Not all commodities are plunging: Game of Inflation Whac A Mole.

By Wolf Richter for WOLF STREET.

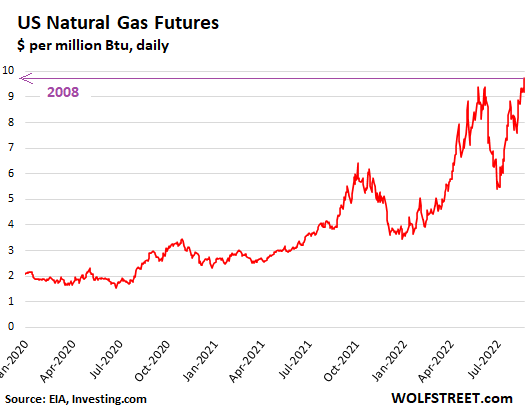

Here we go again. This morning, the notoriously volatile natural-gas futures, which have taken down numerous hedge funds over the years, jumped to nearly $10 per million Btu and currently trade at $9.75, the highest since July 2008, up 146% from a year ago, and up 350% from three years ago, topping off a series of spikes that started in early July, just when folks got used to the plunge in commodities prices.

The price has now recovered all of its plunge that started in June 8, when a fire damaged and shut down the Freeport natural gas liquefaction plant in Texas, which cut LNG export capacity by 17%. The plant is scheduled to resume exports at partial capacity in October. The part of the plant that was damaged will take longer.

The shutdown of the LNG export facility removed some demand from the US, and the plunge in price was a classic knee-jerk reaction that has now been unwound. Since the low point on June 30 ($5.39), the price has spiked by 81%:

The June-July plunge in natural-gas futures prices had been one of the reasons cited why inflation in the US has peaked. Utility natural gas piped to homes accounts for about 1% of total CPI. In the July CPI reading, utility gas piped to the home fell by 3.6% from June, the first month-to-month decline since January, and a welcome relief after the spikes in the prior months, including +8.2% in June from May, and +8.0% in May from April.

Spikes in futures prices don’t immediately translate into higher natural gas prices at home, but eventually they do. And this is another example of the game of inflation Whac A Mole, with price spikes popping up here and there all over again.

Natural gas also feeds into electricity prices via power generators, into food prices via fertilizers made from natural gas, and into prices of all kinds of other products.

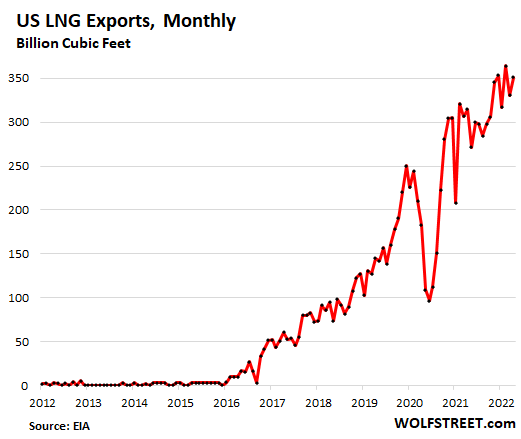

The two-year surge in natural gas prices was powered by US exports of LNG, which have been booming, with new LNG export terminals coming online one after the other — seven since 2016. A small LNG terminal at Kenai, Alaska, has been operating for years. LNG exports added to demand for US natural gas and increasingly linked US natural-gas prices to global LNG prices.

For operators of natural-gas-fired power plants, struggling to meet demand from air conditioning, the hit to natural gas export capacity this summer came just at the nick of time, and the plunge in the price of natural gas during the summer was a godsend. But that is now over.

Exports of LNG have soared since 2016. The US also exports natural gas via pipeline to Mexico and to a smaller extent to Canada, but those pipeline exports have been roughly level over the past few years. What has added new demand on a large scale in the US are the LNG export terminals.

