Auto-loan balances surge on sky-high prices, despite sales plunge. Delinquencies rise to pre-pandemic lows, subprime delinquencies return to 2016-2019 levels.

By Wolf Richter for WOLF STREET.

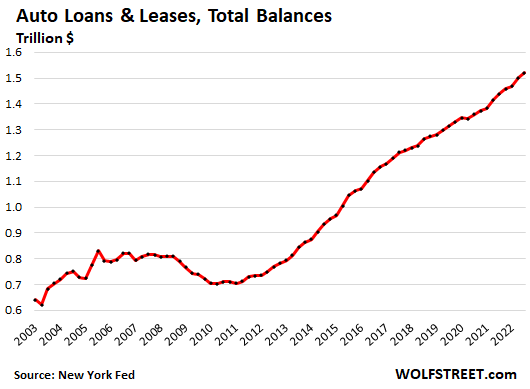

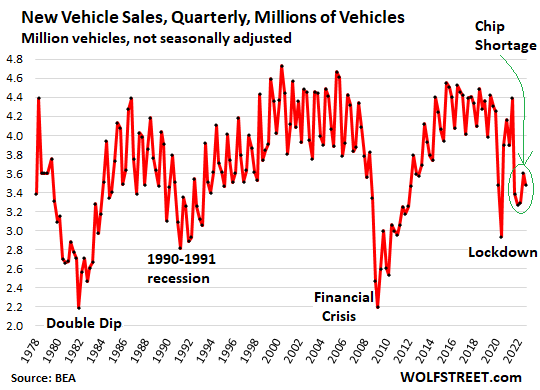

The balance of auto loans and leases continued to surge in Q3 even though new-vehicle sales in Q3 were at levels first seen in the late 1970s – and that’s not a typo – with the number of vehicles sold down by 19% in Q3 compared to Q3 2019; and with used-vehicle unit sales down about 15%.

Auto loan balances surged because new-vehicle prices surged as automakers keep going upscale because that’s where the money is, and because they’re supply constrained and are trying to boost their dollar-revenues and profit margins by prioritizing more expensive models and by price increases even as sales of new vehicles are in terrible shape.

Auto loans also surged because used-vehicle prices had spiked in a ridiculous manner though there were never any shortages of used vehicles. Some of those price spikes have finally started to back off a little.

So balances of auto loans and leases increased by 2.2% in Q3 from Q2, and by 6.1% year-over-year, to a record $1.52 trillion, according to data from the New York Fed’s Household Debt and Credit Report, on a mix of surging prices, going upscale because that’s where the money is, and dropping unit sales, leading to fewer but bigger loans with longer terms:

But in terms of the number of units delivered to the ultimate customer, new vehicles sales in Q3 plunged by 19% compared to Q3 2019. But sales had also been declining in the years before the pandemic. Compared to Q3 2016, sales were down by 22%. At 3.48 million vehicles, sales were back where they’d been in the late 1970s.

Price increases and going upscale are driving the industry – even as more and more Americans are priced out of the new vehicle market – and that process has been happening for many years:

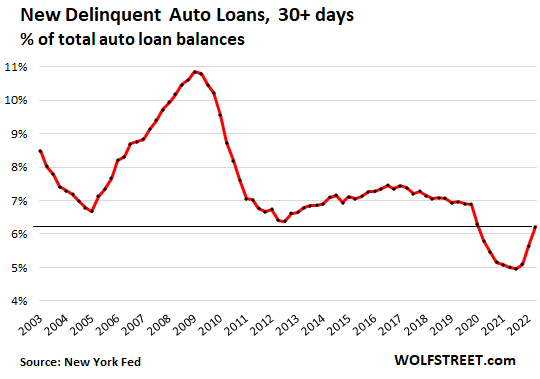

Delinquencies rise to Good Times lows from historic lows.

The rate of all auto loans and leases – prime and subprime – that were 30 days and more past due rose to 6.2% in Q3, according to the New York Fed’s Household Debt and Credit data. This was still below the record lows before the pandemic.

In 2020 and 2021, consumers used their stimulus money and extra unemployment benefits and their PPP loans and the cash left over from not having to make rent or mortgage payments to get caught up on their auto loans. And some borrowers were able to enter their delinquent auto loans into forbearance programs, which turned “delinquent” loans into “current” loans. And the delinquency rate plunged to record historic ridiculous lows, one of the many distortions of the pandemic stimulus economy.

