But the layoff announcements in the media scared workers into surrendering some of their newly found power.

By Wolf Richter for WOLF STREET.

There is an interesting dynamic happening that we have seen on the ground, and that is now solidly showing up in unemployment insurance: some companies are laying off people in the US, but the same companies and other companies are hiring these people, and even big companies with huge layoff announcements are still hiring people; and the whole process of these layoff announcements and layoffs has scared employees, and it cut down workers quitting their jobs, and workers who’d refused to go back to the office are now trudging back to the office a few days a week, and demands for higher salaries have softened.

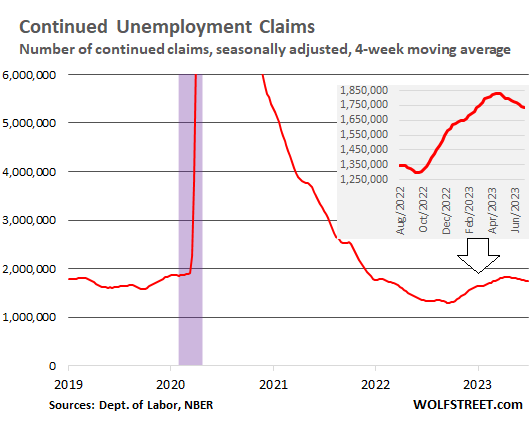

For the last three months, the number of people who “continue” claiming unemployment insurance benefits has been dropping, after seven months of increases due to the layoffs.

Starting in early 2023, we saw an increase in “initial” unemployment insurance claims, up from historic lows, but still near historic lows. And for a while, the number of people who continued to collect unemployment insurance inched up from historic lows, in a sign that it took them longer to find jobs. These were early indicators of the labor market weakening.

But that ended in April. Since early April, surprisingly, the number of people on continued unemployment insurance has dropped.

So here we go, first the “initial claims,” then the “continued claims” — it’s the continued claims where we see this phenomenon.

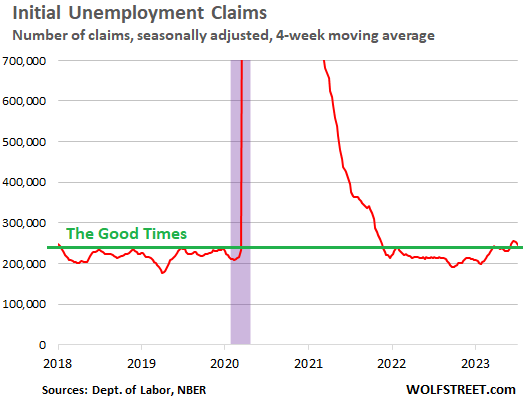

Initial claims for unemployment insurance. We won’t get too excited about the weekly ups and downs; we’ll look at the trends. But here we go. The number of initial claims for unemployment insurance that people filed in the latest reporting week with state unemployment offices fell by 12,000 to 237,000 initial claims, seasonally adjusted, the Labor Department reported today.

The chart of the 4-week moving average irons out those weekly ups and downs. And we can see the mild uptrend that started early this year, from near historic lows:

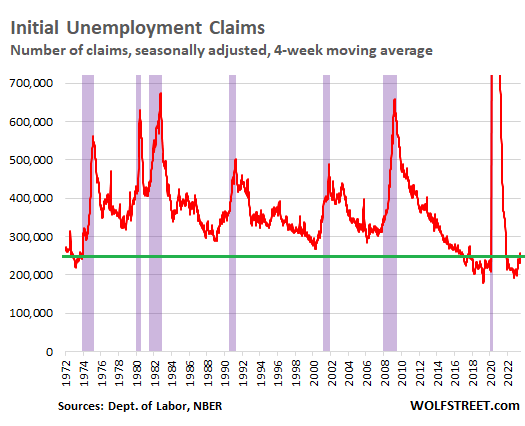

For the long view in the historic context, initial claims for unemployment insurance remain at the low end of the past 50 years:

“Continued Claims” backtrack.

But the number of people who are still claiming unemployment insurance at least one week after the initial application – people who haven’t found a job yet – has slowly fallen from this year’s high in early April of 1.86 million to 1.73 million in the latest week. This was unexpected.

It means that people find jobs more quickly than earlier this year and are rehired more quickly and come off the unemployment-benefit rolls faster.

It means that companies are now hiring people faster than they’re laying off people.

