Powered by the inflationary mindset, consumers pay whatever, and dealers aggressively bid up prices, confident that consumers will pay whatever.

By Wolf Richter for WOLF STREET.

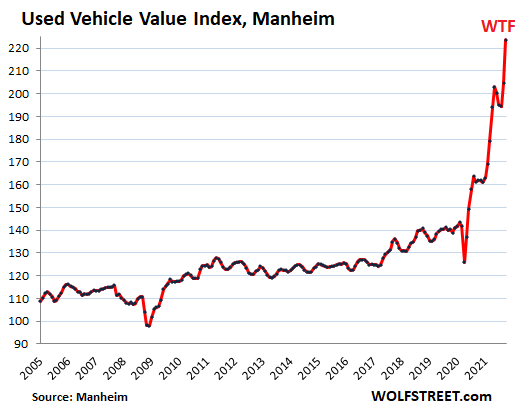

Used vehicle wholesale prices spiked by 9.2% in October from September, the biggest month-to-month spike in the data going back to 1997, after having spiked by 5.3% in September, according to Manheim, the largest auto auction operator in the US.

Year-over-year prices spiked by 38% from the already sky-high levels last October. Compared to October 2019, prices shot up by 59%. A couple of months ago, used vehicles were cited as indication why inflation would be temporary because there had been a slight dip in used vehicle prices, but that has now been tossed out the window.

Wholesale prices, established when vehicles sell at auctions, lead the Consumer Price Index for used vehicles by about two months.

The Used Vehicle Value Index is adjusted for the mix and mileage of vehicles that are sold at auction, and for seasonal factors. So Manheim said:

“October typically sees above average vehicle depreciation and therefore used price declines. This October was the first October in the history of the Manheim Index data, which dates to 1997, to see a non-seasonally adjusted price increase in October. The non-adjusted price increase in October was 5.4%,” Manheim said.

Auto dealers that buy at these auctions are “much more aggressive in buying than is typically the case in the fall,” Manheim said, based on the sales conversion rate that rose to 67% in October, far higher than is typical for that month, and up from a sales conversion rate of 49% in October 2019.

These buyers are much more aggressive because they’re confident that they can pass the higher prices on to consumers because consumers pay whatever, at this point.

At some point, there will be a miscalculation, and dealers will have trouble passing those kinds of price increases on to consumers, but apparently not yet. Consumers are still in the glorious and intoxicating inflationary mindset that price doesn’t matter, and they’re paying whatever.

This eagerness by consumers to pay whatever is astonishing because a vehicle is for most people the ultimate discretionary purchase: Most people can just keep driving the vehicle they already have for a few more months, or a few more years, and they don’t have to buy today. Americans have shown that they can go on buyer’s strike, for example during the Great Recession when vehicle sales collapsed and people just kept driving what they already had.

But the opposite is happening now: people buy no matter what the price. That’s the inflationary mindset.

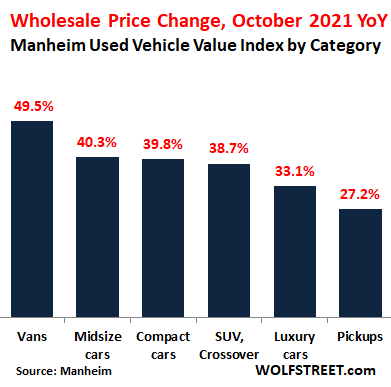

Despite this being October, when used vehicle wholesale prices normally dip, no category saw price declines, and the much-maligned mid-sized sedans – GM, Ford, and FCA have completely gotten out of the business of making sedans – jumped by the most.

On a year-over-year basis, prices of midsize sedans spiked by 40%, behind only vans, which spiked by nearly 50%. Most of the vans are delivery-type vans, and the delivery business is red hot and new equipment is hard to get. Note that pick-up prices surged 27%, down from totally insane spikes of 70%-plus in April in May:

These price spikes are occurring even as retail sales of used vehicles are declining. The seasonally adjusted annual rate (SAAR) of sales in October fell 7% year-over-year to a rate of 19.6 million used vehicles, according to estimates by Cox Automotive, which owns Manheim. Wholesale and retail sales volume combined fell by 10% year-over-year to 35.9 million units.

Supply of used vehicles for retail, which normally is about 44 days of sales, rose to 39 days in October, from 37 days in September, still below normal, but not catastrophically below normal, such as seen with new vehicles.

Wholesales supply, which normally runs around 23 days, remained at 18 days in October, same as in September.

So supply is tight, given the reduced influx from rental fleets, but it’s not a “shortage,” such as there is a shortage in the new vehicle market. Still, consumers are paying whatever, and auto dealers are aggressively bidding up wholesale prices to buy inventory, confident that that consumers will continue to pay whatever.

