All-Cash sales plunge 22% as investors don’t feel like overpaying either. The 2023 version of spring selling season is here.

By Wolf Richter for WOLF STREET.

OK, it’s spring selling season, the famously best times of the year to sell a home, because that’s when prices rise and sales rise due to hot demand from home buyers who were hiding out in the winter. But this year?

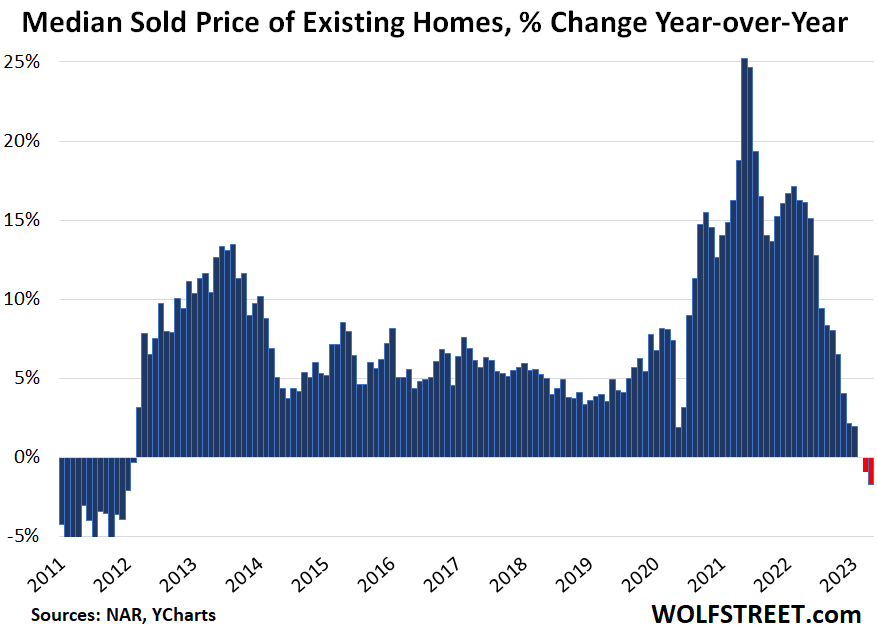

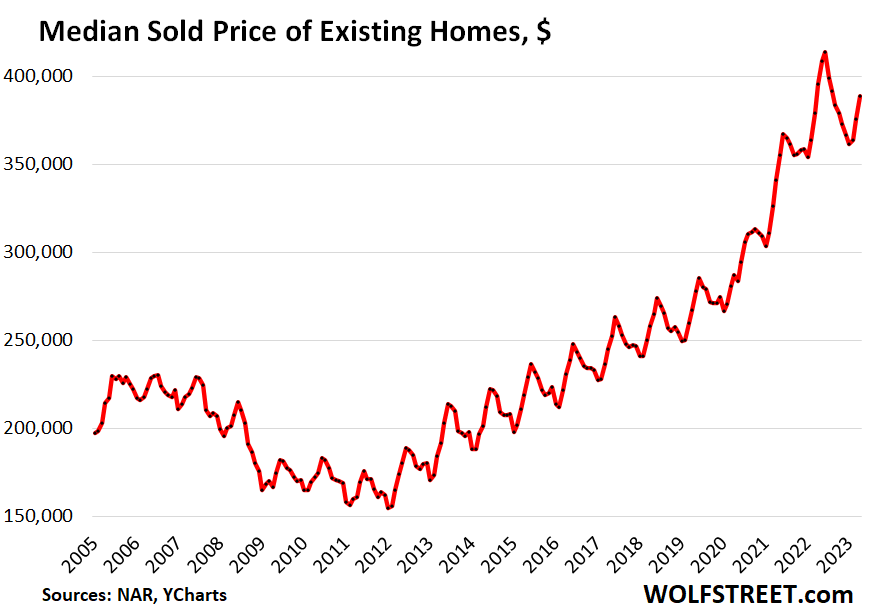

The median price of all types of previously owned houses, condos, and co-ops whose sales closed in April fell year-over-year by 1.7% to $388,800, the third month in a row of year-over-year declines, according to the National Association of Realtors. A debacle we haven’t seen since February 2012, when the market emerged from Housing Bust 1. From the peak last June, the median price declined by 6% (historic data via YCharts):

For single-family houses, the median price fell 2.1% year-over-year, the third year-over-year decline in a row, to $393,300. For condos, the median price still ticked up 0.7% year-over-year, to $348,000.

But it’s still spring selling season when prices always rise from one month to the next. Even during Housing Bust 1, the median price often rose month to month during spring selling season, and sometimes by quite a bit. And the median price in April was up from March, but that increase was smaller than the increase in April 2022 (+4.3%). Hence the larger year-over-year decline (historic data via YCharts):

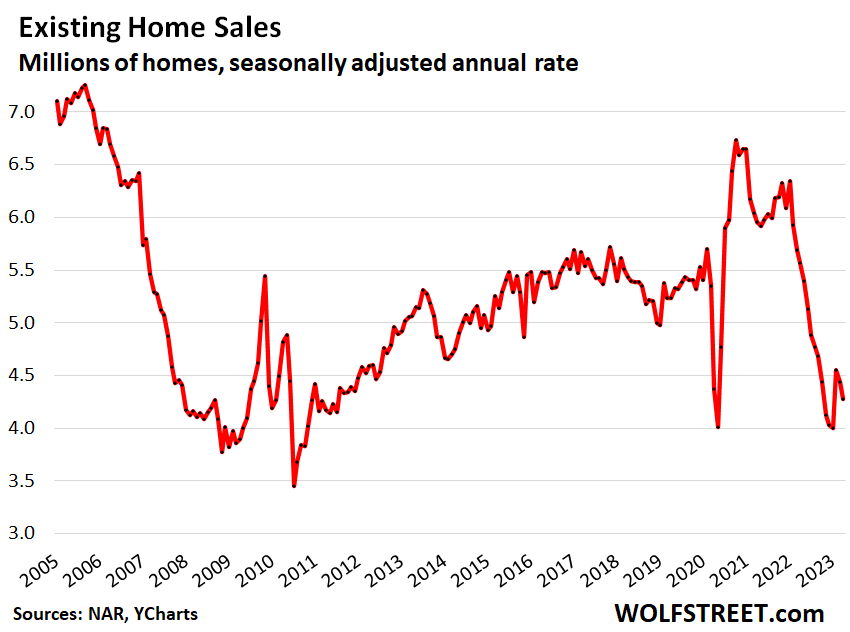

Sales of all previously owned homes fell by 3.4% in April from March, to a seasonally adjusted annual rate of sales of 4.28 million homes, solidly entrenched in the dismal levels of Housing Bust 1.

Sales in April compared to the Aprils in prior years, per the seasonally adjusted annual rate of sales:

- April 2022: -23.2%.

- April 2021: -28.2%.

- April 2019: -18.2%.

- April 2018: -21.2%.

Priced right, nearly any home – nearly anything – will sell. And lower home prices would bring out more buyers which would help unfreeze the market. But that’s just not happening. Sellers are still thinking that this too shall pass, “this too” being the 6.5% mortgage rates.

Actual sales in April – not seasonally adjusted annual rate, month-over-month (MoM) and year-over-year (YoY):

- All existing homes: -6.4% MoM; -27.4% YoY; to 336,000 homes.

- Single-family houses: -7.1% MoM; -26.9% YoY; to 299,000 houses.

- Condos and co-ops: 0% MoM; -31.5% YoY; to 37,000 condos.

Investors pull back: All-cash sales – often investors and second home buyers – plunged by 22% year-over-year to 94,000 homes in April (a 28% share of 336,000 sales), from 120,000 homes in April 2022 (a 26% share of 463,000 sales).

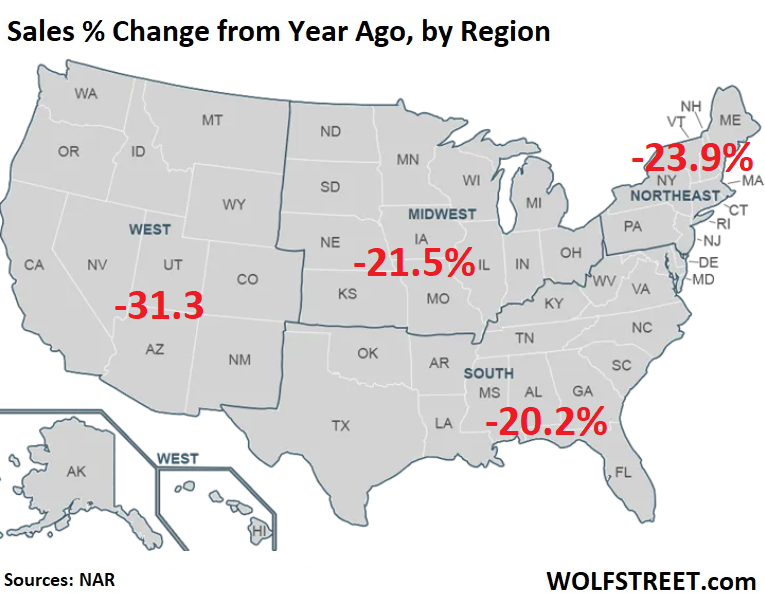

By region, year-over-year sales plunged in all regions (map via NAR):

Median days on the market lengthened. Homes that actually sold spent 22 days on the market in April before they sold, up from 17 days in April last year, according to the National Association of Realtors.

