The ECB reacts to raging inflation, unloads a massive chunk of assets, hikes rates.

By Wolf Richter for WOLF STREET.

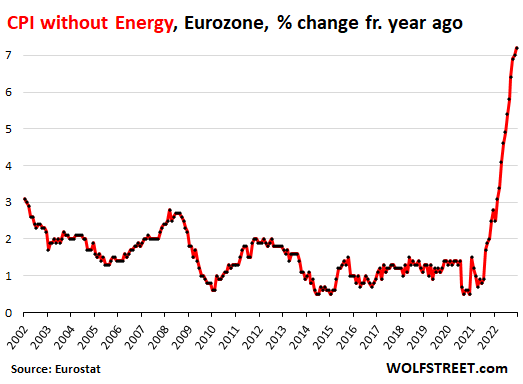

It was another slap in the face that inflation dished out: In December, the Consumer Price Index excluding the energy products that consumers buy (gasoline, diesel, electricity, natural gas piped to the home, heating oil, etc.) rose to a record 7.2% in the 19 countries that use the euro, according to Eurostat. A breath-taking spike:

Fuel prices have come down, as fuel commodities have come down and as government fuel subsidies have pushed them down. But other factors, including services, are now driving inflation.

Inflation without energy products started spiking in mid-2021. By February 2022, the index had hit 3.1%, the highest since the beginning of the data in 2002. And then it continued to spike as inflation beyond the volatile energy prices was worming deeper into the economy.

This index is now being cited by ECB governors, and by ECB President Christine Lagarde as reason for continuing the inflation crackdown, despite the drop in fuel prices.

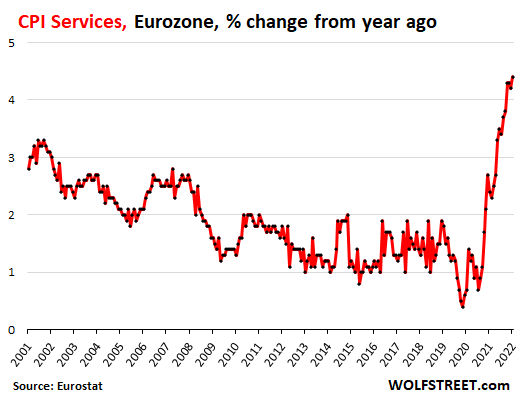

Services inflation spiked to a record 4.4% in December, compared to a year ago. Services include healthcare, education, housing, insurance, financial services, telecommunication services, streaming, subscriptions, lodging, air fares, repair services, cleaning services, legal services, personal services such as haircuts, etc. Services are where the majority of consumer spending goes.

All eyes are now on wage increases as the driver behind this inflation. “We know wages are increasing, probably at a faster pace than expected,” Lagarde told a Croatian paper, cited by Reuters, when she was in Croatia a few days ago to welcome the country as the 20th member of the Eurozone. “We must not allow inflationary expectations to become de-anchored or wages to have an inflationary effect,” she said.

Wages are by far the largest cost component of services outside of rent, and rising wages are getting passed on as higher prices. This is at the root of Lagarde’s comment about wages, and she was echoing Fed Chair Powell on this issue: wage inflation is going to drive services inflation, and services inflation is very hard to crack down on.

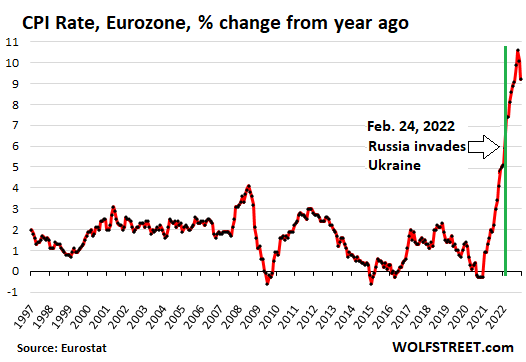

The overall CPI rate fell to a still huge 9.2%, down from 10.1% in November, and from 10.5% in October, after prices for energy products that consumers buy – gasoline, diesel, natural gas, etc. – fell sharply, and were pushed down further by government energy subsidies.

Overall CPI Inflation began spiking in early 2021, a year before Russia’s invasion of Ukraine. This was when inflation exploded globally even as the pandemic money-printing by the ECB, the Fed, and others continued to rage, amid the fantastical stimulus-spending orgy, funded with borrowed money.

