Bank of Japan clings to negative interest rate policy and yield curve control as inflation spreads across the economy.

By Wolf Richter for WOLF STREET.

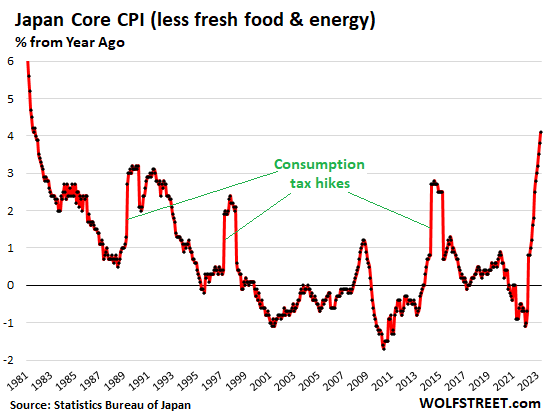

As a clear sign that underlying inflation has spread across the economy, Japan’s core Consumer Price Index – all items less fresh food and energy – spiked to a new 42-year high of 4.1% in April compared to a year ago, blasting past all the consumption tax hikes that had previously powered brief spikes in the CPI.

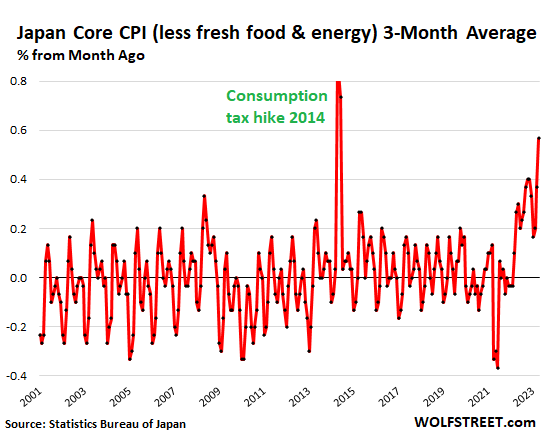

This newly re-energized spike of annual the core CPI was driven by month-to-month spikes of 0.7% in April (8.7% annualized), of 0.6% in March, and of 0.4% in February, according to data from Japan’s Statistics Bureau today. The chart shows the three-month moving average of the month-to-month changes, which irons out some of the variability:

Energy prices have been plunging for months, as everywhere, and in April were down 4.4% from a year ago, having worked off the entire price spike since February 2022, and about one-third of the spike since January 2021.

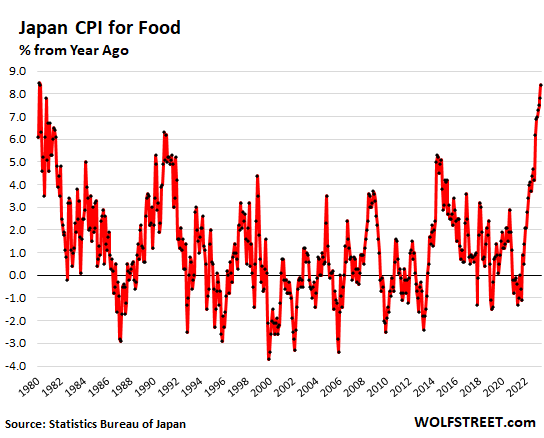

But food prices spiked by 8.4% from a year ago, the worst inflation rate since 1980. On a month-to-month basis, the CPI for food spiked by 1.1% in April from March (annualized 14%), after 0.4% in March, 0.4% in February, and 1.4% in January.

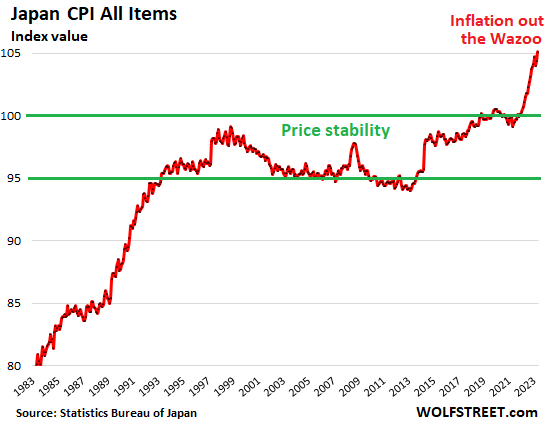

All-items inflation re-accelerated to 0.6% for the month, matching the jump in October last year, which had been the worst in years. But this time, the CPI jumped 0.6% month-to-month despite the drop in energy prices, as inflation has now spread deeply into the economy. On a year-over-year basis, the overall CPI re-accelerated to 3.5%. Inflation blew through the BOJ’s inflation target in April 2022.

Major categories of inflation, year-over-year in April:

- Food: +8.4%, worst since 1980. Fresh food: +5.3%. Food less fresh food: +9.0%.

