The strong economy and labor market can “handle tighter monetary policy.”

By Wolf Richter for WOLF STREET.

Folks kept saying for many months that the Fed is “trapped,” that it can never raise interest rates, that it can never end QE, that it can never-ever shrink its balance sheet. And now the Fed has ended QE, and it has hiked its key policy rates by 25 basis points today, and it indicated that rate hikes are on the table at every meeting this year – seven more – and that there’s “certainly a possibility” that this might include 50-basis-point hikes, Powell said, and that the details of the balance sheet shrinkage (Quantitative Tightening) could be announced “as soon as” at the next FOMC meeting in May, Powell said, and that the balance-sheet shrinkage will be “faster and much sooner” than last time.

The Fed – the most reckless Fed ever – is a gazillion miles behind the curve. CPI inflation is raging at 7.9%, not including the effects of the recent spike in energy prices. But the Fed did move today, and it moved with hawkish twists, in terms of how many rate hikes this year and next year, and how soon QT would start.

The Fed today:

- Hiked by 25 basis points its target for the federal funds rate to a range between 0.25% and 0.50%. St. Louis Fed president Bullard voted against it; he wanted to hike by 50 basis points.

- Hiked the interest it pays the banks on reserves by 25 basis points, to 0.40%.

- Hiked the interest it charges on Repos by 25 basis points, to 0.50%.

- Hiked the interest it pays on Overnight Reverse Repos by 25 basis points, to 0.30%.

- Hiked the primary credit rate it charges banks by 25 basis points, to 0.50%.

- Confirmed end of QE: Decided to keep the level of assets on its balance sheet steady, and will only buy securities to replace maturing securities.

You’ve come a long way, baby, since the last meeting.

The median projections by the members of the FOMC have dramatically changed since their last meeting in December.

GDP growth projections got slashed, inflation projections got jacked up, and interest rate projections more than doubled for the end of 2022.

Today’s median projections vs. those from the December meeting:

- Growth in real GDP for 2020: now +2.8% (still above average growth); down from +4.0%

- PCE Inflation for 2022: now +4.3%; up from +2.6%

- Core PCE inflation for 2022: now +4.1%, up from 2.7%

- Federal funds rate by end of 2022: 1.9%, up from 0.9%

- Federal funds rate by end of 2023: 2.8%, up from 1.6%.

Hawks show up on the “Dot Plot.”

The “dot plot” is where members of the FOMC get to project their view of where the target range should be by the end of the year 2022, and in future years. On the dot plot today, the median projection for the federal funds rate was 1.9%, more than double from the last meeting of 0.9%.

But seven of the 16 members projected the federal funds rate to be above 2.13% by year-end, with 5 of them projecting a federal funds rate between 2.38% and 3.37%. That last one must have been Bullard.

“Every meeting is a live meeting,” Powell said several times during the post-meeting press conference, meaning that a rate hike is on the table at each meeting, and there are seven more meetings.

When asked if there could be a 50-basis point hikes among them, he said that it was “certainly a possibility” that the Fed “will move more quickly than projected now.”

Quantitative tightening coming soon.

The FOMC is now “finalizing details” about the balance sheet shrinkage, Powell said. More details will be outlined in the minutes, to be released in three weeks, he said. An announcement of the balance sheet shrinkage could come “as soon as” the meeting in May. But one thing is already clear: the shrinkage will be “faster and much sooner” than it was last time he said.

Last time was from late 2017 through mid-2019, which included a phase-in period and a $50 billion per-month cap on the pace of the asset shrinkage.

Inflation is now #1 priority, according to Powell.

It was a whole litany. Some tidbits from the press conference: “Price stability is an essential goal,” a “precondition for strong sustained labor market,” he said. “You cannot have maximum employment without price stability,” he said. “We have to restore price stability”

“We’ve had price stability for a long time and maybe come to have taken it for granted. Now we see the pain. I’m old enough to remember what high inflation is like,” he said.

“If we knew then what we know now, it would have been appropriate to move earlier” with rate hikes, he said. Which is funny; lots of people, including me the little guy, “knew then” – over a year ago – that inflation was developing into a massive problem very quickly.

Powell pointed out several times that the economy was strong, and that the labor market was historically tight, “too tight,” with 1.7 job openings for every unemployed person, as he kept pointing out, and that the economy and the labor market can “handle tighter monetary policy.” And I have long agreed with that. It was a huge series of massive policy errors to have waited this long.

“How far behind the curve?”

It’s funny how this went down at the press conference. Powell was asked several times in different ways how and why the Fed had gotten so “far behind the curve,” and why the Fed “made the choice to let inflation run longer above price stability” by not hiking rates sooner. There was some real pushback on Powell for having brushed off and ignored the inflation monster for over a year.

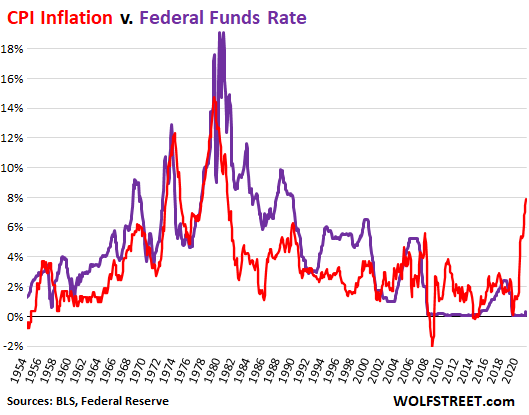

This pushback named explicitly the ridiculous negative “real” interest rates, with the effective federal funds (EFFR) rate at 0.08% before today, and CPI inflation raging at 7.9%, making it the most negative “real” EFFR ever, at -7.8% before today, and about -7.55% going forward.

In the data that goes back to the 1950s, there were only two occasions when CPI inflation shot through 7.9% on their way up: October 1973, when the EFFR was 10.8%; and August 1978, when the EFFR was 8.0%. After the rate hike today, the EFFR is going to be around 0.33%!

These record negative interest rates constitute a record amount of fuel that the Fed is still pumping on the raging inflation fire, and today’s rate hike was way too little, and way too late. Note the tiny uptick in the EFFR going forward, compared to the spike in CPI:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Now more feckless than reckless?

I think what steams me most is the Fed’s apparent abject fear of a recession. Big deal, so the economy contracts a % or three. GDP would still be above pre-Covid levels, and likely bounce back to a new ATH in a year or two. Instead, they choose to allow an erosion of purchasing power to the tune of ~5% last year and 10% this year (much worse if you’ve been unsuccessfully house shopping or waiting to buy). That’s a >15% PERMANENT loss.

Several on this site have said that decision has benefited the rich. That’s not entirely true. The greater the proportion of your net worth in cash, the greater the hit. Lots of wealthy people, people who have lived well within their means, not taken much risk, done all the “right” things by saving, etc., have very conservative holdings and have taken it on the chin.

“The greater the proportion of your net worth in cash, the greater the hit.”

Yes Scrooge McDuck and his money vault is feelinf the pinch, but I’m certain the ultra-rich aren’t so liquid.

Beyond what is FDIC insured I’m not sure who is carring excessive liquidity.

not the ultra rich, but the middle class family that managed to scrimp and save $1 million going into retirement and can’t afford to lose it, so kept it mostly in money market accounts, is getting screwed, so that wall street pigs can get rich.

Mr. Obvious says: The system holds a record amount of so-called cash right now – the Feds made it so – and every bit of the Fed’s liquidity has to be held by someone at all times.

P.S. What you’re calling cash isn’t cash, it’s short-term credit/debt.

Scrooge McDuck had his vault filled with gold coins, as I remember it.

Liquid currency in that universe, as I understand it. But I hadn’t considered people would be heavily invested in money market funds.

I just thought it went without saying that the more exposed you are to inflation’s effects, the worse it will hurt you. For me, the asset class is being affected, but their eyeballs are on their rising valuations, not the implication that those numbers are less meaningful due to dropping purchasing power.

“Permanent Loss” is the whole aim and purpose. Moving money through inflation, from your pocket into the black hole in Washington, makes inflation the indiscriminate harvesting combine of Federal Money Farming. It is much like gravity in the sense that average people don’t understand it but they know the effects and can’t seem to avoid it. Insidious and immoral thievery.

