“Tech” real-estate broker Compass and “tech” renters-insurance-seller Lemonade collapsed too. All eyes on “tech” mortgage-broker Better.com’s delayed SPAC deal. I can’t wait.

By Wolf Richter for WOLF STREET.

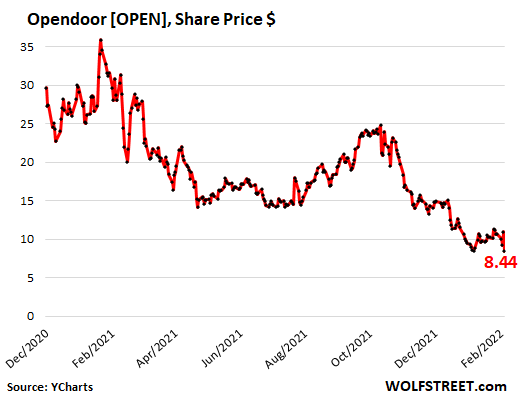

Even on Glorious Friday, the second day of a big rally after five days of sharp declines, the shares of a real-estate “tech” stock, house-flipper Opendoor, collapsed 23%, after having already collapsed in the months before.

Opendoor Technologies [OPEN], on Thursday evening, had reported a loss of $191 million for Q4, which brought its net loss for the year 2021 to $662 million, which brought its total losses for the four years that have been publicly disclosed to $1.5 billion. How can a house flipper lose $1.5 billion in four years? I don’t know either. But it isn’t over yet. And the company ended the year with an inventory of 17,009 unsold houses.

Opendoor went public in December 2020, at the IPO price of $31.47 amid enormous hoopla. By February 2021, shares had reached $39. If “February 2021” sounds familiar, it’s because that’s the month the stock market started coming unglued beneath the surface as highfliers started collapsing one at a time, each on its own schedule. The damage was such that I started reporting on it in May 2021. And this is just another chapter as it just keeps getting worse. On Friday, she shares closed at $8.44, down 78% from the February 2021 peak and 73% below its IPO price (data via YCharts):

Opendoor reported that it purchased 36,908 houses in 2021 but sold only 21,725 houses (for $8 billion) during the year, leaving it with 17,009 unsold homes ($6.1 billion) in inventory.

Opendoor financed this inventory with $6.1 billion in “non-recourse” debt backed by its houses. Non-recourse means if Opendoor defaults, its lenders get the house and cannot go after Opendoor’s other assets. If Opendoor cannot sell those homes and pay off the debt with the proceeds, it can hand the properties to the lenders and let them worry about selling the homes.

In addition, Opendoor was under contract to purchase 5,411 more homes for $1.9 billion.

About two-thirds of these 17,009 homes are finished and ready for resale. About one-third (about 5,500 homes) are “work-in-process” and are not for sale. Any of these 17,000 homes that haven’t been listed for sale, including all of the 5,500 homes that are work-in-process, are in the unknown pile of vacant homes that don’t show up in the official “supply” of homes and that don’t show up as vacant homes either.

Zillow did the same thing with a big portion of its 7,000 homes that were stuck in the pipeline before it quit the business last November and sold those homes mostly to institutional investors, who’re now trying to figure out what to do with them. These homes that are stuck in the house-flipper pipeline and that are shuffled around are vacant, but don’t show up as vacant, and they are not for sale, and don’t show up as “supply.”

House-flipping is easy – the first part, buying the house, when money is no objective, and your algo can spend as much as it wants. The rest is hard, and making money at it is even harder, especially if you overpaid in the first place. The activity is not suited for people who write algos, it turns out.

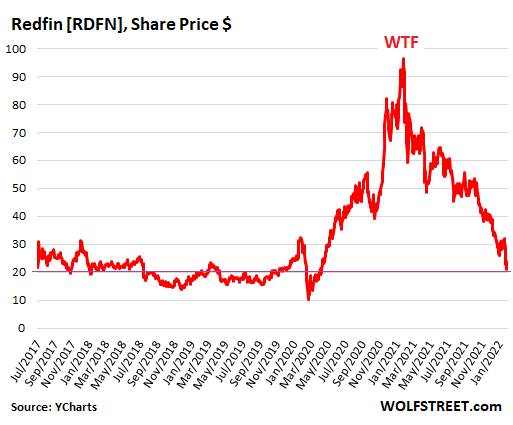

Redfin, originally an online real estate broker, also rode up the algo-based house-flipper craze starting in 2020. And its shares [RDFN] rocketed higher amid endless hoopla by the crazed crowd of stock jockeys and hit a high of $98.44 in February 2021 – yup, that February again.

Then shares began their long collapse. On Friday, they closed at $21.83, having collapsed by 78% in one year. They’re now below where they’d been after the first day of trading following its IPO in July 2017:

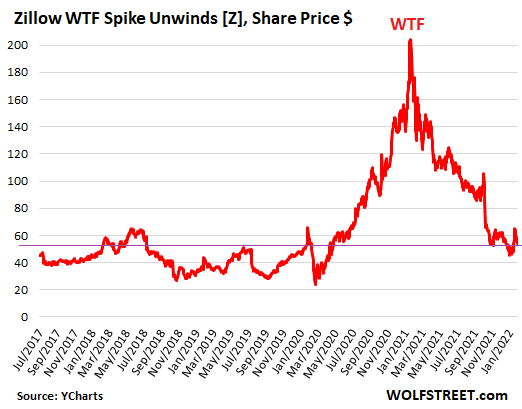

Zillow [ZG] had a brief respite in its collapse when it announced on February 10 that it lost $881 million in 2021 on its home-flipping escapade, which came unglued in November 2021, when it disclosed that it would lay off 25% of its staff and get out of the house-flipping business, and dump the 7,000 homes it had bought.

Later it disclosed that it had sold most of these houses to institutional investors – rather than to people who might have wanted to live in them. Until those vacant houses are listed for sale they don’t show up in the official “supply,” and many of them may eventually show up on the rental market. And while all this is going on as they’re being shuffled around, they don’t show up as vacant either.

