Sales edge up, after sagging for months, amid Crazy Spiking Prices.

By Wolf Richter for WOLF STREET.

Inventories of existing single-family houses, condos, and co-ops rose for the fourth month in a row. Sellers are coming out of the woodwork, and new listings have been rising for months, this being a perfect time to sell a home. Sales ticked up a tiny bit from the prior month, after months of sharp declines that worked off the entire Pandemic spike. And prices spiked to high heaven. That’s the housing market in June, according to data from the National Association of Realtors today.

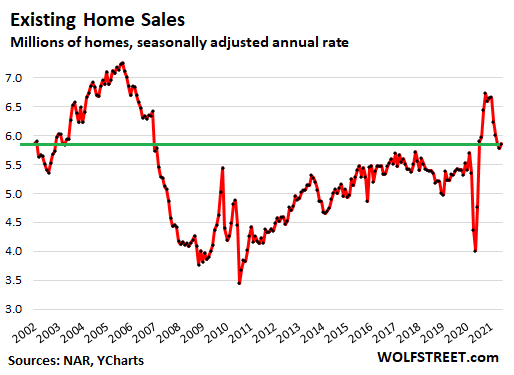

Sales of existing homes of all types ticked up 1.4% in June from May, after the prior steep declines, to a seasonally adjusted annual rate of 5.86 million homes, below July 2020, the month when the pandemic spike in home sales began, having now mostly unwound the spike that started last summer (historic data via YCharts):

Sellers are now gradually coming out of the woodwork. There may have never been a more perfect time to sell a home: Prices have spiked amid clickbait stories in the media of crazy bidding wars where FOMO-driven buyers bid up no-matter-what, sight-unseen, inspections waived, and sellers can get away with anything. For buyers, this is a perfect time to make a terrible deal. But who cares. For sellers, it’s ideal. And sellers are starting to see it that way.

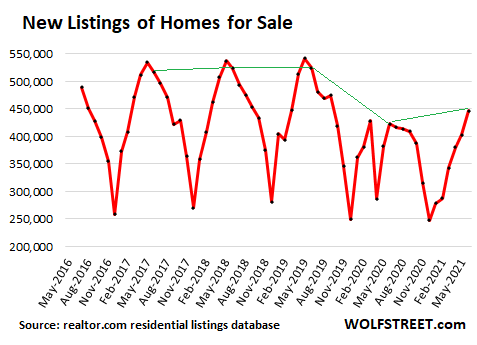

New listings rose by 11% in June, from May, when they normally, in the pre-pandemic years, declined from May, May being the seasonal peak of the year for new listings. But not this year: 446,600 new homes were listed for sale in June, up 11% from May, and the most since September 2019, according to the realtor.com residential listings database (the Junes are connected by a green line):

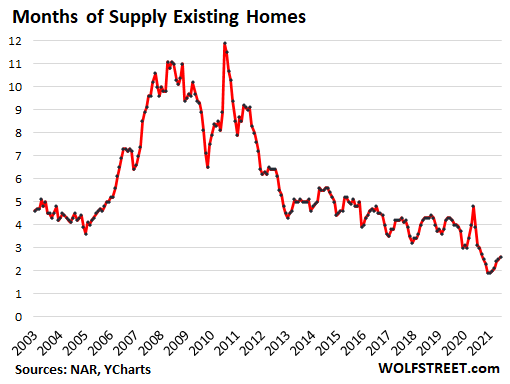

Total inventory of unsold homes on the market rose 3.3% in June from May to 1.25 million homes, the fourth month in a row of increases. Inventories are still very low, but are at the highest level since last November.

Supply of unsold homes on the market rose to 2.6 months, the fifth month in a row of increases, and the highest supply since last September (data via YCharts):

For people who bought a home, the meme during the pandemic has been to not put the now vacant prior home on the market, but instead ride up the steamy price spikes all the way before selling it. That math has worked out so far.

But surveys of homeowners, including a survey of homeowners by the NAR, show that are much larger than typical portion of homeowners plan to sell their home over the next 12 months, with over half of them planning to list their home this fall. And we’re now seeing the first glimpses of the reversal of the meme.

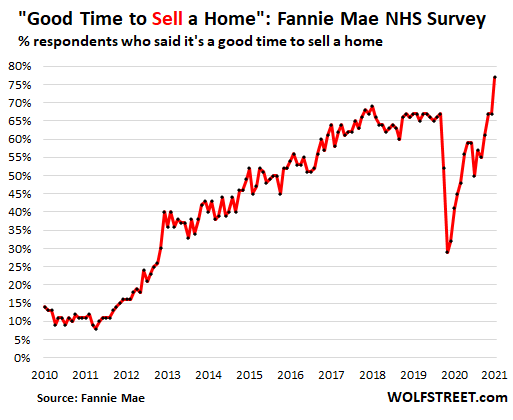

In Fannie Mae’s latest monthly National Housing Survey, the percentage of people who said that it was a “bad time to buy a home” spiked for the third month in a row to a blistering record 64%, with respondents citing home prices as the predominant reason. This survey was created during the housing bust, and the data only goes back to 2010.

And a record 77% of respondents said that it was a “good time to sell a home”:

Investors and cash buyers were big, but mortgage applications dropped to 2019 levels. In June, 23% of the sales were all-cash, same as in May, and up from a share of 16% in June 2020. This includes institutional investors that can borrow at the institutional level, instead of via mortgages for each home, and it includes individual investors and second home buyers that have the cash, or can borrow against their portfolio, and get a mortgage later.

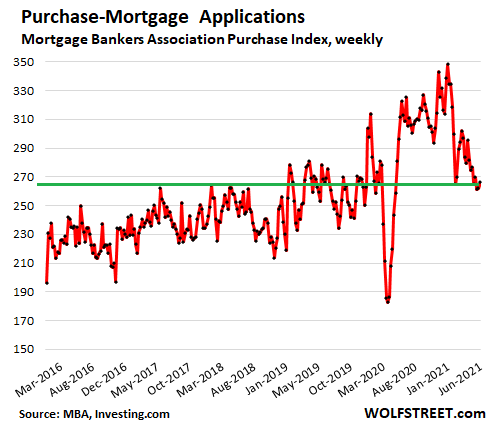

With cash-buyers out there in large numbers, mortgage applications to purchase a home have more than unwound the pandemic spike. The Mortgage Bankers Association’s weekly index of purchase mortgages in recent weeks has been mostly below the same period in 2019 (data via Investing.com):

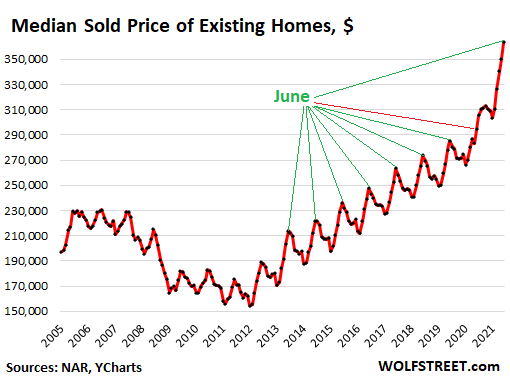

Crazy Spiking Prices continued. The median price for existing homes spiked by 23.4% in June, compared to June last year. The previously typical seasonal fluctuations have been completely abolished since March 2020, an indication of just how upended the housing market has become.

