Biggest home-price drops in the data going back to 2000 triggered by the biggest QT and highest rates in ECB history.

By Wolf Richter for WOLF STREET.

Germany is a great example of what ultra-low interest rates and massive QE do to home prices: They whip them into frenzy. And what rate hikes and QT do to home prices: they tank them.

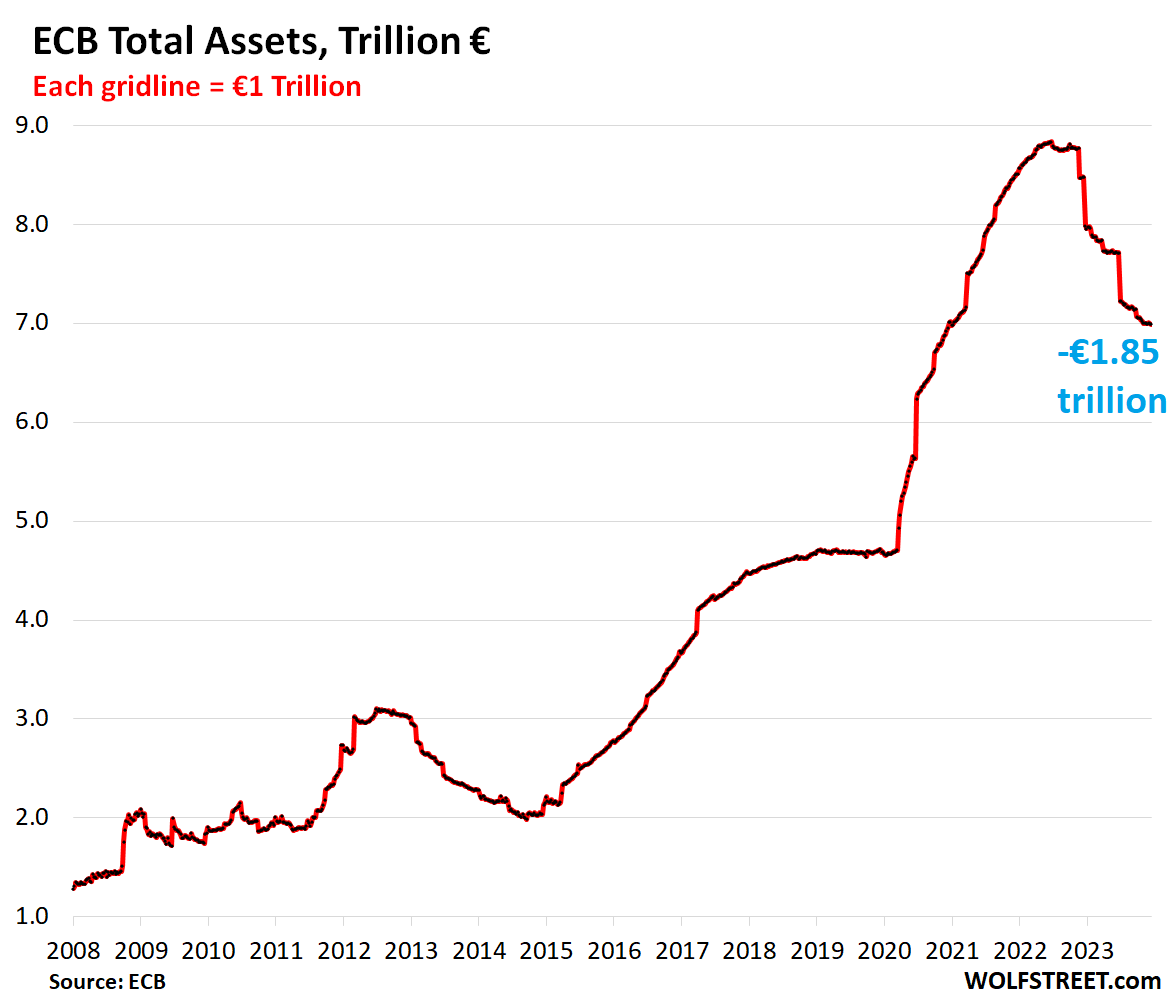

So now the ECB’s deposit rate is at 4.0%, up from -0.5% in June 2022. And the ECB has shed €1.85 trillion from its balance sheet since the peak in the summer of 2022, having unwound roughly 40% of the assets it piled on during the pandemic, and 21% of its total assets.

