Investors exacting their pound of flesh for the risk of a default “as early as” June 1.

By Wolf Richter for WOLF STREET.

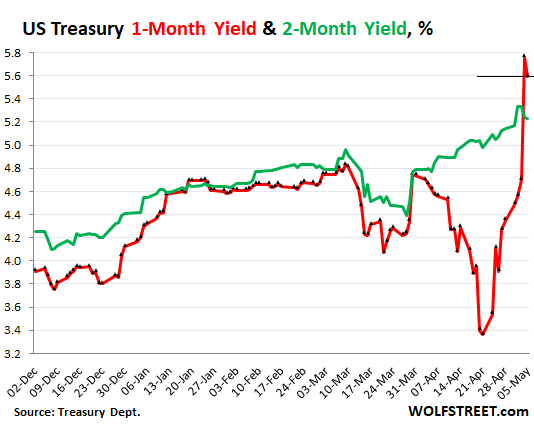

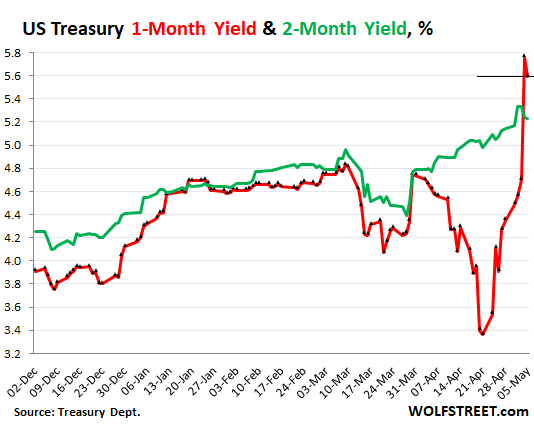

The chaos has been going on for weeks. And then it got funny at the Treasury auction on Thursday. Back on April 20, I marveled that the totally crazy 164-basis-point spread between the one-month and two-month Treasury yields: the one-month yield collapsed to 3.4% in just days (from 4.8%), while the two-month yield was just fine, ticking up past 5%. A plunging yield means that the price is surging amid huge demand. Investors were piling into a safe asset that will give them their money back in about a month, before June. What might happen in June? The US might default. That was the calculus back then.

Then on May 1, Secretary of the Treasury Janet Yellen moved X-Day forward to June 1. She warned Congress that the US will default on its obligations “potentially as early as June 1, if Congress does not raise or suspend the debt limit before that time.”

On Thursday, May 4, the 28-day Treasury bill auction went haywire.

The auction had been scheduled well in advance. For sale would be $50 billion in 28-day Treasury bills. These bills will be issued on May 9 and mature, uhm, on June 6. So let me just show you this chart of the one-month yield (red) and the two-month yield (green), and we’ll dive into the chaos of what happened in a moment. In normal times, those two lines run roughly in parallel.

June 6 is of course “potentially,” as Yellen would say, right smack-dab after the US runs out of money, when the US will be “potentially” unable to pay investors their interest and principal on those bills that were sold at auction on Thursday. And that would be a bummer.

Investors exacting their pound of flesh.

Turns out, lots of investors were willing to take the risk, if they’d be paid adequately for taking that risk – which is how it normally is with bonds. In total, the $50-billion auction got $126 billion in bids, of which $50 billion were accepted (results).

But the yields were crazy – I mean, not crazy, they were very rational, given the risk of a US default at around the time the bills would mature.

Remember, the one-month yield had plunged to 3.4% on April 20. By May 3, Wednesday, the day before the auction, it had re-spiked to 4.7%. Thursday evening, following the auction, the one-month yield closed at 5.76%! In the span of two weeks, the one-month yield had spiked by 240 basis points.

Investors were bidding huge amounts – $126 billion for a $50 billion auction – but at huge rates. The $50 billion in tenders that were accepted had rates at or lower than 5.84% (the “high rate”). That’s what it took to sell $50 billion in bills!

That 5.84% was 114 basis points higher than the one-month yield traded in the market the day before.

The median rate was 5.50%, meaning half of the competitive tenders that were accepted had bid above 5.5% and half below 5.5%.

All auction rates here are annual rates, as if the security paid interest for 360 days at this rate.

Bills (one year or less in maturity) are sold at a discount and the interest is added when the bill matures. But notes and bonds (over one year in maturity) have interest coupon payments that are paid twice a year, and the year is figured on 365 days. This makes the yields difficult to compare – which is why the Treasury Department also reports the “investment rate” of bills.

The “investment rate” of that bill auction was 5.964%! This rate is based on the 5.84%, but calculated to allow for comparisons to the coupon interest that notes and bonds pay semiannually (with the year being lengthened to 365 days).

This huge jump in auction rates didn’t make it into the Tradeweb-based charts on Thursday.

The charts of the one-month Treasury yield, based on Tradeweb data (such as the charts by CNBC, MarketWatch, etc.) did not reflect the spike in yields on Thursday. They show a closing yield on Thursday of 4.56%, and everything appeared normal, even as the auction rates had gone haywire.

But the Treasury Department’s closing yields that it reported on Thursday already showed the huge spike in yield, from 4.70% on Wednesday to 5.76% on Thursday, a 106-basis point blowout.

My Treasury yield charts are always based on the closing data from the Treasury Department, not on Tradeweb data (because I don’t have access to Tradeweb data, which is for the big boys, LOL).

And then on Friday, the Tradeweb-based charts caught up with the Treasury Dept. data and showed the huge spike in yields that my charts had already shown on Thursday.

But on Friday, the official closing yields by the Treasury Department dropped 17 basis point from the spike-close on Thursday, to 5.59%.

Meanwhile, back at the ranch…

With all this intense drama going on around the 28-day bill auction and the one-month yield in the markets, the two-month yield was doing just fine, and closed on Friday at 5.23% (green line). This is the same chart as above (both based on Treasury Dept. data), so you don’t have to scroll back up. It shows the stunning disconnect of the one-month yield from the two-month yield:

One more complication...

The Treasury yield cited in any yield data is a “constant maturity yield,” a construct based on market yields of Treasury securities of various types that mature in the time-frame of the yield. For example, the one-month Treasury yield you can look up anywhere is not an index of one-month bills. And it’s not based on auction yields. But it’s a construct of market yields by securities of various terms that mature in about one month.

In theory, and at the most simplified level, a 10-year Treasury note that matures in six months trades like a six-month bill that was just issued (there are of course big differences in reality, including liquidity). But this basic principle is what underlies the calculations of the one-month yield, the two-month yield, the two-year yield, etc.

Chaos in Treasury bills cropped up before: Lehman Moment.

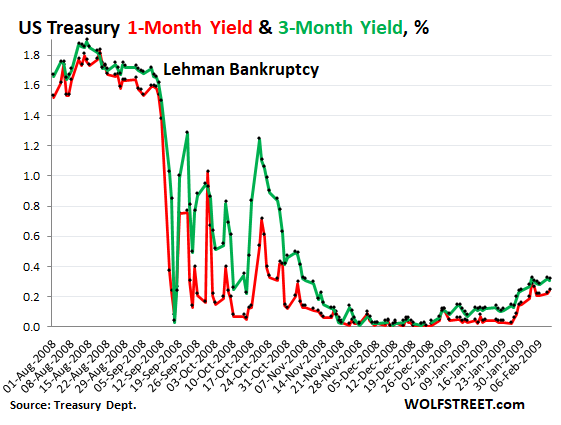

It’s not like chaos doesn’t happen periodically in the market of short-dated Treasuries. The other stunning example of chaos in recent memory was what happened after Lehman Brothers filed for bankruptcy on September 15, 2008.

