The shadow inventory emerges with perfect timing, just as holy-moly mortgage rates and sky-high prices keep buyers away.

By Wolf Richter for WOLF STREET.

“Inventory” in housing means homes listed for sale. Then there’s the shadow inventory – vacant homes that owners want to sell eventually because they have already moved into a new place but want to ride up the surge in home prices all the way, and then at the tippy-top, they’ll sell it to maximize their profits.

We have seen this during the past 18 months when home prices spiked: people bought a home and moved in, and they moved out their other home, but didn’t sell it, expecting a 10% or 20% or 30% gain in price on a leveraged bet with a much bigger gain on equity. The math makes sense, though it doesn’t always work out, and now it’s starting to be time to put those vacant homes on the market, and here they come, just as home sales are dropping because layers and layers of buyers have been removed from the market by the rising mortgage rates and sky-high prices.

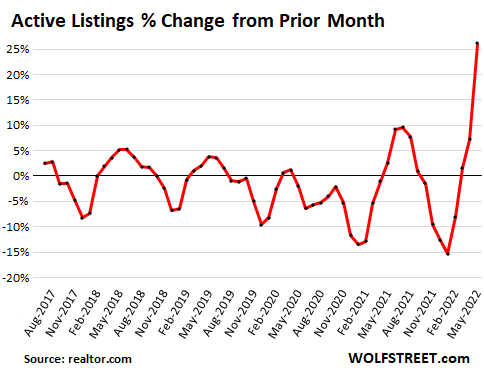

Active listings jumped. In May, inventory of homes actively listed for sale jumped by 26% from April and are suddenly up by 8% from a year ago, the first year-over-year increase since June 2019, according to the National Association of Realtors today. There were about 38,000 more homes listed for sale in May than a year ago (data via realtor.com):

The strategy of not putting the old home on the market after moving out has had the effect of creating record low inventories for sale, and inventories remain low, but that is now changing, and very suddenly so.

Active listings jumped for two reasons:

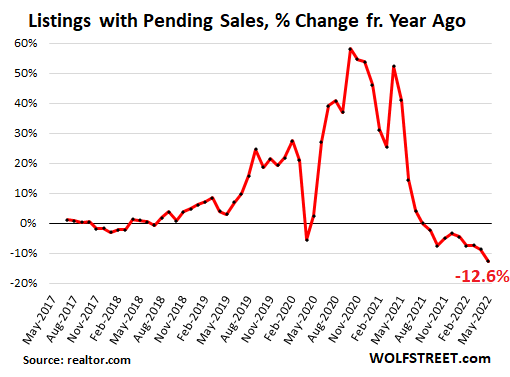

One, falling sales, as potential buyers left the market due to sky-high home prices and holy-moly mortgage rates. The NAR’s metric of “pending listings” for May, which tracks listings that are in various stages of the sales process, but before the deal closes, dropped by 12.6% year-over-year in May, after the 8.7% drop in April, the ninth month in a row of year-over-year declines:

Reported later in the month, closed sales have also dropped for the ninth month in a row, and the closed sales data for May should be another doozie.

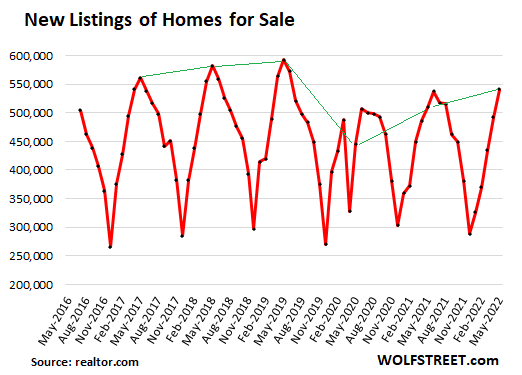

And two, the suddenly surging number of new listings in May. New listings jumped by 10% in May from April, and are now up 6.3% from May last year, the second month in a row of year-over-year increases, after April at 1.3% year-over-year. The 541,000 homes newly listed for sale in May was the largest number of new listings since June 2019.

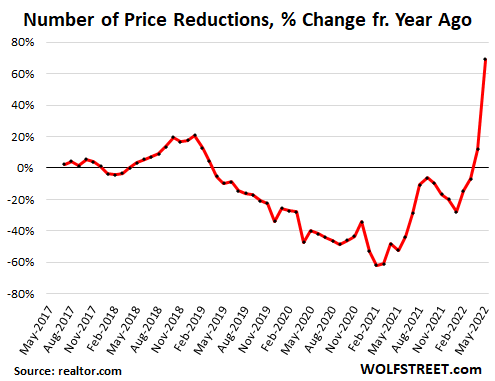

Price reductions jumped by 74% in May from April, and by 69% from May last year, in a sudden and massive U-turn from the very low levels last year and earlier this year:

Huge differences among the 50 largest metros.

Among the largest 48 metros (data for Oklahoma City and Hartford were excluded due to “data inconsistencies,” the NAR said), the number of active listings in May jumped the most on a year-over-year basis in Austin (+85.8% from May last year); and fell the most in Miami (-32.1% from May last year).

Among the 48 metros, active listings fell in only six of them as homeowners there apparently haven’t got the memo yet.

Among the 48 metros, active listings surged by the double digits year-over-year in half of them (24).

The table is sorted by the year-over-year % change of active listings:

| Metro, listings in May 2022 |

Active Listings, % Change YoY | New Listings, % Change YoY |

| Austin-Round Rock, Texas | 85.8% | 19.1% |

| Phoenix-Mesa-Scottsdale, Ariz. | 67.1% | 13.7% |

| Sacramento–Roseville–Arden-Arcade, Calif. | 54.6% | 5.6% |

| Riverside-San Bernardino-Ontario, Calif. | 51.6% | 6.3% |

| Denver-Aurora-Lakewood, Colo. | 49.6% | 16.5% |

| San Antonio-New Braunfels, Texas | 44.1% | 9.5% |

| Raleigh, N.C. | 41.6% | 27.9% |

| Seattle-Tacoma-Bellevue, Wash. | 38.8% | 17.9% |

| Nashville-Davidson–Murfreesboro–Franklin, Tenn. | 38.1% | 22.8% |

| Tampa-St. Petersburg-Clearwater, Fla. | 35.5% | 11.2% |

| Dallas-Fort Worth-Arlington, Texas | 34.4% | 18.0% |

| San Francisco-Oakland-Hayward, Calif. | 32.5% | 2.5% |

| Kansas City, Mo.-Kan. | 24.4% | -2.5% |

| San Jose-Sunnyvale-Santa Clara, Calif. | 22.9% | 3.2% |

| Jacksonville, Fla. | 22.5% | 8.4% |

| Memphis, Tenn.-Miss.-Ark. | 21.4% | 5.0% |

| Charlotte-Concord-Gastonia, N.C.-S.C. | 21.1% | 17.0% |

| Detroit-Warren-Dearborn, Mich. | 19.8% | 2.1% |

| Portland-Vancouver-Hillsboro, Ore.-Wash. | 19.2% | 3.0% |

| Louisville/Jefferson County, Ky.-Ind. | 19.1% | -1.3% |

| Las Vegas-Henderson-Paradise, Nev. | 18.6% | 20.7% |

| Indianapolis-Carmel-Anderson, Ind. | 14.2% | 11.2% |

| Birmingham-Hoover, Ala. | 12.5% | 3.5% |

| Atlanta-Sandy Springs-Roswell, Ga. | 10.6% | 2.2% |

| San Diego-Carlsbad, Calif. | 9.8% | -6.9% |

| New Orleans-Metairie, La. | 8.6% | -2.6% |

| Columbus, Ohio | 7.2% | -4.5% |

| Buffalo-Cheektowaga-Niagara Falls, N.Y. | 6.6% | 1.0% |

| Orlando-Kissimmee-Sanford, Fla. | 6.6% | 10.3% |

| Los Angeles-Long Beach-Anaheim, Calif. | 5.1% | -3.4% |

| Pittsburgh, Pa. | 4.6% | -1.5% |

| St. Louis, Mo.-Ill. | 4.4% | -2.1% |

| Houston-The Woodlands-Sugar Land, Texas | 4.3% | 4.5% |

| Philadelphia-Camden-Wilmington, Pa.-N.J.-Del.-Md. | 4.1% | 4.9% |

| Cincinnati, Ohio-Ky.-Ind. | 2.7% | 5.0% |

| Minneapolis-St. Paul-Bloomington, Minn.-Wis. | 2.4% | -0.7% |

| Baltimore-Columbia-Towson, Md. | 2.3% | -7.3% |

| Providence-Warwick, R.I.-Mass. | 2.1% | -5.8% |

| Washington-Arlington-Alexandria, DC-Va.-Md.-W. Va. | 1.5% | -5.5% |

| Rochester, N.Y. | 0.9% | 5.6% |

| Milwaukee-Waukesha-West Allis, Wis. | 0.7% | -5.3% |

| New York-Newark-Jersey City, N.Y.-N.J.-Pa. | -0.8% | 0.8% |

| Cleveland-Elyria, Ohio | -1.2% | -9.3% |

| Boston-Cambridge-Newton, Mass.-N.H. | -6.9% | -2.2% |

| Chicago-Naperville-Elgin, Ill.-Ind.-Wis. | -14.8% | -10.0% |

| Richmond, Va. | -15.3% | -7.8% |

| Virginia Beach-Norfolk-Newport News, Va.-N.C. | -19.3% | -15.1% |

| Miami-Fort Lauderdale-West Palm Beach, Fla. | -32.1% | -0.4% |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Sounds about right, still pretty insane out here in SoCal. Not seeing any significant price drop and the greed is still full on display. Certain people are still jumping in full speed, maybe $800K for a tiny dump.