The EIA has released LNG export data through May, which doesn’t yet include the potential decline in exports in June and July due to the shutdown of the Freeport LNG terminal. It will release June export data at the end of August:

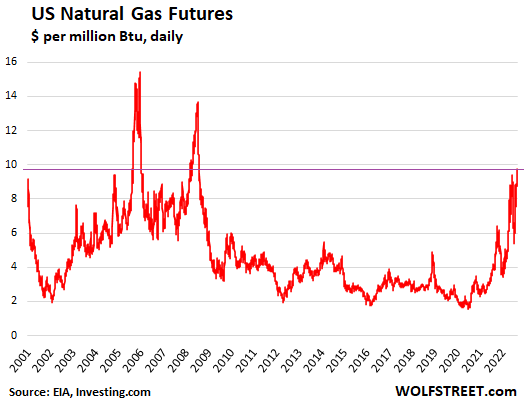

But even at today’s price, natural gas futures are a lot lower than they were during the spikes in 2005 and 2008, and just a tad above where they’d been in 2000. Back then, there was talk of natural gas shortages, and LNG import terminals were built to import expensive LNG to the US.

This episode was followed by the boom in fracking, which turned the US into the largest natural gas producer in the world, which caused the price of natural gas in the US to collapse, sending into bankruptcy court many of the largest natural-gas frackers, including Chesapeake.

And now the US natural gas market has been connected to global markets via large-scale export terminals that are arbitraging away much of the price difference between US natural gas and global LNG prices. So welcome to the new old world of higher natural-gas prices.

Seen in this light, today’s price of natural gas in the US is not all that extraordinary, and it’s still a lot lower than in many other parts of the world:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Probably take out that old high in US before this is done. Especially if any hurricanes occur in the Gulf. Surely not good. There should be nuclear on every block. But I digress.

Hurricanes are now bearish events as they interrupt LNG exports from the US gulf coast and can reduce large scale industrial demand in Tx/LA. The demand loss can overwhelm the loss of off shore and on shore production. With so much production now in the NE and Permain basin the US total production is not hampered by hurricanes

I’ve read that. We haven’t had a test of that. Notice the damage to that lng producer a few months ago did bring prices down. For a hot minute. And here we are

How long before it affects electricity bills? Will utility companies directly pass on the price or will it be through taxpayer funded bailouts?

Why US prices are locked in with global prices? Do European countries have first right on our LNG? I know Europe is desperate for winter reserves and so will pay any price? Why is this affecting US consumers when this gas is produced from resources owned by US citizens?

@SS – that’s a silly question. Why would producer sell the gas to you if Europe pays more? It’s called business. Would you sell your working hours to lets say Ford instead of Siemens/BMW, if they paid twice the salary?

The larger question is should we as a nation allow export of our natural resources.

I read no hurricanes are expected in the upper gulf during the month of September, based on US and European models. This is quite an assumption!

Quite an assumption. Those models should stick to modeling. Better money than talking about weather that hasn’t even packed to leave Africa yet.

I live on the Gulf Coast. NOBODY down here believes an assumption like that.

Just take a look at the volatile EFT, BOIL. After making a few $s in BOIL, I missed the run after the plunge Wolf talked about. Boil hit about $40/share on July 5. Right now it is trading at $116.30 just 7 weeks later…. Woulda, Coulda, Shoulda :-)

Going on steady on BOIL, GUSH,GAZ and what NOT!? It is summer now, but imagine in the fall and winter! COAL also has taken off! Riding on BTU!

Price of natural gas is now set at relatively high global prices along with demand for LNG, although not as crazy in EU. It is a self inflicted misery.

Electric utilities need natural gas, so are fertilizer producers!

Without Energy, there is NO economy of any kind in the World.

Yep. Nat Gas would be about $3 or $4 if we did not build those LNG exporting facilities.

What is ironic they were actually built to import Nat Gas after the Nat Gas spike way back in the 2000s. Then when fracking took off, they reverse the use of these LNG terminals.

What happens when the Russia – Ukraine conflict ends. Will Nat Gas crater?

Depends on how the conflict ends.

Not a chance. Wall Street will find or create another “ crisis “ to “ justify “ artificially high prices. Isn’t that what capitalism is all about ?

If high energy price were the norm then why has Ng been below 3 usd since 1985 when deregulation happened. The spikes are not the norm. The majority of NG producers use hedges and do orbit ride the spot price.

No. It is what Crony Capitalism is all about. US is totally run by it.

Why will the conflict end when no one is making any serious attempt to end it?

War is very lucrative for the MIC and congress and big guys.

LNG import terminals have evaporators. Like the cooling part of the AC unit in your furnace. The trick is to get rid of the cold. LNG export terminals have compressors. Much more expensive than evaporators and require a lot of energy. Compressors produce a lot of heat like the part of your AC system that’s outside your home. The two completely different. Sure, they are both built at the seashore.

