This inflation continues to dish up surprises.

By Wolf Richter for WOLF STREET.

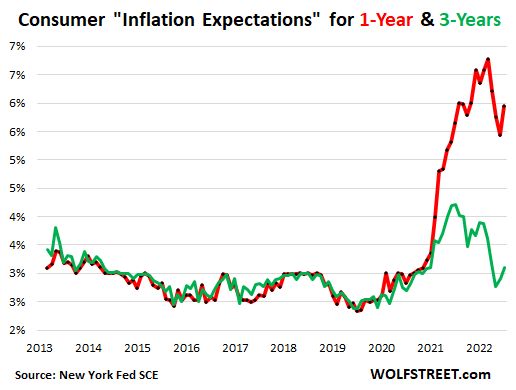

“Inflation expectations” are metrics the Fed watches closely. They feature prominently in the FOMC statements and in the minutes of FOMC meetings. Powell refers to them in every post-meeting press conference. The theory is that when inflation expectations remain “anchored,” even raging inflation will start settling down again; but when inflation expectations become “unanchored,” it’s a sign that the inflationary mindset is becoming entrenched in the decision-making process of consumers and businesses, and thereby is turning inflation into something with a life of its own.

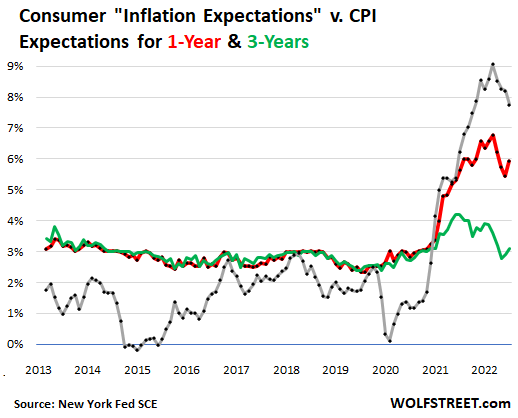

So here we go: Consumers’ median inflation expectations for one year out, after dropping three months in a row, jumped by 50 basis points, to 5.9% (red line), according to the New York Fed’s Survey of Consumer Expectations today. Inflation expectations for three years from now jumped to 3.1% (green line).

It’s interesting because there has been a lot of stuff in the media about inflation already coming down, that it peaked a few months ago, and there has been some stuff like that from the White House too, and this stuff is what consumers see on the internet or TV or whatever, and it worked for three months in a row as consumers’ inflation expectations fell for three months in a row.

And suddenly there’s a change of mind across the spectrum of inflation expectations, across age, education, and income groups, according to the New York Fed?

Inflation expectations may be a product of actual inflation as consumers see it in their day-to-day price observations, and of what they imagine might happen in the future that will impact prices, and of what they read or hear about it, including in the media. “Talking down” inflation is a time-honored practice among political figures and central bankers – calling this raging inflation “transitory” was a perfect example – though it seems not to work and instead makes political figures and central bankers look silly.

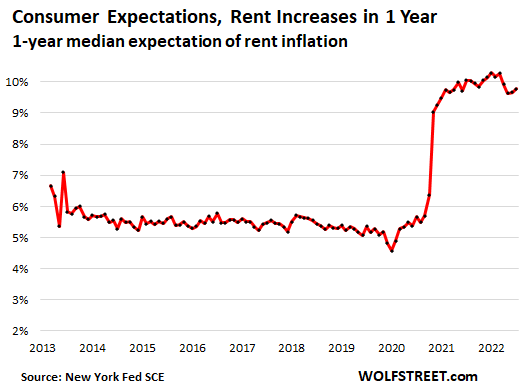

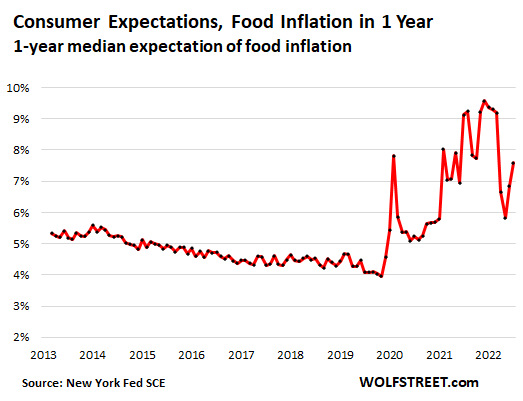

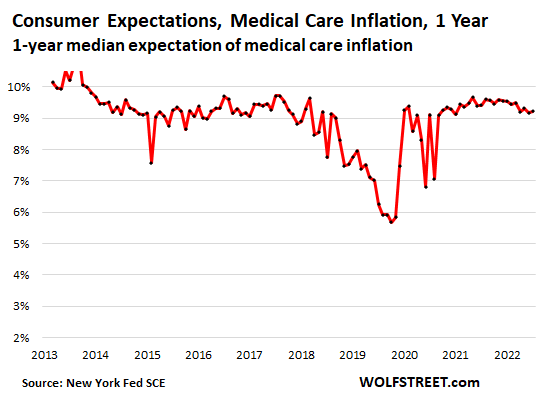

Inflation expectations by major category are much worse.

People expect much faster price increases where they actually spend most of their money – housing, food, gasoline, health care, and college education – than what they expect for the theoretical overall inflation rate.

These are the biggest categories in the basket of goods and services of the Consumer Price Index (CPI). Housing costs – derived from two rent measures – are the largest category, accounting for about one-third of overall CPI.

