Price Cuts and mortgage-rate buydowns, though costly for homebuilders, make new houses more attractive.

By Wolf Richter for WOLF STREET.

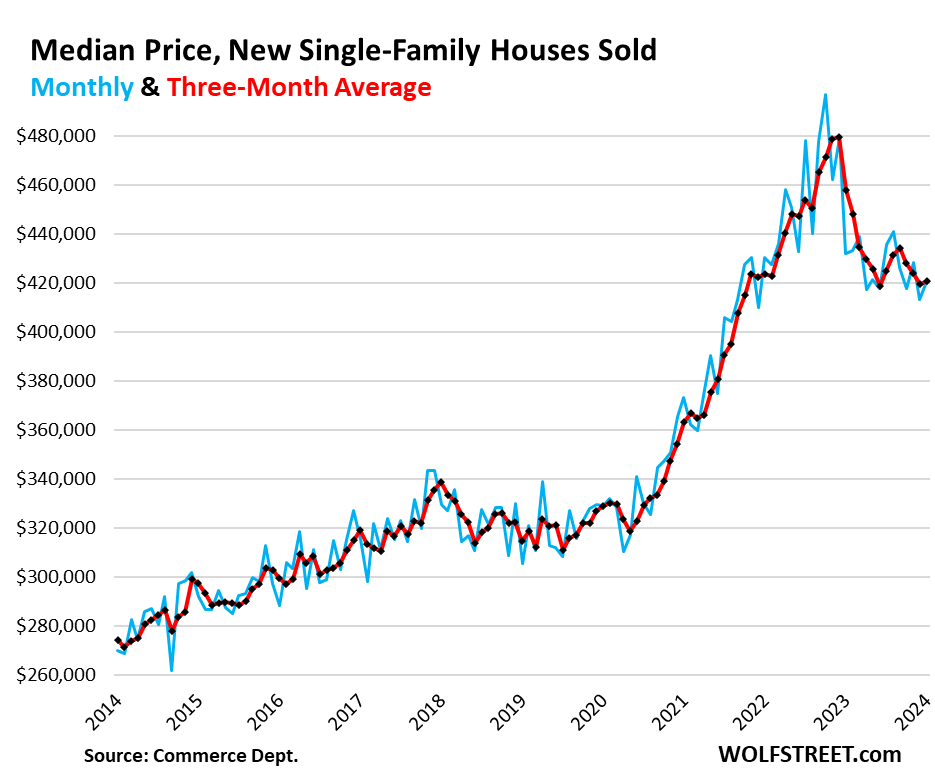

The median price of new single-family houses that were sold in January ticked up from December, but was down by 2.6% from a year ago and by 15.3% from the peak in October 2022 (blue line). At $420,700, the median price was back where it had first been in October 2021, according to data from the Census Bureau today

The three-month moving average, which irons out some of the monthly ups and downs, was essentially unchanged from the prior month, and at $420,700, was down 12.3% from its peak in December 2022 (red).

But mortgage-rate buydowns and incentives are not included in the price declines. These are contract prices and do not include the large and sometimes unexpected costs of mortgage-rate buydowns that homebuilders now use massively to maintain their sales volume in this market, where sales of existing homes have plunged because prices are too high at these 7%-plus mortgage rates.

Mortgage-rate buydowns lower the monthly payment – and also lower the profit margins of homebuilders – but do not lower the contract price of the house.

The price declines also don’t include other incentives that homebuilders throw in to make deals, such as free upgrades.

What these contract prices reflect are the lower price points that homebuilders are now targeting with smaller homes and less expensive amenities.

Price difference between new and used houses.

Homebuilders are now aggressively competing with homeowners, and the largest homebuilders have said so in their earnings calls. And price points between new and resale single-family houses have moved close together. D.R. Horton, the largest homebuilder in the US, has pointed out that with mortgage-rate buydowns, the monthly payments on a new house is lower than the monthly payment on an equivalent resales house.

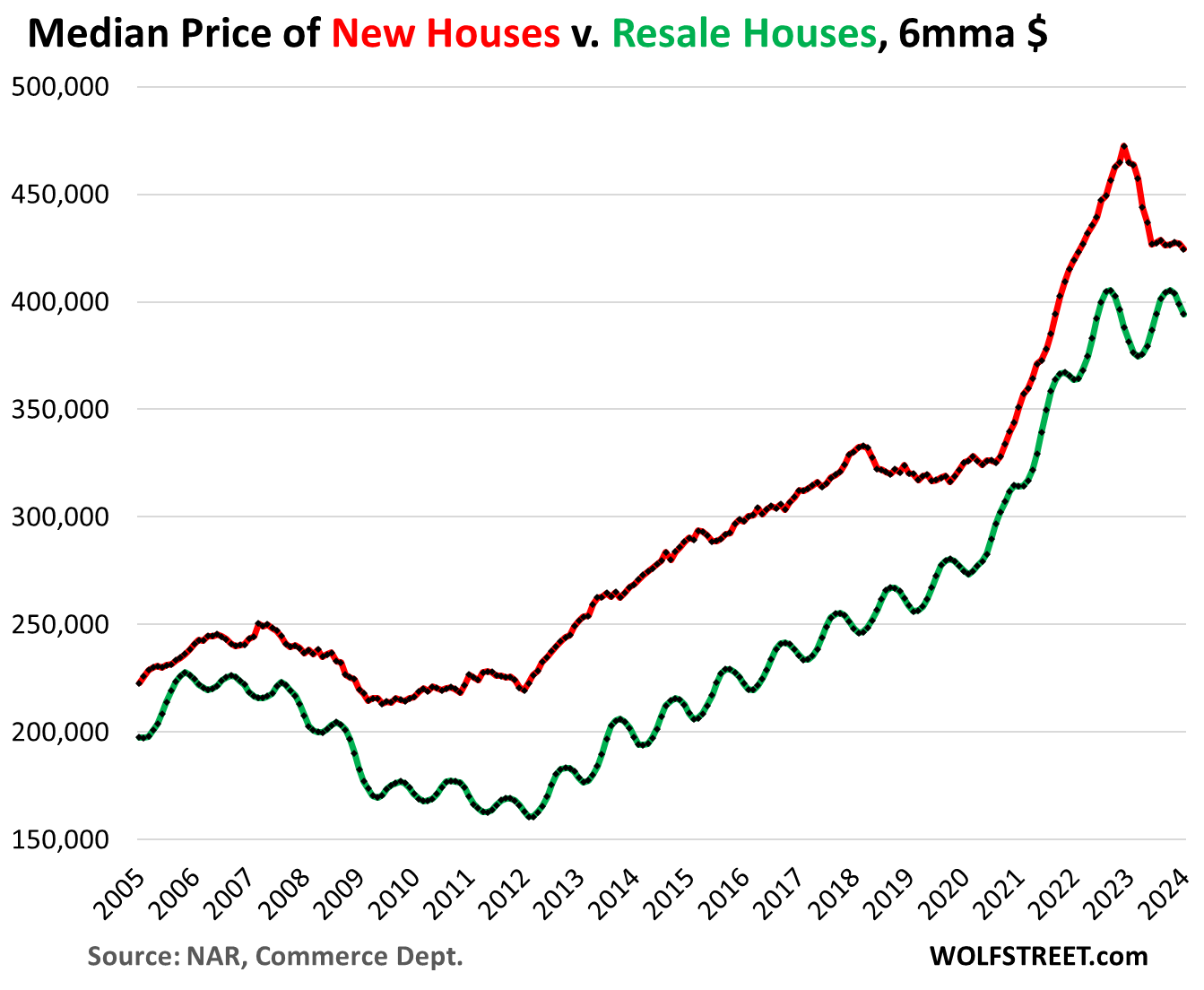

The difference in dollar terms. The national median price of new single-family houses has fallen faster and further than the national median price of existing single-family houses (via the National Association of Realtors).

