“Inflationary pressures pose increasing price risks to Treasuries & stocks” as the Fed will react.

By Wolf Richter for WOLF STREET.

Bill Gross is at it again, now retired from Janus Henderson Investors which he joined after having left Pimco, which he co-founded. But some of the things he said in his editorial in the Financial Times nailed it, and they’d be funny, if they weren’t so serious.

The long-ago deposed bond king starts out that way: “The only bond kings and queens over the past half-century since credit was unleashed from its gold standard in the early 1970s have been the US Federal Reserve chairs.”

None of the other bond kings and queens over the decades have had the sufficient firepower to really move the markets, he says. “The Fed chair with the ammunition of the global currency has been sitting on the monetary throne for the past 50 years.”

But Jerome Powell’s historic money-printing efforts to bail out every asset holder made Gross wonder if he “unleashed the potential for chaotic future economic and market outcomes.”

On top of it comes the US Treasury with its “peacetime deficits of unimaginable size,” that the Fed is now “forced to accommodate” with its monetary policies.

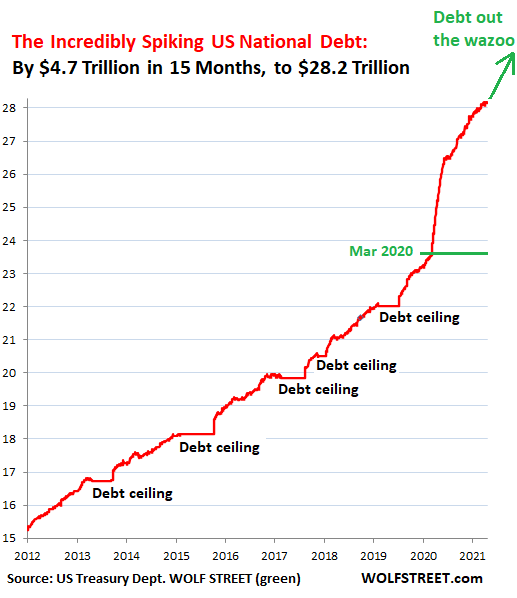

So this is the Incredibly Spiking US National Debt, now at $28.2 trillion, of which the Fed has purchased $5.1 trillion – over half of it since March 2020:

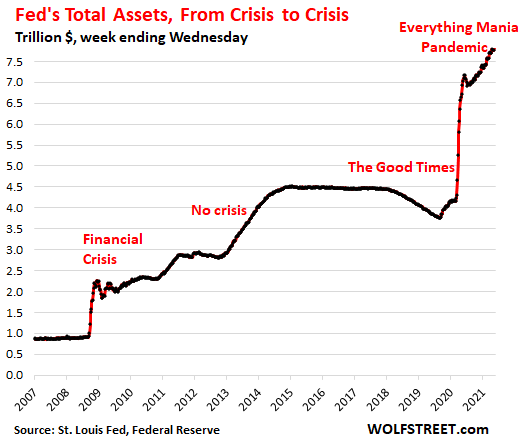

Including the other assets that the Fed has purchased, such as $2.2 trillion in MBS, total assets on the Fed’s balance sheet have exploded to $7.9 trillion:

The issues are inflation and the dollar. The Fed has already said it is going to assume that inflation is “transitory,” and that it will let it rise until it decides that inflation is not transitory. The Fed’s lowest lowball measure of consumer price inflation has spiked to a three-decade high, even without the Base Effect.

The Fed also keeps saying, that if it decides that inflation is not transitory, it has the tools to crack down on it. So Gross asks, for how long will they keep their “pedal to the metal?”

“Even enthusiasts of the Fed’s policy must wonder whether hundreds of cryptocurrencies [well, I mean over 5,000] or a boom in special purpose acquisition vehicles [SPACs] are the result of continuing financial innovation or the product of cheap and plentiful credit demanded by deficit spending and an accommodating Fed chair,” Gross says.

And that question – whether this “raging mania” in just about every market, as Druckenmiller calls it, is the result of the Fed’s policies – well, “Powell will not even acknowledge asking the question about asking the question until Covid is more under control and employment returns to historical norms.”

But those historical “norms” may be out the window, given all the changes that occurred during the pandemic, including working from home, Gross says. So what is the new norm? How long can these policies by the Fed and by the US Treasury go on before “sinking the dollar?”

He walks us through the ultralow bond yields, and negative bond yields in some countries which make US Treasury securities more attractive for them. Rising inflation is producing negative real yields all around.

Given the Fed’s purchases of Treasuries at the pace of nearly $1 trillion per year – Fed chairs being the only bond kings and queens – it’s “no wonder,” Gross says, that the 10-year Treasury yield “rests illegitimately at 1.65%.”

But this may not last: These market speculations “are dependent upon the stability of the dollar and the consistency of Powell’s vow to keep short rates unchanged for the foreseeable future,” Gross says. But “at some point in the next few months, hopes for this will probably be disappointed as inflationary pressures pose increasing price risks to Treasuries and stocks too.”

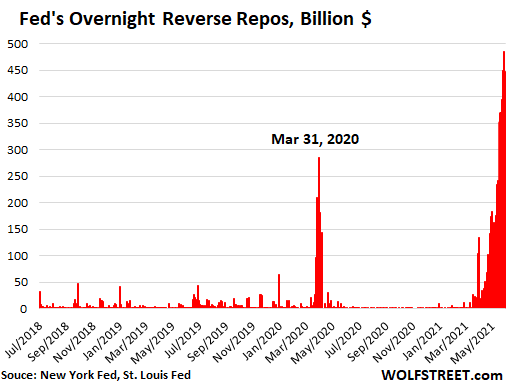

The Fed’s asset purchases have already created so much liquidity, causing bank reserves to more than double in a year to $3.8 trillion, that liquidity is now going haywire, and the Fed is feverishly engaged trying to control it by selling Treasury securities and for cash via overnight reverse repos, thus draining liquidity from the market.

Just this morning, the Fed sold $448 billion in Treasury securities via overnight reverse repos, as Friday’s overnight reverse repos of $478 billion matured and unwound. This is down a tad from the record of $485 billion in reverse repos last Thursday that matured and unwound on Friday.

So the Fed cannot continue its current zero-interest rate policy and its asset purchases that create more bank reserves, Gross says. When the Fed starts dialing back its policies, assets that have been supported by low yields, such as the 10-year Treasury and stocks – “no matter the growth potential for 2021 and 2022,” Gross says – are in for a reckoning when they lose that support:

“Cash has been trash for years but soon it may be the only haven for investors sated beyond reasonable expectations of perpetually low yields and supportive bond kings and queens,” Gross concludes.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Bill Gross….is as good as any of us…..but no better.

He made some bets long ago and did well…….of course it was an historic bond bull market…..and the saying goes to never mistake a bull market for genius.

He also famously sold every treasury from his portfolio’s when they were paying 4-5% because of a downgrade and stated……who will buy them?……scaring the heck out of lots of folks about the future of the treasury market.

