On Delays at restarting the explosion-damaged Freeport LNG export terminal and on weather forecasts.

By Wolf Richter for WOLF STREET.

US exports of Liquefied Natural Gas (LNG) in 2022, at 81.2 million tons, matched those of Qatar, the #1 LNG exporter in the world, according to ship-tracking data compiled by Bloomberg.

The US would have been #1 if an explosion in June hadn’t shut down the Freeport natural gas liquefaction plant in Texas, which cut LNG export capacity by 17%.

Qatar’s LNG exports have been relatively stable for the past 10 years, according to Bloomberg’s ship-tracking data. But the country is now engaged in major expansion projects amid a surge in global demand for LNG.

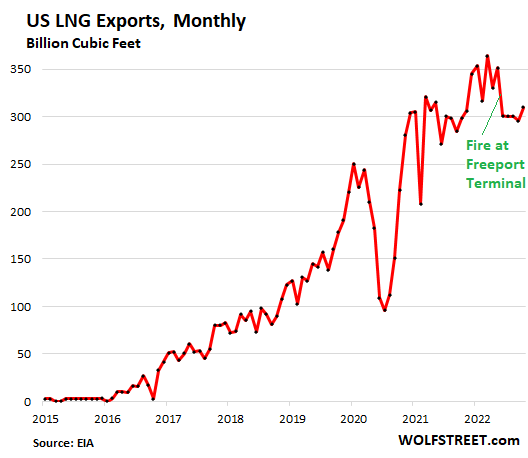

US LNG exports began to surge in 2016 from near-nothing when the first major LNG export terminal – originally an LNG import terminal – came on line. Since then, vast sums have been invested to build and expand LNG export facilities mostly in Louisiana and Texas, but also in Maryland and Georgia.

US LNG exports, in billion cubic feet, according to the US EIA’s latest data through October:

In addition, five export terminals are now under construction in the US, and 11 export terminals have been approved by the Federal Energy Regulatory Commission, but are not yet under construction, according to FERC as of its latest update on December 13.

The explosion in June at the Freeport terminal damaged part of the terminal. The reopening of the plant has been delayed several times. The company reported publicly on December 23 that the reconstruction work necessary to start initial operations was “substantially complete,” and that it was “submitting responses to the last remaining questions included in the Federal Energy Regulatory Commission’s December 12 data request.” And it said it delayed plans to restart the facility until the second half of January.

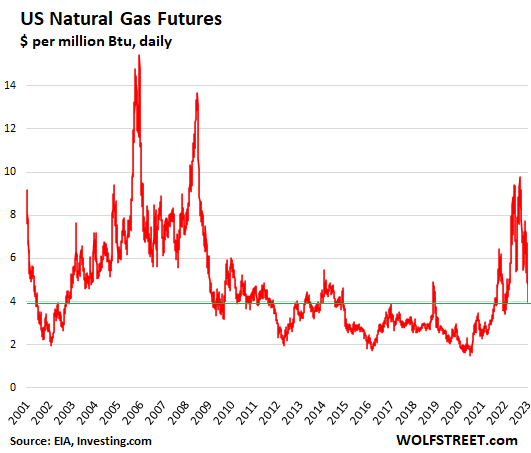

Given the renewed delay – the info must have gotten out days earlier – the price of natural gas in the US plunged from $6.60 per million Btu on December 15, to $4.98 on December 23, the day of the public announcement.

The price then continued to plunge. Today, NG futures plunged another 11%, to $3.98 per million Btu at the moment, on weather forecasts over the weekend, which predicted a milder first half in January for the US. This brings the plunge since December 15 ($6.60) to 40%! Praying for Freeport to re-start exports asap?

LNG exports provided a new market for the surging production of natural gas in the US, driven by fracking, which had collapsed the price of natural gas starting in 2009, as you can see in the above chart. For about the next 12 years, NG traded in the $2 to $4 range per million Btu, pushing many frackers into bankruptcy – including the big natural gas producer and pioneer fracker, Chesapeake in June 2020.

With surging LNG exports, natural gas prices broke out of the $2 to $4 range in 2021, and then spiked to nearly $10 with the surge in prices in Europe, demand for US LNG, now that LNG exports connected the price in the US to global prices. But the explosion at the Freeport plant, which reduced exports, and removed some demand from the US market, brought those prices back down. And then, over the near term, there’s always the weather.

