He fretted about the re-accelerating economy flying above the “below-trend” growth required to get to 2%. “We will keep at it until the job is done.”

By Wolf Richter for WOLF STREET.

The most important aspect of Fed Chair Jerome Powell’s speech today at the Jackson Hole Symposium was his total and repeated smackdown of the folks that had either been clamoring for the Fed to raise its 2% inflation target, or had been predicting that it would raise it.

At the beginning of his longer and more nuanced speech today – and referring to his brief hammer speech last year – Powell said, “the message is the same: It is the Fed’s job to bring inflation down to our 2% goal, and we will do so.”

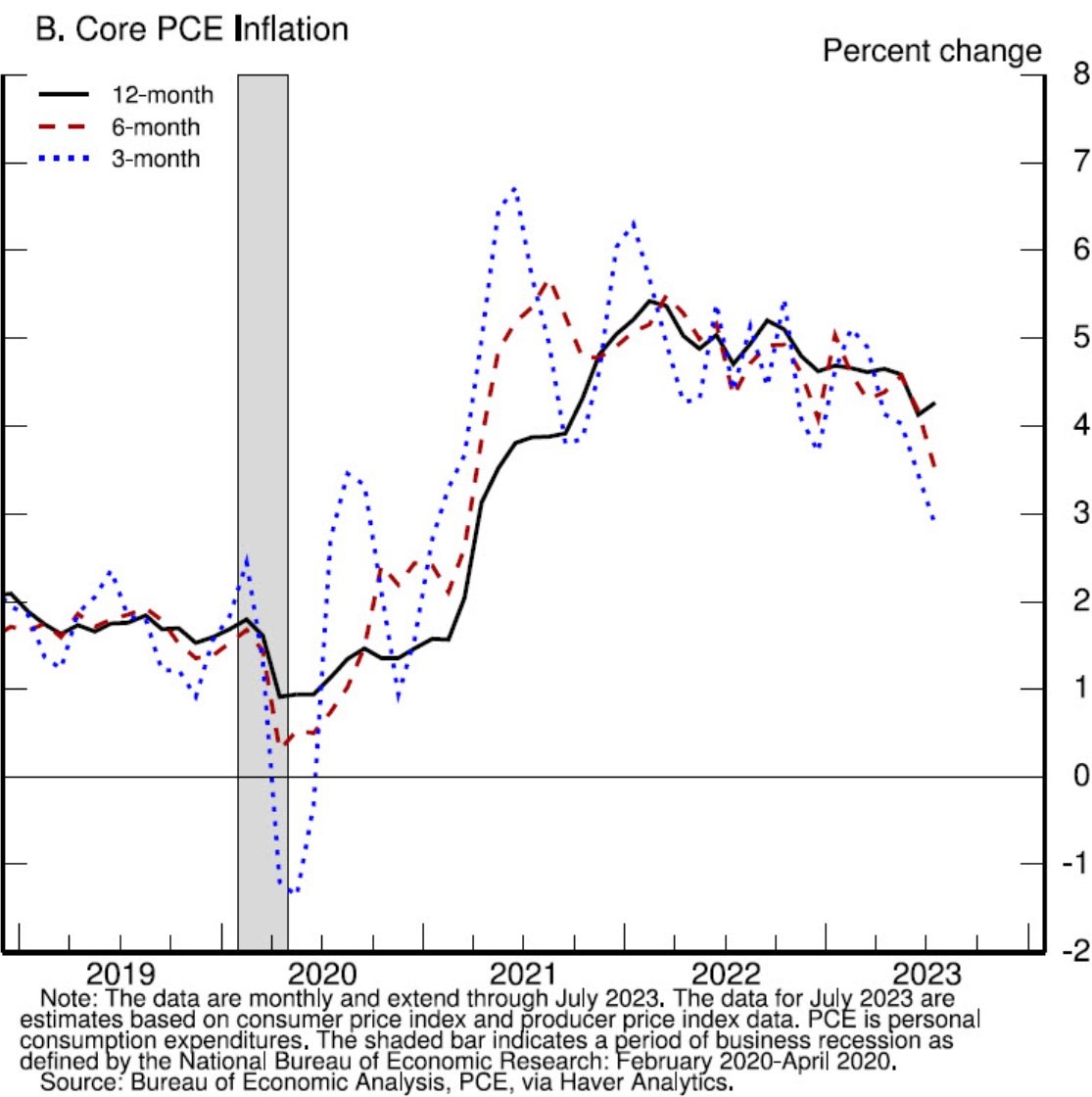

Amid discussing various inflation dynamics, the progress made so far, the lack of progress in some corners, and the uncertainties around it all, he showed this chart where Fed staff is forecasting that core PCE for July, to be announced on Aug 31, will re-accelerate:

And then he said: “2% is and will remain our inflation target. We are committed to achieving and sustaining a stance of monetary policy that is sufficiently restrictive to bring inflation down to that level over time.”

“We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective,” he said. And that objective is 2%, as tracked by the core PCE price index.

He said, “12-month core inflation is still elevated, and there is substantial further ground to cover to get back to price stability,” and this “price stability” he confirmed today is 2% inflation, as tracked by the core PCE price index.

“Getting inflation sustainably back down to 2% is expected to require a period of below-trend economic growth as well as some softening in labor market conditions,” he said.

But that “below-trend economic growth” isn’t happening right now, on the contrary, the economy has re-accelerated, and he said the Fed is “attentive to signs that the economy may not be cooling as expected.” And right now it isn’t:

“So far this year, GDP growth has come in above expectations and above its longer-run trend [Q1 GDP: +2.0%, Q2 GDP +2.4%, and Q3 has started out even stronger], and recent readings on consumer spending have been especially robust. In addition, after decelerating sharply over the past 18 months, the housing sector is showing signs of picking back up.”

“Additional evidence of persistently above-trend growth could put further progress on inflation at risk and could warrant further tightening of monetary policy,” he said.

“While nominal wage growth must ultimately slow to a rate that is consistent with 2% inflation, what matters for households is real wage growth. Even as nominal wage growth has slowed, real wage growth has been increasing as inflation has fallen,” he said.

And he concluded his speech with this line, “We will keep at it until the job is done.”

And there were a lot of doubts.

“There are some challenges that are common to all tightening cycles. For example, real interest rates are now positive and well above mainstream estimates of the neutral policy rate. We see the current stance of policy as restrictive, putting downward pressure on economic activity, hiring, and inflation. But we cannot identify with certainty the neutral rate of interest, and thus there is always uncertainty about the precise level of monetary policy restraint.

“That assessment is further complicated by uncertainty about the duration of the lags with which monetary tightening affects economic activity and especially inflation,” he said.

“In addition, there is evidence that inflation has become more responsive to labor market tightness than was the case in recent decades. These changing dynamics may or may not persist, and this uncertainty underscores the need for agile policymaking,” he said.

“These uncertainties, both old and new, complicate our task of balancing the risk of tightening monetary policy too much against the risk of tightening too little.

“Doing too little could allow above-target inflation to become entrenched and ultimately require monetary policy to wring more persistent inflation from the economy at a high cost to employment.

“Doing too much could also do unnecessary harm to the economy.

And he repeated what he’s said many times that “Restoring price stability [now confirmed as 2% inflation] is essential to achieving both sides of our dual mandate. We will need price stability to achieve a sustained period of strong labor market conditions that benefit all.”

Which was followed by his closing sentence: “We will keep at it until the job is done.”

The smack-down was a good thing for the longer-term bond market.

