Freight volume is down from the red-hot levels last year, but remains relatively high, after the grotesquely overstimulated demand last year.

By Wolf Richter for WOLF STREET.

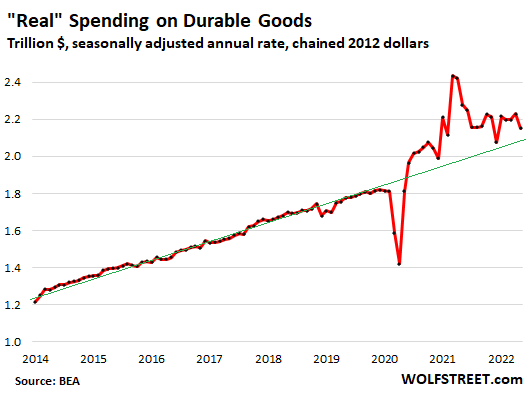

The thing about American consumers is that they were supposed to splurge on goods during the stimulus era in 2020 and 2021, when free money washed over the land, and when spending on many discretionary services collapsed. And they did. Spending on goods exploded, particularly durable goods, in a record historic spike amid grotesquely overstimulated demand. But spending on discretionary services – airline tickets, lodging, rental cars, music and sports venues, elective healthcare services, etc. – collapsed.

Then with the re-opening of those discretionary services, consumers were supposed to shift back from buying goods to splurging on services, which was widely predicted, and even the Fed used it as one of the reasons why inflation in goods was going to be “temporary.” And consumers did splurge on services, and they are still doing it – see the travel nightmare that has unfolded at airports as airlines weren’t able to deal with the flood of travelers.

The growth in spending on services, even adjusted for raging inflation, has been strong. Services account for 62% of total consumer spending.

Spending on services, adjusted for raging inflation, rose by 0.3% in May from April and by 4.7% year-over-year. Spending for June won’t be released until late July. And as consumer spending shifted to services, spending on goods was supposed to fall, adjusted for inflation, and it did fall but has remained above pre-pandemic trend.

On Friday, we got retail sales for June, which is what retailers report – not what consumers report – and retailers reported surprisingly good sales in June. Everyone knew that raging inflation was going to take a bite out of it, and everyone knew that consumers were shifting their spending back to services, and so hopes for retail spending had been low, but in June consumers did blow a surprisingly large amount of money at retailers.

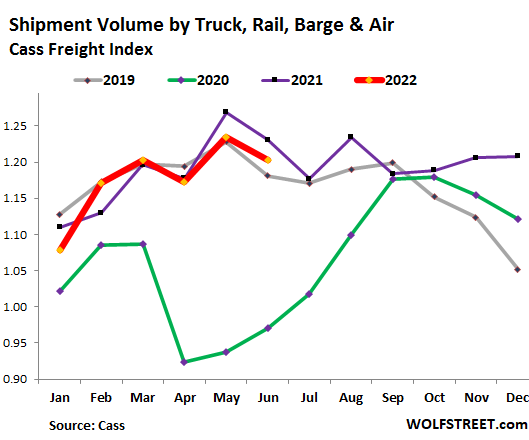

Another measure of the goods business in the US is shipment volume – but for the overall economy. Shipment volume is tracked by the Cass Freight Index, which covers all modes of transportation, but is centered on trucking, with truckload shipments representing over half of the dollar amounts, rail in second place, and less-than-truckload shipments in third place, followed by parcel services, and others. But it does not include bulk commodities.

The Cass Freight Index for shipments in June (red line) was down 2.3% from the red-hot June last year. This was the third month in a row of year-over-year declines, after the 2.7% decline in May and the 0.5% decline in April – relatively modest declines from a very strong year. And May and June 2022 still beat May and June 2019 (gray line).

The huge plunge of shipment volume during the lockdowns in April 2020 (green line) was followed by a rapid recovery. By October 2020, shipment volume already exceeded October 2019 and the gap widened into the holidays of 2020. In 2021, shipment volume continued to boom, and over the last few months of 2021 didn’t even go into the seasonal decline, but just kept rising. That’s how huge the demand for goods was – one of the reasons supply chains got tangled up.

