Never a boring day in the SPAC & IPO hype-and-hoopla clown show.

By Wolf Richter for WOLF STREET.

I assume all the fine print was copied and pasted into every document that no one read, and that no one is going to jail because this is just a funny clown show that peaked in February 2021, after which the whole thing fell apart as these hype and hoopla stocks have plunged by 80% or 90% or more. That any of these outfits found folks eager to buy their shares is proof of the mind-boggling intensity of the Consensual Hallucination that reigned back then.

In 2021, there were still lots of stragglers out there that hadn’t merged yet with a SPAC or hadn’t yet gone public via IPO, and even as many of the SPAC and IPO stocks were already collapsing for all to see, new money had to be found to allow the stragglers to get out too.

One of them was an EV outfit with still no car and no revenues, but with a ridiculous pile of problems, maddening disclosures, investigations, whistleblowers, and internal revolts: Faraday Future Intelligent Electric Inc.

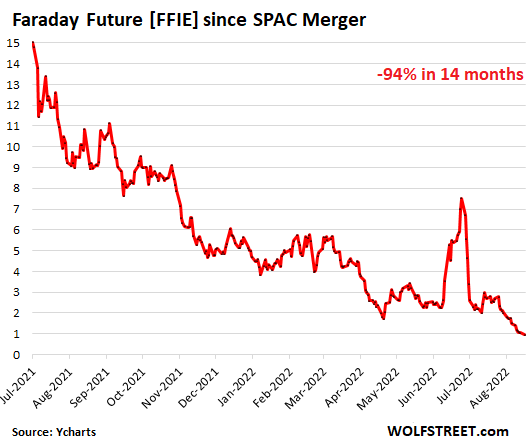

It started trading as a public company in July 2021, and this morning, 14 months later, its shares dropped below $1, having become the hobby of day traders that are shuffling them back and forth amongst each other.

Faraday Future announced with enormous hype and hoopla in January 2021, at the hype-and-hoopla apex, that it would go public via merger with a SPAC. The merger was completed in July 2021 when the SPAC’s stock ticker was changed to represent Faraday Future Intelligent Electric [FFIE].

This is funny because on April 20, 2021, as I was already reporting on the Imploded Stocks, I posted an article titled, The WTF Charts of the EV SPAC Hype Boom Are Imploding Spectacularly. Even though Faraday hadn’t become a publicly traded company yet, it already featured in this article. This is what I wrote about the outfit on April 20, 2021:

“There are a number of other EV startups being currently hyped to the public while they’re being acquired by SPACs.

“Faraday Future is the most infamous one of them. The company was founded in 2014 by a Chinese entrepreneur who filed for bankruptcy in 2019 in the US to deal with $3 billion in debts. The company, which has failed in everything and never sold a single car, plans to go public by being acquired by the SPAC Property Solutions Acquisition Corp, at a $3.4 billion valuation.

“Faraday is now being hyped all over the place. But buying those shares is only attractive if you know that they’re going to be whipped to another silly WTF moment, which is the moment to dump the shares into the lap of some befuddled greater fool that thinks that the share price could multiply again before it’s time to dump them.

“But Faraday would be a great opportunity for potential investors to dig in their heels and go on buyers’ strike, and let someone else get crushed trying to bail out the current investors, promoters, and creditors. Let them eat cake.”

You see how funny this stuff is? On February 1, 2021, days after the announcement of the merger, the shares of the SPAC hit their intraday high of $20.75.

By the time the SPAC merger was completed and the shares began to trade under the new ticker [FFIE] on July 22, 2021, the price had already come down. But in the morning of that day, shares “popped” 9% to $15.02, according to Barron’s, which added to the hype-and-hoopla with its article titled, “Faraday Future Stock Is Popping. Here’s Why,” wherein it explained what makes Faraday such a hot company. And the stock has collapsed ever since.

