Nikkei 225 is flat with February, when the BoJ started unloading government securities.

By Wolf Richter for WOLF STREET.

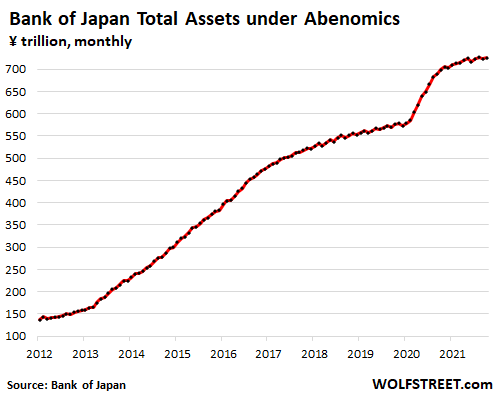

The Bank of Japan’s monstrous QE that had become part of the national economic religion of Abenomics under Prime Minister Shinzo Abe in early 2013 ended without fanfare. Following Abe’s announcement of his retirement in August 2020, Abenomics went out the door, and the BoJ began tapering its massive asset purchases in the fall of 2020.

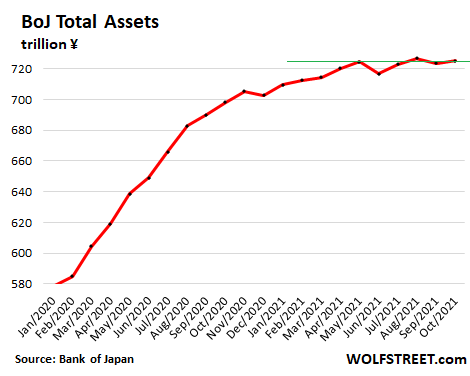

And on its balance sheet as of October 31, released today, total assets, at ¥725 trillion ($6.36 trillion) were down a smidgen from the level at the end of August (¥727 trillion) and have essentially been flat since May except for minor fluctuations:

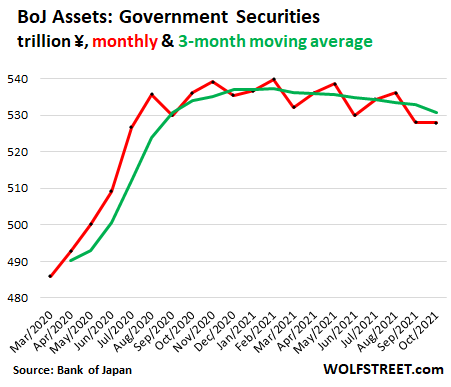

The BoJ has been shedding its holdings of Japanese government securities, starting in February 2021. Since then, its holdings fell by 2.2%, or by ¥11.9 trillion ($104 billion), to ¥528 trillion.

This was initially hard to see due to the fluctuations of these holdings as large long-term bond issues matured in one month and were redeemed by the government, and then in one of the following months were replaced by new securities.

These government securities amount to about 73% of the BoJ’s total assets. At the end of October, they consisted of ¥509 trillion of Japanese Government Bonds (JGBs) and ¥18.7 trillion of short-term Japan Treasury bills. The decline in the BoJ’s securities holdings since February was concentrated on these Treasury bills.

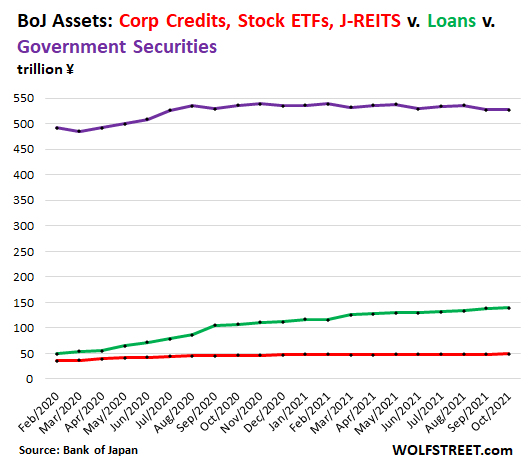

Stock ETFs, Japanese REITs, corporate paper, and corporate bonds were the most drooled-over part of the BoJ’s QE activities. The idea back in 2013 was that a central bank with unlimited buying power would buy lots of equities and drive up the beaten-down stock prices in Japan.