In August 2008 through Friday September 12, after the Fed had been cutting rates amid a blooming financial crisis, the one-month yield fluctuated between 1.5% and 1.7%, and the three-month yield between 1.6% and 1.8%.

Then over the weekend, Lehman filed for bankruptcy. That week, both yields plunged to near 0% on Fed action, but then spiked back, with the three-month yield (green) spiking by 125 basis points in three days, from 0.03% to 1.28%, before plunging again. And then it repeated that feat a month later. This whole episode settled down in early 2009. Just for good old times’ sake:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Lemon brothers was very different from US government.

How many times has debt ceiling played out? Why such panic today only? Something doesn’t seem to add up.

It’s the date when that 28-day bill matures: June 6, right when the default might take place.

So investors went to the auction and bid a very low price (high yield). They’re not worried about NOT getting paid. They’re considering the possibility that they might not get paid ON TIME. And they wanted to make some bucks on that possibility.

If they’re really worried about not getting paid at all, they wouldn’t have bid at all. But the auction was way oversubscribed.

June 6th is Debt Day?

Yellen said, “as soon as June 1.” So maybe June 1, maybe a few days later. June 6 would be just right at the core of the chaos days.

I’m pretty sure Congress is going to get this fixed, as it always does, knock on wood. But they’re now making a little nervous too.

It’s not as if the “investors” who decided not to buy that security because of perceived risk, they will invest in other securities that are not burdened with that risk.

Which is ridiculous while the potential of a substantial adjustment in asset prices downward is more likely than upward. The decision today is too invest in Fed t-bills, and prepare to sit out the storm.

I caught the military history implication

Serious question about: “payed on time.” has it ever happened in relative living history where things were not payed on time? (us treasuries) To me this just does not seem remotely probable. Not being paid on time is not being paid. It’s not like some renter saying they don’t got the money and they need another few days on onlyfans. It’s the f***ing US. government.

Welly, the probability that republicans will cause a default of the United States of America is < zero. The theater that various venues feature should be viewed as entertainment not the truth.

Please stick with paid. Payed does nothing for your credibility on any topic.

The spell’n Nazis are out in flul froce. You can tell tehm by thehir brwon shirits and smug replies!…

Using the incredible power of the human brain, according to research at Cambridge University, it doesn’t matter in what order the letters in a word are, the only important thing is that the first and last letter be in the right place. The rest can be a total, mess and you can read it without a problem.

…is dyslexia, auto-c, or dain bramage at fault, here?

(nuance in English is always walking the tightrope…).

may we all find a better day.

from theglobalist dot com:

“Over a period of three weeks in 1979, the U.S. Treasury Department failed to send checks out on time, for an amount totaling $122 million. Again, by all modern definitions this constitutes a default, even if it was somewhat technical in nature.

Once again, lawsuits ensued. Their very nature and context tied it all together. The class action suit of Claire G. Barton v. United States demanded that the United States government pay interest (which was high in 1979) for the period during which it failed to send out redemption checks.

The U.S. Treasury thought it had no liability, relying on the Supreme Court decision in Smyth v. United States (1937), which was another case to reach the Supreme Court on the gold clause issue. In that particular case, the court held that “interest does not run upon claims against the government even though there has been a default in the payment of principal.”

In fact, the 1937 decision even referred back to the Public Credit Act of 1869, which had attempted to revert back to binding the government to make its debt payments in gold. The Act was never fully implemented. Ultimately, following the 1979 default, the government settled out of court.”

@dang

“the probability that republicans will cause a default of the United States of America is < zero"

not sure I'd take that for granted anymore. I've got a lot of family in those deep-Red rural counties that send these hard-core Reps into Congress, and they're basically in a mood to "burn it all down" now and get the second civil war going (which they see as inevitable). They vote like it in the primaries and ruthlessly demand a hard bargain from their reps. A major difference this time from before is the new rules that were started into gear at the start of this Congressional session, took dozens of ballots to get Kevin McCarthy his coveted House speaker position. His party members in Congress fought him hard, and as a pound of flesh they set up a rule where a single Congressmember–not 30, not 10, not 5 or even 3–just 1, can halt Congressional business and call a new Speaker if dissatisfied. That means McCarthy has to keep the angriest House members, and representatives of those districts happy, and he cannot be seen as caving even an inch to the other side, or he's out. Nothing like this has ever happened before in centuries of Congressional history.

Other unique factors, is that before, Obama was a pushover when it came to these debt ceiling negotiations and gave up a lot–even though the debt limit isn't about new appropriations, it's about paying for previous appropriations Congress agreed on. The Dems have done a 180 on this (they even harshly criticize Obama himself for being a chump) and Biden has made it clear he won't be yielding an inch since yes, the debt limit is about previous spending, not new appropriations. Also the Republicans really don't care as much about what business interests want, it's not just Desantis attacking Disney down in Florida, the whole business community is now seen as "a bunch of woke companies" on conservative social media (one of my cousins uses terms like these all the time) and they simply don't care even if big lobbyists and donors are screaming in their ear. A lot of GOP also see changes in demographics and vote patterns (they've lost at least 6 of the last 7 popular votes) and actually see a default as their only way to scramble the board. Then there are also a lot of experts on the GOP side saying the threat of default is overhyped, the media people are deliberately overdoing it and it won't be that bad (again another thing my family in Deep Red counties is constantly saying). So they welcome a default as a way to say they mean business and force Biden into deep cuts. Again, we can't use past last-second solutions as a comfort that things should be OK this time. The circumstances are completely, even radically different in Congress, with the Presidency and the media than ever before.

Miller,

Maybe when they all recieve their my pillow 2.0 they will get a better night’s sleep, be less cranky, and fewer will think they can solve things by burning everything down?……one can hope, anyway.

There’s real risk this time that a certain unhinged political party is willing to take down the credibility of the nation.

It’s really sad that we’ve come to this.

There both unhinged,corrupt,lying filth .Sorry depth charge didn’t mean to steal your show

Maybe so, but in this case it’s the GOP who is threatening default since they hold the majority in the House.

unhinged,corrupt,lying filth is actually not a friendly vote for the tenured members of Congress that squat atop our lives.

It seems to be more of rallying cry for justice, an opaque conjecture of an ideal that seems too fall on deaf ears since the Supreme Court institutionalized grift and graft.

RobertM700, that’s only true if you start from the assumption that the “default” is to approve any debt ceiling increase with no strings attached. If that’s the case, why bother having it at all? Why should the GOP be obligated to raise the debt ceiling to pay for the Dems $2.1 trillion March 2021 vote-buying boondoggle?

The Dems are also threatening default by not agreeing to any of the GOP’s moderate spending reductions in exchange for raising the debt ceiling.

One is more filthy than the other. One wants unlimited spending and hyperinflation. Weimer 2.0

There are many who dont know but have strong opinions.

How many learn from their chosen news source that the GOP is actually raising the debt ceiling? But still blame them for the situation?

