Underlying pension fund issues can now be dealt with in an orderly fashion.

By Wolf Richter for WOLF STREET.

Bank of England Deputy Governor for financial stability Jon Cunliffe, in a letter to UK Parliament on Wednesday, confirmed that the BOE had stepped into the UK government bond market last week to stop a panic that had turned into a self-propagating death spiral, that was threatening to blow up £1 trillion in gilts-based derivatives that pension funds were using to achieve their investment goals.

Panics can be triggered when someone cries “fire” in a crowded theater. In this case, the panic the UK government bond market was triggered by the new government’s ill-conceived series of announcements over a two-week period, culminating with the release of the official plan on Friday September 23, topped off with comments by finance minister Kwasi Kwarteng on Sunday, September 25. They detailed tax cuts for corporations and the wealthy that would have to be funded by large amounts of new debt, just when interest rates were already rising in response to inflation that had hit 10% and had become the number one economic problem that would have to be delt with by pushing up interest rates further.

The bond market rebelled against the new government’s debt-doesn’t-matter policies in this environment by selling bonds and driving up yields. And suddenly debt mattered.

And the whole thing took on a life of its own. The plunging prices of long-dated gilts – their yields spiked – caused investment banks to send out margin calls to defined-benefit pension funds that had used £1 trillion in “liability driven investment” (LDI) funds. These are derivatives based on long-dated gilts. The pension funds then had to sell gilts into the already panicky market, to meet those margin calls, which caused gilt prices to fall further, which caused further margin calls, etc., hence the death spiral.

Cunliffe, in a letter sent to Treasury Select Committee chairman Mel Stride, told UK Parliament that the BOE had first fielded concerns on Friday, September 23, when the mini-budget with the tax-cut announcement was released, and when yields spiked violently.

On the evening of September 27, after the 30-year gilt yield spiked by 67 basis points during the day, following the spikes of prior days, LDIs warned the BOE that the funds might fail, Cunliffe said.

“Measured over a four day period, the increase in 30 year gilt yields was more than twice as large as the largest move since 2000, which occurred during the ‘dash for cash’ in 2020,” he said.

“It was more than three times larger than any other historical move. Gilt market functioning was severely stretched, particularly at the long end of the curve,” he said.

“The Bank was informed by a number of LDI fund managers that, at the prevailing yields, multiple LDI funds were likely to fall into negative net asset value. As a result, it was likely that these funds would have to begin the process of winding up the following morning,” Cunliffe wrote.

“In that eventuality, a large quantity of gilts, held as collateral by banks that had lent to these LDI funds, was likely to be sold on the market, driving a potentially self-reinforcing spiral and threatening severe disruption of core funding markets and consequent widespread financial instability,” he wrote, reported by MarketWatch.

BOE staff worked during the night on Tuesday, September 27, to design an intervention by the BOE that would avert the crisis, in “close communication” with the U.K. Treasury.

Following the announcement of the BOE intervention plans on Wednesday, September 28, at 11 am local time, the 30-year gilt yield plunged by over 100 basis points.

“Had the Bank not intervened on Wednesday 28 September, a large number of pooled LDI funds would have been left with negative net asset value and would have faced shortfalls in the collateral posted to banking counterparties. [Defined benefit] pension fund investments in those pooled LDI funds would be worth zero,” said Cunliffe.

“This would have resulted in even more severely disrupted core gilt market functioning, which in turn may have led to an excessive and sudden tightening of financing conditions for the real economy,” said Cunliffe.

The risks of leverage from LDI funds had been considered by the BOE before the panic, he said, but the repricing ahead of the BOE’s intervention “far exceeded historical moves.” If gilt yields had risen more slowly, pension funds could have unwound their portfolios in an orderly fashion, without triggering the death spiral.

So the panic has settled down. This wasn’t a “pivot” to QE, but a brief intervention to halt a death spiral, and it did that effectively.

