Ok, so that push-back in the statement was unexpected.

By Wolf Richter for WOLF STREET.

The FOMC statement released today by the Fed after its two-day meeting pushed back aggressively against the market’s massive rate cut expectations this year – what we’ve come to call “rate-cut mania” – and it pushed back against the expectations of an early end of QT.

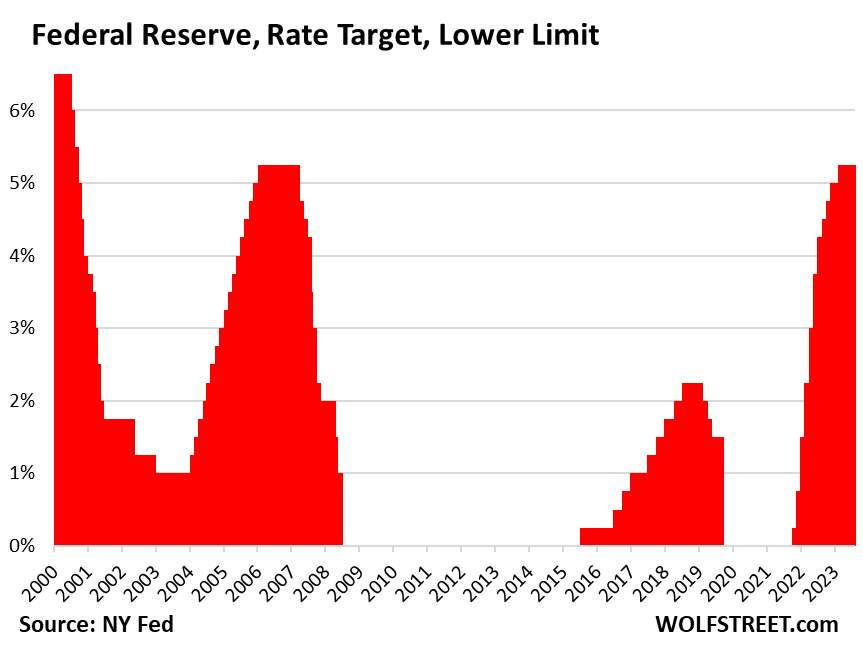

The FOMC voted unanimously today to maintain its five policy rates, with the top of its policy rates at 5.50%, as had been broadly telegraphed in recent weeks in speeches, interviews, and panel discussions by Fed governors in their efforts to push back against the rate-cut mania that had broken out in early November last year. The last rate hike occurred at its meeting in July.

Now the Statement pushed back against rate-cut mania and end-of-QT mania:

The Fed added entirely new language to its statement, explicitly pushing back against the markets’ rate-cut mania and end-of-QT mania. I don’t think I have ever seen anything like this in an FOMC statement. It said:

Rate cuts: “In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks.

“The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.

QT: “In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.”

So QT continues, with the Treasury roll-off capped at $60 billion per month, and the MBS roll-off capped at $35 billion per month as per plan. The Fed has already shed nearly $1.3 trillion in assets since it started QT in July 2022.

Financial and credit conditions: The Fed removed the paragraph about “tighter financial and credit conditions for households and businesses” due to the banking crisis weighing “on economic activity, hiring, and inflation.” It likely removed it because financial and credit conditions have loosened recently, and the banking crisis is no longer on the front-burner.

Policy rates:

Today, the Fed kept its policy rates at:

- Federal funds rate target range between 5.25% and 5.5%.

- Interest it pays the banks on reserves: 5.4%.

- Interest it pays on overnight Reverse Repos (RRPs): 5.3%.

- Interest it charges on overnight Repos: 5.5%.

- Primary credit rate: 5.5% (banks’ costs to borrow at the “Discount Window”).

Note the plateaus after the rate hikes. The one from June 28, 2006 through September 14, 2007 lasted nearly 15 months:

A no-dot-plot meeting. Today’s meeting was one of the four meetings a year when the Fed does not release a “Summary of Economic Projections” (SEP), which includes the “dot plot” which shows how each FOMC member sees the development of future policy rates. SEP releases occur quarterly at meetings that are near the end of the quarter. The next SEP will be released at the March 19-20 meeting.