But this era has ended, and delinquency rates are returning to the pre-pandemic Good Times lows, and that’s what we’re seeing here: delinquencies are normalizing at very low levels.

This doesn’t mean it’s going to stay this way: The delinquency rate began rising in late 2005, in lockstep with the Housing Bust, more than two years before the Great Recession, because borrowers under mortgage stress also fell behind on their auto loans. The delinquency rate continued rising into the Financial Crisis and peaked in 2009 at nearly 11%, and then began to decline.

But today, unemployment is at very low levels, the number of unemployment insurance claims is near historic lows, and the economy is far from the type of unemployment crisis it had during the Great Recession. So for now, consumers are still taking good care of their auto loans.

Subprime loans and delinquencies.

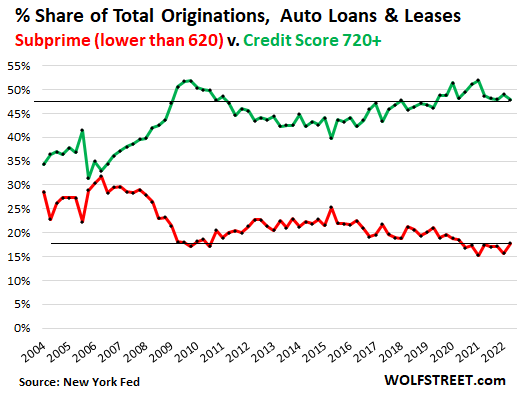

The share of subprime auto loans – borrowers with credit scores below 620 – that were originated in Q3 ticked up from record lows to a share of 17.8% of total auto loan originations in the quarter, and remained in the same low range of the past two years. Before the Financial Crisis, the share of subprime auto loans that were originated ranged between 25% and 30%-plus (red line).

By contrast, prime loans with a credit score of 720 and higher that were originated in Q3 had a share of 47.8% of total originations, in the upper portion of the range (green line).

This means that overall credit quality of auto loans that were originated in Q3 – as viewed by credit scores – was relatively high.

Total subprime auto loans outstanding amounted to about $250 billion, according to data from Experian. So the dollar amounts are not huge.

Subprime auto-loan delinquencies dipped to 5.1% of subprime auto-loan balances in October, according to the Fitch Auto Loan 60+ Days Delinquency Index that tracks subprime loans that have been rolled into Asset Backed Securities (ABS) and sold to investors.

The October delinquency rate of 5.1% was down from the October 2019 rate of 5.4%. The index has been in this range since 2016, after more aggressive subprime lending and securitizations became all the rage starting in around 2014.

Securitizations of subprime auto loans spread the risk and make them immensely profitable due to the high interest rates, the relatively easy recovery of the collateral, and the liquidity of the used-vehicle wholesale market where these repossessed units are sold. Most subprime loans finance the purchase of used vehicles that are several years old, and losses for lenders when they repossess the vehicle and sell it at auction are generally not huge.

In terms of the lenders: most of them securitize their subprime auto loans and sell them to investors, so if there is a hiccup, investors carry a big part of the risk. Lenders have some skin in the game by having to retain a small equity portion of the ABS that takes the first losses.

Some smaller specialized subprime lenders collapse periodically because they got tripped up in some way. Some of them did that before the pandemic. And there will be more of them, but that’s how it goes. During an employment crisis of the 2009 variety – if we get another one like that – most of the losses will be borne by investors such as bond funds, pension funds, life insurers, etc.

But the amounts are just not huge: the total amount of subprime auto loans outstanding is only about $250 billion, and this is spread all around mostly in the fixed-income portfolios of investors

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I used to wonder who was spending 70,000 for a normal vehicle. Now I really wonder who is buying 70,000 vehicles at higher interest rates.

Cars are susceptible to the same market forces as houses. Between the speculative frenzy and inflation, buyers will make different choices than usual.

If you’ll need a car (house) within the next couple of years, and you think the same vehicle will be $80K ($800K) at 10% in the future, then paying $70K ($700K) at 7% today might still be an attractive deal.

Especially if you know you can refinance at a lower rate, should things go that way. Or in a worst-case just walk away from the loan and leave the car to the lender.

