the Freeport natural gas liquefaction plant in Texas, after a major fire, which cut LNG export capacity by 17% for the second half of 2022.

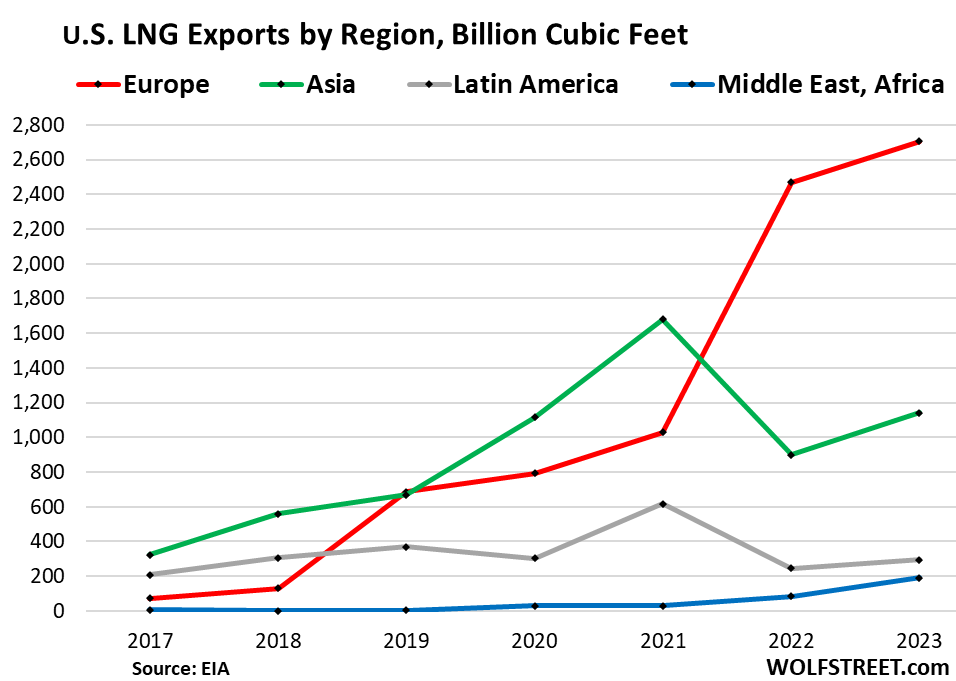

LNG Exports by region. Europe was for the second year the largest buyer of US LNG. Exports to Europe rose to a record 2.70 trillion cubic feet in 2023, accounting for 62% of US LNG exports (red line in the chart below).

Asia had been the biggest buyer of US LNG, at first Japan and South Korea, then also China and India. In 2021, exports of LNG to Asia reached a record 1.68 trillion cubic feet. But in 2022, as sales to Europe soared, sales to Asia plunged. In 2023, sales to Asia rose to 1.14 trillion cubic feet, roughly even with 2020.

Latin America and the Middle East (mostly Turkey and Kuwait) have been smaller buyers of LNG:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I’m not sure what proportion of total production is used for heating, but the warm winter probably didn’t help this year.

I’m no chart analyzing expert but sure looks like some very strong multi year support at current prices.

Any solid dividend paying options in the gas space?

Pipelines and LNG

KMI comes to mind

Look at Energy Transfer LP – 8.14%

Make sure you understand the tax implications (schedule K-1) of LPs before purchasing.

MPLX

As prices collapsed here in the US, that collapsed price of LNG isn’t reflected for the backyard grill. Which is up roughly 10% in order to keep putting out tasty home made dinners….

Backyard grills are usually propane.

Hank Hill here for clean burning propane.

And propane accessories!!

That’s propane in your grill, not LNG. Maybe you’re thinking LPG… liquefied petroleum gases, propane is one of them.

I’ve had NG grills and clothes dryers for almost 20yrs, Canada has been oversupplied with NG for ages. Might depend on the supply capacity in your area.

NG prices earned the name the widow maker for a reason, lol

“LNG” is what Frostbitefalls said. You’re not using LNG.

Not Wolf is correct. Where we have nat gas lines running into neighborhoods in Florida, lots of folks use it for grilling.

