Investors smell the money, billions are flowing, even in the US, which could become major lithium producer.

By Wolf Richter for WOLF STREET.

Who needs fundamentals when you have rampant speculation? And then you can make up a story that fits the speculative narrative, and everyone will jump in, and you’re off to the races. That’s what commodities are all about from time to time. They’re so much fun.

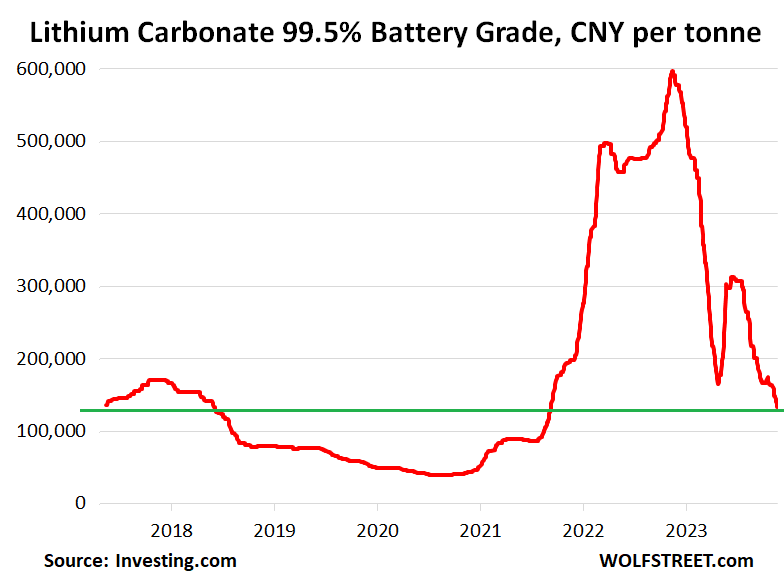

The spot price of battery-grade lithium carbonate, trading in Shanghai and serving as a benchmark, dropped today to CNY 133,500 per tonne, down 77% from the peak a year ago, and below where it had been in 2017.

It had spiked by 1,410% from CNY 39,500 per tonne in August 2020 to CNY 600,000 in November 2022, multiplying by 15 in about 27 months, WHOOSH. The narrative to support the speculative craze was, you guessed it, lithium shortage. But high prices brought lots of new production online. The best cure for high prices is high prices. And soon the new and improved narrative was that there was a lithium glut. And today roughly completes the first full year of a most spectacular collapse in prices.

We already had a lithium bubble followed by an implosion a few years ago: The prior lithium bubble peaked in 2017, at CNY 175,000, and imploded over the next three years, with the price dropping 77% to CNY 39,500 by August 2020.

Inevitably, when you have so much fun, something even more fun happens: A startup company, Stardust Power, announced on November 21 that it would go public – and you also guessed this – via merger with a SPAC. With the money it expects to raise in the SPAC merger, it will build its first lithium refinery. It already picked out a “shovel-ready” location near Tulsa, OK, to build the lithium refinery and then to supply the EV battery industry.

This Stardust Power announcement comes after the stocks of EV SPACs and a bunch of other companies that had gone public via merger with a SPAC have totally collapsed and entered my pantheon of Imploded Stocks. So good luck.

Obviously, there is a lot of demand for battery-grade lithium to go into the batteries for the global EV production boom, and thankfully, lithium is abundant around the world and in the US.

In September, we were treated to this headline: “Lithium deposit found in US may be among world’s largest, study finds.” The area is in Nevada. But in the US, permitting issues, local opposition, legal challenges, and costs don’t exactly make starting up lithium production a cakewalk.

Then there is the long-running Lithium Nevada’s $2.3 billion project, which, after overcoming a host of issues, including legal challenges from tribes, is now on schedule to begin production in late 2026 at what could be one of the largest lithium mines in the world.

The big kahuna of the oil-and-gas industry, Exxon Mobil, announced earlier in November that it plans to produce lithium from briny water pumped up from about 10,000 feet in the Smackover Formation in Arkansas. Production is expected to start by 2027 and will eventually supply lithium for well over 1 million EVs per year, according to Reuters. It cited analysts at TD Cowen that estimated this would require Exxon Mobil to invest $2 billion. So that’s going to be good for the economy.

Lithium production at the Salton Sea in California has been kicked around for years. The area has been dubbed Lithium Valley due to its lithium-rich geothermal activity. Three companies are now working on projects using a new technology of extraction that is still largely unproven at scale. Two of the three – BHE Renewables and EnergySource Minerals – own and operate geothermal powerplants in the area, and that’s a pretty good fit. So we’ll see.