In Europe, natural gas prices have unwound entirely the crazy spike in 2022 and have plunged back to October 2021 levels, amid record supply of LNG from the US and from other countries, record supply of piped natural gas from Norway, combined with a mild winter, and a reduction in consumption.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

For anyone who hasn’t followed the LNG export story in Canada, Mr Trudeau is blocking the producer initiative. He is only willing to export hydrogen.

Sacre’ bleu!

Or sacre vert!

Que tu est bete mon pauvre petite ami!

Je mon fous. Canada is a sovereign state, last I heard, and they don’t particularly like being so tied to what the US does.

Sad you aren’t clever enough to pick up on a hydrogen joke.

Now back to bed child.

Yes, sir.

But but but…Biden shut down the fossil fuel industry!

He’s certainly trying to shut down new exploration on Federal land.

GOOD!!

Let’s not fuck absolutely everything up before we get the Comprehensive Green New Industry life style going here.

Is that OK with you? (You can still wait for the Rapture.)

A growing number of Canadians are fed up with that guy. Keep the natural gas in the ground and let oil dictatorships with poor democratic institutions become richer with their exports and market share.

NG is the ultimate bridge fuel. The US is blessed with an abundance. We should use it. And sell it.

It is interesting just how underappreciated/politically abused natural gas is, considering its stark improvement (environment wise) over the coal it has largely replaced in electricity generation.

(And wrangling a gas is a helluva lot harder than wrangling a solid in a lot of ways).

NG is a good example of how certain elements of the Left make an illusory ideal the frothing enemy of realistic, incremental improvement.

It’s a bridge to nowhere. It’s not actually better than coal for greenhouse gas emissions when methane leakage is taken into account. And building new NG infrastructure locks us in for decades – when we need to be moving away from fossil fuels as fast as possible.

There’s a role for some natural gas in the short term – but building new infrastructure is foolhardy.

But if a fantasy is cultivated before a practical reality is truly ready tens of millions will pay a very steep price.

I see a lot more political types talking than engineering types solving when it comes to a wholesale “post carbon” future.

You want fantasy? Read the fusion shit below…that BS has been going on since the 60’s..Knew a guy involved in it at LL in the ’70’s….PhD in Tritium…brought OD cans full of 95% EtOH (azeotroph, ya know) to our New Years parties…..took trips to the South Pacific..never believed it would work but the money and perks were sure good…why spit in the soup?..The National Ignition Facility (old LL, where this latest miracle was performed) is where we work at reducing size and increasing yield on nuclear weapons.

A sun on earth….sure….take some more Prevegen.

What are your recommendations in replacement for a world totally born and run on fossil fuels?

An innovative, if long forgotten gaseous nuclear fission technology that we should have started deploying in the 1980’s. The developer (NNSA “grad”) recently had an investment offer from a major (non-US) nuclear power company and a key supplier (Hyundai subsidiary). This will be easier to develop than natural gas plants and probably less cost than operating many/most existing power generation. If all goes well the initial demonstration project could be up and operating in two years. The biggest challenge this has seen so far is “to good to be true” reviews which has provided an education about how limited US nuclear engineering training and practice is…

It’s not totally run on fossil fuels. The plan is simple: 1) electrify everything 2) run the grid on as much clean energy as possible. We know we can run a grid with something like 90% clean energy today, and the number is only going to improve with time.

That’s not a plan, it’s a wish list.

1. The GRID is an anachronism and needs to go away slowly but surely, replaced by LOCAL generation at each location electricity is needed. This situation is similar to the generals fighting the last war, etc., etc.

2. If electricity is not available for some reason such as: a. the wind don’t blow, or b. the sun don’t shine, or c. the tide don’t flow, or d. gravity ain’t there, etc.:

ERGO, DONT build anything permanent as such locations that requires electricity.

3. ALL other solutions entail moving money from consumer hands to provider hands FOR EVER…

4. In spite of much conflict, it seems clear enough we MUST do as much as reasonable to reuse, reduce, and recycle ALL needed resources, but in a much more scientifically based way instead of the political and social circus currently under way that will inevitably cause undue/unfair/unnecessary hardship for many.

See “whimsical” solutions below.

Agreed… fire up small scale Nukes and make ‘Grey Hydrogen’ to get the infrastructure moving forward, then supplement (phase out) with Green Hydrogen as the capacity develops!

Agreed, nuclear energy is a requirement in any future green energy plan.

Fusion not fission

WASHINGTON (AP) — Scientists announced Tuesday that they have for the first time produced more energy in a fusion reaction than was used to ignite it — a major breakthrough in the decades-long quest to harness the process that powers the sun

DEL,

Damn you are good at making me ashamed of my species.