Spiking used vehicle wholesale prices produce spiking trade-in values, which support spiking new vehicle prices. Automakers and dealers are making enormous record per-vehicle gross profits. Read… Average New-Vehicle Price Spikes 19% in 10 Months, to $44,000. Unit Sales Tick up, But Still Down 34% from March

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

High inflation is ‘transitory but not short-lived,’ says BoC governor Tiff Macklem.

Can’t make this stuff up. Total disdain of the people.

This is clowns world. CNN published report that German hamster is beating top investors such as Warren Buffet.

If Wolf removes the link, just search for it.

Welcome to 2021, where words no longer have meanings.

Language is the first casualty of a revolution..

Stable prices….now means….stable INCREASE in prices…

Orwellian Monetary Theory (OMT)

• Debt is good.

• Lender is slave to the borrower.

• Saving is Punished.

• “Stable” now means increasing (prices) at a stable rate of increase. (2nd Fed mandate)

• Extremely low interest rates are moderate, even though at immoderate record lows. (3rd mandate)

• The future funds the present. (It is no longer incumbent on each generation to pay their debts.)

• Free market economy is arranged by unbridled unelected power. (central bankers)

• Democracy is ruled by these monetary dictators.

• Ignorance is strength.

• Freedom is slavery.

• We can not raise rates because there is too much debt, so we must allow the current condition of zero cost debt creation to continue.

• Tax unrealized gains

• Rates must stay low to solve the employment situation, even though there are record job openings

Dr Havenstein, German Central Banker, 1923 Weimer Germany

“We have to print money faster and in greater quantities because there is a shortage of the money because as it is losing its value faster than it can be printed.”

Just think of the word. Transitory. It simply means not permanent.

It’s not the implication that the Fed is putting on it. They’re baffling the idiots with bullshit. It’s lie that they speak, but don’t believe.

The universe is transitory. Life spans are transitory. Viral contagions are transitory. The earth is transitory.

But hey, the semiconductor shortage is right around the corner!

(they’ve been saying that since 2H 2020)

The same people who said the semiconductor shortage would be in the past by the 3rd quarter are now saying 2023. Whatever the case, this manufacturing model is BROKEN. Little surprise they’re doing nothing to fix it.

“I can’t believe they are letting me run this inflation hot without raising rates.” J Po_ell

You’re right Larry, no one is watching. We ARE untouchable.

Buddy with more money than me just bought new GM Denali Canyon. Sticker 52 K, C$= eighty cents US. He held out for and got 20 K for his Sierra which is very clean and only 100K Kilometers, but is 11 years old and needs tires and he thinks brakes coming up. Can they get 25K for this trade?

Not sure but I think that is half or less of what he paid.

He told me he was thinking about it before buying. I said if it was me I would replace tires and do brakes for maybe 2K C$ and drive it for another 11 years.

No financing ‘juice’ for dealer. Paid cash on diff.

More money than me.

Wouldn’t a used car bubble be a fitting finale, financially?

We’re already there.

Finally, the Fed’s magic is reaching me and my car! Why shouldn’t I be able to get $100,000 or even $200,000 for my used vehicle?

In the right light, the flaking paint gives it an almost impressionistic flair that rivals any Monet or Picasso.

Used brick has always cost more than new brick…..the wealthy are usually patina fans…(see This Old House)….like you said…it’s artsy.

All the PPP loan money is now absolutely pouring into cars, trucks, boats, RVs, snow machines, side by sides, and every other toy imaginable. Helluva job these idiot politicians and central bankers did. Only the wealthy can afford any of this stuff anymore.

I know lots of business owners in this situation that used ppp money for fun and themselves, not for payroll. (Or had enough business to pay payroll and the ppp loan was gravey). Ppp helped some for sure but man, so much waste and excess. I sold my business to a guy that got 200k and laid off all his workers. It’s a crime really.

Yep, friend of mine with a construction company got $440k in ppp loan initially, all forgiven, got a second loan $580k , he thinks it will be forgiven too as he uses for payroll while saving his own payroll. He told me it was an absolute gift as business was never better during the pandemic and the government just picked the tab for the payroll.

He used the money to buy real estate.

Absolute clown world.

Criminal mindset. They oughta cuff him for his nonsense along with the clowns that allowed this wasted play money.

yeah that was the mistake the fools in congress made. the ppp money should never have been available for businesses that did not demonstrate a drop in payroll.

just like stimulus should never have been given to people who didn’t lose income.

period.

basically, there was a $1 trillion hole in economic activity that these clowns filled with $6 trillion. and now they’re surprised that inflation has reared its ugly head?