Honestly…..at a party I was confronted by anxious friends who asked me the same question that same month…..I replied……He will…….and he did.

The fed is absorbing funds until the huge deficits of later this summer occur and need funding…..made worse by the run down in the cash account…..at that time the reverse repo will be rerreversed and 488 billion will be available to bid on treasuries. Keeping rates low. Sorry Bill. Thanks Wolf.

Prechter calls it a check kiting scheme, and sometimes more than others. The banks are being replaced by the shadow banking system. Nobody holds cash deposits anymore. Money is soon worthless, what that says about credit is a question? Maybe that it negates the Feds monetary inflation policy. Economic growth is shorthand for inertia. Assets prove valuable. Stocks are assets, bonds are money derivatives. When Argentina crashed in 06 stocks came back, bonds took the haircut.

re: “The banks are being replaced by the shadow banking system”

That’s an apt conclusion. And that’s what’s wrong. Savings are being ensconced and impounded, bottled up in the payment’s system. That’s what has destroyed the velocity of circulation since 1981. It will continue. Keynesian economists have achieved their objective, that there is no difference between money and liquid assets.

Sorry, got that wrong. It’s the banks that are replacing the shadow banking system.

I listened to Chris Cole and Mike Greene discuss the idea that money creation via fractional reserve banking has been supplanted by the shadow banking system. Anyone who has a Treasury as collateral can get credit. I have heard estimates (Steve Van Metre, Jeff Snider) that there up to 20 claims on every UST (which I believe means that one UST is collateral for 20 loans (having been loaned and reloaned)

Is there a connection?:

From the immediate exit of the 2008 financial crisis (say around 2009 or 2010) until 2015 (about when Bernanke left the Fed Chairmanship) the Fed balance sheet about doubled. During that same period economic growth during this time was on the lower end historically. It was so notably weak, the person in the Oval Office became the only one at that time to never achieve a 3% full year growth during his terms in office.

Yet dispute that, Bernanke is boastful of how awesome his policy of QE and balance sheet increase was.

Seems his boast ought to be what a failure his QE/balance sheet expansion was.

Nailing interest rates to zero for years after the crisis was over was even worse. The economic system adapts over time, like the human metabolism does to stimulating drugs, so that the drug is needed just for some semblance of normalcy.

Bernanke also brought us the infamous 2% “inflation” target, the camel’s nose under the tent of permanent abandonment of currency stability.

“Nailing interest rates to zero for years after the crisis”

Claimed to be an “emergency measure” after the massive fraud caused GFC. Looks like we never got out of the “emergency”…

And “2%” (ha!) inflation IS NOT “price stability.”

Even a slight “dialing back” will cause a massive crash in the markets.

All markets – stocks, housing, bonds, junk, cryptos, etc.

And the party “in power” will be blamed.

So, now, this is a high stakes political game.

“When the Fed starts dialing back its policies, assets that have been supported by low yields, such as the 10-year Treasury and stocks – “no matter the growth potential for 2021 and 2022,” Gross says – are in for a reckoning when they lose that support…”

I believe it’s no longer a matter of which party will be blamed for the crash of the everything bubble but who will be blamed for the coming inflation storm.

We are looking at the very real possibility of the death of the world’s reserve currency and could be left facing dire consequences if/when this occurs, yet Powell is completely sanguine, he doesn’t even seem to realize the catastrophe this would unleash.

The Fed is creating currency, in unlimited and shocking amounts, to fund enormous and reckless government deficits. I can think of no instance when a society has not completely crashed once they began creating money to fully fund wasteful government spending.

How productive will the US be when the value of the dollar spirals down? Who will work for worthless dollars? If people stop working, how will we feed ourselves? Given that the stakes are so high, why is Powell risking this?

Powell, Yellen, Biden, Bernanke, Trump, Obama, Pelosi, Bush/Cheney, Krugman and the clowns, who believed in a free lunch for all, will be remembered in history books as self-serving, power-hungry traitors.

Interesting points. Logical but there will be twists in that logic.

Ironically, according to the book “When Money Die” about inflation during the Weimar, German Industry did fairly well. They kept their money outside Germany and imported only raw materials that could be manufactured cheaply in Germany for export.

Farmers did well too.

Those wiped out?

Savers.

Those on fixed incomes.

Government workers (and corruption became rampant)

The professional and educated class.

Local, State and the Federal Governments.

You do not think 20 years in Afghanistan was waisted government spending? At least broadband, EV charging networks, and high speed rail is positive productive spending in a an increasing carbon world.

Zbanana

“Even a slight “dialing back” will cause a massive crash in the markets.”

When the Dow made its all time high in 2007, Fed Funds were around 4%.

When the Dow crumbled in December of 2018, Fed Funds were around 2%.

The threshold of what this market can take gets lower and lower.

And now 4% inflation and the Fed, bound to “stable prices”, doesnt lift a finger..

The new threshold is probably just over 1%….

and that reveals how FRAGILE all these markets are….

terribly fragile.

Although Mr. Gross comes across as reasonable my many decades of watching his public calls on CNBC and Bloomberg suggests he is more often wrong than right. I’ve used him in the same way I use Goldman Sachs, as a contra-indicator.

Yield curve control is on the horizon so that should be very good for gold. I wouldn’t go overweight cash unless the stimulus stops.

Overweight cash. Not a problem for most people. Really.

Haha!

Well said.

Both true and ironic. Apparently, americas are the best and the brightest yet pocket change seems to be in short demand…

Wages have been stagnant for 40+ years while cost of living has continually increased. Majority of Americans are living paycheck to paycheck

Gross, Hussman and a few others are on the list of folks who are “smart”, but not as smart as they think. They are very good with encrypted info (read “maths”). They have/had models that were “bottom-up” based on fundamentals- then the models stopped working- in a big way. The people who run/use those models are prone to this type of error.

Top-down models are more responsive to “correlation changes” in that they look for those first and try to find fundamental causation later. That’s the way to stay away from big losses- but will never get you the big gains that happen when these bottom-up models are effective.

The “Intellectual Yet Idiot” description comes to mind (see Taleb).

Wolf! You may not agree with Gross but referring to him as a ‘bong king’…he isn’t Elon.

Maybe Wolf is more right than we know.. I don’t do drugs but if what’s coming is as bad as it can get I might start.

? Made it into the lexicon of infamous Wolf Street typos.

“On top of it comes the US Treasury with its “peacetime deficits of unimaginable size,” that the Fed is now “forced to accommodate” with its monetary policies.”

This caught my eyes. We are definitely a disaster capitalist system, so to unleash some over the top monetary policy, safe to assume we will be in some manufacture war that we don’t need soon in order to come up with more insane monetary policy. Major wars and disasters are really good covers as we have seen what happened after March of last year..

Even High School history books in the 60’s (I assume they were still made and written in the US) told us wars were good for the economy.

As long as you won them.

LOL… good point!