Recessions from the Great Recession back through the Double-Dip recession in the early 1980s began when continued claims for unemployment insurance spiked through about the 2.5-million mark. This is one of our recession indicators, but it has been backtracking over the past three months. The gray insert shows the details over the past 12 months:

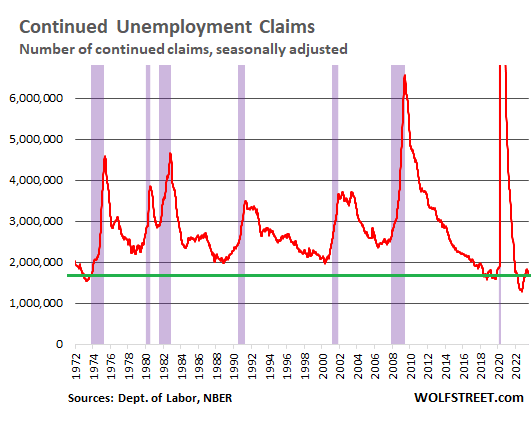

In a historic context, all that has really happened is that the labor market, as depicted by people continuing to claim unemployment benefits, weakened a little in the months leading up to April, to something that was still historically tight, but since then, it has re-tightened a little:

So what we’re seeing in these claims for unemployment insurance benefits is that the labor market, after loosening just a little earlier this year, is now backtracking a little, rather than loosening further, amid still very strong demand for labor.

And we’re also seeing in the data of slower wage increases and dropping voluntary “quits” that workers have been intimidated by the avalanche of global layoff announcements starting a year ago that the media enthusiastically turned into clicks, and that caused workers to surrender some of the extraordinary power they’d gained in the prior two years.

Other data from different sources confirmed this phenomenon in different ways: Landing Still Cancelled: Labor Market Cruises through Updrafts and Air Pockets

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf,

Do you have any good metrics covering organized labor strikes?

It seems like this is starting to kick off again, but difficult to estimate effect on overall employment.

So far seems limited to a few industries.

Thoughts on how this will play out?

Stock market approaching new highs…

Hiring accelerating…

Unemployment at 50 year low…

Obviously,

FED must cut then.

Deflation is bad.

Inflation is worse. Strikes are a big component.

A lot of convulsion continues

I had a ‘decent’ worker who worked around 20+ hours per week

paid him $20 an hour and worked directly with him to make sure work was done RIGHT

then (30 something) who has 6 kids (only 1 living with him) got couple under age 6 and his

1) attitude changed

2) work ability came into decline

3) then grumbling for higher wages

paid him and 2 days later – I quit

covered for now

on vacay for summer – in mobile office looking for investment opportunity

What exactly will it take for the Federal Reserve to cut rates? It feels like they’ve been deliberately ambiguous about this, compared to giving explicit criteria for what it would take them to RAISE rates in 2022, which they followed.

The bulls say as soon as inflation is headed towards 2% (waiting until it’s under 2% will be too late due to policy lag), so rate cuts could come in Q4 ‘23 or Q1 ‘24, even if there’s no unemployment spike or other economic damage. They also point out that not cutting rates amid falling inflation means even higher real rates. But historically, the Federal Reserve doesn’t cut rates (at least not substantially) without a recession.

I think the Fed wants to see the labor market crack: average hourly earnings below 3.5% (it is still +0.4% each month), job openings per unemployed person 4%

I think you answered your own question.

Too much cash in the system. First comes more QT and 7-8% fed funds rate, which will cause a nice big recession and THEN rate cuts – try 2025.

Major banks just wrote off $ 7.6 billion this quarter – mostly credit card debt and commercial loans. We have a way to go, but the pain and bleeding is starting.

It’s weird that everyone suddenly forgot CORE INFLATION.

What a joke. Inflation will be back soon when energy base effects fade.

I should prepare my “shocked face.”

Nobody forgot Core inflation here. We talk about it a lot.

Pandemic messed with all the indicators. Next 2 years is going to be extraordinary, with unemployment staying around ~3.5% in straight line. Not sure if this ever happened before.

Unemployment may even go lower as the last of the post war generation age out of the workforce.

I think those indicators were never really indicators, but just economists playing with graphs and drawing spurious conclusions.

@Arnold,

“Unemployment may even go lower as the last of the post war generation age out of the workforce.”

