Everywhere but San Francisco? Only 11 of the 100 largest cities showed any year-over-year rent declines at all.

By Wolf Richter for WOLF STREET.

In 16 of the 100 largest cities, the median asking rent of a one-bedroom apartment spiked by 20% to 25% in October. In 40 of those 100 cities, rents spiked by 15% to 25%. And in 50 of those 100 cities – in half of them! – rents spiked by 10% to 25%.

But there were only 11 cities where rents declined at all by any amount.

In total, across the 100 largest markets, the median asking rent for 1-BR apartments increased by 11% in October compared to October 2020, and by 11.8% compared to March 2020, according to data in Zumper’s National Rent Report.

These are advertised rents (“asking rents”) for apartments listed at various rental listing services, including Multiple Listing Service. They’re not actual rents that tenants have been paying for months or years. They do not include rents for single-family houses; just apartments.

Asking rents show the current pricing of the market, as landlords see it. Actual deals negotiated between landlord and tenant may differ and may include incentives (one-month free, free parking, etc.), and the effective rents of signed leases could be lower. If a landlord gets too ambitious in their asking rents, tenants don’t bite, and landlord have to cut asking rents – which happened massively and with humorous effect in Newark, NJ, as we’ll see in a moment.

Asking rents are a price tag. “Median” means that half of the apartments are listed at higher rents, and half are listed at lower rents, and the range on both sides can be big.

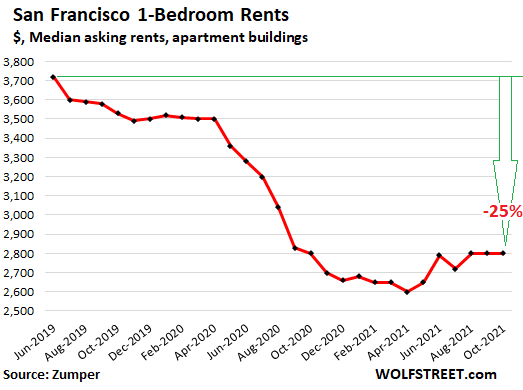

Changes in asking rents reflect the underlying dynamics of the rental market. And these market dynamics differ dramatically from city to city, as we’ll see in a moment. Rents in New York City spiked, but not in San Francisco, were rents lumbered along multi-year lows and are still down 25% from the peak.

Red-hot “asking rents” v. ice-cold CPI rent that’s now warming up.

As bizarre as it seems, the red-hot surge of inflation as measured by the Consumer Price Index this year to 5.4% in September, which matched June, and both were the highest since July and August 2008 (5.6% and 5.4%), with all four being the highest since early 1991 – well, this red-hot 5.4% CPI was held down by the housing components, which account for one-third of total CPI and are exclusively based on rents.

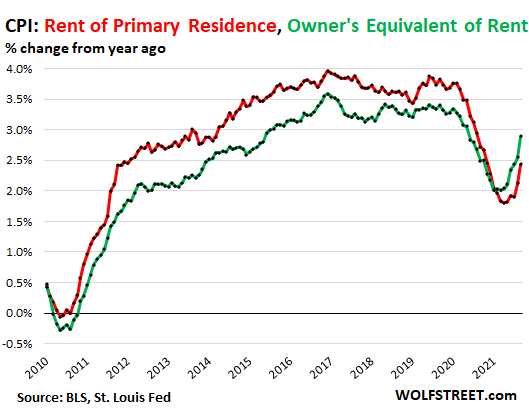

The two CPI housing components are “rent” and “owner’s equivalent of rent.” They’re based on large-scale surveys of tenants and homeowners. These surveys ask tenants about their actual rent, including in rent-controlled apartments, and they ask homeowners what they think their home would rent for.

They’re both based on rents: the first on actual rents paid, and the second on the homeowner’s perception of the rental market. Combined they account for one-third of overall CPI.

Before the pandemic, these measures clustered around 3.5% but plunged during the pandemic to 2% and below.

Over the past few months, the soaring “asking rents” have started to filter into those two CPI rent measures, and in September, CPI rent (red) increased to 2.4% (from 1.8% in the spring) and CPI “owner’s equivalent of rent” (green) rose to 2.9% (from 2.0% in the spring):

“Asking rents” have to translate into actual rents that enough tenants pay – via new leases signed or rent increases – before they start moving the needle of the CPI rent index, and this takes a while, but it has started to happen.

And “owners equivalent of rent,” which is based on the owner’s perception of the rental market, is influenced by information the owner obtains about the rental market, such as this article. And this perception is picking up the surge in the asking rents faster than the “rent” index, as the chart above shows.

Going forward, the surging asking rents we see detailed below will further filter into the CPI rent measures over the next few months and next year, and since they weigh about one-third of total CPI, they will move the needle, just when this “transitory” inflation was supposed to fade. And those surging rents will ridicule the Fed’s “transitory” theme of inflation.

Red hot “asking rents.”

The cities were the median 1-BR asking rent surged the most were less expensive rental markets:

- Irving, TX (+25% to $1,270)

- Mesa, AZ (+25% to $1,220)

- Tampa, FL (+24% to $1,480)

- Knoxville, TN (+24% to $990)

- Glendale, AZ (+23% to $1,190).

