Raging price pressures in the pipeline are heading for consumers.

By Wolf Richter for WOLF STREET.

Even as consumer price inflation has spiked at the worst rate in 40 years, far-worse inflation rages further up the price pipeline as it’s flowing toward consumer prices. Going up the inflation pipeline of goods and services from the Consumer Price Index (CPI), we first get to the producer Price Index (PPI) for Final Demand, and further up the price pipeline, we get to the four stages of the PPI for Intermediate Demand.

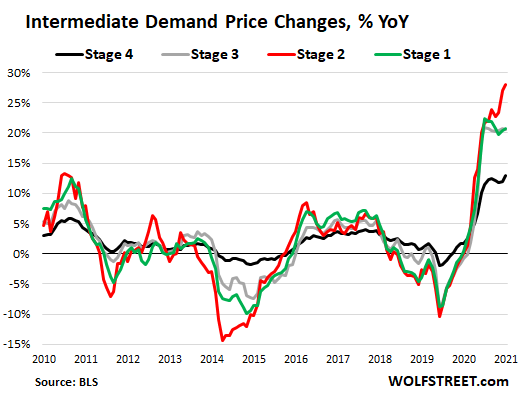

At Intermediate Demand Stage 1 industries, furthest up the pipeline, whose production creates the inputs for industries in Stage 2, prices exploded by 20.8% year-over-year (green line), according to the Bureau of Labor Statistics today. At Stage 2 industries, which create the inputs for industries in Stage 3, prices exploded by 28.1% year-over-year, the worst in the data going back to 2010 (red line). At Stage 3 industries, which create the inputs for Stage 4, prices exploded by 20.6% year-over-year (gray line). And at Stage 4 industries, which create inputs to Final Demand, prices shot up by 12.9% (black line):

These red-hot price increases up the pipeline in the four stages of Intermediate Demand are increasingly getting passed on to the next industry in line, and the price increases from prior months are now arriving at the Final Demand industries.

Producer Price Index for Final Demand.

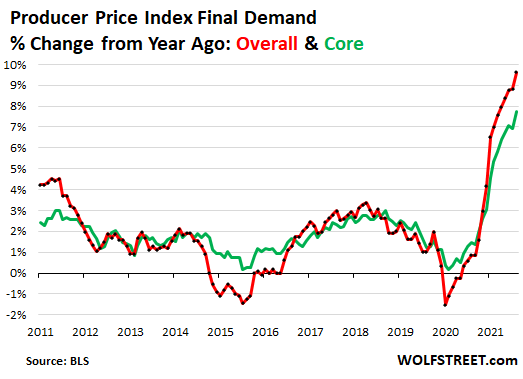

The PPI Final Demand tracks the input prices for consumer-facing industries whose prices then become part of the Consumer Price Index, which already jumped by 6.8% in November, the worst since 1982. But consumers still get to look forward to the impact of the producer prices in November that we’re looking at today.

The PPI Final Demand jumped by 0.8% in November from October. Compared to November last year, the PPI spiked by 9.7%, by far the worst ever in the data going back to 2010 (red line).

Without the volatile food and energy prices, the “Core” PPI Final Demand, jumped by 0.7% for the month and by 7.8% from a year ago, also the worst reading in the data (green line).

Blame the “base effect?” Nope.

In October 2020, the PPI Final Demand rose to an index value that set new highs in the data series and hasn’t looked back since. The year-over-year spike in November 2021 is based off the already record high index levels last year.

But prices of services spiked.

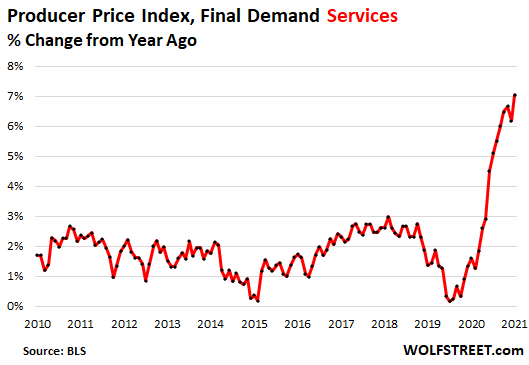

Oh, I know, bottlenecks, supply chain chaos, semiconductor shortages, ocean shipping nightmares, container pile-ups, the whole litany – those are massive problems. But they’re no longer the only factor fueling this raging inflation. Services have caught the inflation bug, and services have nothing to do with semiconductor shortages and shipping containers. But services providers too are raising prices because they can.

The price index for Final Demand Services jumped by 0.7% in November from October, the 11th month in a row of month-to-month increases, and by 7.1% year-over-year, the highest in the data going back to 2010.

Some of the drivers in the price increases of Final Demand Services in November were portfolio management; guestroom rental services; securities brokerage, dealing, investment advice, and related services; fuels and lubricants retailing; airline passenger services; and transportation of freight services.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Debt ceiling will rise $2.5T

Honestly why not raise it to $40T? Get a whole lot while they are in the store rather than return visits. It would appear that Team R wants Team D to take the hit politically anyways. So go big or go home.

$40T would but some breathing room similar to how the last administration got two years of “free” debt ceiling access

The return visits are the point, not what was bought at the store. There is a political utility in having those debt ceiling fights even though any other way to look at it would call it rightfully stupid to keep having those fights.

Overreacting is as bad as underreacting.

.

What if what we are seeing now are just the precursors to necessary adjustments being made to support permanently elevated demand?

.

Elevated demand is what you want because it means more goods for the populace.

.

If you sharply elevated demand you will have inflation until Supply catches up. Then you reach equilibrium and it all settles down.

.

So overreaction may not be useful.

.

We must remember :

What thrills the young scares the old

because they are jaundiced. They have attained their collective society and it is scary.

Which brings us to the debt ceiling, a nebulus concept if there were ever one.

I give creedence to the concept that there really is something wrong with you

if you are considered well adjusted

like everyone else

I am a liar

The truth is that the same brains that sanctioned Iraq, the banking bailout, the clinton deconstruction of the New Deal reforms,

perhaps they had el flagrande evidence that they blackmailed him with to enact the wealth dividend, in the wake of the peace dividend.