Everyone predicted that this boom in goods would eventually decline and return to trend as consumers shifted spending back to services – but shipping volume didn’t decline by much.

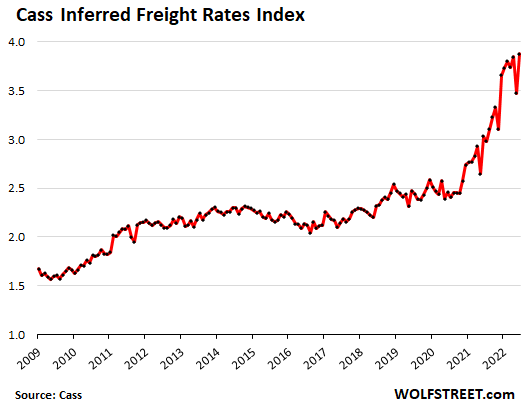

What’s still rattling shippers: shipping costs.

There are now reports of some shipping costs edging down, after huge increases. But the Cass Inferred Freight Rates Index – which includes freight rates and fuel charges – after dropping in May, jumped again in June to a new record. Year-over-year, the index was up 28%. Part of the spike over the past 12 months was due to spiking fuel costs.

Spot rates in the trucking market have been easing since January, when the average rate for van trailers had peaked at $3.10 per mile, according to Dat. In June, the average rate fell to $2.68 per mile, just a tad above where they’d been a year earlier ($2.67), according to Dat.

But shippers – such as retailers and manufacturers – haven’t felt the decline of the spot rates because the fuel costs had spiked. Fuel prices have now turned around, and if diesel prices continue to drop, as they have done in recent weeks, eventually, it may translate into lower shipping costs for shippers.

Spending on durable goods still surprisingly strong, even after inflation.

What we’re seeing is that the goods-based economy is backing off just a little from the grotesquely overstimulated demand in 2021. But it hasn’t backed off as much as expected, thereby frustrating the Fed’s vision of “temporary” inflation, as consumers continued to splurge on goods, even as they shifted spending back to services – with the big spenders still flush with huge gains from stocks, cryptos, real estate, the two-year boom in cash-out refis, and sharply higher incomes.

Inflation-adjusted spending on durable goods in May, despite recent declines, was still up by 21.1% from May 2019, and remains above pre-pandemic trend. New and used vehicles are the biggest components in durable goods. But spending on new vehicles is hobbled by shortages as new-vehicle inventories remain desperately low. Spending on durable goods was expected to undershoot the pre-pandemic trend line for a while in its regression toward the mean, but that hasn’t happened yet:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

If spending is up during high inflation, then it means interest rates really have to really move on up. I’d like them to be, at least 6%, pref 9%………asap

if oil stabilizes or even moves down, and if demand decreases inflation will plummet. 9% interest rates? You’d break the economy in half if you did that. do you want 15% unemployment?

Inflation may plummet, but will prices go down?

Not counting fire sales and liquidation sales.

Also be wary of prices falling due to purchasing power lost. At a price point goods and services will then disappear as the sellers make no money.

America. Consumer debt on CrCds has skyrocketed. Average monthly car payment over $800. Oil prices stepping back but wait till winter. The nation has over $30Trillion in debt and Biden wants to spend more. My point…? When the interest on USA hits $1trillion (Fall 2024) no country will want to own the US dollar and then….and only then will Americans understand the definition of pain.

Not the worst of possible worlds, or the best. Consumers are getting a lot of what they need or want.

The pent-up need to blame others for any imperfections seems not to have dissipated much.

“Consumers are getting a lot of what they need or want.”

Don’t you feel lucky that the world is infinite and you’ll never run out of stuff?

Elon Musk is deeply concerned that the world is terribly underpopulated, which isn’t likely to be the case unless it turns out the world isn’t infinite after all.

I see a possible typo in fourth paragraph. “As consumer spending shifted to goods, spending on goods was supposed to fall . . .”

1) Shipment by volume in the first half is normal. No signs of recession.

2) 2022 might cont in a trading range, as in 2021, instead of decaying towards year end.

3) Thus, for two and a half years, since Sept 2020, most of the vol activity might be near top level.