At the time of the Barron’s article, the market cap was $4.7 billion. This morning, the stocks trades at 96 cents, and the market cap is something like $310 million. From the February 2021 high, the stock has collapsed by 95%; from the $15.02 that Barron’s cited, the stock has collapsed by 94%. This chart shows the stock from the Barron’s cited $15.02 on its first day after it became FFIE (data via YCharts):

So the company is in a pickle.

It still has no revenues and no car and is running short on cash. But ramping up manufacturing burns up a huge amount of cash. The company has been promising that it would start manufacturing soon. But it must first raise new money to start manufacturing, and if it cannot raise new money, it cannot start manufacturing, and without cars, it won’t ever have revenues. Just then, its VP of Manufacturing, Matt Tall, left the company.

And there’s an in-house revolt brewing: In a letter dated August 23, reported by Reuters a week ago, 140 employees called for the removal of Executive Chairperson Susan Swenson. They alleged that Swenson had organized attempts to “push the company into bankruptcy and restructuring.”

According to Reuters, “The group also asked the board to make public the findings from an ongoing investigation of multiple whistleblower letters concerning four directors – Sue Swenson, Jordan Vogel, Scott Vogel and Brian Krolicki.”

Also in August, FF Top, the largest shareholder of FFIE with a 36% stake, called for a special meeting to remove Brian Krolicki from FF’s board. And on and on.

Meanwhile, FF is entangled in all kinds of financial, regulatory, and legal issues.

In SEC filings, the company disclosed:

Inaccurate financial disclosures: In November 2021, the Board established a special committee “to investigate allegations of inaccurate Company disclosures.” The Special Committee hired legal counsel and a forensic accounting firm “to assist in its review.” The Committee found among other things that “certain statements made by or on behalf of FF in connection with the PIPE [Private Investment Public Equity] Financing were inaccurate.”

It added that “no assurance can be provided that such remedial measures will be successful in resolving the problems identified by the Special Committee, will insulate the Company from the consequences of past disclosure inaccuracies, or will be successful in preventing inaccurate disclosures in the future.”

It added that “There can be no guarantee that the Special Committee investigation revealed all instances of inaccurate disclosure or other deficiencies, or that other existing or past inaccuracies or deficiencies will not be revealed in the future.”

Going concern warning, with bankruptcy and liquidation risk. “…FF’s independent registered public accounting firm [PwC] included an “explanatory paragraph” stating that FF’s recurring losses from operations and continued cash outflows from operating activities raised substantial doubt about FF’s ability to continue as a going concern.”

“If FF is unable to continue as a going concern, it may have to seek protection under applicable bankruptcy laws and/or liquidate,” it said.

Then PwC quit as auditor, wreaking further havoc on FF’s efforts to raise cash. The company announced in August that its auditor PwC had decided to not be its auditor anymore. The company is now shopping for a new auditor.

This is funny because without auditor and audited financial statements, raising new cash to burn gets even more difficult for a company with no revenues and no car and a slew of problems after already providing inaccurate financial disclosures.

The SEC is investigating. The company disclosed that “FF, certain members of the management team and FF employees received a notice of preservation and subpoena from the staff of the SEC stating that the SEC had commenced a formal investigation relating to the matters that were the subject of the Special Committee investigation beginning in October 2021.”

The Department of Justice got interested. FF disclosed that in June 2022, it “received a preliminary request for information from the U.S. Department of Justice in connection with the matters that were the subject of the Special Committee investigation.”

Class action lawsuits have commenced, a bevy of lawsuits were filed, seeking class-action status, starting in December 2021, alleging violations of the Securities Exchange Act, “various common law claims,” and “breaches of fiduciary duties.” Among the defendants are FFIE, its current Global CEO, its former CFO, its current Chief Product and User Ecosystem Officer, the CFO of Legacy FF, the former CFO of FF, the Co-CEOs of the acquiring SPAC (PSAC), current and former officers and directors of FFIE.

