Maybe the BoJ doesn’t want to totally crush the yen?

By Wolf Richter for WOLF STREET.

The Bank of Japan vigorously asserted all March that it would buy unlimited amounts of Japanese Government Bonds (JGBs) to keep the 10-year yield under 0.25% (it’s 0.23% now), amid wild rumors in the financial media about massive buys by the BoJ as it was trying to defend the yield peg against the markets that were selling JGBs hand over fist.

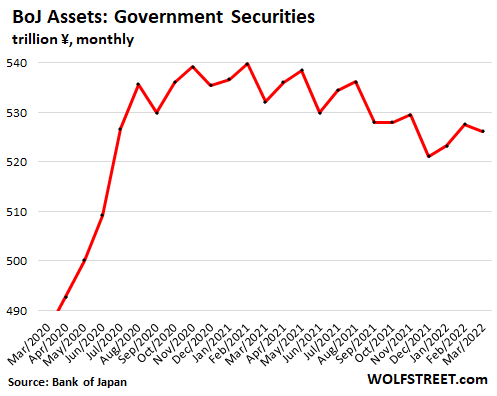

But amazingly, despite all the rumors of massive buys and market interventions, the BoJ’s holdings of Japanese government securities actually fell in March, as the BOJ disclosed on April 7, via the release of its balance sheet through March 31, and are now down by 2.6%, or by the equivalent of $113 billion, from the peak in February 2021.

And even more amazingly, its holdings of short-term Treasury discount bills increased in March, while its holdings of longer-term and long-term JGBs – the very bonds it would have had to buy to cap the 10-year yield – fell by 1% during the month, to ¥511 trillion ($4.13 trillion) at the end of March.

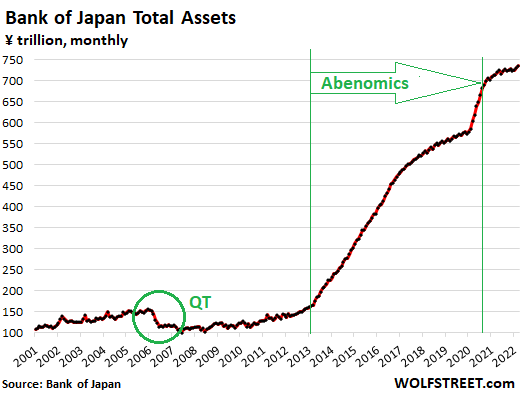

The Bank of Japan, after pushing QE to “shock and awe” extremes under Abenomics starting in 2013, instituted “yield curve control” in 2016 on top of it, threatening to trade unlimited amounts of JGBs to keep the 10-year yield at “around zero percent.” Markets assumed this meant a range from -0.10% to +0.10%. The 10-year yield stayed close to 0%, while the BOJ was piling up huge amounts of JGBs.

But in late 2020, Abenomics was declared dead, and the BOJ began to taper its bond purchases. The peak of its holdings of government securities was in February 2021 at ¥540 trillion ($4.37 trillion) and then zig-zagged lower. In March, they dropped to ¥526 trillion, down 2.6% from the peak in February. The BOJ has now shed the equivalent of $113 billion in Japanese government securities!

One reason the BoJ has to be careful with its money-printing is that the yen has been getting crushed as other central banks are tightening, and Japan is a huge importer of commodities, including nearly all its natural gas and crude oil, and a weaker yen make the imported commodities a lot more expensive for Japanese companies and consumers to obtain.

This is likely why the BoJ played this mind-game with the market of buying large amounts of bonds when in fact it was more worried about the weakness of the yen.

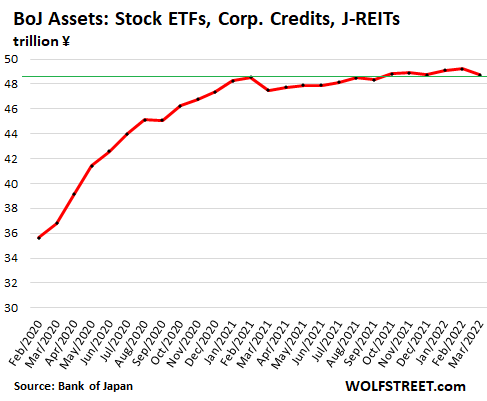

The other over-hyped thing: Corporate bonds, Stock ETFs and J-REITs.

