The drop in new orders was off an all-time high, while unfilled orders rose to an all-time high. Orders by major category.

By Wolf Richter for WOLF STREET.

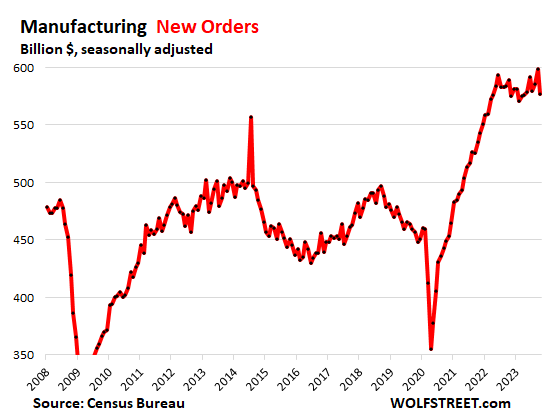

The headlines had a kind of shocking collapse-is-nigh quality: Manufacturing orders plunged “by the most since April 2020.” These are new orders that manufacturing sites in the US received. But the drop was off the all-time high a month earlier. And unfilled orders rose to an all-time high. The Census Bureau released the data today. So here we go.

Unfilled orders rose to an all-time high of $1.36 trillion in October, up by 7.1% year-over-year, and up by 27% from 2019, according to Census Bureau data today. That’s the total backlog:

New orders fell 3.6% from their all-time high in September to $577 billion in October.

The data jumps up and down dramatically every month to the great excitement of the headlines. And the drop in October came off the all-time high in September. And it came after a huge spike in orders during the pandemic through June 2022. So compared to October 2019, new orders in October were still up by 26%!

The drop in new orders of $21.8 billion in October from the record in September was mostly caused by “nondefense aircraft and parts” – a very volatile category powered by huge but irregular orders for Boeing – which plunged by half, or by $15.9 billion. But some other industries saw record manufacturing orders.

What we can see is that after the spectacular spike through mid-2022, the boom in new orders overall has been plateauing at around these record levels for months, reached a new record in September, and declined off the record in October, in data that is notoriously volatile, with big month-to-month ups and downs.

Major categories of new orders at US manufacturing sites.

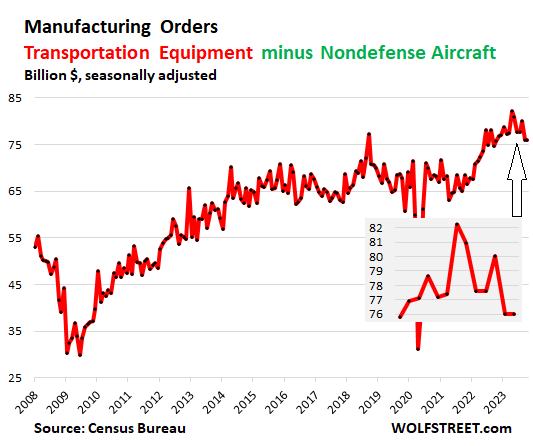

Orders for Nondefense Aircraft and Parts plunged by half and were the big culprit in the month-to-month decline. They are always volatile, spiking and plunging from month to month, as Boeing may get a large order in one month, and not much in the next.

In October, orders plunged to $16 billion from $32 billion in September, and were back roughly where’d they been in August.

See the negative orders starting in 2019? This occurred following the second crash of a Boeing 737 Max that triggered a wave of order cancellations, and previous orders were backed out.

Transportation equipment was dragged down by the plunge in nondefense aircraft orders. In October, orders for transportation equipment dropped by $15.9 billion to $92 billion.

Without nondefense aircraft, orders for transportation equipment were unchanged in October from September, at $76 billion, were also roughly unchanged from a year ago, and were up 12% from 2019. This category too shows big month-to-month ups and downs:

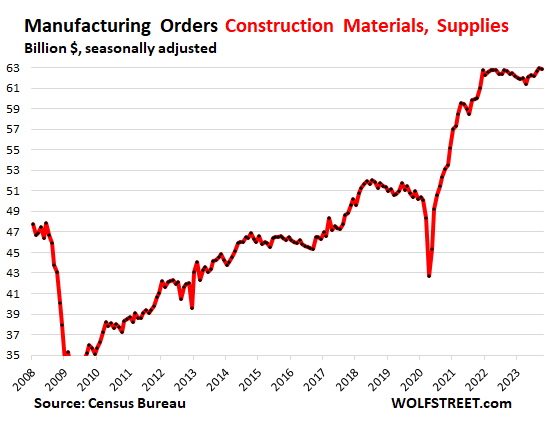

Orders for Construction Materials and Supplies reached a record in September and stayed there in October, of $63 billion, wobbling along a high plateau since early 2022. Orders were up by 24.8% from October 2019.