I agree with you on this. Today the manager of the test lab where I work asked if I would help him interview a candidate for an open position. The position is for a electronic/mechanical technician. From what I understand, they are not getting very many people applying for this job. The candidate that I interviewed was not a very good fit. They wanted to hire another candidate a couple of weeks ago, but he failed the drug test. One of the techs retired back in February, he was 69 and a very knowledgeable guy. He didn’t have a degree, but he was way more than a technician. Another tech in the lab (65 years old) is leaving in a week.

How much are you paying for these STEM candidates?

All part of the FED’s “Inflation Entrenchment Operation.” They are still “letting it run hot.” They want to make DAMN sure that their asset bubble prices stick.

Agreed. Housing turned positive 5 months ago. The stock market is going bonkers. The labor market remains extremely tight. Inflation has dropped but is forming a trough. It’s all about getting us to accept 4% core PCE inflation vs 2%. Nobody should be surprised if MoM inflation accelerates a bit as we move towards this fall.

The Fed will do everything it can, including a pause, from keeping housing from really tanking. All that happened from 6/22 – 1/23 was getting rid of the froth in the top 8-10 markets. In no meaningful way was it a REAL housing downturn. Well, the froth is starting to return.

This entire mess is about housing. We don’t get disinflation without a recession which requires housing to really tank.

And most importantly, you don’t get a recession with the Fed dragging its feet and Congress running a $2T budget deficit. The enormity of the combined (local to fed) government spending is mind boggling. And how do local budgets get cut? A housing bust, that’s how.

I like it: Fed inflation entrenchment program. Nice!

How can the housing market be turning if mortgage rates are at 7%?

Today I got a cold call from a realtor asking if I wanted to sell my house or buy a new property. I politely said, no thanks.

Anecdotal, but compare and contrast with a few years ago when buyers were cold-calling desperate to buy.

I think The Fed realizes that if they tank the housing market a lot of middle class people will be swept out to sea being under water on their mortgage like what happened in ’05-’07. If house values also go too far down too fast many first-time buyers who put 3-5% down recently will also have a harder time refinancing when rates finally do come down (and I suspect many newer buyers are potentially house poor and really need that refinance). And The Fed has itself to blame for all this with what it did artificially keeping mortgage rates down by buying up MBS especially in 2020-2021.

[content of comment deleted by evil editor Wolf. Rhonda thrown into perma-purgatory for posting it. Some of the replies were deleted as well]

Rhonda – verifiable sources, please…

may we all find a better day.

Do those even exist anymore? I’m being serious.

I would argue no, because we’ve found ourselves in an age where everything is political and the truth is the first thing thrown out in politics and war.

No point in doing the legwork only for goal posts to move.

Mr.H – have always found the ‘truth’ to be quantifiable, anything else, opinion…

may we all find a better day.

Dear, 91B20 1stCav (AUS);

Then you’ve obviously not worked for a law firm or a big data company ;-)

DDG – 😂 LOL ‘n I take your point!

may we all find a better day.

The service on hotels. Restaurants..all over is getting bad now with “take anyone you can get” mentality in the US

There is a magical way that a business can obtain better service. It’s called hiring better people, but that costs money so..

And then the owner works more and/or earns less, making business formation and continuation less attractive, or charges more, losing customers to competing businesses, then needing fewer employees… It works itself out, but not without negative effects (including probably higher inflation).

Publius – the highway of the past is heavily littered with the remains of businesses their founders thought ‘attractive’ and ‘easy’ to start and maintain…

may we all find a better day.

@Pubilus

Hire 1 effective employee for 25% more, or two slightly effective ones. Which one saves the employer money?

Not hard at all really. You probably need a high school education though.

Hmm, Wolf is pretty tolerant and enjoys correcting people. Rhonda must have been citing something from the Communist Manifesto, or something like that.

I would have normally deleted the comment. But I didn’t see it soon enough, and when I saw it, there were already a whole bunch of comments attached to it, unrelated comments too. If I had deleted Rhonda’s comment, all of them would have vanished with it.

Maybe it’s not just Japan that wants to deflate the debt problem away. The bond market looks like they are still expecting The Pivot. The precious metal buyers are eyeing the 4-5% inflation and acting like the 5%/year GDP growth can’t keep going.

Best spectator sport ever!!

If only my retirement didn’t depend on it, lol

Just a few days ago, before the CPI print, the bond market took an opposite view. Been back and forth with bonds for some time now.

Companies are hiring, but they aren’t getting much bang for their buck, with labor productivity dropping 5 straight quarters. With labor as tight as it is, the bottom of the barrel is being scraped (hired); seems like the desperation is putting pressure on productivity?