The financial media has long hyped the BOJ’s purchases of corporate bonds, commercial paper, stock ETFs and Japanese Real Estate Investment Trusts (J-REITs). But the amounts were always minuscule by BOJ standards, and haven’t gone anywhere since February 2021. All combined, they account or just 6.6% of the BOJ’s total assets:

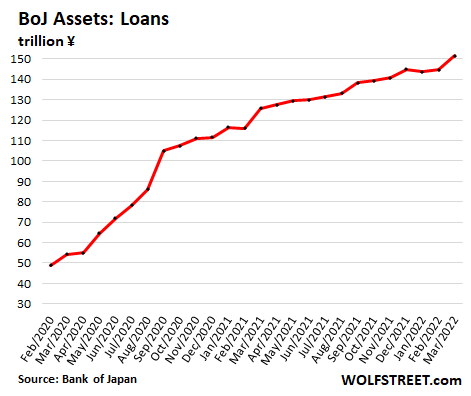

What has increased in March: Stimulus Loans.

The BoJ operates pandemic loan programs, and pre-pandemic loan programs, designed to stimulate bank lending. Combined, they’re the second largest line item on the BoJ’s balance sheet, after government securities, and account for 20.6% of its total assets. These loans have continued to grow, and in March jumped by ¥6.9 trillion to ¥152 trillion:

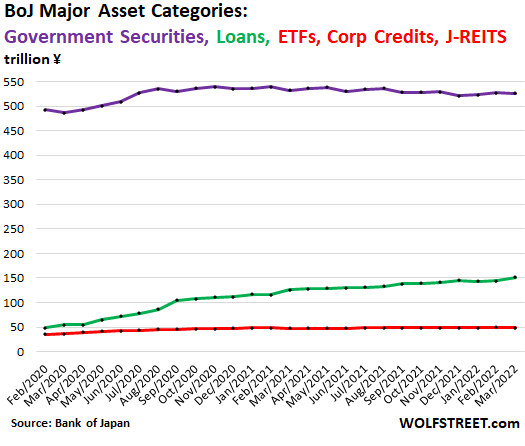

For a sense of proportion, here are the top three asset categories on the BoJ’s balance sheet from February 2020 forward: government securities (purple), loans (green), and the combined total of stock ETFs, J-REITs, corporate paper, and corporate bonds (red line at the bottom).

Total assets.

Driven by the increase in loans, and despite the declines in government securities and the combined corporate credits and ETFs, the BoJ total assets rose by ¥5.3 trillion to ¥736 trillion ($5.95 trillion) at the end of March.

The economic religion of Abenomics under Prime Minister Shinzo Abe kicked off in early 2013 and ended after Abe’s departure in late 2020, when the BoJ quietly began tapering its asset purchases.

Note the period of Quantitative Tightening (QT) from January 2006 through June 2007 (circled in green) when the BoJ reduced its assets by 36%, unwinding five years of QE:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

It seems you’ve succeeded in making me hate the BOJ as much as the FED.

To a significant extent, the central banks around the world have to at least try and roughly coordinate policies/interest rate levels if they aren’t going to see their real assets massively carted out of their countries.

(Although desperate outliers with bad fundamentals – Russia, Turkey, etc. – soar their rates to keep capital in country, regardless)

Otherwise, unbelievably huge international money flows chase yield differentials and cause foreign exchange rate changes that can see huge real asset shifts into/out of the country.

Basically, what we are seeing is the conflict of countries’ desires to manipulate their own domestic economies (through money printing/interest rate manipulation) and the fact that they cannot manipulate *other countries’* desire/ability to do the exact same – with potentially huge real asset flows across nations.