At the last meeting in December, the median projection in the “dot plot” indicated three rate cuts in 2024.

I will publish my analysis of Powell’s preconference in a little while. Stay tuned.

Here is the whole statement:

Recent indicators suggest that growth of economic activity has slowed from its strong pace in the third quarter. Job gains have moderated since earlier in the year but remain strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated.

The U.S. banking system is sound and resilient. Tighter financial and credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. The Committee will continue to assess additional information and its implications for monetary policy. In determining the extent of any additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Lisa D. Cook; Austan D. Goolsbee; Patrick Harker; Philip N. Jefferson; Neel Kashkari; Adriana D. Kugler; Lorie K. Logan; and Christopher J. Waller.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Howdy Lone Wolf. You are the only person I know that types out articles like this. There are only a few sane folks anymore in a Mad Mad Mad world. Keep up the good work…….

Hey Youngins, we may not have reached that plateau yet either……

Good, I love this non-TINA environment and knowing that Tbill yield is paying my rent despite pretty much all assets still at sky high level. At least it’s better than pre-covid when housing price already out of whack but you earned jack parking in Tbill or savings account.

Howdy Phoeneix Hopefully ZIRP is dead forever, and interest rates never go below the historical norms. Savers should be rewarded something instead of nothing……..

It’s amusing to me that American savers reliably view themselves as virtuous, usually while simultaneously decrying US Federal Government deficits and debts.

Evidently they are blissfully unaware that the sectoral balances demonstrate that net private savings in $USD is that very same US Federal Government debt …

“It likely removed it because financial and credit conditions have loosened recently, and the banking crisis is no longer on the front-burner.”

And when exactly is the CRE apocalypse supposed to arrive? Guru’s have been talking about it for more than 2 quarters now.

So, we’re 5 months into what could be upwards of a 15-month or more holding pattern. Wait, did we have the government spending $2T extra each year during those 15 months prior to September 2008?

From the last Plateau FOMC (Oct 2006):

“The Federal Open Market Committee decided today to keep its target for the federal funds rate at 5-1/4 percent.

Economic growth has slowed over the course of the year, partly reflecting a cooling of the housing market. Going forward, the economy seems likely to expand at a moderate pace.

Readings on core inflation have been elevated, and the high level of resource utilization has the potential to sustain inflation pressures. However, inflation pressures seem likely to moderate over time, reflecting reduced impetus from energy prices, contained inflation expectations, and the cumulative effects of monetary policy actions and other factors restraining aggregate demand.

Nonetheless, the Committee judges that some inflation risks remain. The extent and timing of any additional firming that may be needed to address these risks will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information.”

History is never the same, but it often rhymes. Then the opening line was about trying to moderate the housing market (right before it crashed) – now opening line is on labor (right before it…?).

Awesome! Yes, the ONLY thing our real feudal owners fear is deflation of their assets, including productive labor…

Interesting times

Not likely – read the wsj article on the rise of $100 million home sales and how demand is outstripping supply.

Projection is that $200 million will soon be the minimum standard for a trophy property

Yes, the cantillion effect. Back to feudal times.

History rhythms, we know how this turns out.

THEWILLMAN-

Thank you for this useful perspective!

Don’t threaten me with a good time. I’d love to have those cheap home prices again.

These zingers that appear from time to tike is what makes the comment section interesting.

I hope this is good for T-bill and T-note rates. I was not finished buying them.

The big drop in yields today is a loud-and-clear signal from the bond market that they believe delaying cuts is a mistake that will lead to a weaker economy. In other words, odds of a recession just went up.

So the odds of a recession just went up because the morons (and yes, they are morons!) who trade bonds pushed rates down? Their crystal balls are worthless and their beliefs are just that beliefs. Sick and tired of these fools.

So called ‚smart money’. If this is smart I dare not think what dumb is…

Maybe there is hope yet for responsible people who have saved all their lives for retirement and who have not been a burden on society.

The Fed has severely hurt them over the last 15 years when retirees could get almost zero on their savings. It has only been recently that retirees could get an acceptable rate on their savings. Let the free market reign and supply and demand determine interest rates.