The ECB’s QE came in two forms: Massive and very attractive loans to banks that banks could use to buy assets with; and purchases of all kinds of bonds, including large amounts of corporate bonds. The pandemic era loans have now been totally unwound; and the bond holdings are being shed at an accelerated pace:

In 2008, the ECB’s policies started going berserk, first in reaction to the Global Financial Crisis, then in reaction to the Eurozone Debt Crisis, then in reaction to no crisis, an in 2016, the ECB pushed its deposit rate into the negative and it stayed negative until July 2022. And then in reaction to the pandemic, the ECB blew a fuse entirely.

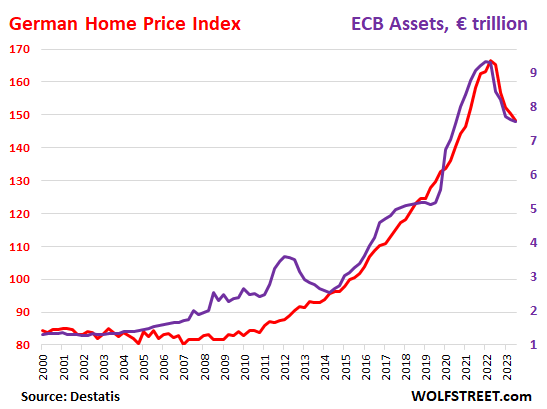

As these policies pushed down longer-term interest rates, including mortgage rates, home prices in Germany more than doubled in 12 years, while the ECB’s balance sheet multiplied by a factor of nine over the same period, from €1 trillion to nearly €9 trillion. But that was then and this is now.

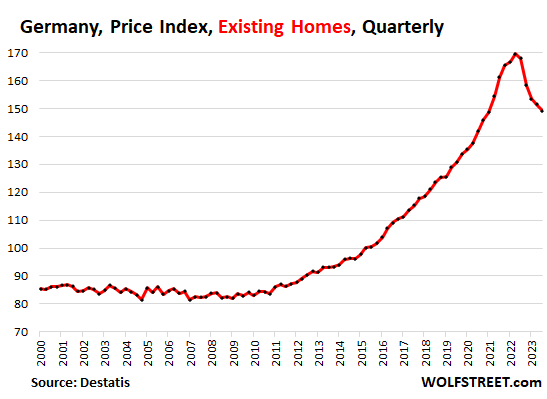

Prices of existing homes in Germany fell by another 1.5% in Q3 from Q2, the fifth quarter in a row of declines, according to the German statistical agency Destatis on Friday. These are used single-family houses, duplexes, and condos.

Year-over-year, prices fell by 11.2%, The year-over-year drops in Q1, Q2, and Q3 had been the steepest in the data going back to 2000.

From the peak in Q2 2022, prices dropped by 12.0%.

Between 2010 and the peak in Q2 2022, the index had soared by 104%. Note how it blew a fuse when the ECB blew a fuse during the pandemic. The index has now unwound nearly all the gains since January 2021:

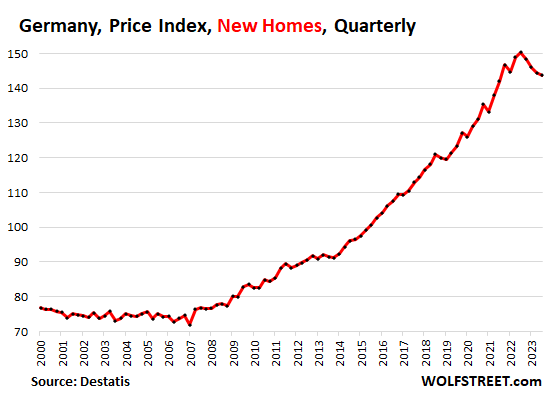

Prices of new homes – new single-family houses, duplexes, and condos – dropped by 0.6% in the quarter, and by 4.5% year-over-year from Q3 2022, which was also the peak. The index has now unwound nearly all of the gains since Q2 2021. Between 2010 and the peak in 2022, prices had spiked by 80%.

Single-family houses and duplexes got hit the hardest. Among all homes, existing and new, prices dropped the most for single-family houses and duplexes: -12.7% year-over-year in the largest seven metro areas (Berlin, Hamburg, Munich, Cologne, Frankfurt, Stuttgart, and Düsseldorf); and -12.4% year-over-year in thinly populated areas.

