Credit cards are the dominant payment method, from reimbursed business travel to ecommerce and bar tabs. And some people use them to borrow.

By Wolf Richter for WOLF STREET.

Credit cards are a measure of spending, not a measure of borrowing; they’re the dominant consumer payments method in the US, having largely replaced checks and cash. They’re used to pay for anything, from bar tabs to business trips that get reimbursed – and those can be large amounts. Credit cards were used for $5.8 trillion in transactions in 2022, according to the Nilsen Report. The new data, when it comes out, will show that consumers ran over $6 trillion through their credit cards in 2023 – very little of it got stuck as interest-bearing debt; most of it was paid off by due date with no interest due. And that’s what we’re seeing here.

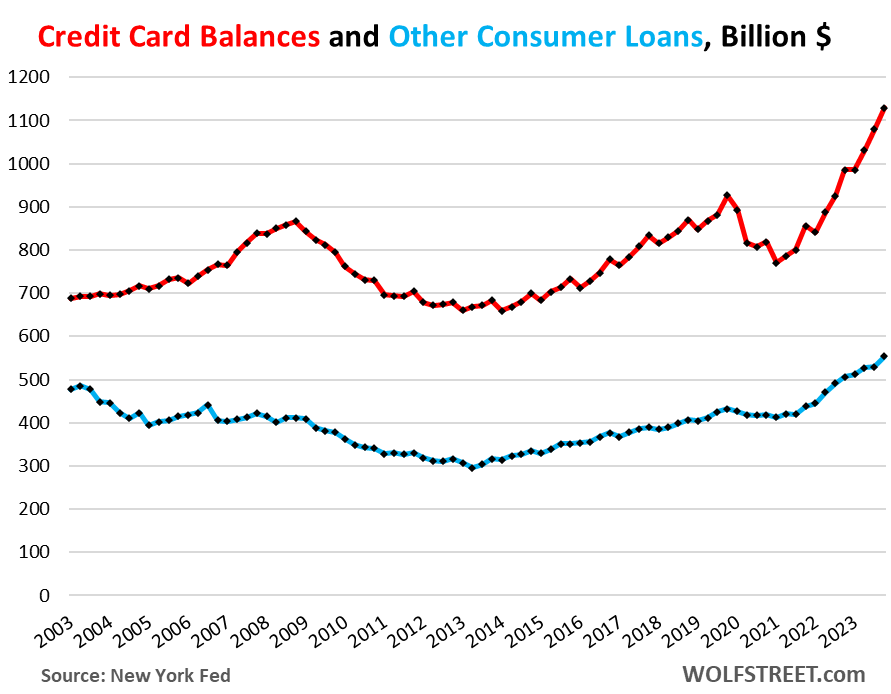

Credit card balances (red line in the chart below) – these are the statement balances before payments are made – rose by $50 billion in Q4 from Q3, to $1.13 trillion, according to the New York Fed’s Household Debt and Credit report. Year-over-year, credit card balances rose 14.3% on much higher spending on goods and services, including “revenge spending” on travels, restaurants, and entertainments – drunken sailors, we’ve come to call them lovingly and facetiously, but not so drunken because their income has risen even faster than their spending, and they were able to save a little.

“Other” consumer loans (blue line), such as personal loans, payday loans, and Buy-Now-Pay-Later (BNPL) loans, rose by $25 billion in Q4 from Q3, and by $47 billion, or 9.3% year-over-year. BNPL loans are short-term loans, subsidized by the merchant, that are interest-free for the customer; and the entire loan has to be paid off in four or five payments. They’ve been around forever; but they’ve gotten a lot more convenient. Note that balances have barely risen over the past 20 years, despite the growth of the population, income, and spending over the period:

Credit-card balances to disposable income.

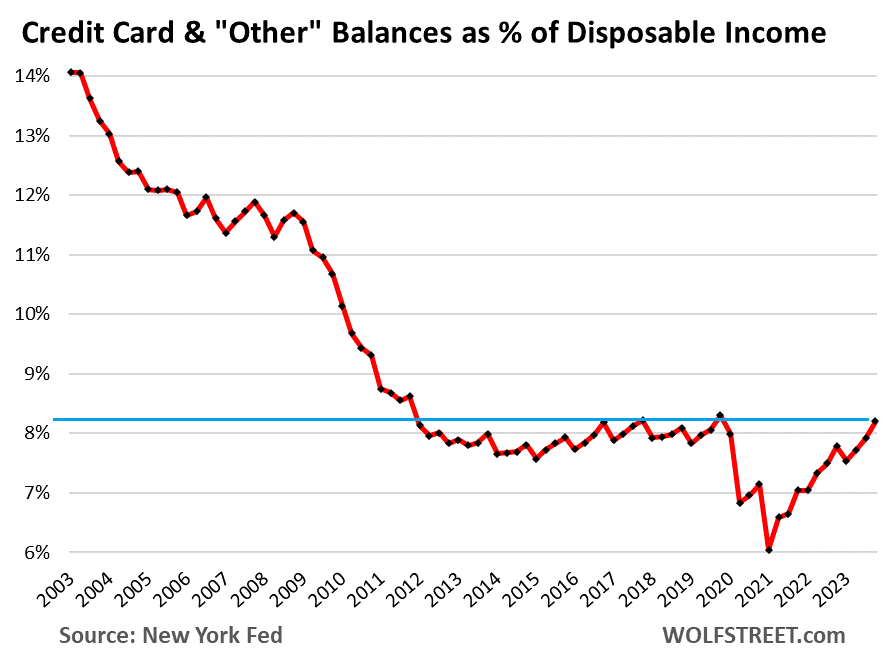

Credit card balances and “other” consumer debt combined, at $1.68 trillion, rose to 8.2% of disposable income (income from all sources except capital gains, minus taxes and social insurance payments; the income consumers have left over to spend).