Chimps ‘n Temps

These companies laying off ,just turn around and rehire same job at lower compensation. Easy to figure out if you have common sense . Got to keep the poor poor

Not even remotely what’s happening.

Absolutely the case where I work. We just had a huge layoff of the well-seasoned and soon to retire. They all signed the ‘promise not to sue, this is not age-descrimination’ paperwork in order to get their severance. This week I see 80% of these “no longer needed” jobs listed on our careers site.

There is something to this. Folks need to recognize the cost of turnover and what it is doing for society right now. At a company level, managers are taught that turnover is expensive. A little turnover is healthy but too much can be a problem. Now take that “expensive” and extrapolate across the economy.

We have dropped all hiring standards to basement levels. If you can show up and hold a tool, you’re in. This “everything all at once” economy means that all the local employers are fighting for the same labor pool to work off a huge pile of work.

Lots of people hopped jobs around here. I don’t recognize 3/4 of the guys on our factory floor anymore. New faces all the time. We’re taking the greenest folks off the street and trying to train them, sometimes with no luck. We’re taking the people fired from other jobs for being loafers and those with poor attendance, and we’re paying a premium for their time! Two pay 5% bumps inside three months now to help fix this turnover and help recruit talent.

I’m grateful for the big backlog. It’s what we call “a good problem to have” but I am stunned at our inability to get it out the door. Five years ago we’d ship this many units without breaking a sweat, and now we run around like chickens with our heads cut-off.

My father in law is a production supervisor over about 75 guys at a similar local factory – a bigger operation than ours though. He said it’s the same story there. They work and work and work and struggle to get anything done.

Random Guy

Thanks good real data! The quality of labor brings to mind the German apprenticeship system. Any talk of that?

We could probably benefit from something like that but the whole issue feels overly big and complex. I don’t know where to start, and even starting feels futile since this is a societal problem.

There are local programs here that seek to train kids out of high school in manufacturing jobs, but they’re largely a waste of time. They get a few job placements and brag about it, but those probably would have happened anyway.

The kids wash out of such programs because work is like…. work!

Think Maynard G. Krebs.

My nieces ex husband works for electrical union with excellent apprentice program,they have been short of people for at least 10-12 years

College degrees are a requirement for receptionists now a days.

Might require a Master’s in the not too distant future…..

…’Shop Class as Soulcraft’ by Matthew Crawford is an interesting read on this subject…

may we all find a better day.

Really seems like a compensation problem.

It sure is. No board of directors asks themselves “Hey, we can really save ourselves some bucks if we hire a mediocre candidate!”. You want quality people, you pay them.

It’s just more evidence that no one wants to believe the laws of supply and demand when it comes to labor.

There are movements like the quiet quitting movement. Since your employer doesn’t really pay you much of a living wage you do as minimal as possible to keep the peychecks coming.

Then there is the r/overwork movement. Remote jobs opened the door to accept full time jobs from multiple employers and bank multiple full time salaries without the employers knowing about each other. I know someone who apparently did this and has been pulling in $500K/year. It’s a grind but it bought him a nice house and he will grind the mortgage down. I guess it’s what it takes to get a starter house now.

He’d better hope there’s no crossover between companies (intellectual property, etc.,) that he could be accused of stealing/co-opting. Might have to sell his house to pay legal fees (even if they are unwarranted).

IRA and IIJA still pouring hundreds of billions into the economy. QT is a pittance by comparison. 25bps is lip service and it looks like the Fed is one and done the rest of the year.

Cue the Market rally.

The real estate bubble fuels the inflation, there is still demand for workers, they want and they will get higher salary, because when a shithole costs 600K, your paycheck and your savings don’t worth shit!

New MLS data in the Swamp shows median sales price up. There are few listings. Days on the market down to 7 days. Properties get snapped up as soon as they are put on the market as is, even with the new higher interest rates. Lawrence Yun is salivating. Everything he has said is coming true.

The Fed has a lot of work to do to bring down inflation. As far as RE is concerned, everything they have done to date has been a total failure. They have destroyed the dream of home ownership for a whole generation of Americans. Congratulations.

Not a huge surprise. When the Fed makes it clear that their long-term strategy is to devalue the dollar, why not buy hard assets?

