Banks unloaded cash today for quarter-end window dressing. Money markets funds are biggest counterparties, Fidelity, Vanguard, Blackrock on top.

By Wolf Richter for WOLF STREET.

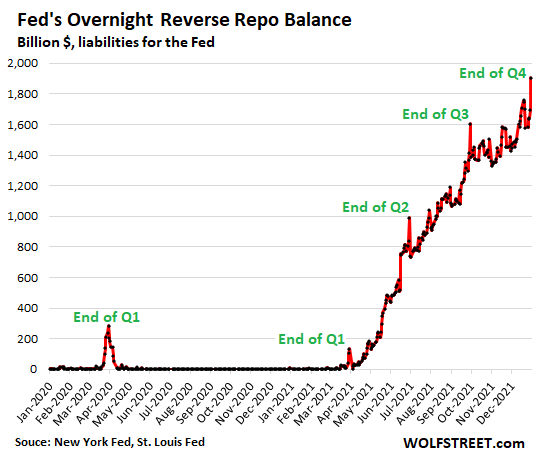

The New York Fed disclosed today that its overnight reverse repos (RRPs) spiked by $208 billion from yesterday, to a record $1.904 trillion. With these RRPs, the Fed took in $1.9 trillion in cash from 103 counterparties, and in exchange handed out Treasury securities, temporarily draining $1.9 trillion in liquidity from the market and financial system.

The RRPs mature on Monday, January 3, when the Fed gets its securities back and counterparties get their cash back. Then they’ll engage in another round of RRPs. Today’s RRPs replaced $1.70 trillion in RRPs from yesterday that matured and were unwound this morning.

A few weeks ago, I posted in the illustrious Wolf Street comments that RRPs would “spike at the end of December, maybe to somewhere near $2 trillion as banks engage in quarterly balance sheet window dressing.” A spike today was expected for that reason, same as with the prior end-of-quarter spikes labeled in the chart.

RRPs are the opposite of repos and QE:

- With repos and QE, the Fed hands out cash and takes in securities in order to repress interest rates.

- With RRPs, the Fed takes in cash and hands out Treasury securities in order to put a floor under short-term interest rates.

The counterparties with too much cash.

The counterparties are financial institutions that are creaking under excess liquidity that the Fed has created with its monstrous QE, and this cash was showing up in money market funds. The funds then needed to invest this flood of cash in short-term securities, such as Treasury bills. This flood of buying caused short-term Treasury yields to turn negative. That’s when the Fed offered to take this cash via RRPs. When it offered to pay interest at an annual rate of 0.05%, cash came gushing into the Fed’s direction, and Treasury yields bounced back above 0%.

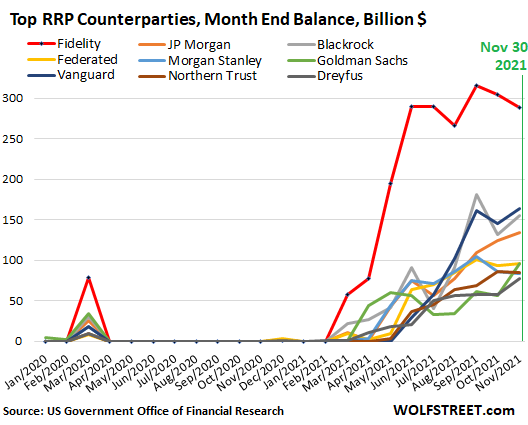

The approved RRP counterparties fall into three groups: Money market funds, banks, and Government Sponsored Enterprises (Fannie Mae, Freddie Mac, Farmer Mac, etc.). Day-to-day, money market funds have been the biggest users of the reverse repo facility.

The Fed raised the limit per counterparty to $160 billion to accommodate the needs of the biggest money market funds. A big financial institution, such as Fidelity, Vanguard, or Blackrock, manages numerous money market funds. But each individual money market fund is a counterparty of the New York Fed.

Of Fidelity’s money market funds, 11 are approved counterparties with the New York Fed. All combined have been the largest user of the RRP facility. The Fed doesn’t disclose on a daily basis the participants, but end-of-month data is released with a lag. At the end of November, all of Fidelity’s money market funds combined had $288 billion in RRPs with the Fed, or 19% of total RRPs at the time (red line in the chart below).

Vanguard’s money market funds combined, the second largest user of this facility at the end of November, had a balance of $165 billion, or 11% of total RRPs. Blackrock’s money market funds had a combined balance of $155 billion, or 10% of total RRPs. JP Morgan’s five approved money market funds combined were in fourth position with $134 billion.

Here are the top nine counterparties as of November 30:

But today: quarter-end window dressing by the banks.

On the last business day of each quarter, banks pile into RRPs to shed cash from their balance sheets and replace it with Treasury securities for a day. The balances at the close of business today will make up the balance sheet for Q4 and year end. These window-dressing spikes are visible in the first chart.

That $208 billion spike up from yesterday’s RRP balance was likely due to banks’ “balance-sheet window dressing.” Banks want to reduce cash balances and increase Treasury securities on their balance sheet at quarter-end for regulatory reasons.

Banks can deposit their cash at the Fed directly and earn more in interest than with RRPs. On the Fed’s balance sheet, these deposits from banks are liabilities that the Fed calls “reserves,” and it pays interest on them at an annual rate of 0.15%, which is more than the 0.05% it pays on RRPs. But on the banks’ balance sheets, these reserves are still called “cash,” such as “interest-earning cash” or similar, and for regulatory purposes still count as cash.

Normally, banks put their excess cash on deposit at the Fed and earn more in interest than they would with RRPs. But for just one day at the end of the quarter, when banks want to reduce their cash holdings and replace them with Treasury securities, they engage in this window-dressing exercise via RRPs.

On Monday morning, those window-dressing RRPs will unwind, and the overall balance will drop back to near where it had been over the past few days.