The price of national ‘equality’ is huge, maybe beyond our means. Or is it the wrong equality we should be focusing on?

Diversify into stocks, bonds, RE and cash. No one can market time everything.

Won’t work for all.

I bet at least 60-70% of people don’t have enough savings (or time) to risk “diversifying”. A big crash in housing or stocks would put me far lower than just staying in cash and losing to inflation, and by far lower I mean LOW as in the price of a cheap new or good used car. Downsizing is my only “financial instrument”, and I’m getting good at using it.

Diversification is a total luxury, as far as I’m concerned, or for those with connections, especially when you are too old to “rebuild” savings.

What do you plan to do?

He’s probably just trying to survive like most of the bottom 65%.

I plan to do nothing. Boring is lucrative. We stay home most of the time and not surprisingly, money accumulates. Maybe we won’t live this way forever, but we kind of like it…

Hah, and boring is the best way to invest too. Boglehead approach. Basically do nothing. Fidelity’s best performing investors are dead people. The market timers are the losers in the long run (generally speaking).

in the immortal words of tom petty: even the losers get lucky sometimes.

Stocks and real estate are hugely overvalued though, it does of course vary by stock and RE location. Predicting the crash will be extremely hard, but shoveling more into RE at this time, wouldn’t be a great idea. Shoveling into stocks, depends on whether you think you can jump out in time. If I had money in RE investments right now, I’d probably pull most out. Alot of those that I know who do have RE investments, have partially sold off already, and will likely sell off more/most over next couple years (this is in a lower priced region too (red hot right now though)).

The booomers are starting to retire, that will for sure crash RE and stocks. When is still a question. I also think that during a major crash, many cities and states will try to tax RE investment, which could crush investors, especially small ones. If you bought into RE, when it was alot cheaper, then holding would make more sense.

If I had a bunch of money right now, some RE is worth considering, but most not; cash, some stocks; precious metals; foreign cash such as a Swiss Bank account or something like that would be worth considering. If the Euro/Eurozone crashes too, that might also greatly boost the value of the Swiss Frank. Bonds wouldn’t be a great option, unless you have millions saved (enough to exceed FDIC insured amount), the returns between now and the next recession, wouldn’t be that spectacular and you’d suffer a penalty if you were forced to withdraw it early, if the need arises.

I wonder if the infamous, Swiss Bank account is one of the best places right now, I never hear about people describing owning a foreign bank account.

The sort of people who have lots of cash in Zurich accounts simply don’t talk about it.

Nor can they advise those poorer than themselves, as they simply can’t conceive of such risibly small sums of money.

The good thing is that one can talk about things other than money and RE with them.

They are such dreadfully boring topics after all, and we all leave this world naked, poor and often screaming (can’t use your wealth on your death bed), just as we entered it……

Americans can no longer open an account in Switzerland because years ago the US government had to pay billions in fines to all Swiss banks that had American resident and non-resident accounts, so the bank now asks if you are an American citizen and if you are, you are not able to open an account with any Swiss bank on the country.

The first rule of Swiss bank accounts is… we don’t talk about Swiss bank accounts.

Gold and silver.

Platinum too.

Palladium.

Gross’s insight into the Fed seemed to diminish when Paul McCulley left Pimco, I’ve heard it said.

I heard Mohamed El-Erian on CNBC today. He called himself a “fully invested bear”. That expression reflects my present sentiment.

LOL… that is quite the contradiction. I guess it depends on what you (and he) are invested in.

Don’t know about Mohamed, but I’m overweight European banks. Up 30-40%, including dividends, since last autumn. Expecting extra dividends when the EU moratorium ends 30 September.

Idea that cash is a haven is absurd. We stand on edge of hyperinflation.

I agree. Right or wrong, I’m buying silver fully knowing that the gov might need to “borrow” it from me some day.

Silver is interesting. In many collapsing economies in crisis, junk silver has proved much more useful than gold to turn into ready cash to buy the week’s food.

Gold you can bite -coins and bars – is most useful for big bribes, etc, not for everyday needs.

Yes, silver.

– Hyper-Inflation is out of the question. If it’s going to haapen then we will see Deflation first. That why cash is going to king (for while).

I think deflation has been side-stepped due to monetary and fiscal intervention on a grand scale. Even if we get a deflationary bust it would last only a few days before the Fed and Central Banks go buck wild and print to the moon. I’m confident that we will go the route of hyperinflation as it provides a mechanism to debt jubilee and reset the system. They will find a scapegoat for it at the appropriate time and then let er rip.

Spot on!

They will engineer a Crisis in order to justify the move to CBDC’s and the Western form of social credit system – ESG – in the new Totalitarian political and economic system.

Reeling from the ‘Terrible Unforeseen Crisis’, we will just have to suck it up.

But don’t worry: we will all will ‘have nothing but be happy’.

The injections will help with that……

Over half the government’s budget is funded by money that the Fed creates and the ratio is getting worse, not better, as time passes.

I don’t see how hyper inflation is out of the question.

I don’t like sitting in cash, but now, when I do hold cash, it is Euros, gold and silver. The US dollar is a hot potato and I’m not playing that game – I don’t like getting burned.

Swiss francs and gold & silver.

How much cash is too much, Bob?

A

You can never have too much the morning after all the markets have crashed and you’re itching to buy everything in sight. Trouble is you could wait with no return for years.

If the market crashes then why is it a given that the market would go up again? Past performance? History doesn’t repeat itself but historians do.

I like cash; it enables freedom to spend without having to sell something first. Selling requires a buyer at the price I want but buyers want to profit on their purchase so the margin has to give. Fortunately for sellers, buyers have been conditioned to think that satisfaction is enough.

What is too much cash?

The amount you look at after the economic earthquake and think:

‘Damn, I should have spent it on some fun while I had the chance!’

Robert,

If inflation (CPI) gets even close to the double digits, which is still a million miles from “hyperinflation,” the Fed will crack down like you won’t believe. That type of inflation hurts all its constituents — and they’ll be screaming. Then, with interest rates shooting up, you wish you could still get any cash for your assets.

Wolf…

we are already in uncharted distortions.

Have Fed Funds EVER been 4% below inflation?

Have 30 yr mortgages ever been below inflation?

And the Fed is idle….despite the overnight stuff…

The citizenry is going to get really hurt in this tumult … and the societal makeup of the nation is in peril, IMO.

We keep hearing about wealth disparity….well when stock enrich the Rich, due to Fed policies…

and the “not so Rich” get hurt real bad by inflation…

what happens next?

It results in politicians who promise to “Make America Great Again” to get elected. And then cut taxes for their themselves and campaign donors and drive up the debt. Eventually, like we’ve seen before, it results in communism and the dictatorial anarchy that goes with it.

The people in power are short-sighted.

Fed’s ‘constituents’ = could you elebotrate? Thx.

Ravi Masand,

“Fed’s ‘constituents’ = could you elaborate”

1. big financial institutions: The 12 regional Federal Reserve Banks, such as the New York Fed and the San Francisco Fed, are private corporations whose shares are owned by the financial institutions in their districts.