But the BoJ never bought much, and the total of all these categories combined, after all these years, amounts to ¥48.8 trillion, or only 6.7% of total assets. Of this, ¥36 trillion are stock ETFs, amounting to less than 5% of the BoJ’s total assets.

The BoJ stopped adding to them in February 2021, and the combined group has been roughly flat since then (red line in the chart below). The BoJ carries equities at market value, and the Nikkei 225 Index at 29,520 currently, is essentially flat with mid-February.

Loans (green line below), the second largest line item on the BoJ’s balance sheet after government securities (purple line), include the pandemic-era-stimulus “Special Funds-Supplying Operations” and the “Bank’s Loan Support Program” designed to stimulate economic growth via bank lending.

I also included the BoJ’s holdings of Government securities (purple line) for a sense of how small these purchases of equities and corporate credits have been, despite all the hype about them:

The long-term chart shows just monstrous the money-printing was under Abenomics:

In terms of the total amount of assets it purchased, in dollar terms, the Bank of Japan is in third place among the top three QE monsters, behind the ECB and the Fed. But the BoJ started 21 years ago, while the Fed and the ECB started 13 years ago. Now, combined, the three QE monsters hold nearly $25 trillion in assets:

- ECB: $9.69 trillion

- Fed: $8.56 trillion

- BoJ: $6.36 trillion.

For years, central banks got away with this monstrous money printing. It fired up asset price inflation, but it didn’t fire up consumer price inflation. Japan was held up as example. And then the Fed and the ECB jumped into it in 2008, and it didn’t fire up consumer price inflation either. And each step along the way, central banks thought, “so far, so good.”

But $25 trillion of money-printing by three central banks was bound to eventually trigger something, and possibly something Big, just when everyone had fallen asleep about the risks of money printing.

And we might be looking at that event now, on a global scale, with inflation raging in the US and Europe, and, mirabile dictu, even starting to take off in Japan, from -1.1% in April on a near-straight trend up to +0.2% in September.

Even as radical and monstrous stimulus continues globally with repressed interest rates and enormous balance sheets at central banks, there are now a lot of concerns that the inflation dynamics have woken up and will be tough and painful to tame if allowed to run.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Money printer go STOP in sync with the developed markets?

While still and SO much more ”sophisticated” for me as a now certifiably elderly person,,

Wolf and many of the commentariat following ARE really helpful to me trying to figure out how to ”invest” the savings my ”better half” with which recently surprised me with…

Gonna take a TON of clear ”indications” for my now clearly ”better half” to do anything in this crazy crazy situation…

PLEASE keep that in mind while ”mindlessly” buying almost anything these days..

Thank you Wolf and the commentariat hereon…

Yardeni just put a report out on central banks balance sheet. Total is still going up and is at $31 trillion, but growth rate is slowing. As Gunlach says if you write it as an equation stock market is a function of QE.

I would say Fed is going to up the lies as they change policy. You know who has power by who has license to lie without getting in legal trouble.

I am still using barbell strategy to try to soften blows of Fed falling of the wire in either direction.

So how will the unwinding of balance sheets go over the next 2-3 years? For example, the FEDs balance sheet will approach $10T once they’ve stopped buying up any assets. Who’s going to buy this stuff and how does that affect the money supply? Some of the FEDs assets are lower interest rates. Who’s going to buy lower interest rate bonds when newer ones are cheaper and have higher yield? It just doesn’t make sense.

Do you actually think the Fed can stop buying bonds? Tell that to the insatiable Treasury or the 500 lb Wall Street gorilla! It definitely will not happen, because it does not make cents.

“You know who has power by who has license to lie without getting in legal trouble.”

Excellent observation. I started to make an excel spreadsheet for this but I ran out of pixels.