Since October 2021, Eurozone inflation rates were in never-seen-before territory. They hit 5.1% in January 2022 before Russia invaded Ukraine. Russia’s war in Ukraine made the trends worse by fueling commodities inflation that is now subsiding:

Inflation by Eurozone country.

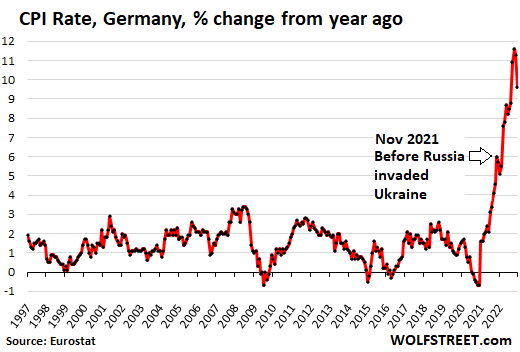

In Germany, where new energy inflation subsidies kicked in, the CPI fell to a still horrible 9.6%, down from 11.3% in November and down from the record 11.6% in October.

Already in November 2021, well before Russia’s invasion of Ukraine, inflation hit what was then an unthinkably high rate of 6.0%.

| CPI by Eurozone Country, Dec. 2022 | ||

| 1 | Latvia | 20.7% |

| 2 | Lithuania | 20.0% |

| 3 | Estonia | 17.5% |

| 4 | Slovakia | 15.0% |

| 5 | Italy | 12.3% |

| 6 | Netherlands | 11.0% |

| 7 | Slovenia | 10.8% |

| 8 | Austria | 10.5% |

| 9 | Belgium | 10.2% |

| 10 | Portugal | 9.8% |

| 11 | Germany | 9.6% |

| 12 | Finland | 8.9% |

| 13 | Ireland | 8.2% |

| 14 | Greece | 7.6% |

| 15 | Cyprus | 7.6% |

| 16 | Malta | 7.3% |

| 17 | France | 6.7% |

| 18 | Luxembourg | 6.2% |

| 19 | Spain | 5.6% |

The ECB finally reacts: hikes rates, unloads massive chunks of assets:

After years of negative interest rate policy – the silliest central-bank absurdity ever concocted – the ECB got religion about inflation and hiked its policy rates at each of its last four meetings in 2022, by a total of 250 basis points, to 2.0%, the fastest rate hikes in its history, and more rate hikes are coming. They’re ridiculously far behind, but they’re now moving, and they’re hiking into what the ECB has said is a recession.

The ECB had two major types of QE: Handing cash to banks via free-money loans, and handing cash to the bond market by purchasing bonds. At its October meeting, it announced Step 1 of QT: Unwinding the loans. At its December meeting, it announced Step 2 of QT: shedding bonds.