Condos also dropped, but not as much: -9.1% year-over-year in the largest seven metros; and -5.6% year-over-year in thinly populated areas.

Home prices and the ECB’s balance sheet. The overall home price index, which covers new and used single-family houses, duplexes, and condos, fell by 1.4% in the quarter, by 10.2% year-over-year, and by 10.9% from its peak in Q2 2022.

And this overall home price index is what we’ll use for our epic comparison to the ECB’s balance sheet. The chart shows Germany’s overall home price index (red, left scale), and the ECB’s total assets in trillions of euros (purple, right scale).

It shows the reality of QE: Interest rate repression through policy rates (short term rates) and QE (longer-term rates) causes rampant home price inflation; and with higher rates and with QT, the equation reverts and home prices tank.

Their movements aren’t proportional: The home price index about doubled between 2000 and 2022, while the balance sheet multiplied by a factor of about 9. But for the last 10 years, they have moved in the same direction with gusto:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Great fact finding and analysis 🐺. Other economies in the West are learning opportunities. You have covered real estate in Canada with gusto as well. Might be interesting producing a peice on recent zoning deregulation changes (less parking, setback requirements) and how that is impacting real estate.

Anyways, Wolf, merry 🎄 🎅. Thank you for all you do! Gracias hermano!

Don’t worry guys and gals, I have already announced Pivot to bubble up US Home prices.

I will create the most exclusive economy with asset bubbles that excluding the bottom 50% who own no assets and make them poorer as the top 10% get richer.

The 50% to 90% bracket must put all their money in the big 7 stocks that just surged 75% or lose out on my benevolence. If you used your old brain to buy the 5% treasury over 2023 you have lost the 50% opportunity in Nasdaq that I created for the super rich.

Thank you J for your keen insight onto how you wheel and deal. I wish I had figured it out 2 years ago,

The US media says soft landing after Santa Claus rally. Still the yield curve is inverted and I cannot figure out what is keeping the VIX suppressed.

J, is this seemingly unreasonable stock market rally your doing? Oh, I must say, you look very fetching in your suit,

You’re a mean one Mr Grinch.

All the time I thought it was because of Trump and his massive real estate holdings in 2019 now I know better. The world can’t function without double digit interest rates. No wonder Mexico is doing so well financially and the rest of the world is doing so poorly.

Before the stock market can drop, all of the bears need to be taken out behind the woodshed and shot.

That is happening now.

Harry Houndstooth

What are you talking about?

All the indexes are deeply in the GREEN!

sunny129, that’s his point.

His point is that the markets can’t drop as long as all bears have thrown in the towel and everyone is optimistic.

We’re almost at that point. Everyone has capitulated and is saying how there are great tailwinds to support asset prices. There is no fear, we’re in extreme greed territory, and the VIX is low. There is no concern about valuations, just FOMO.

All recipes for a drop unless the Fed drops rates to 0 and starts printing again.

Happiest of holidays everyone!

Merry Christmas and Happy Holidays to everyone. I’m going to check out here in a little while to see if I can sneak up on Santa.

Merry Christmas Wolf. Thanks for a good year of analysis and commentary.

Merry Christmas to all!

Thank you for a very entertaining year!

Thanks Wolf, merry Christmas and happy new year to you too!

Merry Christmas Wolf!!

Merry Christmas 🎄 Wolf and the entire house. Thanks.

I wonder if the German mortgage structure is a factor? I believe German mortgages are generally short-term (5 years) with the interest rate resetting after each term to the current market rate.

Similar as in Canada, and similar results. Home prices react faster with mortgages that are variable or adjustable, or have shorter terms.

Here is Canada. Data is monthly, not quarterly, so it looks a little different:

Merry Christmas & Happy Holidays to Wolf..

and everyone else on this board.

From what my friends tell me, German mortgages are shorter in term, usually have a set rate for only the first 3-5 years then “adjust” to the current interest rate. German mortgage loans also transfer, so the funds are there if you decide to change houses. The 30 year loan (USA) is a benefit to the individual, which is why there’s a movement in the financial fields to take it away.

I wonder just how loud Wall Street would be screaming if the FED had already “unwound” 40% of the assets they piled on over the last 8 years?

Merry Christmas everyone!

In Germany in my Opinion the common time for fixed morgage rates used to be 5 – 10 years with an amortization rate of 1%. Longer periods for fixation were / are possible (15/20 years, even 25/30).