You cannot put this kind of stuff off and sell it to the public unless the market is dominated by consensual hallucination.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Just sold all my FFIE and put half in Global Crossing and half in WorldCom.

Giggle. Weak, tired giggle.

Dividend payers are crashing almost as good as IPOs, e.g. Intel, 3M, Verizon. All at 52-week low today.

Andy, three companies that are having troubles of their own. Sad to say, I am still long INTC.

Intel at a 6-year low.

One of my college housemates (and still a friend) was CFO of Iridium. Remember that one?

He was fired for refusing to sign off on falsified financial statements.

The problem is that most people are social creatures, not individual thinkers. When you muddy the waters of society, you can see anything in the reflection. The reflection can be a promising corporation, a political party which guarantees hope and change, a popular new bistro or neighborhood to live in. An individual thinker would be a skeptic from the start. A social creature would be warmed by seeing that there are others out there like him/her.

There must be a lot of “investors” whose brains are being powered by fusion, then.

You’ve coined a new term for the Greatest Fools or Bagholders: “Two Watt” Investors.

“1. that Water Vapor is largest green house gas.”

Water vapor is not a greenhouse gas.

“2. Le chatteliers principles states that temperature must be balanced by equilibrium.”

Meaningless word salad. Blinding With Science fallacy. Minus ten.

“3. What is the cooling force that opposes the green house effect of water vapor to determine temperatures?”

More meaningless word salad. More Blinding With Science fallacy. Minus twenty.

“4. What is the real energy efficiency of EVs over IC engine cars based on losses from power generation, distribution, charging, battery etc?”

Irrelevant. Ignoratio elenchi is one of the oldest fallacies known to us, being first identified by Aristotle. Minus forty.

“5. If human beings we powered by fusion reaction at same intensityas core of sun, we would produce only 2 watts of energy, not enough to keep our brains alive.”

More meaningless word salad. More Blinding With Science fallacy. Minus eighty.

“It’s a complex world with hidden motives”

Your motives are all too plain.

Thanks! Well said.

Unamused, I believe you are being sarcastic. Let me still share the link.

Check “role of water vapor” section in Wikipedia : https://en.m.wikipedia.org/wiki/Greenhouse_gas

Water vapor is in fact a greenhouse gas.

https://climate.nasa.gov/ask-nasa-climate/3143/steamy-relationships-how-atmospheric-water-vapor-amplifies-earths-greenhouse-effect/#:~:text=Water%20vapor%20is%20Earth's%20most,gases%20keep%20our%20planet%20livable.

Just so you know: water vapor is in fact considered a greenhouse gas. Source: literally NASA.

Allow me to clarify, Aaron. Water vapor is not a greenhouse gas that is driving catastrophic climate change. Nitrogen and oxygen are also not greenhouse gases driving catastrophic climate change. If you want to argue that all gases are greenhouse gases I won’t bother citing your argument as a logical fallacy.

“Just so you know: water vapor is in fact considered a greenhouse gas. Source: literally NASA.”

Exactly. Let’s play “spot the narcissist.”

It is quite simple:

The ones driving “catastrophic climate change” are the people that are going to benefit the most from it financially.

There fixed it for you.

For reference see Al Gore, et al.

For those that are getting hurt the most by the movement see:

Europe.

There is no such thing as “catastrophic climate change” unless you were a dinosaur and got wiped out some 60 million years ago in the late Cretaceous period.

Solar particle forcing, also known as our suns energy, is the primary cause of the changes we see in Earths climate. Many scientist, even NASA scientist I am friends with, roll their eyes at the hive mindset “it’s all humans fault”. We all agree we could do better taking care of the earth. However, this science is skewed with inaccurate data by ignoring the sun and it’s energy attached to the Earth. Like an umbilical cord between a child and a mother. The mother, our sun, has been drinking a large quantity of caffeinated sugary beverages. Our Earth, her child, is dealing with those crazy rushes. This is why we have crazy weather patterns, the plates are cracking, and volcanos are waking. I think I am more worried about another Carrington Event.