Yes WG, small nukes are possibly the best SHORT TERM answer to localized electrical generation,,, BUT, and it’s a huge BUT, there are still many specific and known problems with ANY and every FUEL, including nuclear.

Yes, we do need bridging solutions until the physicists and engineers have advanced the technologies to the point of being able to build consistently LONG term solutions that rely only on non fuel sources that are SO clearly abundant almost everywhere on earth.

NBay, if you want to follow on with green energy policies, then nuclear energy WILL be part of it for the foreseeable future. Unless, you intend to eliminate half the earths population with whimsical ideas.

Until they can run a fusion plant for hours while producing much more energy than required to run, then fusion is just on the wish list.

Put more R&D and construction effort into wind and solar and grids (the “free market” WILL NOT do it, so the Gov’t has to force it), along with other measures to reduce the planetary damage caused by needless excessive lifestyles. From huge houses and cars to excessive mammal meat eating, etc, etc, etc.

Then maybe reassess the situation and finally face ZPG measures.

Your response to Mar Mar is what I was mainly responding to, anyway….you “whimsicalled” him away, too. Are you CERTAIN you REALLY understand all aspects of our physical situation well enough to make such judgements? I doubt it.

I see why unamused just plain quit dealing with mass science ignorance and people who refuse to even consider trashing existing “money making industries.”. I don’t plan to.

And your screen name means WORSE than NOTHING to an 11B10 9th Inf 67-8 Vietnam Vet…..perhaps my biggest disappointment with you……and other mindless flag wavers.

unamused didn’t “quit.” I ran him off because he abused this site to badger everyone with way too much BS.

NBay, I have no problem with green energy PLANS, that include nuclear power plants. Bring on the solar and wind fields…great! Reduce the consumption of meat and smaller houses, good luck with that. My favorites, ‘the “free market” WILL NOT do it,so the Gov’t has to force it’. and ‘do you REALLY understand all aspects of our physical situation’. The world is not just the great state of California, able to absorb changes. But I do agree, it has to change, but that’s the problem, yes? Disappointed with me? Who gives a flag waving f**k. BTW, Thank you for your service.

F me for my “service” and you for your ignorant spouting of that line.

Well, stop using those credentials as an objective measure of your standing, and, for some reason that has nothing to do with the subject, of mine. You know nothing of my service history.

It’s January and our natural gas reserves are increasing. Sometimes a bit of luck is needed.

So far, it looks like the FED policies are working at stopping inflation and possibly reducing the inflation rate. It takes time for the rate hikes and QT to start to take effect.

Commodities like oil and nat gas are now down over 30% to 50% from peaks respectively. Energy is a big cause of inflation.

Housing sales have crashed to lows not seen since COVID and 2009.

Goods inflation is dropping. I think Service inflation will follow IMHO. Wages might be sticky but I doubt we see much increases going forward as it looks like a recession is on the plate for 2023. No reason for stocks to go up while liquidity is being drained and interest rates are rising. I know a person who retired mid 2021 and has now gone back to work because his IRA has dropped so much. I think you may see more cases like this and this may help with the labor gap.

Fluffy stocks are all pretty much crashed, and finally Tesla. Hopefully we are now getting closer to a bottom than a top?

If a 20% drop in the S&P forces you back to work, you weren’t ready to retire. If you were more aggressively invested and your IRA is down more than that, you also weren’t ready to retire. I’m sure there’ll be more cases like the person you know, but those “retirees” are hoping and dreaming more than retiring.

“If a 20% drop in the S&P forces you back to work…”

As Wolf has pointed out, the carnage is much more than that for some portfolios.

Exactly. Many safe haven bond funds are down more than 30% to 40%. Look at TLT…it is down over 40%. The two bond funds in my 401k are down 27% and 29%.

Aggressive investing is probably down less than safe bond investing this year which a lot of retired people were probably in

Many people who retired at the peak thought their portfolios were going to increase. So if they had 1 million at the end of 2021 probably thought it would be 1.1 million at the end of 2022 and not $700k which could even drop further. Maybe $600k. You have to remember the Edward Jones people did not tell anyone to sell. Stay the course is what they were preaching.

Nothing was safe in 2022. Energy did well through 3Q but not 4Q.

Yeah, that’s why I pointed out that if the person was more aggressively invested they weren’t ready to retire either. If you’re retiring early you should be able to do it on a fairly conservative portfolio. Otherwise, you haven’t saved enough and may bee forced back to work.