The seasonal price peaks through 2019 occurred in June, and prices began to drop seasonally in July. A price drop in July this year would indicated a reversion to seasonality, which would be a first step back from the craziness (data via YCharts):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“Men go insane in herds and come to their senses one at a time”. Seems like reality will set in soon.

BUT…

Do you sell your largest hard asset in a rip roaring inflation?

and with the Fed lending money 2% below the inflation rate for 30 yrs?

So you sell your house, you rent or downsize….you put the money where?

In the bank and lose 5% a year? Or in the richest stock market in history?

we sold vacay home last fall to cheap

we’re gonna buy lot and build

now we’re on hold and may not do it at all

no big deal

have newer truck and big 5th wheel

so travel is in our future – suffering in mountains this summer

finding lots of RETIREES living in trailers full time

guess they got memo that pensions/ssi aren’t gonna make retirement easy living

no wonder over 50% retirees live under poverty level

and just read article were grocer ceo said he expects 10-14% increase in food prices across board by october

guess my 10% increase in rent isn’t enough

transitory….repeat….transitory.

Only “real” if J Powell, the emperor decides it is so….

Exactly…

Remember, it’s not matter of investing in one thing or another. You put 20-30% in stocks, the rest in cash, gold, and ST bonds. If stocks rise, you’ll beat inflation. If they fall, you are golden.

Anybody who puts 100% into one asset or another is looking for problems, and I would call that speculating, not investing. Speculators shouldn’t cry when things don’t pan out.

B

“Anybody who puts 100% into one asset or another is looking for problems”

Ditto countries!

Not a good idea to day trade houses.

There is nowhere to run and nowhere to hide. Wasn’t it true that after the stock market crash in 1929 every investment went south? It consumed everyone.

We could very well see…

a sinking stock market

and inflation that is greater than the interest rates the Fed will allow..

Any Fed raisings….a few 1/4 pts will do little to curb inflation, but will be enough to take the “shine” off of equities.

Nice job Fed! What a box you put yourselves and us in…

Exactly. If you sell now and wait two years you will have lost 10% to inflation, God knows how many thousands in rent and no tax write off. And there’s no guarantee prices will be lower in two years. Even if they lost 10% with the rent you’ve been paying youd still come out a loser.

There is less tax write off for home mortgages these days unless you itemize. Its not the big benefit it used to be.

Same question I have been struggling with. I’m not planning to sell but was thinking of refi and taking out cash while I can but what do you do with the windfall.

I have three kids about to start college. The first one is a year out. I was thinking that would be a very inexpensive way of financing their education. It would cover any gaps left from our 529.

Exactly my dilemma. But I already sold the house, now sitting on the trash cash!

And as they start to regain their senses, the central banks and western governments will all collude to raise prices *again*.

Using immigration together with a coordinated PR campaign to associate anyone who critiques pressure on housing stock with being racist.

Using all the press to constantly describe rentiers as “investors” and land price inflation as “growth”.

go for it folks.

from the NAR survey, it appears “…a noticeable share of sellers … would list sooner if more homes would come to market in their affordable range.”

once the peak is reached, this wish will quickly come true :)

thus speeding up the process

It’s buyers gridlock in all it’s glory and the only solution is falling prices.

But then there desire to sell will also leave once they can not sell at these crazy prices. Unless you have to move or you have a desire to change housing size, why would you sell now? I guess you could sell now and rent and hope things get better? What if doesn’t? Also depending on your state if buy a new house your property taxes reset and you end up with a bigger tax bill.

I am not sure where all these magical houses are going to come from that going to drive prices down, unless there really is huge shadow inventory out there (which there probably is in some markets). Prices are probably going to level off/go down depending on the market, probably sooner rather than later but anyone waiting for huge correction is going to be waiting along time. They are better off trying to get a raise, or moving where housing is affordable which despite what the media would have you believe is most places in america, just not in places people want to live.

Also has anyone priced out a new construction lately? Nothing afordable about that(assuming there a people to build them).

“why would you sell now?”

Because if you sell tomorrow, you’ll get even less.

Many can’t afford the payments, so they badly NEED to sell.

More than 20% of sales in urban areas in Canada are by “investors”.

If prices start to dip they will all evaporate.

“I am not sure where all these magical houses are going to come from that going to drive prices down”

The end of forbearance, maybe. I wish they would stop extending it just so I can get these ants out of my pants and see what happens.

“Because if you sell tomorrow, you’ll get even less.”

I tend to think so. But nobody knows that for sure. Timing any market is a losing strategy. If somebody has a reason to move other than financial gain then it sure seems a fantastic time to sell.

No one ever rings a bell at the top. It just happens quietly.

The bell is quiet but the knife falls with a roar! I’ll never forget seeing a billboard in Riverside advertising new homes starting at $190K.

Every time, in California, people get this idea that prices will never drop. Every time. Then they drop in the most dramatic way.

“It’s different this time.” Most people believe that at this point. Sometimes even I think it. But it’s never different. Stuff blows up and in California it is horrendously cyclical.

Drop Capital gains and you’ll see the biggest flood of inventory in history…

If there’s a loophole in selling rentals without capital gains, I haven’t found it…

I’ll just sit patiently with my cash ready to pounce again..

Jason:

when did you pounce last time? How did you decide about timing?

Around 2010..

Picked up several 3 bedrooms for 55-60 K

Kick back while workers toil my friend, you deserve it, my “investor” friend.

Landlords are the distributed shake-down team for the central bankers.

Without you guys, this couldn’t happen.

Honestly? ….It’s 50/50 luck vs simple math..

When your mortgage is around 80% of rent value, I went for it and busted my tail trying to pick up as many as possible….

Some will argue the 80% but that my comfort zone..

Live in your rental for 2 years.

You still have to pay cap gain if you went outside of the 2 out of last 5 year boundary.

Let’s say you bought a place in 2016 and rented it, had it on rent through 2020, then moved back in. Then sold it in 2022 after 2 years. The capital gains on the place is going to be ratioed to the number of years you lived there over the total number you owned the place.

But if you moved back in during 2019; before the three year period is up, and live there for two years, your clock resets so to speak.

I don’t think you’re correct. And it’s not that you pay no capital gains necessarily. You get an exemption. But if you have huge gains, the exemption will not take away all of the capital gains tax. Can you provide some sort of source?

Did an account to tell you this?

