Housing, finance, insurance, recreation, other services jumped in June from May. Energy plunged 28% year-over-year, but also jumped in June from May.

By Wolf Richter for WOLF STREET.

This is roughly what happened in June compared to May: Prices of motor vehicles, and of durable goods overall, fell in June from May. But gasoline prices rose in June from May, after plunging for seven months in a row. And services prices bounced off on hot inflation in housing, finance & insurance, recreation services, and other services, according to the PCE price index data released by the Bureau of Economic Analysis today.

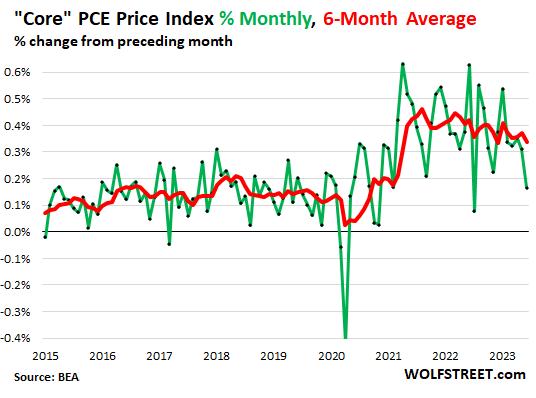

So month-to-month, the core PCE price index, which excludes food and energy products, rose by 0.17% in June from May, the smallest increase since July last year, on a big drop in durable goods (-0.3%) and an acceleration of inflation in services (+0.3%).

The month-to-month index (green line) is very volatile with big ups and downs. The six-month moving average (red) shows the trend. And the trend is moving in the right direction but remains high (0.34% in June, or 4.2% annualized).

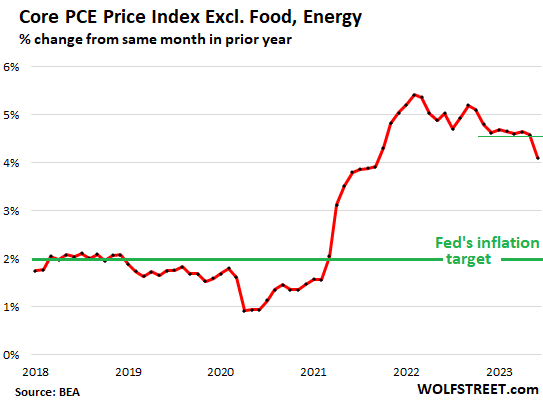

Year-over-year, the “core” PCE price index, the inflation measure favored by the Fed, rose by 4.1%, the smallest increase since September 2021, and the first significant deviation from the 4.6%-range that it had maintained over the past six months. The Fed’s target is 2%:

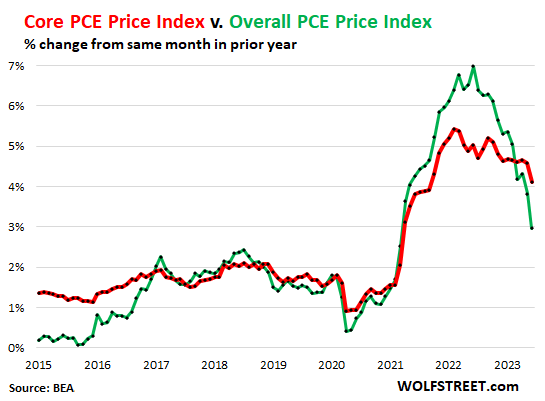

The overall PCE price index rose by 3.0% year-over-year, pulled down by the 28% year-over-year plunge in energy prices, which caused the overall PCE price index (green in the chart below) to be under the core PCE price index (red) for the fourth month in a row.

Food prices dipped in June from May (-0.12%), which reduced the year-over-year increase to 4.6%, the lowest since September 2021.

The energy price spike had peaked in June 2022, and so the year-over-year increase in the overall PCE price index had also peaked in June 2022 at 7.0%.

Year-over-year headwinds for the second half.

The base effect. Today’s year-over-year comparison is against the base of a year ago, which was the peak of the year-over-year change in the PCE price index, after a very steep run-up of the index itself. And this high base of the index itself a year ago lowers today’s year-over-year increase.

But this “base effect” will begin to become less favorable and then unfavorable in the second half of 2023, and will become one of the headwinds for the year-over-year readings later this year.

In addition, energy prices stopped plunging and in June rose again from the prior month. Crude oil grade WTI is now back in the $80 range. So, combined with the base effect, energy prices (primarily gasoline) on a year-over-year basis will become an unfavorable factor in the price index in the second half. And then the overall PCE will revert to its normal place near core PCE.

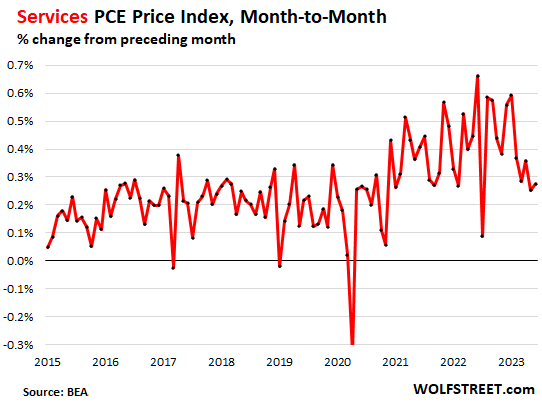

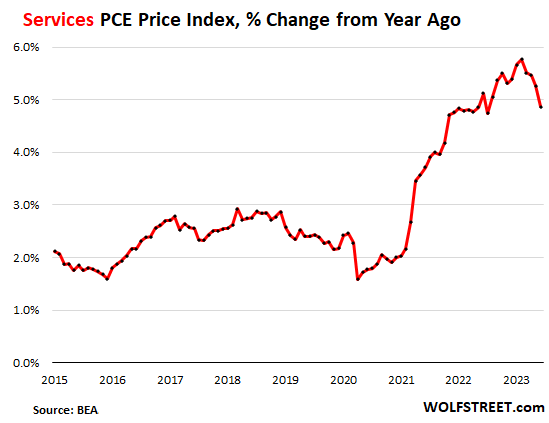

Services inflation in June accelerated from the prior month, to 0.28% (annualized 3.4%), driven by much sharper increases among the usual suspects, with a combined increase when annualized at over 5%:

- Housing costs: +0.44%, the biggest month-to-month increase since February

- Financial services and insurance: +0.40%

- Recreation services: +0.53%

- Other services: +0.54%.

What helped keep the services index from blowing out was the sharp drop in prices of transportation services: -0.37%.

Year-over-year, the services PCE price index rose by 4.9%, the lowest since July 2022:

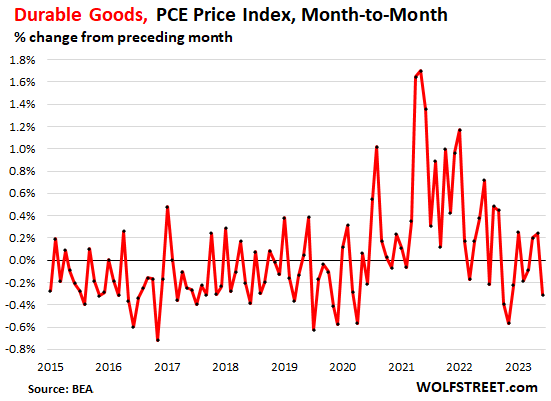

Durable goods prices fell in June from May by 0.31%, with all three major categories declining:

- Motor vehicles: -0.19%

- Furnishings and durable household goods: -0.29%

- Recreational goods and vehicles: -0.67%.

Only “other” durable goods rose (+01.16%). The index has now normalized, compared to pre-pandemic times:

In other words, some of the horrendous price spikes of durable goods, particularly motor vehicles, in 2021 and into 2022 have been getting partially unwound since mid-2022.

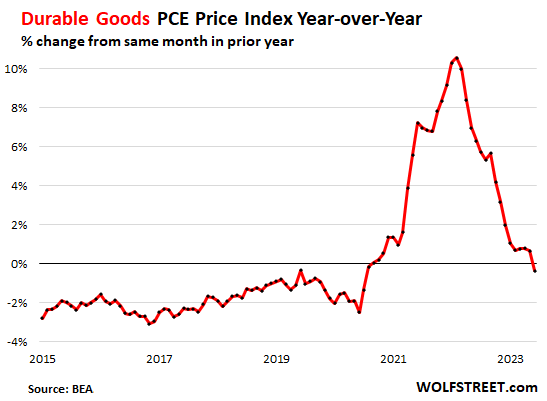

Year-over-year, the PCE price index for durable goods fell by 0.4%. In normal pre-pandemic times, the index for durable goods was negative year-over-year, driven by manufacturing efficiencies, offshoring, and competition, plus the infamous hedonic quality adjustments that remove the costs of improvements from the cost base, on the principle that consumer price inflation is the change in dollars to buy the same product over time, and cost increases due to improvements are not inflation (though they make the product more expensive).