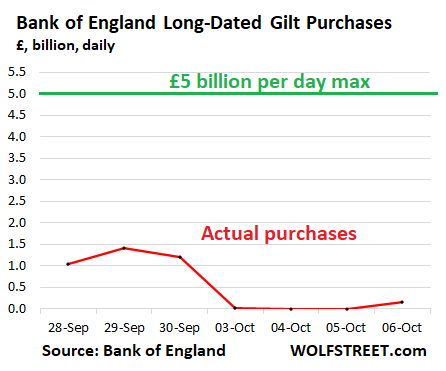

The BOE plans to end the program on October 14, as initially announced. The BOE has purchased only £3.66 billion in bonds since the program started last Wednesday, with only £22 million purchased on Monday, zero on Tuesday and Wednesday, and £154 million today, after it purchased only £1.2 billion per day on average last week – far below the up to £5 billion per day amount that the BOE had initially announced. And the BOE is still planning to start QT by selling gilts on October 31. So far, this was a highly effective way to stem a panic that had taken on a life of its own, without actually buying much:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The BoE found itself held hostage to the momentum and world it had created. The only tool in hand was a pivot: a relapse into the drug that was the problem. That is a sad potential for the USA as well, though we are not as parochial and small.

That said, maybe this contains the problem.Or maybe it is a tremor of more things to come. I recall 2007, the first rumblings, a few funds blew up. The real fireworks were months later.

can’t wait to see Italy’s new premier do her thing

and response her EU masters have for her

one way or another she’s gonna take them to wood shed

I don’t think she has a lot of room to maneuver on economic matters. The E.U. has been and still is being very generous to Italy . . . This might be of necessity, but given money is still given money regardless of the degree the donor is coerced.

Italy would have defaulted already, maybe more than once over the last 15 years, if it weren’t stuck with a relatively strong shared currency (feel free to put emphasis on the word “relatively” but from Italy’s perspective the Euro is very strong).

Expect her to make noise on social policy and, perhaps, if her allies in government get their way, on foreign policy.

Agreed! This whole thing stinks like rotten milk and the lid might be about to blow. Everything feels like Jenga and all stats for months have referenced 2008. Just coincidence? Pivot on!

Yes, what did BoE do to prevent this from happening again : nothing.

So, this will happen and BoE will have to “temporarily pivot” again for QT and then again and then again till the temporary becomes permanent.

In either case, feel free to keep shorting the pound. Don’t know if Soros or Duckenmiller will do this again.

On this side the market reacted to the phrase “bond buying” with a neck snapping rally. Or maybe it was money moving into dollar based assets. It’s not just the Gilt in trouble either. The Feds 2 + trillion RRPO gambit is draining liquidity. I know it’s only overnight, but 352 overnights make a year. The Fed isn’t raising EFFR they are moving out the yield curve, swapping the equivalent of 20 year treasuries for cash. Since the banks are using reserves that don’t really belong to them it costs them nothing. Is there a problem when Main St borrowers pay that rate plus, and Wall St. pays zero? Saving deposits return nothing. It’s not costing the banks anything to pay MM interest and they are pocketing the difference on standard accounts? The Fed broke the bond market, they aim to destroy the job market, and push the economy into recession because growth is “too” good?? The only problem with getting 20Y yields on overnight accounts is that they don’t last twenty years.

The central banks don’t control the real economy, that is based on production of goods and services. The real economy is already shot to FUBAR state.

What central banks control is the Financial economy, a Facade of shadows and dust made by our stocks, bonds, real estate and crypto markets. This parasite is now a liability that doesn’t add any net value. However, it’s still very useful in the zero sum game, Transfer wealth from working class to the 1%!

This time was different! We only printed money because something was going to break. It is only a pivot when you print money when something is not breaking. Will we print money when something else is breaking next time?

Of course not. You pivot mongers are too much.

So obviously, I have to repost the chart in the article, because some people never seem to read anything in the article. Not much of a “pivot,” or “money-printing” this week, is it?

Wolf, I read the article. I read the article last week. I also listened to you on “this week in money”.

Your chart is like the drunk telling the wife “I did stop drinking. It was only two beers this time.”

They pivoted and even loudly declared they will do ‘whatever it takes’. For now that was all it took.

As always, I have the popcorn ready. Cheers.

One of the tools that the central banks have is to proclaim they can buy bonds if they need to. Then the market tries to front-run them and buys bonds. Thus the CB doesn’t actually have to buy any.

A true believer in pivots!

Your dream will come true for sure. Someday the Fed is going to pivot toward a long pause, maybe in the 4%-5% range, to see how it’s going with inflation, and that makes sense and that’s what I think the Fed should do, and then you can declare victory and rub it in :-]

Until then, I’m just going to keep informing you of the latest rate hikes and QT at various central banks, including the BOE.

