Consumer spending and asset prices both were boosted by them.

By Wolf Richter for WOLF STREET.

Homeowners refinance their homes largely for two reasons: One, to benefit from lower interest rates and thereby reduce the monthly payment; or to extract cash from their home whose price has risen. Lower mortgage payments leave homeowners a little extra spending cash every month. And a cash-out refi generates a pile of cash all at once, which can be used to remodel the home, buy stocks or cryptos to get rich quick, pay off maxed-out credit cards that carry 25% interest, make a down payment on a rental property or vacation home, or blow in other ways. Both types of refinancings provide extra oomph for consumer spending and the markets, including the stock and real estate market.

But interest rates have soared in recent months. The average 30-year fixed mortgage rates hit 5.02% yesterday, the highest since November 2018, when it peaked 5.05%, according to the daily measure by Mortgage Daily News. According to the weekly measure by the Mortgage Bankers Association today, the average 30-year fixed mortgage rate hit 4.90%, the highest since December 2018.

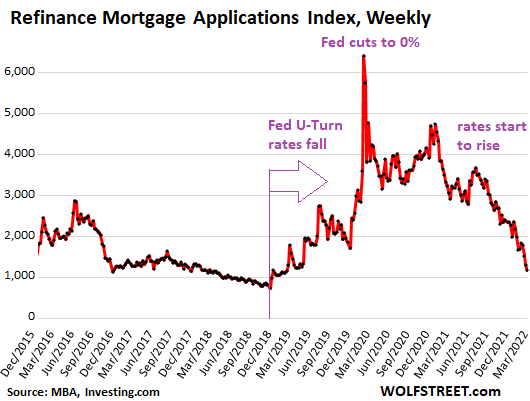

And applications for mortgage refis have collapsed. The MBA’s weekly Refinance Mortgage Applications Index, released today, dropped to the lowest level since March 2019, down 62% from a year ago, and down 82% from the peak in March 2020:

No-cash-out refis are motivated by locking in lower mortgage rates to get lower monthly payments. They’re directly driven by changes in mortgage rates. Mortgage rates having been so low for over two years, many homeowners have already refinanced and recent mortgage rates are far higher than what they’re paying, and refis are off the table.

Cash-out refis, which are motivated by the need or desire to extract cash, surge with rising home prices. And home prices have spiked in a historic manner. And people wanted to – and still want to – extract cash while they can without selling the home.

So at first, homeowners trying to extract cash blew off the increase in mortgage rates. But those refis have now also started to come down from high levels.

According to the American Enterprise Institute’s Housing Center’s monthly update as of March 28, cash-out refis in week 12 (March 19 through March 25) have dropped 17% from the same week in 2021, but remained up by 55% from the same week in 2019.

This was the first period that cash-out refis have shown “some effect from the headwinds of higher interest rates,” the AEI’s report said.

By contrast, according to the AEI, in week 12, non-cash-out refi volume had collapsed by 85% from a year ago.

Layoffs at mortgage lenders, yes but…

The collapse in mortgage refi applications has caused numerous mortgage lenders to trim staff via layoffs that started late last year.

The biggest and most notorious layoffs occurred at Better.com, a Softbank-backed “tech” mortgage lender startup that at the peak had about 9,000 employees and that was supposed to go public via its merger with a SPAC, that was postponed and may have gotten scuttled by now. In December 2021, CEO Vishal Garg personally fired 900 employees, most of them in India, via a Zoom meeting that went disastrously viral. In early March, the company announced another round of layoffs, this time 3,000 people, also many of them in India.

PennyMac Financial Services, which had 7,000 employees in 16 locations, disclosed in regulatory filings in March a series of layoffs in five cities in California, totaling 236 people.

Movement Mortgage is laying off 170 employees, according to a report by HousingWire on April 4 citing sources.

Winnpointe Corp., doing business as Interactive Mortgage, would lay off over 50 employees by April, according to regulatory filings in February.

And other layoffs among mortgage lenders are occurring and will continue to occur in this very cyclical business. During the surge in mortgage rates in 2018, when the refi business also collapsed, thousands of people were laid off across the country.

But the numbers are relatively small in the overall scheme of things. And given the massive labor shortages everywhere, those folks are likely to find a slot fairly quickly.

The bigger impact on the economy & markets.

But the collapse of refis have a bigger impact on the overall economy, on the housing market, and on the stock market, and on cryptos even.

Non-cash-out refis: A homeowner that cuts their mortgage payment by $300 a month through a non-cash-out refi will likely spend some or all of this extra money over time. And this provides extra fodder for regular monthly consumer spending. That additional boost from lower mortgage payments is now fading.

Cash-out refis are still going strong but are now also facing headwinds, and will face further headwinds going forward. Cash-out refis provide consumers a sudden pile of cash that may come with higher mortgage payments. And this pile of cash tends to get used for specific projects, such as a remodeling project, or paying off other higher-interest consumer debts, such as credit cards, and some of it is plowed into stocks and cryptos, and into down-payments for rental properties, second homes, vacation rentals, etc.

In this way, cash-out refis boosted not only consumer spending but also the money flow into other assets, including housing, and thereby helped boost those asset prices, including in the housing market. And the further decline in cash-out refis will remove some of that fuel.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Will commissioned mortgage-brokers be able to afford their Maserati leases?

Lol, this comment absolutely cracked me up

Just absolutely nailed it in every single way, including the LEASE part

I’m here for the stories behind the stories.

Given that refinancing has reduced, will Fed be able to meet its projected target of reducing MBS by $11 Billion by Mid June, $22 Billion by mid July and $35 Billion / month from Mid August.

Will they need to start selling MBS outright to meet the targets?

Also I was hearing that Fed would like to get rid of MBS sooner to contain house price inflation. That doesn’t seem to be the plan. Also, these reductions will be visible 3 months later! So I am worried that a lot can go wrong between now and August (Ukrain, Taiwan, UK covid rise, petro dollars etc) and all these plans will meltdown like it happened last time.

The minutes put outright sales of MBS in the middle of the table — after the regular roll-off process gets going.

Wolf,

Total whimp out by fed on calance sheet reduction, they want to give time to all the big money guys, They should have been allowing roll off 3-4 years ago and not until June now.

For inflation, what bs jawboning, they darn well understand that by June they won’t be able to run off 100 bill per month.

I’m shorting cmbs so a little irritated but without balance sheet run off now there’s no chance they can get inflation back under 4, so irresponsible and by then economic malaise won’t permit their announced roll off, if they wanted to maintain any credibility they should roll off without announcement to get Mr market honest, stop being a bi@%& and be a parent.

Vishal Garg, if there’s ever a piece of s**t of a CEO on display. Can probably write a book about him in as case study of narcissism and Sociopath behavior in the corp/start up world.

On a different, check check my credit union 30 yrs fixed which I assume is better than major banks and it’s now at 5.5%. Yet home prices haven’t even budge at all in SoCal. Yes, I know it’s a slow moving training for price to come down, it will be interesting to see if it does…talk about a delay reaction for sure

I personally think it will take sellers at least 6 months for them to get the idea that buyers are walking away at current prices. Let’s see what happens this fall when spring doesn’t pop like it normally does and homes sit.

If DOM climbs and we start to see price reductions, then we know it’s on

they’re walking away because they have to. most people can’t afford the higher prices at today’s interest rates.

They won’t leave they’ll squat ,no choice

Where’s Lawrence Yun when you need em.

Oh, don’t worry.

Lawrence will be serving up plenty of Kool-Aid soon. Just like he did in 2008-2011.

And lots of people will continue to drink it, for a while anyway.

