Restaurants and ecommerce in particular. But people are not flocking back to department stores suddenly, that was a myth.

By Wolf Richter for WOLF STREET.

Retail sales, reported today by the Commerce Department, are based on retailers’ revenues, obtained by survey of about 5,500 retail locations, so from the company’s point of view, and not “consumer spending” from the consumer’s point of view, which we’ll get later this month. These revenues show that retailers knocked it out of the ballpark in October, especially online retailers and restaurants, as customers were buying hand-over-fist. And it wasn’t inflation.

Inflation has abated for many goods, which is what retailers sell, and shifted to services, which retailers don’t sell. On a month-to-month basis, the CPI for durable goods fell for the second month in a row (-0.7% in October); the CPI for food at home (bought at food and beverage stores which we’ll get to in a moment) rose month-to-month at a slower rate (0.4%) than the spikes in prior months. But the CPI for gasoline rose 4%.

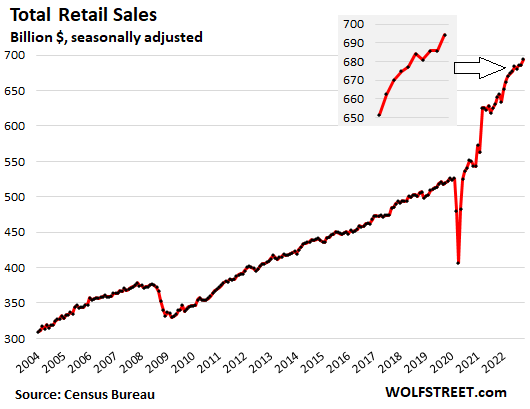

Total retail sales jumped by 1.3% in October from September, and by 8.3% year-over-year, to $695 billion, seasonally adjusted. Compared to October 2019, retail sales were up 34%.

Sales by category of retailer, largest to smallest:

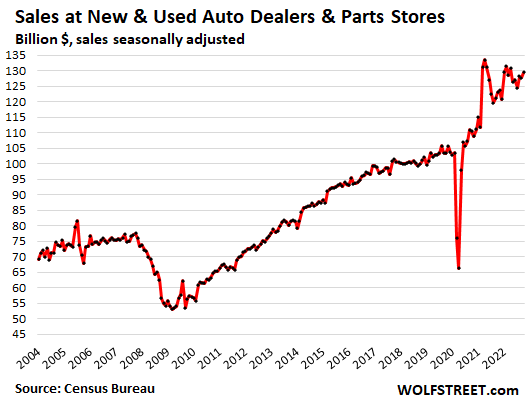

New and Used Vehicle and Parts Dealers: Sales rose 1.3% for the month and by 5.2% year-over-year, to $129 billion, up by 25% from three years ago. This is the largest category of retailers. The sales increase occurred as the CPI for used vehicles fell month to month, while the CPI for new vehicles still rose, though at a slower pace than before.

New vehicle inventories overall are still woefully low: they’re largely depleted of fuel efficient vehicles, though inventories of full-size trucks and SUVs are now building up, as demand has shifted following the spike in gasoline prices that started in 2021. Overall sales are still constrained by shortages of vehicles that are in demand.

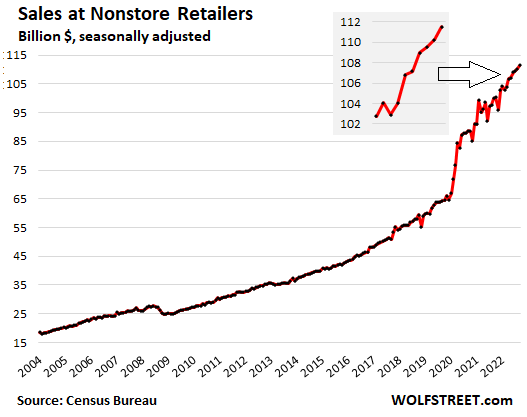

Ecommerce and “nonstore retailers”: sales rose 1.2% for the month, and by 11.5% year-over-year to a record of $112 billion, seasonally adjusted, up by a mind-boggling 73% from three years ago, as the shift in retail sales from brick-and-mortar stores to online operations continued. This is the second largest category of retailers.

Sales by the ecommerce operations of brick-and-mortar retailers are included here, along with sales at stalls and markets:

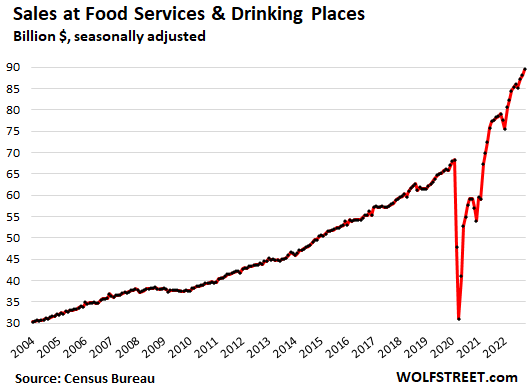

Food services and drinking places: Sales rose by 1.6% for the month (against CPI of food away from home +0.9%), and by 14.1% year-over-year (CPI +8.6%), to a record $90 billion. Compared to October 2019, sales were up 36%. People are thronging to restaurants like never before.

Restaurant sales have boomed so fast that this category has surpassed food and beverage store sales, making it the third-largest category — Americans really do eat out a lot. And here too, revenues are easily outrunning even the raging CPI inflation for food away from home.

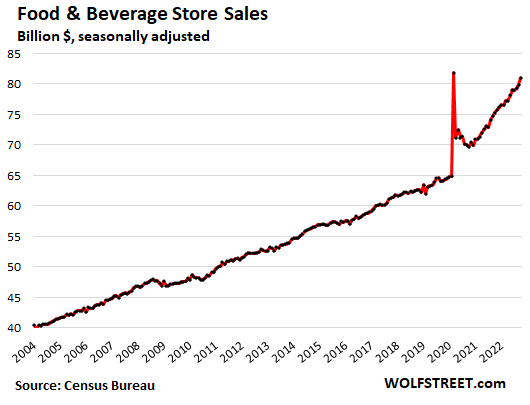

Food and Beverage Stores: Sales rose 1.4% for the month (against CPI of food at home +0.6%) and by 7.6% year-over-year (CPI +10.9%), to a record $81 billion. Compared to October 2019, sales jumped by 26%:

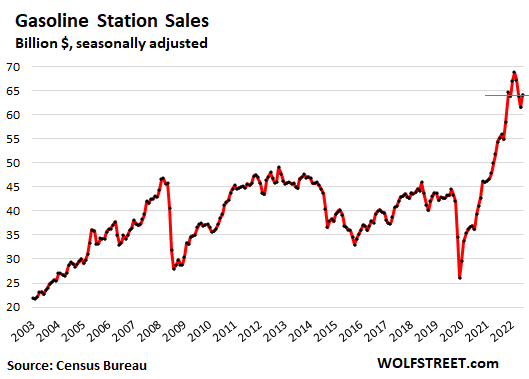

Gas stations: Sales rose 4.1% for the month, after three months of month-to-month declines, and by 17.8% year-over-year, to $64 billion. The CPI for gasoline jumped 4.0% month-to-month and by 17.6% year-over-year, largely explaining the sales increases. Overall gasoline demand, in terms of barrels supplied to retailers, has been dropping compared to prior years.