They are still making mistakes, oblivious to the basic facts that they are the problem. Ivy league fuckups running the world. And now they refuse to pay.

The ceiling has no meaning. Like a diet or a new years resolution,

self loathing over the excesses past the limit of my original resolve, defines some of my fear of the future.

What is on my mind is how a median American that grew up in the post WW2 and is now retired, saving for retirement my whole life, amassing a small fortune for the lower class ( to Gates, we are all wet backs)

has zero income for the past 15 years in order to bail out the criminal bankers. Can not seem to be enthusiastic about the aristocrats policy about the distribution of wealth in our society and the relative value.

Corruption has become the face of Fascist society that we live in. Profit is the goal.

Sickness is a sign of weakness, as is empathy

I wish I was stronger

Is this a single Dan having a conversation with himself? Or are there two… or more…

Just wondering… :)

Just one Dan dialoguing with himself.

“Rate of change” charts hide the accumulation of inflation and the compounding.

Wolfs purchasing power of the USD chart should be plastered on every financial news site. Too bad the objective of the news is not to inform people.

At the FOMC……….So Jay…………after lunch…….. that port was great……..do you think we ought to do anything. Let us shock the world and change that word. By the way Helen, your hair looks great.

It is a wig….shhhhhhh

This morning, in select wealthy east and west coast suburban zip codes, I see a new all time low in housing inventory. Shocking. Extreme bidding wars on the better listings. I saw one get bid 18% over the ask, and the ask was aggressive. Usually, this is a quiet holiday period. This price action is unprecedented.

Several months ago, many buyers decided to stand back and wait for more inventory and lower prices … instead, the remaining inventory was sucked up by buyers. All heck is going to break out in the spring.

Yesterday I noticed a new rental home in 98004. One of the richest zips as well AFAIK. Not waterfront, but next line with a view. 5K/month. Price history shows it was sold a month ago for 2.2M. Selling began in mid-August from 2.85M. And the price went down 8% after it went pending.

But heck; you take on a larger mortgage for an inflated price, while waiting for the value of the $US to collapse . . . which if your guess is correct, free money easy to pay off with a crashed $US. What’s not to like?

Then the revenue sniffers will hike property taxes, bigtime.

People are funneling dollars into real goods as currency becomes toilet paper.

Just keep drinking that kool aid Jim and everything will be juuuust fine.

As money gets devalued through high inflation, prices keep going higher and higher and when people see that government and central bankers are only paying lip service to inflation, they completely withdraw assets from the market, nothing is for sale.

Shortages develop, price controls and misery.

No one wants to exchange their house for money that can be printed by trillions because no one knows when the insanity will stop.

Don’t be surprised if we have less listings in the spring than now.

I just checked our local real estate website and only two homes are listed for sale in our 437 home subdivision. Both were under contract and sold in two days of listing. No idea on the sale prices because in Texas that’s not made public. This is The Woodlands, Texas, north of Houston. Nice area, oil company and biotech money abounds.

Anyplace within the Vicinity of Houston S#&ks. Lived in Manvell 14 years. The entire place is a S&%tlole.

Just type in the home address and Realtor dot com will usually show you the sale price, appraisal and tax history, even in TX.

Jack, thanks for your insight. It’s valuable.

Anthony A.

Wait till the next big hurricane hits the area. The houses that are still standing will go underwater and then into foreclosure.

We’ll see what happens once mortgage interest rates start going up a few months from now. Could definitely cool down this market some.

Although I don’t want this to be true, I am in this Socal market and you are right. What do you think is the cause of this near-zero inventory?

I bought $10k worth of inflation adjusting I bonds from TreasuryDirect (US) today.

Hyperinflation worries me. The current admin is spending like a drunken sailor.

Not any worse than the last administration.

Yeah, somehow the Biden administration seems fine with people thinking that it’s responsible for the CARES Act.

Would be a complete waste of time. TFG’s people don’t really care for facts.

Stop with the partisan bickering. Red and blue are the same thing, they both despise you, they both want to steal as much from you as possible.

Everybody is arguing about which party they want to be in Control, and I’m wondering why anybody wants to be Controlled

IBonds are a good investment as a SWAN place to put your money. You’ll likely forget about it over time and then check it at Treasury Direct at some point for a nice surprise.

Buy these bonds near the end of the month. You’ll be credited as owning it the full month.

I was buying these back in 2000 using a credit card and earning 1% cash back immediately.

That ain’t good.

So how much will a broom cost in March? $95?

Eventually, everyone’s self storage unit will be full of junk and consumers will stop panic buying.

No, the broom will be cheap, it’s the guy pushing it that will be getting $95/hr.

Well deserved Elon gets billions

Haha…the cost of financial services is increasing just as the market is about to tank and bonds are at negative real yields. It used to be a game of finding the “cleanest shirt” but now all the shirts are equally filthy, so why should anyone pay these boys more money so they can watch their nest egg decline? No thanks!

Also, start looking at lumber prices again. Something tells me the FED better start accelerating tapering and raise interest rate soon!

Yikes! Build Back Better now? Why still buying treasuries and mbs’s? Really! Any real reason to? Europe seems worse. Climate, moronic, (omnicron)

too much, I always heard lawyers ruin everything. What a mess. Bond vigilantes cannot fight the Fed. I can’t wait for the fireworks.

What

Wolf, out of all the stuff I watch I am glued to your daily posts. Very good material. This is of interest to me, off grid, rural, retired and one who raises some pigs and sheep.

I have to say your insights are as relevant in our personal lives as they might be to the metro investor. But our risk is fire – not the friggin markets, DOW or S&P. Its LAND VALUES.

Everything has risks. But you might not eat as well.

That’s funny. If I was off the grid, rural, retired and raising pigs and sheep, NONE of this would matter. Go enjoy your life!

