This chart is a warning for dip-buyers that think the bottom is in after each plunge. But the bottom isn’t in until the last dip-buyers get crushed.

By Wolf Richter for WOLF STREET.

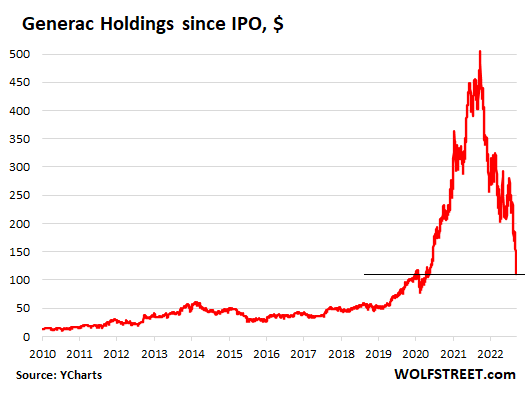

What’s interesting about Generac Holdings isn’t really what happened today, that the stock plunged 25% on another warning on earnings, revenue, and inventories, leaving the shares down by 79% from the peak of $524 on November 2, 2021; but that the shares multiplied by five from February 2020 through November 2021 in the first place, of which they’ve now given up all of it.

This is the kind of stock-market craziness that has been getting brutally unwound since that infamous February 2021 when the IPOs and SPACs started coming apart, and since November when tech started coming apart, and since January when nearly everything started coming apart.

The shape of this chart is similar to a gazillion charts in my Imploded Stocks collection: It demonstrates what went horribly wrong with the markets starting in the spring of 2020, after markets had already been inflated to ridiculous levels before then. And lots of people are now getting wrung out (data via YCharts)

The chart also demonstrates that dip-buyers that weren’t lightning-fast-enough to get out of the brief but violent rallies in time, got their heads handed to them over and over again. The dotcom bubble and dotcom bust served up lots of those kinds of charts, and folks got wiped out.

This type of chart should serve as a warning for dip-buyers that think the bottom is in after each plunge. The chart shows that the bottom is never in as long as dip-buyers are fishing for it.

Unlike some of the other outfits in my Imploded Stocks collection, this company makes real products –power generators including standby units for the residential market – and it has real revenues and profits. It has been around forever and went public via an IPO in 2010. Since 2017, revenues, aided by numerous acquisitions, roughly doubled to $3.7 billion in 2021.

But at the peak in November, the company had a market cap of $32 billion – nearly 9 times annual revenues, which is huge for any company and gigantic for a mature company that makes mundane products and that has grown through an endless series of acquisitions. The stock price was just insane.

And then on that day, on November 2, 2021, the company missed expectations on its earnings report, and that time, it used the pandemic-special excuse: supply chains. And the bloated stock price imploded by $100 in a week. Today the 25% plunge amounts to a drop of just $37.

Today, in its preliminary earnings report, it warned on revenues (up 15%, less than expected), and it slashed its guidance for Q3 net income to be down by 56% from a year earlier. The company warned about weakness in its residential product sales – consumers had bought all the generators they’d ever wanted, and now they’re flying to Europe or Las Vegas or going on cruises instead of buying generators.

And in a scary move, it warned about “higher field inventory levels and lower home standby generator orders from our channel partners than previously expected,” after Q2 inventory had already risen by 13.8% year-over-year, and after its Q1 inventory had risen by 13.4%.

So 11 months into this plunge now amounting to 79% of the stock price, and despite the ridiculous price spike of the shares until November 2 to holy-cow levels, and despite the serial warnings since then, 16 analysts of 22 still have a buy-rating on this stock, and only 5 have a hold rating, and none have an underweight or sell rating, according to WSJ data.

How much does a company’s stock have to drop before Wall Street analysts warn their investors with a sell-rating? -90%? This is on top of the constant hype and hoopla spread around the media and the internet. But then, anyone who still listens to it and makes investment decisions based on this hype and hoopla has it coming.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Generac Holdings Inc. is going from all time high of $524 to at least $80, which is October 2019 levels.

Its now $5 below its pre-pandemic levels set in early March 2020.