But there are some seasonal differences: The median price of existing homes has a distinct seasonal high in June and a low in January, while prices of new houses are much less seasonal, but are very volatile month to month. So we look at the 6-month moving average of new and used house prices, which irons out some of the seasonal differences:

The difference in percentage terms. The median price of new houses (6-month moving average), is now only 7.1% higher than the median price of existing houses (6-month moving average).

Now add the mortgage-rate buydowns into the mix – and it becomes clear how relatively unattractive resale houses have become at their current prices, given the competition from new houses.

The unusual narrowing price difference also happened during the early phases of the Housing Bust, so in 2005 and 2006. Prices of used homes eventually fell hard enough and far enough in the later years of the Housing Bust to make them competitive with new houses again.

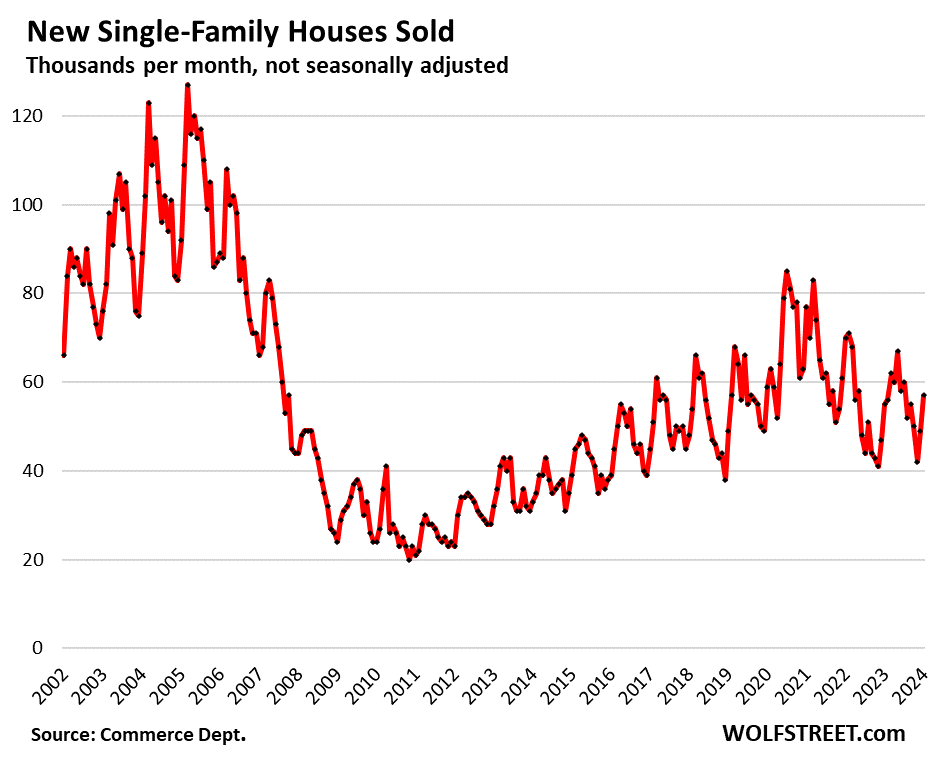

So sales of new houses have held up.

In January, 57,000 new houses were sold, not seasonally adjusted, up by 3.6% from a year ago, and down by only 3% from January 2019. By comparison, sales of existing homes have plunged by 20% from January 2019.

This documents the effectiveness of the strategy to offer houses at lower price points and to offer mortgage-rate buydowns though they squeeze profit margins of homebuilders. But they’re in the business of building homes, and they cannot just try to wait out this market, as many potential home sellers are trying to do.

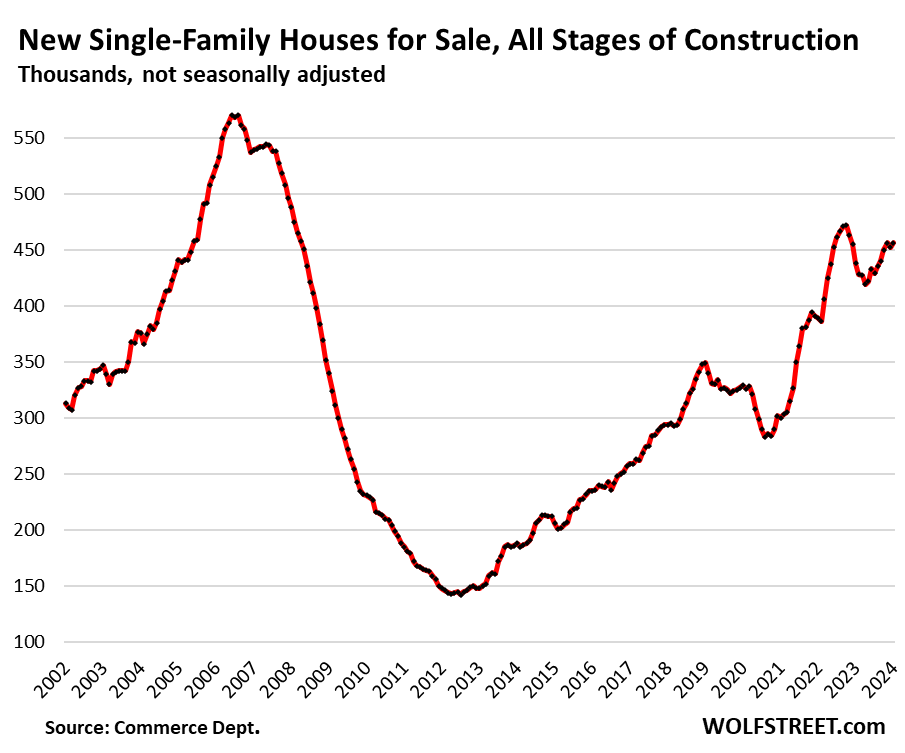

Inventory for sale of new houses at all stages of construction has stabilized at very high levels. In January, it ticked up to 456,000 houses, same as in November, but up a little from December (not seasonally adjusted).

