“The drivers of inflation are changing…. Domestic price pressures, including from rising wages and still robust profit margins,” are increasingly important: ECB’s Lagarde.

By Wolf Richter for WOLF STREET.

Energy prices have plunged from the peak a year ago, and red-hot food inflation backed off though it remains high, and inflation in some other goods backed off, but inflation in services spiked to a record in the 20 countries that use the euro.

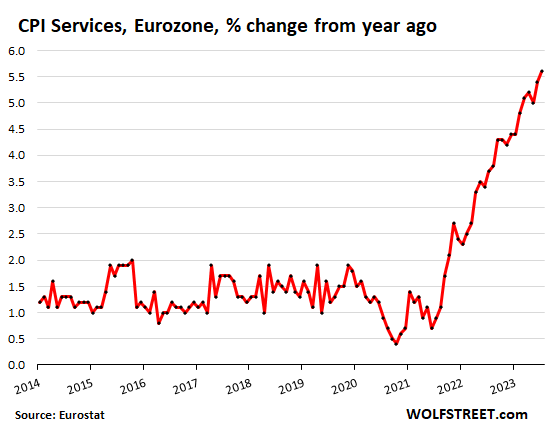

The CPI for services spiked by 5.6% in July, compared to a year ago, up from 5.4% in June and 5.0% in May, another record in the data going back to 1997, according to Eurostat today. And another bad inflation surprise after pundits, following the brief dip in May, had proclaimed the peak of services CPI.

Services are huge. It’s where consumers spend the majority of their money. Many services are essential to modern life, such as housing and related services, healthcare, insurance, broadband and telecommunications, auto repairs, air fares, haircuts, etc. Inflation is notoriously hard to eradicate from services.

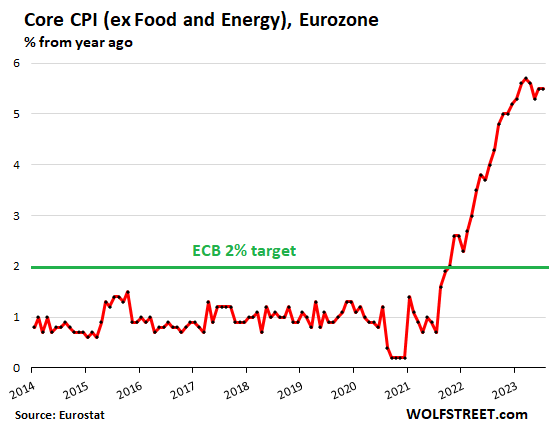

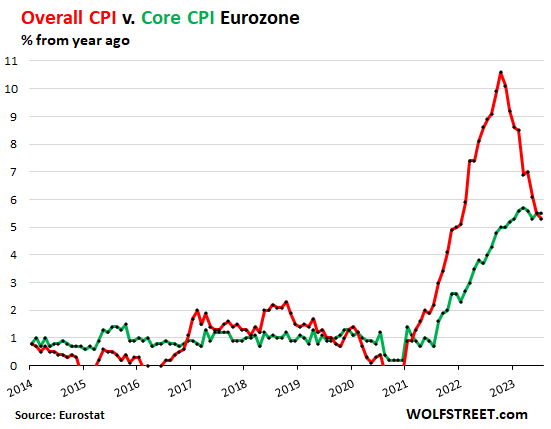

“Core” CPI (without food and energy products that consumers buy) remained at 5.5% in July, same as in June, and up from 5.3% in May. Core CPI had ended last year at 5.2%. And this year, it has gotten worse and stayed worse. But after that dip in May to 5.3%, pundits had come out in force and had proclaimed that core CPI was on the way down.

Core CPI is a sign that underlying inflation, now driven by inflation in services, has turned into a relentless headache.

The ECB’s inflation target is 2% pegged on core CPI. So not any progress here in returning inflation back to target:

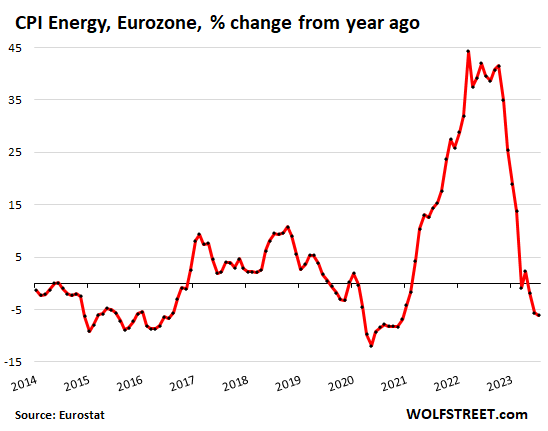

Energy Prices have plunged from the peak last year when the CPI for energy had spiked by 45% year-over-year, and then stayed in that range from March through October 2022. But starting in November, the index has plunged.