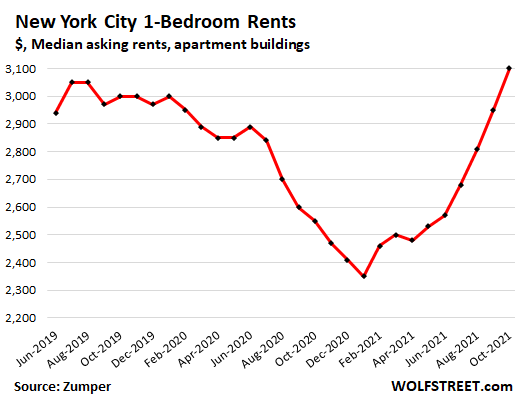

New York City was the only one of the 10 most expensive markets where 1-BR rents spiked by 20% or more year-over-year: by 22% to $3,100 – having shot up by 32% since the low point in January this year:

In Miami, another of the top 10 most expensive markets, 1-BR rents jumped by 18% year-over-year to $2,070.

In San Diego, also in the top 10 most expensive, 1-BR rents jumped by 15% to $2,060.

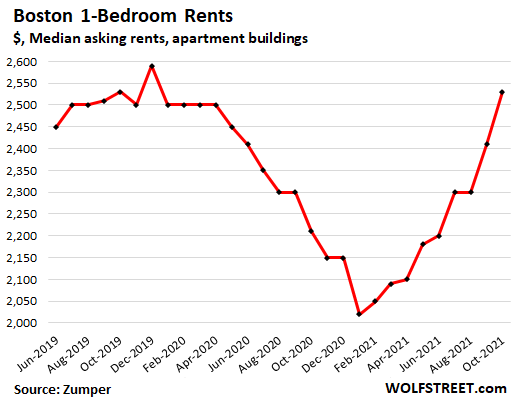

In Boston, 1-BR rents spiked by 5% for the month and by 15% year-over-year to $2,530, having re-gained the sky-high pre-pandemic levels:

These are the 50 cities, of the largest 100 cities, were 1-BR rents surged 10% to 25% year-over-year. These are massive rent increases in half the biggest 100 cities, and they will move the CPI needle!

| The 50 Cities where 1-BR rents jumped 10% – 25% | |||

| 1-BR $ | Y/Y % | ||

| 1 | Irving, TX | $1,270 | 25% |

| 2 | Mesa, AZ | $1,220 | 25% |

| 3 | Tampa, FL | $1,480 | 24% |

| 4 | Knoxville, TN | $990 | 24% |

| 5 | Glendale, AZ | $1,190 | 23% |

| 6 | Orlando, FL | $1,470 | 23% |

| 7 | Detroit, MI | $930 | 22% |

| 8 | Boise, ID | $1,400 | 22% |

| 9 | New York, NY | $3,100 | 22% |

| 10 | St Petersburg, FL | $1,540 | 21% |

| 11 | Colorado Springs, CO | $1,140 | 21% |

| 12 | Plano, TX | $1,440 | 21% |

| 13 | Denver, CO | $1,690 | 21% |

| 14 | Bakersfield, CA | $1,000 | 21% |

| 15 | Anchorage, AK | $1,140 | 20% |

| 16 | Scottsdale, AZ | $1,890 | 20% |

| 17 | Gilbert, AZ | $1,670 | 19% |

| 18 | Miami, FL | $2,070 | 18% |

| 19 | Las Vegas, NV | $1,230 | 18% |

| 20 | Spokane, WA | $1,050 | 18% |

| 21 | Cleveland, OH | $1,380 | 18% |

| 22 | Chandler, AZ | $1,520 | 18% |

| 23 | Henderson, NV | $1,540 | 18% |

| 24 | Atlanta, GA | $1,720 | 17% |

| 25 | Nashville, TN | $1,480 | 17% |

| 26 | San Antonio, TX | $1,040 | 16% |

| 27 | Phoenix, AZ | $1,200 | 15% |

| 28 | Tucson, AZ | $830 | 15% |

| 29 | Reno, NV | $1,210 | 15% |

| 30 | San Diego, CA | $2,060 | 15% |

| 31 | Raleigh, NC | $1,220 | 15% |

| 32 | Anaheim, CA | $1,860 | 15% |

| 33 | Austin, TX | $1,470 | 15% |

| 34 | Charlotte, NC | $1,400 | 15% |

| 35 | Virginia Beach, VA | $1,240 | 15% |

| 36 | Salt Lake City, UT | $1,170 | 15% |

| 37 | Dallas, TX | $1,410 | 15% |

| 38 | Jacksonville, FL | $1,100 | 15% |

| 39 | Boston, MA | $2,530 | 15% |

| 40 | El Paso, TX | $790 | 15% |

| 41 | Washington, DC | $2,240 | 14% |

| 42 | Akron, OH | $650 | 14% |

| 43 | Winston Salem, NC | $860 | 13% |

| 44 | Albuquerque, NM | $840 | 12% |

| 45 | Fresno, CA | $1,220 | 12% |

| 46 | Aurora, CO | $1,230 | 12% |

| 47 | Fort Worth, TX | $1,140 | 11% |

| 48 | Durham, NC | $1,260 | 11% |

| 49 | Pittsburgh, PA | $1,220 | 10% |

| 50 | Lincoln, NE | $910 | 10% |

Other expensive markets.

In terms of CPI, what matters are month-to-month and year-over-year changes in the two rent-based indexes, not the changes compared to pre-pandemic levels. Below are some of the biggest and most expensive rental markets where rents are still below pre-pandemic levels, but are either flat or up year-over-year, and some are up sharply year-over-year.