Expectations of rent inflation rise to near highs. Consumers expect that rents will increase a year from now by 9.8%, the second month in a row of increases, and roughly in the same astronomical range since the summer of 2021:

Expectations of food Inflation, after plunging, jumped again. In July and August, consumers expected to get a mini-break from food inflation. But that turned around in September, and in October, the median expectation of food price increases jumped for the second month in a row, to 7.6%:

Expectations of Medical Care inflation stuck at 9%-plus. Consumers expect that the cost of medical care will increase a year from now by 9.2%, roughly in the same high range since early 2021, and that’s where it also was in pre-pandemic years, a testimony to the ravenous nature of the US healthcare industry that is more and more dominated by huge companies – among the stocks with the biggest market cap – and private equity firms. Consumers can see what’s coming their way:

The New York Fed’s survey also tracks expectations of gasoline prices and college costs.

- Gasoline prices: +4.8% a year from now. Three months ago, consumers thought gasoline prices would be flat a year out.

- College education: +8.6%, in the same range since November 2021.

The Fed has got some work to do to re-anchor inflation expectations.

The idea is that consumer price inflation is in part a psychological phenomenon, that once consumers expect inflation in the future, they will adjust to it, and ask for raises and pay the higher prices – pay “whatever,” as I’ve come to call it – rather than refuse to buy at those prices and switch to a competitor or downgrade. And businesses, once the inflationary mindset kicks in, need to increase prices because they’re having to pay higher wages and higher input costs, and they know they can get away with price increases.

In that respect, the theory says that inflation expectations are a key factor in driving future inflation.

The chart below compares inflation expectations for one year out (red) and three years out (green) to the year-over-year CPI rate. You can see how inconvenient the current jump in inflation expectations is for watchers of inflation expectations, such as the Fed.

Also note that since the New York Fed started the survey 10 years ago, inflation expectations were roughly stable between 2.5% and 3.0%, and above the CPI rate. But when inflation took off in early 2021, inflation expectations fell behind. There is no historical data to compare this to prior periods of high inflation. But we can surmise from this chart – as we can from many other factors – that this inflation will dish up a lot of surprises still:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Inflation expectations have increased because fuel prices have increased. Regular is now >4.10/gal near us. Premium fuel is >$5/gal and diesel is near the nose-bleed section.

If we start drilling as we were doing pre Biden, we’d have lower inflation expectations. And lower actual inflation, despite all the money printing.

I paid $25 to fill up yesterday. For my lawnmower!

“Inflation expectations have increased because fuel prices have increased”

Nope, that’s not the reason… Read the article. The median expectation for price increases of gasoline one year out: +4.8%, lower than any others and lower than the overall inflation expectation. IT HELD DOWN INFLATION EXPECTATIONS

Wolf, I’m surprised that the Fed puts significant stock in consumers’ expectations. 1) The consumer mind is highly volatile, and runs with a serious recency bias. 2) With the bombardment of negative news from so many angles now, the typical consumer doesn’t know what the hell to think.

Maybe the Fed used to take it strongly into account and does less so now. Or maybe they just pretend to take it into account.

I can’t imagine the FOMC deciding to go 25 or 75 instead of 50 due to anything the consumer expectations #s say.

Good points all. The Fed’s inflation expectations measure is a pretty recent thing (starting only ten years ago). In some ways it seems a tool designed to give POLITICAL cover for the Fed doing whatever it wanted in terms of QE or QT.

-“Inflation expectations of the public are low so it is OK for the FED to expand money supply.”

-Inflation expectations of the public are low so it is OK for the FED to restrict money supply.”

In that sense this data run has outlived its usefulness. It is no longer providing the political cover that the Fed has used it for. But the danger is that once you begin to collect such data you have to KEEP collecting it or you look like you are monkeying with the results.

As you said… “I can’t imagine the FOMC deciding to go 25 or 75 instead of 50 due to anything the consumer expectations #s say.” No… they are going to do what they think necessary.

“Inflation Expectations Throw a Curveball”. Only to the misinformed. Inflation is headed for deflation! Look at demographics for crying out loud. Baby boomers hold the money and their deflationary. It’s only a matter of time this helicopter 🚁 money 💰 runs out and Inflation disapears like a fart in the wind.

This stuff is just too funny. I have seen this deflation BS all my life. And yet, we only had a handful of quarters with deflation during my life. Deflation is a rare occurrence in the US. And yet, these deflation mongers keep relentlessly spreading their BS.

Also you need to understand generations. They’re a flow that takes place over decades, not next year. Boomers are now between 56-76. The oldest boomers have a remaining life expectancy of 11 years, and the youngest boomers of 26 years. And the boomers are being replaced by the millennials, the biggest generation now alive. And the millennials are moving into their big earnings and spending years.

I think the Fed gives Joe Consumer too much credit for being able to project meaningful inflation expectations over a 12 to 36 months horizon.

Agreed. The Fed has some work to do to re-anchor inflation expectations, starting with a 101 class for Joe Consumer.

It’s like OER. Let’s stop surveying observationally and actually look at data and price changes of home.

It’s irrelevant if inflation expectations are accurate predictors. No one tracks them for that. That’s not the point of them. The point of tracking them is to see if consumers THINK that there is going to be a lot of inflation in the future, and if they THINK there will be, then they may change their behavior, adjust to it, ask for a bigger raise, agree to pay higher prices, etc., thereby enabling and fueling inflation with their behavior. This is what happens when inflation expectations become unanchored. That’s the theory, and that’s why central banks are watching it. No one gives a hoot whether inflation expectations are accurate or not.

Getting really tired of hearing this “drill more” red herring.

We are breaking records for oil extracted in the Permian basin this year, look it up. Exxon et al have hundreds maybe thousands of leases they can already drill, as well as already drilled wells they shut in during covid, that they haven’t reopened. Why? Because after years of fracking and oil majors barely scraping by or going bankrupt due to low oil prices, they’re finally making good profits again. Would you voluntarily decrease the price of your own product when you’re finally making good profits again after years of not doing that well? Eventually they might increase production more, but they have been bitten by this strategy before and are understandably hesitant to increase supply. Then account for likely global slowdown/recession due to variety of factors, and it would seem pretty dumb to spike production volume now.

