Services inflation is tough to stamp out, and it has taken over inflation. Powell will be talking about it.

By Wolf Richter for WOLF STREET.

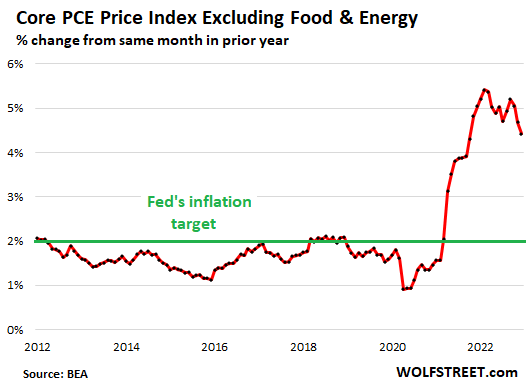

The different components of the PCE price index is what the Fed holds up when it details its reasoning behind its crackdown on inflation. They include overall PCE but particularly core PCE (which excludes the volatile food and energy components) and more recently, services PCE, which is where inflation has now solidly moved to, and from where it is very difficult to dislodge.

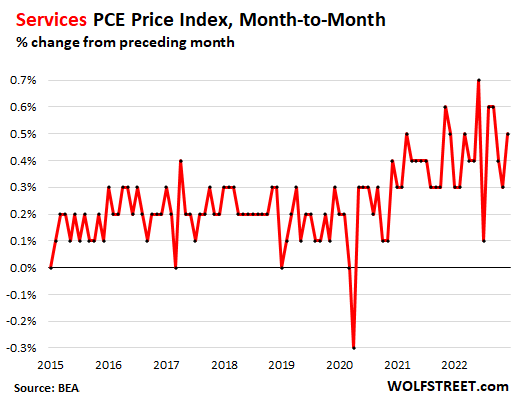

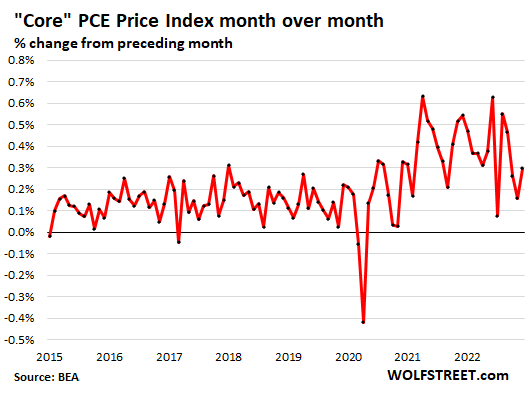

On a monthly basis, driven by price increases in services, both the core PCE and the services PCE re-accelerated in December. On a year-over-year basis, the services PCE remains near its multi-decade high.

The PCE price index for services jumped 0.5% in December from November, the biggest jump since September, according to the Bureau of Economic Analysis today. There is no indication here that services PCE is backing off or has reached a turning point in the uptrend, or whatever. Services inflation has become a horror show.

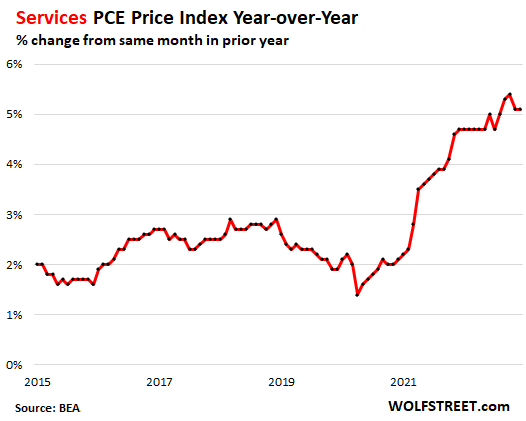

On a year-over-year basis, the PCE Price Index for services rose 5.1%, same as in November. It has now been above 5% for the fifth month in a row, and is not showing any signs of a decline. This confirms the CPI for services, released on January 12, which spiked to a new four-decade high.

This recalcitrant inflation in services is a source of frustration for the Fed’s crackdown on inflation – and it keeps featuring in Powell’s comments.