Tuesday Oct11 “Bank of England expands bond buying to avoid ‘fire sale’” again!

The BofE are acting like a parent with a naughty child. But ending up being an enabler.

“Behave! But if you don’t I’ll save you from the consequences”

No consequences means no lesson learnt, and no impetus to change.

54% of the types involved in LDI etc, seem to think support, or being enabled to not have to deal with their own issues, will be extended.

It’s risky isn’t it.

No lesson learned.

A back-stop that’ll be withdrawn, maybe, maybe not.

Hope in the market, but possibly misplaced.

This won’t end well.

Rock and hard place. The gap grows ever smaller.

At some point the squish will be irresistible and CBs will be unable to stop the systemic risk.

Rather than control a rough descent, they seem to fight until the bitter and uncontrollable end.

Christ, imagine being such a braindead debt hawk that you think the British government is going to run out of pounds to pay their old people.

Everyone else can see that Lizz Truss is a joke, and her ideas of “growth” are a joke, and the rest of us can see the Tories are just giving a kickback to the good ole boys club, and then will use this as a reason to cut social and infrastructure investments, such that production costs are going to blast through the roof in the UK.

Everyone who had their bonds will still get paid, they merely collectively realized they won’t have anything worthwhile to spend them on, let alone be required to pay taxes with them, so they got a lot less valuable.

Then they all collectively asked: why effing bother?

For comparison, the US equivalent of those UK pension liabilities (that were just hours from going belly-up) would have been around $20 trillion…

So what will happen when the BOE takes its planned actions on the 14th and the 31st, in combination with their continuing to raise rates? Will the issue with the pension funds, and others with vulnerable debt situations, just repeat?

No, there is a major difference, the budgetary stupidity was unexpected resulting in a (minor) panic.

The tightening has been announced a head of time allowing anyone directly involved time to prepare for the consequences.

Prepare how? If the market value of their collateral gilts falls, due to the BOE raising interest rates and selling gilts, there will be margin calls. It’s true that the funds can sell gilts now to raise cash for the calls, but that may not be a big improvement for them. The collateral they put up to buy the derivatives is falling in value, sooner or later.

The market reaction (both ways) was psychologically driven.

There is no such thing as a pre-determined “trigger event” causing any crisis.

Look at prior news headlines over decades of market action for proof. Look hard enough and it’s easy to find the same or similar events supposedly causing the price action, both ways.

One example is February 24th of this year when Russia invaded Ukraine. The US market rose strongly. If a big decline had occurred, same reason would or could have been given.

Like all recent financial crashes, this crash was caused by unwise speculation in complex financial instruments. Pension funds used to hold gilts as low-risk assets to support a conservative long-term investment strategy. As the article makes clear, they are now used as collateral to underpin a strategy which has turned out to be extremely high-risk. In the 2008 crash the culprit was MBS’s, and so on.

Yeah but the question is why did they participate in the unwise speculation in the first place. For hedge funds and many speculators I would say the answer is greed but for the insurance companies it was probably more of a case that the BOE suppressed interest rates and none of their models were working anymore at the lower rates so they felt they had to take on extra risk. It would have been far preferable if they had complained loudly about this beforehand to push for change instead of going along with it and saying “we told you so” afterwards.

1) LIBOR3 – UST 3M is rising since Feb 2022. It might popup.

2) Sept 27 Chick-fil-a day for BoE

3) Oct 6 might Chick-Chack June 16 & Sept 30 neckline.

4) Stay in the game, don’t chicken out : SPX for might make a zigzag up,

for fun, in the blue zone casino.

5) The Fed is playing in the 6dots casino, hunting inflation.

Translation please. We don’t all speak the lingo.

1-5) ‘Eat @ Joes’

I speak that language. It says market may go up big time. Unless market goes sharply down. Also, there is no pivot, stop dreaming. There is only 5 Billion pounds (in new money, per day) to bail out any gamblers needing bailing out.

Ha!

I’d love to see a picture-in-picture, sign-language, translator use this approach while cutting through a televised, public servants, BS message to the public.

“It says market may go up big time. Unless market goes sharply down”

This says ZILCH.

I could predict the same.