Yields have been nothing but real estate has skyrocketed due to the debasement, so if you were a homeowning boomer you averaged out ok. Worst case was being retired with just “safe” bonds and renting for the last 15 years.

Government working against us. Our money basically got zero for fifteen years yet the banks still got at least 15 % for credit cards. They are still saying inflation is low. I think they are fibbing.

You do realize the the purpose of the low interest rates was to encourage people to invest their money elsewhere, right? Had you put your money on the S&P500, you’d have come out just fine.

I read your articles religiously and while I may not be the sharpest tool in the shed, I found the Fed’s statement today to be expected. Between your comments about investor over-enthusiasm for cuts https://wolfstreet.com/2023/12/18/fed-members-fan-out-to-step-out-raging-rate-cut-fires/

and your clear explanation of possible head fakes with the inflation numbers https://wolfstreet.com/2024/01/26/on-the-surface-pce-inflation-is-encouraging-but-beneath-it-core-services-accelerated-housing-stuck-at-5-7-for-six-months/

I’m surprised to see you say today’s push-back was unexpected…

Yes, the pushback has been going on, but in speeches by individual governors. That’s the normal route for a pushback. What we got today was the official FOMC statement pushing back with this new language, and I didn’t expect that at all, not in the FOMC statement. That’s very unusual, not normally what an FOMC statement is used for. Clearly, they’ve had it with this rate-cut mania.

Like a lot of folks these days the fed got tired of the wall street media shills spinning its very transparent last message into a self serving rate cut story.

Good for jp and the fed.

They really had no choice Wolf. Still plenty of liquidity sloshing around in the financial plumbing. It’s on CONgress to balance a f&%king budget now. Looking forward to your thoughts in the upcoming treasury issuance. The Fed NEVER should have messed with the long end, instead Bernanke got a Nobel for it! Yellen is hinting are hinting at letting all the short-term debt roll over. Okay, then what Janet? I don’t see interest expense going down any time soon!!!

Interesting times.

“Ok, so that push-back was unexpected.”

nah.. no, not according to some of our beloved commentators here!!! (lol)

/s

Speaking as someone who is often a “beloved” commenter, I fully admit that I didn’t expect it.

Thanks

Observation and theory: The Bank of Canada also kept its rate unchanged at its announcement a few days ago. Also, both CBs have done ten increases but the BoC actually went first with the first hike.

Theory: I think the Fed gives BoC a ‘heads up’ just before change and lets BoC announce first. Reason: nothing BoC does can affect US $ but an unexpected move by Fed will affect C$. It’s just professional courtesy to a good neighbor and ally with a much smaller economy to avoid shocks. Of course this is just a theory but if true, I wonder how the warning is transmitted.

Higher for longer. The Street will have to digest reality eventually?

It took a decade for many to believe lower for longer. Then by 2018 we were all hooked on the ZIRP.

Nobody knows inflation or geopolitical risks anymore. Maybe we will in a decade?

The Struggler,

You mentioned geopolitical risk. Ken Griffin threw out a US/China Taiwan war as potential for global depression.

How do you hedge that?

WB,

What the hell does that mean!

You seem to suggest that China has a growing population. Have you actually looked at Chinese demographics?

I think you should actually look at Chinese demographics. The Chinese are facing a terrible demographic cliff that is going to bring them a lot of pain in a decade or two.

Their decades of one child policy is going to insure they have a large aging population with a smaller generation of workers to support them.

Thomas Curtis:

Buy defense industry stocks? I have not been looking in that direction lately but it’s almost always a good bet.

LMT and NOC charts have been nearly parabolic.

I still believe there’s a rising floor on energy and food commodities. Any major selloff is a buying opportunity.

There’s the most “stability” in the companies that profit from them: Big Oil, even Big Food/ GIS is in a pullback. Even during COVID people eat, heat and transport (when “everything stopped”).

Also I see some beaten down “value” in MMM, PYPL. Making real things and processing digital transactions will be a thing regardless.

ZIRP policy destroyed Japan and the banking system in Europe. Everyone worldwide has become progressively poorer at an alarming rate all thanks to ZIRP.

Last time I looked, Japan was not destroyed.

haha market only down measly 200+ pts, there must be still some level of denial with these gamblers that the FED is just puffing their chest and will cave soon enough..the level of hopium in the market is simply amazing to behold.

