Wages Surged, But Raging Inflation Crushed the Purchasing Power of those Wages.

By Wolf Richter for WOLF STREET.

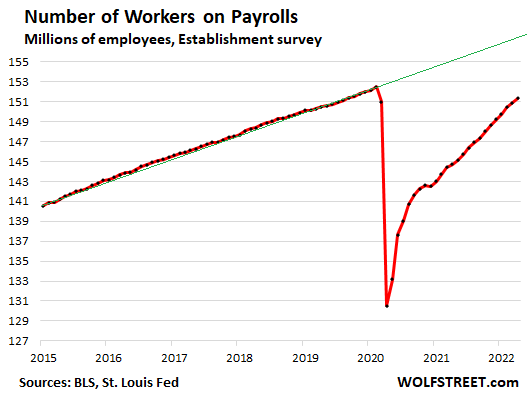

Employers added 428,000 workers to their payrolls in April, according to the Bureau of Labor Statistics today, bringing the total number of employees to 151.3 million. Over the past three months, employers added 1.57 million employees.

But the number of employees remains far below pre-pandemic trend (green line), and remains below the peak just before the pandemic:

Employers of all kinds have been lamenting the difficulty in hiring people. They have raised wages in order to hire and retain people, and there is now enormous churn, with employers luring workers from other employers. But they’re not able to draw enough new or sidelined workers into the labor force, and these “labor shortages” continue to constrain hiring.

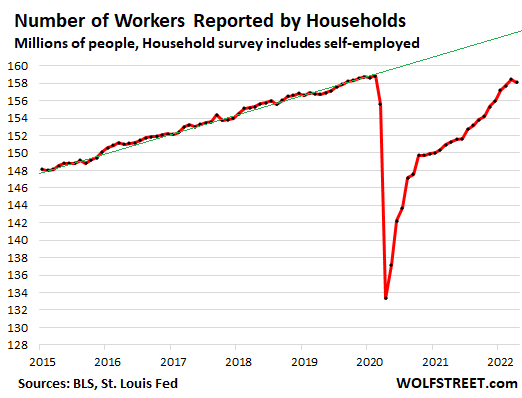

Households reported that the number of working people — including the self-employed, gig workers, and entrepreneurs that are not included in the Employer data above — declined by 353,000 in April, but over the past three months jumped by 931,000, bringing the total to 157.7 million workers.

That dip in April is reminiscent of the occasional month-to-month dips before the pandemic, such as in September 2015, October 2017, and August 2018 that, with hindsight, weren’t a change in trend but month-to-month noise.

The labor force and “labor shortages.”

The jobs report released today is based on two massive groups of surveys: one survey goes to employers; and the other goes to households. They each give a different view of the labor market, one from the employer’s side, and the other from the household’s side. The labor force, the number of unemployed people, the unemployment rate, etc. are based on the household survey.

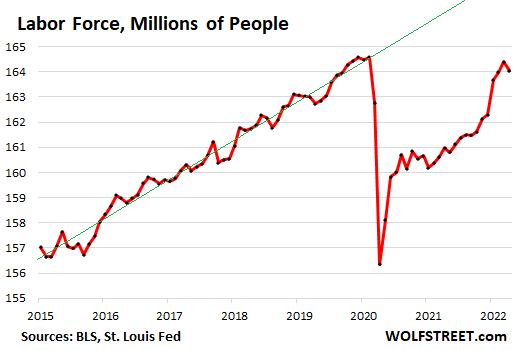

The labor force – the people who are working plus the people who are looking for work – dipped in April, by 363,000 people, similar to the dips and pops before the pandemic along the trend line.

At 164.0 million people, the labor force was still far below pre-pandemic trend (green line) and 537,000 workers below the peak just before the pandemic:

The far-below-trend labor force is another manifestation of the “labor shortage.” It shows that there are lots of people in the US that could work but are not in the labor force for whatever reason.

Among the reasons for the below-trend labor force are ongoing health concerns, difficulties of finding affordable daycare, a well-documented above-normal wave of retirements, people not working because they made a lot of money from stocks, cryptos, and real estate over the past few years (now dwindling), and people not working because they’ve decided to day-trade their way into a fulfilled life. There was some of that during the dotcom bubble, and part of it reversed during the dotcom bust. So let’s see.

The “labor shortage” is also documented by separate data from the Bureau of Labor Statistics by the spike in job openings that reached a record of 11.5 million in March, up by 36% from a year ago, and up by 57% from the same month in 2019. There were 4.2 million more job openings this March than before the pandemic! Employers have all hammered home the same point: It has become very difficult to fill open positions.

Wages surged, but raging inflation far outran them.

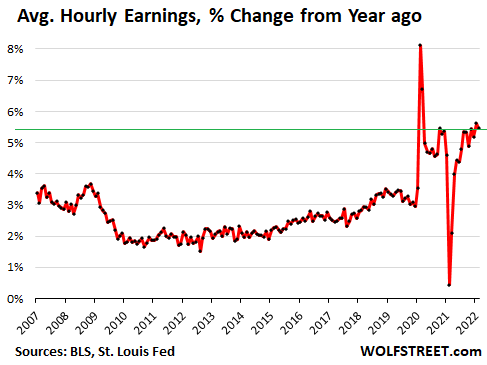

Overall average hourly earnings rose to $31.85 in April, up by 5.5% from a year ago. Beyond the distortions during the pandemic, April along with March were the largest year-over-year increases in the data that goes back to 2006. This category includes supervisors and management, along with employees of all kinds in all industries:

The distortions during the pandemic occurred when millions of low-wage workers were laid off while office workers switched to working from home, which took millions of lower-paid workers out of the average hourly earnings, thereby inflating the average hourly earnings. And when they returned to work, their lower pay reduced the average back into the range.