The $881 million loss was less than feared, and shares bounced magically over the following three trading days, but have since then given up a portion of it. On Friday, shares closed at $57.95, down 73% from their high a year ago, and about level with where they’d been in February 2020 before the crash:

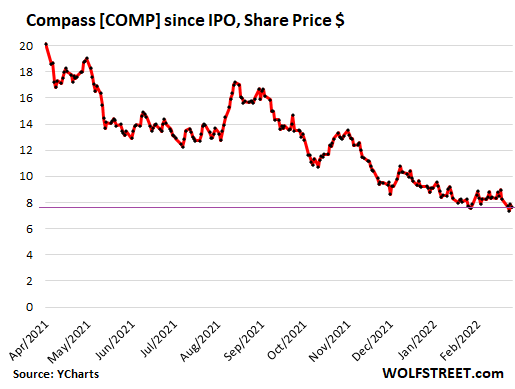

Compass, a real-estate broker that calls itself “a tech company reinventing the space,” is one of those examples – one of very many – when you realize something is seriously wrong with Wall Street. But OK, people have fun with their trading apps, and if they get cleaned out, so be it.

Compass grew by using Softbank’s money, and the money of other investors, to buy up real estate brokerages around the country. Over the five years of publicly disclosed financial statements, Compass has lost $1.44 billion. How can a real estate broker in the red-hottest no-questions-asked housing market lose $1.44 billion? That was a rhetorical question.

Compass shares [COMP] peaked on their first day of trading, following the IPO in April last year, at $22.11 and have declined ever since. On Friday, they closed at $7.65, having plunged 65% in 10 months since the high on the first day of trading, and are now 58% below the IPO price of $18 a share:

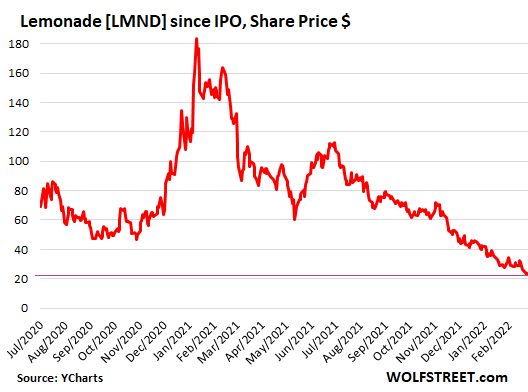

Lemonade [LMND], which is hyped as an “insurance tech company” and sells insurance for renters, homeowners, pet owners, etc., went public in July 2020 at $29 a share and in the first day of trading, amid immense hoopla, spiked 139%. It then continued spiking until it reached $182 in January 2021. And then came said February 2021, when this whole show started unraveling.

On Friday, shares closed at $23.48, down 83% from the high, and 19% below the IPO price at which the shares never even traded because the first trade was at $50 a share, causing the tech stock pundits to lament how the company “mispriced” the IPO and how much money it “left on the table.” Yup, that’s how crazy this show was at the time.

Waiting for a share-price collapse is Better.com, a “tech” mortgage lender, backed by Softbank. It’s not yet a publicly traded stock because its merger with a SPAC was postponed in December 2021 after the CEO fired 900 employees, most of them in India, via a Zoom meeting that went viral, that idiot.

With the SPAC merger, and therefore the inflow of cash, having been delayed, the company raised $750 million from Softbank and its SPAC backers because, you know, these kinds of companies constantly burn large amounts of cash and constantly need new cash to burn.

So I’m looking forward to the moment the stock finally starts trading so I can add it to this list of collapsing real-estate “tech” stocks. This should be a goodie. So let’s hope that the merger with the SPAC goes through.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Amazon and Google will have similar charts inside 2 years.

From your keyboard to G-d’s ears.

Already happened to Chinese amazons and googles. Hundreds of Billions of imaginary dollars wiped out in under 12 months.

Id just like the opportunity to buy a house thats not overpriced or junk. Thx -_-

Possibly, although the big difference between Amazon and Google, as compared to the companies mentioned in this article, is that Amazon and Google make loads of cash, re-invest it in their companies, and are innovative. I believe nobody can predict stock prices, so it will be interesting to see how accurate your prediction turns out to be.

When they go down, they all go down.

Are we supposed to feel sorry for these businesses driving up the costs of homes artificially and then losing money? I hope they all go out of business. Real Estate is just a legalized pyramid scheme anyway.

I believe businesses that don’t add any value to people or the country will all eventually fail and go away. Unfortunately, not before they inflict pain and damage.

To answer your question: not at all,not only should feel sorry for them , even should put them behind the bars , these fraudulent money hungry gready people , use others money, benefit themsely with the big load of wages and intensives , then bankrupt others, betraying Americans by artificially driving home prices to roof and dry up average Joe’s life saving, in name of capitalism. They use same paly book to screw Americans all the time with different scenes , real estate , .coms and so on.

So is Social Security. Government jackboot enforced Ponzi, that everyone who earns a dollar has to contribute in. Maybe it started out with good intentions, but with the bloated, disfunctional institution we call government, the beast is probably guzzling up most whats collected.

Agreed 100%

I agree whole heatedly not shedding any tears here 🙂

Amazon and Google are overpriced (Amazon ridiculously so) and the profitability is based upon a fake economy, not just in the US but also elsewhere.

No amount of innovation can “justify” the price level.

Google is primarily in the advertising business. Nothing innovative about that. It’s primarily taking market share from traditional media and the market size is concurrently inflated by the fake economy.

Amazon is a combination retailer, 21st century utility (that’s what cloud services is), and conglomerate. Retail business is mostly about convenience. Cloud business provides one time efficiency. It makes a lot of money but not enough to support the market cap in a sanely priced market, not even close. The peripheral business, who knows but conglomerates don’t exactly have a long term history of success. GE was successful, until it wasn’t.

Neither company has produced anything close to the transistor, microchip, electricity much less the wheel.

Both are good companies but that’s independent of what the stock “should be” worth.

Look at CSCO. It’s grown leaps and bounds since the stock peaked in 2002 at $82 and now sells for 30% less.

This growth happened the entire time during a mania. No way the mania lasts another 20 years.

