It just never ends with these hype-and-hoopla stocks. And when one wave finally dies, there’s something new. This stuff is just hilarious.

By Wolf Richter for WOLF STREET.

The legalization of cannabis was going to change the world. There are well over a dozen cannabis stocks that trade on US exchanges. These hype-and-hoopla stocks are another classic example of a rip-off of retail investors. Don’t ever buy stocks when you’re high is not financial advice here. And if you ever want to buy cannabis products, go buy them, but don’t buy their stocks is not financial advice either.

So one of these hype-and-hoopla darlings – Canopy Growth Corp, a Canadian company, like so many cannabis outfits – reported its long delayed Q4 and full fiscal year earnings today. Reading their earnings report is probably even more fun when you’re high.

All amounts on Canopy Growth, except share price, are in Canadian dollars. Because the shares trade on the Nasdaq, the company has to file its financial reports with the SEC, which it did today:

- In Q4, ended March 31, it lost $648 million on $87 million in net sales.

- In Q4 a year ago, it lost $394 million on $102 million in sales.

- For the fiscal year 2023, it lost $3.31 billion on $402 million in net sales.

- It’s now shedding operations and cutting out stuff, trying to hang on a while longer.

- Over the six years since 2017, the company lost $7.5 billion.

- I mean, that takes some doing.

And it has just about nothing to show for these $7.5 billion in losses: No fancy semiconductor that would power the future of generative AI, or whatever, no mass-produced EV that would knock the door-handles off Tesla, but just some products based on a, um, weed, and sharply dropping revenues.

Annual net revenues peaked in fiscal 2021 at $529 million. Since then, revenues have plunged by 24% to $403 million.

Fitch Ratings, which last rated the company one notch above default (CCC-) withdrew its ratings; S&P Global, which last rated the company “selective default,” also withdrew its credit ratings, after the company had defaulted on $100 million in unsecured notes and then restructured them with the related-party lender, Constellation Brands, into a cash payment for accrued interest and a new promissory note to be converted into special shares.

On February 10, 2021, Canopy Growth had a market cap of nearly $20 billion. It was that infamous February 10, 2021, when a lot of this hype-and-hoopla stuff peaked and then collapsed to then end up in my pantheon of Imploded Stocks.

We forgot about it already because that was over two years ago, and we have moved on, and this stuff has imploded, and now we’re onto the next hype-and-hoopla thing, generative AI, that is so much bigger than pot stocks, and so much more fun. Now we’re talking trillions, not a couple of hundred billions. The first half of the charts look similar though. The second half hasn’t played out yet.

Cannabis is a valid product. Generative AI may some day be a valid product. But here, we’re just looking at hype-and-hoopla cannabis stocks, and what they did to stock jockeys that got all excited about them. The people that got out in time, made lots of money, the others got wiped out. Which is how that works.

Today, the shares of Canopy Growth [CGC] closed at $0.58, down about 99% from the hype-and-hoopla spike on February 10, 2021, when they were worth over $50 a share.

This chart shows the market cap to show the magnitude of this: $20 billion went up in smoke, so to speak, easy come easy go, which is what hype and hoopla is all about (data via YCharts):

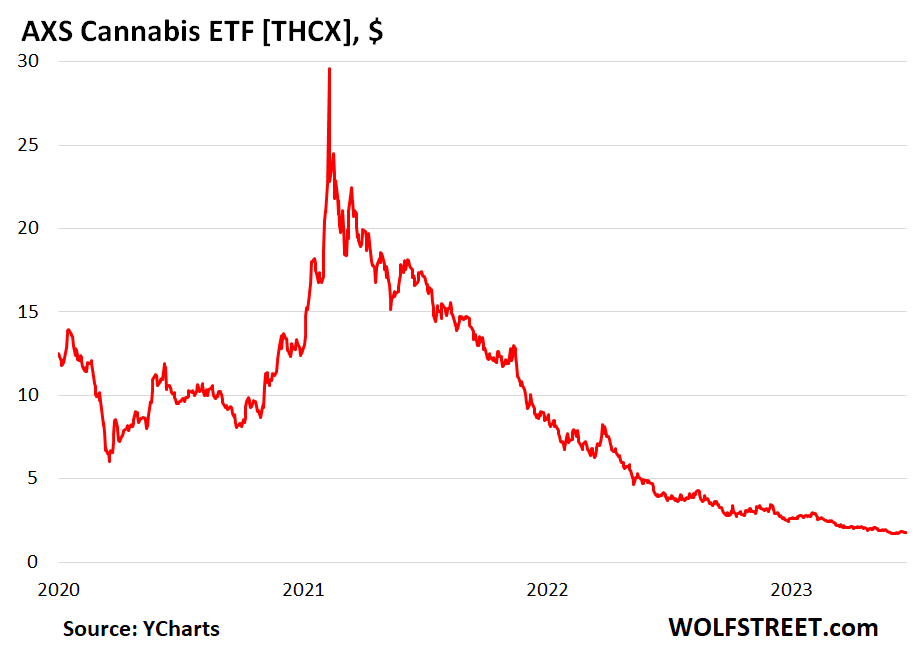

There are a whole bunch of these cannabis stocks. They’re summarized nicely by the AXS Cannabis ETF, which has collapsed by 94% from $30.99 at the peak on February 10, 2021, to $1.75 today.