My 2 cents:

There are many head winds, out there like currency crisis, energy crisis, never ending Ukraine war, river droughts affecting local transportation of goods and grains. Inflation will remain sticky. Labor mkt will remain tight, due on going demographic changes, reverse of globalization and unwinding of fictionalization of the economy – in sum a perfect storm brewing.

Global DEBT (305T) to GDP (around 100T) more than 200%

There is no more investing just swing trading, options trades, favoring bear.Coming recession ‘may’ be mild but protracted.

Been in the mkt since ’82.

“Invest in risk-free assets that deliver a known principle at a known maturity”

Sheila Bair: “One problem is the preferential way the bankruptcy code treats derivative partners. They are given the ability to cancel contracts immediately and take ownership of the collateral the bankrupt firm has posted with them…which are no longer available to pay claims to other creditors.”

Aldi climate change : Vine tomatoes : 2.19/ 5 pcs ; Pumpkin : 3.49 ; Yellow potatoes 5lbs : 3.99 ; Sweet potatoes : 2.89 ; Gr Smith 3 lbs : 3.99 ; Green onion : 0.85 ; Cottage cheese …no plastic bags.

Let’s see. After four decades of serial tax cuts in the U.S., could that cause some asset inflation? Of course it can, and did. The stock and bond markets are casinos. Run by speculators. “When the capital development of a country becomes a by-product of a casino, the job is likely to be ill-done,” declared Keynes in The General Theory of Employment, Interest, and Money.

It was the 40 years of tax cuts???

Meanwhile, a middle class serf in NYC pays 50% in combined taxes.

A question you will never honestly answer.

At what point between 0 and 100% taxes does a person become a slave?

We don’t pay taxes. Only the little people pay taxes.

Leona Helmsley

Total BS

If you want a fundamental cause, it was predominantly expanding debt substantially made possible by central bank monetary policy.

Without this credit expansion, there wouldn’t have been anywhere near the same level of fake wealth that could have been taxed at all.

Debts were expanded because the government wouldn’t raise taxes to cover spending. They thought tax cuts would lead to so much economic activity under the trickle down theory, the tax cuts would pay for themselves. I can’t count how many times I heard that illogical BS the last 30 years.

You even hear it today, when stock buybacks are at all-time highs.

I consider this event a major tremor before a serious earthquake.

Do you realize the government of England intended to cut taxes and the bond market crashed in reaction. Why? Why is that important?

Because regular deficit spending (and tax cuts funded via more deficit spending) we’re totally rejected by the bond market. When was the last time that ever happened? You mean to tell me the bond market is pulling in the reins of government spending because the government might not be able to repay its debts? Whoa.

Imagine if that happens more . Or to the US?

Our entire business model is based on low taxes and high borrowing.

Yep, hard for even the old timers to wrap their brains around the possibility that we might go back to a world where debt is not king and savers are not serfs.

Maybe with interest rates rising to an acceptable higher level for pension fund investments, then the pension funds won’t have to chase risky derivatives and risk bringing down world markets with Lehman style panics?

Who knows

Exactly. And taking that further why is there a limit on I Bonds or why doesn’t the government allow you to buy other lifetime savings bonds. I would much rather park my money in some reasonable interest rate treasury than being forced to speculate in the stock market. Give people 3% of CPI or something reasonable. If people want to invest in stocks because they think they found the next Google and will earn a lot more then good for them.

Pension funds are too deeply involved in interest derivatives/swaps. Coming rate increase will make their position worse.

We are looking down the ‘other’ side of last 13 yrs of bull mkt built on easy-peasy’ money.

CBers are clueless, trapped and helpless against on going ‘reversion to the mean’

Bull and Bear are the two faces of the same coin. One follows the other.

Without Fed’s put there is no mkt of any kind any where in the world.

But hope is eternal, right?

Why are derivatives such a danger to today’s financial system? Because in 1998, “CFTC regulation was strenuously opposed by Federal Reserve chairman Alan Greenspan, and by Treasury Secretaries Robert Rubin and Lawrence Summers”, overriding Brooksley Born’s cogent arguments against derivative instruments as they exist today. Derivatives are weapons of mass destruction. It was obvious from the start, and they should have been blocked, not encouraged.

There is a broad range of derivatives.

Futures contracts are very important to price discovery and risk transfer.

Instead of the concern over the instruments, the margining and leveraging should be the concern.