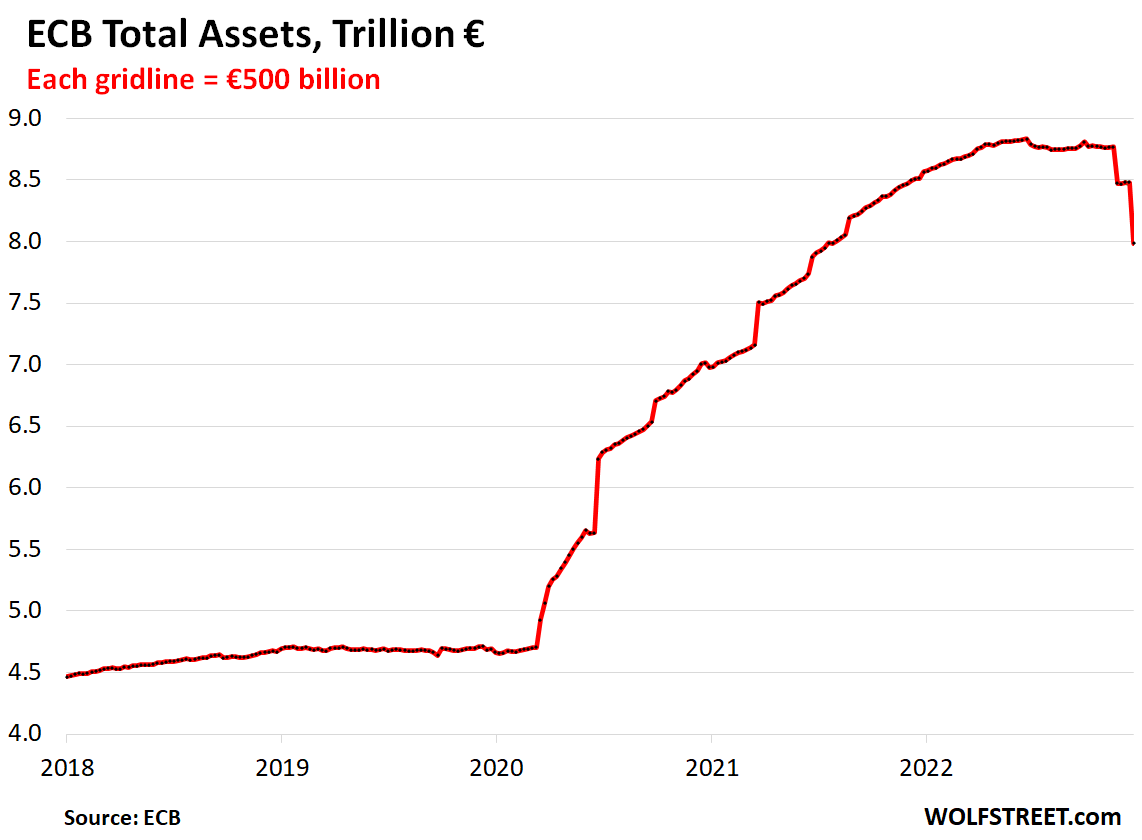

Step 1 of QT has already knocked off €850 billion from the ECB’s balance sheet, since the peak in June (I discussed the details here).

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Central banks going 85 MPH shift into reverse and let the clutch out ….

Troubling. Even if supply constraints are solved, services are zooming. If buyer strikes are the only lever to contain this, it seems like a slow boat. Who will opt out of medical, roof repair, car repair, etc.? It all looks like a very fractious, more deeply unequal society ahead, as some folks (without stimmies) fall into their consumer essentials going unpaid, yet wage demand and price pressures continue. Those who “opted out” of housing are quite evident around here.

A lot of folks were ignorantly pleased about getting stimmies.

our state is now clawing back these stimmies

magically after receiving unemployment for govt decimating his business

they say he didn’t qualify because he only lost 95% income

Unfortunately, “buyers strike” and “opting out” will not fix Europe’s problems.

The electorate now want handouts from government, and they think that government makes “real” money that can make them richer. So this electorate can never hold their elected leaders accountable.

In corporate world, we have investors that are looking for central bank pivots and bailouts to make a quick buck on pump and dump, instead of investing into a productive business. These investors cannot hold our business leaders accountable for their actions and results.

So the broad moral decay in First World societies cannot easily be fixed. Before real change can be made, People will have to get a lot more poor and miserable, and have many of their rights infringed. Sometimes, a rotting house (European union?) with weakened pillars must be broken down before a new stonger and larger one can be built in its place.

Life in west world sucks, central banks,abolish them all.

Controling bastards.!!!

Andy Jackson was on target. 1838.

Old Hickory, despite his faults was right on the money when it came to the banking industry. We’re living a new “Trail of Tears” these days!

There is going to start a fantastic second wave of European travelers to North America looking for a new start.

To what extent was / is the ECB and the blinkered policies of the EU responsible for this horrible situation?

At the time of the introduction of the Euro, I remember the German goverment assuring the worried population, that the € would be as strong as the D.Mk

So much for politicians, the non elected EU governors and the ECB… 😖

I love watching the Trump video when at a UN-speech, he was warning Germany how bad things would get if they relied on others like Russia to help them with Energy instead of being Independant and the german Politicians were laughing at him.They weren’t laughing a year later.

A 4 percentage point increase, across the board on all debt, world wide, takes 20% of WW gdp to pay the interest.

2008 crash was 5% drop in gdp.

Good point. If we lose GDP to rates, government debt must increase to compensate for decrease in central bank balances sheets.

So it would be interesting to see the following number:

(Total Fed balance sheet decrease since QT start) – (Total US debt increase since QT start)

Ok may be government debt was always rising. So let’s be a little more fair and get this number:

(Total Fed balance sheet decrease since QT start) – (Total US debt increase since QT start) + (Equivalent US debt increase for same period in early 2019).