Sales at gas stations include whatever else gas stations are selling, and many of them are in effect convenience stores.

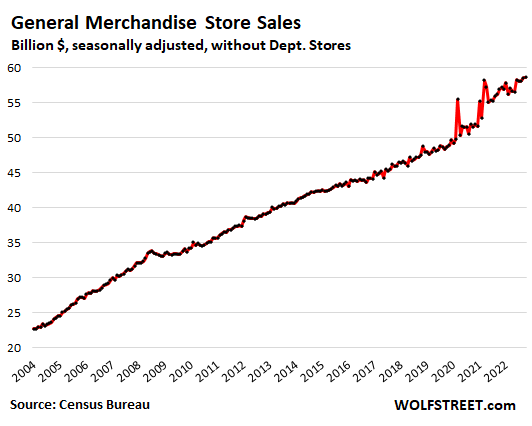

General merchandise stores: Sales ticked up 0.2% for the month, and 3.1% year-over-year, to $59 billion, up by 20% from three years ago. This category includes Walmart and Target, but not department stores which we’ll get to in a moment:

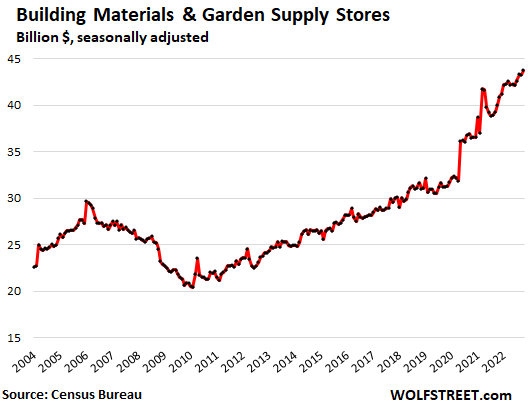

Building materials, garden supply and equipment stores: Sales rose 1.1% for the month, and by 9.2% year-over-year, to a record $44 billion, up 40% from three years ago:

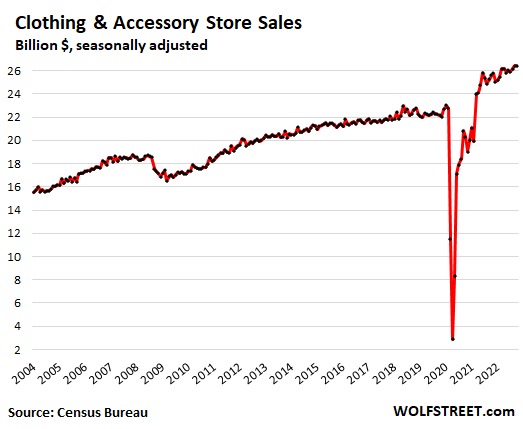

Clothing and accessory stores: Sales were unchanged for the month, and up 3.1% year-over-year, at $26 billion, up 19% from three years ago:

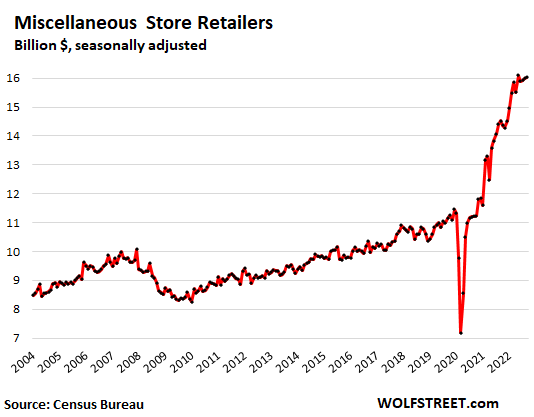

Miscellaneous store retailers (includes cannabis stores): Sales ticked up 0.3% for the month, and rose 10.4% year-over-year, to a record $16 billion, up 44% from September 2019:

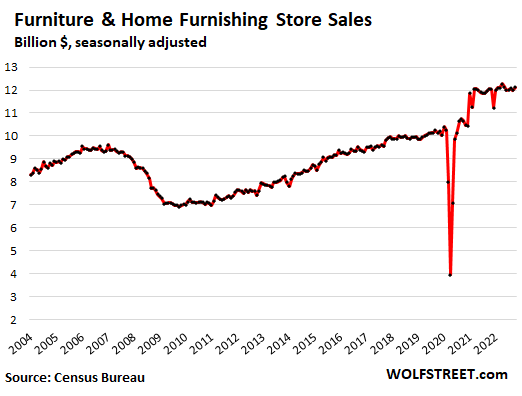

Furniture and home furnishing stores: Sales rose 1.1% for the month to $12 billion and were flat year-over-year. Compared to October 2019, sales were up 19%:

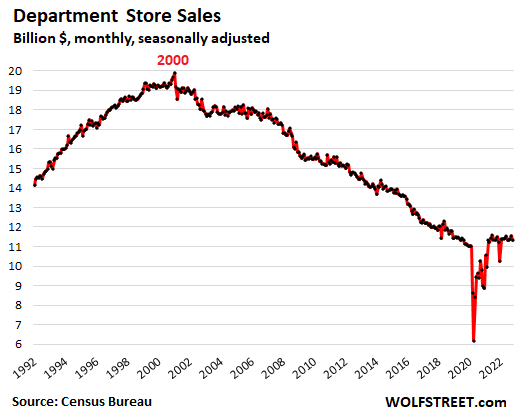

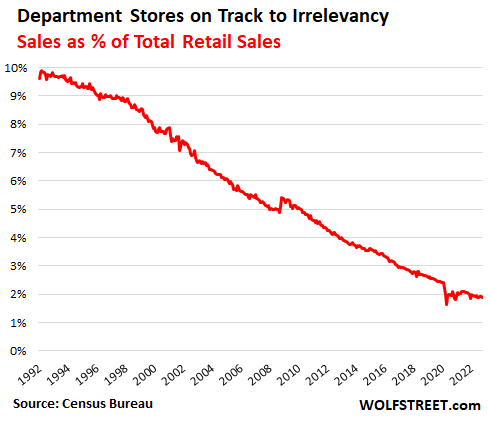

Department stores: Sales fell 2.1% for the month, and fell 1.6% year-over-year, to $11.3 billion, up just 3.1% from three years ago, despite three years of inflation.