Looking at a number of Wolf’s graphics is like seeing a serious horror flick. It’s ignored for one’s own sanity’s sake but never forgotten.

For instance the graph of the CPI vs FFR suggests that the current Fed is either dumb as a wedge or the corrupt financial arm of a criminal organization.

What feckless. They tax us at 10% per year, or more. No representation, no elections. The cartel laughs at us.

They say they will raise to 1.75% by 2024. The inflation will be 17.5% by then. More WTF charts.

Agreed. They have to raise the prime rate more to slow CPI inflation. Until they do, people will capitalize on that negative spread for (short term) profitable speculation, exacerbating inflation.

And to be more specific, since supplies of physical assets are low, you can use loans to aquire essentially all of this “collateral” (corner the market), quickly driving prices to the moon. It is a self reinforcing destructive cycle at this point, leading to huge guaranteed (short term) profits that push up inflation. The only thing that can stop this mathematical juggernaut is morality, lol!

For much less than $400 billion, you could buy essentially every house on the market right now, except those at the very high end. Chump change, considering the conforming loan limit was just raised by 20% by the FHFA, allowing “poor people” to come in behind you and pay the conforming limit price, or above, thanks to Freddie, Fannie, etc.

And that’s why historically, prime rate has *always* been higher than CPI — morality and social stability concerns, which no one remembers or cares about anymore, especially at the Fed.

graph of CPI yoy% – prime rate:

https://drive.google.com/file/d/1vJQc7CFcojimwoKeKiQkqpyI18ZLm7So/view?usp=sharing

And that’s not trapped ? Give me a break ……

In a system that BOASTS of “checks and balances”…..who checks the Fed?

In a system built on taxation only WITH representation….what is promoted inflation other than a tax? and who has representation on the Fed?

Jeffrey gundlach had a interview yesterday,said U.S. is 168 trillion in debt on a economy of 24 trillion were up the creek with no paddle

“They tax us at 10% per year, or more.”

Yeah, but most of the idiocracy doesn’t realize that inflation is a hidden tax.

And on the “representation” thing, the lack of it has been going on for a long time. Taxation without representation. Where have I heard that before?

The Fed promotes 2% …..

Would a 2% tax on dollar holdings pass a Congressional vote….by congressmen who must answer, eventually, to voters? No.

So why is this accepted policy by the Fed?

Only Congress may tax, and that power can not be delegated. Constitution.

Auld Kodjer,

Still reckless. But rates are going up.

Average 30-year mortgage today at 4.5% upon the news. Up 150 basis points since Sep 2021. It’ll be 5% in a few months when QT starts.

Corporate bond yields have come up a lot.

This is happening. It’s just happening slowly.

I think the many want the 10 yr to quickly(instantly) reach the inflation rate, to crush the stock market and avoid letting the rats leave the sinking ship with gains earned through fraud and manipulation by the Fed and corporations.

Exactly. So the opposite has to happen. Obviously.

I feel like Wolf you are trying to find the silver lining in this. “Happening slowly” instead of “Happening too slowly.”

If applauding these folks for something better than nothing policy actions is the only reasonable way to frame things given the circumstances, OK.

Agreed.

The intentional SLOWNESS is a policy decision in itself.

The “we’ll keep a close eye on it” is becoming laughable.

“Procrastination is irresponsible and probable deceit.” Dietrich Bonhoeffer

applies to Fed policy.

“Look, he’s hemorrhaging ! Let’s keep an eye on it”…school of medicine

You do realize that COVID has NOT gone away, and it continues to evolve into ever more infectious variants.

Yet another COVID surge has started in Europe and China, and testing data on COVID in sewage samples across the US has also shown signs of a sharp increase in the amount of COVID.

Meanwhile, Congress just cut funding for testing and treatment for COVID. And everybody is going maskless and thinking we’re all done with COVID

If things go like they did previously, we’ll hit another huge COVID peak again in a couple of months. Expect to see more supply chain disruptions also.

This article isn’t about that. Please stay on topic. Nobody else except you is allowed to comment here on that topic.

My prediction:

1) FED announces balance sheet plan in May.

2) They kick off with $75B ramp up in June.

3) By June, 10YT is at 2.425% & 30YM is at 4.85%.

4) REFIs are down 85% YOY & new loans are down 40%.

5) $100B taper starts in September causing a notable steepening of the yield curve.

6) January 2023 the FED is forced to rethink its tapering program, since the US is on the brink of a recession.

7) 10YT peak 3.25% at 30YM rates peak at 5.25% in late 2022 causing the housing market to begin its much needed roll over with REFIs down 97% and new loans down 53%.

8) By February 2023, the FED ends QT and actively begins discussing QE.

Great comment. Something I can evaluate, mentally test and plan around.

Woohoo, 3% CD’s soon! That will Whip Inflation Now!

Wolf,

You’re missing something.

Consier who is *actually* buying the housing.

It’s mostly institutions and they are *awash* in dollars that they are trying to unload given inflation fears. For that group mortgages were a convenience that was enabling them to commit as little capital up front as possible to purchase hosuing; thereby allowing the remainder to be used for other means.

It’s going to be really interesting watching new housing starts in later months; I expect they will plunge to near-zero for the very simple reason that it’s becoming outright impossible to build any houses due to the labor shortage, supply chain issues, etc.

In sum, whether we are contemplating the purchase of new or existing housing – mortgage rates are fast becoming irrelevant.

BigAl,

“It’s mostly institutions and they are *awash* in dollars that they are trying to unload given inflation fears.”

No, it’s not mostly institutions. They’re buying some homes, but only some.

The big headlines your read about institutions buying homes is about institutions buying whole portfolios of rental houses or apartment buildings from developers or other institutions. These are already rental properties that are getting shuffled around by the big guys. People just read the headlines and never figure out what’s going on here.

The number of houses that are not already rental property and that are being bought in the open market by institutions is relatively small.

iBuyers are institutions (Opendoor, etc.). But they’re house flippers. They buy and they sell. They don’t really impact the inventory on the market, in theory, but when they get backed up and cannot sell their properties, that’s when problems arise with them, which is the case now.

Only about 20% of homes are purchased by investors, and I don’t think that I’ve what percent of this portion is from institutional investors. So I agree with Wolf, you don’t really have a good handle on this.

Also, you state labor & supply issues. Well, I hate to tell you, man, but there’s not a shortage of lumber. Rather, it just costs out the wazoo to purchase. So again, you really don’t have a handle on things.

Last, mortgage rates do still matter. Once the 30YFRM gets to 5%, the REFI market will nearly completely dry up. And, 1st mortgage applications are most likely going to be down upwards of 50%. At 5%, the only buyers will be investors and well capitalized prior home owners who are moving up.

I agree. Up but slowly just like the FED wants which isn’t a bad thing for the housing market at least.

The next 3-4 months will be the final rush to buy into the market. By July with mortgage rates will be at above 5%, and the market will start to flatten out except for a handful or markets, mainly on the coasts.

JayW,

Your comments keep getting tagged as spam and end up in moderation. I don’t know why. This could be because they’re routed through a server that is known to generate spam. This does happen to some people here, and sometimes for quite a while, and I cannot do anything about it, but usually it gets resolved after some time. Please be patient.

It was hard to sit through Mr Powell’s press conference which is essentially slightly modified ‘Jaw Bonning’ with a new flavor. If he was serious, he should have started QT, right now!

The mkt indexes shot up! Why? B/c Fed is still dovish under neeth and will come rescue, if the mkt dives. They recognize the 25 bps bump ia a ‘policy’ error and will replay late 2018 play

Call me skeptic but I don’t think rate will 200 basis points at the end of this year!

Well said. I think its most probable scenario because rate hikes may break markets way before it can dent inflation.

Fed already downsized rate hike from 0.5% to 0.25% in name of Ukraine.

Now Saudi’s are in talks to sell oil in Yuan. If it happens, the dollar decline would be enough to make a complete U turn.

Raj

“may break markets way before it can dent inflation.”

The Fed’s duty is “price stability” not to defend spiked real estate and historically high PE ratios. Maybe the stock market needs to find a real level?

Yeah, price stability is not wild bubbles. Has JP not seen the meme stocks and QQQQ silliness, rents screaming upward, etc.? Why don’t JP and company (and the public) effectively see that, even NOW? I feel I am living in a Bizarro world, a comic book funhouse mirror. Except no fun.