This is inherently more a commercial/business decision than a policy based decision.

Wow, sounds like nationalization would be a solution to that issue. What do you say Orest ;)?

As you’ve written previously, this is a permanent loss of purchasing power. So what if it goes back to 2 percent. No one in power seems to pay any price.

Agreed…the powers that be treat leveling off as some sort of heroic triumph…but damage has already been wrought…and so long as Fed-land treats any *deflation* as evil incarnate, there is zero-effort made to undo the damage.

In fact, any deflation would be cursed by DCMSM as a Russkie plot.

That isn’t a triumph, it is a constrained disaster.

And the attitude it bespeaks makes it hard to believe that these “little” “inflationary fits” suit DC’s objectives (see engorged national debt) and interests (what DC buys with perpetual deficits).

That’s the thing, they raised prices on everything permanently. It was a despicable act. I made a horrible mistake not spending a bunch of money 2.5 years ago, having known that massive inflation was coming because of the mind-blowing printing they announced.

Now I’m in a weird spot where I’m sitting here wondering if I should just empty a bunch of my savings on things that I’ll need in a few years’ time because it will just be even more expensive then, perhaps MUCH more expensive.

When I see these articles talking about sending out “inflation checks” to “help” I am downright frightened by the stupidity and recklessness. We have a crop of politicians in power who are destroying the country.

DC-if you were around in the stagflationary late ’70’s-early 80’s you’ll recall folks doing just that while acquiring as much easy consumer credit as they could…

may we all find a better day.

Yup, and at that time it took 12%+ 30 year mortgages to trim inflation. Many small businesses could not borrow at any rate.

“We have a crop of politicians in power who are destroying the country.”

Destroying the country, on purpose…

Buy electronics they were the only thing to fall in price. That could easily reverse.

Are you suffering from analysis paralysis? What are you waiting for? Go buy! Should have done this 2-3 years ago. I did. I have laundry detergent, dishwasher soap, razorblades for sure, deodorant, aftershave. Everything I knew I would have to buy anyway, I stocked up years worth. Years ago. You don’t need to go prepper mad and get gas masks, night vision goggles or ammo, but what good is all this information here without acting on it?

DC

None of that is going to work in this stagflation environment. The best thing to do is to simplify your life, cut back your standard of living now before you are forced to, and control what you can control. I’ve done all the above. I’ve done it before, and don’t have any problem doing it again.

Exactly, Cut back slowly and under your own control. It can be very painful when done quickly and without planning.

Dollar’s Purchasing Power keeps going to heck in a straight line, denying wolfstreet dictum.

No drop in food prices here in the Naples, FL area – in fact, very steady and substantial price increases.

I stay in touch with local prices – any BS can be spun up by ‘Government’ statistics. We all know the drill by now.

The mass layoffs on the horizon should fix a lot of this.

That’s the hope. So far, from what I hear and from what I see online, those laid off from Twitter get dozens of recruiters a day contacting them, and sure they complain that those jobs are not as good as the job they had at Twitter, but tech jobs nevertheless.

Most tech companies have hiring freeze. Even top tier ones. Well the many top tiers are laying off – Meta, Amazon, Intel, Twitter, Salesforce etc. and almost all tech startups. I wonder who is hiring them.

On the other hand, while these layoffs are raging, real estate (specially multi family) is holding up pretty well.

Financials and energy companies are hiring. Might be a good time to snatch some talents they couldn’t get last 5 yrs

Smaller tech companies, automakers (they’re hiring furiously in their EV divisions), industrial companies, utilities… all the companies that had tried to hire tech workers and had been shoved aside by Big Tech. They’re breathing a sigh of relief now.

But a lot of the people who were laid off were in other parts of the US (WFH) or in other parts of the world. India has gotten hit hard by Twitter’s layoffs. 90% of Twitter’s employees in India were cut, and thousands of contractors. These are global companies, and we don’t know where all the laid-off people are – and maybe they don’t either :-]

“real estate (specially multi family) is holding up pretty well.”

Rents are drifting lower but yes so far are holding up pretty well, given the circumstances. Houses and condos not so much, prices are tanking as sales volume has collapsed. For example, pending sales in San Francisco -50%.

Agreeing with Butters: People forget that “tech” jobs include the throngs in the back offices of Citizens Bank, Fidelity, etc. shuffling copybooks around.

Wolf, in my super-hot Southeasten market (76% median sales price growth between Feb ‘19 and July ‘22) the opposite is happening. House prices are only down 6% percent so far. Inventory is up 21% YoY and due to the meager amount of sales weeks of supply has doubled YoY, but like I said, prices pretty steady so far.

In the meantime, I’ve been watching rents very closely. They have been dropping significantly although you can’t just look at asking rents. At prices units are actually being rented out (vs. units with still-ridiculous asking rents which are sitting vacant for weeks and months), the cost to rent has now dropped far below the cost to own. I would guesstimate that a unit which rents out at say $1,850 now has a total cost to own, with all expenses, of about $2,850/month (using a 30yr mortgage at 6.7% with 10% down). I have never seen such a huge discrepancy between rent and own (not only that, but during “normal” times it usually costs a bit more to rent than own, not the other way around). Note this is in the individual rental market, the lower asking rents seem to have only started affecting the big apartment complexes. I guess the bigger you are, the slower you react.

In any case, although like I said there has been very little downward price movement in this market and the buyer-seller standoff is still in effect, eventually something’s gotta give. People would be crazy to pay 50% more to own than rent. This is not a situation that I can see persisting over time.

10k at Amazon now, is this a one time thing or an ominous sign. second part is new jobs are retail/hospitality, basically 2nd jobs for lower tiered earners to keep up with inflation.

A local nursing home is incessantly advertising for all (non-medical) positions, highlighting “no experience necessary.”

10k right before the holiday shopping season seems a bit ominous to me.

Try the communication’$ industries.