Motor vehicles are the biggest example of hedonic quality adjustments. For example, the standard four-speed automatic transmission of a Ford pickup in 1990 gave way to the standard silky-smooth 10-speed automatic today. For the purpose of calculation consumer price inflation, the costs of that transition were removed from the cost basis because you’re not paying more for the same product, you’re paying more for an improved product.

The durable goods PCE price index is normalizing. Though absolute prices of durable goods remain high, they’re no longer surging, and some are falling (such as big price cuts for new EVs). Those ridiculous price spikes of 2021 had been caused by an overstimulated consumer who, awash in cash, decided to pay whatever to overcome the supply disruptions. And that’s over, thankfully:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wallstreet will focus on the 3% overall increase as a reason to rally, will choose to ignore the rise in services.

Let them have their fun with the overall index while they can. The 28% YoY plunge in energy prices will phase out starting in July due to the base effect. In addition, we already had a jump in energy prices in June from May, and with WTI at $80, more might be coming. So overall PCE is going to revert to its normal spot near core PCE, which is much higher. Services inflation is a wild card. Other than transportation, it’s still very hot and has accelerated recently month-to-month. So let them have their fun with the overall PCE while they can. Those days are numbered (ca. 32).

The stock market looks like a ship of fools to me…. and those buying long bonds are also semi fools…

The economy does not have to crash into a deep recession it can have no growth or a slight decline, and still have 3% inflation…

Then the Fed keeps rates at 5% or so and the yield curve un-inverts into a normal curve where long rates are about 1.5% higher than Fed funds = The 10 year bond crashes in price as the yield rises from 4% to 6.5%…. = Stocks crash and burn… I remember what happened in 1987…but, Shiller PE then was half what it is today, so long yields do not have to rise to 8% to cause a stock crash.

Meanwhile China, 2nd largest economy in the world, has run out of the ability to fuel growth through more debt.

Meanwhile, Japan, 3rd largest economy, is on the road to a massive debt crisis.

Meanwhile, EU is in deep doo doo with German auto industry facing massive losses as China floods the world market with cheap EVs.

Bottom line: People owning the stock market now have clue how much risk they are taking.

What you said about risk. I look at Wolf’s requisite factual presentation with a slightly different perspective. I admit, I am cursed with having taken a statistics course from a great teacher. Although, one is doomed to be at the forefront of the madness of crowds. Relegated to the rank of nay sayor.

Statistically, the recent release of data indicates that inflation is, at best, leveling off. In a statistical view of the status of inflationary measurements, I currently believe that the core inflation is more likely to have increased than decreased by a 50/50 gamble.

The standard deviation for the MoM reports is huge. Ie; the MoM data is subject to a statistical bias that incites a celebration when in fact the good news is not.

The actual reported measure plus the winnings

It seems a little nuts to pay $4500 for $175 – $200 of earnings when you can get 5.5% risk free.

I would suspect that we’re looking at the real possibility of 3% GDP for Q3. I agree that YoY comparisons may begin to skew back to the upside starting this month. And all else being equal, I see the Fed as having to adjust its core PCE expectations at some point upwards of at least 3%. Whether they do this or not is certainly uncertain but so is the terminal FFR that I believe we haven’t reached yet.

How would a 3 pct increase in GDP be achieved by an economy that is debt funding a 6 – 8 pct trade deficit ?

Based on the simple mathematics of the Keynseian formulation of his measurement of the wealth of a nation which he expressed with the equation

GDP = Per Cons Exp + Gov Spend + Exports – Imports

It would seem that a balanced budget is a pipe dream and any promoter should be recognized as a potential charlatan.

Time for the to speed up qe and Dell mbs and treasuries so the bond market starts reflecting the risk of insolvency and lower unrealized asset values.

Haha, I noticed that too, just looking at market action without reading about this more in depth…all I see in MSM is, inflation trending down..

Just wonder how many of those “Mission Accomplished” they have printed out and ready to hang on top of an aircraft carrier….inflation has been annexed…

If you look at this article’s second graph, it clearly shows core PCE Price Index is trending down.

same with third graph.

It is indeed trending down.

Not only is it trending down, the real hit (based on depleted savings) is coming in q3/q4. This will wipe out service inflation.

Luxury goods spend (“stretch” luxury) is softening already. Big swaths of the US population were unaccustomed to having anything saved in their bank accounts. The additional cash of the last few years felt unnatural and those same groups are running back down to where they are accustomed to sitting – no balances. All that spend will come off in Q4.

We’ll have a mild/moderate recession right as inflation is sub 2% and trending to negative in goods. Fed will be cutting rates in Q1 2024.

Truth-

You said:“Big swaths of the US population were unaccustomed to having anything saved in their bank accounts.”

My dad used to say (quoting some other smart old wag):

“Money always returns to its rightful owner.”

Trending down, yes. MOM and YOY

Now, let’s set the measuring peg at the point in which this all began….

June of 2021

Since then prices are up circa 20%.

The Fed’s self authored trajectory for inflation (stable prices ..ha ha) is 2%.

3 years at 2% (sans compounding) is 6%.

20% – 6% = 14% of price increases that SHOULD BE disagreeable to the Federal Reserve. I don’t hear much about that.

2% YOY should not be the goal if a 2% trajectory is truly their mission. Getting back around 6% over 3 years should be the “victory”. IMO this reveals that the Fed is not only OK with the extra 14%, but perhaps that was the goal.

“Fed will be cutting rates in Q1 2024.”

You should end your posts with /s, your sarcasm is very subtle and some might interpret your comment as serious.

Truth,

The luxury slowdown is partly due to the increase in prices and the proliferation of super fakes in every category from watches to sneakers. Consumers are increasingly questioning the real value of these items when the fakes are indistinguishable at a fraction of the cost.

Not statistically, even after the data was smoothed.

What I think is that, the graphic you pointed out shows the hazards of curve fitting.

Even the tortured data, tell the story that a 5 pct core inflation has been anchored in the inflation expectations.

The Fed is feckless. Afraid of offending their owners.

Pet – makes me wonder how many fakes are paid for with counterfeit U$100 bills?

may we all find a better day.

“all I see in MSM is, inflation trending down”

Normal operating procedure when it comes to reporting on finance, always make sure Joe Blow is 3 steps behind at all times.

Durable goods are an occasional hit to the finances but food prices are still sky high.

What’s the grocery bill for a family of 4 or more. Must of doubled, at least.

Grocery prices are very low these days and typically only about 10% of a typical family’s income in the US.

You’re kidding, right? Beef is still up into the stratosphere, and rising. Bacon? All junk food, including fast food, is skyward yet. How can Americans live on dried beans and ramen noodles and keep their present (a bit plump) figures?

I haven’t seen any changes of any significance in prices at the grocery stores here in Southern California except for paper items such as paper towels and toilet paper and I simply don’t buy beef items. Boneless chicken breasts were $1.99 / lb. at Ralphs last week and are $2.49 this week at Vons / Pavillions. I don’t buy Pepsi Cola nor its junk food chips which are part of the laughably greedflation scam. My grocery bills are pretty much unchanged over the years and many prices have come down substantially over the past year and items are on sale all the time. Simply learn to be a savvy shopper.

a bit plump….? 42% obese and climbing…there is your real inflation LOL

I’m with you. Prices seem to have stabilized, but almost nothing has come down in price. And, I firmly believe the official inflation numbers as reported by BLS were understated.

But that’s the problem. A return to zero inflation means prices have stabilized. The average person thinks zero inflation means DEFLATION, which the powers that be will never allow.

SCBD,

With all due respect, you keep posting this and… you’re insane. I live in So Cal, and have for a long time. Food prices have not dropped AT ALL. Just to throw examples attcha…organic romaine is still $4, even at cheapskate Trader Joe’s (was $2 in 2020)…their cheapest eggs $4….Whole Foods chicken breasts $6 (were 4)….pita chips $9.50 (were $4.50). NOTHING has dropped in price. NOTHING.

GYST, man.

If you really want to be ripped off or simply don’t care about what groceries cost you shop at Round Swamp Farm in the Hamptons!

DM: Is Round Swamp Farm in the Hamptons the most expensive supermarket in America? TikToker buys $200 lunch at swanky Hamptons store – including chicken tenders costing THIRTY FIVE dollars

The ‘most expensive’ grocery store in the Hamptons has raised eyebrows this week after a TikToker revealed the exorbitant prices on offer for the rich and famous.