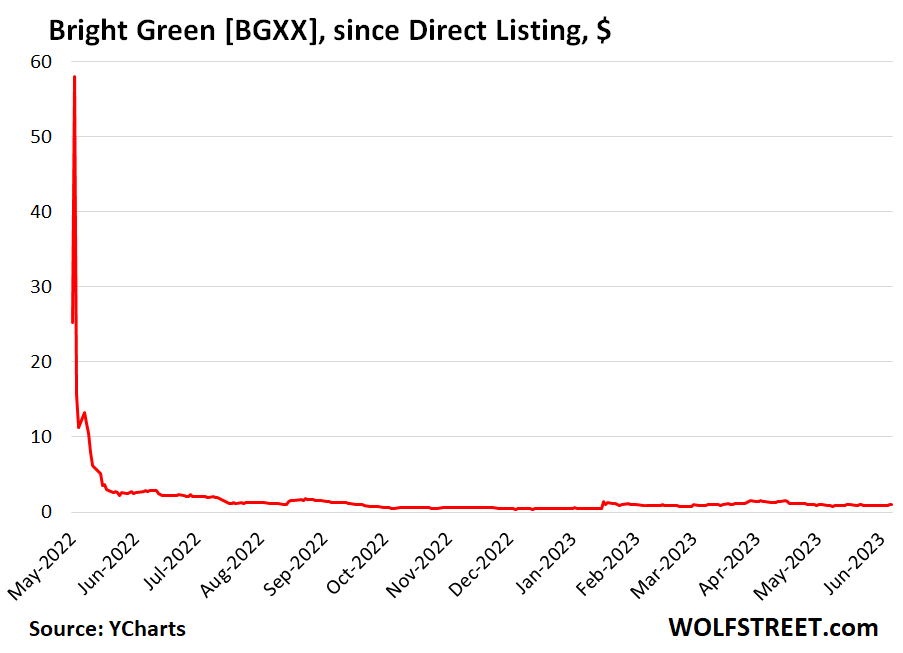

My favorite is Bright Green. I mean, memory in the stock market is like two weeks, or something. The company went public via a direct listing on the Nasdaq on May 17, 2022, after the other cannabis stocks had already collapsed. It was a pot grower with zero revenues. But OK, maybe they were trying to set a collapse record. The stock opened at $15.99 a share then spiked to $58 by the next day intraday, and then did one of those infamous rug-pull insta-collapses. A month later it was at $2.59.

Then a year later, on May 24, 2023, the company pulled off a private placement, selling 3,684,210 shares of common stock plus warrants to purchase 3,684,210 shares of common stock, at $0.95 per share and accompanying warrant. Today it’s at $0.91. This stuff is just hilarious:

We have seen this behavior in the stock market in one sector after another. It’s like a video game, so suspenseful. And it’s so much more fun than the casinos in Las Vegas, and you know, it’s not real money, it’s just play money, of which the Fed printed trillions. But the amounts are big nevertheless. And each time, a bunch of googly-eyed retail investors got cleaned out.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Up in smoke indeed…

… Nice Dreams too.

But you’d have to be smoking something to believe that Canada (a frozen wasteland with no light for half the year) is going to dominate weed production in North America.

The only competitive advantage these things have is access to capital. The Canadian weed companies get to raise cash (which burns more brightly than their crops) via stock listings in the USA. By contrast, US weed producers can’t list in the USA — and ironically end up listing on dodgy exchanges in Canada.

But hey, roll another fatty!

A frozen wasteland with no sunlight half the year? Have you been to British Columbia???

Phogettaboutit,

In terms of high-flying stocks, the problem with cannabis products is that there is limited demand.

Demand was filled by the black market just fine, and now there’s the legal market to fill that demand. So there was big growth in the legal market up from zero, as demand shifted from illegal to legal production and distribution channels. But that wasn’t overall demand growth; that was just a shift of demand from one place to another.

But demand for cannabis is very limited. It’s like demand for beer. The craft brewers came along in the 1990s and cleaned Big Beer’s clock. But demand just shifted. Overall consumption went nowhere. These are not forever-growth industries.

BC ,is the same 53 degrees north as my home town of Manchester UK….we get around16 hours of night in Dec/Jan/Feb with eight hours of gloomy daylight thrown in.

The Cannabis Market.

Is supplied by:

1. Mom and Pop locals

2. Mini private industry, regional, including Indian bands.

3. The Bikers – you know who

4. Government Quota Holders, many of whom slip illegal volumes out the door.

Prices wholesale have dropped 50-75% since pot went “legal”.

Way, way too much production.

No, I am not in the game. But my neighbors in this valley, large and small, have been at this for 40 years.

p.s. It is pretty telling what your society consists of when everyone needs to be stoned or drunk to deal with Mass Cognitive Dissonance.

Yeah. Have friends in said valley. But they were at it in the glory (and risky) days of $5K/lb. Pre Vroman, even. Couple are multi-millionaires now. They just rent their cabins up there….cheap.

Maybe they’re laundering real drug money?

LOL. Maybe.

They are lucky that they are not in China. Now, a new government initiative is jailing failed business owners and debtors who have not paid for a long time of which China has more than 25 million. It is good that this is not like their other initiatives, which turned around and bit them: e.g., their three red lines for insolvent, Ponzi, real estate developers. If we tried that here, given the debt levels (better compared to income but still terrible), we would have to designate a smaller state for use as an open air prison. LOL

(I used to watch comedy shows to relax. Now, I just read about the CCP’s latest antics. LOL Debtors’ prisons for unlucky entrepreneurs. What could go wrong?)

Stock market and real estate markets are still suffering from pandemic QE induced “Confirmation Bias”.

Most investors are thinking: “Wow, look at my investments going up, it’s a confirmation that I am great investor. I am so good at this game, just buy and hold based on memes. Valuations, EPS and P/E don’t matter any more. Only mainstream media narratives matter.”

Most people haven’t given up on this high of passive investing and now claim that stocks are the only game in town. They refused to acknowledge that what they considered as “THEIR GENIUS MOVES” were just the result of Fed and government “PRINTING TRILLIONS” to save a bubble from popping!

Today QE is limited by high inflation and debt is higher and valuations are worse than 2020 and pandemic era earning bumps from printing trillions is reverting. A lot of American Dreams will be broken and these geniuses will wake up to reality.

I haven’t taken a survey or seen one but I dont think most investors consider themselves geniuses at investing. Not even close. I could be wrong.