The spike in 2021 was in part driven by price increases, and in part by a surge in activity. But construction materials costs stopped rising last year and this year, and many materials have seen sharp price declines, including lumber.

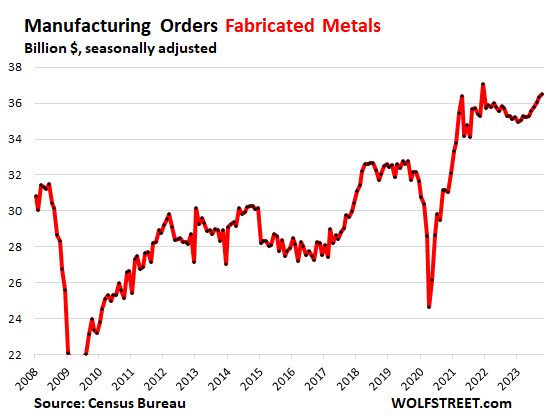

Orders for fabricated metals rose to $37 billion, the second highest ever, just behind the one-month wonder of December 2021. Up by 3.5% year-over-year and by 13.6% from 2019:

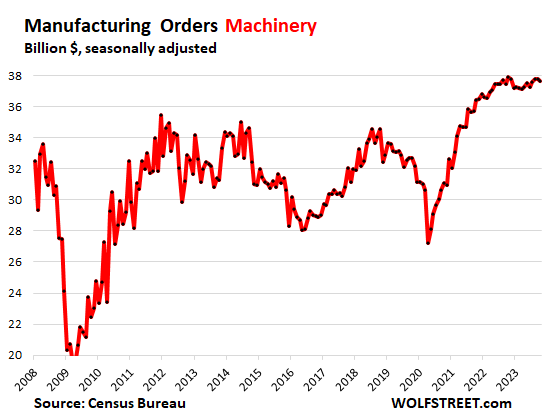

Orders for machinery – equipment for construction, agriculture, mining, oil & gas drilling, manufacturing, power generators, etc. – at $38 billion, were roughly unchanged for the month (-0.1%) and year-over-year, and up 15.1% from 2019:

Orders for motor vehicles fell by 3.6% for the month, to $60 billion, the second months in a row of declines, off the all-time high in August.

Unit sales at dealers are up by the double digits from a year ago. During and after the shortages in 2021 and 2022, dealers have been trying get inventory, and now they have inventory, and they can back off some from their ordering-frenzy. In October, orders were still 14.3% higher than in 2019.

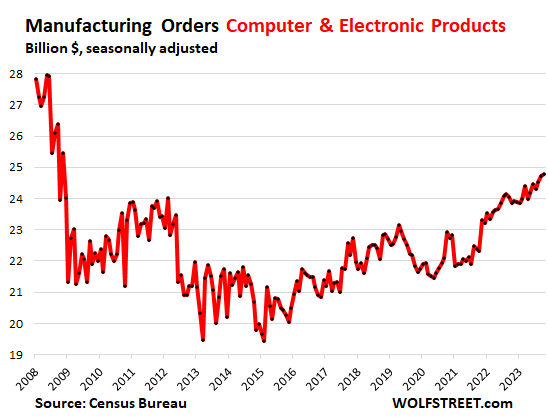

Orders for Computer and Electronic Products rose to the highest level in 15 years, up by 4.0% year-over-year, and up by 13.6% from 2019.

The industry is infamous for persistent price declines as the technology moves forward. Price declines are in the nature of tech products, and have been for decades, where ever increasing performance becomes available for less and less. Since this data is not adjusted for price changes, it reflects the price declines in addition to other dynamics:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“many materials have seen sharp price declines, including lumber”

Lumber futures have declined sharply — about 75% from peak nuttiness, and 20% from just 6 months ago — but physical product is down much less. Approx flat over the last quarter. Amazing how sticky prices have been.