Hopefully it will turn soon and fast soon, do salivate and fantasize about the day when decent house can be bought for 30-50% discount vs current price…pipe dream perhaps.

Los Angeles-Long Beach-Anaheim, Calif. 5.1% -3.4%

The denier’s check list:

– Yeah, but EVERYone wants to live HERE.

– Now is a great time to buy!

– Buy now or be priced out forever.

– There’s such a backlog of demand, prices can’t fall.

– Where else is money going to go? Stocks? No way, real estate, baby.

– This time it really IS different.

Did I miss any?

Sounds like the typical realtor’s sales spiel.

Only heard it 50 times in the past year.

Correct, the same for actions, the descent is always faster than the slow ascent.

One hears the steady ‘click click click’ of the Rollercoaster, inching ever closer to the top of the ride, which are without breaks!

“Wheeeee” ..SMASH – BANG!!

‘This time it’s different because mortgage borrower creditworthiness is so high’.

‘with mortgage rates higher people will stay in their current house forever, hence no new supply ‘ (BTW this makes no sense based on logic because someone how sells and buys in the same area doesn’t really increase net supply. It is all about narrative.)

Some people will always need to move, new job, have more kids, retiring, job loss.

People who have low rates and stable employment won’t move. They would be buying less (or the same house) for higher payments. Of course, this is dependent on equity in the existing house.

Lots of factors individual to each seller.

“Did I miss any?”

Oh Yeah…

– ‘They’re not making any more land!’

– ‘Only 15 minutes from the ski hill.’

– ‘It’s the _____ capitol of the world.’

– “Epic” recreational opportunities.’

And the brochure says so:

– ‘You deserve it.’

– because it’s ‘The last best place.’

And I need the sale to make a car payment on my new Bimmer.

Its a perfect starter home for a million dollars!!

You deserve it…. because you work so hard…

That’s the oldest cup of Kool aid in the bunch

1. We are in a similar stagflationary situation similar to 1970s. At the end of that decade, only hard assets (real estate, commodities, gold) produced real gains adjusted for inflation whereas stock market stayed flat (adjusted for inflation).

2. Fed might ease their inflation target to 4% or higher. Gov might respond to coming crisis with even more stimulus leading to devaluation of dollar and real estate going higher.

In the short term though, prices will go down definitely, but in the medium term, real estate could be best investment IMO. I will buy when the prices become more reasonable and then hold for as long as I can.

Stocks got creamed from 1966 to 1982.

According to price to rent and inflation adjusted case shiller, residential real estate is about 50% above historical norm. The ‘real estate always goes up and is a great inflation hedge’ meme will experience the mother of all surprises when the real values of thoses hourses fall in line with the stock portfolios.

Here’s another oldie but goodie:

“Buy now, you can always refinance later!”

How anyone is supposed to ‘refinance later’ when rates were already at historical lows, and homes go underwater soon, is beyond me though.

Realtwhores have no shame.

Rob posted …

“Buy now, you can always refinance later!”

Well … it worked out that way for US … of course that was back in 1983 :-)

Our kids heard that spiel a lot in the 2010’s. If I was going through homes with them I’d wince.

You are 100% accurate.

Original rate 3.5% refinanced last year 2.625%… in three years refinance at 1.5 to 2%

You did.

‘Renting is throwing your money away’!

– Inflation will keep prices high.

– Everyone’s getting pay raises and can afford higher interest costs.

– The Fed will engineer a soft landing atop the permanently high plateau.

The government wont let house prices fall.

House prices NEVER go down

Hopefully!

Hope to be able to afford to buy something decent, and such a good news for today for me, since it is our marriage 1st anniversary.

Hope to be able to afford something soon

The RE flyers in the mail have eased off. People see how much their house is worth and they decide to list. Move in with the kids, move to Boise, which is the one market I want to see some stats on. Let’s go Idaho! I think there will be a lot of buyers remorse when winter starts (in a few weeks) Happiness is a warm gun, apparently. Nobody is happy here, much less there. Housing is a sterile commodity, like Airbnbs, which look like hotel rooms, cheap oil paintings screwed into the wall, no wonder a Picasso is worth so much. I expect the population will become even more nomadic with climate change and WFH.

Just read that of the 15 large cities with the fastest growth, 3 are in Idaho. Most surprising part of that stat: Idaho has three large cities.

Housing market prices take significant time to change. The inventory levels might be increasing at a face pace, but they are increasing from extremely low levels, so the market is still not back to a balanced market.

I think homeowners will continue to be in denial about the path forward through most of this summer. By fall the homes have have not sold will start to see larger price reductions and then reality will set in and more of the home owners will finally put their homes on the market.

Patience, it just takes time.

I think we will see another spike in interest rates in the coming weeks and that will put the final dagger in housing demand.

Yes, what will QT do to mortgage rates. The million dollar question.

Ground report from So Cal: Although no big price reduction here but definitely seeing softening in the markets.

Definitely don’t see insane price increase as well as seeing big price reduction from initial asking price.

I’m in south OC (Mission Viejo).

I had two homes on my street sell in the last 2 weeks for absolutely crazy prices. One for 1.6M bought a year ago at 1.06M (2400sf) – was asking 1.3.

The other, an 1800sf home sold for 1.19M in July last year, just closed for 1.66M – was asking 1.4.

Everyone in the neighborhood is just scratching our heads. Even the housing perma bulls in the neighborhood are starting to wonder what’s going on.

There’s always special level of stupidity in OC, especially in South OC where the smugness is unbearable even by SoCal standard, definitely rival Santa Monica.

Hopefully when this bubble do burst, the deceleration will be just as dramatic as the momentum up

As a (maybe or maybe not “typical”) realtor of near 20 years I concur that the comical reasons “this time is different” are aplenty. My perspective which I rarely see shared in any piece is that residential real estate may in fact be 60% economics and 40% psychological. Any logical person can see that prices are very expensive. The psychological factor makes someone think “but I keep missing out, I better buy before I cant”. However psychology can shift far faster than 2 quarters of gdp. Once the narrative shifts to “I should wait because prices are dropping ” or “I have to sell now before I get less” the market will sink like a stone because… any logical person can see that prices are very expensive.

Definitely challenging to be a Realtor in LA. So many snakes 🐍. 17 years and I am pretty much over it.

The price drops in the first year of decline are the most significant. We could see a quick 20% loss in some markrts.

On average, nationally, home prices appreciated by 20.9% from March 2021 to March 2022. So if home prices decline 20%, that will get you back to 2021 prices.

That’s not how math works. If a home were $500K in 2021 and appreciated 20%, the new sales price would be $600K. If the same home then depreciated in value by 20%, the new price would be $480K. In other words, 20% of 500 doesn’t equal 20% of 600.

Oh good point, I stand corrected.

Correct, the same for actions, the descent is always faster than the slow ascent.

I think we could stand a 20% drop in the housing market this time without a repeat of 2008.

Why?

1) If you bought a house before 2 years ago, you likely have 30% equity. A 20% drop will keep you above-water and happy. As long as you were well qualified and had 20% down. A a bonus, you now have an extremely low mortgage rate to keep you from selling and buying again.

2) If you bought a house within the last 2 years, you have an extremely low interest rate. Even if you are underwater 5-10%, there is no incentive to foreclose and walk away to pay higher rents or a higher mortgage rate. The volume of sales over the last 2 years has been low so this will only affect the overbidding FOMO people who had cash to burn.