This inventory translates into 8.0 months’ supply at the January level of sales, which is more than ample supply:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Companies competing with homeowners on price is an excellent trend. Lowering the contract price is of course a last resort, because the first major player to do this would cause immense ripple effects throughout the entire market, spelling certain death to the 2020s residential real estate ponzi.

There’s a certain cliff where if house values drop X%, then all the HELOC, short-term rental, and cash out refi schemes based on inflated values collapse – and then the house values subsequently drop an additional 2X%. It’s still amazing that this hasn’t happened yet – there’s so much “this too shall pass.”

“…immense ripple effects throughout the market…”

Yes, and the first domino to fall? The condo market, because the number of baby boomers who are going to downsize from a home to a glorified apartment is static, as most of them have already gone if they’re going to go.

been in my home since 2002 – just small 2,700 SF

wife said no way we’re moving unless we get bigger

re: “It’s still amazing that this hasn’t happened yet”

M*Vt = P*T It’s a tautology.

Howdy Folks. Need a home in this market? Purchase a starter home, less of a home than you can afford. A home that needs updates. live in it while you fix it up. If you can afford a better home then do that. The Freedom to choose is what we should be about. If you cannot nail straight purchase a nail gun but build your dreams however you see fit….. If you think it cannot be done? My 2 sons are doing it on their own. Never did help PA when young so PA just sits back and watches now too. They did fantastic with 40 to 50 % equity within 6 to 7 years…….

Need a home .. just rent for few years.

All these prices are not really sustainable if you think about it

But who am I to judge the prices as I have been wrong many times ..

Howdy Jon. I think they have printed over the bubbles as they deflate. We could be hissing for a decade ?? or more?

Gimmicks that make it appear that house prices are not crashing might go for another year max and will probably stop when there is a credit crunch as cre debt rollovers cause many regional banks to fail or stop lending all together. The US housing market has never seen a more perfect storm.

During the earnings call, Invitation Homes, the largest SFR landlord in the US (80k houses), said that renters save $1,200 a month by renting a nice house v buying an equivalent existing house (mortgage interest, taxes, and insurance).

They’re going after “renters of choice” — people who are making this arbitrage. The average household income of Invitation Homes tenants is $150,000. These are people who COULD buy but chose not to. This is the rental market that everyone is now going after because that’s where the money is.

Build to rent is the biggest thing in the housing industry, where entire neighborhoods are built — including onsite leasing and maintenance offices — to cater to these renters of choice who are consciously making this arbitrage.

I’ll also note that, when I was looking around on Zillow and Realtor, that Invitation Homes was rapidly dropping their rent prices, while other landlords were keeping them at 2022 bubble prices, all while letting them languish empty on the market.

I will say though that Invitation Homes, at least in my market (South Florida) does some boneheaded things. They don’t include a washer/dryer, only “Washer/Dryer hookups,” so tenants have to buy one and have it installed.

Given that you can get a new set for $1,000, even if you assume the tenants are hard on them and you only get two years out of them, they could include it and only raise the rent by $40 a month.

I know several people who said that this was a dealbreaker to them, as they don’t want to deal with it.

@Wolf: I find the statement by Invitation Homes dubious and self-serving – they are just trying to entice tenants by saying that they save $1,200 a month…but come lease renewal time, they would sock their tenants with a stiff increase. Not many tenants would up and move every year – it would be pretty painful and inconvenient to do so.

So, as a short-term strategy, being “renters by choice” would work. But IMO not beyond 2-3 years. Hopefully, there would be some semblance of sanity in the housing market by that time and the “renters by choice” would be able to find a home of their own.

@Einhal: Not providing washer/dryer makes absolute sense. It is in the interest of Invitation Homes and other SFR companies to make a move-out as inconvenient as possible. They would like to keep their tenants captive and milk them as long as they possibly can.

Einhal:

Moving a dryer seems harder than it is. My buddy and I (2 guys in our fifties) moved one with no hassle last summer in 105 degree Texas heat. We were shocked by how easily we were able to move it up and down stairs using a U-Haul appliance dolly.

That said, don’t even think about moving a front-load washer…

Sean, I don’t agree. Every other landlord here provides them, so what Invitation Homes is doing doesn’t lock tenants in. It only keeps potential tenants out.

Kramartini, maybe but, why? No one brings their own refrigerator, oven, or hot water heater. What’s the difference?

Seems true to me. Here in CT, there are “luxury” apartment complexes going up everywhere.

Install coin-operated Speed Queen double-stacked washer and driers and charge the neighbors to use them.

I personally enjoy doing home improvement projects and am reasonably good at it. I won’t hire anyone to do anything on my house and it has nothing to do with the price. I find the quality of the work to be mediocre on average. My best friend can fit all the tools he owns in his glove box and can’t wait to get his kids out of the house so that he can downsize to a rental or town house or condo. Even having to pick up the phone and call a contractor for any type of home repair is very stressful to him. He dreads even mulching his flower beds. Talks about it for weeks ahead of time and how it will ruin his weekend. I mulch mine on Saturday morning before breakfast and often do a “Real” project that day. There actually are people who find homeownership stressful and have judged it to not be worth the effort to them personally.

If his 2 sons can do it, anyone can. Bootstraps, Jon.

Howdy SOL lots of folks rehab houses for profit. Just not as easy as the tv shows make it out to be.

It’s not just ‘not as easy’, it’s dang near impossible now. The profits are gone from flipping, as cash flush investors have already flipped everything left to flip. It’s a very competitive market, and sweat equity doesn’t fix anything, unless you value your time less than a construction workers, plus a little extra since you will be much slower.

Howdy Blake The work is not worth it to most people. Especially those that can make more money doing other things. People brought on with cell phones and video games will probably never be able to do it.

Many “experts” opining n the media on single-family home prices are doing so with their spreadsheets and sales analysis from their ivory tower cubicles and don’t know anything about what it costs to build a house. Somehow they think if demand is down and/or interest rates then builders must necessarily build & sell houses for less.

Go to Lowes, Home Depot, and any building supply store that sells to contractors. Those prices have inflated beyond that of other product categories …. and they certainly aren’t going down.

Then try to hire a mason, framing carpenter, plumber, electrician, etc We have a labor shortage in the building trades in this country. And good luck to you.

My point is …. there is a floor beneath which a builder cannot profitably build/sell a home. And the floor on prices for resale homes will always be a bit below that price floor for new construction, but not that far below.

I’m in East TN (a supposedly modestly priced market) and I don’t know any builder here that will or even can build for less than $200 sq ft.

I see the current market ups & downs as transitory.

Cost of materials has doubled on almost everything and tripled and not a few things … as has the cost of skilled labor (if you can find it! We have a labor shortage in the construction trades – thank God for the illegal aliens, is all I can say.)

There’s a floor price at which a builder cannot profitably build a new house … regardless of what the market or interest rates are doing.