You can use either (nat gas or propane), it just depends on changing the nozzle size of the burner jet. Propane is the most common due to availability and portability, but if you have a nat gas source, you can buy a kit to change the grill over to use it.

But you’re not using “LNG”. The comment by Frostbitefalls, to which I replied, said: “…that collapsed price of LNG isn’t reflected for the backyard grill.”

Both are correct. Nothing technically runs off of LNG. It must vaporize before it burns or combusts. I also have both NG and LPG grills.

Side note. I have put LNG in a coffee mug and lit with a long stick. It burns slowly and you could likely grill with it. That flame is still methane vapor oxygen mixture burning and not LNG.

Is there a way to track the spread between LNG prices, and (non-liquified) residential NG?

Maybe that’s not so relevant, at least in the context here. LNG is presumably priced for wholesale, while residential NG piped to the home is priced by the utility company.

Florida doesn’t import LNG. It gets natural gas from its own producing regions and from producing regions in other states by pipeline. Florida has LNG export terminals, which take US natural gas via pipeline, liquefy it, and put it on LNG tankers.

LNG is priced in the global market since it’s a global commodity. There can be a huge spread between US natural gas prices and the price paid for US LNG in Asia or Europe. That’s how US LNG producers try to make money. But it also costs a lot to turn NG into LNG and transport it across the oceans.

It’s fun OXIDIZING alkanes, eh? Bigger backyard treat than a swing set, and probably (unfortunately) much more common.

None of them are modeled as pure ANYTHING, (except maybe various C-H and C-C combos), by the people who fool around (I mean are in the BUSYness) of obtaining them.

And with lots of other incidental toxic or destructive crapp.

All bad for planet, and we will reap what we sow…..seems a bit sooner than thought to me, but then the “market” which “guides us” doesn’t think….not like these God fellas do, although many think so. Invisible hands of all sizes and opinions.

We have plenty invisible and many fewer and much larger usually visible hands….but no brain….too bad…..cerebral cortex’s were really thinking up quite a pile. Mostly unculled shit, though…..but still just a curiosity as Eatrh’s biomass goes, so no loss however we go……..completely out, or into some really mean dark ages, or a combo of both.

Pity the kids……they will have to face our shit.

Kootkid.

I spent a week with just 6 Canadian HS kids in 54 Ford from Surrey/Burnaby/New West, and a friend from down here in 1963…in Pentiction before it went to hell. Had a BLAST…chewed out by Mounties, lotsa girls, tooled around Skaha and Okanagan in their folks boats. Tried skiing…NG…couldn’t get up and others wanted to try.

Bad part was drive up with 3 of us in back seat of 59 Volvo….and old man into making good time…wouldn’t stop to pee….his kid is/was now the same way when I followed them to house in Bahia Asuncion a couple times. The Death Highway!

Am on Gulf Coast, my grill is natural gas unless Atmos is using buried lines to supply propane.

MM sure there is NYMEX NG chart for USA wholesale gas prices with regional pricing like Henry Hub etc . There also is a spot LNG price but remember shipping and offloading costs are not included plus most LNG is priced on long term contracts many are tied to oil prices as well not LNG . But if you so desire you can tract the two. However the delivered price to your house is through a utility which has lots of fees and expenses for deliver small quantities. And for what purpose as one can see from wolf charts demand increased and supply increased since there is an abundance of NG in USA that can be developed below 3 usd/mmbtu for at least a few years

Bobby Dale,

“LNG” is what Frostbitefalls said, and what I replied to. You’re NOT using LNG. The Gulf Coast doesn’t get LNG. No one on the Gulf coast uses natural gas from LNG. Don’t you people ever read anything?

I remember when gas grills first came out. A friend bought one and when I said, “so you bought an outside stove”, sarcastically, he said, “it tastes better, like camping”.

I have seen many of these quality of life improvers…..over consuming morons loved ’em.

I have never grilled in my life, which shocked all my MANY GF’s (I was considered very good looking, asked several times if I was an actor, even with top half of ear gone)….Anyway, I guess it’s a “manly” pursuit?

Each spike on that natural gas futures chart supplied it’s own list of producer disasters. And each period of disaster for the industry seems to produce a crop of stars.