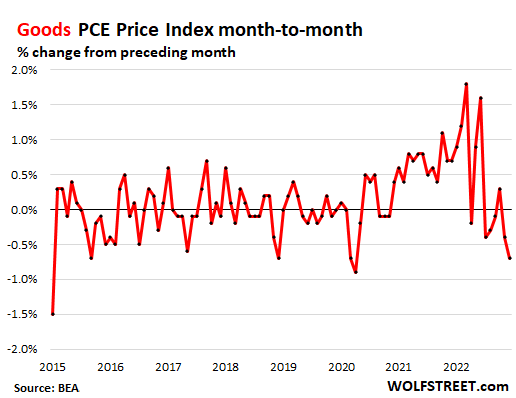

But goods prices are falling.

The PCE price index for durable goods – new and used vehicles, appliances, furniture, etc. – declined by 0.3% for the month, the third month in a row of month-to-month declines, but the decline decelerated from the prior month (-0.8%).

The PCE price index for energy plunged by 5.1% for the month, having now plunged five of the past six months. Year-over-year, the Energy index is down 8.3%.

The PCE price for food prices slowed to an increase of 0.2% for the month, but it still up 10.6% year-over-year.

The PCE price index for goods overall plunged by 0.7% for the month:

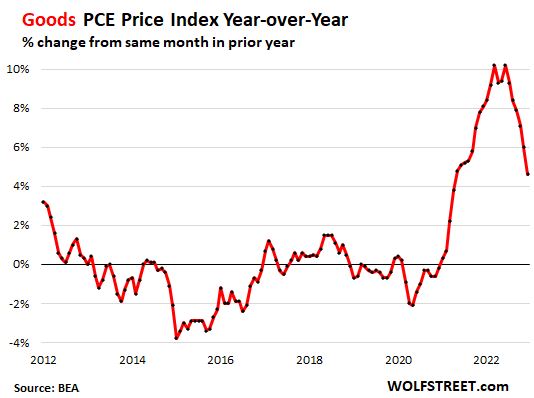

Year-over-year, the PCE price index for goods has been getting whittled down by the month-to-month declines. In December, it was up only 4.6% from a year ago, the lowest year-over-year rise since May 2021:

So we can see what is happening here with inflation: Goods inflation is backing off, with some goods components falling sharply, but services inflation is raging and not cooling off at all.

Core PCE re-accelerates. On a month-to-month basis, the core PCE, which excludes food and energy, rose 0.3% in December, up from 0.2% in November. This kind of reversal is exactly what Powell warned about when he said that “down months in the data have often been followed by renewed increases.” Sure enough:

On a year-over-year basis, the core PCE price index rose 4.4%, down from 4.7% in November, driven by the decline in durable goods inflation that is still out-powering the red-hot services inflation:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

That sounds like no pivot talk…how dare you.

“So we can see what is happening here with inflation: Goods inflation is backing off, with some goods components falling sharply, but services inflation is raging and not cooling off at all.”

The big tech is in very big trouble. Most of these companies saw the pandemic lockdowns as the future, hoping that people would interact with the whole world only through a device. They expected that people would shop everything online, work online, study online, and even entertain online. It was going to be a future where big tech will control all consumer spending.

Hence, they went on a hiring spree, growing many teams in an unplanned way, promoting mangers to executives, and even hiring a bunch of new non-essential executives so that existing executives can get promoted higher.

Then, the world reversed, and everything opened up, and the future tech monopoly on all businesses evaporated. This caused all the jumps in revenues to evaporate when corrected for inflation.

So, now the big tech is trying to cut its costs by laying off a small percentage of lower level employees, mostly in cheaper countries. However, no one in management is ready to breathe a single word about how top-heavy these companies have become and how many executives withdraw multi-million dollar compensations for non-essential tasks. To seem productive, some of these executives are pushing papers.

Big Tech used to be one of the few things going for this country. As these companies are now too top-heavy to compete, they may resort to monopolistic behaviors and may lose customer trust. So big investors should fund startups that now have a better chance of replacing the big tech, thus ensuring that the country as a whole retains its technical and innovation edge.

Big tech is still insanely profitable.

Google made $17.35 billion in Q3 2022 out of revenues of $69.1 billion.