Way too much liquidity due to QE

The real issue is the monstrous amount of QE since March 2020. These RRPs show that the Fed could reduce its balance sheet by $1.9 trillion; it would just mop up the excess cash now absorbed by the RRPs. Long-term interest rates would rise, and they should rise, given that there is nearly 7% CPI inflation currently, the most in 40 years, while back then interest rates were far above the rate of inflation. But in terms of liquidity, reducing its balance sheet by $1.9 trillion would just remove the excess liquidity that has now been absorbed by RRPs.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Dear Readers,

2021 sure has been one heck of a crazy year, full of WTF spikes in my charts, to the point where I actually ran out of WTFs.

2022 should be interesting as well, from what I can tell. So from the vast Wolf Street media mogul empire headquarters:

Happy New Year!

(And I think I’m gonna take off for the rest of the year.)

@W

Bazinga! They’re worried about wages.

Just off to run my 2021 net worth calcs.

Feels sort of good but “ONLY THE NUMBERS TELL THE WHOLE PICTURE.”

Lang may your lum reek!

Happy New Year from Scotland.

think you mean 2022 in the second paragraph Wolf?

In any and every case, HAPPY NEW YEAR everyone!!!

Sure as heck meant 2022 :-]

So now that your long vacation is over, thanks for that really clear article, and it brings up a question that’s maybe relevant to an “interesting 2022”. Back near the start of the GFC, I used to go to Vanguard’s website for info. Noted their money market fund was closed, but mainly wanted to see the latest Market Circuit breakers. They won’t let me now, or maybe I can’t find them. They seemed pretty reliable, so can you tell me where to go? (to find them…)

Also, are they the same for every exchange, and who sets them?

And who sits closest to the door and why?

Maybe I should have stopped at “thanks for the clear article”…….but I’m kinda proud of being the most financially ignorant poster here….unless there is a challenger.

Thanks for all the good work you do Wolf (& company)!

Happy New Year!

Wolf,

Happy New Year from Cuenca Ecuador.

Here’s to an equally exciting new year.

Is Ecuador safe for US expats ?

Red,

Very safe. I’m meeting new expats every day.

I went to The Jazz Society Cafe tonight to celebrate New Year’s Eve and I met a couple from California who have been here for four years. They live in a town north of Quito but live coming down to Cuenca.

Two weeks ago at the same restaurant I met one couple who just moved here from Baltimore, another couple from Sarasota, FL and a third couple from Brooklyn, N. Y.

A friend of mine here likes to tell people that his rent is $2000 per

………..month. And it has not gone up in 9 years.

I was here 5 years ago and i can tell you that all the prices are still the same. Hope this helps.

Caution for any ex-pat is warranted though: history shows that any particular nation may be safe and lovely *now*, but if resources start getting scarce and economic, political and social conditions worsen significantly, the first thing populist leaders will do is redirect popular opinion on “outsider” communities. That is as true in any nation, so just have a plan in place if that sort of thing starts to happen.

Thank you and Happy New year! Enjoy your well earned rest til the year end.

Well deserved great job spread the truth

Happy New Year Wolf and all of the commenters. You all are some insightful folk.

Wolf; Maybe your goal for 2022 should be to create some acronym to replace WTF. It should be something that really expresses your exasperation at the shenanigans of the Fed, the markets, and the government. For me, WTF has become too commonplace. We need something new, more visceral, and more phlegm removing. Happy New Year to you and yours from the Great White North which is really white right now.

FMG?

FMG???

WTHowlingF?…..

Refers back to the old byline, and definitely clears the upper bronchi.

FUBAR?

Words and acronyms no longer work! In the Fed’s world, inflation is never a concern, asset prices never rise to a bubble, and the Fed has no control over wealth concentration. Powell & Co. are deaf to common sense.

You could blow a freight train horn two inches from their ears, and they’d claim there is no sound!!

CF, cluster….

Happy New Year to you Sir

Me, too- I am all out ouf what the f***s to give.

Happy New Year to you, Wolf.

Still chained to the wheel here.

Prices are crazy but government roadblocks grow like mold in a damp forest.

You hold an IOU of mine which will be paid.

Happy New Year to Wolf and all of the Wolf pack….no, no Hangover….your articles and the commentariat keep me sane, more or less…I think it’s going to be one hell of a year…

Maybe 2022 will be the year of FTWs ….. the reverse of WTF

Happy New Year everyone!!!

“The counterparties are financial institutions that are creaking under excess liquidity that the Fed has created with its monstrous QE, and this cash was showing up in money market funds.”

Is this a typo? A referral to the secondary effects of QE? (Implied)

Happy New Year. Silly question, but, why do the financial institutions not want to show cash on their books?

Not silly at all I was wondering the same thing. Funny that the article didn’t explain the reasoning.

Bank regulations are designed to keep banks within certain limits in terms of what they can do and how risks they carry are calculated. Cash goes into the regulatory formulas, such as regulatory capital, that are applied to banks. But cash impacts regulatory capital calculations differently than Treasury securities. If you want to know the ins and outs and whys of bank regulations, I encourage you to spend some time studying them. This is a specialty in its own right. Pretty well paid, I think. A lot of it seems kind of bizarre to the rest of the world.

What keywords should we google to get at the resources we would need in order to read up on these types of regulations?

can I have the overnight interest on this

ought to cover inflation we experienced in 2021

Joe,

For three days the one-tenth of one percent difference ( reserves @ 0.15% vs RRP @ 0.05%) on $1.904 trillion doesn’t add up to much. By my math, it’s only $15,649,315.

Or, $8,219 per billion.

And that was a lazy bit of math since I did not compound daily or even calculate a year @ 365.25 days — which I would normally do.

Dan,

That interest calculation feels just like my bank savings account. I feel like I’m earning a solid $8000 bucks for every billion I’ve got stashed in the bank. Except it’s taking me a year instead of a holiday weekend.

