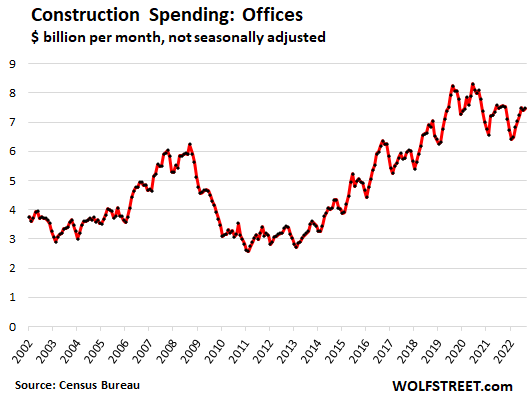

Office construction wobbles along at much lower levels, amid a glut of vacant offices.

By Wolf Richter for WOLF STREET.

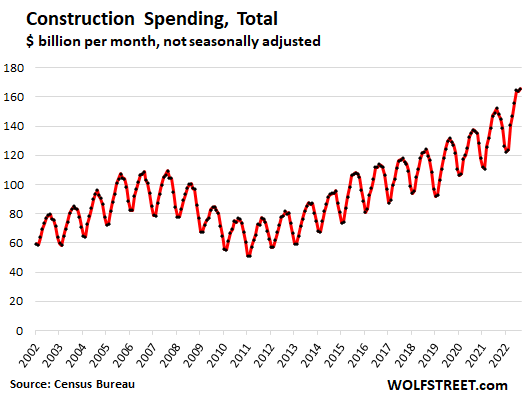

Construction spending – residential and non-residential – in August ticked up to a record $165.5 billion (not seasonally adjusted), according to estimates by the Census Bureau today. Seasonally, construction spending peaks about this time of the year.

Compared to August 2021, total construction spending was up 8.8%. Compared to August 2019, it spending was up 25.8%. Construction spending is not adjusted for price changes; it reflects the actual amounts spent each month.

The Census Bureau also provides a “seasonally adjusted annual rate” of total construction spending – what the whole year would look like based on the amounts spent in August. This seasonally adjusted annual rate dipped by 0.7% from July, to $1.78 trillion, up 8.5% from a year ago. These seasonally adjusted annual rates generally show up in the headlines. But I’m going to stick with the actual monthly dollars here.

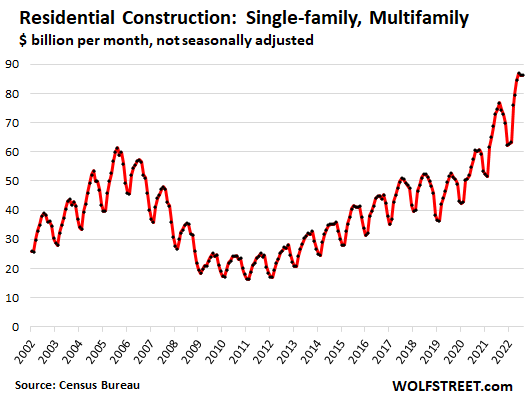

Residential construction – single-family houses and multifamily buildings, plus improvements to residential structures – remained unchanged in August from July, at $86.1 billion.

But this was up 12.2% from August 2021 and by a phenomenal 63.9% from August 2019, following a huge construction boom that caused prices of construction materials to blow out:

Single-family v. multifamily construction: In terms of the seasonally adjusted annual rates of residential construction, the rate of spending on single-family houses fell for the fifth month in a row, as homebuilders trimmed back to deal with their glut of houses in inventory. But multifamily construction ticked up.

But in the multifamily construction segment, the seasonally adjusted annual rate of spending ticked up in August and has been roughly stable at very high levels for the past five months.

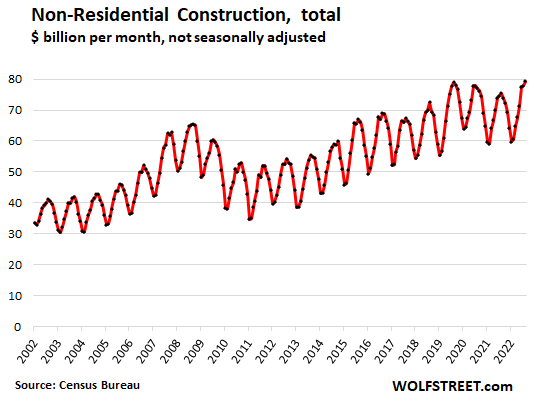

Non-residential construction – spanning anything from offices and power plants to highways – rose to a record $79.4 billion in August, edging past the prior record of August 2019. This was up 5.2% from August 2021 and 0.4% from August 2019, which had been the prior record.