In San Francisco, the median asking rent for one-bedroom apartments for October remained at $2,800 for the third month in a row, and was flat year-over-year, and still down 25% from June 2019:

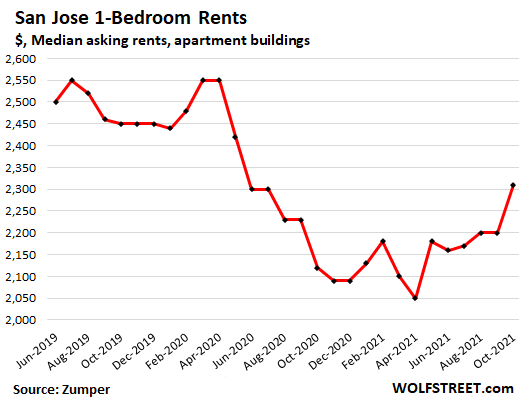

In San Jose, representing Silicon Valley, the median 1-BR rent spiked 5% in October from September, and by 9% year-over-year, to $2,310. But it remained 9% below the peak before the pandemic:

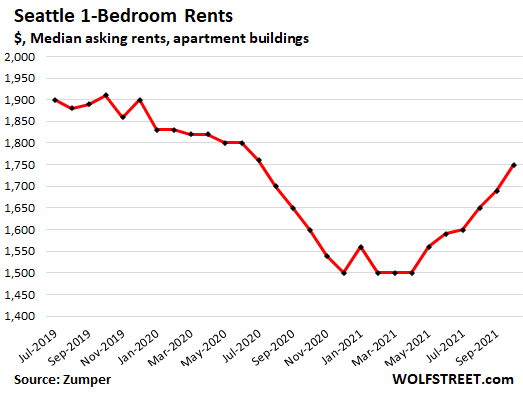

In Seattle, 1-BR asking rents jumped 4% for the month and 9% year-over-year, to $1,750. But they remain 8% below their pre-pandemic levels:

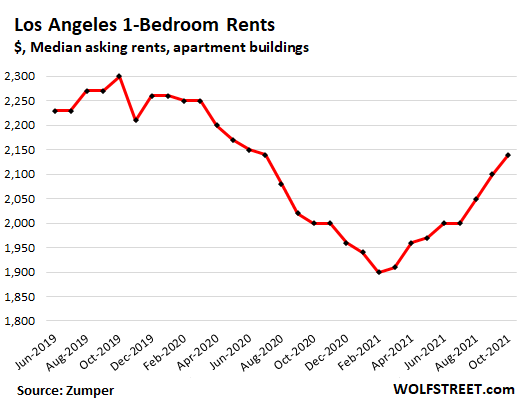

In Los Angeles, 1-BR rents rose 2% for the month and by 7% year-over-year, to $2,140. But they remain 5% lower than before the pandemic:

The 11 cities where rents fell year-over-year.

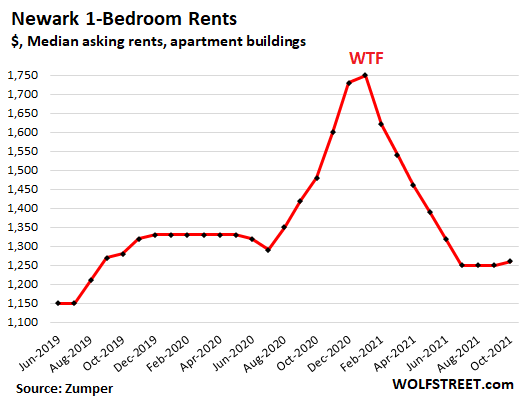

The biggest declines in 1-BR rents occurred in Chesapeake, VA, (-19% to $1,000) and Newark, NJ (-15% to $1,260.

Newark is a case of landlords’ failed aspirations. They were trying to benefit from the exodus of New York City during the pandemic by jacking up their asking rents, thinking New Yorkers would be stupid enough to fall for it. And so they jacked up their rents last year by huge amounts, but New Yorkers didn’t fall for it, and so landlords had to cut their asking rents to get their units filled, and those 1-BR asking rents are now below their pre-pandemic levels:

The table shows the 11 cities where the median 1-BR rent declined year-over-year. This includes the Bay Area city of Oakland (-1%):

| The 11 Cities where 1-BR rents fell by any % | |||

| 1-BR $ | Y/Y % | ||

| 1 | Chesapeake, VA | $1,000 | -19% |

| 2 | Newark, NJ | $1,260 | -15% |

| 3 | Minneapolis, MN | $1,170 | -9% |

| 4 | Philadelphia, PA | $1,360 | -9% |

| 5 | Milwaukee, WI | $950 | -9% |

| 6 | St Louis, MO | $900 | -7% |

| 7 | Providence, RI | $1,530 | -6% |

| 8 | Richmond, VA | $1,140 | -4% |

| 9 | Kansas City, MO | $950 | -4% |

| 10 | Laredo, TX | $750 | -1% |

| 11 | Oakland, CA | $2,000 | -1% |

All of the largest 100 rental markets.

The table below shows the largest 100 rental markets that Zumper tracks, with 1-BR and 2-BR median asking rents in October, and year-over-year percent changes, in order of the price of 1-BR rents (if your smartphone clips the 6-column table on the right, hold your device in landscape position):