In terms of the longer-term Treasury market, it must have been a relief that Powell smacked down the folks that have been clamoring for the Fed to raise its 2% inflation target to a level of around where core PCE inflation is now.

The market for longer-term bonds hates inflation, and they want to be compensated for the inflation they expect over the term of the bonds, plus some depending on duration and credit risk. If the Fed raises the target to 4%, the bond market shifts its long-term expectation of inflation from around 2% now – still believing that the Fed can get there – to around 4% or higher.

And the market wants to be compensated for that higher long-term inflation with higher yields. And that would have pushed longer-term yields much higher as these expectations pan out, which would have pushed bond prices much lower.

And it would have pushed borrowing costs for everyone, including mortgage rates, to the next level. What’s keeping longer-term yields as low as they still are is the hope that the Fed will succeed in getting inflation back down to its 2% target over the next few years. If that expectation shifts to 4%, or whatever, all heck would break loose in the longer-term bond market.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Paul Krugman is one of the crackpots calling for the FED to raise the inflation target. Somebody asked Paul Krugman why he hates the poor and he didn’t answer. Paul Krugman and his ilk are the enemy of the American people.

Paul Krugman has a “super core” inflation he imagined in some self deluded meth binge that strips out housing, education and healthcare and once you remove all the things bleeding people dry “super core” looks great! Man is a dolt.

Before Wolf eviscerates me. Paul did not come up with super core and it is services excluding energy and housing. I stand by the rest of my comment.

“eviscerates” sounds painful. I need to read up on it.

Yikes! (Wolf, I’ll save you the trouble)

“Eviscerate actually means to physically disembowel a body; disembowel means to remove the internal organs; organs are self-contained parts of organisms that perform vital functions, from the Greek organon, meaning tool or instrument; Greece is a country in Europe known for developing cool words.”

I think WR may have been sarc but a short def is ‘to remove

the viscera’ …the guts

Field Dressing.

“Eviscerate” means to remove the intestines from the abdominal cavity while leaving them attached. Surgeons do this every day, and then put them back inside (for a fee, of course).

“Disembowel” means to detach the intestines and toss them into the bin.

Now let’s do “defenestration”.

Classic Krugman.

“If you can’t hit the target, move it!”

b

It amazes me that Powell has not yet heard of the Inflation Reduction Act. That political Masterpiece should knock inflation to zero, without any Monetary help.

No?

“Paul Krugman why he hates the poor”

For the same reason every out-of-touch Princeton economist hates the poor – it’s good for their own wealth accumulation.

Don’t forget, Bernanke was chair of the Princeton Department of Economics.

Good ol’ Zimbabwe Ben.

“We have a technology called the printing press…”

– ZB, Condescending Turd

north of richmond

My guess is that longer term rates are going gradually higher for a long time because of global warming. Some think tech will solve this.

Place your bets: it’s all about which way the frog will jump… (Robert Heinlein).

Bankers and stockholders and investors hate inflation, does that mean they care about the poor?

The poor are hurt by inflation but even more by a recession. Having a job is better than not having one, even with sticker shock every time you go to the grocery store.

Price stabilization is more critical than inflation targets. I haven’t even read much Krugman, but if someone asked me why I hate the poor I would tell them to f*ck off.

Unemployment is temporary, inflation is permanent?

Your comment on “their little hat-wearing club” has no place here. It’s obvious what you’re alluding to, and you should be banned here.

To raise the “target” to 3% is to cheer for a 33% drop in the purchasing power of the dollar every 10 yrs.

Isnt 22% bad enough? (2%)

And what of stable prices?

longstreet (a great general by the way)

You’ve got me wrong. I am not in favor of 3% I just think it is inevitable. I think the world is going to grow much riskier.

Solving the climate is not just a matter of building solar panels, batteries, windmills,…. We also have to pay for ever increasing climate disasters and deal with an awful lot of migration out the tropics not to mention dealing with lots and lots of coastal flooding and relocation…. What a mess but some say tech will saves us. Place your bets!

Did not mean to direct that response to you. Sorry if I did.

There is no climate crisis.

I see someone is into science fiction.

Perhaps treating the store of value like Monopoly money ain’t the greatest idea for a rational economy/society.

If the government can infinitely create and distribute the token (money) which everyone is pursuing, that gives the creators and distributors a tremendous amount of power to shape society and enrich themselves. They want the free money era to come back. Simply accepting that three percent is now the inflation target can get them closer back to that happy time.

He has been so so wrong on so so many economic calls, it is a wonder he’s still given the time of day.

…seems a lotta economic prognosticators seem to blow it regularly (…why I frequent ace economic pathologist Wolf’s most-excellent establishment) in the face of a system now-relentlessly short-term and devil-take-the-hindmost-gamed by it’s players…

may we all find a better day.

The stonk market still rose at the somewhat hawkish tones. What a Twilight Zone.

-50% inflation in the housing market would get us down to that 2% target real quick

Amen to this….a far-fetched fantasy, unfortunately…I would love to be proven wrong though, not holding out any hopes

Carlos: Not necessarily.

If the interest rates rise and the home purchase price drops, the monthly housing cost likely ends up in the same place and net impact on housing expense is near zero. Landlords will add costs associated with higher interest rates and maintenance fees and rents will not plummet as sale prices on a multi-family doesn’t lower rents. You can’t count on interest rates dropping to 3% again, so mortgage refinancing might not be in the cards, so your long term prognosis for “relief” is unlikely. Property taxes will just get adjusted (mill rate) as the cities and towns have become addicted to the income, so the lower prices may not reflect in tax relief.

you forget the mass of savers with cash in the banks. They are not interested in the interest on loans

Median home price grew by +166% from 1970 to 1980, and another +90% from 1980 to 1990. And that was with much higher interest rates. Even the decade from 2000 to 2010 saw the median price increase from $165k to $222k at the bottom of the largest housing collapse since the great depression.

While we’re at it, name 1 decade on-record in which U.S. house prices didn’t increase. I’ll even let you present a rolling decade, any 10 year period you want. Harder still, name 1 decade in which the U.S. median dropped by 50%. You won’t find these things because they don’t exist. You might be able to fnd local drops during the GFC. Outside of 2008, big local collapses generally only happen when major employers leave, which is only useful to you if want to buy into a ghost town. If you’re waiting for a -50% collapse, you might want to be equipped with the perspective that it is a rare occurence locally and a practically non-existant occurence on a national scale. And you’re making a big assumption that you will be in good financial shape to buy during such a large crash. A 50% price cut doesn’t do you much good if you lose your income during the economic calamity that causes the price crash.

We still manufacture lots of things here in states, but don’t forget that our favorite products to make are new dollars and new debt. As long as we keep it up, don’t hold your breath for a -50% collapse in house prices. Price is not a measure of an asset’s value as much as it is a measure of the dollar’s value.

When you buy a house, you don’t buy the house that is simultaneously in all US markets. You buy a house in a specific market. And there are many US markets where home prices plunged and stayed down for decades. Tulsa was the one I know personally. There are many many others. People in those markets got used to the simple fact that moving to a new home 15 years after having bought the old home — selling the old one and buying a new one — means losing money.

The good part is that they could buy a nice house for less than the old one.

It’s very common that specific markets tank and prices don’t recover for a very long time. What is rare is that the overall US market does this at the same time. But the overall US market is irrelevant to home buyers. It’s relevant only for us in looking at the overall US economy, inflation, rates, banks, etc., which is what we’re mostly doing here.