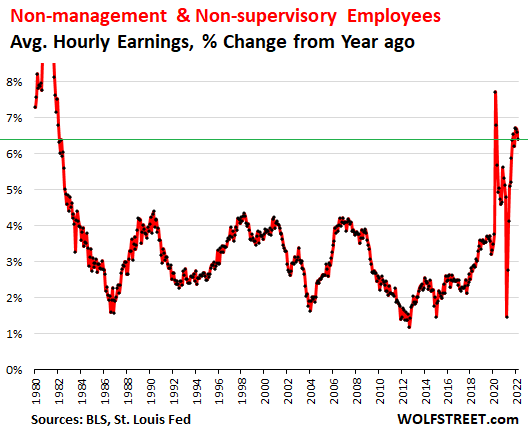

Average hourly earnings of non-management workers, the “production and nonsupervisory employees,” is a data set that goes back many decades and comprises workers in all industries of the private sector, and in all jobs that are non-management jobs, ranging from waiters to Google coders.

For these non-management workers, the average hourly earnings rose to a record $27.12, up by 6.4% from a year ago. Other than the lockdown distortions in the spring of 2020, the past five months were the biggest year-over-year jumps since early 1982. This confirms other reports that percentage wage gains – not dollar wage gains!! – have been strongest at the lower end of the wage spectrum.

Raging inflation and the labor force?

These big wage gains were not enough to keep up with inflation. The headline Consumer Price Index (CPI-U), the measure most commonly cited, jumped to 8.5%.

The less-often cited Consumer Price Index for All Urban Wage Earners and Clerical Workers (CPI-W), which is used for the Social Security COLAs, jumped to 9.4%.

So with average wage gains in the 5.5% to 6.4% range, the purchasing power of those surging wages got crushed by raging inflation.

Raging inflation is the enemy of the people who work. For workers, there is nothing good about inflation. They’re at the losing end of this deal. There are beneficiaries of inflation, including companies that can raise their prices to whatever, and heavily indebted entities with fixed-rate debts, but it’s not workers. They’re getting hammered by this inflation.

This raging inflation might thereby in part explain the peculiar phenomenon why the big wage increases have not been big enough to draw people back into the labor force: Effectively lower “real” wages don’t provide enough incentive to rejoin the rat race.

Much bigger wage increases might then be assumed to cure the labor shortages. But much higher wages would fuel the wage-price spiral further, and wages would never be able to outrun it, and “real” wages would continue to decline, which would then effectively not provide any incentives to rejoin the labor force, and would not improve the labor shortages.

The other option is to crack down on inflation, which would allow wage gains to catch up with price gains and maybe make it worthwhile again to join the rat race. That’s what the Fed is trying to do now, even if too little too late. And the Fed has been citing the labor market as one of the reasons for its crackdown on inflation.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“The other option is to crack down on inflation, which would allow wage gains to catch up with price gains and maybe make it worthwhile again to join the rat race. That’s what the Fed is trying to do now, even if too little too late. And the Fed has been citing the labor market as one of the reasons for its crackdown on inflation.”

If the FED is indeed going to crack down on inflation, then they’re going to have to raise further and faster than they have already indicated, especially if the inflation print is worse than last time.

I’m starting to see articles suggesting that Powell is sugar-coating and soft-peddling his intentions in order to not thoroughly spook the markets, and that he’s actually going to raise faster and further than people expect.

Based on the last few years of blatant obfuscation, I’d say that’s a very real possibility.

“This new inflation is mild”

“This rising inflation is transitory”

“We don’t see a need for 50 basis point rate hikes”

“Get ready to get hit in the face with a soft-ish baseball bat”

-Paraphrased from Central Bankers.

Up there with:

I’ll call you in the morning…

It’s only a cold sore…

I’ll gladly pay you Tuesday for a hamburger today..

In the 70s, it was called “The three biggest lies in LA”……

The Benz is paid for.

I can get all the money I want at 10%

It’s only a cold sore

And speaking of car buying…wait till all these newer cars need electronic gadget related maint, at least at the lower wealth levels, that is going to be some REAL PAIN.

Yep. And let us not forget this January 26, 2022 news conference bold faced lie by Federal Reserve chairman Jerome Powell:

“I am not aware of, um, you know, inflation literally falling on different socioeconomic groups.”

Picture of Powell with the above quote added:

Like most here, I have been observing the Fed’s modus operandi for several years. I am unconvinced that the Fed will do anything beyond lip service to stop the galloping inflation THEY DELIBERATELY CREATED to bail out Wall Street, that has been adversely impacting mostly the lower-income households for at least TWO decades.

The only reason they are making sympathetic noises now is because of the rapidly rising bond coupon rates, which are now starting to adversely impact the top 10%’s ability to “leverage” (i.e. borrow money cheaply for) their profit over people and planet corporate speculation rampage. In addition, rapidly rising mortgage rates will kill the home asset “wealth effect” (also deliberately created by the Fed) because home prices will be forced down.

The Fed has never cared about anybody but the top 10% because that wealthy 10% own nearly 90% of the stocks.

I am certain that right now some Fed crooked bean counters are busy trying to convince Biden to “change” the method the BLS uses to compute the CPI so that it further disguises the inflation THEFT misery visited 24/7 on the poor and middle class. That “new” method is called the “Chained” CPI. It is a masterpiece of mathematical legerdemain. They’ve been trying to foist that on we-the-people for about 20 years now. I hope they don’t do that, but the Fed tiger has never changed its ‘kotowing ONLY to the Social Darwinist top 10%, and neither have Biden or the Republicans, for that matter.

Yes, like 2% rate increase now, and another 2% rate increase in June.

It appears the 3m T-bill effectively follows the FFR, but in times of recession, FFR increases have minimal effect.