Its like catching a falling knife so the analyst ratings are just background noise.

The Fed can chalk this up as one of their successes as far as wiping away COVID gains. Just look at how AMD is near its February 2020 price level.

Get this, Shopify (the biggest Canadian stock in this bubble) trades at 10 x sales AFTER it crashed 85%.

The recent laudatory Forbes article on Generac should have come with a warning label. That is why I get all of my financial advice from this website.

But you do know who owns Forbes now?

“On August 26, 2021, Forbes announced their plans to go public via a merger with a special-purpose acquisition company called Magnum Opus Acquisition, and starting to trade at the New York Stock Exchange as FRBS.

In February 2022, it was announced that Cryptocurrency exchange Binance would acquire a $200 million stake in Forbes as a result of the SPAC floatation.”

Mike G,

Forbes’ SPAC merger was called off in August — after the implosion of just about every post-SPAC stock.

Ditto!

I know next to nothing about finance, but I believe this is the true “No Spin Zone”.

I agree! This site is the best.

Jim Cramer had recommended Generac a few months ago.

There is something wrong when a power generator stock crashes during hurricane season.

So how many more stocks will be just like this before the market actually bottoms ,and the indexes are off 80 to 90% from their ATH’s ? Most everyone probably believes that no way could that many stocks fall that much, to make entire indexes fall 80 to 90%.

We really have not seen much of a bear market yet in the indexes. Individual stocks, yes ! As Wolf always shows us.

That’s because many still think MSFT, AAPL, and the other big ones are a decent way to protect capital. But look at MSFT. Even after a large percentage drop starting last November, it STILL has a P/E of nearly 25, and that’s based on the inflated “earnings” from the last two years of printing and stimulus.

A 25 P/E is not appropriate for a mature company with reduced growth prospects unless you have ZIRP. Well, we no longer have ZIRP. It still has a long way to go.

The Fed Chairman indicated or hinted about asset inflation since 2008.

As far as price discovery, everything is chaotic as the market adjusts.

But I won’t be surprised if the Fed Funds rate peaks no more than 5.5% by next July and then is held steady.

I doubt they’ll have to raise it that much more.

They’ll try to bring us back to pre 2008 paradigm as far as interest rates and Federal Reserve balance sheet.

Microsoft and Apple were the last to top out (6-12 months after many others were in decline), and marked the top in the indices. Perhaps same on the downside.

The Shiller Cape ratio is still > 27 (long term average /median is around 15..16).

The Buffet indicator (market cap over annual GDP) is over 145% as of today (=market still “Significantly overvalued”).

The bottom is still far far away.. It may take several years to get there, but there is still a long way down to go.

@Sea Creature

Thanks for mentioning this as I was unaware. Unfortunately, having looked it up I have to contradict:

Buffet Indicator: “Fairly Valued”

Oct. 14th: “The current ratio of 151% is approximately 18% (or about 0.6 standard deviations) above the historical trend line, suggesting that the stock market is Fairly Valued relative to GDP.”

https://currentmarketvaluation.com/models/buffett-indicator.php

I just looked at four other presentations of the “Buffet Indicator” and they vary significantly in charting AND interpretation so…

Thanks for a wonderful article.

I liked this part: “How much does a company’s stock have to drop before Wall Street analysts warn their investors with a sell-rating? ”

If it was a good buy at $450, it’s gotta be a steal at $110!

Analysts: In a bull market you don’t need them, and in a bear market you don’t want them.

More seriously, you have to always keep in mind that it’s not actually their job to issue accurate recommendations. There’s a ton of grade inflation involved to avoid pissing off management and retain insider access.

The mess with the Generac valuation is another example of how the Fed’s reckless ZIRP and QE policies for the past decade (practically the past 4 decades, stretching back to Greenspan’s over-loose policies) have made accurate valuations and price discovery all but impossible, and all but ruined the equity markets and their basic purpose. Right now there is no true free market and there hasn’t been since at least the GFC, when too many central banks way overstepped their limited mandates (and above all price stability) and went whole-hog in fueling asset bubbles for the benefit of their ultra-rich cronies. This goes back many Fed chairs, though the one defense for JPow is that at least Powell did try to claw back some of the monetary looseness in 2018, until he was pressured to keep the ZIRP and QE faucet overflowing (another example of politics messing things up). The current inflation is a direct result of that blunder in 2018 and the compounding of it with the pandemic monetary looseness excesses.