- Meals outside the home: +6.6%.

- Housing less imputed rent: +4.3%

- Repairs and maintenance: +7.6%

- Energy (gasoline, electricity, piped gas, propane, kerosene): -4.4%

- Household durable goods: +9.8%

- Communication services: +7.8%

- Clothing and footwear: +3.8%

- Services related to clothing: 5.2%.

Governments hold down inflation where they control prices.

- Healthcare inflation: In Japan’s system of universal healthcare, the government largely decides what consumers have to pay:

- Medical care: +1.7%

- Medicines: +1.6%

- Medical supplies and appliances: +5.7%

- Medical services: +0.4%

- Public transportation: +2.4%

- Education: +1.3%

This inflation reversal was so bad that…

The new boss of the Bank of Japan, Kazuo Ueda, came out swinging, in favor of letting inflation rip, thereby letting inflation take care of Japan’s huge government debt burden, and the Japanese people are just going to have to eat it, so to speak.

His comments were full of hypocritical central-banker-speak, perhaps purposefully deceptive to prevent the bond market from triggering a massive bond-selloff to front-run any changes to the BOJ’s “yield curve control.” Under its current yield curve control, the BOJ keeps the 10-year Japanese government bond yield repressed below 0.5% by threatening to buy unlimited amounts of long-dated bonds.

The next step of monetary tightening would be to raise the yield-curve target rate again. But that would have to come as a surprise, or else the bond market would massively attack those yields in advance with a big sell-off.

The BOJ already sprang that kind of surprise on the market in December 2022 when it raised the cap of its yield peg on the 10-year yield from 0.25% to 0.5%. But it left its short-term policy rate unchanged in the negative, at -0.1%.

So today, Ueda stuck to the surprise-strategy when he said in Tokyo: “The cost of impeding the nascent developments toward achieving the 2% price stability target, which are finally in sight, by making hasty policy changes would likely be extremely high.”

By the phrase, “nascent developments,” he means inflation that is beginning to rage across the economy. Everyone knows that letting this inflation rip is how Japan will resolve its government debt burden. Debt burdens by all governments that control their own currencies are ultimately resolved by raging inflation.

“It is appropriate to take time to decide on adjustments to monetary easing toward a future exit,” he said.

“The bank will carefully support these nascent developments to mature and aim to achieve the price stability target of 2% in a sustainable and stable manner, accompanied by wage increases,” he said.

By the phrase, “achieve the price stability target of 2% in a sustainable and stable manner,” he means letting inflation rip well above 2% but not let it get completely out of control. That’s what it looks like to me. And that may be the least-worst option Japan now has, after decades of overspending and money-printing.

Once upon a time, there was true price stability…

In the two decades until 2021, the all-items CPI remained in the same narrow range: the now bygone era when mild inflation and mild deflation alternated to produce true price stability. As this chart of the overall CPI as index value (not percentage change) shows, this era has now been superseded by US-style…

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Thanks for the report.

I don’t think Japan’s CB would agree with your assessment :-).

OTOH: Powell made a statement that rates don’t need to be higher to tame inflation.

People in power seem not to agree that inflation is coming up again.

Didn’t burns try not raising rates ,how did that work out ,inflation is a hidden tax for uncle

Nasdaq is 23% higher in last 5 months, wallstreet is saying that inflation has been defeated. but today Powell again says “Bank stress should prevent further hikes”. Why only this crook can see bank stress, and not the rest of the markets.

On paper Fed is tightening, However the real rates remain negative, inflation remains high, the 1% are having a blast while 99% are getting screwed.

Nasdaq is down 22% from Nov 2021.

Wolf, if you analyze the last quaterly results of biggest Nasdaq companies, you will see that the Revenue increase YoY when corrected for inflation was between -3% and +3%, and the YoY EPS decreased despite burning cash on stock buybacks. These stocks have P/E ratio of 25 to 35 like unicorns, but their results point to P/E of 15 like average companies. So why the 23% rally, if not for excess liquidity?

When reading about Japan’s $200bb stimulus late last year and continuing negative rates, I shook my head. Now seeing their stock market have massive gains in that time period I can only think of Argentina. Look at their inflation and their stock market. DAX and FTSE 100 both hitting 52 week highs recently just like Nikkei 225 and they are at double digit inflation (UK at least and Germany near). That’s the only thing I can think of…big money sees inflation sticking for a while so go into some type of asset like Argentina’s market.

Someone here a month or so ago said it well. The Fed can only pick one: save the dollar at the expense of asset prices or save asset prices at the expense of the dollar. They are right now doing the former with QT and raising rates, but unfortunately they don’t control fiscal policy which is out of control.

Venezuelan stock market 1 year return: 412.81%

Inflation is a friend of the bulls :)

The top 1% who fought the Fed got screwed too, per FT article in which Carl Icahn lost $9 billion per a short bet during the pandemic:

“I obviously believed the market was in for great trouble. [But] the Fed injected trillions of dollars into the market to fight Covid and the old saying is true: ‘don’t fight the Fed’.”