It really needs to be noted that much/most of “Big Tech” revenue (not Apple of course) is related to advertising (Google, Meta, etc) – and that once you get huge enough in advertising, it is hard to grow faster/better than GDP growth (ie, you can only take so much share from competitors).

Big Tech has eaten a huge percentage of the advertising biz (for good or ill) but they can’t invoke miracles and make *advertisers* spend more than their budgeted/profitable sums.

Funny seeing how the market is so going so far today…you know those dip buying, glue sniffing WS bull junkies want to bet the market up higher but the Core PCE on service is confusing the algo probably and it’s kind of been tug of war so far, MS earnings didn’t help either. I still think the market will rocket up by closing..

There’s still too much glue soaked panty for this market to hallucinate over a rate cut is coming soon..

Seemed like this week might have been a turning point with Microsoft and Intel earnings but markets keep chugging along.

Next week is the big test though with the Fed and Google, Apple, Amazon. Last quarter it felt like the market barely hung on through the earnings and we were quite a bit lower.

With the ridiculously resilient rallies we gotta be near a short term top. It’s feeling a lot like the summer rally at this point.

Ultimately, markets keep chugging along because they’re absolutely convinced that the Fed will bring back the punchbowl. It’s that simple. No analysis is needed beyond that.

And it will start with a skimpy 25 basis points increase in the FFR this week. That will be a big day for the markets. Punch bowl could very well return by the end of the year, particularly if the debt ceiling “crisis” lasts longer than is comfortable and causes economic upheaval globally.

The secret of a good movie is to “delay the eff”. There will be pathetic results next week as well and markets will rally again on expectations beat (as expectations are even more negative).

This will go on for 2 more weeks till we have significant drops because of the bad results.

It did. So did Tesla and meme stocks. Animal spirits are taking their revenge.

Exact ! I shall add to your point all the money coming from markets or private equity to unprofitable companies advertising heavily to get growth.

SPX : June 3 of 3. // Oct low wave #3. // Jan 2023 wave #4. // Wave #5, a low slog down in 2023, below Oct low, for fun and entertainment only…

Michael, I’m not a xenophobe but it would be efficacious for you to write in English so we might all benefit from your insight.

He is writing in Engel-ish. Some people here have become fluent in it.

I tried one of those ‘learn a new language’ gigs and when I told them I wanted to learn gibberish, they looked at me funny.

I actually find Engel’s post easier to read than the ones with all the words and letters…ha

If the forum would allow, I’d “speak” mainly in pictures…

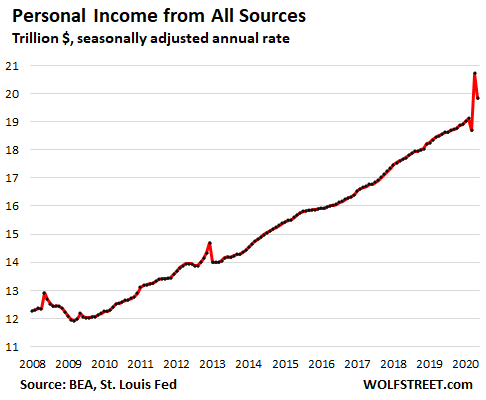

For example, this “Real Disposable Personal Income” chart “Picture” instantly shows the insanity of how much stimulus was injected compared to the 1970s, and how quickly it got sucked out of the system via higher inflation. <—My paragraph is "whatever"…the chart is "WowZa"…

Yort,

Why do keep dragging this stuff into here, like you just discovered something new? I’ve been reporting on this forever, practically on a monthly basis, going back to the beginning of the stimulus era. Here are some samples. The fact that you don’t look at it, doesn’t mean that I didn’t post it. Here are a few samples going back to May 2020. There are hundreds of these kinds of charts on my site:

Aug 2022:

From Jan 2021:

May 2020:

Braincamp,

I think what Michael is saying is that the SPX in 2023 will take a long slow ride down below October 2022 levels (Wave #3), and believes the current January 2023 wave we currently are experiencing is called ¨#4¨. Not sure about his 3/3 re: June 2022. I will guess he is referring to a cluster series of higher frequency waves perhaps during June 2022, but I am not sure. June of 2022 is a blur to me, as that was when my ex-wife wanted to get back together.