This measure of the burden of credit card balances and other consumer loans, in relationship to disposable income, has come up from those free-money record lows and is in the range of the Good Times before the pandemic.

Note something else: 20 years ago, that ratio was 14%, and some consumers got in trouble with them during the Great Recession – it seems, some lessons were learned:

Credit is not tightening – except for subprime.

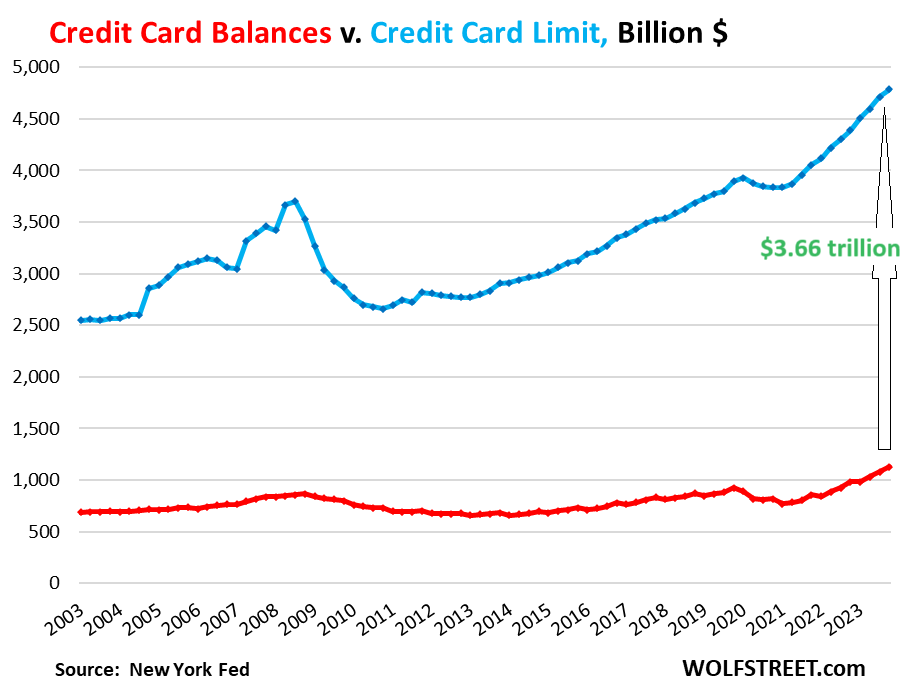

Despite all the hoopla last year about credit tightening for consumers – now forgotten, and even the Fed has axed this language from its January meeting statement – credit has not tightened in the arena of credit cards. Banks are trying as aggressively as ever to get people to set up new accounts, and they have raised the credit limits, and the aggregate credit limit has surged from record to record last year and in Q4 hit $4.79 trillion, while credit card balances ticked up to $1.23 trillion.

And the total available unused credit surged to a record $3.66 trillion. There was a credit crunch during and after the Great Recession, visible by the sharp drop in unused credit (blue line), as banks cut credit limits, closed accounts, and licked their wounds.

Subprime is always in more or less trouble, which is why it’s subprime. And the subprime segment is tightening, which we’ve already seen with auto loans. But for everyone else: banks are eager to lend them money:

Delinquencies left the free-money trough behind.

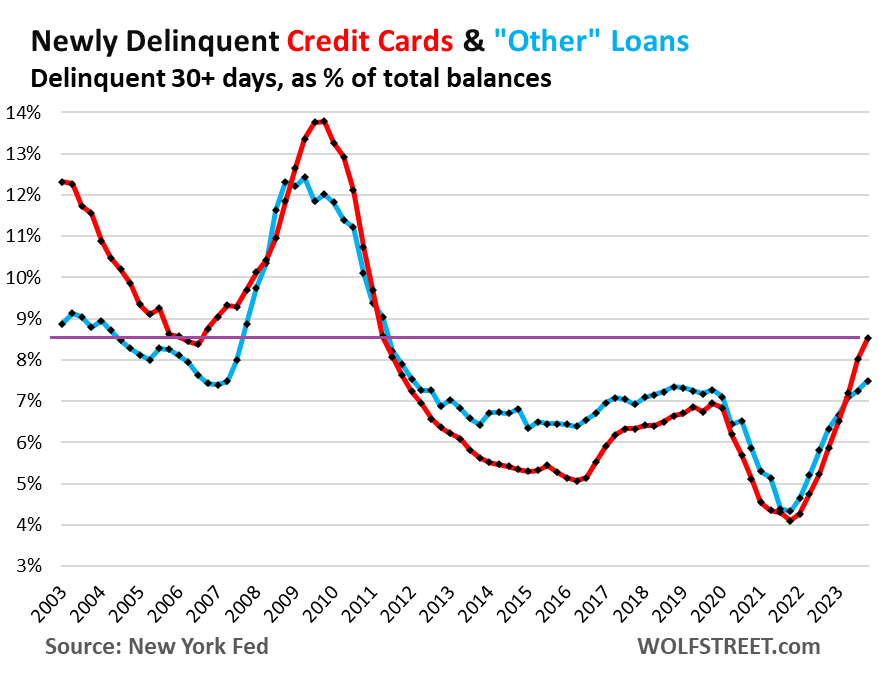

Reality is setting in for some people. Credit card balances that are 30 days or more past due – that transitioned into delinquency at the end of the quarter – rose to 8.5% in Q4. In 2019, the rate was about 7.0%. Before the Great Recession, 8.5% was around the record low (red line).