***** New Year, everyone!

Peanut Gallery,

For example, this document lists the different types of capital ratios, with dozens of links to detailed explanations, such as “Standardized total risk-weighted assets.” Don’t expect a simple answer. Bank regulation is hellishly complicated. That’s why I don’t get into it. You peel away one layer, only to confront an even more obtuse layer, and layer after layer.

https://www.law.cornell.edu/cfr/text/12/3.10

That’s a LOT of money just to look good to the regulators. Wonder if it’s all written off as “business expenses”? Cosmetic upgrade like painting the C Suite doors?

BTW, I laser engraved a bunch of those “three hump style” world globe projections for a C suite door contractor at the B of A monolith in SF in the 70’s…..lost or sold mine, but sister has her’s.

It would be simpler if there were no fractional banking, almost like personal finances, I bet. And I know what a bank “has” is/was divided into Tier1, Tier2, and Tier3 capital, in descending order of questionable and/or liquid “assets”.

I gave up, but it seems like an ongoing process, new laws/policys/whatever it is they do at Davos/amounts, plus the old “moral hazard”, etc, all the time, but good luck.

Shiela Bair seems like a smart cookie, and nobody has to know regs better than the FDIC chair.

It’s all about stopping bank runs/failures with minimal damage….getting tougher for small outfits, hence “Too big to fail”.

But Corporations have been trashing smaller outfits since they were “enthroned”, as Lincoln said.

That’s a lot of RRP “activity”.

There is no such thing as “RRP activity” as defined by your prior comment. Only morons would try to add up all the ins of (reverse) repurchase agreements without subtracting the outs when they mature the next day.

That $1.9 trillion is the outstanding balance today.

Wolf, have a welcome and restful New Year!!

Maybe each time in 2022 you turn the WTF chart images in NFTs?

Happy NEW YEAR Wolf and gang…..

Things still going to Heck in a crooked line..!!

Happy New year to the whole pack (Wolf)!

Wolf, with every issues I learn something. Unfortunately, what I learn I often find disturbing. May your mission continue with good cheer into 2022. I now better understand the saying: Ignorance is Bliss.

Darn! New Year’s Eve already? I started shoveling snow right after Christmas. And the Fed won’t let me exchange any of this pile of ice for securities. They said it might depress the short-term temperatures and cool the markets’ rocket engines. Happy whatever, don’t drink and drive…just park the car and keep consuming.

Happy New Year Wolf. Thanks for taking the time to educate us all.

I hope the Government has a new year’s resolution to address the CPI. Instead of sending signals to US citizens is 7% they should tell the truth. In 2022 the government should focus on the largest piece of the CPI – housing.

This is the question they ask

“If someone were to rent your home today, how much do you think it

would rent for monthly, unfurnished and without utilities?”

Take a moment and think about this. The inflation this survey found for rent was 3%

3% rent inflation? Really? Come on!

But if we used real data the figure would be at least 20%

So why is the government lowballing the CPI?

I can think of a lot of reasons.

Let’s tell our elected officials to address this in 2022!

Fingers crossed

Jay Jay Powelless,

I removed the three links. You can get all of this inflation data, including that inflation doesn’t show housing costs, plus more, plus charts, in one place, including the chart below:

https://wolfstreet.com/2021/12/10/woosh-shock-and-awe-loss-of-dollar-purchasing-power-hits-americans-worst-inflation-in-40-years/

So, the CS is about 50% higher than CPI OER. Nice! Way to go BLS! Keep up the good work covering for the FED.

Except 100 = 100% = 1x.

So 270 case shiller = 2.7x

And 180 OER = 1.8x

So the total % increase (inflation) from the start of the graph is actually 170% case shiller and 80% OER. So the case shiller is actually showing more than twice the inflation the OER is registering, not 50%.

It seems silly that they would create a huge bubble of liquidity in order to manipulate short term interest rates. If the Fed has true jawboning panache they could simply decree, interest rates to be such and such. Abolishing LIBOR over its somewhat fraudulent use (and self righteously at that) is the most humorous of all. At least the people rigging LIBOR have a business purposes in mind, while the Fed is counting angels on a pinhead, creating liquidity which has no ancillary use. The MM system broke in 2008, and it was a clean break along Treasury/non-Treasury lines. The bubble in liquidity is like an empty lot full of FEMA trailers. By the Wall St analogy, they get to rent those trailers out, by the hour. Whatever they put into bank reserves is something banks themselves don’t need to do? That frees up cash to buy stocks and front run the muppets, or underwrite unicorns. But that isn’t corrupt.

A shout out to Ambrose Bierce for very original and consistently novel comments here!

I second the emotion. Still have a copy of “The Devil’s Dictionary”, Mr. Bierce.

Ambrose Pierce

‘Abolishing LIBOR over its somewhat fraudulent use (and self righteously at that) is the most humorous of all’

NOT YET!

Reports Of Libor’s Death Are Greatly Exaggerated: Fed Extends Libor Life From End-2021 To June 2023 (zh)

B/c a lot old derivatives (in Trillions) are stil traded on libor!

I bitch at “Private Enterprise” also. Like who just built that brand new 3 story half block long SELF STORAGE place on Hwy 12 rather than low income apts…..and for WHO?

People who complain about any homeless encampments near their 2500+ sq ft 2 car garages?

“ If the Fed has true jawboning panache they could simply decree, interest rates to be such and such. ”

But that would make them admit there is no “market” as such, only an illusion…

Of course that would actually be the truth…

The inflation rate is 7%. Banks are force to hold more US treasuries.

Interest earning and non interest earning accounts reached $16T.

Happy and prosperous new year time to short market hohoho

Happy New Year from dawn’s early light to next year’s last night!

Stay Safe & Healthy!

And so the adventure begins…

Happy New Year Mr. and Mrs. Richter and to all the brilliant people who gather here.

Cash is a liability on the Fed’s balance sheet. Bada Bing Bada Boom buy a treasury debt instrument and it’s an asset. Fiat debt system cycle almost complete. Shave a little off the top for “cost” of the churn rinse and repeat and cycle complete. One of my New Years resolution is staying out of moderation and spend more time on the data. Life is good, 2021 (5 hrs left) was no exception.