———————

In regards to Japan, their markets are on fire, so does that mean investors love higher inflation in Japan. Is there something I’m missing, besides the BOJ leaving rates near zero?

I’m cost averaging out of my Japanese ETF as it is up almost 20% YTD, which seems unreasonable at best given the reality of the Japanese monetary fiasco.

“In regards to Japan, their markets are on fire,..”

Let me just remind you that the Nikkei 225 index, at 30,808 today is at the highest level since … drumroll … 1990.

It had peaked in 1989 at around 39,000. Back then, they had the same kind of everything bubble that we had here through Nov 2021.

And the Japanese stock market rips higher.

Japan was the first to do ZIRP and they are the apparent “trail breakers” for the Central Bankers and their nuevo tactics.

Yield Curve Control is the sport of the CBs.

Now we have “pause” talk because of banker mismanagement, and inflation becomes second in concern.

“When central planners decide, they intentionally assist one group at the expense of another.” Hayek

Deciding NOT to fight inflation as it should be fought, both in Japan and the US is a clear decision to “assist” one group at the “expense” to another.

Here on the ground in JPN inflation is much worse and wages have never, ever kept up for the little guy.

Neither has housing except in very selected markets like Tokyo, Osaka, Sapporo , and recently resort destinations. Electricity is up 30%. Food is way over 8%, and shrinkflation has been ongoing. For example my haircut went fron 1500 to 1800, yet my wages are stuck . Gasoline is still high, lpg too. Meat is up 30%, eggs. Bread 20%. The only saving grace is mortgages at 1% and (tiny) tiny apartment rents can be had for 500usd. Only those working for big companies like Toyota (in the city or suburbs) are getting raises. That’s not the general population by far. Inflation here is far worse than 8% all around, it’s ajoke to think otherwise.

Policy rate in the US: 5.25%

Policy rate in Japan: -0.1%

people in power do what benefits the royal “I”

The global printing binge and mountains of debt were never sustainable. They’re running out of even theories now how to keep the houses of cards from crumbling. Inflation is not the answer but there are no other good answers. I sense global crashes the hard way or the very hard way. This debt ceiling is a last chance but they will blow it, and no one not even Powell wants to be the scape goat when hyperinflation causes forced very painful actions. Unrest looming.

My gut feeling for usa is: Official govt inflation metric would hover around 4% or so. Real inflation on ground would be around 10%. FED would start QE and cut rates even at the slightest pain to their elite friends.

Powell is already gloating over his achievements to tame inflation and said higher rates are not needed.

Good example is: SVB and First republic Bank elite depositors were made whole at tax payers expense.

jon

“SVB and First republic Bank elite depositors were made whole at tax payers expense.”

add in Signature Bank…….and lets not forget the FTX fiasco which likely will end the same way. (the news blackout is telling)

PRETTY sure the FDIC is coming after top banks to make them whole, not the taxpayer.

Unrest looming? Surely you jest. In the US, the people are complacent idiots. There will never be civil unrest here.

When people get hungry ,it’s a game changer

Escierto never say never there is always an event when the masses have had enough ,seems a lot of people are complaining. Plus everyone hoarded lead and weapons. Trouble is people will turn on each other instead of where consequences should lead them .United we stand divided we fall no truer words were spoken

United? There is no United in the United States. It’s the Divided States of America and even within states there are deep divisions between urban and rural areas. If we do experience civil unrest in the future, it will not be directed at the government – it will be directed against each other.

I wish I had a quarter for every time I’ve heard it reported over the course of my career, “it’s different this time.” Unfortunately, now I’ll probably need a buck and a quarter…

That is the problem. It really is different everytime.

For instance, the world will be forced to endure a longer time frame of higher inflation. from the looks of things.

This appears to be the way that the governments will get the masses to accept socialiasm in the long term, while capitalism slowly deteoriates to a mirage that is obfusicated by a new reality.

Times are different, just not always for the better financially for most people if this portends the future.

No one knows how any of this will all go down, and speculation is about financial bets to hedge against problems. My outlook leans me towards gold, Just another old school bet.

The bull market ain’t over until the last bear is sucked in. This is the most forecasted recession and the short interest has been significant. The bear has been postponed. The AI bubble may suck the last holdouts in tho.

Gold? Oy! I guess that’s why it’s been such a great investment lately. NOT! The USD was kicking sand in Gold’s face last week and it’s probably not over yet. Back to the weight room, Gold, you’re still a weakling!

Check gold in yen, its been ripping

Gross domestic product for the 1st quarter of 2023 in Japan is too high. The BOJ needs to tighten.

Great stuff!!