Well there is a measurable cotillion that believes that living in So Cal would solve all of their problems. Then you come along, throwing cold water on the fire of hope.

Or perhaps, like Bowie’s song about putting out a fire with gasoline.

SCBD,

I care plenty, I shop around, go to 5 or so stores to buy specific things where they are cheapest.

FYI, Whole Foods chicken breasts, not organic, just raised 50 more cents to $6.50 today. Even cheap Sprouts is $4.00 for their value size (read: 4 lbs or so). Vons/Ralphs? Cheapest was $5/lb the last time I was there, about a month ago.

Have you become a grocery troll?

Agreed! And food isn’t going to drop. You’ve got 7M+ new mouths to feed. Most clued in people would wonder how many more years we’ve got before we’re hit with the beginnings of food scarcity?

Ben – given that many must shop harder than ever (or frequent struggling food banks where available) it could be implied that a shortage is already here. Belief and pronouncements to the contrary, our spacecraft is not an inexhaustible larder given our historic expansion of its crew and it’s concomitant technoindustrial demand/effects (old term: ‘seed corn’) for onboard supplies…

may we all find a better day.

Very low!

Good one!

/s

I was at a store the other day that had a wall cooler full of soft drinks. There were no prices listed.

I asked a manager how much a 1L bottle of Diet Coke cost, and if I could find a price list somewhere. He looked at me funny, as if those were such strange questions.

He checked the price at a register. $3.15. “That’s a great deal,” he proclaimed. “We should be charging more than that.”

Again, for a 1L Diet Coke. 35 liquid ounces.

It seems “the new normal” of unlimited absurd price increases has been embraced without any resistance whatsoever.

So don’t buy it. Diet soda is terrible for ya anyway, artifical sweetners are poison to older people but don’t expect your doc to tell you that. I you opt to drink this junk they figure you’ll pay any price they charge you.

People are addicted to their junk food.

Not really, Arnold — people are simply goddamn’d miserable from the socioeconomic vagaries created by the almighty technocrats in charge and so they palliate with salt, sugar, fat and sometimes alcohol.

Close Bullfinch.

Dubious digit is increasingly being lifted to all the nodes attempting to control how we live. They went to far; grew too abusive/dictatorial. Fabricated too many false narratives.

The “opposite and perhaps not equal reaction” is settling in.

Even if food prices stays at high point and does not go down or up, then it is zero inflation.

The point is: even with zero inflation, working class is scrwd.

Same with homes prices and rents.

But this would be celebrated with FED, Govt and WS as victory.

And if prices declined, the Fed would cut rates to get inflation back to 2%.

Is 2% a target or the desired cap?

I have always interpreted 2% inflation to mean a range of 0-2%…

It was a target of 2%. And then just before the pandemic, the Fed came out with a new policy statement that changed the target to “symmetrical,” allowing for some overshooting to make up for undershooting, and that was one reason the Fed was so slow in reacting to the surge of inflation in early 2021.

Wolf’s point below about the Fed’s average inflation targeting (AIT) is somewhat new to me at least in the given name. I knew the Fed has been clear that they expect inflation to run higher than it’s 2% target. If so, then they need to some up with an acceptable range IMO.

1.5% to 3.5% core PCE inflation would seem to be about right. Either way, they’ve still got work to do. I for one don’t think the FFR is as being high enough yet. I foresee at least one more hike to take it up to 6% which should happen in September, and I personally won’t be surprised with one more before the end of the year.

I don’t see the job market deteriorating meaningfully this year, and the Fed KNOWS the only way we get back to 2% core PCE inflation is with a rise in unemployment up towards 6%. But when that happens, that’s when the housing markets is looking at a national 10-15% decline and then we have to wonder how loudly E Warren will be screaming for rent & mortgage relief.

Great point unfortunately except food and energy very rare for economy to have deflation. Some of the Wall Street pundits have said over the years deflation can have devastating effects on economy as well. Yes a victory by the government will not help the poor and fixed income elderly unfortunately. Opportunity for the poor will exist though with stable pricing and employment society does not guarantee an income . The elderly will suffer as they have for generations before the current monetary system very difficult to save enough for a long retirement with the cost of rent transportation housing and medical care in the USA . Tough situations for the elderly are coming unfortunately as we age and fewer young folks are available to support the system. That too will pass as the cure for old age is in the bank.

Agree.

But watch – energy prices, as Wolf notes, are increasing again. I’m betting on it as China tightens oil & gas spot market.

Then, there is the absurd Federal deficit spending that continues unabated.

While I agree the current working class will continue to be screwed, like they have been for the last 40 years. Walmart is a case in point.

Union members shopping, buying the foreign produced product that is cheaper than they could produce.

Passive labor are suckers.

More than doubled, in my own family’s experience. It depends on what you buy each week, of course. Former not truly “Federal” Reserve Chairman Volcker showed what it takes to stop inflation with high, interest rate hikes that current, “Fed” leaders will never do. The bankers are even angry at the new Basel III Endgame, capital requirements, which no longer allow them to underestimate their own risks as much— by relying on their “Fed” and the US congress to bail them out yet again.

This could actually mean real reform in 2023, at last, and of banking no less! It could not come at a worst time for the bankers, most of whose banks are secretly, legally insolvent, because the net realizable value of their total assets are already less than their total debts (our deposits and banks’ other debts.) They lost their (2% to 13% max) capital via losses in real estate, car, commercial, governmental (treasuries) and foreign (CCP Ponzi company) loans (mostly indirectly as to CCP loans, through over leveraged, crony companies.) LOL

“Former not truly “Federal” Reserve Chairman Volcker showed what it takes to stop inflation with high, interest rate hikes that current, “Fed” leaders will never do … “.

Volker was anything but a hero. His final capitulation, like now, was to prevent an out of control inflation that he helped create.

dang – how many, throughout human history, have been subsequently lionized for precisely that???

may we all find a better day.

What I’ve noticed is that the prices of some processed foods have increased about 50 percent since Covid. For example, a frozen meal by Amy’s used to be $3.98 when not on sale. Now, the price is $5.98. A jar of preserves from France used to be $3.84. Now, it costs $6.18. I’m waiting for the politicians to declare victory over inflation.

In Canada all the low priced foods around the 50 cent to a dollar and 50 cent range doubled in price. 100 percent inflation.

Absolutely! This is a really good point- we tend to get these quick-prep meals for my kids, and it’s amazing how much they’ve gone up in price.

Did you ever think about simply serving them real food?

We do cook meals for us and two teens in Canada. My weekly grocery bill is up roughly 40% in the last few years. I buy good quality food (very little junk food) from a no-frills grocery store.

Honestly, it would be cheaper to buy junk food than fresh fruit.

Thank you Wolf. You are a booming voice of logic and reason in a windstorm of BS.

The markets have little to nothing to do with logic and reason.

Then it makes sense Brendan was talking about Wolf and not the markets.

Carry trade in markets has been great since ZIRP inception! There has been a speculative logic!

We’ll see where the lags eventually lead. In my own mind, we’ve passed the debt point of no return. But what the H, the numbers are so large now who knows…and with CB digital currency around the corner – with little public release of implementation details – hard to assess whether this will turn out to be a net negative/positive for banking system stability – i.e., the future economic environment.

YEP… Like the Unsinkable Titanic,,, Mr Wolf would have been the only person questioning that…….” It is made of iron Sir, it can sink “…..

My portfolio is 75% stock, 25% cash. When should I pull out of the stock market? Or should I keep stock to deal with inflation (since earning will be inflated too)?

Nobody can absolutely answer that. No non-financial-adviser with any brains would dare to. No financial adviser would either because they don’t know you and don’t know in general.

I recommend the “Buffett Indicator” as a good place to start. Also remember that you can currently earn >5% risk-free on floating-rate government bonds, easily purchased via an ETF.

Great question!

My numbers are the exact opposite of yours based on some macro assumptions that proved incorrect. Ergo, while the investments I hold have done reasonably well, I missed out on a nice market melt-up that started around Nov last year.

No easy answer other than usual – what’s your risk tolerance? Can you build a portfolio that addresses your risk tolerance?

There are other considerations: I have half my investments with professional investors; half is self-managed. The professionals, for some obvious reasons, hold a lot less in cash. Which do you think is the more volatile account?

Think of it as the sleep strategy – how much risk can you tolerate and still sleep comfortably at night!

rbug,

If you are young you can run a really high stock percentage just as long as you understand that 50% plus drawdowns can and probably will happen several times. Figuring out how to get in and out of market is probably not a good strategy unless you have exceptional skills.

If you are already retired and want to ensure you can support a stable income withdrawal from your portfolio then you can have very low exposure to stocks unless you are willing to cut your life style if you are unfortunate to retire at the wrong time.