Precisely

WS,

I respect you but do you really think you can just walk away from a contractual debt and that your creditors won’t pursue you for a deficiency judgment of one sort or another?

Why do you think they make you sign the contract/loan note in the first place?

I only bring it up because I see more and more people believing that if they just turn in the loan collateral (cars, houses, whatever) that the creditors will automatically be satisfied with the (significantly) depreciated collateral.

That isn’t how it works as far as I know.

If you borrow $50k for a car and then can’t make the payments when the note balance is $40k (but car is only “worth” 25k…as determined by formula drafted by the creditors) then the original creditors (or, much more likely, some innocent holder in due course who bought the paper) want their effing $15k deficiency from you.

Why do people not see/realize this?

Law books are filled with thousands and thousands of such cases.

And it is pretty much common sense too.

And it is in the loan agreements.

@Cas127: I hear you, and I confess I’m not familiar with the default-handling industries, and I’m not advocating deliberate default. I was talking about decision making among people with a speculative mindset in a time of inflation, and I think many people will think the way I outlined for a “worst case”. I wasn’t talking about a casual/stupidity sort of default where deficiency judgments would work.

In “worst case”, by the time the auto payment doesn’t get made, creditors will find very little meat on the bone in terms of deficiency collections, and a lot of competition for whatever there might be. Worst case is often an unexpected medical crisis or massive recession leading to loss of job, huge credit card bills, unpaid rent and/or home foreclosure w/o residual equity, and so on.

When there’s no ability to pay, willingness to pay no longer matters.

“I only bring it up because I see more and more people believing that if they just turn in the loan collateral (cars, houses, whatever) that the creditors will automatically be satisfied with the (significantly) depreciated collateral.”

“That isn’t how it works as far as I know.”

You don’t know far enough. Google “non recourse states” and you will know farther.

Auto loans are a different story.

Pea Sea,

I’m familiar with “non-recourse” home mtg states (although it is a pretty open question as to the ultimate net effect for borrowers in those states…do they simply pay higher rates/addtl fees in order to offset the increased risk the creditors in those states have to bear? Hard to imagine that CA mtgs can easily be bundled into marketable securitizations unless some addtl protection/cashflow is created for “non-recourse” loans).

And, non-recourse only applies to purchase-money primary mtgs in CA, pretty sure everything else (home equity loans, etc) are not shielded.

Free lunches tend to be pretty rare, so I don’t think “non-recourse” is a cost-less gimme for borrowers in frequent-imploder CA. Creditors have *long* memories and tend not to survive if they don’t learn, adapt, and offload as much risk as they can.

The rich (non-inherited) tend to be rich for a reason – they are methodical and cynical.

Those lacking those traits tend to stop being rich.

Are there non-recourse loans for autos as there exists for real estate in some states?

I don’t know.

If there isn’t, many people might be in for a nasty surprise, if they have anything left to lose.

I don’t think the US would have a gigantic Auto ABS securitization mkt if there were all that many non-recourse auto loans.

Although your pt does raise the question of if/how, say, CA mortgages (those plump little turkeys), end up in MBS.

Given CA mkt size, hard to believe they don’t end up in MBS…but if so, then who is buying CA’s collateral castrated mtg loan MBS?

I mean, the crazier the mtg loan amounts get, the more important deficiency claim rights become.

most USED vehicles are sold by shister companies

with 20%+ interest rates

those with great credit now do 96 month loans

of course there’s problem when fiat $dollar devalues at 30%(inflation) annually

wage increases can’t keep up unless you are 1%

as trickle UP always works

Most used vehicles are sold by big franchised and independent auto dealers, including huge ones that are publicly traded, such as CarMax and AutoNation.

Recourse is they seize the asset. That’s it.

Katz,

I’m pretty sure that it doesn’t end with seizing the asset.

If the collateral value is less than the remaining loan balance (it almost always *is*, the creditors draft the loan agreement formulas that way, to protect themselves) then there is the legal right to deficiency judgments (the difference between the unpaid loan balance and the current value of the collateral).

Creditors ain’t your “buddy” – they are hard nosed business people who have learned from decades of experience. Their loan documents are drafted to shift the maximum amount of risk (valuation and otherwise) onto the borrower (who doesn’t read the docs 95% of the time).

Statutory law might constrain what the creditors can do, but the creditors adapt and, at an extreme, will simply stop lending if statutory rules try to shift too much risk back onto them.

