Their huge sales, dizzying growth rates, and high pay-scales move the needle.

By Wolf Richter for WOLF STREET.

Services that are being bought by consumers, businesses, and governments account for nearly two-thirds of the US economy. But four huge sectors totally dominate. They have seen explosive growth over the past few years; three of them by over 30% since 2019. These are the titans of the US economy:

- Finance and Insurance

- Healthcare Services

- Professional, Scientific, and Technical Services

- Information

These four sectors are huge in terms of sales, but only one of them, healthcare, is also big in terms of employment. Workers in these sectors are often highly educated and skilled, and well paid.

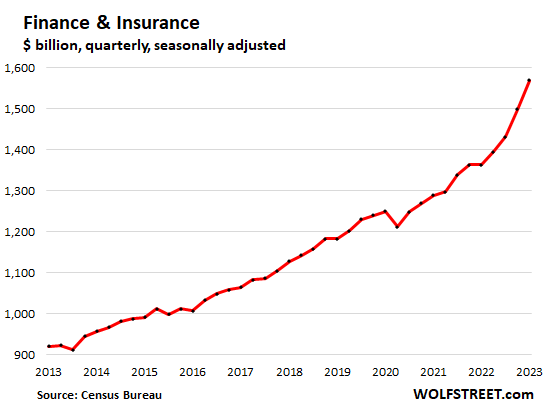

The absolute monster: Finance & Insurance: +33% since 2019.

Sales jumped by 15.1% year-over-year to $1.57 trillion in Q1, and by 33%, or by $386 billion, from Q1 2019. These are huge percentage increases on huge dollar amounts.

The Finance and Insurance sector has about 6.7 million employees. Includes banks, credit unions, brokers, mortgage brokers, portfolio management, securities and commodity exchanges; trust, fiduciary, and custody activities; employee benefit funds; pension funds; investment funds; all insurers, including health and medical insurers, insurance brokers, claims adjusters, etc.

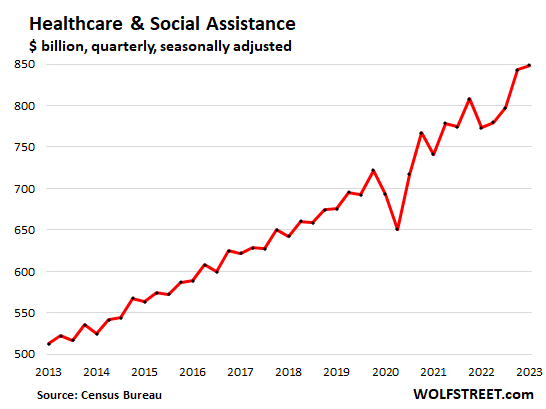

The #2 monster: Healthcare & Social Assistance: +26% since 2019.

Sales jumped by 9.8% year-over-year to $849 billion in Q1, and by 26% from Q1 2019.

This sector has about 21.3 million employees and includes services provided by doctors, dentists, hospitals, clinics, diagnostic labs; nursing and residential care facilities; child care services, etc.

It does not include health insurance, which falls under finance & insurance. And it does not include other healthcare related sectors such as pharmaceutical products, medical equipment and devices, etc.

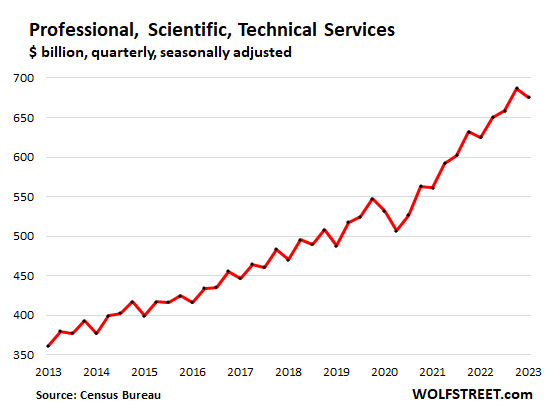

Professional, Scientific, and Technical Services: +38.5% since 2019.

Sales jumped by 8.1% year-over year to $675 billion in Q1, and by 38.5% from Q1 2019.

The sector, with about 10.9 million employees, Includes lawyers; architectural, engineering, and related services; design services; computer systems design; management, scientific, and technical consulting; scientific research and development; accounting, tax preparation, and payroll services; advertising and public relations; polling, commercial photography, etc.

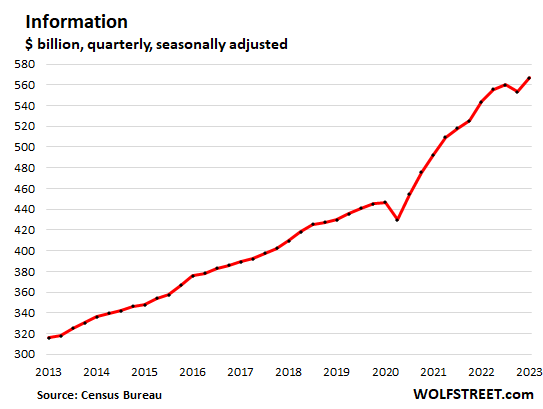

Information: +32% from 2019.

Sales rose by 4.3% year-over-year to $567 billion in Q1, and by 32% from Q1 2019.

The sector has only about 3 million employees. It includes telecommunications services, web search portals, data processing, data transmission, information services, software publishing, motion picture and sound recording, broadcasting including over the Internet, etc.