Very very few people retire with $1 million in their portfolios.

Median is less than $150k excluding their primary residence.

I think the bond bubble of 2022 was the most obvious investment idea of the last 5,000 years. We had the silliest situation with negative interest rates in I-bonds, in euroland, and with zero interest rates on our money market funds. I remember reading that some analyst had examined interest rates going back to early human civilizations and 2021 was the trough of all time. How could it not revert to the mean, and how could anyone think bonds were safe if they paid no interest.

Anyway, I backed up the truck and loaded up on inverse triple short 20 year bond funds like TTT and TMV. Me bad, I made 150%. Of course, I did this some time ago and at one point in 2019 got my face ripped off. But in the end, I made 30% positive return on my 401K portfolio in 2022. So don’t say no one foresaw the long bond debacle. It was obvious.

Yeah, my bond fund is down 15% in 2022 but I am holding and not selling, so the losses are not realized. Tough year for bonds, close to unprecedented. Who knows what happens this year?

rojogrande – “If you’re retiring early you should be able to do it on a fairly conservative portfolio. ” That was part of his problem. His portfolio was too conservative and to much in bonds. Invested mostly Bonds, plus some SPY and NASDAQ and he is down over 25%.

If he would have just been more aggressive and put half in the

DOW and half in the SPY, he would only be down about 13%. IF he was all in on the DOW he would be only down -7% and with a 2% divy he would only be down -5%.

Being too conservative has hurt him. He does not want to pull anymore out of his retirement at these lows so he went back to work. Once the market goes up again, he will retire. He probably never thought he would go through the worst bond market performance in history. I bet the worst case scenario models did not even who these returns. If you go back to 2003 with a regression trend line. TLT stayed within 2 standard deviations up until the beginning of 2022. A 2 standard deviation has the probability of 95%. We are at -6.1 Standard deviation right now. The odds of a 6 standard is 0.0000001973%

It is nice to know probabilities and standard deviations. But, I do not need a math major to know that it is a loser’s bet to invest in 20-year or 30-year bonds yielding 0.5%. What were people thinking.

ru82,

He wasn’t being conservative if he invested in TLT, he just misunderstood his investment. Being invested in bond funds such as TLT is extraordinarily aggressive when interest rates are near zero. That’s something I learned here on Wolf Street. Unless rates go negative, there’s really nowhere to go but down. It sounds like he thought he was being conservative when in fact he didn’t understand he was making a directional bet on interest rates that was bound to be a loser when inflation spiked.

By the beginning of 2022 he should have known inflation was a huge problem requiring rate hikes. Powell retired the word transitory in November 2021. The problem with looking at TLT only back to 2003 is that it coincides to a large extent with the period of extraordinary interest rate repression and low consumer price inflation. Once those dynamics changed, the outcome was bound to be very different. I hope he has better luck next time.

Andy,

You’re absolutely right.

@Andy – you should go to work at Edward Jones. You could make a killing because they did not think the same thing and advice their client to not invest in bonds.

rojogrande – I was only using TLT as an example as it is easy to find a chart and do analysis. He was invested in what Edward Jones told him to invest into.

He is not an active investor. There are many people in the same boat when they are using Financial Advisors. They will tell their client the models suggest this allocation they do it.

I have another friend who was using one of those Fidelity RobotTraders. It asks you if you are conservative, moderate, or aggressive. It put over 50% of the portfolio in bonds. They showed me their statement in March of last year and the portfolio was already down 11%. I told them to sell everything and wait until the FED pivots. I prevented them from losing another 20%. RobotInvestors do not care that interest rates were at .5% at the beginning of the year.

My friend was just following advice from his financial advisor. Thus he is working again.

+1

Stock index PE ratios are probably still 25%+ overvalued given where semi-normalized interest rates are/are heading.

20 years of ZIRP really, really created a delusional financial fantasyland which is currently being disassembled.

Totally agree, potentially 40-50% overvalued by margin adjusted CAPE.

The perceived wealth effect from housing will take a while to come back down to reality. Many homes in my area are priced MORE than the time when mortgage rates were at 2.75% (while many owners have had to pull their listings and joined the Fed Pivot chorus). These owners are still spending like there is no tomorrow due to their perceived wealth effect.

Some still have money from the pandemic stimulus. Many laid off workers are still receiving generous severance on top of unemployment.

The rest of big name investors (Wood, Burry) are not selling and positioning for another massive round of QE.

Give it time.

Housing certainly was in a frenzy last year into 1Q2022. It is sort of out of sorts now based on the following.