Office construction – a small portion of non-residential construction – also ticked up for the month. But this sector has been languishing ever since work-from-home became the big thing in mid-2020, causing vast amounts of vacant office space to show up on the market across the US. It remains unclear why anyone would now plan another office tower, with this kind of office glut all around, but current construction spending largely reflects projects that were planned years ago.

At $7.5 billion in August, spending on office construction was down 0.8% from August 2021, and down 9.4% from the peak in August 2019. This segment will continue to hobble lower as the industry figures out how to approach the new environment for offices:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Does this refer to ground up office? Class A office tends to be renting the best these days, so I would suspect a lot of the construction might be to renovate office buildings.

“Class A office tends to be renting the best these days,” should read: “renting the least worst,” maybe? That statement is actually only partially correct. What is renting better, or rather renting at all, is NEW or NEW-ish Class A. Lots of older class A already lost their tenants and defaulted on their mortgages. I covered some of them.

Residential construction includes “improvements.” In terms of non-residential, there is no mention of “improvements” in the methodology. But if you gut an office tower to redo it, or to convert it to residential, it’s a construction project, requiring permits, architects, etc., and construction work, and I would assume it’s included (the methodology makes no mention of it).

Without correction for inflation in construction costs, these numbers don’t paint a true picture though, especially with the rollercoaster ride we’ve seen the past few years.

Indeed, if total dollars spent is “only” up 9% from last year, then total construction activity might actually be *down*, no? And if basics like lumber have doubled or quadrupled in price in the past 2 years, than total spending being up 60-70% may simply reflect stable, rather than growing activity.

Commodity prices have plunged, including lumber and steel. Lots of these crazy price spikes and shortages are getting resolved or have already gotten resolved.

And that may be in fact be why some of the spending numbers have come down a little.

Wolf, construction commodity *futures* prices have plunged. Lumber quite spectacularly as you note. BTW, interesting that the FL hurricane hasn’t moved lumber futures at all.

Meanwhile, the actual *physical* product never spiked as much as the futures did (in %), and from those lofty heights haven’t yet come all the way back down either. Serious ratchet effect in physical product.

I’m pretty amazed at how construction spending doesn’t crater. But I guess it’s because construction has huge momentum. Most of that spending is likely projects that have been underway for anywhere from a couple months to a year+. And then for individuals, there’s a huge emotional momentum as well. It takes a lot to convince someone to cancel an improvement or home build.

The homes that were destroyed in Ft. Myers were mainly older wood-frame. In photos you can see what was left of lumber around the slab. Concrete block homes not fail-safe…you can lose everything but the walls.

Building codes vary from town to town in FL but I assume anybody rebuilding near water will have to go concrete block at minimum. Less lumber, except for interior walls and roof.

A photo of Ft. Myers waterfront showed what was once a wood frame home and a newer home across the street, unscathed. The new was built on concrete stilts. No problem with their car, they left in it.

After Sandy wrecked NJ coast, saw images of new homes being built on stilts…of wood.

“Commodity prices have plunged, including lumber…”

Three weeks ago I bought 3/8″ osb at $19.99 at Home Depot. I bought two sheets. Another guy was buying 10 sheets. We helped each other load our respective carts. I asked him what he was building. He said “nothing, I’m saving these. These were $40 and I’m buying more before the price bounces back up.

This week they were about $14 a sheet.

Those plywood sheets will be useful for the coming Great Depression when millions are foreclosed upon, and booted out of their homes. People will be desperately buying up anything they can use to makeshift shelter with. It won’t be just tents but miles and miles of shanties, shacks, lean tools, teepees, you name it, outside every major suburban metro area in the US.

Credit Swiss will be the first of many banks to default, and the dominoe effect around the world will shatter far more lives than the GFC did. In fact far more wealth, $36 trillion has already gone up in smoke, dwarfing the stock market losses during the GFC.

So buying lumber, nails, hammers, tools, pipe, tubing, etc. and anything else someone could use to make shelter,or things related like self installed ‘plumbing’ , could turn out to be a wise investment, especially once our own currency finally drops like a rock, as all the others are in the process of doing. Think primitive but functional and more durable than tents.