Einhal,

“to raise the debt ceiling to pay for the Dems $2.1 trillion March 2021 vote-buying boondoggle?” is to pay for what the people of the United states through their Congress have already voted in. Questioning this, you are suggesting the GOP should declare itself outside of our lawful, constitutional, process: to nullify what We the Poeople and our government have set up and done. “I don’t happen to like it” is not a valid excuse to jettison our laws.

Phleep,

Laws can be changed. The debt ceiling itself may be a dumb idea, but is just as much a part of our lawful, constitutional process, as the 2021 spending plan. The debt ceiling was voted in “by the people of the United States through their Congress,” as you say.

I want the the debt ceiling farce to end, but it’s disingenuous to say some “laws” (e.g. 2021 spending plan) passed by Congress are sacred and questioning them is outside our “lawful, constitutional process,” while other laws (e.g. the debt ceiling) are not. If Congress was concerned about funding for its spending plan in 2021, it should have raised the debt ceiling in conjunction with passing that spending plan. It didn’t, and here we are.

Rojogrande, very well said.

Putting aside that I question the wisdom of spending $2 trillion on a 50-50 vote, the fact remains, the people also voted in a GOP House to rein in spending. One way to do that is to get spending reductions in exchange for raising the debt ceiling.

To your point, the idea that money already spent must never be questioned and as such, the debt ceiling raised without any conditions is absurd.

Divide and rule!

Yep. And the sheep are dumb enough to pick sides.

Federal deficits:

2018: 0.78T

2019: 0.98T

2020: 3.13T

2021: 2.77T

2022: 1.34T

Perhaps a little awareness would help?

Shouldn’t we try to get at least a few years of surplus (negative deficits)?

Projected deficit 2023 = $1.4 T

Projected deficit 2024 – 2033 is $2T per year.

Since 1970, the Federal Government has lost money in 49 of those 53 years. There lies the problem.

I think that might exclude Ukraine war support.

Who prints dollars faster….the Fed or North Korea?

Wait until the digital currency is in conjunction with nationalized banking.

Please do a little research into past debt ceiling battles, as recently as 2017 for example, when roles were reversed and the other party demanded negotiations for a debt ceiling increase. Now, if we actually default, then we can talk about one party’s irresponsibility.

Both parties are pushing for the limit to be increased.

Yeah I totally agree the Dems are totally holding up the process. The red team passed a debt ceiling bill out of the house and the Dem controlled Senate of holding it up and the Dem. president has threatened a veto even if by some miracle the blue team gets it act together and actually legislates in the Senate.

Oh and….I forgot to add, back under the bridge with you troll, sunlight hurts your kind. A political statement designed to piss off both sides come on people it is a troll. the comment is designed to be ambiguous and irritating.

Venkarel,

One can criticize Democrats and Republicans and not be a troll.

I’m somewhat socialistic but often

am upset by left leaning media.

Not because they aren’t left leaning enough but typically for one of these 2 reasons:

1. they (like right leaning media) only present one perspective of an issue or almost only one side,

2. they ignore important issues, especially as affect the poor. A terrific example the 2019 Democratic debates: very little discussion of affordable housing. VERY LITTLE. I reviewed 11 transcripts of the debates. A few sound bites in 10 of them; thevother, Atlanta, had 3 candidates who answered a question about it.

Otherwise Nothin.

I’m agnostic. I occasionally criticize my Christian relatives’s beliefs. I also criticize atheism in general… to some extent. Doesnt make me a troll.

I get very annoyed when people label someone a troll without very much evidence of it.

Yes IF a person were a troll they might want to attack both Democrats and Republicans and create ambiguity.

But that does not mean the converse is true: just because one criticizes Democrats and Republicans one need not be a troll.

Probably more often than not

A => B does not imply B => A

(took a course in Math Theory of Computation looooong ago and

predicate calculus was not a natural for me !).

This is the orginal comment above, “There’s real risk this time that a certain unhinged political party is willing to take down the credibility of the nation.” Notice it can be construed as an attack by either party, but is designed to upset all? Notice there is no substance to the post, no argument, no point? Next, here is commenting guideline #3 “When commenting, we check our political views at the door. WOLF STREET is a business, finance, and economics site, not a political site. Readers from across the political spectrum are invited and should feel comfortable. It’s OK to mention politicians and policy issues. It’s not OK to descend into partisan bickering.” Was the OP designed to fulfill these requirements?

Venkarel,

You are right… his comment didn’t add anything. I just didn’t like your inference this is a troll. How does one know ? Unfortunately people can be great at masquerading there intentions… reverse psychology probably fairly common etc.

But yes I get your most recent post.

Wolf may find some of my posts too out of bounds, not on topic enough.

I get that too.

I was a software engineer, math compsci student. Prone to want to criticize vague assertions.

My background makes it inappropriate, near impossible to contribute useful comments w.r.t financial nitty gritty, macro economics here other than mutual fund investing.

Did ace micro/macro economics courses when dinosaurs still roamed the planet. Not much use here.

Peace.

May the political parties and media both do a better job of keeping their egos and theatrics under control. (I also aced a graduate accounting class UTD having never taken one before. Grad course in Cognitive Processes… no reference to Freud… evidence based theme…fine… but I still like “ego”, “egotistical” even if his other theories are discredited to varying degrees).

So Americans please control your egos and not the other way round, eh ?

(whatever the neural makeup it be).

Politicians.

And media PLEASE … more breadth to your coverage of issues. Pros, cons, unintended consequences.

Confirmation bias feeds on itself.

@Randy

yep, neither party has the interests of the American people as a whole in mind. Especially not since the Supreme Court ruled that money equals speech and big donors and grifters can buy up members.

Or maybe government agencies will just spend less money temporarily until the impasse is resolved?

There is no requirement that the government spend all funds appropriated, much less at a specific point in time.

Lets be clear here.

A “cut” in Washington DC is a reduction in an increase.

No one is getting less money

yep, got a lot of family in those Deep Red counties and the entire media and perception of things they take in is a world apart from before. And because of changes in House rules early in this Congressional session, just a single one of them can shut down House business and force McCarthy out if he yields even an inch. This is a totally different situation than ever before, completely unprecedented in centuries of history of the legislative branch.

Thanks for this report. No major media organization is even mentioning this. This jump in interest rates on 1 month Treasuries could be a signal that there will be no compromise on the debt ceiling increase in June. Both sides are miles apart and not even negotiating. They are both playing “Chicken” The bond market doesn’t lie. Risk premiums are spiking. This could get very ugly real soon. We are in uncharted waters.

Nah, they both will happily add trillions to debt once they land on which businesses will get the money and what commissions will be extracted.

All paths lead to high inflation and then higher inflation.

Not so sure of it this time. Everything seems to be pointing to deadlock in this case.

While I’m not disagreeing with your general sentiment, I don’t see how ‘The bond market doesn’t lie’ is a factual statement. Parts of the the bond market has been acting irrationally for a long time now, especially since the Fed started raising rates. Just look at what Wolf said in his very first paragraph about the third week in April. How can you explain that third-week-in-April?

The bones market *doesn’t* lie…about what bond market participants think will happen in the future. The thing is, though, bond market participants are very often profoundly wrong about that

Er, the BOND market. I have no opinion about what the bones market has to say.

