Overall supply at retailers still 18% below normal, huge shortages in some segments, gluts in others. Thankfully, grocery stores are only a tad below normal.

By Wolf Richter for WOLF STREET.

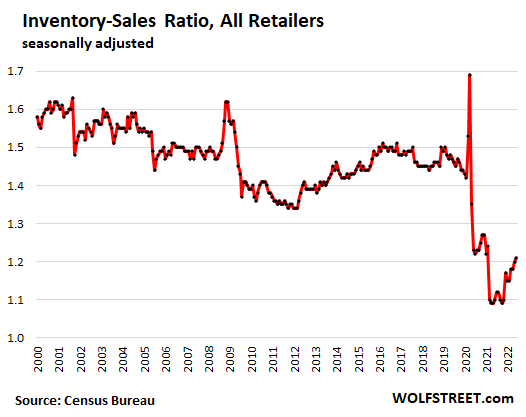

The retail industry measure of inventory levels – the inventory-sales ratio – ticked up to 1.21 months’ supply at the end of June, according to data from the Census Bureau last week. This has come up from the empty-shelves era, but was still down by 18% from the average supply in 2019. And there are vast differences by segment of retailers, from relentlessly huge shortages at some, to slightly below normal at others, to overstocked at others.

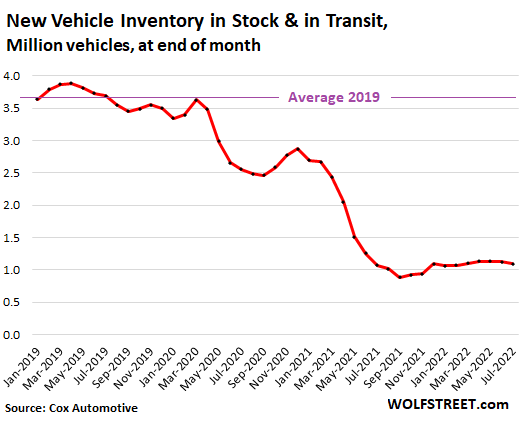

New-vehicle dealers are still woefully low on inventory and essentially out of stock of fuel-efficient vehicles. The number of new vehicles in stock is down 70% from 2019. At other retailer segments, such as grocery stores, the shortages are over, thank goodness, but supply remains lower than it had been before the pandemic. But some general merchandise retailers, such as Walmart and Target, ordered too much of certain items, and by the time those items finally got in, consumer spending had shifted to other items. More on those segments in a moment.

This inventory measure includes what is in the stores of that retailer, plus what is in the warehouses of that retailer. So this is not just what is inside the store, but the total inventory that the retailer holds including in its warehouses.

Patio furniture and some types of apparel are what Walmart brought up as problem items. Consumers bought a huge number of laptops and PCs and smartphones and networking equipment during the pandemic to work and study and sit at home, and now they’ve got all this stuff, and they’re spending their money on plane tickets to go someplace, and sales of some types of electronic devices, furniture, etc. are weakening, and inventories have built up.

The pandemic, from the very beginning, has made a mess of the normal game plan of retailers, and continues to do so. And Americans, notoriously fickle about their spending preferences, are at it again, with sudden shifts that can leave retailers with the wrong inventory.

Inventory in dollars shows raging cost inflation. What matters: months’ supply. Inflation in goods has permeated the entire supply chain, resulting in higher costs of merchandise for retailers. Higher costs push up the dollar levels of inventories, even if the number of items hasn’t changed. So the dollar-levels of inventories are not relevant to measuring if retailers are overstocked or understocked.

To eliminate much of the impact of the surging costs of goods on inventories, and to get a feel for what actual inventory levels are in relationship to sales, we look at the “inventory-sales ratio.” This classic industry metric shows how many months it takes to sell the inventory on hand at the end of the month at the current rate of sales.

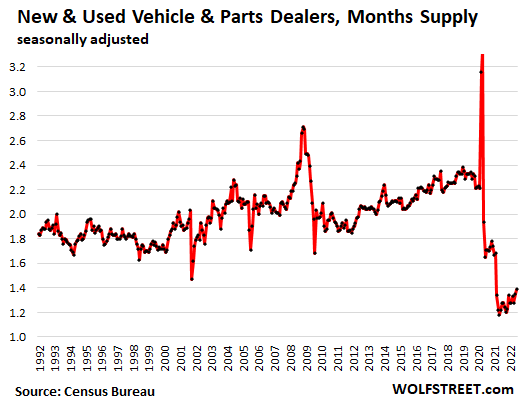

At auto dealers, the inventory-sales ratio rose to 1.39 months’ supply, still down by 40% from the average 2.3 months’ supply before the pandemic. But there is a huge difference between used vehicle supply, which is nearly back to normal, and new-vehicle supply, which is still hampered by massive shortages, though those shortages have shifted from pickup trucks and large SUVs to fuel efficient vehicles – more on that in a moment.