2. the asset holders in general, on top of the pile being the billionaires.

3. Congress and the White House.

Probably some others, but it’s getting late and I’m giving up for now.

Inflation hurts the boomers and they are the electoral king-makers.

Consumer price index hyperinflation?

Base money hyperinflation?

Broad term moneytary hyperinflation?

I guess not the first, that pretty much tied to the puchasing power of those that have purchasing power.

Do you even know the definition of the word? Look it up and then tell us your reasoning about how it is going to happen….

hyperinflation-loss of confidence in the currency and prices rising to avoid money, rather than being bid up by too much money.

how does it happen? something none of us will see probably, banks not making trades because of uncertainty and it spreads. a big dollar drop and foreigners raising prices. the us government insisting they need the imports so printing to get it. countries see this and dollar drops more – > vicious circle. or something along those lines from a layman’s view. why not? the fed isn’t in control. if they were they wouldn’t feel the need to BS us so much. it’s been an endless stream of perception management for 20 years. they’re losing it.

of course people said that 20 years ago as well. i still believe it, run my affairs that way and am happy to hold quite a bit outside of the system. it’s a fantastic way to view the world for simple, working savers.

so maybe we’ll be saying this for another 20 years. but when it happens it’ll be faster than you might believe. the last 14 months have shown just how fast really huge events can happen. and when it rains it pours so we probably aren’t done yet.

every year that goes by, talking about hyperinflation seems less and less crazy while investors go crazier and crazier. it’s fun to watch nonetheless.

It USED to be fun to watch. Now it’s just like watching a clothes dryer go around for twenty five years.

i thought thought last year was pretty spectacular

Wrong. The definition of Hyperinflation is inflation at the rate of 50% or more per month.

Now tell me what is going to cause inflation at that rate, and be specific.

Hyperinflation will occur when the Fed starts printing to pay the interest on the debt. We are no where near that point. Dollar still is a store of value unless the Chinese open their current account.

Certainly no one thinks bitcoin is a store of value anymore.

Hyperinflation will not happen at all. If you think it will, then spend 15 minutes studying the subject and then you will know better.

High inflation is not hyperinflation. They are completely different, and caused by different things.

So what do I know to be true?

1. The Fed’s solution for everything is to print more money.

2. Can the Fed stop printing money now? No. They can not stop.

3. If the Fed stops printing money, everything collapses.

4. The Fed must continue printing money, no matter what happens.

5. The US economy is too small to provide value for all the existing USDs.

6. Excessive debt burden reduces future economic growth potential.

7. Reduced future growth rates should reduce future inflation.

8. The current financial system needs to nominally grow ever larger.

9. Real US economy not growing enough to sustain financial system.

10. Financial economy has to provide growth to sustain financial system.

11. Financial system no longer produces real wealth growth.

12. To grow more powerful, gov require ever more money.

13. Gov needs more money to nominally grow financial system.

14. Gov needs to create inflation to reduce it’s debt burden.

15. Gov needs people to maintain it’s power.

16. Gov survival more important than people’s survival.

17. Gov will not let people stop or escape supporting gov.

18. USD’s is nearing end of it’s life. 1971 marked halfway point.

19. Fractional paper gold market can not last.

20. Gov will keep spending no matter what happens.

21. Communist central planning is running out of other people’s wealth.

22. Communists, like cancer, will win by killing their host.

23. Communism will die along with fake money!

24. There is a hole through to the other side!

25. We will survive our ruling idiots!

26. The sun is still shining!

27. Life still goes on!

#4 was also cited in 2012/2013. But in 2014, the Fed stopped printing money; and in 2018/2019 it reduced its balance sheet, doing the opposite of printing money — quantitative tightening. Powell has said recently that this showed how QT can be done, and how it will be done in the future.

That kind of slo-mo QT can work in a low inflation environment. But I have serious doubts that Powell’s Fed has the mindset to raise interest rates by multiple points at a time to fight inflation… the way Volcker could (and did).

The money stock can never be managed by any attempt to control the credit. Interest is the price of loan funds. The price of money is the reciprocal of the price level. We can expect Powell’s FAIT to fail.

Great article. What really struck me is the painted into the corner aspect; having to accommodate the debt with policy. Or else.

It will be really interesting to read articles and comments when the shaking starts. Right now people are concerned with inflation. I live on the west coast and am always prepared for earthquakes. About 8-10 years ago we had a pretty good one. I remember running outside only to see the surrounding 150′ trees threatening to topple. It was more dangerous than staying put. Some things are just out of our control beyond basic individual preps and supplies. That is one reason why we have cash and forgo debt. It provides some options.

Thank you for the thoughtful article. Sobering stuff.

There’s a lot of politics intertwined in this Federal Reserve/Federal Government policy mess. Last week a certain political party launched a formal campaign to blame consumer price inflation on the purported profligate spending of its rival party. This campaign strategy is timed to come to a crescendo in time for the 2022 mid-term elections. Appears to be a “turning lemons into lemonade” tactic. Time will tell if the voters are thirsty.

“So this is the Incredibly Spiking US National Debt, now at $28.2 trillion, of which the Fed has purchased $5.1 trillion – over half of it since March 2020:”

The national debt may be spiking but the net interest payments that the government has to make are not going up as much.

When the Fed buys treasuries, this eliminates the interest the govt has to pay on that debt and also lowers the interest rate for future debt issuance. This affects the currency, although this is buffered by other governments doing the same thing.

QE, ZIRP, and spending are the three horses carrying the asset markets up the hill. And all they have to do to keep the ponies running is incorporate enough hedonic, substitution and owner-equivalent-rent calculations into the inflation statistics.

With all the printing and waves of deficit stimulus, the camel’s nose of MMT is squarely under the financial system’s tent.

Not a single 10y bond traded today in Japan. Zero.

BOJ owns about 45% of the outstanding government debt.

Fed is at 20%. Pretty soon it will be there too and government bonds will stop trading.

This can go on for a long time. Yields on US treasuries mean nothing, they can be whatever Powell wants them to.

My question is why are private investors buying corporate bonds yielding less than 1% when inflation is more than 4%?

If inflation is raging, why aren’t yields on corporate bonds going up?

Surely the Fed can’t be buying them.

I have no answer for you except I like to speculate. So if anybody wants to add I’am all ears.

Foreign buyers at one time saw our yields as yummy good. But, they now they factor in whether the old dependable dollar might not strengthen if rates go up. In fact it might weaken due to the drunken party we’ve had. The only counter is where do you go….everybody else makes our party look like a 5th grade birthday. So on aggregate they usually buy a little more than they sell….except for the Russians.

Pension funds swollen with cash from boomers in their last years of work and pumping as much into their plans as possible have no good alternatives. Overpriced stocks or high yield crap or hope to lose less treasuries. Many of them are precluded from commodity or other riskier investments. The taxes mean little to pension managers, it is paid by the pensioners. They usually don’t speak about inflation to the pensioners.