(and builders are affected by interest rates as well — the higher rates are, the more it cost them to build.

Bubbles tend to inflate equity. You could sit around the last 7 years and soak it in….It can also go the other way where you bought in 2006 and didn’t break even till 2020. There is no free lunch

Howdy Minutes. Recessions dont seem to hurt anymore. Kicking the can continues to work????

I bought my first home in 04. Just a few years in we were backwards. 2015 we sold that piece of … for a loss.

Howdy SOL New or used homes require maintenance. All the homes I purchased were dependent on the price I paid for it. If I overpaid no amount of work can over come that. Still simple math, purchase price and how much can you sell it for.

“Buyers’ strike” is a term that means FMV (what willing, informed buyer would pay a willing seller, without compulsion) already plunged! We are just seeing stubborn sellers taking losses in rental value to avoid recognizing the FMV losses! Of course, who would not prefer a new, modern house over an equivalent used one, so what?

I would prefer a well-built older home to a slap-dashed together new home many of the national builders are building nowadays (with a lot of inexperienced labor)

Give me copper plumbing … not Pex, please.

I agree Minutes, but I believe those that are buying now are going to enjoy another leg up in the housing market. The housing market is currently frozen, but once it unfreezes the winners will end up being the sellers in waiting and current buyers. I think once the next leg up is over, those that have been waiting for a large crash in housing will finally get their wish.

Howdy beatleme. Rehabbers are out there rehabbing. Stupid is always out there and rehabbers rehab because of Stupid. When No money down loans were the thing, there was plenty of Stupid and I made $$$…..

Homes are a durable good, and as such need constant updates and maintenance regardless. Interest rate repression and helicopter money have more to do with asset prices than any hard work or intrinsic value. Asset bubbles tend to swing both ways and take out all of the speculators in “unexpected” volatility.

“Need a home in this market? Purchase a starter home, less of a home than you can afford”

Are you sitting down? No, seriously, are you sitting down?

OK, check this out: “starter” homes are unaffordable in this market too.

Howdy Pea Sea. For the average person you could be correct. Some of US rehabbed houses from 1980 to present. Takes a lot of work and learning.

No doubt that it did, and does.

The difference–the huge difference–between then and now is that there was such a thing as a cheap fixer back then. Now it’s all eye-bleedingly expensive, with the fixers and “starter” houses only slightly less expensive than the stuff you would actually want to move in to.

Howdy Pea Sea. The competition was always fierce and very competitive. But there was always $ to be made over other peoples mistakes.

That is eye wateringly accurate here on the Island. Average median price for Nassau County? $698,000.

An original, non expanded cape with oil heat and no garage, listed for 699. For 750 starts you into reasonable homes you can get into and start renovating one room at a time. New construction is 1.2-1.5. Property and material costs at crazy highs these builders are making out with 2-300k profit of that (400k for the land and prolly close to 5-600 to build the home). But I see those close to 7 figure and homes sitting for weeks if not months on the market as the prices slowly get reduced.

Since it’s been a while, I’m going to insert a classic reminder:

You buy a house, not a home. A house is physical content.

“Home” is something you add to the house, emotional content in particular.

Some folks would say that “home” isn’t even a place, it’s people, family.

Classic rule of sales: sell the emotion, not the physical item.

“House” is a rather sterile term, similar to “building.” “Home” evokes emotions you’d like to have in the future, but currently don’t.

Since so many people are lacking in the realm of healthy relationships with others, it’s easy to sell the dream of having better relationships. All you need to achieve this is to take on $500K of debt, and happiness is yours to possess.

It’s also a status thing. “Owning a home” puts you above the other people in your social circle that you are trying to one-up. It’s a ridiculous flex of “adulting.”

Just from personal experience, living in a big fancy house without the people I love also present is kind of lame. But realtors will never tell you to simply nurture good relationships with people, regardless of owning a building. Instead, you *must* to own a home to enjoy the happiness that all other homeowners have achieved!

Howdy DFB You also forgot to mention Foreclosures and short sales are possibilities too. Right O DFB. Thanks

Exactly how I did it then ladder up,then get old and realize things aren’t really that important

Howdy Flea Sorry you feel that way. This almost lifelong entrepreneur reached retirement and older age, and realized how important it was.

Howdy Folks My one son told me my numbers were wrong. His equity is 50% in 5 years. Sorry and not kiddin. I checked to see if I had exaggerated….

I have few home in so cal but I don’t keep tab of equity generally.

But I do understand some people do keep tab on daily basis.

Howdy Folks My son also reminded me the lower mortgaged amount, added up too. Of course the 3 % saved is not 7% saved. But to squirrels and off spring, saving is saving. Its what squirrels do.

So just doing some thinking out loud here…

Homebuilding and construction are one of the industries with a dozen gigantic players and thousands of smaller ones…

If the cost of materials, land and labor are the same, mostly, between all of these players…

But only the big dogs have access and ability to “buy down” rates, even though it is painful to them…

If this continues for a long time, do the smaller guys just get screwed thanks to yet again more intervention by big gov, big banks, etc ?

The smaller guys will probably become subcontractors for the big guys. Or they’ll scale down and become owner-operators that occasionally hire day labor.

Screwed is a strong word, there are still lots of opportunities in construction. But the days of bootstrapping a new construction business are winding down.

Some may fail, but there are always going to people who would never build with a national builder due to the stigma of lower quality or because large builders are not available in their area. Some of these people may be paying cash, perhaps from the proceeds of a sold home, which negates the incentive of buying down the interest rate. I also doubt that many smaller builders were ever trying to compete directly with national builders.

“The unusual narrowing price difference also happened during the early phases of the Housing Bust.”

That doesn’t really connect 2005/2006 to today’s market. Pre-GFC price growth was driven by nominal buying power artificially boosted by bad debt, not inflation. COVID price growth was driven by actual nominal buying power boosted by money printing. As several astute WS articles have pointed out, consumer debt is in excellent shape (also a nominal effect driven by money printing). So, it doesn’t seem likely that the American consumer is in for a debt crisis any time soon.

Money creation peaked in 2022, then QT took a little of it out of the system, and the money supply has settled at about 1.3 times its pre-pandemic size. It’s been effectively flat for a while and now every measure shows it changing course and rising again. We’re now creating at least as much new money as QT is removing. House prices also peaked in 2022, and have settled around 1.3 times their pre-pandemic level. This just isn’t that complex… If we create money faster than we grow productivity, asset prices go up at a similar pace. Interest rates and industry-specific reactions can make those price increases uneven, but in agreggate, the average American’s life is nominally about 1.3 times higher than it was a few years ago.

I think this is fairly well reasoned. However, the one component that seems to be unaccounted for is the relationship between house prices and mortgage rates.

While asset prices may have kept pace with money growth (not sure if this is universally true), affordability, as measured by mortgage payments made on homes with 20% down payment, has grown by significantly more.