Lumber retail prices: the definition of highway robbery.

Hasn’t translated to lower fence rebuilding quotes, at least where I am at. We might do it ourselves but time and retail lumber are a factor but $50+ a sqft is also high for paying out. Labor costs could be a factor but my guess is gouging more likely. Never seemed to go back down after raised given shortages after the fires here in CA. The few decent quotes we got they never returned our calls when we tried to book them. Last Winter was brutal so perhaps the Spring will see some relief. I paid $55 per sqft on fortunately only 18 feet of a shared good neighbor fence.

From the Commerce Department, from March 2022 through October 2023, total orders are down 6%, with inflation taken into account. Shipments down the same amount over the same time period.

Non durables are down 8%, factory orders excluding transportation down 7%, taking inflation into account.

You have plotted “unfilled orders” and “new orders” from the “census bureau” instead of actual production from the Commerce Department, and have done so without factoring inflation. That makes a decline look like a boom.

“…from March 2022 through October 2023, total orders are down 6%, with inflation taken into account.”

BS. You’re applying overall CPI, which is dominated by SERVICES (where inflation is hot), to GOODS (now in deflation). That is a total no-no.

Even applying CPI is conceptually wrong because CPI is for consumer price inflation; and many of the manufactured products are not directly sold to consumers. But OK, I’m going to play along with you.

1. The CPI for durable goods is -1.6% since March 2022; and -2.8% since August 2022. This is goods DEFLATION. You need to ADD this DEFLATION to the orders of durable goods to get inflation-adjusted durable-goods orders.

Durable-goods orders grew by nearly 1% since March 2022. So now add the CPI deflation for durable goods of 1.6%, and you get inflation-adjusted growth of durable-goods orders of around 3.5%!

2. Inflation for nondurable goods has been about flat year-over-year. Nondurable goods orders since March 2022 are down 2%.

3. Orders (new and unfilled) are early indicators. Production lags, because first you have to get the order, and then you have to make the product (DUH)

4. “… actual production from the Commerce Department,…”

The Commerce Department doesn’t track manufacturing production. The Federal Reserve tracks it (last release was in mid-November).

And yet, the ISM manufacturing PMI has been in CONTRACTION for 13 months (contracting in all but one of those months), with NEW ORDERS CONTRACTING 15 consecutive months, currently at a dismal 39.3! And new ORDERS LEAD PRODUCTION, as you said.

I believe you when you say prices for manufactured durable goods are DECREASING. That’s good if it is INPUT prices. But OUTPUT PRICES DECLINING makes things WORSE for manufacturers, not BETTER. They are manufacturing less (per PMI), getting fewer dollars per item (as you said), and those dollars are worth much less when they go to spend them for anything else, due to general inflation which is measured by CPI. If true, then manufacturers are even more screwed.

Are your generally rosy analyses of the economy correct and everyone else wrong? Or visa-versa? I wish I knew. I’ll keep reading if that’s okay. The truth must be out there.

1. Look, these recession mongers have been recession mongering for 18 months, and some of them forever, and the economy keeps rocking and rolling, and we just had 5.2% GDP growth in Q3, which is huge for an economy that averaged 1.9% before the pandemic. I’m so sick of their ridiculous moronic BS. If you like to wallow in it, go wallow in it. But it’s not here.

I’ve been watching for indications of a recession since the rate hikes began, and the data keeps telling us that there isn’t a recession yet, and not on the horizon. Someday we’ll get one because recessions are part of the normal business cycle. And this economy needs a recession. But it’s just not happening.

2. Try to understand what a PMI actually is. It’s a sentiment survey of executives who are asked: was production/orders/employment/etc. in the current month higher, the same, or lower than in the prior month. Higher = 1, same = 0, lower = -1. That’s all it is.

Almost without exception those charts are up and to the right. Beats the other scenario…

Yup, that’s what I was thinking.

Of course they are. The FED and .gov made sure of that. In 2020 they told us EXACTLY what they were going to do insofar as their money-printing scheme. “The risk of doing too little far outweighs the risk of doing too much…..”