Last I look veriZon and others are making bank.

-S

Inflation expectation might change if QQQ will make a lower low and

AAPL will fall < $128. Consumers start saying : f.u.

Green leaf sku # 4076 use to be 2.99/lb until three weeks ago. Then 4.99/lb

before 6.99/lb. It's down to 5.99/lb, because consumers said : no. Saying NO is a new trend unheard for decades. Pain is back.

Not sure where you are but all of the lettuce sku’s I’m familiar with in my neck of the woods have not made anywhere near those wild gyrations. Currently, #94075 (organic red) is 2.69, #4640 (romaine) is 2.99, #94640 (organic romaine) is 3.39, #94632 (organic butter) is 1.99. They’ve held fairly steady at those prices for weeks. I’m in the West, though, so it could be transportation costs if it’s higher where you are.

With mortgage rates having come down to the mid-6s%, this would be a good opportunity for the Fed to start selling MBSs (vs. just letting them roll off the balance sheet and missing its self-imposed ‘cap’ every month).

They announced today that they will sell $150 million of MBS spread over two operations on Nov 17 and Dec 8, as part of their routine “small value” operations that they use to keep their system prepared.

Even though these “small value operations” are routine, over the past years they were dominantly buy-operations; with some sale-operations thrown in. Suddenly we get two sale-operations and no buy operations. So maybe they’re testing the sale-operations a little more thoroughly in preparation.

I expect to read something in the minutes of the last meeting about potential MBS sales.

Good to know! Let’s hope they get the sales started. At the rate they’re currently moving, it’ll take ages for the MBS balance sheet to come down significantly.

I know he’s not a voting member, but I saw a Tweet from that filthy Kashkari clown of the MN FED which said “I wish we would have started raising rates sooner.” One of the first responses was “I wish you wouldn’t have printed over $4 Trillion dollars.”

People despise these rotten actors and are onto them. The hubris of this guy to talk about what he “wished” in hindsight, when it doesn’t square with what he was saying at that time, is almost unbelievable. They are doing way too little, way too late. There is no reason mortgage rates should have crashed like they just did.

What the FED is doing while slow-poking around is death by a thousand paper cuts to the people can least afford to navigate this storm. They are financially destroying them permanently. Most people, when they become destitute financially, never recover. It’s for life. Becoming destitute because of the necessities like food and shelter spiking is something that Jerome Powell and his buddies should have to ******BLANK******* for.

Ran out of FED adjectives? I’m disappointed…..

Wolf – I am curious – where and when does Fed announce 150M MBS sales like this? Thanks

I get this stuff in my inbox. But you can also see it here (AMBS = Agency MBS, which are the government backed MBS that the Fed has on its balance sheet).

https://www.newyorkfed.org/medialibrary/media/markets/ambs/AMBS-Schedule-111522.pdf

Nice catch captain!

I’m contributing, and very pleased.

-S

WWJD? What Would Jefferson Do?

The overwhelming majority of millennials lived through the 2008 Depression, err, I mean . . . Great Recession. Being kicked in the balls twice, now, with the 2023 Depression, err, I mean . . . Great Downturn. This should get the young in the streets like nothing we’ve seen since the late 1920s/1930s.

Explains all the gaslighting, btw. Welcome to the 4th Turning.

The kids will stay home and tweet waiting for their stimmies. Crypto or bust!

I think the word “recession” itself was invented to “gaslight the populace”.

They needed a different word for the next Fed caused depression – and came up with the “gaslight” word recession to again befuddle the masses.

Sure sounds like Bernie Sanders might be the “People’s Choice” in 2024!

There may be a lot less “wealth” to seize than the hard Left likes to fantasize about.

For instance, hasn’t anybody noticed that if you totally expropriated dem ebil Silicon Valley oligarchs today…you would be getting half of what you would have gotten a yr ago.

There is a lot of hot air and horsesh*t in wealth valuations/GDP estimates…but the Hard Left treats them as gospel to salivate over.

A lot of the time that depiction of practical reality is as accurate as Scrooge McDuck’s vault.

There may not be a lot of “wealth” to seize, but there is a lot of “wealth” to be viped out.

Say they did pull the new “currency” that other countries have done when inflation added to many digits to all coins and notes.

With a little catch that money as debt was not replaced with the new currency.

“Sure sounds like Bernie Sanders might be the “People’s Choice” in 2024!”

Right – the older the better for America ! Seems to be working well.

/S

All these events courtesy of the Federal Reserve and Wall Street…

Look at natural gas, bear market for years, then they threaten to outlaw the commodity and the price rises. Logical conclusion there was a manipulated market in these things, for a long time, and the fix came off. Assuming energy is a free market, what to make of that? Perhaps less volatility in pricing, everyone agrees prior to the rise in gasoline prices, they were artificially low. (How else do auto makers justify selling 700 hp cars?) Now they are probably going to find a new somewhat higher level, where price stability is important for the economy, and inflation expectations (which are always wrong)

Interesting, thanks. I have personally reached a point where saying “no f.u.” and looking for alternatives or diy silutions have become enjoyable. I spend less, and these are habits I intend to keep. I now realize how many things I used to automatically purchase, that I can easily do without, it’s liberating. Until my car breaks down and I need to spend on a big ticket item, I guess :(

I remember Joe Walsh and Welcome to the Club.

“Didn’t know the reason

You start to feel the rub

You know it isn’t easy

Well, welcome to the club…

Standin’ in the runway

Wavin’ at the plane

There goes everything

You own

-J

I keep noticing that I get smaller quantities in packaged goods, like rice or cereal or whatever. The CPI statisticians are supposed to account for that but I suspect a lot gets missed.

I’d been considering writing certain manufacturers to give them a piece of my mind about this, but I decided it’s just a waste of time. Can you imagine the landfill waste alone from this shrinkflation? I have to buy 2 and 3 packages of the same thing to get the old amount. I hate these people.