I think the Fed is a genius for pumping up the market quickly before pulling the rug. There is a huge 20% buffer for safety.

All bets are off if there are massive job losses and people can’t pay their overbloated mortgages.

If we see that, the Fed will step in and lower rates faster than they raised them. (See March 2019)

I think we are finally at a peak now. The Fed will allow a 20% drop with little pain before jumping in to stabilize the market again.

I think by the end of the year, house prices will be flat YOY. Meaning if you purchased in Dec 2021, you will have no sale gain by Dec 2022. However, 10% inflation will have eaten away at any gains.

This would be a soft landing.

The big difference is mortgage rates. This time they dont have the option of dropping interest rates to stimulate demand.

Once housing prices have fallen for six months in a row, the psychology of the market will change. FOMO will become fear of getting screwed (FOGS). So my guess is that housing prices will fall for a longer period of time, since the interest rates will not be reduced to stimulate the market and put a halt to price declines. The other reason the Fed will allow prices to drop longer is that banks are generally in good shape and have alot less exposure. WIthout a banking crisis, the homeowners pain will be borne by those homeowners and many will be wiped out of their only real asset.

The last time around we had a market crash based on the lending standards. I think this time around we have a worse situation. A long term bear market in housing asset prices based on extreme overvaluation and the changing cash flow required to buy a home with a realistic interest rate.

Banks do relatively well in times of higher interest rates, so it is unlikely we have a financial crisis. I think a lack of a financial crisis will keep interest rates higher for longer.

BTW, i disagree that the place to put your money is in so-called inflationary assets. I think that the only way to make money will be to put money into disruptive companies that are leveraging technology to grow rapidly, but profitably. There are a few companies out there that are really cheap now. It is “searching for the gems among the trash” time. Technology is transforming industries and only the highly efficient will survive. (for example, buying a Tesla has proven to be a great purchase, with the gas, maintenance, repair costs skyrocketing on ICE cars). But ARK is not good at identifying truly disruptive companies, so dont look at their portfolio for ideas

This inflation will continue for a while, but we will soon see even more signs of decreasing demand, which will result in a cap on interest rates and inflation later in the year or next year.

Good one, “FOGS”. Man this could lead to a Randy Marsh moment with a typo. Remember when Randy went on wheel on fortune… for the category “people who annoy you”.

“ 2) If you bought a house within the last 2 years, you have an extremely low interest rate. Even if you are underwater 5-10%, there is no incentive to foreclose and walk away to pay higher rents or a higher mortgage rate. ”

The actual incentive is not “ needing” to foreclose when a rental contract will more than pay for the house and give you a profit…

That’s the difference between now and before…

people who own home and are underwater can rent it, but if the price drops for a long period of time, then people come to view declines as the likely path and wont want to rent it out and take future capital losses. they can walk away and turn the keys over to the bank.

last time around the financial crisis caused the Fed to step in with much lower rates very quickly.

the psychology of rapid declines is that buyers look for a bottom, thinking they will get a quick rebound, in a very long slow decline the buyers just stop trying to buy the bottom and the slide gets much deeper.

Most of the unsophisticated people would chase the market going down.

One of the guy I know in San Diego, bought a home for $700K, listed it for $800 after 6 months and then finally sold for $450K after 2 years.

He was literally chasing the market down.

When he listed the house for $800K, he had many offer in mid 700s but he declined.

But in 2019 we did not have high inflation. Unlike 2019 the Fed’s hands are tied. It will not be able to lower interest rates swiftly like it did in 2019 to protect the stock market and housing market.

@Bobber: I’m not so sure about that. What do you see genuinely motivating sellers to unload fast?

From what I saw, the price drops in 2005-2009 didn’t come down “fast at first”.

It was more of a “trickle, then a flood” scenario.

Prices tend to be sticky near the peak. Sellers aren’t motivated by fear yet, rents are still high (less competition to “owning”), and there are still some over-enthusiastic buyers keeping the dream alive. And real estate is one of the few assets that people (naively?) think will keep up with inflation despite rising interest rates.

I think the time when house prices will drop the fastest will be when unemployment surges and suddenly millions of people become distressed sellers, trying to salvage their equity before it’s gone. At that time rents also plunge so there are attractive options to owning a declining asset.

Wolf’s data suggests we’ve entered the “trickle” stage.

Soon we will find out who can really “afford” their home – the true test of affordability is whether one can keep paying the mortgage during a time of economic adversity, when income is down (or out) for a while.

The time to look for and find motivated sellers is at the peak in the mortgage rate cycle. There’s very few buyers because the buying stampede happens at cycle lows. Anyone who needs to sell at cycle highs is not going to find many buyers.

The right way is to buy from a motivated seller at cycle high and refinance at cycle low. That way you end up with a low priced home and a low rate mortgage. Buying at cycle low you end up with a high priced home and low rate mortgage – half a loaf!

The data is presented, as reported. The confusion begins and ends with the interpretation of the data. That is when the monster, bias, rears it’s ugly head.

For instance, from my POV, I see the girth of liquidity provided to the financial markets by Powell’s politically motivated QE, establishing record home price increases.

Ultimately, the cost of QE will be revealed, as the markets are forced off the mother’s milk of banking and finance, free money for generating a suckers market rally today.

Could be the last chance to catch a falling knife, at so high a price.

dang,

QE??? Where have you been? QE is finished. QT is now starting. Rates have risen sharply. Are you still living in the happy spring of 2021?

Yes, of course, But I was referring too was the $5 T of cash that sits silently in the reserve account, being paid interest. So much of it that they reopened the repo window.

QE has not gone away. The huge reserves in the criminal banks accounts are still available for funding coordinated speculation.

I think it would be a good time to consider making 30 year federally owned housing mortgages, assumable.

This would allow families to buy houses that were purchased on speculation, at a monthly mortgage payment that is acceptable.

A nationwide housing crisis is unfolding. The prices can, suddenly, be justified by the asking price.

Until the elephants and donkeys reinstitute QE, individual speculators are at risk.

All of the markets are synthetic, dominated by the Federal Reserve, which controls the distribution of speculative cash.

And, like the right wing focus group, SCOTUS, are controlled by their clients, the ones they regulate, the criminal banks.

Thank you for your insights. So, this excess money will be slowly drained by QT only? Or do deflating asset prices also help? Not sure about the mechanics…

@dang:

So… how does making the low mortgage assumable help deflate the housing market? IMHO, the next bag holder would pay up because they are payment buyers. What was a major contributor to the run up in prices was the availability of low mortgage rates.

Rational buyers already ran to the sidelines a few years ago and watched the spectacle from afar, unless they sold their over-inflated house and simply moved the profits to a new location.

It’s never the payment. It’s the price you pay. Write it down. Many will soon learn that lesson.

And don’t hold out hope for “jingle mail” as refinancing can often erase any buyers mortgage non-recourse protection.

RRPO hit 2T recently. I mean the question is do the Feds actions match their words? Are you willing to give them a pass based on their good intentions? EFFR is 83 (range 75-100) SOFR is 79. RRPO puts floor under rates, and 2T is huge, and this is all they can manage? 8 points off the lower bound? The market will do the Fed’s work, it will lower rates.

Dang,

I like the idea of assumable mortgages.

My parents purchased a house in 1974 with an assumable 5% mortgage. The going rates were over 6% at the time.

They had the cash to close the deal on the balance.

This works when the mortgage is above water. If the mortgage is underwater, the seller might as well foreclose.

I think that the probability that a Loyd Christmas moment may be at hand. Grantham’s analysis seems sound about the three bubbles and change, blown by the liberal application of versions of QE across the world, now we worldwide inflation. The train is running, head long into the brick wall of economic reality of low wages.

So….. you’re sayin’ there’s a chance. Yes!

Lol!!!

Is that you Lloyd?

Wages have never been higher than they are now in the US, and they need to come down significantly by reducing them and firing people without any further delay just as Elon is now doing at Tesla.

Powell was only one actor here. BOJ, ECB and bank of canada love those low interest rates.

i imagine that this time around real estate crashes in America, Canada, New Zealand, Australia, Hong Kong, etc will all excerbate each other, as debt destruction around the world causes more panic and debt destruction.

just a guess.

One of the main arguments I see from the “real estate only goes up crowd” is that millennials are all trying to buy houses and they’re the biggest age group or whatever yadda yadda. Thus, houses might plateau but they won’t drop.

