Speculators are reacting to other speculators who are reacting to whatever.

By Wolf Richter for WOLF STREET.

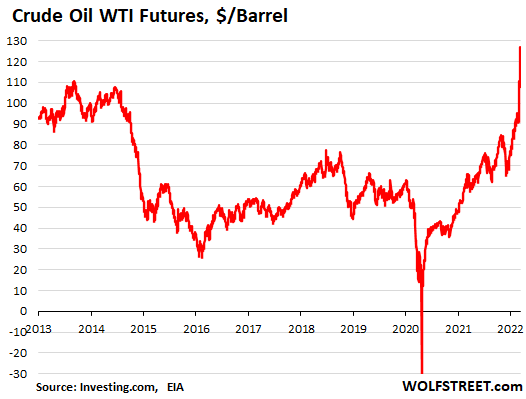

Sunday night, crude oil WTI futures, as soon as trading started, spiked to $130.50 a barrel, the highest since July 2008. Maybe it was just one contract someone traded to get it over with and nail that number. But this came after discussions in Washington whether or not the US should ban the imports of Russian crude oil. After the crazy open, the price of WTI futures fell, eventually to $123 a barrel, still the highest since July 2008. And then they started rising again. Currently, WTI trades for around $126, also the highest since July 2008.

The reason the price spiked isn’t because the US is suddenly running out of crude oil or anything, but because traders and algos smelled an opportunity and jumped on it, and drove up the price of those futures, and it’s pure speculation, but that’s what futures trading always is.

The US doesn’t import much Russian crude and could do just fine without Russian crude – and that’s why the import ban is even proposed. And if some buyers in the US actually buy Russian crude, it’s simply another trade, like a gazillion others, but Russian crude is a big part of the gigantic complex global oil trade.

For example, California is cut off from other US producing regions because there’s no pipeline across the Rockies. It produces some of its own crude oil and imports some crude oil from Alaska, and imports crude from the rest of the world. The local refineries, such as those in the Bay Area, buy this imported crude and refine it and export large quantities of gasoline, diesel, and jet fuel to Latin America, which is a huge profitable business.

Those exports of gasoline, diesel, and jet fuel also go to Mexico, which in turn sells a large amount of crude oil to the US. This is all part of the vast and complex global oil trade. Everyone’s doing it, and it is now getting thrown into chaos.

So far, Russian crude oil exports have been very carefully exempted from the sanctions, but there is such chaos around blocked payment systems and shipping involving Russia that buyers are reluctant to buy physical Russian crude and ship owners are reluctant to transport it. And futures traders are jumping all over this.

Now, the “76” tourist-trap gas station here in my neighborhood in San Francisco – the brand “76” is owned by Phillips 66 – doesn’t sell crude oil, and it doesn’t sell futures either. It sells physical gasoline that has been in its tanks for some time. That gasoline came from the Phillips 66 refinery in the Bay Area, which took delivery of the crude oil well before then at prices that were set even before then – when prices were a lot lower.

Nevertheless, even as the cost of the gasoline in the tanks hasn’t changed, the price has been surging. And the difference is just extra profit.

And this is what inflation is about: Ridiculous price increases stick because consumers are willing to pay and because companies are confident that they can get away with charging them, because the inflationary mindset has taken over. I’ve been discussing the appearance of the inflationary mindset since January 2021. It means, people are willing to pay whatever.

So here we go. The price at my tourist-trap 76 gas station has been going up a few cents nearly every day. On February 5, regular was still $4.99. This evening it was $5.85: the price has surged by 17% in one month, though the actual cost of the physical gasoline in the tank likely hasn’t changed over the period.

And if consumers go on a buyers’ strike and drive less, and if they use their most gas-sipping vehicle, and if they start shopping around, as demand comes down by 10%, well then, gas stations start competing on price again, and prices come down. But that hasn’t happened yet. That gas station below still had plenty of customers. It was still getting away with those price increases.

February 5, regular $4.99:

February 28, regular $5.13:

March 3: regular $5.57:

March 6: regular $5.85. Next step: $6+

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf, you must live near bay street and fisherman’s wharf. That gas station is always crazy expensive as you said it is a tourist trap.

Yup.

Expect crude to reach at least $150 in a month. Reason: Now media can help blame everything on Russia rather than the Trillions printed by Fed with Government support.

100 thumbs up. The Fed now has an out for what they caused on purpose. It’s really this simple – asset inflation is good, and wage inflation is bad. Why is this true, because 90%+ of all institutional grade assets are owned by the elite and the mega corps. Conversely, paying one extra cent to the proles is repulsive.

I’ve said this to a few people. The day invasion happened, day of the gun fight in front of the nuclear plant and todays threats. Based on a few MA’s I pay attention to, they couldn’t have TIMED any of it better. Oh and everything happens to happen a couple hours after market close haha.

Wolf-

We love your area (well actually Fisherman’s Wharf) in SF. The smell in Boudin’s. (enjoy in moderation) The seafood. The family loves Hyde Street Pier with the Musee Mechanique (best antique arcade collection anywhere, the submarine and the Liberty Ship (their nerd father can’t help but point out that we learned about welding plates together subject to low temperatures and high waves which caused failures – as if these kids are going to mechanical engineering school).

Not only is the gas expensive, so is the parking.

“…so is the parking.”

Yes, a lot more expensive than gas. And wait till you get a ticket for not turning your front wheels the right way when parked on a hill, or having misread the forest of parking signs that explain when this parking space turns into a tow-away zone. Parking enforcement is a huge profit center for the City.

Wonder what current year color license plate stickers are going for now?

Plenty I bet.

Cops can’t tell they aren’t for your vehicle (unless they read it up real close), and it saves money!

For cars that won’t smog, no DMV/smog fee, no insurance or even drivers license fee required…..all sorts of savings for poor people who can’t afford all that stuff anyway, but still need to get to a mix of day and PT jobs, and grocery store. Or they will be homeless, or without nice secure vehicle to live in, and store what little they have.

I used one off a friends parked homemade utility trailer for a couple years during the 80’s recession. Traded him for electrical work (car and home).

The cops WERE much easier on “home” cars parked on street back then, if you couldn’t find a friend’s driveway or backyard.

Not only the rapacious public parking, but there’s a San Francisco 14% tax on private parking lots too. One nice thing about tourism dying is that there’s more street parking, but that’s offset by van livers coming into the neighborhood and of course, the break-ins to steal even a quarter left in the console.

Our block is organizing a phone tree where we can alert each other about suspicious activity. Don’t bother calling the cops, send the young men out with a baseball bat to “play ball.”

In Philadelphia they raise a lot of money from parking tickets by speeding up the parking meters. For example, when you put in $2 worth of coins for 1 hour of parking, you actually only get 55 minutes of time. That 5 minutes is not noticable by most people but the tickets have to be paid, and the city government cleans up.

Union 76 commercials in 70s to early 80s were great entertainment, especially between innings of a Cubs game broadcast. Murph and then later Nick as a side-kick. “Nick and The Blonde 1982” classic non-pc for the sensitives of today.

Atlanta Braves broadcasts in the late 70’s too.

And Dodgers. There was a 76 station in the parking lot back then.

In Denmark, gas just passed $10/gallon. That’s something like +$20/100mi. Thank god for EVs: charge them at night for $0.20/Wh or ~$6/100mi.

Well said. I hope this pushes more people towards EVs and away from gas guzzling pollution mobiles.

What most consumers of regular unleaded seem to be clueless about is those underground storage tanks at every tourist trap fill in station MUST be refilled, at minimum, every other day. Those tanks can hold at most 12,000 gallons. Do the math, if you doubt my statement.

The only math that is applicable here is, as Wolf said in so many words, price gouging.

The hydrocarbon industry has a pet “economics math” sounding phrase they are very fond of: “Fuel prices are INELASTIC when the price of oil goes down and ELASTIC when the oil prices go up.” (wink – nod).

That fuel price setting modus operandi is a disingenuous excuse to price gouge on the way up and not lose a penny of profit on the way down.

Another part the of math that Wolf has done, and the petroleum industry doesn’t want you do do, is the oil futures price relation to physical supplies of crude oil and fuels at the pump. There is no excuse whatsoever for raising the price of fuels based on zooming up price futures contracts frenzy, yet they do that with glee.