“Other” consumer credit transitioning into delinquency – including BNPL – rose to 7.5%, just a hair above where it was in 2018 and 2019 (blue).

How many adult Americans are behind on their credit cards?

The New York Fed’s study in November, based on Equifax data and its own Consumer Credit Panel data, found that only 2% of credit-card holders were 30-plus days delinquent. So 98% of credit-card holders were current. But those are cardholders.

Only about 166 million adult Americans had credit cards, that’s 64% of the 260 million adults (18 and over) had credit cards, according to TransUnion (Feb 2023 report). The remaining 36% of adults didn’t have credit cards; they had only debit cards (the second biggest payment method) or no card at all. And those Americans cannot be behind on their credit cards because they don’t have one.

So the percentage of adults – not “cardholders” – who are 30-plus days delinquent on credit card balances is around 1.7%. That may be tough for the 1.7%, but not for the economy.

We already discussed our drunken sailors’ mortgages, delinquencies, and foreclosures: Here Come the HELOCs: Mortgage Balances, Delinquencies, and Foreclosures. And their auto loans and delinquencies: Auto Loan Balances, Subprime, Delinquencies, and Income: Who Are those Drunken Sailors?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Holy hell, why are these companies extending so much credit? Great information. No crisis here, so long as we allow the companies that extend that credit go bankrupt if their clients can’t pay their bills.

Its not always the retailers themselves. BNPL is also available from companies like Affirm & Paypal which have nothing to do with the retailer.

That said, Affirm financing is not 0%. Manufacturer-sponsored financing is however – e.g. the website I manage offers 6-month deferred interest on financing thru Synchrony, which is subsidized by Sony because we sell their products.

We do pay a higher fee for Affirm transactions vs Visa/MC, but its not much higher, and we get the benefit of customer verification and not worrying about chargebacks.

BNPL payments are also a tiny % of our overall revenue. Nearly all our customers are just paying with a credit card.

“Holy hell, why are these companies extending so much credit? Great information. No crisis here……” God! I swear Wolf works for the FED! No Crisis….Please ninja!

[email address deleted by Wolf]

The only thing you put into your comment is your email address — maybe a copy-and-paste accident. I don’t allow email addresses in the comments — to protect your privacy, and to prevent spam.

Because they’re now getting 30% interest! This is outrageous; might as well go borrow $ from the mob.

They’re getting zero interest when people pay off their credit cards by due date, and instead they end up PAYING 1% or 2% in cash-back on the amount that cardholders charged, which is what most people are doing, as you can tell by reading the comments here.

Read the article. Clients are paying their bills easily.

Is it certain that its drunken sailor spending (i.e stoppable) ? I’m not saying its not. But it could also be a cost of living crisis because credit cards are the first borrowing facility when you can’t cover the month with fixed outgoings.

RTGDFA.

Credit cards are primarily a payment method, not a borrowing method.

In 2023, over $6 trillion was paid for with credit cards, most of it was paid off by due date and never incurred interest, and almost none of that $6 trillion became interest bearing debt.

People get 1% to 2% cash-back from the bank (or miles or whatever) when they use their credit cards. You’re almost stupid not to pay with your credit card. And then people pay off the balance by due date, and never pay interest on it.

It is amazing how it adds up when you pay big ticket items with a 2% cash back credit card. We get over $500 cash back a year with our family health insurance on credit card auto pay and have all our car insurance and all our SFH insurance on credit card auto pay (a few years back all my over $10K/year apartment insurance policies said no to credit cards). We also have an Amazon card on auto pay that saves us 5% on everything we buy on Amazon (that it set on auto pay to get paid off every month from my checking account)

I think that’s a function of the lower income people really having it hard, even more so in recent times.

The insurance companies decided they’d rather eat the 2% fee than not get paid at all.

Its also a function of them being a private company that has to compete with other companies.

There’s a reason my town gets away with charging insane fees to pay bills online – its not like I can take my business elsewhere.

But my insurance company will gladly take my credit card.

Yes, I do the same, almost all purchases are CC even stuff I have to get for work that I expense with my employer, then pay off the balance and no interest charges. One of my banks offered me a 0% for a year if I transfer my “debts” onto their card, probably hoping that by end of term I still can’t pay it off so they can earn, but I just used the feature for couple months to pay off my balances on a cashback card from another bank and the money I didn’t use to pay those balances I used to buy short term T-bills lol.

I have to think issuers hate us but have enough customers who lapse often enough to actually have interest payments to make on their CC, that and I guess the fees they charge merchants. I’d love to actually see a breakdown of how they make their money, every time I check Visa their stock price is higher than last time 😆

Yup. Checking account earns 1%. Credit card let’s the money sit for an extra month. Then you get 1-2% back.

VVP, you can up your game – credit card autopay from high yield savings account earning 5%+.

Almost stupid? I’d say certainly! I have my credit card auto-paid monthly, I barely look at the statement. I spend well below my income, put EVERYTHING on my credit card (which has no annual fee), and I got over $500 back this year. For doing nothing but spending the money I’d spend anyhow. It’s free money – as long as I pretend I am not paying for it elsewhere in higher prices, etc. But, since I am paying for it anyhow, I might as well get it back. I don’t even have to carry the card most of the time, I just wave my phone at things and then carry home my stuff.

TEMPLE

Credit Cards issuers charge businesses 3% (average) for any CC transactions they process. Businesses markup the items by 3% to cover the CC transaction cost. If your card gives you 1.5% back, you are still down 1.5% due to the cost of the transaction passed onto you. It is not free money.