Although the stated goal is general inflation, at the same time Japan imports considerable quantities of workers from Asia on low salaries (and three years stay only), so I have always found it hard to believe that there is, or has been, any serious attempt to generate specifically wage inflation. Also there have never been any serious reforms to employment law (widely ignored in Japan or bypassed).

My own personal view is that the vested interests of state spending just intend to keep living high on the hog as long as possible, and that inflation, far from being actively courted, is actually an end to the pork barrel that nobody in power wants, for all they may say in public.

If you look at it, the Japanese government has never made any attempt to increase wages. They could have banned unpaid overtime. They could stop the “trainees” coming in for low skill work. They could give people permanent employment rights -before 5 years…yes its 5 years.

The problem of insufficient domestic demand, or basically the insecurity of the Japanese leading to savings, has never been addressed. The government, for this reason, are not believable when they say they desire inflation.

Inflation in Japan, I think, is more like the wheels coming off and given their large external savings will certainly be a interesting event for all of us paupers interested in economics!

I do think though, that despite the current weakness of the yen, that due to the repatriation/realisation of overseas assets as the population declines for inheritance tax (fairly heavy) plus the possibility that the BOJ will increase the base rate by some token amount, that the yen won’t remain as cheap as it is now. I live there, not at the moment, and just as when (I’m from the UK) I was in the US when the pound was worth 2.20 dollars things were noticeably out price wise, things were too cheap the markets must have overdone it, and now its the same, the yen is getting overly cheap (and for US people as well). You can get a restaurant meal in Japan for 8 dollars. You can have an unlimited two hour drinking sesson for 15. This isn’t in some 3rd world place, these are all decent places. So I think be careful about the value of the yen because really it does seem cheap.

I personally think when the Japanese repatriate their savings it will push the yen up. The US alone is into Japan for a trillion dollars of consumer goods/commodities. Its not a trivial amount.

Interesting perspective colored with personal experience.

Wow, a meal for $8.00!

I got the haddock sandwich (real haddock) yesterday for $16. The haddock meal was $24 with a lot more french fries, and not much more haddock.

Cost/valueing like crazy when eating out or shopping.

Where in Japan is this meal?

Nailed it!

“If you look at it, the Japanese government has never made any attempt to increase wages. They could have banned unpaid overtime. They could stop the “trainees” coming in for low skill work. They could give people permanent employment rights -before 5 years…yes its 5 years.

The problem of insufficient domestic demand, or basically the insecurity of the Japanese leading to savings, has never been addressed. The government, for this reason, are not believable when they say they desire inflation.

Inflation in Japan, I think, is more like the wheels coming off and given their large external savings will certainly be a interesting event for all of us paupers interested in economics!”

Mr. Wolf or anyone

“Debt burdens by all governments that control their own currencies are ultimately resolved by raging inflation.”

How the heck does that work? I only made it through High School and had other things on my mind.

Inflation means prices go up, and wages go up, and therefore nominal GDP goes up (not adjusted for inflation), and tax revenues go up, not because the economy produces more, but because production and pay and tax receipts and debt are all denominated in a currency that loses its purchasing power. So the government’s income goes up, but the debt that was issued in prior decades is fixed, and the relationship that describes the debt burden, the debt-to-GDP ratio, improves. Note that “real GDP” is adjusted for inflation. But Debt-to-GDP ratios are calculated with neither debt nor GDP adjusted for inflation (inflation would cancel out as it would be in the numerator and in the denominator). Inflation is a form of tax on everyone and everything.

Got it. Thanks. Just had no idea how inflation could help Governments that spend too much.

I have some good news, neck…

These clowns in congress aren’t getting the debt-ceiling fixed. Yes, they are mostly rich, and yes it’s going to hurt them by not doing so. However, have you seen these people?

There are some real economic extremists on both sides. I don’t see either caving. Like Alfred said in Dark Night, “some men just want to watch the world burn, sir.” I truly believe they don’t care about the debt, inflation or whatever. They just want to stick it to the other side.

We may not even have a government 3-weeks from now. Or, at least one that pays its debts. Memorial Day fireworks aren’t just for partying, my friend…. Get a good seat because these clowns are gearing up for a big circus.

All Good Here..

“There are some real economic extremists on both sides.”

Both sides promote raising the debt limit. One side requests some sanity in spending INCREASES, clawbacks of unspent COVID relief, and other conditions. I paint that rational rather than extremist.

I’m not sure the extremists have any power on the right or left. For the time being, the advertising and promotion of them provides valuable negotiating leverage. For example, McCarthy can say he can’t agree to raise taxes, because his party won’t agree to it. Biden can say he can’t cut social programs.

After the deal is made, however, the extremists lose their value and my bet is they’ll be ring-fenced by party leadership. These extremists don’t want to commit political suicide. They are glory seekers, who need the spotlight that only a major political party can provide.