Check out how much crude oil is stored at any refinery at any time. You will find that it is, at the very least, a month of pre-refined crude. Often it is much more than that because they have a large tank farm on the grounds.

You cannot take a load of crude off of a tanker and start refining it right away. This is because several steps (e.g. stripping the crude oil of excess oxygen), required to prepare the crude for refining, take a significant amount of time. The actual process of refining takes place in the cracking towers. The “crude” that goes into the cracking towers is quite a bit more pure than the crude that arrives at the refinery.

So, ANY actual increase in crude oil price should certainly not be reflected at any refinery for at least a month.

The new gasoline and diesel and heating oil coming out of the higher priced crude should not see a gas station tank or a heating oil truck tank for at least 6 weeks. Yet, they pull the old “ELASTIC” price (gouging) on the way up TRICK, with a straight face, every single time.

No wonder the oil majors are up around 5% today (i.e. March 8, 2022); they are in price gouging heaven and we-the-people are getting the “elastic” shaft.

I payed $5.79 at the Shell on Geary and Cook. So 5.85 in North Beach seems about right.

Just filled my tank which I do less than once per month for under $3.60/gallon for a grand total under $40. So as a consumer largely unaffected thanks to the godsend that’s WFH.

High gas prices are great for my city and state, and likely awesome for the environment as the higher users are forced to shift to more environmentally friendly options, so a good thing mid to long term.

Very short sighted and privileged view, of course paying extra 50-100 a month is a drop in the bucket to higher income earners.

What about the lower income earners who have to commute god knows how far to get to work? What about the senior citizens strapped for cash because their social security checks are no where near keeping up with inflation?

You think high gas prices will make food cheaper for them?

Why don’t they get a better job?

Or invest in Bitcoin, or start a disruptive business, or buy stocks?

Pull themselves up by their walker handles,

or their Kneepads Handles?

Gee, I’ll bet they didn’t think of that.

Note the caveat “…so a good thing mid to long term.”

I believe the point is that high gas prices will force society – over time – to shift to a more sustainable and environmentally-conscious footing. And that is a very good thing.

Cattle need to be prodded to greener pastures that they’re too stupid to find themselves.

I have been hearing that mantra since 1968. When is it going to happen?

Degobah Smith,

I think you are correct. There is an upside to this.

A few years ago – before COVID – we visited Hawaii. Once you got away from the tourist traps/wealthy areas you could drive where normal people were. I would estimate that about 1/3 of the homes had some sort of solar energy capture device on their roofs.

Here in the midwest it’s likely only 2% or less.

If we planned on staying put we’d ‘go solar’. But we’ve been planning on downsizing since the beginning of 2020. Lots of scrapers on our block so it just doesn’t make sense.

For us.

Our children, at least those who plan on staying in their homes for another 5-10 years or longer, are going solar. We encourage them as best as we can afford.

So … maybe higher fuel prices WILL push things along.

DS, the world runs on hydrocarbon based fuels and chemicals and has for over 100 years. Not much is going to change in that regard for a long, long, time.

You make it seem that high income earners are the problem.

They have nothing to do with it and are NOT at fault.

Ever since I could remember, I have strived and worked and studied and gave up week-end after week-end to BE a high income earner so I would not have to eat dog food, or any of those other scare phrases.

I am the elderly. I don’t rely on Social Security nor even need it. Why am I being arrogant and obnoxious? Those of us who have worked their @$$ off deserve what they have and should feel absolutely no guilt. I feel No Guilt. I feel Pride in my work ethic. I will never retire (boring) but enjoy working and making MONEY. What else is there to do?

Rather, these poor and and old you speak of, what is their story? Their past? Bad luck? I’ve had it….numerous times, ….went back to work and recovered. Sometimes 2 jobs. Sickness? Normal. Get up. Go to work and stop eating the junk-filth food.

Attacking good people who THINK and PLANNED and WORKED will never solve your problem. Spend more time on why your poor and old, (that you care about), are in the problem situation. Who did they vote for? What do they buy? Did they take stupid and worthless vacations every year?

My last vacation, was 1998.

(I have taken my kids to Disney and Busch Gardens etc., when they were young, but believe me, that is no vacation.)

Sorry (in a way) that my tone is rough, but enough of this “It’s somebody else’s fault”. I am tired of the “poor” blaming the “rich”

for being poor.

The poor will blame the rich for as long as Americans fail to distinguish rentier activity from wealth creation. If they used the correct dividing line most of their world would start to make sense.

Marcus Aurelius, like Jesus said: “The poor you will always have with you…” :D

It sounds like your life and environment abused and brutalized you, I am sorry for your plight. Then again do not rush to force the same onto fellow peasants, who feel it’s not worth destroying your body and crushing your soul to make your owners richer and to die faster. Some prefer to enjoy life now, pay later.

Agree with you 1000%. And what about all the taxes we paid while working our butts off, and the taxes we still pay now that we are old and retired?

Imagine, for a moment, that there is some luck involved. The “hard work” narrative is tired. I bet there are some people that worked hard their whole lives in the Ukraine that now have nothing due to a situation they did not individually create. I bet there are some oligarchs running scared right now for their money and lives, even though, by American standards they must have worked the hardest of all (don’t all Billionaires work the hardest amongst us??). When all wealth disproportionally ends up in one small section of society, it is not a problem – until it is. Bread and circuses are fine until some type of catastrophe hits. And then what?

Nice post Marcus.

I’m old and worked and saved all my life too. And I worked until I was 73 to help out some family members who had real bad luck. But, now at 78, I kind of enjoy not working and paying gobs of tax into a system run buy thieves. You know, maybe a little time off for yourself is not a bad thing once in while.

“Rather, these poor and and old you speak of, what is their story? Their past? Bad luck? I’ve had it….numerous times, ….went back to work and recovered. Sometimes 2 jobs.”

Man, have I been there and done that! Knocked flat, given a backhanded slap by the government for not paying taxes like I used to, gotten back up again, worked myself half to death after a stroke to become financially independent [with no help from anyone but my family], only to be told by a worthless grifter named Obama that “I didn’t earn that”.

As an ex liberal I hate all those assholes.

Now after a lifetime of having a carbon footprint the size of a candle I am being told by Bill Gates, John Kerry and AL Gore, guys that have had the carbon footprint of a small city all their lives, that **I** have to give up enjoying the last few years of my life [no travel, no heated pool, no 70″ degree home] so they can fly around the world in their private jets to their many fully heated or fully air-conditioned homes.

Oftentimes I wonder why there isn’t a middle class revolution here.

If it sounds like I am really pissed, it is because I am and you should be too.

Delayed gratification and it’s scarcity makes it all the more sweet and unladen with guilt when you finally enjoy it.

Except for prescription caused opioid addiction, every homeless bum on the street lacked that. Scrimp and save, or get high? It’s a choice.

“Sorry (in a way) that my tone is rough,…”

…And get off my lawn!

Biblical scholars have suggested that “the eye of a needle” was the small man door next to the large gates of ancient cities.

It being easier to pass a camel through the “eye of a needle”, than a rich human to gain Salvation, I ponder the plight of the young rich man saddened by his unwillingness to sell his possessions and give to the poor. Little else keeps me awake at night.

If you are conservative in youth, you are intelligent.

If you are liberal with age, you have a heart.

BTW, the best way to enjoy (or at least tolerate) Disney is vicariously appreciating the joy in child guests, IMHO.

The funny thing is you lumping yourself in with the “rich”. You work for an income. You’re a speck of dust compared to the wealth of the elites. Insignificant.

Quite right.

People who struggle to hold down three part-time jobs have nothing but their own laziness to blame for their poverty.

> My last vacation, was 1998.

This is very sad, people outside of the US with all sorts of income levels don’t seem forced into such sacrifice.

“What else is there to do?”

I can think of lots of things. How about something truly productive? Grow a garden, teach a child, learn a musical instrument, give a friend a hand expecting nothing in return but friendship, create a wildlife habitat, learn how grow food and store foodstuffs, restore or repair something so it can be used again, recover material(s) that our wasteful society discards so they can be put to use, pick up trash in the local park, etc.