| Rents, Top 100 Cities | 1-BR $ | Y/Y | 2-BR $ | Y/Y | |

| 1 | New York, NY | $3,100 | 22% | $3,310 | 14% |

| 2 | San Francisco, CA | $2,800 | 0% | $3,860 | 5% |

| 3 | Boston, MA | $2,530 | 15% | $2,800 | 5% |

| 4 | San Jose, CA | $2,310 | 9% | $2,850 | 6% |

| 5 | Washington, DC | $2,240 | 14% | $2,960 | 10% |

| 6 | Los Angeles, CA | $2,140 | 7% | $2,950 | 6% |

| 7 | Miami, FL | $2,070 | 18% | $2,730 | 18% |

| 8 | San Diego, CA | $2,060 | 15% | $2,730 | 15% |

| 9 | Oakland, CA | $2,000 | -1% | $2,650 | 1% |

| 10 | Scottsdale, AZ | $1,890 | 20% | $2,540 | 24% |

| 11 | Anaheim, CA | $1,860 | 15% | $2,250 | 13% |

| 12 | Fort Lauderdale, FL | $1,830 | 9% | $2,500 | 15% |

| 13 | Santa Ana, CA | $1,780 | 9% | $2,540 | 14% |

| 14 | Seattle, WA | $1,750 | 9% | $2,340 | 11% |

| 15 | Atlanta, GA | $1,720 | 17% | $2,190 | 15% |

| 16 | Denver, CO | $1,690 | 21% | $2,190 | 14% |

| 17 | Gilbert, AZ | $1,670 | 19% | $1,980 | 24% |

| 18 | Long Beach, CA | $1,610 | 3% | $2,150 | 5% |

| 19 | Honolulu, HI | $1,550 | 2% | $2,250 | 4% |

| 20 | St Petersburg, FL | $1,540 | 21% | $2,160 | 26% |

| 21 | Henderson, NV | $1,540 | 18% | $1,690 | 24% |

| 22 | Providence, RI | $1,530 | -6% | $1,770 | 0% |

| 23 | Chandler, AZ | $1,520 | 18% | $1,740 | 15% |

| 24 | Sacramento, CA | $1,500 | 3% | $1,880 | 9% |

| 25 | Chicago, IL | $1,500 | 0% | $1,760 | -2% |

| 26 | Tampa, FL | $1,480 | 24% | $1,750 | 25% |

| 27 | Nashville, TN | $1,480 | 17% | $1,580 | 11% |

| 28 | Portland, OR | $1,480 | 6% | $1,800 | 0% |

| 29 | Orlando, FL | $1,470 | 23% | $1,600 | 15% |

| 30 | Austin, TX | $1,470 | 15% | $1,830 | 15% |

| 31 | New Orleans, LA | $1,470 | 3% | $1,760 | 4% |

| 32 | Plano, TX | $1,440 | 21% | $1,910 | 26% |

| 33 | Dallas, TX | $1,410 | 15% | $1,900 | 15% |

| 34 | Boise, ID | $1,400 | 22% | $1,570 | 23% |

| 35 | Charlotte, NC | $1,400 | 15% | $1,610 | 13% |

| 36 | Cleveland, OH | $1,380 | 18% | $1,480 | 24% |

| 37 | Philadelphia, PA | $1,360 | -9% | $1,730 | -1% |

| 38 | Baltimore, MD | $1,320 | 3% | $1,380 | -14% |

| 39 | Irving, TX | $1,270 | 25% | $1,750 | 20% |

| 40 | Durham, NC | $1,260 | 11% | $1,410 | 14% |

| 41 | Newark, NJ | $1,260 | -15% | $1,550 | -15% |

| 42 | Virginia Beach, VA | $1,240 | 15% | $1,450 | 13% |

| 43 | Las Vegas, NV | $1,230 | 18% | $1,440 | 15% |

| 44 | Aurora, CO | $1,230 | 12% | $1,610 | 12% |

| 45 | Mesa, AZ | $1,220 | 25% | $1,450 | 21% |

| 46 | Raleigh, NC | $1,220 | 15% | $1,410 | 15% |

| 47 | Fresno, CA | $1,220 | 12% | $1,580 | 20% |

| 48 | Pittsburgh, PA | $1,220 | 10% | $1,390 | 7% |

| 49 | Houston, TX | $1,220 | 9% | $1,530 | 12% |

| 50 | Reno, NV | $1,210 | 15% | $1,690 | 21% |

| 51 | Phoenix, AZ | $1,200 | 15% | $1,520 | 19% |

| 52 | Glendale, AZ | $1,190 | 23% | $1,470 | 26% |

| 53 | Madison, WI | $1,190 | 1% | $1,600 | 14% |

| 54 | Salt Lake City, UT | $1,170 | 15% | $1,450 | 12% |

| 55 | Minneapolis, MN | $1,170 | -9% | $1,720 | -6% |

| 56 | Colorado Springs, CO | $1,140 | 21% | $1,410 | 15% |

| 57 | Anchorage, AK | $1,140 | 20% | $1,240 | 3% |

| 58 | Fort Worth, TX | $1,140 | 11% | $1,520 | 16% |

| 59 | Richmond, VA | $1,140 | -4% | $1,380 | -2% |

| 60 | Jacksonville, FL | $1,100 | 15% | $1,330 | 15% |

| 61 | Chattanooga, TN | $1,080 | 6% | $1,220 | 3% |

| 62 | Spokane, WA | $1,050 | 18% | $1,400 | 25% |

| 63 | San Antonio, TX | $1,040 | 16% | $1,300 | 15% |

| 64 | Norfolk, VA | $1,040 | 7% | $1,330 | 23% |

| 65 | Buffalo, NY | $1,030 | 0% | $1,080 | -11% |

| 66 | Bakersfield, CA | $1,000 | 21% | $1,200 | 15% |

| 67 | Rochester, NY | $1,000 | 2% | $1,170 | -2% |

| 68 | Chesapeake, VA | $1,000 | -19% | $1,300 | 1% |

| 69 | Knoxville, TN | $990 | 24% | $1,180 | 24% |

| 70 | Arlington, TX | $970 | 9% | $1,320 | 12% |

| 71 | Cincinnati, OH | $970 | 2% | $1,220 | 9% |

| 72 | Indianapolis, IN | $960 | 4% | $1,020 | 2% |

| 73 | Kansas City, MO | $950 | -4% | $1,110 | -5% |

| 74 | Milwaukee, WI | $950 | -9% | $1,100 | -8% |

| 75 | Detroit, MI | $930 | 22% | $1,050 | 17% |

| 76 | Columbus, OH | $930 | 9% | $1,140 | 1% |

| 77 | Des Moines, IA | $930 | 5% | $980 | 3% |

| 78 | Lincoln, NE | $910 | 10% | $1,010 | 7% |

| 79 | Louisville, KY | $910 | 6% | $1,050 | 9% |

| 80 | Memphis, TN | $900 | 7% | $950 | 7% |

| 81 | St Louis, MO | $900 | -7% | $1,200 | -6% |

| 82 | Augusta, GA | $880 | 9% | $990 | 13% |

| 83 | Corpus Christi, TX | $880 | 7% | $1,150 | 9% |

| 84 | Winston Salem, NC | $860 | 13% | $970 | 14% |

| 85 | Tallahassee, FL | $850 | 8% | $970 | 2% |

| 86 | Baton Rouge, LA | $850 | 6% | $1,000 | 10% |

| 87 | Omaha, NE | $850 | 2% | $1,120 | 7% |

| 88 | Albuquerque, NM | $840 | 12% | $1,070 | 14% |

| 89 | Tucson, AZ | $830 | 15% | $1,080 | 15% |

| 90 | Syracuse, NY | $830 | 4% | $960 | -4% |

| 91 | Greensboro, NC | $810 | 8% | $930 | 8% |

| 92 | Oklahoma City, OK | $800 | 5% | $930 | 2% |

| 93 | El Paso, TX | $790 | 15% | $990 | 18% |