Sorry swamp, I beg to differ with your assertion that the ” bond market doesn’t lie ” by bringing a breath of reality to that popular delusion. For goodness sakes we have banks dropping like flies all around us because they believed in the zirp economy. sheesh

Big picture is extreme debt levels breed extreme fiscal and monetary action to keep the system functioning. We are in the third period of the hockey game where the only way to keep system afloat is to run ponzi like financing by issuing new debt to be able to pay existing debt.

Could be that financial crisis is going to be bigger than GFC because debt bubble is bigger.

The financial crisis in the making is guaranteed to be bigger than the GFC.

It’s fantasy ultimately meeting reality.

The ultimate outcome?

Lower or much lower living standards for most Americans.

A combination of higher inflation, noticeably tighter credit conditions, much lower asset prices (in real money), and a lower USD exchange rate.

Lower standards of living are happening already. When you have homeless squatters parking their buts in the lobbies of the 4th largest bank in the US, you know it’s all over.

So…

Both sides dig in, no agreement reached…

How does it play out, day to day?

Where to hide? Foriegn stocks and bonds? Gold?

Gold and silver.

Gold is already expensive, relatively. Silver a lot cheaper but not an equivalent monetary metal to the past.

Timing is critical. I expect gold to ultimately noticeable relative value versus the goods and services people actually need.

Couldn’t quite catch your drift here.

Relative value…the other day I was thinking about my $2/hour job back in the 1960s and suddenly realized I was making a little more than two ounces of gold per week back then. Gold was $35/ounce but it was illegal to buy it.

2banana

Where to hide?

Get over it. There’s “Nowhere to run, and nowhere to hide”

Song by whom?

Bent and twisted stuff.

Yet the 10-year acts like all is well. Nothing to worry about…even though inflation is likely stuck at elevated levels the rest of the decade.

I agree on the 10-year; I can’t understand why it’s acting the way it is.

The Fed has sopped up around $5 Trillion of long maturities off the market….between the MBSs and Treasuries longer than 10yrs.

Imagine what the long rates would be if those securities were flopping around in the free market looking for a bid.

The Fed’s yield curve management that started in 2009 set the trap for the banking system…IMO.

Positive yield curves are natural….and we have been given unnatural for 14 years.

Yeah, you wonder how somebody so smart, Bernanke, can be so dumb.

Because few consider the long term impact of making hasty decisions to solve short term problems.

It reminds me of my last years working at the company that I spent decades at. I watched people become more concerned about their careers and being among the in-crowd than the future of the company.

El Katz

Don’t feel so bad

When I left the Intel Agency I worked for, the place was so corrupt that I could not get through a single day with running into some sleasebag who was lying and trying to do something illegal. I refused to join the party. My boss was one of those scum that sign the letter from those 51 Intel experts that said the Hunter Laptop was Russian dis-information.

Having only recently become a bond investor, it’s amazing how much of this fixed income stuff I used to know (for the tests) but failed to retain.

Thanks to this discussion (and other), Fabozzi’s “Fixed Income Analysis for the CFA Program” — which I haven’t picked up in at least 15 years — is going into the carry-on bag for this evening’s budget airline flight. When Vietjet Air says “7kg maximum” they really mean it, so I may have to jettison the beach novel. Hopefully they won’t check.

What I fail to understand here is why the market is exhibiting fear about one-month paper (because June 1 is Auntie Janet’s doomsday) but not securities with a later maturity. If the US Federal Government defaulted on June 1, would longer duration bills/bonds be a safe haven? That’s a rhetorical question, of course.

Phogettaboutit: I think it’s important to first say that no one really knows what a default would really look like if it did happen. There’s nearly an infinite amount of possibilities the federal government can take as options to combat running low on money (like the absurd 1 Trillion dollar coin). That uncertainty is going to be part of market volatility moving forward. But, for the sake of speculation, lets say the Treasury really does run out of money, say on June 1 (the true date would likely be later). They wouldn’t be able to pay the principal on bonds that mature on June 1 and any date thereafter until the ceiling is raised. That is potentially why there is volatility on the short-end of of the market. But it’s also true the treasury would stop paying interest payments on the longer dated bonds. But people worry more about not getting their principal back on time than they worry about having an interest payment or two delayed.

There will come a time (unpredictable) when it will be impossible for the government (federal) to collect enough in taxes to pay all of its expenses, including interest on the national debt.

The Gov’t can of course borrow an indefinite amount through the Fed. (Concealed green backing) given a few changes in existing law. But that would lead to hyper inflation – i.e., a collapse in the credit of the Gov’t.

So the easy way, is the way the French did it in 1960. Simply say that beginning Jan 1 (or any other date), new dollars will be issued, and that each new dollar is worth 100 old dollars. Then follow that up with a largely state controlled economy.

In 1960, the French economist / mathematician Jacques Rueff, during Charles de Gaulle’s presidency, converted the old franc, to a nouveau franc, equal to 100 of the old franc.

However, even with this substitution, inflation continued to erode the currency’s value, though at lower rates of change, in comparison to other countries. And this new franc equaled 20 cents to a U.S. dollar. The old rate was 5.00 to a dollar.

In 1960, the French franc, which was one of the weakest currencies, overnight, became one of the strongest. Correcting policies included plans to 1) balance the budget, 2) stabilize the currency, and 3) eliminate currency controls.

The gold content of the franc increased 100%, & 1) foreign exchange rates, and 2) France’s internal prices, reflected the conversion overnight. Internally, prices dropped about 90 per cent, and the foreign exchange value rose from about 0.238 cents per franc, to about 20.389 cents per franc.

Domestically, France was on a managed paper standard; externally, on a modified gold bullion standard. With the new policies, France’s economy strengthened, and the franc became fully convertible @ approximately its gold par, into gold for foreign exchange and into foreign currencies.

With the introduction of the Euro, the franc in Jan. 1, 1999, was worth less than 1/8 of its Jan. 1, 1960 value.

After default, it might be beneficial to transfer many of the Federal powers back to state-controlled powers.

Spencer,

Much of this i admittedly don’t relate to.

But what of this:

My $100 is now worth $1.

Yet that $100 (old currency) lawn mower (let’s say) now costs $10.

(90% reduction).

Consumers would be quite upset or am I not understanding something basic.

Randy, I think he is suggesting a default without wanting to come out and call it a default, even though it is…

Aka re-valuation of the dollar like North Korea revalues their currency. He is suggesting a default on the common man (who holds no assets and therefore will lose out). Cash heavy people will lose heavily with this devaluation. Its also a default on everyone who holds US debt.

Obviously asset holders and the completely utterly broke on the government dole might survive but middle and common class will get wiped out. I’m going to theorize that Spencer will not take as much damage from this.

But I’m going to politely have to disagree. I think the cash holder should be salvaged along with the value of the USD and a major default be permitted on the asset market aka stocks, bonds, property as well as debt holders. We shrug and renegotiate a discounted amount, acknowledging we are defaulting on them because we cannot possibly pay back the principle with interest… given the absolutely irresponsible spending… It will cost us in terms of being the reserve currency but its the honest way forward…

You cannot feed a cancer and demand the rest of the body takes the loss, at some point, the regular joes in the body are overwhelmed with the demand of supplying this cancer and the entire body and cancer dies.