Do these gun slinging hedge fund operators get access to cheap Fed money when trapped?

Maybe Wolf has insight to this.

…..the margining and leveraging should be the concern.

Yes. The DTC has increased margin requirements and applied collateral haircuts across the board from equities – to treasuries – bonds/notes (corporate, Gov, and Muni’s) – CD’s – MM’s – and on and on. So, there has been some dialing back but, essentially, the DTC is just saving face and their own a**.

As for Fed access, of course the big boys do – maybe not directly, but possibly through their Prime Brokers (JPM, BAC, C) – using OTC tactics to keep it all in the dark.

Pure speculation. But when all but 1 of the top 25 banks, who hold the highest notional amounts of derivatives, trade over 90% of those OTC, speculation is all an outsider can do.

No, that’s not why.

The primary reason is a combination of expanding debt and reckless speculation; the asset mania. The latter is the result of moral hazard, mostly caused by government but also from financial intermediation those making these trading decisions aren’t placing their own capital at risk. It usually belongs to someone else.

The inference expressed in your post that it’s possible to successfully regulate moral hazard (on steroids) indefinitely is a myth.

I challenge the premise that central bankers have any business in the long end of the curve.

Max employment and stable prices are current concerns.

Depressing long rates is admittedly a tactic to force investors into more risk real time.

Former President Fisher admitted just that in the PBS documentary “The Power of the Fed” which can be seen on the PBS website

All I know is that the economy is not moving in Fl USA. Our revenue is as low as it was during Covid times and it seems like everyone that I talk to or see is experiencing the same thing. We’ve let go of half our workforce and if this continues for another six months will shutdown. We survived Covid with no bailouts or handouts but it doesn’t feel like we will survive this. I can’t understand how anyone can think that allowing l-t rates to double and then some in such a short time period will not stop the ‘engine’ working. The Fed should be an institution that provides stability and predictability, and not contribute to destabilising the economy. First policy error : leaving rates unchanged in the face of rising inflation. Second policy error : raising rates at such a rate that it seizes the economy.

No flow through the economy will result in low growth, less taxes and no employment.

What shuld the Fed do when the (financialized) economy itself is the source of destabilization? I would say, pretty much, exactly what they are doing.

1) If tomorrow the Dow will close Oct 3/4 open gap, the weekly Dow

might have a large selling tail.

2) If next week the Dow will close Sept 30/Oct 3 gap it’s likely breach the neckline between June 16 low and Sept 30 low. Options for fun and

entertainment only :

3) A bearish option : Oct will close below Sept 2020 low.

4) A bullish option : tomorrow the Dow will popup and reach May 17 high, before moving higher.

5) A bullish option : a Failed H&S ==> ” A”.

Any indications of the impact when the selling of gilts really (?) starts at October 31?

“Panics can be triggered when someone cries “fire” in a crowded theater. In this case, the panic the UK government bond market was triggered by the new government’s ill-conceived series of announcements over a two-week period”

So the government set the theatre on fire.

A Kwasi finance minister ?

A Quasi finance minister !

Are we sure he is not Howard from Halifax?

The central banks’ most powerful tool is jawboning, which tells the front runners what the CB will be doing next. Then, front runners then do most of the heavy lifting

According to Bloomberg reporting, even though the crisis has been averted for now, the UK defined benefit pension plans continue to sell assets either to cover margin calls (now smaller) or raise cash for future problems.

Yes, and they should. It’s their opportunity to unwind their derivatives in an “orderly manner.” That’s how you do it. They’ve gotten the message.

Unwinding in an ‘orderly manner’ when the whole environment has become suddenly toxic, is tough.

Who are the parties holding ‘counter-derivatives’ against the plans? Banks?

Investment banks and fund mangers, such as BlackRock.

RickV

Defined Benefit pension plans are at more risk (to the employers) compared to Defined Contribution pension plans in USA where risk goes to employee!

Defined Contribution pension plans in USA are just self perpetuating inflation machines and contributors to the concentrated wealth and power of financial dynasties like Blackrock and the gifts to Private Equity. It works against workers. An intended “unintentional consequence” of government/corporate regulation.

much the same for defined benefit plans ………….

for government defined benefit plans there is an extra dose of suffering for tax paying common workers ……….

The UK was staggered after a right to the chin, the Fed’s sudden tightening, but only after being weakened by a gut punch to the body: Brexit.