And…with the rise of massive loan securitization, those creditors are much, much more sympathetic holders in due course who simply paid good money for the loan paper.

It is much more difficult to screw over CALPERS than Bennie the Sleazy Auto Salesman/Lot/Company, in the interests of trying to save defaulting auto loan borrowers.

The only place that I know that you can get your t** in the proverbial wringer is with a lease. There is such a thing as a “gap” with a lease that is the difference between the lease contract and the wholesale value of the car if stolen or destroyed. That’s why they sell gap insurance on leases – to cover that spread. Only dummies lease a car without gap insurance. Some captive leases include gap in the calculation (baked in) to save the unsuspecting from disaster.

Retail repos are – as far as I know – different as the vehicle is the only security for the loan. That’s all they have and the recourse is repossession. The ding on the credit report for a car repo is particularly harsh as most captives won’t touch them for 7 years. The standard line was “You can live in your car but you can’t drive your house” and, in many cases, cars were paid for before mortgages.

I’d watch the credit buyers (I had eyes into the contract terms but not the identifiers such as VIN or customer info) that would finance out of equity deals….. sometimes far beyond what could ever be recovered by repossession. The customer would be upside down in their trade 10-20K, and the dealer would just tack that on to the loan and the buyers would take the risk because the dealer “was a really good guy”. When the first payment was included with the contract, you knew the deal was going to go bad as many finance contracts only have first payment recourse…. once the first payment is made, the vehicle is the only security. The dealer is on the hook for the contract if the first payment isn’t made…. not the customer.

With all due respect, El Katz doesn’t seem to know what a deficiency judgment is. But just skips that keeps pontificating at full speed onward.

Outside of the supply issues because of the pandemic, when have non exotic cars gone up in value? Why would a $70k car be worth $80k in the future? That insanity seems to be over.

I think the writer was alluding to the fact that the MY2022 Fancymobile sold for $70K but the MY2023 Fancymobile would have a MSRP of $80K.

Insanity is never over. There are far more stupid people than you can imagine.

@Chris: not up in value, up in price.

We’re talking inflation, not improvement.

Inflation plus rising rates means it’s a cost saving to buy stuff early rather than waiting. That feeds the inflation.

Fait accompli by the industry. Got the public thinking they were all outdoor enthusiasts and rugged people in need of AWD SUVs and 4WD pickup trucks. But also you must have all the new tech. Your vehicle is an extension of you. So do you really care about the price or payment anymore?

Agreed.

“Your vehicle is an extension of you”

It really is pretty amazing that hundreds of millions have been so thoroughly convinced (regardless of circumstances or consequences) that you are only what you consume in this moment, every moment.

When in reality it is much more likely that your (largely unused) stuff is consuming *you*.

I have 2, 1 for work(I haul 4×8 sheets regularly

and 1 for travel pulling big 38′ 5th wheel

happy with both

The percentage of ‘rugged’ AWD offroad trucks/SUVs that never leave a paved road? Gotta be 95% LOL.

I sometimes envision that when the nukes start to fly, tens of millions of SUVs will venture off road for the first time (ever) and break both axles within a mile of the Interstate.

In the early days, the first SUVs may have been engineered to actually go off road for decent distances but 30 years on?

My guess is that today’s SUVs are designed, optimized, and engineered for Lady SitHigh Perch, who buys a SUV because it “feels” safer.

Engineering for seat elevation is a helluva lot cheaper than engineering for true off road capability.

The “rugged” AWD rarely leave the road on purpose.

You ever considered why Americans love SUV’s so much? It’s not that the population of soccer moms who need xtra room is skyrocketing, it’s that Americans are too damn lazy to lift their arse up out of a sedan. Yeah, it actually takes a little energy to lift yourself to stand up from sitting in a car but with an SUV you can just roll out & your feet are on the pavement

Americans love SUV’s because they love extra loading space of a van, combined with a higher seating position, which is perceived as safer.

In fact most newer drive thru lanes (ATM especially) are designed for SUVs and are a PITA to use, if you are sitting in a regular sedan. Buyers don’t care about offroading, especially since most SUV’s sold in US are not even AWD.

Europe is slowly picking that trend up and moving away from wagons to SUVs.

AverageCommenter, Nissanfan

“ever considered why Americans love SUV’s so much?”