Lots of things that don’t involve monetary compensation, overuse of precious resources, or pilfering wealth or resources form future generations.

Enlightened One,

All that misery yet you persisted and now you say you are worth $20 Million. What an amazing person you must be. The most amazing here, I daresay.

A good old Carrington Event of 1859 could cause the EV market to collapse in a burning ball of fire. Literally! It’s the reason I have not moved to a more sustainable EV. Our poor neighbors lost their home, and everything they own, after their EV van caught fire due to a battery issue. It happened in the middle of the night in their connected garage. I know gas is expensive, but the unreliability of an EV automobile spontaneously combusting is very frightening concept. The government gave the green light on EV by removing financial from manufactures as a buyers beware warning. Do research and don’t count on the government for anything. I do feel for the hard working individuals who have to drive places to build the things the remote workers use on a daily basis. We all will pay for tunnel vision in some way. We are the sum of every decision ever made!

Why are so many people on this site talking about EV’s blowing up and burning down houses? Gasoline powered vehicles can do the same thing. Heck, people have burned their houses to the ground trying to fry a Thanksgiving turkey. Is it possible for an electric vehicle to suddenly catch on fire? Yes. But it’s also possible for a hurricane or tornado to level your house as well. I think you’re highly overstating the risks of owning an electric vehicle.

“What about the senior citizens”

I just want point out here that senior citizens, a group that I belong to, the post WW2 generation, had the greatest opportunity in history of the world to save for their old age. And a great many of them just pissed that opportunity away with both hands. All they want to do is suck off future generations.

I think that running up tens of trillions of dollars in debt to take care of them, money to be paid by our children and grandchildren and great grandchildren is just absolutely criminal and unconscionable and morally indefensible. How can we do this to our kids? 30-40-50+ trillion dollars?

I tell every 20 yr old I can that they should refuse to pay the debt that we have ran up. Just vote to defund the debt.

728huey

Mar 7, 2022 at 8:28 pm

To Enlightened Libertarian:

You’re not aware of this, but the birth rate in the USA and most developed parts of the world has been dropping below the replacement rate for a few years.

I am aware of that.

1] World population dropping below replacement rate is a great idea.

2] US and world population is still going up. Like I said, 8 billion and racing towards 10 billion.

3] Robbing future generations to fund present generations is so morally wrong it ought to be illegal and unconstitutional. Every generation [in most circumstances] should pay their own way.

What’s killing low-income earners is high housing costs.

Defeat NIMBYsm if you are really on their side.

No NIMBYism here.

I was preaching density 30 years ago [in the city where you infrastructure already-sewers, water, power, roads, etc]. I was a builder.

But after watching this for a long time I would like to point out that:

You can complain about not enough housing, not enough schools, not enough hospitals, not enough roads, not enough parks, and ad infinitum, or you logically conclude that there too damn many people.

World population at close to 8 billion and racing towards 10 billion and our priority is subsidizing people to have more children? Talk about crazy!!

To Enlightened Libertarian:

You’re not aware of this, but the birth rate in the USA and most developed parts of the world has been dropping below the replacement rate for a few years now. In some parts of Europe, South Korea, and China, it has seriously dropped below the replacement rate, so it’s not younger people having mad sex like rabbits. Actually, the number of elderly people living into their eighties has gone up dramatically, and more people are surviving well past the retirement age by a decade or more.

The answer for high prices is high prices.

The loonie greens should love it. It drives resources into normally not economical (without taxpayer subsidies) technology for the development of other methods.

The goal (for the green religious fanatics and rent seekers) is to artificially prevent all other technologies they don’t like (but maybe millions of others do like).

It is still cheaper than 1964.

I work, I prioritize my spending, I drive conservative, I plan my route and shopping, therefore the price of gas has no effect on me.

Stay away from Starbucks, Dunkin Donuts, Movie theaters, HBO and all premium cable, keep your i6 or i8phones, purchase 95% of all cloths at Goodwill, Kiwanis, Consignment Stores, Garage Sales, etc., and your shoes at Costco (just bought a nice pair of FILA for $29).

Put your money into purchasing the healthy food you want, and never be concerned about the price of gas. You will have so much less stress. Gas and healthy foods are not luxuries so don’t treat them as such.

> Put your money into purchasing the healthy food you want

I completely agree with everything you wrote.

Also, prioritizing living in a place where permaculture is possible so that you can grow your own fruits and vegetables. That’s a key path to health that has worked for generations.

After paying $6.89 for 4 (four) golden crisp apples today at Walmart, I’m starting to think about planting an apple tree in my yard.

Our one apple tree generates about 10 dozen apple muffins and 25 jars of applesauce annually. Our one sour cherry tree generated enough for 22 pies or crisp last year. Peaches, strawberries, blueberries, raspberries, a vegetable garden. Healthier, cheaper and better for your mental spirit than following the news.

These fuel prices destroy rural economies. Better learn how to make your own toilet paper and grow all your own food.

> grow all your own food.

Everybody should do this, regardless of the price of oil.

My family in the US does have a sizeable farm – wheat – and mineral rights. Good times, indeed!

Not surprised you barely leave your house.

> Not surprised you barely leave your house.

I do when it suits me and on the nicest days.

Why would I do it any differently? Life is to enjoy it, not to compete on who suffers and sacrifices more.

I don’t think this is inflation so much as the financialization used for price discovery going into cardiac arrest. Leverage up a market on cheap credit and price everything for perfection, then throw in covid lock downs, rate hikes and geopolitical risk and things go nuts!

I still don’t feel bad for the average person. They’ll just need to cut back on Starbucks and fast food, Amazon trinkets and use it for gas money instead.

“Rate hikes”? Where, when?

historicus wrote: “Rate hikes”? Where, when?

Probably in the same universe as those “Lock Downs”.

Not everyone ‘looks’ like you. There’ a group of people in America who you and your kind have maybe never heard of. They don’t buy Amazon trinkets, or pick up a couple soy lattes at Starbucks. They are not ‘your’ idea of average. They are the working poor, struggling to put enough food on their family’s table, to put gas in their little beater car, struggling to put shoes on their kid’s feet and get them off to school, struggling to afford their medical co-pays and they sure as hell aren’t in ‘The Market’. But you don’t feel bad for them because they are beneath your vision and you don’t know or perhaps even care that they exist in lives of struggle. Frankly, I think it says more about people holding this viewpoint than is does these struggling folks. Just my opinion and I could be wrong.

They took their risks, I took mine. I am sincere, indeed dead serious saying this. If people make choice amounting to wading into a pool of risk, then who should bear that risk? First and foremost, those whose own choices put their own selves there. I had no say or participation in their having those children. Should the parents now be able to offload the risks and costs of that choice to me?

The parents would keep all the benefits or upsides of having the children, with no thought of me, or my situation or preferences. So why should the downsides be transferred to others?

The casual creation and transfer of this risk in a cloak of condemning righteousness (toward better managers of life and choices, as supposed elitists) disgusts me.

And I could be wrong too!

Here here.

In America taking a risk on rentier activity paid off, being a teacher did not.

Did you preach this to the purveyors of Mortgage Backed Securities?

That’s a long way of saying “I’ve got mine, Jack.”

“And I could be wrong too!”

You are not wrong.

What a sad worldview. I feel sorry for you

georgist said: “In America taking a risk on rentier activity paid off, being a teacher did not.”

________________________________________

A lot of rentiers confuse rentier wealth with hard work, some on this board.

Get 2 jobs.

If your kids can get a part-time job, be a parent and discipline them, and have them pay for things they get. I did that. At 9-10 I bought my own bike. I bought the first SONY transistor radio since I “wanted” one from money I made, with my bike, picking up glass soda bottles on the side of the road and at construction sites…….for example.

Then on to mowing lawns.

Then on to being the first “Amazon Delivery” for my neighborhood and would run to the store for neighbors.

5 cents here. 2 cents for each bottle. 10 cents here and there. Real money. That 10 cents is $2.45 today.