4) We might import less from China, buying less durable goods, export

more oil, wheat and military hardware. Our allies need us more than ever before.

5) The Iranian rial was devalued in stepping stones from USD/IRR @2 in 2000 to 42. The cost of bread in Iran is x10 times y/y. Rice x6 times. Hear wave destroyed Iran.

6) Iranian drones for Russian wheat. Iranian leaders bark, because US boomerang. Their kitchen cabinet entered a strict diet to survive.

Michael, watch inventories at all stages of the supply chain start to build as in Used Vehicles, etc., as the American Consumer cannot keep spending up due to Disposable Incomes that cannot keep up with today’s budding Hyper-Inflation. CPI going into the teens and not looking back for quite a while. As Wolf states, the hydra of inflation is deadly for spending since installment credit can only be expanded by so much for an already well-leveraged consumer, and the Income side of the ledger stands little chance of catching up. The Capital Gains side has turned to Net Capital Losses so that money tree was axed by a 2022 George Washington.

“CPI going into the teens and not looking back for quite a while.”

The fact that the FED has thrown cold water on a 100 basis point hike shows that they are deliberately slow-poking around. Because the last CPI print which came in “higher than expected” should have given them every reason to go bigger.

If the FED hikes 75 basis points, then CPI comes in in the teens, these clowns will have egg all over their faces. Even the Canadian central bank just hiked 100 basis points.

A reasonable argument can be made that even a 100-basis point raise qualifies as slow poking. The FFR should have been at 3% at the end of 2021 and had that not tampered inflation sufficiently, the FFR should already be at 5%, maybe even 6%. The Fed should have ended QE last June and started the runoff simultaneously. Had they done that, the 30YFRM would have already made its way above 5% causing a much-needed slowdown in the housing market.

But, I agree. 75 BP would show how untruthful he was over the last two FMOC meetings about being committed to tamping down inflation.

Unless Russia does something to cause a real gas shock or there’s some sort of crop(s) shortage of significance, CPI isn’t going into the teens. With petrol prices falling and diesel to follow in the coming months, June WAS THE PEAK. The question that no one can answer is with a high level of confidence is what happens to CPI through the rest of the year? Does it go sideways and stay around 9% for a few more months, or decline but stay above 8% the rest of the year, or does it make a slow trend down just below 7%? A full-on collapse isn’t in the cards for this year is about the only thing that’s reasonably certain at this point.

I’ve heard others say June was the peak. I don’t follow your reasoning, other than being wishful. There is a slowing of containers being imported, but my shipping expenses have yet to be reduced. Plus my wholesale costs just increased 5%,July15. Gas prices, my opinion, won’t come down much, home heating oil is high. My thknking, we won’t see peak until 2023!

The drop in fuel is likely to be offset – or more than offset – by an increase in housing, especially rent, given the much higher weighting of the latter.

My daughter worked at major trucking conglomerate,there freight volumes are declining for last three months,allowing them to discard bottom 20% of inefficient drivers

There’s plenty of other jobs available. Teachers in Arizona are no longer required to have degrees. Plus there’s a shortage of doctors, for those who do their own research.

So much for that truck driver shortage.

My concern is that consumers are buying to avoid future inflation, front loading demand, potentially creating a larger drop in demand down the line.

Good observation, Bobby, cause I just bought two years supply of motor oil before crude really took a jump. Inflation Expectations is a key determinant to intermediate to long-term Debt Instrument pricing, yields up and bond prices down, and expectations are on a persistent upslope at the moment.

Lumber prices are falling along with some building materials, but at the moment, most are still rediculously inflated.

Plywood cost is a joke. In hurricane areas, if plywood materials are needed for shoring up against a storm, I’m sure during these times, retailers can Gough prices as high as they can and FIND AN EXCUSE for doing so. Same with bottled water, gasoline, needed supplies in a disaster. Welcome to dog eat dog USA.

Inflation can be sticky.

0% inflation means prices just do not go up from the current price. I am not so sure a lot of building material prices will drop much more unless we have a big recession.