It is a progressively collapsing system that tries to reconcile the impossible, domestic monetary manipulation (in the service of..,who knows?) and largely free international capital flows (valued despite *domestic* manipulation?).

As usual, Baal wants it both ways.

They can only attempt to target interest rates or the exchange rate, not both.

Major central banks are living off of borrowed confidence from the past. This too will be lost and when it is, the wheels are going to come off both the financial system and economy because it’s all smoke and mirrors of artificially supported prosperity.

I think that there will be a modulated or controlled let down, as Wolf’s post illustrates. There is no free market to crash or re-calibrate or adjust. The markets across the world have been orchestrated in a manner reminiscent to the middle ages where an aristocracy ruled.

No one, with a half a wit, wants a crash. The Federal Reserve will raise the short term interest rate to 7 % where it should be.

Japan has never had huge flows of investment money into the country.

About the only flows that they have seen from foreigners is in their share market and to a very lesser extent their bond market.

And in the big scheme of things these flows are not that big anyway.

Last data available for the week ending 2 April 2022 shows net purchases of about US$4 billion or so in shares by foreigners.

To put that in perspective Apple traded twice as much dollar volume today (US$10 billion) in one day than foreigners bought for that entire week.

There was some hype about foreigners initially buying RE especially in the tourist market arena when the Abenomics allowed the yen to fall and the number of tourists increased to around the 10 million per year area in 2013, but that has basically now died with the pandemic.

Just imagine your country going from a little over 30 million tourist visits per year in 2019 to basically zero so far in 2022 and what it does to your economy.

CAS127

There’s a scene in The Godfather movies where all the Dons are gathered in a posh hotel conference room. Topic of discussion: how big a piece of the action everybody gets.

That’s what the CBs/governments are doing. The problem is they are even more deceitful and greedy than the Mafia.

I sometimes think that it illustrates the disgrace of the Fischer theorem as the fig leaf it really is.

A fictitious. zombie currency kept afloat by the Breton Woods peg.

Like all of the worlds economies.

A change of generation is coming. I am, rightfully, relegated as an old, innocent bystander, clutching his meager purse.

Life, is definitely hard. At some point, weariness sets in and one feels comfortable in accepting the observation that the Bard made several centuries ago: allegedly

That life is a comedy and we are just the actors.

The atrocities that the Japanese have conducted on their fake currency, they felt, was therapeutic for survival after their calamitous collapse of dual bubbles back in the late eighties.

Like Italy borrowing a trillion lira for -5% for the next 100 years, the yen seems rather tame.

Japan is the husk left after capitalism moved on looking for greenfield exploitation of the people and lands of the earth, in search of the next society so desperate that they will give away the value for food.

Or worse, false opportunity, that engine of creativity and satisfaction.

Clearly, the world requires a currency that can be marked to market. How else can we make sense of this obvious weight of Atlas that we have carried since we became aware.

The world depends on a successful implementation of a Federal Reserve that is more in line with the historical experience and less with the experimental, which has pretty much been proven as counter productive, wrong, dumb, a colossal failure, reckless, destructive, etc.

OK for Japan, I suppose, but not the United States of America, land that I love.

Not every man is like me, accepting the every day world as it is. I was never a contender for the olympics or being admitted to harvard. Having said that, I proffer the following statement that:

Pareto dominance is the aphrodisiac for war.

and money of course. For instance, the US military industry, with a tax payer funded budget of nearly $1T just realized that a Russian weapon, the alleged hypersonic missal had just made our defense systems obsolete, requiring an increase in expenditure to counter the threat from the small, but respectable, community of Russia. GDP like Spain.

The US has reached the level of military spending like funding an orgy, the more money available too be spent will increase the size of the orgy.

I thought the BoJ was limited in its tightening by its huge debts…unaffordable interest payments if rates go up…be interesting to see what comes next

America’s baburu keiki.