Maybe there is a reason somebody is poor. IT is NOT the fault of those who are not poor, BUT, most people “poor”, (in spirit and philosophy), assume all “RICH” got that way from Privilege, or Greed ,or Dishonesty………… No. ………..Most of us WORKED for it.

I smile when I hear the typical “reasoning” that the Rich stole everything they have from the Poor. Hey, the poor don’t have anything to steal from, so how did that happen?

Go through your pantry? Chips and cookies? Crackers? Breakfast cereal? etc…Real poor people in this world don’t buy that filth…Go through your frig (real poor people in this world don’t have one) and toss out the Barbeque Sauce, Teriyaki Sauce, Ice Cream, etc….Real poor people of this world don’t have that.

Repairs for your beat up car? Real poor people don’t have one. They do take the bus, or walk, or ride a bike. Just what is “poor” in America compared to the real world out there?

I don’t have ANY of that in my house but I could buy the entire inventory at my local Publix if I wanted to. Ah, you will read my “ego” in that, thus missing the entire point, but that is why you are “poor”.

If you are poor, my first words of advice is ACT LIKE IT.

Stop wasting your money. 2) Work MORE 3) Become healthy 4) Stop drinking all alcohol, sodas, gatoraide,, etc., common sense concepts that “the poor” don’t get……maybe there are reasons they are poor and stay that way?

Sorry, I am on a roll here. I’ve been triggered.

There is a HUGE difference between the “rich” who built, earned what they have (i.e. those who produce things, build things, grow things, invent things which make other people’s lives better) and those who are rich by creating nothing but effecting extracting and removing from the system the wealth created by others (bankers, securities traders, stock brokers, ppl who inherited their wealth etc)

The rich should always be placed in 2 categories and they are opposites. All of societies’ financial troubles come from not understanding this difference. And all the REAL wealth is in the hands of the second group

You forgot to mention smoking. Give up cigarettes.

Better for health as well.

You’re not rich you weirdo. Get over yourself.

“Frankly, I think it says more about people holding this viewpoint.”

Frankly, I can’t understand why there is any problem with the poor when I hear and read of all the liberals who care so much about the poor.

If every liberal who is virtue signaling all the time about how compassionate they are would spend THEIR money on the poor, no one would be poor and homeless.

Lead by example,. Take a homeless family into your house and feed them-buy their Healthcare.

Get a 2nd job and donate that money to the poor. Get a 3rd job and work at a homeless shelter.

Quit hanging out at Starbucks drinking $10 lattes with your “compassionate comrades” and bragging how much you care. Put your money on the line.

Mike, you see it !!

Great article! Now please do an article on wheat futures!

In both these commodities, US producers are now governed by FOMO: farmers (spring wheat planting season is coming up) and frackers. Watch what’s happening later this year in terms of production.

Wheat is far easier to plant than oil is to frack. The frackers have real shortages they have to deal with (labor, equipment, sand???, etc.)… although it gets a lot easier to solve those shortages when oil prices are well above $100 a barrel.

Still fertilizer will cost more, fuel for the tractor and harvester will cost more. Wages will be higher. If the farmers are not sure they will recoup the higher cost by charging more for the harvest they may not increase production.

Have to disagree. Wheat is at the mercy of the weather, pests, and diseases. All of which are unpredictable. Fracking, once the oil has been found, is much more predictable. No oil – some people will survive. No food – no one survives.

From my Red River Farm Network weekly email one week ago:

The USDA’s “Ag Outlook Forum” predicts that we’ll see 88 million acres of soybeans, up a little from 2021; 92 million acres of corn, down a little bit; and all-wheat should reach 48 million acres, up from 46 million in 2021.

The exact same thing has happened since about six 3 months after covid hit with lumber futures. There’s never been any real supply shortages after the TX resin factory was brought back online. It’s pure speculation which is one downside of capitalism when the FTC isn’t willing to step in and launch investigations.

Import volume of crude oil and petroleum products from Russia in the United States from July 2020 to December 2021

In December 2021, the United States imported over 12.5 million barrels of crude oil and petroleum products from Russia, marking a notable decrease from the previous month. The May 2021 figure was the highest import volume recorded over the observed period. 26.1

https://www.statista.com/statistics/1094286/us-imports-of-russian-oil-and-petroleum-products/

Yes, minuscule. Thank you for the confirmation. The December figure you cited = 403,000 barrels per day. That same month, the US EXPORTED 9.7 MILLION barrels per day.

In the past when gas prices spiked it seemed like that moved people to buy smaller cars, hybrids and EVs. But given the semi conductor shortages which has led to fewer new cars being built and prices of those cars skyrocketing, consumers are stuck between higher gas prices or outrageously priced car with better gas mileage. You can’t really go on buyer’s strike when it comes to gas and you need to commute to work. This probably won’t resolve itself for months until car prices come down and people have a real choice again.

I noticed this too. In the past you saw a lot of those big, expensive trucks and SUVs parked because they cost too much to drive.

It is true that the US doesn’t import much russian crude, and it can be easily replaced. The problem is what happens if 10 million barrels a day is taken off the world market. Demand is still 100. Supply is now 90. The shortage could drive the price to infinity, in theory. The futures set the world prices. So even though the US has all it needs, the price would still be high.

That is what is spooking the futures market. That kind of supply inbalance is probably happening now in the initial chaos, but will resolve within weeks. Assuming cooler heads prevail.

You are correct.

But don’t worry, it’s for a good cause, supposedly in support of a country most geography challenged Americans probably can’t find on a map without the internet or didn’t know it even existed before this incident. It’s also a country with zero actual strategic interest to the US, except as defined in the post-Cold War era where apparently every square inch on the planet represents a vital “national interest”.

If sanctions are applied, it will also be direct evidence that the economy, markets and the public will be thrown under the bus to benefit the Empire.

> You can’t really go on buyer’s strike when it comes to gas and you need to commute to work.

Who ya calling “you,” kemosabe? One CAN do that. It’s called prudence and long term risk management. My income is hovering around “working poor” yet I live in arguably the priciest city in the US (relative to income) as an owner essentially free and clear, on a forested park where I can walk in the woods without getting in a car or crossing a street. I’m a block from every essential store. Gas could go to $40 and I’d be alright. And the way that was done? Reining in appetites and setting up short lines of supply over decades. It is about setting the baseline as if living in hard times, all the time.

This is the way.

If gas goes to $10/gallon it will not affect my lifestyle nor standard of living one bit.

Swamp Creature,

When the Southern California housing market was crashing in 2007/2008 I thought, “This won’t affect me, I’m not over my head on my mortgage”. And I was right it didn’t affect me directly. However, the neighbors on both sides of me had to short sell their homes. The neighbors who moved in were a nightmare. In fact the whole neighborhood changed for the worse.

Just saying… you may be affected by $10/gal gas in one way or another.

Lumber prices should be in the 650’ish a 1000 board feet. This over $1,400 is a joke. All it’s doing is driving up the prices of new homes for the start of three years in a row now and will make it harder for the FED to engineer a soft landing.

You can go on a buyers strike.

Don’t buy all the stuff you don’t really need. Go on Strike. Shrug.

You have 100% control over what you buy, or better, what you want to buy.

This is gonna work great when all drinking water is privatized by the likes of Nestle

I saw $6:15 last night.

One station in California is posting $8/gallon. Some serious price gauging is going on.

No Russian energy will spike worldwide inflation. Wait until we see how the FED deals with oil inflation!

“Wait until we see how the FED deals with oil inflation!”

They won’t. They will craft an excuse.

The citizens’ roar is about to become deafening. I’m reading a book about Powell (Trillion Dollar Triage), and I don’t think he has the “minerals” to withstand the pressure. Interesting to see which direction he caves in. The world has become very interesting.

Side note: guess who, per this book went to Georgetown Prep (Catholic boarding school) and were appointed by Trump to upper reaches of “the Swamp”? Powell, Gorsuch, Cavanaugh.

Then Powell was reappointed by Biden. We need a second political party in this country.

Cavanaugh.

He lived a couple of miles from me.

I suspect they can use “Russia” as the excuse for anything now and probably for the next 10 years.

There is a Russian-crude tanker enroute to Washington refineries at Anacortes. Since that ship was on the water when the SHTF its exempted from re-assignment. Q: Final tanker? …that was not discussed in the RT commentary.