All kinds of lithium production projects are being worked on in the US and around the world. Currently, Australia, Chile, and China dominate lithium production. Australia alone accounts for nearly half the global production. The three combined account for about 90% of global production. Everyone is now trying to get in on it. Investors have smelled the money, and the billions are flowing.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Happy Thanksgiving, everyone!! I wish you a wonderful day!

Happy Thanksgiving Wolf. Take a day off once a in a while, will ya? Hah

no way. Need Wolf’s cooking on thanksgiving

🤣 ❤ Hope you liked my cooking. Too salty?

Every drunk sailor needs a salty captain… Happy Thanksgiving Wolf!

+1

Happy Thanksgiving Wolf to you and yours!

And to all the rest who enjoy the information shared on this site!

From one Turkey to another… Happy Thanksgiving!

:-)

Same Wolf! Thank you for everything you do.

Much love, Wolf

Happy Thanksgiving, Wolf and everyone!

To you too, Wolf!

Hope you had a blessed Thanksgiving. Thank you for providing us with honest and spot on opinions of so many subjects. My go to guy for years.

I am grateful for the best website and with the best comments section on the internet!

Happy Thanksgiving to you and your family!

On this day if gratitude, I am thankful for Wolf, bringing us his unflagging insight and analysisx even on Thanksgiving Day. Huzzah!

Happy Thanksgiving one and all.

Happy thanksgiving Wolf, and thank you for your service!

Way ahead of you! About a month ahead, actually, being Canadian and all. 😁

But seriously, have a great holiday everyone!

and to you!

Also…. “Obviously, there is a lot of demand for battery-grade lithium to go into the batteries for the global EV production boom, and thankfully, lithium is abundant around the world and in the US.”

1. Thank God (x2 that China is not in control)

2. Conceptually I am more of a fan of hydrogen fuel cell power (but recognize there is almost no infrastructure to support broad adoption)

The USA has become so currupt at the top living on printed money i dont know who is worse The USA or china.The USA is not the country it use to be the debt is spiralling out of control lets just print currency that will fix everything really now the USA are involve in all the wars lets keep printing that will fix everything really

i like wolf

Thanks Wolf.

I will still never buy another car made in this century, but I do enjoy your insights, and will continue to contribute to your membership in the socialist state of Kalifornia.

You too Wolf!

Thanks so much for your evidence based guidance. Love the tongue in cheek asides. You remind me of Louis Rukeyser, at the top of his game ;-)

Louis Rukeyser…………..there’s a blast from the past. I liked that guy.

At his peak, Rukeyser was good. Then his ego got too big and he insisted that Wall Street Week be officially renamed Wall Street Week with Louis Rukeyser. Then he wanted more money. The final straw was that people tracking the show determined that the stocks recommended on the show actually underperformed the market. Keeping the sponsors (big wirehouses) happy and recommending what is popular (to keep the viewers happy) ultimately yielded poor long-term results. No surprise there. It had a good run, though.

Sounds like cramer

Joe Lowry: “ as someone that has been in the industry 30 years, I am thankful for lithium chemical prices in the $20/kg range. Much of my career, price was 1/10th of today. To those talking about a price crash, I have one word: “perspective”.”

Yes, I was curious to see the price in dollars per kilogram as that is something that “registers” in my mind’s eye.

$18.695 a kg is the spot price now.

An interesting company to keep an eye on is 24M Technologies. They introduced their “Electrode-to-Pack Technology” at the Japan Mobility Show on 26 October — 5 November.

I have commented on this company and their research into lithium-ion battery construction using what they call SemiSolid design in the past, and I hope they succeed in what they are doing. They claim to be able to build much more efficient and safer batteries for EVs and other applications.

24M is headquartered in Cambridge, Massachusetts.

So is 24M a smarter investment than 3M? I have a hunch it could be worth 8 times as much as 3M and we all know that 3M is quite the conglomerate. So what’s the secret? Packing the layers of a lithium battery cell into a bigger case with other layers that are part of other cells is probably what they are doing but that doesn’t seem like so profound idea if that’s what it is. Do they have some patented technology. You brought them up, so I’m asking. Or should I go to Cambridge, Massachusetts and ask them myself? If they are headquartered in Cambridge that means they are a promising company tied to the MIT economic atmosphere and I can assume this is the next A123 Systems.

https://wolfstreet.com/2023/04/29/remember-the-lithium-shortage-huge-price-spike-in-4-months-since-then-lithium-collapsed-70-amid-talk-of-lithium-glut/#comment-515070

Well thanks for the link to the info. I like to learn about what’s out there. I hope anyone with good intentions success. A lot of companies with good products and promising technology have still failed though. This battery technology may have many benefits but there may be saw drawbacks that aren’t being presented such as lower charge and discharge rates but who knows, progress happens and they could have some answers to major challenges.