‘The ones driving “catastrophic climate change” are the people that are going to benefit the most from it financially.’

Exactly. The global fossil fuel industry makes $3 billion a day, but that’s considered an extremely conservative estimate and doesn’t include $5 Trillion a year in subsidies.

The larger corporations have always disregarded the utter waste of anything, even the largest numbers of human lives and miseries, to be a mere externality because it’s only the profits that matter. Always, and only. Period.

Michael Faraday, 1791 – 1867, was a man of experimenting brilliance.

Physics and chemistry have his signature written everywhere.

The number of discoveries he made, and their importance to today’s technology, is absolutely incredible. Human’s lives today are from ‘Faraday’s Future.’

UnAmused, its hard to swallow facts that dont agree with one’s views: Search following in google: “wikipedia greenhouse gasses role of water vapor”

“The problem is that most people are social creatures, not individual thinkers.”

True but too simplistic. Studies have shown people would rather electrocute themselves than think for themselves. But the real problem is that once a person has become personally invested in a false worldview there is very little chance that any confrontation with reality can resolve the cognitive dissonance. Jordan Peterson and Seventh-Day Adventists are favorite examples.

Money loss, I have found, can assist the mind in focusing, just as it plays with the digestive harmony.

But yeah, a generalization so broad claims everything and nothing at once. It cannot be sensibly verified or falsified.

Far more accurate to simply say, some people are suckers.

Unamused thoughts are echoed by the documentary “The Minds of Men.”

Well I am not amused.

As far as people go Jordan Peterson has better qualifications and a better record than some unnamed, unknown person who spouts nonsense on a blog.

WU, you’re making unsupportable assumptions about what my qualifications and record might be. Your fallacies include unaccepted enthymemes, apriorism, non-anticipation, and several others. Minus ninety. Peterson has been definitively discredited in numerous articles, and for those you would be unable offer any defense even if you were dimly aware of them.

Studies have not shown that people would electrocute themselves then think for themselves. Quite the opposite. People are scared sh*tless of electrocution, while as my ancestors were saying: “If this creek was carrying all the minds of this the world for people to choose, everyone would reach for their own”. People love to think for themselves, except they struggle with it. World is complex. My favourite example of “a person… personally invested in a false worldview” is you. Do you understand this simple retort? There are no wrong world-views. Second, you are throwing shade at successful people unrelated to the discussion. You sound like one startup biotech co recruiting me, while their “corporate values” page tells a story about bad, bad Exxon “lying about the climate change for years” and so woke Patagonia saving the world with their rugs for the upper-middle wannabes. Throwing shade at the champions of the industry, other industry? I’ve told them that based on their values we are not a good match. In short, there are no wrong world-views, but I’m not align to most of them.

Dear Socrates, of course there are wrong world views. In a world full of billions of views some are bound to be wrong. I know some of mine are proven to be wrong. I used to think there were far fewer idiots in the world. Wrong. Do YOU understand this simple retort? And I am not a biotec recruiter and no, not everyone is out there recruiting you.

Unamused, so are Democrats and Republicans.

Unamused-I don’t know you. And I hardly ever comment. And I have very little to go on. But I like you!

Wolf I keep scratching my head who is crazy enough to buy into these IPO’s? Is it the like of total market index funds that have no choice but to buy the total market?

That is a pretty clever possibility.

There are a fair number of financial products that are brought to mkt that seem so inevitably doomed, you *have to* ask, “Who buys this s*it?” The financially suicidal? Suborned intermediaries? Broke Bad fiduciaries?

But for all their built in advantages, a lot of passive indexing products are starting to show some pathologies (concentration risk due to mkt cap weighting, opaque portfolio entry/exit, opaque rebalancing timing, etc).