In July, the index was down by 6.1% from a year ago. This plunge in energy prices was the big driver behind the much-hyped cooling of the overall CPI. The index includes the energy components that consumers buy: gasoline, diesel, natural gas piped to the home, electricity, heating oil, etc.:

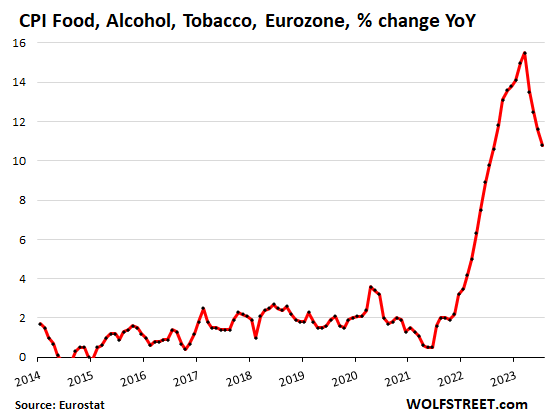

Red-hot food inflation is cooling. The CPI for food, alcohol, and tobacco rose 10.8% in July compared to a year ago. While this is still a dizzying amount of inflation in goods that consumers buy on a daily basis, it has backed off from 15.5% at the peak in March and is going in the right direction:

Overall CPI, driven by the plunge in energy prices, has been cooling off for months. In July, the annual inflation rate, at 5.3%, was down by half from the food-and-energy-driven peak in October 2022 of 10.6%.

So in July, overall CPI (red line) dropped below core CPI (green line). Core CPI represents underlying inflation, and it’s near its all-time high, while overall CPI was pushed down by the year-over-year plunge in energy costs. But energy prices aren’t plunging forever. On a month-to-month basis, some have already risen, including gasoline. So the days are numbered before energy prices start pushing up overall CPI again.

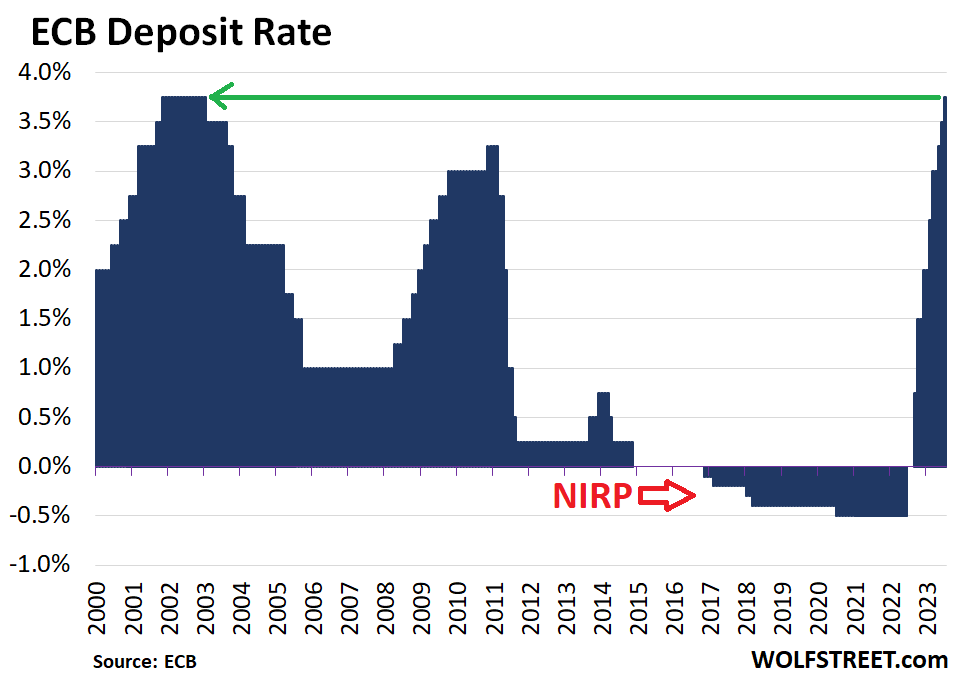

The ECB is fretting about this inflation in services. And it has tightened its ultra-loose monetary policies.