I can’t recall the exact quote, something about being blinded to what one is being paid not to see.

“I can’t recall the exact quote, something about being blinded to what one is being paid not to see.”

It is difficult to get a man to understand something, when his salary depends on his not understanding it. – Upton Sinclair

historicus,

Here’s the problem.

Those inflated asset price levels are attractive to overseas investors who make these asset purchases with dollars. Thus it helps to strengthen the value of the dollar.

It is somewhat unintuitive – but there is a case to be made that higher interest rates could actually *hurt* the dollar this time around because it will reduce the attractiveness of USA assets for overseas investors. And nobody really wants to touch the sovereign debt of Western countries any more (which – in earlier times – attacted foreign investment when yields rose).

It’s a brave new world I guess.

What we need is the Saudi oil production to completely shutdown. Bury it.

This was my take also, Powell is a man telling his wife he won’t sleep around ever again, then turning to his next mistress and giving her a big wink.

You’d have to be a fool to believe him. In the UK Carney was known as “the unreliable boyfriend” in the press because of his constant lying.

I am wondering when Powell will be fired. The masses are angry and there are election in 8 months. It is important to be seen to be doing something. The fed might yet turn hawkish.

First he has to get approved by the Senate, which hasn’t happened yet. If he doesn’t get approved, there will be a new chair.

He is doing exactly what those who finance the senators want, so will be approved.

If he gets approved by Senate, its an endictment on them. JPow is by far the most incompotent, inept ever to take the position. This clown has done more permanent damage than ever in history to the American public with his reckless, careless policy moves.

“a new chair” picked by the multi-millionaires in Congress to protect themselves and all their rich friends.

Gee that’ll be some big change.

Other than making Raskin walk the plank, wonder what else is going on in those Senate negotiations…

I suspect the ruling elites want to avoid triggering a recession and subsequent chaos before the election in November.

Market peaks and recessions are suspiciously close to elections, and 1980, 1992, 2008 and especially 2020 were not pretty. 2000 was much cleaner.

Likely it’s not the market peak that concerns the elites, it’s high unemployment at election time – recall the 1992 Dem slogan “It’s the economy, stupid”.

So they’ll let the poor suffer inflation for a few months (more…), but with full employment for as long as possible, so that the elites and their Congressional lackeys don’t lose power to an angry unemployed mob in November…

As long as he is raising rates this little and this slowly, his job security is in tact.

Pretty wild if this is all one guy looking after himself and his Goodfellas over the welfare of hundreds of millions.

Guido,

Regardless of what the fed does or doesn’t do – there will be anger.

An oil supply shock and other supply chain issues will inevitably carry with it higher inflation and demand destruction in many sectors. There is no reason that these can be resolved in 8 months or any forseeable timeframe.

Gazillion miles behind, and they will stay that way. At least until Powell is re-confirmed, and after the election.

Then they have one year to solve this before the 2024 election run up. They fully understand the box they’re in, but politics is number one in DC and everybody wants to keep their fancy jobs.

Powell showed up to a raging inferno with his squirt pistol again. This time he forgot to even put the water in it, so it was full of air. How this guy still has a job is beyond me. A 25 basis point rate hike in the face of the most massive inflation in over 40 years? This guy is a major tool.

JPow has the mind of a criminal…looking out for his and his cronies. How is thia nonsense tolerated?

Depth Charge,

Remember it’s the FOMC committee that votes on the actual increase.

Only one member (Bullard) even voted for a 50 basis point increase.

There are probably grounds for a 750 basis point increase.

” he should have started QT, right now!”

Yep. They need months to figure out how the balance sheet will come down? It could be decided in 30 minutes. What else do they have to do?

It is a one-way ratchet (racket), like gas prices. It takes 5 seconds to drop rates (raise gas prices), but the reverse is made to seem extraordinarily slow, complex and difficult. While the masses pay actual money for this asymmetry.

historicus,

If they are not careful with how they unwind the balance sheet…

…well just imagine a world where no USA manufacturers or farmers can produce anything because they can’t borrow any money.

That nightmare could – aboslutely – be in play if there is an unchecked deleveraging arising from a poorly-timed balance sheet unwining.

Remember what happened in the repo markets in the summer of 2019?

This is like walking a tightrope while juggling molotov cocktails all the while with a thermonuclear bomb perched on one’s nose…

Yeah this will be the soft landing. Or maybe that’s just Powell teabagging me every day at the grocery store and the gas pump. “Powell keep your big sack of dough off my chin!”

Haha. I did laugh out loud.

Reminds of being thrown a water logged life preserver, after the anchor tied to your legs has pulled you down beyond reach.

Wow, a 2 percent rate increase for the year! Sounds like a tip, but who’s paying the bill?

Yeah. Hurray, I only lose about 6.5% of my savings this year to inflation, instead of 8%!

And, what if they use this accumulative 2% adjustment to partially counter any COLA adjustment in January 2023?

Who’s paying the bill?

Who’s paying the negative rate bill for the past 12 years?

“When central planners decide, they intentionally aid one group at the expense of another.” Hayek

And who are the ‘other’ planners? Don’t planners always aid one group at the expense of another? If the oligarchs own Congress and Congress controls the nation’s money supply, then the oligarchs are the real planners. They are the central planners.

“ Reminds of being thrown a water logged life preserver, after the anchor tied to your legs has pulled you down beyond reach.”

For some reason, it reminds me of the honey badger in the Gods Must Be Crazy movie…

With inflation being the honey badger… and Powell being the guy…

When I see that, it cracks me up… every time…

Look it up on u-tube if you don’t know it…

Fed wants to push the US economy into a modest recession. The only problem is that the Fed has never been able to achieve such a delicate achievement, and the most likely outcome is a violent slowdown coupled with a quick easing of monetary policy, i.e., a policy error… precisely why risk assets soared later in the day.

(zh)

The economy is already in recession. The FED wants to provide lip service to cushion the blow, along with a couple token rate increases. After the next big (enter name of boogeyman here) event they’ll reverse course and start buying MBS and bonds again. And this time they’ll include ETF’s, just like Japan CB. The markets will wake up to this by next week and resume their downward fall. SPX 3,200 is the new FED PUT, and until they hit that the rate increases will continue.

JM,

“The economy is already in recession.”

BS. Look at the data for a moment, instead of listening to some gold bugs. Here are retail sales in February, released today, up 17.6% from a year ago:

https://wolfstreet.com/2022/03/16/americans-make-huge-efforts-to-keep-up-with-raging-prices/

I think he meant to say –

The economy, minus the freshly printed $trillions, is in deep recession.

Could they be hoarding in the light of expected inflation? Could hoarding explain hand over fist buying? I know we have been hoarding dry foods since November.

Is that inflation adjusted ?, asking for my business that has had to raise the sales price of fabricated steel products by 57% and we are still losing money hand over fist. Sales growth does not equal profits but I might make it up on volume if I could source enough product. I am screwed.

RTGDFA that I linked

OOOps I couldn’t even get reservations for St Pat’s Day. Every Irish pub was booked morning till night. No recession there. War’s, gas prices, inflation up the wazoo, don;t matter. Be careful on the roads tonight. A lot of firewater will be consumed tonight and these minions will be out on the roads in droves.

I am thinking about the sharp change in the 10yr/2yr yield curve , if it means anything. It is coming to us as fast as it can be imagined ,any thoughts?

Wolf,

This is called “demand pull” – it’s very typical to see this at the start of a high inlfation environment.

Jettisoning one’s fiat is just what one does when presented with such a situation.

Wolf,

Retail sales up 17.6% because inflation is up 25%. The more prices rise, the more $ is spent. Come on, I thought you were smarter than this….

Inflation is not 25%. You’re in fantasy land.

25% inflation means your income needs to DOUBLE every THREE years. Do some basic math.

Wolf, if you look at the same graph for Real Retail Sales adjusted for low-balled CPI inflation components, it does not show a continuing spike but a distinct consolidating pattern in a topping trend. A good half of recent, 6 to 8 month’s of recent surge in year-to-year gains in non-adjusted retail sales is due purely to inflation. IMHO, we are not going to the moon from here in retail sales, too many inflationary headwinds, not to mention higher and higher interest rates on everything but our bank accounts.