When the mania ends, their profits will decline or crash with the economy and their multiples will too.

Amazon, Google and all the other “high-tech” public companies exist primarily on Central Bank (the Fed) largess of increasing money and credit far beyond the ability of the real economy to absorb it.

All that excess money is used to kill off smaller competition, creating price advantage for the controlled market. And the nation is poorer for it.

Yes, obviously. Does the guy think e-commerce will disappear in 2 years to be replaced by the next new thing, malls? Amazon moves stuff, not just electrons.

The next question in the transit of goods from manufacturer to customer: is retail, the middle men, an endangered species? Could the mall of the future consist of manufacturer outlets where just one of each item is displayed, and delivery of yours is by Amazon?

The crown jewel of Amazon is AWS not amazon.com

Tesla (-35%) is already on the way :-]

Wolf, surprisingly Tesla puts are not performing as well as I hoped. Were pricey to begin with. So far my best was on Shopify. It went down like a stone. Fecebook puts did pretty well.

Yeah -35% after +1000% in 2 years.

Most people here just sound envious to big tech creating gobs of wealth. Wishing bad for them doesn’t mean bad will happen to them. Based on their rate of growth, deep pockets, profits and talent pool they have no threats whatsoever except government crackdown like in China which is unlikely because they can buy government and best lobbyists.

Kunal,

Tesla is an automaker – not some kind of miracle tech. And eventually it will be priced like an automaker. It’s a fast-growing automaker, so it can have a higher PE ratio than slow-growth automakers as long as it grows fast. It’s ridiculous to assume that Tesla should be worth as much as the 10 most valuable global automakers combined, when it has only 1.5% of the global market.

Tesla was once the only EV game in town. Now there is EV competition from all sides. Every automaker has trouble making enough vehicles due to the chip shortage. So we won’t see what that competition looks like until production can ramp up to full speed. But we know: there will be lots of competition in EVs for the first time.

In terms of dollars: TSLA went from $180 a share two years ago to $1,243 in November. And that was a great run. Now it’s at $810. Tesla has gone down much harder than the overall markets. Which tells you something.

I’m soooo envious. I hope you own plenty of Tesla stock!

I m completely with you , as long as corrupt politicians are in offices and lobbyists are around , these people can do whatever they like and end of day average Americans will feel the pain.

You should take out a second mortgage and buy stocks of all these tech companies you spout about.

It doesn’t take a genius to see the writing on the wall for Tesla. Their lead in battery tech is gone with autonomous driving nearly eroded. Tech gurus proclaimed they had a 5yr lead only to be proven wrong.

They dodged supply chain issues better than other manufacturers but it’s caught up with them now and will impact sales this year.

All this for a vehicle that consistently rates at the bottom in quality.

Tesla seems ripe now. I took a loss shorting it longer back and shorted again tiny from 1006. Added later in small steps. Still planning to increase the position.

It is most important to see media and fans slowly turning against Tesla. Social media was decisive for the mania in Tesla and all EV related stocks. The same will work powerfully on the way down.

Good luck to all!

Clearly you don’t know Tesla and you don’t know the car business. Your a fool. Keep shorting Tesla lol.

If you had a brain you would be shorting GM. Get the popcorn out I will watch both of you go down. Lol

Given my outlook for the stock market as a whole, Tesla is a stock that I expect to ultimately lose at least 90% and maybe over 95% of its peak value.

A 90% loss would still make it worth over $100B, still overpriced or at best “fair value” as a “mature” company.

If it’s losing buckets of money as most or all auto companies should be doing in the upcoming massive recession or depression, 95%+ loss in a market crash is hardly drastic. It’s been insanely overpriced based upon hype the entire time.

There is no comparable in the history of technology of so many well- financed, competent competitors entering a field as suddenly as the E-car. No doubt a main factor is the absence of any patent as a barrier to entry.

As Tesla’s e-niche becomes e-world and it comes up against Toyota. VW, etc. it is going to need to learn what mass car production refers to as the ‘Toyota System’. Along with ‘just in time’ inventory and a very flat management pyramid, Toyo introduced ‘zero defects’.

In pre-Toyo production, defects were taken off- line and corrected. They were considered undesirable but a fact of life. ‘Zero defects’ means not accepting them, finding out why they occurred and fixing the cause.

At least one major financial analyst, not sure if it was Goldman, predicts Tesla’s share of e-cars is going to drop to 20% in 2 years.

And still up 1500%. I would guess at this stage it’s not about the business it’s about the money, 837 billion. I don’t see the stock is the problem its the currency. So in any deflationary reset losses are all relative. The only threat to Tesla is the next Tesla, whatever that is. However if the Fed abandons its expansive money supply policy that possibility is moot. I think owning Tesla is as a good as a zero interest money market account. Hussman projects negative stock returns for a decade, but at zero return on savings and 5% inflation what’s the difference?

It just keeps getting better and better.

Right when you think Wolf has outdone himself he comes up with a review, consolidation and opinion (hilarious: “The activity is not suited for people who write algos, it turns out.”) that is just priceless.

It is a privilege to be a part of these incredible times with clear, clean wisdom.

Metaverse formally facebook is down by that much too. What amazes me is they produce nothing. At least tesla produces a product. Alphabet, Facebook, Twitter, etc. Produce nothing.

“Advertising is the art of convincing people to spend money they don’t have for something they don’t need.” ~ Will Rogers

Great article!

I find it funny that these company’s stocks are considered “Tech Stocks”.

And these companies aint even the big boys on the block buying up houses contributing to the housing bubble. Blackrock and Vanguard make these companies look like small fries.

These tech firms have a version, I think, of what in crypto is called “the oracle problem.” Meaning, in taking in data and forming judgments, the interface between an algo and reality lacks the rich knowledge and data a human has. The models are too crude (and perhaps the coders lack the deep subject matter expertise). A lot of that one-sidedness in programmers was shown, I think, in the whole meme-stock phenomenon. There is an unavoidable learning curve for youth that involves experience and perhaps pain.