I don’t think that analogy works.

Someone could be lying for the benefit of the real ones in power. Or the ones in power/the public like to pretend certain lies are true or don’t care about those particular lies.

.

More people working, people getting more money and only the nether beast of delirium, inflation, gets mentioned.

We seem fixated on the cost versus the benefits.

There seems to be more psychology than logic to that dynamic.

We can always kill the inflation at any time, but we have to kill the economy too. That would be like shooting your foot to cure a pimple.

Inflation is cancerous.

Oxygen is very cancerous. But going without is worse.

“We can always kill the inflation at any time, but we have to kill the economy too. That would be like shooting your foot to cure a pimple.”

But high inflation will also kill the economy, so there isn’t really much to choose once inflation goes out of control.

Why will high inflation kill the economy?

Is it a certainty or merely a probability that varies with the cause and level?

So the policy is to ride out inflation as long as possible because it so much benefits the .01%. The economy for the rest of us is doomed anyway.

We’re only in the second phase of ‘Strip the Riches of America for Ourselves’ by the Elite.

During the third phase, everything gets physical:

The hungry peasants go to fighting in the streets,

while for some strange reason, the .01% end up owning any and all of the land, property, physical wealth and essentials for life that matters.

Yes, but the good news is that the masses can get still get rich off of crypto, NFTs, SPAVs, junk bonds, overpriced “crap shacks”, and ridiculously overpriced cash burning “unicorns”.

It’s all part of the “new normal” where the perpetual fantasy of something for nothing lasts forever.

Killing the economy, causes massive inflation. How much will that cash or bitcoin be worth if economy craters? Not much.

Only stable, well planned/lucky growth, can slow/reverse inflation. Deflation can be bad to though.

You can get a screwed up economy and inflation with to much monkeying around by central planners and politicians.

I think that a better analogy would be cutting off your pinkie toe to cure gangrene. But much like inflation there is a certain point where you have to make hard choices about curing the gangrene by cutting off part of your lower appendages. The wise person with a knowledge of history and expected consequences chooses to cut off one toe when it is time, knowing that it is the lesser evil. But we are run by a financial and political cabal that will wait until the gangrene is at the bellybutton level before they decide to do surgery.

Let’s think about current Fed policy, real wages down year over year. Real interest on savings massively negative. Speculation on everything rampant. The Fed is a joke of an institution.

Well, pushing on a string time, baby.

Real inflation will only be solved with real interest rates.

And that means money will have to become scarce, and that scarcity will once again mean money will have a functioning price, instead of infinite QE.

What a horror awaits, all of us who have lived through the times of plenty. The transportation horror, the labor shortages, meh.

Food prices will be far more difficult, and the ridiculous house price inflation will end, just as inflation soars.

Almost no where to hide ones piles? After all, everything looks like a ponzi right now.

Canada was last week, now Japan, and now Switzerland is starting to slow the sterilization of the Franc:

“Analysts have said the reduced rate of interventions showed the SNB’s more accepting attitude to the franc’s strength, driven by inflows into Switzerland’s defensively dominated stock market.

During the second quarter, non-residents spent 9.16 billion francs on Swiss equity and debt securities, driving demand and the valuation of the franc.”

So, go long the Franc and hide under the bed.

My guess is that it could soar versus the dollar….bad old days are coming…

Someday this war’s gonna end…

I’d argue the inflation didn’t really kick into gear until the fiscal policy support was put in place to keep people in jobs during the pandemic. The combination of fiscal/monetary is what set the inflationary forces in motion, we probably need some re-calibration of both fiscal and monetary tightening in order to slow it all down.

Undoubtedly they will first try taxing the middle/lower class through energy/food/inflation before actually addressing the real problem of hyperinflated untaxed billionaire assets from money printing.

The Dems were just caught trying to sneak tax breaks for the wealthy (SALT deductions) back into this sham “stimulus” package they’re putting together. Crazy Bernie wasn’t amused.

The DEMS are phonies who are actually beholden to and working for their billionaire globalist masters. The poor people who think they care about them are some of the most unsophisticated, foolish humans on the planet.