Anyone familiar with the TIPS breakeven trade? You short fixed-coupon treasuries and buy TIPS, then if inflation expectations continue to rise, you make profit on the spread (both could go down at the same time but TIPS would go down less). I’m trying to figure out if the Fed could manipulate this spread, or only manipulate the overall direction and arbitrage will keep the spread accurate. Anyone have any ideas? Thanks!

@A

Watch for the fees and transaction costs on anything that complex.

Yes, they buy both TIPS and T-Bills and are therefore able to manipulate the spread.

If you were the Fed Tomorrow Wolf why would you do ?

*what

We will taper slowly and then consider gently increase rates. Please do not panic.

But, tapering, even slowly, means less money in the system.

Gently increasing rates, means higher costs, lower Real Estate prices.

You can’t stop what is going to happen, regardless of how gently one wants to be. It is like a gentle gun shot wound, or slow hanging.

Can’t be done.

The best thing for the FED is a real Black Swan event. A nice V8 Volcano. An 9.0 New Madrid earthquake. This will have the effects wanted, but not the FED to blame.

Or, how about Russia invades the Ukraine on the same day China moves on Taiwan, on the same day Iran finally upsets Israel, with massive snow fall in Europe crushing their natural gas supplies.

Maybe this is what the FED is waiting for.

I would cash out my stock portfolio and quietly disappear.

Marco,

1. End QE cold turkey on the spot.

2. Announce that maturing securities and pass-through principal payments of MBS will not be replaced with new purchases, starting Jan 15, 2022, and that thereby the balance sheet would decline. This will allow long-term rates to rise, and will avoid that the yield curve inverts.

3. Announce rate hikes of 50 basis points at every meeting in 2022 and 2023, until the federal funds rate is near the yoy CPI rate (currently nearly 7%).

4. If inflation gets worse – and it may well because there is a lag of about 1-2 years between changes in monetary policies and inflation – announce 100-basis-point hikes to get there faster.

5. Make clear that this is a total U-Turn, come hell or high water.

6. Make clear that there is no put under anything. Vanquishing inflation is priority #1.

7. Announce that as a permanent policy change, the Fed will not ever do QE again, but that the periodic seizures in the Treasury market (and there will be some) will be dealt with through repos or reverse repos.

8. Announce a permanent change in inflation targeting to 0% inflation as measured by core CPI (not core PCE), with slight inflation and slight deflation alternating being considered normal, for true price stability.

I might have forgotten a couple of announcements in the heat of the battle, but that gives you the gist.

good calls Wolf but we all know this is just our wild dreams. This would never happen.

:-]

I would add:. “We are on a GOLD standard”.

Was gonna say I’d vote for you, but the fed isn’t an elected position :/

Still, you’d do a hell of a lot better job than the current crop of people.

Spot on

9. Tax the unimproved value of land to crush rentiers, thereby restoring real growth to match your interest rate rises

Also tax the value of “intellectual property,” which is created and protected by the U S gov’t. Whereas land value is created by communities and gov’ts at all levels.

About intelectual properties.

Rather go back to where copyright ended at the writers death and patents was less than 20 years.

I will agree to this but only if you wear Yellen’s wig on Fridays and promise that all future Fed decisions will be made by slamming beers and playing spin the bottle!

Do it Wolf!!

He’s lonely. It’s a small sacrifice. Just don’t sign any contracts with that devil.. I can hear him saying all this in the voice of King Julien “King of All Lemurs”..

I mean.. obviously.. that’s how he’s been making these decisions all along anyway..

So the Fed will do the exact opposite of everything you just listed, because they’re idiots.

No way in hell any of that is going to happen. Fed is now a part of the Political Class. Watch for lip service to your 1-8 points, but actually doing the same or worse.

@W

Halleluah! Great stuff!

One question, what will you tell Ms Yellen when she tells you she needs to sell $3Tr in treasuries to send people stimmies to buy food? Go **** off and find a buyer?

Well, if I get my wish and all these things happen, the 10-year yield might reach 8% or 9%, and lots of people, including me, would load up on 10-year Treasury notes that the government wants to sell. There will be plenty of demand for this stuff at a 8% or 9% yield. Yield fixes demand.

And Congress, looking at the cost of borrowing, would be encouraged to be less profligate in spending and more attentive to raising money.

Yup!

Who would be first in the rush out of Tesla and Bitcoin to get into good old solid Govt debt.

You might see it, I won’t.

I would nominate Wolf as Fed chief in a heartbeat, with Depth Charge as Vice chairman. I would then fire the rest of the clowns that are on the board and not fill the vacancies.

Wolf,

In the rare event none of your recommendations will be picked up by Powell,

what would you recommend your readers to do to take advantage of the coming mayhem?

Follow the example of that german guy a century ago who borrowed to buy a lot of assets and 10 year later repaid his debt with a wheelbarrow full of worthless money?

Or for the less adventurers among us, just buy everything you need for the coming years , pay ahead subscriptions, all the stuff people in the Southern part of our continent do to keep their head above the water?

Thank you Wolf.

I wish you , the grownups, were in charge. Do you think they will deliberately let the Stockmarkets drop 40% or so just to take the steam out of the situation quickly ?

Letting markets crash isn’t an option either. The US Gov is on the hook for all those pensions. Plus, as Peter Schiff points out, any losses on the Fed’s balance sheet are also guaranteed by the US Government.

And don’t forget, $10T of US Debt is coming due in the next 12 months.

It’s either default or keep printing.

“And don’t forget, $10T of US Debt is coming due in the next 12 months. It’s either default or keep printing.”

Nah. The super-low yields tell you that there is super-high demand for this stuff. If there is less demand, yields go up, which brings out new buyers. If the 10-year yield goes to 6%, the whole entire world, including me, will be buying 10-year Treasury debt. Yield fixes demand problems all the time. Just let the market do its job.

Wolf,

This is not much different from what Paul Volcker did. It worked then and will work now. Bring it on!

No, it is extremely different now. Volker had trade surpluses, not deficits. In 1980, the US was the world’s largest creditor nation. Today, the US is the world’s largest debtor nation. In fact, the US has more debt than all of the other debtor nations in the world combined.