RM

However, if inflation rages for years (and it looks like it could), and the US continues to run deficits (more borrowing), higher inflated bonds are purchased for that borrowing and eventually the interest required on that debt gets close to, or surpasses “inflated” tax receipts, especially if wages start to stagnate.

This is assuming the new lenders don’t revolt (demand interest rate much higher than the inflation rate and longer the duration higher the interest rate – no inversion curve BS even if the country is in recession) and there won’t be anymore 30 year fixed rate mortgages (who would want to take that kind of a duration risk). I know that is what happens in most other countries (all Canadian home mortgages are 5 year adjustable). In Japan, they pulled off with almost zero % interest rate for 20 years because in my observation it has been a feudal society. Think what would have happened here if we had the same nuclear disaster like 2011.

Based on my experience, I feel we had a great time from 1950-2020 because of many factors. Now things have changed considerably. If petro-dollar era ends, we will have to face the music like any other nation.

Dr…

“no inversion curve BS..”

Agreed. There is no reason to have an inverted curve other than it is what the Fed wants. They delved into the long end…..circa $5 Trillion of MBSs and long treasury debt…..a severe departure from decades of the Fed avoiding such action, all with the intention to FORCE the investor (and banks) to take more risk.

How’d that work out for the banks?

But all will be made whole …. and the games will continue, apparently.

Japan’s central bank owns most of the debt, unlike the case here in the U.S. and Europe. So what? The Japan central bank can dissolve the debt without affecting the government spending, or control of liquidity. It will be interesting to watch.

“So what?”

INFLATION. In the end, there is always inflation for these kinds of policies. It may just take a little while.

In democracies, hugely influenced by the rich and corporate and real estate interests, it’s illusory to fantasize about cutting government spending enough and raising taxes enough (on the rich, companies, and real estate because that’s where the money is to generate big tax receipts) to produce a big enough a government surplus, which would reduce inflation. That’s one reason why MMT (which you’ve been trying to promote here for years) is a braindead theory.

Replace raging inflation with raging money printing = easy answer. At some point feds won’t be able to sell anymore debt,then when they buy there own fix it’s game over

@Redneck

For perspective, following WWII the government had a massive problem: $241 billion deficit which it could barely handle. Notice there are individuals today with more money than that. It’s an insignificant amount for a government, now.

The hope is $32 trillion looks similarly small in 50 years. This inflation was no accident.

Good information. Thanks. Japan, along with the Australian Central Bank increasing rates after a pause and the Canadian Central Bank considering raising rates after a pause due to higher inflation, makes it look like this worldwide problem is not yet over.

The cornerstone of market based capitalism is healthy competition to foster improved performance and lower cost.

Looking at central banks as a form of corporations or quasi corporations with their form of money as their brand, then healthy competition between currencies should produce improved performance in their brands; i.e., monetary policy as the paper itself is just a symbol of what it represents (no inherent value in the actual cellulose or other fibers).

This is an interesting time to live as the whole world is trying to find the best mixture of types of money, with dedicated and thoughtful discussion of issues formerly only discussed behind closed doors amongst banking elite.

Hopefully, a historic improvement in professional economic and monetary policy will result; maybe even the ability to change the currency in one’s wallet to any other currency instantly.

Gary

IMO what’s coming is a Nationalized Banking system (Yellen covering all deposits is a leap toward such) and a digital currency.

The private sector and free markets will suffer to the increased power of the government.

Longstreet everyone is buying gold and silver,in digital currency ,how will gold work seems unlikely that I can go to grocery store and buy groceries with it .Might work for bartering but it has a 28% tax base . I also believe that it’s in a bubble like everything else .The price will crash and every hoarder will sell assets,same song and dance

The problem with physical gold is that it must be assayed to determine its actual worth…..

that’s tough to do at the check out counter

This central bank policy to let inflation rip is present in the US as well. Today, Powell said inflation will remain elevated for “a while”. He wants it that way, of course. If he didn’t like the inflation, he could take it down in an instant, simply by saying he won’t print any more money.

My sympathies to those who are buyers of long-term fixed income instruments that are yielding less than 4% today. Those instruments are going to lose a lot more value. I predict GDP will be growing 5-10% per year going forward, almost all of it inflation.

It’s a lie when the fed says they’re fighting inflation. At the same time the treasury is issueing over $1 trillion a year in new debt. And the BOJ is stubbornly insisting on zirp. They all work together. It’s like your left hand is playing inflation hawk, while your right hand is printing at full tilt.

It’s all a big game.

Harrold – astute observation. I agree it is “all a big game” in which global CBs collude to ensure the global monetary house of cards stands as long as possible for the elites and super wealthy at the expense of the majority.

Global markets tend to follow the money flows via global CBs balance sheets, per “Yardeni” research site.

Scroll down to “Global Money & Credit”, select “Central Banks”, then click “Balance Sheets Monthly” to pull up the global central banks PDF charting.