Sure, some wood prices will drop because of the lumber price spike and pop. But labor prices, energy prices, and land prices are up and will probably not go down. So wood based products will have a new price floor.

I don’t have space for it now, but when I do, I will consider buying everything that can be stored long term that I will need for the next 10 or 20 years. It’s equivalent to pre-paying part of my retirement expenses.

When inflation was high in the ’74 – ’82 period, there were investors who were buying lumber and similar “imperishables” and storing in small warehouses. Of course, when Volcker finally increased rates, these investments turned into liabilities, in terms of money lost, paid rental space for the commodities, and the headache involved in disposal. Be careful.

I wonder how long it took Gary North to eat all the rice and dried beans he stored for Y2K in PVC pipes (with the ends capped). He bragged about having them in his attic rafters, standing up in his basement, etc.

1970’s all over again when consumers did just that. Back then we had oil sanctions on Iran for the US Embassy hostages. This sounds a lot like Ukraine / Russia these days.

Volcker came into office in Aug 1979 with 9% inflation and a FFR already at 10.5%. JPowell is so far behind the curve he’s barely turning the ship.

Eat, drink, and shop ’til you drop, for tomorrow…

Hey, this is America! We all must do our patriotic duty and spend like drunken sailors until we max out those credit cards! Don’t worry, Uncle Sam will take care of us…

Uncle is the taxpayer,we the people pay it back ,or ptinting press gets suck on high speed .Either way u lose

The millennial generation, over 75 million strong is America’s largest—eclipsing the current size of the postwar baby boom generation. Millennials make up nearly a quarter of the total U.S. population, 30 percent of the voting age population, and almost two-fifths of the working age population.

They went through a period of unemployment living with parents to full employment parents retiring and now children. Pent up demand for durable goods that were purchased with stimulus and now house furnishings yards upgrades etc. These trends are not to be underestimated and these children of mine have a completely different set of values and spending habits than I had.

Can you elaborate on the spending habits? I guess tattoos are part of the budget.

“These trends are not to be underestimated and these children of mine have a completely different set of values and spending habits than I had.”

It’s not too late to teach them the value of a dollar, about 14 cents.

Una:

”Value of USD,,, compared with when???”

Compared with the year 2000 per Wolf’s wonder charts, appears to be $0.569 as of Wolf’s latest on that…

Compared to 1913 when our oligarchy started the Federal Reserve Bank to save the banksters when the LOLs,,,

(little old ladies of all ages and genders, far shore)

of all kinds had put their gold into jars in the back yard in the ”good times.” Looks like less than 3 cents per ”official” BLS data…

And then, back before FRB took it away,,,, those same LOLs dug it up and bought ”assets” for dime or less on the dollar FROM the Banksters who then,

exactly as now, were totally willing to sell their ”clients”/ depositors, etc., etc., down the drain to maintain their failing/bankrupt institutions…

OF COURSE banksters could not let LOLs get away with that, and hence we got the FRB to make sure the banksters will always,,, repeat, ALWAYS, WIN…

Mom, and grandma too, were very clear about this kinda ”stuff”,,, both well educated ”auto didacts” as WE the PEONs ”should bee” to get beyond the very clear ”propaganda” and ”brainwashing” from the MSM and their oligarchy masters in every ”school” in USA.

Public schools not just brainwashing with the dogma of/from ”approved” sources from oligarchy.

Any information as to how much of this spending is debt centric? Ideally the Fed would have avoided the debt, because it isn’t needed to fund Congressional spending, but I doubt the Fed actually did it that way. Which brings up the question, just how much debt overhang was created by the stimulus? Some of it in Treasuries, but not all of it. What is the private debt? Up. Or Down? The more debt the more demand destruction is embedded in the data. IMO

Cash-out mortgage refis were big in 2020 and 2021, and that funded some of the spending. But refis collapsed this year due to the spike in rates. I would assume that a pile of this cash-out refi cash from last year still hasn’t gotten spent, and is waiting to get spent.

The government added about $7 trillion in additional debt since March 2020. Some of this funded the various stimulus programs for consumers, businesses, and state and local governments. Some of those trillions are still circulating around out there and are getting spent and handed from one entity to the other.