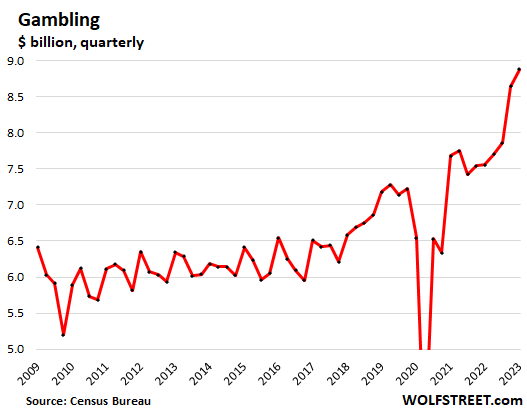

And for your amusement only… gambling.

There is another very vibrant service sector that is now seeing explosive growth: gambling. But it’s still a small sector. Sales piked by 17.5% year-over-year to $8.9 billion in Q1,

This industry group does not include casino hotels – they’re under hotels. But it includes casinos, bingo halls, video gaming terminals, enterprises that provide gambling services, such as lotteries and off-track betting. It seems gambling mania has broken out:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

1) #2 monster : healthcare and social : $850B.

2) Some counties are infested with beyond prime age, 55Y and up. Heart surgeons, dentists, opto… feast on them.

Covid was a nightmare, but dentists and dental surgeons are doing very well.

3) Walmart vision center eye glasses frames cost between $25 and $200. Independent labs cut lenses. Independent opto, part timers, provide prescriptions.

4) Cataract surgeries takes 5/15 min. There are 3 options : laser plus fancy

lens for $5K extra, laser plus driving lenses for $2K extra and basic surgery. Laser surgeries are not covered by insurance.

The O.R can perform 20/30 surgeries/day, 3/4 times a week : $5K est x 25 surgeries x 3 days/week = $400K/week. The diagnostic center can serve 50/70 patients/day at $200/visit, 5days/week : $200 x 50 patients x 5days/week = $50K. The total : $400K$500K per week. This small business employs about 100 full time/ part time workers. The boomers keep them very happy.

5) Many small businesses can hardly survive, but some are doing well, without buybacks, and executive perks.

I can comment on insurance – up biggly

at 15% premium increase

—

on auto side I dropped Progressive after 20 years

saved 25%

like they forgot prime people shop

I’m sure next year Travelers will raise their rates biggly also

then I’ll shop again

My AAA increased it 50%, without any coverage change

My Travelers Home insurance is up by 50%. Have to see how much they are going to bump up my Auto insurance 🙁

funny as Travelers is company that beat Progressive auto by $1k

expect to change companies each year as they play who’s aggressive this year

Where does Real Estate fit???

Use your Trillions of Defense Dollars to Re ignite US state of the art innovation and manufacturing

Imagine

Ai and automation invigorating a new Global manufacturing base

8 Trillions spent on wars of ‘going’ no where since 2001.

Warmongers and MIC are getting rich by the month.

But some how, NO outrage, public discussion or accountability!

Don’t blame the other guy, his/her ideology. Just look in the mirror. you found the enemy!

and net 0 new workers needed

Can’t wait two years to get the necessary building permits in place to build a new factory. Can’t compete with countries that don’t have employee safety and environmental regulations and cheap coal-fired electrical generation. CNC machines don’t care where in the world they are located.

Hasn’t war been a massive catalyst of technological innovation throughout history, which ultimately integrates into civilian ecosystems?

Beyond prime is 55? Speak for yourself, bub

Part of the healthcare inflation is due to the influx of private equity into healthcare and the continued consolidation of health insurers and hospital chains. Private equity groups have aggressively bought up physician practices and have turned many areas into near monopolies. They jack up their fees, yet cut healthcare staffing to a bare minimum to make as much profit as they can.

In addition, there is an endless fight between health insurers consolidating to be able to reimburse health systems/physicians less, and health systems consolidating to have more clout when negotiating with the insurers. This is why we have few independent physician practices anymore – how can you run a practice when the insurer reimburses you $40 to see a patient, yet the corporate hospital chain receives $100 for the same service?

It is an endless spiral of healthcare inflation. It is a shame the government has allowed the corporatization of medicine to occur.

Couldn’t agree with this comment more. But here is why corporatization had occurred under blind eye of gov regulators- it’s a feature not a bug.

Can you say “single payer?”

When you are finally fed up with skyrocketing costs, the government will sweeping and cover the few remaining with employer-sponsored health plans.

Hillary Care 30+ years later

or you do like friend did – died dec 2022

he had beneficiary deed to his paid off house recorded

also had investment account setup to go to beny’s on death

—

had no insurance since he couldn’t work, was living off cc

just turned 62 and was about to receive his 1st SSI payment

needless to say he ended up in hospital for week before he died

$100k medical, $45k cc debt

after he died – the hospital had already written off $85k bill(for 1 week)

had another $20k for ambo, radiologist and few other specialists

each of his beny friends got around $100k for sale of house

plus plenty more for his nearly 60 gun collection, etc.

Physician daughter just quit a practice that had sold out to PE just before she joined. Originally owned by six physicians, who sold only 49%, with assurance their standards would be upheld. But one or more then sold his share to the PE group, putting them in control. Management penny-pinching is making it very difficult to provide proper care, so doctors are leaving one after another, making the workload steadily more intolerable for those who remain.

Fortunately she is brilliant, and just got a research fellowship in her specialty, in which she has rare expertise enabling her to start an independent practice. Not greedy, so will do just fine.

Eventually only the doctors unable to find other, better employment will remain at this practice. But if the PE scum have taken control of nearly all, there’ll be no where to escape to.

Optometrists can send the prescriptions to a lab next to the airport in Shanghai and get the glasses back in a day. Markup is astounding. The refraction is a trivial exercise.