JM – You have to have negative GDP growth for a recession. Nobody is cutting back spending yet.

– Housing prices are still firm

– Unemployment is low and has not increasing…yet

– spending is still up

– credit card defaults are not increasing.

– unfilled jobs is still very high.

Now every time in the past 30 years when the FED raised rates by more than 2% in a 2 year time frame led to a recession. This Ukraine war and rise in commodities may hasten a slowdown though.

For a year or so, Powell has been talking about doing something to fight inflation. Today, we got a tiny rate increase, and now we will have to wait to learn what the Fed is going to do about reducing its balance sheet. Perhaps Powell will announce in May that the Fed will start reducing its balance sheet in December. In my opinion, restoring normalcy to long-term rates is more important than raising short-term rates a few points.

It’s not by accident. The people that benefit most from high inflation and low rates are…….you guessed it, THE BANKERS and their Wall St cronies. The middle class is dying off bit by bit every month. Powell will never raise rates meaningfully or it will crash all bankers’ assets. When the Yuan becomes a commodity backed currency the USD will be in free fall, then your purchasing power will drop 50%+ in less than a year.

JM – That is partly true.

What is really happening to the middle class is monopolies in almost every industry. It is killing the mom and pop middle class business owners.

Big business lobby government. Pay for political campaigns and get laws passed that benefit them and not the middle class. Everything is turning into a gig job with no benefits.

Just go read about how Dollar stores are killing the small town mom and pop grocery stores.

I had a friend who lived in a town of 4000 people . They had 3 grocery stores and other mom and pop stores like clothing, auto parts.

Walmart moved in and now and all the grocery stores closed, clothing stores closed, and autoparts/hardware stores closed. The middle class business owners became minimum wage workers at Walmart.

All the profit from retail sales stayed in the community with the mom and pop business owners. Now all the profits leave to Bentonville Arkansas.

The real profit is going to China.

Assets reverting to true value is hardly a crash 😆

It really shows how people are led by the nose.

We know rates need to be far higher. But Powell sets up his stall at zero raises. Then after lots of howling he eventually comes out and says “well I don’t know”. More howling. “Ah I don’t want to do this but you guys…0.25%, maybe”. More howling. Eventually he comes out led by a brass band and a man eating fire. I Jerome Powell am here to give you the thing you have asked for! 25bps!

And the crowd go wild! We thought he wouldn’t do it, just look, he did it! That crazy guy did it!

Well, no. I’m still able to think. I’ve not been hypnotized. Powell is a rentier in mid filibuster.

georgist,

Average 30-year fixed rate mortgage hit 4.5% today, upon the news. Up by 150 basis points since September.

The average 30 year fixed rate mortgage interest rate is currently 57% below the rate of CPI inflation. How long before the two are even equal?

The value of the debt is currently evaporating at a rate more than twice that of the interest you pay on a mortgage. Is it really any wonder that house prices are currently shooting up at ~20% per year in many metros.

All the while the rich get richer, the poor get poorer, and the middle class shrinks.

So just 16% profit this year in Canada at zero risk, guarded by the state.

On the ground report. Mid march and almost 70 deg. in flyover country yesterday.

30 years with this business. The phones have never been this quite in March. Very happy this time around we are prepared.

Business tied to home construction.

The gas spike is offsetting the increased in mortgage interest rates. People will be moving back into the cities and closer to their jobs, in spite of the high crime rates. Pandemic flight from the cities is no longer a factor in dampening demand. This happened in the late 70s. when the second oil embargo took effect and we had gas lines and is happening again.

Or, he will announce at the next meeting that they will “start” QT at the following meeting, without numerical targets for what that means.

Right. They’re stalling, and even though people ask them why, they don’t answer.

“They’re stalling” And they’re trapped. If all they’re doing is a baby step .25% – when true inflation (1982 CPI) is above 15% – they are trapped.

It’ll become obvious when the Banker’s FED panics at the stock market and real estate crashing at the first few “baby steps”- and resumes pouring counterfeit gasoline on the fire they lit.

Confused.

The Federal Reserve Act 1977 states that the Board of Governors and the FOMC should conduct monetary policy “so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.”

Notice the third mandate…”moderate long term interest rates.”

(moderate = not extreme)

This was put in place to prevent exactly WHAT THE FED ACTUALLY DID……pound the long end, allow massive debt creation burdening future generations, force investors to take more risk.

Never mentioned is “moderate long rates”… always omitted via the “dual mandate” mantra. There are three.

If the Fed had been held to the third mandate, much of this mismanaged monetary policy would have been prevented.

Historicus is on to something here: the Fed should be concerned about “moderate Long rates.”

The problem is in interpreting the word “moderate.” “Moderate” compared to what, I ask?

If “moderate”compared to inflation, it should move dramatically in proportion to the gap between FFR and inflation.

If “moderate” compared to where rates were last week or last year, then it should move SLOWLY.

The reality is that long-term bond cycles last for a couple of decades, and as Mr. Richter says, the bond market doesn’t “go to heck in a straight line.” It zigs and zags, on its way to its next stopping point.

Yesterday’s move was a mighty small zig, but (barring significant recession later in year), the 1.75% intended move for 2022 is much more understandable.

Weak as 0.25% is, let’s not get too hung up with this fraction of yesterdays overall shift in policy.

***All that said, Fed manipulation of the economy using the free market for bonds and interest rates sucks!!***

They have to let cmbs roll off and sell now without alerting the market or it will never happen, Powell is trapped and he’s allowed himself to be.

If the labor market can deal w higher rates, Mr market can be left to ensure its own liquidity and have some peace discovery

Buy AU/AG now or you’ll regret it. The wheels have come off the bus.

Count me in your camp, JM.

USD is being actively debased, first via rampant printing, and now by

sanctions and confiscation of foreign assets and central bank reserves.

Countries like China, Russia, India, etc. can no longer afford to rely on

USD for trade or savings. They will be looking for alternative form of

money, and gold may be just the thing IMHO.

Is Fed behind the curve because it thinks that Rate hikes will break markets way before it can dent inflation. If so, it may make a U turn again.

What is exactly is a “break” in an overvalued market other than a correction?

Maybe markets NEED a correction rather than constant goosing by the Fed.

I bet when you owe the IRS or Canada Revenue money they take action faster than fighting runaway inflation that is happening in the G7.

When you pay tax above a certain rate in Canada the CRA contacts you at the start of the year to pay them in advance otherwise they will miss out on the interest they would have collected pro-rata vs if you pay them at year end.

So in Canada I pay 50% marginal. Housing is going up like the US national debt clock. Potholes in every road. My shopping bill is higher every week.

And then I get an email from the CRA about paying early “because interest”, when the rate on my savings account is something like 0.1%.

ps housing is up 50% in 5 years

Housing have more than doubled in price since 2015 in Canada. From Goggle: Back in 2015, the average Canadian house price was $413,000. But by the end of 2021, the average had reached $811,700 — a 97% jump.Feb 18, 2022

Add about 6 percent to the 97 percent as of March 2022 and they’ve gone up about 103 percent since 2015. If you factor out Alberta prices have gone to the moon the last 6 years.

I wonder if the Prime Minister, Finance Minister, Adam Vaughan, Tiff Macklem and the central bankers will one day face trial for TREASON against the Canadian people.

This is unbelievable. They are allowing Canadians to suffer in inflation while celebrating real estate gains. If Canada were France, there would be a trial system named Place de la Revolution.

You’ve got that right Revenue Canada charges a 2 percent a month penalty on unpaid taxes or money owed. They can also garnishee your wages.

This was hawkish for you WR? You’re in dreamland if you think so. This was a hike because they were forced into it. It will be reversed and QE started at the first sign of trouble, maybe by q3/q4.

Average 30-year fixed rate mortgage hit 4.5% today, upon the news. Up by 150 basis points since September.

Since my life is so boring, I will be watching with a close eye the “price reduced” properties on Zillow.

I’m curious what that increase will change.

And if people can borrow 3.5% below the inflation rate for 30yrs….they will….especially corporate money looking for a place to go.

We had 3% 30yrs and inflation under 3%. In a sense, the arrangement is now more attractive to some investors. IMO

Meanwhile, housing starts are at a sixteen-year high but lumber fell 20% today?