Auto dealers are the largest segment of retailers by size of inventory, which in normal times account for over 35% of total retail inventories:

The number of new vehicles on dealer lots and in transit dipped further in July to just 1.09 million vehicles, down by 70% from the average level in 2019, according to data from Cox Automotive. But the mix of those inventories has changed in reaction to the spiking gasoline prices this year:

- Hot demand for fuel efficient vehicles has depleted inventories of minivans, sub-compact cars, compact cars, and midsize cars.

- But inventories of full-size pickups and SUVs are building, with some brands already at very high levels (Ram 1500 trucks):

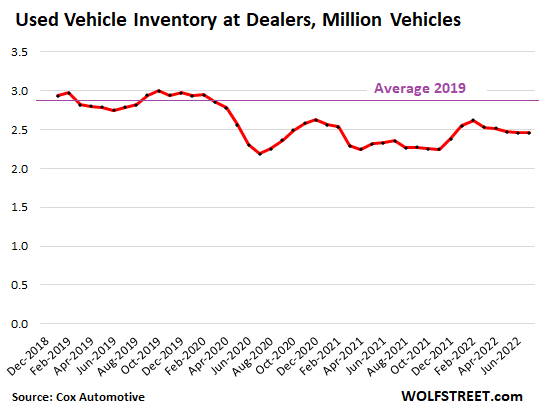

The number of used vehicles on dealer lots has remained flat for the past three months at about 2.47 million vehicles. This is only 14% below the average levels in 2019:

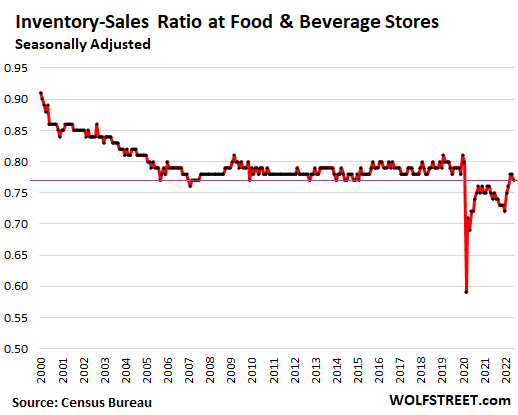

At food and beverage stores, supply has risen from the empty-shelves era – which is a really good thing – but it remains below pre-pandemic levels, and in June dipped to 0.77 months.

Note: This inventory measure covers what is in the organization’s stores, plus what is in the warehouses of the organization. Inventory levels at grocery stores are generally low as inventory goes through a pipeline, with new merchandise arriving daily, as merchandise is sold. But this measure also covers what is in the retailer’s warehouses and in transit from the warehouses to the shelf.

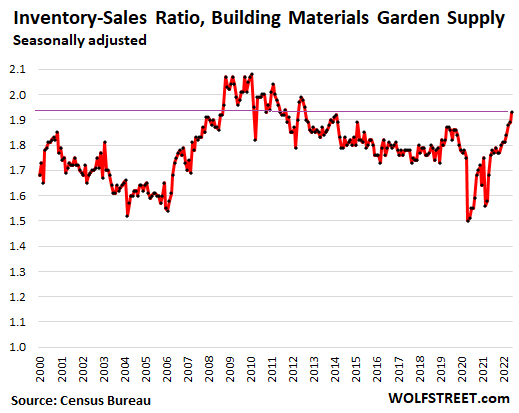

At building materials and garden supply retailers, the inventory-sales ratio rose to 1.93 months’ supply, the highest since 2012, as consumers have switched from buying patio furniture and materials for DIY projects, that boomed during the pandemic, to buying tickets for sports events, cruises, plane tickets, or whatever, to do what they’d missed out on during the past two years.