“But at the peak in November, the company had a market cap of $32 billion – nearly 9 times annual revenues, which is huge for any company ” Yep, and that seems to be the pattern across the market. From Tesla to the otherwise “more reliable” FAANG’s, valuations and market caps are utterly detached from the reality of these company’s abilities to actually generate revenue, especially given how tapped out, leveraged and indebted American consumers are getting. The worst part of the Everything Bubble is that it’s even spread to essentials, and not just the housing bubble–education, healthcare, it’s all a mess, these equity market valuations are just tip of the iceberg.

Miller, you’re calling out the historical record of the Fed and the mistakes that were made. IMO, the fundamental mistake was the Fed’s inaction on the housing market after the relatively brief recession in the early 2000’s. Greenspan was a Republican who believed that the “free market” self-corrects and wanted to keep Fed involvement to a minimum.

Why they didn’t recognize the housing bubble that was forming (I’ve bitched about this several times before) nor did they rein-in the liar-lending practices and no-money-down (or worse: 120% loan origination for promised renovations) loans of the banks. One would have thought that the Fed was sufficiently chastised by the S & L debacle when they “deregulated” the S & L institutions. You’da thunk they would have been more vigilant of banking and mortgage company activity.

That laissez faire b.s. led up to the GFC in 2008 which blew out the financial system. So, in an effort to restore a functioning economy, and avoid a deflationary spiral, the Fed had to resort to ZIRP and then a few rounds of QE because their backs were against the wall.

Now, we’re just watching the FED as it keeps fumbling the football and getting penalties that will drive them back toward the one-yard-line, on the wrong side of the field.

I absolutely do not think this is the result of crony capitalism or intentions to help the wealthy get wealthier. I think it’s ideological and, to a great extent, an effort to bandage a festering wound. The festering wound is the shipping out of production overseas, and you can thank Sam Walton for much of that. By buying cheaply produced goods from China, American manufacturers either collapsed or moved production to foreign soil.

After watching these various “crises” come and go (S&L, dot.com, GFC, etc) and the Fed’s reaction to them I can no longer come to any other conclusion that these situations are manufactured for the sole purpose of creating these improbable condition vis a vis the money supply and that those on the inside make out like bandits because they know exactly what is coming.

You don’t even have to wear a lot of tinfoil to know that Greenspan knew damn good and well what was going on with mtgs and where it would end, and the same for most of the other situations. The old “who knew” act is getting pretty stale.

As Jim Grant concluded, the Fed are the firemen and also the arsonists.

“As Jim Grant concluded, the Fed are the firemen and also the arsonists.”

People have been shouting it for years, yet the FED is accountable to nobody. They do whatever they want. This is why we’re doomed. Until the FED can be neutered, the younger generations have no hope.

Even Wolf himself talks about not wanting markets to crash too quickly because then the FED will be back with more QE in spite of all of the evidence, like this particular thread, which shows what a miserable failure QE is for society. QE should be illegal.

I agree with a lot of what you say, but I don’t think there’s any reason to make this political. Sure Greenspan was Republican, but he was embraced (and appointed) by both parties. To the extent these monetary disasters have been ideological, elites in both parties have embraced the ideology. After all the “Committee to Save the World” on the cover of Time magazine when Long-Term Capital Management imploded was Greenspan, Rubin, and Summers. Two Democrats and a Republican on paper, but no substantive difference when it comes to policy. Remember Rubin moved to Citibank after he was Secretary of Treasury and profited handsomely from HB1 even though it led Citibank to insolvency and a massive government bailout. Rubin wasn’t clamoring about a bubble at the time. The policy errors, and there were many, for the most part seemed designed to increase the profits of the finance industry and the lucrative revolving door between government “service” and Wall Street. Why stop a bubble when all of your friends (from both parties) are getting rich? It’s better not to see the bubble, so no one on either side in a position to influence policy saw it. There were a few outliers that tried to sound warnings or limit the bailouts, such as Sheila Bair at FDIC I believe, but they were ignored.