Last day of the month profit taking albeit not much profit taking. Even ponzi’s have profit taking.

The market goes up because myself and millions of other Americans are putting hundreds if not thousands into 401k/ Roth accounts.

I really think we give too much credit to those con artists in Wall Street. Day to day of markets really doesn’t matter to us does it? I’m not sitting there playing with options and daily trading. I’m simply putting money in the general index funds every 2 weeks.

The rest goes into t bills

Powell also effectively took off a rate cut for March. That’s what sent the markets reeling downwards.

Market didn’t like that so no quick cuts.

I heard to watch ‘goods deflation’ for signal.

No surprises to me.

Powell said a rate cut in March is *not* the base case.

With financial conditions having loosened up so much in the past couple of months, the Wall Street boys really shouldn’t be that surprised I guess.

Powell explicitly acknowledged two things, which I don’t believe he has in any other recent presser:

-The possibility that inflation stabilizes above the Fed’s 2% target

-That home price inflation is *not* part of the Fed’s equation when looking at inflation data (but that they do look at rents & OER).

Thanks Wolf ,

If 2 Trillion in reserves at the Fed is the key to ending/slowing QT; will the Fed wait for that to occur first before cutting rates extensively. If so then the wait for rate cuts will be futher delayed by smaller bank’s arbitrage on the BTFP; which increased the reserves as you have discussed in great detail.

Will you also do analysis on the Treasury Departments Qtrly refuding details and compare to article from Monday?

Makes sense. Hard to really see any market corrections with this. Economy and job are solid and what the market says and what they think are not the same. More hype about tech and other layoffs but seems overblown.

The interesting thing I’m sticking in my pipe and smoking was Powell’s comments on AI, where he saw it having intermediate and long term effects on jobs, whereas, it had been my guess that this generative AI would have more effect in the shorter term, on jobs like customer service and programming. My guess was, companies would race to AI to reduce costs and remain competitive.

Indeed. AI is nothing more than machine learning with exponentially faster processors and access to an exponentially larger data base. I expect that, while it will learn some good things faster, it is going to pump out exponentially more dog$hit, exponentially faster. Successful folks will be those that figure out which is which first.

Yes, I look forward to waves of noise across the whole system. The ease of generating content means a glut of it in the near future, arriving in big dollops, going in all kinds of directions.

AI can replace junk programming that goes into creating web pages and database queries, but will never beat a human at real/complex programming tasks such as production-level operating systems, compilers, and complex embedded systems.

As a retired real time process control embedded system programmer I agree. What it will do is allow conversion of legacy Cobol programs and others to more modern code that can then be modified and enhanced a lot faster.

Is there any university on this planet that even teaches Cobol any more?

Markets are not up because of good economy and jobs. Markets are up in the anticipation of loose monetary policies.

Markets can come back to ground if these conditions don’t exist.

Lots of concentrated wealth in this country and has to go somewhere as most of it isn’t being spent. That was in the extreme with ZIRP but the wealth is still out there.

Even a bull market runs out of money at some time

Also remember money on sideline is a myth perpetuated by financial media

Best Wolf Street articles each month.

A free rate of interest will clear the market as treasury bills, notes and bonds are auctioned. $34 Trillion is a monster number and will require a lot of buying power to fund.

The Fed can support those auctions, but that ultimately comes with a price tag…….inflation.

My guess is that we’ll see support when treasury and the Fed are concerned by “market conditions”. And, that includes the stock & bond markets.

Cheers,

B

Yellen and Powell are walking a tightrope right now.

With a really cushy net, as is the case with most technocrats and almost all politicians (except when there hand is caught directly in the till).

Crazy to think about how many of those in power today are gone in ten years if not sooner.

Lauren, It’s called “leaving the scene of the crime”

All we need now is a NVDA miss.

I told everyone to buy it at 20 dollars back in August 2015. I did a parlay bet of NVida onto AMD with NVidia at $120 before any stock splits and AMD at $6.25. I would have killed it if not for Trump’s trade war with China.

My MSFT, money markets and house value are earning more right now than I am, working. I wonder how long that lasts.

Expecting a big raise, phleep? I like that optimism!