I owned a bit of Lemonade stock I bought around $38. Its subsequent fall was just enough pain to cure me of buying single meme stocks. As in 2000, a little bit of real survivable innovation tends to fade as the prevalence of promotional stories creep in. Some good stuff is there, but not ready for prime time. I don’t need to be the financial beta test. I sold out in November.

“ Meaning, in taking in data and forming judgments, the interface between an algo and reality lacks the rich knowledge and data a human has”

phleep,

Better research would have shown you that the guys writing the algos were the same crew trying to figure out why the tire was only flat on the bottom… :)

Zeroes TV did a shocking exposé on Lemonade. Too late to do you any good except that it’s educational and entertaining.

Worked in IT all of my life (30+years). Most writing algos are not from this country and only understand RE values from college economics class. The problem, looking at the text book, was the college professors utilized a popular UK text and the teachers were from India or China. None of the algo writers studied history or knew much about the 2008 housing crisis. Needless to say they are constantly amazed by the American way of life on TV and the reality they currently live in. This could be the single point of failure in these models. Those who do not study history, or comprehend the lesson, are doomed to repeat it.

I’m an IT guy too. Writing algorithms is easy. Providing non-garbage input is a different ball of very sticky wax.

But the companies are not “tech”. That’s marketing BS to inflate the stock price.

Using technology doesn’t make you “tech”. Every company does that now.

A real technology company sells technology, not something else. MSFT is a tech company. So is CSCO.

Even a company like Google is primarily in the advertising business, whatever you want to call on-line search since there is no brick- and-mortar counterpart.

You are missing Google Cloud Platform is one of the biggest technical advancement in enterprise information technology. They sell Infrastructure as Code, like AWS, a cloud platform. They are now the data centers instead of on-premise. It cost a little less “renting” data centers then hosting them yourself. Most of it is automated. They got their start in telecommunications. That is technology. Google is equivalent to Microsoft and Apple. They received additional money by collecting and selling user data. It is why I am always shocked Fortune 500 companies use them. They sell data. Period. Organizations everywhere believe an SLA saves them from primary IP theft. Shady business practices always happen under the hood of big data. I would personally look at NSF enabled data centers. I digress….

The post to which I replied didn’t even mention Google or AWS. So no, I did not miss anything.

I’m familiar with both, since every company I work with uses one or both.

It isn’t revolutionary. It’s still a data center. A more efficient one but still a data center where these two companies are part of an effective oligopoly, along with Azure.

Longer term, cloud service providers should be valued like a utility because that’s what it is, a 21st century utility.

Right on…. I am not joking here, some woman make 200K selling bottled farts online. Google it. So is she a tech innovator, maybe she could go public through a SPAC and call the company farts-are-us.

If our soulless corporate government could privatize air it would.

Andrew Jackson was right. Many in my family are prices out of this market because FED and corporate interests have pushed people out of the market.

We are living in a fully fledged corporation folks. It ain’t a country, it’s a god damn corporation.

Profits over People ™

James,

Take a little time and research GE and what happened when Jack Welch took over…

There’s your template of corporate behavior…

The devil didn’t even want this guy…

Wasn’t Jack the one with the plan pushing 7 shortcuts to hell?

Yes, but Jack Welch was just reacting to government incentives. GE got on the bandwagon of financialization which was where most of the profits came from til it blew up in GFC.

Similar story to the S&L crisis. Government’s hands were all in the blow up.

Savers should be upset that government policy was to give you a negative yield and foster stupid speculation with your free money.

I think we do indeed buy “air!” Think cereal, chips and cheese curls. Over time the weight goes down and the package gets larger. I wonder why people keep buying the stuff?

Would the optimal weight-to-package size ratio for such groceries be just short of the threshold at which the packages float away like helium party balloons?

TK-

One problem with your complaint about the selling of air: I actually like cheese-curls and Cherrios.

You’re marginalizing my right to choose products that I value just because they don’t appeal to you.

Please don’t outlaw the innovation that makes my product choices more broad.

Remedial reading assignment: Milton Friedman’s Free To Choose

Spotted the cunsoomer

People are now considered a liability and just warming a seat until a company can purchase AI to replace them. Just like the old saying, “A computer can replace 100 ordinary people but no computer can replace one extraordinary person.”

Good quote Kim!!

Now retired after 50+ years in the construction industry, I can testify that is exactly the truth in that world.

One of my best examples was the guy who could drop 16d framing nails with one hand, hit them once to drive them home, and do twice the work two average folks could do in the same time.

Thanks for the reminder!

Replaced by the nail gun!

Not that guy AA,,, though I certainly understand the reference:

I put him up against two guys with one nail gun, one of them to align the pieces, the other to pull the trigger on the nail gun, and he beat them,,, every time,,, and laughed at them, of course, it being a construction site where PC, meant something totally other and politically correct in the 1980s…

IF I could have found just a couple more of his ability/or cloned him,,, I would have been on easy street for the rest of my natural life,,, LOL…

Deborah Tavares (and other persons who once had videos on YouTube before they were memory holed) has been calling the United States a corporation run by insiders for over 15 years. A corrupt corporation.

And the Supreme Court made it official by ruling that corporations are American citizens. Worst scotus decision ever.

Yep, and that’s because the founders and those who wrote amendments very unfortunately failed to specify “natural person” in their wording which allows an “artificial person” like a corporation to be included. We all know they meant the former, but see my P.J. O’Rourke quote and don’t tell me that the SCOTUS interpretations aren’t influenced to decide what is in the best interest of corporations. Too late now…

We the Corporations: How American Businesses Won Their Civil Rights – 2019

The 14th Amendment (along with the 13th and 15th) written to integrate freed slaves legally into society was usurped by the corporations to not be considered organizations but a gathering of people. The last remaining drafter of the 14th Amendment lied to convince the Supremes that Corporations were part of the definition of “persons” as stated in the Amendment.

There is a legit and completely ethically justifiable rationale behind allowing a bunch of natural persons to aggregate and organize as a corporation. Making tghem do a matrix of atomic contracts is super-inefficient, read Ronald Coase. This revolutionized human wealth creation and is largely responsible for many benefits some here take for granted, including whatever gadgets you are typing on, and at a public corporate level, creation of the Internet we are conversing on. The actual explicit recognition that Henry Ford couldn’t subvert his corporation’s operations to benefit himself at the expense of his investors, Ford vs. Dodge, is a good place to start.