The refineries at Cherry Point and Anacortes were developed, expanded to handle Alaska crude when north slope pipeline to Valdez opened in early 80’s. Originally about 4.0 m bpd, now down to slightly under 2.0 mbps. To adjust for this decrease refineries began to receive foreign oil, but especially Russian shipped from their east coast. This is where the majority of that crude goes. If it is cut off it will have a pronounced negative effect on the refineries but also the supply of gas diesel for Wa, Idaho, Or, Mont, Ak which is supplied from these refineries. McCord AFB in Tacoma is major, Seattle airport is major hub for travel to Asia. Elmendorf in Alaska is major strategic air base, ditto Adak. Shemia out on the chain. All get fuel from these refineries. Oh so connected is the world today.

Sort of humorous, land of the greenies, exporting gasoline to other countries for profit.

Crack locally, burn globally.

I’d link to a graph of EU natural gas production vs Russian imports which is very revealing, but links are verboten here. The level of gas imported vs EU production drop is stark and a perfect match. Stupid greens manipulating a stupid citizenry. Also, shutting down German nuclear power plants, another brilliant move.

“Europe had an estimated 966 trillion cubic feet of technically recoverable wet natural gas resources as of 2013, about enough to supply the EU for 60 years. Much of this is located in eastern Europe, including Ukraine, Poland, Romania and Bulgaria. But France, Britain, The Netherlands and Germany are also sitting on shale deposits.

“Former NATO secretary general Anders Fogh Rasmussen blamed Russia for fueling the fracking opposition. “Russia, as part of their sophisticated information and disinformation operations, engaged actively with so-called non-governmental organisations – environmental organisations working against shale gas – to maintain dependence on imported Russian gas,” he noted in 2014.

“A 29-year CIA veteran Kenneth L. Stiles analyzed the links, and followed the money, as much as anyone could. The dollars track back from local Virginia green groups right through one or two layers of NGO’s and back to opaque Foundations in Bermuda which were set up by people who also used to work with a Russian Minister and friend of Putin.

If you believe anything NATO says, I have a bridge to sell you.

Why should petrol stations reduce prices if demand comes down?

That implies that they make more money with lower prices, which can only happen if volume go up enough to compensate for a lower margin. If The numbers tell the sellers that no, they will not make more money on a higher volume they will let the high prices stick.

Another question is how much the petrol station have to say on the prices. If the refineries do not lower the price that set a lower limit on the price. And the refinery business may have consolidated enough to choose their price level.

Sams,

“Why should petrol stations reduce prices if demand comes down?”

They do when competition forces them to. A company always charges the maximum price it can while still getting to its sales targets. When demand slides at a gas station, they want to sell more product, and so they lower the price a little, and consumers flock to that gas station. And then another gas stations responds with undercutting that gas station, etc. This happens a LOT in huge waves across the US, as you can see from the average retail price of gasoline:

Competition may lower prices, I know that. Still there are a lot of if’s when it comes to pricing and competition. A few of them.

Around here, the refinery and distribution is about half the pump price of petrol, taxes make up close to 40% and the petrol station get their profit from the last 10% or at the best 20% of the pump price. Petrol stations compete in selling the best hamburgers and hot dogs, not that much on fuel price, they have nothing much to give there. Low fuel price is then only to make people stop for fast food.

Then, a business will try to maximize profit. A sane business has a sales profit target, not a sales volume target. As I said, the petrol stations will lower their price if that increases their revenue. If the numbers tell them they are better of with high prices the price will stay high. A common understanding between petrol station chains that a high price is preferable and there may be less incentives to compete. The USA market may be more fragmented, I see a lot of localisations where only one or two chains are present and there is not much competition.

One step back in the fuel supply chain are the refineries. If they have consolidated, the incentive to compete might not be there. No cartel, no shady agreements, but everyone know their best self-interests…

Bottom line, a sane business reduces prices if that increases profit when competing with other business. If they do not make more money by reducing prices, they don’t.

Sams,

Gasoline has a shelf life….

They have to sell it or it goes bad…

They will have to reduce prices if it sits very long…

Along with what WOLF said…

I remember back in the Summer of 2008 the price of gas spiked up to $4 per gallon and there was a big push on the Saudis to open the spigots. They said “NO”… that the price hikes were the result of speculators in the markets bidding the prices up rather than there being any fundamental shortage of oil in the system. They were right. Prices fell to $2 a gallon by December.

Same thing is going on now. The price is going up because speculators THINK it will go up in the future. The weird part is that when the Russian invasion of Ukraine started, the price didn’t really move much. The price where I am at on the Gulf Coast was $3.08 a gallon and had been there for a couple of weeks. I mentioned to my Dad that I was surprised that it hadn’t gone up by 10%… maybe the stations couldn’t charge more for what they already had in the ground without violating the price gouging laws???

Tonight it was $3.68… up 19%… and now I am wondering if the speculators thought (like most people thought) when Russia invaded that Ukraine would collapse in a hurry and things would soon get back to normal. Not gonna happen!

There is no shortage of oil. There is also no shortage of Diamonds.

They are controlled commodities and have agreements to limit supply.

US consumes 338 MILLION gallons a day. Think about that? Could that really come from Dinosaur skin and guts? From Blue-Green Algae? From pond scum?

No.

That is PER DAY. Multiply it by 365 and then realize we have been using oil for 150 years.? Imagine how much the world uses? A Billion gallons a day?

There is NO WAY this is “fossil fuel”. Coal, yes, and a hint is that coal is a few hundred feet down, while we drill for oil miles beneath the sea floor.

How did Dinosaurs guts get under the sea floor? How did Dinosaurs get under the Continental Plates. How could there be so many Dinosaurs?

Why are old, dead, oil fields refilling?

There is no shortage of oil. Never will be.

(The above is my opinion and does not reflect the opinion of anybody else.)

Close…

Compressed peat…. Among a few other things….

When you tell this to most folks it’s like you just told them there is no Santa Clause…

Retired from a company with wells in the Gulf. One which has been refilling for many years. I can’t vouch for the truth of this statement but heard it from R&D some 30 years ago.

So you may be closer to the truth than any of us know.

What ever happened to that well, that freaked everybody out, that blew, in the Gulf? If I remember it was spilling out 250,000 gallons a day, or barrels? Huge amount.

It was eventually capped.

Are we “pumping” out that oil or is it still capped?

I have spoken to retired oil industry experts (in all aspects of the industry) and they tell me of proven welsl-fields that are “shut in”. Why? They drill. They find it. They cap it.

One of the reasons given for the “refiling” of wells is that the original drilling reached only the top reserve……Vertically, there could be more and more oil but they stopped at the top one, not aware there was another one beneath, with fractures linking them.

OR, the source of oil is not Barney.

Old oilfields drilled with conventional wells (vertical) only recovered about 20% of the reservoir oil available. Newer technology used in old oilfields (horizontal drilling, high pressure fracking) is responsible for recovering a great deal of the remaining oil. This alone, has been responsible for bringing old fields, like the Permian Basin here in west Texas, back to life for at least the next couple of decades.

Also, deeper geologic formations have been successfully developed below older fields and have provided a new supply of crude and natural gas.

Probably the most significant developments in the last 20 years that brought U.S. oil production to a new level has been the advent of horizontal drilling technology, better fracking techniques (fracking the formation was done in the 1920s also), computer assisted reservoir mapping and 3D analysis, and improved down hole tools.

Re: Gulf of Mexico Oil remaing:

https://science.thewire.in/environment/deepwater-horizon-oil-spill-ocean-floor-gulf-of-mexico/

Why some of us natives of what was a fishing paradise don’t fish or eat anything out of the Gulf these days, except for some of the shallow water stuff.

VintageVNVet:

My father was the director of a Gulf Coast laboratory for NOAA until recently. There was a lot of testing of the fish after the 2009 Deepwater Horizon oil spill. It is safe to eat. Just because scientists can find contaminants with an electron microscope doesn’t mean your body will notice them. The very fact that the FISH are still swimming around alive with the contaminants inside of them tells you that the effect is minimal on humans.

Especially when the Earth is only 6,000 years old,huh?