Fed Governor Kashkari says the neutral rate is 2%. LOL! Clearly the Fed is *very* serious.

JeffD,

Tightening deniers and tightening-denier-trolls have been getting hammered month after month by reality. At first they said that the Fed will never taper QE, and when it tapered QE, they said it will never end QE, and when it ended QE, they said that it will never raise rates, and when it raised rates, they said that it will never do QT, and now that QT is starting to happen, they say all kinds of other stuff, always denying that tightening is now the name of the game. Look at the markets, even THEY are finally figuring it out gradually.

Wolf, out of all the financial analyst noise out there, you stand head and shoulders above the others because you are consistently right, including about this issue. You are level headed and can read people.

I am just extremely skeptical they will go as far as they say, and rightly so. They have consistently cut bait to inflate the markets on every previous occasion they had to act responsibly, and I Just have trouble with their credibility at this point. They are still meandering in their “quest” to implement QT, with at least three more months of baby steps before they bring out the purported big guns.

Yes and the Fed is still not tightening. One of them remarked that 3 1/2% would be NEUTRAL. And the markets get it, but retail investors are spooked. Then there is the commonly held position that Tech stocks are overvalued. BofA has something they call FANG 2.0. And shell shocked stock investors are buying bonds because they don’t believe yields will ever NORMALIZE. Inflation has the collateral effect of bringing workers back into the workforce, and workers need to keep their resume current. So the Rat Race is back, (50s term, 50s economy, 50s culture) If you are living in your parents basement and you have a good job you can put some cash together and blow town. The upside is strong economic growth for a decade or more. A lot of it is replacing stuff we lost in deglobalization. Forget China, they are going back to the 50s as well. It’s time to start pounding nails and building stuff. I plan to put some money to work myself, and do my part, being an old fart who can’t hold a hammer.

Give Kashkari credit:

That’s infinitely more aggressive than LeGarde. We are talking about a recession. Europe is stagflating and their central bank’s response is to say maybe we will make rates positive not just in NIRP terms but in actual terms.

Who the hell even buys the boonies anyway?

MMT is a disaster. This is going to be a major issue and China and Russia are going to make sure everybody bleeds.

Wolf wrote – now that QT is starting to happen, they say all kinds of other stuff, always denying that tightening is now the name of the game.

20 years to late IMHO

and I’ll believe it when I SEE IT

we MIGHT even get to end summer

but if BIG JEROME has balls and CONTINUES instead of capitulating

then all bets off

right now sept 2019 comes to mind

It’s going to be ugly no matter what they do.

Since 2008 The Fed has done little more than salvage the big banks and resume feeding their malign behavior, so they’re back to the old tricks. Worse, regulations have been seriously weakened so as to enable recovery, enabling more bad behavior. Proposed reforms have been dismissed.

So their beacon’s been moved under moon and star.

Where are they to go, now that they’ve gone too far?

Good post!

We are in the worse clusterphugged period of US financial history!

“It’s going to be ugly no matter what they do.”

That’s for sure. Yesterday my wife walks in the house and asks if I have a gas can available. (I usually have a can of gas with 2-stroke oil mixed in for my dirt bike, that’s why she asked). So I said yes and asked why. Apparently this lady with 3 little kids in her car ran out of gas. Either the lady wasn’t paying attention to the gas gauge or she was trying to push it before spending money on gas. My wife drove to the gas station and put a couple of gallons in the gas can. She put the gas in the woman’s car so that they could make it to where they needed to go.

👩👍

Exactly right.

In a way, the Fed’s morally bankrupt behavior is a perfect example of what just about every large corporation these dark days does when they realize that unethical polices they not so surreptitiously champion are endangering their image. Instead of attempting to admit fault and fix the problem ethically, they always opt for “Perception Management” (i.e. lies, doubletalk, obfuscation, blame the victim, etc.) while they double down on their financial legerdemain.

He looks to be in pain. Shall we call the ambulance or the coroner? let’s have a beer and discuss.

There are multiple types of “Inflation”:

– Growth in the amount of money and credit available (monetarism)

– Growth in corporate profits (esp. as a share of GDP)

– Growth in the price of “assets” (esp. relative to wages)

– Growth in consumer living expenses (CPI)

– Growth in workers’ wages

Events of the past 20 years show that the Fed only fights against the last of these – wage inflation – although their mandate is “stable prices”, “maximum employment” and “moderate long-term interest rates”.

The Fed has an enormous capacity to print up monetary bubbles, to overlook asset-price bubbles, to ignore inflation of corporate profits at the expense of workers, and to declare “transitory” rises in consumer prices … provided wages don’t rise.

But once wages start to rise, the Fed’s gloves come off…

Given the high compensation of folks working on Wall Street, you’d think they can handle a bit of spookiness.

Why doesn’t the Fed worry about spooking the markets when it cuts rates 2-3 percent at one time? (Rhetorical question).

Until oil prices stabilize,fed is f,,,,,,,,d everything is correlated to oil pretty simple ,best part is there stealing everyone’s wealth = chaos when there’s no food

I don’t think he is worried about the markets per se. I think he is worried about the Senate… his confirmation vote by the full Senate is still pending. Schumer could pull it at any time prior to the vote.

That’s all too believable. Regardless how close to reality it may be, I hope somebody keeps Powell dangling awhile longer. He and his peers, including big bank execs, need to be reminded what it feels like to be on the edge.

If you had asked me three days ago, I would have said that Powell was full of it, and didn’t care about controlling inflation, because his personal wealth and that of his buddies depended on not controlling inflation.

I’ve changed my mind after watching him speak. I see a spineless, weak man cowering in fear. He obviously cares about his own wealth, but I think he’s more terrified of going down in the history books as the guy who destroyed the U.S. dollar. He cares more about his legacy than his money.