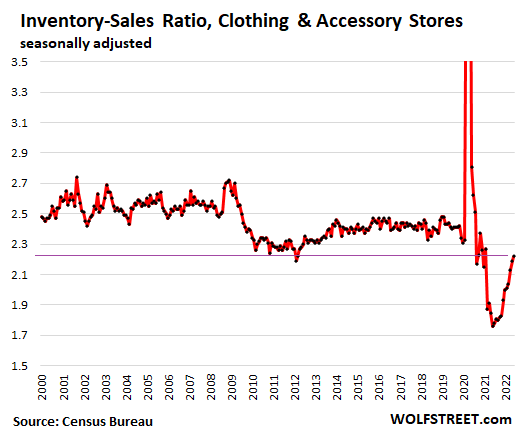

At clothing and accessory stores, the inventory-sales ratio ticked up to 2.22 months’ supply, up a long way from the out-of-stock levels in 2021, but still below the pre-pandemic levels of 2.4 months’ supply:

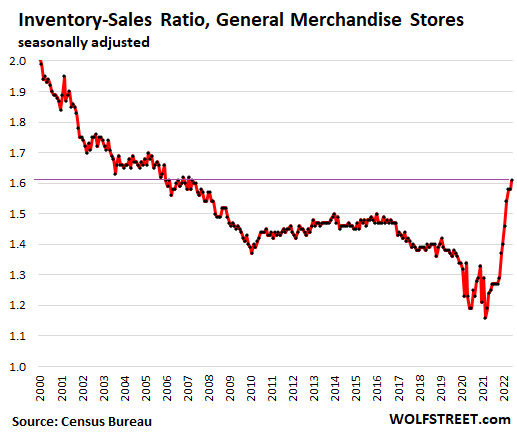

At general merchandise stores, the inventory-sales ratio jumped to 1.61 months’ supply, the highest since 2007, having solidly surpassed pre-pandemic levels earlier this year. This segment includes stores like Walmart and Target, and department stores.

The segment accounts for only 12% of total retail inventory. And it’s in this segment where overstock levels are now an issue that these retailers have acknowledged during their earnings calls. Retailers being overstocked is a classic and common problem, as consumer preferences shift on them, and they know what to do: Offer some deals.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I leased a RAM 1500 Tradesman in 2015. The MSRP priced was $31k but they were running a big cash back special and I chose to lease and the price of $26k was used as the basis in the lease payment. I really liked the truck. It was a 2 year lease with 12k mile per year. The lease was for $199/month and $1500 down.

At the end of the 2 year lease I could have purchased it for 20k but I turned it in.

My local Carmax dealer has 2 of the same models on its lot. One is listed at $29k and has 91k miles. The other is listed at $32k and has 52k miles.

There are 43 RAM 1500 trucks in inventory near me which is a lot compared to any other vehicle. Cheapest quad cab starts at $50k and the most expensive is $101k. The majority for sale are probably sitting around $60k to $65k.

I can now do the same 24 month lease on a RAM 1500 Tradesman for $975/month and $3900 down. As I said, in 2015, my 24 month lease was $199 and $1500 down.

I regret not buying that RAM truck off of lease. I cannot afford a new one nor can I afford to buy the same one I leased in 2015. Crazy that RAM trucks prices have doubled since 2015.

They’ve quickly turned new vehicle ownership into an endeavor reserved for the wealthy. Most average people, even if they sign up for the debt, can’t really afford the vehicles based upon traditional measures. That’s why they’ve got financial “products” like 170% loan to value, etc.

I keep fixing my vehicles as if I lived in Cuba. I only wish mine were the 1950s models like they have.

my oldest daugher moved to San Francisco and doesnt need a car anymore, so my younger daughter can take it. it was passed down from me to my older daughter, now to my younger daughter.

bought a tesla and that is the only car my wife and i drive. save about 250 a month on gas, plus probably another 150 a month on maintenance.

the auto industry will undergo massive transformation soon. autonomous ride share will result in the largest demand destruction for cars that we have ever seen ( deflationary force). just another 3-5 years until most major cities are in the midst of this upheaval.

i think that over the coming six months to year, we will see inflation really get squashed. the core of the whole enchilada is the mortgage rates. the Fed really needs to sell all that MBS. i really wish we would eliminate Freddie and Fannie and have the banks keep the loans they source. it would lead to much tighter lending, and a much more stable and reasonable home market (and rental rates would follow).

to me, the real story in six months will be how inflation has adjusted back down so rapidly and yet the Fed still has a pile of this debt on their balance sheet. that debt becomes systemic because they cant sell it or they wreck the economy. they have barely even sold the stuff off and look at how fast things are changing. as companies start to lay off employees, we will also see a much weaker employment market.

so the question will be whether the Fed goes right back into a low interest rate environment to “save” the economy. i firmly believe we should embrace deflation, particularly the type of deflation created by technology advancement. instead of trying to create fake inflation in goods, why doesnt the Fed focus on the wealth gap and deflating it? that would be a far more important objective than inflating another bubble to keep inflation positive.