Makes sense to me.

It did? That’s not what futures did. The limit down is just a couple percent.

Wolf,

if we define “real” mortgage rate as the absolute mortgage rate minus the inflation rate (CPI or CPE), then how did it change between September 2021 and February 2022 ? I have a feeling that while absolute mortgage rate increases as you pointed out, inflation increases faster, and therefore “real” mortgage rates becomes more and more negative (i.e. more stimulative for housing market). Could you please tell us if this is indeed the case or not. Thanks in advance.

Let’s say we have two people. One is an entrepreneur. The other is a landlord.

The entrepreneur. He’s got a great idea for a business, but he needs a loan. This great idea – do you think he is aiming for 2% ROI? No, he’s going for 10% or more. So what happens if you raise rates to 4%? This guy still starts his business.

The landlord. He’s hoping to borrow to get yield on an “investment” property. If he can borrow at 2% he can pay the insanely high real-estate prices and make the 3% yield, leaving him with 1%. What happens if you raise rates to 4%? He won’t buy the real estate unless it drops to a point where his yield becomes 5%.

And that is why Powell is dragging his feet. He’s not looking to foster enterprise. He’s looking to prop up assets and rentier activity. The mainstay of the West.

SoCal Joe is going to come to your house and slap you in the face for such hearsay!

Out of the money stock options in crashing story companies means no free money to buy RE in the respective regional markets.

Wolf,

Does no one at the Fed notice how distorted the curve has gotten? 20 yr and 30 yr have been inverted continuously since late October. Now the 7 yr and 10 yr have inverted with the 5 yr in the on-deck circle.

All talk, no action. 1.9% FFR by the END of 2022? Who can take these juveniles seriously? What do they smoke at these gatherings?

I’m with you. Should have hiked 100 bps today. 150 in April, 200 in May, June, July and August. That’s what serious, sober monetary authorities would do.

At this rate, inflation will be in the low teens by summer, if not sooner. Go long wheelbarrows?

The Fed is going to do QT and that will push up long-term yields and steepen the yield curve majestically.

Right now, the Fed raised the front end of the yield curve and is still holding down the long end with its huge balance sheet. QT will change that, and that’s why the Fed will start QT soon.

Average 30-year fixed rate mortgage hit 4.5% today, up by 150 basis points since September.

Why didn’t the FED raise 50 basis points, and start QT today? Why not 100 basis points. Why are they stalling, Wolf? Nobody has answered this.

Depth Charge,

It should have never started QE. It should have raised rates in May 2020. We know why it did QE and interest rate repression: to make the wealthy wealthier. It thought it could get away with it without triggering this massive inflation. Now it got caught with its pants down. And it’s going to reverse course, but it’s not going to do it all in one day, but it will reverse course over time because this kind of inflation is bad for the asset holders too. They’re not stalling. They’re going a lot faster than people expected a month or two ago.

Here in Canada, those who bought homes in 2020 resold them for as high as double the value they paid for. I heard that there is no capital gains tax enforced.

But try owing student loans or the CRA, and they garnish your bank accounts faster than the latest supercomputer.

HR01

The next CPI and PPI will be ball busters…..

but the excuse is already baked in…

Its “just the Ukraine” numbers finally hitting……move along, nothing to see here, in the market.

Well, after the .25% hike I can most assuredly state the FR is taking care of the precise people it wants to.

Unfortunately I ain’t in that group

Damn that dicksquirt Powell, damn him to hell

J POW is an absolute rockstar! He could have just stood there without saying a word and the stock market would still rally on his presence alone.

Imagine if Yellen we’re still Fed chair???

Powell is a very smart, savy, financial guy who respects (I believe) Volker greatly. But, as your readers may recall, there was no halo on Paul Volker’s head in those early 80’s…he was viciously condemned by Congress and the most hated man in America. Today, can U imagine what Congress would do to this guy with 100 point moves, reverse repos, etc., etc. The wackos would be picketing his house, throwing rocks (if he’s lucky they’re not Molotov cocktails) thru his windows…he’d be called all these hateful monikers we now hear regularly and the papers would crucify him for weeks/months on end. Anyway, I think that’s in the back of his mind and explanatory to his extreme cautious’ness. Best…PJS

What a ridiculous statement. Powel stood there and did nothing except print money while the inflation went up 10% under his watch.

andy,

Do you think any other member of the FED would have done differently?

Or any other candidate that could be confirmed by Congress?

I find it absolutely hiliarious to read the likes of Stephen Moore (a one-time candidate considred for Powell’s job) lambasting Powell’s inaction on rates..

…given that Moore, himself, was pushing for negative rates while Trump was in the white house.

“When vice prevails and the impious bear sway, the post of honor is a lonely station.”

Volcker stood to his post…

Powell does not.

All one has to look at is the CPI FF chart provided…and look back pre 2008…even Greenspan checked “over whelming exuberance” ..

The Fed is supposed to do certain things… and the Fed starting with Bernanke is a different animal, one designed by others rather than guided by mandates/instructions/agreements that allow their existence and special powers.

Powell is protecting the banks and the Wall Street cronies. He’s one of them too. This “soft landing” is giving all the wealthy time to exit their positions and inflated assets before things go south.

Anthony A.

Agreed

Powell wants to protect his private equity buddies, hedge fund managers as well as the Wall Street establishment. He doesn’t want the system to blow up on his watch like it did in 2008. That’s what would happen if he did what many are suggesting. Middle class folks and retirees losing their savings and purchasing power are just collateral damage in his book.

A good question would be: “why the hell were you buying MBS when the housing market was a raging inferno?”

Best question ever. One that I hope is asked over and over in the future.

I’d be happy to see it asked once.

Gee….

Dare anyone ask?

2006 the Fed owned no MBSs

Now, the Fed owns 24% of all residential backed MBSs.

Why? Great question. There is a bunch of great questions never asked.

At one point, the Fed held no U.S.Treasuries.

Welcome to 110 years of mission-creep!

Here’s the answer: in a post scarcity world high land prices force people to work, which enables capitalists to continue to extract surplus value.

Actually we should thank President/Chairman Xi for providing air cover to the Fed.

What is so interesting about the CPI vs FFR chart is that during the 70’s and 80’s, the FFR led the CPI and that the FFR was greater than the CPI at the tops of the CPI spikes.

Now the FFR lags the CPI with today’s pimple-on-a-gnat’s-a$$ rate increase of 0.25.

So, if history is any indicator, at some point in the future, the Fed will have to increase the FFR at such a rate as to cross over the CPI and once again, lead CPI and yield a positive “real” FFR.

Even with hypothetical 0.5 FFR rate increases at the next 7 meetings and today’s 0.25 increase, that puts the FFR at 3.75 by EOY. CPI is currently 7.9.

The Fed must raise the FFR much faster than current projections to rein in CPI.

“Now the FFR lags the CPI with today’s pimple-on-a-gnat’s-a$$ rate increase of 0.25….The Fed must raise the FFR much faster than current projections to rein in CPI.”

Exactly. Think of inflation as a vehicle moving 8 mph, and the Fed Funds Rate as a vehicle that is stopped. In order to catch that vehicle, the stopped vehicle has to go faster than the 8 mph to catch up. Yet the FED has decided to try to catch a car going 8 mph by driving 1/4 mph for a while. Then they’ll tell us in a month and a half if they’re willing to speed up to 1/2 mph. Meanwhile, the car going 8 mph is lost in the distance.

Agreed.

Inflation is a race to the bottom.

The 8% price increases we have seen, (more to come in next report) is baked in. Thus, even if we revert back to 4%, 3%, 2% inflation…it will be tacked onto the 8%.

If 8% is year one, and if the Fed’s goal of 2% is in effect for the next 9 years, the dollar purchasing power will drop about 30% in ten years!! And that’s if we go back to 2% inflation which is highly unlikely. So plug in 3,4,5,6% and we can see how bad this is going to get….and 1/4 pt incremental raises won’t do a thing.

The outcome at this point = it does not end well. Even a small uptick in interest rates will prove lethal for goverment balance sheets, probably corporate as well. That is probably why they haven’t raised before this. The raising of rates will likely accelerate the ‘inflation’ in the short term before this blows up in all our faces baring WWIII from happening before that.