The fed, debt holders, in this gamed fake gimmicky ponzi market are the tumor whether they want to be or not or see themselves as such or not. I’m not saying its anyone’s individual fault, but in effect they are. As a nation, we need to salvage the dollar and let the equities reset. If this means defaulting on someone we borrowed from and losing confidence, its unfortunate, but we must never default on the faithful worker in our country. They are not a slave who can be defaulted on and I think we have an obligation to eat the damage together. I strongly strongly disagree with Spencer… and I say that as someone who sits in the first tax bracket…

But trillions… we need to stop spending. Seriously…

By the way, we are already where we cannot pay. I understand why people are saying we cannot afford this debt because they are right.

What I’m saying is if its going to be a default, then let us default on the investor and not on the common man. Inflation is bleeding them dry. Restaurants run by family for generations are closing because they are no longer sustainable….

Intentional inflation after spending money is a dishonest way of transferring wealth. I’d rather fight our way out of this with another national investor than fight a civil war of desperation…

Anyone suggesting punishing inflation for longer doesn’t understand what that will do to our national fabric. We cannot survive that. I’d rather default on another country/investor even though its not fair to them because we can maybe survive that. Desperate common man cannot afford more inflation…

As the head of the british central bank said, people need to accept they are poorer. Because of this ugliness… but they cannot be intentionally made poorer… there are no more margins. The wealthy must understand this… No more theft… No more cheating via inflationary policies. Desperate people do desperate things… need to avoid this…

@Anonymous:

“What I’m saying is if its going to be a default, then let us default on the investor and not on the common man. Inflation is bleeding them dry. Restaurants run by family for generations are closing because they are no longer sustainable….

Intentional inflation after spending money is a dishonest way of transferring wealth. I’d rather fight our way out of this with another national investor than fight a civil war of desperation…”

Well said Anonymous, all of this. Been seeing this too, uncontrolled inflation is just an additional form of breaking promises on financial obligations and it hits the common people the hardest. If a de-facto default is going to happen, it would be an outrage to bid up the fortunes of already wealthy asset holders while crippling and devaluing the savings of the big majority of the people who’ve worked hard and are saving their money. That’s exactly what uncontrolled inflation does, like our econ professor said, inflation has brought down far more great powers and major empires than any war ever has. When inflation gets out of control, the people of a country see every promise of the leaders to the people fall apart, and it ceases to be a functioning nation. Paul Volcker knew this, it’s why he knew his sound money policies weren’t just preserving American’s savings, they were protecting the very foundation of the nation itself.

The net to the working stiff is the same…. if he earns $1,000 per week and now takes in $100 before taxes, etc., WTF is the difference? He’s hosed unless everything (including his mortgage debt, kid’s tuition, medical care, etc.,) is pencil whipped the same way.

We should appreciate that the US has been in low grade civil war for at least a decade. It’s unprecedented gun violence, police abuse, dems vs repubs, ethnicities, genders, but above all the financial/debt class war that the elites are waging on the common man.

Having also flown on vietjet, I have an appreciation for the truth of these weight limits.

I can predict that any CFA self help manual from 15 years ago will likely help you lose a lot of money fast in today’s “market”.

I think t-bills are like oxygen for financial system. You have to be able to count on them as money good. If you can avoid the hint of a hiccup, some people have to do it.

Basically this tells you that the market believes the debt crisis will be resolved within one month after the first failure to pay, so before the 2 months come due.

There is a calculation of how many days the rate is implying the government will be in default. Because the return is really the net return divided by the number of days and if it takes extra days, the return is adjusted up.

This stuff is not really that interesting. It says nothing about the long term fiscal issues that will drive markets.

Thanks for clearing that up, Wolf. I saw the Treasury data for the one month yield Thursday and was sure it was a fat finger mistake. That 5 must be a 4. 106 bp in one day? You almost make it seem sensible;-)

Hmmmm. No one believes anything truly troublesome will happen – it was just an opportunity for disparate people to collude to get a higher rate.

I think the chaos has nothing to do with the fear of default.

My guess: it is because the Fed does not say it will stop increasing interest rate. After the SVB drama, people expected the Fed to stop increasing interest rate after May. But Fed did not give a certain answer this time.

Now, since the inflation data is still not ideal, people may expect a raise in June again. So the one-month Tbill due in June has skyrocketed. Or, in other words, the Tbill has returned to where it should be (if there was no bankruptcy).

3 certain things in life:

Death

Taxes

Debt limit gets increased

I was fine with getting 5.19% (annual) for a 13-week T-bill issued May 4.

With the yield + a couple hundred $ or so, I’ll buy a nice induction stovetop to make it less hot for wife cooking her healthy style Thai cuisine.

If the system defaults and economic things start melting down, I’ll just have to think of it as easy-come, easy-go.

Driterprof ,apperantly you never did manual labor. First money is never easy even if it’s come or go

Nice explanation about how the once-boring Treasuries’ market works. I still don’t understand the huge jump in yields from crazy low to crazy high in two weeks. It could be about x-date, but Congress does this dance every year, and then they come to a resolution. I read somewhere they could extend the whole mess, and then keep negotiating. Somebody said something about the 14th Amendment, but I read the 14th Amendment and it does say something about defaults, but nothing definitive.

The last time something dangerous like this was about to happen, Congress established some protocol where Treasury debt would be paid first (they have enough in tax receipts for that), and all other debts (social security, medicare, military, etc.) would just have to wait to get paid.

This year is a bit more complicated because people living in almost all counties in California do not have to file their income taxes until October. That is 12% of the US population, and probably quite a bit bigger percentage of taxes since California is still a relatively wealthy state.

I take some solace in the fact that most in Congress are wealthy (there are a few middle income people and a few nuts). In general they are not going to risk reducing their net worth significantly by plunging the world into financial chaos for a few trillion dollars which are not even theirs.

Like with the Lehman example, maybe the Fed is just f–king with the markets. But in the Lehman situation, the 1 and 3 month t-bills at least jumped up and down more-or-less together. Now it is only the 1 month that is going crazy, while the 2 month is fairly placid.

I think only a small number of people are really worried about a default on Treasuries. I’m not worried. I doubt if the bond market is worried. Something else is going on with the 1 month t-bill. Maybe the commercial banks are more f–ked up than most people think and this volatility is somehow reflecting great uncertainties in the banking system.

William, I’m in agreement with you. While yields going up on 1 month t-bills is a rational event considering the June 1 scare-mongering, the part of this whole thing that “doesn’t add up” for me is why there is all this volatility in 1 month t-bills but not 2-month t-bills.

I am fairly confident June 1 isn’t the real X-date. Surely this is just Treasury trying to light a fire under Congress. Surely others think the way I do on this too (but maybe not?). Personally, if I were worried about actual default, I’d be way more worried about my bonds that mature in July, August, September and October than I am about bonds maturing at the beginning of June.

I think last Thursday’s shockingly high auction yield of 4-week T-Bills (due June 6) will probably recur in this week’s 4-week T-Bill auction, given that the secondary market is currently pricing the T-Bill due June 13 at 5.45% bid – 5.33% ask.

Persons wishing to buy the auction should submit their order thru their broker-dealer after the Treasury announces the 4- and 8-week T-Bill auctions on Tuesday (5/9). The auctions will take place Thursday morning (5/11); settlement will be Tuesday (5/16).