Waiting for monster #5

What are you anticipating?

The first sectors. Why not call their sales growth as inflation.

It’s not that our insurance benefits are increasing or that more people are insured or that doctors are giving more effective advice or that surgeons have to make bigger or deeper cuts in surgeries or that dentists are installing teeth of gold……….

The list is very long. To an average Joe, it all seems like either inflation or shrinkflation (smaller burger and larger fries).

Leo,

You need to get away the simplistic idea of services = “my insurance premium.”

Read the descriptions I provided.

Give it some time, and it’ll be gambling, LOL

Oh… ‘gambling’.

You mean !CONgrease!, am I right?

Wolf it hasn’t been called Gambling for years now.

It’s GAMING..a replacement word that makes the person gaming thinking it’s all innocent and fun just like the good ole days.

Exactly what the casino wants one to think when they are taking your money 90% of the time…

Let’s go gaming! Fun? WOW!

My 100-year-old m-i-l, and wife occasionally, and my 82-year-old b-i-l regularly, patronize a popular local casino who advertise regularly on local tv (not a ‘gaming’ fan, myself, but tag along as driver/health aide). Am always asking where all of the pretty people in the ads are whenever we attend…

may we all find a better day.

@91B20,

“Am always asking where all of the pretty people in the ads are whenever we attend…”

Lol!!!

Where does Real Estate fit???

The sudden burst in gambling seems to correspond with the switch to QT and the failure of unicorn IPOs and bitcoin exchanges.

I wonder if the bitcoin and meme-stock addicts had to revert to ordinary non-innovative betting?

Read a book one time on on risk. If I remember correctly gambling is the ultimate boom / bust industry. People get feeling flush with money and new casinos get built at the end of the cycle. After the bust people don’t have money to throw away and a lot of casinos have to shutter.

My state has shifted policy during my life time from outlawing “sin” activities to encouraging them to collect revenue. The list includes casinos, a state lottery, sports betting, moonshine taste bars, tattoo parlors, drinking as a pedestrian, and marijuana consumption.

Old School

Chicago to open temporary casino…

in the former Medinah Temple…

to your point.

“Read a book one time on on risk. If I remember correctly gambling is the ultimate boom / bust industry. People get feeling flush with money and new casinos get built at the end of the cycle. ”

Robert Shiller’s book Narrative Economics sort of talks about this… If I remember correctly, he posits a “gradual process of fear extinction” that occurs after a crisis (like a market crash or losing your shirt at the blackjack table) that takes about 7 years. Which helps explain why speculative bubbles suck in the same people who *should’ve* learned their lesson last time.

I just re-listened to Paul Harvey’s broadcast entitled “If I Were the Devil” where he decries the historic State shift from regulator of morality, to the new State role of encouraging “immorality”.

He mentions State gambling as particularly hypocritical. I’m not trying to make a case that gambling is immoral, but State promotion of gambling sure is, IMHO.

Sort of like enforcing laws against counterfeiting while increasing the money supply…

John H,,

There’s a 501 (c) (3) organization named “Stop Predatory Gambling”. It’s main purpose is lobbying against government encouragement of gambling as you described. Les Bernal is head of the org and you can find their website easily enough if desired.

look at states legalizing sports book to explain gambling’s burst

So you want to gamble? There’s always 0DE options ;)

People are probably revengambling after being locked up for too long.

I believe stock market is going up because people are getting money out of banks and or trying to front run fedcoin,unicorn

It’s old people going to casinos in retirement. There’s more retirees as the boomers continue to retire. They are bored, they have money, there are a LOT of casinos around RV-frequented vacation spots, and casinos tend to be RV-friendly, too.

I find that sad…work your entire life to sit on your ass pulling a slot machine to give away your savings.

It’s their money though and right to do so.

Long Depends.

Danno finds it sad that geezers like slot machines. +1000 upvotes!!

Excellent comment!

I’m a geezer and I find that very sad too.

I get my enjoyment from my family; grandchildren are a gift from God, my Church activities and my friends.

Reading Books and solving puzzles too. Cooking with the wife.

Life itself is enough of a gamble. I don’t need to feed the one armed bandits for that “thrill”.

It’s an addiction about like any other addiction: liquor lights and larceny, all conspiring to tickle the glands. Pull that lever hard enough and maybe there’s a tiny secretion of just enough of the good stuff to relieve the agony of being.

YEP. Guilty. Old, retired and spending $$$$. Not gambling, but paid 8 bucks for a croissant while in Las Vegas.

Some casinos send a bus to retirement homes to pickup the ones that can’t drive.

BINGO. Life is good…. Spend it how you please.

Apple,

Happens in New Jersey all the time.

Have a great friend that does slots for the last 10 years even moved to Reno from Dallas to reduce commute and his wife . Both 70 and they gamble max 400 a day loss each and if they win more than 100 that day it’s a hard quit . They have an annual loss budget of 48k . This year 2023 they are up 2000 for x first time ever. Hobby free meals and shows

Read the NYT article about the Chinese New Yorkers who spend everyday at the casino. It’s entertaining.

They all pack their lunches and hide them in a ditch. Lol

Wow finance and insurance hardly blipped down in 2020.

Just the kind of economic activity the country needs to maintain the 1 percent growing their stash.

Would be interesting to see a chart for just defense industry activity. I would assume in about a year the chart would show huge growth what with the replacement of tanks, Bradley fighting vehicles, rockets, artillery shells, etc that we must send to the ukes to kill the nasty russkies for us.