Via its QT, it has shed over €1.6 trillion in assets from its balance sheet, over double the rate of the Fed’s QT.

And it hiked its policy rates by 425 basis points since July 2022, when the deposit rate was still negative (-0.5%), well behind the Fed’s 525 basis points in hikes.

When it hiked by 25 basis points last week on July 27, lifting its deposit rate to 3.75%, the highest since 2002, the ECB said that “underlying inflation remains high overall.” So that “underlying inflation” is captured by core CPI and services CPI. In its press releases, the ECB has started to specifically emphasize services inflation, which has become a relentless headache due to its link to wages.

At the post-meeting press conference, ECB president Cristine Lagarde added:

“The drivers of inflation are changing. External sources of inflation are easing. By contrast, domestic price pressures, including from rising wages and still robust profit margins, are becoming an increasingly important driver of inflation.”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Is inflation all that matters ? Doesn’t the new higher price level also matter or is the assumption that wages increase to catch up to the increased price level so that nominally everything is flat ?

Inflation is about the devaluation of money (purchasing power). There are different forms of inflation: Consumer price inflation, wage inflation, asset price inflation, producer price inflation, etc. This was about consumer price inflation. One topic at a time.

If 2.0% CPI is “Normal” and you look at the chart, there have been 7+ years of CPI at 1% below “Normal” (I didn’t look back before 2014) Thats a total of 7% of what you could call accumulated “underinflation”.

We are now catching up with that underinflation and can expect 2-3 more years above the 2% normal rate to eliminate the accumulated underinflation.

Simplistic, but it makes sense to me. Sort of like reversion to mean.

In case nobody has noticed, these reports are all based on old data and energy prices are soaring upwards with oil at more than $81.00 per barrel versus about $68 a few weeks ago. I’d say these reports are just useless garbage and should be entirely disregarded as irrelevant.

RTGDFA. This is NOT old data. You’re just clueless because you didn’t read the article.

1. The energy CPI figures reflect the year-over-year price drop in July. It said that in the article. And WTI is still down 13% YOY, LOL.

2. In addition, it said this in the article that you didn’t read:

“…overall CPI was pushed down by the year-over-year plunge in energy costs. But energy prices aren’t plunging forever. On a month-to-month basis, some have already risen, including gasoline. So the days are numbered before energy prices start pushing up overall CPI again.“

Plus, we’re talking Europe here, and energy in total, not WTI. And the price of natural gas in Europe has collapsed and has stayed collapsed, without measurable increase. Natural Gas EU Dutch TTF futures are at €28 per MWh, around the lowest point since May 2021. Down roughly 90% from €340 per MWh at the peak in August 2022. That August peak will be the base for the year YOY energy CPI readings in a couple of months.

But then later this year, the YOY comparison will be against prices that started collapsing in Sep 2022.

Wow, WR, it’s like, I dunno, you know your shit or something.

SoCalBeachDude, adding this to your b.s. about grocery prices plummeting and, well, I don’t know what to think and wonder whose payroll you’re on.

I live in the UK, and the phrase “still robust profit margins” uttered by

LaGrandeDame, is an indicator that they see increased taxes, in the near future, as a way to control inflation. If this works !!! – will those

extra taxes be removed ??.

“Extra taxes removed”….Ha ha ha,,, that’s a good one!

Hi Wolf.

I read that at this stage for oil to have a meaningful impact on CPI print going forward it will have to double in price from here.

I am not an expert and would really appreciate your view on this.

Forget crude oil, it’s not in CPI because consumers don’t buy it.

Gasoline retail prices are in CPI, and gasoline weighs about 4% of total CPI. Overall energy weighs 7.5% of CPI. That’s nearly the same as food at home (7.7%)!

So energy overall has nearly the same impact on CPI as food at home. Gasoline alone has over half the impact of food at home. But food at home might go up 10% or 12% when it heats up, while gasoline can go up 40%+ as we’ve seen! These huge moves of 4% of total CPI have a visible impact on total CPI.