15 years ago or more Michael Sivy (or Jason Zweig maybe) published a fairly short article in Money Magazine or some financial magazine.

At the time the S&P 10 year return was something like 11 or 12%.

But the average investor’s return over the same time period was only, I believe, 4%. Quite a considerable difference.

Too many investors, too often buy high (relatively high) and/or sell low… that was the point of the article.

I’ve done it myself. Wall Street wants us to be conditioned to buy on the dips. At the bottoms of the dot com bust and GFC I found it hard to force myself to buy … how do I know another great depression might not be forthcoming ?

Update to my comment:

Add the word “annually “.

At the time the S&P 10 year return was something like 11 or 12% annually.

There is only so much market. Lots of people don’t want to imbibe mind altering drugs as adults. Even if they did when they were younger. Those things being suddenly legal doesn’t make us go out and buy them. It wasn’t hard to buy before either.

Heck I always thought it being illegal was half the fun.

So true. The pharma companies spend a trillion dollars on understanding and controlling the quality of their products: chemists, biologists, engineers, statisticians, data scientists, lab equipment, regulatory compliance, etc. And even with this effort, they sometimes get it wrong. Who in their right mind would consume anything from ignorant criminals looking to enrich themselves without caring whom they harm?

Mike: I never thought of weed being illegal as half the fun. It was completely the opposite for me during my college days when I was constantly paranoid that cops were going to handcuff me just around the corner.

How can I benefit medicinally from weed with those fearful thoughts constantly invading my mind? The drug became much more useful for me when finally legalized in my state. No alcohol hangovers, a mild enhancement to creative ideas for any practical life problems I have, etc.

I actually feel pretty angry it was illegal for so long. Just incredibly stupid, IMO.

Hahahaha, this article is cool and serves as a guide for the foolish investor

Government also believed its own spiked kool-aid about an amazing new source of revenue to spend and taxed the snot out of legal weed.

So the black market is humming along quite nicely paying zero taxes.

Not really.. From what I hear the illegal pot market went from $5,000 pr lb to $500 for top rate outdoor to even $200 pr lb wholesale. Accounting for labor, land etc I’d guess someone might make more money moonshining in the deep south. Plus enforcement on illegal grows is going up in California, and each bust carries hefty fines upon fines upon fines – from every agency from Fish and Game to DEA to Calfire. So maybe the risk is even greater, IDK. Oklahoma black market might do OK but it put a lot of people out of business in northern Ca. Even the Bulgarian Mafia (big dogs) seem to be getting out of it. Rumor has it they’re all moving to Oklahoma.

Now, local governments in some areas are also sucking the blood out of everything they can because their plans didn’t pan out. Some governments are fining people who recently bought properties $1000 pr day plus $10K fines on water, excavating, road violations etc for stuff which they had nothing to do with, and which a title search does not bring up because the violations charged and abatements given were never recorded in an accessible part of those government records. A group of owners recently lost a court case challenging those fines. It’s being appealed, but will take years if it goes anywhere.

Encouraged by all this are the building, planning and environmental depts of some locals.. You can guess where that might go, even when there is no cannabis involved.

So, no, I don’t think most of the illegal market is doing well either unless they got out of it soon enough. Just the middlemen maybe.

Give it 5 years and General Mills and Altria will be farming it like wheat in the central valley with combines.

That’s less that 10 times sales. NVDA is trading 40 Xs trailing or 20 Xs sales if they can double Rev’s this year over last. Good luck with that, just saying.

Maybe that is why sales hype is called “puffery.”

That’s a pretty straight line…

Where is Gary and the SEC to safe investors?

I hope you’re joking. The SEC shouldn’t protect people from being dumb. If someone bought this thinking they would be rich, that’s a speculator. If someone bought this thinking this is the future, that’s wishful thinking. If someone actually bought this as an investment, then they need to go back to how they analyze investments.

Every day people are out there selling dreams. And every day a new sucker is born.

Wolf your last paragraph is absolutel gospel ,everyone thinks they’re going to get rich . This is why there are so many billionaires. A tulip festival on never ending merry go round,.

“last paragraph”

I noticed that too – and agree.

Jerome Powell : “Yes”.

Whenever “a bunch of googly-eyed retail investors got cleaned out”, a couple of new billionaires were born.

Hark now here, the angels sing, a billionaire was born today.

And the Fed will live forever more.

Because it’s Bezzle day …

When Pot was legalized in Oregon, the state law would only allow verified residents to get licenses. But the story I keep hearing around town as the “pot rush” was blowing up the commercial real estate market was that big Canadian companies that access to financing would buy or lease locations for retail or production ( oil, edibles etc.) and then set up a deal with a local weed entrepreneur who would hold the license. They would take on all the expense of the high dollar leases, the renovations etc. and then hope the shop (or shops) could generate big bucks and pay them back in extravagant fee structures. The problem was in Oregon there was so much over production that prices dropped through the floor. The profit was then so low the poor pot slinger could barely pay wages, and taxes and the big Canadian Pot Landlords got stiffed, and there wan’t much they could do about it.

…moonshinin’s still moonshinin’…

may we all find a better day.

91B20 1stCav (AUS),

‘Copperhead Road’ by Steve Earle, 1988.

Minnesota’s legislature passed, and governor signed into law, a repeal of the prohibition of cannabis on Tuesday, 30 May 2023. So, on 1 August 2023, eight plants will be legally allowed to be cultivated in a citizen’s home, but only four can be in the flowering stage at any given time. Not sure how the police are going to enforce that provision, eh?

And when the law was signed, I spun a little gem. Track 2 of Primitive Radio Gods’ ‘Rocket’ album, 1996. Song title is: ‘Motherfuc#er.’