Since 2000, sales have plunged by 43%, despite 22 years of inflation, as department store sales have moved from mall stores to the internet, including at the ecommerce sites of the few surviving department store chains. Ecommerce sales by department store chains are included in the ecommerce sales data above:

Department stores on track to irrelevancy. Many department store chains have been liquidated in bankruptcy court over the years, and others have used the bankruptcy process to shed stores, and the few that haven’t filed for bankruptcy have closed many stores, and continue to close stores, such as Macy’s. Americans have discovered that anything you can buy at a brick-and-mortar department store, you can buy online, including at that chain’s website. And lots of stuff you cannot buy at the store because they’re out of the right color or size or whatever, you can buy online just fine and have it shipped to your place.

In the early 1990s, department stores sales accounted for nearly 10% of total retail sales. In October 2022, they accounted for less than 1.9%. On track to irrelevancy:

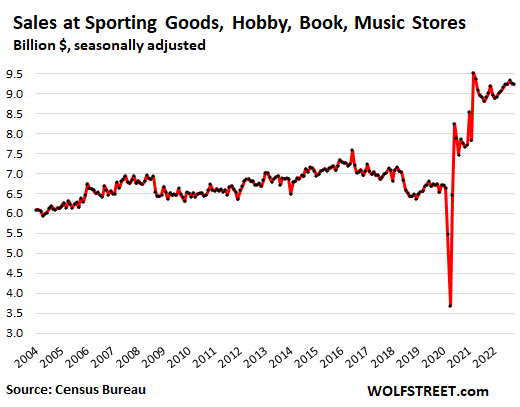

Sporting goods, hobby, book and music stores: Sales dipped 0.3% for the month, to $9.2 billion, and were up only 2.5% year-over-year. Compared to October 2019, sales were up 37%:

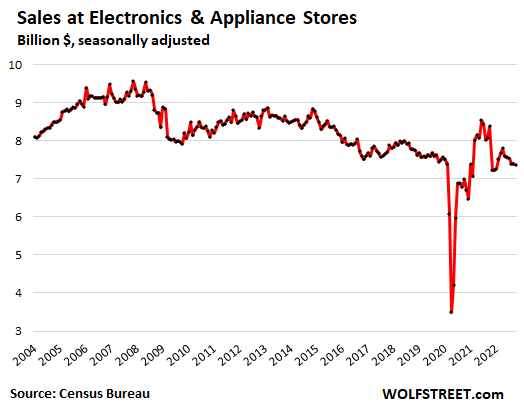

Electronics and appliance stores: Sales fell 0.3% for the month, and 12.1% year-over-year, to $7.4 billion, and where down 1% from October 2019. Electronics retailers are dealing with price drops across the board, which is the normal trend for consumer electronics: the CPI for information technology fell by 1.0% for the month and by 10.8% year-over-year.

Only specialty electronics and appliance stores are in this category, such as Best Buy’s brick-and-mortar stores or Apple’s brick-and-mortar stores. It does not cover the electronics and appliance sales at other retailers, such as Walmart, and it does not cover ecommerce sales of electronics and appliances:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

With this retail sales report the Fed will have no choice but to keep hiking interest rates at 75 basis points and reducing the balance sheet at a much faster pace. Otherwise, their credibility will be shot, that is if they had any left to lose.

1) Their credibility is permanently destroyed.

2) They will not be raising 75, but 50 basis points.

3) All of this is 100% intentional.

4) “Soft landing” = soft on inflation fight.

I too believe the Fed hikes by only 0.50% next meeting, and they will be hiking “slower yet higher” all the way to 5.0%-5.25%, not 4.5%-4.75% that is the common belief at the moment.

The main reason why is investor stubbornness towards “Don’t fight the Fed”, as the market mantra is bi-directional, per WSJ reasoning:

Goldman Sachs’s overall measure of financial conditions combining stocks, interest rates, corporate bond spreads and the dollar loosened at a rate only previously seen in March 2020 and during the Fed’s emergency response to the 2008-9 financial crisis. The index is now back down to where it was just before the Fed’s 0.75 percentage point tightening in September, which was followed by another 0.75 point rise this month.

If Fed stops at 4.5% or 5.5%, we will start hyperinflating.

Fed will have to hike to atleast the prevelent CPI + 2% to control inflation, because the supply is sliding and so Fed can never control inflation only by demand and demand has a floor, supply doesn’t.

This will all be evident by February.

Hyperinflation is when prices are increasing 50% a month.

A Fed rate of 5.5% will not cause hyperinflation.

Apple, The only reason we say that Fed rate of 5.5% will work is because we know that we cannot withstand higher rates and we don’t know what to do if it doesn’t work. This was the case a year back also when Fed said:

1. Inflation is transitory.

2. Fed rate of 2.5% will control inflation when clubbed with QT.

Is there any accountability for these misleading statements.

Government measured >20% annual inflation is Hyperinflation. Baltic states are already Hyperinflating.

Yield on 2 year closing in on earnings yield of sp500. That spread will eventually widen.

Amen. The banksters are making over a trillion dollars just on their depositors’ funds from inflation, which reduces the real value of those funds; while banksters’ and their cronies’ companies can increase profits by raising prices and (again due to wonderful inflation) still pay their employees wages that get effectively reduced every year. The banksters thus will not allow their “Fed” to eliminate inflation for YEARS. Americans are spending in part due to the expectation of higher prices next year.

Xi and Putin are our unintentional saviors (LOL), because what they are doing to their people is better than any number of B52 air strikes. They may tame inflation (as to commodities and some but not all things) as they crash their and their allies’ economies. LOL

“ Americans are spending in part due to the expectation of higher prices next year.”

Yep. Me included. I have been, uncomfortably, spending down my retirement savings stocking up, fixing up, and filling in. I have been careful, however, to get the best value for money I can. No luxuries here because I think we’re in for a rough ride.

I am a small farmer, a real one. It doesnt come easy.

I’ve been out for month due to minor surgery

now I’m back and raised our hourly rates just as higher rents kicked in for owners

spent 1/2 day walking owners property

bought lunch but billed out rest time – ie time is money

The Fed said months ago they would raise by .50 in December. In August, they said .75 Sept through Nov. Then .50 in December. I guess it’s a Christmas present to Mr. Market.

The fed will keep following the same game plan they laid out way back in 2021 that no one believed. +0.5% in December, +0.5% in January and then reassess.