I’ve been looking at home in Tucson, Zillow has a handy price history on their site. Typical house I’m seeing sold for $250k in 2006, sold again in 2011 for $125k, sold a couple of months ago to Open-door or some flipper for $250k, now listed for $350k. They all have new “luxury Vinyl Plank” flooring. It’s always the exact same flooring, they must have brought in rail car loads of that crap.

Most buyers are clueless regarding construction quality. I’ve seen so many homes with granite countertops installed on older builder-grade cabinets. Wood-grained vinyl looks something like wood, so it must be as good as wood, right?

I see exactly that all the time. LVP throughout, fresh paint throughout (including on the cheap cabinets). But there’s granite and SS appliances. I guess these cheap flips look good to the first time buyers.

I always buy the location…

Structures can be changed…

Ideally, you don’t want to buy somebody else’s idea of chic…

I’m usually suspect of a “makeover” and will discount appropriately if outside the normal price per sf…

I need Swamp Creature here reference appraisals that have had a makeover and those that didn’t…

Ditto for entire Rocky Mountain states, with higher prices than in Tucson. The environmental waste of cheap flip remodels is mind blowing. They were still selling, although I suspect prices will drop soon. Inventory is not up enough, but recent listing are more of these homes bought in the last two years.

Foreclosures that I follow, filings of which have significantly increased in 2022, are getting bid so high that in certain counties they are often near or above retail comps for similar houses in good condition. That is a red flag.

Luxury plastic. I love it. Adjective inflation increases prices?

there is just very little inventory and price is about supply and demand. homes are still selling well, some idiots dont understand that the prices are simply too high and will collapse.

but changing the imbalance will take time. demand has to fall first, then slowly supply builds. the reason supply is so low is that people think that home values will keep going up, so they dont want to sell. but as soon as prices start to fall, there will be a rush of sellers. that is the way that asset markets work and why they constantly rise and fall. it is driven by FOMO and panic. asset prices always run up too far and then fall too far.

Most of my friends in socal have multiple homes and they believe come what may the home prices can never fall.

I hope your friends have safety net build into their assumption. Hot hand fallacy can reverse in a pretty dramatic fashion.

If that does happen, I do have tons of crocodile tears reserved just for them though.

Rates are movin on up. A nice 7% 30 year mortgage needed to wake some the F-U.

You had better fix this sentence before the company sues you. ;-)

“Interactive Mortgage, would off over 50 employees…”

You know, if this was Twitter, etc., Wolf would have immediately been banned due to violent language (according to some bot)

Wolf,

Apologies if you’ve already answered this in a previous post. How is the thirty year fixed set? Is it a group of banks? Is it an average of different lenders?

Thanks.

It is set by the individual lender and it is usually pegged to the 10yr UST + additional points depending on the risk the lender is willing to take. By in large most lenders will come near the same rate give or take a couple .25’s.

Mostly.

Correct. I might add that these days that most mortgages track closer to the 7 year UST, as the average life of those loans have come down a lot over recent years as people live in their homes for shorter durations and as refinances become (became?) more common.

Regardless, JTM is right in that it is a consortium of lenders who set price based on the risk free rate plus whatever margin they need (or at least what they believe they need anyway).

It’s not uncommon for lenders to add something like 130bps on top of their cost of funds and then set their rates accordingly, as an example.

We are seeing spreads on the mortgage rates blow out a bit, as the Fed has exited their monthly purchases of MBS. Plus, if rates trend higher and I own a bunch of 4% mortgages, they have less value when market rates are 6%.

Thanks!

For most mortgage loans, the bank doesn’t hold the loan, it sells it to the underlying market for MBS via Fannie Mae / Freddy Mac.

Jon,

The rate is not “set.” It differs widely, depending on the lender and all kinds of factors. The rate that I cited of 5.02% was an average rate of a fairly wide range.

It’s a competitive market with lots of players who compete against each other amid a variety of factors, including yields on MBS, risks, etc. Most mortgage lenders sell the mortgages, and most of them will get securitized into MBS. Everyone in the chain is trying to make money on this. So the yields of MBS are very important in shaping mortgage rates. And the yields of MBS that are backed by taxpayers track Treasury yields but are somewhat higher.

Thanks, Wolf :)

WOLF – Always wondered how MBS packages with an average of, let’s say, 4% APR mortgages get packaged and sold to investors as a REIT fund or whatever and that REIT fund pays a 1.5% annual dividend, yet the share price of the REIT can go up as much as 5-7% annually? It’s basically like a bond fund with a predictable rate of return. Mind boggling.

Beardawg,

You’re talking about mortgage REITs. Mortgage REITs don’t hold properties. They hold MBS, and they’re doing it in a highly leveraged manner. They’re borrowing short-term in the repo market at the lowest possible rates and they’re buying MBS with the proceeds. They’re massively leveraged, and they’re paying out high dividends, but they threatened to implode when the repo market blew out in the fall of 2019. The Fed’s repo operations saved them all.

You said: “ …the share price of the REIT can go up as much as 5-7% annually?”

No, the share prices of mortgage REITs have plunged. The biggest and original mortgage REIT, AGNC, for example, peaked in 2012 and in the 10 years since then has done nothing but decline. Today it’s down 66% from its peak.

AGNC pays a huge dividend, with a yield of 11%, but it’s eating itself up paying that dividend. I know the people who started it (the American Capital crowd, ACAS at the time).

I discussed this when the repo market was blowing out, using AGNC as an example:

https://wolfstreet.com/2019/11/06/whats-behind-the-feds-bailout-of-the-repo-market/

WOLF – thanks so much for the explanation and the article link. I read it again – very helpful !!

Wolf,

I am thinking that existing homes will stay tight for a very long time. Those who bought homes at the top or refinanced will not be able to afford to move since their falling equity (as rates rise) will not allow them to sell and move. So the market will stay tight and they will see their gains evaporate quickly as flippers and new homes will lower the comparables.

Yes John, It’s almost like homes should be for living in. Not a hot potato asset that has been financialized and blown into rolling bubbles.

Retirees with RE appreciation and mortgages paid off should be selling, if they are smart. Need to preserve the nestegg. Good time to downsize.

Cap gains can put a large dent in that plan. As an up to the minute example, a new listing in 93923 has come on for $2.2mn-ish and tax records show the sellers bought for $8,000 in 1971. The house does not appear to have many upgrades so the cost basis must be pretty low. Ouchy. Taxation has the power of strangulation.

The listing likely shows what the seller paid for the bare land back in 1971….. then add the cost of improvements (aka, well, septic or city utilities, electric utilities, and structures).

Long term capital gains tax is a bargain at 20%. There would be a 500k exemption if not rented and then 20% of the remainder. Plus whatever the state needs…

Reverse mortgage would solve that tax conundrum.

Yes. At that point it might be a better move to stay and let the kids inherit.

Or do a sequence of downsizes over ten years to take advantage of the 500k homeowner exemption every two years.

Apple, how does a reverse mortgage solve the above issue on cap gains?

Please kindly explain.

Proceeds from a reverse mortgage are not considered income.

As a retiree with a paid off house and in my late 70’s, the only way this house gets sold is if my wife or I need to go into assisted living or a nursing home. Otherwise, this is our home.

None of my retired friends with paid off homes have sold during this run up.

Not for the ultrarich who created so many tax loopholes that are being kept open now that the tax burden on the ultrarich proportionally is light in the US. See how Apple avoided paying $50,000,000,000.00 in taxes in Gizmondo. See “How Do Rich People Avoid Paying Taxes? It’s Easy, Actually” in yahoo finance. See “How the richest people on Earth avoid paying taxes” in CNN. As to their being job creators: they are job creators in hiring many workers— in Communist China due to the exclusion of foreign income of US persons from US income taxation.

As someone indicated below, it might be better for some folks to die in the home, if possible, and let the kids inherit the house with a free-basis step-up, as long as total assets are under the estate tax exemption amount. The kids could then sell the home without any taxable gain.