Barry Bannister explained it well in 2011:

“Centuries of data support the view that commodity production is a price taking, high fixed-cost, capital-intensive, deeply cyclical industry, with periodic bouts of pricing power that lure new capital into the industry only to be dashed against the rocks when commodity prices stagnate.”

Disasters for producers? There is so much price manipulation from, likely the producers, that they are no victims.

Just today, Nat gas futures are up 10%+ and the world has a glut of Nat Gas. I note that EQT stock is up during this glut and wonder how that can occur in an honest market.

The price has not collapsed Wolf… take a look at Nat gas futures prices for the past week.

It collapsed and it ticked up from collapsed levels and it’s still collapsed at $1.93. Look at a long-term chart. You cannot even see the uptick today it’s so little, LOL

The increase today came because EQT said it would curtail production to tamp down on the NG glut.

Art Berman doesn’t think that our pre-eminence will last long, though —

Art Berman has been saying the same BS for over 10 years, including on this site in March 2014:

https://wolfstreet.com/2014/03/06/shale-oil-gas-not-a-revolution-but-a-retirement-party-2/

In that article of March 2014, Art Berman said: “On the gas side, all shale gas plays except the Marcellus are in decline or flat. The growth of US supply rests solely on the Marcellus and it is unlikely that its growth can continue at present rates.”

But NG production exploded after 2014!!!

And this BS:

Art Berman: “I’m a technology enthusiast but I see the big breakthroughs in new industries, not old extractive businesses like oil and gas. Technology has made many things possible in my lifetime including shale and deep-water production, but it hasn’t made these things cheaper.”

So don’t drag him into here like he’s some kind of Jesus Christ. He has been a broken record for 10 years. And oil and gas production has exploded over that time.

Mic drop.

Excess gas supplies are the direct result of OIL exploration and production. A huge amount of natural gas (associated gas) is produced as a byproduct of wells drilled to produce oil – so much so that we have gone from a net importer of gas to a net exporter, as you mentioned.

Continued oil exploration in the most productive and most highly drilled oil fields, such as the Permian Basin in west Texas, will also continue to produce large amounts of gas and likely keep gas prices depressed until export or domestic demand increases substantially.

Art Berman clearly has no idea the NG resource available in USA with Hz drilling and frac . Unless federal and state government mess things up we have decades of low cost NG to develop. In the commodity business and energy business there are always capex weather and supply issues that can spike the price high for a bit but that is not a long term issue with this new technology. Pre Hz shale we were building import LNG plants and terminals for billions that had to be scraped . We went from import high NG price to low cost NG.

The simultaneous spike in exports and strong downward trend in prices is great news for the US. Why anyone would want to destroy our natural gas industry instead of focusing on point source pollution control is beyond me.

Thanks for the data Wolf!

I agree.

From an emissions perspective, lumping all hydrocarbons under the same umbrella is dishonest. NG is the cleanest-burning hydrocarbon that exists.

You forgot to mention that the Bidden administration has stated its intention to perhaps curtail LNG exports for ‘climate change’ reasons. That announcement has of course had a negative effect on nat gas prices. You don’t suppose they’re trying to buy votes in the coming election, do you?

Naw. What had an effect on prices was over-production, the currently unusually high storage levels in the US for this time of the year due to over production and a milder winter, and maybe more competition from renewables in the power generation sector. High storage levels are a killer for natural gas prices. But people blamed Biden for the high energy prices, and now they blame him for the lower energy prices??

A lot of people are bunheads that ignore facts and blindly repeat whatever fox news & a.m. radio tell them.

Oil & gas production in the U.S.A. hit record levels this year, but to believe the propaganda, Biden is reducing production through the magical power of hiding in his basement.

Come on now, Wolf! You know there’s a dial on the Resolute Desk for energy prices. Draining the SPR to suppress oil prices will do that. Need to refill it, but that’s another post or posts. Gorozen.com addresses the energy issue pretty comprehensively. Thanks!

We’re talking natural gas here. There is no SPR for natural gas. NG storage is an essential private sector activity to get the US through heating season every year.

But to play along with your theme in terms of the SPR (crude oil), selling high and buying low is just good business for taxpayers.

But what really caused oil prices to head lower was huge massive crude oil production in the US, stimulated by high prices (without corresponding demand growth from the transportation sector), article coming today.