Social security and others are forced to buy the stuff.

Other government agencies…..ie Bureau of Indian Affairs are forced by regulation to purchase Government bonds for their clients…..the Indians.

Banks are so stuffed with cash, that they are literally paying nothing for, that any yield to them is a small marginal profit on huge sums. Some banks are paying almost nothing for CD’s with 5 year maturities. Not to mention the regulators want to see a portion of their reserves in high quality assets…..LOL…..like securities from the biggest debtor nation on earth.

A lot of automatic time horizon retirement or savings plans which allocate investments based on client age specify a percent of treasuries which increases as you age. The US population is aging.

Some other investors see a world in which a black swan event could undo everything overnight…..so a little peace of mind is welcome…..even at a cost.

Some have such large flows from salary that all they want to do is to pile it up in something where it will be there in the AM.

Corporate treasurers having a known liability in the future like to match the liability with a rock solid investment.

and some…..are lazy, stupid, unknowing or just don’t care.

There quite a few other examples.

The government bond market in Japan is just for show. There are just a handful of huge participants that exchange bonds amongst each other as needed: the BOJ, Government Pension Investment Fund, Japan Post Bank, and the big banks.

Is that because of Basel restrictions on Japan’s banks?

Why ? Because for so many companies with stocks trading at stratospheric levels , it is much cheaper to finance via stock secondaries than by selling bonds.

In fact it is prudent for such companies to retire their bonds with monies raised via stock secondaries.

Some companies are also retiring their preferred shares. I had two issues called in the last few months.

– I thought Gross was a smart guy but here he proves that he “doesn’t get it” regarding a number of things.

– E.g. he (like so many others) thinks that by getting rid of the connection between gold and the USD in 1971 was the reason debts went through the roof from 1971 onwards. When 2 things (A & B) happen at the same time then it doesn’t mean that B was the result of A happening.

– Earth calling Bill Gross: Rising interest rates are Deflationary. And are not a sign of inflation.

A high interest rate is not necessarily deflationary. At least not if you look at monetary inflation. The way the monetary system work, high interest rates inflates the amount of money. Observe that interest is a math function at work on a variable, the amount of money

The advice to hold cash is nonsense, because the coming, increased inflation will make it worthless. I might have asked you to make a report about the banksters’ “Federal” Reserve (which is deceptively named bank cartel that uses the word “Federal” in its name to deceive the public but is owned by the ultra-rich owners of the private banks that in turn own its “Fed” district banks.)

Please do NOT report how the “Federal” Reserve keeps bailing out the ultra rich owners of its banks (the “banksters”) by purchasing their garbage, uncollectible, mortgage-backed securities (“MBS) at $40 BILLION a month after GIFTING them $2 TRILLION starting in 2019 by buying at HUGELY inflated prices that much in MBS. Thus, the banksters effectively turned the entity authorized to print US legal tender (the “Federal” Reserve) into a “bad” bank that gave them the face amount of their GROSSLY depreciated MBS and holds their sewer discharged MBS, so the “Fed” ALONE will bear the losses and cover them by printing US legal tender, NOT THE BANKSTERS. See “The Fed Should Get Out of the Mortgage Market” in the opinion section of the billionaire owned “Bloomberg.”

In other words, our cash will swiftly become WORTHLESS. We will all suffer from MASSIVE INFLATION to bail out the most corrupt members of our society. Since the US dollar is the word’s reserve currency, that includes THE WHOLE WORLD who must trade with more and more inflated, US dollars due to the banksters’ massive corruption.

That must remain unreported, because of the major banks are closely linked to the organized crime members whose money they have laundered for decades or they are actually owned by organized crime members. Inquiring minds wonder which is true. See in DW “FinCEN Files: Tracing the flow of dirty money” and note that DW has a huge series of reports and videos on organized crime’s close links to the banks. See “FinCEN Files: A swirl of revelations about banks and money laundering”

After the banksters spent so much money buying most of our politicians, we must respect their right to privacy to engage in massive crimes and tax frauds in privacy. See Simon Johnson’s “The Quiet Coup” in the Atlantic Magazine.

Went to local Lowes and Home Depot today. Had to buy a few sheets of plywood and ZIP board to finish a year long project. Fortunately I bought most of the material for my house exterior redo last year before things went crazy. Various thicknesses of plywood at 50-80/sheet.

The most notable observation: Not near the number of contractors/handy men in the store and no-one (except me) buying plywood/lumber.

These prices will come down and will come fast as soon as project in process finish. Very few people are going to start a project with prices like these. And this is just lumber. Copper wire, electrical supplies, plumbing supplies, all up too.

So many of these inflated prices will come back down. But to what level? Likely higher than before; maybe 15%? Who knows. But these current prices will not hold; of that I’m certain.

Home Depot must be slowing down. For the first time ever, I received a “$10 off $100 purchase” coupon.

There wokeness is coming back to haunt them… just like coke.

Grocery store isles and shelves jammed packed with skids of Coke. I bought Pepsi but noticed there was little Pepsi òn shelves. Is Coke woke yet?

Wes, Google “Woke-a-Cola”…or “Coke Goes Woke and Broke”

The prices will come down?

There are a few other variables to the equation. Raw material cost, manufacturing cost and price/volume optimisation.

If a retailer can make more money on a lower volume at high price than a large volume at a low price they will do. Especially if they can get rid of low price competition by other means than price competition.

Here in Oz, 90×45 KD F17 hard wood priced last week at local timber yard…….$14.95 per metre, so one 3m. stud costs $45 !!!

Did he just read ‘The Street’ and comments for the first time last month. Tell us something new!

The game is not over for the Fed, it’s at the crux point in the current ‘Covid crisis’. If making Americans 3% poorer doesn’t kill demand and inflation, nothing will. The question is, ‘will the politicians allow them to face this out, or will they demand more intervention to ease the pain for voters?’ It’s crunch time for ‘transitory’ or ‘out of control’

All his comments assume it’s out of control. I’m still waiting to see.

Did he actually ever have any doubt about what SPACS and other ‘special’ vehicles were? LoL

“ When the Fed starts dialing back its policies”

Maybe that’s why he’s the former King, Gross still presumes these folks want to take the punch bowl away.

Lou Mannheim,

The Fed will likely raise two administrative rates at the next FOMC meeting: the interest on reserves and the offering rate on overnight reverse repos. By just a little.

And they’ll begin to outline some form of tapering. The Fed won’t raise the federal funds rate until after asset purchases have stopped. This is how it did it last time. Powell said they’ll follow the same sequence this time.

The Fed has already ended a bunch of other stuff, including purchases of corporate bonds and bond ETFs, repos, and foreign currency swaps.

That all sounds prudent. How much more time do you think they’ll need to unwind the $8T in assets compared to the $4T from the GFC?

They still haven’t unwound from the first time. Their balance sheet will keep increasing long after we’re all gone. The FED needs to be destroyed to save the country.