Another measure of median days on the market also lengthened: Homes were either sold or were pulled off the market after 49 days in April, up from 32 days in April last year, according to data by realtor.com.

Inventory for sale rose to 1.04 million homes in April, from 980,000 homes in March and from 970,000 homes in February.

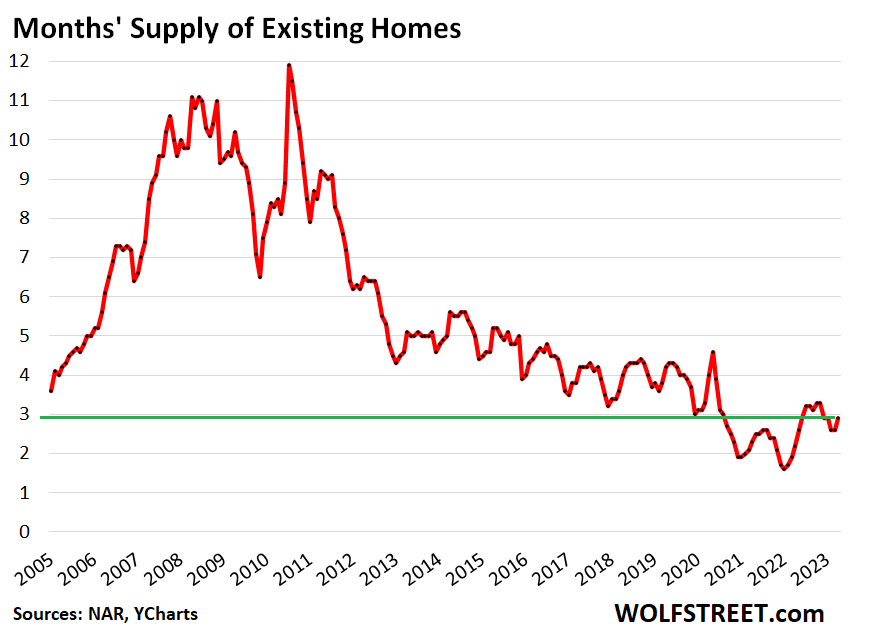

Months’ supply rose to 2.9 months, up from 2.6 month in March, and up from 2.2 months a year ago. In 2019, supply ranged between 3.0 months and 4.3 months.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Housing prices here in California need to fall about 75% to 80% to get anywhere near reasonable and so far they’ve barely fallen at all here in Southern California.

They aren’t falling where I’m at either-Midwest. They aren’t going up though but still too high. And our local market never spiked too much either.

Already my house doubled in last 2 years as per Zestimates on my house!

Zillow saying house prices rising again and will reach all time high by year end.

Wolfstreet is fake news. For real news only contact your real estate agent. He/she can you that :

1. Bidding wars have restarted and you must bid 20% over asking price with 10% earnest money and wave all contingencies.

2. If you don’t buy that small crappy house now, you will NEVER be able to buy again.

3. There is no supply. All selles know that they can just wait. Fed will Pivot and and houses will double again.

/s

Leo, would you mind sharing what zip code you live in? Even the first three digits would be fine as that gives us a general idea of where to look to see this kind of a market.

Oh never mind, Leo. Reading your other comments I see you are being sarcastic. Time for another cup of coffee.

Another Craig,

Also the sarc tag “/s” at the end was helpful, on my second try, LOL

The sad part of it is that the scenario like this is not entirely off the table, at least in some areas of the country. And whoever manages to make money this way (by buying now and selling in 3-5 years with a huge profit) will forever discredit any kind of common sense anywhere.

If that magically happens, I doubt there will be any prospect of soft landing within a decade or so.

Not true… I’m a buyer now and have been underbidding in spring market. I’ve been bailing, even when negotiating because of lack of willingness to go lower amongst current rates and/or requests to waive contingencies. Sure, it’s not easy being a buyer now, but I was given options 30-40k under asking, just wasn’t my number based on what I felt it was worth. Didn’t offer more than 1-2% EMD either. The competition is slowing, so don’t scare people with your fake info.

Also noting now from other comments this is sarcasm… in which case, I completely agree and disregard other message!

Next time I will use #Sarcasm instead of /s to clear my intent.

…much like ‘RTGDFA’, mebbe ‘rtEfc’ (‘read the ENTIRE *** comment’)?

may we all find a better day.

Sarcasm, yes, but you’re not too far off. Seeing bidding wars and 5% over asking on every decent SFR in SoCal (mainly SD and OC). It’s all fun and games on wolfstreet when we talk about the housing crash, but in many locations there is NO crash in sight.

IIRC Lisa and I live in the same general vicinity. In the ‘burbs near Chicago.

And, as before, her observation is 100% correct.

Spring here is considered prime selling/buying season because a family can buy now. Move in during the Summer. And be in place for the kids first day of school in late August.

>>be in place for the kids first day of school

Never really understood this whole “must be there by day 1 to start school”, as least for those who are not hs seniors or at least juniors.

If I have had a freedom to choose the last time I moved, I would’ve absolutely chosen late fall (at least for southern states) or early spring – no insane vacation traffic, no loading/unloading/running around in 90F heat, good availability of UHaul/Penske trucks compared to peak times in summer etc.

I’ve been told before that I would eventually get it once my kid gets older, but somehow I keep seeing the opposite. At least I don’t think we experienced any issues moving between schools mid year (but it helped he was not too deeply involved in team sports and such)

Prices in USD likely will not fall that much.

But in real inflation adjusted, prices will go down a lot as the USD is becoming less and less used in international trade and we may get pretty closr to that 70% you mention: Add an extra 10-15% for the real inflation (instead of the cook the books CPI) and since last year, houses are down not 20-25% but 30-40%

Expect the fertilizer to hit the fan once China starts pricing their stuff in their currency or when bought with USD, thry are immediately sold back into a currency or PM that is not at risk of being frozen or confiscated.

The only good thing that will come out of this is that condpiracy theorists will be proven wrong that the vaults of Ford Knox are not empty and the 50 year hiatus in auditing was just an oversight

I wouldn’t put the nail in the eurodollar coffin quite yet. Not even sure if or how dedollarization (really eurodedollarization) would impact domestic inflation. I imagine it wouldn’t be good but from what I understand the eurodollar it’s its own quasi closed loop system. Would be interesting if Wolf could shed some light on the topic.

Real estate agents in Seattle area are getting desperate as house sales have collapsed. They are now down to lying and outright fraud:

Spreading rumors on how that bidding wars have restarted, and supply has decreased.

They want to pretend that buyers are now at their mercy, when in reality, half of them will go out of business by year end!

I saw a prominent commercial real estate guy on Twitter say he put a bid in on a listing that has been sitting on the market doing nothing for ten months. The selling realtor got back saying there were nine other bids, and the property would go fast. Yeah. Right.

San Diego reporting in …. My neighbor listed his house for $1.2M a month ago .. it just sold for $1.5M. I was stunned … prices are not going down in our area at all…. In fact there are few houses for sale and when they come on the market they get bought quickly.

Did the seller list it below what it would sell for?

$1.5 million…which of great architects designed it? Did Lincoln sleep there?

There’s always one or two semi-numerate maniacs only too eager to pay too much for something in any kinda market. It’s a bizarre thing to behold, really — bordering on pathology. There’s often a remorse/hangover period, too. That’s pretty ugly.

Either way, one house and one greater fool does not an average make. SD market is in the toilet.

bulfinch, just open up Zillow and look at recent sales? Whenever someone mentions sales in their neighborhood they get attacked (accused of lying, being a cheerleader or even being paid to post propaganda). People like me who are actively looking to buy see how competitive the market is and how quality properties sell quickly. If you truly want to know, just visit a new community and take a pic of their map showing what’s available and what is pending / sold. Then go back there 2 month later and see how it changed. Or, just look up recent sales in your hood and track houses for sale in your area. People who can afford to buy, they buy.

In San Diego that gets you a beach shack that you and a friend could kick over flat in about an hour. Actually maybe you can’t get one of those because at least those are freestanding on their own lot. In some ways of course I’m kidding but not really in others. Some of the houses I saw for over $1M in Sand Diego in areas like Pacific Beach look like they are about 900 sq ft and built with about $50K of materials. $1M probably just gets you another small bedroom in a plain, generic, low ceiling condo now.

That said we used to call it Lollipop land because its so nice it seems fake. There just isn’t much like the part of Sand Diego you can walk to the beach from….wish I was wealthy enough to live there like all the trust fund kids it seems to be populated with. It’s the greatest place in the US to be a rich dummy trying to drink, surf and scam on young bikini clad girls.

So after seller fees and gains taxes. He’s about at even.