Yes, there are downsides. To natural persons too. All have motives and opportunities to screw others.

I disagree with treating corporations as persons but it’s not the only example.

Unions are another one. Employees should be free to organize while employers should be free to ignore and not bargain with them.

The absolute worst is “democracy”, which is the application of awful math.

It’s where 1+1=3. It’s where a collective of individuals pool their rights and magically end up with rights they didn’t have before, like with every government administered social entitlement program.

Treating corporations as person is a mechanism for the wealthy to avoid being plundered by the populists. That’s the real reason the populists are against it, they can’t strip the wealthy of their political defenses.

If government was limited to selling favors as it was in 1789, the subject would mostly be irrelevant.

@ phleep –

A corporation is a collective allowed by government. It provides limited liability and limits or eliminates recourse by injured parties against organizations owned and or run by sociopaths. It has endless life and competes against individuals. A corporation is a creature of the state.

As for being a revolution of wealth creation ……….. how can you prove that oft used assertion of corporate lobbyists and apologists. More a revolution of wealth concentration.

@ Augustus Frost –

So a democracy is worst than a dictatorship, an oligarchy or a plutocracy?

Do you favor the corporations and corporatists over democracy or the populists or the population at large?

The biggest threat to free markets is concentrated wealth and power. Corporations, with their limited liability, money aggregation, unlimited life, ability to buy lobbyists and politicians, etc. are a masterfully contrived plan to concentrate wealth and power.

Worship them at your peril.

So when a corporation, now a person, breaks the (criminal) law, who goes to jail?

If no one can, because the corporation is not a person, then how can SCOTUS think their position is rational, let alone “reasonable.”

The only people with natural rights in a community are those who can and do show up. Corporate lawyer(s) don’t count. Any property owned by a corporation cannot be homesteaded, and is a ripe target for squatters and the dispossessed.

Also, any house with one of those “We believe in human rights” “property is theft” “Love” “Smashing patrioarchy” et al, is a place to which we refer homeless as a good place to erect a tent.

Wolfbay-

You are absolutely dead-on-center correct.

The Russians and Ukrainians both have oligarchs; we have corporations (which, although available for investment by the masses, primarily belong to the classes). Wolf has elegantly documented the wealth disparity, with selfless passion, IMHO.

“We are living in a fully fledged corporation folks. It ain’t a country, it’s a god damn corporation.”

“When buying and selling are controlled by legislation, the first things to be bought and sold are legislators.” – P.J. O’Rourke

Good quote!

RIP, PJ Orourke…

HEAR HEAR, JH!

So sorry to see that old soul willing AND able to tease us, tempt us, and teach us, with humility and honest or at least somewhat honest ”hubris”…

RIP indeed…

Nobody forces you to participate. Vote with your feet. Take their money and retire comfortably abroad. And – no children. That will starve the country and make the feudal lords reconsider.

Seems there is a bit more complexity in flipping thousands of yet to be re-furbished houses into a place called a home for people than just a slick App. Attention to detail is a bitch on one house much less thousands.

Back in the Eighties I flipped several houses in a row successfully. You need three things to make money. The market must be rising. You have to know what your repairs and improvements will cost. You must move quickly–in and out.

Add one more item – got to know the wind direction and time to batten down the sails. Ditto on flips during the 03 – 06 period in San Diego. Felt the storm coming and got last one sold just in time before the SHTF.

Every time a house is flipped = value increases higher taxes retired taxes ,insurance,utilities will force me out of home in 5 years ,my insurance agent said people leaving Nebraska moving to other states can’t afford to stay here

Surprised that is happening in a red state.

Propeller-head geeks, like all humans, are energy-conserving, i.e., lazy and looking for shortcuts. And over-relying on the same as soon as it seems a free ride appears. Ditto for investors (and yours truly at sloppy moments). This also allows young males to externalize emotions that make them feel squeamish, by worshiping and emulating robots. Hence the popularity of the Terminator character. It is a boy’s power fantasy, and a surrogate worship of a kind of magic, tech magic, a quasi-religion, scientism. We can push a button, presto, the algo makes me rich and powerful. Presto. But sucker-ism is so often the net result. Rinse and repeat.

Great points.

These “high tech” real estate start ups burned oodles of cash and lost tons of money in the hottest real estate market in 50 years with falling interest rates…

Now…with rising rates, a slowing economy and the bubble about to pop.

Carnage is coming.

2b,

You got me thinking….

What was the influence of the “high tech” on the actual market…

Could they have actually juiced a market via psychology and subliminal inputs to create the mania…

Particularly, the people who use these apps and data, are incensed when you question them, especially on “tech” valuations…

I look at a lot of this crap and think I’m the deaf child when the Pied Piper came calling…

Like vodka and tequila at a college frat party…

“Could they have actually juiced a market via psychology and subliminal inputs to create the mania…”

“Could they have actually juiced a market via psychology and subliminal inputs to create the mania…”

ABSOLUTELY. Redfin’s listings ALWAYS say “homes in this area usually have accepted offers within X days. Tour it before it’s gone!”

Work with a tiny private firm that does a lot of EH (Environmental Health) work in the Midwest. One of our business lines is in the private sewage and private water (wells & septics) areas. We handle all the evaluation, paperwork, & ‘Chain of Custody’ areas related to wells & septics. There are millions of private water/private sewer installs out there, and the systems go bad over time.

We can tell you that the whole ‘Chain of Custody’ evaluation process on these installs seems to be like an alien concept to lots of these so-called Real Estate ‘Tech’ firms.

We’ve had a number of these Real Estate ‘Tech’ places contact us over previously ‘flipped’ properties (or ‘in process’ flips) and when we try & explain what a mess they are in, their eyes glaze over and they have actually, in a few cases, tried to buy us and have us try and clean up their messes.

No thanks. Not interested. Our reputation means more than that.

These Real Estate ‘Tech’ firms with all their fancy algo’s don’t do so well when the ‘manure hits the ventilator’ situation occurs.