Four- and eight-week T-bill auctions are “reopenings” of pre-existing T-Bills, which is why there is already a secondary market for T-Bills due 6/13 and 7/5/23.

If Yellen doesn’t say anything important about the debt ceiling before Thursday morning, I believe this forthcoming week’s 1-month T-bill auction price yield will be in the neighborhood of last week’s auction price of 5.964 %.

Rational consumer behavior is for the banking system to be drained dry by 5% pick up in interest in short term treasuries and money market. In about a month Vanguard m/m should be about 5.02%.

Fwiw:

As of March 1, 2023 the Treasury has been publishing the bond-equivalent yields (BEY) of Treasury bill auctions on a 366-day basis because 2024 is a Leap Year. This will persist until Feb. 29, 2024, after which date, Treasury will revert to calculating BEY on a 365-day year.

Fidelity Investments, for instance, sends its customers errant auction price trade confirms that report bond equivalent yields calculated (to the sixth decimal place!) on a 365-day basis, which produces an error of 1 – 2 basis points.

I expect chaos ahead as the entire world shifts to a sound currency regime from a race to the bottom in currency devaluation in a vain attempt to counter the capitalists romance with Chinese Communist dictator. Who invented the ruthlessly worthless, yuan. We shall see where this drama plays out.

My first impression was that is due more to people/businesses with big deposits is some fragile banks, and wishing to avoid any bank failure issues, but stay liquid (short treasuries)….big big money, moving in and out of the short end of Treasuries for this reason.

But a sudden influx of new buyers would lower yields not raise them. Somebody fleeing worry about unsecured deposits isn’t going to hold out for higher yields.

1) Between Oct 2008 and May 2023 US gov debt rose from 10T to 32T.

The Fed financed about 25% of that 22T new debt.

2) Until Oct 2008 the Fed was poor. Fed asset were only 800B. They

plunged to 500B during the financial crisis. The Fed was helpless. Until Oct 2008 the Fed controlled only short term interest rated. The Fed didn’t have enough money to buy medium and long terms treasuries. Prof Bernanke ==> keep your hands to yourself

3) In Oct 2008 the rules have changed. The Fed saved US banks, foreign banks and non banks like GS, Morgan Stanley and Merrill. US treasuries “held by the Fed to maturity” rose from 500B to 2.5T in Apr 2014. TNX fell from 4.1% in Oct 2008 to 0.4% in Mar 2020. In Mar 2020 the Fed bough a truck load of long term bonds.

4) The first round of “held to maturity” expired Between Apr 2014 and Oct

2019. “Other” people cash in the Fed fell 50% from 3T to 1.5T. The Fed

became powerless again, but from Mar 2020 the Fed bought a Pour House with new “held to maturity” treasuries hangover.

Thank you Michael.

That sums things up, and it don’t look good to me. Thirty-two trillion, or three point two times ten to the thirteen (3.2 x 10^13) simply will not, and can not be reduced, let alone maintained at this already stupid amount with the demographics of Congress and the Executive Branch currently residing in Washington D.C..

Five things need to happen to deal with this debt:

1) Uncle Sam needs to reduce its spending .

2) Uncle Sam needs to increase its revenue taken (taken, ie. taxes).

3) The USA needs to have much higher real GDP growth; ideally from an industrial and manufacturing base to grow the economy.

4) The USA needs to have long-term, and sadly, punishing inflation to make the $32T “cost less.”

5) The interest rates paid by Treasury to carry Uncle Sam’s monkey on its back need to be low enough so as not to create a huge carry cost of the national debt each year. This carry cost simply adds to the debt. But, if interest rates are not at a reasonable percentage higher than inflation, we continue on a path of distortion in price discovery and asset allocation. “Can you say, Catch-22?”

So, the question is, can the national debt continue growing at such a fast pace?

Time will tell. “So rolls history’s wheel.”

In this uncertain environment, the one thing I will bet money on is human behavioral deficiency. Problems won’t fixed until disaster strikes.

As I recall, Warren Buffett worked a deal with Goldman Sachs, and bought a chunk of Bank of America which picked up Merrill Lynch (We are Bullsh-t on America, remember?). Buffett made a pretty tidy profit on both deals.

The Fed powerless?

They started QE in July of 2009…..with the PROMISE it would end and rates would normalize when unemployment dropped below 6.5%…..ha ha

1) Take a cluster of rates, the whole spectrum from 1M to 30Y :

10Y – 1M = (-)2.22% this week. // 20Y – 1M = (-) 1.84%. 30Y – 1M = (-)1.89% this week.

2) 10Y – 3M = (-)1.89% this week. // 30Y – 3M = (-)1.59%.

3) 10Y – 2Y = up from (-)94% in Feb to (-)0.17% in Mar producing a huge gap. If the trend is strong this gap should stay open.

4) The 10Y – 1M is noise.

The yield curve looks just the way the Fed wants it to look

Long rates havent been over inflation for years

The Fed has taken out of circulation and thus protected from market discipline roughly $5 Trillion in long maturity paper. What would the curve look like if that supply was out there looking for a bid?

It is obvious that the Fed wants to force investors and banks, to take more risk by pounding the long end. How’s that working out for the banks?

Nice to see that the bond vigilantes have finally ridden into town! Better late than never!!!

Regarding the possibility of default…

I’m banking on it.

The MAGA cult is still fuming about 2020 – they will never accept the results. A group so focused on destroying our democracy will have no compunction about destroying the full faith and credit of our government.

It’s just a vehicle for their petulance.

SOME of those to whom you refer, (and i want to make sure you know i am an always independent, and always voter, (NPA, since 1966,))

Will always do the dumb and dumber thing and ”vote the party line.”

Many many others are NOW ,, ‘at least considering’ that the ”party” IS NOW wrong about almost everything…

”REAL” education is the only ”long term” answer IMHO as a teacher to SO many kids who had been done low by an education system that was more,,, actually much more focused on teacher benefits than students learning HOW TO THINK…

did my best, but came into major conflict with ”those in charge.”

FIRST and MOST FUNDAMENTALLY,,, WE the PEEDONs really and truly MUST insist on an education system devoted to clear help for every student to ” LEARN ”HOW” TO THINK.”

Corruption, corruption, corruption! How can public policy decisions be made in the best interest of the entire society? They can’t. A certain percentage of humans are corrupt and will do anything for money and power, even convince themselves what they are doing is righteous. The path this society is on is no different from past failed societies. Just a matter of time.

Happy Sunday!

Doolittle is this Rja start of the 4th turning

It’s interesting you supposedly hate corruption but support a party that blatantly attacks the IRS tax enforcement budget with falsehoods.

Do you think wasteful spending should be curtailed?

If you dont, what is the answer…..?…freeze spending for one year would be a good idea

The House passed a debt ceiling bill. It’s there for the Senate to act on. My concern is that Biden is okay with the system crashing on his watch if he can blame it on GOP. Look what he’s doing with the southern border.

This feels like a marriage where both sides want a divorce that they can blame on the other side. Those are not nice processes. The kids always get hurt the most.

Regarding the possibility of default…

I’m banking on it.

The corrupt dem cult is still grabbing/stealing as much money as they can – they will never change. A group so focused on destroying our democracy will have no compunction about destroying the full faith and credit of our government.