DR DOOM,

When it comes to loans, one person’s liability is another person’s asset by definition. I lend you $100, and this loan is an asset for me, and a liability for you, by definition.

For banks that deposit cash at the Fed, this cash is an asset; but for the Fed, which owes the banks this money, it’s a liability. By definition. This has nothing to do with “cash” but with the very nature of loans: there are always two parties to a loan, the lender and the borrower. For the lender, a loan is an asset, and for the borrower, the loan is a liability. In the case of the “reserves” at the Fed, the banks are the lenders, and the Fed is the borrower.

Wolf

I’ve understood this for a long time. Where I have trouble is when I consider what the terms asset and liability imply. They sound so inviolate and assured. But when the borrower doesn’t repay the lender all hell breaks loose. So doesn’t it all boil down to “what are the odds the borrower repays the lender”? This is where I want to crawl back in bed a pull the blanket up over my head.

Happy new year! And may fortune be soo good to The Wolf Street empire you complete a hostile takeover of Bloomberg!

RedRaider,

Yes, financial assets can and do evaporate. Your stocks (your assets) can lose 60% of their value, and thereby 60% of that asset has evaporated. But that usually doesn’t cause a financial crisis.

When this happens with loans, it’s a different story. That’s the cause of financial crises and banking crises. Mortgages are assets for banks. When the borrower defaults, and the bank forecloses on the home, and then sells the home for 50% of the outstanding mortgage, 50% of that bank’s asset has just evaporated. When this happened in large numbers in 2006-2010, lenders collapsed.

When the Fed bought impaired MBS in GFC they referred to them as “deferred assets”. Any loan can be floated on a protean bed of inflationary money given enough time and enough leverage.

That difference between stocks and bonds explains to me why well known political wise-ass James Carvell (?…the skinny little guy with the southern drawl) once said, “When I die I don’t want to come back as Jesus, I want to come back as the Bond Market, and then I can scare the hell out of EVERYBODY!”

It’s about ratios : banks capital/ deposits.

The Fed drain $2T , while increasing banks capital by $2T, between

Dec 31 and Jan 3rd, improving banks ratio, making them safer.

So the fed now can control the floor and ceiling of the o/n market with their RP and RRP facilities?

At what point do the above Fed facilities then basically replace MMF, commercial paper, etc.? Or will it?

Anyone who is familiar with this, some explanation would be greatly appreciated.

HNY everyone!

The fed is creating artificial demand for treasuries. It keeps the interest rate low too, which is just an added bonus. The primary dealers are being forced to buy the treasuries, which they don’t seem to want, and they resell them to the fed. Then the fed forces the primary dealers to RRP them back to show how much everybody wants them.

Think — real estate agents trading the same house back and forth to increase demand.

Thanks Petunia. But as Wolf and many others have said, yield resolves all demand problems. Once yield goes up (if yields go up?) then will there even be any need for some of this?

I thought the Fed was stepping in and replacing the overnight market? Or is it not that simple?

The fed took over the repo markets a few years back when the interest rate for overnight repo went to 10%. It wasn’t a mistake by the market, it was where the market rate really was, but the fed wasn’t ready to deal with that reality. That’s when the fed killed the repo business for the banks.

The fed has been consistently working to suppress rates. I don’t expect that to end soon. If rates rise to some real market level which is higher than in the last decade, expect tax policy to claw it all back to pay for the higher rates.

Wolf Pack Alert:

The North Pole has reported Santa and his reindeer are missing!

It is thought Santa might be hungover in downtown San Francisco from drinking too much egg nogg!

Rumor has it he ran over Grandma on Christmas Eve!

If you see any hoof and sleigh marks, please notify authorities.

They really shouldn’t license a drunk old man to drive a sleigh at night!

Happy New Year!

The intoxicant runs a black market operation paying wages lower than what an illegal immigrant can get. It’s the only way for him to stay in business. And no 1099’s issued. He was just seen in a Seattle tatoo parlor getting shot up with ink. Claims he can pay for it with pandemic unemployment that he had filed for. Did not realize they now know all about him. Do not expect toy deliveries at a future date as the taxing authorities will close him down soon by burying him in paperwork that will jack up productions costs to the point of losses exceeding income.

Let me give another try without reading any of the text.

1. Happy new year folks. (and top class people also). 2022.

2. The last year 2021 is one of the fast moving year for me. I cant speak for you all. If 2020 gave me troubles, 2021 amplified it. I wish everyone well.

3. Did I heard vanguard? are they in-charge of all public pension programs?

4. Wolf did a good job of reporting and bringing all of us together. I like every one of you in the comments sections (this excludes ME, you know who…)

5. Also, lets not forget the good old days of ZH (the name I cannot mention here) who is not sold to a bigger media conglomerate. Everything ends.

6. One important thing about “new year resolutions” is health. I will reduce my Bodyweight, go to gym everyday, eat right and sleep well. No stress and so on. Everyone knows “Health” is the right wealth. Nothing matters even if you had a billion dollars at hand.

7. We cannot control Feds, MMT, members of the house/senate, rules and stock marker. Ultimately, we decide if we want to be happy or not.

+1000 to #6…I’ve never felt better the past 2 years…amazing what (manufactured) crisis does to focus the mind …

Respect and regards from Thailand.

Does it strike anyone else as ironic, if not downright incongruous that with private financial firms awash in surplus cash, the nation’s program (via Biden’s watered down green new deal) can’t go forward because of inflation worries covering over ideological objections. It’s not that the nation can’t afford it, it’s that the private sector has no interest even at the risk of missing the opportunity that China and Germany have seized, and Denmark, in leading the way in new green technology. The private sector Neoliberal spell has not been broken yet: public bad, private good; fine, then where’s the private sector itself? All over the place, torn like the public, half in to the old fossil fuel economy, and not willing to give scientists, environmentalists and Sanders lefties the credit they deserve for pointing the way into the 21st century as opposed to Joe Manchin’s 19th. Maybe someone could invent “Pain derivatives” that could be bought or sold as austerity waxes and wanes. That would make Catholic sufferer Manchin very happy on his yacht – I mean barge.