It is regional but this is what i am seeing in my area and talking to a close friend who has been a realtor for 30 years is the following. There are plenty of buyers out there but they cannot afford homes at these prices that are in the inventory now that interest rates are up. But builders are not building affordable homes. They are building $600k to $700k homes which are 5x or 7x local household income. The inventory for homes that are 3x to 4x, sell very fastl.

The city is still growing and there is a need for housing but about all that is being built besides the expensive McMansions are apartments. During HB1, these multi-unit buildings were townhomes or condos people could buy. Not this time. The companies building them are only renting. So what is happening is the pool of wannabe new home buyers keeps growing but affordable homes for this demographic is not increasing.

My friend the realtor had 56 people show up for an $320k affordable 3 bedroom home two weeks ago. She was hoping for maybe 10 people. To put this in perspective, the average new list price is $630k. The median home value for my city, according to the U.S. census is $330k.

So the average new listing is $300k over the median home value for my city. The number of house for sale is 270 and 250 are new construction. That is 92%. This is a city of 145k. So only 8% of the homes are resales. I have never seen such an odd disparity.

This, and the strong labor market, is going to make housing inflation come down slower forcing higher rates for longer. Everybody still has plenty of money and are seeing massive wage growth so of course there’s plenty of people looking to buy any house that isn’t priced crazy high.

I have friends in long island that are finally ready to buy based on life circumstances but I’m trying to encourage them to rent for a year. I know long island isn’t as bubbly as many other areas but 20% drop in prices could certainly be in the cards

The new home builders must list their inventory and sell it. They can’t wait for happier days. The interest and tax expense of holding on will kill them. So, new to used home ratios like you describe mean that price cuts are around the corner and coming soon.

Do we live in the exact same area???

Most of the fall in energy prices has nothing to do with the Fed.

The fall in oil prices is in part to the huge drain of SPR oil put on the market by the current US administration.

The fall in NG prices has absolutely nothing to do with the Fed. It has to do with the unusual warm weather that has happened in in Europe and parts of the USA except for a few freak storms.

I can confirm – from minus 10° to plus 16° since 20 December and still holding.

They push NG down every year end, it’s a game, I bought more NG royalty symbols now at 16-19% yield

Love it, played this game in 05-12, paid off well

Hiroshi

Energy prices are hyper-sensitive to QE and QT. Watch as central banks tighten further.

It is puzzling why the Fed disavows influence over energy prices. They are grateful for your support.

It will be intellectually stimulating to return to a time when analyzing the price effects of invasions and war, explosions at gas liquefaction plants in the US, sabotage of critical pipelines in Europe, extreme weather and SPR releases actually matter.

Well my rent just went up 10%. I find your pointing at highly volatile inputs to inflation like energy, and non inputs to inflation like stock prices, to a be a laughable justification for inflation ending soon. We’re witnessing the biggest labor movement in a generation as workers are simply refusing to work at poverty wages. The only thing I agree with is that there may be some unretirements in the future, but this will not outpace the rate of retirements of the aging boomers.

I went to a McDonald’s drive through to buy breakfast this morning. There was a sign like Crew Members $12/hour. The price of my breakfast was about $9.00. The cashier was college age.

David, what did your MD breakfast comprise of?

Any chemistry buffs on the board?

It would interesting to learn more about natural gas (which appears to be a pretty simple molecule) and gasoline (or really most any other industrially significant hydrocarbon…which appear to – in my very limited knowledge – also have pretty simple, if highly repetitive, structures).

These hydrocarbons, in a very real way, form the backbone of modern, machine driven civilization (not to mention their role in plastics, etc).

Given their comparatively simple structures (at least to my uneducated eyes) it would seem easier than it apparently is, to convert hydrocarbon family members into one another (NG into gasoline, vice versa, etc).

Since easier/lower cost hydrocarbon transformations would radically alter world economics, it would be interesting to learn more at the 101 level.

Coal gasification has been done forever (syngas). In my lifetime, coal gas was standard in Germany before piped natural gas from Russia arrived during the Cold War.

Coal can also be liquefied and used in gasoline or diesel engines. The Germans perfected this during WW2 to fuel their aircraft. The process worked fine, and it’s worth it if you’re under blockade and cannot get enough gasoline.

A friend of mine worked for a US company that tried to do that in the 1990s and early 2000s, using this Fischer-Tropsch Synthesis, named after a couple of German inventors in the 1920s. Technically it has worked fine for 100 years or so. But it makes for very expensive gasoline and diesel.