“When do I get paid for all the money you made

Selling souls on Capital Hill

Another law’s been passed designed to break your ass

And keep the middle class quiet and still

You talk a lot about justice and then go and bust us

Except for the chosen few

I’ve got a God-given right to smoke whatever I like

So tell me how it got given to you…Motherfuc#ers”

Been well over a year since I’ve had any cannabis. But I will definitely have a “Freedom Toke” on the day when a good sativa/indica hybrid strain can be bought at a local shop. “Runtz” is a nice one that’s 50% & 50%.

“Life, Liberty and the pursuit of Happiness.” Yup, God-given; right there in the Preamble to the Declaration of Independence.

DanRo – among the finest of Earle’s work (title track should have been given a special award for: ‘Best Use of Bagpipes’ in the Americana category…).

Though well-south of the Emerald Triangle, the small-grower neighbors in my rural area always seemed to enjoy a steady and lucrative business, spiking with CA legalization (the steady parade of suv’s bearing plates from states east cresting as well), but it has experienced a steady decline since. Funny thing was, most of them seemed to favor legalization, thinking that it would let them continue business as usual, just without legal fears, rather than understand, as Wolf noted, ‘legitimate’ small farming is damned hard work where surplus yields can hammer prices with the bonus of plenty of tax and legal exposures (and, at a Federal level, still not legit-obviously remote-sensing equipped C17’s from Travis make multiple low ‘n slow passes a couple of times a year for well over a decade…).

(Reckon ‘disruption’s where you find it).

…and don’t get me started on the trespassing wildcat/cartel-affiliated water-theiving land-raping ‘growers’….

may we all find a better day.

Here Here!

Max 6 plants flowering or not in Ma is legal in each home,

12 if ur married.

6 plants is enough for 2-3 lbs of buds not including leafy scrag. Any 1 person ingesting more than that in a year is hallucinating when not sleeping.

They don’t bust anybody unless your growing a shpload more than the allowable, and your careless.

Next-up for legalization- psychedelic shrooms

These states allow homes to grow “limited” amounts of pot:

Alaska.

California.

Colorado.

Maine.

Massachusetts.

Michigan.

People love to alter their states of consciousness by drinking and drugs-always have and always will. Step up to the bar and take what you lack.

These companies are competing against the black market. When cannabis was legalized, states and municipalities thought it would be a windfall in new tax revenue. But they taxed it so much, that it became cheaper for consumers to buy the stuff on the street, like in the old days. So I have been told.

I remember reading about some place in Canada that wanted to increase tax revenue on cigarettes. So they jacked up the tax which increased the price of cigarettes so much that people started buying cigarettes in or from the United States. As a consequence tax revenues actually decreased. I thought that was pretty funny.

In Colorado visited Idaho springs 10 years ago pretty dumpy,went back last year pretty nice = paid for by weed ,probably increased taxes also

Not even ‘black market’. Now that it’s legal to grow a few plants plenty of people do it as a hobby and end up with way more than any person other than hard core can consume, so they just give it away to friends and family. That was always my assumption and, at least anecdotally, it’s what’s been happening. Nice to visit a dispensary now and then as a novelty, but otherwise, why bother?

Just a bit jealous I didn’t score at the casino while the gettin’ was good

58 cents???? Why even 58 cents after losing a mere $7.5 BILLION!!!

As the title to one mining ghost town book says: “Dreams Die Hard”/

Driving thru Colorado, jeez I swear there are more weed shops than gas stations.

I used to joke back in the War on Drugs/Just Say No days that the only way to take the profit out of the illegal drug trade was to get the government involved.

Turns out the best way is to let Wall St take over.

Up here in Ontario the cannabis lobby is whining for tax reductions in order to stay in business. Just say no, eh?

CGC needs to append AI to its corporate name; AI will solve all the cannabis stocks’ problems. It will go back to its old-time Canadian highs.

How bad at business do you need to be to lose that amount of money in the drug industry? The guy selling weed down the road manages to turn a profit…

Maybe because they do not pay tax? In that regard, look up the 280e tax code… This in combination with the lack of banking services, pretty much explains the ongoing problems with profitability for the U.S. MSO’s.

Executives steal all the profits ,rediculios compensation and they get paid to do a crappy job ,just go to Ivy League school . Get in the club . Pretty easy .There’s no accountability in board rooms.

In the first episode of “Tulsa King”, Sylvester Stallone gets released from prison, gets kicked out of his mob family business, relocates to Tulsa, buys a new Lincoln Navigator with cash, seduces an FBI agent 30 years younger, and figures out how to take all the cash from a local pot dispensary.

Which is a lot of art-imitating-life in just 50 minutes.

Thank you, Wolf. I would add that there’s a lesson here for cities. The City of Boulder, CO was one of the first to incentivize the weed tourism industry on the premise that it would be a significant source of sales tax revenues. That was before weed became legal elsewhere. Now the industry’s local revenues are lagging.

Colorado just incentivized the psychedelics industry via a ballot initiative. Watch that space.

This shows how detached from reality it all is. Some pretty good stuff can be grown in someone’s own backyard without too much effort or little investment. When weed was still mostly illegal in all forms many moons ago, money really could grow on trees, some real jack and the beanstalk stuff. Feds thought they could use the sacred ganja as a gigantic untapped brand new revenue stream, as if it just found and declared some major oil field. But the sacred green outmaneuvered the paper green by saying I’m free to all those who keep a seed and deposit it in the good ground in a place with plenty of light and enough water. A lot of these states that have legalized weed were already full of meth zombies. Have you ever been out west? I don’t mean out west in the 1800’s, I mean out west post 2000. Let me know when i can openly invest in a company like National Meth Industries (*NMI) or Canadian Cystal-Meth (*CCM) and I’ll probably buy shares. Legal meth will put the cartels out of business and bring in a lot of revenue for the states to use for things like funding schools and fixing sidewalks and maybe some bikelane programs. The black market won’t be able to compete with a legal and open industry. It should be sold from places that feel like a dentist office and the taxes should be obscene and the quality low.

great explanation thanks

The free market value of pot has always been based on the absurd statutory restriction of its cultivation. The various federal intelligence enterprises (stop calling them agencies) like the FBI, DEA, CIA, and now 40 or so others, are all players in the management of the multi billion $ global pot game.