The evidence of this distortion can be seen by the fact that many people would face a real economic shock if that had to buy their own home in today’s market. If a moderately upscale home would’ve been 550k in 2019, it would’ve carried a P+I payment of ~$2,100/mo. If the same home costs 715k (using your 1.3x multiplier), rising interest would push that same house’s payment up to $3,650.

That’s a growth of 74% in P+I. Well in excess of the growth in money supply.

There are lots of homes being bought with cash (or very high down payments) so it’s not set by the 20% down financed folks. When rates are high, I think we get more price discovery as it gets rid of lots of buyers using leverage and artificially bidding up prices since they’re not really paying the total purchase price. This was evident in the 2000s when lending practices were loose with people “buying” homes and spending little to nothing to get in.

A lot of the “paid in cash” folks just traded one overpriced asset for another and probably aren’t the ones looking for “price discovery”

Newly printed money always finds its way into prices. Not neccesarily evenly, but it gets out there one way or another, especially in asset prices. From 1970 to 1980, median house prices tripled despite 2 recessions and rate hikes. Even from 1980 to 1983, the median price went from $63,700 to $71,600 (12.5% over 3 years) in the midst of double-digit nosebleed rates and brutal double dip recessions. House prices went on to double through the high-interest 1980s.

Interest rates have effects on lending for sure, but money printing imparts all kinds of other effects that that counteract rate hikes. House prices are way up, but burger flippers often make $15-$20/hr now. Institutions are still flush with cash, and they compete with independant buyers or just buy their own build-to-rent developments. Investors are flush with cash. Many independant buyers are swimming in cash. Older folks who have accumulated some wealth are collecting interest income on that money.

Sure, house sales have slowed way down from the crazy peak. But 234,000 existing homes were sold and 57,000 new homes were sold last month. So folks are still buying houses at today’s prices despite rate hikes, and QT, and whatever else the Fed throws at them. And they’re buying houses despite our perception of affordability.

re: “COVID price growth was driven by actual nominal buying power boosted by money printing.”

The GFC was accurately predicted in May 1980 by Dr. Leland J. Pritchard, Ph.D. Economics, Chicago 1933, M.S. Statistics, Phi Beta Kappa.

The Case-Shiller home price index mirrored monetary flows, the volume and velocity of money, the proxy for inflation.

The problem is that in a lot of markets the new houses are on the far fringes and the used houses are 10-15 minutes from your job, kid’s school, friends, etc. An extra 30+ minutes of driving every day means ~75-80 extra hours in your car every year. And the cost of gas, etc. That’s got to be worth something.

Where else would they be built besides in green fields on the edge of town? Infill is normally the domain of multi family

Wonder if the build quality and wages for const workers are going down as well? I once worked as a carpenter for a new home builder and wondered at the time how the company stayed in business with all their shortcuts? One day everything the same, the very next day everything removed from the jobsite. I was the only one who got their last pay cheque as I had a connection to the bank who had their name on the bouncing cheques. They kept phoning on my behalf for account updates and magically a number that would cover my cheque appeared, and was promptly frozen for me to come in and cash out. For several months prior the onsite engineer was glossing over concrete issues and the work quality was under pressure by the company owner. This was in Alberta during the late 70s with the inflation run colliding with an ongoing building boom. Kind of like these days.

Builders can offer a variety of incentives and are includng interest rate buydowns, upgrades, a car or golf cart in the garage, etc. plus the fact that the home is new and comes with a warranty.

Home prices aren’t that out of step with CPI that there will necessarily be a significant correction. All bets are off in a recession, but without that, things can just go more or less sideways for awhile. Resale home prices will have some downward pressure, but homebuilders aren’t in the business of losing money.

CPI isn’t the right metric. The appropriate comparison is home prices to rental prices. right now, it’s a MUCH better deal to rent.

Eventually, you have to have equilibrium, which means either rent has to increase significantly or home prices have to drop.

I’m betting on the latter.

Re “Eventually, you have to have equilibrium, which means either rent has to increase significantly or home prices have to drop.”

Don’t be such an optimist – what if rent drops, and house prices drop even more!

I agree with you that renting is currently a better deal, but rents continue to go up significantly. I guess we will see.

ChS,

“Home prices aren’t that out of step with CPI”

LOL. CPI Rose by 31.6% over the past 10 years, while the median price of existing homes rose by 97% — home prices rose three times faster than CPI and nearly doubled!!!

Depends on your time frame, 40 years is a little different. How long did it take to regain prices from the GFC? Taking a 10 year time frame can show a very different story depending on when you start it.

So are you saying it’s a big asset bubble compared to other asset bubbles?

They have just announced an “affordable housing” project near me. Their metric of “affordable” is between $380k – $450k for a tiny home on a postage stamp lot. Those are not “affordable” by any stretch. You used to be able to buy a beautiful house on 5 acres for that just 6 years ago. This bubble is obscene.

I’m starting to think the bubble isn’t a bubble. It’s a permanent change to the way things are priced. The only thing that will make this better is years and years of wage gains.

and if your employer doesn’t play along… you’re SOL

Wage gains require increased productivity in order for houses to become more affordable.

It could be easier to pay for a house if the cost of construction weren’t bloated by poor policies and regulatory overheads.

More broadly across the economy, policies that reduce productive output by “average” workers, or make housing construction more expensive, implicitly make houses less affordable to those workers.

Put a different way, if it takes, say, 1000 hours of skilled labor to build a house, it will take a commensurate number of hours of work to be able to afford a house.

@Depth Charge

Our city council approved a massive, sprawling development on the outskirts of town (smack in the middle of the wildlife urban interface near Paradise Ca) and tried to ram it through with the affordable housing bait. Turns out there isn’t any affordable housing guaranteed, even by the absurd arbitrary definition of affordable. (We owe that info to the lone millennial member of the city council. I point that out because there’s far too much bashing of the young’uns here imo.)

There was such an outcry that council was forced to go to a referendum. We’re voting on it March 5th, along with our choice for POTUS.

@Depth Charge, what is the area where nice homes on 5 acres were under $450K in 2019? I was just talking to a 30 something cousin on the phone and looked up his home after reading this post. In 2019 he bought a <2,000sf 3×2 home in SF not far from Balboa HS on a 2,500sf (~1/17th of an acre) lot for $1.9mm and Redfin says it is worth $1.8mm today. My cousin is an attorney married an attorney (they met at Yale Law School and have never had kids) and it is still crazy what homes in the "poor" part of SF (what we called "the hood" in the 80's are still selling for even after the recent "cooling" of the market.

I can’t imagine DC was speaking about San Francisco lol.

But I will add that in 2019 when I was looking to buy in Norcal after being priced out of San Mateo I saw a listing for a decent little ranch house on two acres a few miles east of Orland Ca for 300k. Sorry I passed.