I so hope you are right.

Yeah, his lifestyle is not threatened no matter what the Fed and markets do. But reputation? Bingo. Especially after all the prevarication, obfuscation and downright blindness that was on display last year, not to mention he’s got to be dogged by the Fed’s stained record. Making a case against his intelligence or courage or integrity would be all too easy.

Of course, such vulnerability to criticism, whether justifiable or not, is often the case for political actors, so I suspect he’s building a new shell as we speculate. What will it look like?

“I’m starting to see articles suggesting that Powell is sugar-coating and soft-peddling his intentions in order to not thoroughly spook the markets, and that he’s actually going to raise faster and further than people expect.”

You mean surprise this market. This Fed. Most unlikely. This “Timid Fed” telegraphs its message well in advance, makes sure the market digests it even if it is too little too late – never feed the market more than it can digest.

May be this “Timid Fed” should visit BOE to understand how those guys made out what is going on.

Powell wants to go down in history as Volcker II. We’re in for a rough year.

I seem to remember the FED doing this before and people being surprised at how unexpectedly fast it happened. Was it in the 1970’s? the 1980’s?

Both. August 1979 thru August 1982 was the Volcker reign of terror. He took office on August 6th, 1979. It ended on August 18th of 1982 when the Dow Jones rallied hugely (39 points!) on the first 100 million share trading day in U.S. history.

Thank you. I kept hearing Volcker but thought that was in Germany. Guess I should have looked it up.

Nice charts! Where is the chart for the big drop in the college educated tier? Looks like ‘I have to have a job’ positions are only being filled. I guess, if no one is playing by the rules, why should we? These foreign countries can fund their own wars, with their own money.

“There are beneficiaries of inflation, including companies that can raise their prices to whatever, and heavily indebted entities with fixed-rate debts, but it’s not workers.”

Aren’t a lot of workers heavily indebted entities with fixed rate debts? The big distributional impact of inflation is that it’s great for debtors and bad for creditors. Obviously way more people, particularly on the bottom end of society, are in the debtor category.

Inflation is beneficial to debtors – assuming their wages keep pace with inflation. That has not been the case, as real wages keep falling month-over-month. If this phenomenon persists, then servicing debts will become more and more difficult BECAUSE of inflation.

Inflation benefits governments ONLY. It devalues debt at the same time it drives up nominal revenue. Everyone else is injured by it.

Consumers generally have mortgages as their primary fixed rate debt. Inflation benefits there here, with offsets in other housing expenses.

Student loans? Don’t remember (never had one) but this in forbearance now anyway.

Car loans are at fixed rates, but the coupon rate is subsidized and shows up in the price. Loans maturity isn’t long enough where it hardly makes enough of a difference.

Credit cards and other revolving debt are obviously not fixed.

If your premise was accurate, financially illiterate as most Americans are, presumably more of them would like or love price inflation.

They do not.

How about if they make student loans eligible to file for bankruptcy. Then any credit/degree earned due to the student loan is declared void.

I like that idea, except there should be severe legal punishment for those claiming to have degrees on their resumes etc, despite them being declared as voided. Something alongside of punishment for doctors with suspended licenses or disbarred lawyers, if they engage in their practices.

DEL

You win the grand prize for nuttiest idea ever !!!!!

DEL / N

Nice to know neither one of you has a college education.

We can now make allowances for your utterances.

OTB, you are wrong, on all accounts. Are you afraid of a little personal financial responsibility, or are you loving the government handouts?

Don’t forget…

Assume=A$$(of)U(&)Me

Quite Likely,

Credit card debts are NOT fixed rate. Which is the kind of debt that folks have that, to use your term, are “on the bottom end of society.”

Many home mortgages are fixed rate. But the folks “on the bottom end of society” don’t have a lot of mortgages, and the mortgages they do have are small. And don’t compare home mortgages for the working class to the multi-billion dollar debts companies and rich folks have. Those are the beneficiaries. Working people lose the purchasing power of their incomes.

A homeless person has $5 in his pocket, and I give him another $5. So his net worth jumped by 100%.

So now, a guy with a net worth of $1 billion gains 100% on his net worth, and now has $2 billion. Then the wealth disparity between the homeless guy and the billionaire increased by an additional $1 billion, though both increased their net worth by 100%.

You need to think this trough a little.

I think there is some nuance.

Currently inflation is way more than the interest that reasonably safe investments provide.

Unquestionably hedge funds, private equity, and other indebted corporate actors gain most from inflation because they can inflate away the value of their debt.

But also unquestionably the worst off are the elderly poor or lower income elderly relying on “safe” investments that are eroding in value relative to inflation 3 or 4% per year, with no opportunity to participate in wage inflation.

Low income workers are next worse off, they are least have the potential for wage inflation to make up some of the difference. Retired people without a pension have no such option.

Some low income workers do benefit, those with fixed mortgage or student loan debt who will participate in wage inflation long term. There are people with 100K plus student loan debt and car loan debt and mortgage debt who may have earnings of 60K. They definitely benefit of they are participating in wage inflation long term.

I think it’s more that the prudent (debt free) are punished while the profligate (debt laden) are rewarded. That’s extremely perverse and bad for society.

Sorry but thinking is optional and often discourage in this country..

Buying into a lie,narrative or echo chamber, now that’s actively encourage

You’re right. And it works for them until they lose their job and their credit is frozen. Then they lose everything.

Don’t forget our revitalized military industrial complex. If we haven’t started yet, we’ll be ramping up manufacturing of ammunition, weapons, military services, etc. for Ukraine. Europe will be buying more too, as may other countries. All these activities will have a positive effect on employment and increase average wages. War isn’t cheap.

Yes, it will have a positive effect on US employment until the “blowback” hits American shores one day.