That was a lie, of course, but it was their narrative. If they were honest, they would have said “we are going to render the future of the young and working classes into larger profits and bank accounts for ourselves and all of our rich buddies, so go f*** yourselves.”

And now we are nearing all time highs again in a lot of the bubbles, because the speculators are immensely cashed up and using momentum to continue to pour into the latest, greatest pump and dump. Everything is just straight up degenerative gambling at this point, because the FED never removed the punch bowl, they just started tapered from Everclear to 80 proof.

And defense ordering? Catchup time perhaps – do we have information or clues around that..?

Defense capital goods orders of $15.7 billion in Oct amounted to just 2.7% of total orders. Sorry it’s not more. It didn’t make the cutoff on my list because it’s too small. It’s up by $3 billion from a year ago and up $1 billion from Oct 2019.

Thanks

There is about $60 billion of equipment and supplies we donated to Ukraine, Israel and Taiwan that will be spent soon out of a $105 billion appropriation to replenish our gift bag.

The other $50 billion of the $105 b is in the form of services, humanitarian aid, graft, etc

Thanks so much Wolf. I don’t know why the financial media has been generally negative and wrong for the last year but your sane writing has helped me climb the wall of worry.

Now I am starting to think that 2024 could be one of the record setting years in the markets. Setting tight and doing nothing is often the hardest thing to do in investing.

New records for plunges will indeed be set in 2024.

I think you have this backwards. When people say “the markets are climbing the wall of worry,” they mean that investors are concerned that things are worse than they actually are.

That’s not the case here. Here, the markets have not gone up in spite of negative economy news from the financial media, but BECAUSE of it. In other words, the negative financial news has convinced people that things are so bad that a Fed pivot is on the way very soon.

Wolf’s articles are demonstrating that the economy is still plugging away with no recession in sight. That means that a Fed pivot is not close, unless the Fed has been corrupted and is planning on totally capitulating to Wall Street.

Don’t forget, next year is an election year.

What follows from that?

Einhal,

I have the answer. So just between you and me — don’t tell anyone: Powell is a Republican. He’s gonna trash the economy so that Biden will lose.

🤣

Good point! I better load up on shorts!

I would guess Powell to be in the Never Trump side of the GOP. Plus, since he’s already worked for Trump once and was thoroughly thrown under the bus, I’m pretty sure he doesn’t want round two!

You’ve got to separate the markets from the economy. During the years of QE, the economy was wobbling along at very low growth rates, and markets BOOMED because of QE on 0%. Now we have a pretty decent economy (in 2023 … not sure about 2024), but QT and 5.5%. So I see the economy plugging along at a reasonable pace, but markets going down because of QT and 5.5%.

Just adding to the appreciation for your efforts here Wolf!

Savings now at least ”somewhat” relevant to inflation and the ”cost of money” for the first time in recent memory, eh!!!

‘Course, in some cases, ahem,,, ”recent memory” don’t mean much these days..

Many thanks again.

Hey Wolf,

I can see that I am definitely in the minority here on where equity markets will go next year and if employment drops quickly I will turn short in a heartbeat. But until then:

I think the fed will cut enough to bring us in for a soft landing with GDP growth of between 2-3%. I love all of the factory building that will be priced in. Large deficit government spending from the big bills last year will accelerate and further goose the economy. Finally, Europe is a bit of a basket case (can’t even launch their own rockets or compete in AI or Quantum). China is trying to move toward a consumer driven society but that will take decades and it has a lot of structural problems related to distrust by much of the world and debt.

Compared to the rest of the world the U.S. is well tuned machine. Worldwide, where else are investors going to put their money.

But mostly, I think the FED will handle this. It is 2025 that has me more concerned.

The US is a financial disaster of unprecedented proportion.

“I think the fed will cut enough…”

The Fed can’t/won’t cut as long as inflation remains above their 2% target.

Follow the smartest man in investing Warren ,huge cash pile like a vulture waiting . Be careful

I get what you mean by cash pile but I’m sure it is earning solid returns as is possible right now in fairly liquid positions. I’m sure many of us are parking some cash in short term bills are high interest saving accounts much the same. Very different today than parking cash from just a few years back.

I think that’s Flea’s point. Warren Buffett thinks that cash earning 5.4% is better than buying overpriced assets.