Have you been to that museum where they have the lifesized models of cavemen riding the dinosaurs?

Marcus Aurelius,

“Deep Water Horizon” BP

Check out the price heat map on Gas Buddy or enter a specific location.

According to the AAA site

Today regular is $4.009

Yesterday $3.922

One week ago $3.604

One month ago $3.439

One year ago $2.760

You ain’t seen nothin’ yet

B-b-b-baby, you just ain’t seen n-n-n-nothin’ yet

Here’s something that you’re never gonna forget

B-b-b-baby, you just ain’t seen n-n-n-nothin’ yet

Ha Ha….we called that the Porky Pig song….a blast from the past.

(nothing personal if you liked it)

Wolf – this really is an actual shortage and not speculative.

https://www.cmegroup.com/markets/energy/crude-oil/light-sweet-crude.quotes.html

Oil for 1 year delivery in Feb 23 is trading at 96, $30 lower than April delivery.

If you want to bet on oil going up you get a free $30 for doing so. The market is telling you this is a short term shortage that will get resolved soon.

(European gas markets though are not like this – mega high prices are there for all forward delivery dates.)

Beg Venezuela “(communist bastards)!&Iran’s (terrorist regime)!!” To get Back on line and flood the market with cheap oil :)

Follow these lightweight flogs inhabitants of the swamp to make America eat the humble pie for the foreseeable future!

Buy you’ve been misled into fake exceptionalism BIG F&$))))$?G time.

Isn’t Venezuela oil more difficult to refine…

Paging Anthony A. ….

Here is is…can’t be refined easily unless the refinery is equipped to handle it.

“With nearly 320 billion barrels of recoverable oil, Venezuela will become the world’s largest holder of petroleum reserves. The Faja’s crude is what producers call extra-heavy. Oil from this tar belt averages about 8.5 API gravity, which means that it is heavier than water and oozes rather than flows”

How about Lybian oil? I heard it was the best oil on the planet

I see a massive boom-BUST coming up in all materials/ mining/ energy. Production will be ramped up in a big way while the economy is getting destroyed. But the higher wages that resulted from the current insane inflation will be sticky and therefore crush their profit margins once this thing comes down again.

This always ends the same way. This time is just more extreme than usual. Payback will also be more extreme than usual.

If you’re referring to the fracking fraternity and hold high hopes for them to return to investing in ramping up production, you’ll be sourly mistaken.

The break even for profiting from oil extracted that way will be around the $125-$135 per barrel .

This used to be around $90-100. In 2019.

The lesson of giving oil away and even paying for it to be carted off have been learned the hard way.

In fact there are multitude of ways to make a quid without that risk.

The only way I see any of them returning to Production is if YOU( Mr & Mrs ) tax payer will guarantee a 20% profit for their operations.

The miscalculations by this fickle administration have been biblical to say the least.

Anyway, time will tell.

We might want to invade Venezuela ASAP to get even with the Rooskies :)

sourly crude? I think Venezuela’s your guy!

Biden sent senior folks down this weekend to talk to Maduro about oil.

Apple: Gov forks going down there to beg for heavy, sour crude? They are nuts.

“With nearly 320 billion barrels of recoverable oil, Venezuela will become the world’s largest holder of petroleum reserves. The Faja’s crude is what producers call extra-heavy. Oil from this tar belt averages about 8.5 API gravity, which means that it is heavier than water and oozes rather than flows.

It’s crap oil and can’t easily be refined.

Trump put sanctions on Venezuela crude exports. Since then they cut up some of their oil pipelines to sell the pipeline steel as scrap.

I do only see a bust coming up in all materials/ mining/ energy, but only in volume, not in prices. As prices soar and demand drop, mining, drilling and production will be cut back. Part because the energy to mine and drill have become more costly, part because other costs have risen.

The trouble with inflation is that if costs rise equal or more than prices of the product, there is no reason to invest in production.

Crude futures entered Sept 22 2008 fractal zone.

Trans-Mountain will export oil from Canada

The Keystone XL pipeline from Alberta, Canada to Houston was supposed to bring 700,000 BOPD expandable to 1.3 million BOPD to Houston refineries and terminals. Biden blocked the pipeline construction last summer because environmentalists think oil is a dirty word.

I filled up today. Gas pumps near the Interstate were closed off with yellow tape. Found one with gas in it $3.98/gallon. Not good for a tourist economy.

Commodity supercycles are typically multi decade affairs. Anyone care to opine on whether the surge in commodities represents the beginning of the next cycle?

Also, the oil:gold ratio has popped upward… any thoughts?

I read that Russia and Ukraine are huge producers of commodities, so I would think there are going to be huge issues with supply of basic commodities. I know Russia is #4 producer of copper for example. I think number 1 in Palladium and near exclusive producer of titanium. I think one or both are big producer of fertilizer. World is going to be a lot poorer overall because of Pandemic and Ukraine war. We will eat it in inflation, stagflation or huge debt defaults. To be determined.

Don’t be surprised if Russia retaliates by redirecting supply. But to do that, they will need China’s cooperation.

They can sell to China who will stockpile it. China can easily afford to cooperate with them.

Russia is also the 4th largest wheat producer and 2nd largest wheat exporter in the world. Ukraine is the “breadbasket of Europe”, the 7th largest wheat producer and 4th largest exporter of wheat. The Bosporus Straits are closed at times, thus potentially shutting off exports to the rest of the world. Ukraine is also the 6th largest producer of corn in the world and the 4th largest exporter of corn.

When the Soviet Union fell in 1989, and with it communist collective farming, it opened the door for that area to become exporters of agricultural products rather than importers.

The Ukraine supplies 90% of the worlds neon.Neon is necessary for use in lasers which in turn are necessary to make semi-conductor micro chips.

See a problem?

Some UK petrol (gas) stations today are US$12 per (British) gallon…

The price in Britain is irrelevant. No one in the UK drives anywhere.

About half as far as in USA on average according to the internet, so yes not as far but still significant.

They went all electric, didn’t they? /s

Can’t decide which extreme is more striking in that chart, Wolf, the recent decade high — or the decade LOW in crude!

Yes, crazy.

The sunk cost for the gasoline in the storage tank is irrelevant. The key variable is replacement cost; the station sets the price of gasoline so that it has enough money to replace the gas it sold you.

Now this is the real reason for the increases. Thank goodness somebody understands. Not the implied evil man in the back room joyfully raising prices. Nobody, I repeat, nobody has to pull into that gas station.

RJ

Indeed, it works that way with just about everything that is in current production.

RJ,

The real reason for raising prices is that companies CAN raise price and get away with it.

Every company all the way up the supply chains will raise prices to the maximum possible while still hitting their sales targets. If they raise too much, sales decline. If they don’t raise enough, sales rise, but profits suffer. This is a daily calculation, based on how sales are going at those prices.

The fact that they can now raise prices like this — and this is all the up the supply chain — when they couldn’t before is due to the inflationary mindset, where consumers pay whatever. This started in January a year ago. You could see it with used vehicles first.

COST has nothing to do with it. Never has. Prices are set by the market place. Retailers make or lose money at those prices, depending on how much they paid for their goods. Now gasoline retailers are making a TON of money.

Note that inventory is valued at purchase cost (actual amounts paid for it), not the potential replacement cost.

AAA has a national gas price average which is updated daily around midnight:

gasprices.aaa.com

Gas prices today (3/6/22):

Current Avg. $4.065

Yesterday Avg. $4.009

Week Ago Avg. $3.610

Month Ago Avg. $3.441

Year Ago Avg. $2.768

The $4.114 national average record from 2008 is definitely going down this week.

Oilprice.com has a global gas price average.

It is now $3.70

It was $1.95 on December 1, 2021 although a smoothed average is more like $2.50

We are clearly headed for $5/gallon gas average for the US overall – so get ready for $6 or maybe even $7 handle in California.

Thanks Wolf. Here in Europe the Energy markets are blowing up at the moment. Examples:

TTF, the Dutch Gas Market, is trading at 300 Euro / MWh this morning (price 1 year ago less than 20 Euro / MWh) on expectations of Nat Gas cuts from Russia to Europe.