Nick Timiraos of the Wall Street Journal has been writing article after article calling for the Fed to cut rates. Some recent headlines:

– January 15: “Fed Tiptoes Toward Kialing Back Key Channel of Monetary Tightening”

– January 26: “Cooler Inflation Keeps Door Open for Rate Cuts This Year”

– January 28: “Plummeting Inflation Raises New Risk for Fed: Rising Real Interest Rates”

I laughed out loud when Timiraos asked Powell quite aggressively today in the news conference what it is going to take for the Fed to cut rates (my paraphrasing). Timiraos looked visibly upset as he asked the question. Powell set him straight. I know there are many Powell detractors on this site, but I enjoyed today’s spectacle.

Yeah he was really upset. It was amusing.

Need to get myself a coffee mug that says ‘Timiraos Tears’

Timiraos isn’t the feds mouthpiece, he’s WSJs mouthpiece trying to get the fed to go back to zirp. Hopefully when they do layoffs he will get the boot.

Also, interesting to note that they want to see inflation hold at 2 for a bit before they declare victory. That may take a while to get there, especially with the troll yellen pulling as many tricks as she can to get her zombie reelected.

Reits down on volume. More pain on deck!

I’ve been always of the opinion Powell is a ditherer but he did a superb job today. And this cheap money junkies’ errand boy Timiraos was sent packing!

Yes, I thought that was funny too.

I missed the presser. I’ll watch it later on YT of course, but I hope Wolf writes up a summary, as he often does.

On Feb 4th, Nick wrote.

“Powell Says Fed Has New Focus: When to Cut Rates”

That is his summary of CBS 60 minutes interview.

How much WSJ will twist the words?

MarketWatch’s headline: “Powell tells 60 Minutes the economy’s strength allows the Fed to be careful with rate cuts.”

Bloomberg’s headline: “Powell Tells ‘60 Minutes’ Fed Is Wary of Cutting Rates Too Soon”

The most important thing Powell said, that the markets and financial news seemed to miss, is that the Fed will likely talk about QT at the next meeting, and what they should do for the next *year*. So this means expect QT to last at least another *year*, which may not even include a reduced pace of QT.

Really good point JeffD.

I think you are misinterpreting it, assuming those are the words they used. In my view, the language you cited leaves open all possibilities for QT over the next year, including complete termination.

I hope they continue with it until asset prices reduce by at least 30%. After a 100% to 300% spike in stock and RE prices the past 10 years, it’s warranted.

But I don’t think this Fed has the stomach for it, even if inflation remains 3% or higher. We’ll see. I think you have to play both sides because of the Fed’s inconsistent track record. They can flip on a dime, just like in 2018.

From Brookings:

“Goldman Sachs and Morgan Stanley predict the Fed will stop QT in the first quarter of 2025. JPMorgan economists see an earlier stop in November 2024.”

I took Powell’s statement as a corroberation of this.

First half of 2025 means 3 years of QT, considering that QT started mid-2022. But they could slow down the pace and let it drag out for a lot longer.

I was hoping for a Dovish Powell :-(. Powell tricked me this time :-).

Thanks WR for this report.

Higher for longer is great news for me and many others who are enjoying real positive yields on T-bills and money markets, while they last. It will be interesting to see if the higher-yield short-term portion of the yield curve and rapidly growing debt begins pushing 10-year yields higher. I won’t be placing any bets, one way or the other.

Did Powell finally relocate his spine?

It was good to see Powell walk back his nutty comments from the previous session. I like the way he says he is “surprised” a lot, and trying to figure out what is normal, and why the economy is still so strong.

I’ll tell you why I am not surprised at all. Normal is just another word for average. The average fed funds rate in the last fifty years 1971-2022 was 4.86%, median 4.97%. This is very close where we are today. So the current 5 percent, which is causing such anxiety on Wall Street, is normal. They and the Fed should get used to it. Psychologically, it is tough coming off of 15 years of ZIRP, but they need to get a dose of reality.

As for the housing market, the average 30-Year Fixed Rate Mortgage rate over the last fifty years was 7.76%. A bit higher than now. So real estate salesmen need to quit complaining about high interest rates slowing the housing market. What is killing the housing market are the 3% rates locked in during ZIRP. These people with “golden handcuffs” do not want to sell, or cannot. All my numbers are from FRED.