It’s different this time. And all the idiots who still think the Fed can fight inflation are oblivious to reality.

@911Truther – I think you’ll find there’s more debt in China, but it’s better hidden due to how government/corporate distinctions are blurred.

@ 9-11 Truther

Excellent point regarding our position as a debtor nation. And that you linked 1980 as the pivot point. Those of us who envisioned the offshoring of our manufacturing base back then as the root of our ultimate economic implosion are now being “rewarded” for being right. Great.

An increasing Money supply that is not backed by increasing production can only lead to inflation. And to ward off inflation the answer is cheap and available credit. If that credit were funneled into productive economic activity then the possibility exists to reverse our fortunes. Clearly the private sector is unwilling or unable to sink their teeth into it. They’ve basically given up on the idea of America being a production powerhouse.

So the idea of infrastructure investment (as a start) needs to be front and center. I have no idea what’s in the “Build Back Better Bill” (and I imagine no one on this board has a clue) but I can see why it’s critical to begin the transformation.

Having said that I would implement all of what Wolf proposed but ensuring a strong public sector to perform what the private sector clearly wants no part of.

Unfortunately the public sector is in complete capture to the financial players that run this thing.

Markin, et al.

That is the actual sad situation…the corporation leaders and other related ultra rich obviously will settle for nothing less than some version of the “Hunger Games”, and have no intention of stopping their ridiculous pursuit of it……they are truly insane.

But no predictions…situational awareness is impossible…….way too complex….and info is a full blown corporate business itself, anyway……..I’m just an old man with hopefully the ability to watch and learn… (maybe the next ten years, according to the statistics) and comment here….but there is always hope AND WITHOUT having to invoke a damned diety. More people should try it…free will is fun.

JPow will most likely talk tough and pretend to be tough until the stock markets pukes 20-30%, then he will drag out this high inflation/stagflation mess much longer than necessary by coddling the top 10% who own 90% of all stocks.

Once the fed loses the trust via jawboning make-believe tools for dealing with high inflation, then he will panic and get serious once a black swan event occurs to scapegoat…but until then, JPow is a puppet to Wall Street and big money players, the bottom 90% be damned…

This has to get a lot, lot worse before it gets better…socially, politically, financially…buckle up…

“JPow will most likely talk tough and pretend to be tough until the stock markets pukes 20-30%”

Will he wait till that or will 5-10% puke show him up for the wink he has been.

It all depends on the show that inflation puts up. The more stubborn the inflation the more severe the puke would be my take.

That brought a tear to my eye, especially #8. Preach it, brother.

#3 might be a little harsh after a few hikes, resulting in an overshoot vs inflation. I think you’d have to slow it down, pace yourself.

#6 feels good, but why undermine the belief in the put? Let markets wonder. It might limit the drop in equities to, oh, 30% instead of the 50%+ imminent from such sensible monetary policy!

You sound like an economist! One that might have a few degrees, even, some real world experience, and a whole lot of common sense. Heaven forbid!

7-8% for mortgages doesn’t help working people that much. It cuts a lot of people out of home mortgages. Private mortgage lending is now 10%, or was, till they stopped that on owner lived in homes. An awful lot of people overextended and foreclosed at that rate even at a lower home price.

No problem if house prices are cut in half. And the buyer will save lots of money on property taxes and insurance. You cannot have 7% mortgage rates and today’s house prices. House prices skyrocketed because of these record low mortgages rates, house prices are going to come down with 7% mortgages. That relationship has been very well established.

That was basically the policy of Canada’s central banker in the early 90s – guy by the name of John Crow. We basically got there too, but the incoming government in 1993 refused to renew his term because he refused to accept their 1%-3% band. The adjustment was painful at first, and a lot of people lost their jobs and homes. But we did ultimately have price stability in the early-to-mid 90s. Alas, it was short-lived. Crow always argued that a 2% inflation target does not represent price stability, but merely inflation stability, which is sub-optimal. True price stability means a target of zero, with an allowable variance on either side. Naturally he was – and still is – dismissed and disparaged as an evil, cruel “monetarist” by the conventional economic establishment.

Wolf – What you propose would cause a global economic depression of historical proportions.

Nah. But it would cause asset prices to drop. And some people might have to go work for a living. And then employers could fill some of those 11 million open positions, and we could get houses built in normal time spans, and the plumber would show up, and a host of other problems would get resolved. The idea that a decline in asset prices leads to a global depression is the biggest fattest red herring ever.

Wolf- I am not anywhere as educated or experienced in these matters but is not a double dip recession (in the 1980s)the result of the last time the USA fought inflation in the manner you are advocating?

Matthew Scott,

I lived through that one, trying to find a job just out of grad school. Sure, it was tough. But it broke the back of inflation for 40 years. And a long economic boom followed. Inflation isn’t nearly entrenched like this today, and it would be far easier to crack down on. NO ONE is talking about raising rates to 20%. That would be nuts today. We’re talking about a federal funds rate close to CPI, which would be much lower than 20%. So may be 5% or 6% or 7% if inflation continues to rise.

Just to continue as a “devil’s advocate”, there was much more industry in the USA in the late 1970s and the the US economy was not under a massive trade deficit and budget deficit. Today the economy has dozens of massive companies that never make a profit and an financial system built on decades of very low interest rates. All to say that if we have 8 % inflation today and/or a 8% fed rate in the USA that would be like 20% in 1979-1980 as far as the global economy is concerned

Since 1982 every recession sees a period where interest rates never reach the previous high and then the next recession “requires” a new low. Every recession saw a recovery where participation never fully recovered. And now as you do well documented the WTF flood of money with QE etc was massive in 2009-2011 and never really got taken out of the economy completely before they took it to even more insanity with their response to the economic dislocation of COVID

I just submitted a price change for 2022 for our truck component factory in the American Midwest. From Jan 2021 to Jan 2022, our price changes range from to +20% to +55%, depending on product, and its level of value-add done in house versus raw material content.