One writer thought the US and EU gas prices would converge, and that would double NG prices here. The US has to help EU by selling them LNG and subsidize them as well. That much seems obvious.

Well said Vladimir!

Great article.

I agree on the natural occurring supply/demand from events. I feel like news outlets never put the blame on irrational exuberance from investors as well though. For example oil prices. I knew at least 20 people who bought oil futures contracts further pushing up prices. I can’t imagine the millions of other people playing the commodities sector. Just my opinion.

Tony

“news outlets never put the blame on irrational exuberance from investors as well though”

Irrational? Why? every one knew ESG is delusional without realizing that we are addicted to the fossil fuels in the near term. It takes YEARS to put capital in production before oil/gas flows. But who wants to capital if we are heading for hard landing or worse, recession worse than GFC!

There are ETFs with 3x on oil ( even inverse 3x also!) or buy calls with puts as hedges. There is no such thing as ‘irrational’ when it comes to Energy.

The problem is that they haven’t printed enough money so that the poor people can gamble (I mean speculate) too!

I am getting a coal furnace and avoiding this craziness!

And I can safely store a few years worth of fuel right on the ground.

I am avoiding all this craziness, too.

But I plan to buy solar panels. My up-front investment is bigger, but my operating costs will be much lower, since I won’t have to pay for fuel.

I’m getting both kinds of solar panel – the ones that collect free electricity, and the ones that collect free heat.

I may decide to build the solar-thermal panels here @ the farm. It won’t save much money, but it’ll be a very interesting project.

Generac ( the back up generator company) has come out with their own version of a battery wall… supposed to be cheaper and more efficient than other competitors… grid connection, if you want, or recharge batteries with a small genset that is supposed to be able to recharge in 1.5 hours or so…

Didn’t dive real deep into it but didn’t seem *that* unreasonable…

At what latitude is this cost effective?

I would say just south of Libya ;-)

OK, Tropic of Cancer.

But as Wolf stated, It’s not even that bad in America.

NOT yet!

Wait for the winter!

They will keep exporting more & more if the global prices are higher than here!

Good plan. Eco-conscious Europe is shutting down all their nuclear and going to coal, China has 400 new coal plants in the works (plus what they have), and India is building 300.

Coal is on a roll! The price is up 8x since 2020. 50 bucks a ton, now over 400.

I remember the piles of clinkers outside buildings in the old days. We used to play with them by sticking in old light bulbs while the ashes were still hot and watching them blow up.

Oregon’s largest natural gas provider just applied for a 36% rate increase.

My price is locked in for another year. Hoping for a quick recovery.

This is just the beginning.

1. Europe is currently building more LNG terminals to import more LNG (including from the US). There are 13+ LNG export terminals in permitting/construction phases in the US which will only increase exports once completed.

2. Mexico is in the process of building pipelines and a large LNG export facility to export US gas. They are currently required to pay for full US pipeline capacity to them even though they only receive a portion of it. They plan to eventually take full delivery under their contract with us and re-export the balance that they can’t use due to insufficient infrastructure.

3. The US is transitioning away from “dirtier” fossil fuels (coal, oil). Natgas has been designated as “clean” so utilities will be using more of it in the future.

4. It takes years to find and develop new natural gas fields.

Bottom line – Get ready for higher prices. We will now have to pay more competitive prices if we want our gas to stay here.

I agree! U.S. Nat Gas price will close the arbitrage with the global price

BTW, despite all the whining and complaining about higher Fossil Fuel prices, this is precisely why people/companies/Govt. should be accelerating investments in all types of clean renewable power.

Those myopic greedy people who think that the U.S. should be hoarding its Nat Gas to keep prices lower, are in fact suggesting that we should continue to pump out more Co2, which is clearly resulting in all sorts of increased destruction…. Higher powered storms, Droughts, floods, heat waves, etc.,etc.

Wake up people!!!…Your myopic short term thoughtless greedy mentality is destroying our world!!!

Kenneth M Luskin

“accelerating investments in all types of clean renewable power’

All renewables need ‘fossil fuel’ for production, maintenance and replacement! Lithium and other EV metals are beside being expensive, are also toxic to environment. Wind and Solar are UNRELIABLE depending upon the weather.