Great point Wolf. My response was aimed at folks who comment here wishing for a 50% drop while making massive assumptions. They treat a drop as if it will occur everywhere, including wherever they are. They also seem to assume that they will be in a good position to take advantage of the drop as if their financial situation will stay strong while everybody else’s buying power crumbles. I constantly find myself wanting to say, “careful what you ask for.” A 50% drop absolutely can happen locally, but only when lots of people are hurting. People only walk away with big losses and ruined credit in large numbers when they’re financially broken enough to give up. I don’t think that these commenters realize that they’re often asking to lose their own income and potentially join the residents of the tent city hellscape that their locale could become in such a crash.

It’s really weird that’s your reading. My reading is that most commenters desire the standard correction/over-correction which follows every jet-fueled mania.

People are tired of this speculative trash. Not everyone wants to feel like they’re trapped playing in some depressing casino when looking for a place to live or raise a kid.

Not Sure-

Drawing inferences from long-term median home prices ignores a big determinant in the success of an individual home-buyer: “functional obsolescence.”

Homes are built with then current state-of-the-art methods, materials and technologies that through the decades become millstones at worst, or annoyances at best (e.g. hard-wires intercom systems or 1980’s vintage “whirlpool” baths.)

I believe that examining nominal median home prices over the decade masks the real, inflation adjusted change in value experienced by the actual homeowner.

My dad bought his Midwest home in the 1960’s for $35k, and sold it nearly 40 years later for $99k. His return was OK, but his “investment performance” (even excluding all the improvements and upkeep) was nowhere near what earned in equity investments over the same period.

On the other hand, the 1960’s home housed our chaotic double-digit catholic family for 40 years!

Respectfully, your median home price analysis is too simplistic to address the real estate realities under discussion, IMHO.

We could get there fast with a Volker move in rates.

For there to be a Volker move in rates, there would have to be a Volker.

If that happens in America, people will just hand over their keys.

If that happens in Canada, the mainstream politicians will be jumping from roofs like the 1929 Stonk Market crash (because they own real estate investments).

Not everyone can simply “hand over their keys”. Only origination loans (in most cases) are non-recourse. If they refinanced to take advantage of the stupidly low rates, they’re likely up s***s creek without a paddle. The bank may or may not seek to be made hole but, in the words of Dirty Harry, “You feelin’ lucky?”

Slight bounce from the post-NVDA smackdown yesterday.

“The stonk market still rose…”

Listing all SP 500 stocks in descending market cap order (with PE ratios in the next column) is a useful exercise.

Stonk market is a casino, nothing more. Powell didn’t give Wallstreet anything today so no reason for stonks to be up. It is so corrupt, nothing left to do but burn it all down.

Big group here that doesn’t understand equity markets and likes to call them ‘stonks’.

Bonds have been taken to the woodshed much more than equities during the last couple of years.

In times of inflation you want to own real assets not money. For me that is the large global mining companies that have been around over 100 years and pay big dividends and are in a long term secular bull market.

Big mining companies have ‘huge moats’. If stonkers don’t understand what a moat is they should ask Warren Buffet.

“Big group here that doesn’t understand equity markets and likes to call them ‘stonks’.”

Get over yourself. I use it as a pejorative. I have my own definition. Doesn’t say much for someone who can’t pick up on nuance.

Fed Up,

My reply to you was a pejorative in case you didn’t get the nuance.

Powell’s comments were reasonable, perhaps a bit too dovish. Maybe he does not want to crash the stock market. We have a tight labor market, a roaring GDP, stagnant core PCE.

Gasoline prices are up ten percent last month. Food prices are ticking higher again. So headline CPI will accelerate again.

Higher, much longer.

Stagnant core PCE? Am I the only one seeing a downtrend in the core PCE chart Wolf posted in the article? Sometimes I feel like my eyes don’t work the same as others’. Is it a sharp downtrend in 12 month core PCE? No. But is it a downtrend? Yes, obviously

Wolf, what do your eyes see in the core PCE chart you posted? Mind drawing a trend line for us?

What I see in the second half is the reversal of the base affect, and the uptick in July was the first step of that reversal. I discussed this a lot. Happening now.

In terms of drawing straight trend lines: draw one through the period 2018 through 2020, and see where it goes, LOL. Drawing straight trendlines works great until the trend changes.

The trend I still see is: a breakout/ backtest. Once human behavior gets riled up, out of a longer term situation, there’s a big clamor to “go back to the way (price, place etc ) things were.

Once back there, those people who clamored are momentarily “satisfied” and the “new reality” sets back in.

Stock prices, interest rates, inflation… all results of human behavior and mass psychology.

Natural trends are fascinating. If only I weren’t human: I would be better at profiting from it all!!!

Sure, slight downward trend from “peak”. I would not get too excited about it. Compare it to the run-up. Powell wants to get to 2%. If we think this downward trend from the “peak” will persist, maybe 2% in 2025 using annual data. We need more data points, of course. Must be patient.

I think I can see what you’re looking at, but I’ve also seen inflation charts from the 70s, there were some actual trends confirmed over like 2yrs only to reverse and spike even higher. Maybe current FED is better at this and situation is different, I don’t know, but what we see in this chart is relatively short term IMO. Moreover if you look at labor statistics which Wolf also talks about, it doesn’t look very promising that this short term trend will hold up over a longer period. That is my interpretation anyway.

He works so hard at making his job that much more difficult.

William Leaked,

Then the Fed will hike. This could be a long process. But still, long is better than layoffs and recession.

William sorry about the Xtra ‘d’. Fat fingered. I took much agree with you.

That’s okay, I had to go to the bathroom anyway.

A bit too dovish? By that standard what would be too hawkish?

How about: ‘The Fed will no longer reimburse deposits beyond the limits of the FDIC’

To be fair, the Fed didn’t reimburse deposits beyond the limits of the FDIC. The Treasury decided to do that, and the Fed loaned the money for it.

At that least that’s the way I understand it.

Einhal,

No sarc intended, do you think the sequence really makes a difference?

From my perspective, so long as unbacked money is being printed for whatever is DC’s latest “Great Adventure”…the result is going to be the same…inflation.

Shuffling money/responsibility from government pocket to government pocket really doesn’t change the macroeconomic impact.

But I’d be interested if you have a different take.

Cas127, I think it does actually, as the Fed will be repaid from the Treasury even if the FDIC ends up taking losses. If the Fed “purchased” the receivables backing the FDIC, then it would be a different story.

Einhal,

But with the Treasury running perpetual annual fiscal deficits (huge ones), the Treasury is still only “paying back” with money it has to borrow (from the Fed, which is printing the unbacked stuff…to keep interest rates from exploding – since such rate hikes would be necessary to lure non-USD-print-empowered lenders/creditors).

Again, I sincerely would like to hear different views – but for me so far, all I see is a Federal Government (Treasury) propped up (barely) by its power to print unbacked money (the Fed). One government hand “lends” to the other with invented money.

In other words, DC dilutes the (horrific) consequences of its 50 year inability to balance its budget (via tax increases and/or spending reductions) by having the Fed print unbacked USD – thereby creating inflation.

Still willing to be convinced otherwise, but need to be stepped through counter-argument.

No such thing as too dovish. It’s past time to start living within our means. He gave nothing to the stonk market. Being too dovish is not what stonks want to hear.

Sorry, meant the other way around, being too hawkish is not what stonks want to hear. I shouldn’t comment when I’m sick lolol. Anyhow, he wasn’t dovish at all. I didn’t think he gave Wallstreet anything.

I’m getting tired of the free money addicted Wall Street and real estate hype artists. They need to take a deep breath, lay off the drugs and hookers, get their lives in order, and go back to fundamentals like value investing. Their antics have gone on way too long and exhausted everyone else’s patience. Including central bankers, it seems, which is pretty impressive.