Cash only transactions fare worse.

My Visa gets 2% back on everything so I stuff as many payments/bills as possible on the thing. Utiliities, groceries, insurance, medical, restaurants…. Made about 2000 in payback last year.

This!!!!

My wife and I recently bought new appliances for our new house. We bought a washer, dryer, refrigerator, stove, dishwasher, and microwave. We spent over $7000. We had the money to pay for it instantly. No sweat.

We were presented with two options. One, pay for it with a credit card and get effectively 1+% cash back or open a credit account with the retailer and get 0% financing for a year.

Either choice would have resulted in us paying for it without any penalty.

I choose the year of free financing. I figured I could invest the money in risk free treasuries and make more money in slightly less than a year than I would get in cash back from my credit card.

Either way (it doesn’t really matter) I show up as a drunken sailor on your charts despite the fact that I am being logical and responsible with my money.

It is clear you are being more forgiving (soft????) In your description of the drunken sailors in the economy (I appreciate it). Sure, they are spending like drunken sailors, but they are not being crazy about it. They are not significantly going into debt they will layer regret.

There are people who are actively looking for signs of the apocalypse and they always look at increased spending as a sign despite the fact that wages more than make up this difference.

I can testify from experience that ”drunken sailor spending” is absolutely NOT stoppable LSTT!!!

Watched many such drunk sailors spend every last dime every time we hit port,,, and pay ”$7 for $5” to borrow more when they were able to go ashore on liberty before the next monthly pay day.

Wolf’s use of the term is essentially correct IMO.

I think this is maybe why we are seeing the amount of HELOC loans rise. Consumers will use the credit card first, and if they get behind or max out, they will tap HELOC to pay off the credit card. Yep, the HELOC has a higher interest rate than their mortgage but a much lower rate than a credit card.

As credit card delinquencies climb into double digits is will be more obvious that the recession is here.

Have we ever had cc delinquencies in double digits?

Yes, if the credit card delinquencies climb into double digits it will clearly be a sign that the recession is here. However shouldn’t they rise into high single digits before we start worrying about double digits?

Are you one of those people who have predicted 10 of the last 3 recessions?

A recession with double digit credit card default is definitely coming. No doubt the future hold a lot of surprises. The real question though is when?

Morning! One minor clarification on BNPL loans.. they do need to be paid off in 4 ‘payments’ or less… not necessarily in ‘weeks’ though. The reason for that is that lenders do not need to quote APR rates to comply with the truth in lending act if the ‘short term loan’ is paid off in ‘four payments or less’. However, many consumers do not make it in less than four payments so the lender extends the payment option, hence, avoiding (irresponsibly and putting themselves at risk of a compliance violation) disclosure requirements.

I wasn’t aware of that. Thanks for sharing.

Is there a median per capita disposable income metric of any sort. Curious how that compares to the average.

None of this is per-capita, so it doesn’t matter. This is the economy overall, and credit card spending overall in relationship to income.

No sorry, unrelated to the article but more asking if that metric exists at all. I was reading the disposal income data after you showed it in a previous article and was curious . Didn’t ask there since the article was already old and I assumed the comment wouldnt be seen.

The best recession indicator I found in the last 60 plus years:

When you can shoot a cannon through O’Hara field without hitting anybody.

Please read the article folks. Its not a cost of living crisis…..balances are being paid off, monthly. We are not in a recession. At 2% delinquency rate, as Wolf says, not a problem for the economy.

Thank you!!!

I should just post the article in the comments, maybe commenters will read it then?

Geez, that’s gold

Wolf – d’ya think ‘RTGDC’ would work any better?

may we all find a better day.

You left out the “F”. You know, the letter that really drives the point home.

I have 3 credit cards.

Credit card 1. Used for business purposes only.

Credit card 2. Used for periodic monthly billing (i.e. subscriptions, home appliance warrantee, medical precsriptions, Internet)

Credit Card 3. Used for car expenses (Parking, gas etc)

On-Line purchases – I use $500 gift card purchased at the supermarket.

Everything else I pay cash.

All my credit cards are paid off every month. They don’t make squat on me.

Well, they do make something on you, the merchant fees that are charged when you use it. You aren’t paying it directly, but it’s woven into the prices you pay wherever you use the cards.

Howdy Dirty. Right you are. 10 % maybe???????

It varies, but typically no more than 3% from major cards, 5% for some specialty products that I deal with. Most of my customers’ cards hit me for between 1.5-2%. Not aware of any 10% merchant fees but maybe they exist?

Swamp Creature reminds me to remind everyone to have at least four credit cards: 1. The cash back card that never leave your house and is set to pay you car insurance, cell phone bill, Netflix bill etc. 2. The card you use every day for everything (except small purchases from small local business and when buying from people that give you a cash discount). 3. The backup card that you carry with you that you will use if your main card stops working of if the kid at the hotel desk makes a “fat finger” entry and puts a $50K hold on your card rather than a $500 hold. 4. an Amazon card. Before I did this having one card just for monthly auto pays it took me hours and hours to change all my autopays when my credit card company gave me a new card with a new number due to a fraudulent charge.

Yes – 100% agree about keeping a separate account for auto-pay of “routine monthly bills”, which never gets exposed to fraud. And then both a and backup card used for shopping. That system has been working for me too.

But… why “Amazon card”, though? There are lots of ways to get perks on the primary card. And personally I try to avoid Amazon wherever possible since it’s a predatory monopolist.

I’ve got some cash sitting in my wallet, it’s been sitting there for months waiting to be used. My credit cards have taken over everything I buy. I did give a homeless man some cash from my stash, other than that the dirty money sits in my wallet next to the picture of my grandma, long dead and gone.