Exactly! And some of the stimulus monies aren’t going to be spent until 2028 and I don’t think that includes the $500/$1T infrastructure that was passed.

And don’t forget all the counties flush with cash from sky high property taxes revenues. The school districts in my area are handing out some BIG pay raises. I’m getting about a $4,300 raise and Cobb County next door is giving EVERY school district employee a permanent 8.5% raise.

Boom!

This is a sign of a peak economy, when local politicians think the party is never going to end. I remember the same thing happening in South FL right before the bust. County commissioners wouldn’t even consider amendments to lower salaries or pension benefits for their workers, if conditions changed, because the tax base was exploding, until it wasn’t.

The total federal government debt is only about ONE-THIRD of the total consumer and corporate debt in the US.

“Some of those trillions are still circulating around out there and are getting spent and handed from one entity to the other.”

The rest got cryptocurrencied away in the Caymans and similar places, never to be seen again.

“Cryptocurrency” is now a verb. I call first dibs.

How about “crypted” an in money getting sent off the the grave?

“Bro all my rent money got crypted in Celsius could you loan me $400 so I can make rent?”

It’s possible companies are still loading up on goods for “just in case” inventory causing the freight volume to remain high? This is anecdotal but I recently spoke with a medium sized electrical component manufacturer in my area. I asked them of they had put in extra orders for the same products just in an attempt to what they need. It was a resounding yes. They had 7-9 times the orders out there than they would typically need. If this is true for 10 to 15 percent of companies we could be in for big supply gluts (except in perishables)

I’m flabbergasted at the apparently unending waves of counterfeit currency flooding our country.

How much actual counterfeiting of US dollars has been done by the millionaires at the FED ? Maybe too much to even quantify ?

Holy Moly

Considering that the economy is currently dropping a load, shipping rates will fall, substantially fall. Once the uninformed consumer realizes there’s no more money everything unnecessary will drop. I have a bad feeling that the necessary stuff won’t be as quick to drop, though, which will cause massive economic pain to the working class.

The unemployment rate is about 3.6%, way below average. There are rising prices and sustained employment. Bank profits are down. Energy profits are up.

You believe that number? LFPR is very low as well; double job holders/regular job plus PT job individuals are up.

As many have noted, trusting in “official” data is faith based activity these days.

The economy is roaring right now. We’re in the biggest everything bubble in history, by far. All of these people talking about the economy collapsing have no idea what’s really going on. The printed trillions are just sloshing around everywhere.

Yep. I know someone who is taking a family trip who has not been one one in 4 years because of COVID. It is pretty much, we are going on a vacation no matter what the cost.

“What’s still rattling shippers: shipping costs.”

I suppose Wolf also includes overseas shipping container excessive costs in this analysis. I wonder if the US port congestion is backing off substantially yet?

I just read an article how a lot of individual investors are buying this dip. Some are skimping on house repairs, eating out, etc, to invest the extra money into the stock market as they see this as a huge buying opportunity.

Meanwhile, the article mentioned that institutions have been taking money off the table.

But I am not sure what to believe. We are at very bearish sentiment and oversold indicators. So we are do for a bounce?

I also just read an article that the title said back up the truck. Then it was quoting Liz Sonders, (Schwab CEO) about staying the course for the long run, averaging in, and stocks always go up…yada yada.

As long as this dip-buying hype is out there, we’re a million miles from the bottom. This is a sign that the bear market has a looooong way to go. But it also shows why every bear market has huge rallies. And when those rallies then blow up, the dip buyers get crushed. A big sell-off — such as the dotcom bust or the 2007-2009 rout — isn’t over until the last dip buyers got crushed.

But dip-buying keeps the downward trajectory from becoming a cliff-dive, and is an essential part of an orderly market decline. And if you’re day-trading, dip-buying can be profitable, if you manage to get in and out in time. But this is a lot harder to do than in bull market.

Banks stocks hit a bottom? Rising interest rates is usually good for them unless you have an inverted curve.

BAC earnings. Rising interest rates are helping with net income. Some industries benefit from rising interest rates.

Also, even in this terrible drop in bonds and stocks, BAC trading desk had profits.