Not sure what market is seeing with high valuations. I guess once inflation reaches sub 3%, market expects rates to go to zero and QE to start. Otherwise the high valuations cannot be explained.

Yes it can, and the explanation is pure delusional manic speculation.

A symptom of too many dollars chasing too few stocks.

Only a very small portion of the more than 7,000 publicly traded stocks in the US are bid up to delusional speculative levels and all of those are on the Dow 30, S&P 500, and NASDAQ indices. Most stocks in the US are down significantly from what they were back in 2019 and many are continuing to fall this year.

Yes with stock buybacks and mergers ie SP500 stocks the number of large corporations keeps slipping. Technology companies have created a whole new market that has become something I never expected but I use mobile technology for all of my daily meds . Amazing

Gasoline and Diesel Prices Will Continue to Soar This Summer…

DM: Pain at pump as gas prices hit eight-month high: Average price rises 20 cents in a month to $3.73 a gallon – $4.95 in California – as it’s warned hurricane could trigger huge increase

Gas prices have surged to an eight-month high after suppliers slashed production, and experts are warning that a hurricane in the Gulf of Mexico could trigger further increases.

I trade oil futures and would not be surprised to see $100 WTI by years end.

In the short term, another $3 up then a return to $78 before another push upwards.

I wouldn’t be surprised at all to see oil go to negative $33 per barrel like it did a few years back with the huge supply glut of oil now floating around in the global markets.

Oil never went negative. A certain type of WTI futures contract went negative very briefly. The spot price of WTI never even got close to negative.

It was a storage issue …

for the deliverable supplies against futures…

there was no space available

Your $3 more gets us to that mid April high and it might also correspond with the end of earnings season. That would be a nice run.

$100 WTI is quite possible if China come along.

If you drive an electric car, you stop noticing gasoline prices after a few months.

well that seems obvious…

and presumably, you drive one?

hows that working out for your electric bill? has it been a significant increase?

I like how the people with EVs who have to charge at a station (my BP gas station has three ports), they have to come in and sit there for 15-20min to charge. I come in, fuel up and on my way in 3min. At what point does the value of your time is worth less to you by driving an EV? Not everyone can charge up at home.

I hardly notice it and at my house, we use 2 EVs. The cost of electricity for my EVs works out to about 4 cents a mile.

Cool! Hope you never get into an accident! Increasing incidence of fire departments/rescue personnel refusing to immediately risk EV leakage threats.

We are at the front end of understanding all the E2E costs (including externalities) and benefits of renewables, electric tech, grid, etc. etc.. See wind driven tech for example. Oil and gas are better understood – i.e., better data for decision-making.

In my own mind, I would prefer an approach that was market driven rather than the highly gov’t subsidized and rhetoric driven approach currently being forced.

Oil is highly subsidized by the government. So is ethanol via corn subsidies. So your comment where you make it seem like “green energy” is the only heavily subsidized energy source is either severely misleading or you’re intentionally being misleading.

The private side is not heavily subsidized.

Look at all major funding bills in the last two years. Subsidies are not going to O&G. Western gov’t have been trying to kill O&G for over a decade.

Well…this is a fail for sure…only hope is lag effect and housing takes time to turn around like the Titanic…

“Housing costs: +0.44%, the biggest month-to-month increase since February”

Around FL, the new houses are a much better deal than the used ones.

No good deals to be had, but I’d take a warranty & a new house over a 30 yo fixer upper for the same price. A local Real estate agent disagreed with me recently, because of 18mo old comps.

Yes, easier here in FL to bargain with a homebuilder than a homeowner. I prefer older homes in central FL as they have larger lots and more privacy compared to the new stuff that have very tiny yards for SFH. There isn’t even room to plant trees for shade like the old homes come with already, too. A lot you can’t even build a pool as the backyard is the driveway and garage now rather than the older homes with garage door at the front or side at the most (and a lot of older homes have pools already). Not that I want to stay in FL much longer anyway…getting way too crowded and weather is horrific. Maybe another job change out of state next year while job market still good…

Same here Z33, we looked at new construction and in our price range the size of the lots was the deal breaker. My TV remote could change the neighbor’s channels. We grew up in suburbia and dammit give us a big American back yard!

If I can’t have outside space and privacy I would rather live in an apartment complex closer to a major city with its cultural attractions.

“I would rather live in an apartment complex closer to a major city with its cultural attractions.”

If that’s a big vibrant not-too-hot city, the whole city is your outside space.

Julie, you’re not kidding about the remote control thing. I had never thought of that as a possibility in a SFH, but my friend in Winter Garden (tiny lot SFH) had a ceiling fan that the neighbor was turning on and off remotely as they had the same one. Funny enough they both installed theirs after purchase and picked the same model by chance…not builder installed…

Although a rare situation, he sold his house end of last year to get the gains ($250k profit I think) and is now renting. He wanted a bigger house for the family as that place was small even though he had refi’d in 2021 a year earlier I think at a super low rate (bought house in 2016 new). Some people sell even with low rates as they want a bigger place…don’t blame him. The new rental they have is way nicer with an actual backyard, too. Both the home he owned and new rental one are not great quality with HVACs upstairs that fail and leak water through the ceiling in both…

FL weather is tough to tolerate – during the Summer. No doubt. Problem is basically Gulf driven – humidity.

Infrastructure (roads) is not keeping up with population influx = quality of life degrading.

On the flip side, having lived in Northern tier states, my arse doesn’t freeze every Winter; the politics aren’t quite as dictatorial; the traffic jams aren’t any worse; my decision on tax burden; lot more choices, public ones at that, for good golfing!

I wonder what the price delta is between comparable new build homes at Bethany/Rehoboth beaches versus, say, a Palm Coast.

Howdy Folks…. Good Deal… Higher for longer…. Interest rates that is…..

A straight line projection from core PCE peak suggests Jerry’s 2% goal might be reached some time in 2025. For what it is worth, which is probably not much.

Howdy William. Mr Wolf and the wack a mole inflation phrase will be fun to watch……. Where will it rise???? Will have to wait and see…..

Off-topic, but: Anyone (Wolf?) have any insights what will be the impact of Japan BOJ interest rate increase? BOJ is letting 10Y jbond rise to 1% yield.

The BOJ is moving at a glacial pace away from its Abenomics monetary policy. It made the first micro-move last December by raising the 10-year yield cap from 0.25% to 0.5%. Now it effectively raised they yield cap to 1.0%. It left its short-term policy rate unchanged in NIRP land. I mean goodness, what radical monetary policy change, LOL. For markets, this is essentially still a nothing-burger. Not even the yen gained from it, and the initial bump got unwound by now.

The BOJ will continue to move forward in micro-steps. Eventually, it’s going to jack up its short-term policy rate in an earth-shattering move from -0.1% all the way to 0.0%.

That’s the plan. If inflation begins to spiral out of control, especially in services, it may move faster.

Thanks for the update.

Wolf,

I think they could move faster than you suspect.

Japan has some big LNG contracts expiring right about now. The short- & mid- term contract market for LNG is in chaos right now. It’s going to need a stronger currency to chase those (long-term contracts are just out of the question right now) – or get raked over the coals on the spot market. If that happens – you might even see the odd month where Japan runs a trade deficit to the USA. Never thought that would happen!

The other thing that I think you are missing is Japan’s commitment to doubling its defense spending. These sorts of pledges among non-US NATO countries mean absolutely nothing – but Japan is not part of NATO and would likely be in immediately-difficult circumstances if the US responded militarily to any Chinese attack on Taiwan. To finance that expansion they are either going to need to offer greater Treasury yields or sell some of their trove of US Treasuries or both. Regardless, some of their excess savings will need to make their way home.

I missed your monthly rant on inflation is going to the moon in Japan when they released the latest stats.

Was that because it came under expectations and was cooling down to just over 3%?

IMO the dumbest trade right now in the world would be to be short Japanese anything especially Japanese bonds.

Why?

Because you have one entity that owns a substantial portion of the outstanding issues, you have one buyer with unlimited funds, and a market that could see huge volatility against you should there be a black swan event. Not only that you have no idea what the BOJ is going to do and when it is going to do it.

How are you going to deliver if there are no bonds available? Classis short squeeze on a massive scale.

There will be substantial repatriation of funds back to Japan that could force the yen to increase in value at the same time cause the price of Japanese government bonds to soar.

And once Japan gets its head out of its collective rear end and gets its nukes running again the balance of trade energy component will greatly reduce the pain in that part of the financial arena.

1. “I missed your monthly rant on inflation is going to the moon in Japan…”

My apologies for this oversight and laxity. The only inflation rant I do “every” month is for the US. There is no monthly rant about inflation in other countries. I only do “sporadic” rants about foreign inflation.