I hope that helps.

Long story short – it crashes.

Adding to Sept/Jan puts here. Nice short sqeeze today.

I got back together with some ex-girlfriends. Bad idea does not even begin to describe it.

Steria, it’s now Jan., 2023. Did you get back together?

wave counting is only good at Waimea..

Moderator Posted – Why do keep dragging this stuff into here, like you just discovered something new? I’ve been reporting on this forever, practically on a monthly basis, going back to the beginning of the stimulus era.

————————————————————————–

Because my chart link, which you deleted, went back to the 1970s. None of your charts go back that far. Note I stated in my post “compared to the 1970s”.

At no point am I trying to compete with your charts. I just wanted to show a longer time range as I think that has significance.

I’m not easy to understand being neurodivergent and thus often times offend others due to being totally clueless on a social level. I’m giving myself a three month time-out from posting.

If you use a 50-year chart to show what happened in the last two years, you get huge distortions, of the type your chart produced. In addition, those were year-over-year % changes in income during the stimulus phase of the pandemic, so you get this huge spike one year and next year this huge plunge, where the plunge is due to the base effect, and nothing else, and all balled up on the righthand side. If you want to show something like this, you can do it on Twitter. I allow some links to charts, but I vet the charts first.

The headlines from the financial news media are so different from the real story. As prices on used cars and other durable goods revert over the coming months, it will offset some of the higher inflation in services (as it did in December), but what happens once the price increases on durable goods have been wringed out of the economy and begin to rise again? That is when the inflation in services will be reflected in the overall inflation rate.

What I would like to see the Fed do is to raise interest rates .25%, but increase the pace of selling assets from the balance sheet. I would imagine they have some assets that were acquired at interest rates where they dont have to take a loss (older stuff). Sell those outright in addition to letting other stuff roll off as it matures. That will put a lid on the speculative excesses in the financial markets.

They are not going to speed up QT even if CPI starts going back up next month. And don’t forget that the Fed is in bed with Wall Street. They could sold MBS from their balance sheet outright a long time ago if they wanted to.

They also could have stopped purchasing MBS in late 2021 when it was clear what it was doing to the housing market.

FED would make sure their their rich friends/buddies are not hurt.

Next week is tiny 25bps hike and dovish signals about pausing.

FED was still buying mBS even in September 2022.

The PCE price index for durable goods – new and used vehicles, appliances, furniture, etc. – declined by 0.3% for the month.

Anyone who reads Wolf knew New and Used cars prices were going to drop. Anyone buy a new car lately? Have you seen the Interest rates on new cars? Unless of course you’re like me and have stellar credit. Interest rates are even higher on used cars. Previous Wolf articles stated that repos were climbing.

Avg Gas price in the US has climbed $ .16 over the last three weeks. (EIA) Though the avg price of diesel has only gone up $ .08 a gallon.

840 Credit Score = 7% interest rate to buy a new Ford Bronco. Told them I would pay with a check, they said price will be higher. I said, no thank you.

Car Buying,

Haggle like a maniac on price but let them finance at whatever rate, so they think they can make it up in F&I, and so they’re willing to give on price. After you take delivery of the vehicle, pay off the loan right then and there. There is no interest cost to you, and you likely got a better deal on the vehicle. Dealers hate that. But that’s life in the fast lane.

Is it certain that paying off the loan early is always allowed? Seems like it would be easy for them to insert a clause against that, buried on page 46.

I forgot the exact number of months – I think it was 3 – but Hyundai gave me a better price buying with some credit (50% minimum I think it was), so I took the loan but paid it off after the 3 month required minimum. The difference in price wasn’t all that significant but was a bit better, after the 3 interest payments, than not using credit.

If the labor market remains extremely tight, high services inflation may persist and as financial conditions remain loose, I’d expect Fed to not be kind to speculative markets, if anything the hawk message needs amplifying!

You DID see the revised data for Qtr2 of 2022? I wonder how the REVISED data for Qtrs 3&4 2022 will agree with you.