Oh well….

Interesting – what would a chain of custody be for a septic installation?

These days, most (approx. 85%+/-) mortgages on properties have to have what is called a loan evaluation for both private wells & private sewage (septics). This is part of the ‘package’ required for any loan to be securitized and processed as a MBS (Mortgage Backed Security), usually purchased by Fannie Mae.

IF too many loans in an MBS go bad (for whatever reasons), the tranches (think ‘layers’) get out of balance, and either the MBS bond rating goes down (painful for investors, and also painful for issuers), because not supposed to happen. Shades of 2008 – See “The Big Short”.

Not sure if the different troubled MBS bonds can get re-opened and adjusted. Supposed to be possible, as far as I know, doesn’t happen much.

That’s why everybody wants CoC stuff, so they can figure out who screwed up where, so no more 2008’s. And fixing wells & septics are big time money for average home buyer, and the locals tend to get unhappy, and NOBODY wants to deal with the messes. It tends to get expensive. And remember, this is all occurring in the public health realm.

All the administrative paperwork is to get to the point of the sale is just a nightmare. But if it was easy, they likely wouldn’t pay us for it.

That’s the ‘Why’.

The ‘What’ is all those messy technical details. Where is it located, age, tank & field location (IF a field is used, where is everything relating to the location of buildings, driveways, parking lots, roads, swimming pools, etc., etc.), type of system (there are LOTS of different types: tank, mound systems, sand filters, mechanical, NPDES compliant, capacity, percolation, # of lines, saturation, interior condition of tank – baffles, screens, etc., etc.).

If you are not comfortable out in the field and getting your hands dirty, it’s not the job for you.

Sometimes you find there’s nothing – just a pipe running out the other end. That’s likely to become an “Effluent meets the affluent” situation. Oops.

Great info SBG.1

Sounds like an anecdote where asymmetric info can work to the benefit of the smaller investor willing to do extra homework. The big guy need not always win over the little guy….

Excellent description and detail. Especially important if buying or selling a RV or mobile home or manufactured home or a park with many of these units in it. Truly buyer beware because what was approved or acceptable years ago is almost assuredly not today. Remediation or replacement can be extremely expensive when systems fail which they can and will.

SBG.1-

Great contribution! Thank you!

How someone could not make money in real estate in the last few years is bewildering. I knew this was coming, just expected it to be after the bubble popped (just about now). Zillow was saved a bit by the final run-up in the past few months. Going forward will be a real bloodbath. Similar to cars, real estate required a lot of due diligence, the algorithm can help grease the wheels but a lot of physical intervention is needed to succeed (inspection, evaluate value factors, etc.). Some thinks just can’t be 100% digitized. Carvana with it’s algo + storefronts figured this out with autos.

Yet the are markets in CA , TX and WA (elsewhere too, I am sure) remain red hot with most offers exceeding asking price. As a landlord and former flipper, I am salivating at the prospects of another crash.

What’s your prediction on the losing value? This seem much bigger than the last one now that institutions is involved

I still see houses selling at 30% over list here east of Seattle. Big news item a couple of weeks ago about a house in Bellevue selling for a million over list.

House in my neighborhood listed at $1.485 million just sold for $2 million.

I keep waiting for the big drop but no signs yet

Fed has been passing out the liquor to keep the party going for a decade. Let’s see see how people react when the Fed tells them there is no more booze and go home and sober up.

Lemmings gotta keep — uh, lemming? Until a sufficient force flips their script. Especially with a slow drip of Fed put. Then they do reset with a bang, Fed or none, and I’m banking that an attempted mega-bailout may work poorly (at least, too slowly for millions of bagholders) in the next turn of the screw. I’ve built equity, cleared out leverage, stashed dry powder, and I’m combing around and grabbing things that efficiently work as slowly-decaying short positions.

Bellevue is still red hot, although to be fair, this is just the very beginning of the tightening process. Let’s see what happens in 1-2 years.

The thing with Seattle and its greater metro area, is that incomes are extremely strong. Seattle has one of the strongest most diversified job markets in the nation, and people are still moving to the area for great jobs.

Another reason why Bellevue is so hot is because everyone is leaving Seattle……

It is coming Soon

Did a few open houses in Bellevue / Kirkland this week-end. Saw a bunch of houses that are obviously being rushed to the market with a number of “renovations” done in a hurry that will need to be entirely removed and redone by the buyer. Gonna sit on the sidelines with my bucket of popcorn.

Just read the press release from Opendoor, and you’ll see how delusional these fools really are. It’s like they learned absolutely nothing from Zillow’s failed adventure in home flipping.

“we are still just scratching the surface of our opportunity to transform one of the largest, most antiquated industries in the U.S.”

And this, while sitting on an inventory of 17,000 homes in front of a Fed tightening cycle. Comical stuff.

They probably will sell the houses to Blackriock soon. lol

Nearly 3 billion loss while sitting on inventory. What is there excuse? Supply? I see plenty of houses being built near me with no issues. People are all over the new subdivision in droves framing, drywall, etc.

Why does Softbank seem to be integral to so many of these messes

Because, evidently, it’s easy to convince Masayoshi Son to give you a billion dollars for a looney idea.

Weworks founder convinced him on a starbucks coffee table business. Masayoshi is gullible.

I’d love to have his phone number as I have a real good idea that needs lots of capital!

The “Mobilitie” telecom project he funded was proof of that!

Knew something was fishy when every third commercial on Tell-a-vision was either for redfin, Zillow, or realtor.com

Every market I’m watching for housing has slowed or made the ever so slightest dip with a large increase in days on market. Seasonal? Probably. Bubble bursting? Probably not. Sign if things to come? You betcha. Wait for mortgage rates to ratchet up and carrying costs on vacant homes to start heating the collars of low level micro investors.

Blood bath is coming. Let’s just hope ole Putler eats a shotgun blast from the black ops guys and the Fed doesn’t get cold feet about the war.

Who knows anymore, WWIII (as if) might have the DOW hit 100,000 pts. We can all use our millions to keep us warm in the irradiated wasteland.