It is at least *possible* that some of these craptastic financial offerings are basically gaming some excessively automated “whole financial market” index products.

You wouldn’t think the “whole market” ETFs/etc could put enough into any one SPAC/dog IPO/etc…but who knows for sure?

I don’t think so. Some of the “world” or total US market indexes are optimized. Instead of holding every single thing, the managers note correlations and select a subset of those smaller stocks. Tracking error is so tiny from those small names that it’s not a problem to be missing lots of them. Even an “extended market fund” that holds say name #500 (or maybe it’s #1000, I forget) through #5000 will be totally unaffected by underweighting (or non-weighting) anything short of a FB, GOOG, TSLA rally in those stocks.

Fair enough.

But there might be more tightly focused ETFs/funds (All IPOs/All Financial Co) that incidentally fund the craptastic (although it would for less money too). And the “sample tracking” you describe may be used there too.

It is just hard to believe that,

1) Substantial numbers of people,

2) With significant funds, and

3) Access to Google or native intelligence,

Can get habitually lured into facially dubious investments that puts substantial $ at risk.

The blind fund nature of SPACs, for instance, just screams danger, but we are just coming off the greatest blind fund boom of all time.

This is like handing your wallet to the guy in the alley, in a trenchcoat, going, “Psst, Buddy! Have I got a deal for *you*!!”)

@cas127,

(1) Greed divorced from morality (2) Other People’s Money. Problem solved.

Gattopardo,

Go for Nifty Fifty. Can’t lose.

All garbage will end up in an index fund, obviously. Boggle overlooked that part in his calculations.

From the article: FF Top, the largest shareholder… 36% stake.

So at least some of the major bagholders appear to be sponsors or “promoters” who failed to get out.

Regarding index funds – most have fairly strict “investability” criteria in addition to market cap. These include things like revenues, share float not all locked in a few hands, trading volume dollar liquidity, minimum share price to stay listed, and so on. Some don’t include recent IPOs. Most only update the index lists every 6-12 months. And so on.

FF Top is literally the board members of Faraday Future before the spac merger. They’re not outside investors who got burned. YT Jia and gang were frauds before and they are still frauds.

This is just another form of QT :)

Absolute FRAUD who buys a company for 3.4 billion with no production

Flea

Fed facilitated this kind of ‘animal’ spirits’ by keeping ZRP too long and insane credit creation. That karma is slowly unwinding!

Flea

Given the headwinds, your sentence still holds true if you replace “$3.4 billion” with “$310 million”.

Fraud legally is a false representation of material fact (a fact that matters). Statements about such things as future asset (say, stock) values are, in general, not statements of fact, but rather, are statements of opinion. Why? because a fact can be proven true or false. The future cannot be proven in this way. Now, it is possible for a company to be lying about its facts. But there was a loophole with SPACS big enough to drive a whole fake future through: they did not have to make the disclosures required by law (such as an ordinary prospectus) for the merger partners: they could issue ridiculous projections that would never fly in a good old legal prospectus. That was perfect (and often,though maybe not always, legal) bait for suckers who don’t (bother to) know the difference. That’s why we have market regulations. But new things always pop up, fit into the spaces in existing laws. In a free country of our type, some behavior generally is legal unless it is made illegal by law. That said, you can whip up a securities fraud case out of almost anything.

“there was a loophole with SPACS big enough to drive a whole fake future through: they did not have to make the disclosures required by law”

Quite right. The purpose of SPACS is to avoid accountability and evade the law, which can make its use prima facie evidence of the intention to commit fraud. The intention to avoid the IPO process constitutes a woefully insufficient excuse when it can be shown that fraud has been committed.

‘For every one that doeth evil hateth the light, neither cometh to the light, lest his deeds should be reproved.’

John 3:20

‘For every one that doeth evil hateth the light, neither cometh to the light, lest his deeds should be reproved.’