A 20 year federalized-banksterized clandestine subsidy of the “illegal” cultivation industry, to the tune of $40 billion or so, only recently ended. There is a psychology to presumed illegality, in what people are willing to pay. If coffee is a 125 billion $ industry, pot is at least twice that. Pot is now being scientifically proven to be one of the most valuable medicinals on the planet.

Yes, that’s the key difference between pot and tobacco. Tobacco only grows in specific soils and climates, and requires special skills, so the growers have a true natural monopoly. Same with coffee.

Hemp grows everywhere. It’s a hardy and invasive weed.

What a nightmare. Maybe you can find the right nail saloon or video game parlor. Or just move to Oregon- it’s just a misdemeanor there.

Elko Nv is tie with the worst place I’ve ever stopped in on a road trip. I was planning on camping just outside of it . Looked like good place to stop on the map.. Every single person I came into contact with from the corner store to inside McDonalds to the gas station to people on the street and rest stops to cops headed out from the station looked high as a kite on meth. I have no doubt. Smirking and jerking. And it was mid afternoon! I skipped the campground and drove all the way to Utah. I’ve managed to live in bad neighborhoods with few problems, but that place actually scared me.

Oregon and northern Ca are trying to legalize mushrooms.

…as surely as the decline of big logging and fishing hit those local economies, earlier, the search for replacement staggers along…

may we all find a better day.

Yep. Going to be a lot of people hurting.

Right now, gamblers are jumping to buy stocks on any news again. The madness during the ZIRP years was so big that I think the markets have to fall for several years, big bounces included.

“Right now, gamblers are jumping to buy stocks on any news again.”

Not “right now.” Right now, the major US indexes are red. And they’re red for the week. The big European indexes are even redder for the week.

Smoke that in your pipe.

What was that song where the guy was watching the police drive off sitting there on a sack of seeds?

BL- “Wildwood Flower”, Jim Stafford. MGM Records, 1974. I have the vinyl.

You’re thinking of “Wildwood Weed.” “Wildwood Flower” is a different song.

Lok at PW. Used to be a nice sleepy Reit, paying its dividend like clockwork for decades. Maybe they’ll go back to that if they can survive.

Cannabis also dings the ERs.

As you know in Canada, ANYONE can grow 4 plants for personal use.

I happen to know at least 20 people that grew so much the first year, they have POUNDS of it still in storage, vac sealed 7 years later.

Ya would have thought the government would have thought of the competition privately screwing their own revenues? Plus in a town of 30,000 we have 7 shops selling the stuff!

It’s a game isn’t it? The pushers never intended to create a going concern. Just build enough infrastructure to be believeable. Then sell sell sell the new stock. Who falls for this? Second, weed is still much cheaper on the illegal market.

I told everyone to short all the cannabis stocks and/or go short the Canadian ones and go long the American ones in equal sums. I suggested both on dozens of blogs and on the misc.invest.stocks newsgroup. I essentially doubled my money on every short sale. My brother’s former wife went long the marihuana stocks so that was even more conviction that almost every listed cannabis company would go bankrupt. I remember I just used to shake my head listening to these imbeciles telling everyone its the nest big thing. Even Garth Turner on thegreaterfool.ca was long dope stocks. I did everything to talk him and everyone else on that blog out of that idea.

This is funny. My husband bought into the frenzy. Luckily he limited his investment 😂

As a Canadian living in the US I could see this coming. Makes no sense to buy the prices at the store. They’re insane.

It takes special talent to lose money on selling a product that costs sun + water.

Great comment, I will remember it, I will use it again in the future, and I will pretend I was clever enuf to come up with it myself. Cheers

LOL. Farmers will be tempted to disagree. Farming is a very tough business to make money in (other than from the appreciation of the land value).

People in Canada were delusional about cannabis demand. In every city near me you can’t go two blocks without seeing another cannabis shop, sometimes even across the street from each other. They sprung up like coffee shops, and I’m guessing they’ll mostly vanish in the next few years.

The number of brick and mortar outlets isn’t exactly the same as stock values but the sentiment seems similar.

It reminds me of the coffee shop and drug store boom and bust. There’s only so many new stores you can open without cannibisalizing existing stores.

Black market price in 1991- $75 per 1/4 ounce. Today roughly $50. Speaking from experience. British Columbia prices.

Wildwood Weed by Jim Stafford:

Frankly, Wolf, I think this is simply a case of bad management. I mean, could you imagine any pre-legalization pot CEO reporting a $3bn loss?

Kevin – You’re right, just looked at my album jacket.

Legalizing an illegal drug seems to be a bust for the profiteers willing to take the risk for the risk premium. But they can do the math too.

No question the cannabis sector was hyped, based primarily on Canada being the first to legalize nationally. Many investors expected the US to soon follow. Ha! Drug warrior Joe Biden was not having it. Nor would the DEA, and certainly not big PHARMA.

But it hasn’t all been a bust. US states that have legalized it are cleaning up with the tax revenue it generates. In Illinois taxes on pot now exceeds taxes on alcohol. Also studies have shown opioid use drops in states that have legalized.

Still, US federal prohibition has crushed growth prospects. It has restricted bank lending and institutional investors, which has slowed industry consolidation. Too many small time players. Section 280E of the Internal Revenue Code also restricts deduction of normal business expenses adding to the burden of making a profit.

Some day this industry will begin to live up to its over-hyped promise, but that is still a few years off.

“Some day this industry will begin to live up to its over-hyped promise,”

No, because there is limited demand for cannabis products. This demand had been 100% filled through illegal production and distribution. It is now shifting (partially) to legal production and distribution. That’s all that is happening. This isn’t a new product that suddenly takes over the world. It’s like beer. The craft brewers came in during the 1990s and started cleaning Big Beer’s clock. But overall consumption has gone nowhere.