Its next to the global inflation dial, and I really cant forgive Biden for turning it up to 8%.

” Draining the SPR… Need to refill it”

I disagree. the SPR is obsolete and should be abolished.

Draining the SPR to pay for tax cuts: acceptable

Draining the SPR to sell high and buy low: greatest sin ever committed

Money is fungible. It was sell high buy low (profits) that paid for the tax cuts.

“people blamed Biden for the high energy prices, and now they blame him for the lower energy prices”

That’s correct, Wolf, because as I’ve said before, Biden shut down the fossil fuel industry. Heard it from reliable sources. You know, the AM radio types….

That the process for federal permits has been smoother and faster under Biden than Trump is the little nasty thing nobody wants to admit. New Mexico and federal land has become the primary grower of Permian production instead of private land.

You may be correct that policy influenced pricing. There was a deliberate policy intention to support EU LNG supply/inventories at the outset of the Ukraine debacle…errr….conflict. Now, there is an announced policy shift to reduce that specific supply conduit.

The gotcha is that the actual mechanics of this often diverges from policy as supply, transport, etc., creatively “adjust” to policy/sanctions – at a higher cost. What is certain is that commodities markets have become more volatile. It is also apparent that policy/ideology has influenced fossil fuel CAPEX since at least 2013; and that construction of new transport (VLCC, ULCC, etc.) has lagged for years following the last boom/bust cycle. There si also the larger slow-down in global GDP since the pandemic though this has been very uneven.

I would like to see a gas pipeline from the US to Europe under the Atlantic.

Then the Russians could blow it up!

I can’t imagine that is feasible. The length and depth alone would be prohibitive. And like we saw with the Nord Stream 2, such a pipeline would become an immediate target for sabotage.

I don’t claim to be an expert on undersea pipelines, but has there ever even been a US to EU pipeline even discussed/engineered?

Undersea gas pipelines tend to blow up all by themselves.

We ARE building new pipelines to Mexico.

Is it fair to credit energy exports for digging us out of ZIRP? The 2015/2016 explosion in NG exports coincides with QT 1 and a rising dollar. Environmentalism be damned if so ..

Dan – It goes deeper than that. The low cost of NG makes manufacturing competitive in the US. NG fuels the industry both directly as an energy source and as a raw material.

When you consider the social cost of fracking, mainly the polluted water table And the wear and tare on roads, is it a good thing to be exporting this natural resources at subpar prices? Or any price at all?

You need to update your thinking about fracking. The lighting water on fire was a PR stunt and was 100% fake news.

Mostly water and sand is injected in these wells, and wells are lined with steel casing to prevent the contamination of nearby groundwater. Since NG is often a substitute for coal, environmental effects (air pollution, CO2, groundwater contamination) are lessened in nearly all studies cases.

Completely agree with JS the oil industry does leave a footprint temporarily but only maybe 100 years or less. Does not seem to have fazed LA real estate prices there has been oil production in LA basin since the 1890s and those home prices are higher than ever . No environmental damage .

The burning tap water was in CBM plays was caused by abandoned but not sealed wells. Very much real but CBM was killed by shale.

I’m not sure if Gas Land was the coal industry or the Saudis but not particularly informative.

As well as trucks pay a ridiculous amount of road tax.

You can thank your politicians for not fixing the roads.

“And the wear and tare on roads”

You mean from all the trucks transporting it? Pretty sure it is sent via pipeline from the fracking sites. Liquification is a cost and energy-intensive process, so it only makes sense to do so when transportation by pipeline is not practical (such as across an ocean).

I admit I do listen to Chris Martinson and Art Berman, as well as James Kunstler, and it was my understanding that it is in the energy and capital intensive process, tough on roads and only made possible due to cheap money.

Natural gas is a capital intensive process. You drill very deep wells and then need to install a new pipeline from the well to an existing pipeline. Maintenance costs are low and the well produces for decades.

Then again wind turbines require significant on-site prep, very expensive turbines, etc, complicated assembly and a high voltage connection to a transmission line / grid. So they also require a lot of up front capital. They require moderate ongoing maintenance and produce intermediate power for 2-3 decades.