There are a lot of things about capitalism that suck, but solving resource bottlenecks is not one of them

Only if providing resources is profitable. And less profitable than market manipulation of said resources.

I have lost money twice on trying to get into the battery boom. I think I am learning that I don’t do tech investing well. More and more I wonder if that it isn’t for insiders within companies, big trading houses with access, and specialists within particular tech fields. Regardless of why I learning to stay away from tech investing. I seem to do best investing in companies that provide the simple necessary things of everyday life.

That’s what I decided long ago. I’m not a greedy bubble chaser anymore. Slow and steady wins the race IMO. I invest in companies with strong balance sheets, have a sustainable and profitable future, and that pay a good dividend yield. I then just sit back and collect dividend checks every quarter. I couldn’t care less what their stock price does because I’m unlikely to sell them anyways.

Dollar Stretcher

My investing approach is, word for word, exactly like yours. I’ve be at it for 25+ years and my divided income is higher than what I earned working. Take Verizon as an example, the stock has tanked but the dividends keep coming and there is, at this time, any reason to think they will stop.

Duh!! it is the same as horse racing. Other people get information you never get, and they get information, and act on it , long before you get it. It is called Crony Capitalism, or blatant corrupt practice, and it works real well. It makes a great spectator sport, but don’t expect to make money unless you are in on the scam.

The problem is… it’s the human condition. Bribery, “crony-capitalism”, insider info., pump and dump, these have been going on since forever. You just have to be wary. As in “beware”.

Thanks, Wolf. I’m still amazed at the depth of knowledge you have about nearly everything economic.

Most is hype – cloud, blockchain, AI, biotech. Hard to find the real in a sea of fake.

Can’t invest without accurate data and number crunching. Can’t buy stories.

Stay away if you haven’t got the skill, or commit entirely.

“The best cure for high prices is high prices.” Absolutely true. I’m hearing echoes of the great Julian Simon in this column.

Great news for home and new car buyers! Any day now, right?

A replay of silicon for solar ~15 years ago.

Or 2016 when the Saudis teached oil producers with high costs a lesson?

Although silicon is something like 28% of Earth crust mass. Lithium is more rare but still fairly prevalent(25th most common element). Good there is such an abundance of it.

There’s still more silicone in a battery than lithium.

Toby – doubtless the mindless auto’correct’, but a big diff between ‘silicon’ and ‘silicone’…

A happy belated holiday to you, Wolf, and to the frequenters of his fine establishment.

may we all find a better day.

….and ….Marijuana!

wall street….humph….

In the ‘everything’ bubble, money chased everything. Lithium seems to be included in ‘everything’. The Fed printed like there was not tomorrow. They can guide where some of the money flows but ultimately has no control over what they unleased. Reeling it back in without systematic damage is the balancing act.

Blessings and abundance for all!!! Happy Turkey Day!!!!

Ha, I wonder if the glut of lithium is because so many of us still prefer our ICE powered vehicles. Prices for EV’s will have to come way down and quality go way up for me to make the switch.

Til then, I’ll keep investing in oil nd gas and leave lithium to the SPAC’s

“Lithium shortage leads to collective psychosis”

The jokes write themselves

Herp – not as well-known as Coca-Cola’s original not-so-secret ingredient is that lithium was initially used in ‘7up’ (“…you like it, it likes you…”).

may we all find a better day.

It is likely lithium will not even be in the batteries of the future. stay tuned.

Can wait to see the speculation on sodium!

Has a lot of development to go but might be a real possibility if they can solve the density issue which results in less efficiency. Also reduces the fire hazard as well. When I worked at Intel the executives joked about how cheap processes are per unit with variable costs. Fixed costs another matter however!

Combine desalination plants with sodium ion battery plants!

That would be funny, wouldn’t it?

Amazing. When we have a commodity shortage the governments prints more money and throws at it, Investors throw more money at it. Then the commodity prices go down.

Good for the consumer.

One thing that i’m an not clear about is does the Government CPI for food at home factor in shrinking packages. I.e. A half gallon of ice cream is no longer 2 pints but 1.5 pints.