| 94 | Lexington, KY | $770 | 6% | $1,020 | 15% |

| 95 | Laredo, TX | $750 | -1% | $950 | 4% |

| 96 | Tulsa, OK | $740 | 9% | $880 | 6% |

| 97 | Shreveport, LA | $710 | 9% | $800 | 7% |

| 98 | Lubbock, TX | $670 | 3% | $810 | 4% |

| 99 | Akron, OH | $650 | 14% | $760 | 6% |

| 100 | Wichita, KS | $630 | 5% | $800 | 10% |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Karma!

Hopefully lots more on the way.

“And so they jacked up their rents last year by huge amounts, but New Yorkers didn’t fall for it, and so landlords had to cut their asking rents to get their units filled, and those 1-BR asking rents are now below their pre-pandemic levels”

now that we’ve been inundated by commiefornians

our rents in Tucson have exploded – nothing in comparison to their rents

couple years back you could get nice 1 bedroom for $600-700

now $1,000(class A)

but with 100% occupancy for nearly 2 years we now command 20-40% higher rents

having owned rentals for years my ROI is exploding – love it(not like I wasn’t making my 20% before)

I thought the economy was absolutely fantastic. Hard to believe “printing” trillions and borrowing “out the wazoo” doesn’t have any impact on the real world supply of goods and services.

Also hard to believe that the loosest credit conditions in history have financialized the housing market and cratered affordability. That’s a real shocker.

Equally hard to believe that porous borders and lax immigration policy create upward pressure on rents, especially if it includes “free” rent at taxpayer expense.

Who could have imagined that?

The FED is a cabal of sociopathic liars who are beyond reproach. It doesn’t get any more embarrassing than Bernanke’s “subprime is contained.” How did he fair after that completely absurd lie? Very, VERY well. “Inflation is transitory” is Weimar Boy Powell’s “subprime is contained.” How will he fair? Every bit as well. The truth is these guys are lining each others’ pockets at the expense of society. That’s their entire mandate.

DC,

Your first sentence can be stretched to include a great many additional institutions in Washington, DC, all of which are run by folks who are unelected. Cabal is right on!

My take is they want to keep jawboning about tightening so that people don’t ditch US asset markets (treasuries especially) while keeping inflation high to devalue the massive accumulated debts and thus put us back in a tenable position. Once they’ve stolen enough purchasing power/savings, they can normalize policy and lower inflation and everything resets at higher price levels. Their key concern, in my opinion, is to execute the process without having a loss of faith in the dollar or central banking structure.

Or a revolution. Just sayin’.

Yes, we can use some of those peaceful protests of 2020.

But I think we are now a ‘Netflix and Chill’ country and no longer a revolutionary country.

that might very well be their thought process, but if they do that, they can kiss goodbye to the dollar as the reserve currency. who wants to hold a currency as a store of value if we’ve already done that once?

When my brother was in 16 he was speeding on a country road and came to a fork.

Unfortunately he didn’t go take either turn and crashed thru the front door of a barn and came crashing out the back. Car then fell about five feet pan caking the suspension. Beautiful tan 65 be Bel Air.

Fed’s going to have to choose a direction. Is 20 years of stimulus coming to an end?

USD would be difficult to replace with a another currency as a reserve currency. All other good/stable currencies suffering the same fate more or less

The percentage of usd as reserve currency may go down but it wont crash right away, or may be in another few decades. By that time we all would be dead

jon, it doesn’t need to be replaced with another currency. we can just reach a situation where no one wants currency period, from any developed country, and everyone demands hard assets. the cleanest dirty shirt argument doesn’t work when someone decides they can ask for gold or oil instead of a dirty shirt.

I think you’re right.

Lots of debt to devalue. The economy is apparently slowing down. Lots of zombie companies facing bankruptcy. Higher national debt interest payments are unsustainable without politically unpopular revenue increases. The stock and bond markets won’t be happy.

In the other corner, making the case to raise rates…well there is the risk of inflation getting totally out of control.

Either way, it kind of looks like we’re headed for stagflation in a very low interest rate environment.

The creditor class needs a good spanking. Raise their taxes (they don’t pay income taxes for the most part) to open up ‘fiscal space’ for government spending to modernize our legacy infrastructures. Put people to work cleaning up all the crap that’s been dumped into our water, air and soil. Chill out.

There is no remedy against government.