Mind-bending stuff. The growth of the balance sheet since 2008, and the Abenomics lift-off, especially.

A chart of BOJ, ECB, FRB balance sheets compared to respective GDPs might be be informative, if such exists.

Thanks for the article, Wolf.

I read recently often some nonsense about the rapidly devaluating of the JPY. In fact the exchange rate to the DM (EUR) is now the same as 1993 when my japanese colleques always claimed “the Yen is to high, the Yen is to high; we cannot sell good.”

Japan want the Yen reasonable weak. Mind Game : Why this is not happen ?

The yen has fallen by a huge amount relative to the Australian dollar recently with it hitting around 93 yen per Australian dollar.

At the end of January it was trading around the 80 yen per Australian dollar level.

It must be the worst performing currency of the developed world in the past several months.

Even the ruble has done better.

It seems the Central Banks, USA, EU, BoE, BoJ, have convinced everybody nothing “economically bad” will happen ever again. Even if rates do go up, whatever the effects, they will only be very temporary. That any bear market crashes, if they are even allowed to go that far, will immediately see a V-shaped recovery.

That inflation can be brought under control with orderly deflation without affecting asset prices. The stockmarket will not go down much or for long. House prices will remain elevated around the top and pension funds can continue to invest in bonds without fear of sensible price discovery. Good lord! A pig just flew past my window.

> It seems the Central Banks, USA, EU, BoE, BoJ, have convinced everybody nothing “economically bad” will happen ever again.

Please introduce me to these mythical straw men, this “everybody.” There would be some spectacular trades there.

I agree if the implication is, risk is undervalued in the markets. I have some money on that idea. But if “everybody” was that naive, I’d be rich already.

Pigs can fly longer than a contrarian can remain solvent.

Great compact explanation. Does anybody know a good book or article spanning this economic history, and adding international context? Does “Big Like” go into that, at all?

Phleep-

Came across an paper by Kosuke Aoki from 10/21 that’s interesting and broad. Titled: The Bank of Japan’s Balance Sheet.

There’s also a Barron’s article (Why China Is Beating Japan in the Currency War, 9/29/15) that I thought added some perspective.

“Currency war” concept has always interested me… like 3-D chess. If a country “wins” race to bottom and devalues its currency, then its exporters and labor win, but maybe its consumers, reliant on imports, lose.

I’m probably hopelessly naive on this subject…

I’d question whether labor really wins in a mercantalist type economy.

Those who work in exporting industries presumably do and all labor benefits from increased GDP which is what everyone sees.

The JPY is now somewhat over 120 to the USD. In 1985, it was about 260. In the 1960’s, it was 360.

I have a hard time believing Japan would actually be richer and better off with a much lower exchange rate.

Japan doesn’t have perpetual trade deficits like the US but there is no doubt most Americans are poorer due to the long-term decline in the USD FX rate.

AF

The Yen is the only souvenir currency I have that is more valuable today than in 1963. In terms of the dollar.

And at one time is was in upper 70’s to the US$.

Japanese people never really got the benefits from the increasing value of the yen in the domestic economy, but had huge benefits in the international aspect of the increasing value of the yen.

For example, foreign real estate and foreign vacations became really cheap. Directly buying stuff from overseas became really cheap, but overall import prices never really reflected the change in the value of the yen.

phleep,

BIG LIKE, my book, is not about monetary policy, for sure for sure :-]

But much of it is about my astonished and over-worked brain’s efforts to grapple with Japanese culture and thinking in 1996, a few years after the Bubble imploded.

Could the 1996 “efforts” and today’s muddle, I ask respectfully, be as simple as this Hayek observation?

“[T]he power to issue money was essential for the finance of the government – not in order to give us good money, but to give to government access to the tap where it can draw the money it needs by manufacturing it.”

-F. A. Hayek A Free Market Monetary System (lecture), Nov. 11, 1977

(I will now sit on my hands for a while)

Libertarians have invented many fancyful theories about money to justify their political goals.