Ouch … that’s disappointing. Japan’s economy was once the envy of the world. Come to think of it, so was Argentina’s…

An Argentine peso is worth about 1/200th of its value @ the turn of the century when measured against the almighty buck.

So was the US’…

Before crying too hard for Japan, check driveways near you. Japan is largely why, absent trucks protected by steep tariffs, there is not much left of US based autos.

Not much chance of getting shot in Japan. Usually about 10 or so gun murders per year. or a Chicago Saturday, but one year recently. zero! For a 140 million people.

Personal and property crime very rare. Vandalism unheard of. Universal medical of course. but almost everyone has that.

In terms of social disfunction, the US has much more in common with Argentina.

“…there is not much left of US based autos.”

Most of the Japanese vehicles sold in the US are either manufactured in the US or in Mexico. All major Japanese automakers have plants in the US. Hondas have among the most US-made content of any brand. Like US automakers, Japanese automakers source a lot of their components from China. When it comes to auto manufacturing, it’s a very complex picture.

Agree. To distinguish these transplants from what used to be the ‘Big Three’. I wrote ‘US based’

A more extreme version is the UK where the somewhat exaggerated saying is: ‘there is no longer a British car industry but there is a car industry in Britain’

Not as prestigious but contrasts well with France’s more national but more troubled version.

Bit of trivia about a branch plant ‘taking over’

When Chrysler went BK in the early eighties there was a hurried distribution of projects. One of these was a van, not at the time a sought after jewel. It went to Canada and the plant ran 3 shifts a day for years cranking out all the Dodge vans for North America.

“Fear is the path to the Darkside” – Yoda

Japan is evidence that a homogeneous society is much more stable, even if its debt/monetary policy is a basket case.

The idea of inflating away your debt is like unleashing a flock of locust to trim your hedges. Inflation is a beast that destroys people at the lower end of the income spectrum and it also causes massive monetary instability, which actually destroys economic activity, because people become risk adverse in an environment where monetary instability is the king.

Maybe the idiots in charge of Japan’s central bank should ask themselves why their economy has remained mired for decades and realize that doing more of the same thing will get them nowhere.

I assume he is lying so that people wont front-run increases in bond yields.

When your central bank chief has to lie through his teeth, you have a problem. Which also means that the US has a problem as well. It is all a game of liar’s poker.

Your first sentence is a keeper! 🤣

A swarm or a plague perhaps…but funny anyway.

I think he used “flock” on purpose versus swarm, as it added to the ridiculousness of the commented situation and made it “funnier”. The comment had depth, as it even had some biblical tie-ins, which spurred thoughts of the “Cult of Fed Watchers” we all have become.

Or are we “Word Watchers”, like bird watchers but way more useless way to expend limited time on Earth?

Although we seem to be word addicts, perhaps why humanity is diving head first into the A.I. bubble. Yet dig deeper and the not so novel A.I. is in the most basic form a very powerful and expedient program that takes a single “word”, searches billions of documents instantly for the best pattern match for the “next word”, and repeats until either a brilliant or insane “story” is formed.

I’ll be impressed once A.I. can fold my laundry, less so once I’m forced to fold it’s laundry…

Energy, world-wide, is at a relative nadir, I fear. The drop’s beneficial effects on CPI numbers is almost played out by this point, so expect it to start contributing to higher inflation numbers going forward if there isn’t a recession.

Failing to raise the debt ceiling would also be highly effective inflating away US debt.

I would expect individuals and companies to be accelerating the issuance of low rate fixed rate longer term debt that the JCB is buying. As this trend grows, it would overwhelm the JCB by its need to buy the debt rate down. So until increasing low rate debt overwhelms the JCB, the game continues. It will be difficult for the JCB to increase both and short term rates in a controlled fashion, or gradually. When the lion is out of the cage, it will be difficult to tame it.

It’s a fallacy to believe that 0% price inflation is price stability. Under a monetary regime with no expansion of the money supply, prices would continually fall due to effficiency increases and technological advances.

No government wants this because then there would be a fall in tax income and govt could not get perpetually bigger. Their model is fiscal drag is where taxpayers get skinned for purely paper increases in income and wealth.

This is the kind of narrow thinking that focuses only on manufactured GOODS.

Yes, prices of manufactured GOODS should and do continue to fall, assuming it’s the same good over time. And since goods are always improved in a competitive world, the equation gets more complicated. Over time, you get a much better product for a price that may be lower or higher. Look at cellphones 20 years ago and today, or look at cars 20 years ago and today.

But SERVICES don’t involve manufacturing. Services account for two-thirds of the economy. Their cost is dependent on other factors. And the “efficiency increases” whereof you speak either cannot happen at all, or happen only to a small extent.

That is why, when you look at US CPI for durable goods, it spent many years declining (before 2020), while the services CPI continued to rise at 3% and higher over that time (before 2020).