Couldn’t this have been simplified? Maybe in Aramaic, it would have been something like, “evil people avoid light”. While today it would be, “lite ain’t right”.

There are communities in Appalachia that still use Elizabethan English.

Easy. Everybody who wants in on the next Tesla and isn’t doing their homework.

Had a fun time with a very pushy (ok, redundant) IPO salesman a few days ago who constantly went back to the ‘but you don’t want to miss out on the next Tesla, right?’ theme. After he rattled off a handful of other big winners, I asked him if the stock he was pushing was so good, has he invested in it?

“Yes, to our maximum of 50K shares.” (About $500K.)

Great, did you invest in the earlier big winners you were selling?

“Oh yes, to the limit.”

Ok, so if they all went up hundreds of percent since you purchased them, why are you still cold calling people instead of relaxing on a warm beach?

He changed topics pretty quickly.

:-)

LOL!!

And I’m pretty sure there’s a Yogi Berra or Mark Twain quote to the effect that “If they have to sell it to me, I don’t want to buy it.”

Although maybe it was really the one about Yogi wouldn’t want to be in any club that would actually take him as a member?

“Wall Street is the only place that people drive to in a Rolls Royce to take advice from people who ride the subway.” ― Warren Buffett

I’m flush with cash and I don’t know what to do with it.

My neighbor heard 3rd hand that all new cars with be electric in a few years and that I should get into Faraday Future at the ground floor.

Everyone is doing it!

I missed out on Crypto, Tesla, and Lotto tickets. I won’t miss out again!

Well, back to watching videos on my Betamax with my daily dose of Hopium.

I’ll be heading to Vegas in the next week to bet the rest.

Wish me luck!

Crazy world.

I get your point…but people like this tend to self-liquidate quickly, if by some miracle they end up with investable funds in the first place.

The basic question is how some/any subset of people can get rolled over and over, over decades, despite vastly improved dissemination of info.

Even the hardest-calling, most immoral boiler room hack has to *find* enough people/money to abuse.

It is like there is some “Has Money/Is Stupid” list that gets published every week.

In my humble opinion, I think it is just easier to find the “Has Money/Is Stupid” folk.

I am overwhelmed with texts and E-mails that promise me immense wealth if I just click on the link and enter my bank account. Many are not even traditional scams.

Decades ago, I’d have to go out and find a shady broker or realtor who wanted to sell me swampland in Florida. Now I can download Robin Hood for free and “invest” in any shady SPAC that exists with a quick link to my bank account while sitting on my couch.

My point is technology has made it also much easier to lose money more quickly with the click of a button. It has become a fad to invest in risky stocks since they never lose, right? Look at Tesla! Don’t miss out! :-)

Maybe this is why Universal Basic Income has so many corporate friends, despite being blatant socialism…. more marks with more cash = more profits?

My apologizes to Hopium (ALHPI), the recent IPO Hydrogen Fuel Auto company.

Their stock hasn’t crashed yet. Don’t miss out!

apologies

Good luck in Vegas!

What surprises me is that Barron’s hyped the stock. I mean they are an investing magazine right? They are supposed to be somewhat skilled in picking winners. If I was a subscriber, this would be the point where I cancel my subscription.

By the way, there is a YT video titled “Jim Cramer makes EV SPAC recommendations after big sell-off”. It’s from last year.

I used to walk a mile every weekend to my local news stand to buy a fresh copy of Barrons. That was before internet browsers were widely available.

Remember the WorldWideWeb? You had to go to a bookstore and buy a book of IP addresses to key into the browser.

My how times have changed…If I could do it all over again, I’d have become an SPAC specialist!

“WorldWideWeb” – yes the “Information Super Highway”.

Methinks bad information crowds out good, just as bad money crowds out good…

“…a man hears what he wants to hear and disregards the rest, lie, lie, lie…” -p.simon

may we all find a better day.