Just some numbers for the CBO

Below is the CBO projected Government debt for year 2028. These are the 3 projections on the May CBO report for each year of the following years:

In 2018: CBO Projected 2028 debt is 32.5 Trillion

In 2022: CBO Projected 2028 debt is 38.3 Trillion

In 2023: CBO Projected 2028 debt is 41.4 Trillion

Also, they are projecting Gross Federal debt in 2033 to be $52 trillion. That is right. From 2028 to 2033 (5 years) they are projection the Gross Debt to go up 11 trillion from 41 trillion to 52 trillion.

Take a look at some more interesting data comparing the DOW to Government Debt going back to 1981. Just close estimates. Not exact numbers.

1981

DOW 1k

Debt 1 trillion

1990

DOW 2.8k

Debt 3.2 Trillion

2000

DOW 10.6k

Debt 5.7 Trillion

2010

DOW 11.5k

Debt 11.8 Trillion

2020

DOW 30k

Debt 27 Trillion

2023

DOW 33k

Debt 32.5 Trillion

So if CBO is calling for $52 trillion in debt on 2033. DOW will probably be about 52,000.

Anyway. Just some fun numbers. Nothing scientific.

Identical place to what I rent is listed at a price that would cost at least $2000/month more for the PITI after $150,000K+ in down payment.

Swamp suburbs.

Right, which means that people are buying properties at cap rates that don’t work expecting the pivot. If the pivot doesn’t come, they’ll be in a world of hurt.

Place just sold in my area that is very similar in size and age to the place I rent. With 20% the PITI would be 4x what I pay for rent.

People are geniuses.

House prices in Sacramento and San Diego, CA (from realtime sources, not the laggy Case-Shiller) are almost back to last year’s batshit insane peak. We’re a bit past the point where it can be dismissed as the usual spring bump–although many here are still plugging their ears.

I’m looking in PNW, nice areas. Price reductions are everywhere and DOM is high. I discovered an interesting thing to do with zillow. I look at listing prices in a region, then I switch to sold prices, with time window set to recent months. Wow. No comparison. Asked a very experienced realtor what is going on. She said expensive places aren’t selling. She also said market is very depressed.

Anecdote:

Place near me just sold in 2 weeks. Prices still eye-watering.

A lot of them are Canadians who somehow still have $$$ for an EXTRA house.

Everyone is nuts imo.

My son and daughter-in-law just bought a $1.1 house, had to out bid 5 others and waive inspection and agree to a bunch of contingencies, basically that they had to have an accepted offer in approx two weeks on their current house. I told them it was insane because they would be lucky to get half that on their small, old (but well maintained) cape in Massachusetts suburb (Waltham). Then their house sold in one day, three offers well over asking price of $800K+. They took one that wasn’t the highest but had no contingencies. Moving in two weeks. My other son bought last month at overask on the open house, outbidding a few slower buyers. Gone are the days when you could spend a few nice weekends driving around, viewing homes and finding the “just right” house.

The job numbers don’t say much about the quality (pay) of the remaining jobs. Companies may be re-hiring employees for lower wage jobs, cutting the excesses. Good for the business, but not so for the workers.

So what is it doing for the over-all economy / the spending power of the workforce?

Howdy Folks

Dont know about Yall but I stocked up on lots and lots of popcorn. Just like the old great movies, this thingy here is gonna take a long, long, time before THE END.

I imagine the FED is pretty happy right now. They have been asking for fiscal help with the economy for years. Now with strong employment, a fiscal industrial policy, prediction of AI economic boost, and the post Bernanke tools they have more ways than ever to manage an economy.

The big miners like; Rio, BHP, Glencore, and Freeport Mc are acting like high tech at the end of a hiking cycle this week. Oil majors are doing well also.

But, I feel for people on fixed incomes. I remember the 70s and how many older people lost much of their savings to inflation. I am in that older person boat but I am pretty liquid so I am able to invest.

I am parking a lot of my assets in these big commodity companies that have a good history with dividends. I think the miners in particular are a safe long term bet to fight inflation. The energy transition is going to require an awful lot of metal. I am holding a basket of them because they have a history of dividends and I am not a stock picker.

Now with … the post Bernanke tools they have more ways than ever to (damage the) economy.

There, I fixed that.

SocalJohn

Well yes if they really really really f-it-up but with soooooooooo many tools even I could bring this evonony in for a soft landing (baring something like nuclear war).

I suspect somebody like Wolf who really understands money could make this economy FLY!

We are embarking on the largest generational wealth transfer in the history of the world and we’re doing it amidst a massive money printing operation followed by interest rate hikes to combat very hot inflation. This is skewing everything in all kinds of weird ways.