The DEMS are liars and hypocrites. It’s like stumbling upon the head of PETA dressed head to toe in leather at an all-you-can-eat rib buffet.

The problem of untaxed billionaire phantom wealth will solve itself when the asset mania collapses, something I might add which central banks and government have been a primary contributing cause.

Of course, this means that the complete fantasy of perpetually taxing fake billionaire wealth to redistribute it to the masses so that they can convert to goods and services in the real economy is never going to happen.

But then, only economic illiterates such as those in Congress ever believed otherwise.

Augustus Frost,

That is true.

The conditions the billionaires create, to make that fake hugely inflated wealth has huge damage to the economy though. Fixing market competition is far more effective in creating tax revenue and keeping spending down.

Tom,

It’s always been there, hiding under the rock…

Every time inflation tried to get going, it was stomped down, usually by a fiscal event…

The times it has really gotten going is usually in response to a physical event… oil embargo, pandemic, etc…

Powell failed to recognize even a smidgen of the chance of this getting out of control…

Kinda like the firemen sitting across the street watching your house burn down and saying it’s not their fault it burnt down because nobody called them to tell them that your house was on fire…

agreed partially. asset inflation occurred right away, and has for over a decade. cpi inflation only really took off until the fiscal spending from the past 20 months. however, i will say that the inflation was not the “fiscal policy support put in place to keep people in jobs,” because if it was only that, there wouldn’t have been massive inflation. it was the massive overstimulation.

In a couple of years, the new 40 year olds will be saying, “ Do you remember the good old days when we were 35 ?”

“Real inflation will only be solved with real interest rates.”

That’s what Volcker did, but as expected it caused a recession. No graceful exit.

This war is not ending anytime soon. for 20 years the physical battlefield requiring USD $T to operate. Before we could close that front up they found COVID was the new battlefield. For now it would appear their efforts have stabilized world financial markets with their money printing schemes. Now just wait for the next narrative title.

Space seems to be the next place to spend with a big blank check. Read that a Chinese satellite had to navigate away from a US spy satellite this week.

Yet Weimar Boy Powell is still printing like there’s no tomorrow.

They started the taper gently. They will increase the taper rate in the coming months.

Pfffft. In the face of raging inflation, they’re pumping $105 BILLION per month in QE. Don’t tell me you fell for their schtick?

You’re welcome! BRRRRRRRRRR!!!!!

why oh why would they stop printing. Nobody has taken away their tools. They are like the last guy at a frat party and it’s six am. Why stop now when you can just start the whole shenanigans again and pay for it on Sunday night. Or not?!?

A.J.D.

” kill the inflation at any time, but we have to kill the economy too. That would be like shooting your foot to cure a pimple.”

If you keep up the Inflation you most likely wount have an economy so you wont have to worry about such things as Pimples and Feet ?

Raise the Intrest rate Now ! End the Inflation ! Change out the Fed Chair stock traders Capitalist’s

No one said the medicine would be pleasant.

Will inflation be allowed to run….yes, until it isn’t. The sad thing is that they don’t really fear inflation enough, as they think they are, oh so smart but even they are noticing that world energy prices are going through the roof. I was reading that, in Spain, electricity prices are up for ordinary people 45% since the start of the year and business owners are talking 100%. I know, here in the UK, that petrol has gone up some 40% since the lockdown low and those without a fixed natural gas and electricty contract (with a firm that has not gone bust) are facing truly massive increases this winter.

To give you an example, my sisters gas/elec contract ends at the end of November and was £130 a month, she has been offered a new fixed deal of £215 a month, that’s a big jump. On top of that the world seems to be short of fertilizer for farming, meaning food prices will rocket as yields drop. The year 2022, looks like it will be an interesting and busy year for Mr Wolf…..very interesting….

So… how is Canada doing? With all this pandemic madness I haven’t been paying attention to it .

Are you going to do a Wolf Street report about all the countries that are ending or have ended money printing?