gametv, I will be astonished if autonomous driving is widely adopted in my lifetime — the regulatory hurdles are nontrivial.

bought a tesla and that is the only car my wife and i drive. save about 250 a month on gas

but you paid $40,000+++

won’t even go into the POLLUTION to mine, process and manufacture your FIRE VEHICLE(hopefully you won’t burn down house with it)

and NO ONE WANTS THE TOXIC vehicle when done

Tesla competes directly with BMW: the Tesla Model 3 v BMW 3-series, etc. The categories are near-luxury and luxury sports sedans and SUVs. You need to compare the price of a Tesla to the price of an equivalent BMW. And they’re very competitive. Tesla has been eating BMW’s lunch.

Any comparison of a Tesla to a low-end economy car is just inane.

Been there a couple of times. They all have disc brakes and PRC diesels and parts. Only the sheet metal and interiors are the same

Yes, and that was inevitable when they started printing money and suppressing interest rates. They figured “As long as all of the printed money ends up in asset prices, who cares? We get to make the rich richer and no one is the wiser!”

The problem is that once you print the money, you lose control over where it goes. Eventually, it was destined to end up in ordinary consumer goods and services, and what we’re seeing now is 13 years of pent-up inflationary pressures all being unleashed at once. It’s going to be very difficult to contain.

The increase in stock prices didn’t create inflation because those are owned by the top 10% and they don’t account for much spending. It was the increase in RE prices that caused the inflation because RE is owned by 65% of families. Each of them say their main asset rise 30% to 300% in value. Some families in the West and South saw a million or more fall in their lap, courtesy of the federal reserve board. They are spending that perceived wealth, just as the federal reserve board intended.

the charts i see here are showing that the inventory issues are starting to return to normal in most categories and as inventories rise, that means the balance between supply and demand is restored and will eventually result in prices returning to normal. food inventories still have a ways to go to get better. only the new vehicle inventories still look poor. but factory output is increasing recently and within just another 4-6 months the vehicle inventories will be right back to normal.

i just dont see this sticky inflation actually happening with inventories returning to normal and oil and transport prices falling. food prices will remain sticky for a while, and rental equivalent will probably be the stickiest component of inflation, but all other inflation is going away rapidly. inflation in services is going to take just a bit more time.

as consumers exhaust that extra money in their bank accounts and run the credit cards back up to their previous levels (maybe another 4-6 months to get there), demand will fall and inventory gluts will be more normal, pushing prices back down.

the nature of inflation has changed dramatically due to the price transparency of the internet. without driving at all, i can compare prices in a few minutes, across goods. falling home prices will also hit the home improvement store categories, which have been real strong. this will help to quell demand.

so energy, home improvement, general merchandise categories slated to fall back down. food prices will also adjust rapidly downward, as big companies like costco will reassert their leverage as shortages start to abate.

the bigger story here is that the Fed will be left with a structural debt on its balance sheet, and will have no way to sell off this debt without tipping the economy into a recession. this is what happens when a country is running such a large trade deficit.

the government has elected to once again spend too much money with these additional spending bills, so maybe that keeps spending going just a little while longer.

more debt on balance sheet and more Fed government debt piled up for future generations. the cycle just doesnt end.

gametv,

Inflation has shifted to SERVICES, which are the biggest part of the economy. Durable goods inflation has already come down a lot.

“…only the new vehicle inventories still look poor. but factory output is increasing recently and within just another 4-6 months the vehicle inventories will be right back to normal…”

Do you have actual facts to back this up or are you just talking out of your ass? Because automakers have collectively said it will be another year at least until output returns to normal. That’s “output,” not inventories, which would take even longer.

PS – A story out yesterday said that auto production cuts this year are “worse than reported.” You know what that means? These guys are probably lying so that their stocks don’t tank.

auto factory production last month increased by 6.6%. that is just the start of the ramp up over the coming months.

those are lagging numbers. each month it will generally get better. but the auto manufacturers will want to promote the idea of supply shortages as long as possible. if you think that there will be a glut of new cars in another 3 months, you wont go out and buy the car they want to sell you at a massive mark-up right now. they are feasting on suckers.

this narrative of shortages is all to create suckers. look at the data Wolf has produced. the only category that is seriously impacted by shortage in inventory is cars. and that category alone accounts for 35% of the total chart, so it skews the total completely out of proportion.