For Japan, I did 7 rants in 13 months. These 7 rants were published in:

June 2023

May 2023

Feb 2023

Jan 2023

Nov 2023

Sep 2022

May 2022

2. Shorting JGBs has been the favorite widow-maker trade for two decades. I’m not sure there’s anyone left doing it.

Japan is an interesting case as the last country left following QE. With government debt at 263% of GDP and $3 trillion in low interest yen borrowings financing the carry trade with other G20 countries, and an increasing inflation rate to boot, it is a teetering economy that is currently my pick for the next global crisis.

Good luck with that and if you ever managed to look at the actual fundamentals of Japanese stocks you would have done like a guy named Warren and doubled your money in a short period of time.

The USA market is way overpriced compared to Japanese share prices, there is no weaponization of the Japanese yen, and no bubble in real estate prices there like in the USA.

When was the last time a Japanese bank went bust or there was a smash and grab in one of its stores.

Lots of Japanese politicians leave a lot to be desired, but none come close to the deranged representatives in the House or senile, old aged cretins that have to be wheeled into the Senate and told to say “Aye”.

Japan will work out it’s debt problem long before the US does.

Japan will never ‘work out’ its catastrophic debt problems.

I don’t have anything against Japan. Most of our cars have been Japanese. They make great products. Their problem is financial. From memory, government interest on borrowing is 24% of GDP with interest rates at .1%. What’s going to happen when rates go up to 3%, and interest expense goes up by six times or more. The government also is the biggest owner of stocks and bonds. What’s going to happen when the government is forced to sell its positions? Japanese finance displays many extremes never seen before in history. Who knows what the outcome will be.

I wonder who will in their current and future demographics. You need a productive young population.

What would the rise in Social Security benefits be if the present figures are used here in the 3rd quarter?

Brant,

COLA percent is probably watched more closely by the federal retirees organization (smiley face): http://www.myfederalretirement.com/fers-csrs-cola-watch/

They try to estimate and are currently at 2.6%. They used the June 2023 cpi number against the Jul-Aug-Sep 2022 average # of 291.901 to get their 2.6%. The number will probably be closer to 2.8% if we get similar increases in the next 3 months that we saw in June. Just my 4 cents worth (inflation adjusted).

Social Security COLAs are the average of CPI-W for July, August, and September. In June CPI-W was 2.3%. If it stays at 2.3% through September, that’ll be the COLA. But that’s very unlikely. The overall headline inflation indices will bounce over those months due to the base effect and energy.

In September, when the August CPI-W comes out, I will post an article with my first estimate. In October, when the September CPI-W comes out, I’ll post an article with the actual COLA.

There is no such thing as “lag effects.” The only thing that looks like a lag is simply the duration of the reporting period; i.e., end of month, quarter’s results, and constant waiting to compare some random year ago irrelevant period with some period coming up; might as well be next Christmas. This lag effect nonsense is to calm the public backlash with a false future hope like spews from any con-artist narcissistic liar.

Conclusion: The inflation problem is right now and 2 years of false future waiting is long enough.

MW: 10-year, 30-year Treasury yields finish with biggest weekly rise in three weeks…

What about today’s real GDPNow result from the Atlanta Fed, our future?

Latest estimate: 3.5 percent — July 28, 2023

The initial GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2023 is 3.5 percent on July 28. The initial estimate of second-quarter real GDP growth released by the US Bureau of Economic Analysis on July 27 was 2.4 percent, equal to the final GDPNow model nowcast released on July 26 after rounding.

It’s way too early in the quarter to pay attention to the Atlanta Fed’s GDPNow. Q3 just started (Jul 1), and the Atlanta Fed’s formula has no input data yet for anything that actually happened in Q3.

“Motor vehicles are the biggest example of hedonic quality adjustments. For example, the standard four-speed automatic transmission of a Ford pickup in 1990 gave way to the standard silky-smooth 10-speed automatic today. For the purpose of calculation consumer price inflation, the costs of that transition were removed from the cost basis because you’re not paying more for the same product, you’re paying more for an improved product.”

Some of these hedonic adjustments are horsesh!t, though, in terms of quality. The products are not improved, they are just overengineered, expensive electronic gizmos designed as profit centers for dealerships and parts producers. The older transmissions were bulletproof, which is why at every race track you will see GM TH400s and Mopar 727 Torqueflites putting the big power to the ground. Newer is not always better.

A 3 speed transmission is just not as fuel efficient as modern transmissions.

Correct.

And the cast aluminum cases on the GM TH400 were known to split easier than peas.

And you only see TH400 and Mopar 727s at *drag racing* tracks. That’s it.

And those 1980s 3-speed automatics were rough shifters, good grief! What a pile of trash that was. That’s why people wanted 5-speed stick-shifts because they were smoother and performed better. Now I prefer a 10-speed controlled by a computer. You can barely feel it shift, and it keeps the rpms in the optimal range. Actually, the CVT works too. It doesn’t shift at all.

Side note – does anyone here still drive a manual as your daily roller? I do, but at my hotel in Detroit this week none of the valets did. Not one. I never felt older.

One of the biggest cost adjustments was those stupid air bags which no one wants yet they stuff them into all the new cars and fleece the buyers. No option to opt out.

“which no one wants”

‘scuze me??? Everyone wants them.

You might want to look at some of the crash test videos before you condemn airbags. Certainly, you can also ride a motorcycle or bicycle without a helmet if you’d like…. but you’re not very bright if you do. We refer to those as “organ donors”.

Depth Charge,

Maybe I was born in the wrong generation. But I’m a car guy, and I love the new stuff, conveniences, comfort, handling, safety features, performance… some of this stuff I completely take for granted, backup camera, tire-pressure gauge in the dash, automatic headlights, keyless driving, 40-50 mpg in our big hybrid Fusion (depending on who is driving), 80,000 miles without repair…

BTW, those old trannies were not “bulletproof.” We made tons of money fixing them and replacing them, LOL, back in the day (through 1995).

Wolf

I’m with DC. I want the old cars back into production. No frills. None of the gadgets which break down and require expensive repairs. None of the functionally obsolete screens which take your eyes off the road and lead to more accidents. I’m putting my money where my mouth is. I’m getting to register my 2000 Toyota Corrolla as a historical vehicle. Next will be my 2003 Subaru.

I had a contractor friend who was collecting older pickup trucks 20 years ago. He said he couldn’t get a 50lb. sack of cement over the sides of the new ones.

Real car guys would never take ‘cars’ like that to any Cars & Coffee here in Southern California where BMWs and Ferraris and other real cars proliferate. Just saying.

🤣 I figured there’d be a “real guy” telling me what car to drive to be a real guy. But dude, I’m mostly on foot. I walk all over the place, out and back to the doctor = 8 wonderful miles. People come from all over the world to see what I see just on my walks to anywhere. Healthy too. A lot healthier than playing real guy. My wife commutes with the car to work every day. And she has no ambition to be a real guy either, thankfully. So we’re all set.

I drive 2 electric cars and don’t care about a lot of frills and features in my car.

I treat my car as an appliances.

My car should be able to take me from point a to point B safely reliably and efficiently.

Thats the reason I drive new cars and all else.

I have put in 200k miles in Evs with absolutely no maintenance other than tire rotation.

Also electric cars are much faster than many ice fancy cars on the road.

I dont care if you car is very fast or not or if it looks good ..

So, which corner does your chauffeur drop you off?

There are a lot of features I don’t care about, like things like mirrors that fold in automatically, air conditioned seats and “upgraded” sound systems.

But safety features like reverse cameras, park assist (where the car beeps when you get close to something in front or in back), blind spot monitors, and CarPlay (where the iPhone’s screen and map is displayed on the screen in the dash) are must haves for me.

The reverse cameras are now mandated by law now, but I don’t believe the others are.

Wolf-

Most of the blame for the problems with the TH400 and Chrysler A727 TorqueFlite transmissions can be placed squarely upon the neglectful owners. In the case of the TorqueFlite, it needs regular fluid changes and band adjustments. Most people ignore that and the wear on the clutches and transmission is greatly accelerated.

In my opinion, and that of many others, the Torqueflite 727 is the greatest transmission ever produced. It was found behind the 426 and 440 Hemis in the ‘Cudas and Challengers, to name a few, and handled all of that power without batting an eye.

The 727 was a 3 speed without an overdrive. In 1990 Chrysler added an overdrive section to the tailpiece, and called it an A518 – same trannie, just with OD. They then added some electronics and other components in the mid 90s and called it an A618. It was used behind the Cummins diesel powered Ram pickups all the way through 2007.

