Prolonging the downturn of for-hire truckers is the growth of private fleets, such as Walmart’s and Amazon’s which eat into their share.

By Wolf Richter for WOLF STREET.

Every Freight recession takes out already teetering trucking companies, and this time, it was long-teetering and bailed-out less-than-truckload carrier Yellow, the largest trucker ever to file for bankruptcy liquidation. During the last freight recession in 2019, a slew of trucking companies were liquidated, including truckload carrier Celadon, which was brought down by accounting fraud, the largest truckload carrier ever to get liquidated in bankruptcy court.

This freight recession, which started a little over a year ago, came as consumers switched some spending from goods to services, such as travels, and services aren’t transported by truck. And it was then made worse as companies, from manufacturers to retailers, began destocking to bring their inventories back in line, after they’d over-ordered during the chaotic era of shortages, confounding levels of congestion, chaos, and huge spikes in freight rates. And when all this stuff finally arrived, the world had moved on.

Private fleets eat share of for-hire truckers, prolonging the for-hire downturn.

Private fleets – such as Walmart’s gigantic fleet of trucks, or the Amazon trucks – have grown to over half of Class 8 tractor capacity, according to the analysis by Cass, and they’re eating into demand that would have been handled by for-hire trucking companies. This expansion of the private fleets, according to Cass, is prolonging the downturn of the for-hire market.

“We think it’s unlikely that [for-hire] industry capacity will broadly tighten until pressure from private fleet growth eases, which looks unlikely this year,” Cass said.

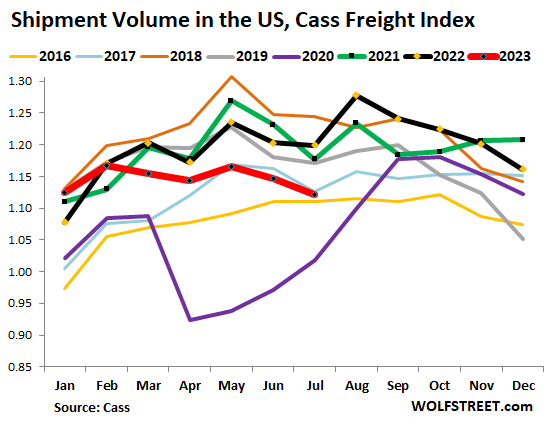

In terms of shipment volume in the for-hire market, the Cass Freight Index – which is concentrated on trucking but includes rail and other modes of transportation – fell again in July, to the worst July since July 2020, and July 2016, which had been in the middle of another freight recession (fat red line in the chart below).

Year-over-year, the index was down 8.9%, and compared to the peak in this cycle, in May 2021, it was down 12%.

We’ve heard similar messages from UPS and FedEx. UPS reported a 9.9% drop in daily package volume for Q2, with June volume down 12.2%. FedEx reported an 18% drop in average daily shipments in its quarter ended May 31.

The Cass Freight Index for shipments tracks the for-hire market. Truckload shipments represent over half of the dollar amounts in the index, with less-than-truckload shipments in second place, followed by rail shipments, parcel services (such as UPS and FedEx), and others. It does not include private fleets, commodities, and new vehicles.

Freight rates plunge back to earth, but are still a lot higher than they were.

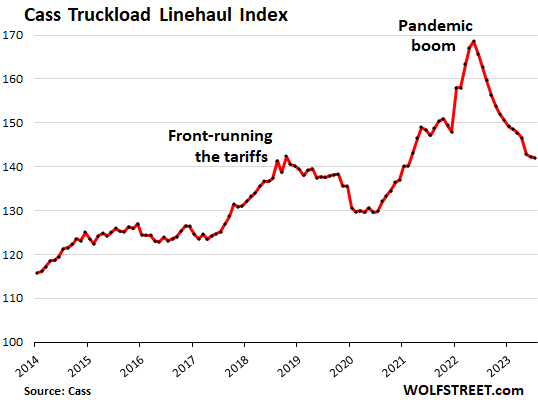

Truckload spot and contract rates, not including fuel and other charges, fell for the 14th month in a row in July, on a seasonally adjusted basis, and were down by 12.7% year-over-year, and by 15.8% from the peak in May 2022, which pushed them back to where they’d been in February 2021, according to the Cass Truckload Linehaul Index.