Larger size and higher position of driver – it’s a feeling of dominance, power. Bonus for a lux brand. [This even for those with a practical ‘need’.]

It’s “Americans” today because we (royal we) happen to be able afford it – but really its just people.

Where I live it’s more like “The way the government maintains the roads has convinced people they need rugged AWD SUV’s and 4WD pickup trucks”. If you don’t want to fix your suspension every six months, you need a vehicle that can handle the conditions.

Roads gave nothing to do with it. It’s all about inflated egos and believing people are impressed with your bloated gas guzzling Truck or SUV. We’re not I’ve driven compacts my hole life on long daily commutes over crap roads. Never broke anything or wore one out. But I quess any excuse will do to justify a stupid purchase.

Like a mini-house and a car

Oil is looking to break below 80. That will help with future inflation. Gasoline in my area is almost down to $3 and this summer it was close to $5.

That is around 35% reduction in cost to fill up. On an 18 gallon tank. The fill up cost dropped from 90 to about 50. Times that by twice a month or 24 times a year, that will be over $1000 in savings. I can go buy a couple of flat screen TVs with that savings. LOL

The question is….will oil stay below 80 if Biden stops releasing oil from the SPR.

Depending on how the market play out. If the price is purchase power limited the price can stay below US$80 a barrel until all oil that can be extracted and sold with a profit at 80 dollar a barrel is sold.

After that the price may go up, or supply get verry scarce.

Sheesh, oil got down into the 30s in 2015 and 2016…cartel cohesion and fracker capital restraint tend not to be long lived.

There is plenty of oil in the ground but *choices* are throttling supply – Saudi aligning with Russia, Iran embargoed, Libya and Venezuela pointlessly suiciding.

But those *choices* tend to yield in the face of cold cash, long term.

In fact, if DC really cared, it could alter the calculus in all these areas.

But by and large, DC buys into Green viability in the near term (likely in error) so it is happy to let elevated prices do the dirty for fossil fuels.

Establishment DC only changes its “consensus “wisdom”” when it gets its ass handed to it in an election.

Otherwise subsidies and kickbacks are the eternal order of the day.

Then in 2016 there was a bust in the oil industry. Investments have not recovered since and production capacity is declining slow.

Yes, there is alot of oil in the ground. The question is if it is to an affordable price.

Also, some of the cheap oil is at the moment out of reach due to political reasons.

These reasons may fade in face of cold cash with the result that few invest in oil production where it is more costly. That posthone investmenst.

You’ve overlooked the US Gov’t becoming a buyer below $80 in order to refill the SPR.

There’s also this issue that for those of us in states like California, $80 oil still means $5.00 gas.

With consumer spending so strong, I can’t think how inflation would be down.

This makes FED job tougher as they need to tighten financial condition more: by hiking rates and and doing QT.

I am surprised why are they not selling MBS out rightly since home prices are off the roof.

So I have a good credit score but I pay cash for all my purchases,have no debts and I say no to those who offer me credit. So I guess the banks and other lenders don’t like me. That’s ok because I don’t them.

My spiritual beliefs.

I admire your spirit but the reality is that in the US a lot of large loans are made at a negative interest rate, the consequences of which are becoming clear now. So its a case of “fill your boots” because what you don’t have to pay back in real terms comes from the sadly naive optimist saver currently being fleeced to retirement poverty which is how bad it will be.

Borrowers receive transfer payments in real terms from savers in the US so there is nothing really great about avoiding debt, although I do personally wish to avoid being in debt as well, its clear that taking massive loans out years ago would have been in my best interests. The US has to destroy the value of the repayments they are obliged to make.

Not connected with your comment but the fiat currencies are going down so holding cash is a mistake IMO.

Is your handle related to the car? One of my favorites from childhood (yes, I’m that old) was the Sunbeam Tiger of the mid-60s. Sweet car!

Yes, a small British sports car with a Ford 289 V8. One of my favorites too!

…and when the Rootes Group was acquired by Chrysler, small block Ford motive power was no longer an option for the Alpine series, so i4’s and v8’s both drove into the sunset (…cue the ‘Get Smart!’ theme…).

may we all find a better day.