7 months ago, the Fed was still doing QE, lest we forget.

I mean, they had to. They can’t decide to stop printing without giving the “markets” adequate notice! I mean, you can print $2 trillion in a week or two, because that’s an emergency, but you need to let your QT “percolate”

I bought the first break

I bought the second break

I was the third break

anonymous

Bitcoin remains the best bubble metric indicator. It is virtually worthless junk selling for $19k per inflated polythene airbag, before energy consumption costs and miner fees. I can’t compare it to a coin. Pop it and fill it with anything tangible, nuts and bolts, slices of cucumber etc, to increase its intrinsic value.

The bottom in stocks is not in. Use Bitcoin as a very friendly guide to that fact.

Most cryptos will be going to zero. They are worthless speculative digits relying upon the greater fool theory.

At my job I had a discussion about crypto, particularly dogecoin. When people started talking about all the money they made I knew that was the “shoeshine” moment.

What really surprised me was the sentiment of a good majority of the people who dabbled in stock/crypto and crowed about their gains in 401ks. My coworkers were so pumped and saw absolutely nothing amiss.

That stock is a poster child for Sornette’s Log Periodic Power Law principle.

It doesn’t always work, but it sure worked here.

To me, from the graph, if we follow the trend line, it looks like a fair price for this stock would be around $70, give or take.

More than doubled between mid ’19 and mid ‘2020, indicating that it is more likely worth about $20-30 IMHO.

Been OUT of the SM since mid 1980s exactly because of this kind of nonsense PK, after doing well from the mid ’50s with coaching from mentors.

BTW Wolf, how’s your short looking these days?

Haven’t seen you comment about it recently, and although I would love to short the entire mkt, I don’t dare because of all the secret manipulation that seems to have gotten MUCH worse the last few decades.

Have you seen any Dragon Kings this month, Pete? It’s October and witchcraft is just getting started.

Let the layoffs begin!

With so many stocks down so much, it is strange that layoffs are not that much and to top it off there is huge demand for labor.

Even with crypto being down so much, the whole industry (defi, etc) has not see much layoff, on the contrary there is quit a bit of hiring going in companies related to them (based on people I spoke to).

Strange times….

Sure stocks are down but “only” in relation to a massive spike that topped out last year, and many solid/profitable companies are still above or in-line with their pre-pandemic levels. I suspect that there are employers who would rather hold on to their employees for now, even if it takes a slice out of their insane record profits… Boomers and moms left the employment pool in big numbers, and good help is really hard to find. Do you let go of a good employee going into a downturn with the fear that they might be really hard to replace on the other side of that downturn? Some companies will have no choice but to lay off workers and we could see many zombie companies close their doors when they run out of runway, but good solid companies may take a profit hit and try to minimize layoffs. That sort of seems to be the plan for my employer.

Housing speculators left the labor force in droves. The housing price crash is what will end this labor shortage for good.

Generac makes real products. Their channel partners are presumably Home Depot and Lowes, who never leave much on the table for their vendors. Their residential whole house products have to be connected by locally licenced professionals and these are putatively in short supply. I wouldn’t buy a generator if I couldn’t get it hooked up promptly. In hurricane country, anecdotally residential generac has a reputation for temperamental automatic transfer function, but residential gensets are rarely serviced and maintained properly without a maintenance agreement. Generac is not in the league of Onan/Cummins, but their products are affordable and reasonable enough for situations not involving life safety. Lots of acquisitions and the tender mercies of HD and Lowes Purchasing, front office brought this weakness on.

Recently seeing a lot of Generac ads: ‘affluent family is sitting around when suddenly lights go off and lots of worried looks…then Generac to the rescue and everyone is blissful’

Because I’d never seen this kind of ad before I wondered if the grid of the viewing audience is so bad it needs backup.

Looked up cost to operate worked out to about 5$/ per hour not efficient

More anecdotal stuff …

My home backup generator dealer does NOT install any Generac products. He only does Kohler. Not sure why.