the dip in food inventories is aggregate, so i would bet there are some categories where inventories are much lower than needed and that has led to the price spikes. once the balance between supply and demand is restored, prices will fall rapidly. food is a commodity and commodity products rarely maintain margins above a fair return on capital.

so the two areas where price hikes might be more structural are housing and services. i would think that healthcare is one of the biggest drivers of service inflation, since it accounts for about 25% of our economy. but the factors in healthcare inflation are very specific to healthcare and government.

my believe is that monetary policy has been more responsible for asset inflation than for price inflation of products and services (outside housing). government policy and funding is responsible for inflation in education, healthcare and housing. price transparency and competition is the very core of why inflation in goods generally gets tamped down very quickly. the internet has been a positive deflationary force for a long time.

i just think the focus on monetary policy is not correct. there are many structural issues that we continue to ignore. monetary policy should really be primarily blamed for asset bubbles, which continue in both the stock market and real estate.

“…if you think that there will be a glut of new cars in another 3 months, you wont go out and buy the car they want to sell you at a massive mark-up right now. they are feasting on suckers.”

Right. That’s why the local dealership new car lots are bare asphalt with no cars. You’re pulling shit out of your ass.

I was once again made to feel small by the mountains of paper products at Costco last week…

Nobodys ass will have to go without for awhile.

From my observations at Costco, the item they sell most of is bottled water. I can’t help but think of the environmental impacts of all that plastic.

I shake my head when I see people paying for plastic bottles of water. Reverse Osmosis filters are cheap and last a long time.

The environmental impact of plastic bottles is immense but there are also health impacts from the estrogen mimicking and other chemicals leaching out of the bottles that get much worse if the bottles are kept in a hot place like a car.

Otishertz – BPA is not used in the manufacture of PET water bottles. You don’t have to worry about growing breasts.

Glass actually has a larger carbon footprint. I agree, we ought to just drink out of the hose like in the good ole days but there is no health concern from PET.

We have a reverse osmosis unit but it is reserved for our salt water aquarium.

I just don’t like the unsightly debris part. Its more of the littering than cheap beer bottles/cans that the teenagers throw out the car windows and the airplane size booze bottles that the wine moms guzzle on their dog walks.

agreed.

the vast majority of the “eco-friendly” products are just a sham. the best ecological policy is to buy less, consume less.

Looked into RO for family undergoing chemo with super shady well water. Whole house RO’s cost around $2k-5k+, not including installation, and require a seperate main line filter first for hard water, else the RO filters will clog quick. Not chump change especially for immunocompromised undergoing expensive medial treatment, who are the ones who most need RO’s.

Under sink units are much cheaper but may still need professional install which kills it for the poor and for renters (and if applicable they still require the main line filter first to fix hard water). They’re expensive, even if the cost is cheaper in the long run vs. buying bottled.

Bottled water is inevitable, not going anywhere unfortunately. If only its quality was as reliable as the companies claim.

I bought a Big Berkey two years ago and haven’t bought a single bottle of water since. Tap water through it tastes better than aquiferna or dasani. Coffee is much better too.

I would rather see a mountain of bidets! Best invention ever! 😁

The sales rate, as measured by inflation adjusted numbers, is still an important consideration in assessing economic activity in the retail sector. Here’s why.

The inventory sales ratio might seem to imply a constant level of each over the long term. However it can be the case, especially during times of persistent high inflation, that sales volume declines, and in lagged fashion, inventory levels decline to match. However, once that adjustment to the lower long-term level of inventory has been reached, the ratio itself is back to what it usually is.

In that case however, it would be a mistake to conclude economic activity is back to where it once was. For example if inflation adjusted sales volume declines to 10% less than what it once was, and if eventually inventories decline to match, then the ratio actually stays the same. But obviously economic activity is 10% lower than it once was.

I suspect the above example, that of long-term declining inflation adjusted sales, followed by inventory levels to March, is exactly what will eventually happen.

Nothing alarming it appears until other factors are added such as the higher costs for all, for everything.

Maybe it’s just me but I really don’t feel like paying these higher prices, for now.

I just got back from the grocery store and it seems like prices continue to make new highs by the week. Processed foods, which I try not to eat too much of, seem to be where the massive inflation is concentrated. Fresh fruits and vegetables, while higher, are not seeing such massive increases.

I don’t see any shortages of anything anymore at the grocery store – UNLESS IT’S ON SALE. Then the entire shelf will be cleaned out. Being aware of my surroundings, I can’t help but overhear young people at times lamenting the prices, obviously struggling with them. I think it’s absolutely disgusting what the FED and CONgress did. It’s beyond shameful – it’s criminal.