Canadians are broke and immigrants have stopped coming to Canada due to the high cost of living. The minimum wage in Ontario, Canada was just boosted to $15 an hour Canadian. No one in Canada is spending or did spend during the pandemic except buying homes.

Retail spending is currently down about 3% in value from pre-Covid times, and has leveled off, with no make up of the big 15% drop in Q2 2021 due to the shutdowns. Data from StatsCan and Tradingeconomics. So, given retail inflation running at an estimated real 9% pa, that’s a drop of about 20% in units purchased per month since pre-Covid.

One big problem is rental accommodation, which is seeing inflation of 30% for many. Renovictions are common, which government tries to ignore.

Given a lot of stuff like appliances is either unavailable or at sky-high prices, there may be a lot of pent-up demand, but I doubt it.

Locally I see 2/3 of people asking for payment plans if they are available at no cost (and they generally are), up from around 10%.

raxadian,

Here is Canada:

https://wolfstreet.com/2021/10/27/suddenly-hawkish-bank-of-canada-ends-qe-moves-rate-hikes-forward-1-and-2-year-yields-spike/

We have had more than a decade of “competitive devaluation” of currencies. I wonder at what point we are going to see “competitive REvaluation”. After all, we are all competing for the same scarce resources.

When you think about it, it is really weird to be thrashing your own currency while (import) inflation is rampant and shortages are everywhere.

YuShan, thank you for answering my question even before I was able to ask it – there is a curious relationship between economies and central banks around the world, and they are all somehow incented to competitively devalue their currencies.

The question is: why?

Is there any country in the world with sound money?

Q1) IMO, to “fund” deficit spending.

Q2) Not of which I am aware, but I’m not that informed.

It hasn’t happened consistently yet but eventually, the currencies of the countries which produce the goods and services people actually need will do best.

Why did 20 years of QE not inflate equities in Japan whereas 13 years of QE in the US did ? Strange.

Lol be theory is Japan stock market reset first then Europe and the USA stock market is next. Japan’s market got to PE of 70 and could do no wrong. Our tech sector is similar to that in my option. Like I said Tesla is pricing in they are going to be making about 25 million cars per year. Not going to happen and at some time stock price will match up with reality.

Not sure about P/E calculations in Japan but P/E calculations of major stock indexes in the US is not what it used to be.

Call it a legacy of the Crash of 1987

1.Companies with zero earnings are not included.

2.Negative earnings (yes,there is such a thing !) are disregarded.

Hence the Permanent Soaring & Surging & Skyrocketing Ad Infinitum.

The U.S. bankers and U.S. Fed rigged the stock market to the bull’s tits. So instead of a dead cat bounce or bear market rally in an endless bear market in 2009 it turned into a 100 percent three ring circus sideshow pigshit ponzi fraud from then ’til today.

OS and Real Tony

I hear your opinion(s), but if US equities (on average) are only in the 30 PE range and the Nikkei went to 70, this indicates a lot more room to run for stocks before Japan-style flatness. The 3 ring circus has only shown 1 or 2 rings at this point?

yes, but the pe of 30 is based on the earnings that resulted from massive stimulus. much of that stimulus is gone. these are peak earnings. you can’t tell me that bigtech’s profits increasing by 50-100% over two years is normal, without the stimulus. so what happens when profits return to 2018 levels. then pe is at 70, like you said.

Look at Tesla p/e get your answer

Beardog,.

You might be right, but Price to sales or market cap/GDP seem to be best overall measure and they are at close too 3.5 times long term average.

Plus you have add in corporate debt so financial assets to real economy is off the charts at maybe at 6.5.

Fed policy mistake, but they will never own it.

It’s not just Japan, look at stock markets in the Eurozone and the UK too which also implemented QE. Valuation wise, the US has been an outlier in deep outer space all alone for up to 20 years. Globally, a few more markets have recently “broken out” to new highs but this is after peaking around 1999 or 2007.

The difference and reason?

Psychology. No way the difference in the supposed fundamentals can “justify” or rationalize the performance difference.