@RoseN

The 2 out of 5 rule is pretty well known, at least it’s readily applicable in CA. The idea is if you live 2 years in the residence out of the last 5 years, you can continue to claim it as a primary residence. So, the primary residence rule apply when you finally sell you property. But go one day beyond that in terms of closing; now all of a sudden, you’re selling a rental property, and that $250K/$500K exemption no longer exists.

However, even if you’re selling primary residence you still have to pay any gains above 250K/500K. That’s universal.

What if it’s a multi unit and you live in one of them?

Is it capital gains proportional to the size, or square footage you live in as percentage of total, as well as the time spent there?

Don’t know how duplexes and such work out.

There are various areas that’s not so obvious as in what if you rented part of your home as an AirBnB. I have no idea how that would work.

> the country is falling apart

…

>> let me tell you about how you can avoid contributing to the cost of maintaining schools

This is why you’re all going to go under.

g-achingly accurate observation.

may we all find a better day.

Is capital gains tax an issue on any more than 1% of owner-occupied houses sold?

It depends on where you live and how long you lived there.

Mostly the answer is no. But in places like the SF bay area, yeah, it could matter if your gain is over $500K, but only a little bit depending on actual appreciation.

It’s a huge issue on the West Coast, where MANY people are sitting on $1M to $2M home price gains. My neighborhood is full of them. Even with the $250k/$500k gain exemption, they still would wind up paying hundreds of thousands in tax if they sell, so they don’t sell.

The retired couple across my street has about $1.3M appreciation in the home. After the $500k gain exemption, they’d still have $800k gain taxed at 20% or $160k tax.

If Biden increases the capital gains tax, maybe they’d decide to eat the $160k and sell before a larger tax takes effect.

To really stick it to homeowners and to ensure a larger cut of the tax revenue near term. Biden needs to get rid of step up basis as well. Or at least threaten it in a meaningful way along with increased capital gain.

That will motivate the senior population in places like CA to sell. Ironically, it will benefit the CA state government as a whole since property values will reset to new levels.

Anyone who made a killing like you describe can fork over some taxes. Although I think this 500K exemption should have been adjusted for inflation.

Bobber:

good point. I can also see that where I am.

But how about property taxes in this case if not to sell?

So you’re whining about some rich people who can sell their home and make $1,300,000.00 and have to pay $160K, which leaves them $1,140,00.000? Cry me a river……

Thanks for me making laugh out loud!! I needed that today.

Poor little snowflakes!! boohoohoo…I only have $1.14M from the same of my home instead of $1.3M!!!! Waahhhhhhhhh

All the people starving and homeless in this country and around the world should pull out their violins.

For a change I agree with Node Centre.

Why should cap gains be exempt?

Why should cap gains be taxed at a lower rate compared to labor?

Why should mortgage interest be tax deductible?

Why should landlords be able to claim deprecation on properties whose market values are increasing?

@NDR and NL

Hilarious, you guys are kinda saying that the tax cut which got rid of the SALT deductions are fair in a way. I can think of a few residents along the coasts who might disagree.

I think the original idea behind the tax exemption on the $500k gain on sale of primary residence was intended to act as kind of a nest egg for ordinary people. Not that such gains are expected. But thanks to the long term devaluation of the dollar, such gains have become more likely in certain parts of the country.

“intended to act as kind of a nest egg for ordinary people”.

It’s not the intentions that count, but the actions, incentives and results.

Anytime someone thinks it’s good idea for the government to meddle with the market to ‘help the little guy’, it backfires.

In case of housing, cap gain tax exemption, mortgage interest deduction etc were to help people with modest means to own a house. See the result now – those policies have fueled the house price increases.

Am I happy with SALT limit? Hell yeah, reduce it to zero.

I am not saying that to sock the rich, but to keep the government from distorting markets.

@NL

And the funny thing is, on the loss of SALT deductions, the people who are most unhappy with those are the ones who scream the loudest for progressive tax brackets so that the rich “pay their fair share.” Go figure.

The argument is our states makes us pay too much taxes, and we have to claw it back through Federal in the form of deductions. So there is a price to pay for that sort of stuff.

BTW, since I live in CA, I voted for my economic interest, that means the elected member of the J team need to get off his old wh*** ass and get the SALT deduction reinstated. Come on, Boomer, get a move on…

Yeah, I know my benefit on this is very marginal, but I’ll take anything I can get. Sorry, I am not worried about how much taxes you or anyone else pays, that’s your problem. :)

See, I’m honest and transparent. No need to virtue signal here.

It’s so funny. Here’s a little thing for “home owners” to think about:

does the govt normally give you money?

No? Why this time?

If you could translate your house gains into gold they wouldn’t give you the piece of paper telling you that you are rich … on paper.

Alku, the property taxes don’t have as much impact as people think. Assuming RE values in a tax area rise at the same rate, the increase in property values will not increase your tax if the government budget stays the same.

The whole property tax process is simply a mechanism to allocate property tax between residents. It does not impact the amount of property tax in total. The government budget is what dictates the total property tax.

For example, in my city, property values have risen 200% in eight years. My property bill has gone up only 50%.

@Bobber

Curious, are you in CA? Wondering if that’s the effect of prop 13 that you are seeing.

One loophole is to live in the rental as your primary residence for at least two years and you get 250k single or 500k couple cap gain exclusion. Only one I know of.

I look at what comes on Zillow in a few select areas each morning. This is a good way to gauge how much new inventory is coming on the market. It is slowly ticking up from the last year and a half lows. But the daily listings are still less than half of what they were before the pandemic. I do have the feeling that the floodgates are about to open. As is normal in any market the average joe waits too late and has to catch a falling knife on the way down.

I have noticed in my area more pending and sold homes that I have seen listed. I have been told that many homes are sold off-market. Brokers can sell without staging or showing, as buyers are waiting in line.

What is to say this will not continue for a number of years?

gravity?

That last graph of median house prices is ridiculous. I am sure if you align that against median household income you are seeing the great decoupling of what working people are paid vs. housing.

https://fred.stlouisfed.org/series/MEHOINUSA672N

The median house price:income ratio was ~ 4.2 in 2019. It must be close to 6 now.

Yes, in the Twin Cities the median price is now $350k. This is up 15% from a year ago.

But to Wolf’s point, June listings are up 11% and sales dropped 2.5% from a year ago.

2000 prices are the only real reference point. Anything post 2006 is all financialisation.

” There may have never been a more perfect time to sell a home: Prices have spiked amid clickbait stories in the media of crazy bidding wars where FOMO-driven buyers bid up no-matter-what, sight-unseen, inspections waived, and sellers can get away with anything. For buyers, this is a perfect time to make a terrible deal. ” -How right you are, Wolf!