Another month, and it will go stone cold. Probably already is, but low inventory gives the illusion of a hot market. It’s not like last year anywhere. Demand is pathetic for spring, but so is inventory so that’s why it looks hot. A few stupid people still smoking that hopium of Fed pivot. Can’t wait until reality hits them over the head. Soon, very soon. June is almost here. Tick tock!

Agree with Brian. I’m seeing over asking and bidding wars throughout SD and OC.

Any time there are more buyers than sellers it means that a good is priced below what is “reasonable,” and if there are more sellers than buyers it means a good is priced above what is “reasonable.” The market determines what that price is.

The free market is even better at determining the real will of the people than democratic voting because people are forced to have a real skin in the game, so to speak – they have to put their money where their mouth is. That is also why so many people despise free markets, especially people who are big on talk and little on action. It’s easy to say you support x, y, and z, but it’s another thing to pay out of your own pocket to actually support x, y, and z as opposed to voting to have your government steal money from other people to support x, y, and z.

Judging how less often I see emails from Redfin and Zillow showing homes for sale and the ones that do, have either price increase or still asking sky-high prices. Looks like we’re still in this Mexican standoff indefinitely at least more apparent in SoCal. Although from time to time, you still hear from friends and family, someone they know sold their house in 3 days in SoCal. In this case, it was actually in Yobra Linda because the husband got a job in Florida, and the price sold is about the same as asking from last year, sold in 3 days…just wow

Guess there’s simply no shortage or FOMOers in SoCal unfortunately…

Last month, I received a flyer from a realtor bragging about they just sold a neighborhood house in 5 days!

This month, the house showed up on other realtor’s fliers showing recent sales…and it sold for about 5% under the listing price :)

This is why I don’t trust realtors. They love to present a very skewed version of things.

They’re sales people, which is what they do. :)

Using the wrong Realtors Lucca.

Lucca all you need to know is that it’s always a good time to sell or buy.

Sounds like the seller wanted to sell rather then just having their house on the market. The sales price is always where it belongs, regardless of the listing price.

Yup, I think that seller and realtor were smart — if they’d held on to the listing price, in the end it’d probably sell for less.

There’s another neighborhood house that’s been on the market for over 5 weeks, and still isn’t pending. (To be fair, doesn’t appear to be obviously overpriced, but if market is going down, then last month’s fair price can be this month’s overpriced).

NAR Total Active listings: Traditionally, we are between 2-2.5 million; in 2007 were a tad over 4,000,000. Today after the NAR report, we are 1,040,000, up from 1,030,000 last year.

With such low inventory it’s not a surprise that homes sell despite sky high prices and high rates. As wolf stated, annualized we will see over 4M homes sales this year.

Bottom line: those who can afford it will buy.

That’s not how the dynamics now work. Read the article linked below. It explains why inventory is low and why demand is low: a homeowner with a 3% mortgage cannot sell and cannot buy. So their house doesn’t go on the market, and they’re not buying, so no house goes off the market. Impact on inventory: +1 -1 = 0. Zero impact on inventory.

That’s why sales are so low and why inventory is low, and why supply isn’t all that low, and why prices dropped:

https://wolfstreet.com/2023/03/29/how-3-mortgages-altered-the-housing-market-for-years-to-come-a-lot-smaller-but-more-in-balance-than-it-seems-hence-dropping-prices-despite-low-inventories/

I’m not seeing price increases in AZ. Not on Redfin, Zillow, or Realtor.com. Haven’t for some time now. I’m seeing lots of price reductions, especially in places like Prescott Valley. But also seeing them in Phoenix metro.

Still a hot market in Denver. I had an offer 5 hours after listing and under contract in a day, with 3 offers. Sold for full price. Why, because the property was at the $300k price point and it is still a feeding frenzy at those levels. All the inventory available is over $500k.

As an appraiser in Denver I can assure you it is definitely NOT a hot market. Lukewarm at best. My volume is down 40-50% over the past 12 months. That primarily comes from the refi bust now that rates are 6-7%, which makes perfect sense. The only thing keep me afloat currently is new construction in the $400-700k range, and HELOCs by people who can’t afford to lose their 2-3% rate. Pre-existing home sales are the slowest I’ve seen in my 12 years as an appraiser.

I just sold my $1.2 million house with 5 acres in FL in 2 days. Still a solid sellers market in FL if you have the right house to sell.

Great sale!

Parts of California, I can kind of understand there being a premium, but the Florida thing…good god, if you’ve got a million bucks to blow, why in hell there??

Um, great weather 10 mo/year, no income tax, easy access to the Caribbean, gorgeous water and palm trees and sand, coastal waterway, boat life, almost half way to Europe compared to the west coast, etc, etc.

My uncle’s dream was to move to Florida. After about 10 years he said never move there because it’s always always too darn hot and humid and people just stay in their houses with A/c running never coming out.

I had the misfortune of living & traveling all around that flaccid wang, thanks to my snowbird parents. It was a swampy sodden vortex of melanoma, vapid culture, chain shops and animus, the latter of which is openly evinced by the transient residents who came looking for perpetual fun-in-the-sun only to find themselves angry and underemployed in one the boredom relief industries there.

The snake birds are cool, though.

This actually for GP:

As a FL native forced back to care for in laws in their 90s, I would NOT recommend FL for anyone who cannot find a good solid job BEFORE they come here.

Surely, folks who have been here since the 1940s or 50s understand the HUGE delta between then and now, with the gulf now poisoned by oil spills continuing and still residing, which is small compared with the pollution from septic systems and lawn poisons that have killed most of the formerly beautiful coral reefs that used to ring the entire state, or most of it south of TPA.

Other natives I know will not eat anything out of the gulf or bays any more, for the above reason, and now, the interior that used to be farms and ranches are subdivisions producing more poisons and pollution.

Time and enough for serious work to clean up the environment of all and every kinds of ”invasive species.” HAH.

As for weather, FL actually has 12 seasons: fall, winter, and spring each ”might” take a week or two;;; the rest are variations of summer, such as ”early early summer to late late summer, summer with 95 degrees in the shade sometimes starting January 1st and ending December 31st…LOL

bulfinch….kinda agree with your observations. However, living on the beach, assuming it is not over-developed…is nice. My only caveat is that I look at the US in toto the same (vapid culture, lousy food, polarized interactions, etc. etc.). I’m waiting for the proxy war in Europe to end and swooping in to buy a place as an escape for 179 days a year. Better food. Better museums. Better transportation. Better approach to those perched on the back end of the life cycle. Cheaper healthcare (in many instances). More things to do. If one has to live in a socialist environment with declining freedoms – oh well….go for lifestyle.

Bulfinch,

“animus” huh.

Well, anyway, good luck with your ongoing job at the CA Department of (Lost) Revenue.

bul/cas – my ongoing observation in my travels and from the remarks of the commentariat (full disclosure, I’m in N. California, and always marvel at the rock-rain) is that there seems to be an embedded amount of displeasure amongst those who have moved to, or visited, and/or absorbed the apocryphal narrative of an area, and discovering they’ve missed the local party (as noted by VVNV-you don’t happen to know Carl Hiassen?), if that party ever existed except in the minds of its promoters…

may we all find a better day.

How are the bugs?

The only stuff in my area that is still active are houses priced at peak june 2022 levels. In San Diego.

Everything else is flying off the shelves. So really it’s only the wishful thinking sellers that represent the inventory.

In SD, it’s pretty clear to me that buyers have lost this current fight with sellers. If mortgage rates drop in second half of this year, buyers will continue losing the whole year.

LOL. Sales in San Diego have collapsed.

They have indeed. And I suspect that were more inventory to come up for sale, sales would rip upward. Currently there is still a backlog of unfilled demand. I know what you’re thinking…if so, then why are any houses still on the market? Two things. 1) A lot of it is overpriced junk. 2) What isn’t, turns over quickly.

Don’t confuse me with a Kool-aid drinker. I’ve been bearish on RE for YEARS.

There’s some really greedy sellers out there and their stuff is sitting a long long time and days on market has gone up substantially but San Diego SFR inventory remains woefully dismal. It’s a very strange time. I’ve noticed that the nice stuff is selling for a pretty penny, but still sitting a while. Junk is sitting and sitting and eventually being pulled off the market, to become rentals I assume, further exacerbating the inventory problem. Lots of SFR’s are being bought up off market to turn into ADU complexes. Sales volume is obviously going to crater if there’s nothing available to sell. Going up against Wolf’s stats with anecdotal observations never passes muster, but those of us in San Diego are all seeing exactly what I’m seeing.

February ’23 Case-shiller data shows San Diego on average down about 8% from peak spring ’22, that’s about 1% decline per month. Model-match tract house in my old neighborhood in SD with very comparable upgrades – spring ’22 sold for $2.44 mil, April ’23 same exact model down the same street just closed for exactly $2 mil.

Prices are down from the peak and sales volume is way down. None of that contradicts that homes – priced right- fly off the shelves. Wolf stated it in his article too. Priced right = it sells. Less supply / less active listings means lower sales volume.