I wonder if a lot of these homes will be sold when boomers pass on. I think it could be significant.

Bobby, didn’t Prop 19 cap the benefit to $1M? Still a good deal but when the house price increased by $2M then you still have a pretty big capital tax and property tax increase.

JWB

Interesting, that in the US, you appear to have tax payable on the house you actually live in(your domicile) if you sell it. Second houses, yes for capital gains but the one you live in?

Agree with Bobber. And this is the “shadow inventory” that Wolf occasionally refers to. Potential would-be sellers waiting in the eve, ready to pop out and list at a moment’s notice once they think the gravy train runs out.

Retirees are a subset. 2nd homes and investment properties being the other. Institutional investors a distant third?

My son is looking for a starter home. Of the relatively few that our out there, he’s seen many that have no furniture, and appear to be owned by the seller, who has already moved to a new home, but hasn’t yet sold their original home.

These seem like a particularly nervous and motivated group as rates rise.

Wonder if it’s common, or just coincidental that he’s seen so many…

There may be lots of other types of sellers in the RE market shortly, in addition to those groups you mentioned.

In the immediate term, there will be people wanting to cash in on price drops over the last three years on the Coasts. I see a lot of that already. Go on Redfin and look at the listings from sellers who bought their home less than three years ago. When prices quit rising or stop dropping, the number of these sellers may accelerate.

Other sellers will be people who suffer large stock market losses and face a financial pinch. They shouldn’t stand by and watch their RE gains evaporate too.

Another group will be people in their 50’s and 60’s selling their parents homes, as they die off.

Another group may be people relocating for jobs in a tough economy.

Meant to say they’d want to capitalize on “price rises”.

What if you are perfectly happy where you are and no need to sell?

I have read that retirees are less interested in moving/downsizing now.

More wealthy than previous generations?

I’ve known several retirees that moved and purchased larger houses. I think it’s a Boomer thing.

“More wealthy than previous generations?”

It’s substantially fake wealth, not real. Remember, this is the greatest asset and debt mania in the history of human civilization. The economy is also substantially fake.

Thanks for reminding me — I’m in that group; no mortgage, appreciation is <500k (no cap gains) and the house is too big. Downsizing is practically a no-brainer. But, the brain loves the dadgum house. That's the problem. It's the brain.

Downsize the brain. Just kidding. But there’s a lot of anxiety and potential aggravation selling and moving. And lots of costs. Are you content with your neighborhood? You may be sorry about the one you move to. Hidden surprises in the new digs? Do you really need the extra cash??

The numbers don’t work as well in high cost areas where the capital gains tax could be very high for am unmarried seller who has lived in her home for several decades.

“Retirees with RE appreciation and mortgages paid off should be selling, if they are smart. Need to preserve the nestegg. Good time to downsize.”

Bobber,

In times of raging inflation I NEED several hundred grand in the bank so I can…participate in eventual penury…yeah, stories to tell the grandkids. The money I leave in the bank now is almost, to my mind, a write off.

No thanks.

Good point.

What are the choices?

1) Cash in the bank making 0.1% interest with 7% inflation?

2) Stock market that fell 30%-50% during the GFC?

3) Bitcoin?

4) Gold?

You could downsize but the downsized house is likely still overpriced.

Maybe medium term bonds since they’ve been massacred.

If you just stay, you may lose some of your net worth, but at least you have a place to live.

This.

‘Retirees with RE appreciation and paid off mortgage’ exactly describes us.

Why haven’t we moved? After almost 4 decades between us and the kids the house is full of … uh … stuff. Oh so slowly donating or trashing 90% of it. The kids take the other 10% if their spouses permit that.

Unfortunately, the virus locked us in placevfor about 30 months.

Downsizing will eventually save us money but transaction cost ‘friction’ will keep that from happening immediately post-move.

Maybe, but since home prices are set on the margin (“comps”), just like stocks, it doesn’t matter what all the home owners think, just what buyers are willing to pay those who have to sell or want to sell.

Your scenario holds only so long as most people can continue to make their monthly mortgage payment. When the housing market crashes, it usually brings the whole economy with it, i.e. recession. If you’ve lost your job, it doesn’t matter if you’re underwater on your mortgage. If you can’t pay the monthly bill, you’ll be foreclosed, or perhaps put through a short sale.

Others must sell because they’re moving for other reasons (job, family, etc).

And there’s also a large contingent of recent buyers who simply haven’t sold their old house yet. Because of the crazy gains the past few years (>20% a year is unheard of in real estate), the carrying costs of keeping the house for an extra year or two was worth it for the extra capital gain. Once the market slows, and especially if it starts to decline, those carrying costs all of a sudden become tempting to cut out, and many people will sell their old home quickly, for fear of further declines.

Bottomline is that there are plenty of people who will have reason to sell (and some to sell quickly with rapid price cuts) when the market turns. There always are.

For example here (Silicon Valley), rents don’t even come close to covering the costs of a recently purchased house. So if you’re keeping your previous house and renting it (with rent covering say 50% of the cost), it’s OK when your Zestimate is Zooming up, but when the market turns, and now you’re paying all that extra for a house that’s falling down in value, the psychology changes.

And if you add in declining rents, tenants not paying rents (from job loss or whatever), tenants causing damage, and so on, the calculations really change.

“So at first, homeowners trying to extract cash blew off the increase in mortgage rates. But those refis have now also started to come down from high levels.”

Cash-out refis for anything other than actually improving the house used to not even exist. Then, with the advent of housing bubbles, it turned into buying the wife a new rack, a new ski boat, his and hers new vehicles, etc. Spending away your equity is one of the dumbest financial moves a person could make. And, like last time, a lot of these are future foreclosures.

Planning to get the wife a set of bolt-ons when the kids are done tearing up the stock pair. Saving up and paying cash though. I’ve heard from several with experience that it is one of the best investments a guy can make..but not sure I’d refi the house for it.

I come to wolfstreet dot com for the comments

LOL

unless, of course, the left pushes for permanent forbearance (just like the student loans) in the name of “keeping families in their homes.”

then, maybe it’s not so dumb.

Amen. The Boomer generation may be partly to blame for this reduction in frequently unwise refis, since the Millenials reportedly have more financial sense and do not engage in foolish re-fis that risk their homes.

As interest rates go up, and the economy, there may be too much fear among homeowners, who will be afraid to refi their homes in case they lose their jobs and thus, ultimately, their homes.

3 – 2 – 1 . . . . BOOM! Goes the financial system over the next 12 months.

Okay, it’s going to be more like a fizzle with some nice pops along the way.

The FED will make sure of that. Let’s see what their meeting minutes real later today. So far, everyone at the FED, especially Brainard, is still all talk and no action. How many months & basis points are the FED behind on?

My goodness.

Saw it reported elsewhere that Better.com is now offering 60 day severance packages to just about anyone and that they’re burning $50 million a month.

I wonder why they just don’t lay them off? Why the severance?

So they don’t burn their old workplace to the ground. Think of it as insurance.

Funny how the douchbag CEO still keeps his job.

I wonder how much these cash out refinances have helped fuel inflation and if their impact could cause the Fed to have to raise interest rates higher than they anticipate. They’re slowly walking, err talking, us into recession it seems without publicly admitting it. So maybe they already know rates are going higher than currently stated.

Ask yourself this — if the fed is as serious about fighting inflation as their rhetoric sounds, why are they waiting until AT LEAST may to start doing something about it? Because they are lying.

Powell wants to be confirmed for another term. He can’t under cut the democrats going into an election. So they are hoping to jawbone the problem away for another 7 months or so. It won’t work. It’s just causing stock market volatility. While food, gas and rent prices go to the moon.