And an ugly recession wil hit once everyone agrees we’re not having a recession… probably second half 2023. Real estate is dead in the water and no one believes that either.

Supply is already in recession. We calculate recession by debt fuelled consumption and so don’t see the recession yet.

It’s simple math and it always ads up despite denial.

Could you please elaborate on “supply is already in a recession”?

Thanks.

US worker productivity is near all time lows and that causes lesser production of goods and services in units (not fiat dollars). So domestic supply of goods and services is near all time low.

Worker productivity went up .3% in Q3.

Apple, look at the whole trend and not one quarter. Also note that BLS labor productivity is measured in dollars and not units, so if I give only 1 hair cut an hour instead of 2 and chare $30 for haircut instead of $13, my productivity goes up as per BLS. In general when inflation outpaces wage growth, BLS labor productivity will go up, but in real units of work (and not hours of work), productivity may be decreasing.

Inflation is really bad because it shifts baseline for all measurements.

I looked this up.. Maybe I don’t understand the data, but BLS data under the chart “Labor Productivity and Real Hourly Compensation, non-farm business sector ’73-’21” seems to show that productivity is extremely high compared to the 70’s. I don’t know what the “all-time” data looks like, but that alone indicates that it’s not a nadir of any kind.

Anyway, just thought I’d chime in.

Britain was clear in announcing that they are in recession and need substantial tax hikes and spending cuts.

Our American pride is just effing with us.

Forgive this dumb question.

Are “Sales” reports based on Dollars of Sales?

If reported product or services “Sales” are up 5% yoy, and the inflated prices of those products and services are up 8% yoy, haven’t “Sales” actually lost ground yoy?

Or are reported “Sales” adjusted for inflated prices?

CreditGB,

READ THE ARTICLE

It’s the other way around everyone but me believes there will be a recession so there won’t be one until 2028 when Trump’s corporate tax cuts expire. Shades of the 1970’s inflation and wage-price spiral.

The, uh, *corporate* tax cuts were expiring? Seem to recall a lot of the bile at the time over that bill was because they didn’t while the tax cuts for individuals did.

Individual tax cuts expire in 2025. Corporate never expire.

With the increase in PPI, and its 9-12 month lead, the Fed is forced to continue its long term attention to inflation. The 90 day t-bill leads Fed allowable FFR increases. The Fed is stuck goosing rate increases, and is already close to spinning one too many plates. Count on Washington adding more plates to the table.

I agree with the .75% raise. The market needs a little shock and awe. The Fed needs to snuff out inflation before it gets entrenched. They cant wait. Better for them to go overboard and cause a recession and then reverse course, than to allow inflation to get entrenched.

The elections are now over, which gives them more incentive to raise now.

Inflation is already entrenched. That ship sailed long ago.

Well, we can still go from entrenched inflation to entrenched hyperinflation. Looks like the dumb Fed is all for it.

Britain was clear in announcing that they are in recession and need substantial tax hikes and spending cuts.

Our American pride is just effing with us.

If the Fed can’t get unemployment up, there is a slight chance we have to go from 5.0-5.25% FFR all the way to 5.75-6.0% FFR to shock the animal spirits into compliance.

Thus not only do we have $180 forward earnings risk in the markets for the next 3-5 months (per GS research notes), we have a 6.0% FFR risk factor when calculating how low we can go in the US markets. Thus I’m personally saving a certain percentage of funds for both scenarios, just less percentage for the 6% rate shock as that is substantially less probable…

Luck plays a huge role when those in control can change the rules mid game, thus why I often state:

Good luck in all your investments…

I agree with you Swamp Creature, but actually think it needs to be 1%, not .75. I also agree with Depth Charge, it is likely to be 0.5%.

Swamp Creature, it seems to me that auto sales would be the item in this article most directly affected by borrowing cost since it is reliant on longer term loans. The rest of these categories, not so much. Wolf’s other recent article shows that credit cards aren’t being maxed out yet, so clearly the American consumer is still flush with cash. A fed rate hike isn’t going to prevent their online clothes purchase or a family night out at the restaurant because they aren’t financing that stuff.

The Fed funds rate isn’t the key here. Too much money was created and a lot of it needs to be removed. If we make cash more scarce, we’ll see consumers pull back. Interest rates are too blunt, too indirect, and have a long/unpredictable lag time involved. High borrowing costs will choke off the consumers that rely heavily on debt. But folks with cash are apparently the large group steering this boat. If they feel like cash is abundant, they’re going to be OK with blowing it as fast as they can “before prices go up more” (the inflationary mindset). If they feel like cash is going to be harder to come by, they’re going to hold on to their money as QT drives up longer-term bond yields and makes “safe” stores of wealth more attractive again… One may not be so fast to spend right away if they feel like high-yield savings, CDs, bonds, etc. can protect their money from inflation. Interest rates are fine where they are. What the Fed needs to do is accelerate QT. But they won’t. They’ll keep using the wrong tool to divert everybody’s attention away from what really matters until credit markets blow up and they’re forced back into panic-mode QE and ZIRP.

Housing prices make people feel rich. Blow a hole in home prices and they will pull back on spending.

Agree…but the problem is that the bulk of people follow *prices*…not transactional *volume* (whose movements precede price movements).

Rapid unZIRP has done the expected and gutted SFH *sales* (by finally having monthly mtg payments soar…in line with yrs of soaring home prices).

Sales volumes are off 30% in many places – thanks to those finally reality-based monthly mtg payments.

But…sales prices haven’t collapsed (yet) because of the historically abnormal low level of for sale listings (60% of 2019).

Once flippers start to panic and start pumping out listings, price collapses will follow quickly.

Cas127, Your observation about Sales $ vs Sales Volume seems to be right on the mark. Are reports of Sales$ just mitigating loss of Sales Volumes in many areas? Are we fooling ourselves using inflated Sales$ to show increases?

Their credibility was shot a long time ago. And in any case, a 75 bp hike in December is extremely unlikely.

Yeah that first graph looks horrible breaking way above trend line.

Bullard says they may have to raise rates to 7%. Punching that in you can get a sp500 that is close to past low of 666 when it is all over. I get 800, but when it starts feeding on itself you just don’t know how low it can go.

Can you share the calculation you use to get these targets? I’d like to play around with a few scenarios to see where this is headed.

The simple one from the finance text book is the dividend discount calculator. You can find several on line, but I like to use the most simple for the sp500. Dividend, dividend growth rate and discount rate.

The theory is all money not paid out in dividends must be reinvested to keep dividends growing. It does a good job telling you fundamental value of dividends which has tended to be more related to where the bottom is. It was pretty accurate in predicting bottom of GFC.