Here in Windermere, FL and nearby Dr. Phillips (Bay Hill for those not familiar) things still going pending quickly. Very little inventory still. I’m still seeing multimillion dollar homes going pending in under a week. Even the $4mm+ homes go pending quickly and close a month later…insane. Lot of people from NY keep moving here though not as much from CA. Maybe Disney cancelling the Lake Nona campus and move of Cali workers will help a bit. My concern is inflation is going to keep on going and that will keep prices up in nominal terms (maybe not in real terms). Maybe Wolf can put up the data from the 70s and 80s of inflation vs nominal home prices. QT doesn’t seem to be offsetting the supply vs demand problem here in central FL. My friends in south FL say the same and think it’s the wealth moving up from central and south America over there.

Real story of today. 33950. Retirement mecca zip, life quality still high especially in PGI sub community. Neighbor in my 24 unit complex of villas. They are in mid 70’s. 1st grandchild coming in couple months up in NE. Unit is 2550 sq ft, 3/3, with boat dock, single level, 2 car garage, in nice condition, essentially move in ready.

In Punta, it is a size, location, etc., where very little comparable. Listed at price a little below market. Pending in 3 days. Talked to them before listing. Yes could have asked more and perhaps waited, but they had good equity and at that age moving to daughters location for grandchild was most important and only so much energy, time.

Take away as discussed in previous comments, priced right, in good condition and if there are unique features it will sell very quickly. Also in area is a fair amount of inventory of houses from 70’s, 80’s, 90’s, built cheap and needing complete redeo, update. Most priced way too high, sit, but even some move at stupid prices.

Big issue when buying is getting contractor or subs to do work, in timely manner and quality, horror stories abound. One cannot expect quality levels, ect., that are more normal in NE or midwest, skill level for anything complex is rare here. Often people buy and then realize this problem or else boomers with dollars who don’t care. New construction is quoted at 18 months, unreal.

Several other factors about Florida that come into play. 1. it is rapidly becoming unaffordable, if not already in most desirable areas for houses and condo’s. New 2/2 apts 1500 to 1800 mo. Houses 3000 and up. Most crap. 2. Many older snow bird boomers that have 2 houses are giving up the northern house or really downsizing it, upsizing or building new in Fl. 3. Younger folks can’t afford Fl., due to low wages. 4. Plenty of jobs everywhere. Go into Publix, checkers are either 70 to 80, even 80+ or in evening 16 to 19 ( seniors gone home to bed ). Ditto HD, Lowes, etc. Skilled jobs go unfilled. 6. Wide differences in wealth, politics, etc. depending upon area of state.

Windermere resident here too. We’ve been annointed to be the Beverly hills of central florida. People paying millions to tear down a shack on main street or Maguire road to build a mcmansion. Hold trough the recession and into the next bubble for 2-3x today’s prices. Thank me later.

If you want to extrapolate what happened during the last bout of inflation, home prices tripled by the end of it

Everyone in the real estate industry and the media keep talking about median house prices. I would love to read an explanation of the relevance of rising or falling median house prices, since few people can buy a median-priced house. It seems as though a lot of house prices can rise even when the median house price is falling, and vice versa. When is the rise or fall in median house price relevant, and when is it just noise?

The national median price is never relevant if you want to buy the specific two-story red house at the corner of Main and Nothing, in Podunk, XS. If you want to find out how much to pay for that house, or whether the price went up or down or whatever, the national median price will not give you the answer.

You do NOT know if the price of an individual house rose or fell, unless there is a sale. And even a sale will only tell you if the price rose or fell compared to the last time it sold maybe 10 years ago. So looking at individual houses will tell you nothing about the overall market.

The median price will give an idea of how the market overall is doing. At this site here, we’re talking about broader economic movements. And the median price is very relevant for that.

Same with stocks. S&P 500 may go up, but your three stocks went down, and one of them went to zero. You cannot tell from your three stocks how the market overall is doing. We still talk about the market overall. And the S&P 500 index is still relevant, though not for your three stocks.

Falling house prices is certainly not a ‘debacle’ but rather a very wonderful and good thing especially here in California. When they fall at least 50% that will be a good and great start towards where they actually need to be and are reasonably worth.

If inflation is heading back up, as it might, the Fed will feel they are losing control, and will plunge us into a deep deflationary depression. Hyperinflation after that, cause that is what governments do. All in the name of “protecting the people”.

The last time CA saw house prices drop anywhere near 50% was due to a historic unwinding of debt, not inflation. Beyond any reasonable person’s wildest dreams, Wolf was able to point out in a recent article that total consumer debt as a function of expendable income is actually quite low. Remember, everyday is backwards day now because our central bank’s printers exceeded the speed of light, plunging us into an inverse reality. This ain’t the GFC again… We’ve gone far further back in time to the inflationary 1970s when the median house price tripled (and then doubled again in the 80s).

Who knows what the actual value of a house is anymore? What we do know is that the value of the dollar is decreasing. An asset’s price isn’t based on its intrinsic value, its price is based on the value of the dollar more than anything. If you’re waiting for a 50% drop in prices following the greatest money printing spree in human history, you might be waiting a while.

50% drop in price, but how measured? If house prices stay put with other prices and wages rising, housing prices lag or could be said to «drop».

Measuring «value» in dollars or any other fiat currency is like measuring lenght with a rubber band. Take a new measurement and the size may have changed.😉

“When they fall 50%”.

We’ll likely not see that anytime soon with such low inventory. Except if there is a zombie apocalypse.

or massive layoffs. Again.

Yes. Large scale and widespread layoffs (recession sized) have been the missing element in the real estate equation thus far. IMHO, the level of job market resiliency has been a surprise to Powell.

Only a personal black swan event will cause the people with mortgage interest rate loans in the 2.75 – 3.4% range to place their homes on the market. They won’t sell in this economic environment (and potentially take on a higher interest rate mortgage loan) unless they absolutely have to.

Sad to think that job loss is the missing link – so far. I don’t wish that on anyone. But I don’t see the current RE market conditions (particularly the low inventory level) changing without it.

Yep massive unemployment will have an impact. currently, we are at 3.4% unemployment rate.

The issue you have is that you don’t buy a house in coastal CA, you buy a lifestyle. That lifestyle is in demand and, therefore, the 1 BR / 1 BA termite infested crapbox will command $700K+ (that would be $250K anywhere else on the planet).

I know this from first hand experience.

720-800 SF 2 br, 1 ba CBS SOG in solid ”working class” and safe hood in the saintly part of TPA bay area tripled or more from $70-80K since 2016,,, holding steady last six months or so;

How some ever, recently totally rehabbed larger, 1300SF, home on busy street just sold for $465K after several reductions from initial asking of $515K.

Last part of reductions, $10K, likely due after buyers inspection, to needing new roofing currently in progress.

Location Location Location, eh

Right? Every one of these articles fills me hope.

The median sold price chart is still aimed in a direction that is unfavorable to buyers. Still high and staying high. The months of inventory chart is still stuck near all time lows. The history of the dollar has largely been inflationary, meaning prices only increase when looking at decadal timescales.

I often see commenters here mistake price with value. They’re different things. Asset price is based on the value of the dollar. How did house prices behave on a national scale in the inflationary 70s and 80s despite economic strife, a costly war, and painful recessions? In 1970 the median price was $24k. In 1980, it was $64k. In 1990 is was about $120k. 2000 was 165k. 2010 saw a low of 208k even after the worst housing collapse in living memory. 2020 was about 324k. And here we are at around $430k+ today after a staggering bout of printing.

Trends over a couple years don’t mean much over the long term. Seasonal changes are nearly meaningless. Well-located cities with more than one industry to lean on will see house prices in 2030 that are higher than they were in 2020. Deflation is not allowed and has never existed as more than a small blip on the chart that Wolf sometimes posts showing the buying power of the dollar over time… A steep line that runs downward to the right.

Meaningless post. Data from the 70s and 80s is completely irrelevant since that Era did not begin with unaffordable price levels, and it was not accompanied by a reversal of the most radical monetary policy in our history. The situation today is insane. The only comparable period is HB1. It’s pointless to cite any behavior that predates the recent period of QE, zirp, etc. If that form of monetary policy is dead, all asset prices will eventually equilibrate accordingly. The ongoung correction is in early stages and will continue unless the fed relapses.

If my analysis is meaningless, it would be because the relatively aggressive money printing of the 1970s was barely a blip on the radar compared to the orgy of money printing we underwent recently… Half of the dollars in existence were conjured into being in the last 10 years or so. A quarter of all dollars were created in just a couple of years!

So you could be right. Maybe this won’t be the 70s all over again. Chances are it’ll be worse.

“The ongoung correction is in early stages and will continue unless the fed relapses.”

At some point, there’s going to be a recession, so invariably the Fed is going to “relapse” and lower rates. Not sure that ZIRP will return, but what matters is if Congress trots out rent & mortgage relief.

If they do as I think they will, then housing is not going to see a major correction until we have that moment major financial crisis everyone fears but cannot predict its arrival.

I totally agree that the overall current situation is insane.

The other thing that is meaningless is failing to extrapolate income increases to home prices. We paid $38,750 for our first house in 1975. Just inflation, alone, would raise the purchase price to $218,500. Redfin says it’s worth $308K. However, during the time we owned it, we added a two car garage, a family room, a fireplace, 2 decks, central air, and a bathroom. IIRC, we spent about $30K doing that…. so today’s Redfin estimate isn’t that far out of bounds. Of course, you’d have to live in DuPage County, IL, not San Diego.