The ones who will benefit from the rise in interest rates are the financial speculators who front run the Fed. That would be Wall Street and oligarchs who always front run the Fed.

So, the FED just announced that they will start lowering their BS by $95B a month in May with a 3-month phase-in, because $100B is just a smidge too much for the fragile US economy.

Okay, you read it here first. My prediction is that the BS run-off somehow / someway will cause some sort of implosion of the core banking system by the end of the year. See September 2019 REPO crisis for reference.

I know, Wolf, the FED made some adjustments, but I still say the BS runoff / sales is what lurches us towards a recession.

All real estate is local and any impact will vary around the country. Here in Beverly Hills, California nearly everybody purchasing a house simply pays cash regardless of the price so there will be nearly zero impact locally.

And BHCA represents MAYBE 10% of the housing market in a downturn. And even prospective buyers in BHCA will wait things out a bit once the economy really starts to roll over by year’s end.

are you sure? maybe that “cash” came from a margin “loan” on overpriced equities or crypto or another overpriced real estate asset. I suspect as rates go up, the “leverage” will come down and thus the “cash” out there will be less.

In ’08, the really desirable SoCal zip code where some of my family lives, prices barely budged. They flattened for awhile. people who buy there are not distressed in any sense of typical people. All they need to consider is if it is a desirable place to live. And some of these places are VERY desirable. Some are even civilized, like dream places to raise kids, etc. Like a Stepford town with really nice neighborly people and everything.

Nice neighborly rich people.

The worst of the GFC only lasted six months, from about September 2008 to March 2009.

Under extended conditions of financial stress, the outcome will differ.

The mania hasn’t burst yet and when it does, it’s a process not an event.

Bond market sentiment is quite negative now, so a short-term low should occur sometime “soon”. Rates have risen in anticipation of FRB tightening. I expect market rates to decline for 6 months to a year even as FFR increases. After that, if the bond bull market from 1981 has actually ended, the next rising cycle will be much worse, for both real estate and economy.

Economy can handle higher rates as long as current very loose lending standards (lowest ever in the aggregate) remain.

Price behavior between stock and bond market is also negatively correlated, up to January of this year. This happened in the 70’s but stock valuations were much lower.

I don’t know…

Newport Beach is a very desirable zip code in SoCal, and prices there absolutely did decline in 08/09, probably bottoming out around 2010/11. Perhaps not as bad as the Inland Empire which absolutely cratered. But 25-30% below 2006/7 prices were common and 50% reductions were not rare.

Heck, I was looking at buying (I was renting a house at the time), and there were small-time builders and flippers who were offering fully built luxury houses for essentially the land value because that was the size of their mortgage and they were desperate to get out of the carrying costs that were eating them alive.

Plenty of “luxury” towns have people drowning in debt. And when the market turns, many of them face foreclosures, short sales, and financial devastation just like the hoi polloi.

In San Diego in 2008 2010 downturn most of the highly desirable coastal neighborhood took a hit.

Its beverly hills, homes are paid in full with star power.

Exactly, highly unlikely that these people are buying multi million dollar houses with after tax income. I sold a measley $380,000 dollar rental a couple of years ago and it cost me $55,000 in extra taxes. To add insult to injury Medicare used that year to calculate an IRMMA that raise our premiums by almost $1000/month.

jr: You should have appealed the IRMMA calculation. We did for similar reasons and they (SSA) adjusted it back because it was a “temporary” spike in income. All you had to do was show (estimated) that your next year’s income wouldn’t be anywhere near that.

I think it took 20 minutes at the SSA office. Won’t help you but it may others in similar stead.

All real estate is local but low rates are available for all.

So this is a national phenomenon affecting all location.

In a protracted downturn i can assure you nothing remain untouched

Why look for a mystery where there is none ?

1.Federal Reserve which cares about the country as a whole published a warning March 29,2022:

“Real-Time Market Monitoring Finds Signs of Brewing U.S. Housing Bubble”

It is on Dallas Fed website.

2.We may safely assume that 99% of house buyers fit the legal definition of “rational person” and are not swayed by the RE shills and BS slogans like “They ain’t making any more land !”

3.Now it is time to stop flipping and “investing” or shaking down your bank for a HELOC loan #3 and start paying off not only 2% interest but >$1M principal too.

One can live off the vegetable garden.But one can’t live off the “permanently” (wink,wink) appreciating $1M shack.

4.And around 2050 some of you (but not me) will see “Mortgage Burning Parties” when people, after making last mortgage payment, burned their mortgage contracts.To the best of my knowledge last time it happened was in the early 70’s.

MarketWatch: Fed lays out a tentative plan to shrink its balance sheet by $95 billion a month, perhaps as early as May

I remember back in 2018 or so when Trump was tweeting to J-Powell imploring him not to tighten the balance sheet so the faux-paper economy can keep rolling.

Now that the resultant inflation has truly arrived and the tightening MUST be done, there will be legions of idiots out there blaming Biden for the resulting crash.

in their defense, $2 trillion of the fed’s balance sheet was due to the wholly-unnecessary march 2021 “stimulus” bill. the other stimulus bills were bipartisan waste. the dems own the march 2021 one all themselves.

Jake, I’ll go so far as to agree much of the stimulus packages were wasted on fattened pigs feeding at the trough, especially all the questionable PPP loans rammed though Congress. If we average out the per capita benefits for each US adult for the trillions spent , I come up with around $25,000 for everyone. ($6 trillion total stimulus divided by 240 million US adults)

Unfortunately some parties enjoyed outsized gains from those packages while most people only reaped a total of $3,200 from the basic direct mail/direct deposit COVID stimmy checks (nowhere close to $25,000 as figured above).

The last two decades was quite something with the QE, to save the economy they say, but it resulted in people suffering from high rent/food/gas. Now I’ll admit, I still got my job and may have lost it during the lockdown but damn was I looking forward to buying my first SFH cheap during that mini recession 🤷🏻♂️

jj, fully agreed. it was outrageous that the ppp forgiveness did not come with a requirement that you actually lost income. it should have gone to restaurants, bars, hotels, tour providers, and other industries that were effectively shut down. accounting firms, lawyers, advertising agencies, and other office jobs that people could do from home should never have benefited.

that said, there is at least a plausible argument that the march 2020 ram through was done before everyone knew how it would shake out.

repeating the same idiocy in march of 2021 was just the height of outrageous. it was a pure vote buying scheme.

zark, i think we should stop calling it qe and just call it printing money. no reason to put lipstick on a pig.

I read every word of every article. You should try it. You might learn something.

“cash out refis boosted retail spending”

Are Americans this stupid?

As Nixon would say, “my God.”

Yes, the ones that cashed out for RVs and jet skis are THAT stupid. But, I imagine much of that “retail spending” was for asphalt shingles and such, so maybe not too stupid.

I did not cash out for a used RV, but rather saved for a few years & shopped carefully for the exact model I wanted.

however, what surprised me financially was the sudden huge increase in shop labor rates to repair & upgrade some neglected problems.

seems what you save in purchase costs buying used, instead of new, you make-up for on the back end w/crazy labor prices!

housing also.

James-

Re: “Are Americans this stupid?”

“It is a melancholy fact that each generation must relearn the fundamental principles of money in the bitter school of experience.”

– Phillips, McMahon and Nelson, Banking and the Business Cycle (1937)

Good one, John!

Hal-

You mean “good one” Phillips, McMahon and Nelson.

That book is an advanced economics course… a post mortem of the Great Depression written in 1930’s by 3 college profs who hadn’t yet been tainted by the “new economics.”

Worth the time…

It’s funny watching the market reactions to the well-known path of policy guidance and mortgage interest rates today. I sure hope that oil doesn’t go negative -$33.00 like it did 2 years ago as that would cause very serious concern in the oil industry in the US.