Our founding fathers knew it and did everything to keep it small.

Along the way we lost sight of it and ended up with a Godzilla because human nature always believes it can get something for nothing.

Government workers pay no price for being wrong.

Au contraire, every failure is seen as due to lack of resources, so usually they get more money and promotions. That’s how they expand, they are parasites and will continue to expand until they kill the host.

The best available remedy is to be rural, poor, and well away from the seat of government. You aren’t worth their attention.

Poor by the measure of declared income, of course ;)

This does of course require you and your neighbors to be resourceful, hard-working, and committed to saying nothing at all to government officials.

The rural vote speaks louder than the urban vote. The amount of time candidates spend in rural America pretending to care about rural interests is amazing.

The parasites are the rentier class. Read some Michael Hudson, who happens to have written a book entitled “Killing the Host.”

Very well said!

Wolf,

Any thoughts on how much of these price increases may be due to artificially restricted supply from the eviction moratoriums? It was lifted last month, however I’m curious whether the cases are still slowly making their way through the courts and having an impact on the equation here.

So no “folks of color” live in the booming list of 50 city rent list from above?

Next to come are “influencers”, to “influence” the great swampy mass of rent-level-setters.

Big mammalian protuberances preferred.

Seems that markets oscillations are reaching new extremes of listed rental values, but are there takers at this level?

From U.K. perspective, I am not so sure. As it happens, we recently reviewed rents of some commercial tenants. With lots of noise shouting “increase” and equal amount saying “decrease “, we opted to keep the rents as they were for last 7 years.

Tenants are happy and landlords income is secured for next 7 years. I can go to my favourite Mediterranean haunts and buy some more waterfront land.

Red wine = very good. What’s not to like.

Big mammalian protuberances : credit FZ

Oh, Frank Zappa! Love the guy!

I was guessing Franco Zeffirelli.

With all the empty commercial space in NYC and SF, it’s hard to believe rents are as high as they are, regardless of the direction. If you are wfh and everything is closed or inconvenient, why pay all that rent money. Both of those cities are hard to live in, in the best of times, why pay more now. Doesn’t make any sense to me.

Also on Miami, if the condo repair situation is causing rents to rise due to empty condo buildings causing a housing shortage, I can understand the increase. If this is not the case, these rents cannot be supported by incomes in Miami or in Ft. Lauderdale. Even hedge funds are going to the Tampa area to avoid the high rents in Palm Beach. These Florida numbers seem high to me.

i think in florida it’s much like san diego, where a lot of people from bad climates moved for the year when their jobs told them they weren’t expected to be back till january of 2022 at the earliest. unless the jobs are permanent remote, i don’t see it lasting.

Great article Wolf!

I noticed on all of the charts, rent has not reached 2019 levels yet after plummeting during the pandemic.

I would expect rents to eventually achieve pre-pandemic levels as businesses re-open (plus some inflation).

The eviction moratorium is in the process of being lifted. Have all who were in forebearance paid up or have they been evicted? Do the charts reflect this? Will there be a glut of eviction properties coming?

Finally, as work-from-home became the norm in 2020, people purchased houses outside the cities and worked from home. Are they coming back to the cities? Do they have a second rental in the cities and a primary home now? Are they all thinking about selling the homes they just purchased elsewhere?

I don’t know why the Federal Reserve Board is attacking hard-working citizens. You shouldn’t discriminate against people, simply because they don’t own expensive housing, stocks, and bonds.

It’s a crime. What good are the politicians?

“US Government: Number of Builders Declined 50% Between 2007 and 2012”

Acquisitions and mergers and buyouts and rollups and shopping sprees. Horton and other big homebuilders went on a buying spree with cheaply borrowed money, and that spree lasted years, and they bought all kinds of regional homebuilders. Consolidation and concentration of power, and thereby of pricing power. That has been US corporate motto for decades.

Antitrust regulators have been asleep.

Any data on lease term?

I’m thinking drop short term to get by, then let em have it when the dust settles…

Oh, Wolfe, you are the one who taught me about the Fed. After they get done making hedonic adjustments for …I don’t know.. double pane windows, laminate floors, high efficiency heat pumps, etc. they will probably show the cost of renting actually went down. I mean, look how much cheaper the Fed says cars are today than 20 years ago.

I really wish Powell was asked questions by ordinary people instead of politicians. I would love to grill him on his qualifications. After all, he is a damnable lawyer, not even an economist.

There are so many ways these guys just lie.

That Powell is NOT an economist is one of the few things he got going for himself :-]

Ever since Trump trampled on him, he has just been trying to hang on to his job by printing money. That’s an institutional-political reaction.

Trump broke him.

Which is why I would never, EVER, vote for Trump again. Once he became just another Keynesian money printing whore, I was done with him. It was a sickening 180 from his campaign schtick. Remember him attacking Yellen and her “big, fat, ugly bubble?” Then the guy decided to blow the biggest bubble in history.

He got a lot of credit from me during his 2016 campaign for attacking the “fake” interest rates. Boy, it didn’t take long for that criticism of low interest rates to go out the window :-]

And people keep commenting that the problem is that he’s unelected. The elected guy was worse AND there was not a peep from his party, the ‘once- upon- a- time’ deficit hawks.

But they are peeping about tax hikes and corporate minimum tax!

Re: Back then: Does anyone remember Reagan taking OMB Director David Stockman ‘behind the woodshed’ for saying: ‘pretending tax cuts will pay for themselves is voodoo economics.’

And they didn’t. After running on smaller govt and less spending, the total US debt accumulated since 1776, one trillion, doubled in 4 years.

Incredibly, Laffer still surfaces now and then still peddling the Laughter Curve. Kind of the plate spinner of economics.