William,

And Sen Warren stated 2 days ago that interest rates for home buyers are “outrageously high”. She must never have taken Econ 101 to know her history, but is just pandering.

Pocahontas went off the deep end about ten years ago. Maybe she has cats.

She made all her money in real estate and likely has large holdings in that area.

Yes, she’s a filthily selfish real estate speculator. Really, really gross greedhead.

Probably owns a bunch of valuable tepees.

Congressmen shouldn’t be allowed to own assets at all outside of their personal residences.

For all your long-term averages to pencil out, home prices as a % of median household income need to drop back down to 4-4.5x, from their current range of 7-7.5x. In the last home price correction, they briefly touched 5x. (which was supported by historically low interest rates)

William Leake, you are 100% correct!

10 and 30 year yields have gone down significantly since the end of the press conference, curious as to why that may be?

Fear in the equity market. That’s a common reaction, selling stocks and jumping into bonds out of fear.

Good. Maybe my crappy Muni Bond fund will start having a positive rate of return for a change. Wolf was right. Bond funds suck.

People will park money into Bitcoin et al, lol, temporarily of course, only to park, not an investment, but maybe they could run it up again:):)

The saddest thing about this whole spectacle is just how much the Fed controls every market. You name it, stocks, bonds, commodities, currencies, real estate – they all hang on every word Powell says. There is absolutely no movement in any market based on fundamentals – it’s all based on hopium about future interest rate moves. Of course interest rates affect most investments but this is ridiculous. The Fed now controls all the markets all the time. And we are worried about the Chinese taking over the world?

Like any centrally planned economy, as in the Soviet Union, the Central Committee (in our case the Fed) wants to control the whole economy. But as it turns out, they cannot. The USSR collapsed. The Fed has relatively limited control, even though Wall Street hangs on its every word. The simple fact is the economy is too complex for them to figure out, which is why Powell uses the word “surprised” a lot. I think he has been humbled enough over his term so that he has learned to proceed with great caution, which is a good thing. If Wall Street wants to treat each word uttered by the Fed as the voice of Truth and Wisdom, well, that is their problem. The economy does not care, if it could care.

It’s the increased financialization of the economy which is choking out the real economy where needed, tangible things are produced, not derivatives that expire in a day or two. Also by shifting from pensions to defined contribution accounts the investment markets are much more of a political football as well as a national security concern.

We jumped the shark in the dot com boom and were not able to face up to the reckoning needed then to clean up the economy. Instead we have just turned to more gambling and lawlessness to keep the charade going.

I think the haves (and their proxies in Congress) were too self-interested to allow taxation coming anywhere near spending, so the solution became an end-run: the technocrats switched spending/inflation from legislative fiscal spending to administrative agency monetary policy (unelected technocrats printing money and flushing credit into the system). This was, I speculate, to keep the 21st century economy from winding down into deflation (i.e., keep it inflationary, and keep the consumer economy up and whirring). I’m not saying this was necessary or not, right or wrong, good or bad. Since we cannot reliably conjure up the counter-factual, who knows where another path would have led?

Phleep-

An excellent post. Nuanced reasoning.

But isn’t agency spending still funded via congressional action? At whose door does the federal deficit sit?

Can anyone throw some solutions into the potential solution set?

The FED does not control the stock market. Millions of people make buy and sell decisions everyday with no input from the FED.

Sure there are some market participants who try and spon what the FED says to try and justify their buys and sells, but their are also some who use Tarot cards, or chicken entrails to justify their decisions. Heck there are people who use the little squiggles in 200 day moving averages to justify their decisions.

A market is made up of all types.

Just because some market people make decisions off of what the FED says does not mean the FED controls the market. Anymore than Tarot cards control the market because some people use them in their decision making.

I agree, JimL. Regarding chicken entrails, I wonder if AI systems rely on technicals or fundamentals when searching out ways to make money on the stock market.

JimL-

In my opinion, the question is not whether the Fed “controls the stock market.” The question, and the problem, is that the Fed ATTEMPTS to control the whole economy by fixing certain short-term interest rates, and by buying or selling longer-term credit instruments. Their footprints in these arenas are enormous.