CNBS headline this morning, “Fed is ‘disconnected’ from reality, must cut rates 5 times next year, portfolio manager says”

😡😡😡

In Europe, some commercial banks have already talked about an imminent return of ECB interest rates to pre-pandemic levels, i.e. to 0.

lol

The best money is free money, LOL. And they all want their free money back. This stuff is just hilarious.

Hello Wolf,

Unfortunately, the addicts own and control the dealer. But for inflation giving the dealer no options but to raise rates, the dealer would have succumbed to the addicts a long time back.

This is not my conjecture, it is the Fed’s own track record. How I wish that the Fed acted in the interests of all citizens rather than the banksters and the 1%.

Those portfolio managers are getting desperate?

The folks who call the shots, both at the fed and with lawmakers, are doing extremely well, which is why we see such wealth disparities in the US now.

A large number of Americans are suffering financially and are the vocal ones we keep hearing who make us think things are worse than the numbers imply and than they really are.

Yes, they are. You can tell by the increased frequency of their whining. Lol

The Federal Reserve will likely INCREASE their interest rates.

Only a few Venezuelans bothered to vote. The referendum was not supported by the citizens.

The economy is humming along nicely, as factory orders and other indicators suggest, within the backdrop of historically normal short-term rates. The problem is financial conditions have eased over the last month; note the big drop in the 10-year Treasury, the stock market is near record highs, and housing prices are holding near record highs. So the Fed is in a bind, because the markets are reflecting an easing and the Fed Funds Rate is about normal. Remember last month Powell was talking about the markets tightening. Well, that ended almost right after he quit talking about it. If there is any connection between what the Fed does and inflation, the Fed might have to think about raising rates.

LOL at the yield curve.

Who needs a Fed cut??

We are in the transportation equipment industry, and these charts seem fitting for our experience at the moment. Things are still really hot. Just when it feels like things are cooling, we get a big glut of business again and it’s back to buried. If December lands just a few units ahead of normal, and we ship the backlog as planned for this month, we’ll close out the year as follows:

– Unit orders vs 5-year average: +26%

– $ Sales vs 5-year average: +38.9%

Dollars sold are lagging their potential and the backlog (and lead time) keeps growing because demand is outstripping supply. We’ve raised capacity about 20% above normal but it is still not quite enough. We were maxing out machine capacity all through the first half of the year and installed some major upgrades this summer. Now it is mostly a labor constraint of our small town in flyover keeping us from shipping more. Competing shops hiring welders are all busy too.

2023 is already our highest grossing year. That is due in part to higher prices, and partially due to high unit sales. It will be either the first or second highest in unit orders, depending on how December finishes. Profitability will be “middle of the road” as expansion costs, materials, and higher wages are clawing back the lion’s share of gains from price increases.

Wow! that’s a big year for you.

Can you say what kind of equipment you manufacture? I think I asked you before on a post a few months back, but I can’t remember your response.

Yes, a very busy year that comes as a bit of a surprise. We thought 2021 was THE peak, and things might slow but have been proven overly pessimistic. Had we known we would stay this busy, the orders for new manufacturing equipment would have been issued a year or two earlier.

If I gave too much about the company, it would take a clever googler only a few minutes to have my face and a name, so in the name of anonymity, I will say we make metal stuff involved in last-mile delivery…Box trucks are our bread and butter.

For additional context… our competitors are in a similar position. We are all buried in work right now, so I cannot chalk up the gains to something I am doing right… yet. Plenty of good stuff in the works though for 2024.

“If I gave too much about the company, it would take a clever googler only a few minutes to have my face and a name,”

Ha ha, yeah I totally get that.

Thanks for the info.

DB: Media giants poised to layoff staffers in droves…

They still have any staffers left to lay off after years of layoffs? I thought they’d all been replaced by AI 🤣

Powell is a Republican. He’s gonna trash the economy so that Biden will lose?

🤣

There is nothing, repeat nothing Powell can do to trash the economy.

Census does not collect data on orders for non-durables; they use shipments from the same month as a proxy…that works until it doesn’t..

also, those “orders” are nominal value, and producer prices averaged 1.4% lower in October…so there’s a grain of salt with that too…

If prices are lower, adjusted for inflation orders would then be even higher.