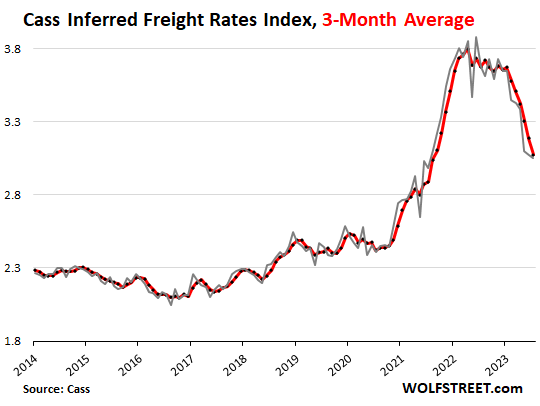

The Cass Inferred Freight Rates Index, which does include fuel charges, dropped again in July and has plunged by 21% from the peak of the spike in June 2022. But it’s not like freight suddenly got cheap: The index is still up by 21% from February 2020, before the spike began, and has thereby unwound about 60% of the up-spike.

The red line represents the three-month moving average that irons out the month-to-month ups and downs.

Diesel, after the plunge, is rising again.

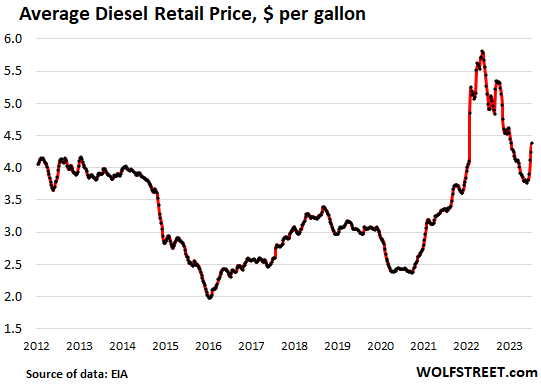

The Cass Inferred Freight Rates Index includes fuel charges, and the price of diesel at the pump has been on a trip!

The price of diesel plunged by about $2 per gallon on average across the US from the peak of the spike in June 2022 to the bottom of the decline in June 2023. This plunge contributed to the decline in freight rates.

But the plunge ended at the end of June, and since that low point, the average price of diesel has risen by nearly $0.60 a gallon, according to EIA data today, though it remains far below where it had been a year ago.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

This is the bullwhip effect from all the hoarding that has taken place as demand panic rolled through the asset classes, followed by inevitable collapse.

First it was toilet paper, food, and bottled water.

Next was hard assets like lumber, gold, silver, and real estate.

The hoarding of consumer goods has mostly come to an end, and high prices/scarcity are being driven somewhat by inflation but also due to corporations seeing what they can get away with.

The hoarding of hard assets is also in the process of unwinding, lumber already taking a significant plunge.

Unlike toilet paper, the hoarding of houses is particularly sticky because of mass seller delusion. Gold and silver have their own unique anti-fiat narratives which are keeping prices high, but as we saw in 2012-2014, there is a Rubicon where this sentiment reverses.

All that “excess” money not being used to panic hoard consumer items and hard assets is now being splurged on services, a large portion of which comprises “experiences,” as the chart for services has shown.

They picked the wrong time to stop hoarding. Drought in Central America is limiting the number of ships that can transit the Panama canal.

Learn something new every day! I always thought it was sea water being pumped through gates.

Well, I sure didn’t need to learn that drought stuff. (I knew about the canal elevation change. We lived there several years when my dad was still in the Army.

I say climate change gets at least half of us before this ever more monopolized (in this case vertically integrated) totally unregulated capitalism does.

Anyone feel lucky?

“We think it’s unlikely that [for-hire] industry capacity will broadly tighten until pressure from private fleet growth eases, which looks unlikely this year,” Cass said.

And why do I think this should say “expand” or “grow” rather than “tighten”….just Econ double inverse reverse speak?

Toilet paper and bottled water are at all time highs in Canada.

One we need the other is a luxury somehow I manage to use a thermos of water and yea the goods boom increased inventories and home basic needs with the spend shifting to services but they too need trucking

Bs ini,

Replace most or all of toilet paper use with a bidet.

AD

Are you saying my basement hoard of Home Depot 2x4s is not gonna fund my retirement?

hide them in the walls… ummm behind something..hmmm how about drywall maybe?

That’s gold!

How much impact will the resumption of student loan payments have on demand destruction?

I’m shorting Revlon because I think the demand for blue and pink hair coloring will plummet.

LOL!!

I’m with Wolf on that. I don’t think it’ll ever resume. Where I might differ from Wolf is that I think the Fed wants to maintain sky high asset prices if possible, meaning I think they’d consider it a “win” if stocks and housing have a floor set at nose bleed levels while inflation goes away (assuming that’s possible).