I remember seeing this article about an Australian realtor who insulted working class people (the renters).

It was reminiscent of “Let them eat cake”. The Napoleon movie with Joaquin Phoenix comes out this fall.

Either the central banks crush this nonsense with much higher interest rates for decades to come, or we’re in for another revolution. I would prefer the former, less violent matter of simply letting the addicts and artists go bankrupt instead of guillotines. Though whatever gets the job done I guess

Stupid being mean to renters. They generally have the bigger hammer…

What I’m tired of is the constant gaslighting. It’s one thing when the Wall Street shills say it, it’s another when CNN, the NYTimes, Washington Post, and others go on and on about how high interest rates will “hurt ordinary Americans.”

The inflation is more painful than the interest rates.

And all delivered by the ignoring of the stable prices mandate and moderate interest rate mandate by this exact same Fed.

And now the Unions are going full bore on wage increases…

spiraling inflation brought to you by poor decision making by an unelected body, unaudited, sitting behind large oaken doors with piles of theories which obfuscate the obvious.

For every action, in physics AND economics, there is an equal and opposite reaction.

Welp, he told them again inflation is too high. Of course, stock go up, because, well, we don’t believe Powell will raise rates until something breaks.

Gas schmass, talk to me when it goes to $10 a gallon. Real estate is starting the real downward shift as interest rates start biting. And it will take a long damn time to work through this. Five years from the peak to the bottom last time. FIVE YEARS.

So figure three years from now, the stock market may finally be putting in a bottom, as rates finally begin to ease.

Meanwhile, long bonds and mortgage bonds from the 2021 vintage are going to be a smoking pile of “value” wreckage.

Just another day in paradise as finance proves the average American just can’t do first year college finance maths.

Rates will not ease for decades to come. You can’t just have 13 years of ZIRP and NIRP and fix it in a few years. Not to mention on a larger timeframe, it’s been 40 years of lowering interest rates. Expect several years of increasing rates and then a few decades of holding it high.

10% is absolutely on the table, 20% is a possibility as well.

You can if something really big breaks. I can happen much faster than you think.

As the wolf says

* this big thing that has already broken is price stability.*

Given that the Fed’s “margin of error” on CONTROL of inflation is like what…~ +/-3%….the whole speech is laughable precision-theater. I love econ dorks. The biggest crimes come from econ dorks!

Credit where credit is due..Pow Pow sticking to his guns…good for him for not waffling on 2% target…now don’t go backtracking like a little biatch like in the past then I’ll give him even more credit to come..

Sink that housing market, and erode your so-called wealth effect…you’ll get your 2% target

Winter is ending. Spring is coming due, the won’t backtrack, it’s not the season for it anymore.

For now.

It’s easy to talk tough when no one is feeling any pain. Almost Full Employment, Rising Wages, Inflation moving in the right direction, GDP continuing to grow.

Wait until something breaks and then we’ll see if he sticks to his guns.

Something BIG has already broken — the biggest thing the Fed is in charge of: Price stability. And now the Fed is trying to fix it.

Fed shows from q4 2011 to q4 2019 right before covid housing averaged 5% inflation.

College tuition has been averaging ~5% inflation for some time.

I can only guess at the inflation numbers for healthcare over that time, but we know theyre not good.

Outside of eggs milk and gasoline, when has there been price stability?

To say that no one is feeling any pain during this period of high inflation is something else. Says a lot.

Exactly. The poor and the middle class are definitely feeling “something.”

“This Act (the Federal Reserve Act, Dec. 23rd 1913) establishes the

most gigantic trust on earth. When the President (Woodrow Wilson) signs

the Bill, the invisible government of the Monetary Power will be

legalised… The worst legislative crime of the ages is perpetrated

by this banking and currency Bill.”

— Charles A. Lindbergh, Sr.

Charles A. Lindbergh, Sr had terrible prognostication abilities. He literally could not be more wrong in what he said.

One only needs to look at the absurd boom bust cycles from the end of the Civil War to the creation of the FED.

There is a reason that every 1st world economy has created a central bank.

Periodic Cycles serve a purpose in a free market.

To deny them, paper over them, allow the poorly leveraged and inefficiently operated to persist is to set up for a systemic threatening “‘cycle”. (ie 2008)

No duh about periodic cycles being necessary. No duh about denying them or paper over them.

However a decently run FED lessens downturns and blunts the upturns. Don’t get me wrong, the FED can be poorly run. It is just a tool. Tools can be misused. However all of that is besides the point which is that a

a central bank is pretty much a requirement for a first world economy.

Do you know of any first world economics that do not have one?

That is why Charles A. Lindbergh, Sr had terrible prognostication abilities. He literally could not be more wrong in what he said.

Well that has to be be one of the dumbest posts i have read on WS in a while.

How many recessions and depressions have there been since the Fed was created in 1913?

Lots, including the really, really big one called the Great Depression, maybe you have heard of it?

The creation of the Fed has done nothing to improve the economic cycle.

What has happened since the Fed was created was the debasment of the US Dollar.

I always find it funny when people say something is stupid when they clearly do not understand what was said.

Of course there have been recessions since the creation of the FED.

What is magical about a 2% inflation target? Left to its own devices and absent central-bank interest-rate manipulations (i.e., price-fixing), what inflation rate would the financial markets target, across the yield curve, for credit instruments? Why would that “inflation target” be anything other than zero since in any market economy the amount of credit borrowed at any point in time precisely equals the amount of credit lent. Put another way, since borrowers presumably benefit from inflation while lenders are harmed by inflation, the equal and opposite objectives of creditors and borrowers should continually produce nominal interest rates that are neither inflationary or deflationary

Right on. It has never been made clear why 2% inflation is a good thing or better than no inflation.

Well, 2% inflation is a lot better than 8% or 10%.

kramartini,

I think the psychology is that positive low inflation (not deflation) makes people feel better, like they are getting a little more when they get a small raise.

Taking a hit from a bong makes people feel better too but I am not sure that is good economic policy…

When I was in econ school I was told that 2% inflation makes all real (adjusted for inflation) prices subject to revision. At zero percent inflation, certain prices would not drop since many consumers were adverse to nominal prices dropping. Well, that’s what they said.

I have yet to meet a consumer who is adverse to paying a lower price.

I always figured it’s a motivator for working class to keep chasing thus spinning the big wheel. If everything keeps getting more expensive there’s no reason to hold on to the cash, just keep spending and keep running till you finally drop. Otherwise we might stop and just wait for prices to fall or grow our savings accounts, then the wheel slows down, consumption slows down, not so good if your business needs more consumption/investment.

Im not an economist though, a total layman if you will, so I may be completely out to lunch on that theory ☺️

Just out of curiosity, what other phenomenally stupid shit did they say?

I believe that 2% is the target because 0% is unrealistic, and 2% is small enough to be almost unnoticeable. As inflation see-saws up and down, if it can do so around 2% (i.e. 0%-4%) people can get small raises, which makes them feel better, and feel like they are “keeping up”, without seriously impacting business bottom-lines. The businesses can keep up by raising prices 3-5% every couple of years, which doesn’t cause much of an uproar (at least in pre-facebook days). This “smoothed” level of inflation prevents wage-price spirals that can eventually lead to unrest and worse.

“The smack-down was a good thing for the longer-term bond market…”

Excellent analysis, Wolf. Even a crack in the door to a higher final inflation target would have kneecapped the Fed’s credibility and panicked the bond market. Powell likely has the already creaking bond market firmly in mind.