Which of these sectors is at risk for significant unemployment during the next recession? I have no idea:

Finance and Insurance

Healthcare Services

Professional, Scientific, and Technical Services

Information

Employment in goods and construction sector is about 6 times more volatile in a recession than service employment. If I remember correctly residential construction (or employment) went from over 8% to under 2% of total pie.

That’s because we no longer make anything. Finance is supposed to be a means of financing real production. Finance isn’t supposed to BE production.

That’s a huge part of the problems we have with our economy. Finance and the stock market have become the de facto economy.

Like I always said – bankers and financiers are like garbage collectors. Service industry workers. One facilitating production of goods and one facilitating disposal of goods. Why are they not paid the same?

“That’s because we no longer make anything.”

That nonsense needs to stop.

1. The US is the largest oil and gas producer in the word.

2. The US is the second largest manufacturer by production in the world, behind only China. US manufacturing production is larger than the next three COMBINED (Japan, Germany, and India). Manufacturing in the US is full of high-tech equipment and services (automation) and highly skilled jobs. What is not made in the US anymore are low-skill low-value products (such as T-shirts).

3. Construction is a huge sector in the US.

4. The US is one of the biggest agricultural products producers in the world, from commodity crops to high-end wines, and especially the best craft beers in the world. Go chill out with a good local beer, dude.

Okay, you’re right that my comment was a big exaggeration, but the fact remains that we have outsourced a lot of what would be good jobs, especially from middle America, to the point where these people are dejected and feel hopeless.

And way too much priority is given to Wall Street such that they have an outsized influence on our policies, and not in a good way.

As for the beer, I have a six pack of juicy haze VooDoo Ranger in my fridge, just waiting until a more appropriate time to start drinking lol.

Companies have turned a lot of formerly good jobs into minimum wage no benefits jobs.

Einhal,

For example , with $60,000 -$75,000 engineering salary will you pay $250 for a regular pair of socks, made in US?

Thats why they had to outsource some cheap products, otherwise you could not even afford to live here. But I think you still can afford a can of cold beer, chill out, its weekend.

*Beer, 😂🍺

And don’t forget that the US is the leader in Bitcoin mining with 35% of the hash rate. Kazakhstan takes second place with 18%.

:)

…the ‘beer bear polka’?..

may we all find a better day.

Educated but Poor Millennial – you need to spend some time on the “American Giant” website to get a more accurate picture what well-made/American-made socks cost.

smashsc,

You are loosing the big picture, no need to explain it more than Wolf have done it here.

Well said ! Go oil and gas

You side stepped the issue:

The absolute monster: Finance & Insurance: +33% since 2019

Why?

We don’t make much that we can afford to own anymore without a payment plan and we don’t make things that last long either.

This is a reflection of dismal productivity, design and the constraints of asset bubbles. It takes 10 people to carry a 2×4 these days, by the time we pay for all the swindlers we need a payment plan.

In 10 years a new ¾ ton loaded pickup will cost $200K and the insurance will be much higher too. I expect financing will be amortized over 10-12 years with mandatory service contracts and a wireless surveillance package.

Manufacturing as a percentage of GDP in the US after you remove all the imported inputs is nothing to brag about, that’s for sure.

In 10 years we might be paying a subscription fee ,where u summons a car it takes u to where u need to go doctor,dentist,grocery store WHO knows

Ahem — we manufacture weapons, image and fear and remain peerless in all three.

We now have over 1 million certified financial planners in the country. You see their ads all over the TV. What are they doing for God and Country other than pocketing money from hard working Americans. I’ve got the answer. NOTHING. I wouldn’t hire one of these jackasses if they agreed to work for free.

I think long term capital appreciation is about 9% per annum over long term. Financial industry skims a full percentage year after year.

@old school,

“I think long term capital appreciation is about 9% per annum over long term. ”

Can you explain this?

I probably should have used the term annualized return of stock market which has a trend line of 6% -7% above inflation over about a hundred years. Financial friction from trading back and forth and all kind of management fees suck out about 1% a year I believe.

Fidelity says their inactive accounts have the highest returns.

@old school,

“I probably should have used the term annualized return of stock market which has a trend line of 6% -7% above inflation over about a hundred years.”

Okay, I get what you are saying. 100 years is a long time though. There are big chunks of time where the trend line is negative. For example, 1929 – 1949, or 1966 -1982.

Manufacturing as a percentage of GDP for the US has declined significantly. Hard to argue against that. Sure, we have grown in production of oil and still have a manufacturing presence. But we are not the mfg powerhouse we once were, that spot has been taken over by China and is seemingly working out greatly to their benefit. They are on track to surpass the US economically, in many regards. The finance/insurance sector took over manufacturing’s presence the US it seems like, a while ago, and you show the continued growth in your charts. Their value to society is often somewhat questionable, as most readers here can probably attest. I’m surprised anyone would see this shift as a good thing. I think the US gave up a lot when we steadily reduced our mfg presence and replaced it with the finance/banking/insurance industry. I would argue that may have a lot to do with the great wealth divide we are experiencing. US manufacturing’s heydays at least seemed to support a robust middle class.

Life coaches popping up everywhere. What do they do?

Coaching the dead doesn’t pay well.

Command the confused. Flatter the insecure. Probably the new priesthood

Also, don’t forget all of the “analysts” whose full time job is to watch algorithmic movements in the stock market. We waste so much productivity and brain power on unproductive things.

But Swampy…

When things are going Up they take the credit and are your best pal.

When things are going South they are no where to be seen.

And think of the money they are missing by not “looking out for your best interests. Fiducairy duty my ass. Most of them I find.

The real problem is that too many Americans just do not know or understand how to invest and spend money rationally. I was lucky, when I was 11 years old my older brother made read the WSJ and taught so very much about money.