————————————

Net interest income, a key source of revenue for the bank, rose 22% to $12.4 billion in the second quarter on higher rates and loan growth. Analysts had expected a 20% increase for NII, the revenue collected from loan payments minus what depositors are paid. The Fed’s rapid rate increases, intended to tamp down surging inflation, have made banks’ core lending businesses more profitable.

The bank’s traders slightly missed estimates, with bond-trading revenue up 19% to $2.34 billion and equity trading rising 1.5% to $1.66 billion.

“minus what depositors are paid.”

I don’t think that’s a big drag on profits.

1) When CL was minus (-) 40, airlines offered 80% discounts to fly

in empty $100M-$150M plane, with $150K/y captain and crew, passing

hazardous TSA employees, for few dollars, if u dare take the risk.

2) A year after the pilots and TSA workers were let go, things turned around.

3) Many restaurants are full because, 1/3 are gone.

4) In early 2020 dealers parking lots were full, but now they are empty.

5) BA-5 is spreading, but we don’t care.

6) Our savings are depleted, but that isn’t going to stop our spending, until

SPX make a rd trip to Feb 2020 and wake us up.

1) Trucking : Robinson made a new all time high in June 2022. Old Dominion all time high in Dec 2021. JB Hunt in Mar. Werner in May.

2) R/R : Union Pacific made a new all time high in Mar 2022. CSX in Mar.

Norfolk Southerner in Jan. Canadian Pacific in Mar.

3) R/R and the large trucking co went vertically up in 2022, creating a bubble, slightly beyond peak. They might stay in a trading range for a while, pumping muscles.

I keep hearing that the big spenders and the wealth effect are behind the ongoing purchases at crazy prices.

If that is true, would it not be better for the fed to do QT faster? The idea being to crash the markets, lose the wealth effect, reduce the number of big spenders?

That would seem less bad for the lower income population, and more bad for the wealthier, who benefited more from QE.

“would it not be better for the fed to do QT faster?”

Yes, and a lot less painful for the overall economy. Former New York Fed president Dudley said that much in an editorial a while ago; he said the Fed needs to crash markets a lot more to get this inflation under control.

Wealthy are are trying to hide assets in hard assets real estate ,farmland,silver gold and commodities.

The strength of the US Dollar makes shopping this Summer in Europe very attractive and wonderful for Americans.

But it will just cost you an arm and a leg to get there., and stay there. So is it worth it?

It would appear that way until you realise how expensive everything is.

Except Europe’s inflation is worse than US inflation. Nice try though.

It’s truly remarkable how closely the various price spikes seem to correlate with expansion of our money supply.

From March 2020, our money supply (M2) grew around 40% in 2 years. It’s a little tough to resolve the exact figures from Wolf’s chart by eyeballing it, but it looks like the Cass freight rate index went from about 2.5-ish to about 3.8-ish in that same time period – up around 50%. From pre-pandemic peak to post-pandemic peak, the S&P500 grew by about 40% matching M2’s growth almost perfectly. Nation-wide median house price went up about 30% and many desirable regions easily matched the 40% growth of M2. From a recent Wolfstreet article, we see that total retail sales jumped by around 30% and services are now catching up fast as well

Money supply jumped between 30% and 50% of its pre-pandemic volume in 2 years. It’s really no big surprise that every new Wolfstreet article on inflation seems to confirm that prices of most things have also jumped by 30% to 50% of their pre-pandemic price.

In order to stay relevant and convince others that their jobs are necessary, economists and talking heads have to keep coming up with colorful ways to beat around the money supply bush. But at the end of the day, it just couldn’t be more clear. If we grow the money supply faster than the economy, we get a level of inflation commensurate with that money creation. It’s that simple. No tricks. Inflation is always a monetary phenomenon. Always.

“It’s truly remarkable how closely the various price spikes seem to correlate with expansion of our money supply.”

Oh darn, the Fed was hoping nobody would figure it out. Now everybody’s going to know.

Spot on, just look at Dec futures ie corn and lumber. Those costs are the basis of future prices and both are up more than 50%.

Wolf always understands the transport part of the big picture. Very refreshing viewpoint.