Old School

Cry to save ‘PENSION” funds plea will come just like in UK.

Mr. Powell is NO Mr. Volcker!

Absolutely

I wonder how much of the $$ increase in sales is due to higher unit volumes versus inflation?

Good question. If inflation is 8% then in theory, if you sell the same amount of widgets, you sales will be up 8%.

I’m curious – will lottery ticket sales show up as general Gas Station / Grocery Store Sales?

The PPP “loan” money is still sloshing around in grand fashion. Some of the “smaller recipients” got a cool $750,000. That’s 15 FREE $50,000 vehicles. They didn’t go buy all of them at once. They’re set up to buy a new vehicle every year for the next decade and a half.

CONgress and Jerome Bowell really f***ed things up this time. There are permanent repercussions from this one. And the idea that inflation is magically cured from a few rate hikes over the course of 7 months or so after this amount of largesse is laughable.

The amount the Federal Reserve has reduced balances is also negligible, so the asset bubble only partially deflated.

And there is the payroll tax credit available now up to 10000 per employee that’s becoming available more cash into the system from free money. Some rules that have to be met for the payroll tax credits but there will be very little oversight and the money will roll out. My CPA says her firm (she owns the firm) will receive 150000 and I heard a commercial on radio about firms offering filing for a percentage of refunds .

While you are all bashing J Powell, I think there is a shortage of accountability to those in the previous administration that signed off on all of these PPP loan programs, and MMT spending which the Fed monetized and led to the current inflation. There was a year and a half lag between the printing of the money and the inflation that we are experiencing. I’m talking about accountability for the Treasury Secretary, Steve Mnucian who was the architect of this PPP loan disaster. He was also the person that recommended appointment of J Powell to head up the Fed. He was a gigantic wrecking ball as bad as J Powell or worse.

Agree totally SC, and just another reasonable basis to consider ALL the folks in federal GUV MINT, elected or appointed to be basically part of the same team…

Until WE the PEONs insist that ALL GUV MINT folks have the same,,, EXACT same SS retirement and Medicare,,, WE the PEONs will continue to be 2nd Class citizens,,,

Etc., etc…

Certainly, some serious constitutional amendments are needed for SO many ”BASIC” reasons…

So, the only way you can be a first-class person is if those above you crash and burn. And those below you never move up.

Then you will be at the top of the ladder.

“Until WE the PEONs”

The PEONS are divided to make any decision or impact, are sorely divided on ideological blinds.

I expect more chaos and in fighting.

Swamp creature

“Treasury Secretary, Steve Mnucian who was the architect of this PPP loan disaster”

What did you expect from this ‘squidling’ from the Giant SQID – GS? The global banking is saturated with their kind.

Sales at new & used cars dealers. The trend is up. The trend is strong. After two years triangle, an incomplete triangle , sales might move higher, at least for a while.

The banks might not be able to lend consumers, after lending to crypto.

Wolf creepto blog might send the markets down in the next few days.

Millennial and Gen Z might not be able spend more money after herding together creating a creepto bubble.

The trend is sharply higher for prices of new cars projected out to 2026. The prices are already set 3 years out in the future.

TRT:

Where did you get the information that prices of new cars are projected out to 2026?

Based on my experience, pricing is done just prior to launch. All other “images” of pricing are based on competitive vehicles, their equipment, and +’s and -‘s based on value of the differing equipment (eg, safety suites, etc.) and in current dollars.

No one knows what it costs to produce the vehicle until the initial component orders are placed…..

Yeah, there’s a nice all-electric car out of Serbia that looks promising. A bit of cash is needed to spend in order to buy one, but seems like you get quite a bit of technology and performance.

A Rimac Nevera would be an upgrade to my current ride, I reckon.

Prairie Rider,

For name recognition they should have gone with eYugo.

The article says total retail sales are up 34% from pre-pandemic levels. Wow! I assume the majority of that is inflation, which is a lot of inflation in just three years!!

Makes me wonder if the CPI is rigged and understates inflation by a huge amount, maybe from the ridiculous black-box quality adjustments they make.

Some of it is inflation (over those three years, durable goods CPI +23%; nondurable goods CPI +19%). The rest was just the HUGE boom in the sale of goods (that’s retail) during and following the pandemic. This HUGE boom caused Amazon to hire 800,000 workers in two years to keep up, which is just nuts… and now it’s trying to unload a few of them.

This was a crazy boom in the sale of goods, and I have documented it with total amazement month after month starting in mid-2020.

We are booming. Amazon stock should quadruple in a big turn around coming soon with these retail numbers. Maybe 5% inflation with a 6% Fed fund rate could be a winner for everybody. Savers can get a taste, spenders keep tasting, Gov’t declares victory over inflation and the Empire gets to sell its non-productive debt to keep the grift circulating from the MIC/ Security State to Congress. Everyone wins. 8% inflation did not slow the consumer down so 5% could actually be stimulative as compared to 2%. This is why Powell gets to sit in the big chair. 5% inflation is much better for the consumer than 2%. Powell knew this all along. We Americans are just discovering the true wisdom of the Fed.

The tent cities tell the real story.

A lot of the tents are in peoples’ backyards that aren’t counted. The figures are now growing exponentially.

Four hundred million dollars in shoplifting this year at Target also tells the story Maybe they should change their name lol

The bureau of lies and stories would say that We all know its “ fake news”

Tent makers are happy about this increased product demand.

BLS??? Really???? When haven’t they lied?

A chance exist the Fed re-states the inflation goal from 2% to 2.75-3.25% as if you look at historical data, getting inflation to drop from 8% or higher can easily take 5-8 years, and with the global debt house of cards currently, the world doesn’t have that luxury of time. Such is a black swan for the market to sky-rocket, kind of like when the banks sky-rocketed after they changed mark-to-market rules to mark-to-fantasy.

When the rules change, the game changes, so best not to attach any emotions to this game if possible. Plus be careful using too much logic as stories triumph over reality when the herd animal spirits either panic or hit euphoria. I’ve learned the lesson that we are not a very emotionally stable species…and logical only thinking can cost a fortune…

If the Fed raises the inflation target, long-term bond yields and mortgage rates will spike. Just get used to the idea. The 10-year 3.8% yield assumes that inflation is back to 2% asap. If the market assumes that inflation will be 4% for 10 years, the 10-year yield will jump to 6% to 7%. A higher Fed target means MUCH higher long-term rates.

The market’s confidence in 2% inflation is one of the factors that keeps long-term yields low. Once this confidence breaks, you’re in an entirely different world.