My Dad briefly had an Alpine — it was NOT ideal for Quebec winters, though, so the experiment was short-lived …

And my favorite. Sunbeam Tiger with Holley carbs that could outrun anything on the road. I never found out her top speed but I found out mine was 150mph on hwy101 north of San Francisco in the early 70s.

People love cash, especially waitresses and bartenders. My tips are always gifts so they don’t have to declare it. This is a gift, not a tip.

They are not making money off of you. In their eyes you are a “Dead Beat”.

Good Job!!!!

The CC companies still make money off the merchant fees. You pay them as they are baked into the pricing. Why do you think truck stops have different cash or credit pricing for fuel?

I once was involved with issuing branded debit cards as incentive payment vehicles… the back side fees were 4% – split between the issuer and the processor (in our case, Visa). Forgot what the exact term was but the “brand” on the card (like a United Airlines card) got some of the fees returned to them. That’s why there are so many affinity cards. Money to be made. The only reason I became aware of them was that the vendor middleman tried to steal the kick from us. Someone tattled. Caught them. Fired them.

So I’m wondering what the economy would be like, what society would be like if everyone, including governments, had no debts, and only savings and investments, and lived a pay as you go life.

The US government would not exist without the issuance of debt. It always has issued debt.

Andrew Jackson famously shrank that debt to zero in 1835.

Same Andrew Jackson who defied a Supreme Court ruling, ignoring our check & balances system and like a common dictator, illegally ordered the Army to remove all remaining Indians from Georgia & “shrank” their land holdings in that state to 0 acres.

There was a Depression under Jackson. The idiot ended the 2nd Bank of the US which was the forerunner of the Fed Reserve Bank. There was frenzy of speculation that ended in a bust that lasted for years.

ooe,

When President Jackson ran for reelection in 1832, his slogan was, “Jackson and No Bank!”

The Second Bank was run by the Rothschild controlled banking cartel, which was based in the City of London. In 1833, Jackson began to remove US government funds out of the Second Bank and had them deposited into smaller banks that were owned outside of the cartel’s control.

In response, the Second Bank tightened the money supply, and that is what caused the depression. This was all done from London in a calculated manner — economic war. Jackson prevailed; the control of issuance of the dollar was removed from London and returned to the USA; as it had been from 1811 until 1816.

“If a nation expects to be ignorant and free in a state of civilization, it expects what never was and what never will be.” -Thomas Jefferson, 1816

It was from 1836 to 1913 that time elapsed between the non-renewal of the Second Bank’s 20 year charter by Congress and the passage of the Federal Reserve Act. I would not call the Second Bank the forerunner to the Fed.

“You are a den of thieves’ vipers, and I intend to route you out, and by Eternal God, I will route you out!” -Andrew Jackson, 1833

By value, most investments are someone else’s debt. So, if debt disappeared, most supposed savings would disappear with it.

But to answer the questions you are actually asking, American living standards would decline noticeably or collapse. It’s not like the country is actually that much wealthier than it used to be.

Yes, but there is a difference between equity and debt. Debt is usually where the bubbles are.

Why should the economy collapse if it was to switch to pay as you go?

Investments would be just that. Ownership of something that generated an income stream. Like a factory producing something.

Living standards would be different, but maybe not lower, depending on what is a high living standard. Less goods and consume, but more time and less work.

Prudent debt has allowed many to start/improve a business/buy a home/get an education/buy transportation.

In the present, with a monetary system backed by debt, it would be catastrophic.

Maybe the “roaring twenties” would be the closest visual?

Today, maybe the Amish? They are all I can think of, sincerely.

I did spend time thinking about it. Unfortunately, I mostly thought of all the key events that led us to this collateralized world – everything down to the people themselves.

I think no debts means no assets, broadly speaking, and certainly US law requires the Federal government to issue debt instruments as part of its fiat monetary operations.

An economy cannot exist without debt. Read Graeber’s “Debt: The First 5000 Years”. Money is mainly a way of making debt daily divisible and exchangeable. The chicken farmer can trade eggs for ham and bacon with the hog farmer without waiting for the hog to grow old enough to butcher. Debt is real money, as long as the debtor has the ability to create goods and/or services of value great enough to repay the debt.

I have no debt. I like the sleeping at night under rated

Me either. Problem is government borrowed six figures on our behalf. We get to pay through inflation, sad to say.