The core driver of these wild increases is the cost of steel. The market has gone absolutely wild. Check out the FRED chart WPU10170301 to understand what has been plaguing metal-intensive manufacturers all year. Aluminum is a similar story.

No area of our company is untouched by rampant inflation right now, but ours is primarily a story of steel prices. US manufacturers are at a horrible disadvantage right now. Prices everywhere are up, but ours are exceptionally high, and I am of the understanding that it related to the extreme market concentration in the American steel production industry.

Add in an increasingly rapacious healthcare system that is being subsidized by private businesses like ours, and it’s becoming even harder to build products in this country.

This is getting ridiculous. Something has to give in a big way.

The paper price of Gold and Silver will “give way”.

It’s already beginning. Bids for nice silver bullion coins are way up in Dec even with $22 paper. It’s too late to buy silver reasonable and too late to find a good selection.

random guy 62,

All the best to you and your company and employees. Curious to know what types of steel are you working with?

Many popular alloys of various thicknesses… lots of sheet and plate. Plenty of tubing and bar stock of various grades. Stuff that goes on big commercial trucks.

If that is true,

Why don’t you buy some futures in the commodities you need —or— invest in some metallic coal miner ?

Short answer… we are roughly 100 employees aren’t that sophisticated.

And we have never had to do so because the prices have been fairly stable for decades.

Thanks for ‘boots on the ground’ report. It adds a lot to my understanding. and thanks to our host for providing a place where such can be discussed.

Moosy-Ford went a step further and tried OWNING its commodity resources prior to WWII. Didn’t stick.

may we all find a better day.

We use a lot of steel, and are getting mauled on prices, and have to increase prices ourselves.

But, people keep buying.

Payroll inflation at the low end already happened, and is now happening at higher pay scales. The only conclusion seems to be: Money is worth less.

Just read an interesting story published in the Atlantic in January about a Ukranian guy named Ihor Kolomoisky who sucked the blood out of one of the US steel companies and let it rot into bankruptcy. Along with several other midwestern companies and buildings.

Bidenflation at 28% a year means producer prices double in 3 years.

And it also means Triump 2024, whether you like it or not.

Well put. Sadly, I (see nowhere my opinion reflected that I) think Trump was bringing the money-pumping, Powell-arm-twisting too-prolonged booze punchbowl to the already drunken 1:00 a.m. credit party, pre-COVID. The economy was starting to overheat, already full of zombies afloat on easy credit. COVID simply created a sudden shock fall-and-rise, and now overheating and inflation are back to trend line. Except, overshot above trend line now, based on printing calls made in the fog of war (and the absence of guts). Greenspan’s simplistic answer to any stressor become the knee jerk Fed response of this era, now to be run into the ground. Hopefully the jagged line on which we (thanks Wolf) “go to heck” won’t go fractal on us! So, Biden policies compared to Trump on credit is like Scylla and Charybdis — no happy answers to the left or right. Trump tax cuts versus Dem overspends have similar systemic effects: weakening the system and not solving the problem.

True that. Reminds me of a joke someone made a few years ago: if aliens invaded the Earth, the first thing we would do is lower interest rates.

“Indeed, you won the elections, but I won the count.” — Nicaraguan dictator Anastasio Somoza (1896-1956), Guardian (London), 17 June 1977.

I looked for a similar quote by Stalin, but apparently that one was falsely attributed to him.

@I

Wow! ‘Russia-gate’ back in Stalin’s day.

I don’t believe it.

With that type of inflation, do you really think the USA economy will survive until the 2024 Election…I would say no chance but as we know, they do like to cheat and steal from the poor to give to the rich and those with bitcoin…..so who knows what will happen..

I like it

The financial endgame draws nearer, y’all can feel it.

It’s time to get ready mentally for what is coming next, if you are holding on to 401Ks/Bonds/Financial Products as the means of your survival you are going to be wholly disappointed.

Every person that drops out of the system/goes Galt, deals one more blow against the financial products most are banking on, those are nothing but unpaid debts/even Crypto.

The system is destabilizing in real time and drastic action is coming down from the gov, this is no mistake/accident.

Get Ready!

Galt is only 47 feet above sea level, and so many funky Ag smells nearby.

FED can continue doing slow tapering like what they have announced and can keep ignoring inflation like what they have done for so long.

Inflation on ground is at least 20% and the inflation is there for last 12 years or so ( asset inflation ). If FED can ignore for this long then they can continue doing this for next decade or so.

Yes, in theory, this is how it has worked in the past.

There are however new variables in the equation which the fed has little/to no control of, the biggest variable reaction is people in this instance.

The rise of the antiwork movement/corruption/non belief in the system is something the fed cannot control, the system is rotting from within in real time.

Fail to prepare at your own risk.

Don’t over estimate the reaction from people aka Sheeple. Folks talk about revolution but I don’t see it happening at all as the govt has become too big and powerful at every level.

People would be given their monthly pittance to sustain their lowly life and would be kept in their comatose condition, elites would keep amassing the wealth like it is happening for the last 40 years or so. Most of the people have absolutely no clue what’s happening out there.

The biggest loser in this would be middle class as they have the most to lose.

In other news the Biden administration announced the moratorium on student loan debt ends February 1 and college won’t be free after all. This should propel a few more people back into the job market.

“…..The corporations have become ENTHRONED…..soon ALL the wealth will be in a FEW hands…..they will then prey on the PREJUDICES of the people until the GOVERNMENT is destroyed.”

-Abe Lincoln

(with some editing, but the meaning is still EXACTLY the same)

Or did you think the Gettysburg Address was merely just another politician’s obligatory funeral speech?

Helpful hint: “Common sense is a collection of prejudices usually accumulated by about age 18”

-Albert Einstein

It has been drawing near like the big earth quake in California I am still waiting after 25 years.

Everytime you think this is it, somehow the system still does not collapse ; everything is worse but no collapse and mayhem yet.

By the way, stay away from the crypto ponzi scam. If you don’t trust fiat money that at least is still backed by a country and it’s ability to tax it’s citizens and production, why would you trust crypto more which is only backed by the good faith in the other crypto owners they will not sell?