As a side note: At the same time (1975), my wife and I were making the princely sum of $13,000 per year….. which, in today’s inflated dollars, is $73K per the handy dandy inflation calculator.

There is a recession. The value of my wages keeps receeding year over year. Value of my dollars decrease so the amount of dollars per McMansion does not have to. Your welcome.

Sorry, I meant “you’re”

When home prices increased 40% (or 120% in my market) in two years, down 6.5% is hardly a ‘plunge.’ Though in fairness you used the term ‘plunged’ when referring to the decrease in transactions, and 30% give or take certainly is a plunge. It’s incredible that with sales down 30%, rates doubled, and both of those following a breathtaking rise in prices in a short time–prices are as resilient as they are. A combination of unrealistic sellers who want the peak price from last year (even though what they could get today is a number they would have dreamt about just 3 years ago if they were told that’s what they could get); and lower inventory, which a year ago was driven by insane buyer demand, but this year driven by high interest rates keeping sellers on the sidelines.

Lack of pressure to sell.

Unemployment should fix that.

Skiguy: I get that you are talking two different things but in general a 30% decrease is bigger than a 40% increase.

A 30% decrease is always very slightly bigger than a 40% increase, but only when the 30% decrease follows the 40% increase (and is therefore 30% of 140% of the original amount).

100 x 1.40 = 140

140 x .70 = 98

@Pea Sea

It’s the same result regardless of whether the increase or decrease comes first.

Pea Sea, what? It is irrelevant the order given the fact of the commutativity of the multiplication.

Increase of 40%, means 1.4 return.

Decrease of 30% means 0.7 return.

Compounded return = 1.4 * 0.7 = 0.7 * 1.4 = 0.98 = -2%, right?

“Unemployment should fix that.”

That’s moistly contingent on tightening credit conditions which will also hit asset (stock) prices.

Despite the recent (2+ years) interest rate increases, rates aren’t high versus the last 55 years.

There is nothing like crashing stock prices to get the C-Suites to issue the pink slips.

Credit conditions are still very loose.

@MN – about commutativity :)

For simplicity, let’s take the same %% up and down – in your logic the result should be unchanged? Not true

For example, 40%

x *1.4 *0.6 = 0.84 x

@Aiku – am I missing \s?

x * 1.4 * 0.6 = x * 0.6 * 1.4 = 0.84 * x

I mean:

it doesn’t matter if you gain 40% and then you lose 40% or you lose 40% and then you gain 60%, you end up -16% worse than your initial capital.

My logic is simply that compounded returns are multiplications, hence commutativity of multiplications. I didn’t say that if you gain 100% and then lose 100% you are at the same capital, actually you end up with zero.

Frost:

I’ve never understood the “rates are still low” arguement. Rates don’t really matter, it’s about the delta. Banks didn’t have sub 1% treasuries and 3% death notes that have lost value, going back 55 years.

Alku:

Y=1.4

X=0.6

(aX)Y=0.84a

(aY)X=0.84a

Ltlftc,

Rates are not that much higher than inflation, i.e. the real rates are still nearly zero.

@MN: no sarcasm – I wasn’t attentive enough while reading, my apologies… My point was only about same % in 2 directions won’t bring you back to where you were.

Interest rates aren’t keeping me on the sidelines. It’s the prices that are. From an historic point of view, 6.5% interest rates aren’t that bad. If someone can’t afford a home at these rates, they probably shouldn’t be buying a home.

Whether or not interest rates hold buys back isn’t their choice – they have to meet the debt-to-income requirements to qualify. A purchaser that could qualify for a $500k loan in 2021 can only qualify for a $370k loan today. And that loan can only buy 87% as much home as it could buy in 2021. The combined effect is that a buyer that could afford a $500k home in 2021 can now only afford a home that would have sold for $324k in 2021.

But I’m not looking to finance, so interest rates mean nothing to me.

But nobody with a 2 percent 30 year mortgage wants to sell a house and have to buy a 6.5 percent mortgage. You would lose money even downsizing. The only true sales will be new builds and forced sales.

Yeah when you’re looking at real numbers of people up-sizing their house, if they can, it makes way more sense to hold onto the old one since just about everyone who bought before 2022 could cash flow their property today. There’s a reason inventory is low…only forced sellers will dump.

You guys are just barely missing the key point here, which is that for the 90% of buyers that rely on mortgages, affordability is a function of BOTH prices and rates.

Someone with a 2.5% mortgage rate won’t move to a new house in this market *not* because their current rate is low, but because the monthly payment on the new house is too high. And in this market, the monthly payments are WAY WAY too high. If I have a current rate of 2.5% and a monthly payment of $1800, then I could easily jump to another house with a $2000 payment, even if the rate is 6.5%. This would of course require prices to come down, as we expect they would in response to higher rates in a healthy market. But we don’t have that. So that 6.5% mortgage and elevated sales prices means that the new house payment is more like $3500. People aren’t selling and buying because the new house is too far beyond their budget, not because the number attached to the rate side of the equation is too high.

This means that returning to a healthy market will require lower rates, lower prices, or a combo thereof. Given the stubborn inflation data explained by Wolf, we probably shouldn’t expect much help on the rate side of the equation. This means that prices *must* come down if we’re gonna rebalance.

According to my calculations, in order to return to 2019 levels of affordability, current prices would need to drop ~30%. I have no clue if that will happen. If it doesn’t, we’ll all remain frozen in place until rates drop, prices drop, or incomes catch up. There’s no fourth path here.

I ask a question in reverse

Why would someone who sees that they could have bought 2 years ago at a 3 percent 30 year fixed now rush to buy at 6.5 seeing the downward trend in the market?

“Why would someone who sees that they could have bought 2 years ago at a 3 percent 30 year fixed now rush to buy at 6.5 seeing the downward trend in the market?”

Two reasons: hopium and fomo. They think they’ll be able to refi and/or don’t think their house will go down.

There weren’t any 2 percent 30 year mortgages (15 year dropped close to 2 for a brief period). There was a trough from roughly June 2020 to December 2021 where the 30 year bounced around the 3 percent level. You can look it up – mortgage news daily has charts.

To your main point: a buyer who purchased a home to live in and has a 3 percent mortgage (or refinanced to a low rate mortgage) is not a candidate to voluntarily sell absent extraordinary circumstances. But most people don’t sell and move frequently; typically it’s due death, divorce, retirement, job/personal move.

There are a few known unknowns this time around (which Wolf has pointed out): unoccupied houses held as an investment (as in someone bought a house and moved but didn’t sell the prior residence), houses bought in response to WFH but the owners now need to be back in an office, and houses bought purely for speculation.

As prices continue to decline (and yes, I know that someone’s sister’s cousin’s landscaper’s barber sold their house in 47 minutes in a 6-way all-cash bidding war for 50 percent over asking), those in the known unknown category may begin to feel the heat. Even a house owned “free and clear” isn’t cheap to hold with taxes, insurance, and maintenance.

Just like HB1, this will take time to unwind and will move at different rates in different locations. Appropriately priced properties in good condition will sell and sell quickly. But don’t be deceived: the trend is down in volume (a lot) and price (a bit).

Have patience. This is not the crypto market where prices crash overnight. The trend is important, and it is downward

No forced selling. Homeowners are doing well.

Homeowners are doing well.

That’s right, for those who don’t want to sell.

But those of them who are trying to sell are clearly having a hard time.

US house prices have jumped +100% in ~7 years. Not a surprise to see them take a breather for a bit.

Yes— a breather before the next leg up…

Ha ha

So we are at the acceptance stage that prices are going down? Not long ago, people were absolutely in denial.

Today Lawrence Yun has moved from “prices will recover” to “they will rise and fall with mortgage rates”. Prices will fall with higher rates? Who woulda thought? It’s a baby step for this guy but at least it’s a step towards the acceptance phase.

“The home sales still struggle to recover,” said Lawrence Yun, NAR’s chief economist. “Right now home sales are just bouncing a little higher or a little lower, depending on the movements of the mortgage rates”.

A 30 percent drop in sales in the peak season is HUGE. This is a crash in this market. If this trend continues, I’m guessing that by this time next year, prices will drop by at least 20 percent.

Lower sales volume doesn’t mean prices have to go down. Not in the slightest. To simplify: last year 10 houses were for sale and sold.

This year: 2 houses are for sale and sold. Sales volume is way down yoy. The median price for the two house might went up (less choice) while sales volume was down.

Richard

Sorry, but what you are saying is ridiculous.

When someone stays for a few months and can’t sell. What is he doing?

Elementary, lower the price or don’t sell.

That is, if the market remains frozen for a long time and the interest rates do not fall, the moment will come when in order to sell you will have to lower the price. It’s the same in every single market. The difference is that this happens the slowest in the property market, this is the psychology of this market

JuliaB, you are right. It should tank. However in Long Island here, people will rarely budge on the price. Their RE agents will pull all the stupid tricks, i.e. coming down 5-10k every 3 months on an absurdly priced home (does literally nothing on your monthly payment), taking it off and then re-listing it over and over and over to beat Redfin or Zillows algorithm so it looks like a ‘new listing’s but keeping the price the same. Eventually some dummy goes emragherd and buys it for said inflated price.