“Securitization of subprime auto loans spread the risk and make them immensely profitable due to the high interest rates, the relatively easy recovery of the collateral, and the liquidity of the used-vehicle wholesale market where these repossessed units are sold. ”

That sounds like the MO of money sharks. Granted, people most likely did not have to buy at those terms, but it sounds like a legal hustle.

Trying to nurse my ancient pickup along till next year (just got the dreaded “check engine light”) in the hope that supplies will go up and prices down. Even then not sure whether to buy new or used or even what to get. I’m dreading it either way.

@w.c.l,

I’m doing the same thing with my old pickup (2003 Nissan Frontier with 219,000 miles). When I put a locking gas cap on my truck I started getting the “Service engine” light turning on. I used one of those devices that you can read the code with. And it said my gas cap was bad. I cleared the error and didn’t get it again for about 9 months. This happened a few times. The last time it went on I just left it. It turned off on its own after a week or two.

Earlier this week it turned on again, Lol!!

H.M.

I also read the code (P0420 emission system problem), changed the gas cap, and cleared the code. No soap, came back on. Fearing a visit to the repair shop and hearing the words “catalytic converter”. We’ll see. What else ya gonna do?

Back when my 2005 Mazda had to have the check engine light off to pass inspection, I used to add various concoctions to the gas, drive it real fast on the express way, and engine light would go off.

Still own it, and I am able to leave it on the past couple of years (>15yrs old). It just passed inspection, along with my 2001 X5 bmw.

The 2 cars are the complete opposites. Ones for around town, the other is for travelling further, and going faster.

One of my vehicles is a 2001 Chevy Geo Prizm 4 cylinder with 245,000 miles, Burns a little oil needing topoffs, all plastic door handles broke off long ago needing zip ties to open the door using your finger, and the check engine light has been continuously on for the last three or four years.

Still runs great!

Knock on wood!! Lol

I used to think my parents were cheap… god rest their souls, it appears the gene was passed down to me!

“Check engine lights” are always emissions related. Gas caps, o2/nox sensors, evap leaks, misfires, etc. Most are easy fixes, but not all. For instance, a transmission slip will set off a check engine light, because once the trans is slipping, the vehicle is “wasting fuel” in the eyes of the government.

I have owned two Toyota pickups, and both were trouble free !

Check engine light most likely the gas tank cap but an auto parts store will check it for free. My friend just took his car into shop for electrical issues and they say battery bad. Also oil change needed so new battery and oil change for 500 usd in small town Texas at dealer!

Make sure you buy an OEM or OEM supplier gas cap. The knock offs are notorious for failing.

Tried one from CarQuest and one from Gates hoping for a cheap fix. Both got the same result, but thanks for the insight.

It’s the biggest credit bubble in history, and it’s still going on. Nobody is refused a car loan, everybody qualifies. The rate is the only thing in question. The FED has completely failed in their inflation fight. It rages on, with accelerating auto prices one of the many examples.

Afro Sam Beckham Fried kneeling sent BCTUSD to BB #1 : Dec 8/9 2017,

16,666/12,701.

Sorry off topic, saw ‘JPMorgan to Acquire More Than $1 Billion of Single-Family Rentals’ in news today. It seems these are more build to rent. But i wonder, does jp think there will be very mild/no recession and there will not be much effect on housing prices/rent and that’s why they are getting into this now?……

Between high sending by consumers and deals likes these by big companies, it is very confusing. Can not make a sense of where the economy is headed.

JP Morgan set up a joint venture with Haven Realty Capital that is then planning to buy these rentals, and they’re not buying individual houses, but whole developments of newly built rental houses. It seems they’re trying to take advantage of the desperation of homebuilders that need to get rid of inventories.

Not sure what they’re thinking except that rents will continue to surge — that’s what it looks like to me.

Maybe thinking USA is going to have to go to the housing model of GUV MINT owned housing at all levels, including SFR.

Reading in the local news of school board(s), cities, counties buying and/or building rental housing so that their employees can continue to afford to live locally.

Wouldn’t be surprised to see that happening all over the place so first responders, teachers, other public employees can live in the communities they serve, as it seems many places they cannot at this time.

Except the police department. Cop is always the gov’t employee who habitually has the lowest percentage of actually living inside of the principality that he/she serves. Not laying your head where you do your job is highlighted in their guidelines of no accountability for constables in ‘Merica.