“Does it strike anyone else as ironic, if not downright incongruous that with private financial firms awash in surplus cash, the nation’s program (via Biden’s watered down green new deal) can’t go forward because of inflation worries…”

No, it’s not ironic. It’s cause-and-effect. All this money printing caused this excess cash and is now causing (among other causes) this huge inflation. The way to crack down on inflation is quantitative tightening and raising interest rates to remove this cash and make borrowing more expense, push down assets prices, and put a lid on demand. Further stimulus will just make inflation worse.

besides what Wolf said, why invest in green technology when the management makes tons of money buying back their own stocks, then the managers sell at the highs and execute their options to buy at 3 or 4 years ago’s price. In this environment, investing is a losers game. All that cash is much better used in making a few very wealthy.

William,

Don’t know which version of Oz you’re reading, but from where I sit, most of todays green has a lot of shades of brown in it….

Unless the government indemnifies a lot of the green tech companies, lawyers will take care of the rest…

Propaganda, hype and PR vs reality are a long way from meeting…

I thought it was a really good post, but you honestly do not do a very good job of pointing out why you disagree with it.

What’s the unsaid prejudice, assumption, or world view I am missing, COWG?

The Fed pumps the money supply 30%, then plays these overnight games with little impact.

While they still conduct QE, and apparently reinvest maturing securities.

To say they are earnest in fighting inflation would be inaccurate, IMO.

1.9 T of window dressing? I can’t even get windows for my house.

WTF = Welcome to Florida.

Happy new year Wolf and all the good folks here!

Thanks to all,

Tom

Most of that $1.9 trillion is money market funds, not bank window dressing. The bank window dressing part is about $200 billion.

“Windows for my house” may be outdated. Heard they’re planning to roll out Microsoft Plywood version 1.1 soon.

You’re on to something with that tech angle.

Yes, why real windows when you have Teams and Zoom?

I’m way late but I think large flat-screen ultra-high-def TVs are just about cheaper than windows, now, and you can put any scene on them you’d like to look at, instead of the same-old!

With the debt ceiling being raised, the Treasury is going to need to issue a gargantuan pile of bills and bonds. That in and of itself will probably eat up more than half of this excess cash in a matter of weeks.

Happy New Year from Calgary, Alberta enjoying -30C!

We were -12F this morning in western Montana. Bundled up and took a short walk in the snow with our dog to watch the sun rise over the Sapphire Mountains. Life is good.

Happy New Year everyone.

This is not an action in any sense, concrete or abstract. Nothing real or definable is being moved. No currency or securities are actually transferred.

It’s just a money-laundered way for the Feds to bribe the banks.

We no longer pay in paper dollars for large purchases. We use debits and credits. Your bank does, your credit card does, your bank account does, your employer does, and the Fed does too. To claim that “no currency” was moved is kind of funny.

He doesn’t seem to understand what’s going on. And you don’t seem to understand either.

To this ignorant laymen, this all sounds completely illogical. One would think that if the central bank “takes in” securities, that would make them ore scarce and raise, not lower, their price. And if the price of securities goes up, one would think it provides financial institutions with cover to raise their interest rates as well. Yet the exact opposite happens. To this ignorant financial layman, this seems completely kooky and irrational

If it’s stocks it will rise…sellers make a profit as they would get ever higher prices to sell. Bonds cost the seller money (pay interest to the buyers) so they pay less interest to the buyers as the demand rises.

What an odd setup.

Regulations mean they don’t want to hold much cash.

So the same ‘system’ lets them count cash on just one day a month (not monthly average or something), and then the central bank creates a product to let them hold this cash safely as an interest generating asset just for those few days needed.

Why not just change the regulations?

Either it’s ok to hold too much cash and the regs should be changed; or it’s not, and an official regulatory work-around (wtf) is another black-swan inducing mechanism just waiting to impart some unintended consequences on the system.

Totally agree. A mechanism that by nature moves a Trillion+ USD back and forth nightly. What could go wrong?!?! Fully agree that it should be evaluated. And the process is not fully automatic as the participants change frequently and the values have been ever increasing between the counter parties. Seems like a glitch in the matrix. Understand there was a process to handle the quarterly events but these have become nightly events. Seeking better regulation

In the size and magnitude of this, and the quick shifting of large sums, I am reminded of the heavy hand the Bush (then Obama) Treasury and Fed brought to the scene in the 2008 era. Huge takeovers and bailouts were orchestrated over a tense weekend, repeatedly (Bear, Lehman, AIG, Fannie-Freddie) culminating in things like the restructuring of General Motors and Detroit. This is exemplified in a book title on M&A I enjoyed: Gods at War: Shotgun Takeovers, Regulation by Deal, and the Private Equity Implosion (by S. Davidoff). Now we seem (?) on the surface to have some of those stresses institutionalized, dispersed and smoothed over (to appearances) by the processes described by Wolf here. But stresses have a way of rumbling until they find new ways to vent and upset superficial smoothness in markets. Maybe the financial engineers can be heard to exclaim, “thar she blows!” as some new dynamic of blowoff breaches the existing order. Let’s hope not too soon in this jolly New Year.

Happy New Year to all! Grateful for the wisdom shared on this site, and for the truth-seeking activity here-

Happy New Year folks…

Love the interaction on this site..

Our government and corporate media keep telling us how politically and economically corrupt and evil both Russia and China are. And how both countries are working overtime to destroy the USA. Perhaps we should examine our own government and economic system more carefully. Let us not forget the words of Pogo: ““We have met the enemy and h is us.”

1) Happy new year captain hook, who drained $1.9T from his sinking ship. For entertainment purposes only. Skip, TA after SPX champagne.

2) The DOW made a new all time high on Dec 30. Dec 31 closed under

Dec 30 low. It’s a setup bar. The DOW produced selling tails in the last 4 trading days.