Perhaps better markups. Perhaps better products. Most likely is his familiarity with the product line.

Whenever we have an issue he either walks me through the solution over the phone or he comes out in person to resolve it.

I think more important than the ‘brand’ is the service guy.

DISCLAIMER: I don’t directly own stock in ANY generator company. One of my mutual funds might do so, but I haven’t bothered checking.

One of Generac’s acquisitions was DR, maker of various outdoor equipment. I purchased a self-powered field and brush mower two years ago and workmanship was lacking. For example, wheel axles and pivots are supposed to be greased via zerk fittings. Three of the wheels arrived without the fittings and the forth did not have a hole to install one. Also, one of the bolts that hold the cutting blade drive pulley mechanism in position was missing. Had I not been minimally handy, warranty work would require transportation of the mower in a vehicle capable of hauling the bulky mower, to a certified repair shop two hours away, where it might or might not have been repaired. There were what I consider to be design flaws, such as omission of a satisfactory means of attaching the idler pulley tension spring — a punched out section of the cowling was hole drilled for attaching the spring, leaving a sharp edge that cut through the spring in short order. Following two broken springs within eight hours of operation, an eye bolt was substituted for the offending piece, that has worked well. Lastly, when I added a missive on the product comments page it disappeared shortly thereafter. It appears many of the employees are unhappy with the new owners.

“Home Depot and Lowes, who never leave much on the table for their vendors.”

So it is, the retail monopolies along with Amazon and Walmart. They squeeze the supplier butts every chance they get for more profit for themselves. Downsize, cheapen the quality, anything, just lower the price to daddy.

Suppliers and manufacturers went through this for years when Sears ruled the roost. There were still lots of small-town retailers back then, but now there is no choice except corporate owned and controlled.

Generac makes industrial products

In fact, they got into the residential game when they acquired B&S’s home generator business about 20 years ago IIRR.

Wolf (sorry, in advance, for the lengthy comment.)

Nice!

As a green-pea (I worked for a Ford dealer too ;)) to the site I have only seen a few of these types of articles, so far, that provide the reader with an opportunity to put their detective caps on and try to get a better understanding about WTF is going on in the stock market. I’m sure there are more in your library that I’ll read as time allows.

Real quick – before I give my theory about this, just a quick response to:

“How much does a company’s stock have to drop before Wall Street analysts warn their investors with a sell-rating? -90%?”

As soon as they close their short position and go net-long? Maybe?

(Off the top of my head, feel free to correct) Goldman (or was it Chase?), who underwrote the Coinbase IPO, never issued a sell either, as it plunged about 84% to its low in May – just over a year later. As much as I despise wrong-sided analysts, they do provide great entertainment.

That’s my huff-and puff.

As Feb 2020, may have served as the genesis to this market madness (if I may), when I study the charts, it appears as the catapult into “the wazoo” began in Nov & Dec 2020. Most likely the direct result of the PPP money flowing in, which also provided the collateral needed to leverage “out the wazoo”. I speculate that Collateral is one of the main reasons behind these stock implosions.

Chinese military securities were made worthless via Executive Order days prior to the Jan GME run along with the other Feb 2021. Coincidence? The EO was extended to May 27th and those securities regained their value. On June 2nd, 2021 AMC runs after it began to get hot on May 27th – the day the EO wiped out the value of the same Chinese Military securities. Still a coincidence? The EO was extended again until June 2022. Nothing out of the ordinary seemed to happen in the Lit markets this time so apparently the holders of this garbage were finally able to repackage it and either dump it into ETF’s, Pensions, etc., or toss it around in dark pools like a hot potato. Who knows?

Bitcoin, as it turns outs, seems to be quite the vehicle for collateral, pump and dumps (maybe to meet margin calls?), and perhaps a secret piggy bank for HF’s? It certainly isn’t the inflation hedge it was sold to be. Digital gold? Yes! It seems to be manipulated and just as ineffective as physical gold against inflation – for now. I do think physical gold will have its day again. Bitcoin? I don’t think so.