There were a lot of homes flying for 700k+ and 2.5-3% rates. Now sellers expect the same 700k at 6.5% and wonder why it doesn’t sell in negative time with a 100k over asking bidding war.

My neighbors house sold after being on the market for over 8 months. No one has the $7300 monthly payment, not including utilities and insurance. At the peak it was $8900. For a home in an average or less than average school district.

That is until an Asian lady from Queens bought it. WITH her parents. It seems they are the ones buying up the RE in this area like nobodys business.

The conclusion is

Stop buying

LOL yes it’s just going to be a gully, a lil ol itsy bitsy gully.

It will be curious to see how long sellers hold onto June 2022 fantasy land prices.

Sellers won’t sell until it’s economically advantageous to do so, unless their situation forces them. When interest rates are significantly higher than your existing mortgage it can tilt the equation a great deal in favor of holding out.

A person holding an existing mortgage refinanced $365k in 2021 for 2.8% and paying $1,500 a month would only be able to secure a $240k loan today for $1,500 a month. That’s a significant downgrade in housing they’d be forced to take.

It literally doesn’t matter if people are shoehorned into low mortgage rates/payments. Even if they decided to sell they would have to buy and in net has no impact on balance except they don’t need a realtor. Only first time buyers, investors, funerals or builders make any impact on balance. The whole neighborhood could be repriced with a single forced sale.

The repricing due to one forced sale may be rather academic as long as no other houses are put on the market. Much the same as unrealised financial gains and losses. With low volumes prices can end fluctuating a lot depending on who buy and sell at any given time.

To predict the price of a house where just a few houses are sold each year is difficult.

I wouldn’t want to miss out on an opportunity to contribute some anecdotal info…. so I just did a scan of the “hot” (Redfin’s term, BTW) north county coastal San Diego area.

Inventory is, of course, thin. Asking prices for new listings are about what they’ve been for the last year. N=1, a house that sold last year in the $4 mil range just listed ~$250k higher. Overall, a few % either way is impossible to detect.

On the sold side, interestingly, condo/townhouses continue to hang in there, ~$1450/sq ft. SFDs, it’s all scattered data, too noisy to tell within 5% whether they’re up or down.

Overall, I’d say flat, or close enough, YOY.

Or, you could use legitimate data. Try it sometime.

May 5-11 in San Diego

New listings 457

New pending sales 509

Active listings 2467

Source SDAR and Mortgage News Daily Data

San Diego county has over 3.25 million people and is the 5th largest county in the country and there’s been consistently around 2500 active listings for some time now. These are numbers that are there for anyone to see. Those of us presenting some anecdotal here and there know what many of the drivers of San Diego’s market are. Interestingly enough, these and the several data always coming out back up our anecdotal observations.

Interest rates priced buyers out of the market, and now rents continue to skyrocket. Home prices will drop until mortgage payments meet rents and we will once again see prices rise for both in tandem. The only solution is to build more housing. This will take decades in many places. Great time to be in construction. The fraction of households rent and mortgage burdened will continue to rise for years.

More houses is being built at record pace.

More houses are being built*. Its not record pace and it will still take years to overcome gap left by 14 years of depressed new construction from the 2008 collapse.

Multifamily is up though, which is very good. I see places popping up all over Boston. This is desperately needed.

Population growth, family formation, Boomers downsizing and deaths.

And once it becomes clear to many that slumlording is not that fun in high interest environment, watch out….

In California, where there is an alleged “housing crisis,” there are just as many housing units per capita as there have been for the past 70 years. In other words, the number of housing units has not changed in relation to the population. There is no supply crisis. The crisis is the Federal Reserve printing money out of thin air and inflating bubbles with artificially low interest rates. The dollar becomes worth less and the prices of assets go up.

I’m seeing a lot of new luxury condos being built in and around the bean, but nothing I would consider affordable.

Boston has been overpriced for at least the past decade.

Nobody has a birthright to live in their own housing unit. That’s another American myth.

There is no supply shortage, even ignoring the shadow inventory.

People will double or triple up if they have to, whether they like it or not.

It’s obvious the ONLY reason US housing is affordable is due to basement level credit standards. It isn’t the sub-basement credit standards of HB1 but still very liberal. These are the same credit standards keeping this fake economy afloat.

Many, many new apartments have come on line in Phoenix over the last few years, with many more being built.

New single family homes, as usual, are being built in the x-urbs. Gas is still pricey if you have to drive 30+ miles one way to work. And everyone seems to have bought a giant truck that costs a great deal to fill up.

@MM

people moving out of their current places into those luxury units will increase vacancies and lower prices. Im sure theres 10 thousand rich yuppies in Cambridge who would love to leave their 4 bedroom with 9 roommates. A tide lifts all ships, and lowers….

LOL I used to live in a 4 br with 9 roommates in Watertown. I’m sure these complexes will be filled by rich Harvard and BU students, paid for by their parents of course.

Anecdotally tho, I always see a significant amount of units with no lights on in these complexes…

The boomer population ,largest ever will solve this problem,evolution I’m a baby boomer

It appears that the only thing keeping the housing market from crashing is the lack of inventory. This cannot last. Once this changes (in a recession) prices are going to drop even more.

And the stonk valuations imo.

The inventory will start when people start letting go their second or third homes. With the stonks still at a high valuation, they are not too pressed to sell atm. Those who bought second or third homes are the same people benefiting from higher stonks/cryptos.

Cryptos – which are still down massively from the heavily transacted highs. With the exception of Bitcoin and Ethereum most are down 60-80%+ from peak (still). The ones who were most aggressive were adding all the “alt coins” for the next big thing.

Same with the high flier “stonks” … they are still massively down.

So there is no big unwind coming. Not in the speculative areas – that is done. Anyone hoping for that is the same type who waited for a further drop when the Dow was at 6,800 in 2009… and still waiting today.

Home prices? Look at any other global market comparison and the US still looks affordable if not outright cheap. On that basis, if those other markets don’t crater (and they haven’t) it’s a pipe dream to expect the US to crater outside a few regions.

Said the Realtor.

Are you comparing median home prices to median household income to measure relative price differences between countries? It doesn’t matter if homes are “cheap” in the US if the pay is also cheap.

That’s what makes Texas real estate less affordable that a lot of suburban California. Sure, the prices are cheap, but the median earnings are so much lower that housing costs eat more of your income in Texas than California.

“Same with the high flier “stonks” … they are still massively down.”

False – Nasdaq is within a few % of its ATH in August last year.

Everything is still overpriced.

Stocks are massively down?

That’s really funny.

You’re ignorant of financial market history.

The S&P 500 isn’t down even 20% from an unprecedented maniacal peak. We’re still in the biggest asset mania in the history of human civilization.

@MM – You said it right. @Truth is putting out False stuff 😂

Utter BS. I have multiple friends who are moving to Europe because the housing is so much cheaper. Of course that isn’t the case everywhere in Europe, but it is true in many places.

14,150 in 2007

6,550 in 2009

53% drop

36,800 in 2022

33,500 currently

9% drop

“Massively down”

So Al John I don’t know much about Europe ,except there’s a huge energy shortage ,stock up on long underwear ,flannel shirts and gloves

@SocalJohn

The cost of housing in isolation is irrelevant. The cost of living in relation to income is the relevant factor. Taxes are a cost of living, too. Of course real estate is cheap in Europe because the governments there generally steal such a large proportion of workers’ incomes that their markets cannot support higher prices.

Americans can swoop in with the cash they saved by living somewhere that steals less of their income and scoop up those cheap properties. The trade-off is that now those Americans are going to be forced to live in a place where there is vastly less individual freedom. For some people that’s a good trade-off and for others it’s not worth any price.

@Flea

I don’t know if you’re aware of climate, but Europe just went through one of its warmest winters in decades, and its causing massive flooding right now in Germany, Switzerland, and Italy.

People will let go of their Air B&B properties when/if unemployment goes to 5% or higher. People won’t be taking vacations and those properties will sit vacant.

In order for the housing dam to break, there must be more people who “need” to sell than people who can afford to buy.

But, that’s not going to change materially. Builders are not going to start rapidly increasing production, and Uncle Sam will trot out rent & mortgage relief as soon as things get dicey.

A slowdown in housing has always led us into a recession. But so far, the current environment is primarily a sales slowdown. It’s not an across-the-board massive price drop outside of 8-10 major markets. And the overall labor market continues to excel. In the coming months, hopefully higher borrowing costs will slash corporate profits enough to markedly increase job losses. That’s what’s needed. We need a fair number of those zombie companies to go kaput. We need CRE to start to crater some.

But for now, none of that seems to be happening quite yet. Time will tell. I’ve thought since late 2022 that 2024 is more likely for the arrival of a recession.