Funny you should mention that. I was at the grocery store last night. When I put my credit card back in the wallet, I noticed the same lonely $1 bill in my wallet. It’s been the only cash in my wallet for about 3 weeks. I think that is a new record for me.

I started keeping some cash on hand for tips, I want to make sure whoever I tip gets the whole thing instead of the establishment. Also, maybe they’ll report the income, maybe they won’t.

“On-Line purchases – I use $500 gift card purchased at the supermarket.”

Do you have the ability to dispute a transaction with those prepaids?

MM

So far have not had a disputed transaction. Had one stolen out of my car though. It took me a lot of work to get a new one. Much more than with a regular credit card.

The gift card never leaves my house. Use it only for on-line purchases so that my credit file is not affected if there is fraudulent charge. I even used it for a quarterly donation to Wolf Street.

I mean, can YOU dispute a charge with a prepaid card?

E.g. you order something, and receive an empty box. What recourse do you have with prepaids in that scenario?

Just curious, but why are paying for home appliance warranties?

They are generally a waste of money to most Americans.

Well said Wolf, another feather in your cap.

Howdy Folks. Golly, looks like more and more people can add and subtract properly. Party on Wayne, good job, enjoy life. And always save some of what you earn……..

Best advice I’ve heard: don’t spend, and then save what’s left. Save, and then spend what’s left.

I have some mild regret I didn’t put more in Microsoft stock a year ago. But that cash cushion is earning well, feels good, and provides such serene sleep!

Party on Garth!

Hi wolf, i have a question that is not related to the article. How many readers are there of wolf street, if you don’t mind sharing?

How many readers? I wish I knew, LOL. The hard part is measuring it since people don’t have to sign in to read. The site gets a lot of traffic from search and links, Google News, Android properties, etc., and many of them show up only once. Then there are occasional readers. Then there are readers who come just about every day. Some people use VPNs. The same people come from different devices. The measures have gotten a lot better at sorting this out, but they’re still not very good.

So the metric being used these days is “visitor” (which replaced the misnomer “unique visitor”). This varies widely, from about 400,000 per month to over 700,000 per month.

“Pageviews” is easy to count reliably, they also fluctuate widely, and range from 1 million to 1.7 million per month.

There are only a few hundred active commenters.

I don’t know how many readers read the comments. One of the reasons many big media sites shut down the comments years ago is that few people actually read the comments. The other reason was the time and expense in managing the comments (moderating), which can be a nightmare. But I’m trying to keep the comments attractive and interesting so that they get a lot of readers. It’s not the number of comments that matter (once it goes over 100 comments, stuff gets lost in the shuffle), but the quality of the discussion. I hear from a lot of readers who actually read the comments (but never comment), and they like them, so I know the comments get good traffic from loyal readers.

Then some people just come for the comments, they skip the articles and just read the comments (and never post a comment). So the comments are kind of their own thing.

Let’s sound off and you can count the comments. :)

1!

@Wolf I have heard from people working in media that while moderation (and deleting spam) took a lot of time one of the main reasons most sites (both right and left leaning) got rid of comments is that they would bring up things the article left out and may push some readers to the “other side”. If someone is writing an article to support a guy with orange hair and the article says he is a level headed great guy, they don’t want a commenter pointing out things that may make him look crazy (and the guy writing for the other site does not want anyone pointing out things that may make the gray haired guy they support look senile).

Years ago, some people forced me to put “orange” on my list of tripwires during the years I had to wrangle with the Trump haters here on a daily basis. You’re still using it? Just say Trump.

Howdy Lone Wolf. This old fart ” ME ” learned so much here.

THANKS

I read all of the articles but I think I spend a lot more time reading the comments. It gives me something to do on my breaks since there’s usually always new ones.

Sorry to say this , but I am one of those, who skim over your articles and then jump to comments.

I am more of big picture guy and don’t want to get lost in too much data.

One can interpret same data in many ways.

Experts have been predicting recession for last 2 years.

But thanks a lot to WR for putting out these articles full of awesome data.

Bottom line:

Consumers are doing great, spending like drunken sailor. Hot job market. Inflation going down. Fed held the rates and is now looking at cutting rates. Stocks/ assets all time high.

What else can go wrong ?

It’s all supported by two powerful but unsustainable forces:

Rising debt to GDP

Rising money supply to GDP (liquidity)

Bernanke’s lit this bottle rocket economy, and it will keep rising until it goes “bang”.

Wolf, the work you put into the comments is very much appreciated. Its extremely valuable and fun to get some viewpoints from people who have experience and knowledge in adjacent fields of expertise, and add additional context or informed opinions. But it would be for nothing if you didn’t work so hard to remove the chaff.

Shout-out to one of my favorite commenters, Einhal. It feels like you always say exactly what I am thinking. (who doesn’t love a nice echo-chamber, hah jk)

Also the legendary Depth Charge. *salute*

Thanks Kevin, appreciate that. I don’t pretend to have the answers, but I do know the status quoa sucks in many ways.

I read the comments but never comment. I also value this site enough that I always make a payment when you send out your email asking for funding.

I only read the articles after you’ve hit triple digits in the comments, the discourse is always entertaining

I just wanted to say that I have found you to be an great resource. Despite you not being directly up my alley (value stock investing), I have found your articles to be extremely informative and educational.

I have an MBA and have always had a slight interest in the FED and interest rates and the economyin general, but it was more of a hobby than an active interest. Nothing worth making long term investing decisions over. That said education is always valuable and I genuinely think there is a lot of value in reading your stuff. I do.