You may be right, but craft beers weren’t illegal, nor were they stigmatized by decades of Drug War propaganda that marijuana was addictive, or a gateway drug. Adults over 50 were inundated with the “Just Say No” and “This is Your Brain on Drugs” campaigns.

If Congress ever gets around to finally agreeing with the 70% of Americans who favor legalization we may find a much greater demand for cannabis. We may even see a demand shift from alcohol with all its ill health effects to a much safer way to relax, sleep, or cope with stress.

It’s actually already been destigmatized and is only going to get worse as it is re-stigmatized. The only way to differentiate in the legal cannibis world is on strength of THC so there is now an arms race to to the strongest and there is certainly negative consequences to that, not the least of which is a link to psychosis.

Chris G,

I could have consumed this stuff all my life. It has been everywhere all around me, all my life, being consumed right in front of me. In my early years, I consumed a little, but it just wasn’t for me. Everyone my age grew up with this stuff, even in school. There was never any lack of access.

I favored legalization all my life, still do. Yet I will never be a consumer of this stuff. Everyone I know favors legalization. But almost no one I hang out with these days consumes it.

For people who are hooked on this stuff, it seems unthinkable that someone might not ever consume it, might not like it, might not like the effects of it, might hate the smell of it – to me, the smoke just stinks; my wife keeps confusing it with the smell of a skunk, and we have plenty of both around here. That’s how it is.

Young people might get all excited about it, thinking that they invented something new, like they invented sex or something. But this stuff has been accessible forever, and anyone who ever wanted to consume it, consumed it. So where is the growth supposed to come from? There is no growth — there’s just a shift from illegal to legal.

People who like beer, like beer. They’re not going to shift to smoking pot. I am among the gazillion of people who would never ever smoke anything, period. And I’m certainly not eating this stuff.

Fact is, most people actually don’t like beer either. That’s the problem for the beer market. Cannabis is no different. Once the novelty wears off when you’re young, and it’s just another legal consumer product, it comes down to what people like.

“Dude, where’s my money?”

I was a consultant to a California early stage cannabis company back in 2018. The company was vertically integrated, holding licenses for cultivation, manufacturing, packaging, distribution but not retail sales. The company had about $3,000,000 in hard assets and little cash, revenues were under $1,000,000 at the time. We were prospected by an investment banking firm that put a $1,000,000,000 valuation on the stock for a capital raise. I laughed my butt off, it was preposterous. I was paid in shares and hoping for the best. With that said, I’m now thinking about framing the shares and hanging them on the wall.

Thanks for this insight. This shows how much liquidity was there in the economy which made Banking Firm put a valuation of $1B for a company with $3M in assets and $1M in revenue.

It’s a Mad Mad Mad world.

Glad I came from the Old Earth. Feels good to be old, living too long will make you crazy. Looking forward to more FED articles Mr. Wolf THANKS

Pump and dumps never end.

It is in the explorer DNA: find treasure, something for (relatively) nothing. Escape the rat race. Or better yet, package and sell the hype to some crowd of hopefuls.

Let’s see — Atlantic City casinos, dot com, subprime real estate, online gambling, pot, crypto, AI stocks. A new generation seems to be born every couple years now. I reckon there is ten percent durable value (if that) and 90 percent draining the pockets of suckers. And, ruinous competition every time, even as the fraudsters move in. “Web 3.0” will put a zillion intangible vapor “investments” into everybody’s phone.

And plenty of gatekeepers — in Congress — are being shills for this kind of stuff nowadays. The US will fall behind, they shout! FOMO!

…is Barnum perhaps the only true immortal?

may we all find a better day.

Living in AZ, I legally grow my own. Garage grows in the winter. Too hot otherwise. I have product from two years ago and much more than I can use at the rate I consume, which isn’t much. It makes for an OK hobby. Not sure I will go for another grow this winter.

…recall reefer being termed ‘overproduced’ in CA as far back as 2016. A lot of money seems to have been wagered on the retail-convenience aspect…

may we all find a better day.

Ed C: I’m not an expert on cannabis production and storage, but I did hear that even if you store it in glass jars at perfect temperature and humidity weed still degrades substantially after 6-12 months. Do you find that to be true? Clearly it means you’d want to consume the oldest batch first.

Cashed-up speculators due to grotesquely reckless money-printing. You don’t get these kinds of massive distortions without it. Jerome Powell should have been fired long ago.

Agreed, he proved his worthlessness when he caved under Trump and lower rates too soon years ago….Hard to prove worthiness in a worthless organization like the FED. I think, sorry, too many syllables make me silly..

This is what’s perplexing- every Fed since the 90s has failed harder, and papered over their failures with bigger bubbles, which implode more spectacularly.

This Fed is the epitome of incompetence, havin now lost control over all the variables under their mandate- financial stability, prices, and employment.

The fact that they get Nobel prizes instead of being fired is the sign of decay and corruption in a failing civilization.

To be fair, there have always been speculators. In the early 1900’s there were hundreds or car companies, many with absurd valuations they would never reach earnings wise. Same with steel, same with computers, the internet, etc.

People are naturally herd animals.

The industry needs to organize. Lobby for government subsidies for Big Weed! Partner with education by sharing profits from vending machines in schools! Advertise during the Super Bowl!

THEY kept the booze and dope flowing during the lockdown. Guess that did not help sales though.

I have heard from several relatives of 20 somethings who went into pot production 3 to 5 years ago in small production houses. There was success at first, but then and now the big complaint is cost of electric power that is driving them into the ground financially.

I know of a few small operators who started growing early in the boom and and have made money and continue to make money now.

The thing is, they are still small time operators. They opened a couple of grow houses the size of a warehouse and have never expanded beyond that. Their profits are decent for their size, but growth prospects are nil.