@Bongo I just looked and the 2,800sf home my aunt and uncle bought in San Mateo (Baywood area just west of SM Park) in 1971 for $56K and Redfin says it is now worth $3.2mm. Like my parents my aunt and uncle didn’t go to college and bought homes on the Peninsula in their 20’s).

“what is the area where nice homes on 5 acres were under $450K in 2019?”

Flyover country.

(there is more to the USA than just the east & west coasts, you know)

At least those come with a lot. All the new builds in my area are condos or townhomes.

re: “This bubble is obscene.”

It will foster more crime.

Yeah, it’s bizarre. The NAR has tried (and succeeded?) to push the envelope on the popular perception of housing affordability. Put it down to Housing Propaganda.

CPI from 2010 is something like 31% but home construction materials are up 50% to 70% during this time according to some reports I read at NAHB site.

Land prices also are up about 50% to 80% to depending upon the type land.

A recession or credit event or an buildout oversupply can drop the price of houses below the cost to build short term over a few years but eventually, prices will rise to meet input costs?

It would be useful to find a measure that compares construction quality of used homes vs. construction quality of new homes, and somehow adjust the price accordingly. It would probably have to be a local measure, not national or state or even city. It sounds impossible, but I think about it.

This is somewhat reflected in the price difference between new and used homes, but I would like a more direct measure. Maintenance costs over say the past fifteen years might do this, but they cannot be calculated for new homes. I can see why Wolf talks a lot about the “renters of choice” market. Buying a house is a pain in the you know where.

There are always people that resist modern technologies, no matter what. There are people here who think that their 1988 Buick was the best car ever built, LOL. Everything was better back then, even if it was the biggest POS.

The teardowns and near-teardowns you see that were built some decades ago were built with the old materials and methods.

Insulation is a biggie now with energy prices as high as they are. Insulation back then was atrocious. That’s just one example.

I had a window engineer in my home a few years back to replace some old windows in my den. According to his documented energy efficiency studies, the windows in these monster homes just build on my block are the bare bones cheapest pieces of crap the builders could come up with to install in their brand new homes. They failed every energy efficiency test. The dude had no reason to lie. NO, new is NOT always better. The cost to replace all the windows in these monster homes with energy efficient windows was quoted at $35K. And that was 15 years ago. Price now is more like 50K.

Don’t confuse quality with age. There is new junk and new quality, there is old junk and old quality. New quality >> old quality.

That guy was lying through his teeth to make a sale? Even the cheapest energy efficient windows today are more efficient than the single-pane old crap from decades ago. Get real.

Wolf. Somewhat disagree with you here, I am bit of window junkie. Some of the new vinyl junk that is being passed as energy efficient is anything but. Even historic wooden single pane windows can be better if paired with good quality storm windows (which obviously adds complexity and impairs usability).

And a good quality 25 years old windows can easily surpass the new junk.

That being said, U.S. windows are generally still subpar and cannot compare to even average Euro tilt-and-turn windows. You are German, you should know something about that.

How long until the double or triple pane seals blow and fog up?

Codedude – the windows in modern German masonry houses were heavy, intricate, well insulated double pane units when I was an electrical apprentice there. Ingenious mechanical construction as befits a northern European product. Very different than the US at the time. I would think that a stickbuilt wood framed house here wouldn’t support the cantilevered weight over time without augmented framing. It would be nice, because those windows are excellent. I’ve restored plenty of double hung sash windows in Victorian and prairie-style houses in Texas back in the day, and they look and feel great, but they’re a leaky maintenance chore forever and bleed energy.

I ask a ton of questions about everything and piss people off…one time shopping for windows, I was making them tell me about every single model. They skipped one that sounded fancy, so I wondered if they thought I was too poor to buy it or something, asked about it. They told me I don’t want that – it is the “contractor special”, the windows you talked about.

…I love old houses! Gotta be before the 30s, though. And I love my old windows paired with storm windows (love historic windows). My Manual J calculations for my old house confirmed that old windows paired with storm are very close to the best new windows (believe it was 5k btu/hr difference for the whole house with lots of windows). Not perfect, but not bad.

I’ve been managing property for over 40 years and I can say that most property built in the 1960’s by guys that fought in WWII and trained as apprentices under master carpenters, plumbers and electricians have less problems overall today than the stuff built in the 90’s by illegal aliens the contractor picked up in front of Home Depot. P.S. the quality of most older postwar homes in the US homes is like the quality of an 80’s Mercedes, while the quality of newer tact homes is like the quality of an 80’s Buick (I have a friend with a MBZ 300D with over 400K miles that looks new the “Skyhawk” with the 80hp 4cyl engine may have been the worst car Buick ever made)…

Your friend with the 300D is driving a horrible, 120-hp, 5-cylinder, slow, polluting death-trap compared to a modern Mercedes-Benz. If that is your definition of higher “quality,” then fine. Then we disagree on what the word “quality” means. Which explains your comment about these older buildings.

@Wolf I agree with you that an 80’s Mercedes diesel is a “horrible, 120-hp, 5-cylinder, slow, polluting death-trap” but it was a “well made” “high quality” “horrible, 120-hp, 5-cylinder, slow, polluting death-trap”. If you slam the door (or glove box) of a well maintained 80’s MBZ with 300K it will feel more solid than most cars with 100K (and probably have less problems driving 300K miles than a lesser quality car will have driving 100K miles).

The 100 year old brick bungalows in Berwyn Illinois will outlast anything built in built in Bolingbrook since then.

That a house hasn’t collapsed yet isn’t a sign of quality. It’s the total minimum. Quality is a lot more than “hasn’t collapse yet,” or “still runs” (vehicle) or whatever.

My definition of quality is, “requires less maintenance for similar core functionality.” I’d rather have a product with 80% funtionality I use and 20% bells and whistles I don’t use, rather than a product with 40% funtionality I use and 60% bells and whistles I don’t use. Cramming more unused stuff into a product doesn’t make it better; It just makes it more likely to break.

Defining the quality of anything is a deceptively over-general premise. Quality of what vs what as perceived by whom & measured how? The durability of the materials? The flow & exposure of the overall layout? The imagination of the architect? The reception of an audience?

Quality is not a linear concern: the ultimate iteration of anything is not always the best version of that thing — be it a take in a movie or home construction/methods. We learn, establish protocols, synthesize and then forget; then we relearn, and the quality of whatever end-product in question often follows that same sawtooth pattern. Google Roman concrete.

Id love me one of those. I’m a big fan of older diesels, they look really nice when all restored on a newer set of AMGs.

Insulation is one good example Wolf, but there are many other serious structural improvements to SFR in FL and CA especially in the decades since Andrew, and the Loma Prieta EQ opened a TON of eyes in the construction industry and the insurance industry backing up their products.

Anyone planning on purchasing an older house in FL should keep in mind that prior to the 1994 code being actually adopted by municipalities, there was very little enforcement of codes, etc., as was SO clearly demonstrated by Andrew.