Can we really put that much faith in the 10yr as the market expectation (+/-) of inflation? Or any treasuries? We’ve had plenty of time where bills/notes/bonds were well inside of reasonable inflation expectations. Investors hold treasuries for lots of reasons, not just to match or beat inflation. For example, flight to quality or “this is the least bad thing to hold”. And some have been willing to bid yields down ridiculously low in hopes of even lower rates from QE, etc.

So while I know you’re broadly right in concept, especially re: confidence, I don’t think it’s quite as tight of a relationship.

To the above post, I have never seen the data but always believed that most buying of longer dated bonds (including treasuries) is by institutions, not individuals directly.

Some institutions (such as pension funds and insurance companies) have offsetting duration liabilities (more or less) but whether they do or do not, it’s not their money.

Bullard hurt the market today by stating FFR may need to hit 5-7% range. Personally I think this correct, in a perfect world. Reality wise, things will break at 6-7%, and we won’t be there for long.

That said, I think “high” 3.5-4.5% inflation could stick around for 3-8 years as you’ve said, nothing goes to hell in a straight line and inflation and historically it has been extremely difficult to drop inflation quickly once the 8% range has been breached…

Housing prices dipped about 3% to 5% in my area from June 2022 through October 2022. They are going back up now and back to the peak of June 2022 prices.

People are just not selling their existing homes.

It seems there are plenty of apartment buildings going up though. A big empty lot developed during HB1 that has been sitting empty for 14 years just was rezoned as apartments. My neighbor said great….just what we need is another apartment building.

Everything is turning into apartments to rent. Old grade schools or high schools. Old office buildings. You name it. In the past these builders would have sold all the units as condos to people. These days they are just keeping them as rentals. I am guessing most of these are REITS doing the funding and want the long term rental income.

IN my hood, I see price reductions galore.

People wont want to sell but they’d be forced to sell and these sales at the margins would define the prices.

Jon, price reductions do not necessarily equate to a drop in sales prices. It’s like shopping at Kohl’s… They price a pair of jeans at double the MSRP and then slap a 50%-off sign on the rack to make the customer feel like they’re getting a good deal.

I’m seeing price reductions in my area on houses that were priced way above comps by ambitious sellers, but the houses priced close to comps at the low-to-mid range are still pending a couple weeks after listing. The vast majority take 30-45 days to close, so they’re being financed, not cash buyers that close in more like 2 weeks or less. I’m with ru82 on apartment construction… I’ve never seen so many apartment buildings go up so quickly in my life. Every single open field or disused building complex around here has been or is being turned into rental apartments. Basically no new single family home construction here in SoCal.

The worst of the mania has lifted, but this housing market is refusing to just properly die already.

Replying to Not Sure..

Wolf has documented the price decrease from peak prices.

These are not mere price reductions.

Also if apartments are built in large numbers then more pressure on homes to reduce price.

The apartments that I see being built are “luxury” apartments, not run of the mill developments. These are going to rent for a lot of money due to the amenities that they are offering and the locations.

And there’s 1,000’s of them under construction in the Scottsdale area.

El Katz

The same insane building of apartments is happening in the urban core of Phoenix. Also every bit of land that can be bought along the light rail has apartments going up.

Some are luxury, some are standard units.

The tall office building at Central & Camelback is being converted to apartments.

@el katz – Yep. Most of the new apartments in my area are luxury. I think the city I live in has a median family wage of $98k and this is in the midwest so that goes a lot further than on the coast.

But, many times they are now requiring that 10% to 15% are affordable based for low income earners. Not all but some of the apartments need to do such a thing to get the permits from the city.

6% interest rates with 5% inflation still means negative after tax real returns, except in deferred tax accounts.

Anyone read the article about the millennial that took $15k in saving and it turned into 1.2 million via trading on Robinhood from late 2020 through 2021. Then lost it all. The article is on the Guarding.com

Or google

“How I turned $15,000 into $1.2m during the pandemic – then lost it all”

I gave people tips that would have turned 15 grand into 1.5 million. These were parlays using simple stock buys. I gave everyone Nvidia at 20 bucks around August 2015 told them to sell around 120 and stuff it into AMD at $6.25. The guy named Garth Turner on thegreaterfool.ca told everyone don’t throw all your money into one stock. That was back around August 2015 and I told him not if you have the right stock and I told him I put everything into Nvidia. I told everyone countless times to buy the stock as it went up right on his blog. Then I told them to parlay the 6 fold gain on Nvidia onto AMD at $6.25 and if not for Trump’s trade war with China it would have really been big. The parlay if played perfect out at the top in AMD would have been around 150 fold.

Up in Canada Revenue Canada tracks all the TFSA tax-free saving accounts for ten years and if you make too much or too much too fast then its taxed as income instead of being tax free. Communism at its finest. They never give you any reason or outline anything. It happened to my brother.

ru82,

Nothing special. During bubbles and busts, this is standard operating procedure.

A gazillion people that during the dotcom bubble and bust. The Nasdaq plunged 78%. If you were leveraged, which many people were, and if you didn’t get out in time, which many people didn’t, you lost it all.

Except $1.2 million in 2000 could actually buy some things, including a couple of houses in San Francisco, LOL

I am a little confused. Are sales determined just by total dollars? Or is volume a component?

If we are just measuring how many dollars they are selling, how can we tell if sales are going up because of higher prices? Or because of more transactions?

Read the article. It will answer your question.

From what I read, the inflation is explained in the text, but not shown in the graphs. The charts are adjusted seasonally, but not for inflation, which may be greater. Again, my take on reading the article.

Question: is there any differentiation between “restaurants” vs. fast-food and/or quick-serve? When lunch for two at Chick-fil-A is more than $20 vs. $15 last year, that’s a lot of additional spending without, like, “going out.”

Clete,

Waitresses are saleswomen. Restaurants are the very few places left that

a great saleswomen, with a smile, can pileup the bills and the tips. The rest are takeout windows and boring warehouses with rows of merchandises.

The online co are not much different than the old catalog houses, like

service merchandise RIP. They can be stuck with unwanted merchandise they cannot move, even with steep discounts. The cost of shipping is higher than 10%-20% salesmen commission.

AI cannot compete with human touch.

All “food services” are included, from high-end restaurant to cafeteria.

As far as auto part stores go, I just bought a $280 replacement battery. I checked my receipt in the glove compartment to see what it was three years ago: $210.

Ouch.

+1 to your comment on the battery costs. I faced the same thing.

Three years ago I bought replacement battery for bmw at Walmart for $80. Same battery at Autozone was $210.

Google the battery and you will likely find non-brand battery (from same manufacturer) at half price. Only difference is the sticker.

Bought a battery for my BMW at Costco. $170 out the door (after I returned the core). It’s an Interstate brand…. AGM….. the right size for the car and actually fits in the brackets.