There are other methods. But it’s hard to beat the low cost of gasoline as a refined product.

From yesterday’s Farm News out of Grand Forks. Story #4 out of 2022’s Top 10:

“Three soybean crush plants are in the works in North Dakota. Another dozen plants are under construction or proposed across the country. ADM and Marathon Oil have a joint venture to produce renewable diesel fuel at the Marathon refinery in Dickinson.”

“The demand for renewable diesel, especially on the West Coast, resulted in this fundamental change in the soybean industry.”

The other two facilities in North Dakota are in Spiritwood and Casselton. Another is set for Grand Forks very soon.

The “demand” is driven by the farm lobby and politicians taking their money & virtue signalling to remain in power in D.C. and in California.

Yeah, let’s grow soybeans on productive farmland in the USA to fuel 18 wheel rigs running down the super-slab!

The 1980 movie “The Formula” was a fictionalized version of what Wolf is describing. Not a bad movie, and if you like George C. Scott, you’ll also like the 1971 film “They Might Be Giants.”

… also in “The Formula” we get to see Marlon Brando as the rich corporate evil doer.. the movie should have been better, but it’s still worth watching…just to see Scott & Brando mano a mano….

South Africa built a coal to liquids refinery that produces hydrocarbon liquids. The company is Sasol. It is SSL on the NYSE.

Yes the company I referred to that my friend worked for built a plant in Australia. It’s not hard to do. Germans did it 80 years ago. You just lose money on every gallon of gasoline you sell.

Fischer-Trospch Process (1925 Germany)

(NOT invented by A.H.)

A modern version would also recover the naturally occurring thorium from coal ash to use in new Liquid Fluoride Thorium Reactors.

‘Liquid Fluoride Thorium Reactors’…

Now you’re talking!

-any chemistry buffs ?-

You like chemistry formulas my friend ?

Ahhh… in our Post Truth World it is so refreshing.

I could post relevant formulas with energy balance and reaction speed but they will not look pretty here.

Therefore:

Hint #1: Siluria Technologies of SF, CA ( unfortunately R.I.P.)

Hint #2: Google Patent “Catalyst and method for converting natural gas to higher carbon compounds” which cites 15 other similar patents.

There is a US DOE study published suggesting Fischer-Tropsch is profitable with oil prices as low as $80 a barrel. The link I include mentions a cost-threshold of $94 a barrel of oil. Looking at the prices of oil over the past year, we’re there folks. It’s a political question, not a question of economic viability.

https://www.netl.doe.gov/research/Coal/energy-systems/gasification/gasifipedia/efficiency

We were at $90+ oil from 2011 through the first half of 2014 and heard crickets from the MSM about breakeven for synthetic oil/gasoline.

Mouse,

That is a very helpful paper, thank you for posting it.

Natural gas is methane (CH4). The most promising technology I see for natural gas is methane pyrolysis: converting methane to hydrogen and carbon black (basically carbon powder). Most people think of hydrogen only as a vehicle fuel, but it is also necessary to synthesize non-petroleum ammonia fertilizer. The main obstacle right now is the process is relatively high temperature and consumes about 1/3 of the methane energy content (or equivalent electricity). Although still much less than electrolysis.

Better just to drive an ICE engine that can handle natural gas than make gasoline from it.

How might the country’s future look if the USA went to natural gas vehicle fleets instead of battery-operated electric vehicles?

ICE engine would last twice as long running on NG vs gasoline, too.

…have seen a few commercial fleets running on LNG for a couple of decades, now. You may have, too, as they are usually marked a such…

may we all find a better day.

1. The synthesis of complex hydrocarbons from simple hydrocarbons is possible but requires energy input.

2.If you calculate the bang for buck, its not preferable when the longer chain hydrocarbons can be extracted from the dinosaur juice.

3. This might take priority if the oil fields are gone. For example, during ww2, Germans made oil from coal and wooden materials when allies captured their oil fields.

4. In general, breaking down complexity releases energy. Like burning gasoline in cars. Increasing complexity needs more energy than the energy released when the same molecule breaks down.

5. Also petrochemicals are more valuable than petrol itself. For example, sulfur from oil refineries

6. If you find any alternative and efficient ways, oil giants will suppress your findings.

Point 4 seems to be the key physics level insight that I was looking for.

I tend to think of it in terms of the natural processes that I’m guessing generate/generated the energy hydrocarbons we use.

1) Surface level organic matter (holding carbon) is born, lives, dies.