They also encourage or discourage banking activity through various means, often exaggerating supply or demand of credit to businesses and individuals.

And as if these interventions weren’t enough, they allow congress to finance their ever-expanding debts at discounted rates.

Finally, all of the Fed’s actions are aggregative solutions, and have important and numerous unintended side-effects scattered over the economic landscape.

That the Fed doesn’t have complete control of markets is a side-question — the real issue is that the compendium of interventions alters the world economy materially, undeniably, and insidiously.

Respectfully.

I prefer FEDs having the control than Musks or 🇨🇳 party leaders.

Really? What’s the difference? Do you actually think the Fed as Masters of the Universe is better than the alternatives? You think Jerome is working for you or Jamie Dimon? I would rather take my chances with the Chinese actually because I know for certain that Chase is trying to screw us all!

Best would be to leave it to the free market forces. But knowing humans, no other real alternative.

Jamie Dimon has done right by me. I am just about to pay of my very reasonable Chase home loan. One time along the way, Chase sent me the clearest and simplest consumer contract (loan modification) I have ever seen.

phleep

Chase wouldn’t let me pay off my mortgage on my home a decade and 1/2 ago. They used every trick in the book to prevent me from doing that. They were making a good interest rate on the mortgage. Finally, I got some nice lady from India to help me get the payoff balance.

We do appraisal work for Chase. They stiffed us for a $600 invoice for a foreclosure sale. Took 6 months to get paid fter the VA threatened them. We will never do any work for this crooked bank.

I liked it better in the old west as I’ve competed in the world fast draw championships left and right handed.

Can the Fed cut the number of meetings and statements in half? Every 12 weeks instead of 6? Powell should have just said “the market is strong and UE is low, inflation is slowly dropping. No change in our position anticipated for a long time”. We need to get away from this manic up down up down QE QT QE QT spiral. How about 5% and steady QT until 2026?

Another 6 months to one year of T-Bills that yield 5.3%

Life is fine and so am I, poetry for the soul.

I knew J Pow would come through for my investments.

Inflation is All they care about.

I am over 50% in short term Treasury Bills.

Have A Great Day!

Fantastic news. Just got home and what a pleasant surprise.

Once again we discover Repetition doesn’t equal Truth. How long must we endure this tendency… sheesh. Got JPowed this time eh lol.

And next week, after the stock market cries like a baby, they’ll telegraph cuts in March just like wall Street wants. Yawn.

There’s always hope, isn’t there?

Not hope, just reality since 2008. 16 years of bowing to wall street means rate cuts when wall street objects….especially in an election year during the biggest credit bubble in history. I’ll screen grab this and see you in March.

I’m giving good odds that February will end in the green. Inflation has become entrenched, and that alone will contribute to gains.

Most people knew there would not be a rate cut in March.

Jeez. Never a peep about de-dollarization by BRICS. Or FED shananigans with banks. Or the fact that JPMorgan is close with the Treasury and Janet Yellen.

Or the secret Davos plot to make everyone born in an even-numbered month wear their underwear on their heads every alternate week. Didn’t see a single word about that one. Wake up, sheeple!

The expanded BRICS includes a collection of wonderfully collapsed currencies. And those currencies collapsed against the hated USD 🤣

You are probably paying attention, and you are probably preparing for the inevitable result of FED shenanigans and Yellen and Dimon collusion at Treasury.

Disclaimer: Not hoping for a rate cut, not predicting one either. But from the chart I can’t help but feel that we’ve finally managed to complete the reloading of the monetary bazooka….

And if we don’t end up having to use said monetary thing in a short while, would that be on the very surface level fit the description of a soft landing, achieved?

Yes it would be a soft landing if

1. Inflation continues to trend towards Fed goal

2. Wages and employment stays strong

3. Economic slowdown can be supported by some rate cuts (recession avoided)

4. And supportive rate cuts do not lead to another round of inflation

I guess its possible but also too much to ask for.

I think soft landing or not….equity prices cannot be supportive where valuations are currently. Even if a soft landing is achieved (which would come with a normal monetary policy), equities are still likely to correct meaningfully.