I hope we get positive numbers here.

That’s an incomplete picture. That 20% of GDP that global borrowers pay in interest goes to *someone*, and that person spends it. Which means it stays a part of GDP. The money stays in circulation. The only difference is who spends it: lower interest rates give more money to borrowers to spend, and high interest rates give lenders more money to spend. But either way, the money doesn’t disappear from GDP.

The only entities that can create or destroy money are central banks.

Big money forced selling at a loss due to liquidity crisis in down markets and increasing bond yields also “destroys money”

I read that about 75% of money is created by commercial banks. Used to be higher. A bank has one main job which is to make good loans. That becomes hard in a recession as borrowers become higher risk.

Just default on it already. At least that is transparent. We always knew that debt wouldn’t be paid back, because it simply can’t. For the holders of the debt (mainly savers and pensioners) it doesn’t matter whether you lose your savings through default of through inflation.

Are we seing the corrupted FIAT money collapsing ag last?

I am suspicious that the western world can deal with inflation going back to 2%. In Japan and Europe real growth is about

Zero. How can you service existing debt if nominal growth is only 2%? In the US trend real growth is only about 1% so you have 3%. Still a problem. I think it is going to be higher inflation or back to zero real rates. Central banks probably hoping for a five to ten year glide path to 2%.

If so, it will just be replaced with another. People want a free lunch, and those seeking power finds ways to provide it to achieve power. Rinse, recycle, repeat.

I’m struck by the fact that the three former SSR Baltic countries are leading the pack in Eurozone inflation by far.

Is there a common explanation for all three?

When I spent time there years ago, they were still heavily attached economically to former soviet countries, especially Russia. Is the inflation a result of sanctions on Russia?

Or is there another reason? Didn’t the three Baltic states undergo the most severe austerity programs of the former Warsaw Pact countries now in the EU? Is the higher inflation a lingering consequence?

I’d be beholden to anyone with insights.

Some info on the inflation drivers in the Baltics is provided here:

Hedward,

I deleted the FT link for two reasons:

1. Unless you’re a subscriber of the FT, all you get is a promo page exhorting you to subscribe to the FT. I don’t allow promos.

2. I don’t allow 1-liners with a link.

If you want to share some content from an article, summarize it in your own words, or copy-and-paste two relevant paragraphs into your comment, and then cite the source. That works better. Everyone can then read it, and no one has to click on anything just to end up on a promo page.

https://wolfstreet.com/2022/08/27/updated-guidelines-for-commenting-on-wolf-street/

I think (imo) its because they -also- have the healthy demand kind of inflation because they are growing, coming from a relatively low wage background.

Poland isn’t listed but its at around 16% for the same reason.

For example average salary in Latvia is 12K USD/year and they are suddenly in Europe connected with the wealthy European countries.

No Poland isnt listed because it isnt a member of the Euro countries It still maintains its own currency the Zloty which by the way translates to Gold

The ECB dumped $1T Euros of impaired assets.

The Baltic states, which blockade Kalinka, pay the price.

The Dow might rise to complete a large distribution area all the

way to Nov 15.

Not that it changes anything but if one wanted to compare apples to apples, does the EU measure inflation the same as the US does?

No, but the “harmonized” measure of CPI in the EU measures inflation the same way for all countries in the EU, so you can compare them. Countries, such as Germany, also have their own measure of CPI. They run in parallel, and they publish both.

Interesting, thanks.

had cnbc on yesterday – rarely do -but wow those wall street folks and money managers really want their “free” money back ! lot of hate directed towards the fed for raising rates and they want rate cuts NOW – and if they are under age 60 all they see are good times and opportunity ahead

Yes the “crybabies on Wall Street,” as I call them, are a hoot. I should write an article about them, again.

I would RTGDFA for sure!

Wolf – yes, please, please, sir, may we have another of you giving them another???

may we all (well, most of us, anyway) find a better day.

I follow a blog written by a mortgage broker named Lou Barnes. Man he is crying the blues right now.

Canadian homeowners and their Realtors are also wishing for a Bank of Canada pivot and Zero-interest rates again.

It’s so bad that if one goes on a Toronto/Ontario/Canada real estate subreddit and mention that there are more rate hikes, your Reddit profile gets so much negative karma because you get downvoted into oblivion.