This is one reason why your argument falls apart. There are other reasons as well.

I remember from my economics classes in college that this was called Baumol’s Cost Disease. It takes a barber the same amount of time to cut my hair today as it did in 1990. There is no technological efficiency improvement there.

The barber is only one possible case out of thousands. What about car maintenance for example, that is labor-intensive but in I would say it has become cheaper –longer service intervals– due to better diagnostic machines, better corrosion resistance of motor oil etc.

Bengt Loyer,

Wait a minute… yes and no. You refer to the frequency of repairs/maintenance declining, and if that is true (probably is), it would not impact the inflation rate directly, except in the weight of the item (declining). It’s the cost of each same repair (such as “replace front struts”) itself going up or down that becomes part of CPI, not the frequency of it.

Here is why services inflation is so tough to get rid of:

From my experience decades ago running a big Ford dealership and creating one of the biggest (or biggest?) Ford shops in the Southwest region with a huge shop, organized by teams, ca. 100 techs working in shifts 6 days a week. Great techs, who were also the team leaders, were among the best-paid people in the dealership.

If my memory is correct on this, we paid our technicians 35% of the “flat rate” service charges that our customers paid. So if the flat rate manual said it would take 1 hour to do the job, we paid out techs 35% of the 1-hour flat rate that we charged customers (we set the hourly flat-rate charge, at the time maybe $40 per hour, today much much higher). We also paid our techs for training, which ads up. We also paid our service advisors a percentage of the amount they sold, customer-pay and warranty (can’t remember how much, maybe 3% or 5% of parts and labor). Then there were salaried employees in the service department. The service manager and the two shop foremen got paid salary plus bonus. There were the dispatchers, warranty clerks, cashiers, etc.

So nearly ALL of the expenses of the service department were wages. And most of those wages were pegged on service revenues, which were pegged on the industry-standard flat rate manuals. And those flat-rate charges went up with the complexity of the repairs (for example, at the time increasingly involving computerized systems). We did increase our hourly labor rate that we charged customers – and we were fairly aggressive with it. So revenues per repair went up, but our expenditures per repair went up with it. And there were pressures from our techs, services advisors, and shop managers to keep hiking the hourly flat rate, because that’s how THEY made more money for the same work to deal with their own inflation pressures. And for CPI purposes, services inflation was sort of set on automatic pilot, driven by what we had to pay our employees and our own profit expectations.

That is the biggest con of all at car dealers repair shops: charging people by the flat rate manual.

It sure as hell doesn’t take a good mechanic the flat rate time to do an oil change, but the dealer still charges for it.

Most of those times are way overstated and are a main reason for most dealerships make huge profits from the repair shop.

An expanding money supply doesn’t result in inflation if the population and economic activity are also growing and bank lending increases to accommodate the resulting economic growth in the proper proportions. An elastic currency doesn’t necessarily result in general price inflation. Loss of central bank discipline and political self-control result in excessive currency creation in pursuit of (i) imperial empire (ii) and generous social welfare benefits, both beyond the capacity of the government revenue base. Money creation directly by the central bank in order to monetize government debt causes inflation. Japan has no empire to support and the Japanese government bond market has been captured by the BOJ for monetary control reasons rather than to fund runaway government military and social welfare expenditures. Inflation in Japan is likely due to the effect of inflation everywhere else in the world dragging Japanese price levels upwards as a secondary effect. That must be what the BOJ is thinking. The Fed, on the other hand, is thinking about how it can slow down inflation it deliberately invited without alienating its political masters in DC, who want to be seen as “doing something” about inflation without actually stopping the monetization of federal debt, which causes inflation.

If you define inflation as 0% price increases, and price declines do not compute in your economic model, then yes.

sorry, that should have read:

“If you define *absence of inflation* as 0% price increases….”

OK I take your point, but your statistic of 3% annual increase in service CPI was also measured under an expanding money supply.

It would be worth examining the factors that increase service costs. Presumably wages/salaries? From which an increasing bite is taken by taxes, social security payments, medical insurance etc. I will grant that health insurance is probably a racket that increases profits for the entire health care complex at the expense of employees.

If you don’t over think it, the following rates tell you a lot.

SP500 div yield 1.6%

10 year treasury yield 3.6%

1 month treasury yield 5.6%

You can’t know the future. Might as well take the bird in the hand and not the one in the bush.

Japanese investors have completely different choices.

1) The Nikk reached 30.8K. Can it reach/breach 40K.

2) AAPL might reach $3T if price reach : $3,000B/15.723 shares o/s ==> $190.8.

3) MSFT might reach $3T if price reach : $3,000B/7.437 shares o/s ==>

$403.4.

4) If u can’t trust the gov, the Fed, the ECB, the BOJ and the banks IOU you might put your money in the stock markets, for defense purposes only, an Anti groupthink logic, like in the 1930’s…or hide your money in the old Steinway.