Lou Mannheim,

exactly.

as if this new schedule of tapering won’t be interrupted by an emergency that completely erases their planned trajectory. 16T fed balance sheet here we come. hello 60T national debt. it won’t shock anyone.

Lou Mannheim,

Last time, the Wall Street hype mongers ridiculed the Fed’s small monthly balance sheet reduction (up to $50 billion a month) — until the markets started blowing up. Then suddenly Trump himself put pressure on the the Fed to stop it.

The FED has a problem. Inflation lasts longer than real growth. The only way to sustain real growth is to drive the banks out of the savings business, i.e., increase the velocity of circulation (which wouldn’t reduce the payment system’s size, aka the 1966 Interest Rate Adjustment Act).

Spot on W,

Softly, softly, catchee monkey!

There’s nothing at all to say they need to do anything quickly, it’s sustained direction that counts, and the more gradual, the better to stop too much indigestion.

If only they had gradually normalised rates for the last 12yrs we wouldn’t be in this mess now, but then we’d have to elect clever politicians for that.

1) Repo is NR. Repo breached the new bent EFFR pipeline bounds. Repo lead the Fed down. The Fed lost control. Traders bend their will. How many primary dealers registered as failed, paying a fine, hiding treasuries in their pockets is more important than RRP.

2) USD have reached Mar 2009 fractal zone. This zone is support. When (if) USD will turn around and bounce up : stocks, commodities and RE will slump, including silver !!

3) US trade deficit : the highest ever. Whom to blame : China !

4) The economy is strong, US markets are strong, but the dollar is weak. Bubbles attract investors, including foreign investors who want to have a drink and participate in the party. But USD is weak, with a large account deficit.

5) In the 80’s when Japan was “Toyota way” queen, JPY slumped (devalued) and USD became the king.

6) In the 80’s and the 90’s the Yuan was devalued (to survive JPY and HK). USD/CNY gap up in repetition.

7) The largest gap was registered between Dec 1993/ Jan 1994.

8) Thereafter USD/CNY is downwards until Jan 2014. This gap is still open.

9) Side by side, as pairs, since Jan 2014, USD/CNY : higher highs and higher

lows on the way to close an upper gap : July 11/18 2005 gap.

10) China have > $1T in US treasuries. China want to strengthen the RMB.

China will take profit in stepping stones, when US yield front end goes NR, The total will stay more or less constant.

On #3 who to blame bill clinton nafta and greedy corporations who don’t want to deal with unions or people fotget there humans too

11) In 2014 China was opened for foreign investors and USD poured in.

Since cash is already yielding a negative return after adjusting for an inflation surely on fire and none of us knows the totality of financial asset landmines dotting the banking system landscape, I think fiat currency taken out of the banking system has greater merit than demand or time deposits.

If T-bills are Mr. Gross’s definition of cash, you had better buy the 5-day variety if available, but the 1-month/ 30-day maturity makes the most sense if you have to buy Treasuries at all due to fiduciary, regulatory, or practical considerations. This financial system environment is merely supported by hopium, speculation, and excess liquidity, a Deadly Trio that will prove exceedingly incendiary should a black swan or derivative failure light the fatal match.

Personally, since 1997 I have turned to both gold and silver bullion that have been two of the best performing asset classes since January 1, 2000, the birthday of the screwiest period in American economic and financial history. Store it close to the Canadian border or overseas, as in Singapore, because Uncle Biden will soon be very desperate to plug the breaking dike of Financial Collapse. Harsh reality, but that is what we are stuck with after a daisy chain of Fed Chairs since 1987 that have sold us Common Folk out to the monied Special Interests and Insiders.

There is only one reason cash has a net negative return…

The FED DECIDED.

That is pure THEFT….from a body that is mandated to “stable prices”.

An out rage.

Never have Fed Funds been zero as inflation roars at 4%.

Before the new breed of Fed chairmen, 2008, Fed Funds now would now be circa 3% and risiing.

I used to enjoy reading his monthly missives when Gross was at PIMCO. They were enlightening.

I thought he was pretty entertaining. A good writer (or his ghost writer was).

I doubt he used a ghost writer (much). One story that he told that sticks with me is from his days as a Naval Officer in the 1960s. I could very much relate to the specifics (and the terminology) from my years as a Naval Officer starting in 1988.

Basically he was loaning out money to the crew members at a usurious rate. An officer shouldn’t do this but he was trying to save for his wedding. Before the cruise was half over the crew couldn’t afford to go out on Liberty and the grumbling made its way to the Captain… who made Gross pay back all of the interest that he had earned and put him in “hack” (confined to quarters except for watch or to do his job) for the rest of the deployment.

The lesson he learned… any deal that is too good to one party ends up blowing up.

Gross is a superstar and he wrote all of his own opinion pieces. I learned a lot from him.

I have been reading on numerous threads, past week or two, every one advising ‘ stay, diversified among stocks, bonds, gold, RE , Cash++

Wonder what happened those ‘diversified’ during Dot com bust and housing bust (GFC) Nasdaq nearly 90% between 2000 -2003 and S&P lost nearly 60% during GFC. Of course they have recovered and then some.

Now we have 3rd largest ‘everything’ bubble virtually in all assets! How this will play out in the coming down cycle, will be interesting.

“Wonder what happened those ‘diversified’ during Dot com bust and housing bust (GFC)”

They didn’t get hurt anywhere near as bad as those who weren’t diversified.

I totally missed the dot-com bubble because I was still a fuddy duddy value investor. Of course I missed buying Amazon (I had a hard time justifying buying a company whose earnings fell as revenues rose), but I also missed the huge majority that were demolished.

Everything bubble? Like the coal bubble?

Look for things that are out of favor. Until recently gold and silver were shunned. Now, not so much. During the GFC I was taking so much cash out of the bank to buy PM I was called in to fill out a Know Your Customer form.

I was sure we were headed into stagflation. I think I’ll be proven right but my timing was way off. I had no idea what rich and powerful people will do to preserve their status and I sure as hell didn’t know how the Fed worked. Actually I still don’t. It looks to me like a Rube Goldberg device that has been collecting weird patches and add-ons that now make it an overly complicated basket of nonsense.

That’s why I’m rooting for decentralized finance, of which crypto is the first step. I don’t own any but since I’m at a loss to think of a centralized system that didn’t run off the rails maybe it’s time for regime change.

What did poorly during this monetary process will do well when it runs in reverse. Think about what’s hated and why.

MG

Being diversified is a broad catch all interpretations.

In the long term (rolling periods 10/20 yrs) the % of amount invested in ‘each asset’ determines the strength to with stand the Bear period.

Another important but less appreciated is the correlation or lack (of S&P) with unrelated assets.

Been in the mkt since ’82. Didn’t have too much to lose during ’87 crash. Did hit by dot com bust but recovered by investing foreign stocks, where I also got currency appreciation. I lost hardly anything during GFC, since I was forewarned about the housing crisis.