I happen to have a job I actually have to shop up for (meaning I can’t work from anywhere) and have been in the market looking to buy my first home for what seems like forever, but even in the high tax state I’m in, even teardowns which are even listed as such have skyrocketed higher by anywhere from 100K-150k over what they were in just 2019. Another success story for the Fed and its policies and for the government and the flood of indiscriminate and often unnecessary stimulus which is having the complete opposite of the alleged desired effect which was to help the lower classes and address massive inequality. Every turd on the block is attracting multiple offers, selling prices way over asking prices (which are already off in the stratosphere), and what I would describe as a feeding frenzy mentality. I for one have been completely priced out of the market and no longer have any prospects of owning my own home and suspect I’ll be robbed of all my savings in short order due to continued government stupidity and criminality and the ever increasing tax of inflation. So I wait and pray for an asteroid to hit the earth and put a quick end to this mess.

Don’t lose hope. I have a rental in SE Wisconsin I’ve been trying to sell since around 2005 (for around 120K). I’m told the valuations are going up, as are my taxes, which are ridiculous for the area I’m in (our mayor is a proud Socialist, bless his heart). Two doors down, a young guy *just* bought a 2 bedroom, 1 bath, 934sq ft. house for $50K. Not in terrible shape, maybe he’ll spend 12-14K “fixing it up” if he really cares. There are many 2-3 bedroom houses in my neighborhood going for 70-96K right now. Check out Kenosha and Racine counties if you truly desire affordable home ownership.

Simple math my friend….you’re asking too much for your crap shack.

Nah. It’s priced accordingly. Same as all of the other similar-spec’ed houses in the area. But thanks for your internet clairvoyance. :-P I resent you calling it a crap shack. It is a great house.

Is it possible that some of these first time home buyers are simply cashing out their 401K to buy their houses. Instead of getting a mortgage to cover it – they instead use the house payment to put back into the 401K at matching? They may anticipate a large crash and feel owning their home is a safer bet?

A couple of the big realty sites are offering to provide financing based on the value of your current home, so you can make an all-cash offer on your next home. I’m assuming they dont give 100% of value, but enough that people with some extra cash can make an all-cash offer.

This market is just showing how stupid Americans have become. Just because you can find a way to throw all your money into a home doesnt make it a good idea, at these prices.

What happens if mortgage rates move much higher? What if you lose your job? And what about saving for retirement?

Magic Money Tree will take care of all that. Everyone knows that.

> And what about saving for retirement?

I just turned 40. Anecdotally, nobody I know in my peer group is thinking that retirement is an actual possibility for them, with the exception of the folks that really cashed in on bitcoin and other crypto (they’re retiring in a couple of years).

Gabby Cat,

You can’t “cash out” your 401k before retirement age without huge taxes and penalties. You can borrow against it with some limitations, and that would work for a down-payment maybe. But you can use the funds in your regular portfolio, if any, to buy a house. And you can borrow against your regular portfolio and use the proceeds to buy a house.

I think I read somewhere that one of the Covid relief bills waived the penalty for early withdrawals from retirement accounts.

Confused,

That was limited to $100,000 and you have to pay income taxes on it.

You can cash out of a 401k when you leave that employer. Need to be aware of any matching/vesting issues.

Shiloh1,

If you leave your employer: To avoid penalties and taxes, you have to roll your 401k money over into an IRA.

Wolf is right, huge penalties for early 401k cash outs.

If you do the rollover to to a self directed IRA or 401k you can buy real estate with those funds. However you the real estate can’t for personal use, needs to be an investment property.

The covid relief bill waived the 10% penalties for early withdrawal up to 100 grand for last year (not sure about this year) and it’s taxes in your current year (it all counts as income). so are taxes going to be higher now or later???? and if you didn’t make much money this year, then it’s a no brainer

and if you can not have a mortgage and just taxes and insurance, well that’s certainly better than just going to the casino (which is all the stock market is at this point). plus it takes THOUSANDS of dollars out of the cost of buying a house. No points, no fees, no appraisal, no BS, little paperwork, etc.

It’s not like anyone is ever going to see any of that 401k/ira money it’s clearly going to get nationalized. for our own good you know.

What is 100k going to get you? Not much. Far better to leave it in the 401k for another decade or so.

Sadly, I know folks who did just that…. cashed out with taxes, penalties and all to make the downpayment.

This is to say nothing of the many more who borrowed against the 401 for that purpose.

But not so for a Roth IRA full of stocks that have quadrupled in price. Roths are funded with aftertax dollars an there’s no tax on the wthdrawals. Sweet, for thos who’ve been made multimillionaires by the Fed.

Thanks, Wolf. I am looking into a pledged asset line of credit from Schwabby to use as bridge financing between the sale of my existing home and the purchase of the next home.

401k contributions must come out of a paycheck. I don’t think you can simply apply some cash to it from anywhere. I’m not sure what you mean by using the house payment to put back into the 401k at matching. Someone please correct me if I’m wrong.

Jason, only homes with gains >$250/500k would benefit from a 0% cap gain. I don’t know what % of homes are that deep in the money, but with a $350k median, a whole lot aren’t.

1031 gets you out of that cap gains on a rental….so long as you don’t mind buying back in at the high. It’s still an opportunity to sell if your market is crazy and then re-buy in a market that isn’t as crazy (e.g., better value, higher yield, and/or less likely to tank).

Why do I so strongly suspect that in a lot of 1031 deals just enough money changes hands under the table to make the tax liability go away?

Anyone in the industry have anything to say about this?

What a shitshow. You buy when the house is cheap. There will be a clamity to come. Insane sheep behavior. Speaking of which, will be having lamdchops for dinner.

Indeed. Amateur housing speculators dreaming of huge unearned capital gains (“I deserve these gains because I’m so smart”) will all be heading for the exits on the same day.

Jamie Dimon’s pals will be waiting with sharp knives…

Watch out for Private Equity Cos ( Blackstone, Blackrock, Blain,KKR++ picking them slowly, later just like after GFC!

Blackrock is an asset manager, meaning it creates bond mutual funds, ETFs, stock funds, and other funds that people can invest in. It’s not a PE firm. Blackstone is a PE firm.

Blackrock, Blackstone, not easy to track all of them. Waiting for Blackignis, Blackmountain, Blackhill and so forth. ?

WOLF STREET is going to start a PE firm called Black Pebble that will buy dog houses and homeless tents and securitize the rents in to tent-backed securities, and invest in cryptos, particularly the Wolfcoin :-]

how do I sign up? sounds like a winner

Well I’ve been trying to earn enough to chase the mkt up for 15 years.

In our really quiet and secluded 55+ community of about 400 20-year old brick and Hardiplank built homes, recent sales of ~2,000 square foot one level homes have been brisk. Three were listed in June/July at $330 K to $350 K and were sold in one day of listing on the MLS.

These 2 K Sq. Ft. homes were bought in the $220,000 – $250,000 range within the last 5 years. Quite a jump in prices.

The winner here will be the county tax office when the homes are re-appraised next year. We are 40 miles north of Houston, Texas in The Woodlands.

Specific info like this is helpful…please keep it coming.

What is hardiplank?

Is College Station much further from Houston than the Woodlands?