5) AAPL & MSFT bear market bull run, for fun fun fun, might be over for now.

6) In the Dow AAPL is bs, but MSFT have risen to the 3rd place.

1) “held to maturity” issued before Dec 2019 expire now.

2) ” held to maturity” issued between 2020 and 2023, mostly at low rates, will start to expire in 2025/26.

3) Within few years US gov debt might be cut by 1/3 or 1/2 ==> by doing nothing, for few years. If the Irish gang get along no harm is done. Just rabble rousers flags parades, for their fans.

4) Consumers spending : from the millions on 1M/5M houses–> to six figures renovations –> to the Tesla –> to the dentists, outpatient surgeries, revenge travel…in the thousands –> to the crumbs. Demand is subdued. Banks deposits are down by $1T. Banks lending, down.

5) The Fed raise rates to 5%, because it need “other” people money to cover gov interest payments and function.

“held to maturity” could be any duration

US Treasuries are issued in one month to 30 year durations, and the maturity of each of those classes of durations is the period from when they are issued until when they mature which could be as long as 30 years in the future.

40% of the population are over the age of 60.

They’re losing over 500,000 a year. The country is literally depopulating on a massive scale.

They don’t like immigration.

They’re screwed.

Younger people are to a degree not having children because the fiscal/monetary policy is making it impossible. Importing culturally different people is not a good solution either.

Nicko2,

Japanese couples have children, but instead of three or four, they have one or two. Like just about in all developed countries.

Go to any of the big cities in Japan and see how crowded they are, how packed the trains are, how tiny the apartments and houses are, etc. People have had it. There is no reason to make this overcrowded situation even worse. The Japanese people do what they want to do, which is that they have fewer kids.

Still, Japan’s fertility rate is higher than those in 15 other countries:

In 2020:

1 – Korea, Rep. 0.84

2 – Hong Kong SAR, China 0.87

3 – Puerto Rico 0.90

4 – Singapore 1.10

5 – Malta 1.13

6 – Ukraine 1.22

7 – Spain 1.23

8 – Italy 1.24

9 – Bosnia and Herzegovina 1.24

10 – Macao SAR, China 1.24

11 – Moldova 1.28

12 – Bermuda 1.30

13 – North Macedonia 1.30

14 – Cyprus 1.31

15 – Greece 1.34

16 – Japan 1.34

Lots of apartments or condos in Japan are now over 100 square meters in size.

Lots of cheap houses with large lots one hour by train outside of the big cities.

Trains and roads are not crowded once you get out of rush hour times.

No poop on the steets either.

******Let me just remind you that the Nikkei 225 index, at 30,808 today is at the highest level since … drumroll … 1990. ******

And in 1990 Toyota Motor Company traded around US$30 per ADR in the US.

Today the price is US$140 per share which is down from around US$200 a share at the start if 2022……….

And if one had enough brains one could have bought it at around US$4 a share in 1980 and held for the past 43 years collecting a huge amount of dividends along the way.

So I think that the level of the Nikkei over time, as with any stock index, is basically meaningless

Boom and bust economics preach doom if population decreases, but is it really so?

Exponential population growt do eventually end with a bust for all spieces that follow a boom and bust pattern.

“Japan is poised to become the third-largest military spender in the world.”

“…letting inflation take care of Japan’s huge government debt burden, and the Japanese people are just going to have to eat it…”

At least the BOJ is being honest. Meanwhile, the Fed has been making half-hearted attempts at cooling inflation a little (but not too much) in order to fool us. There are lots of smart people at the Fed, and they know exactly what they’re doing.

Voters will never agree to suck it up and run a positive (or even balanced) budget, and there’s no political will to force the issue. But the average person is not very smart, and half of the people are dumber than the average, so it’s not all that hard to simply devalue the dollar as a way to tax them behind their backs. They’ll get a little pissy, but they’ll eat it. Powell should just come out and admit, “Look, we’ve run huge deficits for way too long and Congress won’t do anything about it, so we have to print our way out of this mess and y’all just have to deal with it for the next decade or two. Maybe think about voting for fiscal responsibility next time.” I would at least respect the guy for his honesty.

Not Sure

Great statement about what Powell SHOULD do – but there’s no way in hell he would make a statement condemning the actions of CONgress (he does not have the nadz). Would be nice though.

What would Abe have done?

Abe Froman, the sausage king of Chicago? Probably something a lot better than the current cast of can-kickers.

Lincoln? He would have waited for the DVD to come out instead of going to the theatre.

China’s birthrate, at 1.28 in 2020, is even lower than Japan’s so China will have their own problems to deal with before any bombing starts. Don’t fall into the trap of extrapolating current trends into the distant future. It rarely works out that way.

A co-joined twin with yr Ukraine comment