Blue chip stocks. Finance journalists love to list the top 5 stock positions of major Hedge Funds, Institutions, and high-profile traders. Surely, due to the high-altitude returns, that their clients are paying for, and not to serve as a backstop to their OTC contracts.

Evergrande and other Chinese real estate companies. Foreign investors haven’t received a penny on their corporate bond coupons and yet only one of these investors (that I know of) is talking about it. Obviously, these investors prefer the loss of interest payments on their coupons over the companies going into default or BK. Bonds worth pennies, on the market, but worth Par Value as collateral?

With Generac, the triple top with bull trap looked like a good sign to sell at the time. Drop a Fib Retracement, on the daily chart, and the sell-off is almost in perfect harmony. With so many companies following suit, there has to be an underlying issue driving all these implosions. The overwhelming numbers show a pattern, not coincidences, and the money it would take for all these implosions to occur would far exceed the stimulus money that individuals received, right? Pesky retail investors.

Articles like these and the one Wisdom Seeker published the other day can provide a spark for discussion, further analytics, different POV’s, etc., as we try to make a few more bucks on our investments and maybe, just maybe, find that elusive market deficiency that can bring in that 4 digit return one may puff their chest out to.

Thanks for reading. Hopefully not too much BS in here. Just my understanding and concerns, based on what’s out there, as I try to put this jigsaw puzzle together.

Welcome to the site, and glad you liked my article the other day. Looking forward to more discussions!

And banks want to keep investing in a communist country,that is hell bent on destroying capitalism.We should band together and quit paying coupons to them .But we’re to stupid

As I see this type of mindless unwarranted speculation in ordinary manufacturing stocks, I am persuaded that housing was subject to the same forces.

If the housing market were as liquid as the stock market, I think housing prices would have already dropped 25% the past six months. The conditions were there for such a drop, but the actual price adjustment is lagging due to the cost and slowness of transactions.

I think home builder stocks prices are a fairly good market-based reference point for the direction of future home prices, and those stocks are all down 25% to 50%.

Wolf, GNRC is a bad example for your imploded stocks list b/c they are very viable/profitable. I’m losing ~50% on a .5% sized position, but I’ll likely buy more when it starts showing a bottoming pattern.

A 9 month waiting period to purchase a generator for residential use. For example, I’ve heard one saying they ordered a $22,000 whole house generator in February, estimated arrival time is November. Not shipped yet as of yesterday. The installer says that liquid cooled ones have a 9-month backlog.

It seems the gating factor is installation capacity. Which basically means electricians. Installing a generator requires a qualified electrician. So does installing solar panels and/or solar battery. A lot of business for electricians nowadays.

here is another account:

I contacted Generac via their internet link in early July, 2022. I received the names of 2 authorized distributors and 2 authorized installers (independent electricians).

I contacted all 4. The 2 authorized installers stated that they were too busy and in addition the lead time to get a Generac unit was too long. They both recommended one of the authorized distributors.

The 2 distributors were booked with installations and estimates and could not do a site visit until early September. They both came out in early September and I received their estimates the 2nd week of September. The lowest bidder demanded the entire cost up front and did not accept credit card payments (thereby eliminating any recourse in the event of contractor default).

I then negotiated with the other authorized distributor (who happened to be the one recommended by the 2 electricians) and received preventative and required maintenance at no extra charge which brought his quote even with the low bidder. The installation of a our 24kW standby generator is scheduled for the first week of November.

Background: I live just north of Albuquerque NM. Our electric utility PNM was forced to shut down the coal fired San Juan Generating Station (565 MW) per the state initiative to be totally green by 2030. In addition, PNM did not renew their 140MW lease with the Palo Verde nuclear plant in nearby Arizona. PNM expects to make-up this shortfall of over 30% of their peak summer load with solar and wind.

Dream on!

I am a retired electric utility engineer and project manager with over 40 years’ experience. I predict the demand for standby generators in New Mexico will spike in NM during the summer of 2023.

By the way, both authorized distributors mentioned that a majority of their customers have solar panels and are looking for a backup source of power in the event the grid goes down. The cost of a standby generator is about 50% less than a storage battery.

Isaac S: good comment, thx for educating us.