The US Dollar value will benefit substantially from increased US interest rates and it is now just under 100 on the DXY at 99.61 with a very bright future path in 2022.

The quiet understated story of 2021 is the slow and steady increase in the dollar!

Let’s go team USA lol

The US dollar is being supported by a myriad of OTC market swaps, derivatives, and other financial transactions that add up to a massive US dollar short position in the international markets.

US interest rates to support the US dollar will have to be HIGHER than the US inflation rate to generate a real return.

Rates are shooting up but no slow down in home mania in socal. The real estate is hot in socal and so in other places in usa.

Give it time…

Vishal Garg sounds like an exotic sudden death syndrome from mucous build-up . He has a future at the Fed since he has displayed cold blooded F’em all in the mass zoom firings. I wonder if he got excited while doing it. He proabaly ditched all his porn and watches his mass firing performance via zoom to get a boner.

Is that you Depth Charge?? :)

Maybe get over your infatuation with me?

him and outside the box. it’s a sickness.

Apparently high interest rate also destroyed a startup company that burned through $124 millions while generating only $600k in revenue.

I don’t want to post a link but just do a search for “Fast startup SF” … No fast is the name of the start-up. Co-founded by a shady dude named Holland from Australia. The more I read about them, the more interesting it gets. Another startup that business model is to vaporize money as fast as possible so they can do an IPO via SPAC. Insiders become billionaires while speculators (I mean retail investors) become bagholders!

Oh My! That Fast startup was a real sucker grab. Here’s what the CEO had to say about blowing $200 Mil and getting $600 K in revenues from selling hoodies and hats:

“Sometimes trailblazers don’t make it all the way to the mountain top,” Holland wrote. “But even in those situations, they pave a way that all others will follow.”

When the RE (asset) crash comes, and recession, this kind of stuff won’t happen as frequently.

“ But even in those situations, they pave a way that all others will follow.”

Very profound…

Until you become part of the pavement…

You only know who’s swimming naked when the tide goes out, and the fed has been sacrificing every saver to the money gods for 14 years so the tide doesn’t go out ;)

When this asset mania ends, it may take several decades to end the insane financial behavior viewed as “normal” since about 2000.

At some point during the upcoming long-term bear market when society feels the impact of noticeably worsening economic conditions, this financial idiocy will end entirely.

When I was really young around 1999 right before the dot-com bubble peak, I caught some ‘hot tips’ on Silicon Investor message board imploring everyone to buy a penny stock with a ticker symbol FOCS with no solid fundamentals.

I put a $1,000 in it (crazy youth) and watched it grow to $5,500 in less than 24 hours.

I remember saying to myself, “This isn’t grandpa Warren Buffett’s 8% per year stock market anymore.”

PS. I promptly lost back most of the $5,500 in the 2001 crash.

JJ,

Several of my co-workers got caught up buying shares in some offshore on-line gambling company in 2000. It was a pump-and-dump that crashed when the SEC opened a fraud investigation.

One of my colleagues got in very early and was smart enough to sell in time to make money. Another saw huge gains (at least six figures) evaporate. A third bought late and lost like $20K from his IRA.

I watched with amusement from the sidelines.

Yes, there’s quite a bit of that now going on. That’s the fallout from collapsed IPO stocks and SPAC stocks and the Nasdaq decline. For these companies, it’s getting harder to get funding. Those that get funding, will live another day. Those that cannot find funding, will shut down.

This company failed to get a third round of funding and ran out of money. We will see lots of that in all of the start-up hubs around the country.

Higher mortgage may reduce the home buyers frenzy but will find it hard to dent the prices. The insane overbidding in Bay Area is well and alive even after interest rate jump. Homes listed at 2.5M is selling for 4M, like this

And this was listed more than a month after mortgage rates went up significantly. Forget about prices levelling, they are still going up. On any given street, every next home is selling for 5-10% more than the last similar home sold there. Higher mortgage rate has literally no impact at all.

As long as supply is less and mortgage rates are lower than inflation rate, which is accelerating BTW, home trading will be deemed as a profitable trade and home price frenzy will not cool down.

Loving seeing stuff like this. I can feel the panic.

It isn’t higher mortgage rates that will kill the housing market in the Bay Area. It’s the upcoming stock market crash.

No more iPOs (or at much lower prices), underwater long term employee stock incentives, and mass layoffs = a collapse in the buyer pool and possibly many forced sellers.

Something is happening that I did not anticipate. Companies are pressing pretty hard to have return to office. This is impacting IT level employees as well. Companies are not asking they are mandating that employees return to the offices even if in a hybrid mode. That is going to drive home sales as people try to move closer to the office.

That is going to cause some disruption as people grow tired of commuting with extreme gas prices and try to juggle the hybrid model of working 2-3 days a week in the office . Returning to the model used for the last 100 years.

Imagine of typewriters, newspapers and Hawaii shirt Fridays returned as well.

I ain’t going back to the office and no one is gonna touch my effing stapler.

You wuss…

It’s electric…

I,I,I was told that I could listen to the radio at a reathonable volume…..

Hah!

Some co-workers were talking today about the movie “Office Space” and the guy with the red stapler.

:-)

It’s a Swingline…doesn’t bind up as much…

The people who assumed WFH was permanent, and bought a house which is not within a reasonable commute, will be most sorry.

i think it will be permanent for the cream of the crop.

but most people, of course, are not the cream of the crop.

Tech absolutely cannot push for return to the office.

Programmers are in such high demand right now they could quit and walk into another job. My company is not pushing on return to the office for this exact reason.

that’s true for many jobs.

When the folks actually go back to the office, I will be able to get a tee time during the week again! Love it.

Not sure if any of this will repeat but I have a strong suspicion this whole fiasco will follow roughly the same way QT occurred last go around.

FED points to QT in 2017.

FED starts QT very slowly in 2018 raises rates.

Stocks taper tantrum end of 2018.

JPM exits repo market beginning 2019.

JPM buys 40B+ in UST 40B+ in MBS and plans 40B+ stock repurchase

FED starts to lower rates mid 2019 when cracks start to emerge from QT?

FED injects gargantuan overnight loans to keep the plates spinning. Not enough.

FED reverses QT starts buying 120B again? Not enough

No relief in sight. FED balance reaches pre QT level. March 2020 rolls around, Multiple T’s injected. Life goes on another day but this time with 1970’s inflation.

This next QT will happen for a shorter time period, hopefully the money in reverse repo will be enough to soften blows but it’s only ~1.5T. Next liquidity injection needed to pay off the past injections will be an order of magnitude larger and will be needed much sooner than the 10-12 years from the last one.

There are banks/large lending institutions that are functioning but insolvent out there and it’s only a matter of time before another JPM refuses to lend to their friends for fear of being on the hook.

Just my 2cnts, probably not even remotely correct. Thoughts anyone on this QT about to occur? Sorry if slightly off topic.

I believe the futures markets are pricing in higher rates in the near term but also banking on rate cuts shortly after that.

So there are many market participants who agree with your general point of view

But as it always goes, when rates go up the dumb money dries up as well and we will get to see who’s been swimming naked once the tide goes out.

Powell is painted into a corner and about to get those fancy tailored suits all messy. But his problems are ours. There’s no clean way out. The Putins of the world are turning over whatever cards hey hold, as a stress-test this time.

Thank you for this comment, since few here or anywhere want to consider that maybe TSHTF before a certain something showed up on the scene. Its endlessly frustrating. Excellent comment.

It’s getting closer to where the FRB will have to choose between defending the USD as global reserve currency versus your scenario. Currently, there is about 30 points on the DXY by my estimate since this was the all-time low in the DXY according to the charts I have seen.

If there is a deflationary asset crash (still my expected scenario for the end of this mania), there may be a flight to safety into the USD.