In addition, other fuels are indirectly impacting CPI. Diesel is reflected in transportation costs and higher retail prices of goods. Jet fuel price increases may eventually show up in air fares, etc. A lot of times, companies might absorb the higher fuel costs and not pass them on. But in inflationary times, companies can and will pass them on. So the impact of energy costs ranges from immediate (via gasoline) to indirect and more drawn out.

I suspect wage inflation will be a big problem for the US as well. Seems every week we have a huge labor union negotiating big wage increases which will have effects throughout the economy

There are a lot of businesses and corporations taking full advantage of the inflation situation, profits are high. Besides, labor has been beaten down for 40 years, it’s time workers get a break from monopoly corporations and banks.

Cant expect the average worker to just sit back and watch the cost of living explode while not asking for a raise.

In the 1970s, unions negotiated large wage increases for their members, but inflation soon nullified those wage increases. The Fed must tighten more quickly, and Congress and the President must quit spending so much borrowed money.

Must, but can’t. The economy is levitating on borrowed money. Debt is increasing faster than GDP because it all falls apart sooner if it doesn’t, although it all still falls apart if it does, but later.

Billionaire communities, gated and fortified, are big business in New Zealand, and if you’d care to guess why that is so you would probably be more or less correct, depending on how far into the darkness you’re willing to venture.

But us on s might get a 3% bump

In the long term wages never catch up to inflation. In fact the only real way an individual has to surpass inflation is to change jobs or get promoted to a higher salary, an option that is not open of a large number of employees.

Increasing wages increases inflation; those costs must be passed on to the consumer as higher prices, which is why service costs are climbing. We’re two years into this cycle and wage increase are just starting to show.

I’m expecting a minimum five years before this cycle ends and it’s going to take interest rates approaching double digits.

Chris H.

That’s the lesser problem, I think. USA workforce is less unionized than any time in about a century.

Unionizing a few hundred or even thousand Starbucks location is meaningless because Starbucks’ sector of the economy is, itself, toast if inflation REALLY hits.

For services wage-based inflation to stop, someone has to hold the bag and not get their wages increased. Sucks.

It’s really something that after all these years, most still haven’t figured out that throwing money at the problems caused by inflation will end up causing more of it.

Minimum wage still holding steady at $7.25/hr.

Not in California where even the most useless grocery store clerk is paid more than $16 per hour.

Useless? No. But scarce these days.

How much do the self-checkout systems get paid by shifting ALL the work to the customer, who isn’t paid at all for ringing up the merchandise, dealing with the payment system, and bagging?

It peaked in 1968 at an (understated) inflation adjusted $12.12 which is over $10K more per year than the current $7.25 provides.

It’s shameful how politician’s have no problems giving themselves a raise, but stanchly refuse to increase the federal minimum to something a person can actually live on. If that wasn’t bad enough, the wages paid to restaurant workers is even more mean spirited.

That’s a little misleading. $7.25 is the FEDERAL minimum wage, but 31 of the 50 states (and D.C.) have higher (in some cases, much higher) minimum wages. So the $7.25 is only applicable to 19 states.

In any case, even low level jobs are paying $15 or more now, so the $7.25 is likely earned by very few people.

Yes, only .15% of workers earn the Federal minimum wage because it hasn’t been raised since 2009.

Einhal,

And that is actually causing all sorts of weird misallocations of labor in its own right.

An example:

My mother lives in an assisted living facility. It is currently attempting to hire CNAs (certified nursing assistants). CNA training requires about 24 weeks and it will set you back about $2,000.

The facility is attempting to hire these CNAs at $16.80/hr and on a part-time “per diem” basis. This means: a) You do not know how many hours you will work in a given week b) But you DO KNOW that you will never work more than 40/hrs per week c) Per “b” you will not have benefits. d) The per diem arrangement means that you are effectively “on call” to go to work and they can provide as little as 2 hours advance notice.

Not less than 150 yards away there is a supermarket hiring cashiers at $15.75/hr. They offer full-time employment and health insurance benefits (however meager).

Which would you take?

It’s true that many CNAs take that job because they intend to go on to nursing school and the CNA job looks good on their CV. But aside from that? Is that even a serious question?

BigAl,

Useful, helpful example.