Still think that can of Campbell’s Chicken Noodle soup may be one of the best investments around over the next 5 years, assuming the can does not shrink to that of a pill container!!!

Let’s see… one can of standard Campbell’s Chicken Noodle soup contains 890mg of sodium in it. Keep eating that junk and one won’t have to worry about what’s coming over the next 5 years!

Warren Buffett eats hamburgers and coke steak still alive over 90 .It depends on your bodily makeup and good health care

Canned Soup????

I don’t have any of that canned crap anywhere in my house. I buy everything from scratch. Make my own soup from left over chicken broth. Doesn’t have all the sodium and preservatives. Just look at the label. That’s the trouble with Americans today. They can’t or won’t even read a label on the crap they buy. No wonder so many are overweight. Stores sell that crap because the dumb consumers buy it.

Wow! I went to buy groceries and came away with the exact OPPOSITE perception. The whole cooked rotisserie chickens that used to cost $4.50 now cost $6.07. Go over to the raw chicken section instead and what was 99 cents a pound (thighs and legs) is now $1.49 and is mostly sold out.

What??? I haven’t seen chicken breast below $4 for months, and the quality stuff is $6 to $10. Cooked rotisserie are $8 to $14.

“The new phone book is here! The new phone book is here!”

February 2020 (pre-pandenmicmonium)…~300 pages.

August 2022….~200 pages. 33% decline of something printed on toilet paper. Barely enough left to jam an outhouse door open. One stiff breeze and “it’s all over now”.

I still have a stack of old SEARS catalogs, just remember not to use the shiny pages.

BuySome,

At our building, these new phone booklets don’t even get picked up anymore. They sit by the mailboxes for a while and then just go into the trashcan by the mailboxes. The only reason why someone still prints them is because they’re still able to sell ads to some clueless companies, or to companies that have always bought ads in the phone book and now forgot about them and just auto-renew. Phone books don’t have cellphone numbers. So what’s the point anyway?

Hollow it out for a good stash box.

Having worked home care I can attest, phone books are still very valuable to much older folks looking up local business numbers (plumber, lock smith, etc.). And for proping up their sunken sofa cushions/broken furniture. The only ones who don’t leave their books in a soggy, decaying lump by the porch.

1) Thirty years SPX for entertainment only : There is an uptrend line

coming from 2000 to 2022 highs. In Nov 2024 this line will reach the 5,600 area.

Option #1 :

2) The move from Mar 2020 low to Jan 2022 high was approx : 2,600.

3) How far below the current SPX have to go to point X, so that X + 2,600

equal 5,600 ==> 5,600 – 2600 = 3,000. That’s Sept 2018 high. Can it go higher : yes.

4) What might happen after SPX reach the Nov 2024 peak @5,600 – 5,700.

U don’t want to know.

Option #2 :

It’s hard to predict if and when a lot of product prices and inventory will level out. Appliances, electronics, and container goods from China are experiencing factory shutdowns for the shortage of electricity to go along with covid.

A lot of producers went out of business during covid so what is back to normal? For instance: Beef. Is there a shortage or are 100%++ higher prices here to stay? Most grocery stores seem to be well stocked, are the prices justified?

Sanctions on Belarus drove up the price of potash fertilizer. The high price of natural gas drove up the price of nitrogen fertilizer. Without cheap fertilizer, corn prices moved higher. Not much of an effect on the price of cornflakes or corn tortillas, but an effect on the price of beef as a steer needs to eat 6 lbs. of cattle feed to gain a pound of body weight.

Remember that cattle are grazers and live off of grass. They’re all pasture raised, which naturally creates lean meat. To get them ready for market, they are fed grain for a month or so in order to marble the meat. Cattle are not raised from day one on grain.

That would be like feeding your toddler oreos everyday, every meal.

:)

“ That would be like feeding your toddler oreos everyday, every meal.

:)”

I’m sure somebody, somewhere will see a problem with that… :)

MiTurn – You need to fertilize pasture also. Grass isn’t free.

MiTurn, most cattle are finished on a grain diet between 140 to 160 days, not the month or so you mentioned. True, they graze on grass up to the last 4-6 months. However, some “natural” beef (a very small percentage cattle processed), run the whole time on grass but is very inefficient for that “lean meat” experience. If you like your steak like shoe leather, then get that grass fed beef. If you like the other extreme, then go for that Wagyu experience. However, the majority of steak eaters will take a USDA grade choice ribeye cooked properly.