The Woodlands is 32 miles from downtown Houston. College Station is 97 miles from downtown Houston. Hardiplank is a type of fiber cement siding, a building material used to cover the exterior of a building in both commercial and domestic applications. Fiber cement is a composite material made of cement reinforced with cellulose fibers.

Good info! What’s the fire rating on Hardiplank?

On a very marginally related note, does anyone know of a “house plan” site (there are a ton) that offer some free plans with accompanying “take off lists” (lists of all materials necessary to build house).

Given that houses that cost $150k in 2000 might soon be priced at $400k, I would like to see the component cost details.

I think it is a safe assumption that 20 years of ZIRP have been an obscene windfall for homebuilders, whose revenues have far, far, far outpaced their costs.

Dawn-it’s acually spelled ‘Hardie’ after the mfr., James Hardie. Fire ratings are on their website. (We replaced the original cedar-shake siding on our modest rural NorCal home with HP to local fire code some years ago. As others have stated here, with PROPER install, the siding has been durable-and much more fire resistant than shake…).

may we all find a better day.

Hardiplank is a brand name for cement fiber siding. Very common in the Houston area for its rot-resistance.

On our subdivision homes, the Hardiplank is used for siding on two ends of the house (1/2 brick lower on each end) and soffits, fascia boards and roof trim (chimney). So the houses are probably 75 % brick and 25% Hardi.

This is pretty typical construction for south Texas homes in the last 20 years or so. Wood rot is common here due to the high humidity most of the year.

Popular here in the PNW as well. Have it on my home and it truly is like cement…it must last forever.

Anthony A,

My first Olympic trials took place in early August 1988 near you at the Alkek velodrome in Katy.

Every morning it was 80 F with 100% humidity. In the afternoons it was 100 F & 80% humid. At dusk it was 90F & 90%.

Being a math and science guy, I quickly learned that no matter what time of the day it was, the two would always add up to 180. (five years at University pays off, you know)

Dan, good observation here about temperature and humidity.

This place is a virtual swamp most of the year. Now in the winter, it does get pretty nice, except earlier this year when we went into a deep freeze for a few days. Then, once in a while, we will get 53″ of rain in a few days (9/2017).

This is the craziest place I have lived in all my 70+ years, weather wise.

Hardiplank is great if….. you maintain it (seams / joints / flashing must be caulked) and it was installed properly to begin with (flashing behind joints and field cuts painted at installation). You DO NOT want water to get behind it, especially if the house wrap doesn’t have a weep channel. If it gets trapped, it will rot your house from the inside out.

The difference between new listings and months supply shows that homes are still selling quite quickly. The market is still a sellers market. We need to move another 3-4 months through this time period, let more homes come to market and burn through those grown-up adolescents who cant control their impulse to buy a home in the midst of this.

This market is just going to be weird until rates finally move back up to 4% or above and the demand at existing price points gets sucked dry.

It is really the low interest rates that have fueled this bubble in nearly every market. Canada, New Zealand, Australia, China, Hong Kong, it is all just an enormous bubble, blown with public money.

gametv,

Only one problem with your assessment… how many years will it be until interest rates come anywhere close to 4%? The government can’t finance these massive debts at higher interest rates. So the Fed bails them out by inflating them away. It’s a free lunch for corporate buyers and anyone who bought even just a few years ago. For buyers, it’s Dante’s Inferno.

That is to say, for current buyers it’s Dante’s Inferno.

They are full of sin?

Reggie- Maybe…

but there is a change coming in the next couple months. The Treasury accumulated 1.8 trillion and then started to use that to finance the deficit in the past 4 months. As that balance has been spent down to 500 billion, they are now needing to finance about $300 billion more per month than in the past 4 months. In terms of supply and demand in the bond markets, this is like cutting QE by $300 billion per month.

This comes at the same time that foreign banks are ending their QE programs. The BOJ used to be a huge buyer of US Treasuries and they have stopped that cold. I’m not even sure if they are buying more Treasuries when the old bonds expire.

I think with inflation running hot, it would be very difficult for the Fed to step in and actually increase their purchases of bonds.

If you notice, rates were popping higher fast until the Treasury cut their bond issuance by spending the balance in the general account.

This is simple supply and demand. The Treasury just sold some 20 year bonds and the demand for it was rather lukewarm. It resulted in a one-day pop.

If interest rates start rising in the countries that still have negative rate bonds, we will see alot more upside pressure on yields in this country.

One important thing I dont quite understand about the bond market is whether the Treasury can continue to finance the deficit with short duration bonds and as a result, keep long term rates down by limiting the supply. This might be their next move. I think this is called yield curve control. But it has huge risks because those short term bonds must be refinanced often and the risk is that upside pressure on interest rates will then lead to rapidly increasing interest payments if the debt is all financed with short term bonds. By issuing long term bonds now, we are able to lock in those interest payments for a very long time.

The idea of floating very long term 50 year bonds was floated a while back and makes alot of sense with interest rates this low. The problem is that prudent measures have literally gone out the window now. Our government is run by fiscal infants who cant see beyond the present moment in time.

If inflation is not transitory, this Fed is screwed. Of course, that also means we are ALL screwed.

g

This week UK reported a leap in debt interest payments due to increased inflation (2 > 3+) effect on index linked Govt bonds. The old honesty bonds actually starting to show what they were meant to do.

US does TIPS, they can’t fudge that one, it’s got them by the curlies.

Reggie, one problem with your assessment is that purposely fueling inflation in order to reduce the debt burden will cause more people on the margins to fall below the poverty line…a lot more. So what the federal government saves in a low interest rate/high inflation economy, they’ll more than make up for with having to fund safety net programs for all those they screwed with the high inflation. In other words, there’s no free lunch. When you’ve run up nearly $30 trillion in debt, you’re screwed either way.

Who says they have to fund them? They’ve been getting away with eviscerating previous safety net programs for decades.

Rental vacancies have been rising in America as far as 2021 Q1 data reports.

My county population has been growing 2% per year. They are clearing lots and pouring foundations. Tourism is big business. Many homes are second homes used during the winter. Hospitals are some of the largest employers in the region.

There are vacant lots and builders taking orders to build homes on landowners’ lots.

They have an upland planned community under construction north of the Caloosahatchee River with 19,500 homes planned. It used to be part of the Babcock Ranch. This area was ground zero for the foreclosure crisis 10 years ago. Speculation bankrupted banks owning non-recourse mortgages. The construction boom paid workers’ paychecks. When the foreclosures became too many, carpenters were collecting unemployment. Housing values fell. People moved around looking for work.

Sold my house last week in Loudoun County VA, traditionally one of the hottest markets in the country.

Numbers:

Purchased in 3/1/19 for 575k (4 bedrooms, 3 baths, 3000 sqft)

Listed on 7/10/21 for 685k

Contract by noon that day for 725k. No home inspection, no financing contingency.

I’m happy of course, but this is nuts.

Where are you moving to?