Both are popular in my area. Wind turbines have a much bigger impact on the roads than gas wells, but neither are significant.

Nether have a significant environmental impact.(Blade disposal vs accidental methane release).

But the wind turbine footprint is much much larger. If you only own 50 acres, the wind turbine will take up a significant chunk of your property and is noisy. If you are a farmer with 1000 acres, either is fine.

Wait a minute…

A gas well generates natural gas. It doesn’t generate electricity. You need a pipeline feeding into the main pipeline system, and then you need a gas-fired powerplant to generate electricity from the natural gas. You left out the power-plant part, LOL. details, details, details

A wind turbine generates electricity. It IS the power-plant.

Anyone think the price could go negative? It happened with oil.

Oil went negative because of the peculiarities in futures around delivery. The actual cash market for oil never went anywhere close to negative.

From EIA:

Cushing, OK WTI Spot Price FOB (Dollars per Barrel)

2020 Apr-20 to Apr-24

Mon-36.98 Tues 8.91 Wed13.64 Thu15.06 Fri15.99

I doubt if it was a lot; but it’s clearly negative.

Also Nat Gas went negative in the Permian about the same time.

Yes price for NG can frequently go negative (every few years) for a variety of reasons including weather mechanical pipeline and plant issues etc . But that is the spot price . Only a small portion of gas is sold at the daily spot price because if price goes negative industry shuts in quickly and the price adjusts

The problem with exports is that now you’ve priced nat gas on the world price and not on the price determined by the gas available in the US to domestic markets. Not a problem right now, but………

LNG has a much higher storage density than compressed natural gas, making it more suitable as an alternative to diesel fuel than compressed natural gas (California Energy Commission, 2006). However, the heavy duty trucks need to be equipped with a special natural gas diesel dual-fuel engines (Frailey, 1998). Moreover, sufficient special refueling stations are needed with a storage tank for the cold liquid natural gas. The boil off losses at the site of the fueling station can be compressed to CNG and be used in passenger cars. [from ctc-n.org]

Why is the USA a net importer from Canada, despite the supply glut?

I assume for some northern areas, importing from Canada is more practical than importing from domestic sources.

Pipelines from producing regions to consuming regions, largely based on proximity. For energy, the border doesn’t exist. What matters are pipelines to connect producing regions to consuming regions. It goes both ways.

I live on the Gulf Coast and all along here are natural gas IMPORT terminals built in the 2005-2010 timeframe (including in my county). At that point everyone was concerned about natural gas SHORTAGES that would cause electricity prices to spike if we couldn’t import LNG. These terminals sit unused to this day as they wait for regulatory approval to reverse the liquification process to export LNG instead.

Surprisingly the terminal in my home county HAS received the necessary approvals and still sits unused. The company says that they are waiting for market conditions to get right. Apparently this company (Kinder Morgan) isn’t run by the brightest bulbs in the industry.

Kinder Morgan would need to secure some long term contracts to proceed and those are not always easy to obtain years of negotiations. Countries that import manage their business well ensuring enough NG is available and these are 30 year deals . Qatar on the other hand (richest country in the world per capita ) can commit to fund these mega 10s of billion or more LNg export plants just to sell in spot markets . KMI can’t afford that risk.

Granted it may not be easy, but the FERC license to convert the plant was based on a supposed “necessity.” Kinder Morgan spent the millions of dollars required to get that license and it was granted way back in 2019. This IMPORT plant was completed at a cost of $1.1 billion back in 2011. For THAT price they could have built a nuclear reactor… and frankly the containment vessels look like two nuclear cooling towers from a distance. I think they brought in a couple of shiploads of LNG in 2011 and the plant has been idle ever since.

So while it may take time to get gas contracts in place… it also costs time and money to sit on a billion dollar capital project and do nothing with it. I won’t be surprised if the county Board of Supervisors doesn’t call them in pretty soon for a one-way “discussion” of how they have been getting tax abatements for this plant for over a decade now… and those abatements were offered in order to secure tax revenue and jobs for the county. Tax revenues are minimal at the moment… and the only jobs are the ones for security guards to drive by the place occasionally and make sure the fence is still standing.

The first LNG export terminals on the Gulf Coast were converted import terminals.