Charlie, grass-fed = leather? C’mon, man, untrue.

The only cut that isn’t better grass-fed (that I can think of) is brisket. I’m smoked many, and the pricey grassers never turn out as well.

BTW, not that long ago, brisket was $1.50 to $3 most of the time. At a high end butcher, more, but there’s no point in paying that for a brisket. Well now I see them routinely $4 to $8. $8, when you’re trimming off 20% of the hard fat before smoking it????

BTW #2, to the poster who said 100% price increase on beef, I only see that on a few cuts. Most everything else, whether grass-fed ground or Ts or whatever, prices look pretty close to the same as they have been for years. But then I am where it has always been pricey.

Yes, lots of factors with every item we use. Commodity lumber prices have fallen well but it’s still pricey at retail. I’m needing some but with home construction slowing I expect prices to drop well this winter.

“Inventory in dollars shows raging cost inflation. What matters: months’ supply.”

Lots of shaking out still to come. Factors include dropping crude oil prices but surging LPG. Today the Euro is falling below the dollar. Poor Europe.

Patience!! Those trees just keep growing. Windows, doors, hardware, appliances, are all in catch-up mode. There will be a whiplash effect when builders stop building.

True, lumber is still pricey retail. Even when buying a lot of it. Around $1600/1000ln ft.

There is a podcast on “macrovoices” that has an expert on grain production. He is very concerned about future production.

The growing season has been extended by about 2 weeks due to warmer weather in US, Ukraine and Russia over the last 30 years which has facilitated rapid expansion of grain production and making Russia and Ukraine big producers for the world.

Producers are selling there cattle,no feed or too high priced to make a profit . Read a article that said it takes 6 years to replace a cow .

Grass fed cattle were affected by drought conditions. Ranchers sold them to the meat packers rather than buy alfalfa. Alfalfa prices increased. Colorado River water allotments to agriculture have been reduced. Fewer cattle = expensive beef.

Not to California agriculture. Arizona picked up California’s share of the reduced allotment.

Meat is in cold storage ,stacked to the ceiling .From truck driver who was taking pictures,got yelled at and told to leave building.Shortages create inflated prices

Meat is ALWAYS in cold storage. Always stacked, but always moving. So if you walk into a cold storage facility, you’d be impressed too.

Truck driver told me it was stacked to ceiling ,deliveres there weekly ,never seen it so full

Wolf, you are right, beef has to keep moving in and out of cold storage. Here is latest link if you want to use it:

https://www.nass.usda.gov/Charts_and_Maps/Livestock_Cold_Storage/beef.php

Packers anticipating shorter supplies going into next year need to keep the freezers fuller.

Inflating prices make hoarding profitable, which makes current shortages worse and drives prices higher … until the glut hits.

I’d guess meat isn’t so different from houses – supply may be hidden all over.

Wolfster…

Got anything on RV inventory out there…

With the pandemic buying over, seems like we should be headed for a glut…

I live in my RV and follow the market closely. I bought my current RV, and Arctic Fox, about seven months ago. I can tell you since I bought it at the peak the price has dropped tremendously and supply has gone up. At the time I sold my Airstream and I’m currently in the market for another. As popular as Airstream‘s are the market has dropped a great deal on those also. I know I’ll take a bath selling the one I’ve got now but I’ll more than make it up in my new Airstream. Happy travels.

Bill,

I have been surprised by how affordable the trailer market seems to be.

RVs with a motor may be a different story, but trailers seem inexpensive to me (especially when apt rents go up 20% per yr, for multiple years…).

Now, RV park hookup rents are mostly a different matter.

(That may say something about the true nature of US inflation).

COWG – I’ve been watching also. Like to have a lightly used one in time for hunting season. About time to start growing the annual beard. :)

I Follow Fauci patio umbrella glut.

At site of “The Palace of Auburn Hills”, the former home of the Detroit Pistons, now empty land with a giant parking lot, nearly the entire property is filled with new, parked vehicles, all assembled but parked at this giant storage facility. Guessing a thousand or more? Hard to see the back side of the property from the road. The word is they lack some chip or another to be completed and shipped to dealers.

In another sense, I wonder how these are accounted for relating to channel stuffing?

We referred to those vehicles as “hospital cars” and were part of corporate inventory. Traditionally, they do not count as “wholesaled” until they are invoiced (considered in-transit) and drafted (considered dealer on-hand).