The US Stock Market, military weapons, and real estate are the primary USD sinks for our trade deficits. Basically, what the Saudis have been doing for 30 years

Except for China. It uses its USD surplus to build the BRI.

You didn’t see the WS piece about China’s RE bubble? Now 25 % of its GDP. You missed all the news about China’s military buildup?

Look at that BOJ chart since 2012: from 140T to 730T. And what do they have to show for it? Absolutely nothing!

They are a lesson to the US and the USD. Pretty sure none of American politicians (or their people, for that matter) are listening

No PG,,, paid political puppet politicians are made very well aware of ”likely” outcomes by their owner oligarchs.

While WE the PEONS continue to contemplate at least SOME SORT of ”equality” etc., our true owners continue to take the folks who actually work to produce to the ”woodshed.”

They did build that very expensive bridge to nowhere though. Top line infrastructure that.

Hey,

They have a chart….

Got colors, dates and lines… it’s a nice chart…

Big deal. Reexamine this at the next 3 yearly intervals. I am willing to predict by 2024, the net assets on the sheet are at least 10% higher.

The market fears discontinuous movements. Models, like Black-Scholes, if still in use, break down.

As these three money printing monsters unwind their balance sheets, the public markets will have to absorb the dispositions, or buy the bonds that are newly issued to fund the payout of the maturing bonds. With rising inflation, the appetite of the public market to do this may require an increase in rates. What we will have is QE in reverse. The likely result is that it will take a long time to unwind these balance sheets.

Their is a youtube video that shows a seal, hiding on a floating piece of ice, trying to avoid a pod of killer whales that are determined to feast on his fat-laden body.

What amazes me is how people constantly howl about what is happening when, really, it is impossible to avoid what is coming for most.

What? Eat the rich? Economic collapse? 1.5 degree temperature rise in 80 years? Killer whales invading cities? Seals are the new Polar Bears?

Elaborate.

Blow off Tops in Bitcoin, Tesla and now the Russell 2000

The Fed cannot lower interest rates below zero.

Timing is everything. It is time to sell.

BUY SRTY 7.36

When everyone is convinced that the stock market can only go up, get out.

Why can’t they lower rates below zero? Be honest and say that you know what the FED will do next. We could have a new once in generation storm, a new enemy with China that is about to beat us in space (moon landing, their own space station, hypersonic capable nuclear missiles, quantum computing, fusion), a new bubble with cryto crater, drought, debt ceiling decacles, Trumps return…

The rate can and will go below zero. The banks will find a way to make it so. They have to keep the punch bowl filled and laced with the good stuff

I bet you’ve been saying this for years. Someday a crash will happen and you will be right. From then on you can advertise yourself as the person who predicted the last crash. Fiscal Charlatans have it so easy.

Or have you been bullish for the last 15 years and just this week changed your mind?

\\\

This printing has to stop or it will devalue labor and obliterate any meaningful income. That will lead into a cycle of mercantalism with hypermanufacturing and no middle class to purchse products.

\\\

We are on a knifes edge and the natural gas crissis is not helping (exp. next years food pricess will skyrocket since most of the manure is manufactured from natural gas).

\\\

The cycle has started and they have no meaningful tools to contain the situation. The zero interest rate money situation has given the speculative buyers superpowers. We will be consumed by our own monster…

\\\

The money printing ain’t stoppin’ anytime soon, so you best get used to it and prepare accordingly. Weimar Boy Powell just came out and reiterated his intention to “let inflation run hot,” with continued QE for another 8 months at least. Enjoy!

We have absolutely raging inflation, and Weimar Boy Powell just came out and promised another 8 months of QE. He wants to murder the poor.

You have to remember, he doesn’t even put gas in his own car and probably doesn’t even tie his own shoes. He has NO IDEA what is actually going on out here in the hinterlands. To him, inflation is just a number on a piece of paper.

Depth Charge

Correction, he wants to murder everyone except the top 1%, and his banker buddies.