The king of SPACs seems to be Digital World Acquisition Corp (DWAC.O), a blank check company that merged with Trump Media & Technology Group Corp (TMTG) in October 2021. SPAC research describes it as the best performing SPAC stock ever, despite the regulatory risks facing the deal and investors now snubbing the vast majority of such vehicles.

“The Company [Digital World Acquisition Corp] is formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combination with one or more businesses. The Company intends to focus on companies in the healthcare industry in the United States. The Company is not engaged in any business operations and has not generated any revenue.”

$10 IPO … current price $89.47 … no revenue … what could go wrong?

It’s all framed so a certain guy and his insiders are guaranteed a cash-out. This is visible in the terms of the PIPE investment deal on the side. And that guy has a history of defying financial gravity. Screaming the catch-phrases and cheap shots is still a great way to aggregate lots of the little folks’ nickels. Basically the nickel slots of our era.

I feel bad for anyone whose pension plan managers got rooked into the hype of these things. Where else can hedge fund managers go to find the kind of money that has been lost in these deals?

Don’t fell bad, they will still get their bonuses.

Banks lend to the hedgies, and the banks get bailed out. Hedgies walk away sweet as a rose. A couple years of two-and-twenty gets you a little palace in Greenwich.

Why does everyone feel the need to slam the profitability of these businesses? Profitability was never intended. The criticism is misplaced.

These companies were pump and dump schemes, plain and simple. Nearly all the investors knew they were investing in hot air. They were banking on continued price momentum.

Were the companies successful? Of course not. Was the larger effort successful? Of course it was. Insiders and early investors won big, and that was the plan, executed to perfection. On the other side, some idiots learned a basic lesson, and gamblers got what they deserved.

It’s hard to feel sorry for anybody who bought this garbage.

Some small fraction succeed and change the world. Angel investors clean up on that one-in-ten (even after plenty of diligence). But the retail investor has rarely had a good swipe at any of that. It’s the same come-on as the casino that shows the one winner of $500,000 from a 10-cent slot. Same basic grift as many in the US economy: you too can be rich! But in a star system, so few are chosen. And the losers are quiet, or quickly forgotten. Like evolution itself.

I wonder how all of these stock losses will affect the overall economy.

Is it actually a very small part? Little or no effect?

I have received a letter from open door each of the past two weeks offering to buy my house

Which city?

I’m currently looking to buy a house and a couple weeks ago I went to look at an Opendoor listing. Ironically, they couldn’t get the door open!

I looked in the windows a bit but no one could get the “cloud-connected” lock box to operate.

This house had been on the market for 102 days in a place where they typically sell in less than a week. Opendoor got big problems with just the basics.

that is telling. thanks.

Me too! Been looking to buy for 6 months now and we can never get the key to work on the Zillow or OpenDoor houses. My realtor calls for help, no one picks up, and we move on to the next house. Absolutely terrible customer service!

Calling Socaljim whats your take.

Call Lawrence Yun instead – probably get the same thing! lol jk

So when will this show up in lower home prices?

When the ridiculous credit bubble contracts.

When the cost of credit is above inflation.

Wolf this one if best articles yet! Real eye opener of the insane IPO and market we’re in. Looks like the .dot com days just need for the easy credit to freeze up and then boom .dot com2.

I tried selling insurance tech lemonade once when I was nine. Got shut down by code enforcement. Big lesson.

great stuff, wolf. Am still laughing at the line about algo writers not being able to make money at flipping houses.

6) The Fed will not help ARKQ, or buy Zillow and Redfin unsold inventory after they had been kicked out of the door, because they are drunk.

7) What kind of other suffering are waiting for us, after we hit him and ourselves harshly , financially…

The Fed already gave them their Christmas present and dessert up front, in the credit bubble.

I still get twice a month offers from trap door and redfin. North Atlanta market is on fire with lots of houses still selling over list.

parabolic moves happen at the end. We seem to be there or very close. But remember Larry Fink is close friends with Claus Schwab and may want to buy your home as part of the 2030 ” you’ll own nothing and be happy” agenda. Who knows? there does seem to be a strange underlying bid in this market.

did anyone ever actually say the “you’ll own nothing and be happy” or is this just fodder for blogs?

I thought 2030, or the 21 agenda, was a conspiracy theory. Found it in my companies Q2 portfolio slide deck. It is a fortune 50 enterprise corporation in healthcare. Started to dig into the data and it is scary. I asked how could this have happened and I started to learn how the WEF is in everything. Every politician that should enforce anti-trust laws have WEF seal of approval. There is no longer any oversight. My question: will large investors allow the small investors to crash with no bail out? Will they allow entire countrysides abandon homes? According to the manifesto of Schwab in The Fourth Industrial Revolution – the answer is Yes. They want to corral us into urban city life that is controlled much like the book The Giver. That means the prices will be controlled, there will not be a price correction, and most will fall in-line of owning nothing and be happy. That alone is a very scary story! Only time will tell. PS It’s weird Schwab got his backing from Prince Charles.

The good news is that the dream of this version of the NWO will go down in flames with the end of the American empire.

That’s why China and Russia are “enemies”. They declined the marvelous opportunity to become puppets, colonies of serfs, and have their resources plundered through a national LBO.

Without bothering with whatever this is supposed to mean, one irony: serfdom IS Russian. It was the last country to abolish it in 1861, almost a century after the founding of the US and centuries after the basic rights of ordinary people had been established in England, rights Russians don’t have today.

It means exactly what I implied in my last post. Many Western elites are sociopaths and psychopaths who should never be trusted.

He said it.

@Jake W IMO, the origin is the movie “Caddyshack” and the line was “You’ll get nothing and like it.” which has morphed in into the current phrase.

Ted Knight (as Judge Elihu Smails) uttered the line to his son Spalding (played by John F. Barman, Jr).

The US economy is running like a 1910 model T that has never had its plugs or points replaced.

Nord Stream I, on. Ukraine pipelines, on. Nord Stream II valve temp off.