I’m so old I remember when a half gallon of ice cream was 2 quarts!

ha ha, you guys are funny

ru82,

“does the Government CPI for food at home factor in shrinking packages. I.e.”

Yes, it does. It measures price per weight measure, such as per ounce or per pound, price per volume measures, such as ounce, quart, or gallon. Etc.

Shrinkflation is designed to deceive consumers (good luck!); it’s not deceiving CPI measures.

Better to produce lithium in the US then rely on other countries for such a vital resource.

The Lithium Iron Phosphate large prismatic battery cells have become more widely available in the last year. Medium to larger size LiFePO4 battery energy storage products (batteries and portable power supplies, home power supplies) have increased in availability and product offerings and variety, greatly, as well as in the last few months there seems to have been some very noticeable price declines on these products. Earlier this year when I had noticed the availability of the large LiFePO4 cells and the prices of them, I looked into the situation briefly and found that the large price drop in large capacity cells corresponded (it seemed to me) with the expiration of an essential patent related to the technology of LiFePO4 battery cells. I assumed from this that China was now free and clear to produce cells at a huge industrial scale without having to worry about being tied up with patents and the extra cost involved in several ways and so was able to flood the market suddenly with what could have been that way some years before. It makes me think how much patents could and probably do dictate so much of our reality and what is or could be. I’m not advocating for anything related to patents. It’s just random thoughts and nonsense.

Also, the Lithium Ion batteries (Lithium Cobalt, Nickel, etc.) (3.6V nom.) (energy storage battery) as retail level products were cheaper in about 2019 to 2021, and now those are still about the same price or more expensive. The Lithium Iron Phosphate batteries (3.2V nom.) are the ones that seem to have come down a lot in price vs. capacity compared to the Lithium Ion cells (power tools battery cells for example). These are just things I have noticed. Raw lithium commodity prices compared to what’s available on the market doesn’t always respond directly or immediately, look at gas prices at the gas station right. But I do suspect that people have been making too many assumptions about what has emerged as an essential commodity. Do people who invest in this stuff really know much or are they just speculating and gambling blindly? Mining seems to have a lot of variables and require a lot of specialized knowledge to assess the value of a situation.

Still waiting for cold fusion….too many, just around the corner battery companies in Silicon Valley alone…

BRW – now use a single 100AH 12v LiFePo to power the auxiliary DC LED lighting in our offgrid rural home (use 110v AC LED lighting from our 48v AGM solar mains). The economical availability of both these technologies has been a boon to us…

may we all find a better day.

Ah Li. Good for your car, good for your manic (bipolar) depression.

Happy Thanksgiving weekend to all.

Now, do your duty. Get the Hell out there and BUT!!

180-230 billion tons of Lithium in our planets seawater.

Energy Source does not operate a power plant at the Salton Sea. They sold the 60 MW Featherstone power plant to Cyrq Energy LLC three years ago, but kept the mineral rights to the produced brine.

With the EV market now basically saturated, the price will go down further.

Consumers spent an all-time high of $5.6 billion shopping online on Nov. 23, up 5.5% compared with last year’s Thanksgiving, according to Adobe Analytics which tracks ecommerce and mobile shopping.

That’s “nearly double what consumers spent just a few years ago ($2.87 billion in 2017), highlighting the continued shift to more spending online,” Adobe noted. Adobe’s figures were not adjusted for inflation, but if online deflation were factored in, growth in consumer spending would be even stronger, said Vivek Pandya, lead analyst at Adobe Digital Insights.

Happy Thanksgiving.

Be good Americans. Go for shopping and increase the GDP for this holiday season. May be our shorts mature and bulls also have a run in the future.

In order for bubbles to inflate forever, we need a forever mania. Unfortunately, human stupidity is not infinite as imagine. We will come to our senses eventually or production will ramp up.

CB – …now I’m confused, should I now short the human stupidity supply instead of the previous, ‘safe’ long position?

(…of course, ‘stupidity’ is oft-conflated with various forms of ignorance (the moral soul of ‘insider trading’), when other than ignorance’s significant ‘willful’ variety, they aren’t the same, at all…).

may we all find a better day.

Lithium. Another energy commodity that crashes. Just like oil and Nat gas did lats year. speculators got smashed.

The solar and wind green stocks have all been squashed this year too. Oil stocks are down from their high.

Apparently, we have plenty of cheap energy.

This is good for consumers. This saves them money to spend on Black Friday. ;)