Sometimes you’ll find a sticker over the sticker of the brand name. There’s only a few battery manufacturers in the U.S..

1) JP, thanks for saving our lives, protecting our small businesses with ppp loans and sending XLV to a new all time high within few months.

2) The trend is up, the trend is strong. After a year and a half in accumulation XLV might move up to a new all time high. The horizontal length might be equal to the diagonal rise.

3) After closing Oct 21/24 gap it might start.

4) The boomers herd together, imitated each other, spent $10K-$40K on dental implants, replaced their knees, installed heart valves, unclogged

narrow blood vessel, dissected aneurysm, paid their health insurance co

in online banking in monthly installments.

5) When the health bubble will be over, if spending on XLV will fall sharply down, it will start a recession.

6) Spending on healthcare is stickier than rent.

Yeah, that’s me (#4). 4 dental implants, some new crowns, both hips replaced and a new set of golf clubs! Living the good life at 79! Doesn’t get any better than to this and spending the kid’s inheritance. 😂

New Car Prices. Quote of the Day

“Higher rates are already shifting access to vehicles and financing towards wealthier consumers,” Smoke said. “Affordability will be challenged for years to come in both the new and used markets. It’s not the Fed’s fault, but it will impact consumer access to transportation.”

That — going “upscale” because that’s where the money is — has been happening for 14 years. Everyone else gets to buy a used vehicle. New vehicle volume is back where it had been in 1970s because new vehicles are too expensive:

25 years of distribution. The trading range is 1978/ 1982, 15M/10M.

2000 is an upthrust. 2016, upthrust after distribution.

If we cross the half line, 12.5M, the markdown might start :

depression.

Somewhere Henry Ford is rolling in his grave.

I’m very happy to live close to light rail and also have the ability to walk to 90% of everything I need and most of what I want.

The savings of not owning a car is immense.

For trips which aren’t walkable there are friends who will drive, I can take a bus, and there is always Uber/Lyft.

The speculators and the wealthy are the first to win and the last to lose. “Soft landing” = speculators carry on, the poor skip meals and live in tents.

‘Soft landing’ = Rich get to keep their gains on the poor.

“Department stores on track to irrelevancy.”

Walmart’s sales are up, Target’s are down.

Is Walmart a ‘department’ store?

Walmart and Target are “general merchandise stores”

Macy’s and Nordstrom are “department stores.”

Walmart US sales +8.2%

Target sales: +3.4% (not “down” but “up less than expected”)

Wolf – Do these numbers for W-M and T include e-sales or are they only for physical locations? Walmart has adapted more readily to an electronic economy.

On their earnings reports, total sales include all sales, brick-and-mortar plus ecommerce. Their ecommerce business is what’s growing.

Here, the report separates sales by location. So a Walmart brick and mortar store counts as “General Merchandise Store” sales. A Walmart ecommerce operation counts as ecommerce sale (“nonstore retail sales”).

The ecommerce sales here show the ecommerce sales by all retailers that sell online, including smaller operations, and including the sales at Walmart.com, Macy.com, etc.

Walmart’s ecommerce business is doing well. Macy’s is doing well too. So is Target’s. These are among the biggest ecommerce retailers in the US. That’s what is growing. They’re all chasing after Amazon and trying to defend their turf from Amazon.

I would argue that there are not any true “department stores” left….in the original mold of Sears Roebuck or Montgomery Ward. Both Macy’s and Nordstrom are giant clothing stores with a sideline in kitchen and other household soft goods.

The Sears where you could buy an new party outfit, a new toy for your child, a living room couch, a kitchen stove, a hammer and paint without leaving the store is long gone.

1) Just in time, after half a year, thousands of containers coming from

China, arrive AMZN.

2) After processing, each individual piece, a single piece/ or few, are shipped to million customers, within a day/ or hours, in boring envelops, or boxes. It’s AMZN dominate the world.

3) US is AMZN largest market. Millions of pcs are dumped at customer’s door, in an AMZN van, or US Post Service trucks, seven days a week, including Sundays. AMZN rule DC.

4) AMZN is an empire. The cost of singularity is high.

5) After reaching 188 in July 2021 AMZN was down to 86, last week.

And yet retail is not profitable for AMZN.

No slowdown in sight right now. Waiting on 8% 10Y yields after more Fed hikes !! Even if inflation is 10%, it will feel like I am making a real return on my $$$. Perception is reality….right ??

Even if inflation is 10%, no one buys everything that’s measured. Our spending pattern hasn’t changed (same food quality/quantity at grocery stores, same nights out, same gasoline, same clothes purchases, same housing) and we find we now have appreciably more disposable income as a result of the increase in interest rates.

We play the CD ladder game and waiting for a few “losers” to roll over (they’re brokered). And we never eat (spend) the seed corn.

Yes, we see it in the food stores. But just about everything else we buy is discretionary. Our medical is under control because we planned for it through buying premium insurance and establishing a medical spending account prior to retirement.

If someone has enough of an asset base, the increase in income from rising rates will more than offset the increase in expenses, if the basket of goods and services remains similar.

This still doesn’t change that most people are losing purchasing power even with higher yields. It’s just taking longer for their decreasing wealth to become noticeable.

More likely, the Fed will do a rug pull somwhere around April.

I’m also waiting for 8+% 10 yr yields. Or 16% 30 year yields like my parents were able to get in the early 1980’s. I’d be set for the rest of my life. Well, as long as inflation didn’t go to 50%.

I don’t think the Fed wants this. They will continue to suppress long term rates to get people out taking jobs to lower unemployment.

I think they will continue to raise short term rates to temporarily drain the enormous amount of cash out there into treasuries paying less than half inflation. ie inflation at 8%, 1 year treasuries at 4.5%, very liquid savings at 0.1%

If they raise long-term rates, I think there will be a mass job quit and unemployment will continue to drive up wages. If an older person has a million dollars in savings, putting it all into a guaranteed 16% 30 year Treasury would guarantee 160K/year for the next 30 years with no risk.

If I had a million, I’d take it. I missed out in 1980. My paper route money wasn’t enough to retire.

“If they raise long-term rates, I think there will be a mass job quit and unemployment will continue to drive up wages. If an older person has a million dollars in savings, putting it all into a guaranteed 16% 30 year Treasury would guarantee 160K/year for the next 30 years with no risk.”

You have it backwards. When interest rates “blow out” past the 1981 highs which is going to happen later regardless of what the FRB does or doesn’t do, asset markets will crash while unemployment will simultaneously be much higher.

Depending upon the individual’s personal circumstances, they might be able to do what you claim but any belief that there will be mass affluent prosperity to artificially lower unemployment is wishful thinking.