After that, the FRB will presumably attempt large scale QE but ultimately, my prediction remains that the public, markets and economy will be thrown under the bus to preserve the Empire which requires global reserve currency status.

I agree with you.

If we can’t manufacture “Dollars” any more, as our only export product (yes, I am exaggerating) , we Americans will actually have to work for a living.

We all have been living way beyond our means. I look at all the slovenly, over-weight, low information “voters” I see everyday, and realize they don’t deserve “cheap” shoes, appliances, etc.

I think of all the “slave” labor and factory workers, working away, so we can get really fat and buy so much stuff we need storage units on every corner, and scooters in Walmart to cart our fat @$$es up the aisles to buy more chips and cokes.

This can not continue.

JTM,

You cannot compare 2022 to 2018 because now we have 8% inflation and shooting higher, and in 2018/19 we had inflation at and below the Fed’s target. We live in a completely different scenario today. Today, the Fed has a massive inflation problem it’s trying to crack down on, and asset price declines is one of the ways in which the Fed will crack down on it. It’s part of the plan.

Thank you for this comment. I see a lot of people who totally discount inflation as meaningless, when in reality it breaks every rule of thumb developed over the last four decades. Any math based on assumptions that no longer apply is essentially meaningless.

Hey wolf why don’t u explain ,how much a 10k investment earns at 8% interest ,then these numbskulls might figure out inflation is eating them alive especially compounded over time

Good Questions JTM.

Who is going to buy all these bond from the FED plus all the new bonds the Government will want to sell? Where will the money come from?

Just thinkin out loud with various scenarios to discuss that make me ponder as I think about the economy. I am no bond wizard, but I am trying to piece out a cause and effect scenario:

1) Feed is going to try to unload a trillion of bonds a year but so is the Government. If the rates rise enough, as Wolf says, there will be buyers. But that means a couple of trillion dollars needs to come from somewhere to buy this debt? Will people sell stocks, cryptos, real estate, farm land? What happens if other Central Banks sell too?

– To much of a flow into bonds could result in a big drop in stocks, real estate, farm land, etc. The Fed cannot let that happen. Crashes in either of those 3 sectors always seem to lead to recessions. So many jobs tied to those sectors. Thus I am guessing the FED will try to find a sweet spot to get people to buy their bonds but not to sell all their other assets? I did read that 22% of the FED holdings are TIPS. What price do they sell these .125% coupon TIP bonds at to get people to buy?

2) I am still wondering how rising rates will help calm down supply constraint inflation?

– You cannot pump more oil instantly. There are not enough workers, and not enough investment capital right now to dill and meet demand.

– Thus higher Oil and nat gas prices leads to high input prices for food. High interest rates will not help drop food prices. Maybe people will eat out less but they will not consume less food.

– Car prices are high because there are not enough cars. I have been looking for a hybrid and I cannot find one within 400 miles. A person who works in the industry said they do think the chip supply should start to ease but not until 2023.

– There are no starter houses available. I read that 1 in 10 houses sold in 2021 where priced below $300k. In 2020 it was 3 in 10. I have 3 friends who have all bid many times on houses in the mid-200k range, when they become available, and lose every time. That is their budget and they cannot go higher. Also, only 5% of all new homes built are starter homes. High end houses will certainly be hit buy higher rates but low end houses will not drop because there is no new housing supply as the population and demand increases. Heck, higher rates may even keep the people who live in starter homes form moving up because they cannot afford to. So now this limits the inventory of starter homes even more. Higher interest rates will not solve the low income housing inventory. I am guessing it will only hurt more? Builders will need to try to build starter homes…but will they. Some prefer to go bankrupt than waste time on the low profit margins.

So my question is how will higher rates tame inflation.

– Food? Nope

– Cars? Maybe? I need a new car but prices are to high so I keep nursing my 2002 truck along. Higher rates will make it even more difficult for me to borrow to buy a car. Maybe used car prices will drop if we go into a recession. People out of work do not need a car.

– Energy? Maybe. Not at first unless we go into a recession and demand drops. If people are out of work, they will not need to drive anywhere.

Retail – I guess retailers will need to drop prices if people have less money to spend. So maybe clothing prices will drop.

Furniture – Less demand because rising rates will increase borrowing costs.

Vacations – Higher rates, higher borrowing costs could mean less vacations?

It appears to me that we need a recession to stop inflation. The FED will try for a soft landing where they will try to at least keep inflation rising and drop it slowly. I am thinking the FED needs to drop inflation slowly. Shoot for 5% this year, 3% in 2023 while keeping the fed fund rate below 3% and mortgages below 6%. Don’t shock the system to quickly.

Now I can be wrong on all my reasoning. I am just throwing it out there for discussion to see what other people think.

The cure for high prices are high prices.

Fed can’t control supply side issues but they can very well control demand side by hiking the rates.

If you look at the bigger picture you may get it.

You can’t build “starter homes”

I have been indirectly in the real estate market for over 40+ year. I watched my dad develop South Florida real-estate.

Back then, you could clear-cut the land. You could dredge canals. Permitting and ALL ASPECTS of building homes was far less expensive. Building Codes were less restrictive and costs far less. Most of Florida follows Miami-Dade codes (I don’t blame them) but the costs are far greater.

Today, forget it.

Also, in my area, homes are being built BUT only in certain “safe” areas. Contractors and Subs have know for years that one simply can not build in “non-safe” areas since everything is stolen. You simple can not build anything, affordable or not.

So, the builders go to the “safe” neighborhoods, which have prices far higher, and have to build similar type homes.

Therefor, no more starter homes.

By the way, the county I live in has thousands of starter homes built in the 1960-1980’s but nobody wants to buy them and live there. I am trying to figure that one out.

Having been ( w dad ) in RE in FL since 1950s, I can tell you one reason folks who think will NOT want anything built before the 1994 SBCCI codes and sequels updated after hurricane Andrew — MA.

Code was VERY loose and capriciously enforced, with corruption of building departments endemic, and the ‘cane that hit Punta Gorda area in ‘2004 showed the difference clearly: houses built after ’94 lost a few shingles, old houses next door were flattened in some cases, mostly destroyed generally.

Many of the condo projects built as late as ’80s were equally bad or worse, as is becoming public knowledge recently, but was well known by the ”Forensic” engineering and rehabilitation contractors many decades ago.

While I don’t think the odds of a direct hit from a hurricane have changed from the historical 2% — in spite of rhetoric otherwise — there is little doubt that ALL of FL is subject to those odds EVERY year, and that now includes all of the interior areas, formerly considered exempt, but proven otherwise by Charley? going up the Peace River Estuary and causing tons of damage well inland.

One third of US households are real owners – no mortgage debt – one third are homedebtors and the other third are renters.

So only one third of households are impacted by cash out refis. Not as relevant IMHO.

It would be interesting to see how many real estate investors are real owners versus debtors. There might be a real impact in that sector, slowing it down along with price declines.

I’d say most use leverage. Without a housing bubble, leverage (and tax benefits) is the way to make outsized returns.

In 2011 between jobs, I thought about buying a bunch of condos for cash as rentals. Housing market was in the dumpster but I still concluded at the time it was better to buy higher dividend blue chip stocks. Stocks weren’t cheap then but the risk return potential didn’t make rentals worth the hassle of being a landlord to me.

I sold my house in 2017 to a corporate landlord. Never heard of them but a small one compared to the ones most know. They paid “cash” but I assume they had some kind of wholesale financing at lower rates.

Investors never use there own money ,first rule use someone else’s cash

I have a long memory for the 2009 real estate market in Seattle. Leading up to that time, it was a bubble just like we have now. The local media constantly reported on the price increases. Everybody with a house constantly talked about how rich they were. It was euphoria. Buy now or you’ll be priced out forever.