No reason to trust either

PPI doesn’t really lead CPI and crude doesn’t lead intermediate doesn’t lead final by much if at all. They all pretty much move together.

you will own nothing and be happy! get with the program all you sheep! When we do raise rates we’re gonna bust the wheels off all of your wagons and all of our buddies will laugh all the way to the repo court. This stock market reminds me of of Dec. 1972. But now only 5 stocks instead of 50 are the untouchables.

If the Fed waits long enough there will be a recession and they won’t need to raise rates. A consumer spending driven recession would take care of inflation and supply chain bottlenecks. In response to the slowdown government pumps more stimulus into the economy. Pent up demand builds and off to the races again. If you have a long enough time horizon you just buy everything and wait.

“there will be a recession and they won’t need to raise rates.”

Or:

There will be a recession and mucho inflation at the same time, a new and nastier version of the stagflation of the 70s.

Recession is such a civilized word.

Why not call it financial mayhem ?

Some prices go up a lot, some go down. Some surplus and some shortages. All at the same time.

YIT no longer works and financial planning becomes as absurd as going to the casino and make a plan based on the next 10 rolls on the roulette table. You cannot.

“there will be a recession and they won’t need to raise rates.”

We’re already in a recession. Just look at all the closed businesses around here. Prices are going up double digit and like 20% if they calculated the real inflation. So we are already in Stagflation. And it will get worse before it gets better.

Growth has to exceed interest rates or an implosion will follow.

The way to get growth is to migrate from rentier activity to real wealth creation.

Americans don’t differentiate between the two, they’d better wake up. Adam Smith did. Keynes did. Friedman did. Maybe try it?

My intuition, from reading U.S. economic history, tells me that real wealth creation was more profitable, with less bureaucratic and tax regulations. So the big players moved their assets overseas. That seems to be the underlying cause of less domestic wealth creation and more rentier activity.

So it seems that one cannot just rationally change the economic reality without addressing that issue first.

How long before the dollar stores shelves are empty or they change their name to the $2.00 store?

My DIL said that in our local Dollar store there was a sign that said all items now $1.25.

Don’t calc that on a percentage basis, you won’t like what you see.

Used to be called dime store. Before that a five and dime. That was in my life time. Might have a penny store at one time.

Working at the Kwik Chek in Naples, FL in early ’61, there was always a ”special” on 24 inch ”sandwich” loaf bread, $0.10 per loaf!! limit 10 loaves per person per day LOL…

Started the next summer working construction on the rich folks homes in the Port Royal subdivision at $1.25 per hour, journey level folks got $2.50, foreman, a crackerjack carpenter, got $3.50.

Those houses were built for $12.50 per SF, for the finest quality in SWFL at that time.

Try and buy one today for less than a thousand $$ per SF!!

they allready did that > its now $1.25 @ dollar stores in my area

Things change as inflation kicks up. Been watching a guy that puts up a video everyday on building tiny homes. Incredible Tiny Homes. He is a little bit of a clown, but he has dream of getting production up to one unit out the door every two hours.

He is trying everything. He will sell you a lot, rent you a lot, custom build a unit to ship cross country. He has developed a standard unit built out of expanded foam panels with steel inner and outer walls you can live in as is and finish later inside and out.

He can put you in a shelter for around $40,000 grand. There is a need. He is backed up and trying to figure out how to grow even faster.

Did you know that trailers and mobile homes were first marketed as “Tiny Homes” around the time of the depression?

They tend to be a better deal BTW.

GDP is made up of 50% spending by the government. For every two transactions the government was paying for one. There will be no reduction in spending because by their own measures it would put us in a recession. This means that the big spending packages will be passed annually forever.

1) J. Powell is testing his power.

2) JP will accelerate tapering and raise interest rates faster than previously planned in order to save the middle class from the grip of inflation.

3) JP will send the markets down, bottoming before Nov 2022 election.

4) By Xmas 2022, a lower high CPI and a power grab.

5) Cumulative COLA gains for sacrificing freedom.

6) JP will adopt Wolf Richter plan to soften Joe Manchin.

anyone follow the 10 yr. treasury? It acts like we’re headed for recession. I know I know the fed is buying it all so this distorts the market. But the broad stock market is also signaling a slowdown. Half of all stocks are down 20% or more from the highs earlier this year. Trouble next year it seems for sure.

There is a dystopia that we will find ourselves within, created by a Fed not grounded in the reality of economics.

Equities will go sideways or fall….lose

Being in cash will be eaten up by inflation….lose

The manufactured Magic wealth creation of the last several years will have its day of reckoning.

This wealth will erode, and retrace. The over leveraged will likely get chased out. And will that bring more easy monetary policy?

beamrod,

I keep my eye on the 3 Year Treasury & it closed today @ 0.98% .

At the start of the year, 4 January, it was 0.16%.

Totally agree with Wolf that it should be near 7% now.

The Fed needs to quit buying $105 billion a month in Treasuries and MBS. The Fed already holds 25% of all Treasuries outstanding. The yield doesn’t say anything other than what the Fed wants it to say.

This ^^^^^^^, right here, right now. Quibble all you want about the other details of monetary policy, this one just makes no sense. I would guess no one on this site would argue for it. Not one. Well, other than J-POW!!!!!!!

If the economy was healthy, the 10 year treasury would be yielding over 2 1/2% if not more. The smart money is bailing on the stock market and running for cover just before the impending meltdown. Black Swan anyone?

The Fed is NOT EVEN ATTEMPTING to adhere to their mandates/instructions/agreements that allow their existence.

Whom do we call? Sherrod Brown, chairman of the Senate Banking Committee? These pols are FEASTING on the free money, dare not they interrupt the game.

The Fed has been hijacked, and is rogue, off the rails and under the spell of some other power.

Fed has been a shill for the oligarch bank cartel since the day it was created in 1913.

The only solutions: Congress to take firm control (unlikely because the majority are bought and paid for, and gridlock), or popular uprising to demolish it (unlikely because the masses are financially ignorant).