Americans assume that will never happen.

It’s coming, one day.

I’m not a pacifist but the US isn’t wealthier for outsized military spending. The country is poorer for it. Economically, most of the Department of Offense budget is a waste of resources which appears as a form of fake “growth” in the backwards mirror of economic statistics.

Confrontation with Russia might prove pretty nasty. Previously, the US has engaged with countries that couldn’t do much to fight back. Even if Russia is a lot weaker than the US, I’m sure it still could do a lot of damage.

Russia and America are using up military resources while China sets back and laughs ,countries mostly politicians areSTUPIS

There is a Rand Corporation white paper on this subject available for download. It’s from 2018 but I doubt the reality is that different now.

They didn’t come out and say but in not saying it, basically concluded that the US and NATO would lose when the chips are down.

Why?

Many more vulnerable targets, hallowed out forces, and for the US, thousands of miles of the logistical supply chains.

The current US strategy seems to be to prolong the war as long as possible to the last Ukranian in an attempt to economically bankrupt Russia.

I don’t believe Russia is going to give up and withdraw and they aren’t going to conduct the campaign as they are now until they are economically crippled either.

if correct, I presume the conclusion is obvious. It means “blowback”, of some sort.

Augustus Frost,

If that’s the kind of nonsense the Rand Corporation produced — did it really? — then it needs to go find something else to do.

This war has shown how rotten lousy the massive Russian military is and how good the small Ukrainian military is.

Augustus…

If the RAND corporation said that then they are idiots. Is NATO less than it was 30 years ago… sure. But so is Russia.

As to the current strategy, it seems to be to have the Ukrainians destroy Russia’s “kit” rather than having NATO do it in a BIGGER war. Another two months like the last two and Russia won’t be a threat to ANYBODY for the next two decades.

“Another two months like the last two and Russia won’t be a threat to ANYBODY for the next two decades.”

Um, no. Russia has nukes, and any increase in its political, economic, and/or social instability increases the possibility those nukes won’t be secure and otherwise could be used.

Political instability in the US poses analogous risks. The last administration was seriously considering pre-emptive Patroit missile attacks on Mexico, and strangely supposed those attacks could be kept secret.

There have been so many horrendous things that could go so very badly, and for so long, that we’re extremely fortunate to still be having these pleasant conversations at all.

If a crystalline form of water with a high melting point were ever discovered it would wipe out civilization practically overnight, and even the cockroaches would have a very bad time of it.

Russian military has performed worse than I thought to this point.

Concurrently, I don’t believe anywhere near everything the consistently lying western media report either.

the now obvious effect of its kleptocracy on the Russian nation’s military capabilities in such a relatively short span of years has surprised me. only time will tell if they sort themselves into competent operational efficiency, withdraw ala Afghanistan, just grind until they exhaust available personnel/will on both sides and/or have a Cody Jarrett moment…

may we all find a better day.

Blowback in the form of a Russian sabotage of electricity to Chicago? The city would be looted and burnt to the ground within hours.

Those CBOE traders are a rowdy bunch.

I think that the “blowback” has already arrived, unpacked its luggage wrapped in human-skin leather, and settling into it’s comfy-chair with a drink before going to work tomorrow :).

The problem with empires is that people that are enterprising and ambitious, yet, mostly for sound reasons, are not “making it”, they go to the frontiers to make a name and a fortune, then they come back and now they wield power, what worked in the colonies come back to home with those folks and becomes local policy.

In the old English empire days, about 80% of the chancers never came back because of diseases or tribals thinning the herd, so the situation was sustainable until they discovered Quinine and the Maxim gun. Then most of them came back and England went to shit.

“The headline Consumer Price Index (CPI-U), the measure most commonly cited, jumped to 8.5%.”

“So with average wage gains in the 5.5% to 6.4% range, the purchasing power of those surging wages got crushed by raging inflation.”

So, 3% real inflation? That is only 1% above the fed’s goal for the last several years. “Crushed”? I can stand 3% inflation indefinitely. And it if is another percent, well, it has been that for a fairly short time, to date, right? Scarcely end-of-world levels for employees, given the strong employment numbers and their bargaining power.

Recent article on CNBC.com claimed 64% (or somewhere near it) are living paycheck to paycheck now. So yes, I’d say it’s a problem because it’s evident these people are actually broke or near it. This includes a noticeable number living in high cost areas with “high” incomes, people many wouldn’t expect to be under financial stress.

The average or reported inflation isn’t relevant. It’s every individual’s personal inflation rate based upon the goods and services they buy. This has been covered here before.

So yes, if the big-ticket items represent a low or “manageable” part of your budget, probably not a big deal. Otherwise, one or more from housing, medical care, formal schooling (“education”), day/elder care, or a combination will eat your budget alive.

If other mostly lower cost budget items create budget stress, the person is at or near broke.

You actually believe the prices on the things you ‘need’, actually only went up 8.5%? Whose basement are you living in?

Had over 8% increase in diesel this week alone.

Pass it along. Our 3rd increase to our customers this year.

And its only May.

If you can stand indefinite 3% erosion of the value of your assets, you are extremely wealthy or mathematically illiterate, your assets will have half their current value in 25 years.

But their is always some invest out there that offers a return. As long as the spread is 3% any you are over 50 with a moderate amount of assets, you are hunky dory. And don’t forget, COLA adjusted Social Security eventually kicks in to cover some of that inflation loss.

@JeffD

“But their is always some invest out there that offers a return. As long as the spread is 3% any you are over 50 with a moderate amount of assets, you are hunky dory.”

And you will then be hunky DOH-ry when you get the tax bill for the “false capital gain” after selling your, now, not-so-brilliant investment.

Armchair economists, there’s no shortage of them on the Internet.