At the first whiff of prices coming down the mood changed. It seemed like everybody listed at once. You could drive down some residential streets and see every 3rd house with a “for sale” sign. And buyers sat on the fence waiting for better deals. It was basically a locked market, where sellers refused to lower prices and buyers refused to raise bids.

Only people who had to sell lowered their prices and got out. I told people who wanted a house, go around making ridiculous low ball offers until you find a motivated seller.

In flyover. Went through the GFC.

Housing industry will be in recession by this fall.

This one will be a harder landing than 09.

This happened to someone I knew in PHX, during housing bubble 1.

They went with the realtor who recommended listing at the higher price and rode it all the way down. They listed somewhere over $500K and eventually sold for $350K.

and let me guess. had he not been greedy and listened to the realtor, he could have easily sold it for $450k at the very beginning of the process?

i knew a few people like that too.

I bought a house in SoCal in 2011. Originally listed for 780k in 2009 but sold for 460K in 2011. couple of my friends made offer of 680K or so when it was listed for 700K plus. Their offer were rejected

They’ll need to sell down their balance sheet when fiscal spending hits the wall. The war with Ukraine should give defense a boost but not certain the obstructionists will fund the one thing they love most. They’re already discussing sanctions on China. Coming next sanctions on the red states of America. The last time the Fed reversed policy the incumbent wanted to make Wall St. a talking point. This guy doesn’t care. Does the global reserve currency matter when you no longer need ballooning deficits. Besides killing the forex dollar should improve currencies domestic spending power, even if prices rise. Good to own gold, but only in Euros?

U can sell gold in any country in the world

Real Estate REITS have been on a tear the past week.

The ones that do not deal in Malls or office workspace.

The health care, commercial and industrial real estate has been hot.

Public Storage stock keeps hitting all time highs and has been. Not sure why? The fundamentals are way overbought. I guess the actual land must be going up in price?

These REITs were looking good because of yield chasing and low yield on govt bonds.

When the yield spikes, it’d be fun to see how this allure on REIT would be maintained. Same goes for commercial/rental housings.

It does not make sense to invest in REITs or housing or stocks when the govt bonds are paying me 6% risk free and tax free :-)

Not tax free except in a Roth. Only tax deferred in other retirement accounts.

No local or state taxes in treasuries.

Yields would go up if fed wants to tame the inflation.

The yield on GOVT is 1% and the YTD return is minus 7%

So the US is going to run a 2.5 trillion dollar deficit this year…….

So the fed wants to sell about 92 billion per month of assets which is approximately 1.1 trillion per year

So the US in total is going to sell 3.6 trillion in debt into a market that has no fed as a buyer

So if rates continue to go up substantially most central banks and even our domestic banks holding treasuries would need to be insane not to sell some longer dated treasuries to avoid serious losses.

So lets say 4 to 5 trillion of treasuries need to find a home with private hands.

Who has 4.5 trillion to buy these treasuries except the fed?

Nobody………what JP does at that point is going to be interesting and dangerous.

fred flintstone,

“Who has 4.5 trillion to buy these treasuries except the fed?”

I’m going to buy some of it when the yield is high enough. Lots of people will. Including lots of commenters here. Big financial institutions will buy. International investors will buy. Yield solves all demand problems.

When you can get 6% from a 10-year Treasury, people will sell stocks, and risky commercial real estate, and pesky rental properties to get that 6% yield without worries. And yes, those prices will drop.

Wolf,,,,,,,,move over……I’ll be lapping up more than my share of those yields with serious money…..happily………however ….. if its going to be 6 to get the buyers….the prime rate will be 8-9.

Will our fed have the political backing to sustain the rates in light of what those rates will do to demand……..and what those rates will do to those other markets. Unlike some others I believe inflation will be halted in its tracks inspite of the supply issues but will the fed ignore the political drumbeat to open the spigots. Will the Congress cooperate and stop passing more inflationary spending bills?

I understand you believe they will…..or we’ll be a shithole…….I sure hope you are correct….a few decades ago I would have agreed…….not sure today who our leaders represent.

FF-

“however ….. if its going to be 6 to get the buyers….the prime rate will be 8-9.”

Maybe that was the reason Brainard included the 1979 Jim Lehrer/Paul Volker interview that showcased the Prime Rate at 14.5%? (Variation in the Inflation Experiences of Households, 4/5/22, Note 2)

A tell. Slightly hidden, but not so subtle once seen.

Waiting in the wings as well.

Going to start buying these at 5 – 6% and stagger the buys if it keeps moving up.

Took a calculated risk and sold most of our rental properties again in late 2021 just like back in 2006. Could be lucky twice… who knows.

It doesn’t smell right that US is running $2.5 T deficit with Yellen at the treasury and Fed is Jawboning about killing inflation. Spending $2.5 T you don’t have is inflationary.

to a point, yes. but if you are actually borrowing money that other people have, as opposed to printing it, it’s much less so, as the money that the other people would have had to use for something else is now out of their hands.

I wonder how bad this APR jump will impact the 26% ARM mortgages that are sitting out in the US today? Many individuals in the new home subdivisions got in with 3.5% down on an ARM. They have 2.2% first year and the adjustable in year 3 and year 5. Others got a scary ballon payment at 10. This smells exactly like 2006 all over again. They could not qualify for the 30 year fixed for credit reasons. Many think they will get their credit up and can refinance in 2. Ouch!

Perhaps Biden will issue another Executive Order this time placing a moratorium on foreclosing on properties with delinquent FHA insured mortgages. If you don’t have to repay a government insured student loan why should you have to repay a government insured mortgage?

Greenspan promoted the refinance boom in the early 2000s and a way to boost the economy. Using the home as an ATM machine. We saw how that worked out.

Most of the people that do this to pay off credit cards wind up running up the credit cards again so they wind up worse off than before and with a home that goes underwater and high credit card debt. Same thing will happen again.

Wolf – Would love to see an article about the ridiculousness of forgiving student loans.

My view is that the proponents of this larceny are really just trying to kiss up to the higher education industry. What other industry gets the government to finance purchases of their product to people who are completely unqualified to borrow the money?

This is a scam that needs to be brought to an end. The higher education industry needs to be forced to become efficient, not given more money.

it’s a vote buying scheme. that’s all it is.

This.

I work in higher Ed. I’m against the scam of debt forgiveness.

i used to work in higher ed as well. i’m going to venture to guess that, at least at the place i worked, 2 out of every 3 employees in administrative type jobs were unnecessary.

around the country, i’m seeing schools build luxury dorms that rival the nicest apartments i’ve ever lived in.

they can only afford to do this because they get essentially free money from taxpayers.

get rid of government guarantees of loans, and get rid of the non-dischargeability in bankruptcy of school debt, and watch higher education prices come down to something way more reasonable.

I’ve beaten my head against the wall of student loans before. The problem is that the wall is still there and my head is all banged up. Folks who put it into their mind that they’re somehow entitled to have their loans forgiven don’t give up easily.

Good comments to a well written article. For those who have not read or seen “The Big Short” now is your time to see what’s coming. And yes I think it’s going to be worse for a lot of other reasons. Got Au and Ag 🤣🤣

I just bought $10.00 worth of Ape coin

So, I am set for life.

I just new it was the real deal.

9500 is my lucky number, like so many others…

Ape coin to replace them all.

I don’’t need to refinance my mortgage, I am an Ape coin billionaire…

In the city I live in, local media report Afghan refugees are having difficulty finding affordable housing. The state government has responded with the creation of a new office with the goal of “streamlining support for newcomers to the state.”

That’s a shock. Immigrants many of whom presumably don’t speak English (and certainly not Spanish) can’t find employment.

Your example is another instance of dysfunctional government policy. Idiotic foreign policy has consequences on domestic housing. US civilian population isn’t responsible for the social welfare of endless number of foreigners.