Anyone notice the 11.5oz beer?

Or the 14oz Haagen-Dazs “pint?”

My frozen burrito today was 2″ shorter than 3 months ago.

The result of inflation in my home has seen me go back to doing the family car oil and filter changes myself now and home brewing my own beer.

Inspired by the Fed, I’m going to start printing my own money…

In the crypto world, everyone is doing it. And so now they’re having lots of fun with it.

Yahhhh, good one.

Why bitcoin was invented and will thrive again after the carney shitcoins get flushed.

There can be unlimited copies of Bitcoin. It has already forked a few times. Bitcoins allure is the it was first to market and therefore has “brand recognition”. Other crypto like Litecoin and Bitcoin Cash are based on Bitcoin and proof of work unlike the ethereum based cryptocurrencies.

I’ve considered that but don’t have the room to house a brew vessel commensurate with my consumption.

Don’t forget waste oil can be easily sold to unfortunates who have to run a constant loss rear main or whatever. You can easily beat fast gas cheap 50 wt prices, and pick up some cash for your other efforts. Store it in a junk yard 30-50 gal drum. Go to local JC auto shop to find your sales contacts.

Asphalt is just thicker oil, anyway, and it’s spread well.

So much effort from the Fed to grotesquely overcomplicate what is ultimately a very simple concept… Inflation is entirely a monetary phenomenon.

Expectations are meaningless in the grand scheme. What matters is how many dollars are chasing goods and services. If too many dollars are left in circulation, inflation will stay hot until prices rise to meet the oversupply of dollars. Consumers can expect whatever they want, but they either have the dollars available to chase prices higher or they don’t. When they run low on dollars, prices will stabilize. If they run out of dollars, prices will fall.

Instead of just admitting that they printed way too much money and solving the problem by removing that surplus of dollars at an appropriate rate, the Fed’s army of PhD’s are tasked with finding ways to spin the simple reality of it all. They’ll use every distraction they have at their disposal to avoid hurting their masters (the banking industry) instead of simply making dollars sufficiently scarce.

totally agree with you . it is all about the printing money!!

It was on purpose in the first place.

Not Sure,

“Inflation is entirely a monetary phenomenon.”

That is PRECEISELY what inflation is NOT.

Just because someone said doesn’t mean it is.

A large portion of inflation (rising consumer prices) has to do with mass-psychology — the willingness to pay whatever; and with businesses’ confidence that they can get away with charging higher prices without losing sales. The inflationary mindset. I pointed at that phenomenon in early 2021, when used vehicle prices started spiking, as a source of this inflation. And this has been true every step along the way.

This is a chicken vs. egg kind of argument. I posit that nobody can pay whatever with cash that doesn’t exist. Extra cash has to be conjured into existence before anybody gets the luxury of forming an inflationary mindset.

It’s like when somebody comes on here claiming that the Ukraine war caused inflation and is greeted by a perfectly sound Wolf Richter rebuttal with a graph showing that inflation was already spiking months before the war started. The sequence is key.

If car prices started blowing up in late 2019, then I wouldn’t have much of an argument. But in real life, we printed trillions, and then we basically froze new car production, and THEN used car prices went nuts. People only pay outrageous prices if they either have the cash to do so, or they can come up with the cash to support the loan. Their mindset is irrelevant if cash is scarce enough that they can’t afford the outrageous price or can’t secure the loan. The inflationary mindset is a symptom of having plenty of cash available to pay whatever, not the cause. If you take somebody’s access to cash away, you kill their ability to chase a higher price.

I get that there have been periods of time where money printing didn’t immediately cause high inflation, but I have an honest question… Has there even been a period of high inflation not accompanied by aggressive money printing?

I simply explained this to a 13 year old who mows lawns, sells on line, knows monetary values and more.

He totally gets it!

Inflation is the over printing of currency.

Everyone aboard here knows this.

The absurd marketplace prices are the result of inflation not the cause.

Sorry I bored you Wooffer’s. Peace out as they say.

-K

NS,

nice commentary! Yeah broad and base money supply are key in to flush out as well, just like the enormous Reverse Repo facilities smoke and mirrors trick. So many factors involved and the sick consumerism credit — American Values – culture only adds fuel to the fire.

Inflation is more about psychology than currency in circulation although both matter. A few examples: if a company has “pricing power”, they will raise prices as high as they can until they hit a wall – when there’s a reduction in unit sales. If people want a coke bad enough, they’ll buy it, regardless of money in circulation. They may have to skimp elsewhere. Whether it’s a service or a product, the providers will charge whatever the market will bear.

Aside from the inflation we’re experiencing here, if you were in a poorer country, you might experience inflation due to external, global pressures and not have much to say about the increased cost of milk.

Supply shortages will drive up costs no matter what.

When George W. sent money to everyone to stimulate commerce after the attack of 9/11, there was no appreciable inflation. The inflation meme was not circulating.

Robert Shiller has argued this matter in several of his books. He’s considered a “behavioral economist” and sizes things up, about inflation, for example, using research and experimentation, so it’s better than “opinion” or rants from some of the commenters here.

Further: consider the aftermath of the 2008 financial collapse after the bursting of the housing bubble. To stimulate economies worldwide, the CBs dropped borrowing rates to zero. Yet the psychological shock and devaluation of real estate was so great, that the Fed had to go further, using QE to stimulate, then doubling down on QE. Indirectly it forced savers to seek higher returns through riskier assets. It took about 12 years to recover. Then, COVID again shocked the world, and we had a meltdown of commerce.

These were real and psychological shocks to the system. Yes, money was doled out, debt payments were suspended, and extreme measures were taken. Assets continued to soar. The FED was operating by the seat of their pants.

Bottom line, psychology and monetary infusions seemed to set-off serious inflation, and part of it was the slow reaction from the FED that caused today’s inflation. To believe that “inflation is everywhere and at all times a monetary phenomenon” is an exaggeration of what Friedman even said.