The reason that the new generations bet on meme stocks and crypto is that they know the Wall St casino is rigged, ‘legal’ corruption has captured politicians and bureaucracy, their only choice is to own nothing and be happy corporate slaves. They are betting against the system.

“They are betting against the system.”

Yes, and the tragedy is that their money is becoming fodder for the “system.” The “system” will take it from them. There will only be a small number of them that will come out ahead, largely because they got out in time and stayed out, and thereby became part of the “system.”

sometimes referred to in earlier days as ‘selling out’…

may we all find a better day.

If nothing else, FFIE stock appears to have enjoyed the summer rally.

Probably a lot of insider buying this summer. /s

That makes sense. Insiders hate it when retail investors are left holding the bag. ;-)

Even if money was cheap a year ago, it doesn’t justify having your investment wiped out. Makes you wonder just who is involved here and if it should be restricted.

Uh, investments have risk? The government is not an insurer against all investment risk? The only governments that fancied themselves sort of insurers of the people for and against everything were, um, communist. And that has away of going belly-up on a vast scale.

phleep-for many years now, some folks just don’t see that ‘investment’ is no different than walking into a casino lacking the shiny lights and food/liquor comps (still often has the loud music and general noise, tho-…).

may we all find a better day.

You should look at serial SPACer GigCaptial. One train wreck IPO after another and yet the public buys the shares. Then implosion. BBAI is good example . It’s crazy daisy .

RIVN and TESLA will be the only two pure US EV plays to make it.

Why would RIVN make it? Forget the valuation (which is totally insane). Are they going to be able to fund themselves to eventual profitability?

RIVN and Tesla. I don’t know if Tesla qualifies as pure EV. I think they sell inverters and home power systems and maybe Tesla Solar roofs.

Tesla makes good cars and they’d be around but their stock price needs to come way way down.

Are these SPAC and others leaving the world of Finance and stepping more into the world of psychological disorders?

I recall the hype over anything…anything… with “block chain” associated with it. Somewhere in some dark back room, a “key word” committee must come up with “hot words” that will trigger some kind of psychological, FOMO, response among those with more money than brains. Akin to Pavlov’s dogs.

Foreign startups 1720s (Louisiana Company, South Seas company), railroad stocks and US states’ bonds 1830s, radio 1929, anything computers 1960s, dot com 2000, . . .

How could they fail, they cribbed the name of an old time electrical inventor and genius ( David Faraday) just like Tesla, and Nikkola. Has anyone ever noticed that the ” real deal” inventors named things for themselves ( Edison, Tesla, Westinghouse, Ford, etc.) while todays crop of financial swindlers and would be inventors try to steal their mojo from the past. It would be more honest for Elon to call his Battery Karts, ” Muskmobiles”.

Good point. Enron Musk went for one unused (finacially) name with great pedigree. That’s innovation. Nikola and Faraday are just two-bit copy cat hustlers.

Think you will find it was Michael not David

As you note, because of the low share price of FFIE,

as well as the bountiful “liquidity” in the stock

it had all the criteria for an ideal “day trading” candidate.

I day traded the stock often.

and honestly didn’t know a thing about the company.

In and out, in an out, trading scalping “pennies” a day in profits

However, when the stock broke it’s very important support at $2,

it was all over technically.

I stopped buying it there.

Good thing too.

In less than a month,.. it fell over 50 %,

certainly wiping out those folks who were “‘Clueless in Seattle”

Say what you will about consensual hallucination, just don’t say it doesn’t work.

Some argue that religions were the first institution to arise out of consensual hallucination. You can’t argue that they aren’t raking in huge profits to this day.

Because there are no historical documents going that far back, a case can be made that the original consensual hallucination was morality or justice or equality or liberty. In every instance, huge money making industries were founded that are in operation even today.

So that an electric car maker got into that action is a mere trifle.

Regardless of the product, the mechanics of consensual hallucination are always the same. It’s very easy to spot.

It’s consensual hallucination when the words “I know/understand” are replaced by “I believe.”