In recent years with ultra low interest rates in my estimation it was quite common to fix the rates for 10 years with an amortization rate of then 2% p.a.

=> in 8 – 9 years there could be serious problems if interest rates are still at recent levels.

A transfer of loans usually needs the consent of the lender (solely replacement of a property which serves as collateral, while continuing the loan agreement).

In Germany mortgages are always longterm. 10 to 20 years a fixed rate. A friend of me still got very low rates 2 years ago for 20 years and was very happy about it at that time. Whatsoever rates the price of his condo decreased properly. If no hard recession kicks in, they will sit it out.

no ,thats rong we german take longe life mortgage 10 -20 jears ist standart.

Merry Christmas to all!

Thank you for a very entertaining year!

Merry Christmas!

Merry Christmas to everyone out there. Tonight, we joined the drunken sailors and had a nice time out at our favorite Irish Pub. The place was packed. No recession there. Ms Swamp even won the football pool and pocketed $650, for just watching some overpaid, under performing athletes doing their thing.

A night in a pub somehow magically represents the state of the economy?

Talk to your local car-dealer, Rolex AD, realtor, businessowner, manufacturer and shop and perhaps you’ll be enlightened.

The mania is over and reality is starting to sink in.

These hysterical and delusional last few years were unbearable.

Greed needs to be punished.

Wolf, is ECB selling assets or just rolling off?

The bonds are just rolling off.

The loans — the ECB made the terms less attractive (made them unattractive, starting in late 2022), and the banks paid them off. It’s much easier to get rid of loans than of bonds.

Wolf

You said for the FED balance sheet to be normalized at around 6 trillion dollars, that is at around 2 trillion dollars of reserves in the system. What would the numbers for that be for the ECB?

1. I haven’t spent enough time to figure out the ECB’s balance sheet, and its causes and effects. It’s completely different from the Fed’s. Among the differences, it holds a huge amount of private-sector bonds, and I think it can get rid of all of them without causing damage to the banking system. The Fed doesn’t own any private-sector bonds. The bigger worry with the ECB would be that a weaker Eurozone country (such as Italy or Greece) might find itself in a debt crisis again if the ECB goes below some magic level.

2. The only reason that the $6 trillion is sort of a lower limit for the Fed is that it wants to operate within its “ample reserves regime.” It could just abandon that and revert to injecting liquidity via repos during moments when it’s needed, which is what it used to do before 2008, and then set a minimum reserve requirement for each bank, of say 10%, as it used to do before 2020, and under this old scenario, its assets could drop below $6 trillion.

A very merry Christmas to All ,and peace on earth .Excellent learning experiences here by host and community

Wolf – Thanks for all the great data and stories this year. I come here daily to learn. Looking forward to more in 2024.

Germany’s entire economy has been in a significant recession for quite a while and is currently considerably worsening with a record number of business bankruptcies with many centered around energy.

German stock market all time high. With this, I suspect the housing market will stop dropping, IMO.

First thing you need to know is that the German “DAX” is a total return index (which includes dividends), and you cannot compare it to the S&P 500 index, and most other stock indices which do not include dividends, but are price indices.

The DAXK (DAX Kursindex) is the price index, it’s the DAX without the dividends. It’s equivalent to the S&P 500. The DAXK hit an all-time high in January 2022 (6,796) and now is 6,610, down by 3% from the high in Jan 2022.

And it’s up by only 7% from the high in March 2000 – which was over 23 years ago. And it’s among the lucky European stock indices. Many of them have not returned to their all-time highs around 2000 or 2007. The big Japanese and Chinese indices are also way below their all-time highs.

Excellent clarifying points.

Thank You!

Anyone sane person would have pumped everything into long term bonds not into all times overvalued stocks.

Isn’t that what it’s for?

YES WOLF…YOU AND YOUR SITE ARE SYNONYMOUS with the 120 yr old lighthouse during a winter storm on the rocky coast of Ireland!

THANKS SO MUCH FOR YOUR HARD WORK & EFFORT TO HELP EVERYONE “SEE THE LIGHT!”

Happy Holidays Wolf. I don’t necessarily agree with everything you say but I know your statements have basis on numbers instead of feelings which makes this the only financial news piece I still read.

Otherwise it’s just checking trading economics for daily numbers and the gas buddy blog.