My story with Generac: A few years back I bought a used 15Kw Generac with about 2000 hrs on it. It was a trade-in on a new unit. Bought it from a Generac dealer/installer/maintainer.

Bought from Generac a new transfer switch to connect the generator to the house wiring.

Did the install myself. Wiring, propane line, replaced gas regulator, masonry pad for generator. Technically, it was a piece of cake. Passed county inspection first try.

Generator works great. No issues with transfer timing or reliability.

Cash outlay: generator: $750. Transfer switch: $650. Wire, electrical boxes, breakers, gas line, new regulator, another $600. Total about $2k.

Effort: About 2 weeks solid work, most of which was on the masonry pad-site (which is on a hill, stair-stepped, also houses air-conditioner compressor. Generator wiring and gas line work was about 3 days.

wow! that was a hell of a deal you got/made yourself there, esp. lucky you did it pre-COVID. Do you have any warranty on that trade-in? or is it void anyhow b/c you installed yourself?

I actually think Generac is a good example of an imploded stock.

There is no reason why a manufacturing company stock price should rise like it did, given the lack of intellectual property value and story that goes along with it. In terms of story value, it is not in the same league as Tesla and other ARKK companies that saw massive expectations growth.

Generac may be profitable, but that profitability will not grow at anything other than normal rates in the long-term. There is no home-run potential, so valuation will be kept in check for decades after this latest speculative bust.

I view Generac as a pre-pandemic stock that, like Peleton, saw a brief once-in-a-lifetime sales spurt that will never recur, for good reason.

re “There is no reason why a manufacturing company stock price should rise like it did, given the lack of intellectual property value and story that goes along with it. ”

I believe you are wrong about that in general. ENPH proves my point. They’ve surpassed COVID highs, and their (price) growth seem unstoppable, esp. as they expand globally. Yet, they have practically no IP. BTW, GNRC is starting to make competitive inverters to ENPH’s, so I’m hoping that starts to give GNRC some valuation boost over time, as solar takes more share in the US.

Great comment. I hope you’ll keep us updated on the grid situation in NM.

A great company with a viable business and strong prospects can still have a screwed-up stock chart.

Just ask Cisco or Amazon or Apple from days gone by. Or, for that matter, the entire oil industry from just a few years ago.

And no doubt “the transition” to an electric economy is going to have a lot of hiccups and natural-disaster events where generators will be valued. Just ask Texas after the Big Freeze.

GNRC, the stock, will get another turn to grow after value is restored relative to legitimate earnings prospects and interest rates.

Generac is a good company with good business/profit and would stay for quite some time.

But the stock is altogether a different story.

This story tells the impact of cheap money brought in by FED’s recklessness.

Isaac S,

It’s a perfect example for my Imploded Stocks, which track the total utter craziness that markets had reached in 2020 and 2021, and what came of it. There are already some big names in it. Meta is on the verge of being in it after the 4% drop afterhours today. The SPAC & IPO crazies were just the first to let go in the spring of 2021.

To get into it, the stock has to drop 70% from the recent high.

OK, well I do get your point, and I think 70% drop generally represents a fall from COVID fiat helicopter money induced heights. However, like all single threshold rules it does work for all companies. For example, AMD and NVDA (both I own) are nearly down 70% (each ~65%). However, unlike META their prospects (esp. AMD) should easily return to prior highs soon after the coming recession. AMD only has a PEG of .6 now. In normal markets, a PEG of 2 for a hot, high growth stock is normal. So, that is a 70% PEG valuation drop from a normal valuation level which AMD had pre-COVID. See what I mean? That is not an imploded stock, in my book, but a falling (imploded) market tide that takes down the valuation of all yachts. When valuations normalize to pre-COVID levels, AMD will return to prior highs.

that said, I’m not expecting GNRC to return to prior COVID highs b/c people are not locked up in there homes anymore. But, I do expect it will double from current levels post recession.

I can sympathize with your situation. My 16kw Generac is powered by propane which requires one or more tanks and a contract with a supplier. Unless one has other substantial uses for the propane, the supplier charges equipment rental fees for the tanks and regulators. We had the resources so purchased two 125 gallon tanks outright and shop for propane when a fill is needed.