“Hey man, it’s (cough-cough), transitory man, (heh-heh), like, you know, man, temporary and stuff, man.”

Jerome “Chong” Powell

I don’t want what you’re smokin’, Powell, it’s damaged your brain.

To be fair, he is not the only one saying that. That stance seems to have full faith and backing of this administration too.

Former Fed chair and current treasury secretary Yellen – who raised rates multiple times times during her tenure – is saying the same things.

the same yellen who said that we would never see another recession in her lifetime? the same yellen who only started raising rates once trump was elected? the same yellen who spewed off about “going big” despite all of the evidence that it was going to do just what sensible people predicted, massively overheat the economy?

she’s either a blithering fool or a political hack. take your pick.

Joe has real hair.

More of it now than when he was 40.

Click.

Powell only goes for the hard stuff. You know, the stuff that makes you think you are living in….well, the kinda world we are in now. Maybe we all got a puff of Powell’s hard stuff too. This stuff is beyond ridiculous at this point.

I think the prices for new and used cars will keep going up. The number of new cars available for sale will keep dropping until there are a few flashy rides left for the .1%. We will be back to the days before the model T when the only cars on the rode were expensive toys for the rich.

I’m a Porsche fanatic and watch the new/used US Porsche car market quite closely. After watching used Porsche prices rise astronomically over the preceding four months, I sold my late model 911 Turbo S back to our local Porsche dealer for a HUGE profit after enjoying it for 15 months. I received FAR more in “dealer wholesale” (whatever that is these days…nearly retail from my observation) than I ever could’ve imagined, and they’ll sell the car for well over original MSRP as is the case with almost ALL late model used Porsche sports cars in the current market. Yes…I could’ve sold it for a bit more on a private sale…however there’s a limited market for a car of this value…and I avoided all the usual tire-kickers and joy-riders. I’ll order a new Porsche once there’s more sanity in the market. That may take a few years however I invested my profits so no problem, inflation excepted.

FWIW…one of the Chicago area Porsche dealers recently listed a new 911 Turbo S that they somehow obtained as new stock for $100K over MSRP…and sold it rather quickly. Now *THAT* is the inflationary mindset!

Maybe a Bitcoin millionaire made that purchase. Who would do that unless you got money to burn

I knew a racer that had a 935, held the record at our local

track said it was like driving a ball bearing on a razor blade.

100 K Over! I take it you can’t buy direct and import?

The REAL prestige of owning any kind of high performance car used to be in soap writing on a window from the local track.

Haven’t seen that for almost 50 years.

‘…glorious and intoxicating inflationary mindset…’,

Sounds Wonderful! 🤑

I usually get a lot of new car offers around Veterans Day, from the local dealers. I have noticed all the offers include, in big bold letters, ‘Any and All Trade-ins accepted’.

Our local community has it’s own website and has a classified section with a category for used cars. Over the years, there were always 75 to 100+ private listings and usually pretty good “non dealer” cars. I have sold a couple of older VW’s and a 1998 Lexus to folks in the area from listings i posted.

Looking at the classifieds now only shows 20+ cars and most of them are newer Mercedes, BMW, Audi type higher end units with high prices (Yeah, what’s “high”these days?). Gone are the used Camry’s, Honda’s, Hyundai’s, etc.

Its not over till the fat lady sings.

Hey Mr Wolf,

What is your feeling as to how long the Inflation will build for and possibly how high it could reach in the coming months ? I know it may be a nearly impossible question but I am sure that the Wolf Pack would be interested in your view for the coming 10 months ?

Regards Marco

Back in early spring, I said in an interview, which was posted here, that 4% CPI inflation was “baked in” this year. At the time, it kind of shocked people that inflation would go that high. Other people ridiculed me because inflation would never go that high, it was just temporary, you know, and the base effect and whatever. Now, we’ve been over 5% for the fourth month in a row, and it is clear that I completely underestimated how high inflation would rise.

If I were to venture a guess about inflation next year, it would likely be off as well. There is just nothing and no one slowing this thing down. It just keeps getting fueled.

Thanks Wolf

In short term, North Americans (USA, Canada, Mexico) is suffering from high inflation, however, this is cost of USA long-term strategy renovation, which is to re-establish global supply chain (sea transportation in block) that will speed up rebuilding local supply chain and made-in USA coming back from China.

Used vehicle value ==> creepto,

Starting in 2009 : three waves up. Rotation : vans are #1. Cars : 2nd & 3rd and pickup trucks are last.

I saw a record amount of Teslas today. All I could think of was cash out refi. Does anyone have any statistics on how many more refis were done this year than last.