Happy New Year.

That Canada chart is indicative of the insanity of the last 4 years.

Obviously it’s a global phenomenon, but Canada, Australia, Ireland are all prime examples of the very real effects of fraudulent monetary policies, financial repression, mass-immigration and an absolute lack of supply vs demand.

Homeprices aren’t isolated from very abrupt and profound changes in society, population, central bank manipulation and corruption in politics.

A complex system that’s severely impacted by these interventionist acts of manipulation will of course show extreme moves.

When housing stopped being shelter and became the object of speculation, did you really expect anything other than hysterical mania?

And now with the pivot-propaganda everyone just assumes a re-run of the last 4 years?

I guess hype, hysteria and mania are the only plays left in this hopelessly broken and corrupt debt-based ponzi-scheme.

In Canada it was possible to lie about your income to obtain a mortgage even if you didn’t have a job or were on welfare or were homeless living on the street. Everyone tried to ride on the coattails of the Chinese.

Yes! – best wishes to Wolf for 2024, and also for all you subscribers.

My understanding of the German housing market is that a large

proportion of families are renters. And consequently the number

of houses/flats coming to the market is smaller than e.g the UK,

where owner occupiers are a majority %age, comparec with

renters.

Merry Christmas to you wolf and everyone involved here.

Wolf, I can’t understand why QT and high interest rates are still not affecting property prices in France and eastern europe? In Eastern Europe, prices continue to rise.

That’s because interest rates are still far too low.

Is unemployment in Germany turning up?

A Moody’s report puts the unemployment rate at 5.9%, up over the course of 2023. I though it had been closer to 3% in 2022…

That seems significant.

Any depth of understanding that can be added on German unemployment trends?

Wishing you all a peaceful and meaningful holiday season!

On the surface, it almost seems funny. They’re still talking about labor shortages in many professions, especially in the trades where fairly high qualifications are needed (electricians, bakers, plumbers, fabrication, specialized manufacturing, etc.), and they’re even having trouble finding apprentices because young people don’t really want to do these jobs, but also in healthcare and many other areas. But the unemployment rate has been ticking up (5.9% is still low for Germany though). Seems to be a classic misalignment, with people wanting to get jobs that don’t exist, and other jobs that do exist cannot get filled because not enough people can do them or even want to do them. In addition, there is rampant age discrimination where older people are forced out and cannot find another job, though they could do those jobs well. These are very frustrating problems. We’re seeing some of that in the US too.

Great analysis! This is the inflation/asset price inflation and the housing bubble no one wants to see in Germany, and the correlation in the last graphic is more as impressive.

Merry Christmas to you, and many thanks for your insightful reports. Greetings from Franconia!

Location, location, location…

A Munich radio station (private) reports that an equivalent SFR in Fürstenfeldbrück is €800k, while in Starnberg, anecdotally the most expensive town in Germany, twenty three kilometers south of Munich, around €2M. If it goes like Austin and Boise, the extravagant real estate price spikes should recede in a similarly exaggerated manner. But I delivered the South German newspaper along the Starnberg lake when I was a teenager, and it only carried real estate advertising on Thursdays, and apartment rentals was usually a column and a half in a city of a million people, agent fees were shamelessly high. There just wasn’t much available and since it took a long time to get anybody to move out many houses and apartments stood empty for speculation. Maybe some working class suburbs in Munich might see prices moderate somewhat, but it’s difficult to imagine houses in Grünwald or Nymphenburg doing that. It takes longer to build anything in Germany than almost all of the US, and lots of people want to live there. Recently a smallish town in northern Germany decided to occupy empty houses with homeless immigrants through some sort of eminent domain. Things must be pretty desperate to commandeer private property. And it gives real estate investors something else to worry about.

In terms of the last part of your comment: There are lots of vacant apartments. And some big construction projects have recently run into trouble because the builders filed for insolvency. The problem is that immigrants — Germany had a flood of them — cannot afford them without subsidies.

Let them eat cake.

It’s a shame because the german culture was to rent housing and save by financing the mittlestand sme etc i.e. saving was investment. Stuck with the euro they are now obliged to pile into housing.

Chasing the nominal appreciation of housing really is a social disease.

I remain befuddled by U.S. housing prices. Fitch said:

“Fitch Ratings-New York-20 December 2023: Fitch Ratings estimates that national home prices were 9.4% overvalued for 2Q2023 on a population-weighted average basis and expects overvaluation to remain elevated due to the continued rise in home prices in Q3.”