I have owned 3 of these variants, Wolf, and still have one to this day for my work truck. The problems from the factory were a weak torque converter and poor valve body specs. The TC was because of penny pinching, and the valve body issues were to make the shifts smoother for comfort at the expense of durability.

With an upgraded torque converter and valve body, the A618 can handle 1,000 lb feet of torque for 500,000 miles, so long as the owner changes the fluid and runs a transmission temp gauge to avoid any overheat situations. The A618 is what you will find behind almost all of the diesel trucks at the drag strip, regardless of brand – the GM guys jettison the Allison and retrofit the A618. These trucks are running well over 1,000 horsepower and doing boosted launches. It is an amazing transmission.

Depth – would suggest ‘neglectful owners’ are the key to many of today’s automotive advances or ‘advances’ (…not a big fan of manually-adjusted ignition advance curves or top-end lubrication, for example, yet they were once common…).

may we all find a better day.

‘For the purpose of calculation consumer price inflation, the costs of that transition were removed from the cost basis because you’re not paying more for the same product, you’re paying more for an improved product.’

I think adding quotes to improved is justified. I learned about this marketing strategy on this website. If you want to charge more for your product it’s easier to attract customers by explaining that’s it’s not the same old (perfectly decent) product. You add a spurious feature, use a cheaper existing element and bingo, a better (probably inferior) result.

Not sure if this is still the case, I haven’t worked in consumer packaged goods for 15 years…but,

As recently as 2008 WalMart required that, in the absence of “meaningful improvements” the base price of all products on shelf would be expected to decrease by 2%-3% year over year (same product/package->UPC). In effect requiring retail price deflation on static product, in keeping with their everyday low price policy…

As you’re likely aware, this policy did not drive down prices to the consumer,* but at least everything is new and improved, all the time

*did keep a lid on arbitrary (i.e. easy) base price increases

I respectfully disagree with the concept of quality adjustments.

Personally I can’t stand these new cars and all the technology in them. I feel like I’m flying the friggin space shuttle. Way too many distractions. There are 20+ pages of menus in the little screen on the dash now. No wonder there are so many distracted drivers these days.

The last time I brought my 2011 in for dealer service and was given a 2023 loaner, I hated it and couldn’t wait to give it back.

My 2011 is just the right amount of tech: 5 speed auto w/ manual override (computer doesn’t override your selected gear, I can drive around towm going 30mph in first gear), and I play tunes via MP3s on a USB stick.

I solved my car’s lack of “blind spot detectors” with a pair of $10 fisheye mirrors from autozone, etc.

More technology != better, imho.

“they are just overengineered, expensive electronic gizmos designed as profit centers for dealerships and parts producers.”

If you consider the facts, not emotion, you’ll realize that those changes were made to conform to fuel efficiency mandates from the U.S. EPA. Keep in mind that the manufacturers have to provide warranties on drive train components – some up to 10 years / 100K. It is also in their best interest to keep them simple, inexpensive, and easy to repair.

As Stockman points out, hedonic adjustments do not measure price changes. It’s a metric that, at least conceptually, captures quality-of-life changes.

It is also, as Stockman suggests, a number generally pulled from the rear quarter.

Stockman himself got pulled from the rear quarter. The guy has a big mouth but is totally clueless about this stuff. If you want to know how the BLS gets the data for the hedonic quality adjustments, go to the BLS website — they explain it there… they’re using cost figures from the manufacturers for those added features and benefits.

hedonic quality adjustments adjust price changes for the costs of quality improvements so that inflation measures the price of the SAME product over time.

Band-shifted automatics are garbage compared to modern slushboxes that use clutch packs. I recently serviced the 6-speed ZF box in my BMW at about 150k miles and saw basically no wear on the clutches + no sludge in the fluid from clutch material. At the track, there are plenty of BMWs putting 700-800+ hp or more through stock ZF transmissions. Try to put even 500hp through a totally unmodified th400 back in the day and you’d find it to be pretty short lived. As for the 727, Dodge uses ZF transmissions now too. The 8 speed ZF box in our Grand Cherokee was excellent and entirely problem free for the 100k miles that we had it. More gears = better use of an engine’s power band making smaller engines feel bigger and really helps with fuel consumption. My 1998 Grand Cherokee made 250hp from a 5.2L and 14mpg combined on a good day with 4sp AWD. My 2016 Grand Cherokee was a bigger vehicle with 295hp out of a 3.6L and often saw around 20mpg combined on an 8sp AWD driveline. AND when some crazy mothereffer came over a median at light speed at my 2016 GC with my wife and child in it, they walked away unscratched… If they were in my 1998 GC, I could have been a windower who also lost a child.

Sorry Depth Charge, I too lament that we can’t buy bare-bones basic/affordable transportation any more, but if you’re out of your mind if you think modern vehicles aren’t lightyears better than the unreliable rust piles that U.S. automakers were cranking out in the 60s/70s/80s. Modern vehicles are more comfortable, much more reliable, and vastly safer. Oh and even an average boring mini-van bought new today would blow the doors off of most iconic 60s muscle cars stock-for-stock at the drag strip.

That being said, I do agree with you that lots of hedonic adjustments are B.S. and do not accurately represent inflation. There have been so many tweaks, big and small, to inflation calculations over the years that you can’t really compare today’s inflation to the 70s nominally, at least not very accurately.

The trouble with hedonics: You don’t have the option of buying yesterday’s nonimproved product. Its price has become effectively infinite. And technology is supposed to improve living standards. Attempting to cancel it out of goods prices is tantamount to the government claiming unto itself all the benefits of technological advance.

Inflation is a monetary phenomenon. Cost reductions due to technology improvements are real phenomena, having nothing to do with inflation. In a world without inflation, nominal goods prices would decline and living standards increase due to people being able to buy more with each hour of their labor. It is human time, not things, that is the true unchanging measure of value.

It’s better for nominal prices to stay the same and the nominal value of an hour of each person’s labor to go up over time. Otherwise people hoard the currency too much.

The value judgment is debatable, but that’s a separate issue. My point is about the measurement of currency depreciation, aka inflation. The assumption is that fundamental value lies in things, not people. To illustrate the cumulative error over time, imagine trying to compare the value of a buggy whip in 1923 versus a buggy whip in 2023. Or even more absurdly, the value of an iPhone in 2023 versus an iPhone in 1923. This is the folly embedded in the attempt to use a consumer goods and services standard to track the value of a currency over time. There’s no way to get it right because the premise is fundamentally flawed.

Greedflation is most certainly NOT a ‘monetary’ phenomenon and is entirely based on greedy companies just jacking up prices in order to post ever and ever greater profits for shareholders.

SCBD-

The company that jacks up prices solely “to post ever and ever greater profits for shareholders” will soon lose customers to less short-sighted competitors. Reciprocally, the company that chooses NOT to raise prices when the demand for its product allows will lose SHAREHOLDERS.

The beauty of capitalism is that the free market steers companies, shareholders and customers toward the fairest price, and without authoritarian control.

To call companies that raise prices greedy reveals a desire for authoritarian price fixing, IMO. I prefer live in a world without a “bureau of fair prices,” thank you.

John H, I agree in theory, but what we have now is not capitalism or a free market. If we had that, large corporations wouldn’t demand (and get) bailouts every time something goes wrong. They wouldn’t get laws written in their favor (for example, in most places, Walmart was allowed to stay open during the pandemic closures because they sold “essential” items and could sell the non-essential items at the same time, while a small business that only sold non-essential items had to close).

Governments would not mandate certain benefits that are non-affordable for small businesses because they don’t have the negotiating power with the insurance companies that the big boys do.

Good comments, Einhal

Bailouts, subsidy and government favoritism are current problems. We don’t have a perfectly free market, and never will. But at least so far, prices are not generally determined by price boards (exception: FOMC)

That said, Beach Dude implied that there is a certain price level that once exceeded is “greedy” and presumably immoral.

My belief that the best arbiters on that question are the consumers of the company’s product and the owners of the company itself. When the government attempts to influence prices, things break (think 2008 mortgage market, wage and price controls, and 1970’s interest rates)

Thanks John. I agree that’s true for some products, but for others, prices are somewhat oligopolically (is that word?) set. See airlines, for example. Yes, they compete on price, and yes, they compete on other things (like Southwest giving two free bags, as an example), but in a lot of ways, when one institutes a fee, the others follow along shortly thereafter.

We definitely don’t have a free market, but in a lot of areas, we have crony capitalism, which is the worst of both worlds. All of the excesses of unbridled capitalism along with the wealth transfers of socialism.

Einhal

Does dissing the “excesses of unbridled capitalism” imply that “bridled capitalism” is a more viable solution?

If yes, which individual, department, bureau, committee or institution get’s to do the “bridling?”