Perhaps “Vans” have risen the most percentage as people are living in them down by the river?

Seen another Fed presented another magical IQ-250 speech today:

“Inflation so far this year represents, to me, much more than a ‘moderate’ overshoot of our 2 percent longer-run inflation objective, and I would not consider a repeat performance next year a policy success,” said Fed Vice Chair Richard Clarida in a Monday speech.

“As always, there are risks to any outlook, and I and 12 of my colleagues believe that the risks to the outlook for inflation are to the upside,” he added.

These idiots should have immediately quit the QE, and announced rated hikes this month. F**k the stock market.

In dealer’s lots : brand new vans are invisible.

Wolf, you say “people are willing to pay whatever for cars” but you also show the data about how the dealers are focusing on their highest margin vehicles and that units sold is down “The Seasonally Adjusted Annual Rate (SAAR) of sales – which adjusts for the number of selling days per month and for seasonal factors – ticked up to an annual rate of 13.0 million vehicles, down 21% from October 2020, and down 22% from October 2019.”

So is what we are really seeing is that those that are better off continue to pay whatever for vehicles but much fewer people are buying ?

You’re citing my new vehicle figures from the other day. There is no inventory of new vehicles. There is practically nothing to buy off the lot. You have to order what you want or be really quick to buy something when it comes off the carrier.

Talked to one of my dealer friends last week (Ford, Toyota). His unit sales are way down, his inventory on the lot is near zero, his gross profits per unit are huge. It’s really really crazy out there. There is just a massive shortage of new vehicles.

And yes, because everything has gone upscale and above sticker, even more people are locked out from buying new, and they buy used and keep their vehicles longer.

Now you HAVE to be better off to buy a new vehicle.

I drive my car one day a week now to visit my elderly parents.

Everything else is 50cc scooter with all mechanical and electrical technology. I can do all repairs like you could with an old car. Just a few screw drivers and wrenches is all you need. It’s a freeing feeling riding it and knowing you are not going to have big repair bill.

Got to live in the right area where it’s all side streets or back roads to get to where you want to go. For me it’s a fun thing, not a money thing.

It beats a $80k truck, hands down. I’m not sure why people are so afraid of motorcycles, scooters, bikes, etc. They don’t know what they are missing.

Because most people who end up riding get killed or badly injured. Especially for people who didn’t grow up riding motorcycles as kids/young teens. Also, motorcycles aren’t viable in winter outside of Brownsville or Florida and their ridiculously inflated as well.

Roughly 50% of all motorcycle fatalities happen to people with six months or less driving experience. I always tell my friends’ kids who are interested in having a motorbike this statistic, and urge them to buy a small inexpensive bike to ride on and learn on for a while before moving up to faster machines.

On Labor Day, I window shopped for a Ferrari SF90 Stradale at the new Minneapolis Ferrari dealership. Beautiful, fast and just over $500,000, she’ll go from zero to 200kph in 6.5 seconds!

When leaving the dealership, there’s an entry point to get on the highway that let’s you open up the throttle. My $15,000 motorbike goes zero to 200kph in 8.1 seconds, and it took about nine seconds to hit 120mph from a stop before coasting down to a “slow 70mph.” (Aprilia Wheelie Control working its magic)

Probably as much of an adrenaline rush as the Ferrari at a lot less money, eh?

In my area…weather. Scooter is only good 5/12 months, and only for some trips in the good months

If I’d known this was going to happen, I’d have bought a used sports car last year, driven it for a year, then sold it for a profit right now.

Crazy how these used car prices are though.

Man, with passage of the infrastructure bill and Brainard, who I’ve read is more dovish than Powell if that’s possible, potentially be nominated to lead the Fed….f$#!

Uncertain times…

I think wholesale prices are spiking more because the online wholesale auctions are being treated as a casino by dealers who are essentially speculating that vehicle prices will continue to rise.

My dealer friend says that half of his revenue comes from these auctions, and he doesn’t have to ever see the vehicle. he can buy a vehicle that’s somewhere in another state, and sell it again 30 minutes later without the vehicle ever moving.

Anyone who buys a new vehicle is impaired. Always let the “pretty boys” buy the new crap. There is nowhere that a “new” vehicle can drive that my 1979 Corvette, or 1995 Expedition won’t go. As a matter of fact, my 1937 Cord does really well, and before the Fauchi-Covid crap, I made many new friends with it.

When I want to show off, I drive my wife’s new 2002 BMW Touring Sedan.

Sorry…, it is a 2002 BMW Touring Wagon. A nice little car. Too many computers, but still a nice car once fixed.