Yeah… like the one in my county. But some of these companies are getting regulatory approval to make the conversion but then squatting on the rights to the approved conversion without actually spending the money to make the conversion. My guess is that they are looking for a buyer willing/needing to do that conversion work. The one in my county was approved for conversion by FERC back in 2019… that is a long time to let a multi-billion dollar capital project sit idle.

How did the price drop from 9 to 2 but my national grid gas bill doubled (nyc)?

On my National Grid bill only about a third of the bill is for the actual gas and the price per therm does move with market prices. The rest is for delivery charges which only go up.

Some of the LNG stocks I hold which many pay over 10% LPG, FLNG, ET, KNTK, DMLP, TRMD and many others.. just research and you can find many more.

Quote from an energy analyst I follow:

Today in the USA, a million BTUs of natural gas costs less than a McDonalds happy meal.

If Asia isn’t buying US LNG anymore (or lots, lots less) where are they getting it from now?

Asia is buying just fine (look at the chart). But US producers got a higher price in Europe there for a while, and that’s where the cargos went. Highest bidder is who gets the LNG.

Comment is for Wolf.

Gas plants are very compact. You can site 5 simple cycle 250MW turbines on a few acres. Combined cycle need a few more acres and a source of cooling water.

The wind farms are 20×50 miles with hundreds of miles of cable buried between turbines and collector substation. The collector substation is typically hundreds of miles from the load so 20’s of billions in transmission needs to be added.

https://www.utilitydive.com/news/miso-midcontinent-tranche-2-lrtp-transmission-expansion/709576/ Lines to bring wind from Southern MN to load centers.

1. For a wind turbine, the fuel is free. So the variable cost is very low and doesn’t spike with use and price spikes, as NG does. This changes the math.

2. “The wind farms are 20×50 miles with hundreds of miles of cable buried…” LOL, that’s a wild and woolly exaggeration. Today’s turbines have a capacity in the 3-4 MW onshore and 8-12 MW offshore. So for a land-based system, you can put about three 3-MW turbines on a mile. So 1×1 mile area can have 9 turbines, with a combined capacity of 18 MW. So 10×10 miles would give you a capacity of 2,700 MW. To use your figure of 20×50 miles, of 3 MW turbines, it would have a capacity of 27,000 MW. That would be about 27 of your theoretical NG powerplants (1,000 MW).

Maverick Creek is a 492MW wind farm located in Concho County, Texas, US. The Maverick Creek wind farm is located on 50,000 acres of land in Concho County, north of Eden, Texas, and along US Route 83. The project site is located in a favorable wind area in central Texas, which is a leading state in the US in terms of wind energy generation, with more than 24.8GW of installed capacity.

The Maverick Creek project features 127 Vestas wind turbines which include a combination of V150-4.2MW and V136-3.45MW turbines in 3.7MW power optimised mode. It is expected to generate enough clean energy to power nearly 200,000 homes a year.

50,000 acres / 492 MW = 102 Acres per MW

50000/640 = 78 Square Miles

492 MW / 78 sq miles = 6.3 MW per Sq Mile

You claimed 27 MW per Square Mile. Maverick creek built in 2021 with 127 of the 3-4MW of turbines comes in at 25% of that. It’s getting hard to source the prime sites and hard to line up all the turbines in the proper sequence to avoid shadow effects.

To match the 1250MW of gas turbines it would take 1250/492 *50000 = 127,032 acres or 198 sq miles built to the density of an actual windfarm. Then a couple of billion in transmission upgrades to get the power somewhere useful.

But until we get a massive breakthrough in energy storage and a much stronger US Grid with 765KV or HVDC ties you have to do both. The next polar vortex of 2 weeks of 20 below across the Midwest and cold across a large region will be enlightening. You CA residents don’t have to worry about freezing to death and trying to restart frozen plants.

Anyhow enjoy your stuff but there are many hurdles ahead.

https://www.renewableenergyworld.com/wind-power/10-largest-wind-farm-projects-completed-in-the-u-s-so-far-in-2021/

https://www.power-technology.com/projects/maverick-creek-wind-project-texas/

Yeah, the ranch house is located on a 50,000 acre ranch. That doesn’t mean the house needs 50,000 acres, LOL. Get real.