In every stock discussion board I participate in I have recommended your site. Not because it has to do with the type of stocks I invest on, but just because it is very informative.

I hope this has shown up as increased traffic to your site.

Thank you!!

I think the other shoe that’s going to drop is auto loans. New cars are rapidly reaching an average price of 50K. Banks and auto credit companies are coming up with 7 year loans in order to make the payments manageable. The problem is that the customer will upside down for the life of the loan and the car will be worth much less during trade-in time. Remember, after a house, a car is the second largest asset that most people own. Unfortunately, it is a depreciating asset. Used cars are getting more expensive as more people turn to this option for affordability. I am not sure how the automakers are going to keep making money for an ever shrinking market for new cars.

Apparently, car companies like GM and Ford are booking record profit despite historically high car prices, decade high interest rate, lower demand, and unsold cars piling up in the dealers’ lots. I wonder what is going on. Ford dealers are still selling tons of 2023 cars and we are well into 2024.

Ford booked a loss in Q4 and only booked $4 billion in net income for all of 2023. Tesla booked $15 billion in net income in 2023.

Automobile dealers have consistently had prior model year vehicles on sale well into the next calendar year. Sometimes it’s release date (not all current year vehicles come out in September). Sometimes it’s production dates. Sometimes it’s the *mutts* that are built with leftover parts. Could be delayed shipments from assembly plants in other countries due to logistic issues. Other times it’s service loaners, demos, and the like. Other times it’s cars with the wrong specs (too heavily equipped or stripper models). Then there’s the vehicles that the manufacturer shoved down their throats that have all the market appeal of a porcupine. All kinds of reasons.

Interest rates are easily addressed through a manufacturer’s captive finance company. Want zero percent? Done. Manufacturer sends the finance company a check for every one sold that way (not really checks, but…..). Ditto the leases with a bought down money factor. Then there’s back end rebates. Dealer cash. Customer cash. Stair step programs.

Losing money on hybrids / PHEV / BEV / Nat Gas / hydrogen vehicles isn’t a new phenomena. In my previous life, I witnessed the CEO of the company once laughingly asked a group of dealers to quit ordering the BEV’s as the losses on each one were staggering (but they had to be built to meet federal / state mandates). The truth is that it would have been cheaper to give the car away than subsidize the financing plus eating the loss. Warranty costs were also stupidly expensive due to the complexity (and lack of training/special tools/components) of the vehicles. That’s why a not insignificant number of them became company cars, driven for a few hundred miles, and dumped at auction. At that time, they were a hot commodity in our CA offices because the qualified for single occupant carpool lane access – for a fee, of course. A big deal for someone commuting from Southern Orange Country up to the mother ship.

The latest thing coming out of dealers (per NADA news) is they are now asking the manufacturer to develop a strategy to remarket used battery powered vehicles. This one should be fun to watch.

This won’t be a popular take, but one of the better things to come out of this inflation era is the countless amounts of businesses, primarily small ones, who now add 3 or 4% (or subtract 3 or 4% for paying cash) for paying with a credit card. It isn’t the business’s job to make donations via their cc fees to your airline miles and cash-back accounts.

I wonder about this though. All credit vs all cash. Does say a restaurant or other small business save the 3-4% fees by no theft of cash passing thru hands when people use credit cards? I’d think that at least partially offsets the fees. It certainly makes for a more convenient transaction for both parties. If you are an outlier in your area in charging for cards it also will somewhat impact how much business you do.

I’m not against cash, I did cash only for most of my life, and still do quite often. But once it became the norm credit cards simplify enough to justify the fees I think.

A business that only takes credit/debit cards is a much less attractive target for thieves.

I read a couple of months ago that legal Cannabis Dispensaries were a prime target for robberies, specifically because all their transactions were cash – apparently the credit card companies won’t/can’t process payments because weed is illegal at the federal level.

Besides convenience, the other issue is that cash is gross.

Its just as easy to steal using credit cards.

“Its just as easy to steal using credit cards.”

A thug walks into a convenience store and robs them of credit card transactions (that are electronic)? Or do they go for the register to score cash for their next fix?

Are jugging victims robbed of their credit cards or the cash they just withdrew?

Yes, you can steal with a credit card – but it’s likely a non-violent act.

It’s also a much less attractive target for customers. I never visit such businesses if I can avoid it.

I wholly disagree. It’s just a stupid gimmick. They know most people pay with credit cards, and will pay the 3-4% fee. So all it really is, in my opinion, is a way of raising prices without raising prices (much like shrinkflation). The problem with this is that you can only do it once. They won’t be able to raise the fee to 6-7% next year, so they would have been better off just raising their prices 3-4%.

Also, as DRM points out below, you get protection against skimming, you don’t have to pay Brinks to come take your cash at the end of the day, and so forth.

The only reason I’d want to take cash these days is if I was trying to not report income.

I was in Swtizerland, city of Lucerne few months back. I went to a small restaurant and the guy told me they take only cash, absolutely no debit or credit card.

I guess, his reported income is zero and he dips into all govt benefits.

Einhal

Agree it is a stupid gimmick. Lately I have begun paying with 100 dollar notes. Wonder how long it will take to break the habit with handling the notes.

For years I went to a store that offered a 5% discount for paying with cash.

Then one day they stopped offering a cash discount but instead began charging a 5% fee for paying with CC.

Yet the price marked on individual items remained the same. Net effect their revenues just increased by 5%.

My response to this practice (in the relatively few instances where I’ve encountered it in the wild) had been simply to avoid those businesses if at all possible. That usually works out fine for me.