Meanwhile I read in a realtor.com article that most millennials who are first time buyers don’t have a down payment to buy. And with rents up so much, none of them can save for one.

I guess we’ll see.

We are high earning millennials and have backed off from the housing market for a bit after 1.5 years of unsuccessful house hunting. Higher mortgage rates have already taken some steam out of the market in our area — days on market up, with a small but growing amount of properties seeing price cuts.

It is true, the median down payment among first time buyers is a mere 7%. Higher mortgage rates (and more expensive PMI) hurts this group more than people like us that “foolishly” saved up 20% down. We will see who gets the last laugh when lending standards tighten.

Re: millennial demand in general, I think in hindsight we will find that the pandemic FOMO pulled many buyers forward in terms of their plans to buy. Many 30ish couples we know bought large 4 bedroom homes in the last couple of years, despite not having kids yet.

“Many 30ish couples we know bought large 4 bedroom homes in the last couple of years, despite not having kids yet.”

or that she might now be too old to have kids….. Nature can be a swine…………

They will pay up for in vitro fertilization for a test tube conception at 39 and have autistic triplets to make up the difference.

45 year old hypothetical dad in this case means the poor guy is going to be dealing with teenagers at 60. Going on 70 when the freeloaders are out of college (where they will learn to hate you)… probably no fault divorced at 53 – in the meantime bound to the justice system making payments for at least ten years.

If you don’t have kids young don’t do it at all. The eggs get all weird hanging around for 40 years of antidepressants and the epigenetics of dad’s wastrel years so you get weird ass kids from inheriting dads trauma and mom’s weird old eggs.

Better yet just don’t procreate if you are over 35.

Sad, funny, true.

49 yo dad of a beautiful 1 1/2 yo girl. Much younger wife. First child. I know it isn’t nearly as easy when you’re older, but by God, I love her dearly. She is the most incredible blessing. Sure, I’m bound for some headaches but, dammit, I’m her Dah Dahhhh! Knowing my age and my health, well, it has been my top priority in life to stay healthy as long as I can to take care of those that I care for. The little monkey is stuck with me FOREVER! :D

Generally I would agree, but I was 40 and she turned out great!

I’m 50 and I have one son at university, one is 2 1/2 yrs old, and one is coming in a few weeks. I love children and I’m not afraid of life. My many challenges (that’ll be “traumas” for the differently minded) made me strong, vital, and attractive to fertile females, thus my offspring will inherit the World.

This is great, love it

there were alot of high earning millennials in tech industries that will soon start to feel the effects of the tech wash-out. lots of VC money getting pulled back. lots of companies that were losing tons of money overpaying their employees are now going to be looking for a path to profitability.

lots of stock options that once were worth a small fortune and now are worth zero.

Much like narrative of millennials don’t have money because they are blowing it all on avocado toast. All freaking BS and a different form of gaslighting and blame shifting by mainstream.

I am not a millennials but I even I get tired of the bashing they get.

BS

Well I’m a younger aged millennial. I bought into the whole trades bullcrap and didn’t get a degree and went into various trades, ended up truck driving. I make 50-60k a year. I save annually about 20-25k. I’m taxed in two different states living on a border so that soaks up a ton and I don’t live in a truck anymore.

My rent went up 15% a few days ago with the expectation of cleaning and doing the yard work now without that burden before.

I don’t have a down payment enough and I’ve been priced out of everything anyways. When local real estate in “The world’s biggest trailer park!” Goes up 30-50k every month, there’s nothing you can do except hit the lottery.

I don’t blame the millennials, there’s a lot of stuff about the age group I don’t care for but this current economic climate isn’t really their issue. I’ve forgone all the things your suppose to do in your twenties by living in a truck working everyday a week for a bunch of it, not having any social life or friends, not having a significant other, not starting a family, not having fun in general just working endlessly, and I’ve got little to nothing to show for it except for handing over thousands to a bank to sit there.

Any normal millennial making the normal median wage for their age group that has any life has probably 1-2k in liquid cash at best if I had to guess. I’m considering buying an enclosed trailer to live in homeless to try and save more money. Most people aren’t going to put up with that or waste their lives doing that. They’ll instead pay 1400 bucks for a studio apartment.

I’m not one to crap on the US or anything but it seems quite obvious to me, the younger you are, the bleaker your likely outcome. I think the direction the US is headed is one of eating our young.

I know I’m much more frugal and hard working than my parents were at my age. And I have less than they had. My mother had a sports car, my father a Harley and a truck, they had a 2 story, 4 br 2ba house in a nice subdivision, and had a kid at 26. When I was 26 I had 30k in the bank, a 30 year old truck, and some clothes in a company owned tractor trailer. All of my relatives in my age group are in the same position but they’re financed to the hilt and doing side hustles like Mary Kay and yard work to avoid bankruptcy. They have a lot of toys and new cars but don’t even have savings accounts, an IRA, nothing. One has a plot of land with a big camper trailer on it trying to raise 3 kids in it. The rest rent. One of them cleaned out their 401k to keep a crappy Jeep that ended up lost in bankruptcy a few months later.

“Prime millennial home buying years” they say breathlessly. If things go South and lay offs start happening, it’ll be “Prime millennial breadline years.”

After all, surveys show 8 in 10 millennials plan to use a firearm of some description for their retirement plan…

Excellent post. You sound like a smart guy. Hang in there!

When the boomers were your age when something was overpriced they didn’t buy it. So consequently the prices would fall. Something Millennials never get through their heads.

How in the heck on a wage of $60K a year can you save $25K annually?

I don’t believe it.

How much of that $60K is taken away in income tax?

How much do you spend on food, shelter & transport out of the rest?

Sure Tony, if only the poor Millennials would stop buying houses then prices would fall.

Do you even read what you type?

You sound like a very smart and responsible young person. Do not despair. You say you save 20-25k a year so buy yourself a 1 or 2 bedroom condo. If you marry and have a couple of kids later you can always sell it or rent it out. Do not let the “McMansion or Die Renting” mentality hold you back.

I’m a saver by nature, and socked away up to 50% of my income in my 20’s. Glad I did it because it put me in a position to live a little nicer with a family now. But I’ve come to realize it’s important to have balance. A spendthrift friends once told me “saving all that money is stupid…you’re going to die or be too old to enjoy it.” There is a happy medium.

Your posts often sound a lot like one of my best friends. He’s highly aware of the screwing we all get from our dear leaders, and the insanity of our financial system. He makes about 50-60k doing light blue collar work and saves a pile in hopes of one day kicking back and living off the savings and snorting white powder from between a dancing girl’s heinie. But his approach seems to mostly just make him miserable. Plus his family has a history of only living into their 60’s so he should get to living some.

Happiness and financial security are not the same thing.

My $0.02 from a random dude on the internet is to make a big change. There is a lot of talk on here about the insanity to the East and west. The American dream is still breathing here in flyover.

@julian

60x.70(ish) tax rate = 42.5 take home. If we’re assuming 25k saved.

Rent was 600/mo so knock off 7200 from 42.5 = ~ 30k.

I ride a motorcycle to work once, rarely twice a week. 70mpg, gas is quite negligible. I only drive my 40 year old truck if it is snowing or under the low to mid teens in temperature. I spend less than 1000/yr on gas. 29k

Only bills I have is phone plan (burner phone) and car insurance. ~1000/yr 28k

I spend about 300/mo on food. 3600 or so, we’ll round to 4000. 24k.

Out course there are some things over the year that pop up, miscellaneous expenses, we’ll round that up to a generous 4k to make a happy 20k.

You may think you have me cornered here with 20 instead of 25, but in the words of Billy Mays, “Wait there’s more!”

I take home an extra 5-7k a year in per diem pay which isn’t taxed for being on the road during the week. Additionally if I didn’t live in Idaho and lived in Washington that is a 6% tax burden gone and also WA doesn’t tax groceries.

So with per diem I am up to 25k or so every year if I make 60k on the high side.

Now again, I don’t go anywhere but to work and home, I don’t have any social life, I don’t have hobbies, and if I’m not working, I’m laying in bed with nothing to do but watch crap on my phone.

As I said, I know how hard it is for me (granted one income) so I know there are very few going to my level of extreme. I used to live in a tractor trailer not getting out for 3 months straight to try and save money. It gets to be too much. Then again, I’m considering buying a cargo trailer and just living in it with rent going up again.

It sounds impossible, but that’s only because you aren’t crazy like me and willing to waste all of your best years chasing pitiful sums of money.