Solution to CURB the consumption mentality by discerning NEED vs WANT. Perpetual growth is a delusion!

“are in fact suggesting that we should continue to pump out more Co2”

Do you mean “we”, the world? Because “we” the U.S. have reduced CO2 output by 43% since Y2K and continues on a downward trend.

https://ourworldindata.org/co2/country/united-states#what-share-of-global-cumulative-co2-has-the-country-emitted

“ are in fact suggesting that we should continue to pump out more Co2, which is clearly resulting in all sorts of increased destruction…”

You’re right…

Can you help us out by not breathing anymore….

“ Higher powered storms, Droughts, floods, heat waves, etc.,etc.

Wake up people!!!”

You’re not real bright… these things have happened many times in the past… Galveston 1900, Florida Keys 1906… you ever hear of Pompeii… jeez…

Of course, I guess you feel if you didn’t see it on The Everything But the Weather Channel, it didn’t happen… Still have that poster of Jim Cantore above your bed?

🤣

A voice of reason in the middle of the insanity, thanks COWG

COWG,

You are an imbecile beyond reason…. I hope Mother Nature finds a way to punish you and your fellow idiots.

I take issue with point 4. Aren’t there a ton of old spudded frack wells from back in the boom times of the mid 2010s? For that matter, pretty sure Azerbaijan has lots of NG too.

No more “ton of old spudded frack wells back in boom times”

They were not fraced because of low oil price which ended. And the companies had long term drilling rig contracts so they drilled and waited until the time was right to fraud which was 2021 and 2022!

Tonight whilst walking the dog I saw a bloke in the woods with a saw and a wheel barrow collecting firewood. I have never seen such a thing in my entire life!

In Germany the number of Google searches for firewood have grown exponentially.

Electric chain saws are very quiet…wood poaching is real and getting realer.

“ Tonight whilst walking the dog I saw a bloke in the woods with a saw and a wheel barrow collecting firewood. I have never seen such a thing in my entire life!”

Pretty common among rural folks… crept we use the pickup…

The metro crowd crowd not so much… they hold a candlelight vigil for the fallen tree…

Just wait til they start exporting cordwood to the EU!

The US exports wood pellets for heating to the EU & UK. They mix the pellets in with coal to produce electricity.

Green Power folk love the high prices of traditional fuels here

along with the draw down in the SPR

Many are MMT folk also who prescribe taxation as a cure for inflation

Anyone see the idiocy here?

It is idiotic to run fiscal deficits and not tax anyone. That’s what’s been going on for decades.

It is idiotic to deficit spend in a roaring economy. Even Keynes said pull back in good times

But the unrealistic cost of debt creation from a reckless Fed monetary policy subsidized deficit spending. Whatever is subsidized becomes more prevalent.

The amount of natural gas in U.S. storage is well below the average for this time of year. Record heat is increasing the use of air conditioners. NASA reported this past June was the hottest June on record. Environmentalists try to reduce the use of coal electric power and switch to nat gas electric power generation. The price of coal is rising as China and India burn more coal. EV’s are becoming popular. They require more electricity than solar cell installations can provide. LNG facilities are being built or expanded in numerous nations. Canada is building one along their Pacific coast. Qatar is expanding their LNG facilities. The U.S. exports natural gas to Mexico.

Follow the money.

David Hall,

NG storage levels are well within the 5-year range:

Yep, and they would be much higher if we were not exporting so much. If we have a cold winter and the NG storage gets to low, I would think the Gov could just temporally shut down NG exports. The U.S. is producing more NG than we need.

Australia might be a good lesson. After they turned into a huge LNG exporter some years ago, there were periods of shortages at home with huge price increases. But exports were largely based on long-term contracts, and so they come first.

Several Australians here have warned us years ago that this would happen in the US too once the US export capacity gets ramped up, and we’re now seeing it happening.

Below the middle line. The middle line is the average, not the bottom line.

In Ontario we closed all the coal plants. One of the nicest benefits has been much cleaner air and bluer skies. I can actually breathe again quite comfortably even at the height of summer.

Coal kills!

David, Google the summer of 1936, 1937. The THATS record high temperatures. Also check out the summer of 2011 in the north east US. The weather channel lies.

Sorry, 1911.