I would have thought they were way more overpriced than that but I am confused.

I am in a Starbucks this Christmas morning and it confuses me too. Coffee milk shakes for breakfast and lots of low wage young people trying so hard to be happy. I definitely don’t fit in but my regular diner is sensibly closed.

Thomas,

Our ‘local’ Starbucks is open too. Got a mocha for the wife and a vanilla latte for me. No treats as the kiddos are bringing some later.

Yeah … the forced cheer made me thankful I have family coming over for lunch and gift exchange in a few hours.

Merry Christmas to All!

A mocha and a vanilla latte ARE treat! ;-)

Unless your rents take a big fall home prices are well undervalued in America. Americans never understood that in the first place as renting never made sense compared to home prices.

Rents v. Home prices in America:

Merry Christmas and Happy New Year Wolf, thank you for your detailed coverage of our financial world. Your observations and insight is much appreciated.

With the massive immigration into Germany, you would think with supply and demand, that German house prices would not fall.

Most immigrants are poor by German standards and cannot afford to buy houses or condos. They have trouble even renting something unsubsidized at the low end.

1) RRP is down : (-)$1.8T.

2) Fed balance sheet : Fed assets – RRP. No QT.

3) Add the “anti inflation act” ==> QE in 2023.

4) RRP provides good collateral in the o/n market. Starvation and dehydration in the o/n market will elevate demand for good collateral. Liquidity might dry. RRP might move up, up to a new all time high.

Michael Engel-

So, when contracting an ON RRP, the Fed supplies “collateral” to the MMF by selling acceptable securities to the MMF, on day 1, with an obligation to repurchase the the securities on day 2. And the MMF is obliged to sell the securities back to the Fed on day 2.

Through this activity, the MMF parks cash at an advantageous rate (subject to FOMC generosity on this facility), and Fed expands its balance sheet?

If I have that much right, I’m not understanding how the ON RRP increases “good collateral in the o/n market” if that collateral is already obligated to be self-liquidated one day after issuance.

Seems circular, and like it could be spectacularly unstable. Isn’t the Fed just just subsidizing and propping up the money market fund industry?

Is the money market fund industry the week link in this picture?

Apologies if this is an idiot rookie question, which I’m guessing it is….

Found this in an article entitled ‘Ins and Outs of Collateral Re-use’ (at the Fed’s FEDS Notes website, 2018, 3rd paragraph) that states my point about unstableness better than I did:

“However, the free circulation of collateral comes at a cost. Namely, the re-use of collateral increases interconnectedness and can contribute to fragility in financial markets by increasing the uncertainty regarding who holds the collateral, the ability of counterparties to return the collateral, and who is entitled to the collateral in case of default. The use and re-use of collateral can create long “collateral chains” in which one security is used for multiple transactions. These collateral chains have the potential to propagate uncertainties and amplify fragility in times of market stress.”

Akin to rehypothecation?

When the Fed hiked aggressively MMF and banks parked their

money in RRP switching their bills and notes. Those bills and notes

provided good collateral in the o/n market.

Since RRP is down $1.8T the o/n market starves for good collateral. MBS aren’t good enough.

Micheal Engel,

Your #2 = BS.

Your #3 = BS.

Your #4 = BS.

What did you smoke this early in the morning?

Wolf-

I think I asked this once before some time ago, but when a commercial bank enters into an ON RRP, where/how does the collateral show up on its balance sheet?

Same question regarding the Fed when it issues a Repo… where does the collateral reside on the Fed balance sheet?

Separately, but I think related, in the Fed article I referenced above (In’s and Out’s of Collateral Re-use, Sebastian Infante, Charles Press, and Jacob Strauss), the authors discuss the concept of a “collateral multiplier,” and make this statement: “ Collateral Multiplier: This measure is the fraction of all outgoing collateral relative to the firm’s outright security holdings financed through SFTs.” [SFT = secured financing transactions]

Perhaps this subject is too far afield from the German SFH article’s theme. If so, I hope you’ll consider covering the subject of “collateral re-use” in a future RRP related article.

“…when a commercial bank enters into an ON RRP…”

That’s already wrong. Money market funds are using the ON RRPs. Not banks. Banks use the “reserves” account. If commercial banks have extra cash they want to earn money on at the Fed, they put it on deposit at the Fed, which is their “reserves” account, and which shows up as “interest-earning cash” or similar (asset) on the bank balance sheet and as “reserves” on the Fed’s balance sheet (liability).