But if history is any guide….it always feels like a soft landing till the very last minute. Find me one example when that was not true.

“to complete the reloading of the monetary bazooka…”

That has been a topic of discussion at the Fed. If they need to, they can stimulate the economy by cutting 300 or 400 basis points, which is big, and not get near 0% or QE. This is how the Fed used to do it, and they’re trying to go back to their old ways.

I do remember the commentaries that once the Fed went to ZIRP, which wasn’t stimulating the economy, then the series of QEs, the Fed was believed to be “out of ammo.”

They’ve fixed that.

When the Q&A session started. Powell dropped the Apple Logo displayed laptop and used a paper notebook. It looked like each questioner was a different reference page…or response notes. Scripted.

No journalist asked the question…how did this insane inflation begin?

Was it perhaps by printing money and giving it away for free?

Or, do you remember when you mentioned the inflation you created was “transitory”?

Another simple question. “Why do we allow 2% inflation?”

No inflation, no Fed.

Who is voting for this incompetence?

When I was at the university, back when universities were still good (a long time ago), professors and students were using Apple OS laptops or Microsoft OS laptops. After a while, it became very clear that the more intellectual challenged were the ones with the Apple laptops.

Just because you are still stuck in the past does not mean others still are. They care about going forward.

As for why 2% inflation, that has been answered on here many times. It is to avoid deflation completely. No one wants even a little deflation as that can be really dangerous for an economy.

Just because you do not grasp things does not mean others are incompetent.

Powell has done a great job bringing around that soft landing. Far better than anyone expected. Though that makes some people who want to watch the world burn unhappy.

Umm, our dollars are worth 30% less than in 2019. Price stability is the core of the Fed’s responsibility. As such, Powell is a complete failure and it’s shocking to hear someone defend him.

If Journalist wants to ask these hard hitting honest questions, they’d never be allowed to be in the presser alone.

From my standpoint, 2% inflation mandate has been a complete failure of FED. How would they account for 27% plus inflation ( gov metrics, which I dont trust )in last 4 years.

If FED is saying 2% average inflation, does it mean they’d rescind the inflation of last 4 years to bring it down to average 2% ?

Moving forward from your deliberate mistakes which made rich very rich seems to be a bad idea. Fix the mistakes and then move forward,

I’ve been saying for weeks that taper of QT would be DISGRACEFUL.

Who’s surprised?

Watch the small balance CRE space, not just the big boys projects. No rate cuts and tightening of LTV and DCR and refi from easy money. I had 4 CRE folks hit me up last week, asking if I were interested in their “pocket” listing. I had to be polite, but hard. Not interested, unless they realize that I can get 5%+ risk free and there is no price discovery. No rate cuts or end of QT anytime soon. Figure out what is the motivation of the seller and bring me desperate people who need to sell and not f*ck around. Or send me the contact info from the banks.

Cold wind blowing in from the north. Winter is coming. (rewatching GoT)

I expect the Fed not cut rates anytime soon unless there is a significant increase in unemployment. If you have a labor shortage and full employment, what is the need to cut rates? (other than political pressure due to the Federal Debt) and Wall street wanting stocks to rise.) Besides with the huge wage settlements this past year causing costs to rise may cause higher inflation in the near future. Cutting rates would cause the dollar to fall further making imports more expensive (inflationary) and thus allowing domestic suppliers to raise prices more freely.

Nasdaq down 2.3 %, BC down about 2%, gold down .17 %.

Hmm.

Great post on the Fed’s decision to hold rates! I found your analysis of the potential economic effects particularly insightful. As a mortgage broker, I’m curious to see how this decision will impact the housing market. Do you have any thoughts on how it might affect mortgage rates or buyer demand?

The average 30-year fixed mortgage rate (a US standard) has drifted back up to 7% (it was below 3% in 2021). It generally trades in relationship to the 10-year yield, with a spread of 2-3 percentage points. The 10-year yield is back over 4%. Higher mortgage rates mean lower home prices over time.

I get into the weeds of the US housing market right at the beginning of the interview here:

https://wolfstreet.com/2024/02/04/how-the-housing-market-split-in-two-doubts-about-the-taming-of-inflation-and-whats-going-on-with-new-used-vehicles/