The origin of money is to be found by the names given to currency units, Libra, Lira, Pound, Peso, Shekel, all were once a measure of weight.

There were many problems collecting debts, taxes and fees using sheep, goats, cattle, donkeys, etc. Long before coins were invented, governments used silver and gold as way to standardize THEIR take.

Money is pretty much whatever governments will accept in payments. If they wanted payment in bags of feathers, that would be the new “money”.

“Libertarians have invented many fancyful theories about money to justify their political goals.”

Good thing no one else has done the same to justify the theft they support.

I am still waiting for the sequel to Big Like.

It has been almost finished for 12 years and will remain almost finished :-]

Dang! I was waiting to buy the 2 volume set :-)

The over-dependence on a credit/debt financial system is part of the problem. Public debt is always identified as the primary culprit, but it is private debt loads that inevitably crush demand and create recessions. A national job guarantee would help price stability.

“A national job guarantee would help price stability.”

It’s an economic fantasy because there is no deus ex machina available to guarantee what you infer. Government doesn’t produce actual wealth and therefore can’t guarantee any arbitrary living standard except by acting like the parasite it is on its host. When the host expires, the fantasy ends with it.

This is nonsense. We have mixed economies where neither the public nor private sector alone is responsible for value creation.

Wherever do such notions arise?

“This is likely why the BoJ played this mind game….”. Holy Lawyer Lincoln! The conspiracy theory detection monitors have hit the klaxon jackpot at deafening levels. Wolf’s gonna get that passport stamp that reads “Troublemaker”. There’s men in white coats and a Ford ambulance in your future.

I invested in an NFT of Mrs. Watanabe

Wolf said: “One reason the BoJ has to be careful with its money-printing is that the yen has been getting crushed as other central banks are tightening”

———————————————

What is the relationship between other central banks tightening and the yen getting crushed? Why would that be the case?

Money printing, as you know, destroys a currency. If all central banks are doing it, the currencies move in parallel (through inflation), and the exchange rates stay within range. But if there is a breakdown of this harmony, with some Cbs tightening (supporting the currency) and other CBs still money printing (destroying the currency), you could have a major currency disconnect in the exchange rates, where the remaining money-printer currency gets washed out. That could be very disruptive.

What’s even more “disruptive” is the inflation all of this money-printing is causing for the citizens of their respective countries, regardless of the exchange rates. The idea that any time there’s a bump in the road, you just print money and cause inflation is one of the biggest jokes I’ve ever witnessed. The “treatment” is worse than the disease.

But if you look at the official figures from Japan and the USA there has been almost no increase in inflation as a result of Japan’s QE over the years compared to the USA and of course nothing like the inflation in the USA recently.

Remaining money-printer currency gets washed out?

Do you mean the remaining currency fails because there is no other currency to determine it’s value against?

One of my favorite personal charts displays the performance of each of the currencies relative to gold. Gold is going up and all the currencies are in a race towards the bottom.

RedRaider,

When we talk about “dollars,” it’s generally not the paper dollars in your pocket we’re talking about — no one holds of lot of those — but assets denominated in dollars. So now compare those assets denominated in dollars (RE, stocks, bonds, etc.) to gold.

Pretty old playbook for a systemically central bank to buy all they need to prop up a currency.

Japan is what they are, a systematically important reserve currency, and pioneer in QE, but buying unlimited amounts of cash and bonds in defense of a currency shows that they are down and needing a defense.

A main reason the scam has gone on so long is the coordinated global central bank devaluation AKA inflation. Simultaneous coordinated devaluation moderated exchange rates with tons of central bank spending with money they make with their fingers.

So, exchange rates remain relatively static while inflation goes berzerk.

The sweet interest rates we had were just part and parcel of that very same manipulation. And the band plays on.

Jesse Felder posted a chart of the Feds balance sheet versus volatility. CBs holding assets represses volatility and inversely when they sell assets. Caveat markets can go higher along with volatility. I suspect all of them have surrogates to take these bonds off their hands, and the [bond] vigilantes often work with the sheriff. Or 1930s LA Water and Power working with developers in the subplot of the movie Chinatown. Where was that water going?