“Even a small uptick in interest rates will prove lethal for government balance sheets, probably corporate as well. ”

To me this means these borrowers were betting…and bet wrong. When did debt become good? Real costs must be placed on debt creation, and that has been missing for the past 12 years.

Did any of these debtors ask “what if…..”? Or did they just float debt for meaningless government expenditures….stock buy backs, venture capital games?

Example:

Just one part of the 2,700+ page omnibus bill that funded the U.S. government to the tune of some $1.5 trillion.

As RollCall explains, “the $5.9 billion fiscal 2022 Legislative Branch funding portion would substantially boost the office budgets of House members” and “would provide $774.4 million for the Members Representational Allowance, known as the MRA, which funds the House office budgets for lawmakers, including staffer salaries.”

The increased taxpayer funding for congressional offices is $134.4 million more than was allocated in the last fiscal year — a21 percent increase — according to the House Appropriations Committee summary. In addition, congressional offices on the House side get $18.2 million for paid internships.”

This is what happens when govt borrowing costs are near zero….and this is to be defended?

“It was a huge series of massive policy errors to have waited this long.”

Shall we put it this way…

“It was a huge series of cozying up to the markets that has led to the Fed waiting this long”

Even with the inflation on a roll, the Fed wants to be in the same bed as Wall Street and does not want to leave it. Good luck with that. Thanks to the mean inflation fella!

“The Fed – the most reckless Fed ever – is a gazillion miles behind the curve.”

Truer words were never spoken. From a monetary standpoint, the Covid emergency was over within six months. The Fed should have started withdrawing its emergency monetary flush by fall of 2020. But it didn’t, and it’s paying the price now.

No … we’re *all* paying the price now.

No, our kids and grandkids will be paying for this all their lives [unless they just refuse to pay].

Jay’s hope is that there is a deflationary shock to the financial System some time this Year which will save the Fed’s blushes. He is treading dovishly in this vain hope…I trust actions not diplomatic Words, he is not serious about inflation. The Fed is 100% political these days.

“deflationary shock to the financial System some time this Year”

Like Russia defaulting today, perhaps?

It’s immaterial and expected.

> including me the little guy

… says the media mogul as he surveys his vast empire.

People with loads of doe, and past fixed low interest loans will be paying off their debts with deflated dollars when inflation is over 15%, the dollar is deflated, and the term petro-dollar isn’t the only game in town.

Unfortunately, the poor will suffer the most, and it’s membership rate will accelerate.

Hard to predict when the whole thing will crumble. Batten down the hatches for a rough ride

“Unfortunately, the poor will suffer the most, and it’s membership rate will accelerate.”

At my complex, they are sweeping the parking areas every night, and breaking into cars and the mailroom. Rents are rising the same crazy percentages as food items: go to the store and it is 25% up any day.

Sorry, but I don’t care what Powell says. “Certainly a possibility”, “will move more quickly than projected now.”. Bull crap, just more jawboning. They cut 150 points in the snap of a finger and now we’re getting the “we’ll take it under advisement” play. I still think we’ll get a couple of cosmetic rate hikes and then they’ll stall or revert. I hope I’m wrong, but until they actually do what they say and stand their ground it’s just more of the same.

Yep I’m sure I’ll just be another emergency like back when it started in 2008 and we HAD to pay all the banks

The 2008 emergency was never resolved. It was merely papered over with debt. Kicking the can down the road is the national pastime.

Meanwhile Americans are spending like there’s no tomorrow, which I would say is remarkably prescient.

unamused,

Welcome back. I miss the wit.

Thank you, root farmer. It has been a while.

RF:

Clearly NOT the same guy IMO,,, though certainly willing to learn, from Wolf only, that I am wrong, once again…

Wolf?

You bet … they can cut within days but take years to hike. It’s not clear why they think rates being too high is an emergency, but too low … not really any such thing.

Short term interest rates five, six, seven percent below even understated CPI inflation is an economic emergency. No excuse for the foot dragging. Those that complain they can’t raise now because the economy may be slowing down … well, that’s just one of the problems created by being so far behind the curve. Now they can’t *not* raise rates.

I’ll just repeat it: Average 30-year fixed rate mortgage hit 4.5% today, up by 150 basis points since September.

What a quick rise within the quarter. I know its based off of the 10 year treasury but I think home lenders will attempt to draw blood from stone every chance they could

The spread between the 10-year Treasury yield and the 30-year mortgage rate is widening. This is not unusual. The spread had been very narrow. It means that when the 10y rises a little, mortgage rates rise more. Part of this has to do with the expectation that the Fed will be more aggressive in shedding MBS than Treasuries.

It doesn’t make any difference to lenders unless they hold the paper which they mostly do not.

It’s securitized and sold to someone else.

Whether you take the punch bowl away quickly or slowly, the heavy drinkers head for the door as fast as they can.

Speaking only for myself ,the Fed’s response was a yawner. Not worth the time I spent listening to it today. Going forward it will be better time spent trying to protect what’s left of my buying power than listening to the Fed who is stealing it . Congress has more important things to do for its donors than my inflation/de-basement or the stealing of the time value value of money. Congress just got a 21% increase in its staffing budget, so why should it be concerned? Congress can out-run inflation and get a bonus to boot. F$&k you and me. There are external events that are for the first time actual emerging threats to King Dollar, and its crown prince the Petro-Dollar. King Dollar has been good to me and I have been a good vassal. External Events invading the realm are troublesome.

The Prime and retail interest rate will just affect retail borrowers like Joe Homebuyer and credit cards. If you want to slow inflation in rents and home prices, you have to raise rates at the Fed Window (Primary Dealer Credit Facility) where Wall Street goes to borrow at .25%. Actually, anyone with a bank can borrow and give a good deal to their friends. That’s why Grandma’s house goes for 75k over list price and all cash. This “Rentier Class” wants the passive/unearned income of rentals and has billions to invest in real estate. More cash that properties to buy. Just the competition between them raises prices then rents. So you have to raise the Fed Window rates to close to the inflation rate to stop the party. This has created the Greatest Transfer of Wealth in History. Read economist Michael Hudson on the Rentier Class. And this is part of the Great Reset; By 2030, “You Will Own Nothing and You Will Be Happy”. Read the new book by Glenn Beck: “The Great Reset”.

The FED created a desperate search for yield with its artificially low rates. Cashed up people would rather get easy returns with high interest rates in savings accounts, money market accounts, etc., CDs, treasuries, etc., but with no yield they’ve turned to unconventional type investments like single family residences, which are actually a b!tch to make money on, historically.

This served to drive house prices through the stratosphere, and the bubble gains were even better than the actual cap rate itself. Once the appreciation stops, many will be unloading them because, like I said, they’re a nightmare to deal with. Deadbeat tenants, leaky roofs, broken HVAC systems which cost $10k to repair, etc. Houses are money pits.

The FED has absolutely destroyed the economy over the past 25 years. In my opinion we need to go well beyond firing Jerome Powell. The FED as an entity needs to be severely neutered, and QE abolished and made illegal.

also, most of these “investors” are incompetent with their hands. so a leaky faucet or a dead electrical outlet which i could fix in five minutes they’ll have to hire a handyman.

well, there goes their margins.

Jake W. Your self-reliant,self motivated attitude will out-run inflation with a surplus. I have done just that during my life and it has paid off. A focused mind attached to use-able hands are a true blessing. People of modest means are becoming less so by the actions of the Fed and abetted by Congress. Productivity will demand it’s due. The reckoning will be brutal and it will come.

DC

Agreed. Single family homes are a bad investment especially when there are big mortgages on them. Condos are a lot better as there is little to no maintenance.

Ahh finally the QE was put out of its misery 🙏

Great article. The last time inflation raged this bad, the Feds interest rate was 13%.

So that’s 26 hikes of a half point, or 52 hikes of a quarter point.

Lol.

If they do 7 hikes a year, they are only gonna take about 4 to 5 years . But of course if they take long and go that slow, inflation rages out of control into hyperinflation and you kiss adios to the US dollar way before you’d get to 4 years.

Their rhetoric today and quarter point was akin to spittle in an ocean, claiming they would cause the sea level to rise. The US dollar is done folks. If you aren’t finding ways now to take those dollars and convert them basically to anything else that has intrinsic value, then you are an ant treading water in the middle of a toilet bowl that uses compressed air to suck you down into the sewer.