(There is a certain cell provider that has instituted something like this for autopay customers; while switching isn’t really an option for me, there are little subterfuges one can do, for now, to get around it.)

Back in the old days credit card companies charged merchants 3-4% because they had to ship those carbon paper slips around, then use scanning machines to read them into a database. It was time consuming and expensive. Now it’s all electronic and instantaneous. The cost per transaction is a tiny fraction of a percentage.

The only reason they still charge so much is they are a monopoly, and they can get away with it. They should be broken up or something. Merchants in my area are getting around that by only accepting debit cards which are cheaper for them. Here’s what I found… it’s just price gouging:

“For a merchant, debit cards are cheaper than credit cards. Most debit cards have a fixed transaction fee of around $0.07 that is charged to merchants. Most credit cards have a percentage fee of 2.3% plus a $0.10 transaction fee.”

Hi Wolf. With credit card interest rates increasing a fair amount, does this impact the magnitude/strength of debt burden on consumers in a significant way? I’m thinking something like an accelerating force that will drive the “Debt vs Disposable Income” metric more quickly upward than in the 2000’s? A sort of lag effect, I suppose? Half formed question from a non-finance person.

Welcome to the new world of levels of money- just like China.

White money=paychecks, taxed proceeds from all large transactions, paid electronic or by check. A huge percentage of the commerce of America, by consumer or corporation. All regulated by the credit reporters, credit card companies, and the big banks. They know more about you than the government, but if big gov wants to know more, they all will tell everything about you.

Grey money= paypal, small amounts. Cash from your garage sale, car sale, etc. Flea market entrepreneurs, etc. This is also the space inhabited by the money laundering community. Bitcoin, halal networks, Chinese export of money, etc.

Black market= money involved as a result of crimes- Silk Road, etc, etc, etc. Money is moved up the chain and the movers take a cut the whole way.

So, for the average Citizen, they live in the white zone, unless they want to raise more flags by trying to live in the grey zone. In other words, cash is also not that anonymous, like it used to be. Buy a lot of gold, and when you sell it, boom more than $10k reporting. It all becomes a so what if you just live below the event horizon.

The biggest problem is most criminals end up being successful enough to attract the attention of the gov, because they are big enough to make someone’s career take off.

In short, live like the legendary Stainless Steel Rat, but with a lot less splash…

The FED has indicated no more hikes and lower rates in the future (It may not happen but that is what they are saying). So you have to invest accordingly based on this input.

It seems like the economy is in a sweet spot. Inflation is dropping. Commodities are dropping. Jobs are good. Unemployment is low. Cyrptos are rocking. Stocks are hitting ATH and this is with a Fed Fund rate over 5%. 2022 ATHs were when we were still at ZIRP.

Last summer, I thought we would be looking at a recession about now with the high interest rates. Hats off to the FED. My Home builder shorts were crushed. Ouch.

I have a feeling that home prices are going to rise this spring? Wealth effect from Stocks/Cryptos may have the home buyers feeling like they have some equity to burn?

I think you’re reading it wrong. The economy is plugging along, but that’s because inflation is still at 5-6% on everything people need (rent, insurance, health care, child care, etc.). I wouldn’t see inflation is dropping except in the sense that it dropped from the 9% high from a year and a half ago.

I think what you’re seeing is that the “markets” are so used to 0%, that they’re pricing everything as though rates are 0%, or, if they’re not, that they’ll soon by 0%. Once the reality sets in that the 0% from 2009-2022 is a mistake not likely to be repeated, because the deflationary trend from globalization is over, the markets will adjust.

No one would be willing to pay these prices for stocks when the risk free rate is 5%. Not unless they’re trying to front run the central banks, and think the risk free rate will be back at 0% shortly.

Going by the govt metrics, inflation is at a striking distance of FED’s target rate of 2%.

From CNBC, this morning:

“Updates to the consumer price index showed that the broad basket of goods and services measured increased 0.2% on the month, less than the originally reported 0.3%, the Labor Department’s Bureau of Labor Statistics said.”

I don’t have trust in Govt inflation metrics and I think real inflation is very high.

But FED is the one which makes policy decisions based on Govt metrics and at this time, based on progress they have made, they have already paused for quite some time and are planning to reduce rates.

People are already paying a lot for these stocks even though rates are at 5% plus.

Market is up because it knows that Govt/along with FED would not hesitate to start printing $$ with a smallest of trouble.

Govt is already running 2 trillion USD deficit.

That’s really the question. They had the cover of COVID to print last time and of the Great Recession the first time. They don’t this time, and I get the sense the rest of the world is more wise to our games now, meaning that they couldn’t print without endangering the dollars reserve status.

With China and Germany on the rocks, I wouldn’t rule out future deflation just yet. Also, CPI-U, not seasonally adjusted, has declined for each of the last three months. That is real deflation, not disinflation.

That said, I agree with you that there is a disconnect in essental services pricing that I doubt will go away any time soon, especially given the tidal wave of fiscal stimulus by the US government. As Wolf has mentioned often lately, a good chunk of core services inflation is high, and so far, extremely sticky.

Inflation is still at 5%-6%!?!?!?

LOL. Too funny.

Since we are making stupid shi… er stuff, up to fit our dreams, I will say that my relationship with Taylor Swift has hit a rough patch. She still loves me, but our future is in doubt

Deficit spending/”borrowing from the future” and risk on appetite levitating things here for now but all kind of warning signs out there. Farmers protesting across Europe, famine worries and a democracy postponed in Africa, religious buildings bulldozed in India, China bubble deflating (a good thing), continuing war in Ukraine and the one in Palestine now spreading to further states in the region. We need to turn the financial risk off to help settle things down or nature will take its course.