Frankly it doesn’t take hundreds of millions of dollars of capital to operate in the industry. There is zero reason for any of these companies to be public. That much capital is not needed and is overkill.

As Wolf repeatedly points out, this isn’t a growth industry. Existing sales cut into the black market. There are not really any opportunities to scale up for size. Getting more capital and investing it doesn’t always lead to bigger companies. The market is only so big and not big enough to need public money to scale up.

There are plenty of private cannabis companies that grow from a single grow/warehouse, sell it at a local dispensary and make ok/fine/mediocre money doing so (pending how tight of ship they run). Giving them a second grow house will not double their sales. It will just give them extra product which they will have to severely discount to move.

The industry does not need capital so they are only on public markets to swindle investors.

Wolf, why do obviously doomed companies keep running in hopes of recovery? Seems like the economically prudent thing would be to immediately close up shop, instead of burning more investor money?

These companies run to extract money from investors and make executives rich.

They’ll keep running until they run out of money. And they’re still getting new money, like Bright Green with its share sale at $0.95 a share in May. Some of these companies have gotten funded with huge amounts of money from startup investors, and then through their IPO when they sold the shares to the public, and then through follow-on share sales. The executives are doing just fine, don’t worry about them.

If the executives are the only ones making money, why aren’t investors and/or the board demanding that the company closes, instead of losing more money?

Always a good question. Here is a dose of reality:

1. Shareholders express their opinion by selling the shares and moving on. And they have done that.

2. Board members are paid, and they have no interest in stopping the gravy train.

3. Company management (paid also, LOL) is going to use up what funds are available, and then they might file for bankruptcy.

4. The only entities that might be interested in shutting down the business before it loses even more money are the lenders, but they have no say until they get the company under the supervision of a bankruptcy judge, by which time it may be too late to salvage much of anything.

I’m bored with cannabis. None of those stories about it being good for you are standing up to rigorous scientific study.

I’m switching to the quixotic quest to legalize magic mushrooms. I hear it cures everything from alcoholism to PTSD.

Knew this neighborhood kid. He’s in prison. Him, his family, his friend, their family, all their lives ruined. Magic mushrooms indeed.

“Murder suspect Steven A. Rogers exhibited bizarre behavior and told police he murdered someone the night he is accused of fatally shooting a friend after they took hallucinogenic mushrooms together.”

Suspect schizoaffective disorder or some other pre-existing twist in his melon. Bad mix.

Some guy was on a “peaceful magic mushrooms” trip and murdered a couple women at a concert in WA a few weeks ago.

My NPR station here in San Francisco keeps talking about it. We’re at that state already, LOL. A whole industry has now formed that is lobbying for legalization of psychedelics. Fine with me. Bring back Pink Floyd, I mean, the kids, not the geezers.

I concur. I was hoping cannabis would conjure up that deep insight that would clarify some issues that psychotherapy didn’t reach. I have seen documentaries that have shown psychedelic assisted therapy to be a real game changer for things like addiction and PTSD. Not confined to mushrooms. MDMA and maybe even LSD or such.

MDMA is is marketed as a love drug but it is chemically very close to meth. I’ve seen several people get marked damage after several years of too much use. Not a safe or loving drug. Even LSD is safer IMO. Mushrooms? Pretty harmless I think unless you have schizoid tendencies or are seizure prone. Then again, I don’t see people doing it constantly either..

“…if a little bit is good, a whole lot more is better…” being the ‘Murican modus operandi with so many things…

may we all find a better day.

Firing up at low temp. flames is a bad way to ingest long term.

Vaping small amounts of pressed resin is pure, and it is not as bad for you.

However, the advertisements you see for vaping with young people blowing huge clouds of smoke is not the way to go if you like pot.

Small vapored clouds of pure resin, tea or ingestibles are varieties of ingestion pathways that will not give you the emphysema associated with lung damage from typical carbolized firing up weed long term.

In general, because every gram of shrooms has a differnet potency, about 1 gram of shrooms is equal to have 2-3 beers if microdosing.

Mushrooms will be the next big bubble in several years.

Moderastion

Not a smoker here but I like the oils and tinctures available. No smell and I sleep great.

Not to lessen the fact that this stock is an unmitigated dumpster fire, $2B of that loss is accounting treatment/impairment. Cash burn was $0.6B on declining revenue… not a great story either way

“Accounting treatment” = finally recognizing prior hidden cash burns, or recognizing that revenues never happened, or that cash never existed except on the books, or that cash expenses were far higher that disclosed.

It’s a “noncash” adjustment now, but when it happened, it was cash. They had to restate their revenues (never got the cash that they said they got), and restate other stuff what was cash at the time. It almost always boils down to cash.

Hello,

I am professor emeritus Hogwards, from Hahvahd Business school. I take offense at the hype and hoopla designation. You are making a common error in the analysis of new companies, which i teach all my students: modern day accounting is flawed; it fails to account for intangible investment, instead accounting for it as an “expense”. The 7 billion “loss” is really a 7 billion brand-equity/R&D/goodwill intangible asset!

This stock is a tremendous new era company.

Thank you very much.

PS: I am tenured. Shareholders are manured. LOL!

I love the Wolf statement about the youth inventions of cannibus and sex. For me I’m in the same generation as Wolf and never understood the consumption of anything that would alter one’s mind. I want the stuff legalized for sure just like alcohol. I would like some sort of technology to keep folks off the roads that smoke the stuff or drink since they affect the safety of roads . This is one hilarious story !

About 7 years ago I had a piece on WS titled: ‘Pot stocks soar as pot price plummets’ This was just as Canadian mega pot co Tilray, headquartered here near Nanaimo, BC hit a valuation in the billions, equal to Clorox Bleach.

I’d followed the biz for years but by 2014 the market was getting flooded, and lots of guys were getting out. In BC the medical licenses were a huge factor.