Then there are the commodity speculators who want oil and gas to be very high even if it means making foreign oligarchs, oil cartels and America’s enemies richer.

Reddit is great. If I want to know the absolute dumbest, most uninformed opinion on something I’ll just sort by most popular comments. If I want to see the absolute worst financial advice, I just sort by most popular. If I want to see the most ridiculous take on the housing market, badda bing badda boom! Top comments on Reddit has me covered.

I need to venture to the political boards one of these days.

The dumbest people I’ve ever met were always at the professional wrestling matches.

The average salary in Ukraine in 2021 was less than $1000/m. Retirees got

$80/m – $100/m. Many Ukraine best brains entered free vocation schools to acquire cyber & programmer skills. They did it for mom. They became

useful idiots for foreign forces & entities.

Interesting analysis as usual sir

Ukraine is about to receive the largest development aid package in modern history (mostly funded by USA, some from EU). $2 trillion was spent in Iraq over twenty years; Ukraine will receive more. Boom times ahead in Ukraine when peace breaks out.

Ukraine is finished as a country by 2024 and quite possibly nato and the eu will follow Ukraine into oblivion shortly thereafter! Russian is grinding the Ukrainian army into pieces in the Bakmut theatre as I type, with whole brigades being annihilated almost on a daily basis!

Greg

You make a huge geopolitical forecast and statement and back it up with your version of a status update from the frontline in Bakhmut, which, respectfully, few people had even heard of 6 weeks ago, had a pre-war population of 71,000 and which you failed to spell correctly.

And your point about Eurozone inflation is?

Greg,

Too much desperate wishful thinking for just one paragraph, LOL.

That’s right and Russia will keep talking more and more countries after they annihilate the Ukraine.

Very little of that “aid package” will actually arrive….it’s a gigantic laundromat and most of the dosh goes back to the source….think Bagman-Fried, anyone?

I find it interesting that no matter what region or country, no government or bank will ever point to the levels of government spending as having any inflationary impact. Is it really that small so as to be ignored?

“We must not allow inflationary expectations to become de-anchored or wages to have an inflationary effect”

But somehow government spending has no inflationary effect?

“Fuel prices have come down, as fuel commodities have come down and as government fuel subsidies have pushed them down.”

Seems a bit like “the kettle calling the pot black”.

The price of gasoline of gas was 55.9 cents in 1975 according to a photo of a gas station sign. That is nominal dollars. If you switch to inflation adjusted dollars, all sorts of misunderstandings might occur.

This 6x inflation is temporary, the rate will change, it is not constant.

Governments invested in roads, bridges, canals, dikes, airports, education, health, retirement plans, defense, etc. Some of these projects should bring a favorable return on investment. Not all spending is bad.

While in theory government spending could be productive (you gave the example of infrastructure), the fact remains that most government spending today is inflationary, and is not productive. Today’s educational system, pension system, or healthcare system are hardly among what we might call productive activities, so they should not be mentioned in the same breath as things like infrastructure. There’s not more than a fraction of government spending that is actually going to anything useful today.

Government spending follows the same rules as every other kind of spending. To the degree the money spent produces a tangible good or service, it is not inflationary. The problem is, the vast majority of government spending does not produce anything tangible, it is simply stolen and the taxpayer gets little or nothing in return. The money is funneled to government contractors who in turn make generous campaign contributions to the elected politicians in return.

Government is the ultimate con man, they create problems, by not doing what they are supposed to do in the first place, and then present themselves as the solution to the problems, by confiscating even more of your money and funneling it to their financial supporters. Meanwhile the roads and bridges never get fixed and your average high school graduate cannot figure change for a dollar.

We do however always have billions to spend on wars that have no National Interest, including pallets of $100 bills to make local war lords rich…..

a very big drop from the top, yet I still wonder if these central banks will get close to liquidating any significant portion of that debt before economies slide into recession and deflation.

what we really need is the awareness that central banks are just playing money games and that real prosperity comes from private enterprise. effective government regulations and taxation policies hardly get any attention, when these are the levers that should be used to impact the economy long term.

the europeans were able to cut down the time to install a new LNG system in 5 months rather than many years. why not learn from that lesson how to make government policies more responsive?

The EU brought this on themselves. This was a voluntary situation. Those in the ‘know’, know why.