So, read Wolf report for anticipation of what will come, diversify, live smart, and enjoy life.

Read The Creature from Jekyll Island. What’s happening today in the banking world is just lather, rinse, repeat.

I think the US is in the middle of a devaluation. If I were to manage it I would let inflation run at 6%, 12%, then reduce to 8%, 5% back down on an annual basis. I would copy the Volcker devaluation. The reduction will effectively reset debt levels in the US. The world is going to do the same because the weakened dollar gives them cover from import price shocks.

Powell will announce a series of insufficient policy changes that will be behind the curve. So this is year 2021 at 6.8%, you can see 2022 is going to be the hot year, then a much stronger policy response for the landing.

Lord

You jest

“I think the US is in the middle of a devaluation. ”

If the inflation rate went flat would you think that deflation?

If it dropped 1% would you call that defaltion?

That would leave a net 8% increase in PPI.

NO. A retracement of rampant inflation is NOT deflation. The NET drop in the value of a dollar is still unretrieved.

To be clear, what I’m suggesting (as possible) is that by 2025/6 the dollar will be worth about 60% of what its worth today, and -at that point- inflation will be around 3%. I’m not suggesting any retracement and in fact I often point out that Volcker “tightening” wasn’t a slayer of inflation, he devalued the dollar for exactly the reason you state, that net drops in the value of a dollar are never retrieved.

My point really is that Powell is not responding to events, he is orchestrating them.

WTF! This deserves a Whooooooosh….. (Delayed version)

JP will not repeat a 2018 Xmas massacre

These charts are looking like early 70’s.

If wages don’t follow suit, there may be strikes, like the 70’s. If workers win rises, the Govt either has to make the money available to support the rises or it has to stand firm in which case the rises will be nullified by a recession.

In the 70’s the Govts caved and the wage price spiral started. I keep hearing that wages are not keeping up, that means people will run out of money.

If food becomes an issue, the Govt has to cave and make payments to avoid a revolution.

The comparison to the 70s and now can stop with this one fact.

In the 70’s the Fed FOUGHT INFLATION

Now, the Fed PROMOTE INFLATION.

and that is undeniable.

Arthur Burns was nominated by Richard Nixon in 1969 to head the Fed on the condition that he not raise interest rates . Nixon did not want a recession to ruin his chances of re-election in 1972. Burns did not push for interest rate increases until later in his term as Fed Chairman. The gold window was closed on August 15, 1971 meaning that the US would no longer sell gold to foreign central banks at $35 per ounce.

Agreed ,except prices of fertilizer are doubling . Food costs going thru the roof ,terrible situation for people in charge

Aul,

Also the 73-74 stock market lost 43%. Ouch!

Really don’t want to see that movie again. But who knows?

Hang on and hope for the best!

Great Post’s here from lots of blog readers and Wolf : Unfortunately The creators of this mess with all those millions flowing I don’t think are going to do anything without Law Enforcement. IE : Force basically forcing them to act. That’s where the Buck stops when the Bars appear blocking the way

Ya I Bonds are great but you can’t put enough in them to gain income to live on .Now If you can put in $500,000 or a Million then you can get some income back ,But Wait : Heck the inflation will eat all that income up anyway I guess if you have no law enforcement then you need to reassess what’s right and wrong these days ?. No wonder all the Smash and Grab perhaps it’s just craziness Why Invest in Property when you know it’s most likely going to Crash ? Moss is green and grows on Houses Not money ? that’s just printed up like newspapers

Good thing the Fed’s got the BLS on the case to start under reporting inflation even more starting in January. And if that doesn’t tame it

I’m sure price control mandates will nip it in the bud.

Gov and Fed can under report to an extent, but when inflation starts hitting the street bad enough, the more and more people stop believing their scam. Then a grass-roots inflation mindset spreads — which is not easy to control.

Yeah they’re able to keep the ball rolling right now because people are high on asset price increases. Many people I know have had student loans cancelled and are no longer upside down on their cars and are “trading them in for a profit.” As if. Then they buying a car substantially over sticker price and often brag about.

People are just giddy about everything right now because money is cheap, assets are wildly inflated, and wages are ticking up and you can get a job anywhere. They don’t mind inflation yet.

I have written a speech for Powell tomorrow, short and sweet:

“The party’s over. QE is finished as of my comment right this moment, we will be reducing our balance sheet from the more than 8 trillion level of today down to less than 1 trillion in a year’s time, we will be raising rates aggressively to hit a level of 10% by the end of 2022, and Wall St. is on its own.There is no more FED put or support for the markets. Thank you.”

There is no more FED put or support for the markets. Thank you:

That would be a great start ! but what about all the people who got all those low Interest loans to buy Homes and more at highley inflated prices that all of a sudden are not worth it anymore .

You know what’s going to happen > Gone all Gone.

Lets see who comes and buys everything then, same old story the people who have all the money right ? the ones who sold out and waited

This. If it goes quickly from one extreme to another it’s not going to help the majority of people. It’s just going to benefit those who had a heads up beforehand. All the foreclosed homes will be sold in bulk lots again. All-cash sales ONLY just like the GFC- no odinary people allowed to buy. It’s just going to be investors. Ordinary people will be left out.

Nah, in the GFC ordinary people like me bought bank Repos and HUD foreclosures like they were going out of style.

We bought a 2,000 sq. ft. 3 year old brick ranch house in a really nice area for $62/sq.ft. There were plenty to choose from at that time.

Anthony A.

You paid all cash? This is what I mean, one person or family looking to buy just one home was at a disadvantage as they usually did not have all cash.

Be careful what you wish for :) If he says this, they will take him to the hospital to check for serious mental health issues.

DC

You may add: to Jim Cramer and the other Wall Street shills who are going to take beating if and when this policy is implemented

” I don’t give a f$ck about your problems”

1) Option #1 : today JP will start a new Xmas massacre for Joe Manchin convenience.

2) Option #2 : Dec 14/15 low is a spring board for a new Xmas rally.