…reminds me of another old SNL silliness (nod to NBay).

A spoof-commercial couple were bickering over whether a certain consumer product was a dessert topping or a floor wax. The omniscient unseen announcer breaks in to say: “…stop arguing, you two! It’s BOTH!…”.

may we all find a better day.

HowNow,

I follow the luxury fashion markets. Prices are literally insane, so high, that the value is no longer there. Even the affluent consumer feels ripped off and has moved to “cheaper” brands or has dropped out. I can already see deflation happening. The luxury brands are now making smaller handbags at lower price points to capture that lost market, but the value still isn’t there.

Six years ago we left Florida over a $115 a month rent increase. We hit a brick wall on income and could no longer afford to stay. For us the value of Florida was no longer there. We don’t miss it. That’s the danger brands face when they price out their customers. The customers are forced to look elsewhere and may never come back.

This is a great debate and both arguments have merit!

My husband and I have bought and resold for many years. Right now, people are still flush with cash and it’s burning a hole in their pocket. Why not ride the wave while you can? We just sold an enclosed trailer this weekend and almost doubled our money. Not getting rich, but not a bad little profit either. Three years ago when we bought the trailer for personal use, we never would have dreamed it could bring that type of profit. And, in another year or two, maybe it wouldn’t.

The total number of dollars in the economy is just one variable. The velocity of money is also important. The velocity of money plays into the psychology of inflation if people are spending money as fast as they can because they anticipate future price increases. On the other hand, printing may not seem inflationary if it is offset by a declining velocity of money, which has been the case since the GFC. I’m sure the Fed is well aware (since I looked up the FRED chart) that although still historically low the velocity of M2 has been going up over the last year at the highest rate since the GFC.

Velocity is more a result than a cause. Somebody has to press the pedal for velocity to increase.

Why does there have to be a direct arrow from one cause to one effect? Complexity is about feedback loops, things that nudge in circles, often.

I guess you said that: “The velocity of money plays into the psychology of inflation if people are spending money as fast as they can because they anticipate future price increases.”

Yes, but you’re right in your previous comment and I didn’t spell it out clearly. I think the printing is the catalyst, but once the Fed started the inflation fire so to speak, the psychology of inflation can take over and overwhelm all but the most draconian attempts to rein it in by reducing the money supply. If you look at a historical chart of M2, it did go up significantly in the 1970s, but its a nice smooth line compared to the last few years. We had high inflation in the 1970s without nearly the same spike in M2, but the velocity was much higher at the time. If the velocity continues to increase now, it will offset QT to some degree I think.

M2 has stood the test of time extremely well….almost 100 years and still used everywhere.

Here’s an idea from the fiscal side that might help J Powell out in his inflation fight. I’ve found many in my circle of friends justify the historic Covid money printing as something, “we just had to do to avoid a collapse of our great country.” I always rebut this notion by stating the adult thing to do would be to pay for that money printing binge now with higher taxes until the Covid debt is paid off. I get no takers, or silence, every time even though it would crush some of the demand and, you know, be the right thing to do for those coming up behind us.

Cyclone, that has been exactly my position as well — ok, so we handed out dough, let’s make sure it’s all, ALL funded. If we had a balanced budget amendment, a wholllllllllle lot of this frivolous spending like PPP wouldn’t have happened.

Making the people pay back all the money they should have never gotten would be a good first step. Countries were never meant to run on the Robinhood principle. It promotes laziness and higher unemployment.

Yes, and if the Buffalo Bills would not have called a QB keeper on their own 1-yard line, they might have beaten the Vikings.

That’s great, so a heavy-handed government confiscating property would fix that heavy-handed government minting property from nothing?

Best case, I guess that would simply be called a tax increase? (Good luck with that in a democracy! Our Revolutionary war was about dodging taxes!)

Phenomena cannot simply be put into reverse, expecting they will be cleanly undone. The arrow of time keeps moving forward, on a path from whatever just happened. Lots of blockchainers and political reactionaries think we can just go back to the last fork and start fresh. Doesn’t work that way.

Phleep,

I agree with you on principle. Unlike the Revolutionary times though, we elected these politicians and re-elected them after they misspent tax revenue. Then, they misspent beyond the collected taxes by printing money. And it has accelerated, arguably, since 2000. It took 42 presidents through Clinton to accumulate about 5Tn in debt, but the 4 successor presidents (Biden included) have taken it to 31Tn.

Like it or not, we own this mess. Sadly, most Americans want nothing to do with the fallout. In addition to helping tamp down inflation, paying for Covid expenses (that most people received to some degree) with tax increases would hopefully wake folks up so they pay better attention to what is being done to us. Worth a try maybe. The current fiscal path is not registering with the average American.

I enjoy your comments – they’re always colorful and eloquent. And they seem to enclose chaos, gently, and give it a comfortable place to rest. An asylum.

Cyclone.

I believe a little research will show that Reagan is your OFFICIAL starting point for that particular game.

Give credit where credit is due.

Cyclone,

Maybe your friends would rather see money go to the masses where it may do some good, rather than the endless spending on destroying other countries that are not even a threat. Did you ever complain to your friends about all the money wasted on that?

I spent every penny of the stimulus money. I considered it a refund of my tax money. They can send me more of my tax money this year as well.

I know a guy with a small custom mfg biz. 40 plus employees. He tells me to retain or new hire he has to pay 10 to 20 percent more. To poach (as he is being poached) he has to pay 20 to 40 percent wage increase. Wages are second to cost of material. He says he can hardly wait for a recession

you wont have to wait very long. it is right around the corner!!

What recession? We’re now in a wage price spiral. Looks like he’ll be waiting a long, long time for his recession.

In the early 80s, it happened fairly quickly. But we needed a Volcker for that: going 60 MPH, shiftinto reverse and let out the clutch! And the world didn’t end, though unemployment soared for a little while.