And like magic, the stock market rocketed to another all time high after Weimar Boy Powell promised more QE for the wealthy. “Oh, you can’t afford even a tent on the street, pleb? Too bad, sucka.”

Prediction: The economy for the working poor, and in general, is slowing markedly, while inflation is raging (stagflation) and by the time 8 months rolls around GDP will be negative YOY. Weimar Boy Powell will announce that ending QE is not warranted, nor is raising rates. In fact, increasing QE is what he will be calling for. Welcome to QEternity.

DC-This anticipated announcement just means they have already set up a back-channel for even more liquidity from the Standing Repo Facility, Reverse Repo Facility and FIMA swap lines, which are all just “QE” by other names.

Fed’s tapering but still sees inflation as temporary. J Pow is already wearing Facebook’s new glasses it seems i.e. he’s been living in the metaverse for some time already.

China was the global devourer of inflation that allowed all this money printing; CPC policies to maintain favorable forex rates led to under-consumption by its people. Well, that consumer class is waking up now.

First shot across the bow will be energy, and it will hit Europe hard.

“First shot across the bow will be energy, and it will hit Europe hard.”

Yup, Rowen, you nailed that one…winter coming and all.

I love the Ontario Ford government giving me another raise for teh new year in my minimum wage to $15 an hour. This will happen in 2022. First 35 cents now another 65 cents an hour. This $1 an hour raise me working in 2022, now I am working 55 hours a week and overtime paid after 44 hours a week means $63 a week gross, or $45 a week net to my paycheque. I work very hard in the restaurant for 15 years now coming from Romania. I saved alot of money in these 15 years, $277,000 in RRSP’s, TFSA’s, GIC’s.

I look forward to keep saving my money in GIC’s 2.70% right now with all the extra cash. Finally deposit fixed interest rates are rising. I live a very frugal life living in a senior’s basement 1,100 square feet, look out for her as she has no living relatives and I get to pay cheaper rent, $890 a month+ utilities. It helps pay her bills and I help her with things around the house. I have been very fortunate to be in good health and try to avoid problems of all types. My wife stays home takes care of our now 10 year old son and helps save alot of money and she deserves alot of credit for that too. We are debt free every year we are in Canada.

Good for you sir. It can be done, but most 3rd generation and later Americans had rather complain than live a modest lifestyle like you. Keep it up and enjoy your family as much as time allows.

“even starting to take off in Japan, from -1.1% in April on a near-straight trend up to +0.2% in September.”

Day late and a dollar (YEN) short as the October data is out for the “KU” area of Tokyo and it tells a different story which will probably be reflected in the next monthly report:

“The consumer price index for Ku-area of Tokyo in October 2021 (preliminary) was 99.9 (2020=100), up 0.1% over the year before seasonal adjustment, and down 0.4% from the previous month on a seasonally adjusted basis.”

1) US 20Y > US 30Y.

2) US 10Y might rise for few days, before the plunge.

3) Gold is a thud. It’s either in accumulation, for an insane rise, or

cont of the anti-bubble, crossing backbone #2, — Dec 6 2010 high/ Jan 24 2011 low, 1431/1308, — on the way to backbone #1, — Nov 30 2009 high/ Feb 1 2010 low, 1226/ 1045. — slightly above 2008 high.

4) If so, buying bonds is a good thing.

Per Powell today, its simple, ignore price stability in order to create more minimum wage jobs (wink wink…Plus forcing the SP500 to 5,000 level should benefit the bottom 80%, right???):

“We don’t think it is a good time to raise interest rates because we want to see the labor market heal further,” Powell said. “The level of inflation we have right now is not at all consistent with price stability.”

He’s not just “not doing anything about inflation,” he’s CAUSING IT, and has promised to keep doing it. This guy is a dangerous financial terrorist looking to destroy the country.

Wow, go figure…. 10 yr currently at 1.44%.

This is not the type of QE Richard Werner talks about. When and if the CB’s encourage private banks to start lending to productive parts of the economy this will keep dragging on. They will just have to keep mopping up the bad assets indefinitely.