Home health care aides (another demand source for CNAs) is one of the BLS industries/occupations that has seen the largest growth in the last 5 years.

The newsfeed today says “Eurozone inflation fell to 5.3% in July”!! HA! Obviously citizens believe they need at least 5.5% higher wages, as being seen first in the services sector; and that’s just the beginning if you look at the slope of the curve.

I sold my last stock holdings today which was an international index fund. Its was about 3% of my porfolio. Its all in short term treasuries or fed m/m because it meets my goal of keeping up with inflation now without the price risk that is everywhere. Only other holding is about 3% in precious metal coins.

Wouldn’t surprise me if we have a blowoff top, but no need to risk what you have if you don’t have to.

As an aside I took my dad to local strip mall. They had at least 7 Tesla chargers all empty. I ride out to another small town a lot on my scooter. It is a one gas station town with two old style gas pumps. Two EV chargers were installed at a tiny library. I have never seen a car get charged there in my 20 times passing the place. Maybe these chargers will be a good use of resources, but right now their money losers for someone (maybe part of VW settlement for all I know).

Howdy Folks, Good and more good. Higher for longer and NO more ZIRP.

Okay, I will bite. Where exactly did the ECB and Fed target core inflation of 2 percent come from, and why 2 percent, not 1.5 or 3? Inquiring minds want to know.

The ECB’s target, when it was formalized, was “below, but close to, 2 percent.”

The ECB changed that during its strategy review in 2021, at the eve of the greatest outburst of inflation it had ever seen. The new language said: “…aiming for a 2 percent inflation target over the medium term. This target is symmetric, meaning negative and positive deviations of inflation from the target are equally undesirable.”

The Fed had gone through a similar process a few months earlier.

In theory, the target range means that when inflation (as measured by core) gets near it or over it, central banks would begin tightening.

Thanks. “Two percent” must be based on a bunch of academic or in-house papers.

Supposedly the 2% target came from an off the cuff remark during a TV interview by Roger Douglas, New Zealand’s finance minister in 1988. As result, 2% quickly became official inflation target of the Reserve Bank of New Zealand in September 1988.

This was shortly followed by Canada and the UK. The US, of course, was last to the party.

‘“Two percent” must be based on a bunch of academic or in-house papers.’

Two percent is optimum for financial profiteering while still minimizing the bleatings from the sheeple, who are okay with getting sheared but not okay with getting fleeced. The process of arriving at this number involves a lot of variables and higher-order equations that have no solution anyway.

Arnold is correct — New Zealand was the first to adopt a 2% target and the rest of the central banks have fallen in line via groupthink. It has no empirical basis other than it’s close enough to zero without hazarding deflation when the target is missed on the downside (which it was with regularity for a decade following the Great Financial Crisis.

planet money “How 2% became the target for inflation”

-10 minute listen

longer version- episode #879 “The Secret Target”

“This target is symmetric, meaning negative and positive deviations of inflation from the target are equally undesirable.”

This language seems to imply that policy following a bout of high inflation should expect to overshoot the 2% target and accept some level of (potential) deflation to offset the spike.

I guess it depends on the definition of “over the medium term”, but this reading seems contrary to the principal mandate of price stability

Yyyyyyyyeahhhh, NFW. I wish.

It came out of somebody’s ass.

I guess the central bankers want some control to cut to zero in periods of panics etc.

Unfortunately the desire to control it close to 2% causes booms and busts. For example the economy was improving till Bernanke failed to bring inflation to 2% and embarked on the deranged QE policy that has now bought us here.

Till GFC, the Fed did not have a 2% target or goal. It was informally considered a good inflation rate. But friendly Ben actually lobbied to have the Fed target fixed at 2% formally.

Therefore now the Fed is maniacally focused on 2% target irrespective of other social consequences (inequality, asset price inflation, high debt levels, unstable financial system) and willing to do anything it takes to be there.

We make systems and then systems make us.

2% is about as low as can be without risk of short-term variations going negative (i.e. “deflation”).

The government really, really, really doesn’t want deflation, even briefly, because it’s a horrible positive-feedback loop that kills the economy: Don’t buy today; it’ll be cheaper tomorrow!

Yeah, deflation is a deadly menace, don’t buy today; it’ll be cheaper tomorrow!