It will resume, but it will be “$0 payments” and then discharged after 10 years of those “payments.” I’m not making this stuff up. They are changing (unless sued again) the minimum amounts to pay back a loan where in their words many borrowers will make “$0 payments.” So then politicians can claim they resumed student loan payments, but then also not taking any money from borrowers…the entire system is a joke. More inflation and falling productivity as far as I’m concerned.

Well on one hand education borrowing was ridiculous. Like made up amounts of crazy.

Kinda like when you go to the doctor, they charge you $1,000 but your insurance reimburses the doc $125.

The economy does benefit from the educated jobseekers by having an edge on most of the world.

So in a way, this is just the government rewarding those who got the education because in the end it benefits the government (by the people), citizens and the economy.

And apparently no one wants to see middle men companies like banks profiting off the education people need to get jobs to pay the same bank’s mortgages.

Most of what people borrow to “learn” doesn’t benefit society at all, much less the economy.

REPAYE (the current plan) is 10% of discretionary income after a deduction of 150% of the poverty line. They’re proposing to replace it with the SAVE plan which would be 5% of discretionary income after a deduction of 225% of the poverty line.

Just to throw some numbers at it. Median household income is about 71k and the poverty line for a family of four is 30k (don’t ask me how that works).

Combined payment based on tax filing status (Single, Married, Etc) is…

REPAYE – $216.66/mo

SAVE – $14.58/mo

Forgiveness period under REPAYE is 20 years (25 for grads)

Forgiveness period under SAVE is variable based on original loan balance (10 on first $12k plus 1 year for each additional $1K). Assuming and average of $37k debt at graduation forgiveness would be granted after 35 years.

Sucatash:

No, it’s not rewarding those who got an education. I paid back my student loans and sacrificed to do so. This is a moral hazard, and hopefully someone sues soon. I believe there will be lawsuits. This new plan is too new yet, but the lawsuits will come hopefully. And the new plan doesn’t go into effect until next year, so there is time to sue the crap out of this administration.

This shows how much power individual agencies have but shouldn’t have. Hopefully SCOTUS hears the Chevron case soon which will rein in this corrupt, out of control government. I am pissed these deadbeats aren’t paying their student loans and Biden is buying votes. Many people are pissed about it. We can’t afford to bail out student loans, and it isn’t fair. I hope it backfires, I’m so pissed.

Fed up,

Did you walk to school 10 miles uphill both ways, too?

Look at the bright side, you have really strong legs.

My best guess is that they will prime the pump until the US election. Once that’s over, for worse or worser, they will let the S**t hit the fan. In fact they won’t be able to stop it.

I doubt if the student loan payment would ever resume.

The tax payers are on the hook for this and Govt won’t allow resumption to win incoming elections.

Just like those forgiven PPP loans and the billions of dollars to farmers as “not socialist” handouts against retaliation when Trump put sanctions on China against products we don’t produce domestically?

They might keep trying just to buy the youth (and parents’) vote.

Except the taxpayers are broke too ,hahahaha

I hope you are right. I paid mine back at much higher interest rates than these current deadbeats. I’m sick of the pandering in this country anymore.

As a UPS shareholder, I’ve read all of the articles about the Yellow trucking bankruptcy. Nowhere have I seen anyone mention the tremendous growth of the private sector truckers at Amazon and Walmart. Everyone can see that they have expanded greatly but I was stunned that they now comprise over half of the class 8 trucks! Thanks Wolf, you provided insight no one else did.

Wonder if their pay and working conditions are abysmal?

I can tell you the private trucks pulling Amazon blue trailers are getting paid peanuts. Amazon pays nothing on their loads, the few guys I’ve talked to said they only take loads to get out of bad freight areas like Florida.

I really like reading your commentaries, Trucker G. I’m wondering what you meant by “bad freight areas”?

Bad freight areas depends on what trailer you’re pulling and what freight you go for.

Pulling a reefer is pretty solid across the country except Florida. Mainly because tons of loads go into Florida but not much comes out. So you’d take a crap paying load out of Orlando to Memphis because a huge amount of freight comes out if Memphis. But nobody wants to go to Florida so loads pay better going there.

Likewise, if you’re pulling a flatbed, you might take a high paying load to Northern Maine and then get there and have limited options getting out of there.

Some jobs and companies specialize in regional freight too but have authority to run other states if they’re hurting for money. Like a heavy haul outfit might stay up in the oil fields of north Dakota but run a load to Houston at a high rate and take a crap load back to nodak and come out better than running the scraps locally when they’re on lean times.

It really just depends on the freight you can haul, and taking whatever risks to try and make a living on an industry with razor thin margins. I read in freight waves years ago that the mega OTR carriers like JB Hunt, Swift, CR England, etc operated on 4-5% profit margins on a load. Hence all their lease op new driver scams they all run. They make a killing ruining greenhorns with that.