CreditGB,

These are counted as the manufacturer’s inventory. GM said it had 95,000 uncompleted vehicles on storage lots at the end of Q2. Ford has a bunch. They all do. It’s a way to keep the plants operating. The missing component may be something like a rear-view mirror or whatever – all of which require chips. And when the components arrive, they’re installed and the vehicle is then invoiced and shipped to the dealer.

This has zero to do with “channel stuffing” but is a sign of the still rampant chip shortages (cheap trailing-edge micro-controllers mostly) and production short-falls. The good thing is, when the component arrives in large numbers, those vehicles are completed and are going out to dealers very fast.

The auto industry is completely crippled at this time, with no signs of improvement. NONE. And it has been for 2 years. This is a FAILED MODEL.

Dude, where do you get this crap? Sales aren’t zero, FFS. I live in a busy area with lots of dealers around. The Ford dealer has a FULL lot. At least 10 new Broncos, several F-whatevers, etc. It looks NORMAL. Same for BMW down the road from them and a bunch of others. Sheesh.

From JP Morgan Analyst

“We’re going to get a lot more semiconductor capacity in the second half of 2022 – we’re nearing the end of the supply crunch. However, capacity still needs to be qualified for use in the automotive industry. Can the right matching occur between available supply and correct qualification? This is the difficulty that remains.”

There will still be issues, but it will get alot better soon. Also, demand for cars will probably come down a little as consumer bank balances and credit cards get back to past levels.

the full story on car production is shown here

https://www.jpmorgan.com/insights/research/supply-chain-chip-shortage

bottom line, it will get much better by start of 2023. my guess is there will be a glut of cars for sale by mid-2023.

It seems to me that if the grocery channel has roughly the same amount of inventory as always then that the steep inflation we see in groceries isn’t “transitory” or whatever. It is NOT due to supply chain constraints.

Inflation at Home Depot – in November 2019 a 3 cubic foot bag of Scotts Mulch was $2.98. – $1 per cubic foot.

Today, 1.5 cubic foot is $3.98 – $2.65 per cubic foot.

Same product – same price with the bag size reduced from 3 Cubic foot to 1.5 cubic foot.

265% increase in price. Inflation is not 10% a year.

The home improvement market has been impacted by rising housing prices and the fact that people were trapped in their homes. Wait for housing prices to fall for 6 months and people will be alot more price sensitive.

Seems like new vehicle inventory is the standout that is really dragging down the total. Pretty much every other segment shown in these charts is at, near, or above normal. That jibes with what I’m seeing on the ground. I really don’t notice shortages on store shelves anymore other than maybe OTC medication and baby formula. Home Depot has so much out on the retail floor, the isles are nearly impassable (just like the chart). I also would expect lots of new car inventory to start hitting the market in the coming months as missing electronic modules are installed on nearly complete vehicles. With demand dropping off all over the place and gluts hitting in various retail segments, it’s hard to imagine that product inflation can stay hot. Service inflation will cool as folks get their missed vacations and projects out of their system. Probably just in time for the Fed to take its pause in rate hikes at maybe 3.5% FFR or less. The rest simply hinges on jobs. The Fed won’t back off of QT until unemployment starts to show the effects of this dropping demand against plentiful supply, which it will. Then the economy goes back on that sweet government glucose IV drip. By 2024, the new Republican slogan will be “Make America Japan Again” vs. the Dem’s “I think I’m turning Japanese, I really think so.” Maybe we can keep going until the Fed’s balance sheet is bigger than our GDP like the BOJ. We have a smoke and mirrors economy with fundamentals far weaker than they were in the 1970s… Won’t take much QT or a big FFR to kill it.

Not Sure,

Before your get too carried away with this “pause” notion or whatever, let me remind you that inflation has shifted to SERVICES, which are the biggest part of the economy. Durable goods inflation has already come down a lot. It’s in services where the music is going to play:

Household debt is growing and savings are shrinking so the drain has been opened. Can the Fed and Government stop inflation without an economic collapse? I’m starting to move savings out of my small neighborhood bank. Going with the to big to fails.

Anecdotal but weird: as a Gentleman of Stature (TM), I order most of clothes online. I was stalking a particular pair of pants from King-Size. The ‘catalog’ price was a ridiculous $89.00 for the color I wanted. I watched over the summer as the price held steady, then suddenly appeared on clearance for $25. I placed the order, and a couple of days later I received an email that the item was back-ordered (from Clearance!!) and would be coming in mid-September. A week or so later, so early August, it magically appeared in my mailbox. The point? Beats me. Maybe K-S just doesn’t know how to run its business.