Wonder what will will happen to Sam Zell ,property portfolio after his passing. God bless him always enjoyed his straight forward way of communicating. Hope his family knows where the gold is stored

I don’t think Congress, at least if it’s divided, will approve rent and mortgage relief after the 2020-2022 experience.

That said, I wouldn’t put it past the current occupant of the WH to try to do it unilaterally through executive order, and then claim that no one has “standing” to challenge it. That’s his MO.

I think it’s more likely to happen than not. And I base this solely on the fact of how entrenched the federal government has become in manipulating the economy ever since the fall of 2008. I think Trump would certainly allow it, but I think DeSantis would have a hard time going along with it. Yes, it’s critical that the current regime be voted out of office.

This whole shift to Modern Monetary Theory-based running of the economy is well entrenched, in my opinion.

I would say your headline should read: “house prices barely changed over last year, in spite of higher mortgage rates.”

The first price bubble falls for 6 years before bottoming out. It is normal for trades to collapse first, and once prices start to fall, as has happened now, The bursting of the bubble does not mean a sharp drop in prices but a long smooth decline until a bottom is reached.

Exactly! But I think the “pandemic gains” will be wiped out a lot quicker.

Yes.

In addition, our brokers in Europe also talk about this nonsense about lack of inventory. This is complete bullshit. It is full of ads for sale but at ridiculously inflated prices.

Really? Seems prices bottomed around 2009 last time. Some drifting afterwards but effectively bottom was pretty quick after the decline.

There may be a 10-15% correction still to come as recession hits but that will be matched with worsened fundamentals for many buyers.

Prices actually bottomed nationally in 2011.

Yes, really. From the chart in the article, it’s quite obvious median prices bottomed around 2012. “Drifting” lower still means prices are going down.

Truth*

Yes, really. The national median price (the data here) averages out all the local prices — and they were all on a different schedules, and the magnitude of the declines was different.

So the national median price (the NAR data here) peaked in July 2006 at $230,400 and bottomed out in January/February 2012 at $155,600. That’s a 32% decline.

Local prices plunged much more, but on a different schedule, some starting in 2005 and other as late as 2007. And they all hit bottom at different times. So that national median price cannot show the timing of the local tops and bottoms, or the extent of the declines. But you own a house in the local market.

For example, per Case Shiller:

Los Angeles: peak Sep 2006, bottom Feb 2012; -42%

Miami: peak in Nov 2006, bottom Dec 2011; -51%

Phoenix: peak Jun 2006, bottom Mar 2011; -56%

Las Vegas: peak Jul 2006, bottom March 2012; -62%

*You should change your screen name to something a little less cynical.

Agree

I tried to buy a house two years ago, missed it.

It came back on the market two weeks ago with an asking price 22% higher. The second day it was on the market I bid the offer, cash, and flexible dates for seller. I didnt get it.

And that is not unusual where I live.

The market is stiff here.

Either an anomaly or fiction. I suppose it could happen somewhere, but the CS data indicates otherwise, and strongly.

MitchV,

That’s how a paid real estate promoter would try to twist the data to give it positive spin. Even Yun didn’t try to do that.

“NEW YORK (CNNMoney) — Existing home sales during the housing bust were actually 14.3% worse than previously reported, a revision to Realtors’ group numbers shows.

On Wednesday, the National Association of Realtors (NAR) revised home sale counts back to 2007 due to flaws in their original data analysis.

…

The errors started in 2007 and continued to accumulate over time,” said Lawrence Yun, NAR’s chief economist.

…

When NAR investigated, it found a “notable upward drift” in the numbers compared to other measurements such as courthouse deeds records, said Yun.”

LOL. Blast from the past! That was an article from 2011!

But yes, it was quite a scandal back then.

Here is the link to the CNN article in 2011 that you cited.

https://money.cnn.com/2011/12/21/real_estate/home_sales_revised/index.htm

In my midwest metro area, SFH permits have plunged to 2013 levels. The MOM drop off has happened in just the last 3 months. Only years 2011 and 2012 had lower monthly new permits going when I look back 20 years. I have not seen such a big 3 month plunge in SFH permits plunge since 2008.

Yet inventory is still 50% less than normal. New home construction is 55% of inventory(historically it is 15% to 20%). Some suburbs new construction is 80% of homes for sales.

Homes under $500k are hitting new highs in prices. Homes over $800k are struggling.

That being said, I noticed US census rental vacancy rates are trending up starting about 3 months ago after trending down for many years.

Seven years ago you bought your home for $300K, and refied your mortgage down to 3% or about $1000/month. Now your house (or one like it) sells for $600K with a 6.5% mortgage, or about $4,000/month. Why would you sell a house costing $1000/month for a similar house costing $4,000/month? This is going to be a dead market for a long time.

totally agree with this statement. dead market until there are enough layoffs and economic downturn for there to be distress in the markets.

Even with layoffs and economic downturns, where can you find housing for $1,000 per month? If you lived in OR, you could collect soda bottles and return them for the deposit and make that much.

The biggest question is if you can afford anything at all in the current environment if you walk away from your house.

If you have a 1MM house in Cali and can’t afford it anymore, you can still downsize massively, move to a much cheaper state and make through tough times.

But if you had a loan on a 200k house in SC/TN/KY and you pay less than $1000 a month, it may well be that it is literally THE BEST you can get for this kind of money and, most importantly, there’s simply nowhere to downsize – there are no cheaper places either to buy or to rent.

It almost seems like the Fed knew what they were doing to prevent another housing crash this time.

They lowered rates enough so everyone could refi their homes such that it would be foolish to sell now and buy a similar home for a higher payment. Especially if they purchased their home before 2019 which is likely the majority of homeowners. If the supply is low, there won’t be a crash.

What could cause supply to increase? The 4 D’S.

1. Depression- If enough people lose their jobs, they may not even be able to afford their cheap home.

2. Death- You can’t take it with you. The annual death rate is low.

3. Disaster – Fire, flood, or wind. In this case, you will likely have to buy another house.

4. Divorce- For every divorce, there will likely be one house sold but potentially 2 houses purchased.

Depression or Recession would be the most likely cause of more inventory like in 2008 if there are massive amount of jobs lost.

Houses are not a finite commodity. Despite what we are being fed by Realtors. Build more and inventory grows.

The problem with “build more” is zoning and permitting. Even if you own land and and will put in all the required utilities, you still have to be zoned and permitted to build. In much of the US, zoning is bought and paid for. Yeah, its corrupt and thats how city officials and developers get rich.

You have to promise to give back something the city wants (a school, park, roads, open space, other utilities, etc.) in the future, but, then, it just never happens because Miraculously!, you just can never get that required zoning and permitting!

4. depending on how bitter, and sense of economics a divorce may only be followed by one potential house purchase. Around here it is not uncommon that one party buy out the other and keep the house in a divorce.

You’d sell for all of the usual reasons: death, divorce, job relocation, etc.

The real question is who can afford to pay you 4 times (on a monthly basis) what you pay for your house? Annual income required (based on a conservative 33 percent of gross for housing) goes from $46 – 50,000 up to $141,000+. Not many people have had their income triple in the last 7 years.

Yes it will be a dead market until the price (of money or of the property) meets what buyers can pay.

Not sure why we think that falling home prices are a ‘debacle’?

Assets correct in prices all the time, on account of simple demand and supply. All along we had an artificial supply constraint and easy money for investors to buy second and third homes, and private equity to buy residential housing using leverage. That era of easy money has passed, and supply is the same, while demand has decreased.

Debacle for home owners who have been trained to look at a home as a piggy bank that will always keep adding change, or investors used to relatively risk-free gains, but certainly not for gen z and millennials who have been priced out of the housing market.

The era of easy money is temporarily paused*. The Fed will absolutely return to their asset inflation policies the moment a recession starts in earnest or when they say inflation is beat.

“Debacle for home owners who have been trained to look at a home as a piggy bank that will always keep adding change,”

Never understood this idea, it’s not like a home’s value is a liquid asset that you can just tap into for extra cash to spend, it’s only worth anything if you’re actively selling. Rising home values for the big majority of Americans are much more of a financial burden by increasing the costs of insurance, property taxes and maintenance and repairs. So why would people be celebrating rising home values as a “piggy bank”? It’s just the opposite for most, it means more costs without any increase in real liquid income. It’s only value is if someone is actively selling, but even then, you’re just buying back into the same inflated market, unless for ex. you’re early-retiring in Costa Rica or Ecuador, or moving to one of the cheaper places in Europe a lot of Americans are going to. And I can’t imagine those numbers are all that high. Most Americans including homeowners should be happy about lower prices.

“Rising home values for the big majority of Americans are much more of a financial burden by increasing the costs of insurance, property taxes and maintenance and repairs.”

Bingo. I *want* my house to come down in price – I bought it to have a roof over my head, not a piggy bank.

You want to be upside down on your mortgage? Why would you want to owe the bank more money than your house is worth? That’s literally the most financially unsound thinking I’ve heard today so far.

In Costa Rica major dental work is much cheaper.

It’s a debacle because our economy is driven by consumer spending, which in turn is fueled by home equity for a huge chunk of the population.

The median price chart of existing homes looks like one side of Mount Everest.