Empire has to sell its debt. The whole asset market stocks,bonds,housing and anything and everything that was rolling around in the free money liquidity mud hole will get washed off under the QT water hose in order to sell the Empires debt. Apple selling a hyped up over priced phone with overnight waits in long lines to get it ain’t in the cards. Buy a treasury and take a nap or have a cash cache. Party is over. Class C shares are for gambling. It’s fun to do with money you don’t need. You own nothing with Class C shares.

Yes, stock is a residual claim after debts are paid. How can that work with this massive debt overhang? Absent a Fed capitulation –yikes!

Another possible scenario is like the transition into the early 1980s, when stocks finally fell enough, and the raiders showed up. Being, as you note Dr D, folks with cash. Oil was cheaper on Wall Street than in the ground.

I foresee tons of asset sales. And alas, deeper inequality, as the middle class model of family wealth building (and their capital buffers with it) get stalled or bottom out, for many. Worst case: post-USSR dynamics: fire sales to oligarchs. I don’t think we’ll get there. Just a thought-experiment.

The thing that keeps me away from the stock market is that I dont think the true ramifications of a housing bubble burst have been factored in. The most highly overvalued stocks have plunged, but what about the overvalued homes?

We still have a ton of debt out there propping up asset values. As Wolf keeps saying, interest rates still need to go higher and yet, housing prices have only barely fallen. It is a market that takes a long time to go from top to bottom.

What if this time the Fed cant lower interest rates for at least a couple years? What if home prices need to decline by 50% to be affordable and we have a full-blown recession at the same time? What price will stocks sell for in that environment?

What are Ichan and Cohen doing?

My brother in law lives in North Carolina and has lengthly power outages every year it seems. He has a Generac and loves it. He has a maintenance

agreement and it is serviced regulairly. What I have noticed is that for many years Generac had the market to themselves with little competition. Now is seems like everyone is selling standby power generators.

Two words: Voodoo Economics

Love your user name

No new taxes: read my lips.

Forget US companies, buy Japanese companies.

Better quality, better balance sheets, real products, and on sale with the yen falling.

Just pick a decent buy point and if afraid of further yen weakness hedge.

Japanese companies will be a better buy over then next ten years than US companies.

Maybe a big enough bear-market rally would suck the punters back in, and suck all this phony money out of their pockets. They seem not to have fully regained sanity on asset prices yet. I guess they like to look at book value and feel good.

In the recent phase of relative optimism (early-mid August) I accumulated some VIXY. As of the close today it is up 22.6%. I am still awaiting a more spooky day to cash it in.

Gas generator’s are OLD technologies now. They might as well be making whale oil lamps and candles.

The new solar and battery technology is miles ahead in many ways. There are several videos of people who rode out the recent hurricane Ian where their neighborhood was without grid power for 8+ days but because they had solar and Tesla’s batteries, in was normal living for them. Central air, electric water heater, electric stove, etc. Not only that they could charge their Tesla car at home. No worrying about gas lines and all that hassle.

And it’s less money that those old noisy, high maintenance, air polluting, gas clunkers.

Was even better, they can live like that permanently. They don’t really need the grid. That’s progress. I can’t wait until old gas guzzler technology is finally illegal.

Can’t agree here. I looked at Tesla batteries to go with my solar panels and the batteries have 13.5Kwh of capacity. My home uses ave 25kwh on a hot day plus charging electric car, so there is only 12 hours of power, not 8 days, without sunshine to recharge the battery. Maybe in a decade, but not now.

Generac stock seems to be a victim of hype, but home generators do play an important role in my area. We have a number of retirement communities in town where home generators are very popular. It is really a matter of life safety for seniors with health problems and various medical contraptions which use electric to help them stay alive. Even air conditioning becomes a critical necessity for many old people and so when the electric goes out, they panic. I, myself am comfortable with the way this game ends, but the thought of flopping around on the floor of a sweltering hot house, like some fish out of water who is gasping in the hot air… Well… lets just say there are better ways to go. So I understand why they want generators. One less thing to worry about.