Those of us who eat food have not noticed much in the way of grocery prices abating. Unless you consider that the prices may not be increasing quite as vigorously recently.

Anyone else here fond of putting victuals into their face? Perhaps we should protest by not eating until the prices drop.

For example, it seems the great cornflake flu has really goosed up the price of a box of these little carbohydrate bombs.. Or maybe there was an auspicious mysterious fire in the flake factory again.

Beef and pork prices have come down at our Safeway, which now even has some specials on this stuff. They’re still higher than were they were in 2021.

But beer prices jumped. And eggs are just gone (avian flu).

The price for a large loaf (20 oz) loaf of whole wheat bread at my local Aldi has collapsed all the way back to $1.09 (it was $1.55 last December).

Blueberries were $1.99 for a dry pint.

Eggs down 40¢ a dozen, but not enough to where I would buy them again.

Humus went from $2.45 to $1.99 on some selections (back to where it was 2 years ago).

A 4lb oranges was $2.49.

Canned tuna went the other way, up 3¢ to 80¢ a can. Dry roasted peanuts up 20¢.

Beer & wine are both up over 3 years ago (the last time I purchased any). Beer up from $4.99 6-pack to $7.99 (sale prices). I have a closet full of wine & beer, and at the rate we go thru it somebody will probably inherit it down the road.

I bought 20lbs of rice at Costco for $20.

I keep buying lamb chops at Costco for 6.99lb. It is a steal. Price is flat and hasn’t gone up for 5 plus years.

Here where I live, Aldi, Walmart, and Publix all have fully stocked egg shelves, but egg prices are through the roof compared to a year and a half ago (Aldi egg prices then – $.88 cents a dozen. Now? $6.90 a dozen).

So I wonder, why are there no egg shortages showing up on the shelves if the chicken wipeout due to the avian flu was/is so bad? Or could it be something else… like maybe egg producers using the avian flu as an excuse to jack up egg prices due to greed. Who knows.

I’m tired of paying for golden eggs.

Must be gold ones at over $8 for 18.

I still buy eggs. It is still a good relative value.

Greed is a possibility (just like with record oil profits), but the fact that shelves are not bare doesn’t necessarily mean that there is no shortage. It could also mean that consumers have changed their behaviors such that the shelves don’t empty out as fast as they used to.

In my opinion eggs are a good commodity and the price will come down there is no shortage at the price they are charging. Crude oil is similar and currently Opec is controlling the prices of crude. Energy prices swing wildly hence the reason for excluding in many of the inflation figures

Wolf,

Just to clarify for the newbies/drive-bys…”PCE Services” includes the big honking sector of *housing costs/rent*, correct? I think it is a huge fraction of the total.

(I swear I didn’t see a mention of the topic in the post)

I don’t think that most people think of housing as “services” per se, so the labelling can be confusing/misleading.

Rents are a service and are included. Utilities are a services and are included.

After Safeway merges with Kroger the specials will disappear and they will charge whatever the traffic will bear. The Safeways around here are a joke. The escalators/elevators are out of order and don’t work, the employees don’t know anything about customer service, and the food is substandard, and expensive. The only thing I buy there is bottled water.

I forgot to add that one of the benefits of shopping at Safeway during the pandemic was there was usually no one in there. Good for social distancing.

Bought frosted mini wheats last week for 99 cents a box ,alli wanted got 7 boxes for me and kids

I wish there was a way to judge how discretionary all the services that are inflating are. Like the dozens of tunnel car washes with free vacuums going up everywhere and trying to charge up to $20 or more for ‘premium’ washes (that really just scratch up your clearcoat). Now that’s discretionary. I would love to get to a point where goods are deflating. Would the Fed step in if services were still inflating while that happened?

Jamie don’t care. JPM might popup > Feb 2020 high and close

Feb 21/28 2022 open gap.

Stocks should be tanking. But since the markets are nothing more than a casino, what do you expect.

Yeah, PE ratio for SP 500 has crawled back up to 22 (from 20, down from Nov 2021’s 25)…it really should be 15 (or lower) given the 10 yr Treasury.

So the market is still very much tap dancing on very thin ice. (Pivot faithful?)

If I had more time, I would try and id the SP 500 overweights…screw it, here goes

(remember, a 15 PE, given these 10 yr interest rates, would likely be a more realistic PE, given historical valuation ratios. The Pivot Faithful may still be holding on for dear life..)

Microsoft has a 26 PE (not insane, but the question is how can huge revenue, index overweights grow much faster than US economy…)

Comcast 35 (expect ruthless cable bill inflation…)

Apple 23 (has no one heard of Android…)

Eli Lilly 43 (new disease to be discovered…)

P&G 24 (expect ruthless non-generic pkg good inflation despite G rpts?)

Estee Lauder 41 (draw your own conclusions)

This could go on and on…there are plenty of stand alone crazies propping up the SP 500…but they can all be taken out and shot one by one, as analysts actually look at their individual valuations.

Looks like the stock market sees this in completely opposite way and MSM is serving a different narrative than what WS is telling us.

The bulls who’ve overtaken Wall Street seem to think there will simultaneously be a soft landing AND the Federal Reserve will be lowering rates this year.

Powell has yet to make it clear what will be the necessary conditions for lowering rates:

1) inflation decelerating, as it is now?

2) inflation on track to 2% PCE? (It was still expanding at a 3.x% in Q4)

3) inflation to 2% + unemployment needs to go up?

Will they do “insurance cuts” in the absence of labor market deterioration?

I would think Wall St secretly prefers a hard landing because that would make ZIRP/QE more likely.

My 30 day TBILL paying 4.5% is looking pretty sad against the recent market gains.

I for one, feel your pain. I dumped what little I had that last big downdraft. I had considered double up but I took the safe route and liquidated my account. Not much into looking at where I would be if I had held my longs, much less doubled up.

That rudimentary question: What percent of the US population can cover an unexpected $400 expense – without dipping into credit cards or 401k accounts, etc. – might need to be reframed with a number closer to $500.

This BS question has been posed for years. It’s a BS question because it asks a question that was appropriate for the payment methods and money-handling of the 1950s. Today EVERYONE pays for nearly everything they buy with a credit card. That’s a modern payment device. People don’t even have savings accounts anymore. They have checking accounts, 401ks, IRAs, home equity, investment portfolios, etc. but no savings account. So nearly everything that gets bought at the store or online is paid for by credit card. So if you ask if they can buy $400 of something without using their credit card or Apple Pay or whatever, people are stumped.

And then, every month most people pay off their credit card charges in full to avoid interest. They just collect the 1.5% cash-back. Last year, about $5 trillion was paid for by US credit cards, and nearly all of it was paid off before due date.

My apologies for posting this off topic. Hope some one here can help me understand this, as lot of you guys buy treasuries. I saw this for a 4 week t bill on treasury direct.

”

Investment/Interest Rate: 4.446%

Yield: 4.370%

Price per $100: 99.660111

”

No matter how I calculate, I am coming to ~4.8%. Not sure how treasury direct is coming to above %.

any thoughts?

Are you taking into account there are 13 4-week cycles in a year?

If you divide the interest rate by 13 and multiply by the price, you should get 100. You need to add 1 to the interest calculation to account for the return of principal:

(1+(.04446/13))99.660111=100.000949

You buy the bill for $99.66, and after 28 days you get $100 ($99.66 in principal and $0.34 in interest.) There are 13.036 such 28-day periods in a year, so $0.34 x 13.036 = annual total (but not APR) = $4.43 in interest on a $99.66 investment = 4.447%.

LOL. Yes that’s more exact:

(1+(.04446/13.036))99.660111=100.000007

The extra day matters!

I know from what you’ve previously said about how you see comments you probably didn’t see mine before replying. I didn’t bother accounting for the final day, but accounting for it does make the calculation look very clean.

Exactly. In my commenting software, I see comments in chrono order, across the site. So I didn’t see your comment until after I’d posted my comment and checked to make sure it was in the right place and looked OK (my commenting software’s font is like 1 pixel wide).

Had I seen your comment first, I would have saved myself the trouble of doing the high math here, LOL

I don’t remember the Volker hikes fondly. When the say, “Don’t fight the Fed.” They mean it. If you think food inflation is sticky don’t look at your insurance bill!

There are no guarantees that the Fed will raise just .25% They are driving full speed down the “data driven” road. They will be done raising when inflation has actually dropped 3% more- not before. So far what they have done has not shifted the game. It is only muted.

Trade the market you have, not the one you want. Do more of what works and less of what doesn’t. Need dry powder- sell your bottom 10% and move on. A time correction and “soft landing” recession will grind the bottom families in our economy to a pulp. This isn’t going to be pretty.

Along the lines of the Fed being data driven, what does not seem to be discounted is the possibility that the Fed hikes by 0.25% this meeting, but then keeps at it, over and over and over until we’re way above the current target rate. It sure seems like JPow’s statements keep this possibility open.

“There are no guarantees that the Fed will raise just .25%”

Yes, there are. Before every meeting, people in the comments sections of blogs start to speculate on how THIS is going to be the time that the Fed shocks the markets with a greater-than-expected hike. Sure, it didn’t happen last time, or the time before, but THIS time will be the time! And each time the Fed announces the exact hike that everyone expected. It will happen this time too. Charlie Brown is not going to get to kick the football.

The Fed does not want to “shock” the economy. Depth Charge, AF, and SC want to see shock and awe, but not the Fed. After the COVID stimulation, they’re trying to get inflation back in the mental bottle. They don’t want to tank the system, regardless of the conspiracies.

As always, pure wisdom dispensed daily. Thank you Wolf Richter!

Quoting JP speech & Wolf’s article:

Of the 19 members who participated in what is officially called the “Summary of Economic Projections” (SEP), 17 saw this peak rate of at least 5.13%, meaning another 75 basis points in hikes. Seven of them saw the mid-point of the federal funds rate rise above 5.38%.

Market is pricing 25+25; almost no chance of 50.

Very unlikely we get a 50; but if we do?

We won’t get 50bps hike next week. We all know who does FED work for :-)

What we will likely get is 25bps with strong hawkish commentary.

Pain and what not… Also I’m expecting not only no mention of, but hopefully a direct statement in the q&a saying no pause and no cuts.

Throw in some tight job market and service inflation comments, a splash of jolts and NFP, and a slew of earnings should make for an exciting week. 🎢

Maybe the last 30 minutes of the trading session today is foreshadowing for next week. Time will tell!

.25 is essentially a pause. They may not think the country can handle a recession that may push the economy over a cliff. The are taking their foot off the brake.

And if the Fed does only a 1/4 point hike, I bet the stock market takes off… to infinity and beyond!

heh, heh, heh.

Are not, services the first thing people will eliminate during a recession and certainly during a depression?

I cut my own hair several times during the pandemic and it is definitely not a service that I want to eliminate. Oil changes, also come to mind as a service that I do not want to do without.

I have a hard time viewing things like rent as a service.

Services are the part that is growing. Surely, if you lose your job and have no money and no resources and cannot find work and end up on the street, you’re going to eliminate a lot of services.

But other than that, there are a lot of services that you are not going to eliminate just because it’s a recession: housing, insurance, healthcare, utilities, financial services, communications services such as wireless bills and broadband, pet services, childcare and educational services. That’s the majority of services.

Maybe you can eliminate home/auto maintenance and repairs; and maybe it’s not a good idea. Maybe you can eliminate parking fees, tolls, and mass transit costs; or maybe you can’t because you have to go to work.

You’re referring to “discretionary” services that you can more or less easily eliminate, such as hotels, rental cars, cruises, airfares, memberships, gambling, streaming, subscriptions of all kinds (good luck cancelling them), entertainment, sports events, cleaning services, haircuts, etc.

In terms of your haircuts: I’m on the other side. I too learned to cut my own hair during the pandemic, but I like it, and will keep cutting it myself. But that has nothing to do with a recession. That’s a permanent lifestyle choice.

George W

Nope, services are not the 1st thing to be eliminated. Buying stuff is.

I googled it. PCE = Personal Consumption Expenditure. SHUT UP! I didn’t know.

Inflation gone full Zimbabwe here in So Cal. Jan gas utility bill up just a tad…a mere +160% (per therm) from one year ago.