3) SPX daily look like a hook. The market was resting in the last four trading days, before exploding next week. 1:1 from Dec 3rd low is done. Speculators are absent. To some analysts SPX is an inverse H&S, on the way to 5K.

4) SPX weekly : Dec 20 is the largest bar in the last two months, on

half the volume of the previous week, Dec 13 and 2/3 volume of Dec 6.

Red bars volume dominate. Last week ended in a selling tail.

5) NDX daily failed to reach Satya Nadella Nov 22 fractal zone.

There was a high, Dec 27 high. Yesterday close was < Dec 27 low, a

setup bar. If on Jan 3rd NDX close Dec 23/27 open gap, there will be

a trigger. Trigger what ?

6) NDX weekly ended in an ugly black shooting star. Dec 20, the largest bar on half volume of the previous bar. Red volume dominate.

7) Satya Nadella might have opened the flood gates like Billy boy during

the dotcom collapse, dragging Sundar Pichai and Zuk with him.

Love the astrology. The Russell 2000 has reached a permanetly high plateau. For close to a year now. Can we call it a “black horizontal bar” chart?

There is likely some truth in Astrology, but my guess is you have to go back to when diets and food scarcity changed drastically during the seasons.

The mother’s diet at different times chemically affected a growing embryo and also an infant’s first several months, and probably made for noticeable changes in the child and/or the adult that was then noticed by close knit small bands or tribes.

It sure lasted a long time if only one prophet type came up with it as a “truth”….pretty unlikely.

AI long on $3T AAPL.

1) QQQ backbone : Nov 5 hi/ 10 lo.

2) Dec 28 high, a lower high, retraced 0.858 to Nov 22 high.

3) If next week QQQ decline, but stay > Dec 20 low, QQQ, in a sling shot, might rise to the 430 and 438 area.

4) This decline is needed structurally, as long as it’s a higher low.

Paying the banks to prevent the interest rate rising is what it amounts to. Effectively, the big banks are extorting the taxpayer. They don’t just want free money now, they want interest on it too.

“Nice economy you have there, be a shame if something happened to it.”

This is the problem with removing moral hazard: you promote worse behavior in future.

And a Happy New Year to one and all, from a guy who is just around.

Cash deposits are a liability for the banks. It is the depositors that are demanding interest.

Yancey Ward,

On the bank’s books, the “deposit” (a debt the bank owes the depositor) is a liability for the bank. But the “cash” from that deposit is an asset on the bank’s books.

When you put $100 into the bank, the bank creates a liability of $100 (it owes you $100) that it calls “deposit.” At the same time, the bank creates an asset of $100 (the money you gave the bank) that it calls “cash.” So the bank cannot lend out the “deposit” (the liability), but it can do whatever it wants with the “cash” from that deposit, including lending it out. When it lends the $100 to a customer, it changes the asset from “cash” to another asset it calls “loan.”

This is why we have debits and credits in modern double-entry accounting, where everything is entered with two entries, a debit and a credit.

And the ultimate number of “overvalued” claims against each serial numbered note is the real reason we are in this mess. They are slowly losing the ability to manage it and are covering up the truth by printing to dilute.

An interesting reality here not normally explicitly mentioned, is that banks do not lend based on their reserves. They lend to what they hope are credit worthy customers. So the ‘reserves’ narrative is misleading, No?

perpetual perp,

You’re changing the topic. Yes, banks lend based on demand for loans from their customers. But “reserves” is cash that banks have NOT YET done anything with, and instead deposited this cash at the Fed. They can buy Treasuries with this cash, and they do, and they can lend it to customers that want a loan, and they do, and they do other stuff with it. Reserves = cash.

Wolf and PP,

There is as of recently no reserve requirement at the Fed for banks, and so this idea that banks are required to have a portion of their cash in reserves with a Fed is now obsolete.

Wolf, perhaps one idea for a future article is to talk about how banks are creators of money / credit, and banks are the only entity in the world that can do the fancy accounting trick where they make money out of thin air?

So it’s a license to print based on the notion/belief in/of fractional banking? Which is further based on the assumption that it’s unlikely all the depositors will want their deposit back at the same time?

No wonder there is constant inflation….it’s the banker’s cut for the risk of printing…..if they are good at kiting it all.

Wolf said: “At the same time, the bank creates an asset of $100 (the money you gave the bank) that it calls “cash.” ”

————————————————–

???? and when the bank puts that $100 cash into a deposit with the FED, the bank receives .15% interest annualized interest. correct?

“IF” the bank… The bank can do whatever it wants to (within regulations) with this $100 cash. It can also buy securities with it or add it to the funds that it lends out, etc. It will do with it whatever makes it the most money and will keep it within regulations.

Happy New Year to the year the Great Awakening evolved into the Great Reckoning.

Godspeed!

So what are your views, both Wolf’s or anyone else, on the Federal Deposit Insurance Corp. Chairman Jelena McWilliams departure? Was she a partisan money nincompoop appointed to hobble a federal agency or a competent Chair unfairly ousted?

Intriguing question.

Notice the word “Corporation” in there? Not government, nor agency, nor anything else with the power to create. Ever seen a corporation that actually paid off everything they owe and then formally dissolved the shell and charter? And I don’t mean hide the debts in a transfer of titles.

“Resolution Trust Corporation” – Greenspan creation (FED) disposed of bad S & L holdings, then dissolved.

Not sure what the direct relationship is between QE and interest rates on debt. But getting rid of QE, to me, is a no brainer. I cannot see how it as any real positive effect on the economy. To me a steady QE draw down would be a least problematic way to rationalize interest rates. That said the FED could simply dictate those rates by fiat. It has that ability. Bond buyers are supplicants.

I guess my question is this- why do it every night? Why not do it on a weekly basis?

Maybe it has something to do with keeping people employed at the banks and financial institutions? It’s just computer digits that are changing. Lots of meetings being held over this too, I bet.