Oldest problem in insurance and finance (likely unknown to coders): adverse selection. Buy houses for high prices or sell insurance for low rpices, you will get the most messed-up houses and insureds, with the biggest unseen costs. It is classic info asymmetry. Mispricing of risk. Plenty of counter-parties will be enthusiastically gaming you. Only as long as there is a bigger bagholder (investor), will this remotely seem not ridiculous.

High overhead (a lot higher than some individual doing it) and don’t know the local market.

1) 17K unsold house.

2) China munis sell land to finance themselves, build new community

with dozens high rises, for 100K tenants. China RE problems dwarf Redfin and Zillow.

3) During covd sale plunge. China blow high rises up to cut excess inventory.

4) In China RE is #1. Export and consumers are next in line.

5) SSEC, BB : 3,403 / 3,400. This month, BB was breached twice in and bounce back.

6) China might suck the air out of US.

Despite crashing, all of the cited examples are still way overpriced. As serial money losers, every one should sell for less than book value which continues to decrease.

Still a long way down to go.

1) A Treaty of Amity will be signed between the two stepbrothers, to extract US.

2) Wall street fools will celebrate.

3) In mid year wave III.

Serious question, are you a bot or just dumb? You post nonsense constantly

Wolf,

You should do an article on all the retail investors, billions, idiotic pensions, 401ks, that are losing moneydue to investing into the tulip bulb mania. I mean real estate.

The entire idea of house flipping and institutional ownership of houses is a good example of Wall ST screwing the average person .

JP-

That sounds like victim talk.

If “the average person” follows institutional leaders like sheep into the slaughterhouse, then aren’t they really “screwing” themselves?

Reading posts here leads me to believe most of the W-Street commenters are not blind followers, and are not falling for the “sucker bets” served up by much of government, most of academia, too many on Wall Street, and all of the charlatan opportunists.

JH-never underestimate the seemingly congenital urge of so many to place their total faith, without critical corroboration, in anything ‘…as seen on TV…’ (or Internet, these days)…

may we all find a better day.

Recently read this:

“Quicken Loans has entered into a partnership with Airbnb that will enable the property rental company’s hosts to use their rental income on a primary residence to refinance their mortgages through the Detroit-based lender.

According to the companies, using this additional revenue in debt-to-income calculations will expand refinancing opportunities to Airbnb hosts by allowing them to tap into their home equity. The Airbnb hosts’ home sharing income is shown on their proof of income statements.”

So, Quicken is in cohoots with AirBnB to stick their legs into a new warp of mortgage lending. When AirBnB and Quicken’s clients blow their home equity on vacations and on buying the homes that Opendoor and Zillow et all cannot sell and chickens come home to roost, Guess who’ll be hollering at the Feds to save them with taxpayers money because they’re too big to fail?

Not a peep from the Feds that this is the same 2008 pig of mortgage derivatives, just with different lipstick.

Ahmed-

This certainly deserves further investigation.

AI : A Treaty of Amity will be signed :

4) In 2008 a Caucasian war, SPX & WTI tank.

5) In 2014 a Crimean war WTI tank.

6) Option : after peace talk I & II break down, nuke I & II, to bend his will. First since 1945.

These companies weren’t meant to sell houses at a profit. They are the housing equivalent of patent trolls or stock buybacks. Their sole purpose is to take salable houses OFF the market.

It always amazed me that the Redfins, Compass and others, grew by snatching up competition at inflated prices and showed “growth” accordingly, then “valuation” based on increasing multiples of said “sales” (profits were mostly absent). A log scale event.

It seems to always be the greater fool theory at play.

Now the profitable players in mega techs are, to me, a variation of the same giant game.

Until it breaks.

It is breaking.

Here’s where you see which companies have good management. Some will find a way through and others won’t.

I’m not sure why Lemonade is included in this deck. It’s an insurance company. Sure, it sells renters and homeowners policies but also auto and pet insurance. Given the hot RE market there should tons of new policies and indeed there were, up 45% YOY. In-force premiums grew 78%.

Lemonade wasn’t pulled down by flipping houses. It had bad numbers for Q4 with a 96% loss ratio and the analysts took it to the woodshed. In the earnings call management tried to make seem like it was a one-off due to a handful of older large losses for which the company under-reserved.

They never blamed the housing market, other fintech companies or anything else.

If they can get over this hump, their stock chart will look very different from Zillow or Redfin.

That was a great article Wolf. Full of interesting information. Thank you.

The Ukraine war combined with the Chinese RE problems would certainly have an effect on offshore money. PLUS, it’s interesting that Softbank has made so many bad investments. I would guess that a LOT of unseen offshore money has also. I did find some articles a while back that suggested the offshore loans to Evergrande would not be paid back. I’m further guessing that a lot of “whales” on the regular stock market and involved in RE acquisition world wide might be funded in part by offshore money.

What happens when banks in the Cayman Islands and in Macau collapse?

“The rest is hard, and making money at it is even harder, especially if you overpaid in the first place. The activity is not suited for people who write algos, it turns out.”

Could have told you that. I did tell a few friends, several years back. But you can’t make money shorting a slow-motion train wreck, particularly when there are so many “fans” of the approach.

And of course none of the people working for these companies can hear or understand the message because “it’s very difficult to get someone to understand something when their paycheck depends on them not understanding it”.

It’s an asymmetric information market in the first place, and if you’re going to be making blind offers that just makes the information asymmetry total.

Oh but database mining machine learning rule-based buzzword application they say. Well, Dirty Harry, I say.

“A man’s got to know his limitations”. *BOOM* as the guy who didn’t blows up.

I hope the greedy turds who lent them non-recourse money take such a hefty bath they’re burned from doing it again for a generation.

It’s comical to call Compass a tech company. Full disclosure I am a broker there. The tech is near nonexistent just some fancy “proprietary” CRM like every other CRM out there. What else? A lot of fancy offices and hmmm there is nothing else. A lot of agents have left disillusioned with the performance of their shitty stock they took in lieu of commissions. Smoke em if ya got em!

What a business model, lose billions overpaying for crap real estate and then unable to sell the crap after all of the improvements required to make it sellable. Real high tech alright. Stupid fucking millennials, and the firms that invest in this garbage.