A basic overview of it in case anyone is interested is this:

A new driver with a CDL wants to be their own boss and make 200k a year driving a truck.

They sign into a lease agreement with a company line Prime Inc.

For simple approximate math, they pay 1k a week in the lease payment for the truck for 3 years. Prime Inc has thousands of trucks and gets them at a deep discount. So they buy a 100k dollar truck and then after three years the lease operator has paid them 150k. Then the company keeps the truck and sells it used for 50-75k dollars with 250k miles on it. The lease operator can typically now do a lease to own program when the company doesn’t get the truck after 3 years.

The lease operator pays all maintenance on the truck, all fuel, all repairs, and sometimes insurance. They also pay self employment taxes and most lease op programs roll you into an LLC. Which that is one of the few good things in this bag of rotten garbage.

Then the company dispatcher picks what loads you get offered. You can reject them but that pisses off dispatch who will give you crap loads constantly. You never see a load board as a lease op at any company I’ve ever heard of.

The vast majority of these lease ops fail before a year is up walking away with nothing but paying a huge sum of money to the company to work for the company.

I got flack for defending the unions in the other article but this is what trucking is like. I’ll repeat it again, the whole industry should be burned to the ground and rebuilt. Nearly everything in trucking is like this. Scam after scam, honest people trying to work hard to get ahead losing their shirts, and it all being legal because there’s always an exemption in trucking to all the labor regulations every other industry has to abide by.

I’m probably jaded and bitter to be sure but go to a truck stop sometime and just look around. Everyone in the place is miserable and look destitute. Because they are.

TG – many thanks to you and for the frontline report…

may we all find a better day.

He is good at providing such insights… and I agree with you… that percentage of Class 8 trucks blew me away!

No, it was just a poorly written-sentence. Total private fleets maybe 50% (I would like to see the source report on that one, it just seems high to me), not just Walmart and Amazon, those were just examples. Think about it, is every other truck you see on the highway Walmart or Amazon? No, not even close. Plus, Walmart outsources a lot of their haulage to JB Hunt, you might see a Walmart trailer on the road, but it’s really a JB truck.

Here, Pepsi has a bigger tractor fleet than Walmart.

https://www.ttnews.com/private-carriers/rankings/2022

Walmart has lots of trailers, but the power is coming from other truckers. Walmart doesn’t want to deal with the mess of managing truckers. But if Pepsi is only 12k of the 3.9m Class 8 trucks in the U.S., that is 0.3% share for the biggest private operator. And for comparison, the largest for higher players (FedEx/UPS) have over 25,000 trucks each. Walmart wouldn’t even make it into the the top ten truckers.

It will be interesting to see which of Yellow’s assets are attractive to private fleet operators.

Full truck load are more an indicator of consumer demand and compete more directly with Walmart and Amazon shipping. ‘

LTL trucking is more closely tied to manufacturing and construction activity. Almost no one brings in a pallet of toilet paper via an LTL trucking firm. But a pallet of bearings or gearboxes is commonly shipped from one business on another via less than truck freight. Less and less of America’s manufacturing activity is carried by LTL trucking.

As an example, when Traeger Pellet BBQ’s were made in Mt Angel Oregon , 10 LTL trucks a day left the factory loaded with pallets of BBQ’s headed out for various dealers. Now they come in a container from China and go to a consolidation warehouse near the port of entry. They are grouped with other goods bound for big box stores or Hardware chains and sent on single truck loads to those places.

From just in time…..to “destocking”.

We did a lot of destocking during the GFC.

Am curious, because I know nothing about trucking, but the drivers / carriers getting whacked of course is somewhat bad. But my question is- if Amazon & Crapmart are almost half the total volume, are those not good jobs for truckers? I would think it’d be at least equal, truckers work pretty hard and so Bezos’s boys probably don’t scare them with the demands.

“But my question is- if Amazon & Crapmart are almost half the total volume,”

Just to clarify: I used them as examples of private fleets. There are other private fleets. All private fleets combined total about 50% of the class 8 capacity.

I’m a 25 year truck driver. In the early stages, circa early 2000s, Walmart was well above average and had loyal drivers, but they have been steadily eroding the truck drivers jobs on all categories. It’s now reduced to military strictness, harsh consequences for slight shortcomings, sweatshop hours, and ever eroding pay to where its not much different than other mega carriers, but you do work steadier if you have seniority. As for Amazon I have no insight for you there.

I have some Amazon insight for you. If you see one of the big blue trailers trying to park near you have your hand on the air horn.