Mike R,

Let me just repeat it here since no one seems to be reading it:

Average 30-year mortgage today at 4.5% upon the news. Up 150 basis points since Sep 2021. It’ll be 5% in a few months when QT starts.

Corporate bond yields have come up a lot.

This is happening, and a lot faster than people expected it. It’s just happening slower than you want it to happen.

Mr. Wolf,

I read your blog regularly ( cause I love it, thank you for taking the time to write it) and comment infrequently because I understand little. I think we are reading it but what is getting misconstrued is that the rapid rise in the 30 yr, will be the catalyst to either end the rate hikes or cut rates again.

gRant,

CPI inflation is at 8%. The Fed is under intense pressure to deal with it. Powell said many times that households, businesses, and banks are able to withstand tightening, and the consequences of it.

Inflation is now the #1 issue and will remain so until it goes back down. If inflation goes back to 3%, the Fed might back off. But at the current rate of inflation, the Fed isn’t backing off.

This rate-cut nonsense floating around out there is just that … nonsense. ZH certainly has a lot of fun with it, and they’re doing it just for fun.

The Fed won’t cut rates when inflation is 8%. Not happening. We haven’t had this situation in over 40 years.

So if you look at 2019, last time the Fed cut rates, you’ll be fooled because in 2019, inflation was BELOW the Fed’s target.

If you look at late 2007, when the rate cuts started, you will be fooled because back then, the EFFR was over 5% (compared to 0.33% now), and above CPI (3.6% at the time), and the financial crisis was starting to hit the banks, with some smaller mortgage lenders having already collapsed.

None of the rate-cut periods after 1982 compare to what we have now because now we have this huge bout of global inflation, and the US has the worst inflation of the developed economies.

And the Fed has to deal with it to protect the dollar, to protect the dollar’s status as reserve currency, and to protect its status as trading currency. There are some big issues involved here. And the Fed does understand that.

Time to bring back those mortgages with adjustable rates with teaser rates for the first two years.

“Up 150 basis points since Sep 2021. It’ll be 5% in a few months when QT starts.”

Lol, Wolf that paragraph is now tattooed on my retina.

Fingers crossed. Its shocking to see 1 rate hike cause the curve to flatten so drastically. Discounting the “transitory” inversion at 5 – 10 it still bodes badly for future rate hikes unless the long end is allowed to correct.

4.5 % in my opinion is still good. It was around 5.5% October 2009 post GFC. The party isn’t over we’ve just turned the music down a little. Good old 3% a distant memory, but we can all handle this current rate.

The party will end when market sentiment tightens credit conditions noticeably. That’s what has forced or convinced central banks to change course, slow as it is.

Tighter credit conditions don’t just come from higher rates but stricter lending standards. It doesn’t matter how high or low rates or if no one will lend to you. That’s what happens when credit markets “freeze up” as it did in 2008.

If you look at US corporate balance sheets, it’s easy to see that in the aggregate, they are crap compared to prior history. But because of low interest rates and lax covenants, debt coverage ratios are high and it’s easy to borrow.

Raising funding costs something like 150BP alone won’t change the equation for many though not all borrowers. That’s how the conventional thinkers see it. They are looking at it linearly whereas when psychology changes, it’s a non-linear event.

In theory, someone can “extend and pretend” forever as long as someone will roll over the debt or increase the credit limit, regardless of the interest rate.

In reality, that doesn’t happen because sentiment does not accommodate endless borrowing.

I hate to break it to the Fed, but if people are wondering whether your rate hikes will be .25% or .50% then at least one of them needs to be .75% (or higher) to show that you are serious.

If Powell really does remember the era of high inflation then he should remember that as well. Granted that he isn’t battling DOUBLE DIGIT inflation the way that the Volcker Fed was… but once inflation takes hold you are trying to break a mindset that it is better to spend money today rather than save for a rainy day. Incremental rate increases won’t do that.

The way the Fed’s doing it is almost like: “let’s fine tune the economy so that inflation will rise 7.75% instead of 8%”. Hei, one’s 25 basis points lower than the other. We win!!!

More debt means we are in ever lower interest rate that breaks something big. Fed doesn’t know how much, but it is why they are talking so much and moving so slow and saying raising rates will not affect employment.

The asset mania combined with current inflation is far worse than inflation in the late 70’s and early 80’s. It’s not even close.

The budget was in deficit and there was some “printing” but nothing like now. Private debt was also much lower versus national income. There was no fake economy and the quality of GDP was much better without a massive trade deficit.

“ If Powell really does remember the era of high inflation then he should remember that as well. ”

He doesn’t remember squat… he was in extended college…

He just thought it sounded good for his image trying to sound like he feels the pain for the little people…

Although to be fair, he could have overheard somebody talking about it…

rates have to go up till they hurt. The fact that Wolf has to keep repeating that mortgage rates have risen 1.5% is like Wiley the coyote not realizing he’s over the cliff

How many bullions in a gazillion?

1 bazillion.

Yep, but Wolf says we aren’t in recession because everyone is re-loading up on debt and still buying stuff. Too many distortions. For example I bought a washer/dryer only because next year it will be more expensive. They are garbage BTW. The pendulum will have a long way to swing which means it will have a lot more momentum.

“. The printing press allows the government to tap the property of its people without having obtained their consent, and in fact against their consent. What kind of government is it that arbitrarily takes the property of its citizens? Aristotle and many other political philosophers have called it tyranny. And monetary theorists from Oresme to Mises have pointed out that fiat inflation, considered as a tool of government finance, is the characteristic financial technique of tyranny” mises.org

“What kind of government is it that arbitrarily takes the property of its citizens?”

Probably every single government in history.

To that, you can add modern governments using asset forfeitures without any due process.

Don’t know how old you are…

But it didnt used to be this way.

Volcker stepped to the plate and squeezed the excesses out of the system….and the system benefited for decades.

Now all that has been SPENT by irresponsible fiscal and monetary misguidance and GREED.

Hulsman’s “Ethics of Money Production” is excellent on this subject.

Buy through Mises.org

> In a far more dovish statement than February, or the Fed yesterday, Andrew Bailey’s central bank said a further tightening of policy “might be” appropriate in the coming months, a major softening from the wording in February, when they said such a move was “likely.”

BoE renege on their “likely” rate rises a few weeks later.

The Bank of Brazil hiked another 100 basis points yesterday, to 11.75%, up from 2% a year ago.

Why did you not mention that??? Lot’s of cherry-picking going on here. And the BOE did hike for the third time, and now you’re focused on a change in wording.

Seriously, the BoE vs the bank of Brazil? Yes, I cherry picked the cherry, not the far less important FX ccy pair.

Look up FX volumes, GBP is 11%, BRL is buried somewhere in “other”.

The BoE, like BoC, will say they want to follow the Fed as long as the Fed drags them by the hair, but the UK wants low rates *forever* to prop up their one industry: housing.

Thunder: sorry to hear it.

I don’t mean to be flippant, but that was a joke back in the dotcom days: a dotcom guy with no revenues was saying, “I’m losing money on every unit, but I’ll make it up on volume.”

Hopefully the situation gets brighter. We need actual businesses like yours, and not the scams that have been sucking up so much money.

What a joke! Fed action today is kind of like being a little pregnant. Condition does not exist, and the ghost of Paul Volcker will be roaming the halls of the Eccles Building forever; former Fed Chair Volcker is not only rolling over in his grave, he is doing somersaults. So much for our Wolf Collective front-loading forecasts with a Fed that has been wrong for over several decades now, blowing its third massive speculative bubble. This Fed is way too politically driven, and whose actual masters are the canyons of Wall Street and not the venues of the common folk on Main Street.

So, our illustrious Central Bank has once again elected to support its alma mater on Wall Street, risk addicted investors, and kick the American taxpayer to the curb. So my savings account goes up 25 basis points in yield, basically a gnat on an elephant’s butt. Have these economic lightweights ever considered the extremely positive effect on the U.S. economy of paying savers 4% to 5% interest, still a negative real yield today, on their money. Banking system continues to steal from depositors, and force retirees into risk assets chasing yield at a time when their earned income has gone to zero.