@amander

No way in hell would I ever buy a condo. I live in hotels half the week and I hate the endless slamming if doors, kids screaming, people talking at 90db, etc. That’s why I won’t live in an apartment. I work nights driving around in the dark working 12-14 hr days, I need quiet to sleep. Plus I can’t stand being crowded in around people all the time. My trucking gig makes me a target for angry people in America’s most entitled yuppy land. I don’t care if it is a shack built by pioneers with cracks between the walls, I’ll take living 2 hours out of town without power or water before I buy a condo. Hell is here on Earth, and hell is other people.

I guess that gives you a good idea about my feeling on being married with children.

People saying I’m smart… I really doubt it. People look back on their 20s with fondness, I look back and grumble about what nanny trucks I had at various ages and which companies were worse. The kids are onto something with that whole YOLO deal. What life is it if it is little more than wage slavery? The level of savings I commit to weighs like the shackles of debt, but I don’t get the toy neither.

My advice, don’t go to either extreme and find a job that pays enough to allow working to live not living to work. That’s the real smarts. I know hanging out with Plutus and Mammon haven’t done me too many favors.

TG

You are wise beyond your years. The Boomers did F*** a lot of things up (or at least those we elected did so), and Tech played a big part in destroying the family unit. When you are under 30, 5 years seems like an eternity, when you are 65, it’s just around the corner.

I will throw a twist into your potential real estate future. Consider buying LAND somewhere that you like – maybe even 2 places. You can afford it now. You can already build an OTG property today with ZERO attachment to the “Man.” I have a small OTG Shangri-Las on 1/2 acre in a fun tourist town and my only (dwelling) expenses are property taxes, insurance, wi-fi. and minor maintenance costs (peat moss for the digester, landscaping, etc). No electric costs, water, sewer, gas etc…FOREVER.

Mine is a custom built home but you can buy pre-fabs and the manufacturer will often finance it for you. I’ve seen as low as $60K to as high as $500K depending on size, amenities etc.

Just a thought. This is something the Boomers really could NOT do back in the day, but you can.

That sucks, I am sorry to hear that. But I think you are in the wrong business, need to step back and re-evaluate everything. Cant keep digging for water in the middle of a desert. I am a first gen immigrant, came to the USA in 1999 with $200 in my pocket. My saving grace was my education and the first job offer (granted they were screwing me big time, paying $19/hr while charging $150/hr to the client). Things turned out ok, love the USA!!

Look, I don’t have a crystal ball into the future, but I think you are going to be one of the millennials to survive without being bailed out by a parent. If you buy something, buy small – a studio or a really small one or two bedroom house. I have an economics degree – and I am the first to admit that traditional economics has been defied by all the hocus pocus of current financialization – but I reckon the laws of nature and economics still stand. The fact is, the guys that caused the last Great Recession are doing basically the same things. Sooner or later – probably in the next five years – the system, based on a house of cards, is going to crash. I wish you good luck. You sound like a really decent person.

Trucker Guy,

I’ve read many of your posts over the last couple years, and always enjoy them. You’ve got to be one of the most articulate truckers out there. You are an excellent writer, have a colorful way with words, and an interesting, unconventional perspective.

Wishing you best of luck finding a refuge in the woods somewhere far away from the noise and chaos of the crazy ape.

(Sorry this post is a few days late in Wolf Street commentary time, but I always seem to be a few days behind reading his prolific articles…)

Let us all know once you start The Trucker Guy blog, as you are a talented writer with a unique way of delivering your message.

Lord knows, I scroll past many posts but yours have a catchy and genuine “gotta read more” feel to them.

Your new blog would garner attention I’m sure of it.

Best of luck TG, hang in there good things will happen with your work ethic and drive (no pun intended).

I got zero percent down from NFCU.

That’s very much what we’ve discovered to be the case as millennials (early 30s) in Ventura County, CA – in terms of “how the heck do we ever save up for a down payment?” I’m a nurse, my husband has a decent office- based (but not remote) job, our combined income is now $250k/year+ but we were probably more like $160k not too long ago.

We had a decent rental situation for about 5 years that allowed us to pay off our almost- six- figure-total student loans and any other debt (one car note), Dave Ramsay style. I mean, neither of us have ever had a free place to stay almost since turning 18, no help from parents – none of that. So we did what we thought we needed to do to get the good jobs, then wanted to be responsible humans and pay back borrowed money, but that has proven catastrophic in terms of home ownership.

Having graduated high school right at the height of the meltdown in 2007, my parents not being homeowners themselves, and my husband’s parents having a run of their own rental properties that were a nightmare and net loss for them after crappy tenants and costs associated with issues with the homes themselves, I had always wanted a home but never saw ownership as the end-all-be-all of all things.

But in the summer of 2019 we thought ok, we’ve been saving and sacrificing forever, we’re debt free, and we’ve scraped together a baby down payment – got approved and even had an offer accepted for a decent $700k house. We were TIRED of living rice and beans style for 4+ years, picking up shifts, etc. It would have been nice to get out of “epic save mode” But then the numbers were just so high ($4800/ month with all associated costs on the home) and we decided to be wise and just save more, wait, etc. We were pretty close to being able to get into a better neighborhood at that price. Even our realtor at the time and our realtor neighbor said “oh you guys are being smart, just wait two years, it’s softening” and remember the good rental situation? Our rent was about $2800 for a house. So we decided to save and wait. So smart, so wise, don’t be house-poor right?

Fast forward two years to 2021. Same $700k house that in 2019 the realtor referenced and said “you’re almost pricing yourself out of the neighborhood” is over a million dollars, easy. Crappy houses literally half the size are $800k. And that “down payment” we had feels like nothing and the loan we would need is *so* jumbo now that you can’t squeak in with a smaller % down payment. So we’re looking to try to save an ADDITIONAL $150k just to be maybe, sort of a little bit competitive. And then additionally have to pay whatever extra beyond the appraisal out right? Is this a bad joke?

And we’re those wise young folks, right? So we still contribute 15% to retirement, stay in the affordable house, decide to wait… COVID is crazy but it won’t get us down! And then…the land lords call us summer of 2021 – sorry, selling the house – no, you can’t buy it for what it’s worth, we want to put it on the market and see how high it goes. Wonderful. We had 60 days to move, with a kid in the local elementary school and jobs to keep. The cheapest rental house in the city was $4200/mo and we were *miraculously* chosen out of 50+ inquiries they had gotten in the 12 hours since posting the rental. The property manager said she was just so overwhelmed, we seemed fine, she couldn’t sift through that many applications…Honestly we thought we’d be homeless, or have to move completely out of so-cal. 60 days is not a lot of time to plan your life like that. There wasn’t even an apartment in the entire city with enough rooms for our family available!

So we’re not homeless, but suddenly our rent has increased $1500 overnight for a much smaller/less nice home, we spent $4000 of our home savings on moving since it was such a short time between the two places (2 weeks). And now the math, if we’re really good savers and don’t live lavishly buying Starbucks or going on vacations like those crazy kids do, continue paying two arms and two legs for childcare, and don’t sacrifice retirement savings or our health, etc… about 7 years to save what we need at current rates, which are ever moving farther out of reach. Joke’s on us!

The difference between millennial owners and renters- from what I’ve seen surrounded by this population at work and in my personal life- is really their parent’s ability and willingness to provide:

1. College

2. Free living expenses while in college

3. A full down payment on a home or significant assistance.

Quite literally the only homeowners I personally know our age who have bought their own home without SIGNIFICANT help? They’re in Bakersfield. BAKERSFIELD. And in my desperation – trust me, I looked – and it ain’t that cheap out there anymore either!

I guess the moral of the story is firstly, I hate COVID, and secondly, I hate the Fed and general population for making me believe my whole adult life that “the way things are now” is “the way things always will be”.

Also don’t be born of people of no or little means.

Damn, sorry to hear you all have been through the grinder through no fault of your own.

However, based on the charts above, you will end up being the smart ones. Sometimes the best thing to do.. is the same thing you’ve been doing.

Heather, thanks for posting that. It should be required reading for everyone in government in a position to affect interest rates, borrowing, and student loan debt forgiveness (as in don’t forgive any, since others honestly paid).

I know how you feel. My circumstances were and are nowhere near as rough as yours, but indeed similar. Through wisdom and good conservative decisions since the early ’90s, I have cost myself all kinds of RE sadness.

This much I can tell you, and it will seem contradictory…it has been like this for a long time (just not as quickly moving as the last 18 months), and many others have experienced just the same. However, stay tough, patient, and you will get there. Either prices will come to you or you will reach the prices. Or both. Eventually.