Is there some way to sell a home I don’t own, like short selling? I could hedge my exposure by renting. There must be some owners would gladly take the deal, the short must buy the house back to cover his position. I guess maybe that is the essence of a RevMo. I understand the fees on those are often high.

‘Is there some way to sell a home I don’t own, like short selling?’

You mean the other side of ‘Flipping houses’!?

A Revmo is like shorting against the box. You only owe the amount you borrowed, so that’s a plus (plus fees). You lock in the value at point of sale, it will never be worth less. Been thinking about Revmo but what if housing prices double again in five years, and inflation? The stock market is a TIP bond, at the real rate of inflation not the rate for their stingy COLAs. All you get in stocks is the privilege of staying even, (on the asset side, and while asset inflation is 10x consumer inflation conspicuous consumption is the only option). Once money in aggregate is deployed from assets to consumption it virtually disappears, transferred to individuals who live hand to mouth. A house is a consumer product under those circumstances and after the laws on land ownership are abrogated you have nothing really. It makes sense to cash out. Someone needs to rewrite Fahrenheit 451 with money instead of books.

Folks in FL been doing that for eva ab;

However, at least most of them end up in jail sooner or later LOL.

Doesn’t seem to stop them,,, just slows them down a bit having to do their biz with smuggled phones, etc., etc.

My father, in his younger days, while finishing up his mandatory 2 year military service in Poland in the 60s (they were doing demolition in Warsaw), did exactly this successfully! Person came up off the street and asked why they were demo’ing a perfectly good home “only slightly damaged in the war”. He replied with, “we got an order to perform, so we do it. I’ll give you a great deal if you got cash though.”. Sure enough, two months goes by, and everybody else’s man is back from mandatory duty, except for my mother’s. He ended up doing about 8 months in military prison for that stunt, but it sounds like it was worth it as he took his company of young men out on a night of binge drinking that nobody ever forgot, financed with the gullible person’s cash. Good luck!

Just as I predicted, FOMO still well and alive. Price still going up and sales ticked up, people will still continue to buy…what buyer strike?

MSM already came out full force in their narrative saying sales up and market is back..guess us bubble watchers just have to enjoy this lunacy indefinitely.

I’ve learned to cheer it higher. I root for bubbles to go to the most reckless, delusional levels possible. The bigger the bubble, the bigger the pop. People can’t afford these prices. Wages didn’t go up. So fall they will.

I would appreciate Mr. Wolf Richter’s analysis of the key U.S. economic factors that appear to me as shadows of 1929 once again reappearing in different perspectives but much the same in the past, such as a speculative stock market, speculative housing investments, huge U.S. government deficits that are close to a flash point, whereby our interest payments on this debt will be close to 30% of GNP, the endless dollars into education with no payoff ( as an example )enough students tackling computer science, majoring in the fields of electrical, mechanical, quantum, and construction engineering. The U.S. spends in defense what 11 other countries spend, and what do we receive as great military products, but F-22’s that have oxygen problems, and F-35 with electronic problems; I am not sure the U.S.A.F. has enough technical expertise to maintain these highly evolved combat weapons. Both Congress and the Senate are so politicized over every issue, that important issues are simply not resolved to make America strong against adversaries. Critical issues such as cyberdefense are clearly lacking, leaving America open to a SCADA attack without firing one shot. The best makers of complex algorithms reside in the GRU or Sandworm ,which is Russian. Then we must contend with China that has built a vast network of cyber trained children identified by eight as math whiz kids, and were sent to cyber security schools. When Mr. Taleb wrote his ” Black Swan “, I read the book three times, and have come to grasp his chaos theory identifiers; two being greed mixed with inequality, tulip speculation, and a growing monopoly appetite that serves only ten major companies; that is what appears to be on the horizon today. And having studied the natural order of complexity theory, my additional thoughts lead me to believe that America appears to be, hopelessly lost with regard to ideals and the meaning of as stated in the Federalist Papers. Are we becoming a

” former great empire ” with dire consequences coming our way. I would truly appreciate your thoughts on this matter, on a macro basis. And if you are right about hyperinflation, or general inflation becoming the norm in America, much like Mr. Summers has been trying to communicate to P. Biden, then we are in deep trouble. You have also brought up the issue of the dollar losing it’s reserve status due to massive financial deficits and that is beginning to concern Mr. Powell in his private thoughts. I would appreciate your short take on my bothering issues, as maybe I am looking at the data incorrectly, or simply did not get enough sleep lately. A fresh view on these issues are always advisable and your daily comments are fresh views; I also like Ambrose Bierce as he often gets it right. Thank you.

Emil, that’s a lot to ask for clarity on, most of which is never clear anyway.

What does most of what you have requested answers or comments on have to do with this U.S. housing frenzy?

My question global in nature does not dwell on one singular function, such as housing. I am asking Wolf for his global viewpoint on several issues which I am sure he is familiar; for instance, the Chinese have brazenly denied an attack on our Microsoft Exchange servers,yet their fingerprints are on the attack. That is mighty brazen of the Chinese, and knowing their culture it is in effect a step toward Pacific domination. Would you really care about homes, making money, and hoping the market continues to go up despite the assault on our financial markets stops everything in it’s tracks. What are the possibilities of some form of chaos entering the global picture given that the Russians and Chinese do have cybertools to attack our infrastructure; thus you may see my concern from larger global issues that are starting to be of concern. I did make it clear in my first sentence that my questions, tall in order,might be best be answered by Wolf directly to myself. I must apologize to all the readers, if any one thought my query was intertwined with solely the housing market.

Not to get off topic here too much, but take it back 100 years plus, you could say the same thing about the US being brazen in taking on the Spanish for their possessions overseas. Or taking Hawaii, or countless other things. Very much in it with naked aggression.

So, China and Russia, and anyone else who is the least bit honest want to be top dog on the planet. They can’t get there without taking out the top dog now. Can you blame them? If the method involved is underhanded, it comes down to the end justifies the means. Asymmetric warfare is all about playing to your strength, not the other guys.

From that regards, the US is absolutely no different. We simply hide behind the veneer of democracy proclaim how great we are because of it.

Emil-agree with MCH’s last paragraph-at present, many of us appear to have read and come to believe our own press releases of global primacy, and, in doing so, have perhaps fatally wedded ourselves to a historically-false ‘exceptionalism’ that requires no serious knowledge of, or commitment to, the constant hard work required of the citizenry to govern the goals and practices that conduct the path of a great nation.

“…self-deception is the root of all evil…” -r.a.heinlein

may we all find a better day.

Emil,

I’m not Wolf, but I am just down the road from him :) You are not alone in your fears, observations, and extrapolations into the future. I think a lot of the readers here feel like you do. Perhaps we can get Mr. Richter to do an article on warning signs/history of bubbles in the past.

That would be great, I have seen Wolf’s articles being referred to on other sites. We need to get people to stop fighting each other on every issue and look at these looming problems in the distance. This is something I worry about as well. What good is a capital gain today if the grandkids will be living under the shadow of a communist controlled world tomorrow.