A hybrid capitalism with government price controls sounds like Fabian Socialism to me.

There is no free market and fair capitalism.

What we have is cronyism.. privatization of profits and socialization of losses.

Politicians are in the pockets for big corporations.

Govt bailouts?

Like extending deposit insurance to those who didnt have it?

Watch the FTX SBF fiasco disappear and those caught rolling the dice made whole.

While we are speaking of capitalism and its good side and bad, anyone notice the bi opoly microsoft and apple enjoy?

Often a greedy company will lower prices to gain market share and thus improve profits. Greed can work in both directions with regard to prices.

Why do you think that companies started to be greedy over the past few years and not before the current inflationary period?

kra – reduced competition…

may we all find a better day.

SCBD,

“Jacking up prices” is LITERALLY the definition of consumer price inflation.

That’s like saying “people driving too fast is the cause of speeding.”

As long as consumers continue to spend like drunken sailors, there will be price increases. It takes two to tango.

As Nancy Reagan used to say, “JUST SAY NO”. Nobody is forcing you to pay higher prices for most all things these days. If you don’t like the price then just don’t buy them and nearly all of the so-called ‘inflation’ is now coming from totally discretionary and unnecessary service purchases which is easy to deflate by folks just saying no.

SoCalBeachDude, exactly.

That’s why economists who say inflation is always a monetary phenomenon are wrong. Ultimately, an expansion of the money supply won’t always cause an increase in prices if consumers exercise some level of self-control. That’s why money printing has not had near the inflationary effect in Japan as it has here, although Japan is getting worse.

Thank you Finster. Well put.

blahblahbloo: “Otherwise people hoard the currency too much.”

Bank notes used to be not money, but receipts for money, that is gold, deposited at the bank. The banks committed an act of fraud now rechristened as “fractional reserve banking” where the banks would print more bank notes than the gold they represented claims to. To deflect blame for the inevitable economic crises, a lie was manufactured: The problem, so they claimed, was that people were ‘hoarding’ gold. In the service of the banks, the use of gold as money was outlawed in 1933 by executive order 6102.

SoCalBeachDude: “Greedflation is most certainly NOT a ‘monetary’ phenomenon…”

As Finster explains, an increasingly productive economy would not allow “greedy companies” to arbitrarily jack up prices. It is indeed a ‘monetary’ phenomenon.

Thank you, Sam. Inflation isn’t merely an inconvenience, it’s a covert means of transferring value without the knowledge or consent of the transferee. People experience the loss of purchasing power, but don’t know where it’s going. There’s a reason it’s so popular. Fraud isn’t too strong of a word.

should be, without knowledge or consent of ”transferer” Finster:

”er” is the one losing, ”ee” is the one gaining, and IMHO,,, those receiving these benefits know full well what’s happening as opposed to those who are losing purchasing powers who don’t ”REAL eyes” any reasons at all for why they are either becoming or continuing to be poor;;; by current metrics.

Honda is trying to get younger riders into motorcycles and are importing old technology bikes into the US. Their latest is a 150 cc dual sport for under $3,000. Its a bike that’s been used in other parts of the world for 20 years with 20 year old technology.

Its a cheap price for Honda quality. I really enjoy my 10 year old Honda PCX. A good used one is about $2000 and you can go 60 plus and get 100 mpg. Probably 125 mpg if you ride it in sweet spot about 40 mph.

old school,

Honda also has the 2023 CB500F for $6.8k. It’s a good starter bike and general purpose set of wheels.

Long ago, one of my favorite bikes was a 1982 CB750F that I set up as a café racer. A great city bike.

Quite a lot of motorbike manufactures are now pushing mid-displacement vertical-twins as their volume and profit makers. They’re typically under $10k.

And reading the comments about hedonic adjustment in this article, I will repeat myself on the jump in technology and performance on today’s motorbikes. For under $20k, a new “hyper-naked” is simply the most performance for the dollar that can be bought.

old/DanRo – have to smile, remembering one Honda’s engineering responses in the effort to reverse severely-softened US moto sales in the 1980’s was ‘…how do we make a motorcycle provide more of an automotive experience?…’ (old – your PC was a result of this).

Recall a question frequently asked back in the day was “…what happened to all of the small-displacement Motos?”. The importer I worked for at the time said the basic issue was unit manufacturing cost-there wasn’t that much difference between a CB250 and a VFR750, but Americans wouldn’t pay a similar price-point (more displacement/performance, more$ and vice-versa).

Seems everything old is new again (…recognizing that Motos and Autos are separate types of vehicles, as different as rail engines and aircraft…).

may we all find a better day.

Until the money supply returns to pre-2020 trendline growth, we will continue to have high inflation, mostly in services. The monetary impulse from the pandemic knee-jerk reaction will continue to circulate and recirculate throughout the economy over the next year or two until QT and tighter credit does its job to get us back onto pre-2020 trendline growth. My two cents.

Saw a plot of last housing bubble vs. unemployment. Housing bubble grew as unemployment went down and burst at the lowest unemployment of the cycle. I don’t see why its going to be different this time.

This JeffD ^^ – that’s what I’m telling my clients, 18-24 more months to taper back to anything akin to the before time

Do you expect CPI report will revert to the upside next month due to new base effect and some insurance adjustments?

Thanks

The base effect will start phasing out in the July report. so for the year-over-year numbers, we might see the first increases in July or August (obviously, there are other factors that go into YOY inflation measures, not just the base effect).

The insurance adjustment only impacts CPI, not the PCE price index. Those adjustments started in October 2022 and I expect them to run through September 2023. October should bring the new adjustment. And my guess is that it will swing the other way. But note that in the past (2019, 2018), they shifted earlier, with the adjustment running through July, and August got the new one. So I’m not sure that they’re married to running the adjustment through September. But that’s what it looks like now.

I don’t think the base effect, or any other mathematical effect is going to matter. From here, it’s all about the monthly change, and there’s no base effect for that. IOW, we will likely see higher index values, but anyone expecting markets to react negatively to that are going to be disappointed (I’ve already had my share of disappointment, I give up).

Yes, but i remember markets reacted VERY positively when inflation was down due to insurance adjustment. Apple went up like 9% that day. Amazon 11% or something.

The way I see it, individual readings on the CPI, earnings, and anything like that has nothing to do with the stock market. The stock market is in a mania that has existed since 2009.

Outside of the February and March 2020 “flash crash” it has been straight up. The reason for that is that “investors” by and large have a faith in the Fed’s willingness and ability to stop crashes. If their risk investment is guaranteed, why not put money there, even if you can get a 5.5% risk free? No one would be buying stocks at these prices and valuations and taking that extra risk if they really thought there was any downside.

The only way these mania ends is if a recession starts, banks start failing, jobs are lost, earnings start dropping, etc. and the Fed does NOTHING.

No “emergency rate cuts to zero.” No “new programs to ensure orderly working of markets.” No “new bond purchases to ensure liquidity for companies.”

If the Fed backs off and stays back, the mania ends. A lot of people, for good reason, aren’t convinced they’ll do that, and are investing accordingly.

I can’t predict the future as to whether their predictions are right, so I’m staying out right now.

Peter Schiff just predicted mortgage rates will hit 8% in the very near future. Look for foreclosures to go up and housing to go into a 2007 style meltdown.

Swamp – Peter Schiff is right once every 10 years.

Peter Schiff has predicted 10 of the last 2 Market Crashes.

Mortgage rates to 8%, okay but not until late 2024.

Why would 8% rates on NEW mortgages cause foreclosures on existing loans locked at far less than that rate?

The only way that could happen would be if the 8% mortgage causes house prices to plummet and those who must sell find themselves underwater. For them, a short sale is possible – not necessarily a foreclosure.

Most Americans are payment buyers. If their underwater property can’t be replaced at the lower price / higher interest rate, they’ll likely stay put as moving ain’t cheap.

Wolf is correct, oil at $80 and going higher will keep inflation alive.

US Dollar remain strong, because rates will not come down, anytime soon.

Pivot – not happening.

That sounds about right to me and you can add industrial policy to the list of things that help sustain inflation. Infrastructure bill, chips and science bill, and green energy and healthcare. Lots of companies are thriving on this money.

During inflationary periods I think it is better to own things like stocks/companies that benefit from government spending and rising oil prices rather than cash (5% money markets).

I have a number of small oil stocks that give me a 5% dividend and nice stock appreciation with rising oil.

Diesel in our area went up 15% this week.

Our costs for a lot of our supplies have double in under 2 years.

Retirements/quits in my field keep stacking up.

I have turned away more work in the past 2 weeks than I do in a typical year. 30+ yrs in the business. Thought I had seen it all…….