And hope that when they rip a mirror off your truck they can speak English or don’t turn and burn before you wake up.

So, like almost everything else in America, trucking is becoming monopolized. Boy will we pay for that. Remember the railroads?

I don’t think it’s quite that tragic, Private fleets might be eating a bigger share of the pie but unless Walmart or Amazon want to get into hauling construction equipment and material or there’s some kind of revolution in how building is done then some trucking companies for hire will have to exist. If I remember correctly Walmart went in house because they figured they could do it for less and be more reliable, yet driving for Walmart from what I’ve heard is a decent gig, if true then it sounds like they’ve introduced a lot of efficiency rather than simply crushing competitors with their size and might.

The railroads owned the tracks. The truckers don’t own the highways.

The truckers do not own the highways, yet.

Just wait untill the highways are all privatized toll roads. Then the big trucking fleet operators negotiate individual deals with the highway operators.

No, that is absurd. Trucking is by far one of the most fragmented industries in the US, the largest public fleet is <0.5% of the market and the largest private fleet (Pepsi) is 0.3% of the market. And shipping freight on railroads is safer, cheaper, and significantly more environmentally friendly than truckers.

“And shipping freight on railroads is safer, cheaper, and significantly more environmentally friendly than truckers.”

And much, much slower in many cases. I used to buy large copper ingots from Asarco in El Paso, Texas and have them sent to my manufacturing plant in Detroit (years ago).

The lead time was two weeks from order to delivery , from what I remember. On occasion, the RR would “lose” a car full of copper, maybe 100,000 pounds of it in ingot form. Sometimes it took a month or so to figure out where they left it in some switchyard and get it delivered.

Trucking is so much more reliable and faster. Although, the RR’s probably gotten much better at this.

Assuming PSR doesn’t destroy the railroad industry more than it already is.

I don’t have a close connection to it but I’ve heard it’s gone dramatically downhill. Lest we forgot the rail workers were going to strike recently but they were stopped due to some kind of government override on critical industries not being allowed to strike.

Went on a road trip a few weeks ago. Couldn’t believe how many Amazon trucks were on the road. Must have been close to 50% of all of the trucks we saw. Small sample size, but I can understand how that would cut into trucking companies.

Are all Amazon trucks actually owned by Amazon? I thought they actually do use a lot of “for hire” truckers that they just contract it out to but use their logo.

No, they are not, but they may be financed by Amazon. Amazon also still uses a massive amount of independent truckers also.

Independents have been involved in transportation throughout history. Tough bunch. A lot of these guys, and gals, would never go to work for a private company.

IMHO trucking is currently racing to the bottom.

Leaving CA rates are still decent.

Going back to CA forget it.

I’ve heard of brokers posting loads for less than a buck/mile.

That barely covers fuel and food.

I see more trucking companies/independents going bust…

Keeping out of the corporate stores. I’m not subsidizing their losses from the looting while they and local governments allow it.

The solution to this trucking problem is taxes. Just change the tax code to some ridiculously long period of depreciation if a company’s primary business is not transportation.

Second, once their equipment gets old due to that long depreciation time, then “Smog” their truck out of existence with a standard that doesn’t take into account the truck’s high mileage.

Those 3% loans certainly leave a lot of disposable income to pay taxes. Most jurisdictions would do well in increasing the percentage taken as tax; and higher tax appraisals as well. Perhaps it is time to implement the concept if imputed income tax of rent equivalent; those with more equity (no mortgage deduction) could afford even more Federal and State taxes.

By that token, would car owners be taxed on the imputed rental value of their vehicles? Where would it end?

$1.3 billion from Estes. $1.5 billion from Old Dominion. Do I hear $1.7 billion?

Yellow has $2.5 billion in liabilities. So they need to get an offer of $2.5 billion+ to roughly make all creditors whole and it would still wipe out the stockholders.

I am more interested in the US Treasury loan, since I am a taxpayer and not a Yellow shareholder. I pulled the S-4 related to the loan and it looks like the entire amount is secured by a junior lien on all assets in addition to the senior lien on certain rolling stock. It is possible that the Treasury loan will end up being over secured and the Treasury will get paid all pre- and post-petition interest in addition to principal. Given that the cost of funds for the Treasury was under 1/2 of a percent (5 year fixed T-note rate rate at time of loan), and the loan to Yellow was at LIBOR(!) + 3.5%, this could end up being a money maker for the US Government. Sometimes it is better to be lucky than to be good…

Yes, looks like the Treasury loan principal will get paid in full, if the sales transactions close in the $1.5 billion range. Not sure about the interest. Maybe.