It’s gonna be very difficult to get down to sustained 2% inflation with the labor market continuing to be as tight as it is and with the Federal government continuing to run gargantuan peacetime deficits. If the labor market doesn’t cooperate and relent, it may take some time for enough of the Federal debt to be reset at higher interest rates so as to begin reigning in some of the government’s spending – given that few politicians (on both sides) seem interested in taking real steps (besides talking) in order to attain some measure of fiscal sanity.

Too much spending stimulous on tap for inflation to be tamed with .25 pt rate hikes.

Atlanta Fed GDP is north of 5% but they are an outlier. The BRICs added new members. What does that mean for trade? Do the colonial vendor states start undercutting each other? VFS’ IPO was up 100% in one day. Add to Wolfs list? Spoiler alert, US Navy is protecting the waters off Taiwan and the So China Sea, King Dollah keeps the good moving.

I love it that the BRICS are adding all the countries with the worst most-trashed currencies in the world, including Argentina whose top presidential candidate vows to DOLLARIZE the Argentine economy, replacing the peso with the dollar, LOL

Yes that might be the case currency wise but what natural resources do they own? Weren’t most wars fought and won over natural resources? I think Argentina has a good lithium production and if Chile joins you can forget about it. They already have Saudi Arabia and their oil production.

The US is the largest oil and natural gas producer in the world, and has a trade surplus in both. And the US has huge lithium deposits. And we also make the most and best craft-brew IPAs. So there.

Many wars were fought to force neighboring people to worship God is a slightly different manner.

BRICS money may be laughable, but a BRICS payment system competing with SWIFT is quite plausible. SWIFT has 11,000 global members and packages data analogous to the Internet, it is just a computer program.

A BRICS payment system may run through several different banks and money, but SWIFT has been criticized for going through several banks with just the dollar. A BRICS system could easily settle transactions up to trade balance, just couldn’t handle imbalances longterm; gold backed BRICS electronic money could smooth out individual transactions as it alternates back and forth over a day.

There are political benefits to the world’s countries of giving them freedom from sanction threats and foreign (to them) monopolistic economic policies; i.e., the Federal Reserve dollar; the boom and bust policies are unworkable to everyone but Wallstreet elites.

Who would control the BRICS payment system? Like any closed software system, it is only trusted, stable, and reliable as the people who control it. None of the countries involved scream stable and trusted. There is no reason the think the payment system will be any different.

Like a single currency could satisfy all in that group…

Of course the dollar is weaponized, all currencies are but none are anywhere near as huge and stable as the dollar.

How are you gonna weaponize a Brick Currency for a China consumer of energy and Russia and OPEC sellers of energy? That would be messy and not stable at all in comparison to the dollar.

This Bric talk is a China gambit at best. Reminds me of the 70s and how a number of the Middle East oil producers supported Russia.

Agree – Saudi was a good addition but with the other new BRIC members (especially Argentine and Iran), it detracts from their credibility and makes the association almost comical.

It could have been almost popcorn worthy to see what this group comes up with – but now I doubt anything will come of it.

They just know what they do not want, but expect now will never agree on anything worthwhile.

You are forgetting UAE. And those two are not biggest friends to begin with. When Saudis and UAE are running away from Dollar, into BRICS I think there is more to the story.

With that said, its the news I like to hear. Just shows that FED has one shot at preserving whatever trust US Dollar has left on international arena, hence sticking to interest rate hikes.

Those also added Ethiopia to the mix…Ethiopia is worse off now then it was,when Mussolini invaded the country in the 1930’s…

Argentina has been a basket case since the Juan Peron and his wife Eva ruled the country…

Here is a quote of what Peter Zeihan had to say about the BRICS summit. I thought it was pretty funny.

“Have you ever seen a couple of 3-year-olds sitting on the playground talking gibberish and acting like they’re making life-changing decisions? Well, that’s what’s going on at the BRICS summit in South Africa this week.”

Saudi Arabia stabilized the dollar (“petro dollar”) after President Nixon took us off the gold standard. Saudi Arabia is now in BRICS, settled it conflicts with Iran, brokered by the Chinese, with a wide open door for the rest of OPEC+. We had gold standard, petro dollar will be gone, to be replaced with ticky tacky constructed wildly overpriced housing REIT shares.

If you think the Saudis and Iranians have “settled” their conflicts then you have been smoking too much of your own product.

When the radio is selling physical gold because “BRICS is going gold-backed” and stackers suddenly need more stuff to stack because they listen to the dire news, it’s a good time to stand pat

Last weekend, the serfs bought my coin guy dry of bullion, no gold and dregs of silver by ten AM. Usually that presages soft PM prices.

Most BRICS suitor countries come as supplicants seeking Chinese lucre and market access. Dedollarization is lagniappe, won’t happen quickly, and will turn on a dime if austerity in US governmental spending ever becomes fashionable again, and foreigner’s repaying debt won’t feel like vigorish.

Even more comical is that the two big 3 year olds always get into fist-fights in their adjoining backyards when they get back home to their parents house.

GDP NOW, per the ATL FED’s site, is not a forecast, rather a running estimate based on available economic date. The large majority of estimates throughout a given quarter are over stated relative to the final estimate.

I would caution anyone relying on this data that it is highly likely to be over stated. For example, their nowcast, of third quarter real gross private domestic growth stands at 12.3%.

Everything hasn’t doubled in price, yet. But it’s getting close.

Agree. Somethings have gone up 3x.

Name one single thing that has gone up 3x.

Last time I got an oil change at the BMW dealer it was $99. Last week they quoted $289 and I went somewhere else.

Boneless, Skinless Chicken Thighs at Walmart. 79c to 99c per pound before Covid… $2.98 per pound this week when I looked at them.

Here are three things that have gone up 3x:

1) Tomatoes in India (flooding).

2) Natural gas in California.

https://www.nbcbayarea.com/investigations/consumer/california-natural-gas-prices/3165124/

3) A vacation in Hawaii

https://beatofhawaii.com/hawaii-visitors-left-reeling-by-up-to-300-cost-increases/

The reason the cost of Hawaii vacations have soared especially on Oahu has to do with the State of Hawaii changing the ability of condo owners to rent out their units for short term stays.

They have limited and restricted the number of available condo units for short term rent thus reducing the supply of rooms.

People who used to be able to rent a condo for 30 days or less for vacation now have few options other than staying in a hotel. So they go for shorter periods of time or don’t go.

Hotels have jacked up the price of rooms as a result.

Those that do have the ability to rent out their units have also been hit by higher taxes and new state fees pushing up their costs as well.

And speaking about costs of ownership, the monthly maintenance fees on condos on Oahu has soared over the past ten years as well.

MW: Hot U.S. economy pushes real yields to around 15-year highs after Powell’s Jackson Hole speech as Dow soars more than 300 points after Jerome Powell Jackson Hole speech…

Evidently J Powell had another secret press conference 10 minutes later and said “Alright boys that was all for show” . Stock market went up and yields went down. SMH

I listened. My opinion: Feds going to stay the course. The marketd will be a while, a year or maybe a lot longer, before they can establish a nice long uptrend. It’s going to be choppy and I do not enjoy trying to trade that.

The problem with equities is bonds and and borrowing costs. Bond holders will be taking more beatings and selling more of whatever they can to pay for the beatings and that will too often be equities. Higher for longer borrowing costs will slow everything.

So, I am betting a large part of my portfolio on large resource extraction companies who have historically paid large tax free (qualified) dividends.

Then when markets finally get through this malaise I expect a secular bull market in my long term hold resource companies.