While retail sales are still on a sugar high, certainly from cheap borrowed funds, not growth in real disposable income that is sinking like political approval ratings, this grossly widening disparity between incomes and spending will have likely hit a brick wall in March as gasoline heads to $5 and beyond. Can only spend what you ain’t got for awhile before retrenchment sets in.

This gold bug is really more content to own one of the best performing assets since 2000 (and in 2022, as of this nanosecond gold is up 7% in 75 days, ahead of inflation), than to hit the economic forecast on the head as to when this developing recession starts to bite us all. Scared and paycheck-to-paycheck consumers who may be again turning to credit cards to make the monthly nut are not good spenders.

But the Fed action’s yesterday, while supposedly impressive from their pathetic last meeting and prior policy statements, is guaranteeing a U.S. recession, or worse, within the next 12 months. Why? Welcome to a cost or inflation-driven economic decline. Haven’t had one in a very long time, and we have forgotten how ugly they can really be.

“ Have these economic lightweights ever considered the extremely positive effect on the U.S. economy of paying savers 4% to 5% interest, still a negative real yield today, on their money”

My learned friend,

The bank doesn’t want your money…

They can get all they want from the Fed for nearly free…

75 days, hmm somewhat curious horizon. Gold peaked in Aug 2020, when S&P was 3300. Since then it has been in the bottom 1 percentile of all assets in terms of returns, still below Aug 2020 peak. CPI index is up 10%+since then, market is up 30%, crude is up 100%…Except perhaps some bonds or Chinese assets, one would struggle to find such a terrible performance. And this was the goldilocks period of massively negative real rates, geopolitical strife, global CBs buying gold hand over fist..guess what happens when real rates move up no matter how slowly?

Okay, Tweedle, start any place you find advantageous to your argument, but one can go as far back as January 1, 2000 and there indeed do we have a curious horizon. Since when is Year To Date performance a contrived time frame? Gold has had normal corrections over the last 22 years, unlike some financial instruments like stock and bonds which have a proclivity for crashing.

Gold was at $290.30 on December 31, 1999, hope that starting point is acceptable. My, now at $1937 for a 567 % increase over 23.3 years let’s say, another cherry-picked timeframe, for a simple average return per annum of 24.3%, beating inflation in virtually all countries on the planet except for hyperinflating exceptions to the norm. Real inflation in U.S.A. probably more like 5% during this very oddly picked timeframe.

Just out of curiosity, I wonder what housing has done since then? I assume that in some areas it has beaten 500% return in 20 years?

Actually, I looked up on Redfin some houses I built and sold back then [in Shoreline WA] and they are up over 500% over the last 20 years.

So housing is like gold?

To the Enlightened below: Case Shiller Home Price Index in the United States averaged 173.08 points from 2000 until 2021, reaching an all time high of 285.63 points in December of 2021 and a record low of 100 points in January of 2000.

This equates to a national average increase of 186% over the 22 year period, way below the total appreciation for the Yellow Dog. Trying selling a home in an economic downturn, one of the most illiquid investments on the planet with about 10% off the gross in transaction costs. Try transporting your home to a foreign land should your homeland implode.

Re: yesterday’s action, can anyone (Wolf?) explain the significance of the references to repo rates and reverse repo rates.

Is my understanding accurate that these standing facilities are:

– Relatively new (at least at the levels of current usage)

– are expanding

– are designed as one-more-tool in the Fed toolbox to triage credit markets disrupted by past Fed meddling

??

sign me “Confused” (oh, that’s already taken)

John H.,

1. They’re classic tools that the Fed used before 2008. It was the “standing repo facility.” When it started doing QE, it ended the repos. The reverse repos continued. Last year, the Fed revived the “standing repo facility.” This is designed to supply liquidity to the market (repos) and draw liquidity out of the market (reverse repos).

2. Expanding?

Repos = $0. Not in use due to the relatively high interest rate that the Fed charges;

Reverse repos = $1.66 trillion (due to the interest that the Fed pays on them). This is liquidity that the Fed removed from the market.

3. Hahaha, yes, kinda.

He also used the term normalize a few times. The dot plot indicates this, that 2 1/2 or 3 is top of their range. There will be no Volckerish surge. Granted if double digit inflation becomes entrenched they could fall further behind. Just about everything points against that happening. The Euro war and China’s slowdown all point to a global recession.

The new excuse in D.C. is blame it on the Russia/Ukraine war. And a fall back position is to blame it on Trump, although that blame has lost some of its luster.

Your future…… Japanification. Japan has been running negative interest rates for 30 years with their dept now 260% of GDP and the place still functions. ZUSA debt is only 140% of GDP so negative interest rate policy will be with us for at least the next decade. Buy rural property with cash, physical gold and silver, lots of ammo, and of course many cases of booze.

At least they now have 0,25% to lower when the brown matter really hits the ventilating device.

When do we know QE has ended for sure?

Or, is it all smoke and mirror, based on the stock market’s first reaction to the rate hike?

First, to clarify the terms:

1. QE means the Fed buys more securities than are maturing, and the balance sheet increases over time.

2. End of QE means the Fed buys some securities to replace the maturing securities, to keep the balance sheet level. If it didn’t buy anything the balance sheet would decline (=QT)

3. QT means the balance sheet decreases over time. Which means the Fed buys no, or fewer, securities to replace maturing securities, and the balance sheet ends up shrinking.

So we know when QE has ended when the balance sheet stops increasing over time and stays flat.

But there is one complications related to MBS. It will take a couple more month before today’s activities are fully reflected on the balance sheet because…

The Fed buys MBS in the To Be Announced (TBA) market, and the purchases take 2-3 months to settle, which is when the Fed books the purchases, so that what we see added to the balance sheet today was bought 2-3 months ago. And MBS come off the balance sheet via pass-through principal payments when mortgages are paid off or are paid down, and these pass-through principal payments speed up when rates fall, and they shrink when rates rise (fewer refis, like right now); but they’re impossible to predict. And that’s why you see the jagged line in the balance sheet.

When you look at the purchase schedule, you see the much reduced numbers in actual MBS purchases that will be reflected on the balance sheet in about 2-3 months. These purchases are designed to replace the pas-through principal payments the Fed receives that lower the balance of MBS.

And then there’s the corporate junk bonds on the balance sheet that are just going to hell. Noone will pay principal on them, noone will buy them, they will have to be written off – which is impossible since it would bankrupt the fed and require it to be bailed out itself – or stay on the balance sheet and be rolled over forever, which will lead to more and more zombie companies in the economy, courtesy of the Fed.

How about those ?

Franz Beckenbauer,

The Fed sold ALL of its corporate bonds, junk bonds, bond ETFs, and junk bond ETFs in the fall last year into the hottest bond market ever and made money doing so.

It never bought much to begin with, only about $13 billion.

I reported on this all along the way. Here are just three of them, in chronological order:

June 2020: Turns out, the Fed didn’t buy much

https://wolfstreet.com/2020/06/28/fed-discloses-it-bought-tiny-amounts-of-corporate-bonds-including-a-whopping-15-5-million-with-an-m-in-junk-bonds/

June 2021: turns out, the Fed plans to sell those bonds outright…

https://wolfstreet.com/2021/06/02/it-begins-the-fed-will-outright-sell-its-corporate-bonds-bond-etfs/

Nov 2021: turns out, the Fed sold those bonds and ETFs outright and booked a profit of $513 million on those bonds:

https://wolfstreet.com/2021/11/19/after-fueling-corporate-bond-junk-bond-rally-to-lowest-yields-ever-fed-ends-bailout-spv-with-513-million-profit-sends-90-to-us-treasury/

The SPV “CCF” which contained all the corporate bonds and ETFs is the yellow section in the chart of the bailout SPVs that the Fed set up in the spring of 2020. The Fed discloses this data on its balance sheet. By mid-September, the SPV paid back the loan it had received from the Fed, and it paid back the equity capital it had received from the Treasury, and the balance went to zero:

Wolf. On your comment.

Nov 2021: turns out, the Fed sold those bonds and ETFs outright and booked a profit of $513 million on those bond

I get how they produced a profit from the buying and selling of the bonds but can the Fed even lose money? They just sort of create the money out of thin air so even if they sold those for a loss….they really do not have a loss?