‘Thought I had seen it all’…to your point, I’m almost 4 decades into this job market and have never seen anything like it. Incredible opportunities everywhere.

Such as?

Job markets are definitely skills based. Plus location with mobility more difficult. Two wage earners in a household plus sub 3 percent Mtg combined with high rents makes job change’s difficult. Yes I could find work in West Texas but my age is the biggest determining factor for not employable . So opportunities are not everywhere. 66 years old living in a smaller city in East Texas. New home prices and used home prices are elevated 200 per sq Ft. The average family is struggling with inflation vs their wage . I would not be surprised to see more flight to the bigger cities as these smaller towns don’t offer the amenities that Wolf mentions. Public transport walking cities thrive economically.

@BS ini,

San Francisco and Chicago aren’t exactly thriving.

JeffD,

SF is thriving just fine, except office CRE. Pleasure yourself with these braindead right-winger fantasies in the privacy of your own home.

BS ini: I hear opportunities open every day in Baltimore!

But, you are correct, there is a definite age bias in hiring practices.

Public transportation figures, as implied by BS ini’s comment, tell a different story. That’s what motivated my response.

June Muni ridership: 414K vs 709K 2019

June Bart ridership is 41% of pre-Covid levels.

JeffD,

Ever heard of “working from home”? Ever heard of the whole movement of people driving instead of taking public transit? I’ve reported on it a bunch of times. Highways are as packed as before, despite working from home. Congestion in SF is HUGE. Over the weekend, there were a gazillion people at the Aquatic Park down the street from us, enjoying the beauty of the place, kids playing on the beach, people picnicking in the old (redone) bleachers, people getting ready for a swim, with gorgeous views of the sailboats and the Bay. There are people everywhere enjoying this city. That’s why housing is still so expensive.

Inflation is a self propagating fire…. It is more than just numbers, it is the lost culture of productivity.

Just curious,

If there was a grassroots effort to get Americans of all stripes to starting pulling cash money out of the banks suddenly, for whatever reason to be determined later, what effect would this have on interest rates ?

Would the effect be similar to people en mass deciding to not pay taxes on Tax day ?

Interesting times.

There was a story on CNBC on how Americans are leaving $40 billion on the table by not moving their deposits from low interest options to higher interest options.

Money should be making 5% interest these days. Brokered CDs and treasuries are getting 5½%.

DF: But you can’t move all your funds into CD’s and treasuries.

For example, we keep about $20K in a bank MM fund that pays squat and $30K in a checking account that pays less than squat. Why? Cash flow. We keep $50K liquid and the rest gets tied up for 30 days on upward. Our bills hit in chunks (when we moved all our insurance billings set to July – home, autos, umbrella, etc). We’ve been running our CC up lately administering my sister’s affairs as she is no longer capable of doing so. So.. that money sits – non-productive. Shifting it around short term is a royal pain… even if we move it into “Preferred Deposit” temporarily, it still takes 2-4 days to get it to become available. Not worth the brain damage and sometimes surprise billings show up and have to be dealt with immediately.

Ditto my sister’s funds. She has a bunch o’ money in low paying accounts – but, in order to move it, I had to jump through multiple flaming hoops, despite having legal documents that authorize me to act on her behalf…

So, it’s not all stupidity or inattentiveness. Sometimes it’s just a necessity to keep all the balls in the air.

I can’t afford to keep $50K in a non-interest account. That is $2500 interest.

I have accounts at Schwab and Fidelity. Both brokerages can put money in, or take money out of my credit union account.

I have a credit card with a $15K limit, which is my buffer for emergencies.

A brokerage firm maintains a secondary market to sell CDs prior to maturity, so one doesn’t necessarily lose all the interest if they need to access the money ahead of time.

But even the money markets, which gives you access to money quickly are approaching 5% interest.

Meanwhile the credit union is 0.1%. It insults my intelligence.

Schwab gives me almost 5% on a one day money market which I don’t use often, especially now. It’s still slow moving it to my bank which is a rip-off.

My money ought to move instantly from my broker to my bank. They are charging me 3 days of my interest to move that money.

In fact I am going to call Schwab and Wells Fargo right now and bitch at them!

Thats the problem I face.

It takes few days to move money and hence I always keep few k in my checking account which earns me nothing.

Hey Wolf, you probably saw that blurb on social media that there are 20k car repos a day. I’ve found a few mainstream media sources that cite 15k. Any truth to that? And if so, are these instances of people just handing over the keys? I can’t imagine there are that many repo men in the country to get that large number of vehicles. Make a good sequel to the classic 80s movie repoman though!

My friends that run their used car lot say the majority of repos are just to drive to the lot and hand over the keys. That way when they need the car again he will finance the loan. Been doing this for 3rd generation families he says. Sub 4000 usd retail cost current book of 50 cars out he self finances the cars

There’s definitely an advantage in life to doing things the easy way and not pissing people off.

There are ALWAYS a lot of repos. There are 265 million vehicles on the road in the US. So the repo numbers are always big, and a whole industry has evolved around it: companies that repo them and companies that recondition them (sometimes the same), car carriers that transport them, special repo auctions, etc.

But the repo business collapsed during the stimulus-check era, as people used their stimulus checks and forbearance programs to hang on to their cars. So now the repo business is recovering from that depression and is moving back into its comfort zone.

Nearly all repos are subprime loans. But only about 15% of all auto-loan and lease balances are subprime, so total subprime loans are a small $ number ($230 billion or so).

Two specialized subprime auto-dealer chains, owned by PE firms, shut down earlier this year because they had trouble selling their subprime-auto-loan backed structured bonds (ABS), as rates were hiked.

https://wolfstreet.com/2023/04/18/second-pe-firm-owned-subprime-auto-dealer-lender-suddenly-shuts-down-after-its-subprime-auto-loan-bonds-make-huge-mess/

When these dealer chains shut down, a lot of borrowers apparently stopped making payments to the surviving finance arms, and that has increased the distress on those bonds. These two companies are leaving behind a mess. And just looking at the default rates of those specific ABS, it seems these two companies’ customers are choosing to default in larger percentages. Some of them reportedly don’t even know anymore where to send their payments to.

Subprime customers often get ripped off with way-above-market prices and huge interest rates that essentially doom those loans, and borrowers know it. At some point they stop making their payments and drive for free for a month or two or longer, and then the car gets repoed and they start all over again. If those deals were done right, the lender makes a huge profit on the sale and a huge amount of interest for a while then either takes a small loss or no loss when the car is repoed. It’s a very profitable business. But subprime dealers can get too aggressive, and when their own funding dries up, it’s over for them, and they just shut down. But the PE firms that owned those subprime dealer chains still made a lot of money on them. The bond holders are now taking the losses.

I really don’t know what to say about Canada.

It’s like you try to find a 25 cents savings in eggs or a frozen dinner, but at the same time, the slumlords and landlords collude to set a higher rent price by 25% in a year.

It’s like every dollar that is tried to being saved in Canada ends up being funneled to the landlords as rent increases.

The people who purchased homes one year ago look smart. In many places prices are rising again. Entry level homes are impossible to find west of boston. Multiple bidders on many houses. Stocks are moving up. I went back and looked at Socaljims posts and he was right. What do you see from here. This is hard.

“The people who purchased homes one year ago look smart.”

Today, they only look smart in markets where prices went up year-over-year.

They look dumb where prices went down year-over-year. Nationwide, the median price is down year-over-year. So in aggregate, they look less smart.

In many markets, prices are down a lot year-over-year, and those people are looking at BIG losses. If they bought a median-priced house in San Francisco in June 2022 ($1.9 million), those folks are now down 21%, and they’re out $465,000. Maybe their lifesavings went up in Luan-Tran-smoke?

Depends how far west. Worcester was always a lot cheaper than anything inside 495. If you work in Boston, you just have to deal with pike traffic or the commuter rail, neither of which are that bad imo.

If you’re trying to live in one of the rich metrowest ‘W’ towns (Wellesey, Wayland, Weston, etc.) you’ll have to pay the price.

I just want to note that prices are rising, but at a much reduced volume. So what’s happening a portion of houses are selling at higher prices, but a lot are sitting on the market or selling for lower prices.

So it’s not a sure thing that if you bought at peak prices last year, YOUR particular house would sell at a profit today.

We recently replaced a tv and a washer dryer set all purchased about 2016. The new washer dryer set with the same features was the same price as the last set and the tv was much bigger and only slightly more expensive. Everything was roughly the same price as in 2016.

Thanks for the example. Effectively the TV got cheaper if “same product over time,” since it’s much bigger, but only slightly more expensive. That is typical for consumer electronics, they improve constantly (bigger, better resolution, more powerful, more memory, etc.), for a similar price or even less.