I will watch for opportunities for trading with the smaller portion of my portfolio because it is kind of my duty but I don’t enjoy it much anymore. It gets in the way of riding…

“Bond holders will be taking more beatings”

Only those out on the long end… those of us in bills are continuing to earn 5+% risk-free, quite the opposite of taking a beating.

MM,

Is that 5+% risk-free also tax free?

My dividends will average 5-7% and are tax free qualified dividends.

Also, I will be able to stay in the market and so benefit from the very beginning of the next bull market and if and when I sell part of all of my holdings my earnings will be treated as long term capital gains which will be tax free up to ~41k per year (82k married) in income which will be fine for most years in my retirement.

“tax free qualified dividends.”

arent qualified dividends taxed at 15%?

I can confirm several friends and family members (Millennials and Gen Z) will be resuming their student loan payments on time and have plans to reduce spending. Generalizing this across millions of borrowers, I think the resumption of student loans will take more wind out of the economy than most people expect. I understand there are PLENTY of reasons to remain skeptical of student loans actually being paid en masse, but this will undoubtedly cause at least some consumer spending to evaporate. A fully iced over housing market fall into winter should also help cool things off more. I think achieving that 2% target will be a bit easier than some are suggesting.

Does anyone else have anecdotal data on how people will restart payments?

I do not know anyone with outstanding student loans.

My son just paid off his loan balance of $6K, didn’t want to pay them interest any more, which had averaged $100 a month. Another family member paid down $55K during the moratorium and is also free and clear.

Resuming student loan payments will lead to an increase in consumer spending. For consumer spending to fall people would have to cut back in excess of student loan payments. This will not happen.

I agree that consumer spending on items other than student loans will fall which will be problematic.

So they didn’t pay their student loan payments at all during that time? All they did was push those payments for longer…

When will you make the first payment?

After you make the first payment, can you please let us know? I’m very interested in when the first payments actually are getting made.

@Wolf

If I’m not mistaken, they will resume by the end of this month for some. I just finished reconverting my loans to TEACH grants and getting them forgiven due to completing my service obligations 2 weeks ago (took 6 months to process). Before they were converted, payments were set to resume by the end of this month. My loan servicer was MOHELA; not sure if different services all adhere to a universal repayment start date or if they differ, but hope this helps.

My first student loan payment is set to be on Sept 26, 2023 in the new SAVE plan. It’s set to auto-debit so should go through smoothly.

During the pause, I took the money that would go towards my loan payment and put it into a HYSA every month.

I have the standard repayment plan (10 years of flat payments), I paid extra to knock the balance down prior to the pandemic but haven’t paid since 2020. Remaining balance is low, I get repayment assistance as a work benefit, and the interest is lower than after-tax yield of a HYSA, so I will be back to making the regular payments per the amortization schedule and not a cent more when automatic payments resume on 10/26.

“The 2 percent target widely adopted by central banks today originated from New Zealand, and surprisingly it came not from any academic study, but rather from an offhand comment during a television interview.”

J Pow, gone from the Pee Wee Herman of inflation to the Chuck Norris of inflation in a few short years.

And the stock market party continues! Nothing to see here!

Bernanke held the money stock constant for 4 years: M1 NSA money stock peaked on 12/27/2004 @ 1467.7. It didn’t exceed that # until 10/27/2008 @ 1514.2.

Powell needs to hold DDs constant for 2 years, or another 8 months to quell inflation.

The FED can lower the O/N RRP award rate at the same time it continues with QT.

https://research.stlouisfed.org/publications/economic-synopses/2023/08/23/the-mechanics-of-fed-balance-sheet-normalization

“Bernanke held the money stock constant for 4 years: ”

Why are you referring to M1?

https://fred.stlouisfed.org/series/M2SL

Just in: The digital subsidiary of Scotiabank (Tangerine) is offering 5.95% 1-year GICs (CDs).

It looks like 6% GICs are on the horizon here in Canada.

18 mth is 6% with Tangerine.

I just sold the last of my bond funds earlier this week (in an old forgotten account) – was too lazy to sell them. Super short term is the way to go.

I bought one of those 3x short long term bond funds before rates started to increase. Made good money but sold them too early.

Wow that’s high, and if you buy a TFSA GIC you keep the gains tax free.

I’m waiting for someone to tell me that I’m losing my gains to inflation, and that buying NVidia stonk at C$625 is a “hedge against inflation” mixed with an insult against the Prime Minister’s “justinflation”.

Gen Z-

“The digital subsidiary of Scotiabank (Tangerine) is offering 5.95% 1-year GICs (CDs).

Are GICS the same as CD’s? Last I checked, the insurance on a GIC came from the insurance company’s general account. Perhaps I’m behind though, or maybe these work differently in Canada…

CD is the American equivalent. The American FDIC have different laws compared to Canada’s limits.

GICs covered by CDIC (a Federal government insurance), very similar to FDIC – except insurance maximums are different – believe 250,000 in US and 100,000 in Canada.

Thanks GenZ and Jack.

“So far this year, GDP growth has come in above expectations and above its longer-run trend [Q1 GDP: +2.0%, Q2 GDP +2.4%, and Q3 has started out even stronger], and recent readings on consumer spending have been especially robust.”

Might want to coordinate a little with Congress, J. They’re shoveling in (deficit-fueled) stimulus as fast you’re pulling it out, bro.

Gattopardo,

“They’re shoveling in (deficit-fueled) stimulus as fast you’re pulling it out, bro.”

I think the deficit spending is why we are not in recession. I think the hope is that the extra tax revenue from not having a recession will pay for the deficit spending.

Everyone on “right” and “left” is screeching as usual, wishing for the return of infinite counterfeit as usual.

I’m envisioning a pie chart titled “Economists who understand how economics really works”. The pie is 100% Wolf, with no other slices.

If an economist, or anybody, understood how the economy really worked, he would be basking on an island, sipping his favorite drink, and enjoying the millions of dollars pouring in everyday. He would definitely not be telling anyone else how the economy really worked.

Yeah, the 30% of U.S. who is able to benefit from counterfeit. The other 70% gets wacked and doesn’t even know how they got wacked.

I’m surprised the 10-year ended pretty flat from where it was before Powell’s speech (I thought we might see if hit 4.30% again). I’m thinking maybe this was because it’s a Friday in August and many traders just decided to take a half day? I guess let’s see what Monday brings.

There’s always the day after. That’s when the algos run out of batteries or whatever. This happened many times with Powell. So Monday might be interesting.

Well, I’m surprised again. 10-year basically flat again today, and 30 year-fixed mortgage down to 7.29% according to Mortgage News Daily. I can’t figure this at all.

It’s a loser’s game to try to tie daily market ups-and downs to ANYTHING.

It would be nice to get back to 2% inflation.

Maybe with student loan payments coming back online and higher interest rates will take a bite of of disposable income to slow down spending.

In reading earning calls from retailers, it appears a lot of people are not paying for their spending sprees. They just take it.

So does shoplifting free up disposable income for other items. Does shoplifting increase inflation? I have no clue. I have noticed some headlines lately where a lot of the shoplifting is organized. People are actually starting illegal legit businesses. LOL. They are setting up garages or even warehouses full of stolen items and selling them online.

Local police just busted a man how had $150k worth of new power tools he was selling out of his garage. I read another story where they had a huge warehouse.

Parasitic crime is indeed inflationary and cancerous on any functional society.

But it is getting harder and harder to call this a “functional” society.

…reminds me of the old ‘making work pay’ act.

(…appears it didn’t succeed…).

may we all find a better day.

Yes inflation trending lower for the moment, a few years,

BUT – Inflation is going to continue higher in the long term.