3) The 6.8% CPI is a one time spike to ignore. It will decay next year.

4) There will be a rotation from online pickers and restaurants jobs

to producing real goods, real stuff, using AI and advance mfg tech, protected by tariffs.

5) OmiXi enhance WFH, reduce traffic, for infrastructure projects

convenience. Less traffic, lower WTI consumption at the pump. Last year trails pickers fad is over.

6) Supermarkets competition will reduce food prices.

7) Higher interest rates truncate RE.

8) Option #3 : the $2.5T jump of debt ceiling is good enough for wall street traders, even with JP negativity.

1) The 3Y and 10Y are pulled down by gravity with Germany negative rates.

2) Any attempt to lift the 3Y to 7% will end in crash landing.

3) Lifting the debt ceiling to $32T with 7% 3Y will send the economy to a deep recession.

4) O/N at 4% and 3Y at 7% will destroy the shadow banks.

1) So true. German 10 year yield is -0.38%.

2 & 3) Yes indeed.

4) Good.

US yield curve sustained severe injuries. JP have to use crutches. JP ==> invalid

Hot topic here, judging by the many replies.

Whether anyone wants to admit it or not, hyperinflation has been baked into the cake for a long time. The latency of it finally appearing was caused by continuous currency debasement in all other fiat currencies.

With the worlds primary reserve currency now in its final stages of collapsing, what comes next is a massive reset. Interest rates will not likely be raised by much, because the entire world is far too focused on propping up equity markets.

Musk is getting the heck out, bc he knows what is coming, so he will have $16 billion before year end, to diversify into hard assets outside of the fiat. One of many billionaires who have already embarked upon this,

A dollar reset of at least 1/3 rd, is probably the only way to forestall a complete freeze up of credit in the near term. In the long term it’s going to have to be new issuance of a currency, most likely digital based, with a ton of debt just wiped away, along with a lot of equity destroyed in the process.401ks will become 101ks. If the average stock holder, retiree, etc has 25% left in value, they will be deemed ‘lucky.’ The reset should have been done 20 years ago, but no, the Fed insisted upon perpetuating a total illusion of ‘wealth.’

Hyperinflation is now the outcome of that illusion. Until the currency ceases to exist.

Mike R,

I think you’re contradicting your own hyperinflation prediction with the assertion that CEOs (Musk et al) are cashing out of their company shares. If they thought there would be hyperinflation coming, they wouldn’t sell any shares because in hyperinflationary times, equities lose a lot less purchasing power than Treasuries. Musk also sold and cashed out of ALL his homes (very expensive mansions). Selling real estate is something you would certainly NOT do if you expect hyperinflationary times.

They are betting on a semi collapse, and if it happens they are right to get rid of mansions in populated areas , cash out of the system, etc.

When the going gets tough they will be prime targets for the populace as they are the most visible of the “rich”, they will also be sacrificial lambs the government will throw the publics way, either way they are in a precarious position if the economy goes south in a big way, they are being setup for the blame.

I agree with the poster above that a currency collapse is inevitable at this point, and the issuance of a new currency is the only way out the hole.

Keep your eyes open for a manufactured black swan that spins out of semi control, something like Russia/Ukraine, Israel/Iran, etc. It would have happened already except that Iraq/Afghanistan are still on the public mind and there is little to no support for U.S ground troops engaging overseas in masse.

Nice feed! Good to know at least some people are thinking.

Produce a real, needed product and you should be just fine. Products can be traded directly for the other stuff.

Play games and try to live on your guessing skillset… might work, might not. Still some unoccupied bridges out there.

Inflation means the “price” of everything goes up, not necessarily the “value.” However, everything is denominated in USD so the price of equities can only go up. Since markets look forward and all signs read inflation, why are indexes languishing since Aug/Sept ?

Makes no sense.

The nickname “Bidenflation” has started catching on. I’m starting to see this on the main stream media. The Swamp started using this several months ago on this site. I was surprised it didn’t get canned as being too political. I’ve been pushing the envelope. I realize that. I can’t help myself.

What specific mainstream media? I’ve only seen it here. Dangerous illusion

Fox business news

I see here lots of people hope that house prices will go down. They will NOT.

Yes, the interest rates may go up. You know what’s going to happen?

40 year mortgages. 50 year mortgages. 100 year mortgages.

Alternatively, or as a supplemental measure, partially-government owned housing, where you pay for 50% of the house, the other half is government owned. Kind of like in China, where government owns all the land, but you lease it. The government will buy land with front-run money, knowing full well it will double in nominal value shortly thereafter.

For all of you who hope home prices are coming down, and think that this time is not different, you are in for a rude awakening. All the number-throwing, carefully planned schemes based on financial machinations…. Kaput.

What’s on the line now is the world domination between China and America. So far, America was in control, and that’s why we had booms and busts. China is winning simply because it controls manufacturing, just as we once did. Meanwhile Russia didn’t disintegrate, much to the chagrin of our vaunted intelligence community. The dollar may not disappear, but it won’t be the king any more.

That’s what’s changing right now.

If foreclosures develop, Home prices will drop simply because there will be a lot of foreclosures, not a few .Think back to 2000 to 2008

What happened to the Las Vegas housing market in 2008?

The amount of residential mortgage debt doubled in the U.S. between the years of 2000 and 2008. Las Vegas was one of the hardest hit because it had the biggest gains. When the bubble burst and the country went into a recession, people were forced to give up their homes.

Don’t think that people shall keep paying for homes that become worth less than they owe on them. With continued Inflation they will walk , Run away. Why do you think Banks are cracking down on Loans now ? It’s simple to figure .

Don’t forget Wolfs Bubble Charts.

That’s why they will have to Raise Rates. Of course this may require Law enforcement like Smash and Grab to stop what developed because of dubious questionable government activity .

Why raise Rates ?

Simply because the economy will Collapse similar perhaps to 2000 to 2008 Raising Rates will provide support deterring Inflation to the toppling dollar. To think of supporting the stock market but lose your home is stupidity