Wolf – Correct me I am wrong but the only way rent can rise in this environment is, if house prices don’t fall + interest rate remain high + unemployment do not increase, there by people are not only forced to rent but they also are able to pay the high rents as they are employed. Which also means no recession. Not sure what will happen to inflation in this scenario??? (though I would assume that inflation will not come down in this scenario).

If I remember correctly, last time (GFC 2008-2011) there were lot of bargains on the rent as lot of people where unemployed + could not afford the rent so they moved in with their family (parent, in laws, etc).

My limited experience in middle TN: rents are still surging. We go to market rent each time we put in a new tenant and they will pay. 100 applicants in 2-3 days. Many offering a years rent up front just to get into a place. Big scam in property management is the $50 application fee. They’ll run a 100 apps knowing the place is already rented…

Smart people knows that real tangible assets are the only real wealth, and everything else like paper currency bonds, USD, Crypto, FIAT are all fake money. They can be printed at the whim of politicians and political environment.

Real Estate, Gold, Stocks of solid companies will keep growing and even more so as money gets debased constantly. USD today is 100x less worthy than USD 100 years ago. OTH an ounce of gold or a piece of land or a home retains the same absolute value. This is not rocket science.

“This is not rocket science.”

Neither is correct use of capitalization of proper nouns vs regular ass nouns.

This article explains it all. Damn fine work Wolf!

The risk is spread with distribution of the sub primes over a large number of investors.

Wondering if the sub prime sellers offer different tranches of loans that are more risky than average sub prime, and pay higher interest rates. It is a small market as it is, so maybe not enough of a market for different risk tranches, like a casino

The lower-rated higher-risk tranches pay a higher yield, so investors who buy them take greater risks for a bigger yield.

The Atlanta Fed is predicting a 4 1/2% growth in Q4. J Powell has got some work to do if he wants to bring down inflationary expectations. Like everything else he has done he will fail miserably. Time for him to do everyone a big favor and hand in his resignation. Appoint someone like Judy Shelton to be the new Fed Chairwomen. Why didn’t Trump put someone like her in when he had the chance instead of one loser after another?

1) Wolf, where do repossessed cars go : banks parking lots, or dealers parking lots. Who fix them after repossessions. Do the banks need court judgement, or it’s built in the sale/ lease contract.

2) C/C delinquencies either go to zombie loans or the recycle bin. Their smallness might be misleading.

3) Banks like rental homes, but not empty commercial buildings and vacant

retail spaces.

4) Banks liked Sam Beckman Fried, who became a blab hole.

1. Bigger repo companies have facilities to clean up and recondition vehicles. When that is done, which can take a few hours or days, then off to the next auction. Vehicles that need repairs are repaired and then sent to auction. Some vehicles are auctioned off as is, damage and all. This is a well-honed business. Been around for as long as auto lenders. No one wants to sit on used vehicles. They need to be sold.

Banks don’t have parking lots. They send them to the auction houses where they often have reconditioning lots and they get run through the lanes.

If it’s a captive lender, the first stop might be a branded dealership who is offered the first right of refusal – they gets it as is/where is at a price that is attractive to them. The lender saves money by not having to truck the vehicle to the auction (several hundred $) and incurs no reconditioning expense nor “lot rot” (dents, dings, scratches, pilfered parts). If the dealer doesn’t want it, the captive lender puts it on their “virtual auction” where dealers in other markets will bid on them.

If it’s solid but goes to auction, it gets a “mop and glo” reconditioning and run through the lane.

If it’s a damaged unit (frame, sheet metal, blown airbags), it goes to a place like Copart whose business it is to liquidate such vehicles. Those usually have a branded title.

the guy who made the comment about flying nukes causing awd vehicles to run into the woods missed something. in a nuclear airburst, the the electromagnetic pulse will stop all electronically controlled devices. eg. cars. seen a points ignition lately? or know what one is? maybe it’s time for our fearless leaders to quit warring and learn how to practice diplomacy.

cap-EMP, the pulse that keeps on giving…

may we all find a better day.

The clowns still pontificate. Who cares?

My 1936 Cord still runs, as well as my 1999 GMC pickup.

My 2002 BMW 525I has been a near disaster, but I felt a need to salute to the new century.

It won’t happen again.

The crap that the people buy amazes me.

My 1967 Mustang is quite average, but still runs decently.