Wages are going up fast. Soon $100,000 salary will be the norm.

Skilled labor will climb even faster.

Result – Interest rates will be higher for longer.

Remember when “six figures” actually meant something?

It never meant anything — it was always just marketing.

36-24-36?

JoshWx wrote:

> I can confirm several friends and family members (Millennials

> and Gen Z) will be resuming their student loan payments on

> time and have plans to reduce spending.

Everyone I know with STRs have been seeing a big drop in advanced bookings. I don’t know if it has to do with overall inflation like $5/Gallon + Gas ($6/gallon + in Tahoe) or the kids knowing that they are going to have to start paying on student loans again but every STR manager and owner I talk to say they are hearing from young people that they are cutting back on travel since they know the loan payments are starring back up soon. My goal has always been to not have to rent our place in Tahoe so I have been working hard to pay off the loan, but I know others who thought they would always be grossing over $10K a month on AirBnB and refied to buy more STRs (usually with variable rate debt)…

Oh, that STR bubble burst is going to be splendid to watch. They’ve been running up the prices of those for the last 3 years with every “influencer” claiming they made $10M with their BRRRR strategy or whatever. I had heard there were some risky loans called NONI where they allowed these STR investors to buy portfolios of these properties with only a simple cash flow proforma and no personal income qualifications. Those NONI loans sound a lot like the old NINJA loans with a twist.

I suspect we will be adding a fourth category of forced residential real estate sales… the 4th D…

1) Death

2) Divorce

3) Default

4) Disillusioned Airbnb Tycoon

Here’s a problem that high interest rates are not going to solve. Inflation favored the already wealthy. Slowing down their ability to fleece the masses is not going to make things more equitable. In the US we long ago crossed the Rubicon, where social contracts are broken. It’s always an eye-opening experience to visit another country where American Style FU Vampire Capitalism doesn’t rage.

I can’t get over the fact that in many countries, if you have a car, a hatchback is a normal sized vehicle and a compact wagon is a large car. In the US if you can’t have an Expedition to ferry around your two kids, you’re not protecting them adequately and if someone questions your choice you must get defensive and say “It’s a free country” or “I can drive whatever I want”, as the lamest intellectually bankrupt form of debate. Just one example where community needs come first, not individual. In the US we’re structured to pit everyone against each other so the wealthiest can suck even more money out of us. I don’t see how pushing rates high is going to tilt the table back to the common folk.

I hate large SUVs and pickup trucks driven by people who have no utilitarian need for them.

That said, I would never be in favor of imposing limits by law, because Americans hate being told what to do. Over time, the cost of energy will make the decisions for these people.

I am amazed that there are people who think they get to decide what is in others’ self-interest. By definition people get to decide their own utility for any good or service. Those who think they know better are totalitarians who want to force their views on others.

In the end when everyone doesn’t comply to what is perceived as their own “self interest” they are then forced into them.

The thirst to subjugate others to their own views is just unstoppable in some people.

I guess reading comprehension isn’t your strong suit, huh?

Einhal,

LOL. I’ve gotten nailed numerous time for doing the same thing.

Wolf, wait, are you talking about for driving a pickup truck or for criticizing others?

Eihal,

Whatever is just the person that Digger Dave was referencing.

Can also confirm, Whatever also did not read what you were saying.

I wonder if you might be so kind as to share how you are able to tell if a driver has “no utilitarian need” by watching them drive by. Wondering if you also hate the same vehicles that actually fit your allowance.

I am regrettably not able to judge others so easily on sight alone.

Pickup trucks were built for two things, towing trailers or carrying things in the bed. If you do neither, you aren’t using your pickup truck for anything that it was built to do. Period.

Some dude commenting on another Wolf Street article recently called them “Emotional Support Trucks”. Love that.

Big truck makes up for small _________. (Fill in the blank – I can think of numerous things).

He was sold the truck by advertising. I find any vehicle I buy, regardless of price, becomes just a vehicle after 6 months.

It is like the people who buy their huge mega dream home in the middle of nowhere after their kids move out. They really needed 4x the space with only 2 people now living there.

Einhal

I hate them too. We need an annual personal property tax on vehicles based on their weight. That would take some of these monstrosities off the road.

I really hate minivans. They are made for carrying lots of people only, and I hate when I see just the driver in them.

And don’t get me started with Porches! There is no reason at all for any vehicle to be able to move faster than 65 MPH at any time ever!

Anything that goes 0-60 in less than 20 seconds is a waste of resources and energy.

A horse on the other hand…………….

Nah, I’d rather just let the free market deal with it. I do think states should increase the minimum insurance (the $20k-$30k that states require is nothing, that wouldn’t even cover a broken arm and ambulance ride), and let the insurance companies figure out who is worth insuring.

DougP, how many people buy minivans for a status symbol when they rarely if ever use it for the capacity?

Do minivans take up a disproportionate amount of space in a small parking lot? Do they major car accidents much more severe?

Not even close to a good analogy.

“ We need an annual personal property tax on vehicles based on their weight.”

This is called a gas tax.

Can’t talk right now, I have to go to the dealer, my Ford lightning is ready for delivery today!

DougP,

How long did you have to wait (since ordering) to get it? Or did they have it in stock? Or was this sarc?

Oh look, an authoritarian environmentalist who thinks he knows better than everyone else and is willing to use the force of government to impose his misguided will on others he seems “selfish.” How shocking.

Do you have an “Emotional Support Truck”? Is it a Dodge?

Oh wait, an entitled consumer who feels they have the right to buy anything they want, everyone else be damned.

Do you manufacturer the vehicles? Build and maintain the roads? Refine the fuel.

Acting like choice exists inside some free market vacuum with no consequences for anyone else is idiotic. Society gets to dictate what you are able to buy.

“society gets to dictate what you buy” I’ll take the big dodge truck.

You can keep you sentiments.

The Holy Grail of 2% is still 2% too much. I imagine, if we had no inflation, there would be no annual pay raises. So is that the justification for that figure?

Nissan fan-

“The Holy Grail of 2% is still 2% too much.”

Agreed!

The reasons for a positive inflation target:

– Keynes’ correct (but cynical) analysis that some less educated wage-earners are fooled into thinking their financial situation improves when they get COLA’s (though many wage-earners see through this BS).

– Unions make a living by “protecting” their constituents from the inflation by negotiating COLA’s.

– The government benefits by taxing the higher capital gains and interest income that occur due to inflation.

– A heavily indebted government benefits by depreciating the value of future maturities.

– The government benefits during the inflation process (rate suppression and QE) by keeping new issuance interest costs lower than they would be otherwise. Rate repression directly hurts bond buyers such as pension plans, retirees, and others seeking safe income at reasonable rates.

(Do I sound jaded? Why yes, I am.)

All that said, at least Powell did not cave to pressures to raise the “target!”

“All that said, at least Powell did not cave to pressures to raise the “target!”

Did anyone ever, really, expect Powell to say such a thing? NEVER. Even if the Fed and whoever else puppet-strings USG would never say it out loud. The mayhem would be insane. Even if we had Venezuela’s inflation, they’d still be saying we’re working getting back to 2%.

I’d never imagine Jpow explicitly saying it either.

But, what if a year from now PCE is still >3%?

MM,

I kind of doubt it will be (I know others differ), but if it is, the Fed will keep saying whatever they need to say. But they definitely won’t say “yeah, we’re calling 3% cool now.”

Well, ok maybe if the whole world has priced that in, and the Fed is powerless, has drained all the QE out, taken rates to a level that gives us a recession, and every politician is screaming for heads to roll. The only way that happens is if federal deficits continue out of control. Sayyyyyyy, could be…..