Since ’09, there is surreal bull mkt in the abscence of price discovery

aka Free Mkt Capitalism is dead. Fed is the mkt for all practical purposes. Since I am already in retirement, I am conservative with almost 50% in cash ( enough to tide over 5-10 yrs of Bear!), less than 1% in bonds, 5% against the mkt ad the rest in Div paying ETfs of all sorts through out the globe.

The most and acute dangerous is those in early stages and those with 5-7 years of retirement. Capital preservation is of paramount importance! The coming down cycle will be unlike, any other previous bears, IMHO. Hope I am wrong!

Coming volatility in the mkt will be unnerving to many, especially to those who entered the mkt after GFC.

Btw:

All the instability and various mal feascene/ structural problems in global financial/banking system, which brought us GDC are still there! Just covered with more DEBT (credit) This is the reason the ferocity of coming bear will be unlike any other.

S129

There are about 15 Co’s in the UK which have increased their dividend every year for 50yrs.

Their prices have been all over the place in that time but if it’s income you want, who cares?

They are generally reporting that 2020 was the most difficult year ever, while still bragging about keeping their payouts.

I am in my 4th year of retirement and I agree with you totally about the risks in those early years. Capital preservation is your job!

If the Fed is “forced to accommodate” the profligate policies of the politicians, then how can they possible taper when Washington is still spending money (buying votes) like there will never be a day of reckoning?

If the Fed doesn’t mop up this biblical flood of cash, what happens then?

“If the Fed is “forced to accommodate” ”

The Fed is certainly the great “enabler” for all the pork, fluff, social programs, and voting buying schemes of this Congress. Whether they are being “forced” is up for discussion.

Powell seems to think that when he walks past a “tent city”, that keeping rates at zero will solve the issue. Nonsense.

The book will be written that low interest rates can be stimulative “short term”, but when protracted, malinvestment, over leveraging, asset bubbles result.

And here we are.

SM

Nail on the head!

Fed is the inflation arm of Govt spending. (prints the cash)

Treasury is the borrowing arm. (flogs treasuries)

IRS is the taxation arm. (sends out demands for cash)

IRS gets the easy job because the politicians very rarely use them.

MMT has not been kind to guys like Bill Gross. Game has changed, and I don’t feel sorry for him since he could not adjust. Cash is still trash, like it our not. Face the reality or get crushed.

More and more investors are reallocating out of financial assets and into hard assets. That is what the rally in house prices is all about.

While the low mortgage rates help the housing rally, the fact is the biggest driver is a rush to hard assets.

The smart money has an overweight in hard assets backed with an above average position in cash equivalents.

The rally in house prices will only stop if inflation is brought under control. If mortgage rates increase, but inflation continues to run high, house prices will continue to move higher.

People who refuse to buy a house at these prices are making the bet that inflation will come tumbling down very soon. Personally, I would not make that bet.

I’m refusing to buy a house because I like mine.

People who buy a house right now are also buying higher property taxes.

If inflation persists all the little hidden gimmicks the Fed uses to drain liquidity will fail (will they raise reserve requirements? ), interest rates will rise, mortgage rates will rise and housing prices will fall.

And if we get deflation (which so many people are sure is impossible that it’s almost guaranteed) those debt burdens are gonna hurt.

We are in the biggest debt and asset bubble in the history of mankind and the economy is not functioning well. Buying anything you don’t need right now would appear to be risky.

Have cash to live to fight another day. If you need hard assets gold and silver seem ok and they don’t have a carrying cost.

SoCal – In the 90’s I did a lot of real estate work internationally (more than 30 countries) many of the markets were “developing” and had a history financial upheavals that we haven’t experienced, at least in my lifetime. Turkey was running something like 40% inflation at the time. One thing that they all had in common was people owned real estate as a way to preserve capital. The valuations were often extreme relative to what they might expect for a return on capital for other financial assets. The price per square foot of a retail property in Mumbai was higher that most areas of New York for example. It’s not like the rental return was great or the retail sales were that great. Buying good locations was difficult, owners simply did not want to sell.

With that said, they also did not have the leverage available that we have in the USA. Most were owned with no debt. While you may be correct in the long run, the leverage in the system is what makes us vulnerable to a huge swing in price,

The rally in house prices is more about not enough people selling and everyone wanting to buy. Including investors who the Fed has forced to search for yield. So they figure why not buy RE and earn some yield that way and they also compete against the home buyer who wants to live there.

“The Fed also keeps saying, that if it decides that inflation is not transitory, it has the tools to crack down on it.”

The question isn’t whether it has the tools, it’s whether it has the will to use them.

But it really doesn’t even need them … all it needs is to give the tools creating inflation a rest.

The Fed has been desperately trying to create inflation for over a decade without success. Now that we have it, suddenly it’s the Fed’s fault.

I don’t think you need the Fed to explain what happened, but what’s important is that they’re painted into a corner.

Emerson said “A foolish consistency is a hobgoblin that haunts little minds” and we’re seeing it in action.

There has been consistent money expansion (inflation 1) and rising prices (inflation 2) for decades.

It is the FED’s fault, corrupt bastards that they are.

Finster

“it’s whether it has the will to use them.”

“Will” is not the question. They have DUTY to “stable prices”.

They are off the rails and no one seems to care.

Here’s a question.

If the Fed tightens to head off inflation, asset prices will slump, collateral will be impaired, many borrowers will go under, and defaults will cascade. This is a system addicted to the drug of cheap money.

Does the Fed then sit back and watch bank and other lender balance sheets fall apart, or does it intervene? If it intervenes, as surely it would have to, aren’t we back at debt monetization, in one form or another?

In other words, is there really any way out of the stimulus trap?

And this is why central bankers are frauds.

They can get in, but they can never get out of their “temporary” implementations based on theories that eventually prove wrong minded (MMT).

QE, never before used, was to be temporary said Bernanke. The needle never left the arm.

Exactly so. The theory that the Fed (et al) can tighten to head off inflation doesn’t pass muster when we take the inevitability of defaults, failure of zombies, slumps in asset prices, etc etc etc, into account.

TSE

It’s all in the mind!

For 12yrs the markets have known that the Fed will always cover their back and have taken advantage of its softness.

This can all be changed permanently, and as gradually as possible if your idiot politicians only had the ba**s to stick to a steady long term plan and stuff the MSM.

All the players would then learn they were up against a strong player and would start to unwind all their ‘risky’ positions in a controlled manner. If it was done slowly enough and over a long enough period it could all be managed.

I’m not holding my breath with uncle Joe and co. (I hope he doesn’t try to hold his breath too long either at his age)

The global share of US-dollar-denominated exchange reserves has dropped to 59.0%. That number will likely fall further as inflation can no longer be ignored. The Fed is not all powerful and their actions don’t take place in a vacuum. I suspect they will have to fight inflation because it won’t matter what your dollar denominated assets are valued at if the dollar has no value. The US is no longer in a position where they can just create a new currency and value it as they please.