You could see a doc in Duncan, pay a hefty fee, and walk out with a license for 199 plants. Which should handle your personal needs.

But here is the fundamental problem for Tilray, now fighting to survive, and Canopy etc. They planned on getting a black market price for a product that was very easy to produce and was becoming legal or at least de facto legal, as with the medical licenses, the vast majority of which were for profit. You could also ‘gang’ them, as on outfit near me did: hung multiple medical licenses on the wall in a ship building shed. A lot of this stuff was technically illegal but in practice, it was tolerated. Society had lost interest in this prohibition.

But Tilray imagined getting 1500- 2000 per pound, or the black market price. For something no more difficult to produce than tomatoes.

199 plants to meet personal needs! Hahaha.

I look at some industrial properties and you would run across $/SF sale prices on a few. They were the ones in the pockets allowing pot companies. Same thing for retail properties in areas that had a cutoff date to close to be approved by city council. Those properties are likely getting smoked.

Took an MJ patient to a dispensary, she picked up an ounce for $60.00,when illegal she would pay $100.00 for a 1/4 ounce.

Reading Along: Legal states such as New Jersey, Illinois, and Missouri are still charging $300.00 per ounce while Oregon and Colorado are selling ounces for $50-$60 as you stated. The US national market is still way too unevenly priced due to federal restrictions on interstate commerce.

In New York City, legal cannabis went nowhere. The City allowed unlicensed dealers to open storefront shops all over town. Big Cannabis thought NYC would be boom city, they busted. Many pot co’s selling for .20 price to book.

Widespread use of a psychoactive substance with undesirable pharmacokinetics is a bad idea. Always smile when politicians and stoners argue it’s consumption is no worse than ethyl alcohol. Obviously those people got their biochemistry degrees from Cheech and Chong University.

Longterm overconsumption of anything is the health issue-food, alcohol and drugs

Send lawyers, guns, and money

Food and alcohol are quickly eliminated from the body; cannabis chemicals don’t. Google “ADME/tox” and learn something about the science of physiology. Stoner platitudes are not science.

Science is statistically considered not not right or no tnot wrong. The more you know the more you don’t know. Self appraisal is not approval

Albert Hofmann, the original discoverer and experimenter of LSD is here? And he is warning us against widespread use of psychoactive substance with undesirable pharmacokinetics? Should I conclude I am under the influence of LSD myself right now as I read this?

Maybe. Keeping an open mind.

“just some products based on a, um, weed,

I am glad Wolf pointed that out. I had to do the same thing about eight years ago when a Navy Reserve officer I was serving with was blathering on about how governments would be able to balance their books with the taxes on legal weed. He really didn’t have an answer when I pointed out that the only thing valuable about marijuana is the fact that it is illegal. He was from Pittsburgh and had no clue that in the Southwest the stuff grows in ditches… so much so that most states have laws against picking it and smoking it. How do you charge a premium for something that wants to grow wild? As soon as you legalize it then every Beevis and Butthead out there can grow their own supply with little more than a corner of their mom’s flower garden.

As an investment it is even worse than that.

1) Every state out there “legalizing” it is still putting restrictions on its sale… not to minors… only for “medical” purposes… etc. So the Black Market weed/producers aren’t going away… and they are not going to abide by the tax laws or anything else that raises the cost of THEIR marijuana. So THEIR marijuana is ALWAYS going to be cheaper than YOUR marijuana.

2) But just because your company is abiding by the law to avoid getting nuked doesn’t mean that the law is being enforced any more. So now you are competing with a black market where the possibility of getting caught selling illegal marijuana has gone down rather than up… along with the price.

3) Legal Liability: the death toll on Colorado highways has just skyrocketed since they legalized pot. It may not be possible to sue someone with an anonymous baggie in their car who causes a wreck… but it is a lot easier for a clever lawyer to sue a company when that baggie has a corporate logo on it.

4) Transportation cost… practically free to pot smugglers… not even possible to corporate Marijuana producers since moving it across state lines is NOT legal at the federal level.

5) Banking… again the Black Market has it rather simple… it is an all cash business of fairly low levels of cash at the street level. But open a literal store front to sell the stuff and the dynamics change considerably… you need access to banks to deposit the money into so you don’t get robbed waiting to pay the light bill or whatever with it. But it is illegal at the federal level to provide banking services to drug dealers… and most bankers are pretty conservative people by temperament anyway.

My guess is that people invested in this “industry” thinking that these problems would go away as soon as the Feds legalized marijuana at their level. “SURPRISE SURPRISE SURPRISE”… the Federal government moves at a snail’s pace.

SG – VERY-well stated…

may we all find a better day.

As I recall, from my adrenalin junkie youth, illegal activity was always more fun than legal ones. So I drank much more alcohol before I was of legal age to purchase and consume it (which was 18 years old back then). And when I turned 18, illegal pot (and its various forms) such as hash or Thai-sticks became the drug of choice (among other things). But youth is fleeting and when I became an adult and took on adult responsibilities, I left childish ways behind… However, I do remember thinking nearly everyone smoked pot back in those days. But that clearly was not the case then and it is not the case now… the market is too limited for the investments being made. And many of those involved in this new legalized industry are disillusioned pot heads…. like I once was.

Speaking of stoners, did anyone notice that Jerome “Jerry” Powell said in Congressional testimony that he has been a deadhead for fifty years? A deadhead is a follower of the band Grateful Dead, known for audiences with plenty of atmosphere. This might explain some of those confusing bits we hear from him now and then.

ha!

Agree with overall thesis but money can still be made in the sector. e.g made $991 or about 20% selling CURLF at close Friday. 2nd time making 20% in two months. I put the money into SPPP and OXY since I’m a bottom-picker. Palladium is down $1000/oz recently and platinum is $1000/oz less than gold.

Gee, it’s almost like Wall Street and the banking system as a whole is a giant organized crime theft operation.

Naaa, couldn’t be. Crazy talk.