This is the best single explanation of the reasons central banks desire and are designed to destroy the value of currency, and the reason we need to return to hard currency and abolish the Fed.

The mantra is that the GDP must increase every quarter. Why?

What if in promoting these GDP increases, policies are implemented that are a risk to the entire system?

The self authored 2% rips 22% off the dollar each decade….and now the discussion involves (3% target) ripping 33% off in each decade? Insanity. That can only end one way, and it involves wheelbarrows and pitchforks.

Powell said they “will keep at it” in terms of the inflation fight. I read today that “keeping at it” was the title of Paul Volker’s autobiography. I wonder whether Powell is serious or not????

What I don’t understand about folks who call for an increased target is that the fed has been heavily subsidising the economy for a decade+. All Powell is saying is that we should peel back those subsidies to see if that will bring inflation back under control. If the fed’s balance sheet is at $0 and the target rate has been in the double-digits for a few years, then I can see having a discussion about maybe adjusting the target.

P.S. If you want to reduce the number of SUVs, fight for a carbon tax, not a higher inflation target.

Jason,

“If the fed’s balance sheet is at $0”

This nonsense needs to stop here. You cannot still be posting this BS here on this site that is so focused on the Fed. Do you ever read any of the Fed articles here?

The Fed’s balance sheet was never $0, and can never be $0. Every company, bank, and household has a “balance sheet.” Households may not write it down, but they could write it down.

A balance sheet is composed of assets, liabilities, and capital. It is always in “balance,” meaning: assets = liabilities + capital.

The Fed’s biggest liabilities are reserves (bank cash on deposit at the Fed), RRPs (money market fund cash on deposit at the Fed), Cash in circulation (paper dollars), and the government’s checking account (TGA).

The Fed must and will always have enough assets to balance these liabilities.

READ THIS and don’t ever bring up the $0 balance sheet BS again:

https://wolfstreet.com/2022/09/05/by-how-much-can-the-fed-cut-its-assets-with-qt-feds-liabilities-set-a-floor/

Agree. Instead of subsidizing green, simpler just increase gasoline taxes.

Eliminate subsidies. Slowly raise price of gas to $10/gal and we will see what people buy.

Along the same lines, simplify income tax. No need for such a huge tax code – should be limited to one page.

I see the FED continuing on the same path it has for the past few months. They are going to gradually let their balance sheet run down through QT. They will geadu6raise rates for the next few months. Obviously gradual is a relative word. Despite the FED raising rates faster than it has in a very long time, it wasn’t fast enough for some who wanted instant 10%+ rates. By gradually, I mean a quarter point hike every month or two. They will gradually bring down inflation. They will error on the side of going too slowly rather than too quickly, but they will eventually get there. It will just take a long time.

Everyone also needs to remember that the FED loathes raising rates much through election season. Therefore I see them raising rates a bit aggressively the next few months and then pausing (or at least slowing down) early next year.

Modern Malthusian, WB!

Your comments reminded me of one of my Favorite TV villains: Mel Proffitt (young Kevin Spacey) from the 1980’s show Wiseguy. Worth viewing or re-viewing.

If history continues to repeat, shortages in food and energy will surely continue to rock the world, and just as surely, technology will be used to address shortages and make the average inhabitant of “the rock” more comfortable. (Not ALL individuals will be more comfortable, regrettably.)

Of course, disasters natural and man-made will plague us, as they always have.

As you wisely advise, “hedge accordingly”

Powell is like a little boy with a messy room. He has finally gotten around to cleaning it but is dragging his feet. You don’t want to discourage the little guy with criticism but shouldn’t praise him too much either…

Same guy who said we’ll let inflation run a little hot. Now he’s got to put out a out of control forest fire.

A ton of energy is simply wasted today and does not enhance quality of life.

The part of the world that expends the most energy could reduce energy consumption by half and have an excellent quality of life, if not a better quality of life, because lives would be more focused on worthy principles instead of consumerism. With agreement from the spouse, I could probably discard half the stuff in my household and it might be a simplification and relief. Lots of living space in most homes is rarely used – unnecessary space to house unnecessary stuff. Transportation cost could easily be cut 30% by consolidating trips, buying more online, limiting vehicle size, using auto-sharing and public transportation and bicycles, and altering schedules to avoid traffic jams, etc. Heating and cooling costs could be cut 10-30% just by simply allowing a more reasonable degree of temperature variation in homes.

And who couldn’t get by with 30% less food production? A lot of today’s food goes to the trash can, or to the belly.

There’s a ton of conservation potential in all areas of one’s life. As prices shoot higher, a lot of this conservation will happen naturally. It’s a helpful of side-effect of inflation that partially offsets the negatives.

Wolf, since you’re the lone voice of reason in the financial world let me ask your opinion. Reading a lot lately about how after this inflation is tamed worldwide debt burden will inevitably lead to anemic growth, 0% rates, and central banks having to print to sustain economies like Japan did. It seems to be inevitable and makes sense when you look at how things have been since 2008. Is this your long term view as well?

The stuff you cited — “Reading a lot lately about how…” — is the kind of hilarious BS that makes me laugh for hours. What is more serious is that people are taking this BS seriously, LOL

You must be reading Lacy Hunt. This sounds just like his stuff. In May , 2021, He called a for a serious deflation starting in the fall of 2021 caused by the massive worldwide debt which would cause and slow endemic growth.

Oops. Way off.

Re: “2% is and will remain our inflation target.”

As long as they insist on maintaining a fraudulent arrangement based on Fiat Currency (Smoke) and Fractional Reserve System (Mirrors) our financial system will remain in a black hole forever from which there is no escape.

And what is this “Inflation Target” nonsense they keep parroting all the time, anyway? Inflation is not a fever, it is obesity and unless we go on a crash diet (Deflation) and return to real money there will be no cure, just posturing.

We should ditch all of these fraudulent cars and go back to horse drawn wagons. Might as well also ditch these fraudulent computers and go back to ink and paper.

Yes, that was sarcasm.

Fiat currencies are not going anywhere. Modern economies couldn’t function without them.

JimL-

Fiat currencies, collectively, are not going to disappear… that much is surely correct.

However, individually, fiat currencies do disappear (Weimar), or at least debase themselves into world-wide insignificance (Argentina). They DO go somewhere.

Your reference to horse-drawn wagons and ink/paper reveals a desire to paper over (pun intended) the risk of fiat currencies: they are eventually debased in the governmental thirst for funding.

This antiquated quote explains the fate of fiat by analogy:

“Making notes redeemable in bonds, which are again redeemable in notes, was like trying to keep a ship from blowing to sea by lashing her to another, then anchoring this one by lashing her to the first.”

– Simon Newcomb, A Critical Examination of Our Financial Policy During the Southern Rebellion (1865)

Fiat currency is eventually swallowed by the government funding it makes possible.

The U.S. fiat system and centrally controlled banking will prevail until it becomes politically unbearable or until it consumes itself.

Evergreen died tonight Sunday August 2023

While 2% may be the official target, there have several been times over the last 20 years and prior to the pandemic) where BLS reported inflation exceeded the 2% target. Add in the regular fudging of the numbers using various BLS adjustments, and the actual inflation numbers rise further. So even if the target is 2%, and the BLS reported numbers begin to achieve it, the real rate is probably still 3% or higher.

In any case, wage inflation is probably not actually the root cause of, but rather the result of, the ridiculous levels of deficit spending, leading to significant levels of currency debasement. All of this occurring during the “good times” as Wolf likes to say.