I suppose that is why nobody is buying computers, flatscreen TV’s or telephones that constantly fall in price.

Oh…wait…

From 23 May 2022:

“Monetary policy normalization in the euro area.” by Chrisitne Lagarde, President of the ECB

“Conclusion”

“To sum up, the environment facing monetary policy today has changed significantly from that which we confronted before the pandemic. The tools we were deploying at that time, aimed at combating persistent too-low inflation are no longer appropriate.”

“In the end, we have one important guidepost for our policy: to deliver 2% inflation over the medium term. And we will take whatever steps are needed to do so.”

I do recollect that it was on 26 July 2012, when Mario Draghi made his “Whatever it takes,” speech.

2% inflation? Yeah, whatever …

Perhaps they should have thought about before they decided to do away with Russian energy (oil). Of course prices are going to go up when you rely upon far more expensive energy sources. Duh!

Energy prices are cheap compared to inflation food and housing.

Nat Gas is still at 30 year lows. Basically no inflation over 30 years. The economy is doing well and we are having heat waves. LOL

Oil is the same price it was in 2010 to 2011 when we had 9% unemployment and a recovering economy. Now we humming economy and oil is the same price.

A lot of electrical energy production has moved to Solar and Wind. They are more expensive but hey, the government is subsiding a lot of the costs. Thus the people buying EVs or installing solar panels on their roof are getting the costs subsidized by those who don’t.

‘A lot of electrical energy production has moved to Solar and Wind. They are more expensive but hey, the government is subsiding a lot of the costs.’

Renewables are less expensive and receive far less in government subsidies that fossil fuels and nuclear.

Do some fact-checking.

Source?

My original point was that energy prices are low historically. We should be happy otherwise inflation would be higher. I was basically saying, after years and years of printing the fossil fuels have not seen any real inflation.

I am not against renewables. I did look up some facts:

Your are right, the government did fund about $20 billion in fossil fuel subsidies. But renewable subsidies are more than 100% greater than fossil fuels YOY.

“The Congressional Budget Office forecast that the IRA’s energy and climate provisions would cost $391 billion between 2022 and 2031, but this appears to be a huge under-estimate. One reason is companies are rushing to cash in on tax credits that aren’t capped. The Biden Administration is also loosely interpreting conditions for the credits…[the Goldman Sachs] estimate for the EV credit [$393 billion] could be low if Treasury loosely interprets the credit conditions” This is just EV credit.

So my last statement was a bit tongue in cheek. “They are more expensive but hey, the government is subsiding a lot of the costs.” I meant for the tax payers.

Subsidies will help the wealthier people who can afford to add solar panels $40k or $50k solar panels on their house and go off the grid per say. The poor people who cannot afford solar panels will have higher electricity rates because they will carry the burden of paying for the utility companies infrastructure. EV Subsidies will help the people who can afford a new car (EV). The new expensive EV car owners are not paying any road taxes (that will probably change). The burden of repairing the roads is on those using fossil fuel cars.

My point is energy is cheap. Oil and nat gas have not seen any inflation. As you stated, renewable energy even cheaper. Yet the government is going to give out hundreds of billions of subsidies for renewable energy that is already cheaper than cheap fossil fuel. It doe s not make sense for any subsidies.

Example: Hawaii electricity cost in 2018 (23 cents/kwh average). Add in more solar panels (people moving off the grid) and and closing their coal plant in 2022. Now the rate is 43 cents for customers still stuck on the grid. If your own a solar panel in Hawaii, you are barely using any of the 43 cent electricity. If you do not own a solar panel, your rates doubled as you are paying for the infrastructure costs and generation cost.

“My original point was that energy prices are low historically.”

That’s the illusion, anyway. The International Monetary Fund reports that globally, fossil fuel subsidies are were $5.9 trillion or 6.8 percent of GDP in 2020 and are expected to increase to 7.4 percent of GDP in 2025. You don’t pay for it at the pump, but you’re still paying for it.

And the IMF would not lie to you about such a thing.

By comparison, subsidies for renewables don’t even show up on the chart.

How’s that fact-checking coming along?

“And the IMF would not lie to you about such a thing.”

LOL I guess your being sarcastic right.

Anyway….nice try to move the subject. My facts are correct for the U.S. Of course oil subsidies are more because renewables is such a small percentage of energy generation.