The collapse of Russia will cause a panic. Until now two myths have driven the market. One is that Russia is not a failed nation, and two is that they even have the energy to sell. The oligarchy has largely depleted their resources without securing replacements, or putting the monetary proceeds toward economic growth.

I wouldn’t count on the collapse of Russia anytime soon. They are a raw material powerhouse and are picking up customers from the global South. I would be more concerned with Europe which is in an energy crisis bidding up the cost of energy through their various mechanisms and limited options.

Agreed.

In re: Ambrose Bierce-

Collapse of Russia? Collapse of Russia? Not sure to type WTF or RTFA. Besides, Russia hasn’t come close to needing to frack with its existing projects and easily available reserves. And another besides: Wolf exposed years ago that fracking is a high marginal cost method that was more fatal to US investors than cancer/strippers/cocaine/crack. My takeaway from this article is proof that when the US exports more nat gas (or commodity traders think the US can export more nat gas) through LNG terminals the the price goes up in the US for domestic use. YMMV

Get ready to pay high mortgage rates in coming years. I saw this in the early 70’s and now retired. I was working as a construction worker until I started a business that I sold in 2017 after 35 years. If you think 6% is a high mortgage rate, this is just the beginning. My wife and I took alot of risk buying homes and selling 3 homes during our lives. We managed to be debt free since 1999. The bottom line is here in Canada just buying guaranteed investment certificates in our local credit unions and some banks. We have waited years to get anything close to 4.25% to 4.5% shorter term and will lock in when rates are much higher. Inflation will be a doozy over the next 5 years.

1) Pollution costs are not included in the price that is determined by the suppy/demand equation. = Pollution costs are external to the suppy/demand inputs that determine prices. = Why economists call pollution an economic “externality”.

2) If you have an ounce of knowledge, intellectual honesty, and care about the world you leave to the next generation, then you should be happy to

see the price of disaster producing Fossil Fuels increasing.

3) The future of energy is clearly renewable + energy storage systems.

===========================

Bottom line:

If you want the U.S. to thrive and lead the way to a more sustainable energy paradigm, then higher prices for U.S. Fossil fuels is a good thing for the long term.

Because being addicted to Fossil fuels, is akin to be an addicted to Heroin.

= They make you feel good in the short term, but they ruin your life over the long term.

I agree with this post in that huge environmental costs are associated with fossil fuel extraction. He business of most fossil fuel extraction methods involve extracting the profits from each fossil fuel extraction sit then leaving cleanup and remediation to Joe/Jane taxpayer.

Drat – wish there was an edit button

USA has approximately 5% of global population but uses 25% of global natural resources. 40% of Food is wasted, while Billions starve elsewhere!

Cannot keep on relying CONSUMPTION based Economy, which needs to replaced ‘slowly’ with sustainable/recyclable economy.

Renewable have their own problems, which I already mentioned above.

In my opinion natural gas will be $20 in coming months probably February, maybe March-2023. This is why sodl my much bigger house and bought a much smaller house back in 2010. It just made sense to cut my expenses back alot. Inflation, cost of living is a real concern for me but a now having a big investments, cash account balance helps me sleep at night.

I knew coming property taxes, natural gas bills, electricity bills, maintenance, repairs etc. would be much higher in 10 years or more. I estimated $1,200 a month is my savings right now and basically that is going towards my state GO’s municipal bonds every month.

I think $20 is an understatement for an estimate of what natural gas prices will be by next winter 2023. I am more confident that $30 per unit for natural gas is coming our way. Inflation will be brutal for many years with a small drop which is temporary.

People in the West don’t want to look at this idea, but the best solution is to just use less. High price will naturally cause consumption to decrease but hurts people living on the edge and people on fixed incomes. This is a genuine problem that needs to be addressed – perhaps a system where the price increases as consumption increases that way basic needs are met. We don’t need to heat and cool every room in our houses. – Solar is easy and should be widely subsidised or perhaps because this is going to be a genuine crisis – the government should actually have its own factories (Yes! I know! The dreaded socialism!) Solar doesn’t work everywhere, but I agree with KM Luskin, we have known we have to get off the fossil fuel merry go round since Jimmy Carter in the mid 1970’s and have been seduced back by the FF industry every time. Surely, all the effects of Climate Change should be sinking in by now. We can’t afford to continue on as we are.