Credit Cards make for very expensive payment system with transaction costs of 1.5 – 3% of the total transaction amount. My guess is that the US has one of the least efficient payment systems in the developed world.

Just about every vendor I encounter – except grocery stores – now pass the transaction cost onto consumers. Those that dont do this explicitly, are no doubt, doing so in their prices generally.

Everyone around is buying new $80k trucks that requie a ladder to climb into. I’m pretty sure they are not putting tons of cash into the deal.

Personally, I pay for most things with cash because it’s easier to budget that way. When the cash runs out, stop spending for the month.

Credit Cards used for anything I buy online and for gasoline so I don’t have to interact with anyone. Like you describe in your article: a convenient (if expensive) payment method.

Ok let’s assume you are correct that businesses are passing along 3% rates on to consumers.

If a business charges me the same whether I pay in cash or credit, why wouldn’t I pay in credit and get the cash back?

Also, I am surprised any business is paying 3% for credit card transactions. I used to do lots of consulting for small businesses. Very small. All of them paid at most 2.5% pn credit card transactions. Most were in the range if 2%.

>If a business charges me the same whether I pay in cash or credit, why wouldn’t I pay in credit and get the cash back?

One reason is that the CC company is recording all your transactions and selling it to data brokers so that marketers can stalk you.

If you use cash you only need to worry about facial recognition on the CCTV cameras (and you can search “ban facial recognition scorecard” to learn which retailers you should boycott for this reason).

Maybe this is irrelevant but I’m curious if there are figures out there that represent the outstanding credit card balances that are carried, that is not paid off monthly, but are also not delinquent.

I’m guessing that would be carried balances, at interest, where at least the minimum monthly payment has been made on time so they technically are not delinquent.

Wonder if that would show much change over time.

Maybe not directly, but interest income divided by interest rate divided by current balances would give you what I think you are asking.

Each bank knows its own figure on that. Interest-accruing credit card balances, is what they call it. But they don’t disclose it in their filings. And there is no monthly or quarterly report tracking this amount for all credit card companies combined.

Periodically, someone does a study via a survey of some credit card operations that then gets extrapolated to the universe, and they come up with a total figure. Off memory, the figure I saw last was around $500 billion.

You’ve got to be careful: you’ll see the term “carry a balance,” but that’s the statement balance, and people who pay off the entire amount by due-date and pay interest are included in this “carry a balance.”

Too bad we don’t have quarterly data on interest-bearing credit card balances.

5.8T in 2022 of 26.4 GDP is 22% of the spending – suspiciously close to the old 80/20 rule. :)

Plus: Debit cards are about $5 trillion. Combined debit and credit cards about $11 trillion a year. That’s over half of total consumer spending ($19 trillion in 2023). In order words, these two payment methods account for the majority of consumer spending. People pay for everything with them, except rent, mortgages, and auto purchases, it seems.

Thanks Wolf. Am still trying to figure out who the Drunken Sailors are, economically speaking… ie Everybody or some particular sector of the population mostly. Seems pretty hard to parse so far, but I’m no expert for sure.

Debit Cards suck. Had one stolen out of my car and they cleaned out my bank account of $4,000 in one day. One charge was for a Blow J%b ($300) from a hooker in NYC.

Did your wife buy that explanation of the hooker charges?

Yeah, but I’m just feeling unburdened by what could be.

Last year, had never seen before, two different plumbers gave payment options, either use debit card or add 3 percent to bill to use credit card. Utility bills that used to allow auto pay on CC have also now disallowed, must use ACH (direct withdrawal from checking).

Some vendors are catching on and soaking customers. One example is my T-Mobile bill that I had set to autopay each month off my credit card. Well 3-4 months ago they have now added on a $25 fee each month if you pay with your credit card (it’s 0% if it’s linked to a debit card). So for my 1.5% cash back I’d lose a lot of money on that. My advice is watch and make sure you’re not getting these little fees either for any auto-pay credit card bills you may have.

Are “cardholders” double-counted when people have multiple credit cards, or is that already taken into consideration? I read the linked study and couldn’t tell. If not, the number of adults who are delinquent is probably a lot less than 1.7%

no

Couple questions Wolf.

1) What is the difference between the 7% figure and the 2% figure? Is that discrepancy because the 2% of people have 7% of the cards and are going delinquent on all of them?

2) Given these numbers are the worst since ~2012, do you see reason to be concerned for US banks’ balance sheets, or not yet?

Thanks.

1. “found that only 2% of credit-card holders were 30-plus days delinquent” = 2% of the people who have credit cards are delinquent on their credit cards.

2. — the 7% (in 2019 or now 8.5%) = delinquent amounts as % of total statement balances. So of $1.1 trillion in statement balances, 8.5% are 30-days delinquent, or about $93 billion in balances are delinquent.

3. the banks…

They’re going to take some hits to their income, and they have already taken some hits, but the amounts are small. Like I said, the 30-day delinquent balances amount to about $93 billion, spread over 4,000 US banks with $2.2 trillion in capital to absorb losses. Most of those delinquencies will be cured, with people catching back up, and so that’s not a problem for the bank (they make some extra fees). When a customer defaults for good, and payments stop, the bank sells that account to a collection agency for cents on the dollar. By that time, it already reserved the loan losses.

In addition, a portion of the $1.1 trillion in credit card balances have been securitized (ABS) and sold to investors, and banks are off the hook. So we don’t know the portion of statement balances that the banks carry on their books, but it’s quite a bit less than $1.1 trillion.

Makes sense now, thank you!