2) Over huge lengths of time that organic matter gets buried deeper and deeper.

3) Very significant heat/pressure at depth supplies energy (*ambiently*) sufficient to break down organic matter/reconstitute resulting carbon with hydrogen (sourced from water – H2O?).

Step 3 would be the key, with the heat/pressure ambiently existing at depth, naturally (cost effectively…over millions of years…) providing the energy necessary to push the broken down building blocks (C and H) “uphill” to recombine into CH4, C7H16, etc.

Ersatz NG/gasoline creation (as mentioned above) uses costly surface energy to artificially generate the heat/pressure necessary to mimic the subterranean environment (which exists at a higher energy state, ambiently).

The key issues seem to be,

a) sourcing the cost-effective surface energy sufficient to push the elemental constituents (C and H) “uphill” into fuels (the subterranean environment doing this naturally, ambiently, for free) or

b) figuring out a way to recombine the constituent elements further down the energy “hill”, at heat/pressure conditions more closely approximating those of the ambient surface – therefore requiring less scarce/costly surface energy.

“In addition, five export terminals are now under construction in the US, and 11 export terminals have been approved by the Federal Energy Regulatory Commission, but are not yet under construction, according to FERC as of its latest update on December 13”.

I am wondering about the numbers. If the world’s energy future is one without natural gas, the investment in these new terminals must have a relatively short ROI as LNG must be phased out to meet 2050 net zero. I have read that between 2030 and 2040, NG usage would be cut roughly by one half so these investments’ returns must be front-loaded.

“…between 2030 and 2040, NG usage would be cut roughly by one half..”

Nah, not even in the wildest dreams of the wildest dreamers, LOL

Maybe you’re confusing it with coal. But not even coal… In the US, coal consumption has plunged over the past 20 years, but that’s not the case in much of the rest of the world. On the contrary.

Sir, I fully agree with you but policy is being made throughout the world to somehow meet this unmeetable goal of Net Zero by 2050.

According to Our World in Data, in 2021 the world consumed 136K Terawatt hours of energy from Coal, Natural Gas and Oil – by the way, energy demand will grow significantly by 2050. Replacing this energy with renewable non-fossil sources and more importantly, storing this energy for days and even weeks is impossible.

So my point is, folks like you need to continue to demonstrate with data the folly of this exercise.

Call me paranoid but if certain political winds align I could see the next big energy Bill being over $1T in order to seek Net Zero.

And to make high quality steel alloys such as Reynolds 531 bicycle steel tubing (chromium, molybdenum & manganese are added), the best coal to be used for carbonization is Australian hard coking coal.

Heat the coal up to 1,100 C and keep all oxygen out of this step as the coal releases impurities such as hydrogen, oxygen, nitrogen and sulfur. A day and a half later, you have crystalline carbon that’s used in the steel making process to be added with iron ore and alloys.

1.5 kg of metallurgical coal reduces down to about 1 kg coke. It takes about 0.63 kg coke to make 1 kg steel.

And many those who are opposed to using coal for environmental reasons also want to stop the use of metallurgical coal. But wind turbines, for example, need good steel as one of the ingredients to be made in the first place. Details, you know?

In 2013, 1.2 billion metric tons of coal was used in the steel industry.

The Supermarine Spitfire was made with Reynolds 531 steel tubing.

Is it possible to substitute carbon black or a derivative for the crystalline carbon? See my post re: methane pyrolysis.

Is it possible to substitute carbon black or a derivative for the crystalline carbon?

Ross, that’s a good question, but above my pay grade.

There is a distinct difference between income W2 earners and those who are wealthy. I don’t think we are even close to the bottom in markets. Liquidity @ 4800 much easier than riding a pipe dream down to 2300. The worst is yet to come, but this time there is justification for the fall of Babylon . QT has turned the magic fountain off, CD, Bonds, T-Bills will never match the rate of inflation. Gamblers sat at the table a little too long after the deal was done. I credit to Fed for fair warning when rate hikes started. Lots of idiots still did not get out, or make it back to fix hole.

Many people, most even, are still betting that the Fed will pivot. It will be interesting to watch. Current valuation is such that it’s improbable that the next 10 years will produce much return on a diversified stock portfolio.

LNG down 6% today on high vol. down since Nov 22 high. It might be

about expired cash tender offer for Cheniere Corpus Christi Holdings.

Michael, at this moment it is 55 degrees F in the Indiana town where Dan Patch was born. Haven’t turned on the boiler in 4 days.