“And don’t forget, COLA adjusted Social Security eventually kicks in to cover some of that inflation loss.”

Key word used: ‘some’. Kind of wheasley, you think? Don’t kid yourself.

I’ve made hundreds of thousands not in tax shelters over the last five years, and have only had to pay a pidlance of Social security tax. 0% state, 0% federal. I structured my entire portfolio and drawdown to avoid taxes. Hopefully the tax code doesn’t change significantly.

Meant to say payroll tax rather than Social Security tax.

10 year bond yields are already approaching the peak reached in 2018. It would seem 10 year yields may struggle to go much higher without something noticeably breaking within the financial system. In light of that, this might actually be a good time to begin picking up some shares of long dated bond ETF’s in anticipation of long term rates beginning to plunge again. The last time this happened, the capital gains realized by these bond funds were pretty epic. EM local currency debt is remarkably cheap right now as well.

makruger

The REAL action is in leveraged inverse ETFs and option trading (PUTS) if one knows how to navigate and strong stomach!?

Your implied assumption is that nothing or little will “break”, presumably because the government or FRB won’t “let it happen”.

Bond market sentiment is bearish now (quite bearish) but if the 39 bull market ended in 2020, this isn’t an ordinary bear market.

It’s the end of the greatest asset, credit and debt mania in the history of human civilization. Any surprises will be to the downside.

It’s also the enabler of all other components of this mania (especially stocks and real estate) which while not preventing a temporary new high in one or both, means the days for both are also numbered.

In 2018 the 10 yr bond yield was above the rate of inflation. Now inflation is approaching 10% depending on the measure. Something has already broken: inflation. It’s doubtful this plays out like 2018.

I would agree. Watch the 5-year forward inflation breakeven. If it spikes above 3% (highest level in a decade), it means the market believes inflation at the 3% to 5% level is likely to be sustained, and Powell will need to do his best Paul Volcker imitation.

SPX monthly, linear, for entertainment only :

Apr 2010 hi to Feb 2015 hi // parallel from July 2010 low.

The May 2022 low is on support line

Let’s face it. The FED has no where to turn at all.

Yes they are trying (cough) to raise rates but no one wants to take responsibility for the carnage of whatever they do.

It’s a matter of choosing who and what they want to save like Sophie’s choice.

I just wish they would do anything, something to get this massive hurt over with so we can rebuild or try to rebuild. It’s more painful absorbing 1000 cuts a day vs. 1 shot. Do they REALLY want to make the masses suffer that much? Do they? Just grow up, get a set and administer the medication. Please.

As it is, no wonder few want to work as they have NO HOPE or are living like it’s the end of the world spending out their wazoo’s.

But, the “people not working because they’ve decided to day-trade their way into a fulfilled life” 😂

Come for the data. Stay for the bitter sarcasm.

Brilliant, as ever.

Brendan-the outcome of years of installing too-many ‘loose slots’ in the big casino…

may we all find a better day.

Yes, indeed!

Inflation will rage on as long as real interest rates are negative. with 8.5% inflation even 3% rates won’t matter (as that idiot Kashkari claimed where the rates should be to pump up the market).

I honestly doubt the reported wage and job gains since much of it is made up by the government. Here is the real word I see highly professional people who can’t even get interviews after sending out tens of resumes, but I do hear that they are looking since their jobs went to India, Singapore, and Korea. Many layoff survivors have not gotten raises at all and are being told by HR to thank the company for giving them a paycheck.

Totally agree. Call me when the Fed raises rates to 6%, then they are serious. Maybe they get to 3% in this tightening cycle. Maybe…

Did Volker really want to raise rates the way he did? Did Carter and Reagan want that? Hell no. The market forced Volker’s hand.

The U.S. enjoyed a very long period of deflation after Volker due to globalization. Cheap Chinese labor was vital, which is why they allowed China into WTO. Then much of the services and technology was offshored to India while we printed money without consequence (until now). The best thing for the dollar was the collapse of the Soviet Union and the flight to safety to US.

The market will force the Fed’s again but more violently this time.

“The U.S. enjoyed a very long period of deflation”

Wtf? Deflation, when exactly did that occur after Volker? Please lay off the jeff snider/brent johnson crack pipe.

Love this violent volatility! Traders’ heaven!

This mkt is for nimble traders’ with option know-how.

Retail investors will get churned and burned by algos/high frequency trading!

Secular Bear mkt with lower of the highs and lower of the LOWS will continue. Fierce re-bounce is a fact, after a churning around key support level. Long way to the bottom with frequent bear traps!

RTFC!

Duh

RTFC ???

I had to google it. It’s kind of an insult, I think.

Duh

Apparently you don’t like what’s happening in the mkts since Thursday! Violent volatility is here to stay, whether you like it or not. So is reversion to the mean. B/w stocks don’t always go up but also go down, way down!

Instead of involving in the discussion, your’insult’ comment is a reflection your character! Thank you for letting know, to all.

I’m a simple man, with not much knowledge of the stock markets, or I should say casino operations.

Yesterday I went to the BLS’ CPI calculator and discovered a disturbing fact.

It takes a $1.68 to buy today what would have required only $1.00 only two years ago.

To my simple mind, rounding numbers, in two years my money have basically devalued 50%.

What $1 would have bought when I was born now takes $9.

This is based on the inflation the government admits to.

Any one else notice number of elderly living on the streets?

Roger Doger,

Hahahaha, no, you read the CPI calculator wrong. That was from March 2000 to March 2022 … 22 years!!! not 2 years.

Maybe he misread the CPI. But if you’re in the market for an industrial property or home, that 68% increase maybe realistic.

BTW, industrial RE is already weakening as Amazon is walking away. Housing is starting to.