There will never be sufficient housing in the US for citizens and legal residents if immigration policy doesn’t control the border and grants residency to endless numbers who shouldn’t be here.

As one example, I recently looked at changes in the population of Pakistan. Now about 220MM versus 78MM estimated in 1980. That’s one country and it’s not an outlier either.

Anyone remember fukk3dcompany dot com? Is there any such tracker for the current bust? Maybe Wolf can start a subdomain called fukkedin2022.

“COVID-19, Declining Birth Rates and International Migration Resulted in Historically Small Population Gains”

“The U.S. population grew at a slower rate in 2021 than in any other year since the founding of the nation, based on historical decennial censuses and annual population estimates”

The CDC estimates about 1,000,000 more Americans died than expected between 2020 and 2021. A majority of these deaths were older folk who died from Covid-19. I would have suspected this would lead to a decent amount of available housing entering the market. The article also states the western and southern states had the highest rates of excess deaths. Maybe the inventory didn’t make a noticeable dent because many of those markets are so hot the impact wasn’t noticeable?

Regardless, a slow down in population growth makes one wonder what will happen to regions that are already facing a mass exodus. The population of Cleveland declined last year, yet new builds have been through the roof, and prices are crazy high relative to salaries. I am selling both of my rental properties currently and waiting this out. Yields are much too low to buy in this market. The average cap rate used to be 12-16% in A or B-rated neighborhoods and is now closer to 7-8%. For a city that has failed to attract new companies and wfh employees, I can’t see the value in buying now. Columbus on the other hand has been growing yoy and attracting young people. Heck, Intel is pledging more than 20 Billion over the next few years, so I can see that market retaining value during a pullback or recession.

https://usafacts.org/articles/covid-excess-deaths-causes-2021/

https://www.census.gov/library/stories/2021/12/us-population-grew-in-2021-slowest-rate-since-founding-of-the-nation.html

On a side note, assisted living and eldercare facilities have been rapidly appearing over the last couple of years. With the 85+ population forecasted to grow 177% to 18.5 million by 2050, I am definitely an investor. I know a man who owns a couple and my lord, are they lucrative. However, I could never see myself letting my parents end up in one of these. It’s much too difficult to guarantee the quality of life and care they would receive, and my parents enjoy seeing their grandkids too much :)

Sandman, I wish your parents the best. But at my age, 78, I have seen a lot of old folks needing daily help. People get old, things go wrong. No one gets out without some health issues.

When your parents get real old and possibly have lots of problems that render them incapable of taking care of themselves on a daily basis, what are you going to do?

In-home health care is expensive ($300/day or so), unless you do some or all of it yourself. The next option is assisted living, if they can do SOME of their daily tasks without help. One of my friends is in an assisted living facility right now. It’s $7 K month and that does not include any medical costs. Then comes nursing home full time, which is even more expensive.

I sure hope they have Long Term Care insurance which will cover SOME of the costs for a while.

God help you and them if they or one of them end up with dementia needing to stay in a memory care facility.

All of the above is expensive and if you are planning on helping by doing part of the daily heath care, it’s generally a full time event.

Yes, these places are making money for the owners and will for the foreseeable future.

Anthony, all excellent points and you offer great perspective. I agree that it is not an option for everyone considering their situation and the level of care needed for their folks.

However, I’m much more in favor of hiring an outside home-health aide or CNA compared to a nursing home if possible. I know many people who have stuck their parents into a nursing home or assisted living center where they rarely visit them and have let them become ancient relics. Speaks much more to the person than the institution but I think they tend to lead to it.

I also believe people blindly trust these corporatized facilities to provide decent and personalized care. That’s what many of them are advertising, at least. When I considered one for my parents, I tried to think about it from their perspective. My parents are Eastern European and Middle Eastern, and I’m not sure many of the workers or other people living there would make an effort to interact with my parents with their accents, my dad’s poor hearing, etc. Also, my parents enjoy certain cultural dishes that most facilities do not offer. Will someone be there to help motivate my parents and keep their minds active? These things ran through my mind and ultimately I decided against it. I guess what I’m saying is, I hope people try their best to take care of their parents until it is out of their grasp.

sandman, wolf has written about this before. it’s because “investors” are buying houses to keep them empty and are banking on capital appreciation. there will never be enough housing, no matter what the population is, if people are buying houses with no intention of using them as houses.

Not sure on “keeping them empty”, but the BnB has been booming the past years. BnB’s are to 22 what spec homes were to 09.

I just received by bi-weekly letter from Opendoor with an estimated offer.

Who knows? Maybe Blackrock and other Wall Street gurus know something we do not.

Maybe housing is still cheap right now when all things are compared and analyzed.

Rising inputs for land, infrastructure, energy measured against an increase in population. What I am saying is maybe we are having a demand / supply housing inflation. I read my city needs 15k homes built over the next few years and it looks like 6k to 8k will be built. They also think the city will grow by 40k people over the next 10 years. It is going to be hard just to build out the infrastructure (roads, sewers, permits, labor, etc) plus build enough housing.

I live in flyover so this is regional. I was in LA and took look at 4 bedroom 2000 sq ft houses that were 2 million near the Los Angeles airport. They would probably cost about $400k to $450k where I live.

“Who knows? Maybe Blackrock and other Wall Street gurus know something we do not.”

You mean like there actually isn’t an unprecedented housing bubble right now. Is that what they know? If not, what exactly do they know that everyone else doesn’t?

“Maybe housing is still cheap right now when all things are compared and analyzed.”

Totally irrelevant

Whether something is (supposedly) relatively cheap doesn’t change whether it is or isn’t affordable to the majority of prospective home buyers.

There are three reasons housing has been supposedly affordable.

The first is basement level interest rates that don’t actually reflect the risk of making the loan. The back-up in rates has been noticeable but by recent standards (more than 50 years), rates are still very low. A 5% 30YR fixed rate remains “low” but still (at risk of) pricing out a noticeable proportion of the prospective buyer base.

The second is that many current homeowners have built up noticeable fake wealth equity, mostly from the housing mania. They can afford bubble level prices because they currently own a bubble level priced house. If their equity mostly or entirely evaporates, many no longer will.

The third is basement level credit standards which have been a farce for a long time, probably most or all of my life. I don’t see this changing any time soon, but it doesn’t change that the number of eligible buyers would collapse if underwriting was much stricter as it should be.

It’s not interest rates that crash the housing market but all the things that cause interest rates to go up. A good example, here in the UK, we see heating bills in 30 million households increase by £1000 a year virtually over night. That’s 30 billion pounds gone out of people bank accounts. We see another 30+ billion pounds gone with increased food bills (food running at about 10%+ inflation) How much has gone because of petrol and diesel increases is anybody’s guess. Add interest rate rises to the pot and …………………….

Over here we print money, shut down pipe lines, strike deals with Iran,

Net zero policies, and have a agency with a 45 billion dollar budget &14k employees to solve these issues.

Those layoffs are significant but not that big a percentage.

Notwithstanding the obvious reasons for refis to go on pause, I think companies are getting rid of some of the dead weight. You know, the work from underwear crowd, AKA work under sedation in underwear crowd. Was bound to happen.

Have we passed peak work from underwear? I don’t know. Probably we will when companies mandate drug tests for remote “workers”

Unofficial by all means but interesting… googled ‘mortgage calculator’ and the generic Google one on the main search defaults to a 6.5% mortgage rate.

I’m curious if anyone has an answer/opinion for this…what, if anything, would cause the hedge funds that have been sucking up starter homes to dump those houses on the market? Would a full-blown Depression create the conditions for that to happen? Since they pay cash, they have no mortgages to worry about. Or have we reached an event horizon where investors continue to buy up homes until only the wealthy can afford one of their own?