A study by the University of Texas projected that U.S. energy subsidies per megawatt hour $0.5 for coal, $1- $2 for oil and natural gas, $15- $57 for wind and $43- $320 for solar.

Your welcome.

That was an unstable house of cards anyway. They foolishly remembered the Soviet Union and that they did not want to be controlled by another Russian empire again.

What was definitely foolish was the early closing of Germany’s nuclear power plants that could have been operated for a few more years without significant, additional investment or additional risks over the risks of maintaining the partially used, nuclear fuel in sites in Germany. Making the EU dependent on Russian energy, for years, after its actions, e.g., in Georgia and Crimea, was also very short sighted.

Some people clearly never met any person that lived in the Soviet controlled countries in what is now the east of the EU or never heard them describe what that was like.

Of course the global financial elites would say “…robust profit margins…”. Makes pure greed sound noble.

At least they’re pointing in the right direction.

Lagarde is a QT vigilante compared to Powell.

It’s not working.

I believe that the ECB bought up a much larger percentage of the outstanding European bonds than the Fed bought. From what I saw it looked like 25% of all European bonds outstanding. And the BOJ has bought assets that I think were equal to 40-50% of the outstanding government debt (if I remember correctly), although they bought a bunch of equities as part of that total.

I have a theory that if the worlds central banks were run by average ordinary folks who had to live on a wage, the policy decisions would be much more rational and would eliminate bubbles. The central banks are run by rich people who love asset bubbles.

The other point, that no one wants to talk about, is that they bought disproportionately more bonds from failing economies. More Italy, less Norway. More Spain, less Germany. they did this to prop up those economies that still, after 20 years of being in the EU, can’t make the political and banking changes required of them to meet the EU standards they pledged to abide by.

There’s a good chance the EU is going to once again run into a situation like they had in 2010-2014.

Yes – and this time Germany will be in no position whatsoever to rescue them.

German PMI was 38.8 at last check.

At this point in time, the conversations about inflation should be more about ending global central bankers’ reign of terror, and ushering in a new model. Because they have FAILED.

CBs are working as designed i.e. to serve their rich masters and do transfer of wealth for working/poor class to elites.

Although their explicit mandate says something else.

This. “Independent” central banks are, by design, aristocratic institutions inimical to labour.

Inflation is being fueled by too much disposable income from people that want immediate gratification.

Re: The cheapest ticket for the US singer songwriter’s Eras tour stops in Zurich in July 2024 will cost 167.50 Swiss francs ($192.57), according to Swiss newspaper NZZ

Money, like water, seeks its own level. Water flows downhill. Money flows uphill. Inflation makes it flow faster.

Greed is never directly identified as a Catastrophic Risk caused by humans, but it is always the subtext.

Greed is what causes a lot of people to get up in the morning and build things, so a decent amount of greed is good.

Excessive greed is damaging. It’s when you accumulate more money than you could ever spend in a lifetime. It’s a desire to control things from your grave via family dynasties.

100% this.

It’s the economic equivalent of metabolic dysregulation leading to obesity and a host of health issues.

I guess the odd one out is the fuel chart. It being a large and volatile part of actual consumer spending I am concerned that if it comes raging back, the CPI increases of the past 3 years will look like a tiny “blip”.

Maybe I shouldn’t be concerned but here are my possibly irrational thoughts on the fuels component.

Regulation of the fossi fuels industry will reduce the attractiveness of continued production increases to meet demands.

Foreign, not friendly, crude producers may continue to reduce output to force up prices.

Airlines and other heavy fuel user’s longer term fuel contracts might be replaced by higher cost contracts.

Just some random, thoughts about the present inflation stuff.

Wolf, please keep up the good work. Your time and effort are appreciated more than you know.

Will that energy chart be headed back up, dragging all the other charts back up with it?

“Oil Rebounds After Reports That Saudis Will “Extend, Deepen” Voluntary Production Cuts”

Man, this stuff sure gets complicated after a while…getting a headache.

Gasoline has been rising for months, but year-over-year, as of June CPI was still down from the spike last June. This will reverse over the next few CPI readings, and gasoline CPI will once again be up year-over-year.

Oil doesn’t go into CPI, but products based on it go into CPI directly (gasoline, heating oil) and indirectly (transportation costs, costs of goods, etc.).