“The power of accurate observation is commonly called cynicism by those who have not got it.”

George Bernard Shaw

I call it cultural mass hysteria. Whenever I get an offer to “belong” to an organization, it’s an automatic response of, “No, Thanks. I’m good.”

It’s the same mass hysteria that drove the bubble in real estate during covid.

I just became aware of the software space and all the companies that are profitless. It boggles my mind, most of these will get bought or go BK. And I use some of their products, can’t believe the valuations some of them got.

Maybe SPAC investors have bicameral minds, that is, one side of their brain is God speaking to them, while the other side does what they’re told.

So, instead of using fundamental analysis to decide on buying a stock, the bicamerals might be using Elliot Waves, or Fibonacci sequences, candlesticks, or cups and handles, obediently following the dictates of either the God side of their brain or maybe just something they read on the Web.

Sorry Michael…

As usual, the American middle and lower income classes bought at the top to enrich the sellers who got the stock for an inside price.

The poor gets fleeced with lottery tickets.

“Consensual hallucination” Sounds kinky. Can I get back in or is it too late now?

SPACs, meme stocks, electronic tulips and other things are crashing, but I really don’t see signs of inflation abating. People are still gobbling up cars, RVs and things, and paying full price. The dealer lots are still empty. I keep hearing about this imminent used car price crash that never materializes. Inflation is entrenched.

People are flushed with money .

I see no slow down in consumer spending.

Right. There’s way too much money chasing too few goods. I was just reading a story about a Chevy dealer which usually has 500-600 new vehicles on their lot. They have 22.

This kind of thing results in lots of layoffs at auto dealerships (salesmen, make ready guys, some admin folks, etc).

I see the same thing- live in the southeast – its a construction site the whole region ! I enjoy people doing well- love a full bar/restaurant – BUT there is too much $ out there and I see zero slow down – maybe its coming but at least here its super charged spending

Hey Wolf, do you have a complete list of your imploding stocks? I checked the “Imploded stocks” tag that marks articles about individual stocks, but don’t find a complete list. Would be great if you could make one post that lists them all. Thanks.

I have a long list, hundreds, growing by the day, with current price, intraday all-time high and its date, % collapse from all-time intraday high, IPO date and price, SPAC merger date, delisting date, bankruptcy date, and assorted info and dates on the company. This is a lot of work since I’m putting it together manually.

Imploded Stocks is going to be a theme here until those stocks are gone. And it is now drawing some big names into it.

Google: imploded stocks

I also own implodedstocks.com

I make them public one at a time, in my articles, to show how insane the world had gotten.

The hard part isn’t getting the stocks on the list. The hard part is putting the supplemental data into it, for each stock, such as IPO date and IPO price, first day pop, etc.

The list and supplemental data are proprietary, and I’m not sharing it. If I post this stuff, everyone will steal it just like they steal my articles, only worse: they could actually copy and paste the list and data from my site into a spreadsheet, and then they’d have their own list and data to work with without having put in the hundreds of hours I put into it. Not happening. They can make their own list.

thank you for your good work – when it comes to SPACS my mind keeps wondering -” who lost these billion$?” individuals – institutions – how felt the pain ?

Sorry To Say. I was uneducated, uninformed with no retirement. I put all I had and hoped for a Future without $400. a moth SSI. Worked since I was 14 and now 60. Shame on me for trying. I rest my head in my hand. Thank you Wolf for the article. :)

I just got back from reading the copy on FFs website, and I now I want some!

“Faraday Future (FF) is a California-based global shared intelligent mobility ecosystem”

oh yeah! I so want a piece of that action!

and they do seem to have built at least one car

eventually there is some pension fund that is losing the pension of it’s members . it’s sad but we know these pension funds ( teachers , firefighters etc..) get to do what they want because their clients are not watching them so close . there should be investigation to see if pension funds were lost in these investments .