Ervin – ’cause if they did, it might stop the music?

may we all find a better day.

Most of these financial advisors won’t talk to you unless you have at least $500,000 in liquid assets to manage. They don’t say that in their ads. When you don’t qualify they pass your name over to some boiler room commission based operation.

Most of the adverts I’ve seen indicate that $500K is the minimum entry point. Wellsfartgoadvisers, Fisher Investments, to name a few.

It is estimated that half of all surgeries in the US are unnecessary. Immense amounts of other care are essentially useless or at best of minimal benefit. The only way to determine what really is worth doing is to have those trained to do that do it….ie. doctors not insurance executives, lawyers or politicians. And the only way to get an honest opinion from doctors would be to eliminate fee for service and put all providers on salary with no production bonuses and have tort reform a no fault insurance system for bad medical outcomes which is something they have in German, for example. We would have to get the legal profession out of medicine. One strategy would be to adopt the British NHS system since they have had 80 years to make all the mistakes and simply fund it properly…..which is the recent problem because private health insurers and hospitals have invaded Britain and are trying to choke the NHS. And, of course, if health care was like police or fire protection the pharma industry could be tamed. Any Medicare for all or Obamacare plan that does not attack perverse incentives is bound to fail as we see today. As Wolf Street points out the largest sectors of the economy are essentially unproductive or negatively productive. Our economy is a slow moving disaster. Maybe we could outsource our politicians to China just like we did our industrial base. China has illustrated with 22 nuclear reactors under construction and 44 more getting ready as well as its high speed rail that other economic and political systems might lead to better outcomes long term for the citizenry. Without campaign finance reform I would advise kids to go into government, finance, insurance, waiting tables or war. Forget the rest.

Felix—

Using Michael Engel’s example above , let’s start with the cash cow— cataract surgeries. In England, salaried ophthalmologists do what every government employee does—not work very hard. They won’t perform cataract surgery on patients until they are near blind, and are practically begging them to do something. Then when the ophthalmologist finally says ok, the patient often has to wait 8 months until there is an opening.

Contrast that to the U.S, where the surgery centers are churning to and making the big bucks. Yes, the financial incentive may be there to do the surgery earlier than absolutely necessary in some cases. But the patient who starts to complain about their blurred vision can often get their cataract surgery within weeks of their symptoms starting.

Not a perfect system for sure, but I’d still take our system over England’s any day.

As long as you have insurance in the US that is, otherwise you’re paying $7,000 per eye.

Alas, true. A two-tiered system here

Up to 2/3rd of tests, imaging and surgeries are NOT medically indicated in the US per studies from Rand Corp and Fraser institute (Canada)

Yeh. America has the best healthcare in the World, for only those who can afford. Health Care expenditure close 19% of GDP, highest among OECD Countries but over all, no significant difference in morbidity and mortality. Decline in Maternal-Infant survive rate. Life expectancy has come down, in post-covid period.

Agree Sunny US health outcomes are very poor for the $ spent.

US is the15th worst globally on Coronavirus website for deaths/million population vs ROW 109 average and 231 total jurisdictions:

https://www.worldometers.info/coronavirus/

The issue with the US healthcare system isn’t with the physician providing the service making a living. They are professionals and should be paid well. The issue is that we have middlemen (health insurers, pharmacy benefit managers, private equity groups) that literally exist to add extra layers and siphon off money from the healthcare system.

Canada also has a single payer healthcare system, yet the delivery of healthcare is mostly private. Australia has a two-tier healthcare system where most receive public healthcare, yet there is an option to purchase private insurance if desired. Faster care is available for extra $$ if desired, yet the public health system is robust and provides good care.

Yea….none of the players in the healthcare system play a numbers game with medicare. And COVID politics had no role in the shortage of healthcare professionals E2E or COVID deaths.

This doesn’t work.

Surgeons near me are all salary. They never do their job. They sit on their hands and fight a ton just to prevent themselves going to the OR.

You have to incentivize talented people with tons of cash and results based bonuses. Only thing that works in medicine.

Huh. And I thought everything except #2 (Healthcare) was, these days, in reality just another type of gambling. Well, now that I think about things, I’m probably risking my health in multiple ways just driving to, shopping in and eating from the grocery store down the street. So it’s all probably a type of gambling when you get right down to it. And, yes, I am amused. With our leaders arguing about the dangers of gas stoves rather than doing something about the $31T in debt my generation is leaving as our parting gift it’s hard not to be.

Wolf where’s manufacturing?

Mike- It’s relegated to obscurity in North America.

No, manufacturing is a huge and thriving sector in the US, and it’s full of high-tech equipment and services (automation) and highly skilled jobs. Low-skilled low-value manufacturing (such as T-shirts) is gone though.

The US is the second largest manufacturer by production in the world, behind only China, and its production is larger than the next three COMBINED (Japan, Germany, and India).

The problem is that the US offshored a lot of manufacturing and now is no longer #1, which it should be.

Manufacturing is a totally different sector. In a three part economy, the primary sector is made up of farming, mining and agricultural businesses. The secondary sector comprises manufacturing and businesses that facilitate the production of physical goods from the raw material provided by the primary sector. The tertiary sector is the services sector, which consists of everything other than the first two.

Mike,

Manufacturing is not a service (so we discuss manufacturing in other places). But it does use a lot of services that are listed here, such as engineering, design, software, etc. Construction is not a service either, but it does use a lot of services, such as architecture, engineering, design, etc.

American’s needs for healthcare, finance and gambling can’t have gone up by 26, 33, or more percent in a few years. We definitely haven’t become 38.5% more scientific. Our information might be 32% greater in volume, but it’s at least 50% less accurate than it was before. Long story short, this is all inflation.