Listings are not growing in BC. Sales are down a bit in Vancouver, but not much inventory on Vancouver Island. Thus, prices high and staying high unless interest rates change…or something catastrophic happens. Lots of new construction. My brother in law works with another guy in construction. They are booked up for a year anyway, maybe more, just on word of mouth.

Son bought a 2nd house, closed on January 1, 2021. After 7.5 months it has easily appreciated 100K, maybe more. Good location in a desirable place to live. The upstairs renters mostly pay the mortgage and taxes. Renters happy, and he’s happy.

If the area is a good place to live, for all the usual reasons, people will come. It isn’t just price.

Too many people are highly leveraged to over-valued real estate markets. They think prices can only run higher.

P, really appreciate your comments on here,,, but gotta tell you from the perspective of having been in the RE mkt since the early ’50s:

You are ”generalizing on the basis of insufficient information”

That was just one of my dad’s fave responses to my claiming stuff similar to what you frequently say here,,, but he had a ton more such long term wisdom, after him and grand dad, etc., being in the RE mkts since the 1930s era…

Just saying,,, please keep on with your local reports,,,

((( And just BTW, I tried to emigrate to BC when they were still ”granting” 1/4 section to ”landed immigrants” and was turned away at the border because I was a Vet, and not either draft dodger nor AWOL…

Either of which status would have gotten me the land, free!!

That alone should be enough for any right thinking folks to avoid CA for eva,,,

1) Existing homes supply have reached nadir in Sept last year. Supply of houses and car are making historical lows. Price to inventory rock. It’s a new economy like nothing before. The switch is “on”.

2) Supply and prices are two inverse charts. When supply is low, prices are high.

3) Between 2013 and 2019 supply was osc down moderately, but prices

went crazy. Prices jumped > 2007 high at $230K, from : $170k to $270K, because prices were in 5 years accumulation, between 2009 and 2013.

4) But new listing are rising above the median line, to 450K.

5) Wide space between M/M, dot to dot, might indicate a gap.

6) In 2020, existing home sales gap sharply lower & higher.

SPX gap sharply lower & higher. But M1 jumped M/M between Feb/Mar last

year and is still moving higher.

“Supply and prices are two inverse charts. When supply is low, prices are high”

When the prices rise again, the suppliers (who own their fourth and fifth homes) are ready to sell again because, they want to pay off their third loan to the banks. Did you watched that movie, an adult entertainment star owned several homes and rubbed it on Steve carrels face? There is a price everyone is ready to sell. There is a price no one is willing to buy…

I’m in South OC and just put an offer at the seller’s asking price + pretty favorable terms (no appraisal waiver, shorter escrow, shorter inspection and loan contingencies). Apparently we are in the running with two others and the seller’s agent is going to do a multiple counter offer.

Not sure if we really want to enter into something like this… it could get ugly depending on how much the seller wants to squeeze.

Seems other parts of the nation things aren’t quite this bad – California *always* seems bad though…

When the U.S. goes into a recession, California house values crash in a spectacular manner. Keep that in mind. I lived there in 1981. I didn’t live there in 2008 – 09.

Hope you used the sellers real estate agent. That is how to pull it off. The seller’s agent will do what it takes for double comission.

And you’re committing financial suicide why?

In the end, if you’re living in the place, and you didn’t go beyond your means, you’re probably fine. Just ask yourself if the value went down 20% after you bought the place tomorrow and wiped out your down payment, would you still care?

A house is for you to live in, just don’t look at Zillow afterwards, otherwise, it is an illiquid asset that takes far too much maintenance.

J

Be careful. Based on past experience Real Estate agents are more interested in their commissions that in serving their clients.

Are you missing the big picture?

The world’s central banks are doing QE. Inflation is a world wide thingy. If most CBs keep doing QE, then world wide inflation continues to run hot. That is a bullish scenario for decent houses in decent countries.

Based upon your reasoning, the real estate bull market will never end.

Spot on Sj

I keep looking for a country somewhere that is not doing QE.

Haven’t found one yet, and I’m probably too old to move by now anyway.

I’m definitely too old for BTC.

Here are some that have already ended QE: Bank of Japan and Bank of New Zealand. Bank of England announced the end of QE, as have others. Bank of Canada tapered for the third time and will soon end QE altogether…

https://wolfstreet.com/2021/07/14/bank-of-canada-tapers-bond-purchases-3rd-time-bank-of-new-zealand-stops-qe-cold-turkey-citing-housing-bubble-in-least-regrets-policy/

I’m holding my breath, W

That’s dangerous at my age!

Watched Legarde ECB press conference. She is a good communicator although I wouldn’t believe everything she said.

Someone asked the question about monetizing the debt. I guess they are closing in on two years of debt monetization. She basically said they had no choice or people would suffer. I didn’t come away feeling too good about it. I could see several years of this monetization, maybe til currency is totally debased.

Legarde sounds like that mad banker Havenstein in 1923 Weimer Germany who said the same thing.

SocalJim,

Most major central banks, except for the Fed and the ECB, have already tapered or ended QE, including the Bank of Japan, the Bank of Canada, the Bank of New Zealand, the Bank of Australia, the Bank of England… And the Fed is going to.

https://wolfstreet.com/2021/07/14/bank-of-canada-tapers-bond-purchases-3rd-time-bank-of-new-zealand-stops-qe-cold-turkey-citing-housing-bubble-in-least-regrets-policy/

When we have to look at the ECB and other foreign Central Banks for examples of prudent monetary management then you know we are in serious trouble.

Wolf, what % of the debt is held by government and not sold through to market? Whatever the amount, it can be ‘zeroed out’ without affecting in any way Congressional spending.

Chris Herbert,

Your assertion is completely nuts. Think this shit through before you post it. The non-marketable Treasury securities are held by US military and civilian pension funds, by the SS Trust Fund, by the disability fund, etc.. This is owed to real people who paid into these funds! You would just tell the beneficiaries, who paid into those funds, “F.U.”

Anyone who tries to implement that, or pushes to implement it should be indicted for attempted treason! I’m not kidding. That MMT shit is sickening.

I understand that you have been my MMT troll here for years and keep trying to post this insidious shit here, and I always delete it. I just let this through to show you what you’re really saying.

The scoreboard reads

Wolf 100

CH 0

According to the Council of Foreign Relations, with the exception of Brazil, most countries with very large economies are easing … see their “Global Monetary Tracker” page. Their index of Global Easing is sitting on the low.

see:

cfr.org/global/global-monetary-policy-tracker/p37726

Furthermore, the CFR forcasts that global central banks as a whole will continue to ease at record rates.

That’s just outdated bs from last year or something. Look at the actual central banks. You can get that info in the article I linked.

And the Bank of Russia just hiked its policy rate by a full percentage point too. Article to come.

You are getting caught up in the first and second derivative. A little less QE still means pleanty of QE.