He gets no credit or mention for creating an environment where Fed could actually think of reversing its near decade long ZIRP and QE.

Of course the Fed did the double punch of raising rates and reducing its balance sheet.

Neither the admin before his nor the one after his anywhere near capable of handling that.

(I was being sarcastic with that “broke him” reference).

Thanks for the clarification of the “broke” reference. That had gone over my head :-]

People have money. Spending on ads hasn’t cratered yet. Best virus ever!!!

Every utube video has 3 or more ads. When they poll me on them, I never remember any of them. Skip, skip, skip.

Brave browser very purposefully blocks Youtube ads, and at least with YT, doesn’t replace them with their own.

You can always install an Ad Blocker plugin on your browser of choice. Afterwards you can always white list some sites. That way you can support the sites you like and get a free ride on the rest.

@MB,

I was talking about all platforms including mobile.

Try it with iOS, and you will see the difference.

Why do we blame the fed? It is congress that spends more than they tax. The fed is just their production operation.

I’d love to know the reason. Is it because the proprietor here prefers on particular political party, making it inconvenient to blame the politicians?

because the fed enables it. if congress had to actually raise taxes or borrow money on the open market, they might be more discerning when spending trillions like it’s $5.

Mark,

Congress has abdicated it’s power of the purse to the fed. The fed didn’t take it or ask for it, congress handed it over. Just like they handed over our industrial base to China, Mexico, and Canada.

In the original creation of the Fed, not all of Congress, but enough, were either bought off or duped by an ongoing oligarch power-play:

The bank “Panic of 1907” was engineered as the final push in the Morgan and Rockefeller financial group cartel manipulations that enabled passage of the 1913 Federal Reserve Act. “To seal the deal, Morgan sent two of his lieutenants, Henry Clay Frick and Elbert Gary of US Steel, to meet President Theodore Roosevelt in order to secure Roosevelt’s agreement to suspend US anti-trust law. The public story was that this was done to ‘save the country.’

Subsequently: “In 1908, the most powerful bankers in America met in highest secrecy to draw up plans for the greatest financial and political coup d’état in the history of the United States. The plan was to rob from the US Congress its constitutionally mandated powers to create and control money … in order to serve private special interests …”

Morgan and Rockefeller’s oligarch cartel “had discovered over centuries, going back to the Venetian Empire, that lending to governments or monarchs was far more profitable than lending to private borrowers, not least because the subject loan was backed by the power of the state to tax its citizens to guarantee debt repayment. To gain entry to the halls of power, money was an extremely effective door-opener. Credit—or cutting off of credit—could be used to control entire nations or regions.

Engdahl’s “Gods of Money” chapter 2 describes in detail the manipulations of the cartel that led to creation of the Fed.

Canada doesn’t have an industrial base. Brotherly country with the USA in this.

Canada was handed a big chunk of the car manufacturing that eventually destroyed Detroit. So while you don’t think Canada has an industrial base, it has a car manufacturing industry courtesy of America.

P.S.

You may not think of mining as industrial, but I can assure you it is, so is logging.

Number 1 exporter of steel to US.

Pet: true, Can has had a good run with Detroit transplants that begun under Auto pact but took off with gov health care playing huge role. When Chrysler went BK in early eighties, we found out their largest expense after wages was health care. One bit of luck for Can: in all the chaos, no one really cared about a weird project Chrysler had cooking: a van. It’s hard to remember but these were not normal. There were sedans and if you wanted to pack stuff, station wagons. At that time the only van was the underpowered VW breadbox.

So the Chryco van went to Canada, which built very Dodge van in NA with the plant running 3 shifts for about a decade.

But fast forward, I think you have to look to Japan, SK, and Germany to explain the downturn in all NA autos ex. Mexico.

“owners equivalent of rent,” which is based on the owner’s perception of the rental market,”

And I ask, if this is a survey, who compiles the information…who issues the results……who really knows what the results of the survey are?

Case Schiller has hard data, yet it doesnt seem good enough (or doesnt have the opportunity to manipulate) for the Fed

This only makes sense. Landlords, many of who have not been paid for the past two years, not only have to make up that lost money but also pay the increased property taxes the runaway market has put on their properties due to tax assessments taking into account the current rise in property values.

When your taxes rise 18%+ year over year, as mine have near Seattle, that’s a cost that has to be passed on.

Unfortunately renters don’t just magically make more income to afford such increases. So, landlords are fooked.

Landlords can ask for the moon, but getting it is another story. People are broke out here. We left Florida over a $115 rent increase because we couldn’t afford it, and enough was enough, said goodbye.

Wolf, how much use are the asking rents without knowing how many contracts were actually signed in the period?

You mention that NJ asking rents were bumped up, “but New Yorkers didn’t fall for it”. Is that based on an analysis of numbers of contracts signed, or supposition based on asking rents then dropping rapidly, or something else?

I’m asking because I suspect there are a lot of prices in many areas of the economy which are highly affected by actual supply and demand, and the number of actual sales done at these prices is not what previous steady-state economics assumes. For example, contractors around here hate saying no to inquiries, so when they haven’t any spare capacity (and they haven’t had for a year), they just quote a ridiculous price and the inquirer says no. Or, sometimes these days, says yes ;)

Truckman,

Asking rents are crucial. They’re posted prices like price tags at the grocery store or on Amazon. People may buy at those prices or they may not buy. Sometimes they get a discount off those posted prices, such as a loyalty discount, or some points for future purchases, etc.

Posted prices – “asking prices” – show the current market. What happened in NJ is that people didn’t buy at the posted prices. That was a unique situation that can occur when dramatic changes take place. This is called “price discovery.” It’s a very important market function.