The pandemic kicked off a rush of retirements and Boomers continue to retire at a brisk rate. They tapped the heck out of their mountains of home equity with very low interest cash-out refis accompanied by what is now substantial interest income on their retirement nest-eggs. They’re not filling spots with an employer anymore, but they sure are out there having fun spending that money like it’s going out of style (because it is).

And the medical – Insurance complex will be there waiting right near the end with bills to eat the equity.

Tell me again, Federal Reserve..

“Why did we have 0% interest rates, 38% increase in M2, and a 2.8% mortgages?”

I seems 5.25% is very “livable”.

The Fed has put the interests of Wall Street and the banking sector over the

interest of the citizenry . That’s why

the dollar is starting to buckle.

Another site is claiming that the CPI

shows health insurance down 24%.

Any idea how they got that number ?

Read the article above!!!!! I explained it, and I put in a picture too, and I gave you a link for further details, for crying out loud.

It’s the result of that infamous “health insurance adjustment” that I made such a big deal out of above, and that I’ve made a big deal out of in every CPI article for nine months in a row.

RTGDFA

Reading the Fed transcripts five years from now is going to be a hoot.

POWELL: Just out of curiosity, did any of your models predict continued inflation, a rapid return of house prices to their peak, full employment and a soaring stock market a year into our tightening regime?

(A long pause)

(Some throat-clearing)

KASHKARI: My model had us in week eight of a civil war.

DALY: Uh, my computer screen just showed a picture of the Transamerica building snapped in half with little smoke curls coming out.

POWELL: Anyone else?

(Another long pause)

KASHKARI: That was at 350 basis points, by the way.

(Laughter)

Pea Sea,

One thing that Kashkari has been consistent about is banking regulations and reserve requirements. He is President of the Minneapolis Federal Reserve Bank, and a voting member of the FOMC.

In my local newspaper today, there’s an interesting article on Kashkari’s essay, published yesterday, stating that banks need to have an inflation buffer, and need to set aside more capital. He has been consistent in this view.

“If inflation proves more entrenched than expected, policy rates might need to go higher, which could further reduce asset prices, increasing pressure on banks,” said Kashhari, who is a voting member of the Fed’s interest rate-setting committee this year. “In such a scenario, policy makers could be forced to choose between aggressively fighting inflation or supporting banking stability.”

“Stress-test results, along with capital-preservation plans, would help reassure investors and the public that banks can survive high inflation,” Kashkari wrote. The article adds, “This is not the first time Kashkari has highlighted the importance of sufficient capital to protect the banking system.”

I live in Minneapolis, and have watched Mr. Kashkari’s actions since he arrived here almost eight years ago. Yeah, he was too dovish on interest rates, and stayed that way for longer than he should have, IMO. But he has changed his position to advocate rate hikes consistently, and for quite a while. His position on banks, saying they need to keep larger reserves and set aside more capital is wise. I hope that he is listened too and that his recommendations are followed.

Rob Nichols, President of the American bankers Association, is pushing back hard against this. The Fed has to make the call, as the regulator of our banking system. The Fed doesn’t have a good track record on this, so we’ll see how it plays out?

Just a guess, but I bet Wolf would agree with me on this.

Kashkari voted again and again and again to raise asset prices, putting windfalls in the laps of older generations, and eliminating home ownership and retirement prospects of younger generations. He’s a reckless short-sighted individual lacking understanding of consequences.

The key to solving this disaster is with the banks. One area is borrowing a lot from the Federal Home Loan Banks if some economic event or condition can stop them from paying it back, then perhaps this inflation nightmare will be over.

These companies saddled with may be fix this overheated condition if their credit lines would in turn be cut off. If they are Zombie companies then they aren’t doing anything but pumping up their stock prices.

We all know FED works for the wealthy.

Going by WR articles, economy is running hot. Stocks are trying to flirt with ATH so are rents and home prices.

The govt and media think inflation is cooling down ( i think it ).

FED thinks time to pause , then piddly 25 bps hike in July with dovish statements.

We should have absolutely no doubt by now for whom the FED works for.

People who are in praise of FED for bring in such aggressive QT and rate hikes , I humbly, think are mistaken big time.

Go by what’s happening around us not by so called explicit mandate.

The FED raised rates at an incredibly fast rate. I completely believe they have a lot more to do, but I also think it is absurd to fret over the pause. After raising rates so fast it is prudent to pause and see what is happening.