Also, don’t get caught up in policy statements … look at what they do, not what they say.

FYI … CFR shows Russia as tighter, just as you say.

The Gary Yary Institute for Finance has concluded after months of academic research.

The Billy Idol song “Dancing with myself” is my firms closest interpretation of the global markets. All classes.

The ECB chairlady today had a speech that was nearly identical to Powells recent diffusion of reality. She parroted the “tools” they can use if needed. Doctor Kevorkian made more sense as a pathologist than these finance czars.

Back to Billy. This whole upward trend of everything is…the players merely dancing with themselves. Remove your money and the music stops. The interest rates keep dropping – it allows the music to keep playing – stimulus checks are mere quarters in the jukebox – music plays on – dancing with yourself.

Big firms use the algo’s to sell to other big firms one asset one day – swap and short the following day. Repeat or decrease increasing minute percentages.

2013 the cycle began. Reverse repo. MBS is still not repaired from 2008. The reverse repo – repo will be next. Or maybe a new buzzword? I can’t wait…

Fed rates will go negative before they raise them.

In consulting the Gary Yary institute, I must ask the question: what makes the music stop?

This the best of the rest !

john,

You made the record and music skip?

Decrease in spending or stimulus stops the monkey grinder according to research. Increase in interest rates hits the brakes.

Reality of the hyper valuations will sober the masses eventually.

Position accordingly.

John Galt….you ask x 2 “what makes the music stop?”

Any number of events/issues mostly but not always man made. Could be environmental destruction/degradation as is Easter Island (no trees) could be fires, floods, heat waves etc…BUT most likely it will be REVOLUTION by the

“deplorables in fly over country, who cling to their religion and guns!” Maybe that’s why ammunition will be difficult to buy even though guns aren’t

But one thing is for sure….these revolts will be “set off” by

the ruling class’s efforts to continue their unbridlequest for money & power at everyone else’s expense & ignorance. Just saying….got gold/silver?

I have gold/silver and other precious metals that you speak of. . .though I feel like one of those “flyover deplorables” right smack in the middle of Silicon valley. Looks like my double post was cleaned up in moderation, sweet.

Nah J:

MOST likely is some sort of natural event over which we hmns have absolutely NO control:

Bee it sun mass coronal ejection, THE most likely IMHO, or something very similar, inside or outside our local sun following planets, et alia,

Or some similarly global changing event of the catastrophe and natural type,,, THAT will be the catalyst for major changes.

People,,, people of the hmn species type, might think at this point in time WE/they can prepare for such events, but her and his story tells quite a bit different likely outcome for the vast majority.

As I told my better half when we moved to within smallest likely blast area of a major military center, just relax, we will be the first to be evaporated, but I really don’t think it will ever happen,, { in our lifetimes,,, } LOL

Wife is on Redfin all day. Thinks we have hit high tide. No one wanted this split-level in a popular area of Seattle for $1.2 million. So they lowered the price to $1 million and still no one wants it. Hope she’s right coz I’m tired of renting. But I ain’t crazy. Ain’t touching this market. What a cluster…

Seems like the stock market. “no way I would invest with values at ATH”. This has been the repeat and break new records hourly, weekly, daily, monthly and All-Time Highs. So why can’t the real estate market do the same. Sure they will have to do something like fractional ownership. But hell these financial wiz’s can figure out a way. This way you would only own 51% of the house

Sure the whole house is too expensive for a single family. Just like a single share of BRK.A but you can fractionalize it and it makes sense

Fractional ownership is already starting. Here, in Newport Beach, for 1.26M, you can own 1/8 of the home at 2628 Ocean Blvd.

Haha love it.

They will not stop qe and low interest rates are here to stay! Sorry folks if you sold and are hoping to rent a few years and then move to your dream house at a low price. Not happening. Only going up from here with small corrections along way due to supply. Nothing more. Buy tech stocks and own as many properties as you can. Last time i help u all.

Do you shine shoes for a living? Or are you a cab driver? Maybe a checkout clerk at a gas station?

Is there some kind of security that tracks residential real estate values, either nationally or on a local basis? I happen to be sitting on some cash and am planning to use it to buy a house in the medium term. Not buying mow for logistical reasons and because the market is crazy.

Wolf ! I love your stuff – but what’s your perspective?

Back in 2013 charts like the Fannie “good time to sell” were blazing green light indicating the housing market was bonkers and it was absolutely the time to sell before the interest rates spike. That mistake cost me $800,000 dollars on my $700k Seattle home.

What’s not to say the home prices keep going up another 10-20%? Rates are back down to historic lows and there is so much government stim cash + home equity (after people sell their ridiculously priced home) in the market, it’s insane.

I don’t see an end to this spike for another year or two.

Michael

It is really hard to get a handle on what is going on in the real estate market. My cousin’s wife is a Realtor and she JUST posted on Facebook that yesterday she listed a house and pushed off the showings until tomorrow… she has three offers already and fifteen plus showings tomorrow. She ended her post with “Lord be with me as I explain 20+ offers to my client after this weekend.”

Once again showing that the middleman salesperson hiding behind the trademarked word Realtor is no longer needed in the transaction.

What’s going on is simple. Housing is no longer just a place to live. It used to be but since 2008 things have changed forever. Housing is now a financial vehicle and as much as many decry such a change, it ain’t going back, sorry. This current frenzy will eventually slow, temporary though, and then continue.

Couple that with simple supply and demand and here we are, get used to it. In areas where the demand outstrips supply houses will continue to rise. Oh sure there will be corrections occasionally, but show me any 10 year period where houses were less expensive later. Natural disasters, factory towns closed etc. excluded of course.

Rates will go up at some point and that will correct slightly but then resume again. Look what happened in 2008, the worst housing crash ever. And where are we now? Nobody thinks housing will crash like that again. Too many people that want houses and too few houses. Isn’t that the classic definition of inflation?

Writing is on the wall folks.

Count of the work “land” : 0

Count of the work “rentier” : 0

(excluding my own comments).

Land prices, not house prices, are rising. That’s why the same house costs more in the middle of New York than in the middle of nowhere.

After this epiphany you can then make the leap to the understanding that the price of land is the main determinant of cost.

From there it’s a short leap to realizing that this value is created by society, not by the owner.

From there it’s clear that one should tax the *unimproved* value of land, allowing society to keep they value it creates and the landlord to keep the value they create (say by building up some nice 5 story mansion block).

From there you should then think about taxing land, not labour.

Or carry on as you are, with everything getting worse. I’m not really that bothered any more.

I have sold a house too big for me in the city and bought a small house on a large plot of land.

I see the future being self sufficient.

Coming out of the woodwork and listing high, tone deaf, to a weary audience of prospective buyers. No, thanks—you can keep your overpriced, not updated, poorly maintained home. Greed has its limits and, as they say, the devil always overplays his hand.

Meanwhile the value of the “overpriced” house I bought jumped another 7%, lol