On 4 September 1906, 90,000 fans packed the Minnesota State Fair Grandstand and watched this magnificent horse break his world record for the paced mile from 1:56:0 to 1:55.0. The record stood until1960.

The main street that runs through the MN fairgrounds is Dan Patch Avenue.

And yet my heating bill last month was almost $400 in the northeast which was relatively mild.

How leaky and how well insulated is your house?

Like Wolf said Cheniere opening was pushed back, so no exports. EU warm weather and over 80% gas stored. Selling begets selling. Rates going higher too.

Three month yield 4.65 pretty big move today.

What?

Sure beats the yield from a year ago!

So much for the prediction that high natural gas prices would cause mass food shortage (natural gas is used to make fertilizer).

So much for predictions.

I think there will be food shortages unfortunately. Maybe not in North America, but in the Middle East and Africa. The Ukraine supplies a lot of grain to the world as does Russia. Grain can be stored for a while… but those reserves will be used up eventually. Also, marginal farmland around the world relies heavily on Pot Ash for fertilizer.

The confiscation of farmland in the Netherlands will add to food shortages. This will hurt poorer countries.but the Dutch can afford to buy whatever food they need.

North Americans could definitely use a diet.

Massive food shortages in West Africa now.

$77 dollar oil would have to be $133 just to be even with year 2000 inflation adjusted – great investment ! energy speculators made some quick $ when the ukranian invasion began but energy has been a disaster for anyone who got in after that – some energy shortage! and it is funny an ironic that europe gets bailed out by global warming ! I keep looking for an entry point as the “experts” scream ENERGY SHORTAGE – but all I see and what those who acted on the siren message of “experts” is losses

Freeport out, Chenire should win. But that didn’t happen. LNG slumped today on high vol.

shakeout day, it might cont for a while.

Interestingly, many companies were given massive taxpayer subsidies to support their construction of liquefied natural gas export facilities.

Why does that not surprise me??? Big companies get all kinds of subsidies when they promise to set up shop in a certain location: see the now defunct Amazon HQ2 deal. See the $50 billion the chipmakers are now getting to set up fabs in the US. Twitter got huge subsidies from the City of San Francisco some years ago to set up its big headquarters on Market Street, including an exemption from the local payroll tax (then mayor Lee was in love with “Tech” companies such as Twitter and Uber). Even the oil-bust ravaged city of Tulsa in the early 1990s gave huge subsidies to Whirlpool for setting up an appliance factory. This stuff never ends. It’s everywhere.

It’s all about not paying taxes. The bigger the business, the fewer taxes they pay.

Best government money can buy.

Maybe instead of voting they can all play spin-the-bottle tomorrow.

or Russian roulette.

I read that without the value of the LNG exports that increased in value and quantity in 2022 the USA GDP would have been negative and in “recession”. The drop in GDP with the recent drop in NG price may result in recession already .

“Real” GDP, which is what you’re quoting, is adjusted for price changes (inflation). Q3 real GDP, which covers a time period reflected in the LNG export chart, jumped by 3.2%.

Yes, US exports of hydrocarbons (natural gas, natural gas liquids, petroleum, petroleum products such as gasoline and diesel, coal, etc.), plus the exports from the petrochemical industry (largest in the world) is huge, and if you take this huge thing out of GDP, sure there might have been a recession. Might as well take consumers out of GDP while at it, LOL

With NG prices way down, now might be a better time to look into locking in you home heating gas contracts, if you live in a state with a so-called consumer market system. I locked in a 2 year fixed rate maybe 1.5 years ago and saved myself some decent monies. At one time I was buying gas at less than 50% of the local default vendor supplier price. But watch out for utility locks that have a early termination fee. That can really bite.

After watching the ETF BOIL, (which tracks LNG futures) for the last few years, I decided to sell some Puts (and Calls) in the middle of November. I received high premiums for both sides due to high volatility. I was set up (or so I thought), to have a large middle to profit from. BOIL was at 35 and I’d only start losing money if it fell below 20 which it hadn’t done in a long time…

Well, I picked the wrong time to pull the trigger… bought back the calls for pennies, but there’s a good chance I’m going to be put the shares by Jan 20, as the ETF now stands at 14.28, down from a high of over 41 just 3 weeks ago….Oh well.. That’s what I get from straying from trading only SQQQ’s last year…

I was thing of buying BOIL tomorrow. It is clearly beaten down by warm weather. I was thinking it was time for a bounce.

Hello everyone, Hello Wolf.

when did gas become a global commodity?

When LNG became feasible, which was decades ago.