And then he’ll have a lot less customers…

How about cutting Federal spending massively instead of taking money with higher taxes? Spending is clearly out of control. From where I sit there isn’t a revenue issue, there is a spending issue, and of course a massive problem with the Fed having suppressed rates for 14 years.

Tax rates are the lowest they have been since 1776.

Inflation is always and everywhere a monetary phenomenon.

~Milton Friedman

Nope. It’s a least in part a psychological phenomenon — the inflationary mindset, people’s willingness to pay whatever.

The bigger question is: What triggers that?

I didn’t mean to scoop you. I responded before I read all the comments.

Powell said that inflation was not a monetary phenomenon and get it horribly wrong.

Professor Steve Hanke who has a long history of helping countries set up new currencies after hyperinflation says there are other factors about inflation but that the amount of money created as can can be approximated by M2 is the dominant factor.

Hanke was able to predict inflation would be 6 – 9% and would stick around for at least 2 years at the very moment Powell was saying it’s transitory.

The inflationary damage was done once they juiced M2 an extra 40% or so.

Instead of letting the M2 run through the system over a couple of years he thinks the Fed is going to put us in severe recession with M2 now being negative. Two wrongs don’t make good policy.

Is professor Hanke correct to focus on M2 instead of inflation expectations? I think he probably is because of his education, experience, recent inflation predictions and being free from all the entanglements of being Fed chairman. Remember a central banker’s job includes telling us everything is going to be ok even in a systemic crisis.

That monetary phenomenon of money printing has been going on in Japan for 20 years, and there has been very little inflation. In the US, money printing went on for 14 years before we have this big inflation. The trigger is psychological. Something happens and suddenly the floodgates open.

I think the inflationary mindset can be as complicated as you make it.

If one isn’t in the marginalized category then there are choices. For many it’s about convenience & laziness and avoid making the sacrifices required. For some they’re just too busy too care.

Uncle Milty is hardly the best source for Econ definitions or theory…..he just represents some big money’s tragic big agenda, to say the least.

Wow, I barely got past your opening paragraph that describes a guiding principle of monetary management, “expectations”, whose signal suggests the complete opposite. Expectations up, the peak has been reached. Expectations down, more inflation.

The effect on society by inflation is much more of a second order derivative than a first derivative. The damage from inflation, progresses in stages from nominal income and wealth to poverty as a result of the discretionary rise of business prices currently being increased to joe lunch bucket.

Personally, first of all,I have a philosophical conflict with the whole reading the tea leaves science of ” expectations”.

Maybe the neighborhood that I grew up in was tougher than I remember.

I await the release of the PPI tomorrow morning which should place one more piece of the puzzle. Expectations are what got us into this mess.

3 month t-bill rate needs to rise substantially, if the Fed is counting on raising FFR even 50 basis points in December.

It will get there. Don’t worry. It always eventually gets there unless the Fed makes a surprise move, which it never does anymore.

Just a wide tails idea, the 3 month may have to rise to 9 pct, given the meager data history of the world economy infected with a pernicious financial virus. Inflation.

If the Fed considers a half point rise rather than a three quarter pct rise, under the halo of the 10 year speculative bull market,that carries on in accord with the premise of your article, expectations about what the Fed will do. I can’t help but think about that old phrase;

the tail wagging the dog.

I’ve been trying to figure out how to enable ads for your site using Firefox.

Being dumb, historically, has been proven beyond a shadow of a doubt. To, sometimes, be an asset.

I think the collapse of the crypto exchange, FTX, is emblematic of the QE era. Money for crooks.

When that happens, one should experience that sensation that the Federal Reserve has gone full on in the quest to create the inflation we are currently enjoying.

The people seem to be immured to the callous corruption that dominates our lives.

Wolf thoughts on workforce participation? Do you see inflation as a catalyst for people wanting to come back into the workforce?

Seems like the perfect storm to kick off a deep recession – people getting laid off while people need to come back to work after getting eaten by inflation…

A perfect storm can be a godsend. I’m skeptical that the deep recession will spread beyond the over-inflated financial sector and their MSM mouthpieces. I have the sense that what is about to happen will surprise everyone. As is the usual.

If people have been doing fine without a job for the past 2 1/2 years, they are not going to return to the workforce now.

My friend returned to workplace after 2 years hiatus.

He made money in 2020 and 2021 in stock market but lost in 2022.

He was forced to join back.

A lot of my friends in 2020 and 2021 thought they love doing day trading.

I meant they can live doing day trading.

With higher interest rates more people will retire earlier as they’ll finally be making serious money on CD’s. The wealth effect with higher interest rates will spike the inflation rate higher. The labour shortage will get much worse.

The real Tony

“finally be making serious money on CD’s”

??

With inflation at 7.7% the real rate is still negative 3.7%.

The actual rate is close to 10% or more. Ask any one on the main street and not the statisticians on Govt pay roll.

Even with a negative real inflation rate, an actual cashflow positive current return allows you to buy food and vacations. Some retirees don’t need to be concerned about a long timeframe.

Two hot dogs, two orders of small onion rings and a small Heath ice cream cup from DQ ran to just over 20 dollars yesterday. Inflation is way above 8% right now. We have a bunch of liars in the BLS.

You shouldn’t be eating this stuff at all LOL

Also, RTGDFA. This wasn’t about the BLS, or inflation figures from the BLS, this was about consumers’ expectations of future inflation.

And you got ripped off, Yancey Ward. Getting ripped off is not inflation.

Same story in the grocery store, Wolf. Are they ripping me off, too?

Should I be growing and raising my own food to avoid the ripoffs?

Beef and pork prices are coming back down, I noticed some time ago. High prices can cause people to buy something else, or stop buying these items, and demand vanishes, and prices come down. The way to defeat high prices is to go on buyers’ strike wherever possible.