And I hope and pray it weakens further, because once leases start to expire and renew, there’s going to be a sharp increase in warehouse rents, which can only be paid through sharp price increases. Online prices will be going through the roof in the coming years.

The only way to crackdown on inflation is to raise the interest rates above CPI levels. This is how money has worked historically. Fed trying to control and depress the yields will always mean inflation.

Now if rates get anywhere close to CPI numbers (let alone real inflation numbers) all hell will break lose. Stocks and housing will crash down to earth in a crash like never seen before. US government in its current form would probably go bankrupt.

There will be great and long due reset and lot of bad debt and unproductive assets and entities will be written off. Then we will start from a clean slate and get back to new levels of growth and prosperity, slowly and steadily The crash and pain and hunger would certainly wake up the lazy and spoilt American labor force and bring them back to the market. America needs this shot in wrist or the wake up call else we will slowly decline into oblivion.

BUT Fed will never let it happen because they are watching out for the wealthy who own all this inflated and many uncompetitive assets that they will never let go of.

Kunal,

This time, the Fed has a new and very powerful tool: trillions in bonds that it can unload and drive up long-term rates and drive down asset prices. I think this will be a very powerful inflation-fighter tool, if the Fed uses it with enough force. QT is the opposite of QE.

So I don’t think the Fed has to raise short-term rates as much as it would have normally, because now it has QT to push up long-term rates. We’ll see. Markets are already playing along.

Wolf

During Q&A Press on Wednesday he was asked about ‘credibility’ of the Fed for his response was vague and mere ending with’ it is strong’!

One press reporter, right in the front line asked why don’t you start the QT now, instead of next month?

His answer: We just do it on the first of everymonth, the usual routine at Fed!

He was too soft, wishy-washy never uttered a word which will affect asset prices! He wanted to be hawkish but ended up dovish.

No wonder, indexes started shooting up at 2.45pm all the way

He mentioned and admired Volcker but cannot follow like he did, to contain the inflation. He ruled out 75 basis increase while the current policy has too little and too late to start with, and way behind the curve. Apparently ECB admitted why they were wrong about inflation # but not Mr Powell!

Mkts and external events will dictate, here after wards! GFC was just a training!

Yes, he is soft-spoken, that’s for sure. And when he talks, he doesn’t want to shock markets.

But a year ago, there were no rate hikes penciled in for 2022, and there was no schedule for ending QE, and no one even mentioned QT. So the world has changed since then — the Fed has made a huge pivot since then.

“it has QT to push up long-term rates”

Oh it has. The problem is this “Timid Fed” while doing QE it buys as much as it wants with gusto but while doing QT it becomes all timid – sells as little as it can to show that it is doing something

I think the market’s reaction shows that the Fed is already pushing its luck. $95 billion a month in QT v. $120 billion a month in QE… if the Fed does this month after month, markets are going to have one hissy-fit after another.

… trillions in bonds that it can unload and drive up long-term rates

So true. But if he drives up yields he’ll be driving down bond prices and who is going to buy those dumped bonds when prices are dropping? Maybe a few yield starved investors. But I don’t think he’ll drive them high enough for that to happen.

I will be buying them for sure for sure. A 10-year Treasury paying 8%… I’ll back up the truck and load up. As will a lot of people. The new buyers will make out well. The current holders get crushed. That’s how it works with bonds.

Yield solves every demand problem with bonds.

IMO, if/when treasurys become more attractive than stonks or real estate with these type of mouth watering yields, and everyone starts to dip into them, the next big move will be hyperinflation.

Wolf

Agreed

Once you level the housing market with QT the rest of the economy follows suit. Already happening here in Swampland. Condos are the only real estate selling without any problems. All the industries that feed off of housing are toast.

Reminds me of the famous quote by Watergate felon and Nixon henchman HR Haldeman who said to Nixon

“Grab em by the balls and the hearts and minds will follow”

or was it John Erlichman who crafted this famous quote? I can;r remember.

Theodore Roosevelt said the once you have them by the balls quote. Charles colson had a sign quoting him either in his den or on his desk.

Interesting that the wage gain comparison to inflation is for wage earners. Is the wage earner curve inclusive of government employees? Also there is a large segment of the population that is underemployed and retired who are not benefitting from wage increases but discretionary income falling as a result of waging inflation.

No idea what the math works out to be but the the Feds target rate of 2 percent inflation does need more aggressive hikes quickly.

Working poor generally are further from their workplace have higher fixed costs because of rent and depreciation of their vehicles due to commute distances. Many factors in the details too numerous to list but Wolf’s comment about the homeless man doubling his wage to 10 usd struck an old cord in my dusty brain. Higher wage earners get 5 percent increase in generally discretionary spending while the lower wage earners (majority) don’t keep up with inflation.

What a mess for the masses! That’s my concern and the majority have no idea what ore why this has happened other than a desire for another stimulus check!

“But Raging Inflation Crushed the Purchasing Power of those Wages”

Pfft! Just charge it to my credit card 😘

Wolf,

Are you using prime age for your stats? I thought prime age participation recovered, and the difference in total “workers” was due to retirements (helped by asset prices).

RTGDFA :-]

1) Employers have difficulties hiring people. They raised wages in order

to hire and retain people, but productivity is falling to minus (-) 0.6%,

while inflation is raging at 8.5%. A warning sign.

2) WFH isn’t productive. Wages are falling in real terms.

3) The Fed tightening policy sucked $1.9T liquidity from the market (RRP).

The Fed will raised interest rates in stepping stones. The Fed fear inflation.

4) If the Fed prevent money supply from expanding fast enough, as

before, as we have been used to, JP might choke the market. Consumption will fall.

5) Unemployment will rise in the midst of inflation. People will seek employment, because of higher debt, falling snap. Producers will cut their labor force, because they cost too much, they aren’t productive and because new orders are falling fast.