It’s just a vehicle for their petulance.

I can’t think of a worse person to have in place as head of the Treasury than fossil Yellen. What kind of extraordinary measures does she plan to implement on June 1st? Another round of bingo anyone.

The Republican party is no longer saddled with saving the Trump presidency.

Get ready for hell.

The powers making decisions are usually one click down, out of sight

Yellen is a figurehead, same as most in high office..even the highest office

You should see who Yellen groomed to take her place at the San Francisco Fed. His/her name is Mary C. Daly, with degrees from a number of third rate universities. She oversaw the failures of both Silicon Valley Bank and First Republic Bank (nice job /sarc). She should have stuck to selling doughnuts.

K a rN ag E

It is pretty obvious that the market is baking in short term risk premiums due to political disjunction. Eventually, if default comes to pass, even if quickly corrected, the bond market will exact some long-term premiums. Only then will the parties feel the heat and perhaps compromise.

The way out is a centrist path — some budget restraints by the Democrats and some consent to wealth levies or tax enhancements by the Republicans, accompanied by some long-term social security and entitlement reforms that make common sense. The Trump tax cuts are toast. The Democratic impulse for unlimited spending needs to be curbed. We just lack the will and consensus to do what the situation calls for.

Everyone loves steak up until the time that it’s their sacred cow that is about to be slaughtered.

Everyone agrees on the simple things but sometimes the simple things are the hardest… like cooperating and sharing… eh? LOL.

We don’t do “center path” anymore. Both sides blind themselves to unpleasant or inconvenient facts, preferring a different reality. This is so pervasive these days that I do not think the leadership that would be necessary to avoid catastrophe is to be found. And both sides have plenty to say about the terribleness of the other side. Default to most of them must seem like just another thing for which they themselves (whoever is speaking) cannot possibly be blamed and that justly can be put at the other side’s doorstep. Do they listen to anyone who does not already agree with them — and believe them? Of course not. And lies and exaggerations abound. Outcome? Default.

Hi Wolf,

Was reading Ashwath Damodaran just now. He expects more banks to have a problem. My question is, In a time and place where technology and connectivity is so advanced, does US really need 4k banks to exist. In short, will there be a bank consolidation in the near future?

“…does US really need 4k banks to exist.”

Good question. The US doesn’t need 4,000 banks, but people and small businesses need them. In addition, small banks in rural areas are a lifeline for the local economy.

So I’ll try to break down my reasoning:

1. “The US” doesn’t need 4,000 banks. In 1985, there were 14,000 banks. This was before interstate banking became legal in the US. After interstate banking became legal, and after banks were allowed to do all kinds of other things that weren’t part of banking, a huge wave of consolidation took off and continues to this day.

2. But “smaller businesses need” 4,000 banks. They need smaller local banks that understand their local economy and business and allow for a personal banking relationship. The huge banks don’t give small businesses the time of the day.

For example, when a recession is approaching, and credit is tightening, and banks are trying to protect their balance sheets and minimize credit losses, they pull or curtail credit lines, and they’re less likely to extend new loans, especially to struggling businesses – that’s just natural risk mitigation for banks.

In this situation, if a smaller business has a credit line with a small bank, and the owner knows the banker, and then a recession hits, and credit tightens, and the business experiences a drop in revenues, and some losses and needs some cash, the owner can walk into his local bank and have a face-to-face with his VP of commercial lending, who’s been there for years, and they have a relationship of trust. The owner can explain the situation, and how they’re going to get out of it, and the VP of commercial lending knows the business, and knows the owner, and sees that it makes sense and is therefore willing to take the risk.

But with a huge bank, when the small-business owner meets with a commercial loan officer at the local branch, it may be a person he’s never seen before because there’s a lot of turnover, and there’s no trust, and the banker doesn’t understand the business and doesn’t care about it, and just wants to minimize the losses on the loan book. So the business owner may not succeed in getting the loan, or preventing the credit line from getting pulled or curtailed, and suddenly finds himself in an existential crisis because of a bank.

3. Many of the tiny banks are in rural areas that serve their communities. And there just isn’t enough business for a big bank to even mess with it. When that small bank closes, it can make life very difficult for local farmers, builders, and other businesses, and for local retail customers that use that bank.

AKA; “It’s A Wonderful Life” Most young people just don’t get it.

So much of the short term Treasury market is buyers for whom getting paid on time is extremely important- probably most of the market for such short term debt. Even a day delay in getting paid can be catastrophic. Me, were I in the market for such short term debt, I would of course be buying at 5.76%- I don’t care if I get the money back on June 6th or July 7th- I get paid for the extra month, too.

If the debt ceiling isn’t increased can’t they just print the money? Is there really a danger of default?

No, ‘they’ cannot ‘just print money.’

money increase via “money velocity” and “deposit multiplier.”

no need to over-print necessarily.

Maybe Austerity Joe will do a “Trump”, and just ignore the norms & constitutional rules that he doesn’t like? Then dare somebody to do something about it. But I don’t think he is the Career Criminal that his predecessor is.

Like Wolf, I think there will be some sort of last minute deal. The Dems will throw some programs like SNAP or Social Security under the bus.

“the Dems will throw some programs like SNAP or Social Security under the bus.”

No chance. None.

“They” are following rules of their own making, so anything is possible. But no, as long as “they” stick to their current rules, “they” cannot simply print money to prevent a default.

When the rules (i.e., laws) are changed, the game changes. Gameplayers (all of us) who were clearly winners and losers before the rules changed are now uncertain and unsettled until the game’s rules are solidified and understood going forward. This power to change (or not change) the rules is what make politicians so happy, as it is at the core of the power they gleefully lord over others.

When default theater starts, the federal government closes national parks, monuments, the Smithsonian, etc. and says Social Security will be next, even though SS has a trust fund and thus can pay benefits without incurring debt. And then, nothing else happens and a deal is cut a few days later. Maybe this time will be different because (i) many in Congress now truly hate each other; (ii) the center is mostly gone in American politics; and (iii) Western fiat dominance is questioned once the man in the street realizes that the dollar and euro are conjured out of thin air. That means we might see some real creativity, rule bending, executive orders, some big new SPVs from the Fed, a court fight etc. this time around as part of default theater. However, if the Rs can get their House debt ceiling bill approved by a few Ds in the Senate then Biden has to sign or his Presidency is over.

Much of the commentary in the financial press regarding the debt ceiling game of chicken fails to recognize an important fact: the country cannot count on the far right factions within the Republican Party to act rationally or in the best interest of the nation. After all, it was these very same people who supported the Jan 6th failed insurrection attempt.

Taking over a political party is a bit more difficult than jumping a few barriers and kicking in some doors.

Don’t feed the Troll.

In all likelihood the investors who drove the yields lower, are not the same investors who jumped in later when yields surged. Same problems on Friday when those short regional banks covered for the w/e, (which is when a lot of deals get made). The two groups probably are those who want the yield even if they have to wait, and those who want their money right now. The next crisis will involve freezing accounts and the 1% will not abide that, they have to remain liquid. When the Fed talks liquidity they are dogwhistling the 1% (which is the stock market). When the Fed backstops depositors they’re talking about collateral (T bonds) and the 99% but the dollar isn’t their problem. Recall when Bernanke said that and Bush pulled him up short, but they really have no control.

dang,

Yes this is not bond market related but

you suggest statistics is a flimsy field which

is bizarre.