The Fed could offer RRPs with longer terms. It was offering regular repos with longer terms, such as 14-day terms, 30-day terms, and 90-day terms during the crisis. But that is somewhat problematic because these longer terms take away the flexibility of the overnight repos. As you can see, they fluctuate a lot with demand. And the Fed is pretty happy with how this is working.

The Fed being happy

and the Fed doing what they should be doing

have been two different things since 2018, IMO

the thieves have been at it since long before 2018

You’re getting soft historicus

Demand from who? for what? It just seems like contrived machinations by a cabal of fraudsters.

So cash is transferred from cash reserves, on which the transferor was earning .15% to RRPs, where the transferor only earns .05% ……..

all to satisfy some regulations.

The FED shouldn’t be paying interest on cash reserves anyway.

Happy New Year, everyone.

Thanks Wolf and everyone who comments here. I enjoy the information on this site, the discussions & all the personalities.

I’m grateful to have found this community.

Bonne année to everyone.

Just to introduce a probable subject for the next few months. It appears that China is going into bonkers mood again and locking down millions and that’s before the latest variant arrives. We may be back to even worse supply chain problems….

On that news, have a great year….ho ho ho

Supply chain problems?

There isn’t any thing I can think of that I can’t buy. They even have masks in Walgreens during the cold/flu season.

Happy New Year all! Here’s to another year of WTFs and Fed shenanigans. Thank you Wolf.

Wolf’s first chart shows the avalanche of reverse repo funds starting in April of ’21, cresting at almost $2T at year end. As Wolf points out, much of those funds come from short-term treasury money market funds at the big brokerages. About 10% is due to quarter end balance sheet window dressing. But the remaining 1.8T are serious money.

My interpretation is, starting April 21 lots of people have moved out of equities/bonds into cash equivalent money market funds. Despite this exodus, the market is at all time highs. Lots of people have missed out on substantial market gains while being subject to significant inflation.

What is going to happen going forward?

Tough choices for the individual investor. Move from overpriced equities into cash/MMF and lose a guaranteed 10+% on inflation, buy overpriced real estate and deal with the carrying costs or remain invested and deal with the quantitative tightening and interest risks?

My question too, as of millions of people I am sure. Truly hope for Wolfs’ answer here xxx

“ Tough choices for the individual investor. Move from overpriced equities into cash/MMF and lose a guaranteed 10+% on inflation, buy overpriced real estate and deal with the carrying costs or remain invested and deal with the quantitative tightening and interest risks?”

Indeed…

A major issue with this is the instability of your ability to get the hell out if it turns south on you…

The speed at which RE can collapse, stock market crashes or other events can be dizzying…

We’re all hoping to see it coming, but with all the machines involved, you can be wiped out in a short period of time and you’re helpless to stop it…

If I were in that position ( I’m not), I don’t think I could sleep very well… but I’m not a gambler by nature so I don’t understand the mindset…

GSH, Vesie, and others with similar questions,

Here is my summary explanation of the phenomenon of this cash:

The excess cash is a result of money-printing by the Fed, starting in March 2020. But it didn’t show up at the time because…

Within three months in the spring of 2020, the Fed printed about $3 trillion At about the same time, the US government borrowed about $3 trillion by issuing bonds to fund the stimulus. But the government used only part of that borrowed money, and the unused portion of the proceeds of the bond sales went into its checking account at the New York Fed, the “Treasury General Account” (TGA). The NY Fed is where the government has its checking account. And the balance in the TGA spiked to from the $200-$400 billion range to $1.8 trillion by July 2020.

Chart of the TGA account balance below. I covered this TGA phenomenon as it was occurring in 2021.

In January 2021, the Treasury Department began drawing down the TGA by reducing the amounts it would borrow while still spending hand-over-fist, including for the last stimulus package (March stimmies). This drawdown brought the TGA back to the normal range by August 2021.

In other words, the government started spending in early 2021 the $1.5 trillion it had borrowed in the spring of 2020 but had not spent. The amount the government had issues in bonds in the spring of 2020 was roughly the amount in bonds that the Fed bought as part of its QE.

This government spending took cash from the government’s checking account at the Fed and threw it out into the economy. And that’s why that excess cash started showing up everywhere early in 2021. This was money that was printed in early 2020 and started entering the markets and the economy in early 2021. By September 2021, the TGA had leveled out in the normal-ish range, and the influx of cash slowed down, and the RRPs didn’t increase much in Q4 except for the quarter-end spike now.

Wolf said: “The excess cash is a result of money-printing by the Fed, starting in March 2020.”

—————————————–

The short answer is often the best answer. My answer is slightly varied. The excess cash is a result of our fraudulent FED/banksters creating money from nothing to save themselves and favored insiders at the expense of the prudent. Same old game been going for at least a decade. It is called FRAUD – where they get to lie truthfully and steal legally.

Happy New Year everyone…Safe and enjoying summer in Cape Town. The beaches are packed, the exchange rate is R15 to $1. Paradise on a budget.

Hoping all these WTF moments of 2021 come back to normal with equities and Real Estate valuations normalizing. (i.e. drop 20%)

With a murder rate of 68.28 per 100,000, 8th worst in the entire world, think I’ll pass on Cape Town. For reference, the US is 4.96. The entirety of SA is 35.9 for an apples to apples comparison.

I’d rather take my chances in Ecuador, where the other commenter is, or any other number of areas which are actually safe to reside in.

Normalizing at a 20% drop????

more like a 50% drop ……….. or more

Row, row, row your boat

Gently down the stream,

Merrily merrily, merrily, merrily

Life is but a dream

It’s all a dream folks! No need to get depressed! Happy new year to everyone!

Were we reside its always a great dream.

Dinner @ Jennings, new years party in Rudolph,

let the dream continue!!

Thanks for all the work wolf.