This is the worst, least affordable housing market for buyers in history. With the rate hikes, it’s more expensive than ever. We were already in a massive bubble in 2018, and what the FED did with the money printing and MBS purchases since that time can only be described as sickeningly twisted.

I know of neighborhoods where stucco shitboxes were already massively overpriced at $499k back in 2018, then went up to almost $800k. Now the houses sit, unsold, asking anywhere from $749k to $799k. A lot of these people are trying to cash in a quick $200k – $300k. There are no buyers at those prices anymore. They have been sitting, unsold, for over 9 months now.

The builders are still building there, too, and they have been doing everything in their power not to cornhole all the people they ripped off the past few years, offering upgrades and other little gimmicks to hide the price declines. The whole area needs a 75% price drop enema.

The benefit to one group is to the detriment of another.

There has been a terrible imbalance …..created by the Federal Reserve.

Terrible.

This market is not “least affordable housing market for buyers in history.” It’s not even close. The worst time for mortgage buyers was 1981, when a mortgage on a median priced home would cost 40% of the median family income at the time. At peak prices in 2022 the mortgage on a median priced home would cost 23% of median family income. Housing is almost twice as affordable today as it was in 1981. In the last 50 years there are 19 years that were less affordable than 2022.

I made a graph using median home prices and median family income data from the St. Louis Federal Reserve.

There was nothing on the chart to explain anything, and no sourcing, no description of the underlying data, etc. Can you provide the links to the St. Louis Fed data that this chart is based on, and I’ll have a look at them. Because your chart looks really odd.

For example, you might have used inflation-adjusted income figures and non-adjusted house prices, or something like that, which would produce this type of odd chart; I have seen it before, which is why I bring this up.

I used nominal dollars, not real for both median home prices and median family income.

https://fred.stlouisfed.org/series/MSPUS

https://fred.stlouisfed.org/series/MEFAINUSA646N

Mortgage payments calculated on 20% down and using interest rates from https://fred.stlouisfed.org/series/MORTGAGE30US

OK, thanks. Repost the link to the chart and I’ll take another look. Seems to be ok, from memory.

https://i.imgur.com/QObM8FV.png

Hahaha. I have been waiting for Wolf to do another housing blog.

Here is the headline of an email I received from Redfin just one week ago:

Limited Listings Drive Rapid Sales

Home sales are slightly down but those that sell are going fast. Prices are starting to stabilize, indicating the Fed will likely hold off on interest rate hikes next month.

I guess they don’t subscribe to Wolf Street or they don’t let the truth get in the way of a good story. :)

Like Wolf says, nothing goes to heck in a straight line but it’s amazing that they are leading people to believe the worst is over.

Wow, the illogical nonsense from scummy outfits like deadfin is amazing… “Prices are starting to stabilize, indicating the Fed will likely hold off on interest rate hikes next month.” WTF?

That’s Redfin propaganda. I’ve gotten to the point I no longer look at their emails. Reminds me I really should unsubscribe. I’m sick of their crap clogging my inbox.

That actually seems true to me. The market

here (Boston area) seems to have been, uh,

guano crazy for the last ten to fifteen years

sort of looking to buy. I dunno about the

entire market, but at the cheapest end of

houses for sale, anything remotely reasonable

sells quickly. Just yesterday morning, I saw

something I thought was serviceable in

Waltham, first day on the market, that I

thought was worth checking out. I dropped

an email to the used house salesman, who

wrote back saying that the seller had already

accepted an offer. I think that’s the third time

in the past six weeks or so that’s happened

when I’ve written or called about a house for

sale.

I’m not going to claim the entire market is

like this, but around here it seems that the

first time buyers and people looking for any

semblance of value are still swarming in

chum.

From a person trying to buy a house, I’d

like to see the fed dump all their MBSes,

hike rates by ten percent, and the

government drop the mortgage tax

deduction, and cut the conforming loan

limit to 300k or so. I mean, it would be

better for me if that happened. Except

maybe for the economy blowing up.

J.

J,

Try looking further outside the city. Boston has always been an overpriced and tight market.

I purchased just over the border in NH a couple years ago – cost of living here is much cheaper than Mass and the commute isn’t so bad if you can avoid peak rush hour.

NH is worse than Boston currently. Boston prices are finally going down, NH they have (seasonally adjusted) flat-lined since October. I put an offer in 51k over asking last week. Outbid. Ive officially called off the hunt for now, just signed a lease.

MM,

What was it people said back in 2006

or so, … “Drive ’till you can buy”?

Weirdly, back in ’97 or so, prices

seemed very reasonable, compared

to rents, in Cambridge, as an example.

Sadly, I could not afford to buy at that

time.

J.

———————————————-

And Herpderp, you probably have

people from MA making offers in

even increments of $100k, and

just being like “keep the change”.

“The spring market is in full bloom here in Ada County (Idaho), with buzzing activity from both buyers and sellers…”

Quote from a realtor mailer received today. It also included these stats:

As of May 1, 2023

Ada County:

Median Sales Price (-13.3% YOY)

Homes Sold (-21% YOY)

Available Inventory (+17.4% YOY)

Perhaps the sound of air being released from an asset bubble makes a buzzing noise.

1) Inventory is less than normal. Both multi family units & single family

“in construction” hit a new all time high, despite the decline of single family.

2) WMT : consumers are stressed. WMT didn’t have a monthly close

above Dec 2020 high for three years.

3) Ilan : back to the office five days a week. DIS send Micky back to SOCAL. Layoffs next. Cut AAPL Apps to relieve stress.

4) SPX might close Aug 19/22 2022 gap before taking a break. MSFT 1M : the AI leader for the next 50 years might trade between : 315 and 270 for CNBC fun and entertainment.

Sold the SFH ‘domicile’ in Dec. of ’22, at below median for the area, 3 – 4 months after summer peak. 2 days on market – BAM! – offer made. We priced to sell relative to neighborhood comps.

Am glad to have done so. Looking to jettison this ever-cancerous wokeville of a state (Wa)!

Canada could crash much harder than US housing this time. The House of Commons just asked OSFI if eliminating the practice of mortgage amortization extensions would help decrease house prices. Short answer YES. If OSFI is allowed to target those variable rate fixed payment loans by allowing the payments to rise as was intended when the loans were written, we could have affordability in our lifetime.

Canada is of course many markets, but immigration (adding 1 million people in a year in a country of 38 million) is putting a floor under everything (and is eventually unsustainable).

New immigrants may be buying houses, or may be renting. Whichever it is their demand keeps rents high and so the follow through is that house prices stay elevated – when rent is $2,200/mth that pays a nice mortgage on a townhouse. And rates in Canada seem to be lower than in the US (BofC stopped earlier).

Outside of Toronto, we are again seeing bidding wars on very low inventory. Houses are lucky (or unlucky) to spend a week on the market. It is crazy time again. Heck I might even be tempted to try and sell.

I saw a clip of Pierre Polidore comparing how unaffordable Niagara Falls Ontario is compared to Niagara Falls NY.

US has land and money driven people. When there is a need, it will get fulfilled. As Wolf has posted before, many builders are clearing back logs and new orders dried up. There are many smaller builders that also are drying up. The whole “builders aren’t building” is quickly changing tune. How can a builder, in business of building houses, not build houses and survive without revenue? Obviously they will be more careful and won’t overreach with building like in 2008 bubble.

Would you rather pay $500k for a new home, than $480k for 1970’s built one and with most original decor still in place? Also, the old housing prices will drop even faster at that time.

Value is not just price.

How good are the schools?

How far/long is the drive to work and back?

How far from family or friends?

How much gas per week?

Will insurance go up?

What are the tax rates?

Do you want to live urban, suburban, exurban, rural?

People think about, or should think about, more than price.

I’ll take the 70’s vintage, thanks. Or older, please.

I’ve seen what constitutes modern residential construction. Fresh garbage.

Newness obsession is a uniquely American bent.

I’m not talking some mass built cookie cutter crap. There are some decent looking SFH built on nice lots that previously had some raggedy shack sitting on it. The only new builds I have seen around me are actually in desirable neighborhoods.

Not so sure what is so appealing about 1970 SFH split level or single level ranch that people overbid like crazy. Even more so that many come with a single car garage. So small, it gets used to store junk. Outdated layout etc. Fun project at the right price, but not at levels people are paying for them.

Yes everything can be looking decent, ripped up and rebuilt. That’s not cosmetics, that’s the layout, framing, roofing, hvac, plumbing etc

At the end of the day it will cost more than starting from scratch and be so much less of a headache. Heck adding a second floor is a nightmare of its own, such as stairway location etc (Don’t ask how I know). Building technology also improved significantly since 70’s.

No, corners got cut, materials became compromised and standards relaxed. Look at the pier spacing, the tile work, the journey man plaster (lower flashpoint than drywall or gypsum board) or stone & mason work (unrivaled) poured terrazzo flooring, unobtanium old-growth indigenous timbers including termite resistant cypress & redwoods. No Tyvek-covered particle board thrown up slapdash by a criminally underpaid crew of amphetamine-fueled day laborers who leave urine filled Red Bull empties in the walls, and butts in the gang boxes.