And the major problem was the vast increase of ”piece work” approximately early 1970s, when it became much more economical to pay a bribe to the inspector rather than install the proper rebar, connectors, even fasteners; one example is some of the plywood blown off roofs in Homestead only had the couple of nails needed to ”tack” the piece and were never nailed off at all.

Most houses older than 1970 in FL and CA and OR were constructed by hand by carpenters who knew the difference when a nail did not hit the stud or rafter or joist, but still did not conform to current understanding of forces of ‘canes and EQs…

The thing that amazes me the most is that the houses that we were constructing the building only for $12.50/SF in Port Royal subdivision in Naples in early ’60s are now selling for up to $2,000.00/SF although the latter includes the lot, etc.,

I would like to add that CA has one of the most stringent building and energy efficiency standards in the country. Every new code cycle is usually updated with even stricter requirements. All the building materials used in a construction project is to be reviewed and stamped by licensed engineers. I seriously doubt that a licensed professional engineer would approve non-compliant materials and risk losing his/her license as well as reputation.

I may add that not only are the windows in these new McMansions cheap crap, but the whole house is as well. They look nice and have all the amenities but when you look under the hood they are nothing but glorified modular homes slapped up for the cheapest price possible. A number of them near me have had major repairs right after they were built with dozens of trucks lined up, for up to 6 months after move-in date, to correct major defects.

Your car is a “modular car slapped up for the cheapest price possible,” no matter which automakers makes it, LOL. Do you expect a $100,000 vehicle to be handmade by US craftsmen? No, it’s slapped together in an assembly plant in Mexico, from components made in China and elsewhere, even if it has the Audi symbol in the grill. And it’s a gazillion times better than that POS from 20 years ago or from 100 years ago. Same with buildings. Us old people just always think that this old shit was better than today’s stuff?

A good modular home company did not build crap,remembering every two pieces put together were both nailed and glued

“No, it’s slapped together in an assembly plant in Mexico, from components made in China and elsewhere”

That sounds like my 2005 Nissan Sentra. It had so many repairs I could no longer afford the cost of operations. I wouldn’t sell it to even my worst enemy. I wound up giving it away in 2018 to a Veterans charity.

My first experience in construction was as a gofer for a lead-and-oakum plumber. There have been a number of new materials used in residential construction over the last 60 years, some have been improvements, some have not. Polybutylene pipe and aluminum wire were problematic. Generally speaking, lumber quality has declined. Time will tell with what has been adopted in the last 20 years.

A professor of mine in the ’80s was involved in a class action lawsuit involving the use of copper plumbing in a housing development. Normally, copper would be good for decades, but the local water had enough dissolved carbon dioxide to tear up the pipes in just a few years.

The copper pipe likely was of lesser quality, thinner, and had iron contamination… which rusted and created pinholes in the copper.

@El Katz

It wasn’t a matter of the quality of the copper pipe. I saw some of the samples that were analyzed. Dissolved carbon dioxide lowers the pH of water. In my own experience, I have watched the pH of a beaker ultrapure water drop from 7 to 4 while sitting on a lab bench.

You’ll never convince me Pex is better than copper …. except it can be installed by the unskilled and it’s cheaper for the builder.

Feels like the market could be “stuck” for some time. Even if ample supply makes it to the market that may very well go to cash buyers who rent it out at high costs. Ideally it would be nice to have significant amounts of affordable housing here which people could have the option to own, or of course, reasonable as well if renting is the choice. Some would argue the natural dynamics of “free markets” would have all this work out but of course if that were indeed true it only works out for some and rent controls wouldn’t be necessary. Would be really nice if an owner or renter could perhaps drop 15-20% of their earnings on rent versus more than 50% of renters paying over 30% of earning, not of course paying serious bucks for utilities.

IF we are so lucky as to get another rate hike, I think that could reasonably cause some acknowledgement among “stuck” current homeowners, that 3% isn’t around the corner again anytime soon. This *could* result in a slew of new listings of existing homes as sellers realize it ain’t getting better quickly.

Howdy Dirty Work. I hope millions and millions of people realize just how stupid it was for Govern ment to have ZIRPed.

Greenspan started the ball rolling but Bernanke was the real culprit.

Give me a new house that will not need one thing repaired in 10 years? Or Give me a used house where the flipper put patches on the dam of repairs it needs?

Hmmm what to pick?! Guess I’ll grab the yellow pages and start dialing the 100’s of tradesmen I’m going to need. lol

Yeah, a few years ago my family sold my deceased grandparents house that was in a 30 year state of neglected maintenance.

This house was hand built by some poor farmer in the 30s. Knob and tube wiring in half the house, 2*6 rough cut stud framing, no lighting in the upstairs, sledgehammer HVAC retrofit, bored well, hardwood floors that were nailed in with no tongue and groove, blue carpeting in the basement. Gray water drained into a field and not the septic tank. Etc. All garbage with a massive total overhaul needed. A teardown wouldn’t be unreasonable. House was 10 minutes outside of town on acreage. Sold for 100k or so.

Small time home flipper bought it, put a new roof on it, bought about 30 gallons of white eggshell paint and went nuts with it, threw down some rye grass seed and put up a new mailbox. Sold it for 350k in 2020 a couple months later.

I don’t know how in god’s name the building inspectors and county approved it for sale with so many code violations. Oh well, some other chumps problem I guess, I got mine, F you, pay me. The American way.

Given enough time and a way to move heavy stuff I could build a house to code from scratch by myself. I know what I’m looking at 90% of the time in residential construction. I’d be very hesitant to buy a used home. There is just such an impossibly large amount of short cuts, cheats, and issues you’d can miss or never see until you start tearing into a remodel. Same could be said for new homes, but at least there are building codes and inspections to set a minimum amount of quality. The number of HGTV watching dopes that do some springtime remodel project and have the hackjob hubby make 20 trips to Home Depot is quite off-putting to me.

The “building inspectors and county” don’t inspect anything if there’s no permit pulled. If you pull a permit, you will be forced to upgrade anything you touch to current code. Buying any home is caveat emptor. Do your due diligence and get a home inspection by someone a realtor doesn’t recommend to you.

Inspections by building departments are no guarantee of quality or that they are well built… just that they meet minimum code. Every house in many of the large developments often aren’t individually inspected. Sort of like Boeing’s self-governance.

My new house needed a lot of work the first and second year. Almost all of them do.

Howdy Folks. Not sure if HUD still sells homes. They use to have first time buyer programs and 2 week auctions for home owner occupied houses. You could even borrow the extra money for repairs. Just need to do your homework and not bid too much.

Technically they do, but because there are virtually no foreclosures, there is almost nothing for them to sell. What little they *do* list is as undesirable and overpriced as anything else on the market, but if you’re desperate enough to buy one, the “first look” program you refer to is still in place.