“Either prices will come to you or you will reach the prices. Or both. Eventually.”

This is how i’m approaching it. I was pretty much paycheck to paycheck even living at home. I’ve tripled my pay since 2018 but didn’t really see a bump till 2021. I’m 33 so i’m feeling a little behind but then I look around and see well I might not be doing so bad. I’ve got zero debt, a large savings balance, a nice 401k balance and a REAL pension. I might not be able to buy a house for another 2-3 years but sooner or later my savings will catch up to house prices. Or house prices will come down to my savings. Thanks for reminding me of this.

Thanks for sharing Heather. We too saved and avoided buying a house or taking a vacation from end of ‘18 until end of ‘19. Then COVID, we were stuck overseas everything crashed….and like you we held off buying and now we see people got free rent, no need pay student loans, even people who had mortgages didn’t have to pay them for a year!!

And BTW we saved like crazy for a year to pay off $52K in student loans…which of course was a waste in hindsight.

Now we have a downpayment but again feel market is peaking. We’re headed back the states and our new rent is $850 more per month than when we left!!

But InshaAllah, doing the right thing will pay off for us over the next couple three years.

We did right. Know that.

Fed policy has consequences and you were a casualty. Biggest everything bubble ever. Probably going to be some bargains when tide goes out. There is a saying that the money is made on the purchase. Don’t get sucked in to FOMO.

Move too Omaha ne u will have more than enough money to live a decent life,but will have to shovel snow.YOUR CHOICE

Yes, it doesn’t pay to be financially prudent in the CA housing market. I don’t know how people afford the property taxes at these stratospheric prices.

Best solution: leave CA behind, it ain’t getting any better. I know so many people leaving. It’s now Switzerland on the Pacific and if you’re not elites there’s no path for the middle class.

Great post and trust me you’re not the only people out there feeling this way. I can completely echo your sentiment as I am in similar situation myself. At some point, you just look at the greed around you, the way it pour out of people’s eyes and what the FED has been doing for years to create this level of dog eat dog “wealth” creation and inequality and ask how will all this end? Maybe time will prove that being prudent and patient is the right thing all along or we are just suckers to go against the herd and this is the price we pay for trying to do the right thing.

Lovely story thank you for sharing. You have a knack for writing. Being a Ventura Country native I can appreciate the struggle. Hold on just a bit longer and you will have the fairy tale ending you deserve

I agree. You are in decent shape. Give it 6 months and things will look (paradoxically, while things overall go downhill) better for you .

Best of luck!

Moving is probably the only answer.

Yes….preferably out of the country…

Heather,

FOMO is about to turn in to OHNO for many people. OHNO as in oh no, I was just laid off and now my house is underwater. It might take the housing market 3-5 years to find the bottom, but there will be deals. Even in CA.

Heather v – Thanks for sharing you story and I hear you loud and clear. I am super understanding of your insane childcare inflation and rental inflation that you’ve been experiencing. But I do want to share with you one thing: When people get desperate and they capitulate to the mania and capitulate against financial prudence, this is when the utter slaughter can happen. Just ask anyone who bought a house 2006-2007ish…or bought NASDAQ stocks in late 1999/early 2000. Also, 2008 and beyond, the people who got hurt the worst were not the people in desirable LA and the Bay Area neighborhoods: they were the people who sought out affordability in Bakersfield, Merced, Phoenix, Las Vegas, etc.

I know I sound just like your real estate agent and it’s true I have NO idea if prices will explode even further from here. I’m not trying to call a top for you. But I am trying to say that it IS possible things will change some day in your favor if you remain financially prudent. (But I can’t predict when that will be.)

Relocate out of California to Pennsylvania. You could buy fairly new 3200sqft in a good public school for 450k on average yes was 325k in 2019. Taxes are reasonable, 3% income and about 1% real estate and nursing pay within 15% difference or less since many reimbursement rates are based on Medicare guidelines which reimburse highest in the south. Is the southern Bay Area awesome of course. Great weather, access to wine country and Carmel. Sure but I’d rather live like a prince here than a pauper there. My friends in Sunnyvale bought small 1800 sqft ranch home interest only loan for 2.6M and will never build equity. They plan on wealth thru that “appreciation” which will always happen. Move to a more affordable area, easiest solution then take lots of vacations to California.

I live in Central PA. Don’t move to PA. It sucks. Pittsburgh and the surrounding area may be the only ok place to consider

Buy 3200 sq ft? Bad advice. That’s twice as much home as the average family needs.

You just move to a state where the minimum wage is $7.50 an hour and when they raise the minimum wage to 10 dollars an hour or more home prices have to go up.

I’d prefer to have someone drop a house on me than live in Bakersfield.

I can only speak for myself here but I think the best way to get back at the system is anti-natalism. Can have slaves if the slaves don’t have kids.

And the fact I just don’t like kids. But I’ll put a Robin Hood-esque moral story behind it to make me look less devilish.

Trucker Guy wrote: “I’d prefer to have someone drop a house on me than live in Bakersfield. ”

WOW. Reading the comments here, I see how places like Huntsville, Ala., and Green Bay, Wisc., can make the top 3 places to live in 2022.

I always did like Colorado Springs (#2). But haven’t been there since 1980.

“I’d prefer to have someone drop a house on me than live in Bakersfield.”

Trucker,

Don’t like Bakersfield? Try Stockton….

Will V: “Relocate out of California to Pennsylvania.”

Seeing a lot of this. Tons of Californians moving out to mid sized cities in Michigan, west PA and NC (Asheville seems popular). Unfortunately even those places are getting their own housing bubbles now thanks to blundering Fed policy, so more are moving out of the US entirely.

Trucker Guy: I get this sentiment, and world population does need to stabilize but it’s tragedy of commons thing. If everyone in the US takes this path, then..

Anthony: “my dad was in the RAF and he dropped bombs on people who thought like that…”

Huh? This sounds nuts in the opposite direction. I worked in Bangladesh for a while where they were providing education to girls and women, contraceptives to stabilize, reduce population to avoid famines from overpopulation. Would you want to drop bombs on Bangladesh because they “think like that”?

elysianfield,

You can also split the difference between Bakersfield and Stockton and go to Fresno. So many options…

Heather you and your husband have the correct principles and are doing the right things. It’s known for 2 decades that the Fed as well as the political leaderships (both parties) ran a policy that repressed savers (future consumption) and encourage debtors (consumption now gravy train). A short sighted if not nation destroying lesson to teach to the generations. Don’t give in the last minute trying to catch that falling knife and bail out those who already spent their future earnings, it’s about time for them to go into the super saver mode.

Wolf and other like minded are now seeing and hoping the Fed will finally turn the ship around slowly. My hope at least for the RE is to see the 30~40% gain of the last 2 years be unwind within 1 or 2 years (fingers crossed), at that time you can have a fair search. Keep watch of new inventory growth for this. There’s also a good article on this site from Jan 2021 that I found helpful. Good Luck!

Wolfstreet.com Article Title:

“When the Market Defies All Logic, it’s Time to Take a Deep Breath: My Observations as Real Estate Broker”

Thanks HS86 for reminding us of this great article from Melissa.

And special thanks, Heather, for taking time to give us a glimpse of the costs of acting prudently when the supposed adults at the Fed checked their courage and principles at the door and sucked up to the financial markets/bankers.

It reminds me of the late 1970s / early 1980s housing inflation when I thought I’d never own a home. Eventually a good time to buy came around. I hope it will come again as I haven’t owned for years but now want to buy, too.

No telling how things will turn out for you or the rest of us, but being careful with your integrity and finances usually bring good things over the long haul. Don’t forget that the stories media likes to feed us overemphasize the lucky ones and downplay those whose experiences are only average.

Thank you for posting this Heather.

Time to get out of California? I hear Oklahoma is nice. Beautiful homes for less than 500k. Your jobs won’t pay as much out there (unless you can work remotely) but the COL decrease would more than make up for it.

I lived in Oklahoma for two years. The state motto is Dumb but Happy. I worked for an oil company and we couldn’t hire anyone from Oklahoma – they were too stupid and uneducated. The whole work force was from surrounding states especially Kansas.

Teacher pay in Oklahoma starts at $36k. Your definitely not getting the cream of the crop at that salary.

“Your definitely not getting the cream of the crop at that salary.”

Apple, speaking as a retired public school teacher, I was shocked at how ‘uneducated’ many (not all) of my fellow teachers were. I since learned that the typical public school teachers were ‘C’ students in college. I generally found them to be sound in their areas of expertise, but uninformed (uneducated ?) outside of their domains (speaking of high-school teachers).