For various reasons the FED has had a loose money policy for nearly 30 years. That cannot be undone in just a year or two. It is going to take a while to undo the damage of all of that.

I don’t see the labor market retaining its strength for much longer.

* A slowdown in manufacturing often front-runs a recession in the broader economy by 6-12 months and PMI data has shown manufacturing has been in contraction for close to 1 year.

* The latest consumer credit numbers suggested consumer credit growth might be peaking

* The oil market has been slowly shifting back to undersupply conditions since mid-June. We’d be wise to keep an eye on that.

* The most recent job reports showed much of the job creation was skewed towards healthcare (which saw huge losses during the pandemic) and local government (many municipalities are burning through the last of their “use it or lose it” state aid dollars).

* The “WFH” movement (predictably) has touched off a wave of offshoring of high-paying jobs.

“the media” aught to be taken out back and shot.

I think that is silly.

“The media” (what a dumb term), is nothing more than a collection of us. It is just people. It runs the full spectrum from competent to silly. From conservative to liberal, from whatever spectrum measurements you use.

After all, technically Wolf is a member of the media. Do you think he should be shot?

It is easy to see that people who complain about the media have been programed by their masters to do so. Break that barrier and do better. Think for yourself.

The media is an all encompassing term. It describes a wide range. Find media that educates you rather than tells you what you want to hear. There is very good media out there. Seek it out and stop paying attention to the click bait junk that is just trying to get your attention by complaining about “the media”.

Looking at the graphs.

Low unemployment rates = financial distress = economic turmoil?

Extreme swings!

AAPL is rising 18 weeks in a row. AAPL looks tired. Amazon closed Sept 9/12 2022 gap, but didn’t close Sept 12/23 2022 open gap that led to

the plunge, to Dec 2022 and Jan 2023 lows. It might, but it didn’t.

1) The Fed distributed money from the wealthy to the poor and to the middle class. The Fed raided bank accounts and CDs and transferred money – for an IOU – to the unemployed, to small business owners, to shingle mums, to every person who earned less than 100K/y…

2) It’s legal to milk the rich without their knowledge or permission, but the rich outsmarted the poor.

Yea, that dog fight ain’t never goin away (rich vs poor)

economy is white hot ! anecdotal – we had 3 cars – decided to sell our 2017 740il bmw 29400 miles – took it to a brokerage so I did not have to deal with the public- listed it for $32500 – sold in 24 hours for $31000- owner told me he is having his best year ever- the most expensive sell the fastest –

The best place to sell high-end cars such as a BMW 740iL is BAT (Bring A trailer) owned by Hearst or alternatively on Cars & Bids.

I remember telling my son and others 20 years ago, there is going to be a worker shortage when the boomers start retiring. There are help wanted signs all over. We need more immigration.

We need more immigration of educated, skilled, qualified workers, not border jumpers who only qualify for mow-blow crews. Look at the requirements to immigrate into somewhere like Australia or New Zealand.

The average American doesn’t want tens of millions of illiterate third world immigrants, but the Reps want them for the cheap labor and the Dems for future votes.

The common man gets screwed.

the truth

Einhal – while we’re at it, would question the literacy level of many of our fellow citizens, let alone immigrants (…few are born literate, in my experience…).

may we all find a better day.

Corolla over $30K. High turnover, high markup, because the competition, Ford and GM, cannibalized small cars. Corolla salesmen get low commission, because Corolla sells itself. Corolla has the lowest dealer supply.

Corolla salesmen get low commission because the margin is small. Salespeople are paid on a percentage of gross profit after “packs” (which are dealer internal adjustments to invoice prices which are already packed by the manufacturer for the dealer’s benefit *see holdback*). Has nothing to do with “Corolla selling itself”. If the salesman sells a Corolla for $50k to some fish, he gets his percentage of the gross profit.

Approaching peak euphoria. Inflation solved. No recession, right?

Labor market was red hot before Covid and inflation remained low; 30yr mortgages were around 4%; fed funds rate was around 2%…

So it’s possible that labor is good and inflation eventually normalizes. Not sure why so many here are rooting against themselves. Or why the Fed thinks hurting labor is a solution. The best outcome here is great employment + inflation normalizes. Which sort of seems to be happening right now, if slowly.

presumptuous statement

“Not sure why so many here are rooting against themselves.”

do elaborate.

THEWILLMAN

“The best outcome here is great employment + inflation normalizes.”

I think we will get there, soft landing. The FED has an awful lot of power and would like the economist immortality.