If you are very advanced in math you might have good reason to believe there are more

open issues in statistics than calculus.

But to suggest it is not a “rigid discipline ” of math is strange. US probably produces thousands (or close to it ) of PhDs in Statistics

annually. Not fly by night degrees guaranteed !

Though some worth more than others.

I studied calculus and limited statistics.

Mostly undergrad level math.

You seem to imply statistics is on less solid

ground than calculus… why ?

2 random variables X and Y.

If X,Y are independent of each other is

their correlation necessarily 0 ?

Alternatively…

IF X, Y have a 0 correlation

are they necessarily independent ?

I dont own the book but Lipschutz, Schiller,

page 164 have a nice example demonstrating

that covariance of X,Y can be 0 (hence correlation

coefficient 0 as well), yet X,Y are not independent

random variables.

Independence implies correlation 0.

But zero correlation need not imply independence.

Mathematics can be amazing.

Statistics can be misleading at a basic level.

This is usually easily explained.

But it can be misleading at an advanced level.

Not easily explained.

Wegman, Richard and Mann, Michael:

statistical disputes. I dont know who was

right or wrong, more or less. Both have PhDs.

Climate change debates, disputes. 2005. Congressional testimony.

Lawsuits even eventually followed (plagiarism related though, not statistics).

Statistics is rigorous but experts can disagree on how it is to be applied, interpreted.

You might have a PhD in math for all I know ?

If you didn’t follow my correlation and independence discussion you surely are not an expert in statistics.

Berkshire Dumps Billions Worth Of U.S. Stocks, Buys Treasuries Instead

Are you predicting the future? I don’t think Berkshire owns any long term treasuries. All cash equivalents including t-bills, plus stocks and wholely owned companies. I was surprised he bought back his stock last quarter. He must have paid around $300/ b share as stock dipped only slightly below that.

I have owned it. I do not own it. I might buy it if it gets cheap enough.

Three failed US banks had one thing in common: KPMG

Sad to see the irate, personalized political tirades swamping the economic and financial character of the comments. Hopefully assuming Wolf continues the cool, deliberate focus, this website will not become another cross-yelling-echo chamber of all the others. This one has been unique, and I hope, continues as such.

People need to realize that you can debate interest changes of 0.25% of 1% until the cows come home. But it isn’t possible to keep the political agenda of the decision makers out of the picture.

Yes, but we do have an interesting political setup.

President and much of DC- Democrat.

Senate- Democrat by a hair.

House- Republican by a hair

Supreme court- Republican

Fed- Republican chair but a lot of Democrat board members I think.

There is a lot of political chess going on I presume.

Well, there is a common denominator, US dollars. 😉

They may figure out who get haw much.

What’s sad about it. Very few of the political types are not scum. FED too.

And it is precisely why we are where we are.

1) Trillions of held to maturity pre Mar 2020 expire now. Post Mar 2020 will start to expire within 3Y/4Y. US gov and the Fed will gradually get rid of their large debt.

2) Other people might put their money in the stock markets. That’s what they did in the 1930’s.

3) Regional banks are safer than the large banks, less exposed to Fed manipulations.

4) After SVB collapse regional banks will support new small modern industries. Within few years they will flourish and grow the real GDP.

5) The Fed saved us from an imminent collapse in 2008/09 and saved

our small businesses and restaurants in 2020. The upper 10% became wealthier along with shingle mums. The Fed raided our money, kept interest rates low, and sent RE prices higher. People didn’t

pay rent/mortgages/ student loans…thanks to the generosity of the gov.

The miracle of our new wealth was created without our knowledge or permission. JP didn’t lie to us. There was a tsunami of money, but no tsunami of lies. The Fed didn’t explain because most American are illiterate financially

It will be interesting to see if and how this impacts the SOFR repo market.

We’ve had the same problem for 20-30 years: Rising debt.

Rather than fix it, they tried to manage it with 30 years of interest rate reductions, which only encouraged more debt. When they approached the zero bound, they started printing money in earnest. Yet, despite all that stimulus, the economy can barely grow 1-2% in recent years.

Draw your own conclusions.

Thanks Wolfman. As a retired, lifelong saver. T Bills have been great for the last 8 months or so. Was wondering what happened and knew you would explain the insanity…….

So the comments of the secretary of the treasury had the effect that the treasury now has to pay way more interest on its debt meaning it will be bankrupt even faster.

In real Life these people couldn’t run a laundromat without going bust.

Wolf said: “Investors were bidding huge amounts – $126 billion for a $50 billion auction – but at huge rates. The $50 billion in tenders that were accepted had rates at or lower than 5.84% (the “high rate”).”

———————————————————

When I “bid” through Treasury Direct, there is no provision to attach an interest rate to the bid. The interest rate is assigned after the fact. I have wondered if I I would ever get surprised with a rate of zero ,,,,,, or less.

You cannot enter a “competitive bid” at TreasuryDirect. Your order gets filled at the final rate. If you want to enter a competitive bid, you can do that through your broker.

@ Wolf – In this case , where there was 126 Billion bidding for a 50 Billion supply, would a TreasuryDirect bid get filled?

Yes. All noncompetitive bids and the competitive bids with the highest price (lowest rate), for a total of $50 billion, are accepted. The dividing line is the “high rate.” Which is what everyone gets in the end.

The bids that were not accepted were competitive bid with rates above the high rate.

I found several comments to be both educational and very well put, but after doing a keyword search found probably the most important fact left out.

Specifically that the US monthly tax revenue is enough to more than cover the interest payments on the debt, so actual default WILL NEVER OCCUR!

What will happen is a govt shutdown as has happened before. Even in the super red state of Utah the locals screamed and gave in when every National Park was shut down during peak tourist season. Biden went through that. He knows how to shut down the Govt with the most pain for voters who hate the Govt.

Only then will an agreement go through – or should. I am fearful that it might not for political reasons discussed above, mainly that the most radical shut-it-down-start-the revolution each has veto power over any agreement.

We shall soon see what happens.

FYI for Wolf:

I tried donating to you but Pay Pal would not let me complete all the fields. I will try again in a month. Sorry about that.

Sorry for your troubles. Try it in this sequence:

1. click on the yellow button which takes to my PayPal page

2. enter the mount you wish to donate

3. click on the WHITE button “Donate with a Debit or Credit Card”

4. that takes you to the next page where you put in that CC data.

This should work.

Having lots of grey hair and having lived through so much before I will make a prediction.

1. All nonessential govt will be shut down until a deal is reached.

2. Six R’s in the house will go over to the D side (there are what, 15 Rs in districts that went for Biden who may get kicked out?).

or more likely

3. The bipartisan house group known as “the Problem Solvers Caucus” released a plan on April 19 to put off any default to Dec. 31, 2023 while having a bipartisan cut-spending task force produce recommendations.

There are enough in that caucus (63 members equally divided between parties) that they will get their way by simply coming together and overriding both parties. This is what happened last time after the big govt shutdown.

Like last week’s humungous drug bust, “Operation Last Mile” (biggest ever @ $100+ million sized, 8k guns, 45+ tons of meth, 3k cartel members arrested etc. with absolutely no national publicity) I wonder why this most likely solution is never given much or any press.