Greystar, which is based in my hometown, needs to be heavily regulated. Because they manage so many apartments, they have access to so much data to manipulate prices.

The reason I love Wolf is I trust him and his data. In a world of liars, Wolf appears to be an honest, good man. Even though I stamp my foot when he deletes good posts of mine, not allowing me to insult the irredeemable financial terrorists who are selling us down the river, I still come back for his honesty and insight.

That was a click bait title par excellence.

If you ignore the cities where rents have been going up, I would say rents have been declining overall.

Add to that 16c people saved on their barbecues in July and things are looking pretty good this thanksgiving. And if you can’t find a turkey, eat mor chikin

Eastern Bunny,

Learn how to read!!!

Third paragraph:

“In total, across the 100 largest markets, the median asking rent for 1-BR apartments increased by 11% in October compared to October 2020, and by 11.8% compared to March 2020…”

When are we going to hear about rental bidding wars? I’ve witnessed property manager sales agents sitting in the living room of an attractive rental property and taking multiple rental contracts from prospective tenants. They essentially auction it off to the highest bidder. This may be illegal but they are doing it anyway. Most of these people doing this are crooks.

Eastern Bunny,

So to paraphrase you “if you ignore the prices that have been going up, prices have been going down”.

Makes sense.

That was sarcasm.

I believe it’s what a WH spokesperson said about inflation, if you take out items going up in price, inflation is very low.

Eastern Bunny,

My apologies. Your sarcasm totally passed over my head. Which makes your sarcasm even funnier, now with hindsight.

🤣🤣🤣

I will tell you what I see in the rental market. Landlords are shellshocked from eviction moratoriums and are selling their rental homes into a strong real estate market. I agree. I was the biggest promoter of rental homes in the right zip codes … no more. Don’t do it.

So, the cut in the rental home supply has caused a very tight market with rapidly rising rents.

i’m going to love to see the big boys realize that being a landlord isn’t as easy as collecting rents every month.

If I was renting from Blackstone, I really wouldn’t panic over the small carpet fire in front of the woodstove I illegally installed, or the grease that I was pouring straight down the sink drain. Gettin’ mah money’s wert, nom sayin’?

The people the mega landlords hire to do repairs cause more damage than they fix. I initially thought it was just incompetence from cheap labor. But I found out they do it on purpose to get more work. The landlord gets screwed, but so does the tenant who has to live with even more problems than they had before the repairs.

In Nothern VA near where I live I saw landlords ignore the eviction moritorium during the beginning of the pandemic. They posted eviction notices anyway and got away with it. There was no enforcement of the eviction moritorium.

This data is a bit fishy. The highest rent decline in the US was in Chesapeake, VA. Yet, rent in the city abutting it (Virginia Beach, VA) it supposedly went up by 15%. Both of these are suburban communities… you can’t really tell where one ends and the other begins.

The Fed will change the “equivalent rent” BS before it jacks up their inflation prints. jerome could throw in a chunk of homeless tent dwellers data in the sampling. Bada Bing Bada Boom no more problem. The electorate thinks the Fed is the FBI. They ain’t going to catch on and proabaly don’t give a shit anyway. They are waiting on more free money before the mid-terms so they will know how to vote.

“Ridiculing the Feds transitory inflation”?

Do you think they care what anyone thinks?

The Fed has been hijacked, IMO

There is no regard for mandates

There is no concern over punishing savers

They serve a different master

I think they serve Satan. I’m not kidding.

As the office vacancy rate continues to increase in many cities , those people who formerly worked in the now vacant buildings will no longer work in those cities . Many of these people will find there is no longer a need to live in the cities and will move out.

My question

If there are fewer jobs in cities , where is the demand for apartment rents coming from?

Honestly it looks normal. Prices fell during covid now just catching up. Also noticed no Seattle or Portland for the big % gainers just mostly rinky dink cities.

Red,

“Rinky dink cities?”

Honestly, give it another read. Here are just a few of them — year-over-year:

New York +22%

Boston, MA +15%

San Jose, CA +9%

Washington, DC +14%

Los Angeles, CA +7%

Miami, FL +18%

San Diego, CA +15%

Anaheim, CA +15%

Fort Lauderdale, FL +9%

Seattle, WA +9%

Atlanta, GA +17%

Denver, CO +21%

Tampa, FL +24%

Nashville, TN +17%

Portland, OR +6%

Orlando, FL +23%

Austin, TX +15%

Plano, TX +21%

Dallas, TX +15%

Boise, ID +22%

Charlotte, NC +15%

Cleveland, OH +18%

Well you listed originally 50 cities.Your reply showed 22 cities. I’m in Portland Oregon so I guess I consider anything smaller than Portland which is just a b-class city as rinky-dink of your 22 cities maybe 10 are bigger cities then Portland so yeah in comparison to Portland to me they are rinky-dink cities.

I recognize my statement could seem harsh. But I look at this as normal growing pains for a 2nd world country.

The problem is: when prices jump 50% this year and are then flat after that, “Inflation” as they define it is “transitory”, “temporary”, whatever. But you have lost that purchasing power forever.

It is sickening how they are f-ing people over and being so dishonest about it all. These people have no morals. The first requirement for anyone in a position of power should be good morals.

Kinda weird that there would be such a disparity between Virginia Beach, VA (+15%, 1 BR), and Chesapeake, VA (-19%, 1 BR). They’re both pretty much in the same market.

And so many wonder why we have so many homeless in America!

First sell out the working class then bleed them to death with unpayable rents.

Perfect scenario for future revolts!

I once had three SFR, single family residents rentals. With the governments ability to have somebody in your rental not pay and you not being able to evict them I personally feel rental rates should be considerably higher to reflect this risk. I see no good reason for a independent renter to not sell their rental in this market.