Still paying 5$ for a treated 2 x4 really

And how much of this spending is to finish construction that was started a year ago when rates could be had below 3%?

Picture seems bleaker down under. According to ABS non-residential is down 22.6%. Private sector dwellings excluding houses down 43%. I also noticed total value of engineering construction down by 31.2%. Seems like our economy is going from houses and holes to exclusively holes.

My assumption is that contractors are racing to complete the homes they started on spec and that are under contract at still inflated prices. It is the traffic of buyers that is important for the future, if that drops then it is a matter of time before construction activity drops.

Too often data can be backward looking.

Buy now or be priced out forever!

There’s one development of 1,300 homes near me that is feverishly building to close out the development. That way they can dispose of the carrying costs, free up capital, and transfer the HOA and amenities to the property owners. This place is tootsed to the 9’s with a spa (a real one with masseuses, steam, sauna, the works), poolside restaurants with waitstaff poolside that would rival a Four Seasons, large rolling very green golf course, a teaching kitchen for cooking lessons…..

I think the developers just want out while the getting is as good as it gets for awhile.

Now there’s an HOA fee I wouldn’t want to be on the hook for forever!

That sounds like a PPP-recipient haven.

I am sure the developer would find suckers to buy these.

I am really surprised at people who are buying homes during these times.

Some of them are my close friends in southern ca.

Investment is almost always driven by looking in the rear view mirror and people still think that home prices can only go up in the future. They see a small dip and think it is a bargain, not the start of a long term drop.

As I said above, the drop in foot traffic demonstrates that things will get very bad for developers very quickly.

What’s really amusing is that this is a “California type” development of big bombers on postage stamp lots nearly built out to the street and “gangways” between them a la the inner city of Chicago. Troll Bros. is hawking $1M+++ sugar shacks in there. What’s even more amusing is that the refugees that are buying these (from WA, CA) don’t realize that the nice little 2-lane country road that borders the development is slated to become a 4 lane. Some of those $1M+++ homes are backed to it. Plus they’re built out of OSB, foam, and stucco over wire.

They look good from far, but they’re far from good.

If you build it-they will loan.

I’d like to know more about the Census methodology for the construction estimates, but don’t have time to dig in. August is a while ago now, and if the data predate J-Pow schooling the markets at J-Hole, it’s definitely stale. And depending on what data they’re using, these estimates could be vulnerable to revisions as hard data trickle in.

I could see spending cranking up in the short term as projects underway are rushed to completion before prices crash further, to recover as much of the costs as possible. And then there will be a boom in Florida… But otherwise one would expect rising rates and declining expectations to put a damper on new plans?

Agree with the comments. Also with the large buildout of residential both multi family and single family in 2020-21 there is then a follow on construction boom for Class A commercial to serve those folks that moved in. In my smaller town in Texas (Tyler) we see contraction increasing in class A office (Dr dentist law etc) fast food grocery hospital and chain restaurants

These stats, even if a couple months old, are surprising to me. Seems there is no noticeable slowdown in construction of all classes, especially residential. I guess it takes some time for Mr Market to get the message, but since Covid (2.5 years), you’d think there would be some restraint on construction. I guess nothing goes to heck in a straight line. Maybe this excess inventory will tame pricing sooner than later (hopefully).

Wolf and team:

Interesting stuff I’ve seen with this brief mega-rally going on now–

1. The UN and World Bank coming out and asking the Fed not to hike? What the heck? Seems sort of political.

2. The pivot narrative is back, oil is up 15% or so, the dollar is down, and of course, they’re now pounding Treasuries with bids. Getting a lot of attention after the Bank of England move to not start QT and Australia only hiking 25 bps.

They say if you can’t spot the sucker at the table, it’s you. I feel like I’m not the sucker here by expecting the Fed to do its job and let QT continue..? I mean if they turn around and cut rates and do a bunch of QE I would be the sucker I guess.

It’s hilarious that suddenly the Wall Street media circus cares about what the UN says. When normally no one gives a hoot.

The problem is, while construction spending is going up, mortgage loan applications are at their lowest point since 2008. This is a divergence that must be rectified at some point in the future.

Refi applications are lowest in decades. Purchase applications are the lowest since 2015.

It took 7 years for the 2008 event, to reach its bottom in 2015, but the dates are not the issue, the divergence is. The point being, it is not a trend that can continue. One of the trends has to change.