6) High inflation, shortages along with high unemployment and falling standard of living.

If we send our unemployed to other nations just like our food, we will spread inflation no?

The other nations are smarter than us….they will send the unemployed back to us.

ME

This surreal Bull mkt was built on easy/crazy credit creation and encouraged animal spirits by Fed/CBers!

Now their karma is unwinding and playing out! Without Fed there is/was no mkt!

Investors are on their own and have THINK for themselves for the first time in 13 yrs! Reversion to the mean and the secular BEAR mkt will continue irrespective who ever says and the Fed is clueless and helpless

For the first time in 40+ years. It’s been a free ride for an entire lifetime for anyone under median age.

Michael, right on, pizone. It ain’t going to be pretty going forward. I question the Job Openings numbers big time, because knowing HR people, they will list 2 to 3 differently labeled want ads for the same, single position. A warehouse worker could be listed for just that, but also as a Logistics Expert and a Materials Handler.

But companies in an economy react to all of the diverse inputs to their costs of doing business in addition to what the order book is looking like, and on a weekly basis. This has been a Sugar High Economy (SHE). Now that the Fed, in its tortoise like reduction of purchasing power stimulus, has turned that sugar bowl into a vinegar bowl. The question remains at what point they will need the helicopter drop of Pampers at the Eccles Building.

Companies are going to find it more and more costly to roll-over debt going forward, and all the Stock Buybacks the corporate suite has pigged out on over the last 14 years have helped shoot that debt into new record levels. Margin pressures are springing up like my lawn’s dandelions.

Furthermore, the need for new hires will diminish as the economy hits an air pocket induced by greatly diminished affordability of just about everything for the consumer, and wage gains that are 300 to 400 basis points below still accelerating inflation. We haven’t even seen the worst of this inflation cycle. Wait until we see tax hikes at all governmental levels to attempt to ward off insolvency of well-known basket case States and major, defund the police, cities.

… but productivity is falling to minus (-) 0.6%

Imagine that at work you are a member of a 6 man work group and that one of you gets laid off. Managements most likely response is to spread that laid off workers workload among the remaining 5. This would be a 20% increase in productivity. Now imagine that laid off worker is rehired and reacquires his former workload. This would be a 20% decrease in productivity. Now imagine the impact the massive covid lockdown had.

With productivity, output is the numerator and number of workers is the denominator. When productivity increases/decreases because of output we’re talking about efficiency of the economy. When productivity increases/decreases because of changes in the denominator (number of workers) we’re talking about a cl*strf*ck…. big difference.

I think we’re in this boat with any economic stat that involves number of workers. Exercise extreme caution interpreting such stats.

My company has a pension plan.

We’re losing loads of people to retirement this month because the rising interests would reduce their lump-sum payments enough to make it financially prudent to leave before June 1.

The number of retirement from teaching this year are going to be nuts. We are looking at ten percent of the staff retiring. The local district loves it cause they get younger cheaper staff.

And American kids continue to score lower on Math and Reading tests than their overseas counterparts. Another reason so many companies are constantly hiring foreign workers, not just because they are cheaper but have more honed skill sets.

Lack of parenting and cell phone addiction cannot be overcome by having kids in school 12% of the year.

Teachers don’t use cell phones and tablets as baby sitters

Mathematics is the universal language. For some people, it is intuitive. For some people, it is never really learned.

Children pick it up with physical example & explanation. Just like physics.

How does culture, and how do parents prioritize the lessons that they teach to the little tykes? That, to me, is the key.

Thomas Hoenig, Kansas City Fed, – on WS with Maria Bartiromo Fox

Business – had a similar comment.

If only Thomas Hoenig had been the Fed Chied instead of Ben Barnanke the US would be in a different place today.

“Why a Crackdown on Inflation Might Bring People Back into the Labor Force”

Absolutely it will. The inflation was created in the first place by mailing out $4 trillion in phony money that 15 million malingerers then spent. When the checks stop, the inflation stops as well.

“When the checks stop, the inflation stops as well.”

Correct. Still however, the checks continue, literally in the tens of thousands for “struggling families”.

And to think, last year people thought I was being sarcastic when I brought up a return to 20% interest rates here in the USA. LOL.

I suspect the FRB is slow walking interest rates for a reason. The Insiders need time to get out of the way. Especially any Insiders who might be on the wrong side of the $1 Quadrillion in Derivatives.

So. No idea on exactly what (or when) the FRB is going to do something. But I know who they are going to do it to.

“Much bigger wage increases might then be assumed to cure the labor shortages. But much higher wages would fuel the wage-price spiral further, and wages would never be able to outrun it, and “real” wages would continue to decline, which would then effectively not provide any incentives to rejoin the labor force, and would not improve the labor shortages.”

Inflation has to be a net cost to the average worker because purchasing power has been transferred to the government and other beneficiaries of artificially low interest rates. It’s a stealth tax … everything the government spends is ultimately paid for either by direct taxes or currency depreciation. When the government runs deficits and the Fed underwrites them, it’s no free lunch … the cost is embedded in the grocery bill, the rent, utilities, gasoline, etcetera.

“Everything the State says is a lie, and everything it has it has stolen.”

— Friederich Nietzsche

Good lordy, someone finally dragged an out-of-context one-liner from Nietzsche into here — who died in 1900 and lived in an entirely different world and who said a lot of crazy stuff and actually went insane at age 45 — and for what reason?

The line comes from Nietzsche’s NOVEL (fiction), “Thus Spoke Zarathustra.”

By itself, the line is just idiotic.

We just got a 20% increase in our fees for appraisals. Not bad. We’re keeping up with the real inflation (13.8%) and then some. Staying in the workforce is the only way to beat this inflation. Everything else is going south big time.