Money printing and interest rate repression are always voluntary — voluntary for the policy makers. There is nothing involuntary about monetary policy.

Besides shoveling out to the pleeps daily?

Stephen

I would happily compete for a place on the podium of anti-QE commentary but we really should distinguish between the monetary response to the pandemic and previous catalysts. The pandemic was an Act of God type event. A true global emergency.

Even I don’t think that ‘do nothing’ was an option, and that’s one of my favorite policy levers, so it comes pretty close to involuntary in my opinion.

Pandemic QE was horribly overdone and overextended and terribly executed. It was also undermined by all the needless QE that preceded it. QE buys time and nothing else. Time’s up. Voluntarily or involuntarily, it will all suction out of the liquid and so-called illiquid assets it found its way into.

AB

Just follow the money. It worked just great for everyone who got theirs first.

Not so well for getting stuck paying for it.

“Pandemic QE was horribly overdone and overextended and terribly executed.”

While energy spot prices may be declining, I can tell you that those parts of Europe receiving LNG from the US, are still paying high prices established in the spring and summer. And when those prices get repriced, they’re only dropping around 40%, way above spot gas. I know because my land produces nat gas in the US and it’s being converted to LNG and shipped to Europe.

I remember Jans Weideman, head of the Bundesbank, being the constant thorn in the side of Whatever-it-Takes Mario Draghi, constantly warning that what is happening now with out of control inflation will happen. Of course, he was poo-pooed and denied the roll that Christine Lagarrd now has as head of the EU Central Bank!

He quit in disgust in Oct 2021, when German inflation was heading to 5%, and by the time it hit 10%, he was long gone. No one in power ever said “he was right,” but he was right to oppose those Draghi shenanigans.

His predecessor (Weber) was (also) basically bullied and left early. I have never understood why the Germans have put up with that. They have been totally cheated with the euro. It’s too late now. All is lost.

“Wages are by far the largest cost component of services outside of rent.” Rent is a bigger component of Eurozone services cost than wages? Can you refer me to a source for this?

Re-read: “cost component.” COST. How much it costs the service provider to provide the service. And the service provider is then going to pass on those higher costs to the consumer via a higher price, which at that point becomes a component of inflation.

What I said:

Wages are NOT a big cost component of rent. The big cost components in rent (what the landlord has to pay) are: building costs (depreciation), interest, property insurance, property taxes, etc. The wage cost to manage a rental property are not huge compared to the other costs.

But when you get a haircut, a big part of the costs are paying for the people that cut your hair (their wages, employment taxes, benefits, etc)

This is old hat. Everyone knows this. Powell keeps repeating it. I’m not saying anything new here.

The dbl McC will make sure that this gov will not be in power for a second term.

The McC’s will cut gov spending, IRS payroll, trim debt in real terms, shut the southern border, fight crime…and reelection this gov for a second term like Gingrich & Clinton.

The poor and the middle class will suffer, but the gov will blame the

republican.

First negative interest rates killed the banking system in Europe and now Europeans are going broke just like the Japanese the last 30 years all thanks to those stupid negative interest rates and zero interest rates.

India must be a misprint all of them run in the wrong or opposite direction on the battlefield. A gust of wind could scare them away.

Looking at that last graph, don’t forget that the pre-pandemic €4.7T balance sheet was already insane. Many people now think that going back to pre-pandemic balance sheet levels would be “normalisation”, but if I’m not mistaken it was <€1T before the GFC.

Wow. Inflation running 10-20% in half the Euro countries, and the ECB still has interest rates pegged at 1-2%.

How ridiculous is that?

Something is seriously wrong with monetary governance.

This MLK weekend nurses are working long hours, day and night, fighting the most contagious XBB 1.5 new hybrid.

After testing Oct lows SPX might rise above Aug high to torture bond

traders before letting them to rip few rewards later on, down below.

For a Alfred E. Neuman “What Me Worry?” graph, take a glance at the Dow.

It’s like Wile E. Coyote just stepped off the cliff, but hasn’t fallen yet. 30 stocks can be manipulated (unlike the S&P 500).

I also think that the financial tape is being painted by a well financed wall street goblin, selling their shares to joe schmuck’s automatic 401k contributions.

Its interesting that this article has attracted so relatively few comments which must be because the US readers don’t consider rates in the eurozone as relevant. But they are of course, and as the EU and the UK -have to- match rates with the Federal reserve, so is the opposite true when the time comes. Watch what happens to borrowing costs in the US when the Japanese stop being the marginal buyer of debt.