Also. I noticed Bullard Saint Louis Fed is stepping down next month. He doesn’t strike me as a quitter so that is probably a good sign. (reading-the-tea-leaves…)

Academic year starts. He got a superb new job that he can do for the rest of his working life:

“… to become the inaugural dean of the Mitchell E. Daniels, Jr. School of Business at Purdue University, effective Aug. 15, 2023.”

We’re rooting against the asset bubble which ruins life for common people at the expense of the rich.

Hey WR,

Do any of these sites that collect the unemployment claim data factor in things like how many people just can’t claim anymore? In CT it’s 6 months of unemployment, so presumably anyone laid off would “fall off the list” when they just can’t collect anymore.

If you already covered this, I’ll go back and read again. Thanks!

I was wondering if this point was raised in the comments and how big a factor it is. It’s also important to keep in mind that in past recessions they extended the amount of months you could collect. I don’t believe there have been any extensions yet so if you compare a past period of time to now you may be comparing apples and oranges as people weren’t dropping off as quickly and therefore increasing the total numbers.

That’s a constant. It has no impact on changes.

Look at the history in the charts, for crying out loud!!! What kind of question is this???

Nice…Pow Pow did it…we got our no landing, heck not even soft landing but no landing…make that to the moon launch next…

With that said…higher for longer cause you know people are still bring in healthy wage so they will spend spend spend…let’s see those T bill rates at 7% soon, my dry powder fund will appreciate that type of return, it pays for my rent :)

As with RE, employment ls local based upon where people want to live…

Aren’t we getting this all wrong. Retirement demographics will keep the next generations extremely well employed. The inflation we see is not typical – it was caused by a huge, very fast, dump of cash from heaven into the hands of consumers – and it is still swirling around and around but it’s not a continuing trend. Is a recession what really needs to happen to flush the cash out or do we just adjust all salaries and prices and then just move on. Just saying.

The royal “we” – followed by “just”. I’m glad someone can just wave a wand and adjust everyone’s salaries and prices. All in good cheer, no doubt, as long as it keeps the bubbles inflated.

Or perhaps Adam Smith’s invisible hand at work? Just saying.

…now, if I could just get the invisible hand to scratch that spot on my back that I can’t quite reach…

may we all find a better day.

Boomers were born from 1946 to 1965. The youngest are 58 years old. The retirement boom has at least another ten years to go, which should keep labor tight and productivity low. It’s an inflationary trend. AI and robotics will be the counterbalance; they’re neutral due to capital investment requirements. US fiscal deficits will only get much worse over time, so the long term picture should be inflationary. OTOH, when the signs point in one direction the economy usually goes the other way- the George Costanza effect.

MarketWatch U.S. Dollar Index (DXY) Overview

US Dollar Index (DXY) ; 52 Week Range 99.62 – 114.78 ; 5 Day. -2.57% ; 1 Month. -2.54% ; 3 Month. -1.88% ; YTD. -3.75%.

I noticed something on the CBO budget projections.

The are predicting the treasury debt owned by the FED to dip from 5.7 trillion to 4.22 trillion to 2026. Then they predict it climb about 500 billion each year to 7.5 Trillion in 2033.

So is the CBO predicting the FED sells treasuries up to 2026 and they thing a recession hits and then the FED goes on a 500 billion QE program for 7 years? I am just looking at spreadsheet tables so I am unsure why the CBO thinks the FED will start buying treasuries again.

LOL. You just explained and illustrated wonderfully how ridiculously terrible the CBO is in projecting the government debt, and then you suddenly take them seriously when they project something about the Fed?

In history, and before QE, the balance sheet has always risen with cash in circulation mostly, which used to rise with the economy when cash was still used. Now there’s the TGA, reserves, and RRPs. Those determine how far down the balance sheet can go in the future.

Hot off the press:

https://wolfstreet.com/2023/07/14/the-feds-liabilities-qt-pushed-down-reserves-rrps-by-865-billion-tga-gets-refilled-currency-in-circulation-hits-record/

I just have to laugh and wonder how the CBO can predict anything the FED is going to do 4 to 6 years out.

LOL…It’s really tempting to ask why health insurance is down 24%…

RTGDFA?

Maybe when the Fed hits 10 percent, companies will finally stop hiring and start laying off.

Sc.

Anecdotal: today I modified my Linkedin profile to signal recruiters I’d be interested on a new job and I already got three offers. IT, Spain.

👍