In German Power, the largest power market in Europe, the April contract traded at 675 Euro / Mwh, driven by colder weather, less wind and high fuel costs. “Normal” price for this season around 25-40 Euro / MWh.

The parabolic rise in prices drive higher margin calls which in turn drive liquidations in other markets such as Co2 which is down close to 40 % since beginning of year despite high fossil fuel burn.

With Germany turning off their remaining nukes this year and Nat Gas supply looking increasingly challenged this could turn really bad for the European economy this year.

It could even cause the end of the euro. Germans and Dutch are getting killed by inflation and housing bubbles, while their governments can easily deal with higher interest rates due to relatively low debt/GDP

Italy and Greece in the other hand, while also getting killed by inflation, will be bankrupted by the rising rates that are required.

In other words, time to finally dissolve the euro (though this will probably happen by itself). The euro was always a bad idea.

A legitimate threat to Euro or the Eurozone is where I believe Europe will revolt against US foreign policy.

There seem to be elites in Europe who will seemingly sacrifice anything in their goal to create a European superstate.

My bet is that they won’t give up the European project to support US policy. Eventually, there is a limit to everything.

Europeans give up 100% Green and cheap Nuclear Power for bird-killing Sky Knives and Thousand Acre Solar fields (that require clear-cutting every living plant)……….so they can virtue signal and go broke being woke…………….and they forget that each country, tribe, ethnicity, has 1,000 years of “pay back” waiting in the wings…..Gee, what could go wrong.

Now, they have 1.5 Million refugees that are doing to need “heat” and food. Good Luck.

Yeah man! Let’s pull a reactionary pivot away from renewables and really seal the deal on climate disaster. If you think the current refugee crisis is unseemly, you’re gonna love the future!

The problem with nuclear power is that there is nowhere to go with the waste material……….or do you have a lot of room in your basement ?

“100% green” Ever figured out how much diesel is needed to mine uranium ore, ship, refine, clean up waste, package into rods, build nuke plant, operate it, store waste, decommission plant?

Don’t forget the cost of loans and the unmentionable, liability insurance. If it’s so “green” why were the V.C.Summers nukes in South Carolina abandoned?

My daughter insisted I post that.

good for her t4,,, and you too!!!

now get her to look into why those nukes were ”approved” and financially supported by USA GUV MINT in the first place, such as who was ”paid off” by whom and for how much and how the payments were diverted/directed away from the recipient(s),,, etc..

your comment just a little addition to my confidence that the youngsters will do better and better to bring total transparency to the entire GUV MINT edifice, most of which is totally NOT needed with a properly functioning education system including especially ”privileges” granted for proving lessons have been learned:::

Driving license;;; buying things on contract license;;; baby making license;;; gun ownership license;;; the list of education lacking is NOT endless, but TONS of education connected to privileges certainly lacking at present, far damn shore.

I believe the ’76’ brand is from Unocal that Chevron bought.

The Bay Area refineries are Chevron at Richmond and Shell at Martinez.

From Wikipedia:

“76 (formerly Union 76) is a chain of gas stations located within the United States. The 76 brand is owned by Phillips 66. Unocal, the original owner and creator of the 76 brand, merged with Chevron Corporation in 2005.

And also from Wikipedia:

Phillips Petroleum created a joint venture with Chevron Corporation’s chemicals and plastics division in 2000 and also acquired ARCO Alaska from BP. It purchased Tosco, which included Circle K convenience stores and Union 76 gasoline, in 2001. The 76 brand, long familiar in the western and southern U.S., was created by Union Oil Company of California (later Unocal) in 1932. In 1983, Phillips Petroleum purchased the General American Oil Company from owners Algur H. Meadows, Henry W. Peters, and Ralph G. Trippett.[14]

In 2002, Phillips Petroleum merged with Conoco to form ConocoPhillips. The merged company continued marketing gasoline and other products under the Phillips 66, Conoco, and 76 brands. However, Phillips 66 Company licenses the Phillips 66 brand to Suncor Energy for its Phillips 66-branded stations in Colorado.[15]

And there used to be several other refineries in California back in the day(s)… Including IIRC a couple owned by 76.

Friend helped with the hazmat removal from one of them in the Central Coast area couple decades ago.

Plumes were reportedly the deepest found in CA at that time, though perhaps exceeded more recently.

After more than a decade of competitive currency devaluations, it is now time for competitive currency REvaluations.

If import inflation and scarce resources are killing your economy as it is now, you want to have a stronger currency than your peers to outcompete them for these scarce resources.

Therefore, time for central banks to outcompete each other on interest rate rises!

My guess is they will get in two hikes and by then financial conditions will tighten up enough that they will not run off one dime of US treasuries, maybe they will get mortgages off balance sheet. Treasury debt has been monetized forever is my guess.

If they really wanted to run off QE most experts say they should run off QE before raising rates as it makes more sense.

The Fed will do a “One and Done” rate increase in March. They will go up .25 and the economy which is already in a recession will go into a major Stagflation economy similar to the Jimmy Carter Days. Energy shortages and gas lines will be in the headlines. No way the Fed will increase rates in that environment. The Fed will stop the increases and work on trivial reductions in the balance sheet instead.

I agree YuShan. We are about to see de-based currencies get re-based (to a certain level/degree).

I will be extremely curious to see to what level / degree countries will compete in this manner.

In the 72-73 run up in oil prices, the FED validated (a 30% roc in AD, the volume and velocity of money), the administered OPEC price hikes. The current situation is different. The FED has now tightened monetary policy using the peg in O/N RRPs (RRPs are an unrecognized subtraction in the money stock). Going forward this will cause a pronounced deflationary impact in other non-oil sectors of the economy.

Looks like a recession is coming. Like the oil price surge in July 2008.

$130 oil in 2008 would be the equivalent of $173 today, adjusted for CPI.

Over the same period, the sticker price of the Ford F-150 XLT base version soared by 50%, from $24,000 to $36,000

WOW, that F-150 must be one fantastic truck!/s

I went to the Truckers rally in Hagerstown Maryland yesterday. Talked to a few of them. They were paying $6000/week for gasoline before the recent increase. If you don’t think this new cost will be passed along to the consumers in the next week or so then I’ve got a bridge over the East River in NYC I’ll sell ya. ENJOY.

Gasoline ?

Really ?

Big rigs ?

The fuel is called diesel.

Pretty inaccurate reporting of basic facts. What else did you get wrong ?

OutsideTheBox

OK diesel. The rest of the reporting is spot on. You just can’t handle the truth or the facts.

Your credibility is shot. We know you are just making it up.

Yep Mr Swamp,

This is the point where diesel thieves make a killing if they can drain a fuel tank overnight.

Don’t forget the gas thieves! Thieves have started ‘spigoting’ vehicle gas tanks. A very quick way to drain the tanks!

You mean $6000/mnth. Do the math.

Yay.

I’m watching household savings rate like a hawk.

Maybe when you have a hammer everything looks like a nail, but I think the acceptance of inflation by consumers and the asset price bubbles are both a result of savings rates spiking at 5x former historical highs.

This all unwinds once the savings are empty. That’s when gas, grocery, car prices and everything else are going to hit some major friction via buyer strikes (as much as possible anyway since the first two are pretty inelastic). That’s when retail will liquidate their stocks. That’s when people will start to downsize or sell their house out of duress and go rent.

Good idea.

Can I ask what site you go to for that data?

Or you can have a Liberal like Trudeau to increase mass immigration and money laundering foreign students to create massive housing and rental bubbles?

Last year it was the stimulus payments spearing inflation. Now it’s going to be commodity spikes back and forth. So-called free markets filled with speculators pumping up dumping with the critical necessities of life. This will make crypto trading look tame.

Good point! All these cheaply super-connected markets will get all sorts of players into speculation. Crowds of punters will rush to try to charge everyone else for the latest anticipated fad consumer demand wave. New players entering this, would feed volatility over time. So “meme-ism” could be widespread.

An “unintended” side consequence is also the potential political blowback in remote or not so remote countries when the local population can’t afford to eat.