Howdy Pea Sea. HUD use to have its own website and then also started to list with the local MLS. The Local MLS listing would not be on the HUD website. Was a lot of fun in the olden days bidding once the first time buyer auction ended. A feeding frenzy would occur with investors… HEE HEE

Debt Free BUBBA… are you a retired contractor or a real tradesman with building skills or a RE shill or a good old boy with your moniker “Howdy Folks?”

You just always. Have to have the last word again & again& again.

Lighten up. & let other folks have a say!

Wolf you see all this Airbnbust talk on Twitter and picked up by ZH?

I guess Palm Springs CA inventory doubled in a few weeks and has some short sales on the market. Maybe the very first pockets of not new houses starting to fall…

Rising property taxes and less people traveling will put a kink in the old bottom line for airbnb owners.

I just saw a flight to LAX from Raleigh was down to $167. Round trip! Not bad. I’m def not giving some Airbnb owner $500 for one night after catching a deal like that. Would look for a $125 a night Marriott or Hilton all day.

Howdy Thewillman There were always foreclosures, and of course not like the first housing bust. They ZIRPed how many homes? Will ZIRPed homes become foreclosures? RE has been interesting during my lifetime and bet I will be amazed this time around?

Just like there are plenty of half empty B and C office buildings that are in trouble there are plenty of people that watched YouTube videos and bought multiple AirBnBs with variable rate IO loans that are in trouble (the people that furnished the places with variable rate credit card debt are in BIG trouble). Like the majority of office buildings are still low LTV with deep pocket landlords the majority of (whole home) AirBnBs are primarily “second homes” (not 100% “investment properties”) with low LTVs owned by people with deeper than average pockets so I don’t see the “AirBnBust” having a big impact in the overall housing market.

Palm Springs is a little special because they cracked down on vacation rentals.

ZeroHedge is calling for a bust, crash, crater? Say it ain’t so..

There is very little reason*** to read anything at ZH. There are better, more informative sites out there.

*** I recognize that ZH has multiple authors who post for their own reasons and there are a few (very few) who are pretty good, but they are few and far in between. For the most part ZH is filled with doom and gloomers, gold bugs, and such.

The Airbnbust people are largely delusional. However, the pandemic domestic revenge travel boom does appear to have peaked, and some–not many, but some–would-be unlicensed hotel kingpins in the Southern California desert are finding that their income wasn’t what they thought it would be, and they had probably underestimated their expenses, and they’re already trying to sell.

And it’s not just in Palm Springs, which Wolf correctly points out is an outlier due to their crackdown on STRs. In other parts of the high desert like Joshua Tree and Yucca Valley (another area that boomed insanely as an Airbnb mecca during the pandemic), you will notice a disproportionate number of SFR listings that come fully furnished with very recent, very Instagrammable furniture and decor.

But it’s just a trickle so far, not the deluge that the Airbnbust people keep calling for (and pushing their predictions for the crash back, and back, and back…every few months).

The Fed did ZIRP for 6 years, and now we see the economy is runs fine with a 5% short rate.

What was wrong with the models the Fed was using? Shouldn’t the Fed explain the bad logic and/or faulty assumptions, so same errors are not repeated. The ZIRP came in a long time before COVID entered the picture.

Failure to explain in detail where errors occurred is why many people harbor negative speculations about the Fed’s true motivations and/or competency.

If you ask me, the problem is current Fed models apparently exclude any consideration of asset inflation. The stock and RE markets were exploding upward long before COVID hit, which is a form of inflation, but the Fed didn’t recognize the negative effects of that until it hit CPI indices. The Fed stubbornly applied ZIRP as asset markets sky-rocketed.

Failure to consider asset inflation in rate setting is a HUGE flaw in the models, and the flaw still exists.

I’m pretty convinced that there would be a lot less cynicism and outright conspiratorial nonsense circulating regarding the Fed if they changed, or were forced to change, their unwritten policy of never admitting to their errors no matter how obvious and colossal.

That kind of institutional habit of what amounts to baldfaced lying is exactly what engenders cynicism and dark rumors.

I honestly believe that’s the second worst thing about the Fed.

Powell did recently admit to the error of having waited too long before tightening. But that was easy to admit to. Much harder to admit to is that QE is a huge mistake, starting in 2008, and should have never been done (instead the Fed should have dealt with it the classic way, via repos), and that interest rates were repressed far too long since 2008. Those are the biggies, and some of the Fed heads will admit to it maybe only after they’re no longer at the Fed but writing editorials or teaching.

I think the start of QE needs to be put in proper context.

When the housing market blew up, the secondary market on mortgages came to a complete stop. Mortgages were chopped up and blended so much that people had no idea what they had. They didn’t know if their securities were solid of if they were crap. Furthermore, they needed to raise money so they needed to sell securities, but literally no one knows what they are worth. So one would buy or sell because no one knew what they were buying or selling.

At the time the treasury and FED got together and came up with a plan where they were going to allow certain qualified high wealth individuals ( think Buffett) borrow from the FED at rock bottom rates to purchase secondary market mortgage products. Basically, Buffett puts up $10 billion of his own money, the FED matches it, Buffett buys MBSs from the stuck market, and they split the profits. The market gets unstuck, Buffett (and whomever else could afford to get in the game) would still have lots of skin in the game, they couldn’t just buy at any price. A good plan.

This was the plan to loosen the market. It would have worked, but the problem was it was going to take a while to set up. There are very few people on this earth who can come up with $10 billion liquid on a few days notice. Furthermore, it was going to be spun as a giveaway to the wealthy. Buffett was going to make a ton of money buying MBSs from banks and insurance companies who were desperate to unload them at rock bottom prices. It doesn’t matter that it was going to get a very important market unstuck, people were only going to see it spun as a rich giveaway.

So the FED decided that it was just quicker and easier for them to buy the stuff themselves. Hence QE started.

Obviously an absolute terrible decision in retrospect, but at the time it was the least evil choice.

The problem was compounded when the downsides of that choice did not show up right away. At the time it looked like it worked beautifully and become a permanent tool in the FED toolbox.

Later the downsides showed up, but it was too late. The FED and the economy were already addicted to their shiny new tool.

I am not trying to defend QE. It needs to be banished. However understanding how and why it came about helps a person better understand the market and not delve onto crazy conspiracies.

In Canada and especially the provinces of British Columba and Ontario new home prices are about 30 to 50 percent more expensive than a resale home. A vast difference from America. This will likely never change.

Wofl,

Could you overlay the Average Mortgage Rate on top of the “Median Price of New Houses v. Resale Houses, 6mma $” chart?

My home in northern CA. was built in 1948. The siding is 1×12 redwood. Nothing built today touches this.

You have WOOD siding in northern CA? Ever heard of wildfires? Your siding is ignitable fuel. So good luck inside your tinderbox. Yes, nothing touches it in terms of reckless stupidity of yesteryear? Maybe you also have wooden roof shingles?

Yep, my cousin is a salesman for a major home builder here in Tampabay. Sold 9 new homes last month alone. He is booming.