Reductio ad absurdum. Last resort of verbally cornered morons. Although “look over here” is worse.

@NBay – No problem. You should just…

Oh, look, a squirrel!

Yancey W

You’re eating junk food! This may lead to larger than normal medical expenses down the road.

Stop eating that crap and then complaining about your food budget. We switched to a much healthier diet and our grocery budget hasn’t budged much from years ago before this inflation took off.

Doing your part to reduce health insurance for all. too.

So I commend the enjoyment of life, because there is nothing better for a person under the sun than to eat and drink and be glad. Then joy will accompany them in their toil all the days of the life God has given them under the sun.

And then there’s sex, drugs and rock-and-roll.

People always underestimate the inevitable. Biblical prophesy states “inflation will rage everywhere” and “not even gold will save you”. It looks like the entire world is on the cusp of hyperinflation.

Can one buy Biblical prophecy options? Long-dated, of course.

Reminds me of a fun book, “Dinosaur Derivatives.” How would you price that?

Yeah. What’s the spread on Rapture calls now?

I really can’t imagine a more useless poll question than “What are your expectations of inflation in the next year (or three)?”

First off, EVEN ON THIS BOARD, people’s idea of what causes “inflation” is all over the map. Monetary phenomena? Psychological phenomena? Oil-shock related? Supply-chain related?

Secondly, even if you could get everyone to agree on what causes inflation… I am not sure you could get them all to have the same idea of what inflation even is. Wolf’s readers may be a bit more sophisticated but to the average person, “Inflation is when prices go up.” I am not even sure they know the word for the opposite condition… so they are rather locked into a rising prices bias from the get-go.

Lastly, as Gattopardo said above, consumers think about things with a rather large “recency bias”… how things ARE going is how they will KEEP going. They are not alone in this… how many PhD’s does the Fed and the Administration have that thought inflation was “transitory”… a word I had never used in my life or heard used until the summer of 2021 when it became all the rage by these overeducated yahoos. They thought that because inflation had been tame for 40 years that it would keep doing so… and looked for explanations (that didn’t hold water) for why the price spikes everyone was seeing were “transitory.”

As I used to teach my Marketing students… it is hard to get good data out of polling. This seems to me to be an example of that. I am pretty sure that the same people who said that inflation would be MODEST going forward would not hesitate to ask for a pay raise… which defeats the whole purpose of the Fed polling “inflation expectations” at all.

As you know from “Marketing”, it’s nearly impossible to reach people’s “belief system” to influence their behavior, but the advertisers keep trying. A poll asking whether people feel one way or another is fairly stupid and blunt, but how much more sophisticated can you be to get some idea of what the lemmings are thinking? Many will run off a cliff together if an “influencer” gets a grip on them.

Just keep reminding your students that if they throw enough shit at the wall some of it will stick….don’t want to have them giving up and pursuing productive careers do you? No money in those nowadays.

LOL… You are closer to the truth than you know. There is an old saying in Marketing that goes like this…

“Half the money I spend on Advertising doesn’t work… But I don’t know which half.”

That “half” part is scary enough too me, I had hoped for a lot less.

Hmm, seems the market disagrees with you yet again.*

*I promise to show up again when/if the Fed kills this rally. But I’m not too worried anymore about that. I hope I’m wrong.

They agreed with it yesterday when this was published. Minutes after I posted the article, markets turned around and soon they tanked hard. Look at the charts from yesterday. LOL

Mister Market (thanks, Benjamin Graham) as a personification is basically torpid, unsure where he is going, then at turns bipolar. I don’t listen to him too much, especially as a verification or nullification of some silly theory of my own. I just check his mood. I just wait until he (erratically, but inevitably) tips into one of his either giddy or morose moods, and sell to him or buy from him, respectively.

“check his mood’

Like investor sentiments!?

Nothing is ‘real’ in the casinos run by Fed.

The power of ‘perception’ is under appreciated, when the rules of the ‘game’ is rigged since ’09.

QT is unashamedly on snail pace compared QEs . Mr. Mkt is calling Fed a bluff, again & again.

The power of perception back in force and indexes are zooming up b/c

“Futures Soar After PPI Misses Across The Board, Drops To Lowest In Over A Year As Service PPI Now Deflating”

(zh?)

There are cross currents on inflation/pause.

One Fomc DOVISH member says time to re consider the rate of increase another hawkish one claims the job is not yet done and rates increase should go on!

Front running everyday on the whisper of any news by the ecstatic hopium crowd. Pick your poison.

I’m reading the book “When Money Dies” again and have noticed many similarities between what the German, Austrian and Eastern European people went through in 1920 to 1923 and what is happening in the USA and the West right now. One thing that stands out is how most middle class people of that time didn’t know what was going on, or how or why it happened, and were pre-occupied with their own situation and declining standard of living. With all the information and data out there and easily available today there’s no excuse for the American People to be so duped and suckered into a similar conflagration.

Swamp Creature

Past is NOT prelude to future.

Checkout when was the last time the Global debt to GDP was more than 300%+ or that of USA over 130%+

We are in uncharted waters.

World stays at Mickey Mouse club Thursday from now on?

“Anything can happen day”.

As Mickey said on South Park, “I’ve been running things since the 50’s, in case you haven’t noticed”.

Inflation is actually kind of a misnomer. The best way to look at inflation is to look at Real Wages. The direction of real wages, and the length of time they have been trending is the true measure of what is happening in the economy.

Real wages have been falling now for 19 months.

When the majority of the workforce is taking a pay cut every month for 19 months, there is nothing positive about it. When it is happening simultaneously to their debt level rising substantially, then that is even more troubling. When you begin to see layoffs and entire industries struggling then you know the wheels are starting to come off the bus.

When there is no clear path to reverse these trends, then why would anyone with any ability to reason at all think things are going to get better going forward?