I found your first sentence as minimally provocative, until I was assaulted by the next sentences of projection without a shred of data. Maybe is not a brave position.

If the Europe continues to forsake its own interests, and believes the US is not going to exploit whatever advantage it can, then they need to study their own history. Like Victoria Nuland said……

Wolf,

Next ECB TLTRO III early repayment date coming up Jan 25…but recipient banks must notify the ECB of their intentions two weeks in advance…so we may have a pre-announcement coming from the ECB later this week.

Last month the ECB pre-announced early repayments on Dec 15…and SPX has been range bound since.

Just something to watch for.

Yes, this will be interesting… interestingly, on Dec 15, the ECB announced that €447 billion in TLTRO III would be paid back. Two weeks later, it then actually booked €498 billion in total loan reduction on its balance sheet.

https://wolfstreet.com/2022/12/28/ecbs-balance-sheet-plunges-by-e492-billion-in-one-week-and-by-e850-billion-from-peak/

Wolf,

Yes, I remember. ECB playing Calvin ball, changing the rules as they go. Upping the interest rate from zero to “currently prevailing rate” is a huge rug pull.

Won’t be surprised if the ECB announces prepayments in excess of 500 B euros for January, perhaps 600 B…and then we see the actual number come in materially higher…again.

It’s one thing for the banks to repay these…but what about the end customers? No one seems to be asking how this impacts the individual customers and small businesses who participated.

Yes, perhaps, the options may or may not have a conniption fit by reality intervening during the implementation of the plan. The ECB is a disaster waiting to happen. A currency that anticipated this moment but decided to embrace it. Come what may.

One and a half paragraphs, attributed to a comment by Legarde:

“We must not allow inflationary expectations to become de-anchored or wages to have an inflationary effect,” she said.

I beg to disagree. Maintaining the current inequality is the cause of the disequilibrium that will only be resolved by a transfer of the concentrated wealth back to the regular people. It would seem a simple fix, but the rich are fighting like the alligators they are:

Greedy, avaricious, and plain.

The current bout of inflation we are experiencing is not an artifact of greedy workers in Europe or America. It a creation by the minions of the wealthy that have been instructed to create the narrative as a platitude.

The transition from an economy based on financial slight of hand, with zero productivity, back to a manufacturing based economy is profoundly chaotically stressful.

Cheap, foreign labor is no longer reliable. With their propensity for periodic unpredictability.

Perhaps your article captures the absurdity of the structure of the European Union in an unintended fashion:

“After years of negative interest rate policy – the silliest central-bank absurdity ever concocted – the ECB got religion about inflation and hiked its policy rates at each of its last four meetings in 2022, by a total of 250 basis points, to 2.0%, the fastest rate hikes in its history, and more rate hikes are coming. They’re ridiculously far behind, but they’re now moving, and they’re hiking into what the ECB has said is a recession.

The single European currency was a fools errand from the get go. Like Mexico adopting the dollar as their currency. Many Mexican-like countries within the European union need to devalue their currencies but can’t.

The general inflation that we are experiencing is the result of the race to the bottom in currency devaluation by the worlds central banks.

Mercantialism is the perfunctory goal of everyone.

Especially nations. Europe is an ancient society, still trying to shed off the monarchies that trained their way of thinking for centuries.

Good wages and benefits are the root of creativity and freedom. It has been a long time since wages kept up with productivity, 1976 or there abouts.

I worry more about the working people having enough than I do about the wealthy securing their birth right against my grand children.

The European data is shocking, suggesting turmoil among the nation states that comprise the 460 million persons of the EU.

I doubt the Libertad will default or lose value. In addition the Mexico Dollar is the strongest horse on the the down stretch of the current currency debasement.

Look to the south for a path forward and keep a eye open for a influx’s by Europe national’s.

So has anyone come up with a solution?

Perhaps individual pathways through the quagmire is in order?

It really is sad fiercely heartbreaking, millions homeless, retirees shorten, up and coming hard working people disillusioned yet prepared.

The shoestrings going to snap.

My advise is to slow down this armchair financial blabber, and take a hour with your fellow down trotted human.

Peace all especially you my sir Wolf. Happy new year and thanks for having me aboard!