UK citizen here: anyone who imagines that this unprecedented shock came out of the blue is not in contact with reality.

Some contacts with reality:

1. A medium- size fish exporter handles the catch of about 40 smaller boats in a UK bay. Most of it goes to EU. Before it was just loaded and went. Now 80 pages must be filled out, including vet’s ok on condition.

2.Honda, in a very polite Japanese way, commented in the run-up to the very unusual Brit referendum: ‘If we can’t access EU duty- free, we have to reconsider new plants in UK.’

3. Many EU companies have long agreed to use UK law for disputes between each other. It is very precise law as some found when bidding wars for Covid vaccines erupted. There are a quarter- million people in the UK still doing EU legal work. For now.

Two conclusions: 1.The UK no longer has world’s largest empire, no longer rules the waves, but instead of going alone it could have been a major player in largest trade bloc. And remember: there is no mechanism to expel a member. You don’t have to jump to Brussels command. Look what Hungary gets away with.

2. Don’t ask lads at pub for advice about trade. Don’t have referenda about highly technical matters.

“The risks of leverage from LDI funds had been considered by the BOE before the panic, he said, but the repricing ahead of the BOE’s intervention “far exceeded historical moves.””

Does this remind anyone else of LTCM?

Has the pension regulator not read Taleb’s book “The Black Swan” or heard of fat tail risks?

Boris Johnson has got to be laughing himself silly. He hasn’t been gone a month and the people who pushed him out for little more than traffic violations almost blew up the British economy.

This is totally amazing, how this turned out. It’s going to spawn a new genre in English Lit, called “The Political Theater of the Absurd,” I think.

except England doesn’t , can’t product literature anymore. A simple record of events would make for a great farce though.

Scrambling for any yield to meet actuarial goals during the ZIRP and NIRP era created dangerous risk positions for more entities than the central bankers bargained for or could foresee. Its what happens when fake interest rate environments are created. Over leveraged, rehypothicated….dancing on a razor’s edge seeking any fair return on money.

How do the pension funds extract themselves though?

The BoE can cap gilt yields against the market, which are rising because of UK inflation, by buying them up with printed money causing more inflation.

All the BoE have done is push the losses onto sterling instead. I’m sure people are bidding up UK shares etc now because the pound has lost so much value but prices adjust. Then what?

There was a pension fund in the UK called Equitable Life which blew up years ago. My father had his pension in it. This fund was guaranteed by the government. When push came to shove the then Chancellor of the Exchequer, Gordon Osbourne, announce there was no money to honour the guarantee. Cue legal action rumbling on to this day.

If the UK pension funds have levered bets against gilt yields going up, and now they are going up with domestic inflation at 10%, what kind of plan prevents the losses?

All the banana sellers applauding the BoE buying up bananas but what about the never ending supply of bananas tomorrow.

LordSunbeamTheThird

Investments are not static. They don’t just sit there. The pension funds are already in the process of unwinding these hedges. That’s how it’s done. You sell stuff and unwind stuff — and they can do that now as markets have kind of calmed down. And they’re going to lose some money on this stuff that they’re selling, but that’s not the end of the world.

Pension-fund beneficiaries might not get what they expect to get when they retire, but what else is new? Or maybe the government will chip in, and what else is new?

So over a trillion with 7x leverage and all the counterparties involved is not the end if the world.

Well, it’s not. It just will be a very different world quite soon.

You over-estimate the magnitude of $1 trillion today. Apple’s market capitalization is $2.2 trillion. Google is $1.3 trillion. Amazon is $1.2 trillion. Microsoft is $1.7 trillion. Those four companies combined = $6.4 trillion.

The risk is that the pension funds get wiped out and that the investment banks lose some money after they sell the collateral. That’s not good, but it’s not nearly at the magnitude of the mortgage crisis we had.

Whenever you have a three-letter acronym like “LDI” and Blackrock in one sentence, you know what’s shakin’.

“This wasn’t a “pivot” to QE, but a brief intervention ”

——————————————-

whatever word is used, it’s market interference to bail out chosen parties, typically imprudent and overleveraged ones. all part of the banker/financial goal of projecting debt slavery and extracting productivity from the working class to the rentier/financial class ,,,,,,,,,,,,,, all while socializing the risks