“Seen in this light, today’s price of natural gas in the US is not all that extraordinary, and it’s still a lot lower than in many other parts of the world.”

Well just wait until you start paying what we pay for natural gas (NG) in Australia.

Lots of reasons for the high price of domestic NG here. Many are a result of state government incompetence in regard to rules and regulations and some as a result of huge exports of NG to other countries.

When some state rules and regs resulted in cancelled projects (mainly coal seam gas) and reduced output in the east coast areas some of the gas previously used for domestic consumption was diverted and used to fill these contracts which left a smaller amount of natural gas in the market.

A classic case of lack of supply and constant demand that pushed up prices. The idiots here in Victoria are/were thinking of building a LNG import terminal to supply the state.

So the result is we pay through the nose for NG. The current first tier for residential NG that we pay is now the equivalent to US$12.75 per thousand cubic feet.

And we are lucky as we were able to switch suppliers just before the huge increases came through. Had we stayed with our old supplier we would now be paying US$17.25 per thousand cubic feet.

We are going to have a huge increase when our contract comes up for renewal next year.

The above relates to residential NG. With wholesale prices it has been even worse.

Another reason for the high wholesale NG prices here is the bad weather we have been having with lots of rain, clouds, low temps, and believe it or not some days with little wind in additional to coal plants being down for repair or scheduled maintenance.

A little while back all this came together and caused the price of NG to soar to such a price that the NG electricity generators were shutting down as the cost to produce electricity was above the market cap for electricity.

The market regulator stepped in and removed the cap and after about a week some coal plants came back online and the weather improved.

We are in real trouble in Australia as a large number of coal plants are coming to the end of their life and given the huge amount of solar and wind that has come online over the recent past are unable to compete on price during the day when the wind blows and the sun shines.

Early closure is coming for many of these plants with reliable base generation replacement nowhere to be found. The above problem we had shows exactly why there is a need for a mix of base load generation along with renewables.

(And by the way the last time a coal plant closed in Victoria it took out about 15 – 20% of the generation capacity in the state. The idiot Labor State Premier stated that prices would only go up by 5%…….

They went up by over 25% in one year after the closure!)

No idea if fossil fuel is the cause of climate change. I do know the use of fossil fuel will continue to be used as long as we have a population of what billions of people globally. I don’t know the number but energy is the reason we have had explosive growth the last two centuries and that growth should continue. I don’t see cooperating countries on the problem if there is one. China India Saudi Russia and any OPEC nation all have interests to keep exporting energy as well as USA. The world will adjust humans will adjust with lots of major problems along the way. After all governments have solved all of our problems in the past and the most recent elections will guarantee solutions in the future if we vote for them. Not sure about the 1 party or no party governments . If peak oil and decline of fossil fuels are correct the problem takes care of itself.

This post and the responses from the readers are welcomed. I love the post from Wolf about No and he is exactly right about shale oil and gas production. The production of the shale resources are much like the large strip mines for gold and silver. The amount of resource available in the shale formations are abundant but the cost of removal is 5 times as much and much less cost effective.

Don’t worry guys, here in Europe we’ll buy anything at any price. It’s just the fantastic brave new German-insanity world. Electricity at 700 EUR, gas at 300 EUR … and the North Stream 2 built and ready to go, closed, after it was a German project, financed by Germany (50%) at 5 billion EUR cost.

Sholtz popularity at 33 % … brave new European world, led by morons.

Just listened to Joe’s energy secretary .

All is well.

As a nation, we must not export our energy. IMO.

“Green energy” is nothing more than a brand, no such thing can exist without defying the laws of physics and that has not yet been achieved. Massive amounts of fossil fuels are expended to produce the technology to generate “green energy” as well as large scale mining (also requires fossil fuels) to secure minerals for many components of “green” technology. Mining happens to be just as destructive to the environment as fossil fuel extraction. There is only ONE solution to the environmental problems we face and it’s insanely simple….consume less!! “Green energy” is a deceptive marketing tool used by the energy industry to create new market sectors, green wash old ones and expand their monopoly on energy. They will still continue fossil fuel operations and rest assured petroleum is here to stay due to our insatiable appetites for goods, most of which involve plastic.

Agree, it’s not a binary decision. Develop and use all sources of energy! Instead, once again they try to force us to take sides (green vs fossil, red vs blue).