Jerome Powel says we need to do more. Well, go on Jay. Don’t just do something, sit there!

Some of it is inflation. But a lot of it is additional services in engineering, design, etc…. that’s where a lot of hiring took place. Then there are subscriptions to everything that consumers and businesses and governments are now paying for that they didn’t have before.

A lot of these services are used by businesses and governments. Not just households. There are a gazillion services. I listed some of them.

The services sectors are huge and complex, and you cannot use a simple sentence to describe where the growth comes from.

Gambling? That should include venturing on Western stock markets for individuals directly or via a middle man these days for anyone with less than 100 million dollars plus being awake for less than 24/7/365.

The House always wins.

I know why the insurance sector is growing. You too can find out by reading the Exclusions section of any policy you bought.

The main function of homeowners insurance companies is to collect premiums and deny claims. I found this out over the years after having them botch 4 separate claims none of which I was at fault. I was loyal up to a point but after the last one (over 20K) was screwed up I had enough and dumped them for another company which will probably be just as bad.

Swamp,

You might improve your odds by using a Mutual Insurance Company, i.e., one that is owned by its policy holders. Otherwise you’re helping people like Warren Buffet enhance their fortune.

Notice I said you might improve your odds, there is no guarantee.

I had a homeowners damage claim that was denied by the insurance company – $50K or so. I sent a registered letter containing my original claim, all related receipts, and a copy of the companies response to the State Insurance Commissioner with copies to the insurance company and a law firm.

Got a check for every penny.

At a condo had bathroom damage from the above unit toilet overflow. I had an environmental company come in and rip everything out and disinfect. The upstairs owner would not even talk to me when I tried to get his insurance to pay. Had a go-around about gray water and black water with the stupid condo management. But my insurance company paid everything except for the deductible. About 6 months later I got another check for the deductible. I figure my insurance company got paid by either his insurance company or him. So it worked out.

Don’t take any crap. I have also lost out on liability insurance coverage in the exclusion fine print when being sued, but defended by being settlement proof.

fwiw, four years ago I suffered a house fire that required major reconstruction. The insurance company (not a mutual) covered nearly all the reasonable cost of restoration and lost contents, plus put us in a decent furnished rental house for a year. They recommended a particular reconstruction company, which did a generally good job.

Then, once all the work was complete, the insurance company said they wouldn’t be renewing my policy.

I’d be interested to see the breakout between price vs volume for these numbers (and almost all sales graphs presented lately 🚀🚀). Some of the increases look to just be in line with inflation YoY. I’m not buying more insurance, but my premiums are +10% vs PY.

Volume of engineering? Volume of design? Volume of innovation? Volume of software?

You need to get away the simplistic idea of services = “my insurance premium.”

Read the descriptions I provided.

Thanks Wolf. I did read the descriptions. Volume meaning # of contracts or # of software sales for example. I simplified it using PxV because I’m a CPA by trade… but I still think the question stands.

Audit fees, which are a professional service, went up 10-15% YoY for all the companies I cover. Companies in different geographies with different auditors with different industries. Same exact service as prior year. So same # of contracts with higher prices. Sales are up 8% in this category per the chart. My point is, is there growth in these industries because we are demanding these services more (more businesses to be audited?) or just because they’re charging more? It’s a different story of what’s happening. I don’t think that data is readily available as it is going to be company specific, but isnt it important? I covered a lot of businesses that have strong top line growth in the 15-20% range and shrinking profits YoY. I’m more concerned with profit as I think about the health of the economy, but I’m not an economist.🤷🏻♀️

We went from a nation of farmers, cowboys, machinists, steelworkers and and miners to one of blackjack dealers ( I include the financial sector in this term), pill pushers, ambulance chasers and digital librarians. No wonder the Saudi’s are not afraid of us any more.

This article was about services. So industrial production and other sectors are not included, obviously.

But…

1. The US is the largest oil and gas producer in the word, larger than Saudi Arabia.

2. The US is the second largest manufacturer by production in the world, behind only China. US manufacturing production is larger than the next three COMBINED (Japan, Germany, and India). Manufacturing in the US is full of high-tech equipment and services (automation) and highly skilled jobs. What is not made in the US anymore are low-skill low-value products (such as T-shirts).

3. Construction is a huge sector in the US.

4. The US is one of the biggest agricultural products producers in the world, from commodity crops to high-end wines, and especially the best craft beers in the world.

“The US is the largest oil and gas producer in the word, larger than Saudi Arabia.”

I’ve said this before…that just can’t be possible. Joe Biden shut down the fossil fuel industry. Hannity said so.

LOL

@Wolf,

“What is not made in the US anymore are low-skill low-value products (such as T-shirts).”

As the garment industry is automating, I wouldn’t be surprised if some of those jobs eventually find there way back to the US.

*Edit

As the garment industry is automating, I wouldn’t be surprised if some of that industry comes back to the US.

McQueen’s Ghost – good edit/important distinction…

may we all find a better day.

So why do I only buy Toyota and Lexus cars?

They’re likely manufactured in the US of A.

ALL major global automakers have plants in the US.

Wolf – 4Runners are made in Japan. Some Lexus are made in Japan and some in Canada. Look on the car door to see where it was made. 20 years on the 4Runner now. 16 on the Lexus.

Full disclosure: First car Chevrolet Vega. Second car Ford Pinto. All Japanese cars since.

Easier to measure bets that go to DraftKings than bets that go to Fat Tony.

Ms Swamp was quoted $360 for a routine eye exam. We need to put that in Wolf’s health care inflation graph. My Dentist told me the only way to combat inflation in health care costs was “Don’t get sick”.