The reason banks put cash into their reserves accounts at the Fed rather than engaging in ON RRPs is that banks earn 5.4% on reserves and 5.3% on ON RRPs.

https://wolfstreet.com/2023/12/13/fed-holds-rates-at-5-50-top-of-range-sees-three-rate-cuts-in-2024-qt-to-continue/

“… regarding the Fed when it issues a Repo… where does the collateral reside on the Fed balance sheet?”

Overnight Reverse Repos (ON RRPs) are carried as contracts. So on the Fed’s books, these contracts are a liability (cash it owes the counterparties). The Fed holds trillions of Treasury securities as part of its assets, and it post some of them as collateral for RRPs. But it doesn’t sell those Treasuries, they’re just posted as collateral. And the next day, when the ON RRP unwinds, the Fed gets its collateral back and the money market funds get their cash back, and then, if they want to, they can engage in another one-day contract, etc.

Thank you for that correction on my question… I was under the mistaken impression that commercial banks or MMMFs could tap into Fed ON RRPs.

1. Commercial banks that are approved counterparties are allowed to but would be stupid to because they make more money with reserves and have instant liquidity, rather than next-day liquidity. And so they don’t. We know the money market funds by name that are participating in ON RRPs and the amounts they have in it. It’s not a secret. I report on it from time to time.

2. And it’s NOT “tap into.” Participants in ON RRPs are LENDING the Fed money (for 5.3% return), they’re NOT borrowing from the Fed.

Pre-approval by the FOMC of 16 commercial banks for ON RRP begs the question: WHY?

Maybe its an oversight, but it seems premeditated….

The German DAX has done nothing for 10 years, since 2014. The

DAX might be in distribution. The jump since Oct 23 low might be a

dead cat bounce. There was no higher close since Dec 11. On Dec 14 the DAX flipped lower. France is in a recession. Germany might enter soon.

France is in recession.

But there is no such collapse of property prices as in Germany. I wonder why?

Good beer might be part of the answer…

lol. Hardly. The best beer is Czech, but there is no real estate price crash there either, on the contrary.

I also am a Czech beer fan! My personal favorites are the Abbey miracles produced in Belgium — nobody concocts a magical brew like a country friar.

Germany makes it onto the podium, though, IMO.

Cheers!

I’ve never had any. Sounds like I should Czech it off my bucket list.

The quarterly measure of French home prices peaked in Q3 2022 and has slid three quarters in a row through Q2, but only a little. Q3 not yet available. They also increased less than in Germany. They’re up only about 22% since since 2011, which is pretty reasonable for a 12-year period.

Thanks for the reply.

It really makes sense for housing inflation to be 2 to 3 percent per year

However, the price per m2 in Paris is 10,000 to 12,000 euros.

price per m2 in Berlin from 5,500 to 8,000 euros.

Germany was the engine of the economy in Europe and the strongest economy.

German’s were always ranked first in intelligence that would explain the rational for not buying overpriced stocks.

The German housing index was dormant between 2000 and 2011.

Between 2011 and 2020 it jumped from 90 to 150. in 2023 it made

a rd trip to 2020 highs. In the last three Qt it’s losing its down thrust.

In Mar 2011 the German 10Y was 3.5%. It plunged and crossed zero in July 2016. After bouncing up to a lower high the German 10 crossed zero until Jan 2022.

It peaked at 3% in Oct 2023, a lower high. Since then the German 10Y is down to 2%.

US10 dropped from 5% to 3.9%.

The “Anti Inflation Act” and the QE are losing thrust.

Does anyone pays attention to the property prices in Eastern Europe. Bulgaria for example. The prices are up and up and up, fueled by the idiotic bank interest rates, which by the way, are the lowest in whole of Europe (excluding Malta). The average interest rate of a mortgage loan in Bulgaria is 2,5%, which in insane given the ECB rates 4% deposit rate and 4,5% main refinancing rate.

Does anyone has any idea how this is possible? The poorest country in Europe, which has the the fastest deteriorating population in Europe, to have the lowest mortgage loan interest rates and the prices of the real estate to be going through the roof.

btw. bulgarian currency in pegged to the euro, since 2007 and before that to the german mark.