Wolf, great article and data.

Since the loans are stimulus loans, are they really loans (intended to be repaid) or grants and handouts disguised as loans, like the PPP “loans” here in the US?

How much of that 20% of the BOJ’s “Assets” consists of real assets and how much is vapor?

I’m still wrestling with how to play this. Short the JPY or the Nikkei, or just watch from the sidelines for a while.

They’re actual loans. Some have collateral requirements. They come with interest of somewhere near 0%.

Wolf, you kind of left us hanging. Interesting facts but what’s your point? The Yen is dropping, at 123 today, and so I can see it impacts the price of imported commodities. But it doesn’t seem to be dropping the price of Toyotas in the US. Also I hear it’s back to the carry trade as people think it will fall further.

You show that the BOJ is selling some bonds but can this continue, accelerate, or will it fail? Can the government budget function without BOJ bond support? I understand the Japanese public and corporations loans support the deficit but inflation arising from overseas will erode this.

I am just as in the dark after reading this as before.

“ But it doesn’t seem to be dropping the price of Toyotas in the US”

From Toyota :

70% of US Toyotas are made/assembled in the US…

I don’t see how Japan can go forward and maintain the standard of living…

The Government has propped up the standard of living with their bonds at appx 0% to the mostly one buyer…

Debt to GDP , is what, only below Venezuela…

The Japanese used to be the only game in town for cheap electronics and cheap cars… now you’ve got China, Taiwan, South Korea all exporting what they used to have a monopoly on 30 years ago…

The rise of inflation and energy costs may prove to be the last straw on the Japanese camel…

I don’t see how they can maintain the current standard of living even with huge amounts of financial chicanery…

You have to look at the over balance sheet of Japan to understand the impact of the exchange rate on its economy.

Japan’s import bill increases when the yen falls and commodity prices in dollar terms increase.

On the other hand the income from foreign assets and the value of Japan’s external assets increases in yen terms when the yen falls in value.

A lot of Japan’s external assets were bought when the the yen was a lot stronger and surging in value and way under 100 yen to the US dollar. In yen terms those assets have gone way up in value as the yen has fallen.

Japan’s foreign assets and income are much bigger than its external debt so that is no problem and benefits the “country” when the yen falls in value.

The problem for Japan comes about when that flow of external income is not big enough to pay for the imports, interest on the debt, and debt both external and internal.

Japan needs to run positive balances in all its external accounts to be able to muck through.

Continued total deficits in these accounts are a danger for the country.

This wasn’t a generic article about the economy in Japan and the price of Toyotas in the US. This was about the balance sheet of the BoJ.

The price of Toyotas in the USA is not dependent on the exchange rate. Those prices are determined by the market and how Toyota wants to compete in it. Many Toyotas sold in the US are made in the US.

Exchange rates impact COSTS of manufacturers, and therefore their margins. A lower yen would raise costs for manufacturers in Japan that rely on imported materials and components.

Japanese exporters would benefit from a lower yen. The big manufacturers in Japan are importers AND exporters. So it works both ways.

If you look at that last chart of the QT. The Nikkei stock exchange dropped from 17k to 8k. It was flat until QE started up again in 2013. The Nikkei took off from 9k to 27k. 200% gains.

If you look at the last 2 years of the Nikkei, it looks just like the 1st Japan QE chart wolf shows. Flat but slowly dropping from 29k to 27k.

So they bought TREASURIES last week. Stalled the US yield rise and allowed their yields to fall back. This spiked the US stock market too.

How would this affect their currency?

If I understood you correctly: The BoJ didn’t buy US Treasuries. It bought Japanese Treasury Discount Bills denominated in ¥ — “Treasury Bills” is a generic term for short-term “bills” a government sells. The Canadian government too sells Canadian Treasury Bills (denominated in C$) that the BoC bought and had on its balance sheet.