What’s the alternate currency, to replace US$? Virtually NONE!

Rest of the world is piling up on $ related assets of any kind. TINA!

There are a number of alternatives, and they are being used more frequently at the expense of the dollar. Our world reserve currency status may not be replaced, but simply eroded. As we produce less, demand more, and print to infinity others will explore and use other options and create new alternatives.

could we be a little more specific on why exactly increasing bank reserves cause the system ‘go haywire’? I keep hearing this without an explanation which makes me think the understanding behind that statement may not be there.

I agree with Bill Gross. Cash is probably the safest asset at this point. Be aware of counterparty risk though. Money in the bank or bonds aren’t safe when the bubble implodes.

Inflation or deflation, stocks will be toast either way. I always read that stocks will do fine in inflationary periods, but data suggests otherwise. Even in Weimar Germany, although stocks were fine eventually, when stuff became unhinged they first lost 80%+ of their value in US$ terms in 1921-1923 before recovering.

Real estate will be toast too if rates go up (inflation) or mass defaults happen (deflation).

Even precious metals can crash in sympathy with stocks and bonds. But at least they lack counterparty risk so they may become the asset of choice.

We are in an “everything bubble”, meaning everything went up relative to cash. When this bubble bursts and we leave the upside down parallel universe in which we currently live, everything will go down relative to cash.

Mr Gross may turn out to be right about cash in hindsight.

However, there is a now a chorus of alternative macro analysts (not the kind to be welcomed on CNBC) preaching the gospel that one must flee all the risk-on markets (except RE) and seek safe haven in ‘real’ assets– cryptos, gold, silver, farmland, rental property, etc.

Their rationale of course is that the end is nigh for fiat currency which is being debased quickly with all the money printing, QE, and ZIRP.

Without enough CASH (for living expenses) to withstand the bear and also one cannot take the advantage of free fall of various other assets!

If you have taken off, portion of profits periodically, you are NOT forced to participate in the FIRE SALE! Beside one can sell ONLY ‘assets’ if there is bid/ask mkt.

When cryptos was crashing, investors were selling ‘stocks’ that thay have mkt and can be sold.

So CASH is NOT trash!

Inflation. Deflation. Hyper-Inflation.

How come we never hear about Hyper-Deflation?

Not predicting. Just asking.

RedRaider,

In the US, there have only been a few quarters of teeny-weeny consumer price “deflation.” The rest of the time, there was consumer price “inflation,” including double-digit inflation. The deflation monster keeps getting trotted out to generate monetary policies that create inflation.

In the US, I’m not ever worried about deflation. A little bit of deflation would make up for a tiny slice of the destruction wreaked by inflation, and that would be a good thing, but good luck waiting for it.

“Hyper-deflation” – I guess you mean the prices of goods and services are dropping by 50% or more per month, month after month – is impossible for a variety of reasons, I would venture to say. It’s not anything I’m going to be worried about for sure. Like I’m not worried about falling off the edge of the world. I mean, maybe it could happen somehow, but I’m not worried about it :-]

When I think of deflation, I mainly think of ASSET deflation and debt deflation caused by defaults. Significant deflation in overall consumer prices is almost impossible, because a large enough deflationary crisis will take out producers, so supply and demand will balance soon enough, at a lower level of production and demand.

Gas is the only price I’ve ever seen go down after going up.

Not at all hard to imagine air coming out of the stock market!

YS

Walmarts stuffed full of cheap TV’s, phones,laptops, etc from Asia is the very definition of deflation from the point of view of the price level of goods in the US.

Removal of this phenomenon by supply (container) shortages is possibly why talk of inflation has appeared at last after 12yrs.

The only thing that could possibly cause Hyperdeflation would a massive shortage of money. Not sure how that could happen……

Why is the Fed buying MBSs with rates well under the inflation rate?

Real Estate market is locked up……crazy land ….

Buyers know the borrowing rates are a steal (3% for a 30yr with 4% inflation)

Sellers know their property replacement costs just jumped 35% in 5 months….

1) Fear. When bond traders smell toxic stench they throw a

ranch on the hypothecation wheel.

2) The keep MBS & treasuries for themselves, creating shortages of

good collateral in the market.

3) RRP is not about too much liquidity. RRP is plumbing, opening the

clog, providing collateral.

4) VIX indicate fear. CNN have a fear gauge. But Failed : “F” accumulation, is the best.

“4) VIX indicate fear. CNN have a fear gauge. But Failed : “F” accumulation, is the best.”

What do you mean it failed? Why? What’s the better model?

MBS allows the government to take the hit when the market tanks. They are THE HOUSE. So if housing were to drop 20% it would not per se take out the banks but be an adjustment to a line item in the the government ledger. They can absorb a swing of $3-6T

That’s assuming they mark-to-market, which, apparently, banks don’t do anymore.

A shared sentiment in the comment section is that “cash is trash”. Personally, I wouldn’t hold trash to diversify but then again I don’t believe “cash is trash”. I wonder what the “cash is trash” crowd is holding instead of cash.

Well, I know at least one person who always urges me to buy the crypto dips that cannot buy the crypto dips themselves because they’re not in cash at all and instead put everything they can into tech stocks, crypto and SoCal real estate. They think the Fed is making a new normal and that the only way is up. In reality, of course, it’s just a “get rich quick” mentality that will probably end in a hard lesson learned and time lost.

Cash is never trash. You can never have enough cash. It’s just not possible.

When/if there is a correction, cash is king.

From SFGate: “Meat prices are skyrocketing, so popular Bay Area deli Augie’s is closing temporarily”

Insane. J-POW with his CAPS LOCK did it!!!

I agree with Bill Gross and I am making a prediction here with 85% certainty in my opinion going back to 2000 year levels on US Treasury bond yields, the highest rate, yield being 6.75% on the 30 year because it is most sensitive the long term inflation expectations.

The 2, 5, 7, 10, 20 year US Treasury Bond yields will be anywhere from 5.5% to 6.25% as well. All the predictions in my post will come by my prediction opinion timeline of 2026 to 2027 the latest.

KS

I really hope I can hold you to that, especially 2027.

– In his last & previous job at Janus (???) Capital Gross made a big bet on “rising Inflation”. Something along the lines of “Inflation was around the corner”. So, he made a bet on (sharply) rising commodity prices. But commodity prices didn’t go up and they actually went down. As a result of that Janus lost a tonne of money and Gross was forced to resign/”retire”.

– Gross is simply one the/too many people who fail to wrap their around the intricacies of Deflation & Inflation. I only know one person who is able to understand “the math of Capitalism” and the implications of that math. No, and it isn’t one Wolf Richter” or Bill Gross. That person is called A. Gary Shilling.

– Gross was short T-bonds between say October 2020 and March 2021. He again was yapping about “rising (price ???) inflation”. Yes, yields in that timefame were rising but not as a result of (price) inflation. Poor bill Gross.