Not trying to be judgmental, just stating the facts.

@Apple- Financially speaking, I think most on this site would agree that a smarter person would actually take a nursing job in Tulsa (68k average salary) and a 180k mortgage (225k median price minus 20% down payment). As compared to a nurse in Ventura, (101k salary) with a 680k mortage (850k median minus 20%).

After tax take home in Ventura would be $72,600 and assuming the 5%, 30 year mortgage from above is paid monthly with property taxes ($4,270), a grand total of $21,350 is left in your annual budget.

After tax take home in Tulsa would be $52,300 and assuming the same mortgage terms paid monthly ($1,220), a grand total of $37,700 is left in your annual budget.

That is almost double the money available to spend after taxes and housing are taken out of the equation. That’s a huge quality of living increase, especially if you have kids. On top of that, sounds like ‘Heather’ has enough of a down payment already saved that she might not even need a mortgage in OK.

Also, OK is not nearly as backwards as some here would make it out to be. Wolf lived there for years!

At least the Chinese didn’t destroy your housing market. Where I live homes cost at least double that.

Househood income 250K, and house price 1M (4x income), interest rate 5%

This is so much tougher than which previous generation?

Tsuda:

It might be the ability to scrape together the down payment at the higher purchase price.

10% – 20% of $1M vs. the same percentage of $500K.

I’m with Tsuda, but the truth is that saving for a first home in California is hard for every generation. (Note for El Katz: when the house price is 4x income, the 20% down payment is always 80% of income. It scales. It’s always hard.)

My spouse and I moved to the Bay Area in the late 90s and were “priced out” of the crazy dot-com housing market … until the dot-com bust. But we had saved like crazy, waited for our chance, took that chance when we got it, pinched every penny for 5 years to get through the 2005-2010 bust, and have been happy ever after.

The one advice I’d add for folks like Heather is that to save that first-home downpayment, it’s okay to skimp on the 401K for a couple years. Just do the minimum to get any “matching” contributions from your employer. You need “downpayment” much more than “retirement”. You’ll be able to save a lot more in the 401K when you hit your peak earnings years and/or after the childcare expenses wind down. Owning a house also helps a lot with retirement b/c you won’t be stuck paying rent to anyone but yourself.

Bonus:

“Affordable house price” = 4x “sustainable” income.

DownPayment = 20% of House Price = 80% of Income.

How to save 80% of your income? Be super-frugal, knowing that “get the house” is the most important goal for your money. We saved ~30% of our income and had a DownPayment in 3 years or so.

If you can only save 20% of your income, it takes 4 years, but that’s still not too bad. (If house prices run away in the meantime, just wait because that situation doesn’t last.)

If you only save 10% of your income then you’re going to wait a long time to buy a house and you probably will never have enough to retire, either.

Too many people ruins everything.

National parks, theme parks, morning commutes, neighborhoods, cities, states, countries, stores, concerts, airports. If the herd is there overgrazing, any place/activity quickly starts to suck.

Cali is a fantastic piece of earth so a lot of people want to live there. Too many people. Too much demand. Too expensive. Too much traffic.

Move somewhere without traffic and be happier for it.

“Move somewhere without traffic and be happier for it.”

Boom! You nailed it Random Guy.

I remember hiking with my family around Mt. Hood. We took six days to do it. Anyplace around the mountain that was accessible by car was trashed, overused, with areas roped off to let the grass regrow, etc.

Nice places get ‘appreciated’ to death by overuse.

Been to Yellowstone recently? It’s a carnival. But some people like that…

One word… move!!! Its not worth it to put so much on the line for a house. You will have a much better life elsewhere, and with the money you save, you can do a yearly California vacation to get your “California fix”. California is like Jenny from Forrest Gump.

Stay healthy. My wife and I have 3 kids — one with mental health issues and we’ve sunk 10’s of thousands into that while paying thousands each month in rent. Can’t even think about student loan payoff right now. Wife is actually going back to finish off psych degree. We make over $200k/year now and that’s not enough. Our 1700’ rental zillows for $715k.

Heather, thank you for sharing in such detail. My wife and I lived in Ventura for 5 years and (left in 2017 to Washington, but was so expensive there we decided to come back to OC a year ago).

We are in a very similar situation to you. In Ventura, everyone we knew who had bought or owned, literally everyone (and this was back in 2017 and before) had ALL received money from somewhere.

We have come to the conclusion that happiness is about having time to spend with your family. It’s about making the most out of the moments you have and enjoying your children while they are young.

Ventur is a great town with beautiful beaches, an awesome Main Street, and plenty of great food. Lots of good people everywhere. Enjoy that and save the money.

This market will turn. It may be a few more years, but the savings and security of having a good income will be worth so much more than owning a home that you vastly overpaid for and is now underwater.

It is all about good timing or just plain good luck……LOL

I know of a couple that have lived beyond their means for the past 5 years.

They bought a big McMansion that was really beyond their fiscal acumen (they are facially irresponsible in making sound financial decisions). Struggled every year making a utility payment or this month house payment or this months car insurance payment. Now after using the mortgage forbearance (which came at an absolute ideal time for them to kick the can down the road for another 1 1/2 years ), they added a bankruptcy when forbearance ended last year.

Currently, they are being forced to sell the house because the could not make the bankruptcy restructured payment. But out of good luck or dumb luck, the house appreciated almost 40% since they bought it 5 years and they will walk away with $160k in cash which means they basically had a piggy bank that increased $30k per year on average.

I am guessing the cash will be gone in 5 years but hey, it was good while it lasted and they can live beyond their means again.

I meant dumb luck

I am a millennial too, and we backed of at least for 1-3 years. But the reality is that for every open house that we were going, 90% where young couples or families with little children. Obviously they were also millennials. This gen were holding the lower segment of housing market and let it keep going for a while. Currently after rate hikes, It see that the higher priced houses are selling , which is purchased by older wealthier people. No more sales in the lower priced homes anymore.

Best advice I never got was to try not to be in the “herd” when it comes to herd mentality…

Bank of mom and dad is covering that problem.

Tiiiimberrrrrrr!!!!!!

Hard to see real correction in house prices while there are unfilled job vacancies. Until then, it’s just casually front-running the FED.

I thought it was the inflation and inflation counter measures that bring down house prices.

Hi Anthony,

Significantly reduced buyer demand is the top way to bring down prices.

Most unfilled job vacancies are that of tier 1, working through school, type of positions. They pay a little more then minimum wage in our area. Most college students do not work, live off of college loans, and guardian hand outs. Most jobs that require degrees are becoming non-existent. Many in my area keep their head down as organizations are restructuring. Some are offered demotions with same pay, no end of year bonuses, but work from home flexibility. Others are not so lucky. The organizations in my area are preaching “We have to do our part for inflation. We are doing the difficult job of raising prices on our merchandise, consolidating positions, and removing some jobs from the sector.” Just two weeks ago they were talking raises meeting inflation and the great resignation. I feel I have whiplash. One thing is for certain, if prices do not fall on entry level houses, average rental units, or used vehicles – I am afraid college students will never go to work. We have to reward hard work with better prices.

People that are able to buy can (should) see that conditions are likely to become more favorable for them. This is assuming that mortgage rates don’t spike. For people that are able to wait there is the question of will there be waves of layoffs coming ? Or perhaps WFH being curtailed further.

When I check listings I also look at price history. Realtor dot com has this feature, I don’t know if other sites have that. The doubling of prices over the last 3 years even in smaller markets should tell you something.

Redfin includes price /tax history in each listing.

Let’s see … should I invest in crypto or another rental property … I’ll stick with real estate. More inventory, softer prices = opportunity – for me at least.

The thing with decentralized cryptos is that they really have not yet found a use case or real deployment that can safely and securely replace other means of financial transactions in mass quantities.

There has been lots of talk and lots of promises but I cannot say any promise has been fulfilled. The two use cases that have succeeded are the black market/laundering and speculation.

If you look back in time at the adoption rate of various technologies (microwave, VCR, smartphone, web 1.0, web 2.0) that were game changers, after 10 years most saw an adoption rate of at least 50% to 70%. Cryptos, from what I read, is still less than 20% after 12 years.

Blockchain technology may get adopted, but I am not so sure all of these decentralized crypto coins will beat out what is eventually coming, Central Bank cryptos.