Demographics are irrelevant. No one gets to quit working just because they reach some arbitrary age. In the much poorer society that Americans will actually experience later, millions of currently affluent households will not be able to live as they plan while everyone else actually produces for them to consume.

That’s not going to happen.

Augustus,

16% rates on the 30 year is definitely wishful thinking.

if it comes close, I will take it. Even 10% on 500K savings would generate 50K/year for 30 years in passive income and would likely allow me to retire now. Of course, I’d be doomed if inflation went to 50%.

You are right, it is not age, retirement is a decision on passive income. 150K/year in a 30 year no-risk treasury would trigger many retirements. Likely at much lower ages. It would drive down the unemployment rate for 30 years so the Fed won’t do it. LT rates will not drop forcing many to go back to work driving down wage inflation.

In a world where peoples income or their real estate equity provides continued separation from increasing costs to these minor inconveniences, people will remain unconcerned about this nascent dollar devaluation, but that too will change.

If you have the means and you know

everything is going to cost more tomorrow, your purchase decisions are more easily made and you buy ahead of those future increase prices (nothing new here). On the other hand, this is just opposite from the deflationary times of Chinas start of the Tee Shirt or Button or “Whatever” City that cause the worlds and industry dis-employment and ruin. Those days are now and forever actuarially gone, just like Japan and Korea cycled through their manufacturing growth curve.

The Fed monetary policy never reconciled against that REAL force majeure, which was Chinas OVER SUPPLY of everything. Now today it looks like a lot of rich Western Nations (advanced economies) people looking around the deck of the Titanic talking as if everything is completely under control.

NPV of Net Asset Values = risk free debt + Inflation + Duration Term + Business Risk

We have a long long way to go to get that equation resolved. And NO one wants to go back to this equation and the true standard measure. In fact MOST working people never even existed in a time where economic rewards were directed to productive output, and why would anyone want to have this equation be the standard measure when economic rewards are so much easier to synthesize through the MAGIC of increasing the money supply in both Fiscal and Monetary orchestrations.

Bullard came out swinging today. From Reuters:

“…Bullard showed that using even ‘dovish’ assumptions, a basic monetary policy rule would require rates to rise to at least 5%, while stricter assumptions would recommend rates above 7%.”

If Bullard wasn’t so dovish not long ago, his bull$hit now may have been believable.

I’ve never liked the analogy that we are trying for a soft landing.

We will always be flying. I think the goal is to try to achieve a stable altitude along an optimal flight path.

I do like the analogy of the economy compared to an aircraft.

We are all flying somewhere with our savings and investments. We cannot land and sit still.

If the jet engines are primed and set to full throttle, we will climb. The Fed set the economy to full throttle during the last few years and we have climbed to altitudes never achieved before (Except maybe Icarus).

The aircraft is becoming unstable at these altitudes and are in the process of being launched into space with unlimited inflation.

It didn’t take much finesse or control by the Fed to increase everything to launch us into orbit or beyond. They gave the aircraft full throttle and unlimited jet fuel.

It will take finesse and control to stabilize the aircraft to return to a stable flight path. It will take massive supercomputers and not martini lunches to return to a stable path. Just like the computers contained in modern aircraft do during every normal flight with turbulence.

If the Fed takes us too low or too low too fast, the wings will likely fall off and there is no amount of supercomputer control that can fix a wingless aircraft. We will crash into a deep recession and be studied for centuries on what not to do.

Currently, we are throwing off the SPAC and Crypto gremlins that were fed with unlimited fuel off the wings. This is a good first step.

A 20% inflation, not uncommon can = Bad news/good news.

“Sales” ARE Improving!!”

Tons Price Sales Improved

115,000 $56.50 $6,497,500.00

110,111 $67.80 $7,465,525.80

(4,889) $968,025.80 <–Yippee!,… I guess.

Back to my corner.

It’s odd that a category called “Misc Retailers” is in the middle of the pack, typically that’s the last item used to group incidental leftovers. It’s time for the govt to carve out the largest group(s) from that. Wolf implies Cannibis stores might be a large piece. Is there any detail on what groups make up that category?

NAICS Code: 453998 All Other Miscellaneous Store Retailers (except Tobacco Stores)

https://www.naics.com/naics-code-description/

This U.S. industry comprises establishments primarily engaged in retailing specialized lines of merchandise (except motor vehicle and parts dealers; furniture and home furnishings stores; electronics and appliance stores; building material and garden equipment and supplies dealers; food and beverage stores; health and personal care stores; gasoline stations; clothing and clothing accessories stores; sporting goods, hobby, book and music stores; general merchandise stores; florists; office supplies, stationery, and gift stores; used merchandise stores; pet and pet supplies stores; art dealers; manufactured home (i.e., mobile home) dealers; and tobacco stores). This industry also includes establishments primarily engaged in retailing a general line of new and used merchandise on an auction basis (except electronic auctions).

Architectural supply stores

Art supply stores

Auction houses (general merchandise)

Batteries, except automotive, dealers

Beer making supply stores

Binocular stores

Cake decorating supply stores

Calendar shops

Candle shops

Cemetery memorial dealers (e.g., headstones, markers, vaults)

Closet organizer stores

Collectors’ items (e.g., autograph, card, coin, stamp) shops (except used rare items)

Electronic cigarette stores

Emergency preparedness supply stores

Fireworks shops (i.e., permanent location)

Flag and banner shops

Flower shops, artificial or dried

Home security equipment stores

Hot tub stores

Janitorial equipment and supplies stores

Marijuana stores, medical or recreational

Monument (i.e., burial marker) dealers

Police supply stores

Religious goods (except books) stores

Swimming pool supply stores

Trophy (including awards and plaques) shops

Wine making supply stores

If consumers are consumin’ at such a high pace, what is going on at the Port of LA? Is this activity not unusual heading into the holiday season? I’m confused.

Total import and export 20 ft container activity is down over 24% YOY. Here is a few year’s for comparison of Container movement through LA

October 2020 980,728

October 2021 902,643

October 2022 678,429

1. CONSUMPTION IS SHIFTING TO SERVICES FROM GOODS. Services are 2/3 of consumer spending. And consumers are blowing a ton of money on them. Services are generally NOT imported in containers.

This has been a theme that I have covered for a year. And it continues.

2. Consumers are spending more money on stuff that isn’t imported in containers, including vehicles.

3. Some of the container traffic has shifted to Texas and East Coast ports due the rail bottlenecks at various railyards. So check the container traffic at the Port of Houston terminals and up the East Coast. This started in 2021.

Drawing broad economic conclusions from some cherrypicked headline stuff can be really dumb, through ZH does it ALL THE TIME: