Another Easy-Money hangover.

By Wolf Richter for WOLF STREET.

During the 14-year reign of Easy Money, which started in 2008 and ended in 2022, everything became possible, and there were no limits to asset prices and valuations because when money is free, price doesn’t matter.

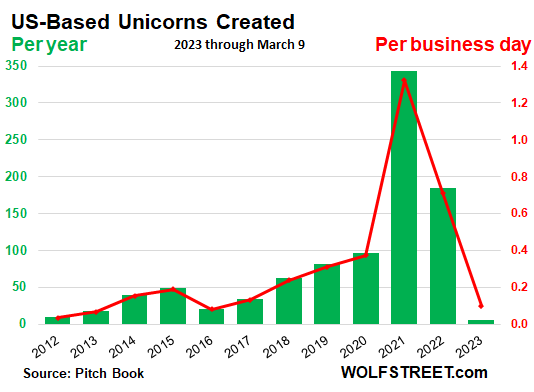

So the number of US-based unicorns that were created in the venture capital world each year soared from 9 in 2012 to 344 – or about 1.3 per business day – in 2021. November 2021 was the moment of peak Consensual Hallucination, as I call it. Since then, the Nasdaq has dropped 27%.

By mid-2022, the whole show started coming to an end. For the whole year 2022, “only” 185 unicorns were created, about 0.7 per business day. In 2023 through March 9, only 5 unicorns were created, about 0.1 per business day (data via PitchBook):

Unicorns are startup companies where behind closed doors a handful of investors during the latest round of funding agreed on a “valuation” of $1 billion or more.

Even though these deals are confidential, the $1-billion valuation is then dutifully leaked and hyped all over the financial media.

There was a time when a newly created unicorn would unleash a torrent of oohs and aahs. But by 2021, there were so many of them – 344 of them, or about 1.3 per business day – that people stopped paying attention.

So what are we going to do with all these unicorns?

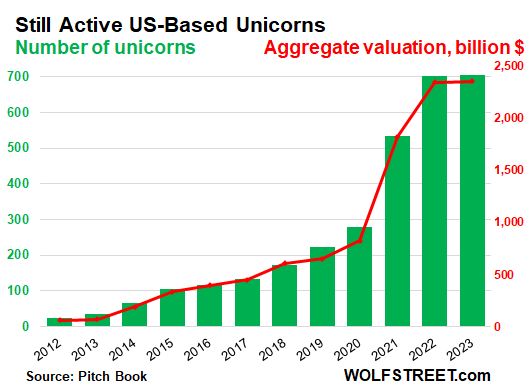

The total number of US-based unicorns that are still active climbed to 704 unicorns by March 2023, representing a mind-boggling aggregate valuation of $2.36 trillion, with a T.

These are unicorns where startup investors were still not able or willing to exit via some kind of sale, either by selling it to the public via an IPO, or by selling it to a company with deep pockets.

During the Easy Money era, there was so much capital flowing into startups that they had so much funding that they could stay private for longer, despite burning profuse amounts of cash, and they didn’t have to seek a buyer or an IPO, because they could always raise new cash to burn.

This trend to more late-stage funding and staying private longer created more unicorns and bigger unicorns, that were burning more cash, and then suddenly the music stopped.

That $2.36 trillion is a lot of money to be finding buyers for. In 2019, which had already been a big year, the aggregate valuation of the 223 then still active US-based unicorns was $652 billion, according to PitchBook data. Now, the aggregate valuation waiting to go public or find a buyer is nearly four times as much:

Late-stage funding into startups has come to a crawl. Many startups have approaching out-of-money dates. So there is pressure on these companies now to figure out how to burn less cash to extend their runway so that they can hopefully outwait this investor liquidity crunch.

For investors, cashing out is tough without Easy Money.

“Some unicorns may be faced with the reality of searching for exit opportunities, particularly through M&A, in an incapable or unwilling market,” PitchBook said in its report, “The Decline of Unicorn Acquisitions in a Conservative M&A Market.”

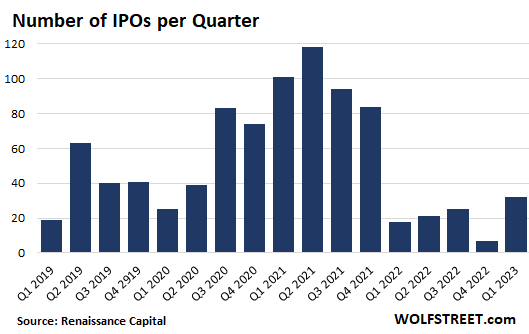

One way for startup investors to cash out is via IPOs, during which shares become publicly traded, and investors can then sell their shares during the IPO and over time to the public.

With freshly minted IPO stocks and SPAC stocks crashing left and right starting in 2021 and continuing through 2022 and into 2023 – I tracked some of them in my pantheon of Imploded Stocks – it became difficult for startups to engineer IPOs, and IPO volume collapsed in Q1 2022 and has remained low ever since (IPO data via Renaissance Capital):

The other way for startup investors to cash out is to sell the unicorn to a big corporation with deep pockets that wants to get rid of the budding competitor, or wants the technology, or the consumer data, or whatever, and they’re willing to pay no matter what for it. But that’s getting tough too.

“Unicorns are likely to face significant challenges when sourcing potential acquirers due to limited buyer interest, and the recent decline in M&A activity coincides with the current economic downturn,” PitchBook said in the report.

“Only $39.6 billion in US acquisition value has occurred since the beginning of 2022, which makes it the least active year since 2015,” PitchBook said.

“Our data shows a mere five unicorn acquisitions in 2022, compared with 24 and 17 in 2021 and 2020, respectively,” PitchBook said.

“Additionally, many public corporations are opting to buy back company shares to appease shareholders and signal confidence in the company’s future. So far, share buybacks have been favored over M&A, with buyback announcements hitting a record high of $1.2 trillion in 2022,” PitchBook said.

Additionally, the current “antitrust crackdown on the tech sector has put increased pressure on large tech companies, such as Meta, which is currently being sued by the FTC for antitrust violations related to its acquisition of WhatsApp and Instagram. This crackdown is likely to continue, affecting cash-starved unicorns seeking acquisition by large corporations.”

In “the frozen exit environment” since 2022, exit value plunged by 87%, from the record $768 billion in 2021 to only $79 billion in 2022 and early 2023.

This “liquidity crunch” has limited the “return potential for investors and is restricting the flow of capital back into the venture ecosystem,” PitchBook said.

“This dearth of capital is further exacerbated by the languid pace of fundraising observed through Q1 2023, as well as an exodus of nontraditional investors that, in recent years, have played a major role in providing the large amounts of funding upon which unicorns are heavily reliant,” PitchBook said.

End of Easy Money. Hangover time.

The end of Easy Money ended many miracles and after the raucous party is now bringing them back to some sort of reality. This reality may be tough for a sector that has gotten hooked on an endless flow of money that made unicorns a paragon of this era.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Pump then dump.

Excellent analysis of the rise and fall of the 14 years of “Easy Money”. The tragic reality is that investors like homeowners are trapped in a “frozen exit environment”. The coming sell-off in the next 5 years will create a massive paradigm shift in the world of distressed investments. The hottest buys will be in the bargain basement of distressed properties and bankrupt commercial buildings. Remember, in 2008 Howard Marks invested $10 Billion in 15 weeks to create astounding investment returns for OakTree Captial Management.

“paradigm shift” – that’s from WeWork’s prospectus isn’t it?

Their “manifesto”, pay attention!

Man the insanity is not quitting any time soon. At work they hired a bunch of people all over the country in places we don’t have offices… now they are floating ideas of using the weworks offices. They cannot give me a decent raise for the crippling inflation, but want to spend millions on renting workspace to bring back people to the office. Hilariously, there will be office space rented all over the country that will have 1,2 or mostly 5 people. So going back to work is just so they can say everyone is back to work. Then the weworks bill will show up, probably needing more layoffs. We need a bloody earthquake or a large sized meteor to clear this mess up. Or maybe a war, yes I can hear the music playing in Washington.

What business is your company in?

Snake oil salesmen with an updated lexicon is all they were.

What the world needs is a self-oiling snake…

Glad you mentioned 14 years of easy money.. Every year that there was easy money, there were distortions. Fourteen years is a lot to undo, but I think it has to happen. Inverted curve is going to suck the money into t-bills at the expense of everything else.

I hear venture capital firms ,are being nuked out of existence.I hope chamatha is in one of the buildings . Theif

The fad has changed!

Outdated Unicorns: EVs, Drones, Cryptos, NFTs, Self Driving cars, Subscription based retail, groceries and food delivery, Cloud, WFH tech, 5G etc.

New Unicorns: AI, ???

And Wolf is no longer a unicorn. My Market Watch daily heads up email gives Wolf front page status. He has arrived.

Yup chatgpt will wipe your ass and sing you a song.

I have used chatgpt, its decent but not that great has severe limitations.

Its like Watson playing Jeperdy, when it could not get the other players response. And would make the same mistakes of other players.

Don’t forget Jerome Powell is a graduate of the Carlyle Group.

I used to work for the Carlyle Group… or I should say, I was working for a company that was acquired by the Carlyle Group.

You act as though the voters choose their representatives. Wrong. The representatives choose their voters. In his first election in 2018 as US House Representative, Chip Roy was elected with 50.2% of the vote. In 2020 the Democrats nominated an idiot so Chip Roy managed to increase his vote to 52%. Still too close for comfort they gerrymandered the district so that Chip now wins comfortably with over 60% of the vote. There is no point even voting now. Only about 30-40 districts are competitive.

Popcorn is getting hard to find.

We will all be broke and destitute before this comes to a natural end.

Pull one lever and everything locks up and you slow grind to death.

Pull the other lever and money spigot comes back on, the music roars back to life and yeah your income ratchets up a few notches but cover your eyes when you’re at the cash register at the grocery store.

The things that need to take place have more to do with the man at the levers than the lever itself.

There’re only so many adrenaline shots to the heart you can administer.

Well-written post.

“more to do with the man at the levers”

I’d say has everything to do with his and his associates’ intentions(essentially character).

I heard if you mate donkeys with unicorns, you get donkeycorn-salt to taste.

…and unlike that difficult-to-find poop from rocking horses (are they still in demand in our screen-heavy age?), unicorn manure appears to be in plentiful supply…

may we all find a better day.

Ha ha made my day!

“Cornpop” also getting hard to find….., just can’t seem to locate him anywhere.

Close Wolf, but the song used in 1984’s Roadhouse 66 begins with the lines “What are we gonna do with all this money? What are we gonna do, what are we gonna do?” They do add some changes but unicorns aren’t mentioned back then. Car guys, what are you gonna do with ‘em?!

Can you blame them? Throw trillions out and endless ideas and business models pop out. Money goes somewhere. But try inventing a new successful business model in a recession where money is really tight. I say most unicorns were not thought out long term and just came up with an idea based on easy free money. The owners of these startups, I say, thought if we can just get our mansions and toys and hidden accounts before we go belly up then we really fleeced joe VC and won. Hence all these silly businesses with unsustainable business models that will all just disappear just like in 2000. But hey if you can walk away with investor money, you did good. Right Mr. Fried?

All the founders of startups I have met have been true believers. Slightly delusional at times, but not crooks.

You haven’t met Holmes, and folks like her. “Fake it till you make it,” is the guiding principle in Silicon Valley.

Her problem was that the scam came out before the IPO, so it blocked the exit for the investors, and that’s unforgivable. If the IPO had taken place, and the company would have collapsed two years later, no one would have cared. But she managed to rip off a bunch of rich people before they could exit, and so she’s going to jail.

Every state has an oligarchy, visible or not.

Holmes’ basic concept was an excellent one. Take determination of medical difficulties out of the hands of the wealthy medical establishment ( physicians, insurance companies, labs, et cetera) and place it in the hands of everyman.

Her corruption rather poisoned the well for the implementation of a device that actually works.

How about an app that runs on your dumbphone and allows you to place your finger up to a sensor and have the present state of your extracellular fluids scanned any time you feel like it. Maybe every week, as you sit in your mom’s basement eating Mcnuggets dipped in honey-mustard sauce, you could check your fluids.

The scary part is she tricked all these “smart” people who at one time ran the government, ran top-level universities, and negotiated with our adversaries.

Speaking of checking your fluids, Kristen Faulkner was disqualified after finishing third (and making a dirty move against another rider late in the race–but, that wasn’t a factor in the decision) on 4 March in the Strade Bianchi bicycle race.

She was wearing, under her jersey’s left sleeve, a continuous blood glucose monitoring sensor.

The Union Cycliste Internationale states, “Devices which capture other physiological data, including metabolic values such as but not limited to glucose or lactate, are not authorised in competition.”

Karma Kristen, karma. You were fast and strong, but you rode dirty and cheated.

By the way, a new technology for bike racing has just emerged. In the Paris-Roubaix men’s race, some riders had devices which linked their hubs and tires together with a pneumatic tube that allows the rider to adjust the tire’s pressure while riding. Lower psi for cobblestones & higher psi for pavement.

That is a brutal and concise summary I have no reason to question. Art.

dishonest,

“Take [named activity] out of the hands of the wealthy [name evil entrenched] establishment” is absolutely the standard meme of every recent innovation fraud. We will disrupt and reinvent the hated ________! Just hand over your money! This is a MASSIVE grift — $2 trillion evaporated in digital assets, etc. Easily perpetrated to rip off the young, and dissuade them learning dusty old things like sound financial principles. Other cliches: FUD! YOLO! Poster child: SBF of FTX. There might have been a grain of truth but it is vastly BURIED in harmful BS. Happened in late dot-com era too. Fraud replaces useul invention.

Ty – indeed, though self-deception is the root of all evil. She should have given the same consideration to the levels of power possessed by her investors that she, say, would have given to investment originating from organized crime…

may we all find a better day.

Sure — in themselves and their meteoric egos.

(It’s just the cocaine)

Holmes was a charlatan. Having a concept is one thing — just about any slob can contrive a concept. I can draw up plans for an invisibility gun or create a slick slide deck for a wearable airbag. If I can’t point to a working prototype, it’s all smoke n mirrors.

Wolf has already accurately defined it as “Consentual hallucination”. For these Unicorns to be born, it must be present in both the investor and the investee.

Turn on Silicon Valley the HBO show for a Real Look into these operations! ;)

Hehehehe …. HTML

I presume the “still active” graph will eventually mimic the M2 money supply with negative slope following the big hump.

What are we going to do with them? Excluding a timely Fed pivot, it’s probably best to use butter, garlic and rosemary for grilled unicorn steaks.

So what are we going to do with all (the government officials whose corrupt policies enabled the creation of) these unicorns?

Nah, It’s the system’s fault. Way too much bowing to “freedom” as a god.

You can do anything you want and any restrictions are pounded down as limiting your freedom.

The system has upsides, but the downsides are far greater as well.

A few basic restrictions would bring some sanity to the market, but the “moneymen” don’t want that to happen, so it doesn’t. Until the public stops believing the free market is all wonderful crap, nothing will change.

…where the Founders were possibly remiss in not placing a ‘Bill of Responsibilities’ alongside our ‘Bill of Rights’…

may we all find a better day.

And the banks that stole savers money by giving them absurdly low interest rates.

The Fed was the orchestra conductor. It guaranteed an income to banks for this distorted behavior, and in a way, the banks just moved with the tide of cheap money/credit dumped their way. Banks took the path of highest risk-adjusted reward — to be expected.

Just a reply to your assertion that holme’s fabrication of a product actually worked:

Lies! It never worked, the idea was science fiction. And she deserves to be in jail.

Also I have a cake recipe that uses a teaspoon of flour I can sell you. Want to invest in my IPO?

Nice article. Now my question would be who will suffer most from the future losses in these investments.

Probably roughly the same people who got bailed out at SVB.

“who will suffer”

Makes one wonder where the FTX story went?

When certain people are in danger, certain levers are pulled.

FTX trial is pending. Motions and discovery are boring. Asset searches and investigation are underway. We are in that trough.

Unicorns are sooo yesterday.

What we need is a new label for tomorrow.

Perhaps, a tiger, rainbow, or phidippus.

I confidently predict my startup, which sells virtual ice creams in the metaverse, will next year be a $5b tiger. Grrr.

Come on, let’s invent the future.

Brilliantly said. I’ll have a double chocolate!

AI is the new snake oil/gold rush meme of tomorrow. Always gotta have one. But I’m putting my chips on “phidippus”!

Ever hear of the ‘allocative effect?’ In a boom and bust cycle, wealth is transferred (allocated) from labor and small businesses up to the RRs (ridiculously rich) class. Both on the way up, and on the way down. Got you going up and down. Suckers.

As a history ”buff”,,, I want to make sure you and all the folks on Wolf’s Wonder, as in wonderfully ”THE BEST” honest and competent source of information, know that ”WEALTH” was NOT taken from any of WE the Peedons who had any kind of common sense, etc., PRIOR to establishment of FRB…..

Before the FRB, ALL folks who could WOULD put their gold and silver into some ”safe place”…

And then take it out and buy after the crash brought prices down to reality… Happened for many decades/centuries…

FRB was established to make sure WE PEEDONs could NOT do so again at the clear expense of the oligarchy.

That FRB has been successful at doing their real job, as opposed to the various and sundry announced jobs MUST be clear by now, when they, the FRB they, have not only reduced the value of USD by at least 100%,,, but continue to do so…

Good observation. Check the current value of your wife’s jewelry.

Now what do you think of the next phase, CBDCs?

The good part is that a unicorn doesn’t have any real assets, so there’s no point in LBOing it into the ground to steal the assets.

There are new “innovations” in that space too! Look what happened with BBBY and Hudson on the way to BBBY’s bankruptcy — whole new ways to flush out a last few suckers, and bleed the last drops of blood from a seemingly doomed, empty vessel. The suckers were warned in the fine print, the regulators kissed the paper for new stock issues in the face of imminent total bankruptcy (and zero stock price), and it happened. The meme crowd bit the hook.

With start-ups and their pre and post-money valuations the pricing exercise more resembles option pricing than business valuation. If a tech startup has an attractive business plan and the right people and you add $250 million in capital to give it a go the company could be truly worth $5.0 billion some day, so the first round of investors, hoping for a 5 bagger, put in the capital at a valuation of $750 million pre-money, $1.0 billion post money, and voila, you have a unicorn. That doesn’t give you a $1.0 billion business of courses, right after the round is completed you only have the cash, the people and the business plan, there is no business yet. The $1.0 billion is just the result of the deal terms, which may be ridiculous. And of course the venture may burn through the capital without creating any, or only modest, business value, then the idea is proven bad and the people leave and the capital is gone so it all goes to zero. Or cash flow and earnings may come, with a rate of growth, and the usual business valuation metrics can be applied to establish a valuation that is real. If there are fewer unicorns it is just because people are being more realistic about the future.

C’est dommage …

Does Pitchbook list the locations of these unicorns? I’d be interested to a bubble chart of metropolitan statistical areas that have absorbed the greatest number of these “business” into their economies. Just yesterday, I was wondering if some simple analysis could be done to show their relationship to homelessness and home prices. It could be there is nothing to it, but I’m curious.

It doesn’t list them in the data that I have access to. But the centers are known: San Francisco & Silicon Valley, Boston, Austin, NY City on top. Further down Boise, Denver, and some other places.

Interesting, and that’s about what I thought. I’m sure you could capture some occurrences of things moving together, but not enough to show the driver of the effect. With QE and low rates, we all accept the general idea the prices of everything will go up, but I’ve been recently thinking of which factor among many offers the strongest effect on both housing and homelessness.

Where is the Seattle on the list? And is Carvana the only big one in Phoenix?

Forgot Seattle. It’s up there near the top.

Discount Tire had a revenue of 5 billion as of 2019. I’m not sure of any other companies founded in Arizona that are over 1 billion.

great article ! just saw stats showing cell phone activity 1999 vs 2023 in largest american cities – SF activity in 2023 is 31 % of what it was pre-covid !

That’s downtown, which is a ghost town. The rest of the City is busy. My part is more congested with tourists than ever before.

At least she didn’t turn into a pillar of salt. We are not quite there yet.

1) US gov Schabacker Horn of “debt + obligations”. Besides it’s $31T debt it piled between $100T and $200T of unfunded obligations, most of it to social security and medicare. Politicians raised mountains of promises, for free, that can never be paid.

2) At 5% inflation debt and obligations cost : $150T x 0.05 = $7.5T/Y.

3) Raiding in on other people money in the Fed no longer works. In Aug the debt ceiling problems might start a green jacket adopted by the Irish gang.

4) Start small. If cities, school districts …munis default on debt no harm is done by this diet. It will clear old toxicities and prevent new debt. It might start at the bottom and rise to the top. The Save America plan :

5) Cut gov spending by 10% each year for 5 years, not adjusted to inflation.

6) Thereafter stay on Year #5 budget for additional 4/5 years, not adjusted to inflation.

7) After year #10 raise the budget adjusted to the GDP rates.

This reminds me of the 1974 song by the Irish Rovers “Unicorn”

“Then Noah looked out through the driving rain, the Unicorns were hiding, playing silly games. Kicking and splashing while the rain was pouring. Oh those silly Unicorns. The Ark started moving it drifted with the Tide. Them Unicorns looked up from the rocks and they cried. And the waters came down and sort of floated them away. And that’s why you never seen a Unicorn to this very day.

That can’t be true. Unicorns show up later in the Bible after Genesis.

What are we going to do with all these unicorns?

Simple: teach them how to play leap frog.

BBQ!!!

8) UTube Prof Anthony Davies : 10 Myths of gov debt, 5Y ago.

Voldemort from Harry Potter had the right take on unicorns…

Wolf, a question for you

Would even Tesla have existed (or lasted profitless for so long) in a world of 5% interest rate?

Tesla has always been mostly equity funded, not debt funded. There were lots of startups in the era of much higher interest rates. So we know that’s working fine. During the Dotcom bubble — 1995 through 1999 — when all kinds of crazy stuff was going on, the federal funds rate was between 4.5% and 5.5%.

Interesting because at that time the Dot Bomb was partially blamed on the Greenspan Fed for keeping interest rates too low (I guess at that time 5% was considered too low by some).

Aren’t these unicorns funded by equity investment anyway?? No debt right?

Thanks!

Ever since the 1980s end of inflation every downturn saw interest rates go down and then when they went back up they never reached the previous high. “Cheaper Money” has been essential to keeping the US economy(and the global capitalist world economy) going for decades, the fact that it now takes 0% AND QE is what is pushing it to the breaking point…

The economy is doing just fine with 5% rates and QT

https://wolfstreet.com/2023/04/27/consumers-governments-spent-like-drunken-sailors-in-q1-gdp-held-back-by-plunge-in-private-investment-change-in-inventories/

The speculative spirit is alive and well, and will remain that way as long as the Fed’s $8.6 trillion balance sheet remains.

The unicorns will be back.

It’s probably too much work / can’t get the data, but I’d be interested in two charts:

1) Cumulative profits or losses by Unicorn companies while private

2) Cumulative profits or losses by Unicorn companies that went public (to capture Uber, etc)

So, next for falling unicorns? Stands to reason, bargain- hunting for personnel and intellectual property, bargain-hunting M&A. Consolidations, acquisitions, bankruptcies, asset auctions. Clearing wreckage after a fire, naturally. Just PLEASE Jerome, or Congress, or President, NO (MORE) BAILOUTS. (Fingers crossed, but I’m cynical.)

Interesting.

Looking forward to Bonfire of the Unicorns.

Fake it until you make it… Indeed. Looking at those charts you can see the explosion in these things was during COVID. If that is what we are going to get out of Silicon Valley when everybody is working from home then let’s send everyone back to the office!

Considering all the free money our government was giving out during those times of covid crisis do you expect anything different to show up?

According to me from what I can see and I don’t know much I’d ranger the whole system is all a joke.

There’s just too much money sloshing around in too few hands that don’t know what to do with it all.

I remember listening to a podcast about how these poor entrepreneurs had to get on the Venture Capital Treadmill coming out of Y Combinator to stay afloat. Instead of, oh I don’t know, trying to be profitable. Or having a profitable idea at all.

Still waiting for the Treadmill running at 100mph to suddenly stop and throw these companies into a wall.