In the past two days, I’ve heard of accepted at- or below- asking price offers and, gasp, even a seller concession in the Hudson Valley and CT (the latter was an accepted, zero-down payment mortgage which I gotta admit I thought was Ws Comment Section exagguration but lo and behold: CFHA).

Still warned by my agent its largely competitive all over, but sellers who went overboard on asking price are starting to sweat and crack now that their properties aren’t moving.

We live and hope.

In Central Ohio there is a mix bag of results in the single family home area. For houses that are 15+ years with little fixed up – they are listing and selling for about 350K. This is 100K decline from this time last year. Houses priced above 400K are sitting on the market an average of 22 days, but they are still selling for asking price. Some of the nicer, older homes in the better school districts are selling within a weekend for about 100k over asking price. All of this is well below new home builds in the areas. They still advertise starting at 325K but when you ask for the 325K house – they have no inventory. All they are actually selling are 600K houses. This search is done on 2 bedroom, 2 bathroom, 1500-200K square feet. However, this is the first time in 2 years that we have over 150 listings in a few suburbs. The new home builders are reporting they have enough sales that they are building two years out. That weekend we saw three of those homes turn to spec homes and went up for sale. They did not reduce the price at all and had buyers close in 1 day. Perhaps the tide is turning.

Thanks for the info. It would be interesting to see the a breakdown of the price ranges of the new listings.

I have a feeling the high-end houses are or is about to get hit pretty hard?

I am not sure about the low end yet.

Thanks Ru82! In 8 of the higher end suburbs and old money pockets- houses between 700K and 2M sell like hotcakes. Luxury/Custom homes in middle income suburbs priced above 500K are sitting longer. There are a few so ridiculously priced (above 1M) have been on the market for about 10 months.

In regards to the last layoff post.

These layoffs are not much at all when compared to the dot.com bubble. That was a carnage event. Maybe this will be too, time will tell.

During the dot.com bust, companies where laying off 5k and 10k people in one swoop.

I read so far the tech industry has laid off about 20k. I went back in time and found an article that said 123k during from mid 2000 to mid 2001.

The current tech layoffs is so far about 1/6 of the dot.com but the tech industry is now so much bigger now than then . Cisco was 30k employees then and now 75k now. Dell was 40k in 2001 and laid off 6k to drop to 34k in 2002. But now Dell has 158k employees. I would say we would need to see over 250k to 300k of tech layoffs to equal the dot.com carnage? It was brutal if you were in the tech industry. As Wolf mentioned, Nasdaq lost 78% during the dot.com bear market. NASDAQ peaked at 15,600 last year and is now 12,300. To drop as 78% like the dot.com bubble it would need to drop to 3,450. The tech job industry was brutal and the NASDAQ bear market was brutal. It just kept dropping and dropping for about 2 years. The drop was slow and long.

The “Year 2000 Computer programming crisis” also contributed to a lot of extra money being thrown at technology as a lot of financial programs were written with no concept of dates beyond 1999. I guess we can thank Alan Greenspan for that too. LOL That also created an extra technology hiring boom on top of the dot.com frenzy.

—————————————————

From an article in 1999.

In the 1960’s Alan Greenspan along with his childhood friend John Kemeny invented the very first sharable computer programming language called BASIC. Greenspan went on to write the banking computer programs that now contain 99% of the world’s “electronic assets.”

———————————————-

That article article is wrong. Greenspan had nothing to do with creating BASIC. Look it up on Wikipedia.

Amen. That claim is beyond absurd.

There are indeed significant layoffs coming. Tesla just announced a 10k cut and more will come. So many companies are not profitable, no way around it. The 2000 pop was extreme, but as you mentioned the tech industry is much bigger now, therefore a more moderate downturn will still have massive consequences especially in tech heavy areas.

SandyV,

If I were Evil Boss at Tesla, and I had a bunch of pampered managers tell me that they want to continue to work from home, but I really want to see the whites of their eyes, and I have this sort of rebellion on my hands, where I have to tweet something to the effect that people who want to stay home to work should do so for someone else, guess what, to underscore that message, the next day, I’d go out and announce that I would decimate the work force, and it would scare people into submission, and they’d all start showing up at the office.

The Roman commanders instituted “decimation” to punish their soldiers collectively, if they didn’t perform. According to my memory, they lined up the guilty legion, and they would have to count, starting at one end, 1,2,3,4,5,6,7,8,9,10 and BAAM. Each tenth legionnaire was then killed on the spot by the others. Decimate = kill each 10th.

So Musk is threatening to lay off each 10th (10%) because they’re being rebellious and don’t want to come to the office. That’s what I think Musk did here.

I think Musk really wants to reduce his work force, just like other tech. If he announces a layoff he’s evil. If he says everyone back to the office he’s hoisted up on shoulders as a hero. Pretty brilliant move I think.

He now said he will increase his overall workforce. With this guy, every day is a new story. But he does want them back in the office, and he going to threaten them with decimation in order to get them there.

Nor Cal new home sales down -40% the last few weeks. -40%. Let that sink in. The ITB at $60 might be your best short of 2022, along with AAPL and TSLA.

Just an idea. Perhaps, being laid off, will ultimately, be a formative event. It was for me during the three year collapse in the miner market during the dot com bubble burst.

American workers have been in a recession for fifty years or so. I’m not sure that most people would even notice that America was in recession.

One has to be wealthy to appreciate the tragedy of a recession. Especially one measured by the volume of Chinese manufactured product imports versus subsidized agricultural product exports.

Just reading the atmosphere that controls whether I live or not. The physical atmosphere which, can, immediately alter our karma, or pshwey du vie, when it reminds us of our insignificence in the future of the world. Good thoughts because, if true, it means it’s not our fault.

The splendor and magic cannot be quantified. Just a suggestion, as the military industrial complex tightens it’s grip on the lower class. Selling death for other people as syrup.

We, as a country, should commit to reduce our defense budget by 12 – 15 pct per year until it is equal to the budget of two times the most scary threats, China and Russia.

Two days ago, I accidentally watched the American national concert, celebrating Memorial Day. I was repulsed by their celebration of Vietnam and Iraq, both conflicts I have lived through.

The military ordered me to attack. As a citizen of this country I had no choice as the military attack Iraq,

Thankfully, I never had to serve, but I respect the men and women who made that awful decision that I never had to make.

Yep, this is just what I remember from 2008. As soon as people hear prices are coming down, there is a race to list. I saw neighborhoods that had “for sale” signs all up and down the street. At the same time buyers stop making offers, waiting for lower prices.

After a while, listings were cancelled. Only people who had to sell, accepted the lower prices. The problem for buyers was all they had to choose from was unrepaired junk.

Yep, like looking at a candlestick chart. Large red stick followed by smaller red sticks and lower and lower volume. Eventually it shifts to green candlesticks and volume increases with the bottom of the market in the proverbial rear view mirror.

It’s a gully.

That was a short reply

The worm has turned but in this case it’s like a Dune sized worm. Absent more profligate fiscal/monetary money tornadoes real estate is going down. I’ve never seen a more obvious and broadcasted imminent decline in RE.

At least to 2020 levels, which puts a gazillion pandemic punters underwater.

Yes, since housing is a speculative asset just like stocks then expect an over correction. Maybe it will drop to 2018 or 2019 price levels and then quickly bounce up to 2020 levels.

You are right. It is shocking to me how obvious this is. The FED is cornered and doesn’t even have much ammo left. It is the perfect storm. Yet many people I talk to are completely clueless. People that usually ring the alarm keep their mouth shut because they were wrong too many times. This will be one for the books…

Things are definitely trending in the right direction (for those of us hoping for house price decreases) but as the third chart shows the new from the 2017-2019 pre-covid years so it’s a little too early to get too excited. Let’s see this play out a few more months to get a better picture.

Wolf,

Your explanation of people moving into a new house without selling the old one at these prices and tnese mortgage rates begs the question, how in hell would they pay that amd qualify. No way.

I guess the more probable explanation is, “therapists” owning five houses and a condo deciding they are must a little over their head.

Lots of people have lots of money. It only takes 10% to move the market.

In my area, inventory’s so tight, it’s effectively negative.

Remember guys. SoCalJim is ALWAYS RIGHT.

How could we forget!

I actually scan the comments just for this guy who is batting 1000.

Wolf is there some method to measure % of RE is “financialized” over the years?

RE inventory shortage sounds like it is talking about if American families of certain age own a primary home or not. But when talking about everyone having 2, 3 or 4 homes? There will always be a shortage. On the other hand, when prices fall, inventory shortage turns into inventory glut in a hurry in a positive feedback loop when RE are traded with each other like trading cards.