For 2022, I’m opening the New Year by calling this all out for what it is…a “Rip-Off” that should be immediately stopped! No, not another cry to end the Fed for J.P. Morgan proved that a central banking authority is a must (Time became irrelevant when they didn’t make him Man of the Century for the full effect of saving this nation just in time.). What we need is:

1) A complete ban on any form of instruments being used in such a manner as to constitute a replacement of national money…electronic, paper, plastic, or bananas.

2) Re-issuance of new money (with domestic red seals and foreign blue and yellow seals) pegged at 1:100 with prices adjusted to match (so we can see real values up front).

3) Remonitisation of Silver. Gold to be vaulted with only notes of claims to be exchanged but no bullion released beyond our borders…tough titty.

4) Serious laws on what bankers and their ilk can do in this system.

5) Everything else to be named at a future date.

@ BuySome-

1. You’re right. It’s a rip off.

2. You’re grossly speculating that JP Morgan was a savior. He saved the nation from what?

The entire system is broken.

Happy New Year Wolf and all the readers. Wolf, I have an idea for you. I listen to a podcast on cloud computing which goes into depths on various topics (equivalent to your posts). They recently started a separate podcast going back to basics for people just getting started. I wonder if you would consider posting “basics” posts explaining topics that come up a lot (e.g. why do banks want to park their money in the overnight repos, how is QE artificially suppress rates, etc.). You often answer these sorts of questions in the comments but having separate “Wolfstreet Basics” posts may make this site more accessible to a larger audience or bring in a new audience altogether. I’m sure you are quite busy already but just throwing it out there. Love your work!

The way I see it is to imagine if there were a Federal Lumber Price Administration. There is a spike in lumber in the US everybody knows,lumber shortage or excess demand whichever. What the FLPA could do is call round all the lumber construction companies and say, look, lend us the money you were going to spend on lumber and 2 months later you get a risk free 2% back, and we back our word with US treasuries you can have them as security.

A lot of construction companies might think well why not, lets play it safe, and bingo, demand for lumber is down. The FLPA has neutralised the money.

The reason why reverse repo operations are conducted by the fed is because they have printed so much money the net amount has gone positive, the banks don’t balance anymore, there is unbacked printed cash floating around. So although the Fed can control the banks with reserve requirements and the federal funds rate etc etc, there are extremely cash rish entities out there like SunbeamHereditary Corp. Now the Fed thinks christ got to tighten but they can’t raise interest rates without crashing everything, so hmm, they have to -neutralise- spending and its spending outside their control, to whit, the printed money the puked over the whole system.

So, instead of the 39 banking institutions they usually deal with (control), they include everybody, including SunbeamHereditary Corp, the 140 major financial players, and to control the secondary effect inflation (Fed spent then everybody spends) the Fed says look don’t spend that cash now, lend it to us, we’ll give you 1.5% (and treasuries for security) and you can spend later.

Thats why the seemingly non-sensical reverse repo exists, because it can neutralise spending outside the Feds regulatory sphere which is the banks.

However, as can be seen in the graph in the article, the amount of spending that needs to be neutralised seems to be going up, and inflation does not seem to be going down. If this is wrong don’t hesitate to chime in Happy New Year all!

Taxes, are there for exactly this problem. But America (both parties being guilty but not quite in the same proportion) has rejected any responsibility. Rights, of course! Responsibility? What’s that?

perp-as you so aptly note, ‘liberty’=’license’: the semantic dissonance plaguing our society’s times…

may we all find a better day.

Funny thing, the FED treats RRPs as assets, and not contingent liabilities. Even as it shifts securities, it reduces bank reserves, but not commercial bank deposits, kinda like large CDs.

Spencer Bradley Hall,

“Funny thing, the FED treats RRPs as assets,…”

No. RRPs (reverse repos) are liabilities on the Fed’s balance sheet.

Regular repos are assets.

“When the Desk conducts RRP open market operations, it sells securities held in the System Open Market Account (SOMA) to eligible RRP counterparties, with an agreement to buy the assets back on the RRP’s specified maturity date. This leaves the SOMA portfolio the same size, as securities sold temporarily under repurchase agreements continue to be shown as assets held by the SOMA in accordance with generally accepted accounting principles, but the transaction shifts some of the liabilities on the Federal Reserve’s balance sheet from deposits held by depository institutions (also known as bank reserves) to reverse repos while the transaction is outstanding.”

So, the so-called asset in SOMA, is really a contingent liability.

RRPs are carried as contracts on the balance sheet as a liability. The underlying Treasury securities remain on the balance sheet as assets. The RRP transaction impacts the balance of RRP contracts and the balance of reserves (also a liability). This way, the RRP transaction only takes place on the liability side of the balance sheet.

Clear as Mud Wolf –

sounds like gobbledegook. It’s all FED?Bankster 3 card monte ………..

done while taking focus off the issue:

They created and gave away dollars to save special interests

Wolf,

You are one of my very few heroes, every since the T. Pit days, may you and your family stay healthy and prosperous, you have earned it in spades.

When I have conversations with friends, I always end with “Go to Wolfstreet.com.” You will learn a lot. Thanks, Wolf. Happy New Year.

Happy New Year and Thank You to Wolf and all here!

I am grateful my house is in order and for being ‘independently healthy’. Still, what’s an investor to do?

– I’ll sit in cash and dividend paying blue

chip gold stocks (AEM merger with KL = World’s third largest and in safest jurisdictions).

– Though my cash may get eaten by ‘transitory’ inflation, I hope to get it back and then some during the impending fire sales (the 2008 lesson).

Meanwhile I’ll sleep soundly, help out where I can and try to avoid the other kind of gold diggers!

The fact banks do this to straighten out their balance sheets for one day just makes it seem like fraud. If any of us did a “shell game” with an asset in order to pass some sort of stress test, it would be categorized as conversion and criminal charges would follow.

@ Beardawg-

The short answer is often the best answer. Same old game been going for at least a decade. It is called FRAUD – where they get to lie truthfully and steal legally.

Bottom Line –

The bastards created a bunch of money out of nothing for the benefit of the select. Now they get to play a bunch of games covering for the beneficiaries. It’s just ongoing theft.