Doctor wages are all a scam.

Plenty of smart people can’t get into medical/dental school.

A friend had 4.0 gpa and she couldn’t get in to dental school.

Limit supply = huge wages

American Medical Association (AMA) spends 20 mil a year lobbying to make sure doctors get paid $$$

Um, yeah, sure. Schools are intentionally limiting their tuition revenue to ensure dentists don’t get their income diluted. Please.

There’s a conspiracy theory for everything.

Gattopardo,

I think Bill Clinton did something exactly like that years ago for medical schools to placate the AMA. Tuition increased, the number of doctors did not.

IIRC, the issue isn’t so much the medical schools… it’s the availability of “residency” positions available that limits the number of doctors.

Or so I have read…..

Medical school spots are limited as the government funds and limits the number of residency training spots. Residency is where physicians complete their specialty training after finishing medical school. The American Medical Association (AMA) now actually lobby’s for an increase in residency spots.

Medical training is also very rigorous involving 4 years of undergraduate education, 4 years of medical school, 3-7 years of residency (vigorous training often with 80 hour work weeks), sometimes followed by a fellowship. These professionals often complete their training with 2-300k+ of student loan debt at high interest rates.

Finally, physician salaries have actually decreased when adjusted for inflation over the last 20 years due to Medicare reimbursement cuts. The majority of a health bill is going to the hospital/facility fee/private equity group, etc; not to the physician.

Most of my doctors have been forced by liability insurance, records maintenance, government and insurance paperwork to join hospital groups. Their work is now controlled and I don’t think they make as much as they used to. Some specialists have stayed independent (like my ENT doctor) and are making big money.

Health care and hospitals have been screwed up by the government as much as universities.

I understand now that equity is a big factor in entry to medical schools. So we shall see.

A 4.0 is nothing. Try being the valedictorian, having an almost photogenic memory and being stellar at any science you put your mind to.

Not all educated people are created equal. Yeah it’s not fair, but the only reason people cry that “it’s not fair” is to gain an advantage on the people who easily out race them in life.

In any local market, dentistry is price-fixed. It’s an industry begging for Federal regulation much like that requiring pricing on car windows at the dealer and price lists at your request at funeral homes.

Right – because teeth are just like cars and the dead.

Actually there are lists of dental fee schedules that get radically manipulated by insurance companies just like in medicine. The fee schedule list would require wall paper, not list on a window because living people are complicated.

If you want cheap dental care, try the unregulated hacks who treat people out of their garage in any major city and see how that goes for you. Dentisty is highly regulated, takes 8 plus years of post high school, lots of student debt and personal dedication and hard work. Providers are NOT the problem – take a look at the profits made by Delta dental insurance companies and what their execs make, which is a lot more than any dentist with zero risk of getting sued. Or look at the private equity folks who own dental offices and make big money on their portfolio of offices where the dentist gets paid a salary and has a production target to keep a job.

Methinks you protesteth too much.

I’ll see your $360 eye exam and raise you a $720 ear exam. $240 over Medicare plus AARP F gap.

Where is real estate sales?

It’s a much smaller category that includes real estate rental and leasing ($222 billion in Q1).

It’s not anywhere near that top four. There are lots of other small services sectors, such as Arts and Entertainment.

Wolf, where does the education industry (schools public and private at all levels K-grad school) fit in?

I mean, they gamble with our very lives Every • Damn • Day they’re in office ajudicatin.. legislatin.. stealin..

Healthcare is going through a lot of turmoil from what I hear. Hospitals are losing money hand over fist. Labor costs have skyrocketed. Something has to give.

My local hospital in Canada that serves a population of 40,000 recently closed it’s emergency room daily from 11pm to 7am.

The nearest is a 25 minute drive.

Many seniors are not feeling too comfortable sleeping these nights knowing if a heart attack takes place, they better hope the first responders know what they are doing and roads are clear….

Luckily as a dual citizen I can access a US hospital within 15 minutes if the bridge is clear and immigration is understanding..

Brave new world.

Been hearing that for decades as an excuse to pay HCPs the bare minimum. When the upper brass stop awarding themselves big money bonuses, and they stop squandering away $ on uselessness like hundreds of flat screen tvs that only play a screen saver to tell visitors where the cafeteria is, I’ll pour one out for my homies in the C Suite. Meanwhile, techs clean bedpans and do postmortum care on patients they cared for regularly for less than a sandwich maker at Subway earns, while the three martini lunches flow overhead. Well educated is mandatory, well paid is relative. Not many plumbers or finance bros I know carry 20 years of personal and professional liability for each person they encounter under the extreme staffing, documentation and stress conditions HCPs work under, yet they make more.

Healthcare’s biggest enemy is itself. Good on Munger for coming out and saying as much.

Lili – ‘…20 years of personal and professional liability…’ sounds a good suggestion for all kinds of upper (especially financial) management…

may we all find a better day.

The medical practice that I used when I lived in California went to a concierge business plan as a result of increased costs associated with the government / insurance reporting requirements. It was originally a two doctor practice, but one retired. The younger doctor continued on. The original practice (two doc) had a nurse, a receptionist, and an office manager. As time went on, the office staff increased to 4 to deal with the reporting requirements, coding, and payment processing. Those costs had to go somewhere. Keep in mind that those 4 people didn’t touch a patient, but were 66% of the staff. He had to switch to a concierge practice because – as in his words – he would have to do assembly line medicine (5 minutes per) and give each patient the bum’s rush or go to work for one of the companies/hospital chains.

My comment above exactly.