I’m all for individual choice but we are wasting a lot of fuel. Witness the ubiquitous large pickups going down the highway at 75+ mph getting 10+mpg. Filing up one of these trucks will be $200 soon. So far, people don’t seem to be bothered by the price of fuel.

The real issue is that energy is a direct input into GDP. There is nothing we do that does not require energy and we are still largely a carbohydrate society.

Being an old engineer I have experimented a lot with my car. It gets its peak gas mileage at 59 mph once warmed up (about 33 mpg). Cruising at 70 takes off about 2 mpg, but my car has a low coefficient of drag. If you are driving a box, speed is more important.

The thing a little surprising is driving 45 mph the car gets quiet a bit lower mileage than 59 probably because it can’t carry the top gear (7 speed).

Other thing that seems clear if my on board instrumentation is correct is a cold engine gets horrible fuel mileage.

High speed driving also is a killer on tire life.

GSH: I drive all large PUs. The worst mileage is 17 on 50 plus mph dirt roads with automatic transmission[excluding mud, but we don’t get rain anymore], and the best mileage is 20 plus to 22 mpg, depending what the moisture content of the roadway is. Cummins engines and manual transmissions are the the desirable hookup.

This means practically everything will become more expensive. 100+% increase in gas prices (crude from 50 to 130 in one year) easily imply average 10-20% additional price increase in everything non energy, and perhaps even more in food.

Even official CPI will go bonkers. Will not be surprised if Feb reading is 8+% and March reading is 10+%.

In spite of this Fed is sh itting in its pants but not raising rates by any meaningful number. 0.25% hike in March when official inflation is running at 10% is a sad joke. The broad day light robbery from ordinary Americans and lies go on.

Maybe the FED isn’t bothering to raise the % 0.25 because they know it will do absolutely no good.

Why spook the market for a useless gesture?

Will 1% make a difference? I don’t think so.

Will 2%?

Will ANY % will make a difference today?

So, why even bother. If you wait till a patient has 107* temp, it’s too late?

Maybe we are riding the Titanic and the smart people are already in the life boats. Maybe they are the Gold hoarders waiting for that “Reset”?

Maybe it is just too late to save what we have now and we really do have to start over. Some have said that is the conspiracy.

GSH

My consumer distress indicator will be the volume of RV’s being dragged around including the sales of new ones. All the RV dealers here are fully restocked with an amazing amount of product vs what was in the past.

There was a big surge in RV sales during the pandemic. We may see a lot of used ones on the market, between normal owner fatigue and high fuel prices.

Lots of people in California live in BFE, sometimes an hour or 2 drive from the big city where they work, I wonder where the cost of gas per gallon cancels out their salary…

$10?

Worth it to live far far away from the ever expanding ghettos. Better schools, less crime, and you can actually patronize businesses without being attacked by the deranged goblins that have no fear due to the lack of prosecution from Soros sponsored DAs. Crime has a cost of it’s own, its why no one buys homes in Detroit that sell for a dollar or some absurdly low amount.

Thank goodness there is no crime on the outskirts of town!

XC, we all know that depends on the town, state, and laws in-place for citizens to protect themselves. There’s very little crime around us here in my part of Texas as most civil folks own and carry firearms legally.

I get that, there’s always a good person with a gun in case there are bad people with guns, but how do you differentiate them?

You obviously know.

You’ve done your research

You will to do the uncomfortable thinking.

You will be condemned for seeing the way it is. Others want the lion to lie down with the sheep. Unless you are ready for it, it is painful to “see” and to realize the lies that got you where you are.

One has to go into the fringe world to find the concepts, to discuss the concepts, and to then know what to do. Those that mock you and condemn you will follow you for “safe neighborhoods”, “good schools”, back yard for the dog and kids, etc. Just smile at them for they know not what they say.

Congratulations.

You’ll know it when Facebook employees have to bring their lunches to work and make their own coffee.

Nah, they will be in the Metaverse, whatever that is. Imaginary work, lunch, and coffee.

Think of it as a place “ where everybody knows your name”…

China’s winter wheat crop could be the “worst in history,” the agriculture minister said A survey of the winter wheat crop found that the amount down by more than 20 percentage points. They are buying all they can from Russia. Fertilizer shortages will not improve things…

Wolf….Please talk about wheat and fertilizer shortages and how the poor countries are in for revolution (Arab Spring) when they cannot afford food??

In Canada, we had our Freedom Truck rally.

On Reddit, posters who encourage others to “eat the rich” by posting the names and addresses of the Toronto elite are not banned. They are encouraged and liked by many.

Times are changing. When a man has nothing to lose, he loses it-Gerald Celente.

The rich in Bridle Path are becoming hated by the peasants.

Russia and Ukraine are the ‘#2 and #4 wheat exporters in the world and do about 28% of all world exports. I like to express ending stocks to use % in terms of days supply of world wheat.

Right now, we have 129 days supply of wheat in the world based on current demand. However, if you take China out of the equation (who holds 53% of ALL world wheat stocks) we have 78 days or about 2 1/2 months of world wheat stocks for the rest of us. Now if you factor in the 7 major world wheat exporters (EU, US, Argentina, Australia, Canada, Russia, and Ukraine), those exporters only hold 50 days wheat supply.

Throw in China’s drought and the drought in the major wheat growing areas in the US midwest, you are now seeing an explosion in price triggered by the war in the Ukraine. Price has still not exceeded the all time price in 2008. Volatility in the wheat market will remain as long as Putin keeps attacking the Ukraine.

Seattle Guy, The top wheat importing countries in the world in order are:

1. Egypt

2. Turkey

3. Indonesia

4. China

5. Algeria

6. Bangladesh

7. Iran

8. Brazil

9. Philippines

10. Nigeria

You tell me if another “Arab Spring” is possible if these poorer countries struggle with food inflation.

Tyrkey, China and Iran will buy wheat from Russia sanctions or not. Tyrkey may get in a squeze, providing Ukraina with weapons, Nato member and importing wheat from Russia.

Okay so what happen now that gasoline is up the wazoo? I vaguely remember high oil barrel price in mid 2000s but Lehman Brothers/stock crash took over headlines.

Dino water make the world run 🦖💨

if consumers spend more money to pay rent, fuel and food, then the consumer economy crashes, like in 2008 after the oil spike. The economy is going to collapse due to less consumer demand, unless money brinter go brrrr again.

I’m expecting the mother of all shocks when the fed meets next – a rate cut followed by the resignation of the treasury secretary yellen, who is replaced by Kathy Wood who immediately buys the entire Softbank portfolio. BAM!

Zark,

Gasoline is not out the wazoo…

More expensive, certainly…

A practical example…

My longest trip is about 1500 miles round trip… I use about 60 gallons… prior to the price increase, I paid ~$4 per gallon for premium…

Premium is now around ~$5 per gallon…

Net difference of $60 for the trip… so not really a factor in making the trip or not… I know people who will pay that or more per person at dinner…

I try to make decisions on real world fact and not hysteria…

I agree with you.

A gallon of gas is cheaper than a Starbucks coffee, and they whine.

People brag, or show off, that they go to Starbucks, but look hatefully at you if you mention the price of gas has no affect on you.

(is that affect or effect?)

effect.

In the early 70’s I was managing a Texaco distributorship in Park Co. Colorado. Under Nixon’s rules, one couldn’t make any extra profit from older inventory. You had to sell it out at the old price. We made nothing extra in those days because of the rules, even though we couldn’t even get the product to replace the old inventories in some cases.

I even got phone calls from Montana offering tanker loads at 30% above the price I could sell it for.

Times have really changed.

It is always a mistake to be too dependent on people who are only out to gut you.

People who are only out to gut you will go through a lot of trouble to make you dependent on them.

There are many examples.

Je m’emmerde. On se casse.

The Bentley runs on hydrogen.

I have a perfectly good fusion reactor that I am more than willing to share with everybody, no charge. You don’t even have to ask. Just go for it.

You people sure have a lot of problems.

“ Je m’emmerde. On se casse.”

I love it when you whisper Spanish to me :)

I don’t know if that 76 gas station you mentioned is corporate owned or privately owned, but I can give you some perspective. My family owned a gas station in a small town for 30 years. It is a tough business. We would commonly make a gross profit of 10 to 20 cents a gallon.