The index charts are so much more valuable than the “rate of change” charts, for these charts show the entire picture and the history….where we were and where we are not. “Rate of change” charts omit the cumulative aspect….IMO.

Finance and insurance belong in the gambling category. The medical industry is driven by insurance companies and doctors are shady and shoddy characters, at best. Dealing with them is a high risk activity. So most of healthcare also belongs in the gambling category.

I notice the biggest service sector, government workers, is not discussed. While it may seem like they do not sell anything, and in many cases actually provide no real services, they do have a huge base of captive customers who pay massive amounts. Tax-payers are forced to buy their “services” by law. I suppose government services would be considered a non-discretionary purchase while the other sectors services may be considered discretionary purchases.

Yeah. Why is government not included for size and scope comparison?

37% of GDP. Government doesn’t manufacture anything so it must be a service. LOL!

Looks like lots and lots of $$$$ out there to me. Stocks are on the move. Banking on higher interest rates? I sure think so. Bet they revise that dot plot thingy again and again. Lets go higher………

Non-farm productivity has been sliding. Wouldn’t non-farm productivity be contributing to services inflation?

BLS: “In 2022, labor productivity in the private nonfarm sector declined in 37 states and the District of Columbia.”

With NVDA trading at 40+/Sales I think direct to consumer investing services should be moved into the gambling category.

My father used to say that the stock market should be regulated by the Nevada Gaming Commission.

Wolf, how were you able to separate “gambling” from “financial”

:)

“The Finance and Insurance sector has about 6.7 million employees.”??!!

I can’t but wonder how many of those gentry will be replaced by AI.

They cannot dig, to beg they are ashamed; theirs is the privilege to starve if they learn no other skills.

There is no labor shortage in blue collar, only a wage shortage.

That is true. Our society has spent the last 40 years denigrating the work of skilled tradespeople (and encouraging people of average intelligence to go to college to get worthless degrees in Women’s Studies or sociology) such that people aren’t willing to pay living wages to many of these people.

Now they’re surprised that those people no longer want to play the game.

I have read that the reason that a college education is required for even somewhat menial jobs is that it is no longer possible for companies to administer certain formal tests to candidates due to the opinion that such tests are “discriminatory”. Thus, the college degree replaced them as it shows the ability of the individual to at least show up, take tests, and fulfill at least the minimum requirements for the degree to be “earned”. I started using that standard years ago (like the 90’s) when I worked for Gigunda Motors.

This is further evidenced by the recent elimination/reduced reliance upon SAT’s, LSAT’s, MCAT’s, etc., for admission to American universities as well as medical and law schools.

Trades are important. However, they are also physically taxing and bodies wear out.

This is largely true. College degrees now are used as proxies for IQ tests, which is not approved of in the modern zeitgeist.

QQQ 1M monster #5 : AAPL to $3T.

Oct 2011 to Aug 2015 lows / parallel from Nov 2014 high.

QQQ losing it’s grip, Toure de Suisse ?

Why are you always spewing this drivel here? No one reads it.

Go on reddit WallStreetBets or StockTwits and do this crap.

May be gibberish to you but NOT to me and many others, who can understand the lingo of ME. More specific and direct. Thanks ME.

Thank you sunny129 for setting that record straight to the newcomer.

And it has been thus for a while.

Thanks ME.

Why exactly are you or anyone else encouraging a poster to comment in code? What’s the purpose? Why not write in coherent English like everyone else?

Finance: 1570 billion to 6.7 million workers = $234,000

Health: 849 billion to 21.3 million workers = $40,000

Professional: 675 billion to 10.9 million workers = $62,000

Information: 567 billion to 3 million workers = $189,000

Finance: waiting on the bubbles to pop

Health: waiting on single payer

Professional & Info: waiting on AI to take jobs

most of these four groups have non blue collar labor workers therefore most of these jobs can be better done by uploading the entire data bases and using AI to administer it including doctors and some nurses. This is already happening but inflation will expedite it as equilibrium always finds its path. When the Fed closes paths equilibrium just finds more painful and unexpected paths, as it must.

Sunny129, thanks :

NDX 1M : Oct 2011 to Feb 2016 // parallel from Nov 2014.

A cyclist was killed in Toure de Suisse when he lost his grip.

Rest In Peace Gino Mäder. A twenty-six year old rider who’d competed on the road and on velodromes. From Flawil, Switzerland.

He’s in a better place. RIP

I have two questions:

1. Are health expenditures double-counted once when counted as insurance revenue and once as healthcare expenditure (minus overhead+profit of course). In general, maybe a lot of other insurance is also double-counted as insurance revenue and house/car/etc replacement expenditures?

2. When the graphs say quarterly does it mean quarterly-but-annualized? (to a full year value). E.g. 1.6T for finance+insurance seems like a lot if it is really 1.6T*4 for the full year. Is it 1.6T*4 ??

1. This article isn’t about GDP or about consumer spending but about sales of services by companies, to all their customers.

But GDP calculations track consumption and investment. So when a service is consumed, it is figured into GDP. When a service is bought to be resold in another package of services, it figures into GDP when the new package of services is finally consumed. But again this wasn’t about GDP or consumer spending — I cover those separately.

2. These are quarterly sales, not annualized. To get a rough idea of annual sales, add the last four quarters together. The last four quarters of Finance and Insurance sales = $5.8 trillion. But remember, this includes health insurance. These are sales by companies, grouped by industry classification (NAICS codes). But when we discuss the costs of medical care overall in the US, we include health insurance. CPI also uses a medical care grouping that includes insurance plus all kinds of non-services items, such as pharma products, in addition to the services listed here.

Thanks.